Attached files

| file | filename |

|---|---|

| EX-32.2 - WESTMONT RESOURCES INC. | wmns_ex32-2.htm |

| EX-32.1 - WESTMONT RESOURCES INC. | wmns_ex32-1.htm |

| EX-31.2 - WESTMONT RESOURCES INC. | wmns_ex31-2.htm |

| EX-21.1 - WESTMONT RESOURCES INC. | wmns_ex21-1.htm |

| EX-31.1 - WESTMONT RESOURCES INC. | wmns_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One)

|

|

[X] Annual Report Under Section 13 Or 15(d) Of The Securities Exchange Act Of 1934

|

|

For the fiscal year ended May 31, 2010

|

|

[ ] Transition Report Under Section 13 Or 15(d) Of The Securities Exchange Act Of 1934

|

|

For the transition period from _____ to _____

|

|

COMMISSION FILE NUMBER: 000-52398

|

WESTMONT RESOURCES, INC.

(Name of small business issuer in its charter)

|

NEVADA

|

76-0773948

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

155 108th Avenue, Suite 150

|

|

|

Bellevue, WA

|

98004

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(206) 922-2203

Issuer’s telephone number

|

Securities registered under Section 12(b) of the Exchange Act:

|

NONE.

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

Shares of Common Stock, $0.001 Par Value Per Share.

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

1

Indicate by check mark whether by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months or for such shorter period that the registrant was required to submit such files). Yes [ ] No [ X ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule-405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, an “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.”

|

Large accelerated filer [ ]

|

Accelerated filed [ ]

|

|

Non-accelerated filer [ ]

(Do not check if smaller reporting company)

|

Smaller reporting company [ X ]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $76,660, based on a price of $0.02 per share, being the price at which the registrant last sold shares of its common stock.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of Monday, 13 September 2010, the Issuer had 53,499,660 Shares of Common Stock and 100,000 of Class A Preferred Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

2

WESTMONT RESOURCES INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED MAY 31, 2010

INDEX

|

PAGE

|

||

|

PART I

|

||

|

ITEM 1.

|

Description of Business.

|

6 |

|

ITEM 1B.

|

Unresolved Staff Comments.

|

16

|

|

ITEM 2.

|

Properties.

|

16

|

|

ITEM 3.

|

Legal Proceedings.

|

16

|

|

ITEM 4.

|

Removed and Reserved

|

16

|

|

PART II

|

||

|

ITEM 5.

|

Market for Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

16

|

|

ITEM 6.

|

Selected Financial Data.

|

17

|

|

ITEM 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

18

|

|

ITEM 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

21

|

|

ITEM 8.

|

Financial Statements and Supplementary Data.

|

22

|

|

ITEM 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

35

|

|

ITEM 9A.

|

Controls and Procedures.

|

35

|

|

ITEM 9B.

|

Other Information.

|

35

|

|

PART III

|

||

|

ITEM 10.

|

Directors, Executive Officers and Corporate Governance.

|

36

|

|

ITEM 11.

|

Executive Compensation.

|

38

|

|

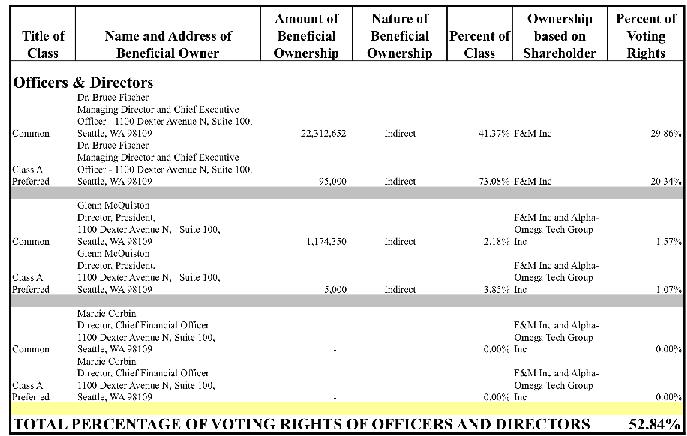

ITEM 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

38

|

|

ITEM 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

42

|

|

ITEM 14.

|

Principal and Accountant Fees and Services.

|

43

|

|

PART IV

|

||

|

ITEM 15.

|

Exhibits, Financial Statement Schedules

|

44

|

|

SIGNATURES

|

45

|

3

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained in this Annual Report on Form 10-K constitute “forward-looking statements.” These statements, identified by words such as “plan,” “anticipate,” “believe,” “estimate,” “should,” “expect,” and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the caption “Management’s Discussion and Analysis or Plan of Operation” and elsewhere in this Annual Report. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (the “SEC”), particularly our Quarterly Reports on Form 10-QSB and our Current Reports on Form 8-K.

These forward-looking statements were based on various factors and were derived from utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to the following:

|

|

·

|

the capital intensive nature of oil and gas development and exploration operations and our ability to raise adequate capital to fully develop our operations and assets,

|

|

|

·

|

fluctuating oil and gas prices and the impact on our results of operations,

|

|

|

·

|

the impact of the global economic crisis on our business,

|

|

|

·

|

the imprecise nature of our reserve estimates,

|

|

|

·

|

our ability to recover proved undeveloped reserves and convert probable and possible reserves to proved reserves,

|

|

|

·

|

the possibility that present value of future net cash flows will not be the same as the market value,

|

|

|

·

|

the costs and impact associated federal and state regulations,

|

|

|

·

|

changes in existing federal and state regulations,

|

|

|

·

|

our dependence on third party transportation facilities,

|

|

|

·

|

insufficient insurance coverage,

|

|

|

·

|

market overhang related to restricted securities and outstanding options, warrants and convertible notes,

|

|

|

·

|

adverse impacts on the market price of our common stock from sales by the selling security holders. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements, and readers should carefully review this annual report in its entirety, including the risks described in Item 1A. Risk Factors. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this annual report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

|

OTHER PERTINENT INFORMATION

We maintain our web site at www. westmontresources.com. Information on this web site is not a part of this prospectus. We file annual, quarterly and other reports and information with the Securities Exchange Commission. Promptly after their filing, we provide access to these reports without charge on our website at www.westmontresources.com. Our principal and administrative offices are located in Bellevue, Washington. Our common stock is traded on the Over The Counter Bulletin Board (OTCBB) under the symbol WMNS. Unless otherwise indicated, references in this report to “Westmont”, “the Company” or to “we”, “our”, “us”, and similar terms refer to and include Westmont Resources Inc., our direct and indirect wholly owned subsidiaries and our interests in sponsored drilling partnerships.

4

DEFINITIONS

All defined terms under Rule 4-10(a) of Regulation S-X shall have their statutorily prescribed meanings when used in this report. As used in this document:

|

|

·

|

“3-D” means three-dimensional.

|

|

|

·

|

“B/d” means barrels of oil or natural gas liquids per day.

|

|

|

·

|

“Bbl” or “Bbls” means barrel or barrels of oil.

|

|

|

·

|

“Bcf” means billion cubic feet.

|

|

|

·

|

“Boe” means barrel of oil equivalent, determined by using the ratio of one Bbl of oil or NGLs to six Mcf of gas.

|

|

|

·

|

“Boe/d” means boe per day.

|

|

|

·

|

“Btu” means a British thermal unit, a measure of heating value, which is approximately equal to one Mcf.

|

|

|

·

|

“LIBOR” means London Interbank Offered Rate.

|

|

|

·

|

“LNG” means liquefied natural gas.

|

|

|

·

|

“Mb/d” means Mbbls per day.

|

|

|

·

|

“Mbbls” means thousand barrels of oil.

|

|

|

·

|

“Mboe” means thousand boe.

|

|

|

·

|

“Mboe/d” means Mboe per day.

|

|

|

·

|

“Mcf” means thousand cubic feet of natural gas.

|

|

|

·

|

“Mcf/d” means Mcf per day.

|

|

|

·

|

“MMbbls” means million barrels of oil.

|

|

|

·

|

“MMboe” means million boe.

|

|

|

·

|

“MMBtu” means million Btu.

|

|

|

·

|

“MMBtu/d” means MMBtu per day.

|

|

|

·

|

“MMcf” means million cubic feet of natural gas.

|

|

|

·

|

“MMcf/d” means MMcf per day

|

|

|

·

|

“NGL” or “NGLs” means natural gas liquids, which are expressed in barrels.

|

|

|

·

|

“Oil” includes crude oil and condensate.

|

|

|

·

|

“PUD” means proved undeveloped.

|

|

|

·

|

“SEC” means United States Securities and Exchange Commission.

|

|

|

·

|

“Tcf” means trillion cubic feet.

|

|

|

·

|

With respect to information relating to our working interest in wells or acreage, “net” oil and gas wells or acreage is determined by multiplying gross wells or acreage by our working interest therein. Unless otherwise specified, all references to wells and acres are gross.

|

5

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

CORPORATE OVERVIEW

Westmont Resources Inc., a Nevada corporation formed in 2004, is an independent natural resource exploration and production company that plans to explore to, develop and produce natural resources to include minerals, natural gas, crude oil, and natural gas liquids. In North America, our exploration and production interests are focused in mineral exploration in British Columbia Canada. Oil and natural gas exploration in the Appalachian Basin, Illinois Basin, Permian Basin, Williston Basin, and along the Gulf Coast in Eastern Texas.

The company is operational and engaged in the future acquisition, and planned development and production of oil and natural gas properties through the use of disruptive technology in an environmentally safe and cost effective manner.

As a development stage independent junior oil and gas Company with ambitions to become an independent major in selected regions, the company’s strategy is two-fold. First, to grow rapidly through the acquisition or “roll-up” of undervalued oil & gas properties with proven reserves in heavy oil and oil shale which have only been partially developed. Second, through the use of proprietary disruptive technologies the company “wrings out” the untapped value of the target properties’ reserves. The company’s growth plans are in modular steps depending on the availability of capital.

Our Expansion strategy is modular and expandable based on funding. Our management team has extensive experience in the implementation of disruptive technology in various natural resources, mining and environmental remediation industries. We have brought together an exceptional team of financial, engineering, geological, geophysical, technical and operational expertise in successfully developing and operating properties in both our current and planned areas of operation. The management team is primarily focused on the acquisition and accumulation of natural resource assets, while building a strong operational management team to manage these assets to the highest effective and profitable degree possible.

Westmont Resources Inc is focused on the acquisition and development of natural resources properties, including oil and natural gas fields, with proven reserves. The company’s strategy is to shun the risks of traditional exploration of undeveloped basins. Rather, the company’s strategy is to more fully develop existing and proven fields. We seek to acquire and develop properties while economically attractive are not strategic to the oil and gas majors and which have not been fully developed by previous traditional operators. We will acquire properties that have produced and may still be producing but, while having significant proven reserves have been deemed not commercially productive. Through the use of proprietary disruptive technologies the company is in a position to “wring” out the untapped value of these proven reserves.

GROWTH STRATEGY

Westmont’s mission is to grow a profitable upstream natural resource company for the long-term benefit of our shareholders. Westmont’s long-term perspective has many dimensions, with the following core principles:

|

|

·

|

Own a balanced portfolio of core assets;

|

|

|

·

|

Maintain financial flexibility and a strong balance sheet; and

|

|

|

·

|

Optimize rates of return, earnings and cash flow.

|

Throughout the cycles of our industries, these strategies have underpinned our commitment to deliver long-term production and reserve growth and achieve competitive investment rates of return for the benefit of our shareholders.

OPTIMIZE RETURNS ON INVESTED CAPITAL

We will focus on optimizing returns on invested capital through strict cost control and the creative application of technology.

6

Our management systems provide a uniform process of measuring success across Westmont. Our management systems incentivize high rate-of-return activities but allow for appropriate risk-taking to drive future growth. Results of operations and rates of return on invested capital are measured monthly, reviewed with management quarterly and utilized to determine annual performance awards. We monitor capital allocations, at least quarterly, through a disciplined and focused process that includes analyzing current economic conditions, expected rates of return on proposed development and exploration drilling targets, opportunities for tactical acquisitions or, occasionally, new core areas that could enhance our portfolio. We also use technology to optimize our rates of return by reducing risk, decreasing drilling time and costs, and maximizing recoveries from reservoirs.

RECENT DEVELOPMENTS

We completed several initiatives during 2010 to strengthen our balance sheet and add liquidity. These transactions have provided us with greater financial flexibility to take advantage of our development opportunities. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

·

|

Convertible Note Exchange: In May 2010, we retired $20,000 of our convertible note with the Brooklyn Group Inc. The retired note was issued in March 2005.

|

|

|

·

|

Sale of Get2Networks, Inc: In April 2010, Get2Networks, Inc was sold to Alpha-Omega Inc. for the return of approximately 433,000 (21,650,000 pre-split) restricted common shares and approximately 30,000 (1,500,000 pre-split) Restricted Class A Preferred shares in Westmont Resources Inc. and the removal of 2 loans valued at approximately $153,893 and $36,340.

|

|

|

·

|

In May 2010, we signed a Memorandum of Understanding (MOU) for the Purchase of a 70% working interest in 92 oil & gas wells located in Scott & Morgan County Tennessee from Domestic Energy Corporation. Transfer of ownership in these wells from Domestic Energy to Westmont began in June 2010 and is ongoing. Domestic Energy Corporation is 87% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc.

|

OIL & NATURAL GAS BUSINESS STRATEGY

Initially the company has targeted for acquisition long-lived, low risk natural gas and oil properties associated with known shale plays throughout the Appalachians/Middle-Atlantic, the Mountains west of Idaho and Montana as well as the heavy oil deposits in Texas with proven reserves. This strategy is centered on rehabilitation and production enhancement, utilizing modern management and technology applications, of producing oil and gas formations. Through the application of disruptive production technologies, Westmont will infuse needed expertise, technology and capital into projects to improve operations and increase production.

In June 2010, Westmont signed a memorandum of understanding (“MOU”) in June 2010 to acquire 10% rights to commercialize a patent pending, disruptive market making technology in the heavy oil production and extraction industry known as Heavy Oil and Gas Extraction technology (HOGEÔ). As of the date of this filing, Westmont has not closed on the acquisition of the 10% interest in this technology. In addition, subsequent to May 31, 2010, Westmont has acquired exclusive distribution rights to a 100% biodegradable and environmentally safe fracturing solutions known as “FracSolv” manufactured and produced by NuEarth Corporation. NuEarth Corporation is 95% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc.

The company hopes to engage HOGEÔ to enhance the extraction of oil from proven reserves of heavy oil and tar sand formations. After maximizing the oil production the underlying shale basins will be “fracked” to release the natural gas through the application of both HOGEÔ and “FracSolv™”. Among other advantages, both of these applications have a more neutral effect on the environment than the traditional industry methods. The increased productions and yields as well as environmental impacts are more fully explored in the discussion below in “Technology Applications”.

7

Taking advantage of its technological edge, the Company has embarked on an ambitious Four Phase “Roll-up” Growth Strategy.

|

|

·

|

Phase 1: Acquire interests in oil and gas fields with significant unrealized reserves.

|

|

|

·

|

Phase 2: Place all wells back into production and add wells where appropriate to further maximize the lease potentials.

|

|

|

·

|

Phase 3: Redevelop all wells to greater depths to take advantage of untapped pay zones in the region. The existence of these formations is based on the productions of several similarly completed wells in the area.

|

|

|

·

|

Phase 4: Expand all wells using current technologies in vertical and horizontal drilling linked with modern fracturing methods to take advantage of the higher yielding natural gas Shale zones and/or heavy oil deposits where appropriate.

|

OIL & NATRUAL GAS OPERATIONS

Westmont Resources has signed three Letters of Intent (LOI’s) subsequent to the May 31, 2010 year end to obtain a number of oil and gas leases in the Chattanooga, Marcellus and Ohio Shale basins. One of the oldest and least appreciated gas producing regions in the North America is the thick sequence of shale found in the Appalachian Basin often referred to as simply “brown shale”, “black shale” or “Devonian shale”. These are vast formations of upper Devonian in age and are variously known as Marcellus Shale (Pennsylvania and West Virginia), Ohio Shale (Ohio & Kentucky), Antrim Shale (Michigan & northern Indiana), New Albany Shale (Illinois & Indiana), Woodford Shale (Texas, Oklahoma, New Mexico), Chattanooga Shale (Tennessee & vicinity, Millboro Shale (Virginia) and other diverse designations in various geographic localities.

Natural gas has been produced from the “Devonian shale” for approximately 200 years; early drilling and production of the shale gas occurred along the shale outcrop area near the south shore of Lake Erie in New York and Pennsylvania, as early as the 1820’s. Although gas was discovered in the Big Sandy area of Kentucky-West Virginia in 1879, serious development of the shale gas did not begin until 1921. Development of the Big Sandy Field has continued since that date to the present.

The wells within this sequence have yielded gas for considerably more than fifty years from relatively shallow depths, they have never been considered by the petroleum industry to be prime exploration targets. This is undoubtedly attributable to the generally low-volume yield by the existing Devonian Shale wells. During recent years however, dating back primarily into the 1970’s, interest in the gas reserves of the Upper Devonian Shale, particularly of the eastern United States, has been demonstrated by various segments of industry and government. Energy companies, gas utility companies in the Appalachians, industrial plants, and others along with the Department of Energy (DOE), have taken a new look at the energy producing potential of the Devonian shale.

Appalachian Basin - is America's oldest producing basin. But with renewed interest in this region has come the discovery of other production opportunities. Historically most of the drilling has been done at shallow depths. Over the last several years’ deeper production zones have been discovered, such as the Chattanooga shale and the Marcellus Shale. There is even talk of even greater formations further beneath the Marcellus. The five state area of Pennsylvania, West Virginia, Ohio, Kentucky and Tennessee is estimated to have a volume of Devonian black shale equal to 12,600 cubic miles spread over 160,000 miles of area. According to Columbia Gas, this equates to an estimated recoverable gas volume of 285 trillion (TCF). Considering today’s methods and technology, that figure is most certainly conservative.

The region is well served by State, County and Township roads, which afford passage the year-round to aid in the County’s oil and gas production. In addition, the climate is temperate, having mild winters, which rarely interfere with daily production.

8

Representing roughly 61,000 square miles, stretches from Upper New York, through western Pennsylvania and into eastern Ohio and most of Kentucky and West Virginia and northern Tennessee. This area is believed to possess one of the richest natural gas fields in the World. In early 2008, geoscientists at Penn State University, and SUNY Fredonia estimated that the Marcellus & Chattanooga contains more than 500 trillion cubic feet of natural gas representing twice the current reserves located in Saudi Arabia. The shale contains largely untapped natural gas reserves, and its close proximity to the burgeoning natural gas markets of the northeast, middle Atlantic and upper Midwest makes it an especially desirable gas supply.

The company’s special expertise is to apply cutting-edge clean technologies to wring additional value from long-lived, low risk gas and oil properties and to o squeeze more oil out of mature basins. The company intends to acquire a number of large contiguous tracts with existing producing wells or in close proximity. In addition, the company has identified a number of other large contiguous tracts of thousands of acres in the region for acquisition. Currently, it is estimated that there are in excess of 20,000 abandoned and capped oil and gas wells in this region.

In addition, to capturing natural gas from shale, the company is also focusing on the extraction of oil from untapped heavy oil and tar sands opportunities through the application of the Heavy Oil and Gas Extraction technology (HOGEÔ) in North America and worldwide through a HOGE licensing program. As mentioned above, in June 2010, Westmont signed a memorandum of understanding (“MOU”) in June 2010 to acquire 10% rights to commercialize HOGE. As of the date of this filing, Westmont has not closed on the acquisition of the 10% interest in this technology.

OIL & NATURAL GAS TECHNOLOGY APPLICATIONS

Heavy Oil & Gas Extraction Technology (HOGEÔ)

In June 2010, Westmont signed a memorandum of understanding (“MOU”) to acquire 10% rights to commercialize HOGE. As of the date of this filing, Westmont has not closed on the acquisition of the 10% interest in this technology. The following is a description of this technology that Westmont plans to acquire.

The HOGEÔ process, which is multi-patent pending process, yields a quadruple-play in competitive advantages:

|

|

·

|

First, HOGEÔ dramatically increase the oil’s viscosity, increasing yields by up to 90%.

|

|

|

·

|

Second, because HOGEÔ utilizes a well’s own gas production, it yields cost advantages of up to 50%.

|

|

|

·

|

Third, HOGEÔ has the advantage of extracting up to 90% of a basin’s reserves verses a 40% recovery when employing the steam extraction method.

|

|

|

·

|

Fourth, as HOGEÔ has virtually no adverse environmental impact the application has the potential for more universal acceptance and negates the costs of environmental damage mitigation, which furthers its economic advantages.

|

The initial pilot project employing the HOGEÔ process produced approximately 100 barrels of heavy oil per day as opposed to the 2 barrels per day previously produced by stripping. Studies show that further refinements of the HOGEÔ process indicate that it has the potential to reach 150-200 barrels per day, which the company estimates is double the rate of the latest steam injection extraction method and at operating costs reduced by half.

HOGEÔ is designed to extract heavy oil from formations such as tar/oil sands and Shale with a calculated recovery of 90% or more. The process mechanically injects a heated solution of natural gas, derived from the production of the well, delivered deep into the formation by a proprietary tool that melts the heavy tar oil and Shale oil to a thin viscosity and then extracts it to heated storage tanks on the surface. The technology is readily adaptable to traditional oil and gas extraction systems as well as Shale fracturing systems. Contrary to other methods, HOGEÔ includes constant control and fracturing with no paraffin accumulation, a cost effective extraction method with substantially lower entry and production costs enabling higher margins and longer lives for capital equipment.

9

HOGEÔ maximizes reserve recoveries due to its ability to penetrate further into the formation at a higher constant operator controllable temperature all of which are not possible with the most commonly applied steam extraction method. All the while HOGEÔ provides a net neutral environmental impact. HOGEÔ is proving to be an environmentally safer solution with no contamination of formation or blocking of production. This is particularly of interest in the more confined and populous regions of the Marcellus and Chattanooga shale basins which are advantageously in close proximity to the major gas & oil markets in the northeast United States.

The technology is designed to extract heavy oil from formations such as tar/oil sands with a calculated recovery of 90% or more. The process mechanically injects a heated solution of natural gas, derived from the production of the well, delivered deep into the formation by a proprietary tool that melts the heavy tar oil to a thin viscosity and then extracts it to heated storage tanks on the surface. The heavy oil formation is injected until a sufficient amount of recoverable heavy oil is heated to 300 degrees F., then the oil & gas is extracted until production temperatures drop below 200 degrees F. Upon completion, the injection cycle is started again.

Shale Gas Fracturing Solution

Subsequent to May 31, 2010, Westmont has acquired exclusive distribution rights to “FracSolv” manufactured and produced by NuEarth Corporation. NuEarth Corporation is 95% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc.

The Shale Gas Fracturing and Extraction industry uses approximately 5.3 million gallons of fracturing solutions of various formulations in the USA every year. Prior to 2008, Diesel fuel was the predominant base solution for fracturing solutions. With current diesel prices approximately $3.00 USD per gallon, this represents a $15.9 million dollar market potential.

The technology will directly compete with existing heavy oil recovery systems, in addition to conventional oil recovery technologies like: 1.) Cold Heavy Oil Production with Sand [CHOPs]; 2.) Steam Assisted Gravity Drainage [SAGD]; 3.) Strip Mining Methods; 4.) Cyclic Steam Stimulation [CCS]; 5.) Vapor Extraction [VAPEX]; 6.) In situ combustion; and 7.) Electricity and Microwave Heating.

The competitive advantages over its competition include constant control and fracturing with no paraffin accumulation, a cost effective extraction method with substantially lower entry and production costs enabling higher margins and longevity, while providing an environmentally safe solution with no contamination of formation or blocking of production.

OUR EXPLORATION AND PRODUCTION ACTIVITIES

Subsequent to the close of the fiscal year end of May 31, 2010, Westmont significantly increased our operations through the signing of a contract for the acquisition from Domestic Energy Corporation of the working interest in 92 oil & natural gas wells in Scott and Morgan Counties of Tennessee. Transfer of ownership in these wells from Domestic Energy to Westmont began in June 2010 and is ongoing. Domestic Energy Corporation is 87% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc. Wells drilled in this area range from 1,800 to 4,200 feet in depth and the well spacing is generally from 20 to 40 acres per well and are predominately in the Fort Payne formation.

ESTIMATED PROVED RESERVES AND FUTURE NET CASH FLOWS

Westmont Resources Inc, takes the position to only release information on proven reserves, and as of May 31, 2010 the Company has no reportable reserves. Our future reserve reports will be prepared in accordance with the generally accepted petroleum engineering and evaluation principles and most recent definitions and guidelines established by the SEC. All reserve definitions will comply with the applicable definitions of the rules of the SEC. The reserve reports will be estimated using engineering and geological methods widely accepted in our industry. The accuracy of these future reserve estimates will be dependent upon the quality of available data and upon independent geological and engineering interpretation of that data. For proved developed producing, the estimates considered to be definitive, using performance methods that utilize extrapolations of various historical data including oil, gas and water production and pressure history.

10

In January 2009 the SEC issued Release No. 33-8995, “Modernization of Oil and Gas Reporting” (Release 33-8995), amending oil and gas reporting requirements under Rule 4-10 of Regulation S-X and Industry Guide 2 in Regulation S-K and bringing full-cost accounting rules into alignment with the revised disclosure requirements. The new rules include changes to the pricing used to estimate reserves, the option to disclose probable and possible reserves, revised definitions for proved reserves, additional disclosures with respect to undeveloped reserves, and other new or revised definitions and disclosures. In January 2010 the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2010-03 , “Oil and Gas Reserve Estimation and Disclosures” (ASU 2010-03), which amends Accounting Standards Codification (ASC) Topic 932, “Extractive Industries — Oil and Gas” to align the guidance with the changes made by the SEC. The Company adopted Release 33-8995 and the amendments to ASC Topic 932 resulting from ASU 2010-03 (collectively, the Modernization Rules) effective December 31, 2009.

Proved oil and gas reserves are the estimated quantities of natural gas, crude oil, condensate and NGL’s that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing conditions, operating conditions, and government regulations. The Company reports all estimated proved reserves held under production-sharing arrangements utilizing the “economic interest” method, which excludes the host share of reserves. Reserve estimates are considered proved if they are economically producible and are supported by either actual production or conclusive formation tests. Estimated reserves that can be produced economically through application of improved recovery techniques are included in the “proved” classification when successful testing by a pilot project or the operation of an active, improved recovery program using reliable technology establishes the reasonable certainty for the engineering analysis on which the project or program is based. Economically producible means a resource, which generates revenue that exceeds, or is reasonably expected to exceed, the costs of the operation. Reasonable certainty means a high degree of confidence that the quantities will be recovered. Reliable technology is a grouping of one or more technologies (including computational methods) that has been field-tested and has been demonstrated to provide reasonably certain results with consistency and repeatability in the formation being evaluated or in an analogous formation. Estimated proved developed oil and gas reserves can be expected to be recovered through existing wells with existing equipment and operating methods.

Proved undeveloped (PUD) reserves include those reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. Undeveloped reserves may be classified as proved reserves on undrilled acreage directly offsetting development areas that are reasonably certain of production when drilled, or where reliable technology provides reasonable certainty of economic producibility. Undrilled locations may be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless specific circumstances justify a longer time period.

Under recent SEC rules we are now also permitted to provide information about probable and possible reserves. As set forth above, prior to 2010 reserve reports did not contain any estimates on probable or possible reserves. “Probable reserves” are additional reserves that are less certain to be recovered than proved reserves but which, in sum with proved reserves, are as likely as not to be recovered. “Possible reserves” are additional reserves that are less certain to be recovered than probable reserves. The various reserve categories have different risks associated with them. Proved reserves are more likely to be produced than probable reserves and probable reserves are more likely to be produced than possible reserves. Because of these risks, the different reserve categories should not be considered to be directly additive.

Our policies regarding internal controls over reserve estimates require reserves to be in compliance with the SEC definitions and guidance and for reserves to be prepared by an independent engineering firm under the supervision of our Chief Financial Officer. We provide the engineering firm with estimate preparation material such as property interests, production, current operation costs, current production prices and other information. This information is reviewed by our Chief Executive Officer and our Chief Financial Officer to ensure accuracy and completeness of the data prior to submission to our third party engineering firm.

Westmont Resources has currently hired an independent Petroleum Engineer to calculate and estimate reserves associates with the 70% working interest in the 92 wells acquired from Domestic Energy Corporation. Transfer of ownership in these wells from Domestic Energy to Westmont began in June 2010 and is ongoing. Domestic Energy Corporation is 87% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc.

11

PRINCIPAL MARKETS

The Principal Markets for our crude oil and natural gas produced in the Appalachian region are refining companies, utility companies and private industry end users. Crude oil is stored in tanks at the well site until the purchaser retrieves it by tank truck. Direct purchases of our crude oil are made statewide at our well sites by Barrett Oil Purchasing Company. Our natural gas has multiple markets throughout the eastern United States through gas transmission lines. Access to these markets is presently provided by three companies in northeastern Tennessee, including Cumberland Valley Resources, NAMI Resources Company, and Tengasco. Local markets in Tennessee are served by Citizens Gas Utility District and the Powell Clinch Utility District. Natural gas is delivered to the purchaser via gathering lines into the main gas transmission line. Surplus gas is placed in storage facilities or transported to East Tennessee Natural Gas, which serves Tennessee and Virginia.

The following table presents information regarding average sales prices and costs, after deducting royalties and interests of others, with respect to oil and gas production attributable to competitive businesses in the region.

In the following table, average production cost are costs incurred to operate and maintain the wells and equipment and to pay the production costs, which does not include ad valoreum and severance taxes per unit of production, and is exclusive of work-over costs.

|

Appalachian region

|

2010

|

|||

|

Average sales price

|

71.33 | |||

|

Average production cost

|

54.64 | |||

COMPETITION

Our planned oil and gas exploration activities in Tennessee are expected to be undertaken in a highly competitive and speculative business environment. I n seeking any other suitable oil and gas properties for acquisition, we compete with a number of other companies doing business in Tennessee and elsewhere, including large oil and gas companies and other independent operators, many with greater financial resources than we have.

At the local level, as we seek to expand our lease holdings, we compete with several companies who are also seeking to acquire leases in the areas of the acreage. In the Appalachian region, we have six significant competitors including Atlas Energy Resources, LLC, Consol Energy, Inc., Can Argo Energy Corporation, Champ Oil, John Henry Oil and Tengasco. These companies are in competition with us for oil and gas leases in known producing areas in which we currently operate, as well as other potential areas of interest. We believe we can effectively compete for leases, however, as in the Appalachian region we have partnered with individuals and organizations that have name recognition over 40 years.

Substantially most of our competitors have more capital, longer operating histories and significantly greater financial and operating resources than we do. Given the relative size of our operations and our limited capital there is no assurance we will ever effectively compete in the area of obtaining the most leases in our target areas.

GOVERNMENT REGULATION

While the price of oil and natural gas are set by the market, other aspects of our business and the industry in general are heavily regulated. The availability of a ready market for oil production and natural gas depends on several factors beyond our control. These factors include regulation of production, federal and state regulations governing environmental quality and pollution control, the amount of oil and natural gas available for sale, the availability of adequate pipeline and other transportation and processing facilities and the marketing of competitive fuels. State and federal regulations generally are intended to protect consumers from unfair treatment and oppressive control, to reduce the risk to the public and workers from the drilling, completion, production and transportation of oil and natural gas, to prevent waste of oil and natural gas, to protect rights among owners in a common reservoir and to control contamination of the environment. Pipelines are subject to the jurisdiction of various federal, state and local agencies.

12

Our exploration and production business is subject to various federal, state and local laws and regulations on the taxation of natural gas and oil, the development, production and marketing of natural gas and oil and environmental and safety matters. Many laws and regulations require drilling permits and govern the spacing of wells, rates of production, water discharge, prevention of waste and other matters. Prior to commencing drilling activities for a well, we must procure permits and/or approvals for the various stages of the drilling process from the applicable state and local agencies in the state in which the area to be drilled is located. The permits and approvals include those for the drilling of wells. Additionally, other regulated matters include the following:

|

|

·

|

bond requirements in order to drill or operate wells;

|

|

|

·

|

the location of wells;

|

|

|

·

|

the method of drilling and casing wells;

|

|

|

·

|

the surface use and restoration of well properties;

|

|

|

·

|

the plugging and abandoning of wells; and

|

|

|

·

|

the disposal of fluids.

|

Sales of natural gas in Tennessee are affected by intrastate and interstate gas transportation regulation. Beginning in 1985, the Federal Energy Regulatory Commission ("FERC"), which sets the rates and charges for transportation and sale of natural gas, adopted regulatory changes that have significantly altered the transportation and marketing of natural gas. The stated purpose of FERC's changes is to promote competition among the various sectors of the natural gas industry. In 1995, FERC implemented regulations generally grandfathering all previously approved interstate transportation rates and establishing an indexing system for those rates by which adjustments are made annually based on the rate of inflation, subject to certain conditions and limitations. These regulations may tend to increase the cost of transporting oil and natural gas by pipeline. Every five years, FERC will examine the relationship between the change in the applicable index and the actual cost changes experienced by the industry. We are not able to predict with certainty what effect, if any, these regulations will have on us.

The state and regulatory burden on the oil and natural gas industry generally increases our cost of doing business and affects our profitability. While we believe we are presently in compliance with all applicable federal, state and local laws, rules and regulations, continued compliance (or failure to comply) and future legislation may have an adverse impact on our present and contemplated business operations. Because such federal and state regulation are amended or reinterpreted frequently, we are unable to predict with certainty the future cost or impact of complying with these laws.

We are subject to various federal, state and local laws and regulations governing the protection of the environment, such as the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (“CERCLA”), the Resource Conservation and Recovery Act (“RCRA”), the Clean Air Act and the Federal Water Pollution Control Act of 1972 (the "Clean Water Act"), which affect our operations and costs. In particular, our exploration, development and production operations, our activities in connection with storage and transportation of oil and other hydrocarbons and our use of facilities for treating, processing or otherwise handling hydrocarbons and related wastes may be subject to regulation under these and similar state legislation. These laws and regulations:

|

|

·

|

restrict the types, quantities and concentration of various substances that can be released into the environment in connection with drilling and production activities;

|

|

|

·

|

limit or prohibit drilling activities on certain lands lying within wilderness, wetlands and other protected areas; and

|

|

|

·

|

impose substantial liabilities for pollution resulting from our operations.

|

13

CERCLA, also known as "Superfund," imposes liability for response costs and damages to natural resources, without regard to fault or the legality of the original act, on some classes of persons that contributed to the release of a "hazardous substance" into the environment. These persons include the "owner" or "operator" of a disposal site and entities that disposed or arranged for the disposal of the hazardous substances found at the site. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek to recover from the responsible classes of persons the costs they incur. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. In the course of our ordinary operations, we may generate waste that may fall within CERCLA's definition of a "hazardous substance." We may be jointly and severally liable under CERCLA or comparable state statutes for all or part of the costs required to clean up sites at which these wastes have been disposed.

We plan to lease properties that for many years have been used for the exploration and production of oil and natural gas. Although we and our predecessors have used operating and disposal practices that were standard in the industry at the time, hydrocarbons or other wastes may have been disposed or released on, under or from the properties owned or leased by us or on, under or from other locations where these wastes have been taken for disposal. In addition, many of these properties have been operated by third parties whose actions with respect to the

treatment and disposal or release of hydrocarbons or other wastes were not under our control. These properties and wastes disposed on these properties may be subject to CERCLA and analogous state laws. Under these laws, we could be required to do the following:

|

|

·

|

remove or remediate previously disposed wastes, including wastes disposed or released by prior owners or operators,

|

|

|

·

|

clean up contaminated property, including contaminated groundwater; or to perform remedial operations to prevent future contamination, and/or

|

|

|

·

|

clean up contaminated property, including contaminated groundwater; or to perform remedial operations to prevent future contamination.

|

At this time, we do not believe that we are associated with any Superfund site and we have not been notified of any claim, liability or damages under CERCLA.

The RCRA is the principal federal statute governing the treatment, storage and disposal of hazardous wastes. RCRA imposes stringent operating requirements and liability for failure to meet such requirements on a person who is either a "generator" or "transporter" of hazardous waste or an "owner" or "operator" of a hazardous waste treatment, storage or disposal facility. At present, RCRA includes a statutory exemption that allows most oil and natural gas exploration and production waste to be classified as nonhazardous waste. A similar exemption is contained in many of the state counterparts to RCRA. As a result, we are not required to comply with a substantial portion of RCRA's requirements because our operations generate minimal quantities of hazardous wastes. At various times in the past, proposals have been made to amend RCRA to rescind the exemption that excludes oil and natural gas exploration and production wastes from regulation as hazardous waste. Repeal or modification of the exemption by administrative, legislative or judicial process, or modification of similar exemptions in applicable state statutes, would increase the volume of hazardous waste we are required to manage and dispose of and would cause us to incur increased operating expenses.

The Clean Water Act imposes restrictions and controls on the discharge of produced waters and other wastes into navigable waters. Permits must be obtained to discharge pollutants into state and federal waters and to conduct construction activities in waters and wetlands. The Clean Water Act requires us to construct a fresh water containment barrier between the surface of each drilling site and the underlying water table. This involves the insertion of a seven-inch diameter steel casing into each well, with cement on the outside of the casing. The cost of compliance with this environmental regulation is approximately $10,000 per well. Certain state regulations and the general permits issued under the Federal National Pollutant Discharge Elimination System program prohibit the discharge of produced waters and sand, drilling fluids, drill cuttings and certain other substances related to the oil and natural gas industry into certain coastal and offshore waters. Further, the EPA has adopted regulations requiring certain oil and natural gas exploration and production facilities to obtain permits for storm water discharges. Costs may be associated with the treatment of wastewater or developing and implementing storm water pollution prevention plans.

14

The Clean Water Act and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges for oil and other pollutants and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release. We believe that our operations comply in all material respects with the requirements of the Clean Water Act and state statutes enacted to control water pollution.

Our operations will also be subject to laws and regulations requiring removal and cleanup of environmental damages under certain circumstances. Laws and regulations protecting the environment have generally become more stringent in recent years, and may in certain circumstances impose "strict liability," rendering a corporation liable for environmental damages without regard to negligence or fault on the part of such corporation. Such laws and regulations may expose us to liability for the conduct of operations or conditions caused by others, or for acts which may have been in compliance with all applicable laws at the time such acts were performed. The modification of existing laws or regulations or the adoption of new laws or regulations relating to environmental matters could have a material adverse effect on our operations.

In addition, our existing and proposed operations could result in liability for fires, blowouts, oil spills, discharge of hazardous materials into surface and subsurface aquifers and other environmental damage, any one of which could result in personal injury, loss of life, property damage or destruction or suspension of operations. We have an Emergency Action and Environmental Response Policy Program in place. This program details the appropriate response to any emergency that management believes to be possible in our area of operations. We believe we are presently in compliance with all applicable federal and state environmental laws, rules and regulations; however, continued compliance (or failure to comply) and future legislation may have an adverse impact on our present and contemplated business operations.

EMPLOYEES

At May 31, 2010 we had 3 full time and 3 part-time employees.

MINING INDUSTRY SEGMENT

Prior to May 2010, we were engaged in mining activities. In May 2010, we signed a Memorandum of Understanding (MOU) for the purchase of a 70% working interest in 92 oil & gas wells located in Scott & Morgan County Tennessee from Domestic Energy Corporation. Transfer of ownership in these wells from Domestic Energy to Westmont began in June 2010 and is ongoing. Domestic Energy Corporation is 87% controlled by The Avalon Group Ltd. who is also the largest beneficial owner of Westmont Resources Inc. through their control and ownership in F&M Inc. Part of the consideration in the transaction above was for Westmont to transfer its interest in all mining claims previously held to Domestic Energy Corporation.

As of May 31, 2010, we owned a 100% undivided interest in one mineral property, the “GB 1 (Tenure #601482), GB 2 (Tenure #601483) and GB 3 (Tenure #601484) Claims”, located in the Province of British Columbia, Canada, that we have previously called the “JB 1 Claim”. During the year ended May 31, 2009, the Company re-staked the JB 1 Claim into the GB 1, GB 2 and GB 3 mineral claims, (collectively the “GB Claims”). The GB Claims are located in northwestern British Columbia, in the Gold Bottom Creek area, approximately 31 miles south of the town of Atlin. Due to restrictions set by the Province of British Columbia on the ownership of mineral claims, title to the GB Claims is currently held for the benefit of our wholly owned subsidiary, Norstar Explorations Ltd., a British Columbia company. As noted above, these claims will be transferred to Domestic Energy Corporation.

15

ITEM 1B. UNRESOLVED STAFF COMMENTS

As of May 31, 2010, we did not have any unresolved comments from the SEC staff that were received 180 or more days prior to year-end.

ITEM 2. PROPERTIES.

We currently do not own any physical property or own any real property. As of May 31, 2010, we owned a 100% undivided interest in the GB Claims. As a result of the Memorandum of Understanding (MOU) with Domestic Energy Corporation, Westmont resources Inc will own an estimated 70% working interest in 92 oil and gas wells in Scott and Morgan Counties Tennessee and will no longer own the mining claims.

We rent office space located at 155 108th Avenue NE, Suite 150, Bellevue, WA, 98004. This office space consists of approximately 1385 square feet, which we rent at a cost of $19 per square foot for a period of three years with a cancelation clause at eighteen months with a termination penalty.

ITEM 3. LEGAL PROCEEDINGS.

We are not a party to any material legal proceedings and, to our knowledge, no such proceedings are threatened or contemplated.

ITEM 4. {REMOVED AND RESERVED}

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

GENERAL

On October 26, 2009, a super majority of issued and outstanding shares of Common Stock (72.75%) and Preferred Stock (66.67%) were voted to approve a 1 – for – 50 reverse split of the issued and outstanding shares of Common Stock such that each fifty (50) shares of Common Stock, $0.001 par value, issued and outstanding immediately prior to the effective date (the “Old Common Stock”) shall be recombined, reclassified and changed into one (1) share of the corporation's Common Stock, $0.001 par value (the “New Common Stock”), with any fractional interest rounded up to the nearest whole share;

On October 26, 2009, a super majority of issued and outstanding shares of Common Stock (72.75%) and Preferred Stock (66.67%) were voted to approve a 1 – for – 50 reverse split of the issued and outstanding shares of Class A Preferred Stock such that each fifty (50) shares of Class A Preferred Stock, $0.001 par value, issued and outstanding immediately prior to the effective date (the “Old Class A Preferred Stock”) shall be recombined, reclassified and changed into one (1) share of the corporation's Class A Preferred Stock, $0.001 par value (the “New Class A Preferred Stock”), with any fractional interest rounded up to the nearest whole share; and

Our authorized capital stock consists of 800,000,000 shares, of which 775,000,000 are shares of common stock, with a par value of $0.001 per share, and 25,000,000 are shares of preferred stock, with a par value of $0.001 per share. As of September 14, 2010, there were 53,499,660 post split shares of our common stock issued and outstanding that were held of record by sixty-three (63) stockholders.

There are 100,000 shares of Series A preferred stock outstanding held by five (5) stockholders.

16

MARKET INFORMATION

Our shares of common stock commenced trading on the OTC Bulletin Board under the symbol “WMNS” on June 24, 2010. Prior to this date, no public trading market existed for our common stock. Although our shares became eligible for quotation on the OTC Bulletin Board in May 2007, the high and low bid price information for our common stock for the quarter ended May 31, 2010 was not available from the OTC Bulletin Board. Quotations provided by the OTC Bulletin Board reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions. As of Monday, 13 September 2010 our common stock is listed at $0.04 Bid and $0.05 Ask.

DIVIDENDS

We have not declared any dividends on our common stock since our inception. There are no dividend restrictions that limit our ability to pay dividends on our common stock in our Articles of Incorporation or Bylaws. Our governing statute, Chapter 78 of the Nevada Revised Statutes (the “NRS”), does provide limitations on our ability to declare dividends. Section 78.288 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

|

|

·

|

we would not be able to pay our debts as they become due in the usual course of business; or

|

|

|

·

|

our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution (except as otherwise specifically allowed by our Articles of Incorporation).

|

RECENT SALES OF UNREGISTERED SECURITIES

On October 26, 2009, Westmont issued Thirty Thousand 30,000)split-adjusted shares of Series A Preferred Stock to F&M Inc for services provided to the Company. These shares of Preferred Stock have 160 votes per share, and each share of Preferred Stock converts into 160 shares of Common Stock. Westmont estimated the fair value to total $30.00 and charged this amount as compensation expense.

On May 11, 2010, Westmont issued Forty Thousand 40,000 shares of Series A Preferred Stock to F&M Inc. for services provided to the Company. These shares of Preferred Stock have 160 votes per share, and each share of Preferred Stock converts into 160 shares of Common Stock. Westmont estimated the fair value to total $40 and charged this amount as compensation expense.

On May 11, 2010, Westmont issued Thirty Million 30,000,000 shares of Common Stock to the below listed organizations for services provided to the Company. These shares of Common Stock have 1 vote per share. Westmont estimated the fair value to total $30,000 and charged this amount as compensation expense.

|

·

|

0692545 BC LTD

|

2,609,666 Common Shares

|

|

·

|

Bogat Family Trust

|

2,609,666 Common Shares

|

|

·

|

Harpreet Hayer

|

2,609,666 Common Shares

|

|

·

|

F&M Inc.

|

22,171,002 Common Shares

|

PURCHASES OF EQUITY SECURITIES

None.

ITEM 6. SELECTED FINANCIAL DATA

Not Applicable

17

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

PLAN OF OPERATION

Our plan of operation is to conduct re-working and re-entry program on the 92 wells associated with the Scott-Morgan 1 project currently under contract for purchase from the Domestic Energy Corporation in order to place these wells back into production and establish a positive cashflow at the earliest time frame. Our future plan of operation for the twelve months following the date of this annual report is to complete the acquisition of the 92 wells and start the first phase of the exploration program on our project consisting of the repair of equipment and wells to place the wells back into a minimal production plan.

Total expenditures over the next 12 months are therefore expected to be approximately $525,000, which is approximately 10% of the amount to be raised by private placement and our cash on hand. If we experience a shortage of funds prior to funding we may utilize funds from our majority shareholder, who has formally agreed to advance funds to allow us to pay for offering costs, filing fees, professional fees, initial well and equipment repair. The Avalon Group Ltd has signed a formal commitment letter and arrangement to advance or loan funds to the company on a Libor +2% compounded interest rate to a maximum of $1,000,000. If we are successful in raising the funds from this offering, we plan to commence Phase I of the program on the project claim in the fall of 2010. We expect these phases to take 6 months to complete. Subject to financing, we anticipate commencing Phase II of our re-development program in spring of 2010.

RESULTS OF OPERATIONS

As of May 31, 2010, we had cash on hand of $1 and a working capital deficit of $768,097. Westmont Resources Inc, has a current rolling line of credit for $1.1M with The Avalon Group Ltd. of Netanya, Israel, of which approximately $357,216 has been draw down on the LOC. Utilizing the remaining balance of the LOC, Westmont has sufficient working capital to pay for the anticipated costs of $325,000 for Phase I of our exploration program and meet the anticipated costs of operating our business for the next twelve months. Financial projections are based on the financial commitment arrangement made with the Avalon Group Ltd our largest beneficial shareholder. We anticipate that we will incur the following expenses over the next twelve months:

PLANNED EXPENDITURES OVER NEXT 12 MONTHS

|

Category

|

Planned Expenditures Over

The Next 12 Months (US$)

|

|||

|

Legal and Accounting Fees

|

$ | 25,000. | ||

|

Office Expenses

|

$ | 3,500. | ||

|

Oil & Gas Property Exploration Expenses

|

$ | 325,000. | ||

|

Travel Expenses

|

$ | 55,000. | ||

|

TOTAL

|

$ | 408,500. | ||

SUMMARY OF YEAR END RESULTS

|

Percentage

|

||||||||||||

|

Year Ended May 31

|

Increase /

|

|||||||||||

|

2010

|

2009

|

(Decrease)

|

||||||||||

|

Expenses

|

||||||||||||

|

General and Administrative

|

367,718 | 122,435 | (199 | %) | ||||||||

|

Acquisition Costs

|

- | 410,396 | (100 | %) | ||||||||

|

Total Operating Expenses

|

367,718 | 532,831 | ||||||||||

|

Deconsolidation

|

33,192 | |||||||||||

|

Interest Expenses

|

46,203 | 14,094 | (228 | %) | ||||||||

|

Net Loss

|

(447,113 | ) | (546,925 | ) | 19 | % | ||||||

18

REVENUES

We have not earned any revenues to date. We anticipate earning revenues starting in the 2nd Quarter of the 2011 fiscal year upon enter into commercial production of our proposed oil and gas properties.

EXPENSES

The major components of our operating expenses are outlined in the table below:

|

Percentage

|

||||||||||||

|

Year Ended May 31

|

Increase /

|

|||||||||||

|

2010

|

2009

|

(Decrease)

|

||||||||||

|

Accounting and Audit Fees

|

51,156 | 17,028 | 200 | % | ||||||||

|

Acquisition cost

|

- | 410,396 | (100 | %) | ||||||||

|

Filing and Transfer agent

|

21,655 | 9,253 | 134 | % | ||||||||

|

Legal

|

54,187 | 19,290 | 181 | % | ||||||||

|

Licenses and Permits

|

129,289 | 0 | n/a | |||||||||

|

Management Services

|

45,825 | 17,000 | 170 | % | ||||||||

|

Mineral Property Exploration Costs

|

0 | 0 | n/a | |||||||||

|

Office and Sundry

|

30,364 | 7,077 | 329 | % | ||||||||

|

Software and Programming

|

0 | 39,128 | n/a | |||||||||

|

Rent

|

20,830 | 8,979 | 132 | % | ||||||||

|

Travel and Promotion

|

12,944 | 4,680 | 177 | % | ||||||||

|

Total Operating Expenses

|

367,718 | 532,831 | 25 | % | ||||||||

The increases in general expenses are primarily a result of the planned acquisition of the 70% working interest in the 92 oil and natural gas wells located in Tennessee from Domestic Energy Corporation.

We anticipate our operating expenses will increase significantly as we proceed with our exploration and operations program associated with this acquisition.

LIQUIDITY AND FINANCIAL CONDITION

Working Capital

|

Percentage

|

||||||||||||

|

At May 31, 2010

|

At May 31, 2009

|

Increase / (Decrease)

|

||||||||||

|

Current Assets

|

1 | 10,465 | 99.99 | % | ||||||||

|

Current Liabilities

|

(768,098 | ) | (654,781 | ) | (26.58 | %) | ||||||

| (768,097 | ) | (644,316 | ) | (28.64 | %) | |||||||

Cash Flow

|

Year Ended May 31

|

Percentage

|

|||||||||||

|

Increase /

|

||||||||||||

|

2010

|

2009

|

(Decrease)

|

||||||||||

|

Cash Flows Provided by (Used in) Operating Activities

|

(348,612 | ) | (41,523 | ) | (761 | %) | ||||||

|

Cash Flows From (Used in) Financing Activities

|

348,467 | 41,636 | (758 | %) | ||||||||

|

Net Increase (Decrease) in Cash During Period

|

145 | 113 | 228 | % | ||||||||

19

The decreases in our working capital deficit at May 31, 2010 from our year ended May 31, 2009, and the increase in our cash used during the year ended on May 31, 2010, from the preceding fiscal year are primarily a result of the increases in general expenses are primarily a result of the proposed acquisition of the 70% working interest in the 92 oil and natural gas wells located in Tennessee from Domestic Energy Corporation.

Since our inception, we have used our common stock and loan financing from our shareholders to raise money for our operations and for our property acquisitions. When necessary, we have also relied on advances from our largest beneficial shareholder the Avalon Group Ltd. We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation. For these reasons, our auditors stated in their report to our audited financial statements for the fiscal year ended May 31, 2010 that there is substantial doubt that we will be able to continue as a going concern.

We anticipate continuing to rely on equity sales of our common stock and loans from the Avalon Group Ltd in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing stockholders. There is no assurance that we will achieve any of additional sales of our equity securities. However, there are no assurances that the Avalon Group Ltd will be willing to advance us additional funds in the future. There are no assurances that we will be able to arrange for other debt or other financing to fund our planned business activities.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

CRITICAL ACCOUNTING POLICIES

We have identified certain accounting policies, described below, that are most important to the portrayal of our current financial condition and results of operations. Our significant accounting policies are disclosed in the notes to the audited financial statements included in this Annual Report.

Exploration expenditures

We follow a policy of capitalizing mineral property acquisition costs and expensing mineral property exploration expenditures until a production decision in respect of the project and we are reasonably assured that it will receive regulatory approval to permit mining operations, which may include the receipt of a legally binding project approval certificate.

Management periodically reviews the carrying value of its investments in mineral leases and claims with internal and external mining related professionals. A decision to abandon, reduce or expand a specific project is based upon many factors including general and specific assessments of mineral deposits, anticipated future mineral prices, anticipated future costs of exploring, developing and operating a production mine, the expiration term and ongoing expenses of maintaining mineral properties and the general likelihood that we will continue exploration on such project. We do not set a pre-determined holding period for properties with unproven deposits, however, properties which have not demonstrated suitable metal concentrations at the conclusion of each phase of an exploration program are reevaluated to determine if future exploration is warranted, whether there has been any impairment in value and that their carrying values are appropriate.

If an area of interest is abandoned or it is determined that its carrying value cannot be supported by future production or sale, the related costs are charged against operations in the year of abandonment or determination of value. The amounts recorded as mineral leases and claims represent costs to date and do not necessarily reflect present or future values.

Our exploration activities and proposed mine development are subject to various laws and regulations governing the protection of the environment. These laws are continually changing, generally becoming more restrictive. We have made, and expect to make in the future, expenditures to comply with such laws and regulations.

20

The accumulated costs of properties that are developed on the stage of commercial production will be amortized to operations through unit-of-production depletion.

Impairment of Assets

Long-lived assets or assets with no amortization, including intangibles, are reviewed for impairment whenever events or changes in circumstance indicate that the carrying amount may not be recoverable. At a minimum, the assets are evaluated annually. The evaluation of recoverability is performed using undiscounted estimated net cash flows generated by the related asset. If an asset is deemed to be impaired, the amount of impairment is determined as the amount by which the net carrying value exceeds discounted estimated net cash flows. There was no impairment loss for the years ended May 31, 2010 or 2009.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

21

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

Westmont Resources Inc.

(An Exploration Stage Company)

Index

|

·

|

Report of Independent Registered Public Accounting Firm;

|

F-1

|

|

·

|

Consolidated Balance Sheets as of May 31, 2010 and 2009;

|

F-2

|

|

·

|

Consolidated Statements of Expenses for the years ended May 31, 2010 and 2009 and for the period from inception on November 16, 2004 to May 31, 2010;

|

F-3

|

|

·

|

Consolidated Statements of Cash Flows for the years ended May 31, 2010 and 2009 and for the period from inception on November 16, 2004 to May 31, 2010;

|

F-4

|

|

·

|