Attached files

| file | filename |

|---|---|

| 8-K - Clarus Corp | v192532_8k.htm |

Investor /

Analyst Presentation August 5,

2010

Forward

Looking Statements This

presentation -looking statements” within the meaning includes “forward Reform

Act of1995. Black Diamond Equipment (“Black “plans,” “expects,” “intends,”

“future,” -looking statements. These”will,” and forward-looking statements

involve a number of risks, uncertainties and assump’tions which are difficult to

predict. Black Diamond

you that any forward-looking statement is not a guarantee of future performance

and that actual results could differ materially from those contained in the

forward-looking statement. Examples of forward-looking statements include, but

are not limited to: (i) statements about the benefits of the acquisitions of

Black Diamond Equipment, Ltd. and Gregory Mountain Products, Inc., including

future financial and operating results that may be realized from the

acquisitions; (ii) statements of plans, objectives and expectations of Black

Diamond or its management or Board of Directors; (iii) statements of future

economic performance; and (iv) statements of assumptions underlying such

statements and other statements that are not historical facts. Important factors

that could cause actual results to differ materially from those indicated by

such forward-looking statements include, but are not limited to: (i) our ability

to successfully integrate our recent acquisitions; (ii) our ability to realize

financial or operating results as expected; (iii) material differences in the

actual financial results of the mergers compared with expectations, including

the impact of the mergers on conditions and the impact they may have on Black

Diamond and our customers or demand for products; (v) our ability to implement

our acquisition growth strategy or obtain financing to support such strategy;

(vi) the loss of any member of our senior management or certain other key

executives; (vii) our ability to utilize our net operating loss carry forward;

and (viii) our ability to adequately protect our intellectual property rights.

Additional factors that could cause Black Diamond’s results to differ -looking

statements can bematerially from found in the “Risk Factors” section of Black

Diamond’s including its latest annual report on Form 10-K and most recently

filed Forms 8-K and 10-Q, which may be obtained at our web site at

www.claruscorp.com or the Securities forward-looking statements included in this

presentation are based upon information available to Black Diamond as of the

date of this presentation, and speak only as the date hereof. We assume no

obligation to update any forward-looking statements to reflect events or

circumstances after the date of this presentation.

Video

Investment

Considerations Formative

transaction creates “pure play” in the A leading

global designer, manufacturer and distributor of technical outdoor recreation

equipment and lifestyle products for climbers, alpinists, hikers, freeride

skiers, and outdoor enthusiasts and travelers Targeting

$500 million of revenue in next five years through combination of organic growth

and targeted acquisitions History of

continuous product development Experienced

management team with significant ownership Well-capitalized

balance sheet Anticipating

cost synergies and near-term revenue synergies Strong

partnerships with leading global retailers Intimate

relationship with consumers / user communities Champion of

environmental stewardship and corporate social responsibility

Black Diamond

Equipment Board of Directors Warren B.

Kanders, Executive Chairman - Chairman

and Chief Executive Officer of Armor Holdings, Inc. (NYSE: AH),

1996 2007 - Founder and

Vice Chairman of the Board of Benson Eyecare Corporation (NYSE: EYE) Robert R.

Schiller, Executive Vice Chairman - Director,

2005 2007; President, 2004 2007; Chief Operating Officer,

2003 2007, of Armor Holdings, Inc. Peter

Metcalf, President and Chief Executive Officer - Co-founded

Black Diamond Equipment, Ltd. in 1989;1982 - present Philip N.

Duff, Director - 15 Years

with Morgan Stanley, Chief Financial Officer of Morgan Stanley - Original

investor in Black Diamond Equipment, Ltd. Michael A.

Henning, Director, Chairman of the Audit Committee - Deputy

Chairman of Ernst & Young, 1978 - 2000 - Vice

Chairman of Tax Services, Ernst & Young,1991 - 1993 Donald L.

House, Director, Chairman of the Compensation Committee - Technology

industry executive; private investor Nicholas

Sokolow, Director, Chairman of the Nominating and Governance Committee - Partner at

Lebow & Sokolow LLP

Black Diamond

Equipment Management Team Peter

Metcalf, President and Chief Executive Officer, 28 years with BDE - Co-founded

Black Diamond Equipment, Ltd. in 1989 Robert Peay,

Chief Financial Officer and Secretary, 14 years with BDE - Accounting

Manager, Financial Controller and Chief Financial Officer of Black Diamond - Arthur

Andersen Christian

Jaeggi, Head of BD Europe, 14 years with BDE - Established

Black Diamond European headquarters in 1997 - Mammut

Ryan Gellert,

Head of BD Asia, 10 years with BDE - Purchasing,

Planning, and Logistics departments of Black Diamond - J.D.

University of Utah Rick Luskin,

General Counsel, 11 years with BDE - Personal

counsel to Frank Wells, President of the Walt Disney Company - Litigator,

Bingham McCutchen

Black Diamond

Equipment Management Team VP of Product

Development, 8 years with BDE - Director of

Product Creation for Reef - Nike, The

North Face, and Giro VP of Sales,

17 years with BDE - President

of Entre Prises, climbing wall manufacturer - Co-founder

and senior manager of Metolius Mountain Products VP of

Operations, 15 years with BDE - Production

Planner - U.S.

Olympic Whitewater Kayak team. VP of

Marketing, 4 years with BDE - Product

Marketing Manager at Patagonia, Inc., 10 years with Patagonia VP of Systems

Integration, 19 years with BDE - CFO and IT

Director from 2000-2007, and a member of the Board of Directors from 2000-2010

- VP of

Finance of Skullcandy Inc., consumer electronics company VP of MIS, 9

years with BDE - Project

manager and software engineer at Boeing

Corporate

Structure Leverage

Global Operating Platform Black Diamond

Equipment, Inc. Future Brands

Heritage and

History 1957

Chouinard Equipment, Ltd. founded by Yvon Chouinard with his purchase of a

second-hand coal-fired forge to make hard-steel pitons for use in Yosemite

Valley 1972

Introduces new aluminum chockstone, called Hexentrics 1982 Peter

Metcalf hired to run Chouinard Equipment, a $900,000 annual revenue company

1989 Metcalf

and employees purchase assets of Chouinard Equipment Ltd. and rename the company

Black Diamond Equipment, Ltd. 1996 Black

Diamond Europe founded; company receives CE certification 1997 Acquires

Bibler Tents 1998 Acquires

Franklin Climbing 1999

Introduces Avalung; acquires Ascension Skins 2002 Black

Diamond Asia founded 2010 Black

Diamond Equipment goes public on NASDAQ (BDE) through a combination with Clarus

and Gregory Mountain Products

Heritage and

History 1965 At age

14, Wayne Gregory designs his first backpack as part of a Boy Scout project

1970 Wayne

starts his first company, Sunbird, with the goal of producing advanced external

frame packs 1973 Peter

Metcalf uses a Sunbird pack for his Alaskan first ascent 1977 Wayne

founds Gregory Mountain Products in San Diego, California 1977 Gregory

forms relationship with Japanese distributor A&F 1980’s

Gregory develops first backpacks in different frame, harness and waist belt

sizes 1990’s

Gregory develops the center-locking bar tack for increased strength at major

stress points 2008 Retail

store opens in Tokyo, Japan selling exclusively Gregory products 2009 Retail

store opens in Seoul, South Korea selling exclusively Gregory products

The Black

Diamond Code We should

always aim to be the best at what we do and be the market leader Our products

and passion should be toward building a true global presence Our efforts

should always support the foundation of the industry, the specialty retailer

We create

long-term partnerships with companies we do business with at every step of the

value chain We should aim

to be easy to do business with Be a fierce

competitor in your pursuit of perfection but always with the highest ethical

standards Aim to

develop a sustainable competitive advantage in every facet of the business Success is a

result of its employees, hard work and dedication and that success should always

be shared The work

environment should be a safe, personally fulfilling place for all employees all

the time We champion

the preservation of, and access to, mountain and crag environments around the

world while working to minimize our own environmental footprint

Black Diamond

Markets to a Wide Variety of Passionate Outdoor Enthusiasts Around the World

Black Diamond

Creates Products Out of Necessity Not Fashion or Fad Black Diamond

began as a Company fueled by providing innovative and leading edge products to

customers who demand the best Creating

superior technical products Each product

is designed and crafted for a specific need or to perform a specific function

from the ground up Company free

from meeting any pre-conceived notions be it hoped for market

success, competitive pressures, or hype and focus on meeting specific

needs of its customers Each product

is crafted out of the most appropriate, high quality materials in partnership

with our top suppliers Each product

undergoes a rigorous, multi-step testing process, surpassing the performance

limits the product would experience in real life use And all of

this process is done in the “Black

Our Products

- Climbing Carabiners

and quick draws Harnesses

Belay and

rappel Protection

Chalk bags

Dogbones and

runners Helmets Climbing

packs

Our Products

- Climbing

Our Products

- Skiing Skis Boots Bindings

Poles Snow gloves

Skins Avalung Snow safety

Snow packs

Our Products

- Skiing

Our Products

- Mountain Lighting

Trekking

poles Gloves Technical

mountaineering packs Backpacking

Backpacking

ventilated Hiking

ventilated All mountain

packs Active trail

Shelter Gaiters Tents Accessories

Our Products

- Mountain

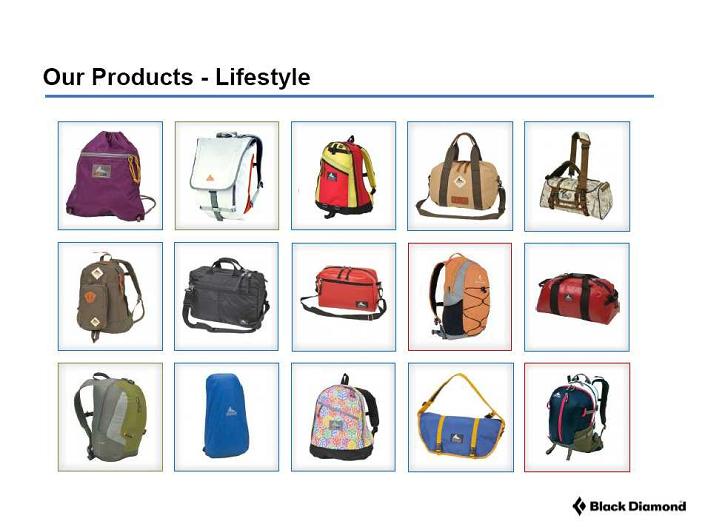

Our Products

- Lifestyle High-end

daypacks Japanese/other

Asian lifestyle Shoulder bags

and carry-alls Satchels Duffle bags

Rain covers

Clothing

Our Products

- Lifestyle

Brand

Positioning - Climbing High Brand

Cachet Arc’Teryx

Five

Ten Patagonia Misty Sterling

Petzl Mountain Rope prAna Wild Mammut

Krieg

Country Edelrid La Sportiva Narrow

Product Range Broad Product Range Camp Metolius

Grivel Evolv Mont Blanc DMM Trango

Omega

Red Chili Pacific Mad

Rock Voodoo Climbing Low Brand

Cachet

Brand

Positioning Skiing High Brand

Cachet Atomic Line

Salomon

Nordica Scott Volkl K2 Marker

Tecnica Dynastar Rossignol Narrow

Product Range Broad Product Range Lange Voile

G3 bca Fischer Swix

Karhu

Dynafit Leki Low Brand

Cachet

Brand

Positioning - Mountain High Brand

Cachet Patagonia The

North Face Osprey Mountain MSR Dakine

Cloudveil Hard Wear OR Marmot Kelty Narrow

Product Range Broad Product Range deuter Go Lite

Sierra Big Agnes Designs REI Leki Eastern Vaude

Mountain Sports Gordini Low Brand

Cachet

Accolades

Winner of

“REI Vendor of the Year” in both specific Consistently

rank as one of the top vendors to key dealers Winner of

product and category awards from industry magazines Outside, Backpacker, Powder,

Ski, Skiing, Climb, Rock & Ice and many others Outside

Magazine 2009/2010 Gear of the Year Award, Gregory Targhee backcountry pack

State of

Utah’s technical manufacturer of the year Women’s

Adventure, April 2009, Gregory Jade 25 Wins Editor’s Choice Award Utah small

business person of the year, Peter Metcalf Ernst &

Young’s Entrepreneur Team of the Year award

Environmentalism

and Corporate

Social Responsibility Black Diamond

and our employees support a number of non-profit organizations that help the

Outdoor industry, our community, and the environment Black Diamond

initiated a solid waste recycling program in 2007 - Recycled

approximately 60% of total solid waste stream - Reduction

in greenhouse gas emissions of approximately 510 tons CO2e, an amount equivalent

to driving 720,000 miles Products

built to minimize our environmental footprint Headquarters

facility has engaged in a series of energy efficiency projects - Duro-Last

roofing - T8 lighting

- High

efficiency HVAC

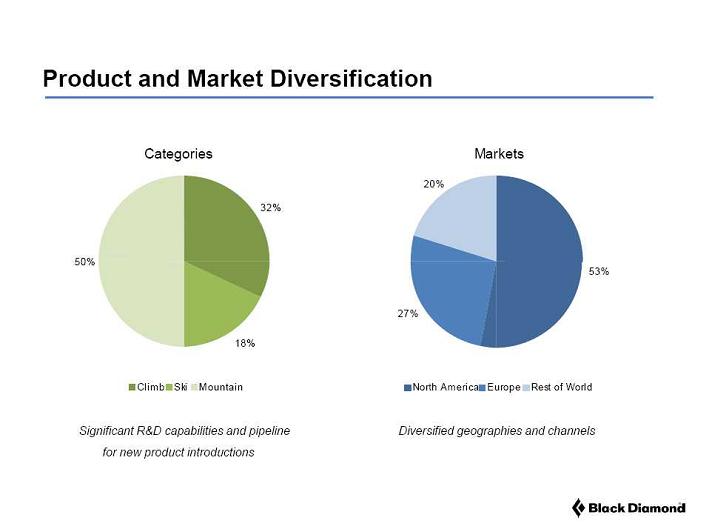

Product and

Market Diversification Categories

Markets 20% 32% 50% 53% 27% 18% Climb Ski

Mountain North America Europe Rest of World Significant

R&D capabilities and pipeline Diversified geographies and channels for new

product introductions

Global

Operations BD: Salt Lake

City, UT Headquarters,

manufacturing and distribution center Gregory: Japan 250+

employees Sales and

marketing 3 employees

Gregory:

Sacramento, CA Gregory,

sales and marketing BD: Basel, Switzerland 43 employees

Sales

and marketing, distribution Gregory:

Calexico, CA 31+ employees

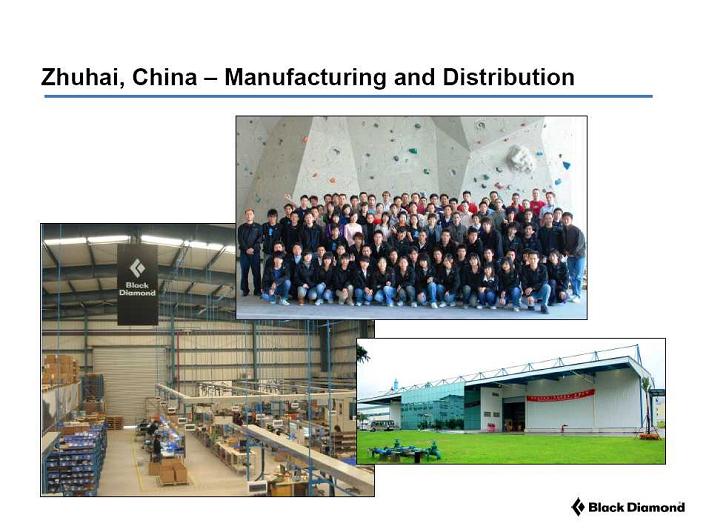

BD: Zhuhai, China Production

Manufacturing

and 50 employees

distribution 113+

employees 40+

Distributors worldwide Dedicated

Gregory retail stores in Japan and South Korea Retail store

in Salt Lake City 28

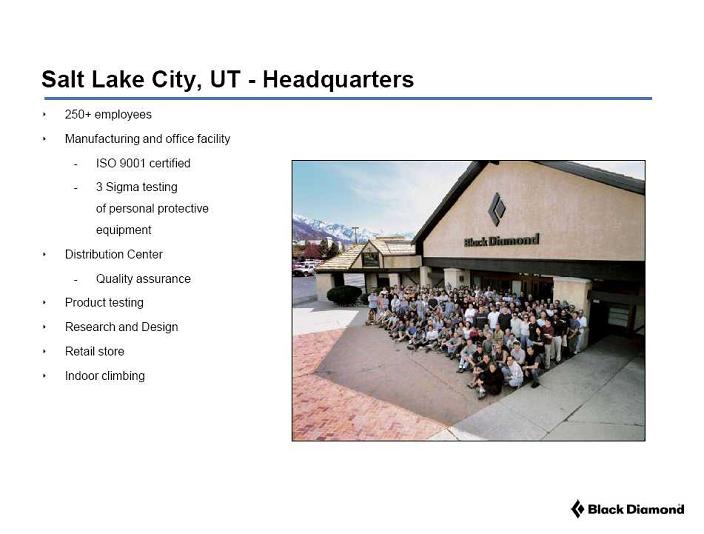

Salt Lake

City, UT - Headquarters 250+

employees Manufacturing

and office facility - ISO 9001

certified - 3 Sigma

testing of personal protective equipment Distribution

Center - Quality

assurance Product

testing Research and

Design Retail store

Indoor

climbing

Zhuhai,

China Manufacturing and Distribution In 2006,

Black Diamond Equipment Asia was established in southeast China - Black

Diamond built, owned and managed facility that is operated and staffed by Black

Diamond employees - The

manufacturing standards are identical to Salt Lake City factory Manufacture

and assemble product Serve as a

global distribution hub Support

product design and development activities Assist in the

sourcing of raw materials, components, and finished goods Provide

on-site quality assurance and inspection Drive BD

brand-building efforts throughout China

Zhuhai,

China Manufacturing and Distribution

Zhuhai,

China Manufacturing and Distribution

Growth

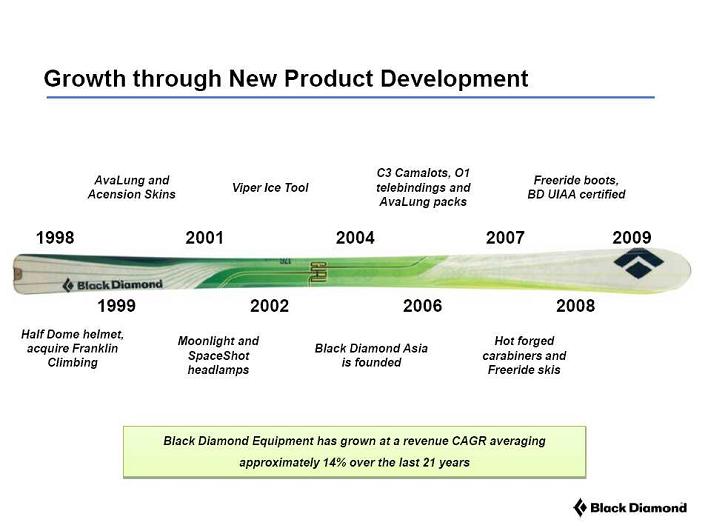

through New Product Development Express Ice

Screw, Move HQ to Salt HotWire carabiner Adopt 3 Sigma acquire Bibler Lake City

Tents 1989 1992

1994 1996 1991 1993

1995 1997 Black Diamond

Riva T1, first plastic FlickLock Europe, ISO 9001

certified telebinding telemark boot adjustable pole BD becomes CE

certified Black Diamond

holds over 60 patents and over 25 registered trademarks

Growth

through New Product Development C3 Camalots,

O1 AvaLung and

Freeride boots, Viper Ice Tool telebindings and Acension Skins BD UIAA certified

AvaLung packs 1998 2001

2004 2007 2009 1999 2002

2006 2008 Half Dome

helmet, Moonlight and

Hot forged acquire Franklin Black Diamond Asia SpaceShot carabiners and Climbing

is founded headlamps Freeride skis Black Diamond

Equipment has grown at a revenue CAGR averaging approximately 14% over the last

21 years

Areas of

Expansion Organic and Acquisition Technical

clothing Technical

footwear Mountain

apparel / products Lifestyle

apparel / products Military

Helmets Goggles Sunglasses

Electronics

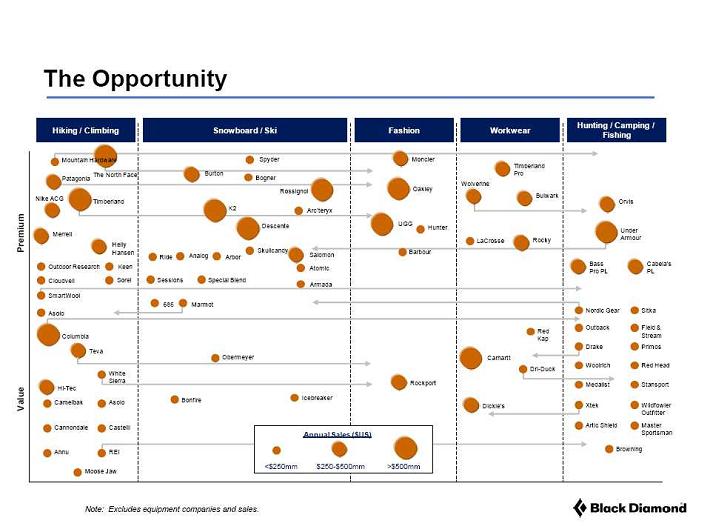

The

Opportunity Hunting /

Camping / Hiking / Climbing Snowboard / Ski Fashion Workwear Fishing Mountain

Hardware Spyder Moncler Timberland

The North Face Burton Pro Patagonia Bogner Wolverine Rossignol Oakley Bulwark

Nike

ACG Timberland Orvis K2 Arc’teryx Premium Descente UGG

Hunter

Under Merrell Rocky Armour LaCrosse Helly Hansen Skullcandy Barbour Ride Analog

Arbor Salomon Bass Cabela’s

Outdoor

Research Keen Atomic Pro PL PL

Cloudveil Sorel Sessions Special Blend Armada SmartWool 686 Marmot Nordic Gear

Sitka Asolo Outback Field

& Red Columbia Stream Kap Drake Primos Teva Obermeyer Carhartt Woolrich Red

Head Dri-Duck White Sierra Rockport Medalist Stansport Value Hi-Tec Bonfire

Icebreaker Camelbak Asolo Dickie’s Xtek Wildfowler Outfitter Cannondale

Castelli Artic Shield Master Annual Sales

($US) Sportsman Browning Ahnu

REI <$250mm

$250-$500mm >$500mm Moose Jaw ____________________

____________________ Note: Excludes equipment

companies and sales. Note:

Excludes equipment companies and sales.

Pure Play in

Active Outdoor Lifestyle Markets $US in

millions CY 2010E Price % of

52- Valuation EBITDA EV / Sales EV / EBITDA P/E PEG Div Company 7/22/10 Wk high

Equity Enterprise Revenue margin 2009A 2010E 2011E 2009A 2010E 2011E 2010E 2011E

Ratio yield Nike Inc.

$71.56 91.1% $34,565 $30,011 19,673 14.2% 1.63x 1.53x 1.43x 10.8x 10.7x 9.2x

18.4x 15.7x 1.3x 1.5% V.F. Corporation 78.40 87.9% 8,632 9,273 7,541 15.1% 1.28

1.23 1.17 9.0 8.1 7.5 13.0 11.9 1.1 3.0% Jarden Corp. 29.36 83.6% 2,707 4,680

5,841 11.6% 0.91 0.80 0.76 7.9 6.9 6.3 10.7 9.2 0.9 1.1% Amer Sports Corp. 10.83

92.1% 1,312 1,631 2,107 7.9% 0.74 0.77 0.74 16.2 9.8 8.3 18.9 13.4 0.5 1.9%

Quiksilver Inc. 4.13 67.8% 548 1,290 1,829 10.6% 0.66 0.71 0.68 7.0 6.7 5.7 20.2

12.3 0.9 n.a. Columbia Sportsw ear Company 48.22 80.2% 1,629 1,230 1,418 9.8%

0.99 0.87 0.82 9.9 8.9 7.5 21.6 17.7 1.7 1.5% Billabong International Ltd. 8.03

73.0% 2,033 2,213 1,394 18.3% 1.55 1.59 1.44 9.1 8.7 7.4 13.7 11.8 1.2 3.9%

Timberland Co. 17.33 72.4% 929 690 1,355 10.4% 0.54 0.51 0.49 6.5 4.9 4.4 13.6

12.6 n.a. n.a. Wolverine World Wide Inc. 27.88 86.1% 1,383 1,273 1,208 13.8%

1.16 1.05 0.99 9.2 7.7 7.1 13.4 12.3 0.8 1.5% Under Armour, Inc. 37.00 95.2%

1,876 1,728 982 13.4% 2.02 1.76 1.53 15.2 13.1 11.5 33.5 28.7 1.4 n.a. Deckers

Outdoor Corp. 47.61 84.8% 1,842 1,509 925 23.6% 1.86 1.63 1.46 7.8 6.9 6.3 14.3

12.8 0.5 n.a. Lululemon Athletica Inc. 40.49 87.1% 2,870 2,696 636 25.8% 5.95

4.24 3.52 25.0 16.5 13.4 35.0 28.4 1.0 n.a. Black Diamond Equipment 500+ Volcom

Inc. 18.71 75.5% 456 347 320 13.9% 1.24 1.08 0.98 9.5 7.8 6.8 17.2 15.3 1.0 n.a.

Rocky Brands, Inc. 7.10 66.6% 53 96 245 7.4% 0.42 0.39 0.38 6.1 5.3 5.1 10.3 8.4

0.8 n.a. Lacrosse Footw ear Inc. 17.60 83.8% 113 96 155 10.4% 0.69 0.62 0.58 8.5

5.9 5.3 14.3 14.8 0.8 3.2% Black Diamond Equipment 6.70 85.9% 146 165 120 -125

n.a. n.a. 1.35 n.a. n.m. n.a. n.a. n.a. n.a. n.a. n.a. Mean 82.1%

13.7% 1.44x 1.26x 1.13x 10.5x 8.5x 7.5x 17.9x 15.0x 1.0x 2.2% Median 84.3% 13.4%

1.16x 1.07x 0.98x 9.1x 7.8x 7.1x 14.3x 12.8x 1.0x 1.7% Notes: Per share

values based on common shares outstanding as of latest SEC filings. Data from

Capital IQ.

Q2 2010 Press

Release Summary Selected

Balance Sheet Information Pro Forma Revenues and Gross Profit $US in

millions $US in millions June 30, 2010

3 months 6 months (Unaudited)

ended ended 6/30/2010 6/30/2010 Cash $ 3.3 Total revenue 23.7 56.8 Net deferred

assets Gross profit

(3) 9.422.5 Deferred tax asset prior year NOLs $ 65.0 Margin 39.8%

39.7% Deferred tax

asset for GMP note discount 3.0 DTL - purchase accounting (18.3) DTL - other

(0.8) Total

deferred tax assets, net $ 48.9 Debt Revolving

credit facility (1) 9.9 5% subordinated notes due 2017 (2) 13.2 Capital leases

0.4 Total Debt $

23.6 Total

Stockholders’ Equity 163.7 Equity Value

per Share $ 7.56 Notes: (1) Company

has a $35 million revolving credit facility with Zion’s Bank. (2) Fair

market value. (3) Three and

six months ended June 30, 2010 excludes $1,163 of non-cash inventory fair value

adjustment.

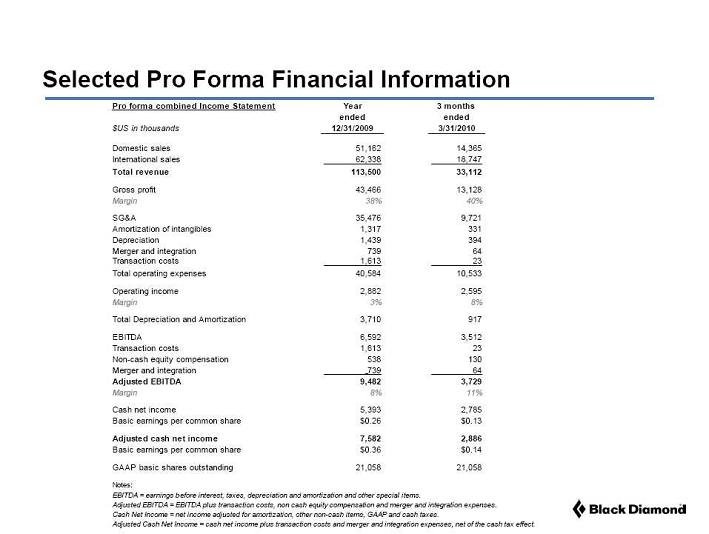

Selected Pro

Forma Financial Information Pro forma

combined Income Statement Year 3 months ended ended $US in thousands 12/31/2009

3/31/2010 Domestic

sales 51,162 14,365 International sales 62,338 18,747 Total revenue

113,500 33,112 Gross profit

43,466 13,128 Margin 38%

40% SG&A

35,476 9,721 Amortization of intangibles1,317 331 Depreciation1,439 394 Merger

and integration 73964 Transaction costs1,61323 Total operating expenses 40,584

10,533 Operating

income2,882 2,595 Margin 3% 8%

Total

Depreciation and Amortization3,710 917 EBITDA6,592

3,512 Transaction costs1,61323 Non-cash equity compensation 538 130 Merger and

integration 73964 Adjusted

EBITDA 9,482 3,729 Margin 8% 11%

Cash

net income5,393 2,785 Basic earnings per common share $0.26 $0.13 Adjusted cash

net income 7,582 2,886 Basic

earnings per common share $0.36 $0.14 GAAP basic

shares outstanding 21,058 21,058 Notes: EBITDA =

earnings before interest, taxes, depreciation and amortization and other special

items. Adjusted

EBITDA = EBITDA plus transaction costs, non cash equity compensation and merger

and integration expenses. Cash Net Income = net income adjusted for

amortization, other non-cash items, GAAP and cash taxes. Adjusted Cash

Net Income = cash net income plus transaction costs and merger and integration

expenses, net of the cash tax effect.

Tax

Considerations Company has

NOLs of $237.5 million as of June 30, 2010 $65 million

long-term deferred tax asset related to prior operating losses BDE has the

ability to issue up to approximately 40 million additional common shares in a

single, fully distributed offering under certain conditions Rights

Agreement limiting the number of 5% stockholders

Investment

Considerations Formative

transaction creates “pure play” in the A leading

global designer, manufacturer and distributor of technical outdoor recreation

equipment and lifestyle products for climbers, alpinists, hikers, freeride

skiers, and outdoor enthusiasts and travelers Targeting

$500 million of revenue in next five years through combination of organic growth

and targeted acquisitions History of

continuous product development Experienced

management team with significant ownership Well-capitalized

balance sheet Anticipating

cost synergies and near-term revenue synergies Strong

partnerships with leading global retailers Intimate

relationship with consumers / user communities Champion of

environmental stewardship and corporate social responsibility

The Beginning