Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Noranda Aluminum Holding CORP | d8k.htm |

Gramercy Site Visit

Exhibit 99.1

Noranda Aluminum Holding Corp

August 4, 2010

|

2

Forward Looking Statements

The

following

information

contains,

or

may

be

deemed

to

contain,

"forward-

looking statements" (as defined in the U.S. Private Securities Litigation Reform

Act of 1995). By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. The future

results of the issuer may vary from the results expressed in, or implied by,

the following forward looking statements, possibly to a material degree.

For a discussion of some of the important factors that could cause the

issuer's results to differ from those expressed in, or implied by, the

following forward-looking statements, please refer to our filings with the

SEC, including our annual report on Form 10-K. |

3

Management Presenters

Layle

K. “Kip”

Smith, President and Chief Executive Officer

Robert Mahoney, Chief Financial Officer

Ramon

Gil,

President,

Noranda

Alumina

LLC |

4

Noranda

Strategy

Noranda

Operating

Model

“Off to a

Good Start…”

Industry

Dynamics

Brief Noranda

Alumina History

Second quarter results: Successful performance while completing foundational projects

that strengthened Noranda |

5

Second Quarter Highlights

Noranda produced strong current quarter results…

–

Net income was $6.9 million ($0.14 per share), and includes the net negative

impact of $11 million, or $0.21 per share, from special items

–

Operating cash flow was $118 million

–

Adjusted EBITDA was $79 million total, and $62 million excluding hedges

–

External volumes grew over 2Q-09 and 1Q-10

–

Integrated cash cost for primary aluminum production improved to $0.66/lb

–

CORE contributed over $15 million in cost reduction, capital avoidance, and cash

generation

–

Total indebtedness was $554 million, representing a 24% decrease from 1Q-10

–

Cash and cash equivalents balances totaled $32 million. Senior revolving credit

facility had no outstanding borrowings and $215 million available capacity

… while setting a foundation for long-term value

–

Completed IPO as part of broad program to increase strategic flexibility, position

company for growth and improve financial profile

–

Obtained favorable result in New Madrid power rate case

–

Signed final agreements for Jamaican fiscal regime |

6

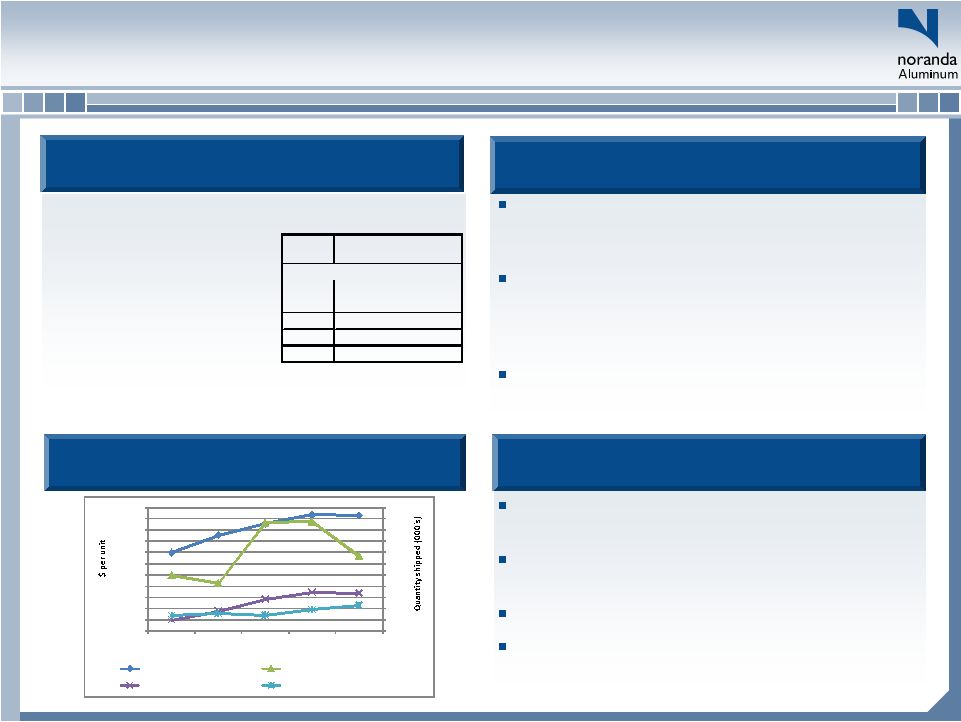

Expect steady demand for billet/rod, subject to

normal seasonal trends

Primary Aluminum Products pricing to follow one

month lag on LME

Peak power rates apply throughout 3Q-10

Most cost inputs contracted through end of year at

fixed prices; upward pressure on others

Integrated cash cost is $0.66 for Q2-10;

normalizing Q1-10 for smelter volume and alumina

ramp up, YTD cost is $0.67

Strong Q2-10 demand in key primary aluminum

product groups. Billet and rod up 40% and 7%

against Q2-09. Billet and rod shipments up 21%

and 22% against Q1-10

CORE initiatives and favorable input prices offset

bauxite shipping delays, alumina ramp-up, and

legal costs related to power case

2009

Normalized

3MOE 6/30/10

6MOE

6/30/10

LME

1.00

0.97

0.98

Midwest Premium

0.06

0.06

0.06

Midwest Transaction Price

1.06

1.04

1.04

Net integrated cash cost of primary aluminum

0.67

0.66

0.67

Integrated upstream margin per pound

0.39

0.38

0.37

Dollars per Pound

Integrated Upstream Business Review

Trends

Trends

Near-term Outlook

Comments

Comments

Upstream Margin

Upstream Margin

0

50

100

150

200

250

300

350

400

450

500

550

$-

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

$0.80

$0.90

$1.00

$1.10

2Q09

3Q09

4Q09

1Q10

2Q10

LME ($ per lb)

Bauxite (kMt)

Alumina (kMt)

Primary aluminum (000 pounds)

Left Axis

Right Axis

Right Axis

Right Axis |

7

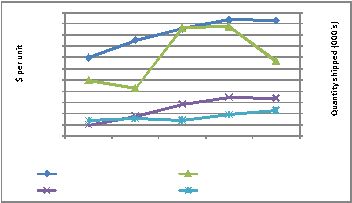

2009

Normalized(1)

3MOE

6/30/10

6MOE

6/30/10

Total primary aluminum shipments

580

147

267

Integrated upstream margin on cash cost

0.39

$

0.38

$

0.37

$

Integrated upstream EBITDA

224

$

55

$

99

$

Rolled products fabrication margin

35

15

26

Run-rate corporate expenses

(29)

(7)

(14)

Total Unhedged EBITDA

230

$

62

$

111

$

Corporate Summary

Strong Q2-10 performance reflects impact of

productivity programs and management

execution, with help from improved aluminum

prices

Q2-10 improvements in cash cost validate $0.67

annual normalized 2009 benchmark

Q2-10 rolled product results well ahead of 2009

Corporate expenses tracking to 2009 or better

Expected GAAP annual effective tax rate is 33.6%

Still have hedge accounting gains to reclassify

through GAAP earnings, despite termination of

aluminum hedges ($22 million per quarter in 3Q-10

and Q4-10)

(1)

Normalized

based

on

$1.00

LME,

$0.06

Mid-west

Premium

Comments

Comments

Business Summary

Business Summary

Corporate Cost Trends

Corporate Cost Trends

Near-term Outlook

2Q09

3Q09

4Q09

1Q10

2Q10

Corporate SG&A (GAAP)

7.9

9.2

7.2

9.7

28.8

Consulting Fees

(0.7)

(1.7)

(1.1)

(4.1)

Stock Compensation

(0.4)

(1.0)

(0.4)

(0.4)

(3.6)

Apollo Fees

(0.5)

(0.5)

(0.5)

(0.5)

(13.0)

Restructuring

-

-

-

-

(0.2)

Other

(1.4)

3.6

2.3

(1.2)

(0.7)

Run-rate corporate costs

5.0

11.4

6.9

6.5

7.3 |

Noranda

Strategy

Brief Noranda

Alumina History

“Off to a

Good Start…”

Industry

Dynamics

Noranda

Operating

Model

Though

we

can’t

control

the

LME,

we

exercise

significant

control

and

influence

over

the

basic

drivers

of

our

success

8 |

Mission

Every day we build a sustainable,

integrated aluminum company founded on

growth and successful long-term

relationships with our customers,

co-workers, suppliers,

communities and investors

9 |

10

Noranda’s

Integrated Operating Footprint

Downstream Business

Downstream Business

Annual Capacity: 495mm lbs

(2)

St. Ann

Bauxite Mine

New Madrid

Aluminum

Smelter

Newport

Rolling Mills

Salisbury

Rolling Mills

East

Mill

West

Mill

Huntingdon

Rolling Mills

Bauxite

Discovery Bay,

Jamaica

4.5mm Mt

Alumina

Gramercy, LA

1.2mm Mt

Aluminum

Primary Metal

New Madrid, MO

263k Mt (580mm lbs)

Fin stock (HVAC) and Auto, Semi-Rigid Container Stock, Flexible

Packaging, Transformer Windings

Huntingdon, TN

Huntingdon West

235mm lbs

(2)

Huntingdon East

130mm lbs

Newport, AR

35mm lbs

Salisbury, NC

95mm lbs

Products:

Location:

Annual

Capacity:

Upstream Business

Upstream Business

Annual

Capacity:

580mm lbs

2009 Cash Cost at Full Production: $0.72 / lb

(1)

Gramercy

Refinery

Revenue

Drivers:

Volume & LME

Residential construction / remodeling, packaging, U.S. consumer

(1) We estimate that due to lost production volume in 2009 from the smelter outage, which caused lost

efficiency and fixed cost absorption, our upstream cash cost of primary aluminum for FYE 2009

of $0.77 per pound was negatively impacted by $0.05 per pound. (2) Maximum capacity, with

actual capacity depending upon production mix. |

11

Primary

Aluminum

Alumina

Noranda

Bauxite

Mine

Noranda

Alumina

Refinery

New Madrid

Primary Aluminum

Smelter

Bauxite

The integration of our Upstream Business is the lynchpin to

our strategy and sustainability

–

Significant Operating Leverage to LME

•

Integration

provides

for

a

more

“fixed”

cost

base

relative to non-integrated producers whose margins

may be eroded by rising input costs that are correlated

to LME

•

Third party sales of excess raw materials (e.g., bauxite

and alumina) enhance our leverage to LME

–

Secure Supply

•

For our smelter and refinery, we have the ability to

provide over 100% of our needs of alumina and bauxite

–

Low Cost & Operating Flexibility

•

Expanded portfolio of opportunities to drive cost out

and increase productivity and sales

Our strategy is founded on integrated production, cost independence from the LME,

growth & productivity Vertically Integrated Upstream Business

|

12

Geographic Mix

Low Cost, Leading –

Rolling Mill Operations

Low cost Production

–

Huntingdon West is the foil

mill with the lowest

conversion cost in North

America according to CRU

–

CORE Productivity

–

Footprint efficiency

Flexibility

–

10-30% of prime metal

comes from New Madrid,

but inter-company volume

can be varied based on

market conditions

Focused Growth

–

Grow with key customers to

“Win with Winners”

–

Increase share of demand

–

Top 10 customers 56% of

sales

Huntingdon, TN

2 plants, East and West

Started 1967 & 2000

Max. East capacity: 130mm lbs

Max. West capacity: 235mm lbs

(1)

Newport, AR

Started 1951

Max. Capacity:

35mm lbs

(1)

Salisbury, NC

Started 1965

Max. Capacity:

95mm lbs

Four Rolling Mills in Three States

40%

17%

4%

4%

Southeast USA

West USA

Northeast USA

Midwest USA

34%

Southwest USA

Mexico

1%

HVAC fin stock

Container

Transformer

sheet

Foil products

Light gauge sheet

Products

Downstream Segment is a stable free cash flow generator

(1) Capacity includes intracompany reroll of approximately 45mm

lbs. |

13

Noranda

Strategy

Brief Noranda

Alumina

History

“Off to a

Good Start…”

Industry

Dynamics

Noranda

Operating

Model

Gramercy provides a critcial

supply of alumina as part of our intergrated

strategy |

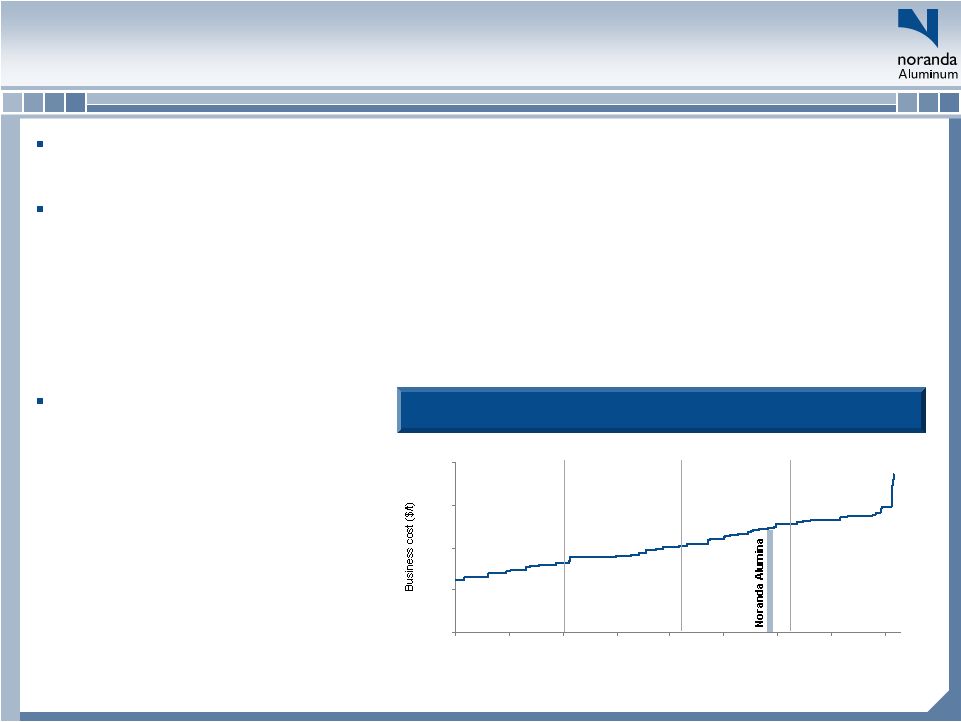

Noranda

Bauxite and Alumina Overview

On August 31, 2009, Noranda

became the sole owner of the Gramercy refinery and St. Ann Bauxite operation

–

Noranda

Bauxite –

St. Ann

–

Economic joint venture with Government of Jamaica

•

Government

receives

royalties

and

levies,

with

Noranda

controlling

the

business

and

output

•

Noranda

maintains strong government relations with a new 6-year fiscal regime

negotiated in 2009 –

4.5 million tonnes

of annual production capacity with ~60% sold to Gramercy

•

Remaining production sold to Sherwin Alumina pursuant to a contract that was

recently extended in principal through 2012 –

CRU estimates that St. Ann was in the 2nd Quartile for site operating costs

globally in 2009 $0

$100

$200

$300

$400

0

10000

20000

30000

40000

50000

60000

70000

80000

1 Quartile

2 Quartile

3 Quartile

4 Quartile

Production (kt)

Noranda

Alumina -

Gramercy

–

1.2M mt

per year production capacity for

Smelter Grade Alumina (SGA) and

Chemical Grade Alumina (CGA)

–

~0.5mm Mt provided to New Madrid

with remainder sold to third parties

–

One of three producers in the U.S.,

providing ~0.2mm Mt of CGA

–

Stable end market with attractive

characteristics that complement the

commodity SGA product group

–

3-years of SGA sales contracted with credit-

worthy customers

CRU’s

2009 Alumina Cost Curve

(1)

_______________________

(1) Noranda

cost

curve

position

excludes

benefits

of

3

party

bauxite

and

alumina

sales.

14

st

nd

rd

th

rd

Strategic drivers: integrated supply, productivity, sales growth – increased leverage to

LME |

A

Brief History of Noranda Alumina, LLC

Construction on the alumina refinery began in 1957 with the first

shipment of alumina occurring two years later. The Gramercy facility

was originally owned by Kaiser.

The refinery utilizes the Bayer process to chemically extract alumina

from bauxite.

Construction on the first red mud pond began in 1974.

The refinery has undergone several expansions and modernizations

since 1957 to increase annual capacity from .4 million metric tonnes

to 1.2 million metric tonnes.

In July 1999 the refinery

shut down due to an explosion of the

digestion unit. The refinery

reopened in December 2000.

In 2004, Noranda

formed a joint partnership with Century Aluminum

and purchased the Gramercy refinery and the St. Ann bauxite mining

operations from Kaiser.

In 2009, Noranda

became sole owner of the refinery, which now

operates as Noranda

Alumina, LLC.

15 |

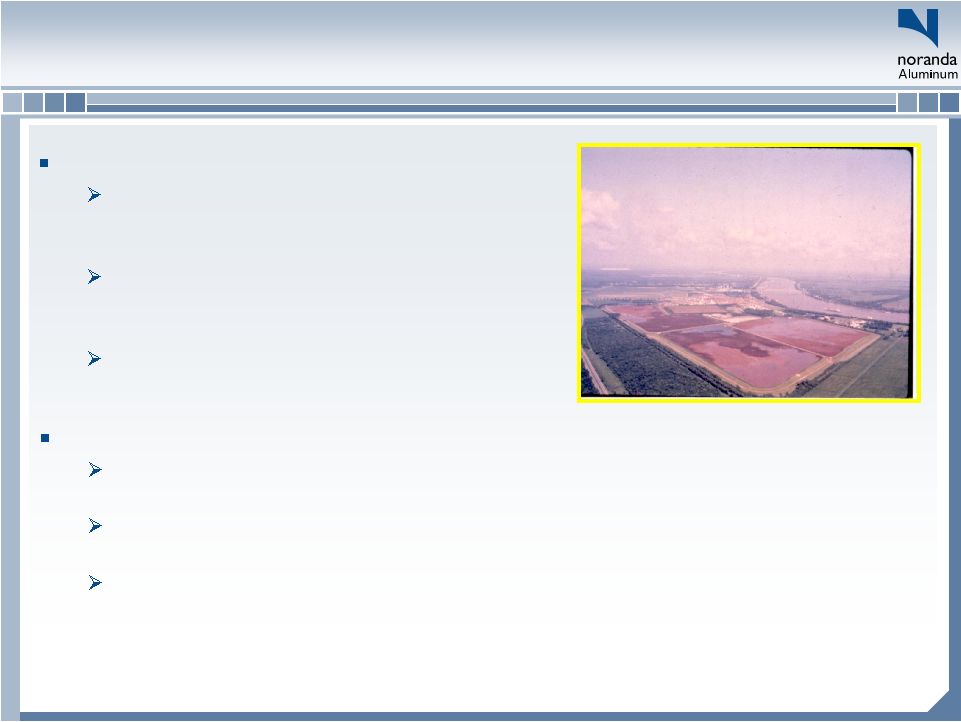

Red Mud Lakes

Once alumina has been extracted, spent

bauxite (‘red mud”) is managed in one of 4

Mud Lakes.

Mud Lakes are permitted solid waste units

designed to dewater the material and act as a

final repository.

Noranda

Alumina has obligation to seal the

Mud Lakes once they are no longer used.

Environmental

Bona Fide Prospective Purchase (BFPP) Protection

Noranda

and Century commissioned a pre-purchase due diligence investigation of

the environmental conditions present at the refinery in 2004.

State environmental officials ruled Gramercy met conditions for BFPP protections

against liability for preexisting environmental conditions.

Gramercy recorded a liability for the estimated cost for the BFPP remediation work

and

continues

to

monitor

and

update

such

estimates

as

necessary;

Kaiser

provided

cash funding as part of transaction.

16 |

Safety is a Core Value

MSHA Regulated Facility

Maintains Process Safety

Management program in

addition to Occupational

Safety

Employee Involvement

(ERT, Safe Start, JSC,

Safety Recognition)

Maintenance activities

planned and scheduled

Supported by SAP (CMMS)

Health & Safety

17 |

Noranda

Strategy

Brief Noranda

Alumina History

“Off to a

Good Start…”

Industry

Dynamics

Noranda

Operating

Model

We have two #1 Priorities: Get the Results, and Do the Right Things the Right

Way 18 |

Our

Two #1 Priorities Noranda

has two number one priorities

Do the right things

the right way

Get the results

•Individual Behaviors

•Team Disciplines

•Sustainable Relationships

•Legal

•Ethical

•Credible

19 |

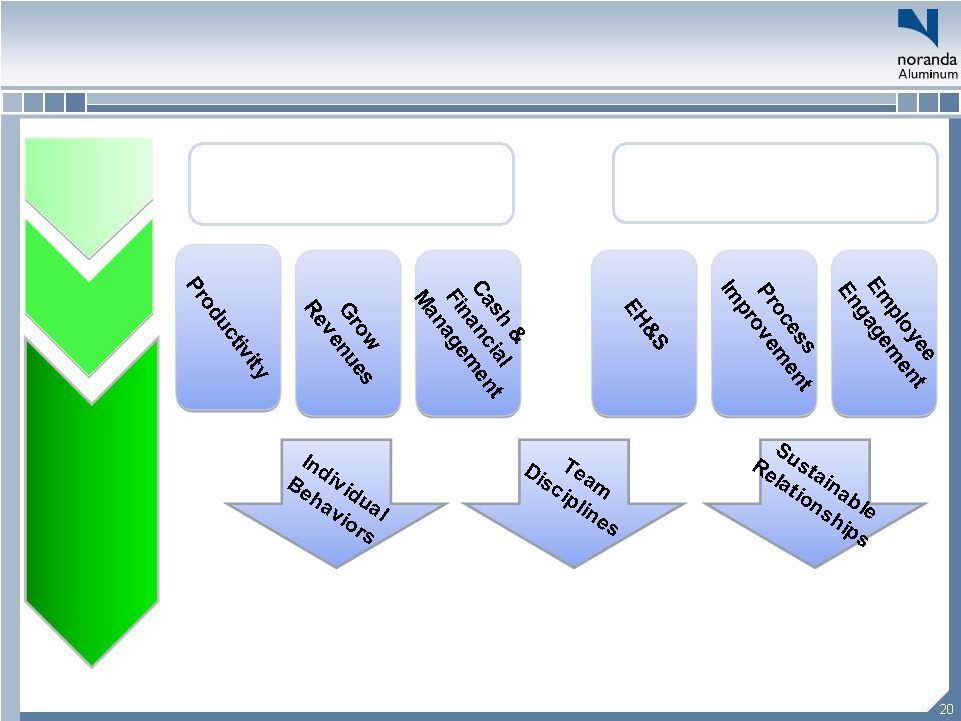

Get

the Results Get the Results

Do the Right Things

Do the Right Things

the Right Way

the Right Way

Action oriented

Ethics and Values

Drive for results

Process Management

Safety Focus

Problem solving

Peer relationships

Priority setting

Managing through

systems

Existing for Customers

Caring for Customers

Respecting Suppliers

Enriching Communities

Rewarding Investors

Two #1

Two #1

Priorities

Priorities

Sustainable

Sustainable

Goals

Goals

Core

Core

Values

Values

Noranda

Mission |

Financial success in adverse conditions

Reduced Production Cost

Reduced Production Cost

Improved Demand Share

Improved Demand Share

Reduced Debt

Reduced Debt

Generated More Cash (Free Cash Flow)

Generated More Cash (Free Cash Flow)

(Millions of dollars)

21 |

Reconciliation of EBITDA to Net Income

22

Comments

Adjusted EBITDA for three months ended June 30, 2010

78.8

$

Interest (Expense)/Income, Net

(8.5)

prospectively,

based

on

post-IPO

debt

balances

at

applicable

interest

rates

(1)

Depreciation & Amortization

(25.1)

2Q

is

reasonable

proxy

going

forward,

at

$25

million

per

quarter

(2)

LIFO/LCM

(9.9)

Will vary from period-to-period with LME and inventory levels

Interest Rate Swap MTM

(5.6)

Will

vary

from

period-to-period

with

change

in

notional

and

market

LIBOR

(3)

MTM (Loss)/Gain on NatGas

(5.8)

Will

vary

from

period-to-period

with

change

in

hedged

volume

and

Henry

Hub

(3)

AOCI Reclassification of Alim. Hedges

22.2

Set

amount,

with

next

12

months

disclosed

(4)

AOCI Reclassification of NatGas

Hedges

(1.5)

Relatively

predictable

amount,

with

estimate

for

next

12

months

disclosed

(4)

Stock Compensation Expense

(3.8)

2Q-10 contained $3.2 million of acceleration

Non-Cash Pension Expense

(1.8)

Approximately

$1.8

million

per

quarter,

based

on

2Q

amounts

(5)

Other on-going items

(1.0)

Represents

gains

and

losses

on

asset

disposals,

other,

say

$1

million

per

quarter

(6)

Gain) loss on debt repurchase

(2.5)

Would continue after 2Q-10 only when there are are

debt paydowns

Charges related to termination of derivatives

(4.9)

Doesn't continue after 2Q-10

Restructuring and sponsor fees

(20.3)

Doesn't continue after 2Q-10

Pre-Tax Income

10.3

Income tax expense

3.4

At

2Q,

forecasted

annual

GAAP

rate

was

disclosed

as

33.6%

(7)

6.9

$

Weighted average shares

49.1

3Q

will

be

based

on

amount

outstanding

at

end

of

2Q-10

(8)

Diluted options

1.0

Will

vary

based

on

stock

price,

but

Q2-10

is

appropriate

proxy

(9)

Diluted shares

50.1

Diluted EPS

0.14

$

(1)

See page 12 of June 2010 Form 10-Q for balance and rate information.

(2)

See page 50 of June 2010 Form 10-Q for 2Q-10 actual amount.

(3)

See page 19 of June 2010 Form 10-Q for hedged quantities and rates.

(4)

See page 19 of June 2010 Form 10-Q for amounts to be reclassified in future.

(5)

See page 52 of June 2010 Form 10-Q for Q2-10 actual amount.

(6)

See page 52 of June 2010 Form 10-Q for LTM "Loss on disposal" (0.4 million) and

"other" (0.6 million). (7)

See page 17 of June 2010 Form 10-Q for 33.6% annual 2010 rate.

(8)

See cover of June 2010 Form 10-Q for most recent share number.

(9)

See page 23 of June 2010 Form 10-Q for Q2-10 impact of dilutive securities.

Note: Amounts in millions, except per share data |

Noranda

Strategy

Brief Noranda

Alumina History

“Off to a

Good Start…”

Industry

Dynamics

Noranda

Operating

Model

Noranda

is well positioned to take advantage of a recovery in Aluminum prices

23 |

1300

1500

1700

1900

2100

2300

2500

2700

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

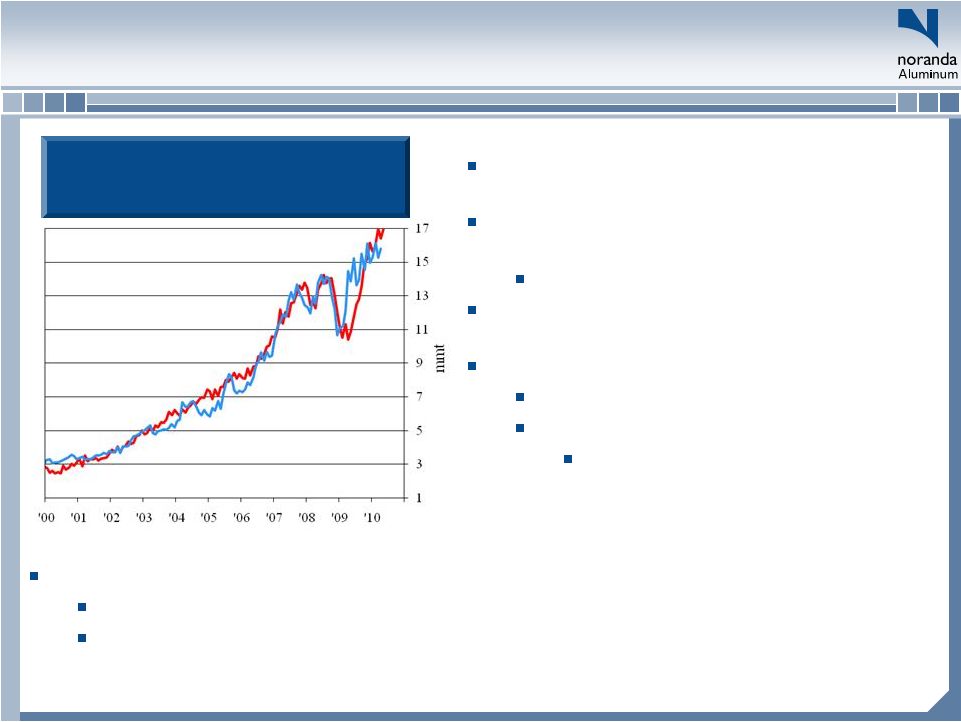

Market Fundamentals

Global demand for aluminum is expected

to continue to increase…

Aluminum’s consensus estimated sustainable

price is meaningfully above current prices…

We hold a positive outlook for Aluminum’s fundamentals

over the medium and long-term, based on two views:

Consumption Growth Driven by China

Total

Consumption

(1)

30.4

37.4

44.3

55.6

65.4

China

Consumption

(1)

6.1

12.6

18.4

25.0

30.1

--

23%

18%

26%

18%

% Growth

--

108%

46%

36%

20%

% Growth

Source:

CRU

(1) In millions of tonnes

Prices Below Consensus Sustainable Level

Source:

Harbor intelligence

ALUMINUM LONG TERM MINIMUM EQUILIBRIUM PRICE

(annual average; consensus forecasts from up to 20 analysts)

ESTIMATED

LT MINIMUM

EQUILIBRIUM

$2,450

CASH PRICE

$2,109 so far

2010

24 |

Source: Davenport

Chinese Aluminum Consumption &

Production

China –

Analysis

Revaluation

of

the

RMB

–

stronger

RMB

relative

to

the

dollar

Increases purchasing

power

of

RMB

–

increased

ability

to

import

products

(aluminum)

Dollar

denominated

prices

increase

–

LME

price

per

tonne

will

increase

in

USD,

supporting smelters located in the US

China historically has produced at or near its

aluminum consumption

China has imposed severe export taxes on

aluminum

Exports are highly unlikely

CRU forecasts China being net importers of

Aluminum in the medium term

Power –

China is already short of power

Unstable prices

Job creation as a primary goal

More efficient uses of power exist

that create more jobs per kilowatt

hour of electricity

25 |