Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Chaparral Energy, Inc. | d8k.htm |

$300mm Senior Notes due 2020

September 2010

$300mm Senior Notes due 2020

September 2010

Exhibit 99.1 |

Company information

Company information

2

2

701 Cedar Lake Blvd.

Oklahoma City, Oklahoma 73114

Phone: 405.478.8770

Fax: 405.478.1947

www.chaparralenergy.com

This presentation contains "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements are subject to

certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Among those risks, trends

and uncertainties are our ability to find oil and natural gas reserves

that are economically recoverable, the volatility of oil and natural gas prices and significantly depressed natural gas prices since

the middle of 2008, the uncertain economic conditions in the United

States and globally, the decline in the values of our properties that have resulted in and may in the future result in additional

ceiling test write-downs, our ability to replace reserves and sustain

production, our estimate of the sufficiency of our existing capital sources, our ability to raise additional capital to fund cash

requirements for future operations, the uncertainties involved in

prospect development and property acquisitions or dispositions and in projecting future rates of production or future reserves, the

timing of development expenditures and drilling of wells, hurricanes and

other natural disasters, including the impact of the oil spill in the Gulf of Mexico on our present and future operations, the

impact of government regulation, and the operating hazards attendant to

the oil and natural gas business. In particular, careful consideration should be given to cautionary statements made in the

various reports we have filed with the Securities and Exchange

Commission. We undertake no duty to update or revise these forward-looking statements. |

3

3

Presenters

Presenters

Joe Evans, Chief Financial Officer

& Executive Vice President

Mark Fischer, Chief Executive Officer

& President |

4

4

Sources and uses and pro forma capitalization

Sources and uses and pro forma capitalization

Sources

Uses

New senior unsecured notes

$300.0

Repay revolver

$172.0

Cash to balance sheet

121.0

Estimated fees and expenses

7.0

Total sources

$300.0

Total uses

$300.0

Capitalization as of June 30, 2010 ($ millions)

Existing

Pro forma

% of cap.

xLTM

Adj. EBITDA

Cash and cash equivalents

$16.0

$137.0

--

--

Senior secured revolving credit facility due 2014

172.0

--

--

--

Other installment notes and capital leases

20.5

20.5

1.5%

0.1x

Total senior secured debt

192.5

20.5

1.5%

0.1x

8.500% senior unsecured notes due 2015

325.0

325.0

24.3%

1.3x

8.875% senior unsecured notes due 2017

323.0

323.0

24.2%

1.2x

New senior unsecured notes due 2020

--

300.0

22.5%

1.1x

Total debt

$840.5

$968.5

72.5%

3.7x

Net debt

824.5

831.5

62.2%

3.2x

Book value of equity

367.3

367.3

27.5%

1.4x

Total book capitalization

$1,207.8

$1,335.8

100.0%

5.1x

Debt/Reserves ($/Boe)

$5.92

$6.83

Debt/Proved developed reserves ($/Boe)

$8.95

$10.31

Net Debt/Reserves ($/Boe)

$5.81

$5.85

Net Debt/Proved developed reserves ($/Boe)

$8.78

$8.86

Liquidity:

Borrowing base

$450.0

$375.0

Plus: cash

16.0

137.0

Less: revolver drawn(and LC’s)

(173.9)

(1.9)

Total liquidity

$292.1

$510.1

1

As of 6/30/2010; source: 10-Q

2

Based on LTM 6/30/2010 Adjusted EBITDA of $263.0mm

1

2 |

Key

Transformational Events Key Transformational Events

5

5 |

CCMP’s

investment enhances Chaparral’s

position to execute its growth strategy

CCMP’s

investment enhances Chaparral’s

position to execute its growth strategy

Key Transformational Event

On April 12, 2010, Chaparral completed a $325 million private equity common stock

investment

in

the

company

–

from

CCMP

Capital

Advisors

The above transaction combined with the proposed offering will result in:

Significant liquidity

Improved financial flexibility & stability

Financial capacity to execute on Chaparral’s operational plan

Executive Summary: Private Equity

6

6

¹Based on 12/31/2009 SEC Reserves

Credit Statistics

12/31/2009

6/30/2010 Post-CCMP

Investment

Total Leverage (“TL”) ($mm)

$1,177.0

$840.5

TL / Proved Reserves ($/BOE)¹

$8.29

$5.92

TL / Proved Developed Reserves ($/BOE)¹

$12.53

$8.95

TL / LTM EBITDAX (x)

5.3x

3.2x

Liquidity ($mm)

$76.6

$292.1 |

CCMP

Capital – Leading Equity Sponsor

CCMP Capital –

Leading Equity Sponsor

CCMP and its predecessor firm (JP Morgan

Partners) have been leading private equity

sponsors since 1984

CCMP currently manages $7.2 billion in assets

across a broad portfolio of companies in

Energy as well as Media, Consumer / Retail,

Industrial and Healthcare

CCMP’s proprietary operating capabilities

enable management teams to drive

operational efficiency, growth and profitability

CCMP appointed partners Karl Kurz (former

COO of Anadarko Petroleum) and Chris

Behrens to the board

Past Energy Investments:

Latigo Petroleum

Bill Barrett Corporation

Encore Acquisition

Carrizo Oil and Gas

Patina Oil and Gas

CCMP Capital

Karl Kurz

7

7

Karl Kurz is a Managing Director in the

Houston office of CCMP Capital and a

member of the firm’s Investment Committee.

Before joining CCMP in 2009, he was Chief

Operating Officer of Anadarko Petroleum

Corporation, where he oversaw the

Company’s global exploration and production,

marketing, midstream, land, technology and

services.

He was a member of the Company’s Executive

Committee from 2004 to 2009.

Chris Behrens

Chris Behrens is Managing Director in the New

York office of CCMP Capital and a member of

the firm’s Investment Committee.

Since joining CCMP in 1994, Chris has

overseen the firm’s E&P and energy investing.

|

Governance based on a partnership approach to

development/growth of the Company

Governance based on a partnership approach to

development/growth of the Company

Ownership

Fischer

Investments

-

25.54%

Altoma

energy –

14.98%

Chesapeake Energy –

19.98%

CCMP

Advisors

–

35.98%

Employees

-

3.52%

(includes

MAF

at

1.08%)

CCMP

Approval

Rights

include:

Incur or refinance indebtedness in excess of

$100 million in any year

Approval of Annual Budget and Capex

in excess

of cash flow and material deviations

Mergers and acquisitions over $100 million/year

Material changes to senior management

Issue equity outside of a Demand IPO

Distribute dividends

Enter a new business

Right to require sale of the Company after 6 yrs

8

8

Mark A. Fischer

25.5%

CCMP Capital

Advisors

36.0%

Altoma

Energy G.P.

15.0%

Employee

Ownership

3.5%

CHK Holdings,

L.L.C.

20.0%

Ownership Summary

Chaparral Rights

Operational control over expenditures within

cash flow

Demand IPO after 18 months if value exceeds

1.75x CCMP purchase price

Right to make acquisitions up to $100 million

Blocking right on sale of Company for 6 years |

Business Update

Business Update

9

9 |

Chaparral’s strategy is focused on capital efficiency,

operational improvement and production growth

Chaparral’s strategy is focused on capital efficiency,

operational improvement and production growth

Over

the past few months, Chaparral has begun executing on its operational

objectives: Prioritized and accelerated conventional drilling program

Increased focus on EOR planning and development strategies and securing additional

CO

2

supply

Increased production growth rate

Executed on tuck-in acquisitions where Chaparral can enhance operations,

production and reserves

Management continued to focus on risk management through hedges

Executive Summary: Strategy

10

10 |

Chaparral’s assets provide stability, predictability

and growth potential

Chaparral’s assets provide stability, predictability

and growth potential

Chaparral’s proved reserves are oil-weighted

Chaparral’s proved reserves are 63% crude oil and 37% natural gas

Long-lived assets with predictable cash flow profile

Company has an R/P of 18.6 years

Large, focused asset base with attractive play-level economics

90% of Chaparral’s proved reserves are in the Mid-Continent and Permian

Basins with 8.8% decline rate from 2010 to 2023

14% of Chaparral’s proved reserves are from low risk Enhanced Oil Recovery

(EOR) Program

Significant near term growth potential from developmental drilling

Executive Summary: Assets Overview

11

11

* Based on 12/31/2009 SEC reserves and 2009 production

|

12

12

Operating Areas

Operating Areas

As of December 31, 2009 (SEC)

Core Area

Growth Area

Acreage

Field Offices

Headquarters

North Texas

Reserves: 2.4 MMBoe, 2% of total

Production: 0.4 Mboe/d, 2% of total

Acreage (gross / net): 26,254 / 18,360

Permian Basin

Reserves: 16.2 MMBoe, 11% of total

Production: 4.4 Mboe/d, 21% of total

Acreage (gross / net): 90,063 / 66,285

Rocky Mountains

Reserves: 2.2 MMBoe, 1% of total

Production: 0.4 MBoe/d, 2% of total

Acreage (gross / net): 52,088 / 18,532

Company Total

December

2009

proved

reserves

–

142

MMBoe

2009

average

daily

production

–

21

MBoe/d

Acreage (gross / net): 1,248,929 / 620,557

Gulf Coast

Reserves: 6.8 MMBoe, 5% of total

Production: 1.3 MBoe/d, 6% of total

Acreage (gross / net): 98,902 / 63,367

Mid-Continent

Reserves: 111.6 MMBoe, 79% of total

Production: 13.7 MBoe/d, 66% of total

Acreage (gross / net): 959,256 / 443,907

Ark-La-Tex

Reserves: 2.7 MMBoe, 2% of total

Production: 0.7 MBoe/d, 3% of total

Acreage (gross / net): 22,366 / 10,106

Val Verde

Basin

Sabine

Uplift

Midland

Basin

Delaware

Basin

Ouachita

Uplift

Arkoma

Basin

Fort

Worth

Basin

Williston

Basin

Powder

River

Basin

Greater

Green

River

Basin

San

Juan

Basin

Anadarko

Woodford

Basin

OKC |

Strong Record of Reserve and Production Growth

Strong Record of Reserve and Production Growth

Year-End SEC Reserves (MMBoe)

(1)(2)

141466

51

73

103

151

164

113

0

25

50

75

100

125

150

175

2003

2004

2005

2006

2007

2008

2009

2003 –

2009 CAGR = 19%

Annual Production (MMBoe)

2.6

3.2

4.2

5.4

6.8

7.1

7.6

8.2

0

2

4

6

8

10

12

2003

2004

2005

2006

2007

2008

2009

2010E

2003 –

2009 CAGR = 20%

142

Note:

1)Reserves

as

of

December

31,

2008

are

based

on

flat

SEC

pricing

of

$44.60/Bbl

and

$5.62.Mcf

2)Reserves

as

of

December

31,

2009

are

based

on

flat

SEC

pricing

of

$61.18/Bbl

and

$3.87/Mcf

Chaparral’s reserve replacement ratio has averaged 514% per year since

2002 13

13 |

PV-10 Value ($Billions)

Reserve Price Sensitivity

Reserve Price Sensitivity

Note:

1) New

SEC

pricing

method

-

$61.18

oil

and

$3.87

gas

2) Old

SEC

pricing

method

-

$79.36

oil

and

$5.79

gas

3) 01/14/2010

Nymex

Strip

–

Avg

14

14

December 31, 2009 Reserves (MMBoe)

0

50

100

150

200

New SEC

Pricing Method

Old SEC

Pricing Method

Flat Pricing

$60 and $6

01/14/2010

Nymex Strip

PD

PUD

142

158

153

161

$0.0

$1.0

$2.0

$3.0

New SEC

Pricing Method

Old SEC

Pricing Method

Flat Pricing

$60 and $6

01/14/2010

Nymex Strip

PD

PUD

$1.3

$2.2

$1.6

$2.7 |

Stable Base and Growth Potential

Stable Base and Growth Potential

Stable Producing Base

Long-lived reserve base

•

8.8% projected annual

decline in PDP production

from

2010

to

2023

(1)

63% oil concentration (SEC

pricing)

66% proved developed

reserves

86% of proved reserves

operated

76% of PDP production

hedged over the next 16

months to stabilize cash flow

Highly diversified production

across fields (8,174 wells)

Note:

1)

Percent

decline

is

average

annual

decline

rate

of

PDP

production

from

third-party

reserve

reports

Low-Risk Long-Term

Upside

Significant Near-Term

Growth

213 MMbo

potentially

recoverable through EOR

properties

Reserve

growth

through

CO

2

infrastructure

Woodford Shale

developments

3,485 identified additional

potential drilling locations

16-year inventory of drilling

locations at 2010 drilling rate

of 299 wells (150 operated

wells and 149 outside

operated wells)

299

wells

planned

for

2010

with

expected

net

exit

rate

production

of

6.9

MBoepd

Low-risk

infill

or

step-out

wells

(99%

success

rate

in

2007-

2009)

1,333 identified proved

undeveloped

drilling

locations

•

Primarily focused on the

Mid-Continent

region

with

1,061 locations

Undeveloped

acreage:

84,396

net acres

15

15 |

16

16

Capital Budget

Capital Budget

Component

2006

2007

2008

2009

2010

Forecast

2010 -

%

Drilling

134

121

176

83

171

55%

Enhancements

31

44

55

35

27

9%

Acquisitions

(2)

489

50

46

18

46

15%

Tertiary

Recovery

13

15

25

15

66

21%

Total

667

230

302

151

310

100%

Note:

(1) Includes allocation of capitalized general and administrative

costs (2) 2006 Includes major acquisition of Calumet Oil Company

2010E Oil and Gas Capital Expenditures

2010E Drilling CAPEX by Major Plays ($MM)

Conventional Drilling

EOR Drilling

Oil

&

Gas

Capital

Expenditures

($MM)

(1)

Drilling

EOR

Enhancements

Acquisitions

Mid-Continent

Other

Gulf Coast

Permian

Basin

63%

12%

15%

18%

7%

9%

55%

21% |

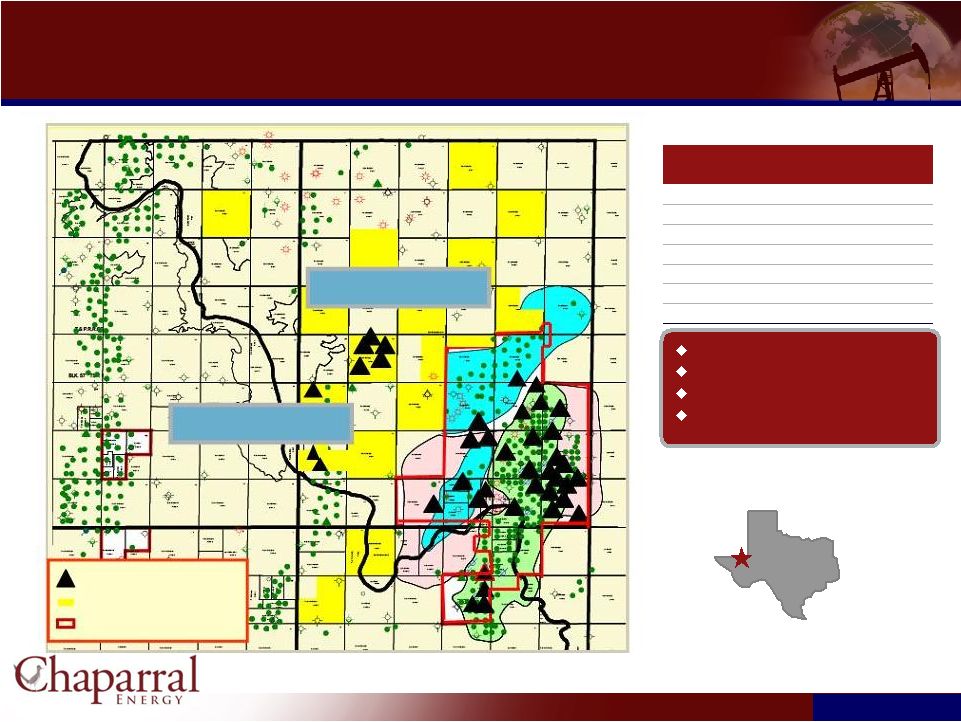

Cleveland Sand Play

Cleveland Sand Play

Ellis County Area

Horizontal drilling

Tight sand play

Depth:

7,900

–

9,700

feet

Scheduled to drill 16 wells in

2010

8

operated,

avg

WI

98%

8

non-op,

avg

WI

5%

Aledo-Bray Area

Gilson 2H-24, Chap Op with 100% WI

1.8 MMcf/d, 240 BOPD

State A 6H-36, Chap Op with 100% WI

2.8 MMcf/d, 250 BOPD

Bray #3-4H Chap Op 98%

IP 3.2 MMcf/d, 320 BOPD

Play Statistics

Gross reserves / well (MMboe):

0.2 –

0.4

Gross CapEx

/ well ($MM):

$3.5 -

$5.4

Chaparral net acres:

9,000

Avg

working interest:

66%

Potential drill locations:

89

ROR

39%

ROI

2.8

Robertson #3-34H Chap Op 100% WI

Recently completed

Bray #4-4H Chap Op 98% WI

Milton #3H-26 Recently Completed

Recently Drilled Wells

Proposed Wells

Sections w/Chap Interests

Robertson #4-34H Chap Op 100% WI

Recently completed

17

17 |

18

18

(2)

Granite Wash Play

Granite Wash Play

Stiles Ranch Area

Colony Wash Area

Play Statistics

Gross reserves / well (MMboe):

0.7 –

1.3

Gross CapEx

/ well ($MM):

$6.4

Chaparral net acres:

12,634

Horizontal Drilling Depth

12,500’-14,500’

Potential drill locations:

46

Scheduled to drill 10 wells in 2010

ROR

41.9%

ROI

2.5

18

18 |

North Burbank Unit

South Burbank Unit

FEET

0

12,441

PETRA 1/18/2010 4:24:50 PM

Osage And Creek Counties, OK

Osage And Creek Counties, OK

Osage County, OK

West Fairfax Chat

Play Statistics

Gross reserves / well (MMBoe):

0.1

Gross CapEx / well ($MM):

$.4

Chaparral net acres:

66,380

Avg working interest:

99.5%

Potential drill locations:

293

ROR

70%

ROI

3.2

Held by production

Leasehold

FEET

0

2,643

PETRA 1/18/2010 4:37:45 PM

SBU Area Burbank & Chat

FEET

0

1,471

19

19

Formations: Burbank, Miss. Chat

Producing Depth: 3,000 feet

1 company rig currently running

Scheduled to drill 55 operated wells in

2010 |

Tunstill

Field Play

Tunstill

Field Play

Play Statistics

Gross reserves / well (MMBoe):

0.1

Gross CapEx

/ well ($MM):

$0.9

Chaparral net acres:

20,440

Avg

working interest:

100%

Potential drill locations:

253

ROR

41.3%

ROI

2.5

20

20

Delaware Basin

Multi-pay environment

Depth: 3200-5400 feet

Scheduled to drill 15 operated wells

in 2010

Loving Co.

Reeves Co.

Recently

Drilled

Locations

Farm-In

Acreage:

10,920

acres

Existing

Acreage:

9.400

acres

BELL CANYON SAND

CHERRY CANYON SAND |

Haley

Play Area Haley Play Area

Bowdle

47-2, Chap Op & 98% WI

TD: 3Q08, IP 18.8 MMcfe/d

Haley 36-4, Chap Op, 91% WI, IP Aug ’06

IP: 8.1 MMcfe/d

Bowdle

47-4, Chap Op & 98% WI

TD: 1Q10, IP 18.0 MMcfe/d

Deep Drilling Locations

Drilling or Recent Completions

Chaparral Acreage

Atoka and Morrow Play

(17,500’

depth)

Expensive wells

High production rates

Large reserve potential

Haley 36-5, Chap op, 78% WI,

Next proposed location

Play Statistics

Atoka

Morrow

Gross reserves / well (MMBoe):

1.5

Gross CapEx

/ well ($MM):

$10.5

Chaparral net acres:

2,605

Avg

working interest:

78%

2010 Scheduled drill locations: (Operated)

1

ROR

22%

ROI

3.3

21

21 |

Bone

Spring Play Bone Spring Play

22

22

Play Economics

(1)

200

–

400

MBoe

gross

per

well

Reservoir

depths

of

6,000’

to

13,500’

Completed well costs: $3

–

$5 million

Recent Industry Bone Springs Gross IPs

So. Calif. 29 Fed 15H:

1,100 Boe/d

Parkway St 17 Com 2H:

970 Boe/d

Blacktip

Johnson 1-39H:

872 Boe/d

Parkway St 14 Com 3H:

760 Boe/d

W. Shugart

31

3H: 560 Boe/d

Note: 1) Play economics sourced from Concho August 2010 presentation

Chaparral Acreage

Industry Completed Horizontal Wells

Industry Completed Vertical Wells |

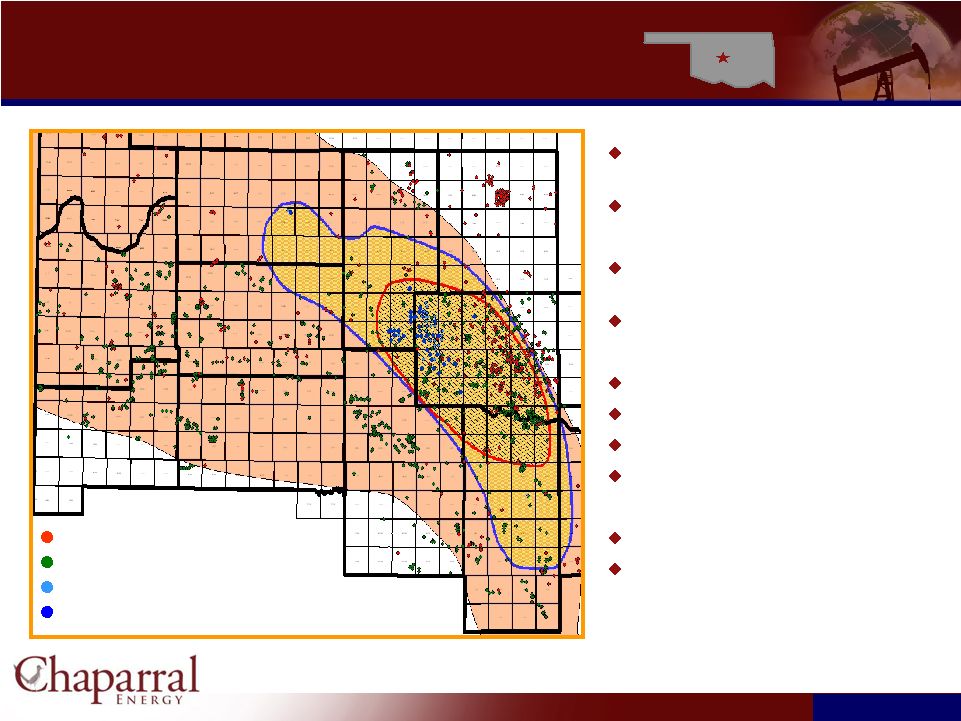

Anadarko Basin -

Woodford Shale

Anadarko Basin -

Woodford Shale

Chaparral Operated Wells

Chaparral Non-Operated Wells

Industry Recently Permitted or Currently Drilling Locations

Industry Completed Woodford Horizontal Wells

Ellis

Blaine

Dewey

Kingfisher

Grady

Caddo

Washita

Beckham

Roger Mills

Custer

Canadian

Chaparral’s Acreage

21,183 (+/-) net acres held by

production (HBP), 1,087 non-producing acres

Potential drilling locations 682 (160 net)

Play Economics

(1)

6.5

–

8.5

Bcfe

gross

per

well

with

4,000 foot lateral

Completed

well

costs:

$7

–

$9

million

Recent Industry Woodford Gross Ips

Kurtz 1-14H:

8.4 MMcfe/d

Guinn 1

–

10H:

7.1 MMcfe/d

Nuckols

1-31H:

6.4 MMcfe/d

Young 2-22H:

6.8 MMcfe/d

Drilling Activity

Expect to drill 1 operated well in 2010

Expect to drill 6 non-operated wells in 2010

23

23

Note: 1) Play economics sourced from Cimarex June 2010

presentation |

Enhanced Oil Recovery Opportunities

Enhanced Oil Recovery Opportunities

Chaparral

utilizes

CO

2

and

polymer

EOR

techniques

CO

2

EOR

involves

injection

of

CO

2

and

water

to

enhance

hydrocarbon

mobility to drive hydrocarbons to wells

Polymer EOR improves areal sweep efficiency and minimizes channeling

The Oil is There

-

U.S. Oil -

24

24 |

CO

2

EOR Focused Areas

CO

2

EOR Focused Areas

CO

2

project inventory

82 units with 1P, 2P & 3P EOR reserves

9 units with proved reserves

10 units with CO

2

injection

CO

2

Infrastructure

380 miles of existing line

49 MMcfe/d of CO2 supply

Includes connecting 12 -

15 MMcf/d

of CO2 from Arkalon

CO

2

Tertiary Recovery Projects

Panhandle Area

Permian Basin

Central

Oklahoma

Area

Burbank

Area

25

25 |

26

26

Currently Owned CO

2

Development Potential and

Infrastructure

Currently Owned CO

2

Development Potential and

Infrastructure

Total OOIP

4,195 MMBO

Primary Production

714 MMBO

Secondary Recovery

638 MMBO

Tertiary Potential

403 MMBO

Net Tertiary Potential

215 MMBO

Existing

CELLC

CO

2

Pipelines

Existing

Third

Party

CO

2

Pipelines

Proposed

CELLC

CO

2

Pipelines

Owned

Active

CO

2

fields

Owned

Potential

CO

2

fields

CO

2

Source

Locations |

Panhandle Area

Panhandle Area

27

27

Total OOIP

709.4 MMBO

Primary Production

73.8 MMBO

Secondary Recovery

116.5 MMBO

Tertiary Potential

73.7 MMBO

Net Tertiary Potential

42.6 MMBO

Existing CELLC CO

Pipelines

Proposed CELLC CO

Pipelines

CO

Pipelines of Others

Panhandle Area

Net Potential: 43 MMBoe, 20% of

total

Number of Projects in Area = 24

Core Projects:

Camrick

Area –

7.0 MMBO (Active)

Farnsworth –

10.4 MMBO

Booker

Area

–

2.0

MMBO

(Active)

RHF

Unit

–

4.0

MMBO

2

2

2 |

Camrick

Area CO

2

Tertiary Recovery

Camrick

Area CO

2

Tertiary Recovery

Consists of three unitized fields

Operated with an average working interest of

54%

CO

2

injection has improved gross production in

Camrick

Area from 175 Bbls/day to 1,950

Bbls/day

Expansion of CO

2

injection operations from 15

MMcfpd

to 25 MMcfpd

has been completed

NW Camrick, Camrick

and Perryton Units: 8/8 Basis

Reservoir

Morrow

Net Acreage

15,200

OOIP (MMBO)

125.6

Primary oil recovery (MMBO)

16.6

Secondary oil recovery (MMBO)

13.9

Estimated tertiary CO

2

recovery (MMBO)

14.4

Beaver & Texas Counties, OK

Lipscomb County, TX

Camrick

Area, OK

Projected and Actual Response

28

28 |

Burbank Area Potential CO

2

Projects

Burbank Area Potential CO

2

Projects

Total OOIP

1,205 MMBO

Primary Production

257 MMBO

Secondary Recovery

199 MMBO

Tertiary Potential

119 MMBO

Net Tertiary Potential

98 MMBO

Burbank Area

Net

Potential:

98

MMBoe,

46%

of

total

Number of Projects in Area= 17

Core Projects:

North

Burbank

Unit

–

71.6

MMBO

South

Burbank

Unit

-

9.5

MMBO

29

29 |

WI

–

99.25%

(operated

property)

Size –

23,080 acres; Depth -

3,000’

Cum.

Rec.

–

317

MMBO

(primary

&

secondary

recovery)

Producing

zone

-

Burbank

reservoir

–

2

zones

Wells -

275 producing, 205 injection, 472 TA.

Upside Potential

Polymer EOR

Phillips instituted polymer EOR Program from 1980-1986 as

pilot area

1,440 acres

Production increased from 500 BOPD to 1,200 BOPD

Shut down in 1986 due to low oil price

Phillips estimated an incremental oil recovery for the

polymer block A, 1,440 acre polymer pilot flood to be 2.36

MMBO

Calumet reinstituted polymer flood on 320 acres; $6MM

cost, 15 well pattern

Return 369 wells to production

History

shows

8

–

15

BOPD

per

well

C02

Enhanced Oil recovery

North Burbank Unit

North Burbank Polymer 57 Project

30

30

Phillips’

Polymer Project

Chaparral

Polymer Pilot |

Central Oklahoma Area

Central Oklahoma Area

31

31

Total OOIP

1,861 MMBO

Primary Production

314 MMBO

Secondary Recovery

252 MMBO

Tertiary Potential

172 MMBO

Net Tertiary Potential

60 MMBO

Existing

CELLC

CO

Pipelines

Central Oklahoma Area

Net Potential: 60 MMBoe, 28% of total

Number of Projects in Area = 33

Core Projects:

Dover -

4.5 MMBO

NW Tecumseh-

2.7 MMBO

EVWB Sims Sand Unit-

.9 MMBO (Active)

NW

Velma

Hoxbar

Unit-

.8

MMBO

(Active)

2 |

Permian Basin Area

Permian Basin Area

32

32

Total OOIP

419.9 MMBO

Primary Production

69.3 MMBO

Secondary Recovery

70.3 MMBO

Tertiary Potential

38.7 MMBO

Net Tertiary Potential

13.6 MMBO

CO

Pipelines

of

Others

Permian Basin

Net Potential: 14 MMBoe, 6% of total

Number of Projects in Area = 14

Core Projects:

West

Goldsmith

Unit

–

3.4

MMBO

West

Dollarhide

Queens

Unit

–

2.6

MMBO

Vinnie

Linker

–

.4

MMBO

2 |

Financial Performance and Credit

Statistics

Financial Performance and Credit

Statistics

33

33 |

$450

Million Senior Secured Credit Facility $450 Million Senior Secured Credit

Facility 34

34

Facility: $450 million Senior Secured

Revolving Credit Facility ($375 million borrowing

base -

Pro forma for Bond Transaction)

Subject to semi-annual borrowing base redetermination

$100 million accordion feature

Maturity:

4 Year term, maturing April 2014

Covenants:

Current Ratio: 1.0 to 1.0

Debt/EBITDA

:

4.5 to 1.0 for annualized periods commencing on April 1, 2010 and ending

on June 30, 2010, September 30, 2010 and December 31, 2010

4.25 to 1.0 for rolling periods ending March 31, 2011, June 30, 2011 and

September 30, 2011; and

4.0 to 1.0 for period ending December 31, 2011 and each rolling period

thereafter |

35

35

Financial Summary

Financial Summary

2009

TTM

06/30/2010

Proforma

2010E

Price

Oil –

Wellhead ($/Bbl)

57.37

71.57

73.33

Gas –

Wellhead ($/Mcf)

3.51

4.25

4.31

NGL –

Wellhead ($/Bbl)

35.38

46.04

51.11

Production (MMBoe)

7.6

7.7

8.2

Oil (MMBbls)

3.5

3.5

3.8

Gas (Bcf)

22.6

22.7

24.1

NGL (MMBbls)

.4

.4

.4

Revenue Including Cash Settled Derivatives ($MM)

348.0

409.4

451.2

Lease Operating Expenses

94.2

94.7

110.9

Production and Ad Valorem Taxes

20.3

24.7

28.4

General

and

Administrative

Expenses

(excludes

noncash

deferred

comp)

22.6

25.8

29.4

Operating Expenses

137.1

145.2

168.7

Interest (Expense)

(90.1)

(87.2)

(82.9)

Other Income / (Expense)

12.7

(1.2)

1.5

EBITDA

224

263

284

Discretionary Cash Flow

134

176

201

Total Capex

(2)

151

210

310

(1)

Note:

1)

2010E includes additional interest from potential $300 million bond

issuance 2)

Includes oil & gas CAPEX and Capitalized G&A. Excludes

Property & Equipment |

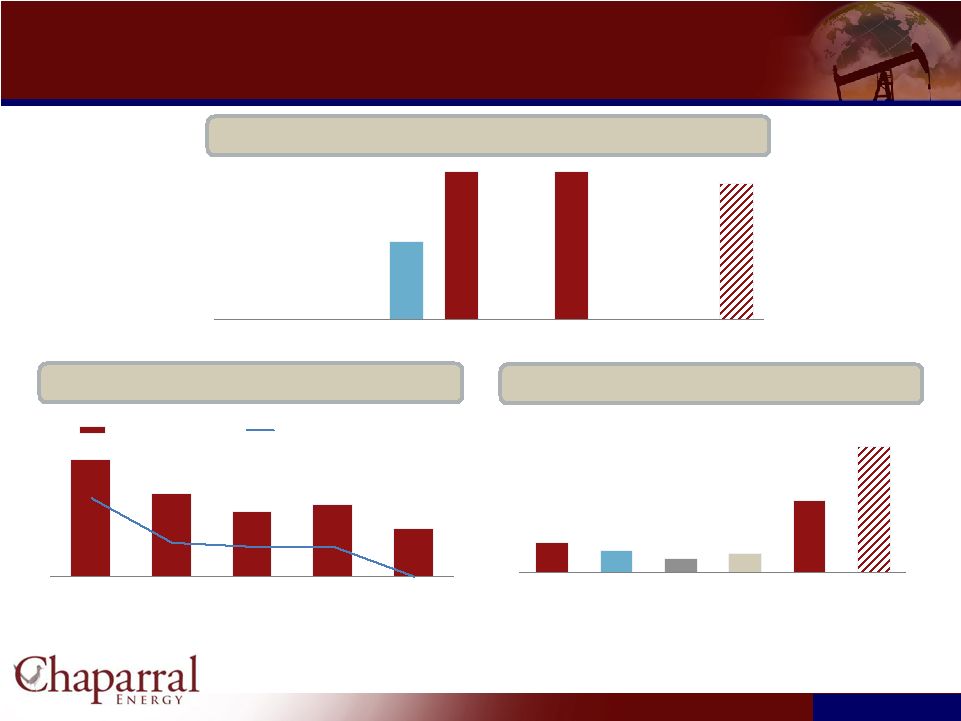

Debt

and Liquidity Debt and Liquidity

Net Debt / EBITDA

Liquidity

36

36

325

325

172

300

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

7.9x

5.6x

4.4x

4.9x

3.2x

5.3x

2.3x

2.0x

2.0x

0.0x

2006

2007

2008

2009

06/30/2010

Proforma

Total net debt to EBITDA

Net secured debt to EBITDA

120.9m

88.0m

55.4m

76.6m

292.1m

510.1m

2006

2007

2008

2009

06/30/2010

06/30/2010

Proforma

Current Maturity Profile ($mm)

(1)

(1) Represents outstanding revolver balance at 06/30/2010. Will be paid off with new

$300 million bond issuance. |

Overview of recent cost improvements

Overview of recent cost improvements

Historical LOE Cost ($/Boe)

Historical Proved Developed F&D Cost

37

37

$13.28

$15.42

$17.05

$12.33

$13.40-

13.75

2006

2007

2008

2009

2010

Guidance

Prioritizing capital and operational efficiency will remain a

key focus

FY’08 to first half of 2010 LOE improved 22.6% to $13.19/Boe

FY’08 to FY’09 Proved Developed F&D cost improved 31% to $15.90/Boe

|

Hedge

Portfolio Hedge Portfolio

Note:

1)

Dollars represent average strike price of hedges (includes all derivative

instruments) Gas Basis Hedges

Price

% Gas

PDP

July-Dec 2010

$0.72

77%

Jan-Dec 2011

$0.67

82%

Jan-Dec 2012

$0.30

46%

$7.34

$68.40

$10.00

$11.53

In 2008 and 2009 -

various derivative

contracts monetized resulting in net

cash proceeds of $144 million

2Q 2010 –

In connection with

execution of new credit facility,

monetized hedges held with banks

exiting credit facility; net cash

payments $545 thousand

June 2010 –

monetized 2012 oil

hedges; net cash proceeds $7.6

million

%

of

Proved

Developed

Producing

Hedged

(As

of

June

30,

2010)

$90.46

38

38 |

$7.37

$7.54

$8.43

$8.71

$8.78

$8.86

$13.34

$13.41

$13.49

$16.92

4.5X

3.8X

3.6X

3.3X

3.2X

3.2X

2.6X

2.0X

1.5X

0.9X

Benchmarking Chaparral’s credit ratios

Benchmarking Chaparral’s credit ratios

39

39

Net Leverage / LTM Adj. EBITDA

Net Leverage / Proved Developed Reserves

($/Boe)

Note:

Balance

sheet

and

income

statement

as

of

6/30/10,

reserves

as

of

12/31/09;

pro

forma

for

announced

M&A

and

capital

market

transactions

(SD

LTM

Adj.

EBITDA

as

of

3/31/10

PF

for

acquisition of ARD)

¹

DNR LTM Adj. EBITDA estimated based on EAC and DNR filings and company presentations

²

Chaparral rating “Corporate Family Rating”

³

Credit rating for bond issuance

Corporate

rating:

Corporate rating:

SD

B2/B+

DNR

Ba3/BB

SFY

B2/B+

BRY

B1/BB-

VQ

B3/B

SGY

B3/B

Antero³

Caa1/B

Chaparral²

B3/B

CWEI

B3/B

SD

B2/B+

DNR

Ba3/BB

SFY

B2/B+

BRY

B1/BB-

VQ

B3/B

SGY

B3/B

Antero³

Caa1/B

Chaparral²

B3/B

CWEI

B3/B |

Key

Investment Considerations Key Investment Considerations

Low-risk, high quality reserves with long-lived production profile

141.9

Mmboe

proved

reserves

as

of

12/31/2009¹

63% crude oil; 66% proved developed

18.6 R/P ratio

Asset concentration (90% of proved reserves) in the Mid-Continent and Permian

Basin Significant upside potential and growth opportunities

Over 1,300 proved undeveloped drilling locations

EOR

activities

ramping

up

with

current

anthropogenic

CO

2

injection

rate

of

approximately

60

Mmcf/d;

existing

ownership

interests

in

380

miles

of

CO

2

pipelines

2010 oil and gas capital budget of $310mm, primarily focused on the

Mid-Continent Strong financial position and liquidity profile

Common equity investment of $325mm by CCMP to reduce leverage

Over $500mm of liquidity adjusted for the proposed transaction

Active hedging program with over 70% of 2011E PD production hedged above $7.00 gas

/ $70.00 oil 40

40

¹Based on 12/31/2009 SEC methodology |