Attached files

| file | filename |

|---|---|

| 8-K - NORANDA ALUMINUM HOLDING CORPORATION 8-K - Noranda Aluminum Holding CORP | a6375987.htm |

| EX-99.1 - EXHIBIT 99.1 - Noranda Aluminum Holding CORP | a6375987ex99_1.htm |

Exhibit 99.2

Second Quarter Results Conference Call Noranda Aluminum Holding CorpJuly 28, 2010 10:00 AM Eastern / 9:00 AM Central

2 Forward Looking Statements The following information contains, or may be deemed to contain, "forward-looking statements" (as defined in the U.S. Private Securities Litigation Reform Act of 1995). By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. The future results of the issuer may vary from the results expressed in, or implied by, the following forward looking statements, possibly to a material degree. For a discussion of some of the important factors that could cause the issuer's results to differ from those expressed in, or implied by, the following forward-looking statements, please refer to our filings with the SEC, including our annual report on Form 10-K.

3 Management Presenters Layle K. “Kip” Smith, President and Chief Executive Officer Gail Lehman, General Counsel Kyle Lorentzen, Chief Operating Officer Robert Mahoney, Chief Financial Officer

4 Second Quarter Highlights Noranda produced strong current quarter results…Net income was $6.9 million ($0.14 per share), and includes the net negative impact of $11 million, or $0.21 per share, from special itemsOperating cash flow was $118 millionAdjusted EBITDA was $79 million total, and $62 million excluding hedgesExternal volumes grew over 2Q-09 and 1Q-10Integrated cash cost for primary aluminum production improved to $0.66/lbCORE contributed over $15 million in cost reduction, capital avoidance, and cash generationTotal indebtedness was $554 million, representing a 24% decrease from 1Q-10Cash and cash equivalents balances totaled $32 million. Senior revolving credit facility had no outstanding borrowings and $215 million available capacity… while setting a foundation for long-term valueCompleted IPO as part of broad program to increasee strategic flexibility, position company for growth and improve financial profileObtained favorable result in New Madrid power rate case Signed final agreements for Jamaican fiscal regime

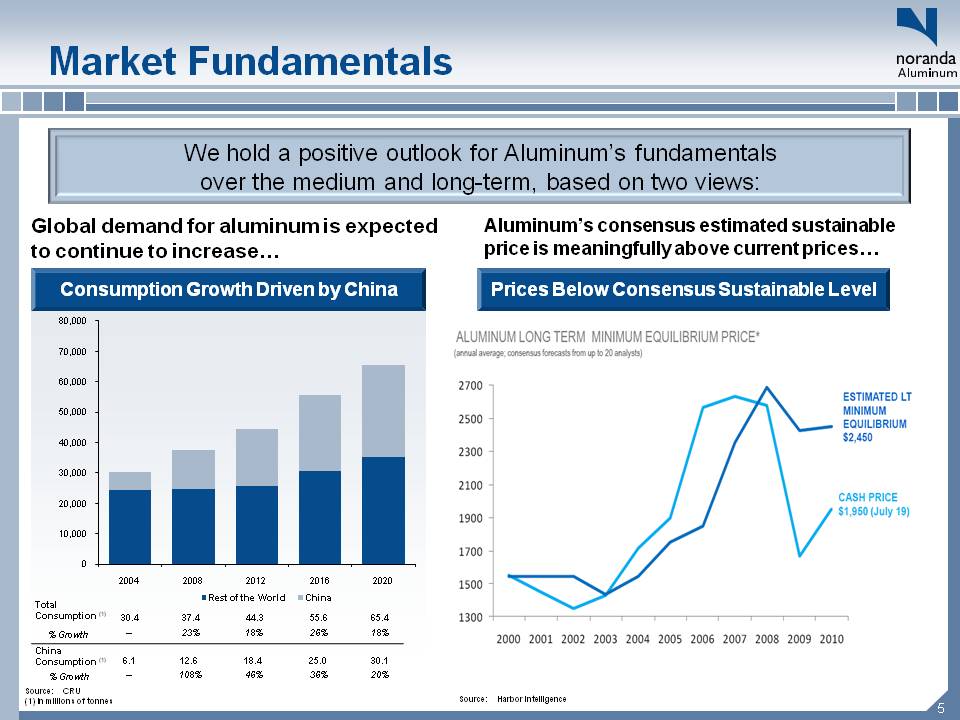

5 Market Fundamentals Global demand for aluminum is expected to continue to increase… Aluminum’s consensus estimated sustainable price is meaningfully above current prices… We hold a positive outlook for Aluminum’s fundamentals over the medium and long-term, based on two views: Consumption Growth Driven by China Total Consumption (1) 30.4 37.4 44.3 55.6 65.4 China Consumption (1) 6.1 12.6 18.4 25.0 30.1 -- 23% 18% 26% 18% % Growth -- 108% 46% 36% 20% % Growth Source: CRU(1) In millions of tonnes Prices Below Consensus Sustainable Level Source: Harbor intelligence

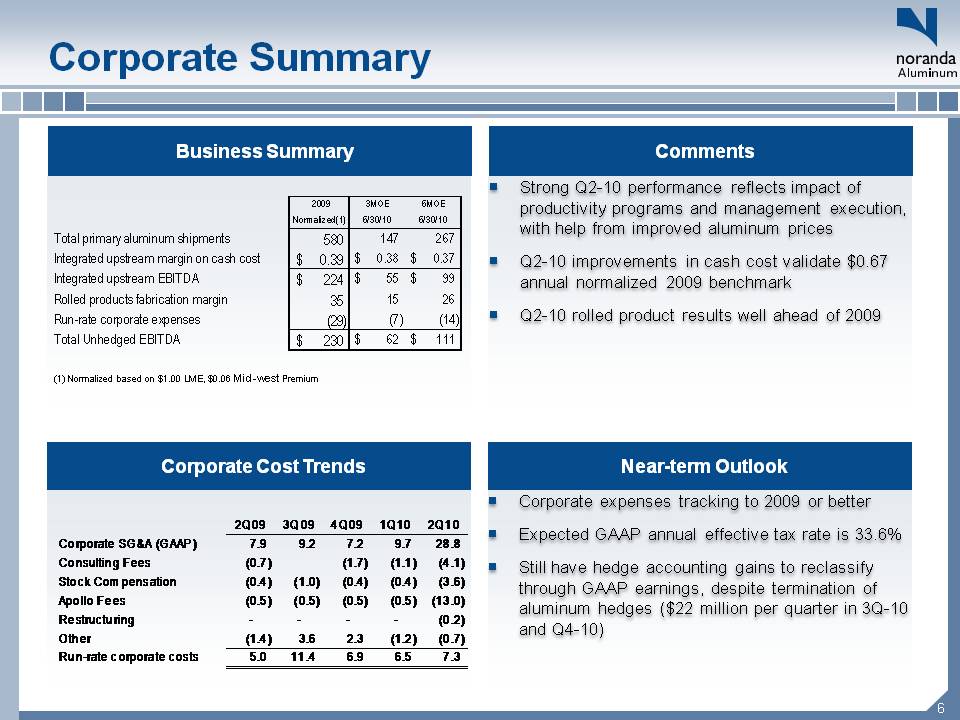

6 Corporate Summary Business Summary Corporate Cost Trends Comments Strong Q2-10 performance reflects impact of productivity programs and management execution, with help from improved aluminum pricesQ2-10 improvements in cash cost validate $0.67 annual normalized 2009 benchmarkQ2-10 rolled product results well ahead of 2009 Near-term Outlook Corporate expenses tracking to 2009 or betterExpected GAAP annual effective tax rate is 33.6%Still have hedge accounting gains to reclassify through GAAP earnings, despite termination of aluminum hedges ($22 million per quarter in 3Q-10 and Q4-10) (1) Normalized based on $1.00 LME, $0.06 Mid-west Premium

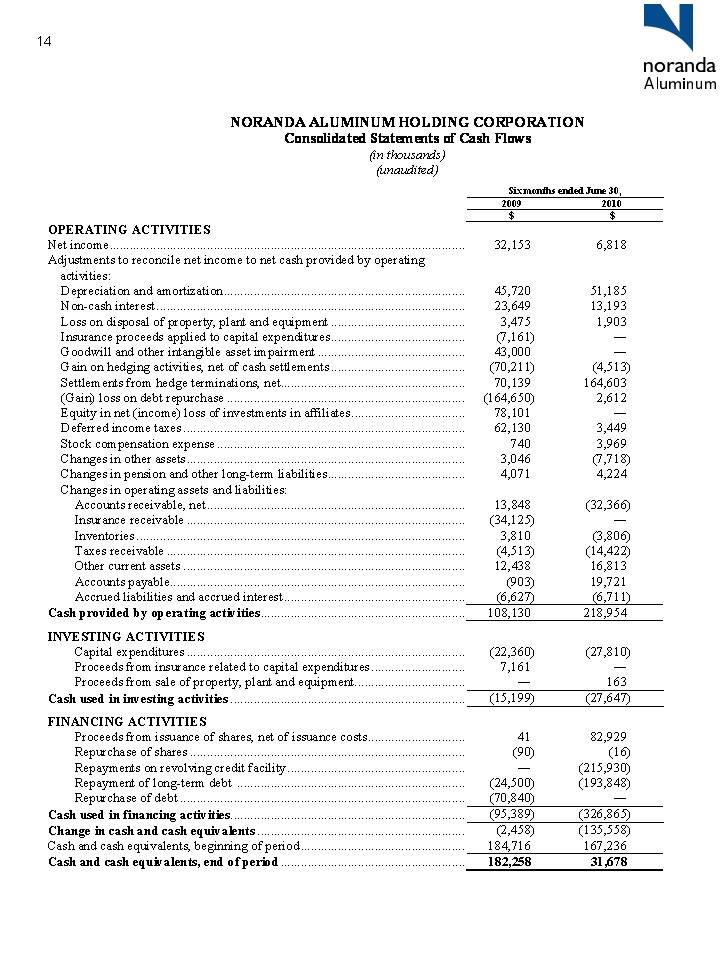

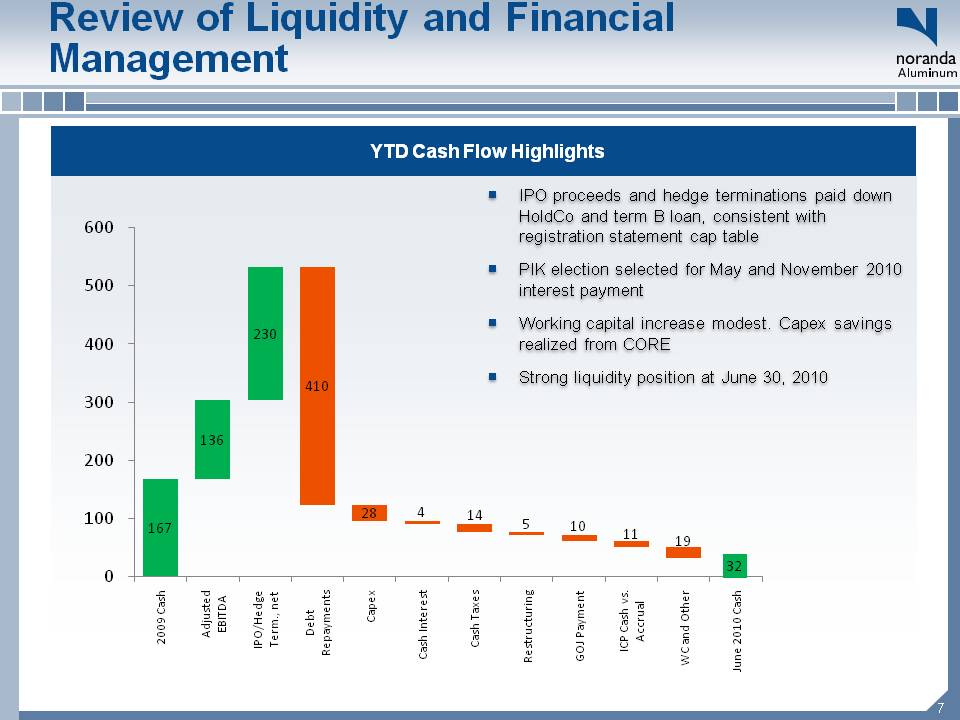

7 Review of Liquidity and Financial Management YTD Cash Flow Highlights IPO proceeds and hedge terminations paid down HoldCo and term B loan, consistent with registration statement cap tablePIK election selected for May and November 2010 interest paymentWorking capital increase modest. Capex savings realized from COREStrong liquidity position at June 30, 2010

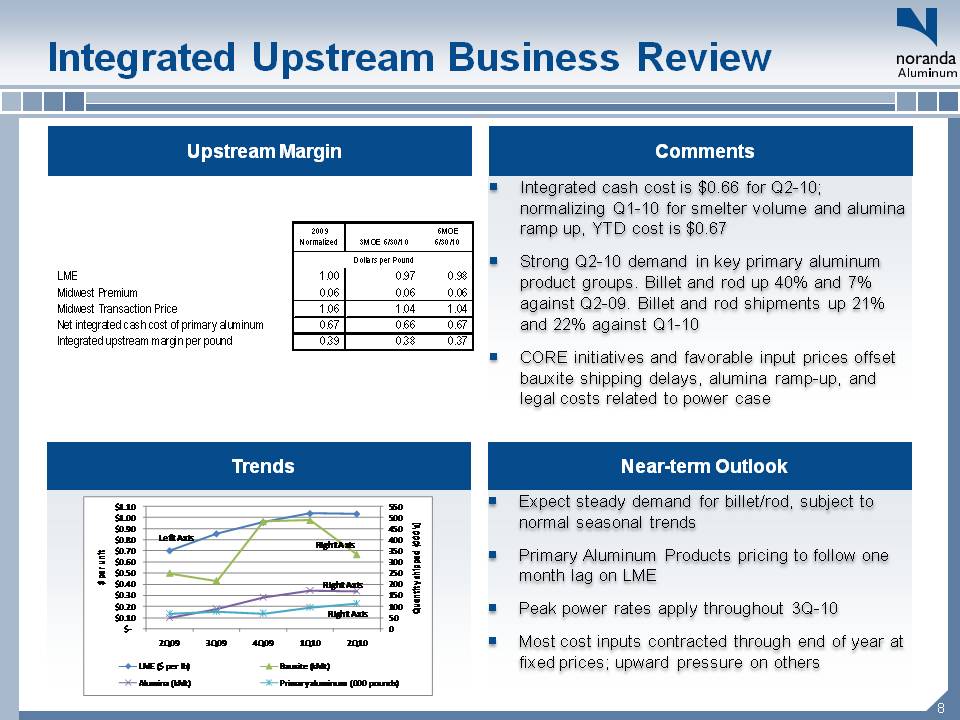

8 Integrated cash cost is $0.66 for Q2-10; normalizing Q1-10 for smelter volume and alumina ramp up, YTD cost is $0.67Strong Q2-10 demand in key primary aluminum product groups. Billet and rod up 40% and 7% against Q2-09. Billet and rod shipments up 21% and 22% against Q1-10CORE initiatives and favorable input prices offset bauxite shipping delays, alumina ramp-up, and legal costs related to power case Integrated Upstream Business Review Upstream Margin Trends Comments Near-term Outlook Expect steady demand for billet/rod, subject to normal seasonal trendsPrimary Aluminum Products pricing to follow one month lag on LMEPeak power rates apply throughout 3Q-10Most cost inputs contracted through end of year at fixed prices; upward pressure on others

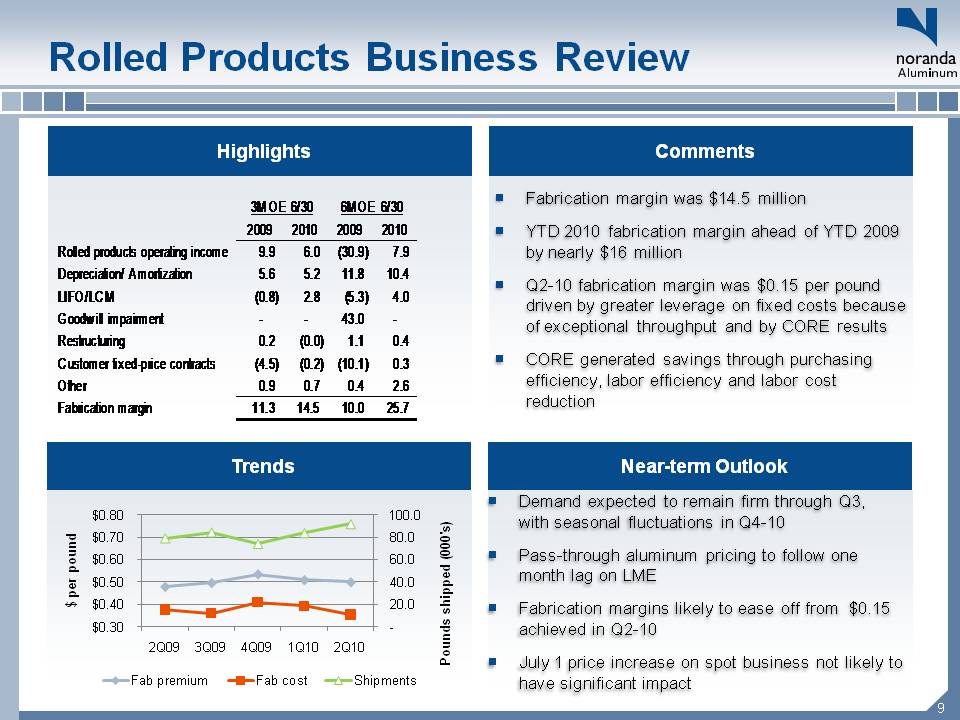

9 Rolled Products Business Review Highlights Trends Comments Fabrication margin was $14.5 millionYTD 2010 fabrication margin ahead of YTD 2009 by nearly $16 millionQ2-10 fabrication margin was $0.15 per pound driven by greater leverage on fixed costs because of exceptional throughput and by CORE resultsCORE generated savings through purchasing efficiency, labor efficiency and labor cost reduction Near-term Outlook Demand expected to remain firm through Q3, with seasonal fluctuations in Q4-10Pass-through aluminum pricing to follow one month lag on LMEFabrication margins likely to ease off from $0.15 achieved in Q2-10July 1 price increase on spot business not likely to have significant impact

10 Conclusion: Key Takeaways We generated solid results during the 2Q-10:We demonstrated the validity of the integrated business model, where costs are largely independent of LMEOur teams exploited improving demand in both upstream and downstreamCORE productivity improvement and cost reduction initiatives contributed over $15 million in cost reduction, capital avoidance, and cash generationWe completed important projects:We completed IPO as part of broad plan to improve our financial structureWe obtained a favorable result in the Missouri power rate caseWe negotiated final agreements with the Government of Jamaica

11 Appendices Noranda Aluminum Holding CorpSecond Quarter Results Conference Call