Attached files

1

2010 Barclays Capital

Back-To-School Consumer Conference

Presentation

September 8, 2010

Exhibit 99.2 |

2

Cliff Fleet

Vice President

Investor Relations

Altria Client Services |

3

Safe Harbor Statement

Statements

in

this

presentation

that

are

not

reported

financial

results

or

other

historical

information

are

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

forward-looking

statements

are

based

on

current

plans,

estimates

and

expectations,

and

are

not

guarantees

of

future

performance.

They

are

based

on

management’s

expectations

that

involve

a

number

of

business

risks

and

uncertainties,

any

of

which

could

cause

actual

results

to

differ

materially

from

those

expressed

in

or

implied

by

the

forward-looking

statements.

The

Company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statement

other

than

in

the

normal

course

of

its

public

disclosure

obligations.

The

risks

and

uncertainties

relating

to

the

forward-looking

statements

in

this

presentation

include

those

described

under

the

caption

“Cautionary

Factors

that

May

Affect

Future

Results”

in

the

Company’s

2009

Annual

Report

and

its

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

June

30,

2010.

Reconciliations

of

non-GAAP

measures

included

in

this

presentation

to

the

most

comparable

GAAP

measures

are

shown

at

the

end

of

this

slide

show

presentation

and

are

available

on

the

Company’s

website

at

www.altria.com. |

4

Dave Beran

EVP and

Chief Financial Officer

Altria Group, Inc. |

5

Dave Beran

EVP and Chief Financial Officer, Altria

Craig Johnson

EVP, Altria

Marty Barrington

EVP, Chief Compliance & Administrative

Officer, Altria

Murray Garnick

SVP of Litigation, ALCS

Altria’s Executive Management |

6

Today’s Remarks

Altria’s plans to continue delivering superior shareholder returns

Why we believe Altria continues to be a compelling investment

|

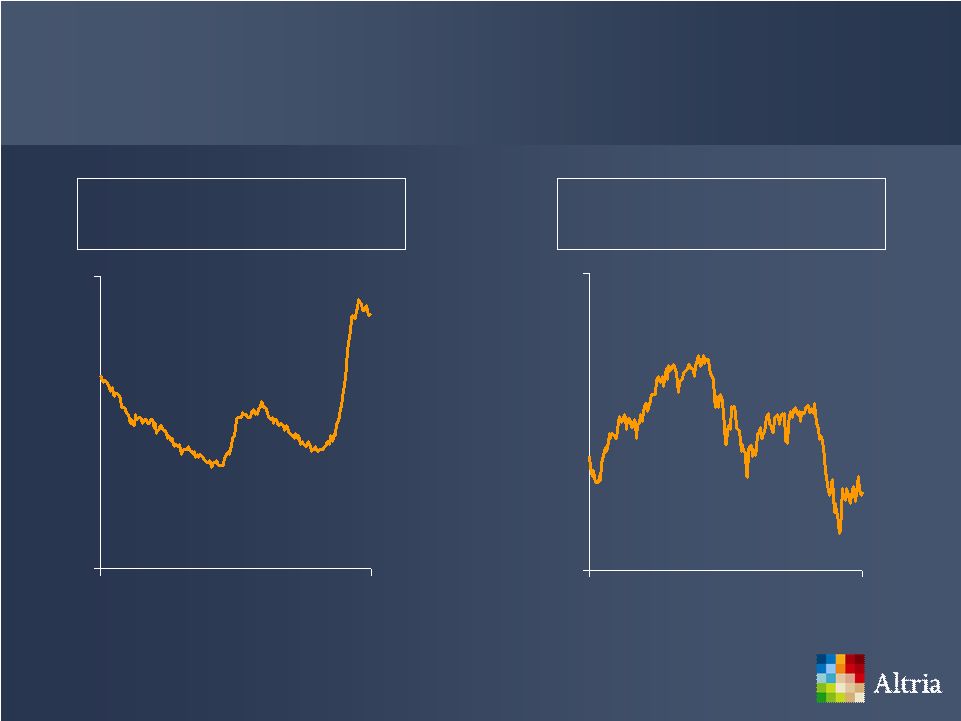

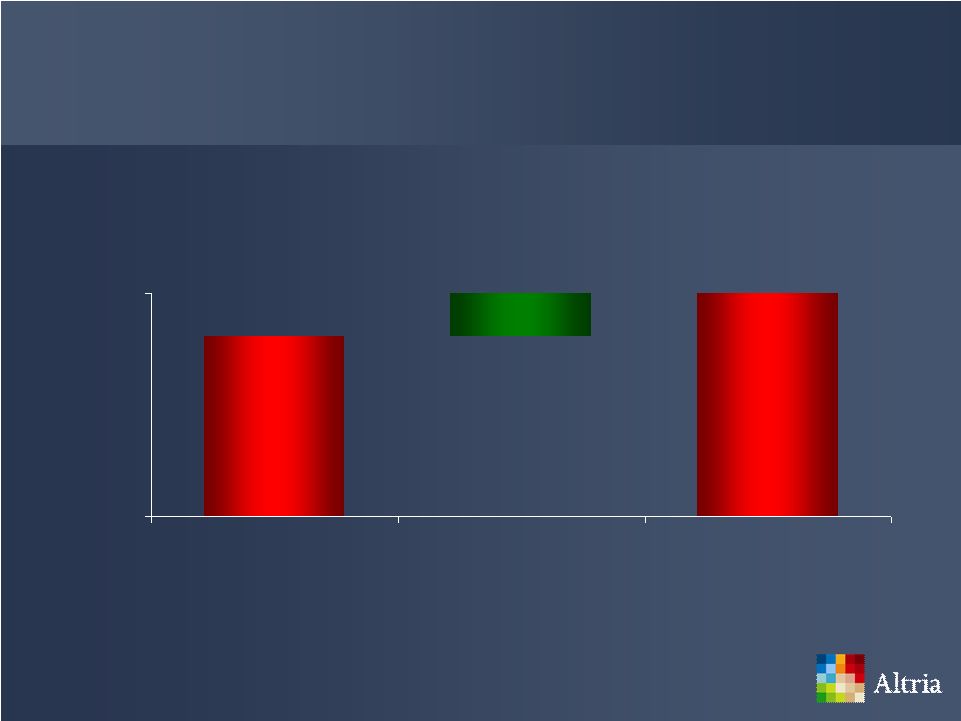

Economic Conditions

Unemployment Rate

Consumer Confidence

54

77

0

200

Jan-93

Aug-10

9.6

7.3

0

11

Jan-93

Aug-10

Source: U.S. Department of Labor Bureau of Labor Statistics. Blue Chip

Economic Indicators: The Conference Board 7 |

8

S&P 500’s Total Shareholder Return

*

* Assumes reinvestment of dividends

(March 28, 2008 –

August 31, 2010)

Source: Bloomberg; 2010 YTD through Aug 31, 2010; Post PMI Spin-off Mar 28, 2008

vs. Aug 31, 2010 (4.6%)

(36.6%)

(15.6%)

25.9%

2008

2009

2010 YTD

Post PMI spin-off |

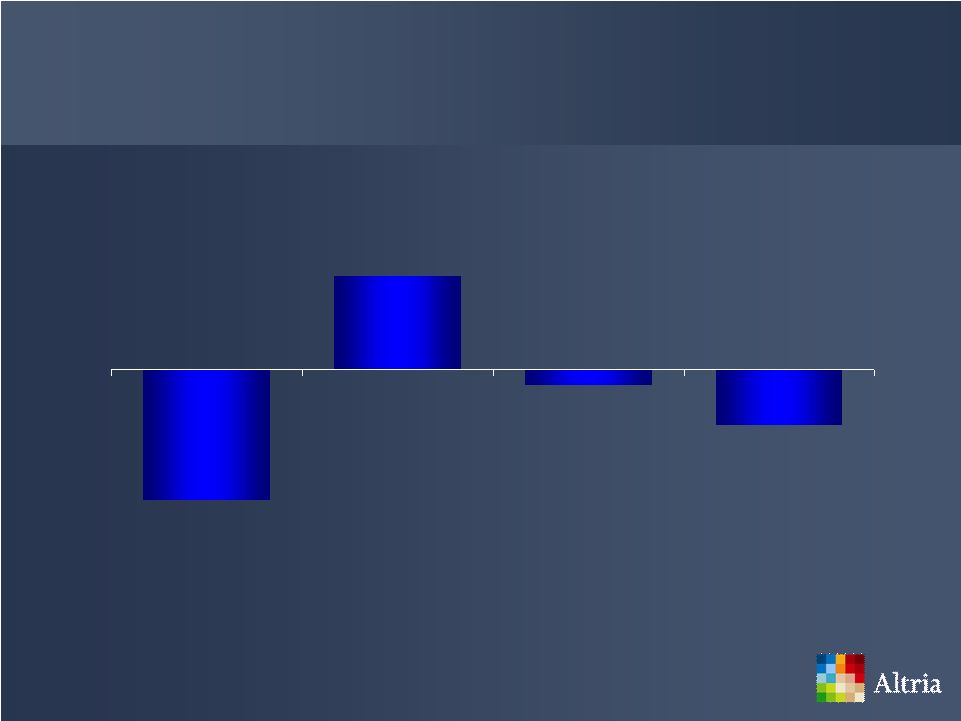

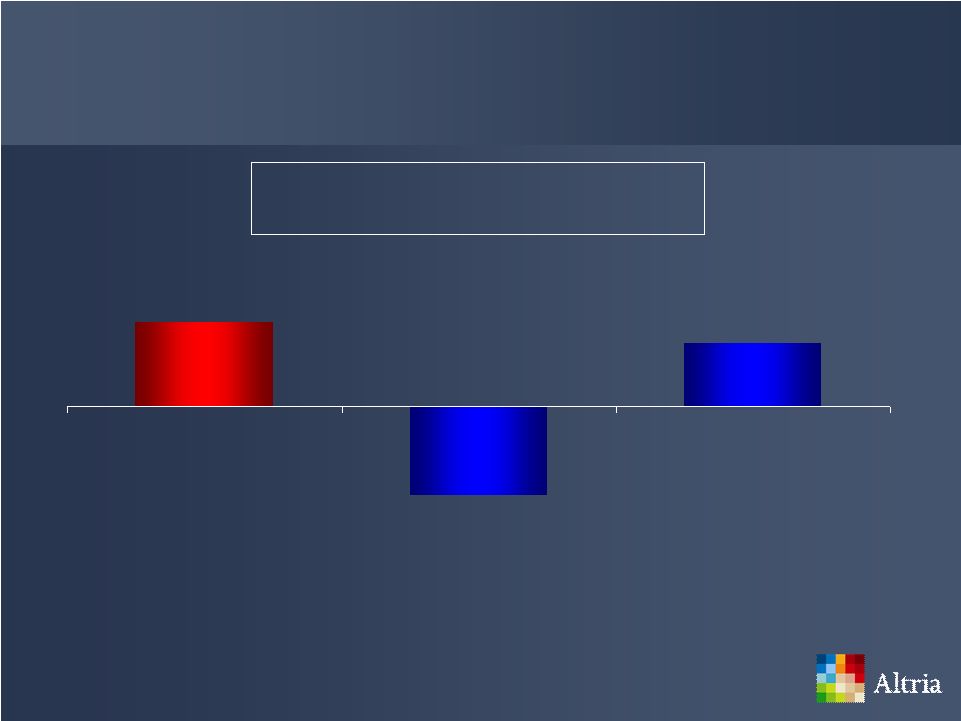

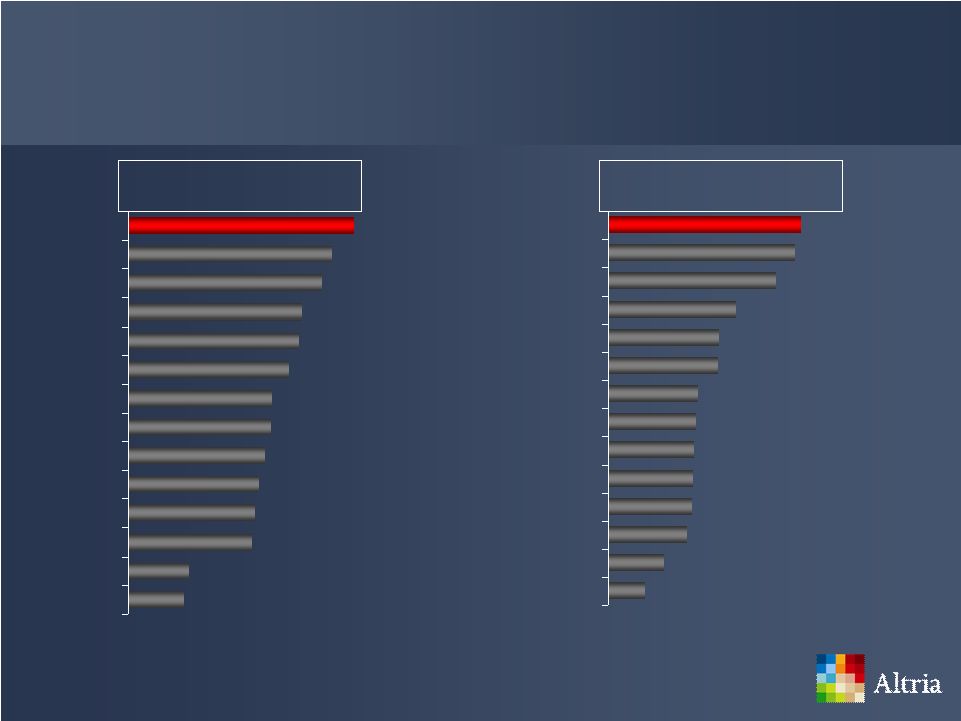

S&P 500 Companies’

Dividends

9

Source: FactSet; Dividend paying companies at Mar 28, 2008 vs. Aug 31, 2010

|

10

Acquisitions of Middleton and UST

Restructuring the internal functions of Altria’s companies

Largest federal excise tax increase in history on tobacco products

in April 2009

FDA regulatory oversight over tobacco products

Tobacco litigation environment

Altria’s Business Environment |

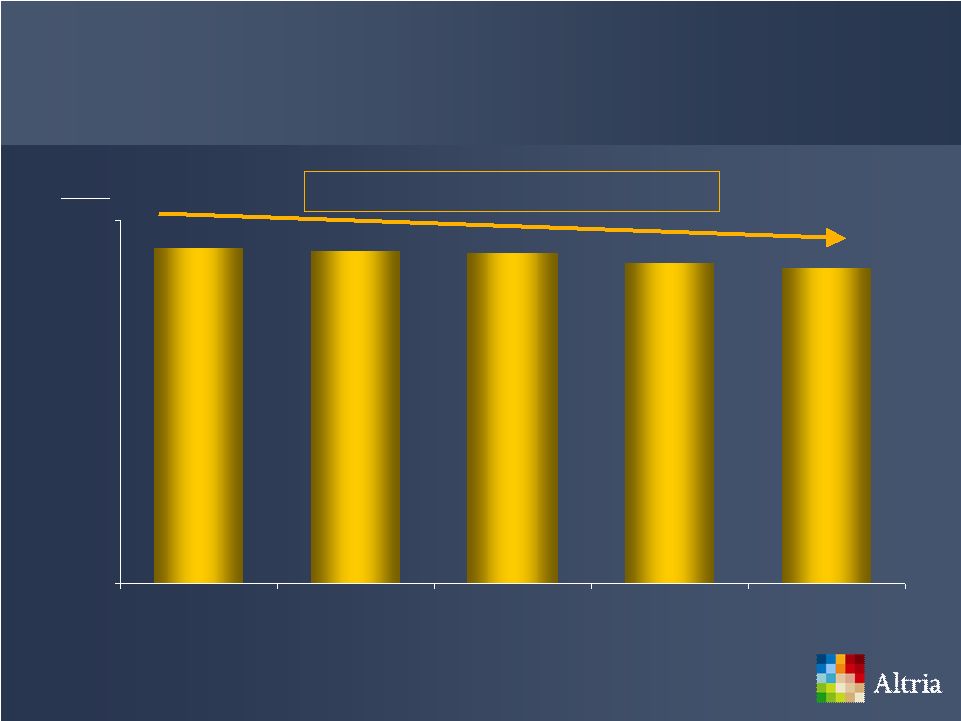

11

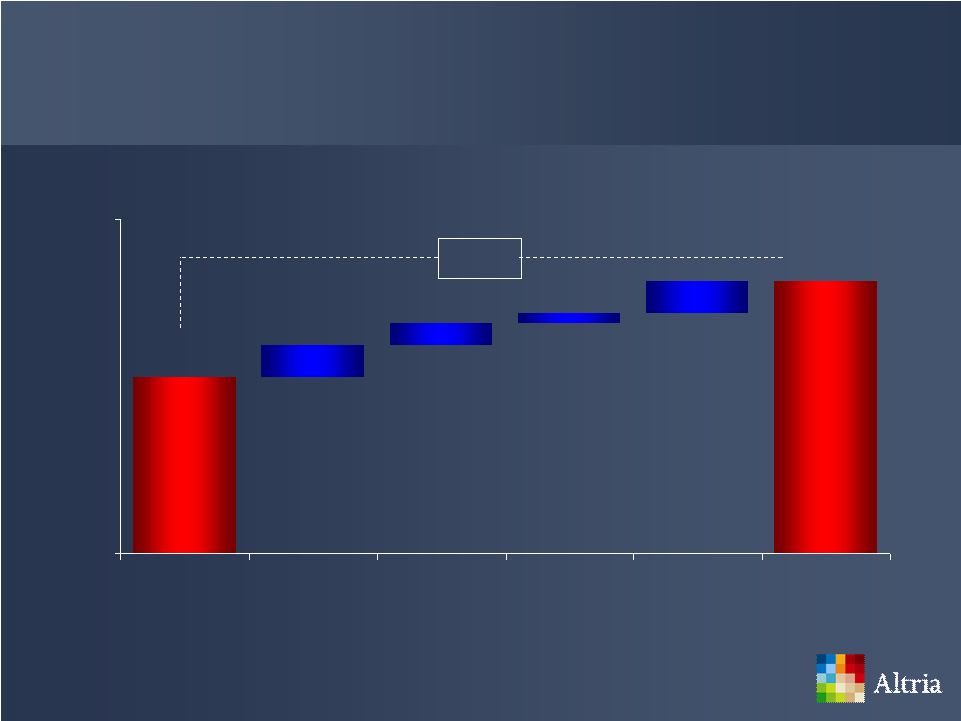

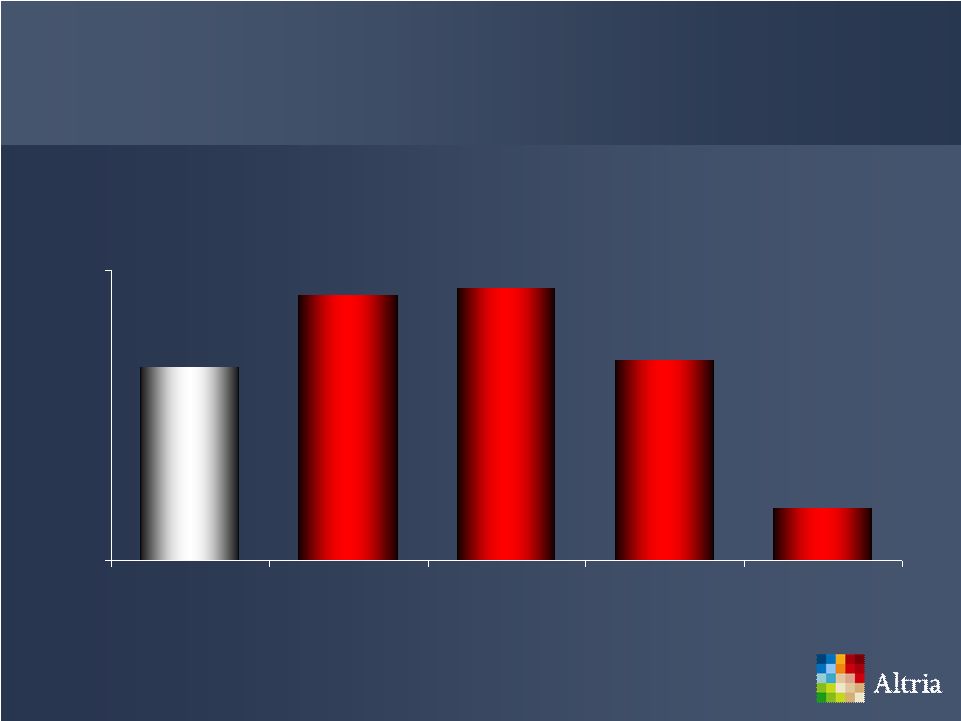

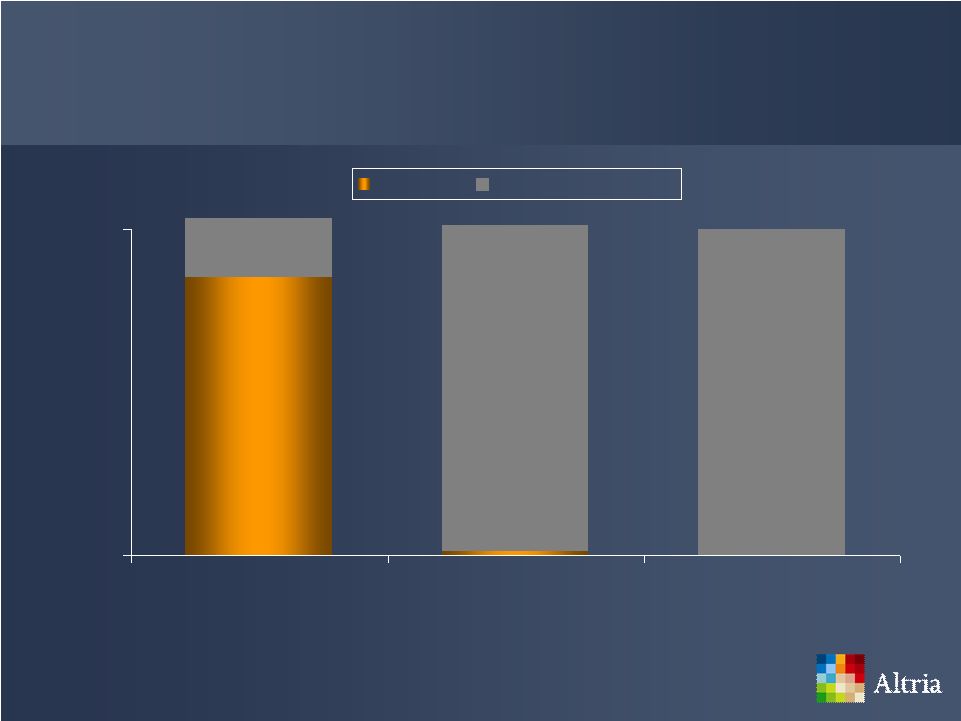

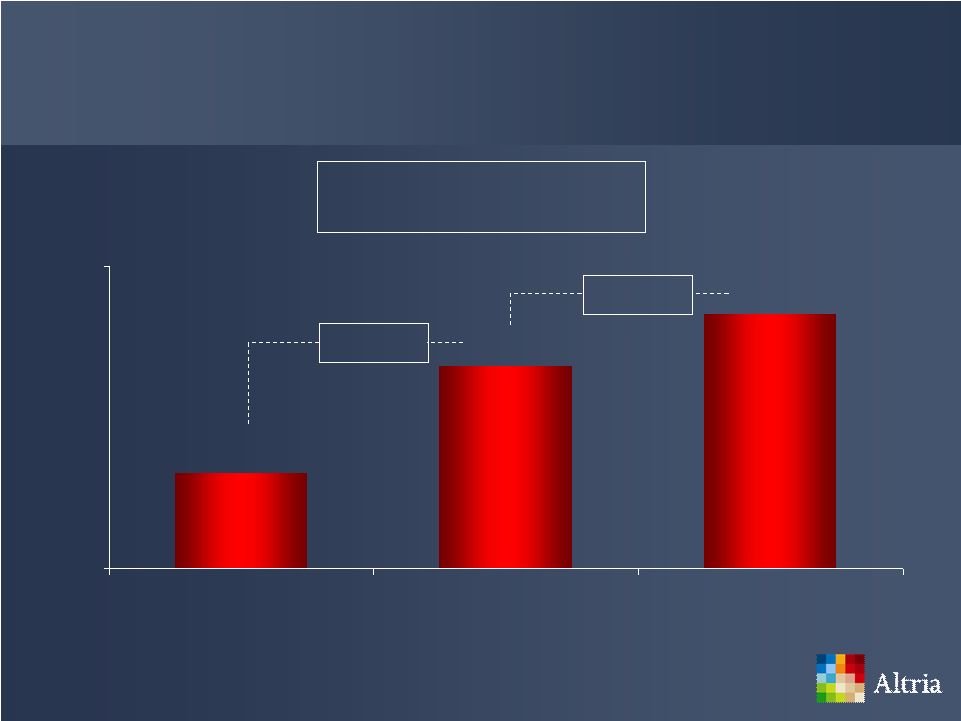

Altria’s Adjusted Earnings Per Share Growth

Adjusted Diluted EPS* Growth

Source: Altria company reports

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com. EPS

= Earnings per share. 10.0%

6.1%

7% to 9%

2008

2009

2010 Estimate |

12

Altria’s Dividend Increases Since PMI Spin-off

Source: Altria company reports

+31%

* Annualized rate

Note:

2008

annualized

dividend

rate

is

based

on

$0.29

per

common

share,

declared

May

28,

2008

2010 annualized dividend rate is based on $0.38 per common share, declared Aug 27,

2010 2.9%

6.3%

10.3%

$1.52

8.6%

$1.16

$0.50

$1.75

2008

Aug-08

Aug-09

Feb-10

Aug-10

2010

*

* |

13

Altria Delivered Superior Returns to Shareholders

* Assumes reinvestment of dividends as of Aug 31, 2010

Source:

Bloomberg

Daily

Return

(Mar

28,

2008

–

Aug

31,

2010)

Total Shareholder Return*

(Since PMI Spin-off)

11.1%

14.9%

(15.6%)

Altria

S&P 500

S&P Food, Beverage &

Tobacco |

14

Company Name

Market Cap.

(in Bil.)

TSR

(%)

1

Altria Group, Inc.

$40.7

39.1

2

Coca-Cola Co

$132.1

29.5

3

Kellogg Co

$20.2

24.6

4

General Mills Inc

$23.3

19.5

5

Philip Morris Int'l Inc

$91.8

15.9

2009

Source:

Bloomberg

Monthly

Return;

2010

YTD

through

Aug

31,

2010;

Bloomberg

Yearly

Return;

2009

full-year

Total Shareholder Return

Note : Food, Beverage & Tobacco companies with a market capitalization greater

than $20 billion as of Aug 31, 2010 Company Name

Market Cap.

(in Bil.)

TSR

(%)

Altria Group, Inc.

$46.5

17.7

Kraft Foods Inc

$52.2

12.3

Philip Morris Int'l Inc

$94.1

9.1

PepsiCo Inc

$102.1

7.1

General Mills Inc

$23.5

4.4

YTD 2010 |

15

Four strong brands of our tobacco operating companies

Superior brand-building infrastructure

Financial discipline with solid cost management

Strong balance sheet with a commitment to return cash to

shareholders in the form of dividends

Altria’s Competitive Advantages |

16

This space is blank because brand images

which appeared in the original presentation

have been removed. |

17

’s

Source: CATTS Database (12mm ending June 2010)

Marlboro

Adult

Tobacco

Demographics

25%

50%

Overall Share

21 -

29

30 -

39

40 -

49

50+ |

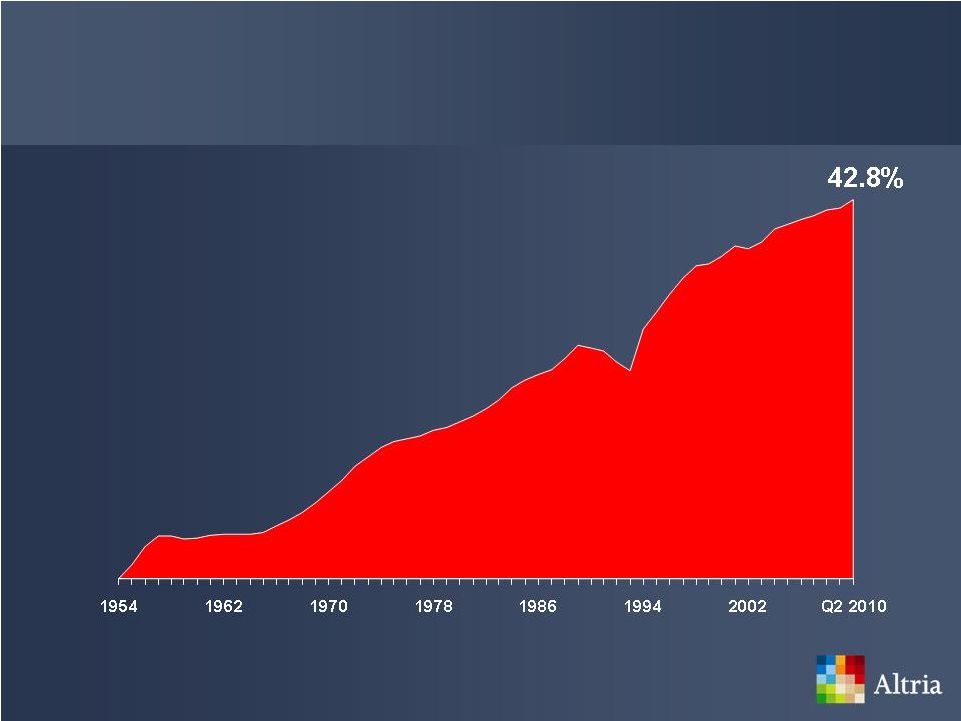

’s

Marlboro

Retail

Share

18

Source: Maxwell; Shipments; IRI/Capstone – Total Retail Panel; IRP SymphonyIRI Group/Capstone

Projected Retail Panel |

19

Source: IRP SymphonyIRI Group/Capstone Projected Retail Panel

Marlboro

Non-Menthol

Retail Share

(2Q 2010)

36.9%

31.9%

Marlboro Non-Menthol

Next 50 Non-Menthol Brands |

20

This space is blank because brand images

which appeared in the original presentation

have been removed. |

21

+2.1pp

Source: IRP SymphonyIRI Group/Capstone Projected Retail Panel

Marlboro

Non-Menthol

Retail Share

of

Non-Menthol Segment

This space is blank because

brand images which

appeared in the original

presentation have been

removed.

50.2%

52.3%

45%

55%

2Q 2009

2Q 2010 |

22

This space is blank because brand images

which appeared in the original presentation

have been removed. |

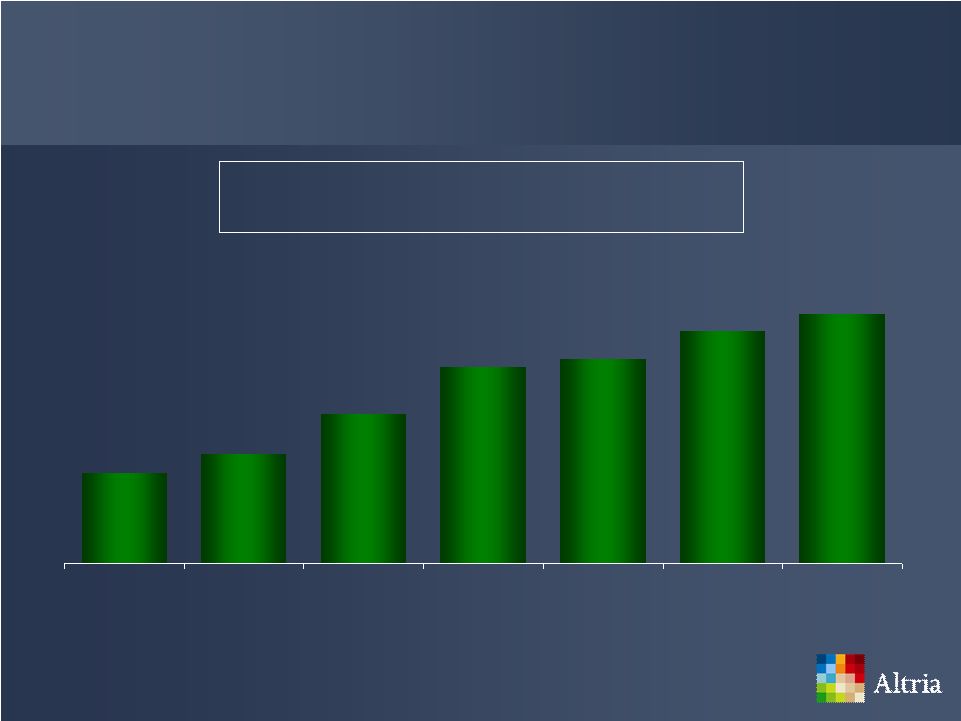

23

Marlboro

Menthol

Retail Share of Menthol Segment

13.7%

14.4%

16.1%

18.0%

18.3%

19.4%

20.1%

2Q 04

2Q 05

2Q 06

2Q 07

2Q 08

2Q 09

2Q 10

Source: IRI/Capstone Projected Retail Panel Database, 2004 – 2007; IRP SymphonyIRI Group/Capstone

Projected Retail Panel, 2008 - 2010 |

24

This space is blank because brand images

which appeared in the original presentation

have been removed. |

25

Source: CATTS Database (12mm ending June 2010)

’s

Adult

Tobacco

Demographics

15%

30%

Overall Share

21 -

29

30 -

39

40 -

49

50+

Copenhagen |

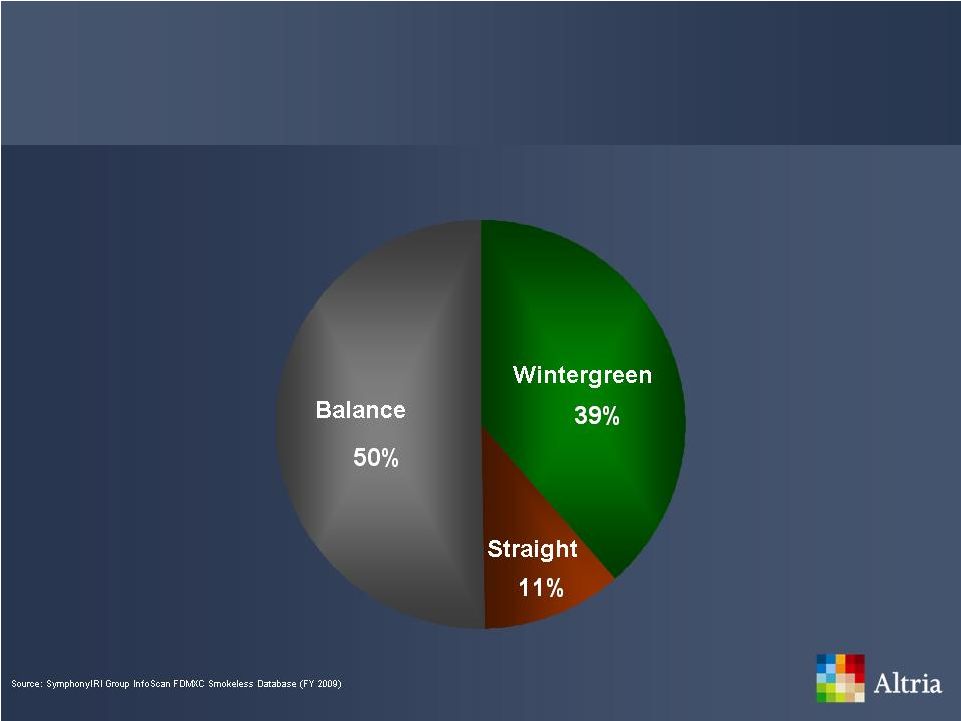

Smokeless Products Flavor Segments’

Retail Share

26 |

27

This space is blank because brand images

which appeared in the original presentation

have been removed. |

28

’s

Retail

Share

Retail Share

+2.3pp

Source: SymphonyIRI Group InfoScan Smokeless FDMXC Database

This space is blank because

brand images which

appeared in the original

presentation have been

removed.

23.3%

25.6%

1H 2009

1H 2010

Copenhagen |

29

Skoal

Strengths

’s

Number one smokeless brand among adult dippers ages 21-29

Number one smokeless brand among adults who use both MST

and cigarettes

Number one MST brand in the fast growing pouch segment

The smokeless brand with the highest brand loyalty among adult

dippers

Strong brand equity in the wintergreen segment

Source: CATTS Database (12mm ending June 2010); SymphonyIRI Group InfoScan Smokeless

FDMXC database |

30

This space is blank because brand images

which appeared in the original presentation

have been removed. |

31

25% of adult cigarette smokers are interested in smokeless

tobacco alternatives to cigarettes

Product opportunity is to provide them an enjoyable, smoke-free

tobacco product

We believe the best brand to do this is Marlboro

Smokeless Tobacco Alternatives

Source:

Smokeless

Tobacco

Attitudes

and

Usage

Study

[conducted

June,

2005

among

adult

smokers,

ages

21+] |

32

This space is blank because brand images

which appeared in the original presentation

have been removed. |

33

’s

Adult

Tobacco

Demographics

Source: CATTS Database (I2mm ending June 2010)

10%

40%

Overall Share

21 -

29

30 -

39

40 -

49

50+

Black

&

Mild |

34

This space is blank because brand images

which appeared in the original presentation

have been removed. |

35

’s

Retail

Distribution

Source: SymphonyIRI Group Convenience Cigar Store Level Database

Average Number of Packings Per Store

+50%

4Q 2007

2Q 2010

Black

&

Mild |

36

Share of Machine-made Large Cigars Segments

Source: SymphonyIRI Group InfoScan Cigar Database 2010 FDMC

0%

100%

Tipped Cigarillo

Untipped Cigarillo

Non-Cigarillo

Middleton

Balance of Industry |

37

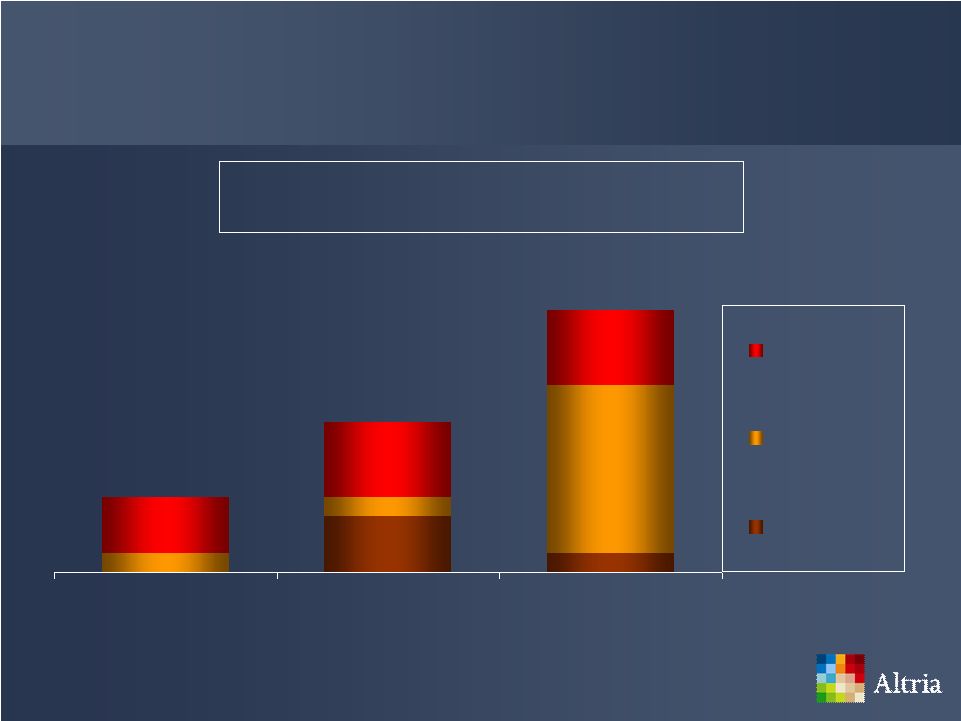

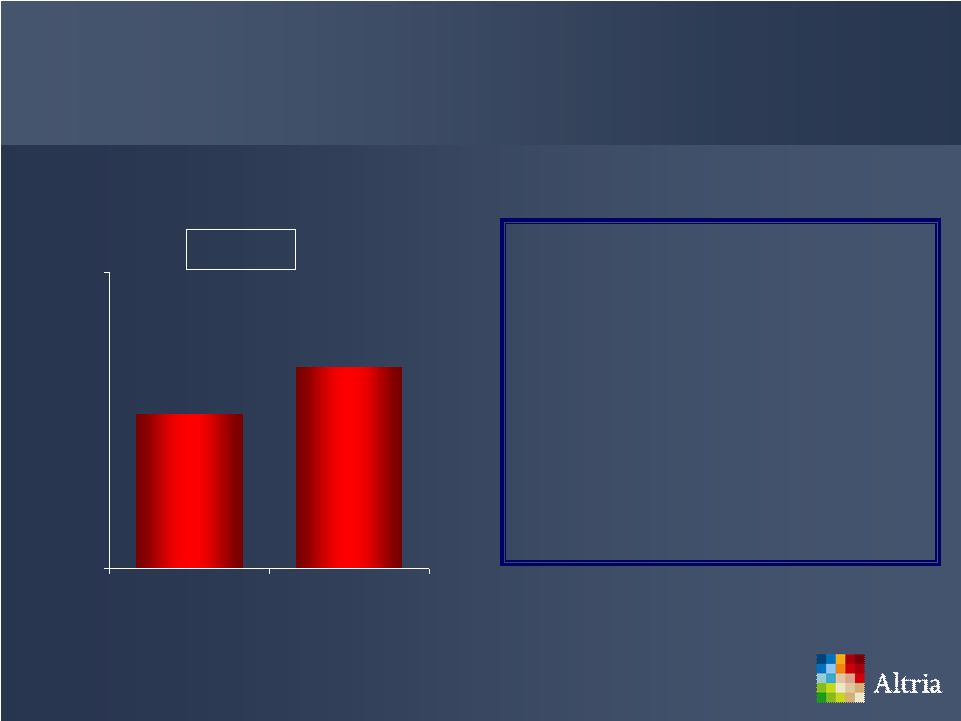

Altria’s Tobacco Companies’

New Products

Products Introduced*

* Year of introduction based on national launch date

Source: PM USA, USSTC and Middleton

4

8

14

2008

2009

YTD 2010

Cigarettes

Smokeless

Cigars |

38

Altria’s Tobacco Companies’

New Products

Retail Share

(1H 2010)

Note: Retail share of products introduced by Altria’s tobacco operating

companies from 2008 to 1H 2010 0%

7%

Cigarette Category

Smokeless Category

Cigar Category

Source: SymphonyIRI Group/Capstone IRP Projected Retail Database; SymphonyIRI Group Projected Retail

Smokeless & Cigar Databases |

39

Superior Brand-Building Infrastructure

Executes trade programs to grow

Altria's tobacco companies'

businesses and their customers'

businesses

Executes Consumer Engagement

Programs and designs &

communicates retail promotion

plans for Altria’s tobacco

companies |

40

This space is blank because brand images

which appeared in the original presentation

have been removed. |

41

ALS&D Programs

Present brands to adult tobacco consumers in the best

positions

Allocate merchandising space to help brands stay in stock and

fresh

Communicate price and promotional offers

Prevent tobacco product access by minors |

42

Altria Sales & Distribution Retail Volume Coverage

Over three million retail

contacts per year

Coverage offers our tobacco

companies reach and speed

to market

Source:

STARS

OTP

Geo

Aggregate

–

Full;

ALS&D

Internal

Estimates

Over

95% |

43

Copenhagen

Product Distribution

Long Cut Wintergreen

Distribution*

Source: STARS OTP Store Level

* Distribution is as % of targeted workload stores with greater than ten industry

smokeless cans per week This space is blank because

brand images which

appeared in the original

presentation have been

removed.

80%

91%

Week 1

Week 2 |

44

Altria Sales & Distribution’s Initiatives

Reallocated sales personnel to high volume areas

Implementing a total tobacco merchandising solution

Introducing new information management tools for the trade

|

45

Altria Consumer Engagement Services

Executes adult consumer engagement programs

–

Build affinity

–

Loyalty

–

Brand awareness |

46

Altria Consumer Engagement Services

Online

Websites

Events

Ranch/Bar

200+ Million

Annual Adult

Tobacco

Consumer

Interactions

Source: ALCES internal estimates

Direct Mail

Sweeps &

Giveaways |

47

ALCES Programs –

Online Experience

This space is blank because brand images

which appeared in the original presentation

have been removed. |

48

This space is blank because brand images

which appeared in the original presentation

have been removed. |

49

Altria’s Financial Discipline

Managing costs

–

Improves efficiency

–

Helps income growth

–

Allows resources to be used on brand-building initiatives

Restructured and centralized various internal functions into

Altria Client Services

Making excellent progress against the cost reduction program

|

50

Altria’s Cost Management Program

Source: Altria company reports

($ in Millions)

$290

$1,500

$1,210

$0

$1,500

2007 -

1H 2010 Savings

Add. Cost Savings

Expected by the end of

2011

Total Cost Savings

Expected by the end of

2011 |

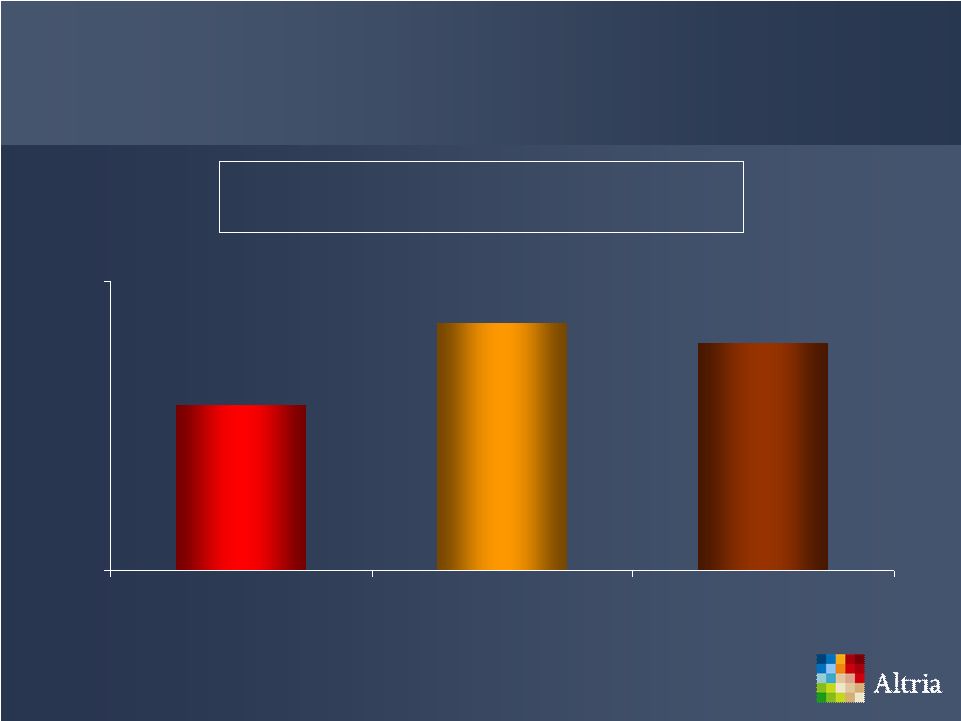

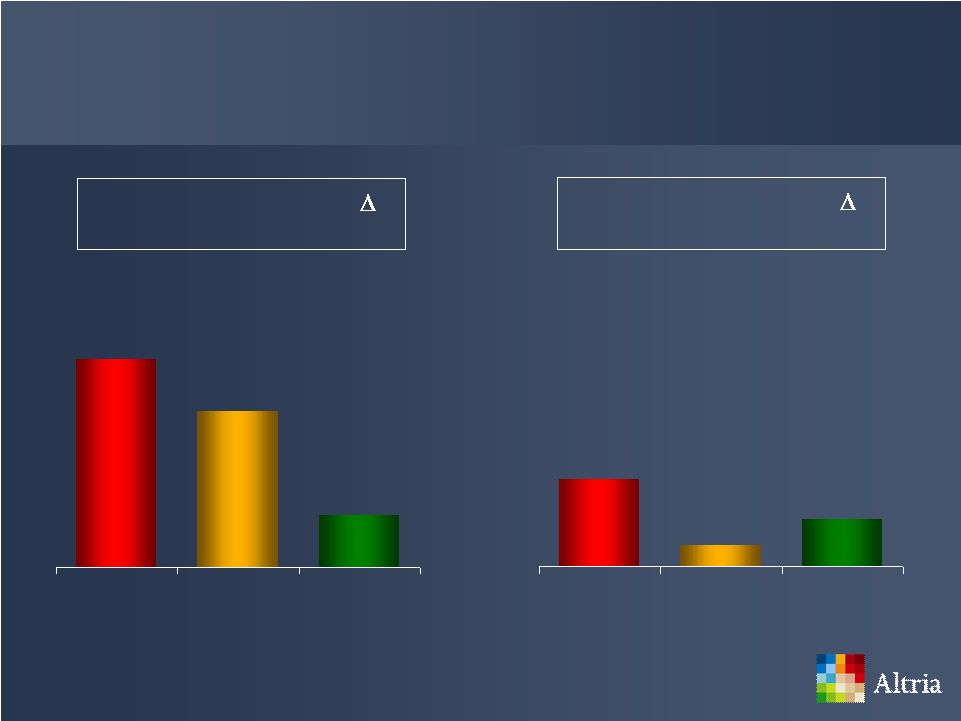

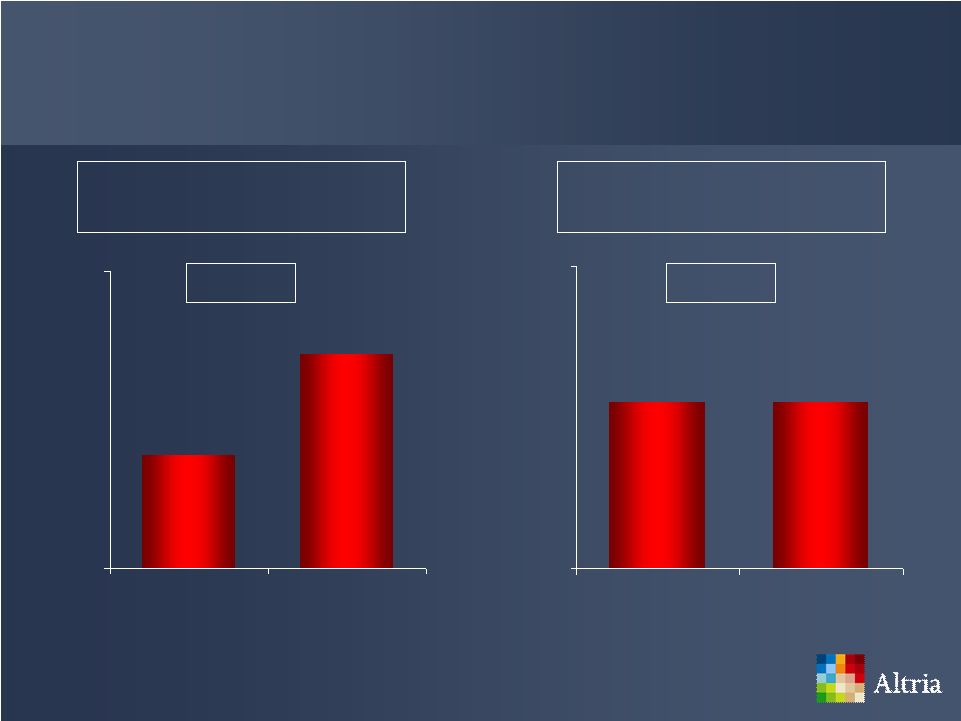

51

Adjusted OCI* Margin

(2007 –

2009)

Cigarette Manufacturers’

Margins

Adjusted OCI* Margin

(1H 2009 –

1H 2010)

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com

1.7pp

0.4pp

0.9pp

PM USA

RJRT

Lorillard

4.0pp

3.0pp

1.0pp

PM USA

RJRT

Lorillard

Source: Altria

company

reports,

Lorillard,

Inc.

and

Reynolds

American

Inc.

company

reports,

and

ALCS

estimates.

Adjusted

OCI

for

RJRT

is

reported

income

plus

reported

amortization

expense

and

one-time

reported

implementation,

asset

impairment

and

exit

costs

of

$27

million

in

the

first-half

of

2010.

Adjusted

OCI

for

Lorillard

is reported

operating income, plus $66 million in reported one time legal expenses in 2007.

Adjusted OCI margins is adjusted OCI divided by reported net revenue excluding FET. |

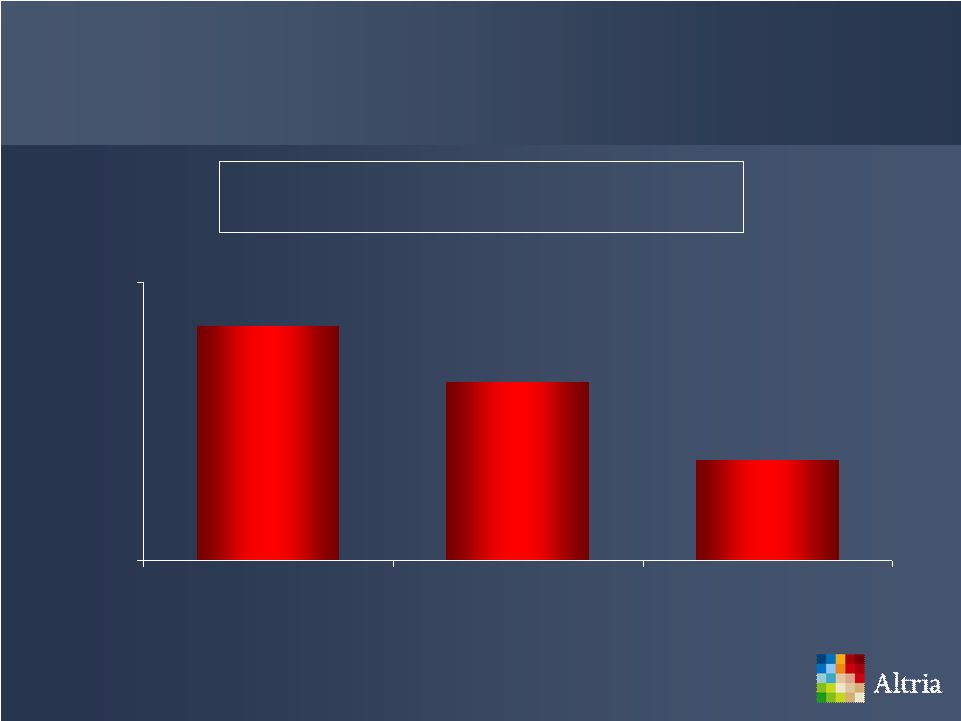

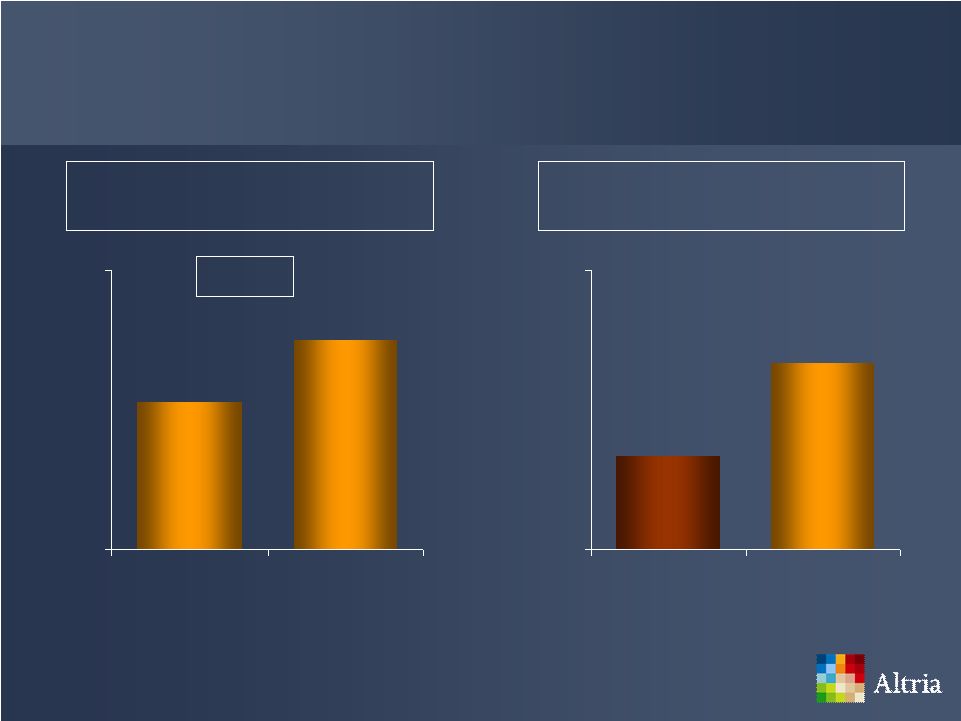

52

Smokeless Segment’s Costs

Adjusted Costs Per Can*

Source: 1H 2008: UST Inc.; 1H 2009 & 2010: Altria company reports

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com. Adjusted

Costs Per Can for 1H 2009 & 1H 2010 include MST and Snus $1.01

$0.96

$0.89

$0.80

$1.05

1H 2008

1H 2009

1H 2010 |

53

Smokeless Segment’s Adjusted OCI Margins*

Source:

UST

and

Altria

company

reports

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com

~56%

~56%

2007

2Q 2010 |

54

Strong Balance Sheet

Protects the company’s investment grade credit rating

Preserves access to the capital markets for short-

and long-

term debt

Secures the cash flow generated by the operating companies

Sustains our ability to grow earnings and dividends over time

|

55

Benefits of a Strong Balance Sheet

Strong balance sheet helped Altria make ~$1 billion payment

to the IRS in July 2010

–

~$945 million of this payment is associated with the

disallowance of certain leverage leasing transactions

entered into by PMCC in 1996 through 2003

–

Intend to contest these disallowances vigorously

Payment did not impact company’s ability to raise 2010 EPS

guidance or increase quarterly dividend

Source: Altria company reports |

56

Altria’s Debt

Debt to EBITDA ratio is in line with peers and under

requirements of covenants

High carrying costs due to timing of financing activities related

to UST acquisition

Focus on reducing financing costs |

57

Altria’s Debt Transactions

Retired $775 million in notes with a coupon of 7.125% in 2Q 2010

Issued $800 million in notes with a coupon of 4.125% in 2Q 2010

Issued $200 million in notes with a coupon of 4.125%

in 3Q 2010

Decision to refinance or retire future debt depends upon:

–

Condition of capital markets

–

Interest rates

–

Altria’s business needs and conditions and other factors

Source: Altria company reports |

58

Altria’s Economic Interest in SABMiller

Important component of

balance sheet

Maintaining position for the

foreseeable future

Strengthens Altria’s financial

profile

This space is blank because

brand images which

appeared in the original

presentation have been

removed. |

59

Altria’s Economic Interest in SABMiller

Source: Altria company reports; Bloomberg Closing Stock Price in GBP converted to

USD as of Aug 31, 2010. Market Value

($ in Billions)

This space is blank because

brand images which

appeared in the original

presentation have been

removed.

$3.4

$12.3

$0

$18

Jul-02

Aug-10 |

60

Yield

Payout Ratios

Source:

Bloomberg

DVD,

Thomson

One

Financial

2010

FY

adjusted

EPS

Estimates.

Payout

Ratio

and

Yield

compares

Food,

Beverage

&

Tobacco

companies

with

a

market

capitalization greater than $10 billion as of Aug 31, 2010. Altria’s

stated 80% payout ratio is a target. Altria’s Dividend

80%

72%

69%

61%

61%

57%

51%

51%

48%

46%

45%

44%

22%

20%

MO

RAI

LO

PM

HNZ

KFT

KO

HSY

GIS

PEP

CPB

K

ADM

CCE

6.8%

6.6%

5.9%

4.5%

3.9%

3.9%

3.1%

3.1%

3.0%

3.0%

3.0%

2.8%

1.9%

1.3%

MO

RAI

LO

PM

HNZ

KFT

KO

GIS

K

PEP

CPB

HSY

ADM

CCE |

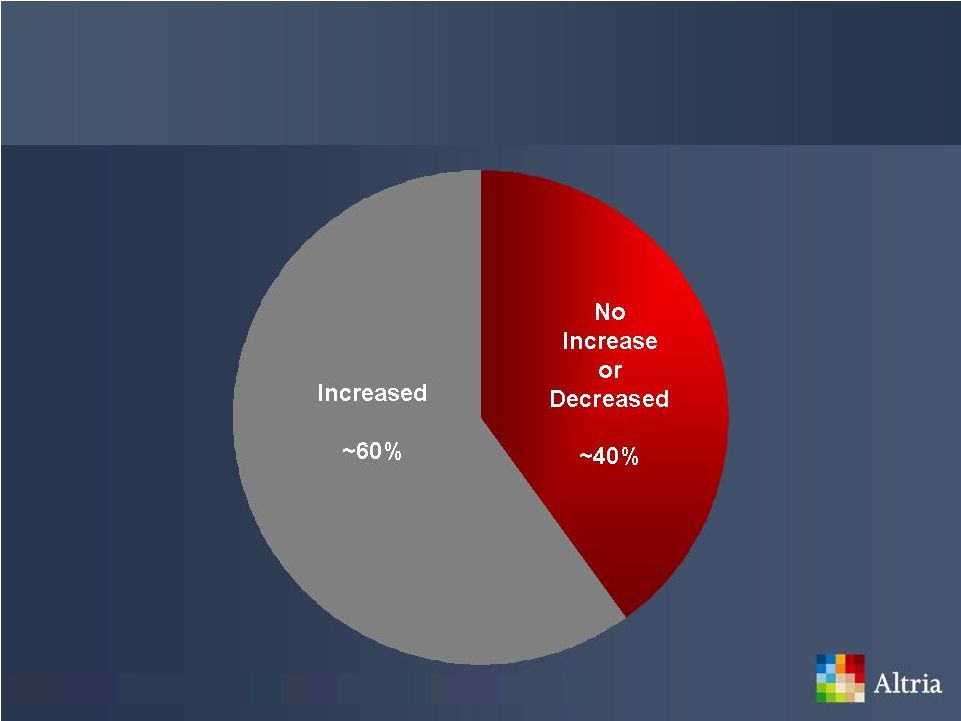

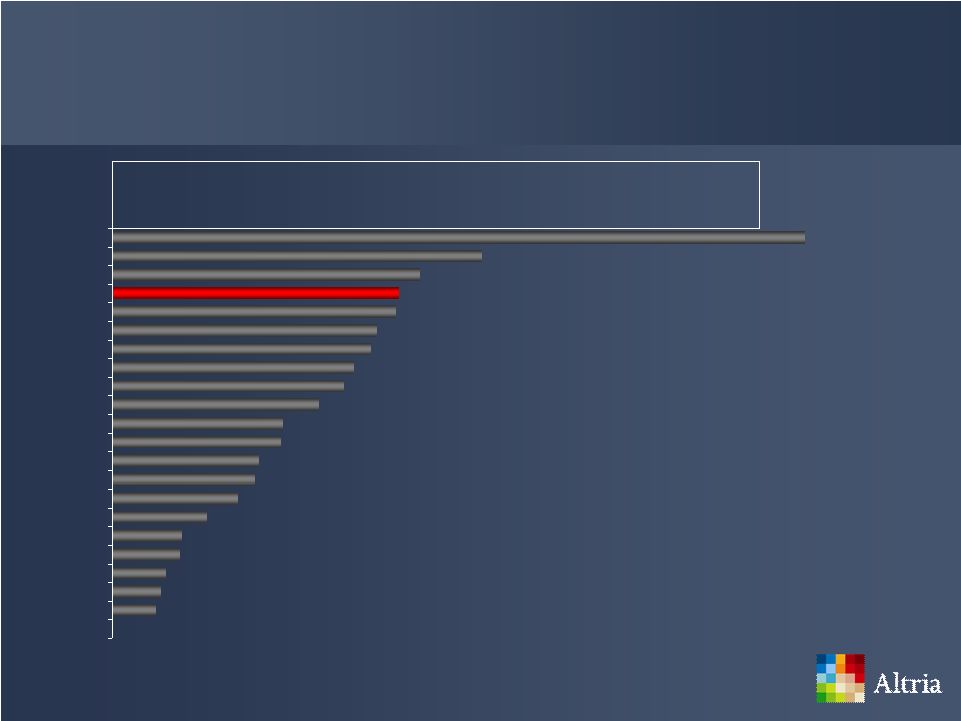

61

S&P 500 -

Food, Beverage & Tobacco Index

(March 2008 to August 2010)

Source: Bloomberg DVD as of Aug 31, 2010

Dividend Increases

* Philip Morris Int’l calculation is from first declared dividend date

6/18/2008 * Lorillard Inc. calculation is from first declared dividend date

8/21/2008 Companies not shown:

DPS –

first dividend declared was 11/20/2009

STZ –

no regular dividend (no dividend, only stock splits (last one 2005))

DF –

no regular dividend (one special dividend $15 paid 4/2/07)

75%

40%

33%

31%

31%

29%

28%

26%

25%

22%

18%

18%

16%

15%

14%

10%

8%

7%

6%

5%

5%

0%

TAP

GIS

SJM

MO

K

CCE

PEP

PM*

CPB

LO*

HNZ

MKC

KO

ADM

HRL

BF/B

HSY

KFT

RAI

CAG

SLE

TSN |

62

Altria’s 2010 Dividend Increases

Raised dividend twice for a total increase of 11.8% since the

end of 2009

–

2.9% in February 2010

–

8.6% in August 2010

All future dividend payments remain subject to the discretion of

Altria’s Board of Directors

Source: Altria company reports |

63

Altria’s Adjusted Diluted EPS Guidance

Mid-term

adjusted

diluted

EPS

growth

target

is

7%

to

9%

Altria

reaffirms

that

its

2010

adjusted

*

diluted

earnings

per

share

(EPS)

is

expected

to

increase

to

a

range

of

$1.87

to

$1.91

per

share,

representing

a

7%

to

9%

growth

rate

from

an

adjusted

base

of

$1.75

per

share

in

2009

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com. EPS

= Earnings per share. Source: Altria company reports

|

64

Four strong brands of our tobacco operating companies

Superior brand-building infrastructure

Financial discipline with solid cost management

Strong balance sheet with a commitment to return cash to

shareholders in the form of dividends

Altria’s Competitive Advantages |

65

Areas Requiring Continuing Focus

Business Environment

FDA Regulation

Tobacco Litigation |

66

Business Environment

Tobacco volumes

Profit pools

Competitive environment |

67

Pounds in

Millions

Source: ALCS MICR Industry estimates for cigarettes; TTB all other tobacco segments;

cigarettes, small cigars & RYO based on 0.0325 oz./stick [FY 2008] 5 year

CAGR (~1%) Historical Total Tobacco Volume

0

1,100

2004

2005

2006

2007

2008 |

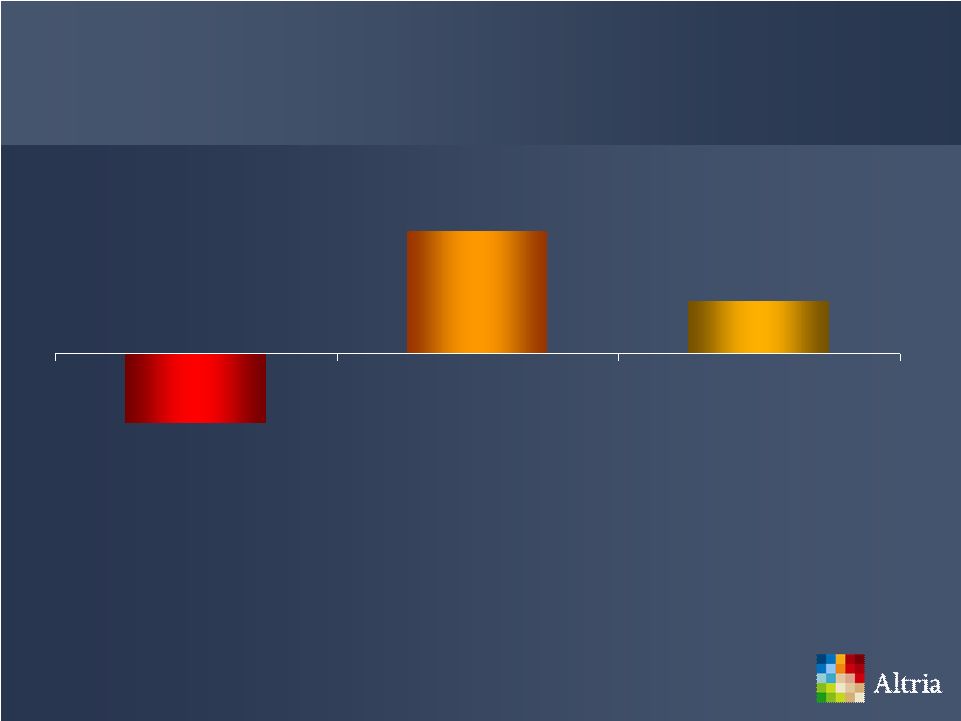

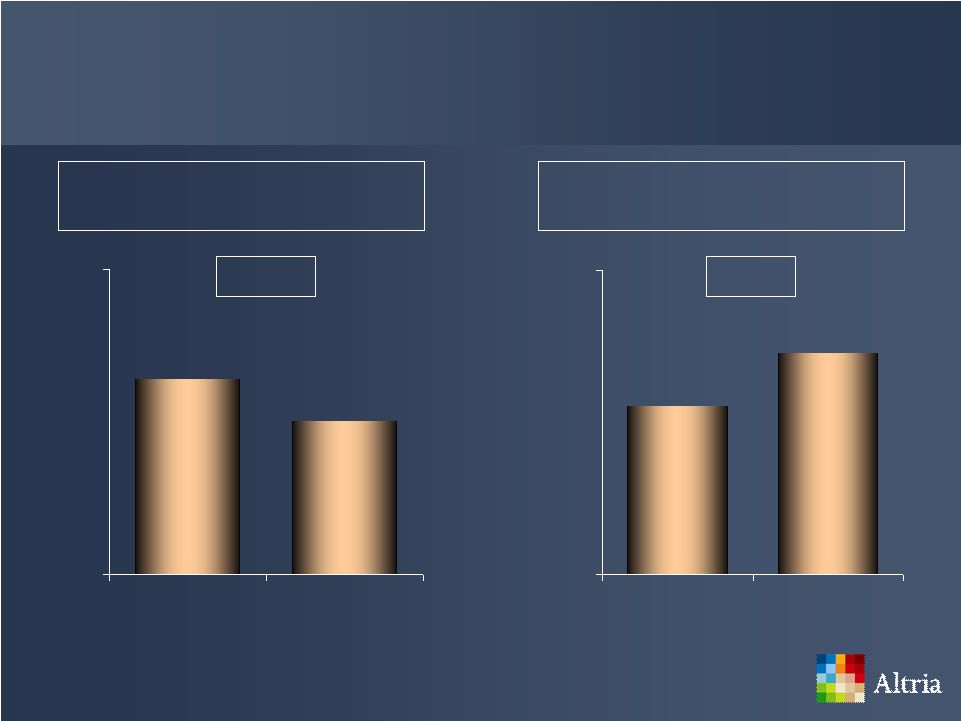

68

Tobacco Categories’

2008 Volume Change

Source: Altria company reports; ALCS MICR estimates

Note: Smokeless is defined as moist smokeless tobacco and spit-less tobacco

products ~3%

~7%

(~4%)

Cigarettes

Smokeless

Machine-made Large

Cigars |

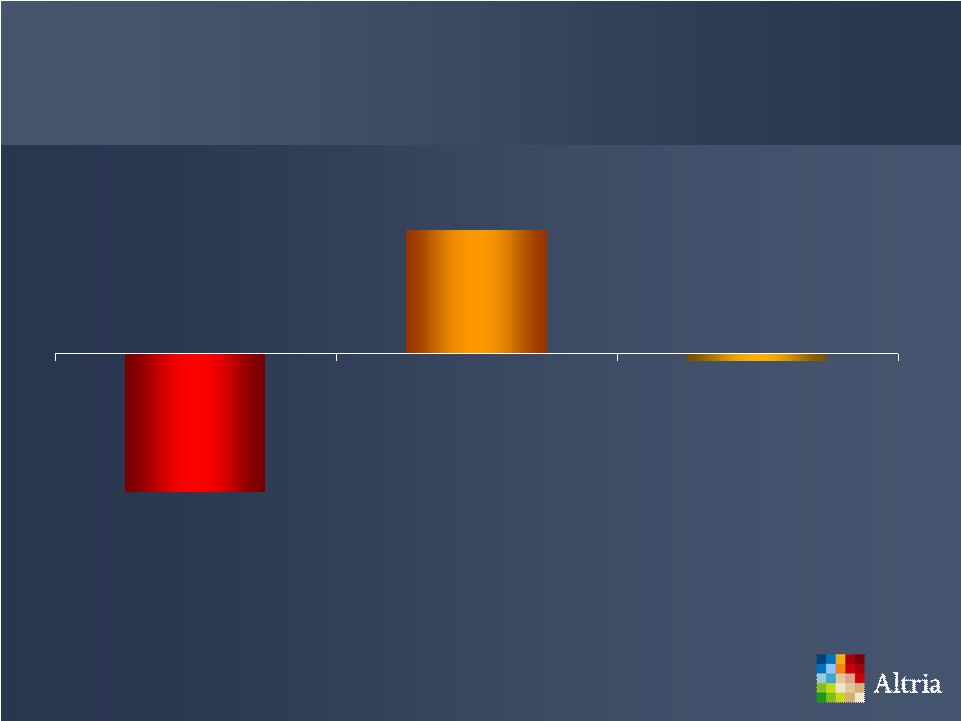

69

Tobacco Categories’

2009 Volume Change

Source: Altria company reports; ALCS MICR estimates

Note: Smokeless is defined as moist smokeless tobacco and spit-less tobacco

products (~0.5%)

~7%

(~8%)

Cigarettes

Smokeless

Machine-made Large

Cigars |

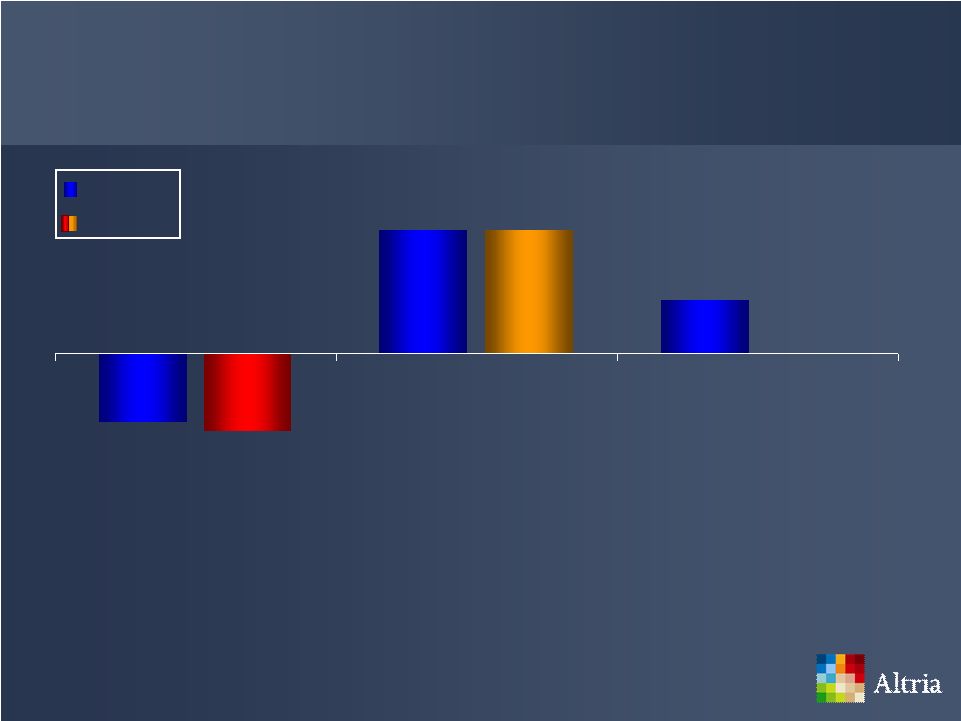

70

Tobacco Categories’

Volume Change

2008

2Q 2010

Source: Altria company reports; ALCS MICR estimates

Note: Smokeless is defined as moist smokeless tobacco and spit-less tobacco

products ~3%

~7%

(4.0%)

~7%

Grew

Slightly

(4.5%)

Cigarettes

Smokeless

Machine-made Large

Cigars |

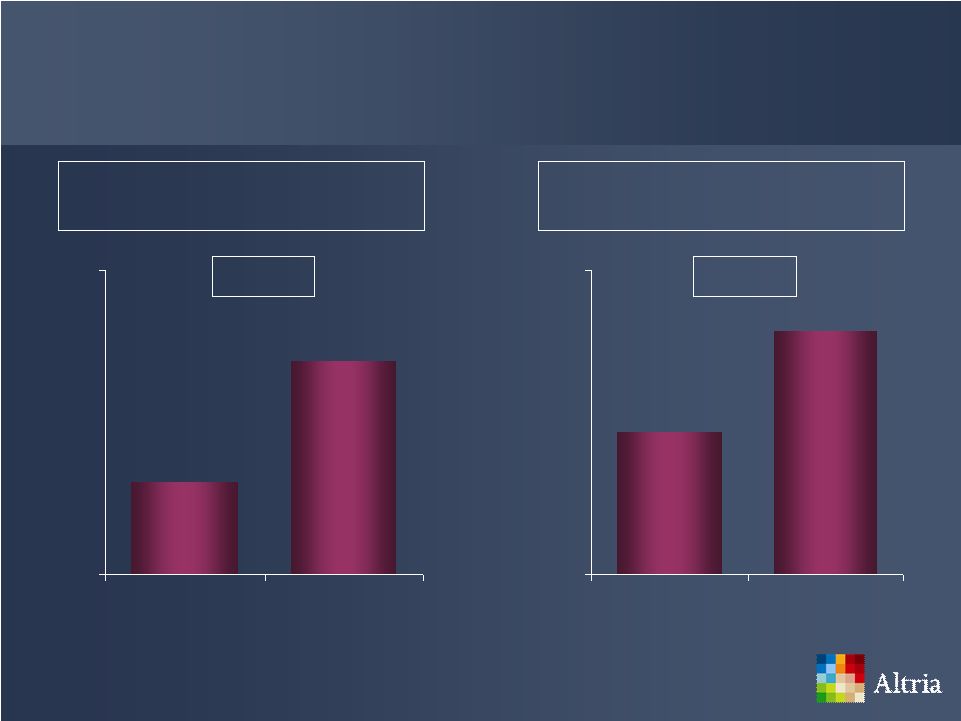

71

*

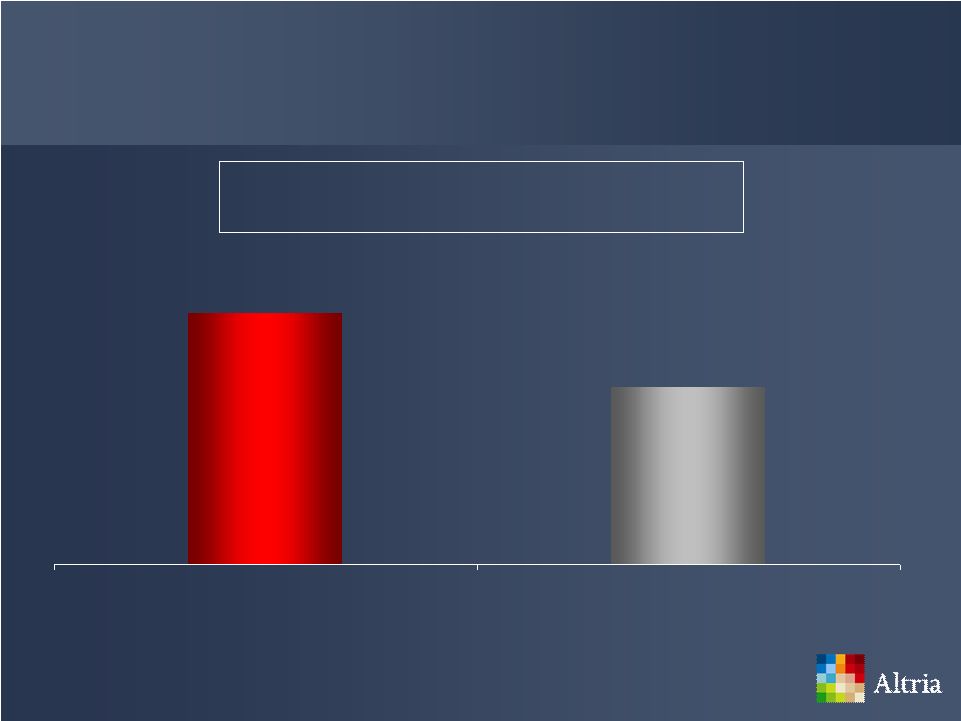

Altria’s Share of Profit Pool

+9.0pp

* Excludes USSTC

Tobacco Manufacturers’

Profit Pool

Total Profit Pool

($ in Billions)

+5.7%

Source: Altria company reports; ALCS BS&D estimates

$10.6

$11.2

$9.5

$12.5

2007

2009

46%

55%

30%

70%

2007

2009 |

|

73

Cigarettes Segment

Grow cigarette income while maintaining share momentum on

Marlboro

Maximize income by expanding margins, while investing where

appropriate to enhance long-term profitability |

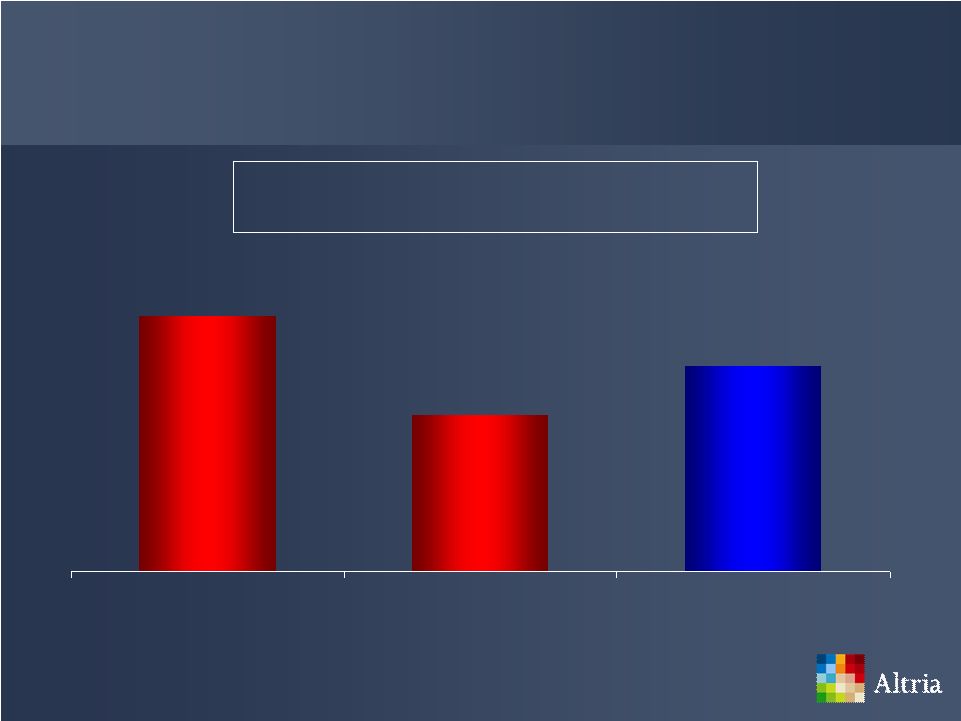

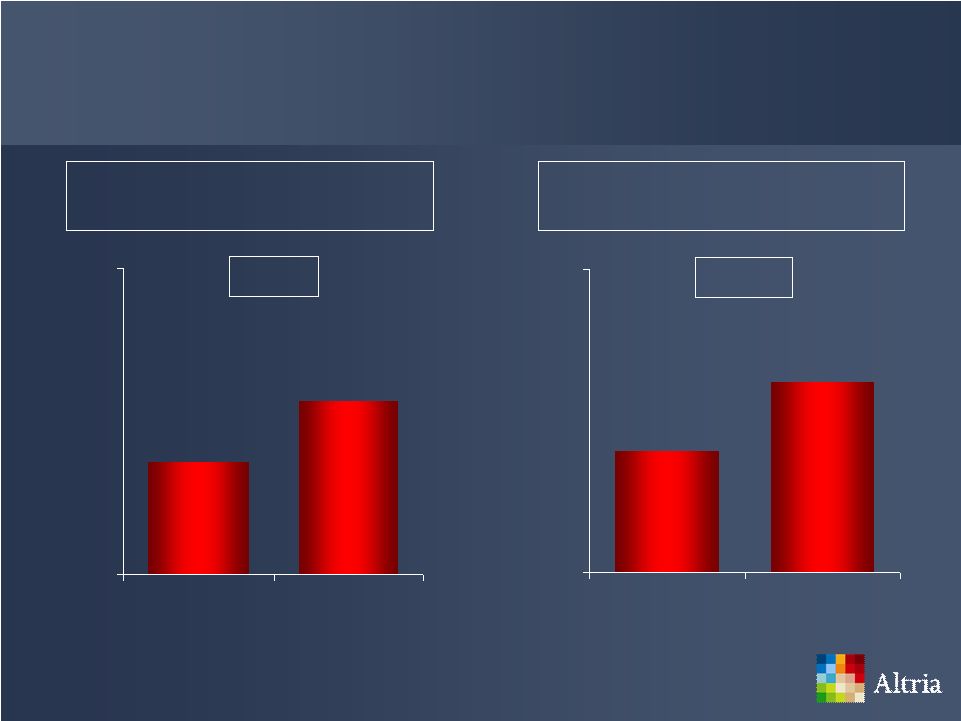

74

Cigarettes Segment’s Results

Source: Altria company reports

Adjusted OCI*

($ in Billions)

+8.8%

+3.8%

$2.7

$2.8

$2.4

$2.3

$2.9

1H 2008

1H 2009

1H 2010

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com.

|

75

’s

Marlboro

Retail

Share

Source: IRP SymphonyIRI Group/Capstone Projected Retail Panel Database

+1.6pp

This space is blank because

brand images which

appeared in the original

presentation have been

removed.

42.8%

41.2%

36%

46%

2Q 2009

2Q 2010 |

76

Cigarettes Segment’s Results

+1.7pp

Adjusted OCI* Margins

(Percent)

* For reconciliations of non-GAAP to GAAP numbers visit www.altria.com

0.0pp

PM USA’s

Retail Share

50.2%

50.2%

48%

52%

1H 2009

1H 2010

38.6%

36.9%

35%

40%

1H 2009

1H 2010

Source: Altria company reports; IRP SymphonyIRI Group/Capstone Projected Retail Panel Database

|

77

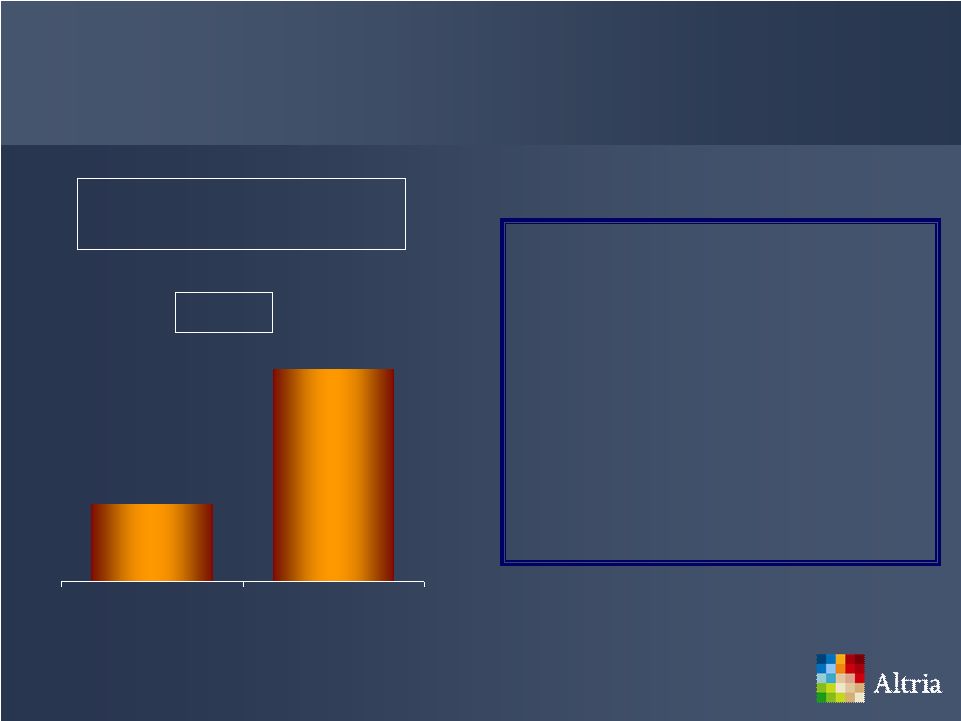

Smokeless Products Segment

Growing volume in-line or slightly ahead of the category’s

growth rate

A retail share point is potentially worth more in income

tomorrow due to category volume growth*

Investing to build category share profitably should grow future

segment income

* Assumes the same profits per can/pack |

78

Retail Share

+1.8pp

Smokeless Products’

Results

Adjusted Volume Growth

(2Q 2010)

Source: SymphonyIRI Group InfoScan FDMXC Smokeless Tobacco Database; Altria company

reports ~7%

~9%

5%

11%

Smokeless

Category

USSTC & PM

USA combined

54.2%

56.0%

50%

58%

2Q 2009

2Q 2010 |

79

Smokeless Products’

Results

Adjusted OCI*

($ in Millions)

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com

Source: Altria company reports

+15.0%

$339

$390

1H 2009

1H 2010 |

80

Cigars Segment

Grow strong position in machine-made large cigar category

behind Black & Mild

A retail share point today is potentially worth more income

tomorrow because of category volume growth*

* Assumes the same profits per cigar |

81

Retail Share

+2.8pp

Black

&

Mild

’s

Retail

Share

Source: SymphonyIRI Group InfoScan Cigar Database

This space is blank because

brand images which

appeared in the original

presentation have been

removed.

27.8%

30.6%

25%

33%

4Q 2007

4Q 2009 |

82

(1.1)pp

Cigar Segment’s Results

Source: SymphonyIRI Group InfoScan Cigar Database; Altria company reports

Adjusted OCI*

($ in Millions)

+7.2%

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com

$97

$104

$75

$115

1H 2009

1H 2010

29.1%

28.0%

24%

32%

1H 2009

1H 2010

’s

Black

&

Mild

Retail

Share |

83

Volume

(Case in Millions)

+15.4%

Wine Segment’s 1H 2010 Results

Source: Altria company reports

Adjusted OCI*

($ in Millions)

+20.8%

* For reconciliation of non-GAAP to GAAP numbers visit www.altria.com

$24

$29

$17

$32

1H 2009

1H 2010

2.6

3.0

2.3

3.3

1H 2009

1H 2010 |

84

Altria’s Adult Consumer Products Businesses

Successful execution of programs can continue to grow income,

despite challenging environment and competitive marketplace

Solid first-half 2010 adjusted operating companies income growth

Remain confident about our ability to continue building our

positions in these profitable segments with our strong premium

brands |

85

FDA Regulation

June 2010 marked first anniversary of FDA regulation over

cigarettes and smokeless tobacco

We believe that thoughtfully implemented federal regulation

should benefit tobacco consumers in the long-term

Should contribute to resolving many of the complex issues that

surround cigarettes and smokeless tobacco |

86

Altria’s Approach to FDA Regulation

Actively participating in processes established by FDA

PM USA submitted and presented information to the FDA’s

Tobacco Products Scientific Advisory Committee (TPSAC)

Shared our belief that there is no science-

or evidence-based

reason that would support a TPSAC recommendation to:

–

Ban menthol cigarettes

–

Impose additional restrictions on them |

87

Litigation Environment

Company continues to face challenging litigation

Successfully managed litigation in the past

Detailed discussion in Altria’s recent Form 10-Q

Vigorously defended claims for decades and intend to continue

doing so |

88 |

89

Non-GAAP Financial Measures

Altria

reports

its

consolidated

financial

results

in

accordance

with

U.S.

generally

accepted

accounting

principles

(GAAP).

Today’s

remarks

and

related

slides

may

contain

various

operating

results

on

both

a

reported

basis

and

on

an

adjusted

basis,

which

excludes

items

that

affect

the

comparability

of

reported

results.

Altria’s

management

reviews

operating

companies

income

(OCI),

which

is

defined

as

operating

income

before

corporate

expenses

and

amortization

of

intangibles,

to

evaluate

segment

performance

and

allocate

resources.

Altria’s

management

also

reviews

OCI,

operating

margins

and

earnings

per

share

(EPS)

as

well

as

other

financial

measures

on

an

adjusted

basis,

which

excludes

certain

income

and

expense

items

that

management

believes

are

not

part

of

the

underlying

operations

because

such

items

can

obscure

underlying

business

trends.

Management

believes

it

is

appropriate

to

disclose

these

measures

to

help

investors

analyze

underlying

business

performance

and

trends.

Such

adjusted

measures

are

regularly

provided

to

management

for

use

in

the

evaluation

of

segment

performance

and

allocation

of

resources.

Reconciliations

of

non-GAAP

measures

included

in

this

presentation

to

the

most

comparable

GAAP

measures

are

shown

at

the

end

of

this

slide

show

presentation

and

are

available

on

Altria’s

website

at

www.altria.com. |

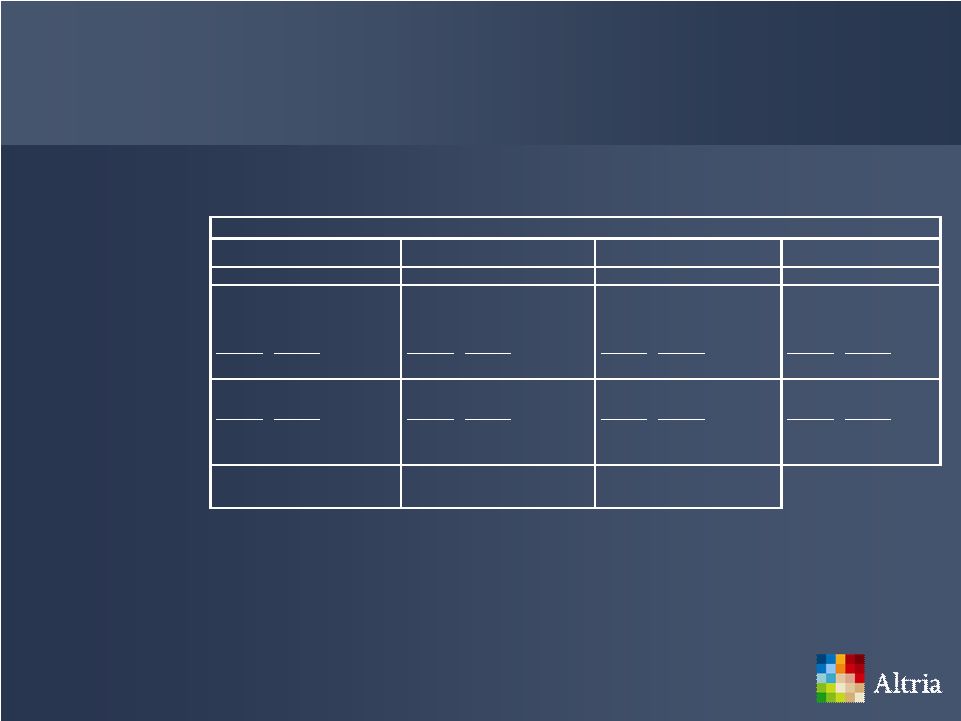

90

Adjusted OCI for Reporting Segments

Second-Quarter Results

Source: ALCS Finance, reconciliation between GAAP and non-GAAP financial

measures 2010

2009

2010

2009*

2010

2009

2010

2009*

Reported OCI

1,450

$

1,426

$

1.7%

198

$

177

$

11.9%

56

$

36

$

55.6%

12

$

9

$

33.3%

Asset Impairment, exit, integration

and implementation costs

45

47

4

35

-

4

-

1

UST acquisition-related costs

-

-

-

1

-

-

5

5

Adjusted OCI

1,495

$

1,473

$

1.5%

202

$

213

$

(5.2)%

56

$

40

$

40.0%

17

$

15

$

13.3%

Net Revenues

5,589

$

6,024

$

(7.2)%

390

$

373

$

4.6%

155

$

118

$

31.4%

106

$

94

$

12.8%

Less Excise taxes

1,847

2,052

27

24

55

44

4

5

Net Revenues excluding excise

taxes

3,742

$

3,972

$

(5.8)%

363

$

349

$

4.0%

100

$

74

$

35.1%

102

$

89

$

14.6%

Adjusted OCI Margins

40.0%

37.1%

2.9

pp

55.6%

61.0%

(5.4)

pp

56.0%

54.1%

1.9

pp

* Altria acquired UST and its smokeless tobacco and wine businesses on January 6,

2009. As a result, USSTC and Ste. Michelle's financial results from

January 6 through December 31, 2009 are included in Altria's 2009 segment results

for the quarter ended June 30, 2009. Altria Group, Inc. and Subsidiaries,

Selected Financial Data by Reporting Segment for the Quarter ended June 30,

(dollars in millions)

Wine

Second-Quarter Results

Cigarettes

Smokeless Products

Cigars |

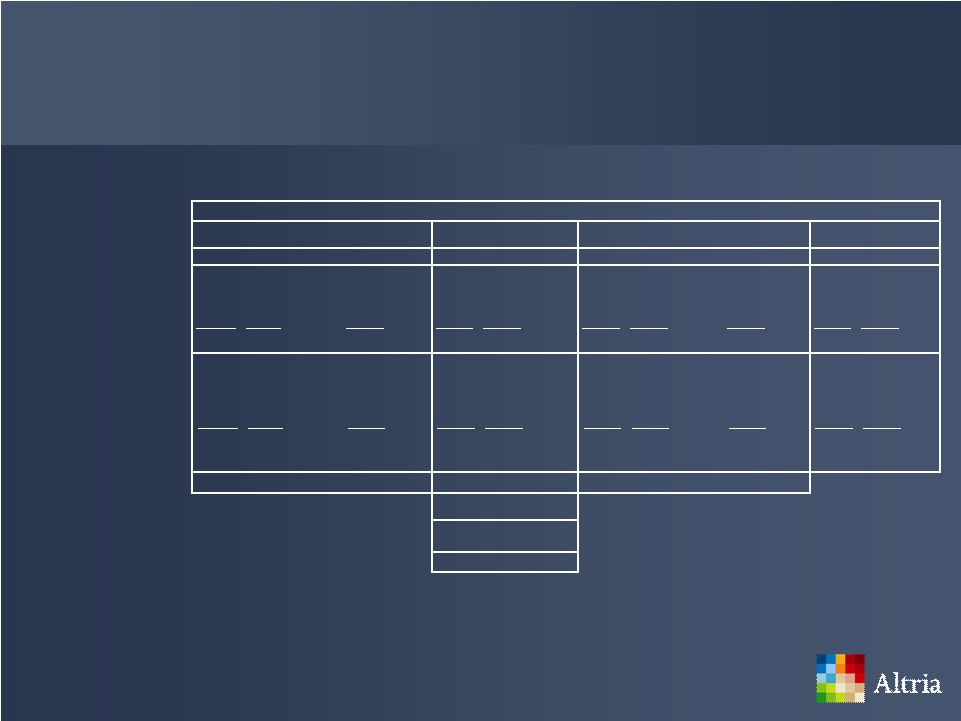

91

Adjusted OCI for Reporting Segments

First-Half Results

Source: ALCS Finance, reconciliation between GAAP and non-GAAP financial

measures 2010

2009

2008

2010

2009*

2010

2009

2008

2010

2009*

Reported OCI

2,680

$

2,569

$

4.3%

2,377

$

8.1%

376

$

175

$

100%+

103

$

90

$

14.4%

91

$

(1.1)%

19

$

10

$

90.0%

Asset Impairment, exit, integration

and implementation costs

74

84

61

13

151

1

7

3

1

4

UST acquisition-related costs

-

-

-

1

13

-

-

-

9

10

Adjusted OCI

2,754

$

2,653

$

3.8%

2,438

$

8.8%

390

$

339

$

15.0%

104

$

97

$

7.2%

94

$

3.2%

29

$

24

$

20.8%

Net Revenues

10,712

$

9,920

$

8.0%

9,149

$

8.4%

771

$

671

$

14.9%

290

$

233

$

24.5%

192

$

21.4%

201

$

169

$

18.9%

Less Excise taxes

3,578

2,732

1,650

53

36

103

60

31

8

8

Less

Revenues

for

contract

volume

Mfg for PMI

-

-

110

-

-

-

-

-

-

-

Adjusted

Net

Revenues

¹

7,134

$

7,188

$

(0.8)%

7,389

$

(2.7)%

718

$

635

$

13.1%

187

$

173

$

8.1%

161

$

7.5%

193

$

161

$

19.9%

Adjusted OCI Margins

38.6%

36.9%

1.7

pp

33.0%

54.3%

53.4%

0.9

pp

55.6%

56.1%

(0.5)

pp

58.4%

Operating Costs²

328

$

296

$

Domestic

Smokeless

Volume

³

368.0

308.3

Operating

Costs

per

can

4

0.89

$

0.96

$

¹

Adjusted

Net

Revenues

are

net

of

excise

taxes

and

contract

volume

manufactured

for

PMI

²

Adjusted Net Revenues less Adjusted Operating Companies Income

³

Volume

is

millions

of

units.

2009

Excludes

volume

(10.9m

cans)

from

Jan

1

-

Jan

6,

2009

shipped

by

USSTC

prior

to

the

UST

acquisition

Operating Costs per can is Operating Costs divided by Domestic Smokeless

Volume *

Altria

acquired

UST

and

its

smokeless

tobacco

and

wine

businesses

on

January

6,

2009.

As

a

result,

USSTC

and

Ste.

Michelle's

financial

results

from

January 6 through December 31, 2009 are included in Altria's 2009 segment results

for the six months ended June 30, 2009. Altria Group, Inc. and Subsidiaries,

Selected Financial Data by Reporting Segment for the First Six Months ended June 30,

(dollars in millions)

Wine

First-Half Results

Cigarettes

Smokeless Products

Cigars

4 |

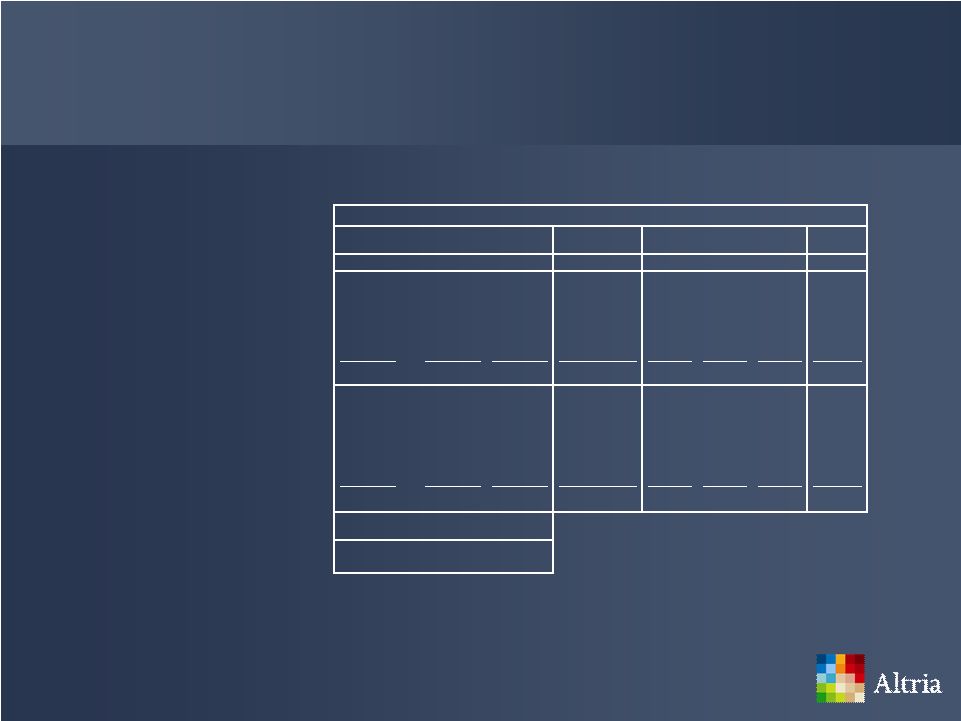

92

Adjusted OCI for Reporting Segments

Full-Year Results

Source: ALCS Finance, reconciliation between GAAP and non-GAAP financial

measures Smokeless

Products

Wine

2009

2008

2007

2009*

2009

2008

2007**

2009*

Reported OCI

5,055

$

4,866

$

4,511

$

381

$

176

$

164

$

7

$

43

$

Asset Impairment, exit, integration

and implementation costs

254

166

371

236

9

18

-

9

Provision for Scott Case

-

-

26

-

-

-

-

-

UST acquisition-related costs

-

-

-

15

-

-

-

21

Adjusted OCI

5,309

$

5,032

$

4,908

$

632

$

185

$

182

$

7

$

73

$

Net Revenues

20,919

$

18,753

$

18,470

$

1,366

$

520

$

387

$

15

$

403

$

Less Excise taxes

6,465

3,338

3,449

88

162

61

3

17

Less Revenues for contract volume

Mfg for PMI

-

298

-

-

-

-

-

-

Adjusted Net Revenues¹

14,454

$

15,117

$

15,021

$

1,278

$

358

$

326

$

12

$

386

$

Adjusted OCI Margins

36.7%

33.3%

32.7%

% point change 2009 adjusted OCI

margin versus 2007 adjusted OCI margin

4.0

pp

¹

Adjusted Net Revenues are net of excise taxes and contract volume manufactured for

PMI * Altria acquired UST and its smokeless tobacco and wine businesses on

January 6, 2009. As a result, USSTC and Ste. Michelle's financial results from

January 6 through December 31, 2009 are included in Altria's 2009 segment results

for the year ended December 31, 2009. ** Altria acquired John Middleton and

its machine-made large cigar business on December 15, 2007. As a result, John Middleton's financial results from

December 15 through December 31, 2007 are included in Altria's 2007 segment results

for the year ended December 31, 2007. Altria Group, Inc. and Subsidiaries,

Selected Financial Data by Reporting Segment for the Years ended December 31,

(dollars in millions)

Full-Year Results

Cigarettes

Cigars |

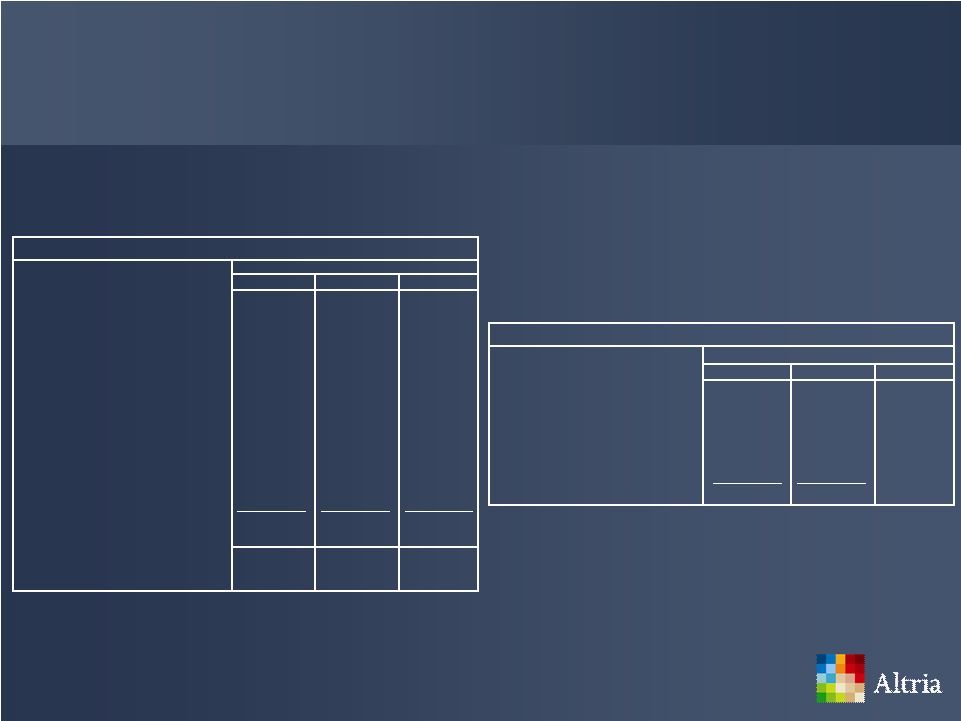

93

Altria’s Adjusted Diluted EPS

for Years Ended December 31

Source: ALCS Finance, reconciliation between GAAP and non-GAAP financial

measures Change

Reported diluted EPS

$1.81 -

$1.85

1.54

$

18% to 20%

Asset Impairment, exit, integration and

implementation costs

0.04

0.19

UST acquisition-related costs*

0.01

0.06

SABMiller special items

0.03

-

Tax items

(0.02)

(0.04)

Adjusted diluted EPS

$1.87 -

$1.91

1.75

$

7% to 9%

* Excludes exit and integration costs

2009 Actual

Full Year

Altria’s Full-Year Earnings Per Share Forecast Excluding Special

Items 2007

Reported diluted EPS from continuing

operations

1.54

$

1.48

$

1.48

$

Asset Impairment, exit, integration and

implementation costs

0.19

0.15

0.15

Interest on tax reserve transfers to Kraft

Foods Inc. (Kraft)

-

-

0.02

Recoveries from airline industry exposure

-

-

(0.06)

Gain on sale of corporate headquarters

building

-

(0.12)

-

Loss on early extinguishment of debt

-

0.12

-

UST acquisition-related costs*

0.06

0.02

-

SABMiller special items

-

0.03

-

Tax items

(0.04)

(0.03)

(0.09)

Adjusted diluted EPS from continuing

operations

1.75

$

1.65

$

1.50

$

% change in adjusted diluted EPS

from continuing operations versus

prior-year period

6.1%

10.0%

* Excludes exit and integration costs

Altria’s Adjusted Results Excluding Special Items

Full Year

2009

2008

2010 Estimated |

94

Source: Reconciliation between GAAP and non-GAAP financial measures from UST

financials UST LLC Adjusted Operating Profits for Reporting

Segments Full-Year and First-Half Results

First-Half Results

Smokeless

Tobacco

2008

Smokeless Tobacco GAAP

Operating Profit

429.8

$

Antitrust litigation

1.5

Restructuring charges

1.3

Adjusted non-GAAP Operating

Profit

432.6

$

Smokeless Tobacco Net Sales

767.3

$

Operating Costs

¹

334.7

$

Domestic Smokeless Volume

²

331.9

Operating Costs per can

1.01

$

¹

Net Sales less Adjusted non-GAAP Operating Profit

²

Volume is millions of units

Source: UST Financials

UST LLC, Selected Financial Data by Reporting

Segment for Six Months ended June 30,

(dollars in millions)

Full-Year Results

Smokeless

Tobacco

2007

Smokeless Tobacco GAAP

Operating Profit

715.7

$

Antitrust litigation

137.1

Restructuring charges

8.2

Adjusted non-GAAP Operating

Profit

861.0

$

Smokeless Tobacco net sales

1,546.6

$

Adjusted Operating Margins

55.7%

UST LLC, Selected Financial Data by Reporting

Segment for the Full-Year ended December 31,

(dollars in millions) |