Attached files

| file | filename |

|---|---|

| 8-K - ANR 8-K 06-28-2010 - Alpha Natural Resources, Inc. | anr8k06282010.htm |

| EX-99.1 - EXHIBIT 99.1 ALPHA NATURAL RESOURCES, INC. INVESTOR PRESENTATION - Alpha Natural Resources, Inc. | exhibit991.htm |

1

Outlook for the Powder River Basin

June 28, 2010

Rocky Mountain Coal Mining Institute Conference

Powder River Basin - Outline

• Basin overview

• Production and stripping ratios

• Safety statistics

• Delivered coal prices and transportation

• Market threats and opportunities

• Alpha PRB operations

2

Forward looking statements

3

Statements in this presentation which are not statements of historical fact

are “forward-looking statements” within the “safe harbor” provision of

the Private Securities Litigation Reform Act of 1995. These forward-

looking statements are based on the information available to, and the

expectations and assumptions deemed reasonable by, Alpha Natural

Resources at the time this presentation was made. Although Alpha

Natural Resources believes that the assumptions underlying such

statements are reasonable, it can give no assurance that they will be

attained. Factors that could cause actual results to differ materially from

expectations include the risks detailed under the section “Risk Factors” in

the company’s Form 10-K filed with the Securities and Exchange

Commission.

are “forward-looking statements” within the “safe harbor” provision of

the Private Securities Litigation Reform Act of 1995. These forward-

looking statements are based on the information available to, and the

expectations and assumptions deemed reasonable by, Alpha Natural

Resources at the time this presentation was made. Although Alpha

Natural Resources believes that the assumptions underlying such

statements are reasonable, it can give no assurance that they will be

attained. Factors that could cause actual results to differ materially from

expectations include the risks detailed under the section “Risk Factors” in

the company’s Form 10-K filed with the Securities and Exchange

Commission.

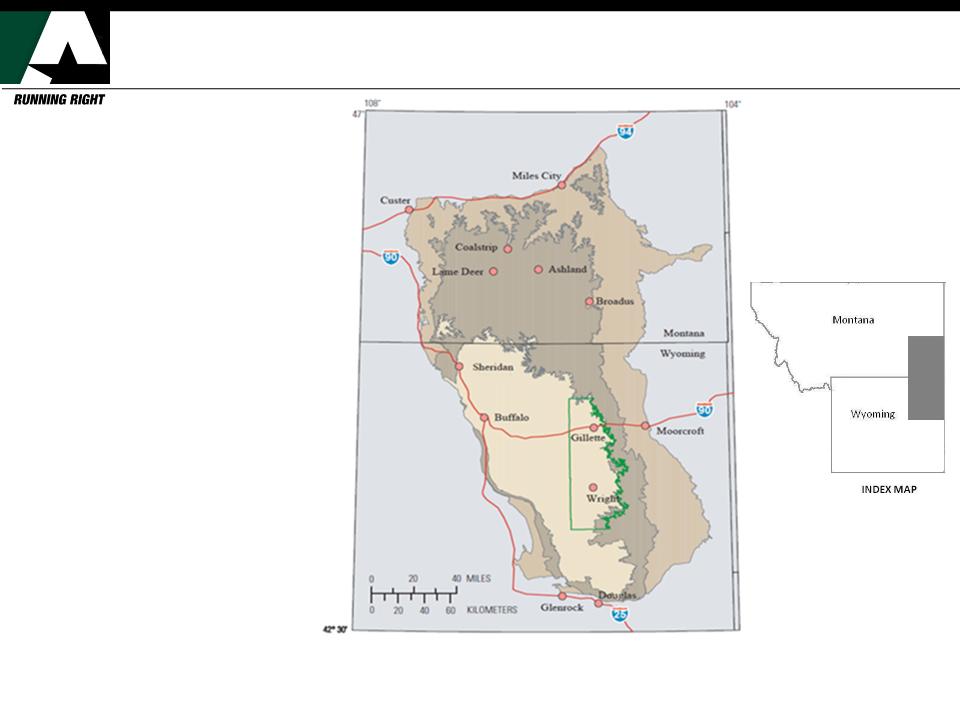

Powder River Basin Overview

4

Source: U.S. Geological Survey Open-File Report 2008-1202

Bureau of Land Management

•There are 20 mines

located in the PRB, 13 of

which are located in the

Wyoming portion.

located in the PRB, 13 of

which are located in the

Wyoming portion.

•One out of every five US

homes and businesses is

powered by coal mined

in Wyoming.

homes and businesses is

powered by coal mined

in Wyoming.

•The largest mines in the

PRB are capable of

producing 100 mt/year.

PRB are capable of

producing 100 mt/year.

Gillette PRB Coal Field

Northern Mines

-74 million tons

-8,000-8,400 Btu/lb

Central Mines

-101 million tons

-8,400-8,600 Btu/lb

Southern Mines

-242 million tons

-8,600-8,800 Btu/lb

Total 2009 Gillette Coal

Field Production: 417 million

tons

Field Production: 417 million

tons

Source: MSHA 7000-2, Velocity Suite

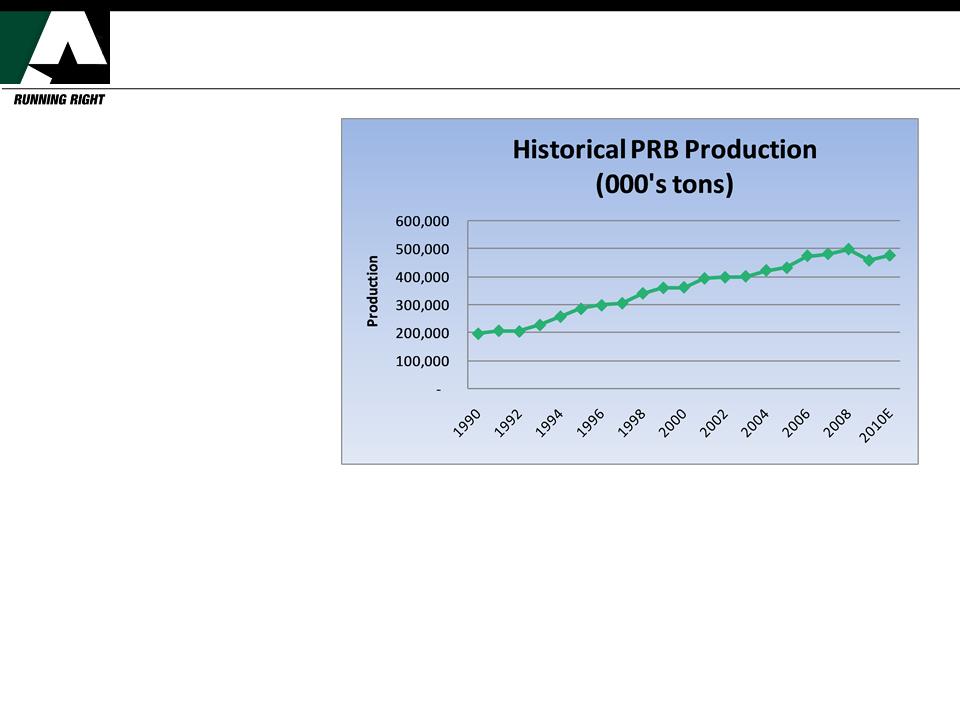

Historical PRB Production

6

•PRB production has steadily

increased over the last twenty

years with the exception of a

dip in 2009.

increased over the last twenty

years with the exception of a

dip in 2009.

•The EIA estimates that PRB

production will reach 474

million tons in 2010.

production will reach 474

million tons in 2010.

•Other basins have fluctuating

production levels whereas PRB

has demonstrated a consistent

upward trend.

production levels whereas PRB

has demonstrated a consistent

upward trend.

Source: MSHA 7000-2, Velocity Suite, EIA

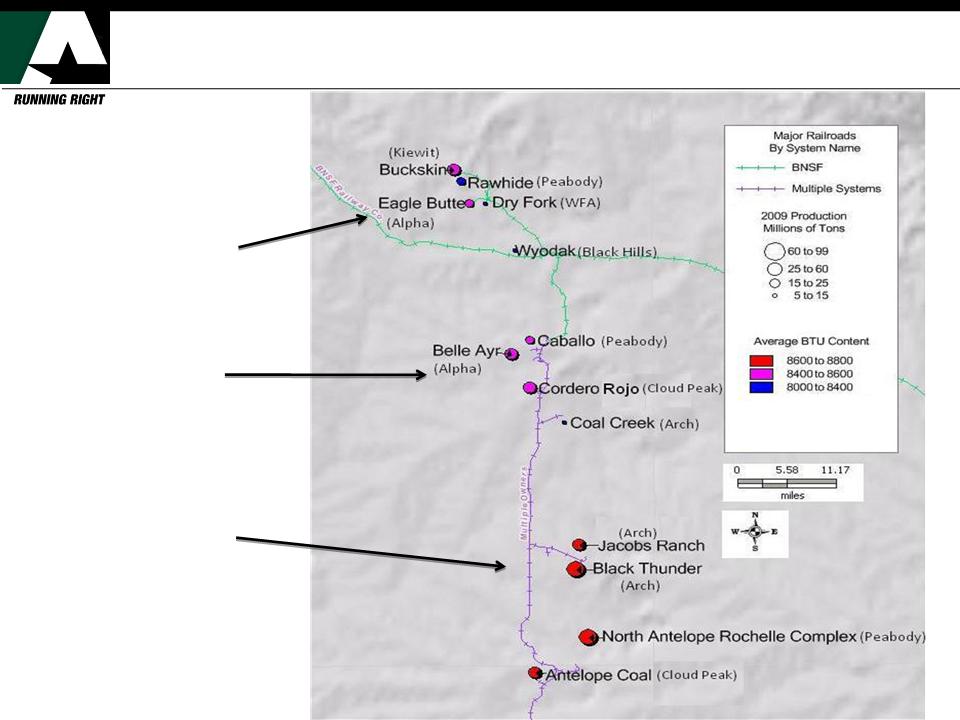

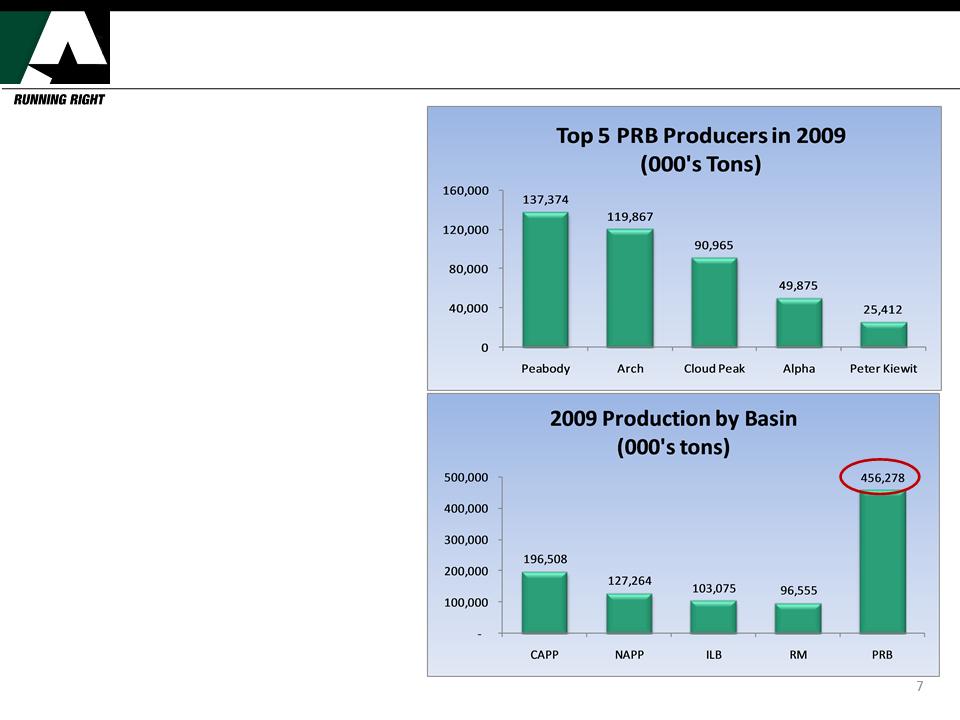

2009 Top Producers and Production

•Peabody, Arch, Cloud Peak, Alpha

and Peter Kiewit are the top 5

producers in the PRB.

and Peter Kiewit are the top 5

producers in the PRB.

•The top 5 producers account for

93% of basin production.

93% of basin production.

•PRB accounts for approximately

41% of US coal production.

41% of US coal production.

•Low price, low sulfur, and desirable

combustion characteristics have

contributed to market dominance.

combustion characteristics have

contributed to market dominance.

Source: MSHA 7000-2, Velocity Suite

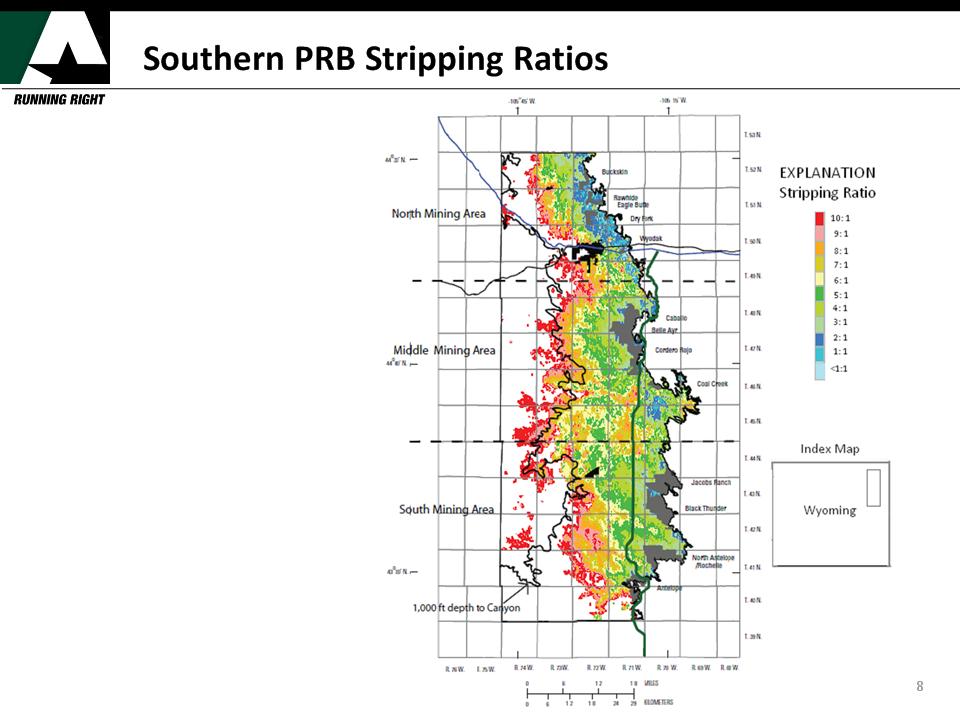

•As mines expand westward,

stripping ratios (and costs)

increase due to greater

overburden and thinning

seams.

stripping ratios (and costs)

increase due to greater

overburden and thinning

seams.

•Mines in the Southern part of

the region will need to cross

over to the other side of the

Joint Line.

the region will need to cross

over to the other side of the

Joint Line.

•The USGS estimates that

over 1 B tons of coal may

be left un-mined

beneath the Joint Line

over 1 B tons of coal may

be left un-mined

beneath the Joint Line

•Northern and mid portions of

the SPRB will not be affected

by the Joint Line.

the SPRB will not be affected

by the Joint Line.

Source: U.S. Geological Survey Open-File Report 2008-1202

Bureau of Land Management

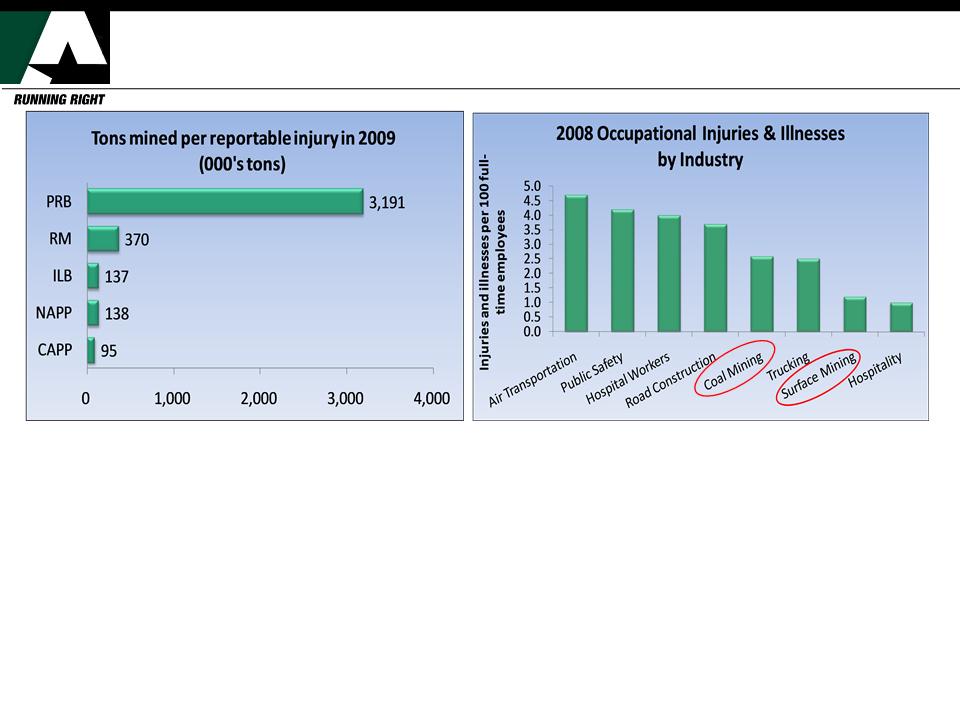

Reportable Injury Rates by Basin

9

•PRB had only 1 injury for every 3.2 million tons of coal mined on annual basis.

•Two-thirds of US coal mines operate each year without a single lost time work injury.

•Between 1990 and 2008, there was a 70% decrease in total US coal mining injuries.

Source: MSHA 7000-1 , Velocity Suite, Bureau of Labor Statistics

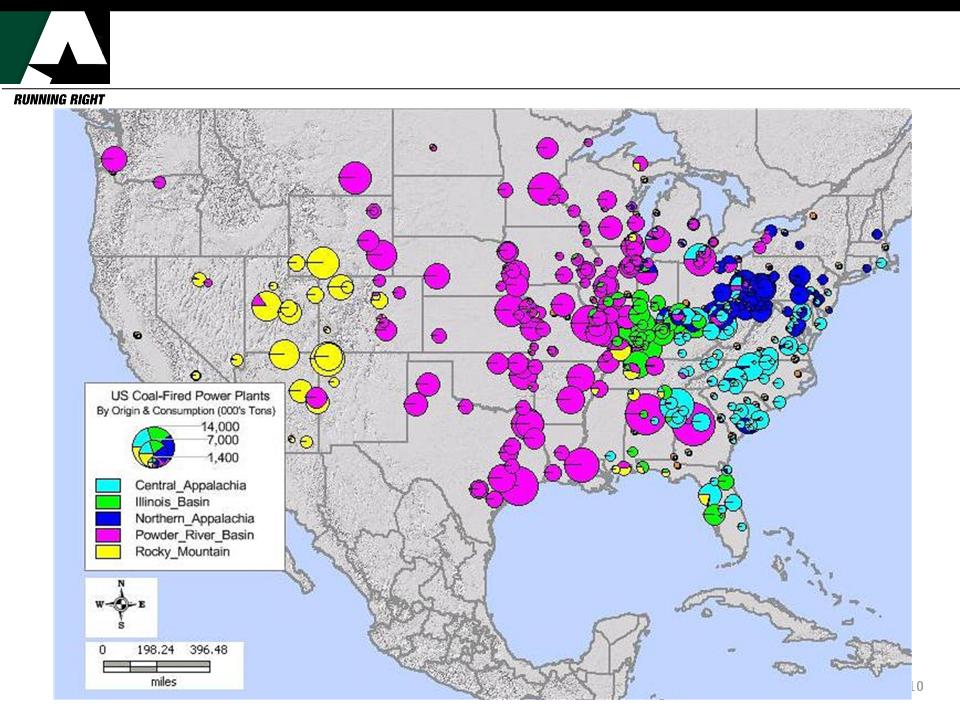

U.S. Coal-Fired Power Plants by Coal Origin

Source: Velocity Suite

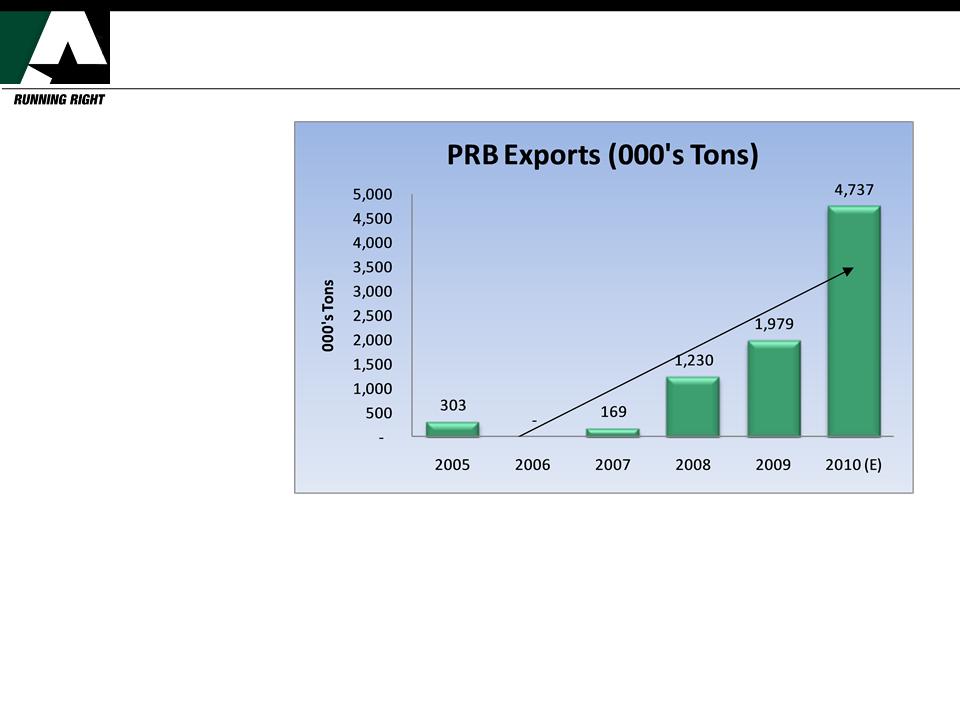

Significant Increase in PRB Exports

11

Source: Genscape

•PRB exports have

steadily increased over

time.

steadily increased over

time.

•Thriving Asian coal

demand has led to a

significant increase of

PRB exports.

demand has led to a

significant increase of

PRB exports.

•PRB coal compares

favorably to Indonesia

coal.

favorably to Indonesia

coal.

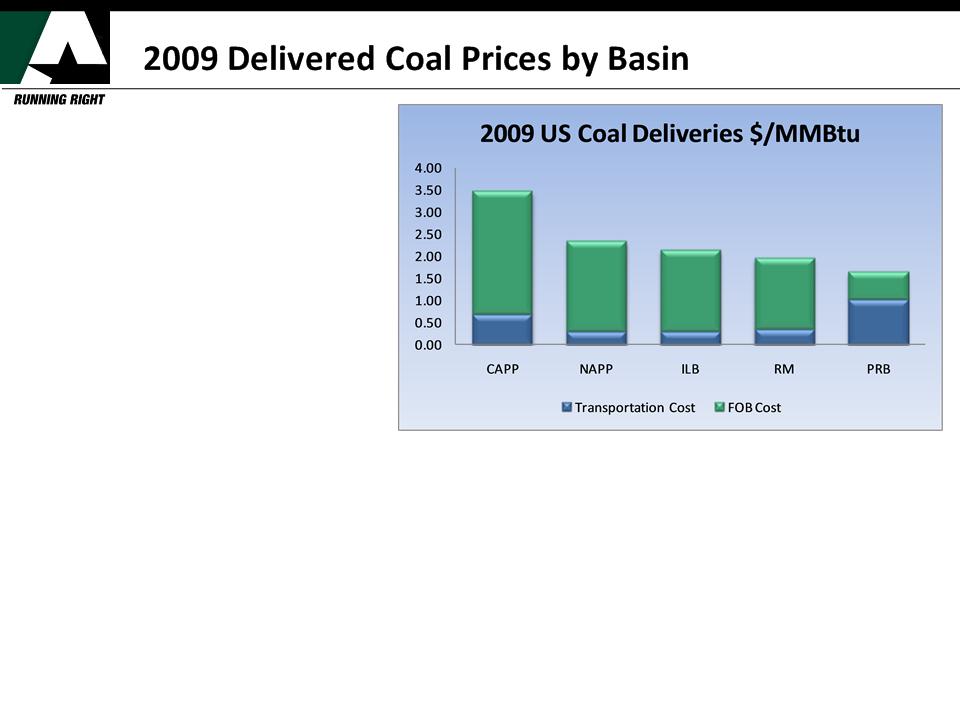

12

•Unlike the other basins,

transportation costs dwarf FOB costs

in the PRB.

transportation costs dwarf FOB costs

in the PRB.

•PRB is a very competitive basin

provided that rail rates remain

reasonable.

provided that rail rates remain

reasonable.

•Average transportation cost in PRB

is $1/MMBtu. For other basins, the

average transportation cost is

$0.47/MMBtu.

is $1/MMBtu. For other basins, the

average transportation cost is

$0.47/MMBtu.

•Average coal price in PRB is

$0.65/MMBtu compared to

$2.19/MMBtu in other basins.

$0.65/MMBtu compared to

$2.19/MMBtu in other basins.

Source: EIA 923, Velocity Suite

PRB Challenges -- Regulatory Issues

• Section 404 Water Permit

– Section 404 of the Clean Water Act regulates the discharge of dredged, excavated,

or fill material in wetlands, streams, rivers, and other U.S. waters.

or fill material in wetlands, streams, rivers, and other U.S. waters.

– Like the East, the 404 issue will affect the PRB.

– The Nationwide Permit 21 will likely expire requiring individual permits for wetlands

that are jurisdictional.

that are jurisdictional.

• Stream Buffer Zone

– Stream avoidance could significantly impact PRB.

– OSM has stated that this rule will affect future amendments and leases.

• Sage Grouse

– The Sage Grouse has been listed under the Endangered Species Act as “warranted

but precluded” meaning that this will be revisited next June.

but precluded” meaning that this will be revisited next June.

– This listing could significantly impact mining and other development.

– Industry is responding by working on Candidate Conservation Agreements with

Assurances (CCAA). This will provide conservation measures for protection of the

bird and its habitat allowing mining operations to continue .

Assurances (CCAA). This will provide conservation measures for protection of the

bird and its habitat allowing mining operations to continue .

• Air Quality

13

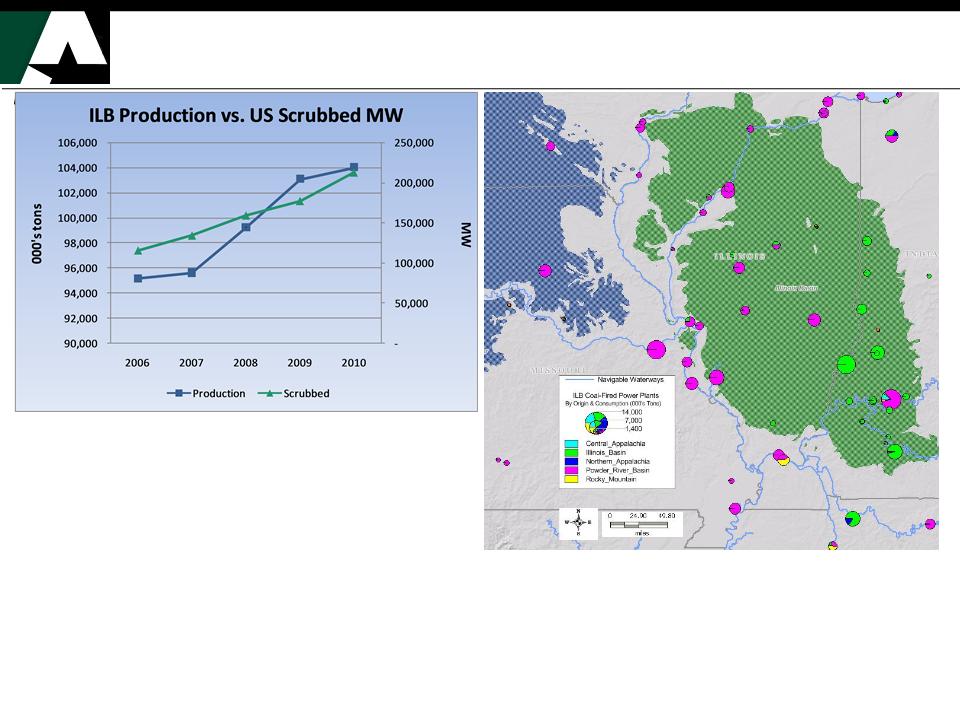

Illinois Basin Challenge

14

•Increased scrubbers, lower SO2 allowance prices, low

mining costs and advantageous transportation options

may allow ILB coal to displace PRB coal at some units.

mining costs and advantageous transportation options

may allow ILB coal to displace PRB coal at some units.

•PRB is losing its low sulfur advantage due to more

scrubbers coming online and low allowance prices.

scrubbers coming online and low allowance prices.

•Average SO2 allowance price in 2010 is $57/ton down

from an average price of $810/ton in 2005.

from an average price of $810/ton in 2005.

Source: MSHA 7000-2, Ventyx, U.S. EPA CEMS, U.S. EPA Clean

Air Markets unit characteristics database

Air Markets unit characteristics database

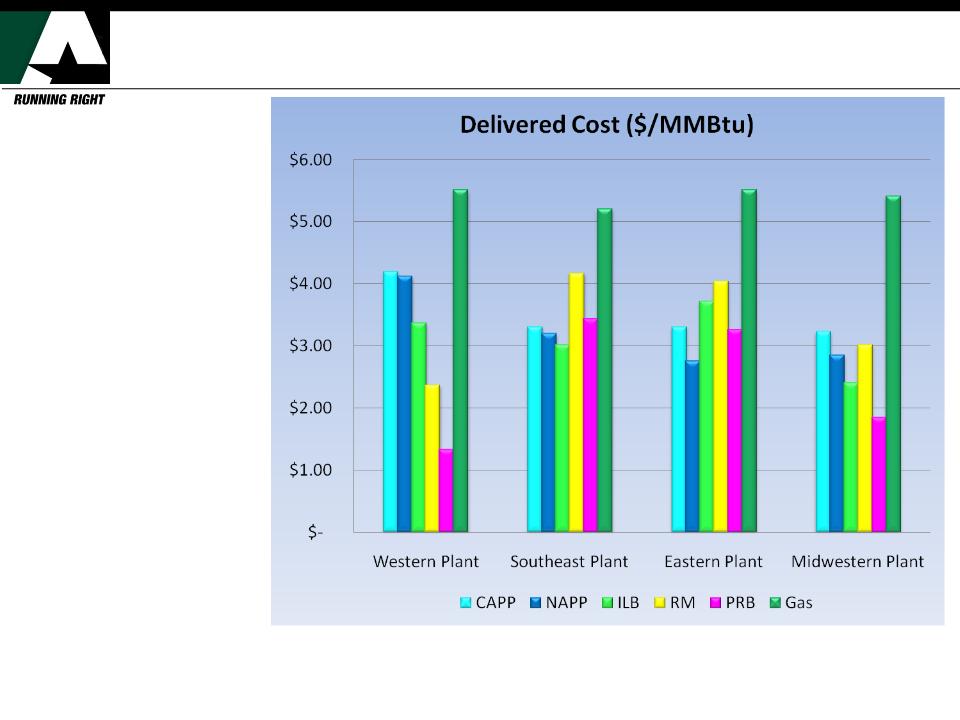

Natural Gas Challenge -- Delivered Basin Cost

15

Source: EIA 923, Velocity Suite, ANR

•PRB costs are more

competitive when

delivered to Western and

Midwestern plants.

competitive when

delivered to Western and

Midwestern plants.

•PRB delivered costs:

•Western $1.34

•Midwestern $1.85

•Eastern $3.27

•Southeastern $3.44

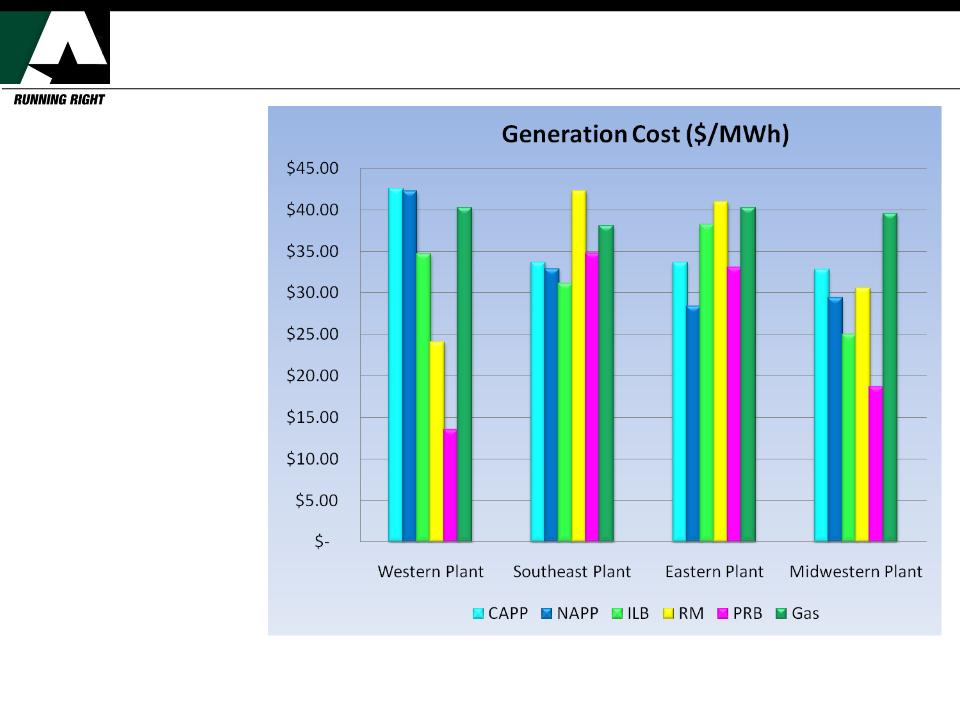

Natural Gas Challenge - Generation Costs

16

•Gas is much more

competitive in the

Southeast and Eastern

regions.

competitive in the

Southeast and Eastern

regions.

•Gas generation costs

don’t pose much threat

to the PRB at today’s

prices.

don’t pose much threat

to the PRB at today’s

prices.

•If delivered coal prices

climb high enough or

gas prices fall low

enough, all basins could

be at risk.

climb high enough or

gas prices fall low

enough, all basins could

be at risk.

Heat rate assumptions: Coal - 10,100 btu, Gas - 7,300 btu; SO2 allowance costs - $25/ton

Source: EIA 923, Velocity Suite, ICAP, Internal

Market Opportunities

• A decline in CAPP production due to MTR regulations and 404

permits could present more opportunities for PRB coal.

permits could present more opportunities for PRB coal.

• There are 13 plants currently under construction that will

primarily burn PRB coal. These plants total approximately 7,000

MW which equates to around 24 million tons annually.

primarily burn PRB coal. These plants total approximately 7,000

MW which equates to around 24 million tons annually.

• Return to $5+/MMBtu gas may allow coal to displace some gas

generation

generation

• Economic recovery and decreasing utility stockpiles will push

demand for more thermal coal

demand for more thermal coal

• Other opportunities for thermal coal:

• Plug-in hybrid vehicles

• China, India and developing world will increase demand

17

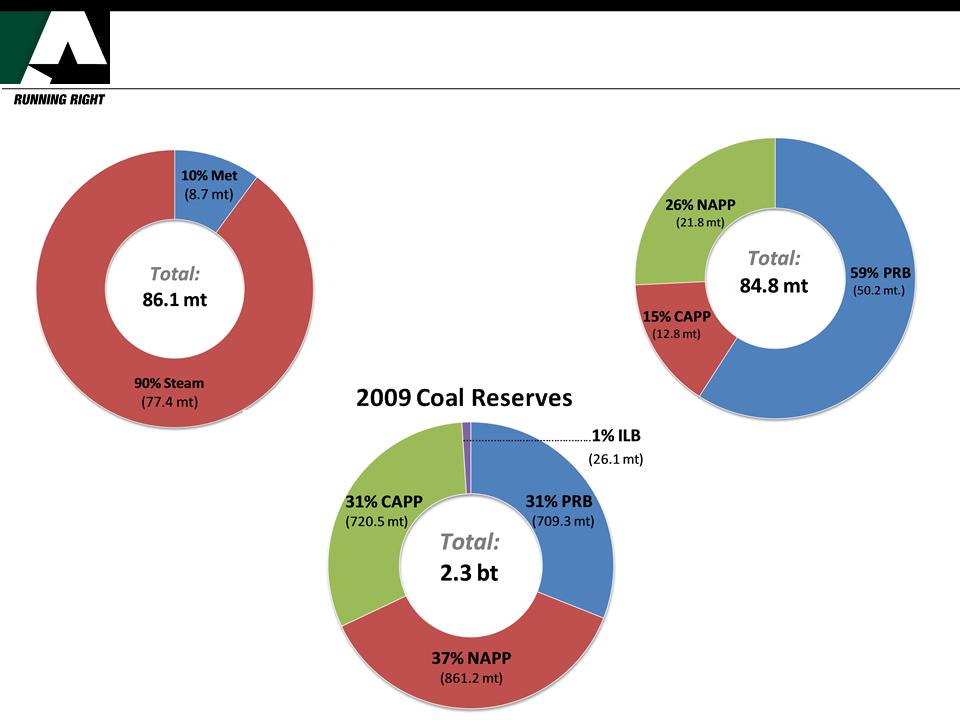

Alpha 2009 Sales & Production Overview

18

2009 Coal Sales*

2009 Production

*Coal sales include broker coal

Alpha Coal West - 2009

19

Belle Ayr

Eagle Butte

• BNSF/UP rail access

• 28.4 million tons

• 8,550 Btu, 0.63 Lb. SO2/MMBtu

• 255 MM tons reserves

• BNSF rail access

• 21.9 million tons

• 8,420 Btu, 0.88 Lb. SO2/MMBtu

• 505 MM tons reserves

§ Truck/shovel mining method

§ 630 employees

Summary

• All coal basins have challenges, but the PRB’s

challenges are more manageable.

challenges are more manageable.

• PRB should be able to continue to provide a

significant portion of US coal for many years to come

and new international markets may emerge.

significant portion of US coal for many years to come

and new international markets may emerge.

• Alpha is well-positioned as one of the top 5 PRB

producers.

producers.

20