Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Higher One Holdings, Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE - Higher One Holdings, Inc. | dex991.htm |

Higher One

Holdings, Inc. Q2’10 Earnings Results

August 11 , 2010

Exhibit 99.2

th |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

2

Forward-Looking Statements

This presentation includes forward-looking statements, as defined by the Securities and

Exchange Commission. Management’s projections and expectations are subject

to a number of risks and uncertainties that could cause actual performance to differ

materially from those predicted or implied. These statements speak only as of the

date they are made, and the company does not intend to update or otherwise revise the

forward-looking information to reflect actual results of operations, changes in

financial condition, changes in estimates, expectations or assumptions, changes in general

economic or industry conditions or other circumstances arising and/or existing since

the preparation of this presentation or to reflect the occurrence of any unanticipated

events. The forward-looking statements in this presentation do not include

the potential impact of any acquisitions or divestitures that may be announced and/or

completed after the date hereof. Information about the factors that could affect future

performance

can

be

found

in

our

recent

SEC

filings,

available

on

our

website

at

http://ir.higherone.com/.

This presentation includes certain metrics presented on a non-GAAP basis,

including non-GAAP adjusted EBITDA, non-GAAP adjusted EBITDA margin,

non-GAAP adjusted net income, non-GAAP adjusted diluted EPS, and non-GAAP

Free Cash Flow. We believe that these non-GAAP measures, which exclude

amortization of intangibles, stock based compensation, and certain one-time or

non-cash impacts to our results, all net of taxes, provide useful information

regarding normalized trends relating to the company’s financial condition and

results of operations. Reconciliations of these non-GAAP measures to their closest

comparable GAAP measure are included in the appendix of this presentation.

|

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

3

Q2’10 Summary

•

Strong performance on both top and bottom line

•

Executing against our priorities

–

Increased OneAccount adoption at existing clients

–

Strong YTD sales for both OneDisburse and CASHNet

Suite of Payment Products

•

Completed our Initial Public Offering in June

–

Raised $37.8M in net proceeds

–

Paid down $10.5 outstanding on line of credit |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

4

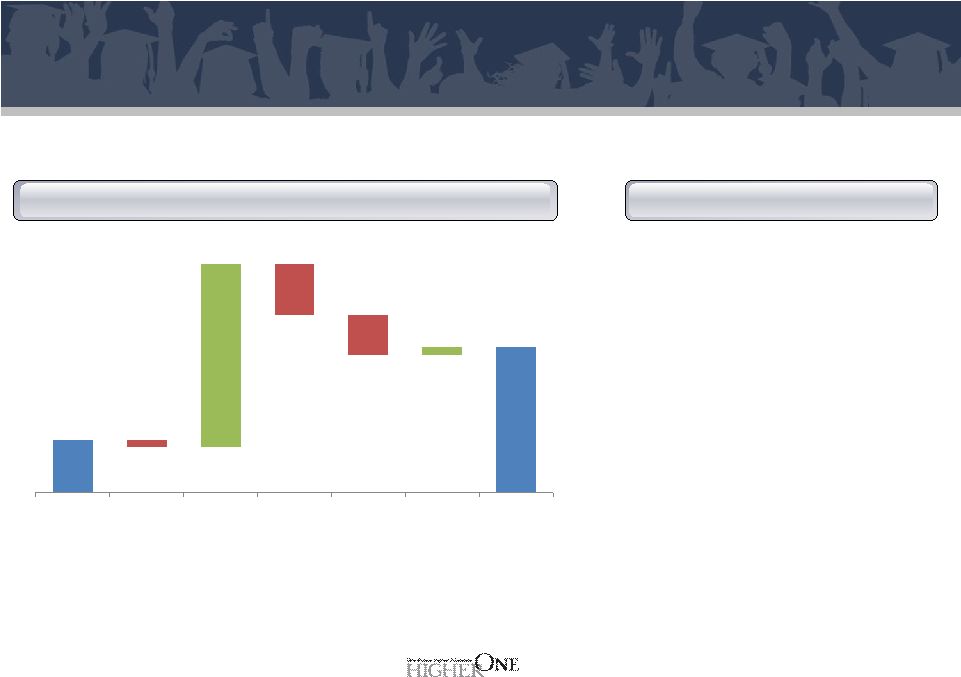

Q2’10 Summary…

Revenue

*Calculation of organic revenue growth is included in the appendix of this presentation

Revenue

(in $ millions)

12.5

20.5

25.3

37.6

26.9

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Y/Y Revenue Growth

--

--

--

118%

116%

Y/Y Organic Growth*

--

--

--

87%

80%

Gross Profit Margin

61.9%

68.6%

66.4%

70.1%

64.4% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

5

Q2’10 Summary…

Net Income

Net Income

(in $ millions)

0.4

4.8

5.0

8.3

1.8

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Y/Y Net Income Growth

--

--

--

104%

343%

Net Income Margin

3.3%

23.4%

19.6%

22.0%

6.8% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

6

Q2’10 Summary…

Adj. EBITDA

*Calculation of Adj. EBITDA and Adj. EBITDA Margin is included in the appendix of this

presentation Adjusted EBITDA

(in $ millions)

3.0

9.1

10.3

17.9

9.2

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Y/Y Adj. EBITDA Growth

--

--

--

121%

207%

Adj. EBITDA Margin*

24.0%

44.3%

40.8%

47.7%

34.2% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

7

Q2’10 Summary…

GAAP Diluted EPS

GAAP Diluted EPS

(in $)

0.01

0.09

0.09

0.15

0.03

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Y/Y Diluted EPS Growth

--

--

--

95%

324% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

8

Q2’10 Summary…

Adj. EPS

*Calculation of Adj. EPS and Adj. Net Income Margin is included in the appendix of this

presentation Adjusted Diluted EPS

(in $)

0.03

0.10

0.11

0.19

0.09

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Y/Y Adj. EPS Growth

--

--

--

109%

212%

Adj. Net Income Margin*

12.4%

27.0%

24.4%

28.1%

18.8% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

9

Q2’10 Summary…

Operating Cash Flow

Operating Cash Flow

(in $ millions)

(1.2)

6.9

9.2

17.3

(0.1)

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Y/Y Operating CF Growth

--

--

--

204%

-89%

Operating CF as a % of Rev

-9.9%

33.8%

36.5%

46.1%

-0.5% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

10

Q2’10 Summary…

Free Cash Flow

*Calculation of Free Cash Flow is included in the appendix of this presentation

Free Cash Flow

(in $ millions)

-1.5

6.4

8.1

16.2

-1.4

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

Y/Y FCF Growth

--

--

--

199%

-4%

FCF Yield

-11.8%

31.4%

32.0%

43.1%

-5.3%

CapEx as % of Rev

1.9%

2.5%

4.6%

3.0%

4.8% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

11

Q2’10 Sales Update

*SSE stands for Signed Student Enrollment, and is the total student enrollment (according to

the most current IPEDs data) at all schools

that have signed contracts for either our OneDisburse or at least one of our CASHNet Payment

Suite products. OneDisburse SSE*

CASHNet Suite SSE*

2,094

2,213

2,331

2,663

2,833

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

1,650

1,765

1,949

2,202

2,315

Q2'09

Q3'09

Q4'09

Q1'10

Q2'10

+35%

+40% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

12

Q2’10 OneAccount Growth

OneAccount Growth

678

1,235

314

243

Q2'09 OneAccounts

Change in OneAccounts

at schools launched

before 6/30/09

New OneAccounts from

schools launched after

6/30/09

Q2'10 OneAccounts

+82% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

13

Q2’10 Revenue Breakdown*

*The lighter colors in the graph represent Higher One Payments, Inc. revenue prior to the

acquisition, broken down into the different revenue buckets. Year-over-year growth

rates and revenue by bucket as a % of total revenue are calculated off of the Q2’09

combined Higher One, Inc. and Higher One Payments, Inc. revenue. As a % of total

revenue*

Account

(in $ thousands)

Payment Trxn

(in $ thousands)

Higher Ed. Institution

(in $ thousands)

Other

(in $ thousands)

11,248

20,923

Q2'09

Q2'10

2

2,671

2,199

Q2'09

Q2'10

765

2,744

1,308

Q2'09

Q2'10

449

603

161

Q2'09

Q2'10

70%

78%

14%

10%

13%

10%

4%

2%

+86%

+21%

+32%

-1% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

14

Q2’10 Operating Expenses

•

Increased operating leverage from

scale and improved efficiencies

•

Decrease in G&A as a percent of

revenue partially offset by public

company expenses

•

Main driver of PD expense is

employee compensation…

not

ramping headcount as fast as

revenue

•

Absolute dollar value of PD expense

up 38% y/y

•

Making the necessary investments

for the future

•

Excluding stock-based and other

customer acquisition expense, S&M

expense as a percent of revenue

would have been 7.5% in Q2’10

(compared to 11.4% in Q2’09)

•

Additional employee-related expenses

•

Increase in S&M as a percent of

revenue partially offset by efficiency

and scale

G&A

(as a % of rev)

PD

(as a % of rev)

S&M

(as a % of rev)

31.2%

28.9%

Q2'09

Q2'10

4.6%

2.9%

Q2'09

Q2'10

19.8%

20.5%

Q2'09

Q2'10 |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

15

Q2’10 Cash Flow / Capital Allocation

•

($1.4M) in FCF

•

Net proceeds of $37.8M from IPO

•

Fully paid down remaining

$10.5M balance on Line of Credit

•

Cash outflow of $8.3M in

acquisition payable

*Other includes proceeds from options exercises and tax benefits

from options exercises

Cash Balance/Flows

(in $ millions)

FCF/Other Movements

$10.6

$29.9

($1.4)

$37.8

($10.5)

($8.3)

$1.7

Q2'10

Beginning

Cash

FCF

Net

Proceeds

from IPO

LoC

Repayment

Acquisition

Payable

Other*

Q2'10

Ending Cash |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

16

GAAP Guidance Update

FY’10

Q3’10

•

Impacted by stock-based compensation, stock based and other customer

acquisition expense, and amortization of intangibles

•

Stock-based and other customer acquisition expense based on the undergraduate

enrollment at higher education clients acquired relating to the acquisition of

EduCard in 2008 and IDC in 2009 and the market value of shares of ONE at time of

acquisition... difficult to predict both future sales and the share price in the future

Low

High

Low

High

Revenue

$35M

-

$37M

$131M

-

$135M

implied y/y growth

71%

-

80%

73%

-

79%

GAAP Diluted EPS

$0.00

-

$0.08

$0.20

-

$0.32

implied y/y growth

-100%

-

-11%

-25%

-

20% |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

17

Non-GAAP Guidance Update

*Calculation of Adjusted EPS is included in the appendix of this

presentation

FY’10

Q3’10

•

Continued strength in OneAccount

adoption

•

Full impact of Regulation E begins August 15

•

Higher share count impacting EPS growth in 2H’10

Low

High

Low

High

Revenue

$35M

-

$37M

$131M

-

$135M

implied y/y growth

71%

-

80%

73%

-

79%

Adj. Diluted EPS

$0.12

-

$0.13

$0.48

-

$0.52

implied y/y growth

16%

-

26%

41%

-

53%

th |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

18

Summary

•

Strong performance on both top and bottom line

•

Executing against our priorities

–

Increased OneAccount adoption at existing clients

–

Strong YTD sales for both OneDisburse and CASHNet

Suite of Payment Products

•

Completed our Initial Public Offering in June

•

Well positioned heading into back half of the year |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

19

Q & A |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

20

Appendix |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

21

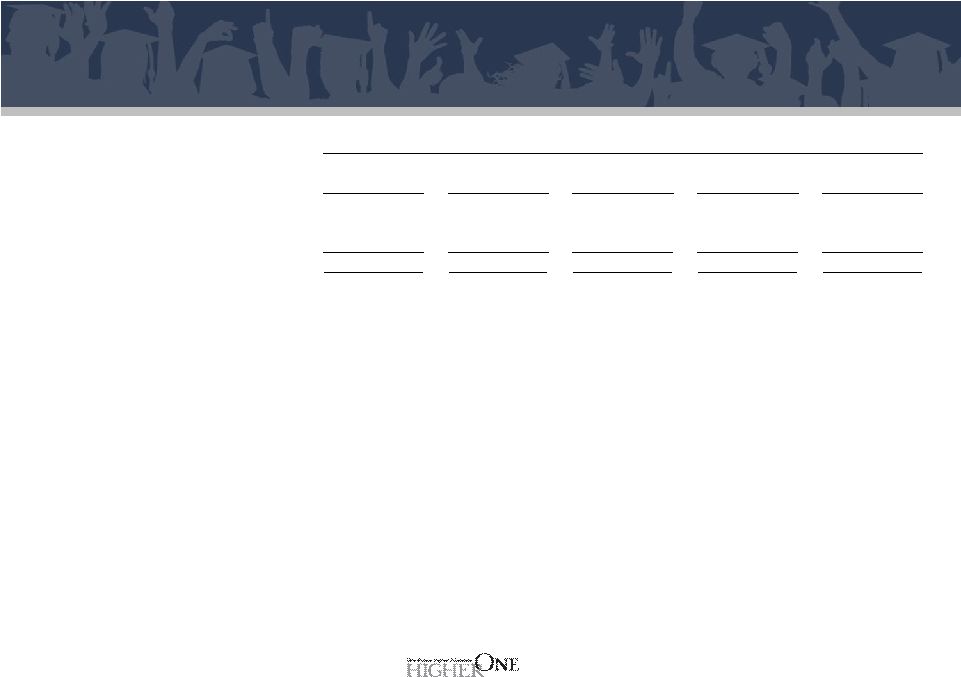

Calculation of Organic Revenue

March 31,

June 30,

2010

2010

Total Revenue Growth

118%

116%

Acquisition Impact

(31%)

(36%)

Total Organic Revenue Growth

87%

80%

Three Months Ended |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

22

Calculation of Free Cash Flow

June 30,

Sept 30,

Dec 31,

March 31,

June 30,

(in thousands)

2009

2009

2009

2010

2010

GAAP Operating Cash Flow

(1,233)

$

6,940

$

9,249

$

17,326

$

(132)

$

Purchases of Fixed Assets, Net of Disposals

(242)

$

(512)

$

(1,158)

$

(1,128)

$

(1,287)

$

Free Cash Flow

(1,475)

$

6,428

$

8,091

$

16,198

$

(1,419)

$

Three Months Ended |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

23

Calculation of Adjusted EBITDA

June 30,

Sept 30,

Dec 31,

March 31,

June 30,

(in thousands)

2009

2009

2009

2010

2010

GAAP Net Income

413

$

4,793

$

4,967

$

8,264

$

1,830

$

Interest income

(1)

(1)

(2)

(1)

(2)

Interest expense

120

113

164

229

247

Income tax expense

252

2,596

2,810

5,167

1,183

Depreciation and amortization

684

633

1,082

1,626

1,747

EBITDA

1,468

8,134

9,021

15,285

5,005

Other income

-

-

(17)

-

-

Stock-based and other customer acquisition expense

1,050

227

489

1,801

3,508

Stock-based compensation expense

329

341

424

849

692

Milestone bonus

150

375

419

-

-

Adjusted EBITDA

2,997

$

9,077

$

10,336

$

17,935

$

9,205

$

Revenues

12,464

$

20,503

$

25,315

$

37,568

$

26,941

$

Net Income Margin

3.3%

23.4%

19.6%

22.0%

6.8%

Adjusted EBITDA Margin

24.0%

44.3%

40.8%

47.7%

34.2%

Three Months Ended |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

24

Calculation of Adjusted Diluted EPS

June 30,

Sept 30,

Dec 31,

March 31,

June 30,

(in thousands)

2009

2009

2009

2010

2010

GAAP Net Income

413

$

4,793

$

4,967

$

8,264

$

1,830

$

Stock-based and other customer acquisition expense

1,050

227

489

1,801

3,508

Stock-based compensation expense - ISO

140

152

206

437

373

Stock-based compensation expense - NQO

189

189

218

412

319

Milestone bonus expense

150

375

419

-

-

Amortization of intangibles

143

86

405

767

768

Amortization of finance costs

22

32

37

51

51

Total pre-tax adjustments

1,694

1,061

1,774

3,468

5,019

Tax rate

35.9%

35.9%

35.9%

38.5%

38.7%

Tax adjustment

558

326

563

1,167

1,796

Adjusted net income

1,549

$

5,528

$

6,178

$

10,565

$

5,053

$

Diluted Weighted Average Shares Outstanding

53,344

53,620

53,821

54,872

55,688

Diluted EPS

0.01

$

0.09

$

0.09

$

0.15

$

0.03

$

Adjusted Diluted EPS

0.03

$

0.10

$

0.11

$

0.19

$

0.09

$

Revenues

12,464

$

20,503

$

25,315

$

37,568

$

26,941

$

Net Income Margin

3.3%

23.4%

19.6%

22.0%

6.8%

Adjusted Net Income Margin

12.4%

27.0%

24.4%

28.1%

18.8%

Three Months Ended |

®

©2010 Higher One and the Higher One logo are registered trademarks of Higher One, Inc.

25

Reconciliation of GAAP to non-GAAP Guidance

Revenues

$35.0

-

$37.0

$35.0

-

$37.0

Diluted EPS

$0.00

-

$0.08

$0.12

-

$0.13

September 30, 2010

GAAP

Non-GAAP (a)

Three Months Ending

Revenues

$131.0

-

$135.0

$131.0

-

$135.0

Diluted EPS

$0.20

-

$0.32

$0.48

-

$0.52

December 31, 2010

GAAP

Non-GAAP (b)

Twelve Months Ending

(a)

Estimated

Non-GAAP

amounts

above

for

the

three

months

ending

September

30,

2010,

reflect

the

estimated

quarterly

adjustments

that

exclude

(i)

the

amortization

of

intangibles

and

finance

costs

of

approximately

$500,000,

(ii)

stock-based

compensation

expense

of

approximately

$550,000,

and

(iii)

stock-based

and

other

customer

acquisition

expense

of

approximately

$2.0

million

to

$6.0

million.

(b)

Estimated

Non-GAAP

amounts

above

for

the

twelve

months

ending

December

31,

2010,

reflect

the

estimated

annual

adjustments,

net

of

tax,

that

exclude

the

amortization

of

intangibles

and

finance

costs

of

approximately

$2.0

million,

stock-based

compensation

expense

of

approximately

$2.5

million,

and

stock-based

and

other

customer

acquisition

expense

of

approximately

$7.0

million

to

$12.0

million.

Stock-based

and

other

customer

acquisition

expense

primarily

relates

to

our

acquisition

of

EduCard

in

2008

and

IDC

in

2009,

in

connection

with

which

we

issued

restricted

stock.

We

calculate

the

stock-based

and

other

customer

acquisition

expense

based

on

the

undergraduate

enrollment

at

higher

education

clients

acquired

relating

to

the

acquisition,

and

the

market

value

of

our

common

stock

at

the

time

the

client

is

acquired.

It

is

difficult

to

predict

with

any

degree

of

certainty

either

the

number

of

new

higher

education

clients

we

will

acquire,

the

timing

of

future

customer

acquisitions,

or

the

market

value

of

our

common

stock

at

any

time,

resulting

in

a

wide

range

of

expected

expense.

Stock-based

and

other

customer

acquisition

expense

primarily

relates

to

our

acquisition

of

EduCard

in

2008

and

IDC

in

2009,

in

connection

with

which

we

issued

restricted

stock.

We

calculate

the

stock-based

and

other

customer

acquisition

expense

based

on

the

undergraduate

enrollment

at

higher

education

clients

acquired

relating

to

the

acquisition,

and

the

market

value

of

our

common

stock

at

the

time

the

client

is

acquired.

It

is

difficult

to

predict

with

any

degree

of

certainty

either

the

number

of

new

higher

education

clients

we

will

acquire,

the

timing

of

future

customer

acquisitions,

or

the

market

value

of

our

common

stock

at

any

time,

resulting

in

a

wide

range

of

expected

expense. |