Attached files

| file | filename |

|---|---|

| 8-K - ANR 8-K 06-28-2010 - Alpha Natural Resources, Inc. | anr8k06282010.htm |

| EX-99.2 - EXHIBIT 99.2 ALPHA NATURAL RESOURCES, INC. CONFERENCE PRESENTATION - Alpha Natural Resources, Inc. | exhibit992.htm |

1

Jefferies 2nd Annual

Boston Energy Day

Boston Energy Day

June 28-29, 2010

Exhibit 99.1

2

Forward Looking Statements

Statements in this presentation which are not statements of historical fact are “forward-looking

statements” within the Safe Harbor provision of the Private Securities Litigation Reform Act of 1995.

Such statements are not guarantees of future performance. Many factors could cause our actual

results, performance or achievements, or industry results, to be materially different from any future

results, performance or achievements expressed or implied by such forward looking-statements.

These factors are discussed in detail in our Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and in our other filings with the SEC. We make forward-looking statements based on

currently available information, and we assume no obligation to update the statements made today

or contained in our Annual Report or other filings due to changes in underlying factors, new

information, future developments, or otherwise, except as required by law.

statements” within the Safe Harbor provision of the Private Securities Litigation Reform Act of 1995.

Such statements are not guarantees of future performance. Many factors could cause our actual

results, performance or achievements, or industry results, to be materially different from any future

results, performance or achievements expressed or implied by such forward looking-statements.

These factors are discussed in detail in our Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and in our other filings with the SEC. We make forward-looking statements based on

currently available information, and we assume no obligation to update the statements made today

or contained in our Annual Report or other filings due to changes in underlying factors, new

information, future developments, or otherwise, except as required by law.

3

ANR: Uniquely Positioned Industry Leader

v Leading U.S. supplier and exporter of metallurgical coal with expertise in

blending and optimization

blending and optimization

v Low-cost, high margin Pittsburgh #8 longwall mines can supply U.S. or

international markets, including recent ~100K ton met shipment to China

international markets, including recent ~100K ton met shipment to China

v High volume Powder River Basin surface mines provide relatively stable

cash flow and reduced operating risk

cash flow and reduced operating risk

v Arguably the most regionally diversified producer in the U.S.

v More export terminal capacity than any other U.S. producer

v Positioned for future growth with excellent liquidity, low leverage and a

portfolio of internal development opportunities

portfolio of internal development opportunities

v Board recently approved $125 million share repurchase authorization

v Manageable exposure to Eastern U.S. surface mining and associated

permit risks

permit risks

v Focus on consistent execution and positive free cash flow generation

4

Coal Industry Themes - 2010

v Strong met coal pricing continues to be driven

by growing Asian demand, global recovery,

and supply disruptions

by growing Asian demand, global recovery,

and supply disruptions

v Met coal tightness intensified in the United

States by recent and unexpected loss of high-

vol production

States by recent and unexpected loss of high-

vol production

v Utility inventory levels anticipated to approach

normal levels in 2H10 - U.S. thermal market

positioned to strengthen

normal levels in 2H10 - U.S. thermal market

positioned to strengthen

v Future worldwide demand for thermal coal

anticipated to strain seaborne supply

anticipated to strain seaborne supply

5

5

Strong Market Outlook

6

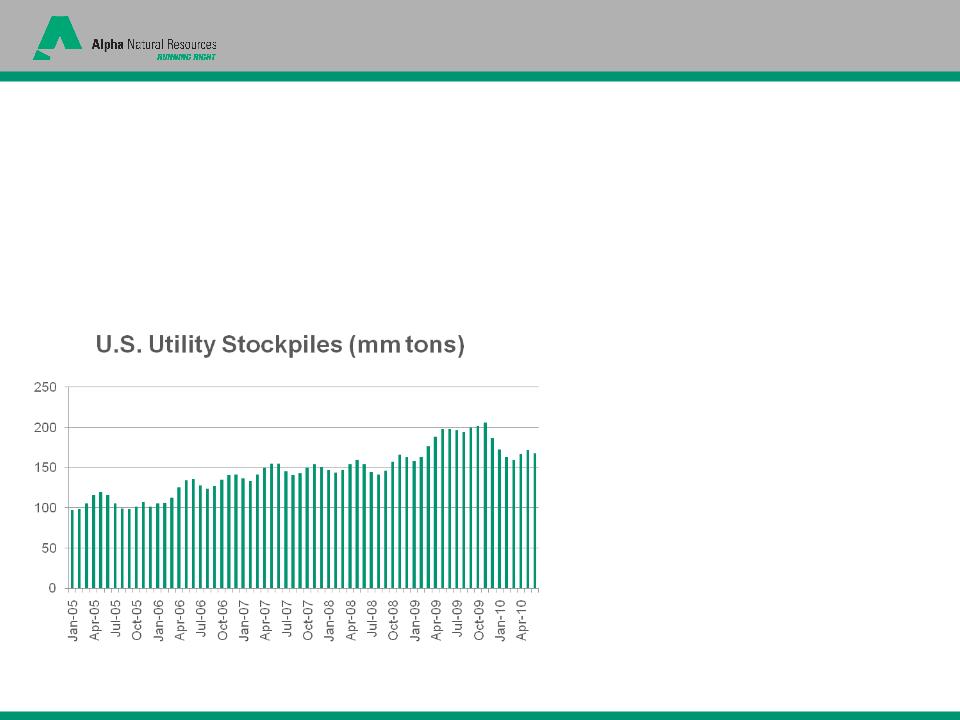

U.S. Thermal Coal Market Improving

— Utility inventories decreased by approximately 40MTs from the 11/09 peak

— Eastern thermal coal production unlikely to expand in 2010 and may decline further

— Economic recovery driving increased industrial electricity demand

— Global recovery and shifting seaborne trading patterns should increase U.S. exports

— Crossover met coal should further constrain available supply in the U.S.

— New coal-fired generation will increase demand

— Current natural gas prices suggest less fuel switching compared with 2009

SOURCE: DOE NETL, Internal Analysis, Genscape

Current inventories of

approximately 170MTs suggest

normal inventories are likely

exiting the summer cooling season

approximately 170MTs suggest

normal inventories are likely

exiting the summer cooling season

7

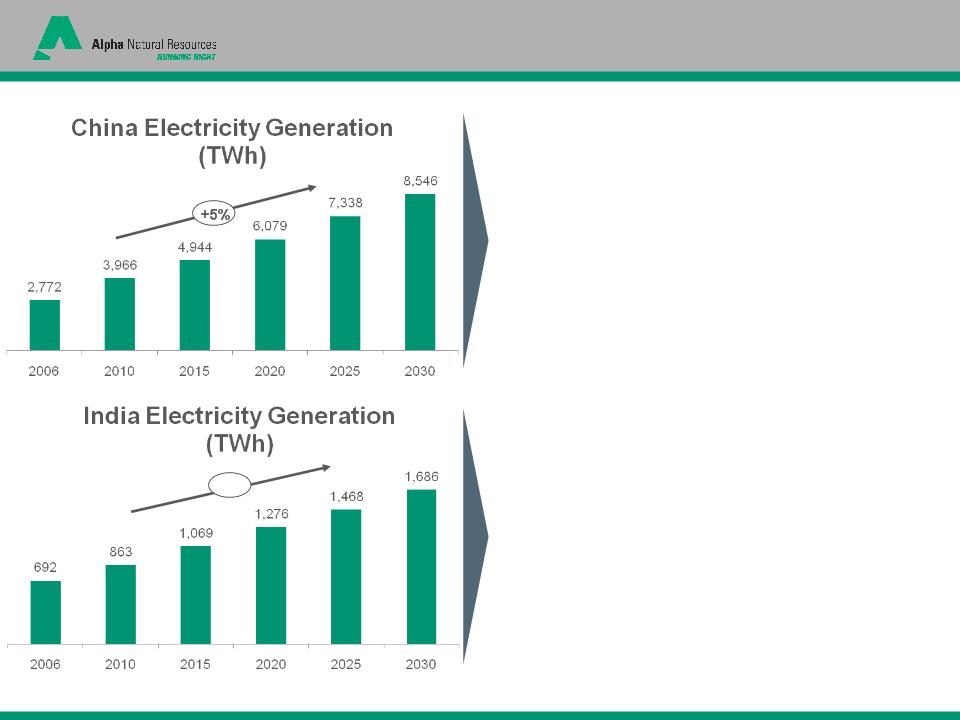

China & India Rely on Coal-fired Electricity

2010E: 78% coal-fired

2030E: 75% coal-fired

2010E: 65% coal-fired

2030E: 56% coal-fired

(Indian thermal coal imports have grown at 13% CAGR from 1990 - 2008)

Source: EIA IEO 2009; Booz & Company analysis

+4%

8

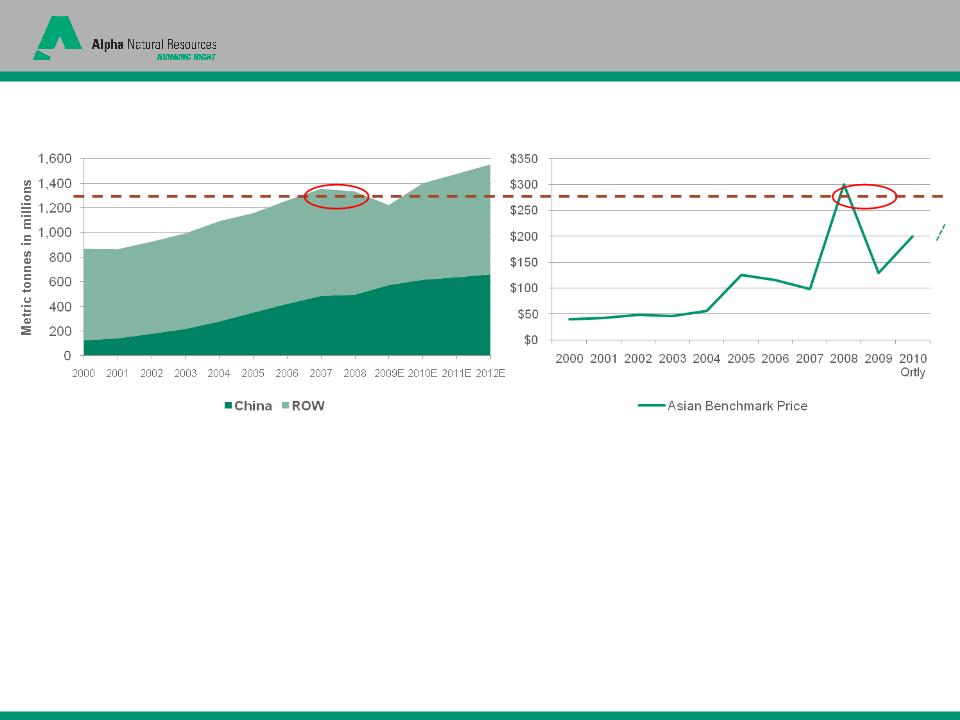

Source: Wood Mackenzie; Booz & Company analysis

China = 14.8% CAGR

ROW = 1.5% CAGR

Scarcity of Metallurgical Coal

Global Steel Production

Metallurgical Coal Pricing (US$)

— As global steel production has grown, metallurgical coal has come to be viewed as a scarce

and differentiated product

and differentiated product

— When worldwide production of steel exceeds 1.3 billion tons, the supply of met coal becomes

strained and incremental pricing can rise sharply as was seen in 2008

strained and incremental pricing can rise sharply as was seen in 2008

— While new projects are planned in places like Mozambique, Mongolia and Siberia, and

additional projects are planned in Australia, all must overcome various infrastructure

limitations or political challenges

additional projects are planned in Australia, all must overcome various infrastructure

limitations or political challenges

— Supply constraints are likely to persist for several years

?

9

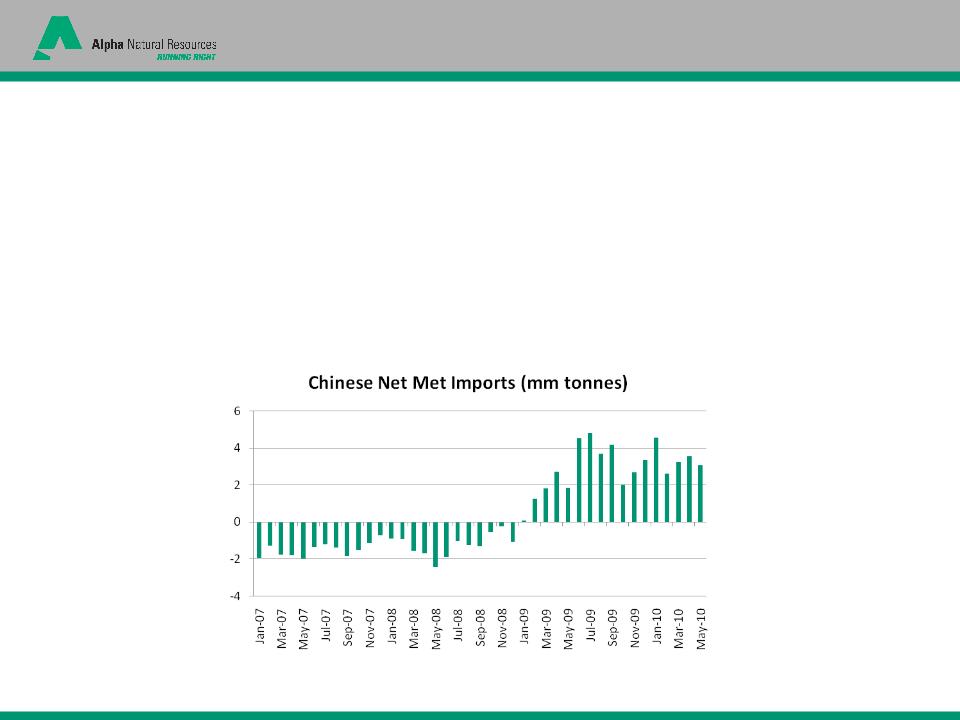

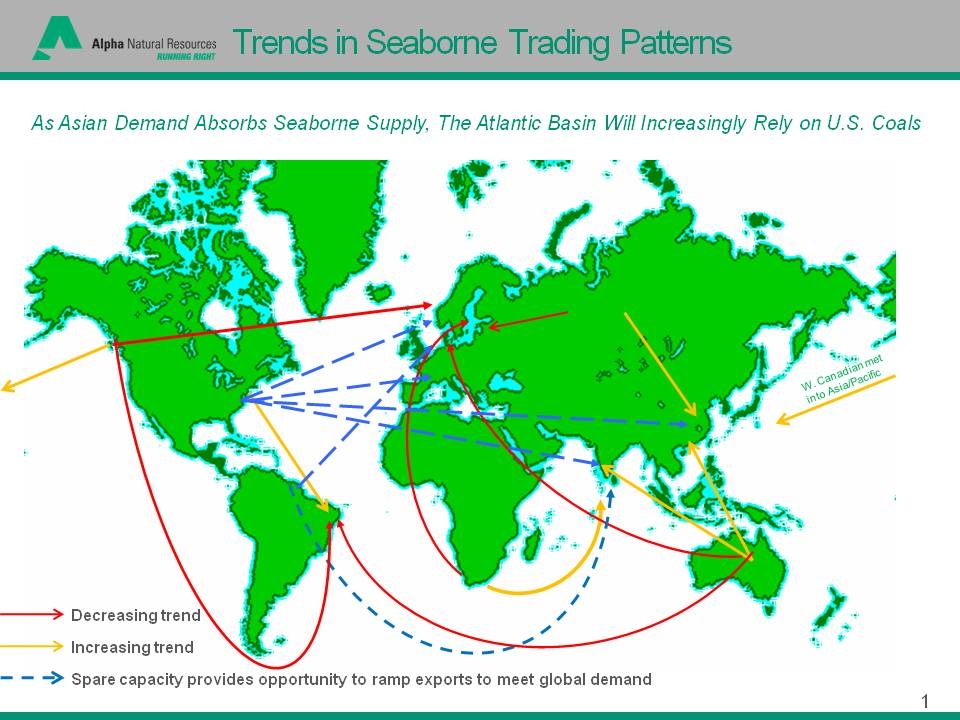

China Driving Worldwide Met Demand

Chinese Growth is Permanently Changing Global Seaborne Met Coal Trading Dynamics

— Worldwide steel production is estimated to be on an annual pace of greater than 1.3B tonnes,

with over 600M tonnes expected from China alone in 2010, despite recent concerns of slowing

growth near-term

with over 600M tonnes expected from China alone in 2010, despite recent concerns of slowing

growth near-term

— Met imports reached 34M tonnes in 2009 and YTD 2010 imports through May were 17M tonnes

— Chinese demand will be satisfied primarily by Australia, which is near its current export capacity

— Availability of seaborne coking coal, which totaled an estimated 240M tonnes in 2008, will be

constrained by the growth of Chinese imports

constrained by the growth of Chinese imports

SOURCE: China’s National Bureau of Statistics, Chinese Customs, Macquarie, Internal Analysis

10

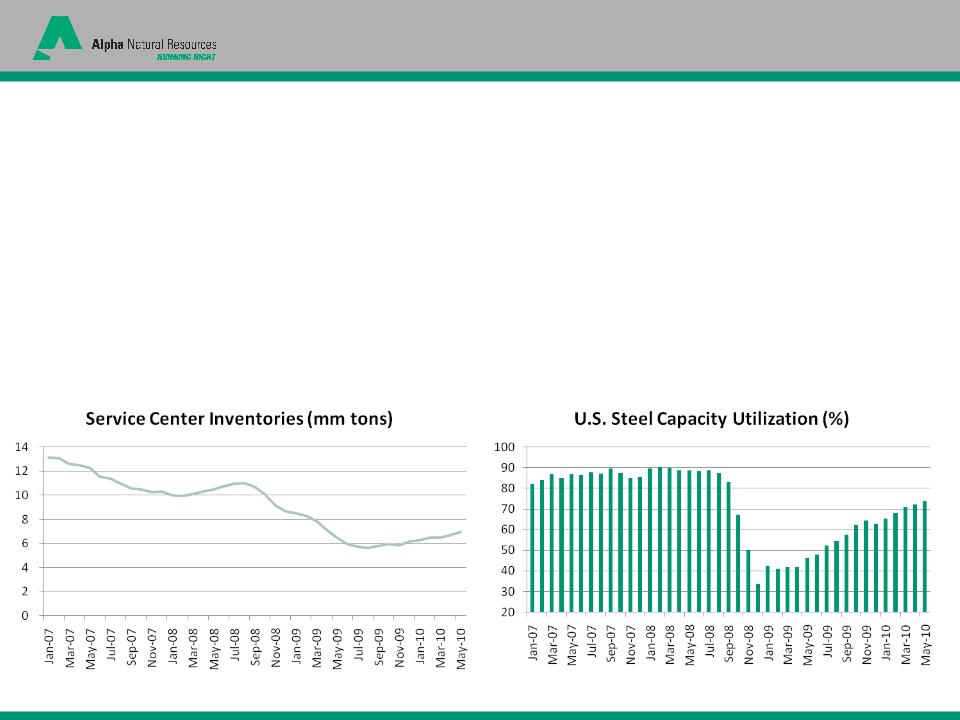

Robust Met Demand in Atlantic Basin

Met Coal Demand in the Atlantic Basin Has Increased As Developed

Economies Have Recovered and Steel Production Ramped Up

Economies Have Recovered and Steel Production Ramped Up

* ANR is a leading U.S. supplier & exporter of metallurgical coal with 13-14MTPA export capacity*

— Domestic producers’ rapid response to the recession in 2009 drove U.S. service center inventories to 26-

yr. lows, despite anemic demand for steel—restocking is now evident

yr. lows, despite anemic demand for steel—restocking is now evident

— U.S. steel capacity utilization has increased steadily to the low-70% range, up from ‘09 lows in the 30s

— The rapid increase in capacity utilization and the unexpected loss of high quality high-vol production in the

U.S. has constrained supply near-term in the domestic market

U.S. has constrained supply near-term in the domestic market

— Strong Asian demand and increasing steel production in the rest of the world should drive robust met coal

demand in the Atlantic basin for several years

demand in the Atlantic basin for several years

SOURCE: Metals Service Center Institute, American Iron and Steel Institute, Macquarie, Internal Analysis

12

12

Investment Highlights

13

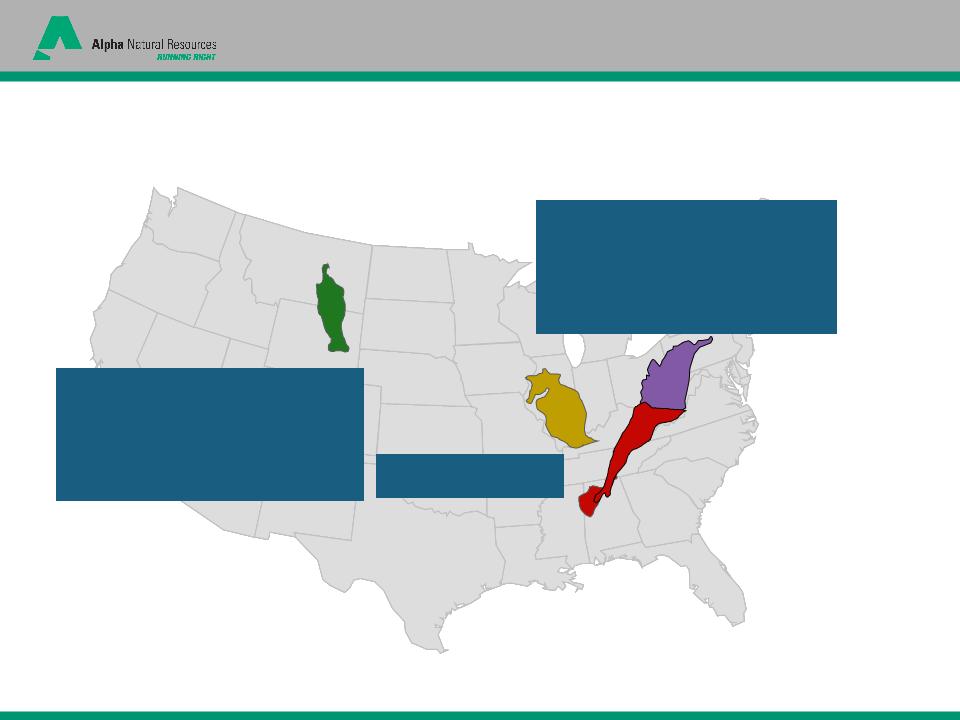

Diversification/Scale=Consistent Execution

Following our merger on July 31, 2009, Alpha has delivered consistent execution

demonstrating the benefit of the company’s enhanced scale and diversification.

demonstrating the benefit of the company’s enhanced scale and diversification.

*ANR is arguably the most regionally diversified producer in the U.S. today*

14

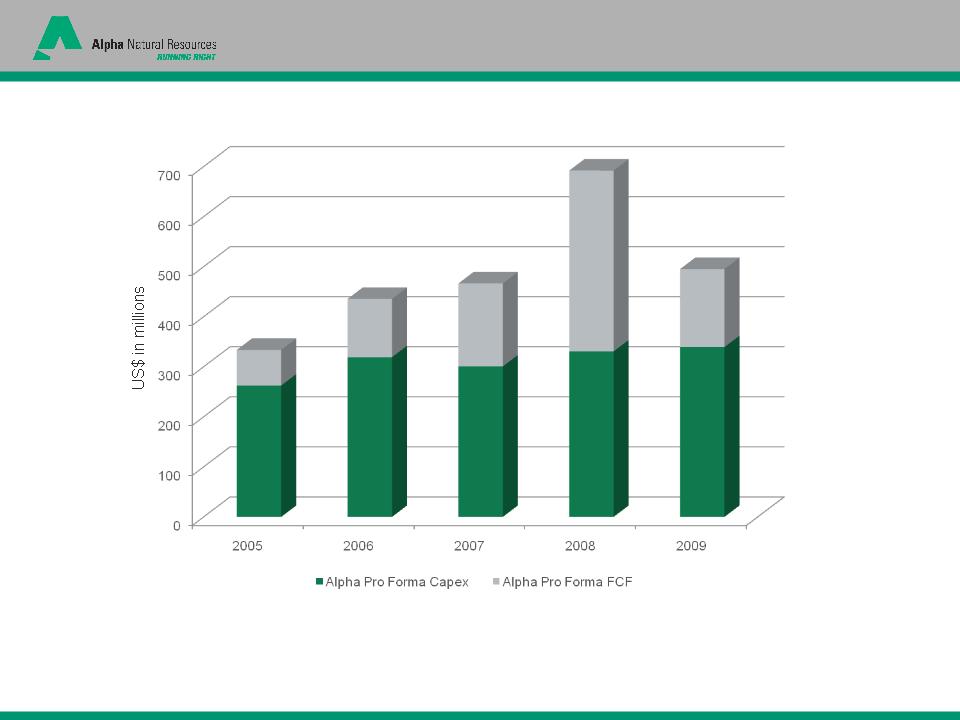

Consistent History of Positive Cash Flow

Note: Pro forma capex for 2008 and 2009 includes Lease-By-Application (LBA) bonus bid payments of $36.1 million each year.

FCF = Operating cash flow less capex

15

Excellent Liquidity and Low Leverage

Note: LTM data as of 3/31/10

(1) Revolver was amended and extended by $300mm to $950mm on 4/15/2010, of which $96mm was terminated with a $39.6mm Term Loan A prepayment on 6/4/2010

(2) LTM combined pro forma Adjusted EBITDA for the quarter ended March 31, 2010

(2) LTM combined pro forma Adjusted EBITDA for the quarter ended March 31, 2010

Leverage of approximately 1.1x debt/Adjusted EBITDA and liquidity of approximately $1.5 billion

|

($ millions)

|

Maturity

|

|

As of 6/18/10

|

|

|

|

|

|

|

|

|

$854mm Revolving Credit Facility1

|

July, 2014

|

|

$0

|

|

|

Term Loan A

|

July, 2014

|

|

236

|

|

|

2.375% Convertible Notes

|

April, 2015

|

|

288

|

|

|

7.25% Senior Unsecured Bonds

|

August, 2014

|

|

298

|

|

|

|

Total Long-term Debt

|

|

|

$822

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liquidity and Credit Statistics

|

|

|

|

|

|

Cash & Equivalents and marketable

securities |

|

|

$669

|

|

|

Revolver1

|

|

|

854

|

|

|

Accounts Receivable Securitization Facility

|

|

|

150

|

|

|

Less: Letters of Credit Outstanding

|

|

|

(184)

|

|

|

|

Total Potential Liquidity

|

|

|

$1,489

|

|

|

|

|

|

|

|

Total Debt / LTM EBITDA

|

|

|

1.1x

|

|

|

|

|

|

|

|

|

LTM Adjusted EBITDA2

|

|

|

$773

|

|

16

• Maintaining safe and well-capitalized mines is priority #1

• Organic development—moving forward with development of organic met projects, DM #41

and Freeport; continuing the permitting of the Foundation Pitt #8 longwall mine; evaluating

other organic development opportunities as market conditions warrant

and Freeport; continuing the permitting of the Foundation Pitt #8 longwall mine; evaluating

other organic development opportunities as market conditions warrant

• Growth through acquisition—systematically evaluating domestic and international

opportunities to increase shareholder return through disciplined strategic transactions

opportunities to increase shareholder return through disciplined strategic transactions

• Seeking long-term access to growing international met and thermal markets—initial step in

2010 likely to include establishment of one or more modest sales and development offices

strategically located to participate in key Asian markets

2010 likely to include establishment of one or more modest sales and development offices

strategically located to participate in key Asian markets

• Focusing on opportunities to improve Alpha’s met and thermal assets within the U.S., with

emphasis on low-cost, long-lived production, sustainable end markets and export potential

emphasis on low-cost, long-lived production, sustainable end markets and export potential

Strategic Intent & Uses of Cash

Alpha’s strong cash position, excellent liquidity, low leverage and consistent cash flow generation

provides significant flexibility and a unique set of opportunities

provides significant flexibility and a unique set of opportunities

Pursuing a balanced strategy of growth through organic development and acquisition with a

disciplined focus on value and return on investment

disciplined focus on value and return on investment

17

• Returning cash to shareholders while retaining the financial flexibility to pursue strategic

growth opportunities

growth opportunities

• $125 million share repurchase authorization recently approved by Alpha’s board

• Approximately $25 million purchased to date at an average price of $36.33 per share

• Repurchases made pursuant to 10b5-1 plan

• Repaying debt and maintaining strong liquidity position—prepaid $40 million of Term Loan A;

amended, extended and increased secured credit facility, resulting in total available liquidity of

approximately $1.5 billion

• Continuing to cultivate Alpha’s valuable Marcellus acreage through Rice Energy JV, potentially

augmenting and consolidating our footprint in order to optimize development

Strategic Intent & Uses of Cash (cont’d)

Pursuing a balanced strategy of growth through organic development and acquisition with a

disciplined focus on value and return on investment

disciplined focus on value and return on investment

Alpha’s strong cash position, excellent liquidity, low leverage and consistent cash flow generation

provides significant flexibility and a unique set of opportunities

provides significant flexibility and a unique set of opportunities

18

A Leader in the Domestic Coal Industry

Eastern Coal Operations

Illinois Basin

Western Coal Operations

|

Production capacity

|

55.0

|

|

2009 Shipments

|

50.1

|

|

Reserves

|

709

|

|

Reserves

|

26

|

|

Production Capacity

|

42.0

|

|

2009 Shipments

|

36.0

|

|

Reserves

|

1579

|

Note: Figures pro forma as of 12/31/09

Strength, Scale, Diversification

19

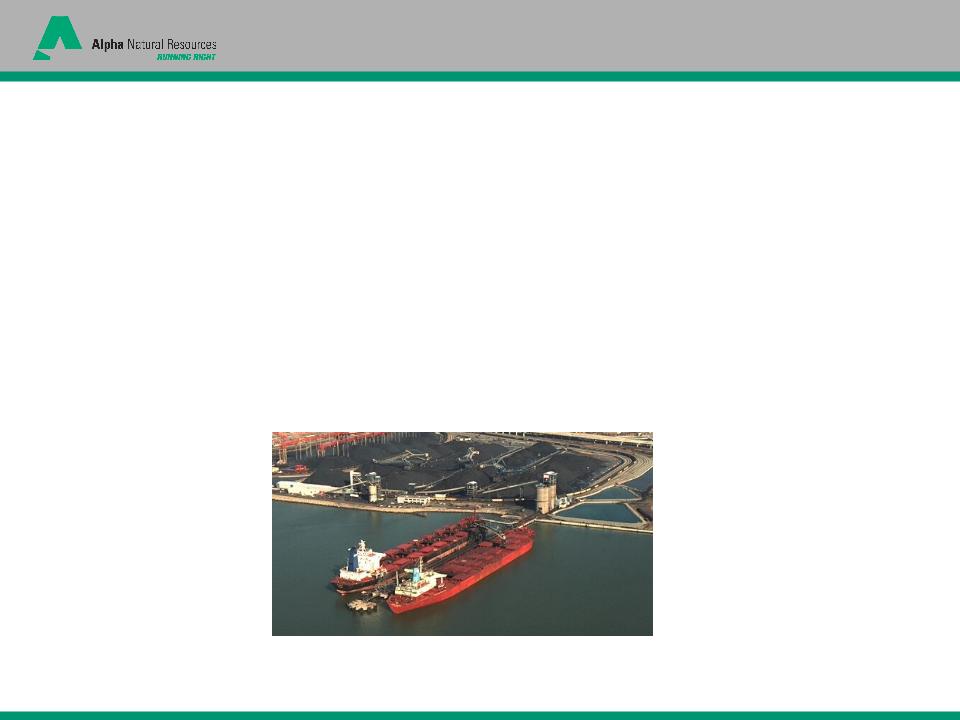

• Alpha’s total export capacity from all US terminals is 13-14 MTPA, providing unique

blending, storage and transportation advantages

blending, storage and transportation advantages

• Alpha holds a 41% interest in Dominion Terminal Associates (DTA): Alpha’s

estimated proportional export capacity is ~5.5 MTPA

estimated proportional export capacity is ~5.5 MTPA

• Alpha controls ~5.0 MT of capacity at Norfolk Southern’s Lamberts Point terminal

located in Norfolk, VA

located in Norfolk, VA

• Additional capacity at Chesapeake Bay piers, Gulf of Mexico/New Orleans, and the

Great Lakes

Great Lakes

U.S. Leader in Export Capacity

20

|

Powder River Basin

|

||

|

Wyoming Operations

|

Expansion (MM tons/yr)

|

Capacity

|

|

Truck/shovel expansion

|

10

|

65 MTPY

|

|

Belle Ayr LBA

|

200 Million Tons

|

Late 2010

|

|

Central Appalachia

|

||

|

Mine

|

Resource Description

|

Production

|

|

Deep Mine #41

|

~ 70 MM Ton Reserve

|

1.0 - 1.2 MTPY (metallurgical)

|

|

Harts Creek/Atenville

|

~ 120 MM Ton Reserve

|

2 - 3 MTPY (metallurgical potential)

|

|

Northern Appalachia

|

||

|

Mine

|

Resource Description

|

Production

|

|

Freeport - CM

|

~ 68 MM Ton Reserve

|

3 MTPY (metallurgical)

|

|

Foundation - longwall

|

~ 420 MM Ton Reserve

|

7 - 14 MTPY Pitt #8 (+ Sewickley)

|

|

Unconventional Gas

|

||

|

Project

|

Resource Description

|

Production

|

|

CBM

|

~ 100-200 Bcf Resource

|

~ 5,000 Salable Mcf/Day (current)

|

|

Marcellus acreage

|

~ 18,000 Acres

|

Entered into JV with Rice Energy 2010

|

Organic Growth Opportunities

21

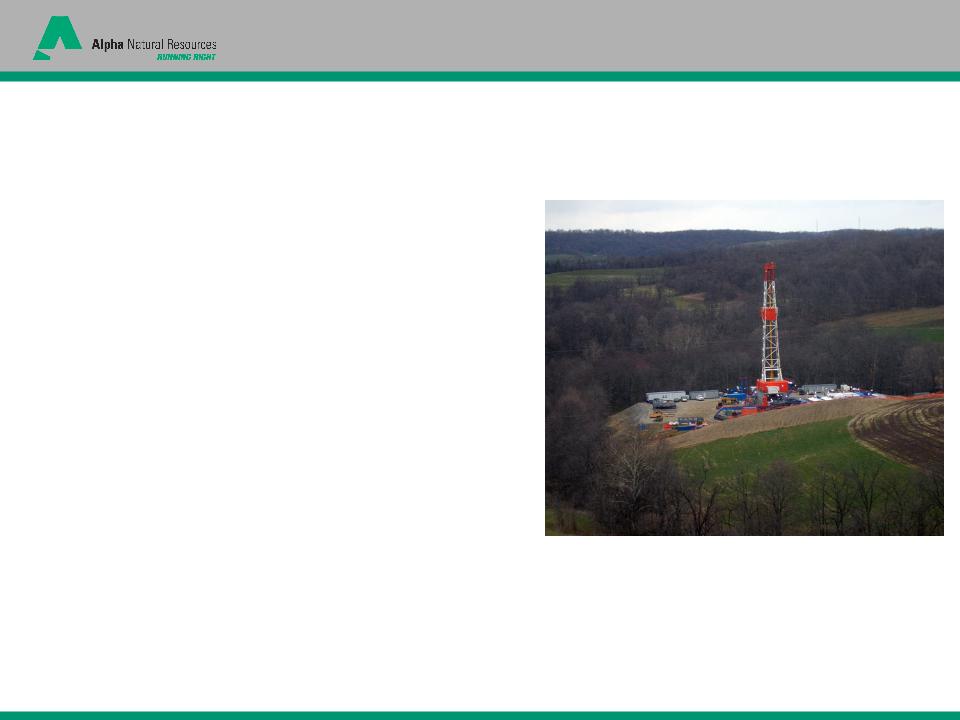

• 50/50 Joint Venture with Rice Energy, LP

• Alpha controls ~18,000 acres of Marcellus in

Greene and Washington Counties of Pennsylvania

Greene and Washington Counties of Pennsylvania

• Initial phase underway, recently drilled the first of

four wells planned for 2010

four wells planned for 2010

• Each partner committing acreage and cash

• Total phase 1 capital anticipated to be less than

$20 million

$20 million

• JV potential to develop ~100 wells in the Marcellus

• Separately, Alpha’s CBM gas processing plant

expanding from capacity of 5,000 MCF/day to

10,000 MCF/day

expanding from capacity of 5,000 MCF/day to

10,000 MCF/day

Unconventional Gas Development

22

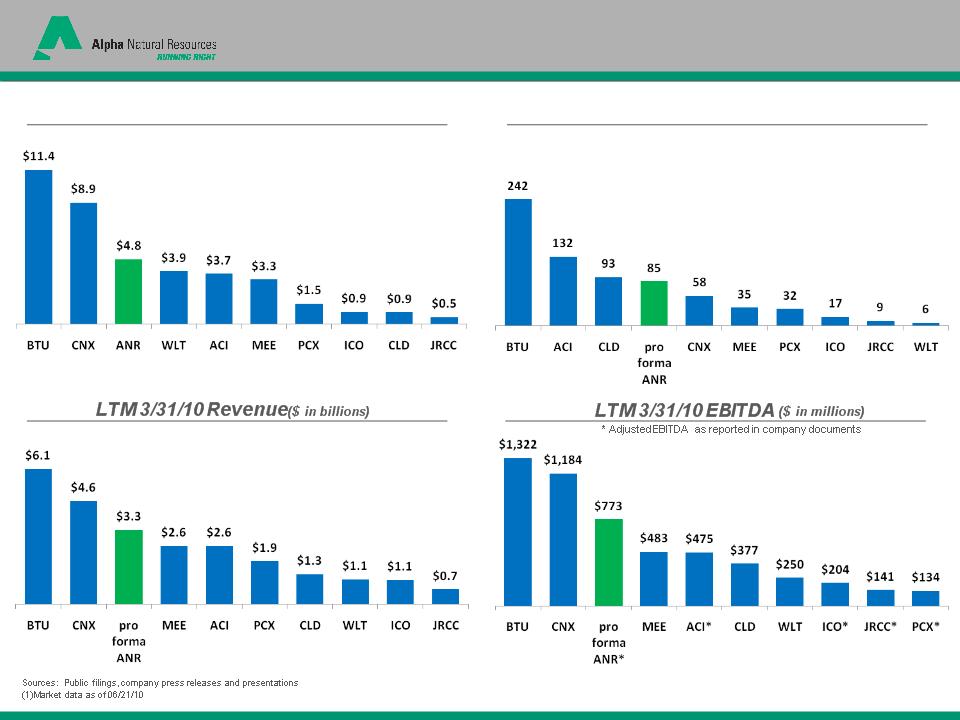

Market Capitalization1 ($ in billions)

LTM 3/31/10 Tons Sold (in millions)

Peer Group Comparisons

23

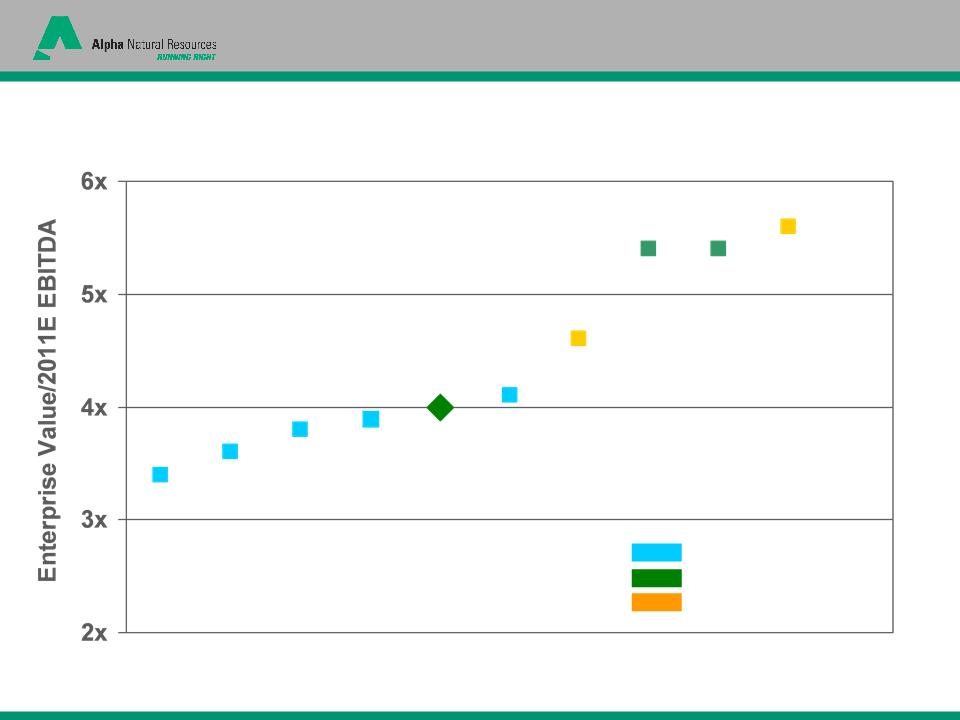

Recent Valuation Comparison 6/21/10

Notes: Market data and First Call consensus 2011 EBITDA estimates as of 6/21/10, pro forma for the MEE acquisition of Cumberland Resources and

the CNX acquisition of the Dominion gas assets and the remaining 17% of CXG.

the CNX acquisition of the Dominion gas assets and the remaining 17% of CXG.

< 50 MM TPY, regional

> 50 MM TPY, diversified

> 50 MM TPY, regional

Compelling Relative Valuation

ANR

24

Coal Industry Themes

ü ANR is a leading U.S. supplier and exporter of

met coal with 13-14MTs of export terminal

capacity and worldwide customer base

met coal with 13-14MTs of export terminal

capacity and worldwide customer base

ü ANR is positioned to benefit from the near-

term shortage of domestic high-vol stemming

from recent mine closures

term shortage of domestic high-vol stemming

from recent mine closures

ü ANR’s operations in NAPP, CAPP and PRB

can respond quickly to increasing demand for

thermal coal in the U.S.

can respond quickly to increasing demand for

thermal coal in the U.S.

ü Low-cost production and export capacity

enable ANR to participate in global thermal

demand growth

enable ANR to participate in global thermal

demand growth

v Strong met coal pricing continues to be

driven by growing Asian demand, global

recovery, and supply disruptions

driven by growing Asian demand, global

recovery, and supply disruptions

v Met coal tightness intensified in the United

States by recent and unexpected loss of

high-vol production

States by recent and unexpected loss of

high-vol production

v Utility inventory levels anticipated to

approach normal levels in 2H10 - U.S.

thermal market positioned to strengthen

approach normal levels in 2H10 - U.S.

thermal market positioned to strengthen

v Future worldwide demand for thermal coal

anticipated to strain seaborne supply

anticipated to strain seaborne supply

25

25

Appendices

26

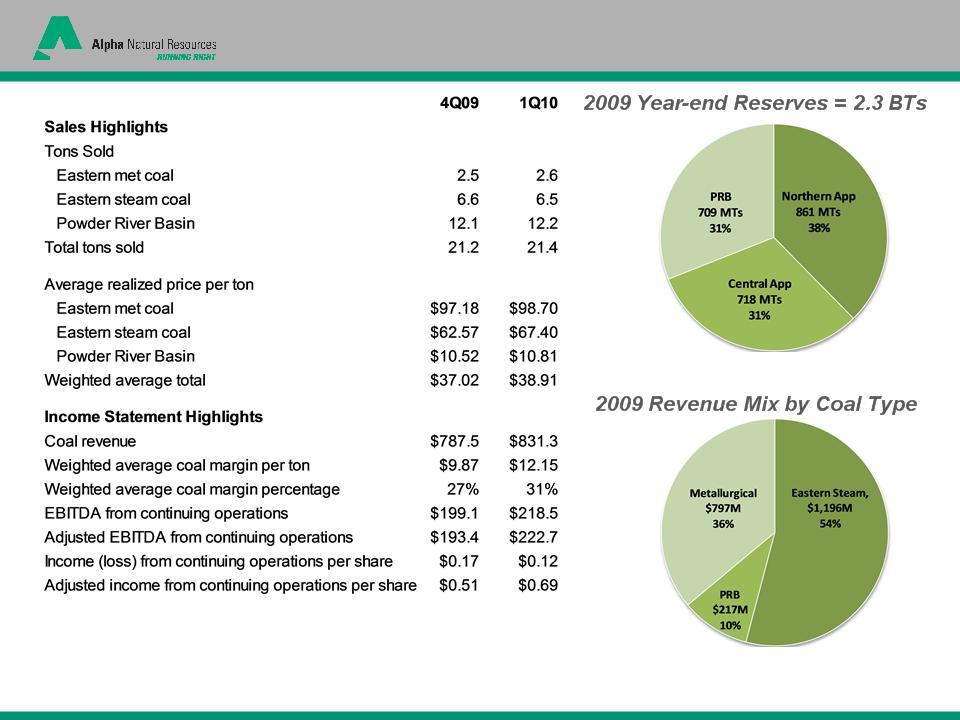

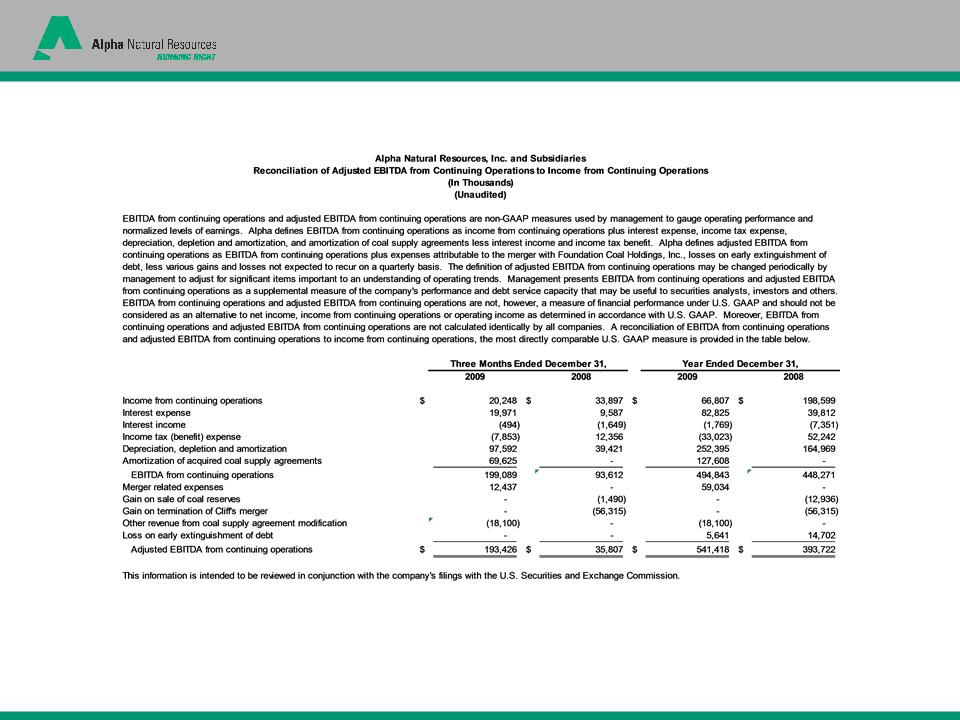

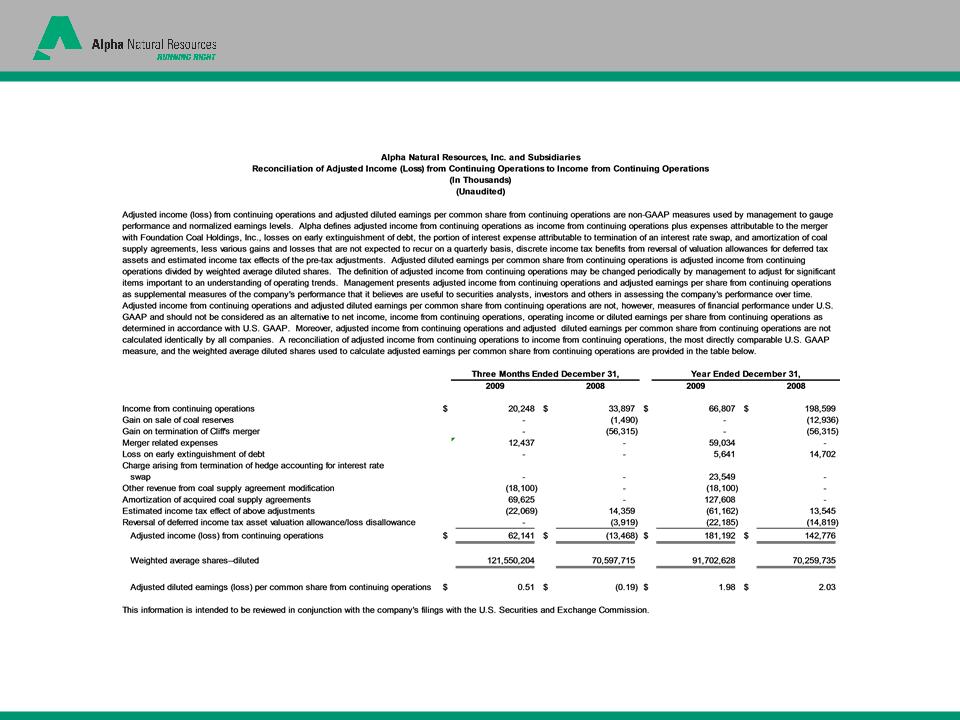

4Q09 Reconciliation of Adjusted EBIDTA

27

4Q09 Reconciliation of Adjusted Income

28

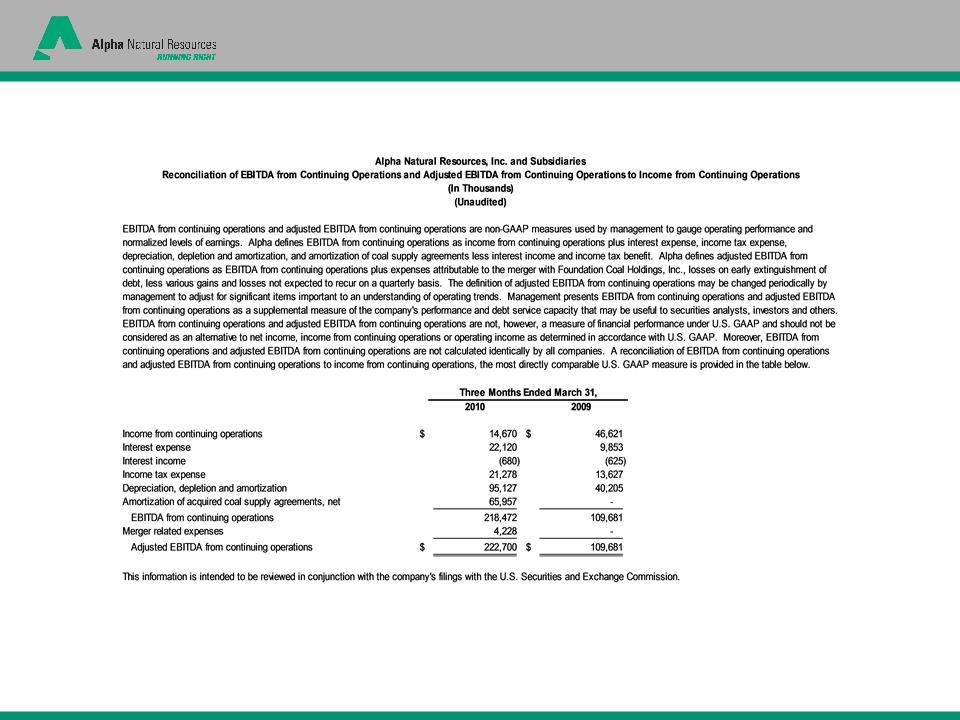

1Q10 Reconciliation of Adjusted EBIDTA

29

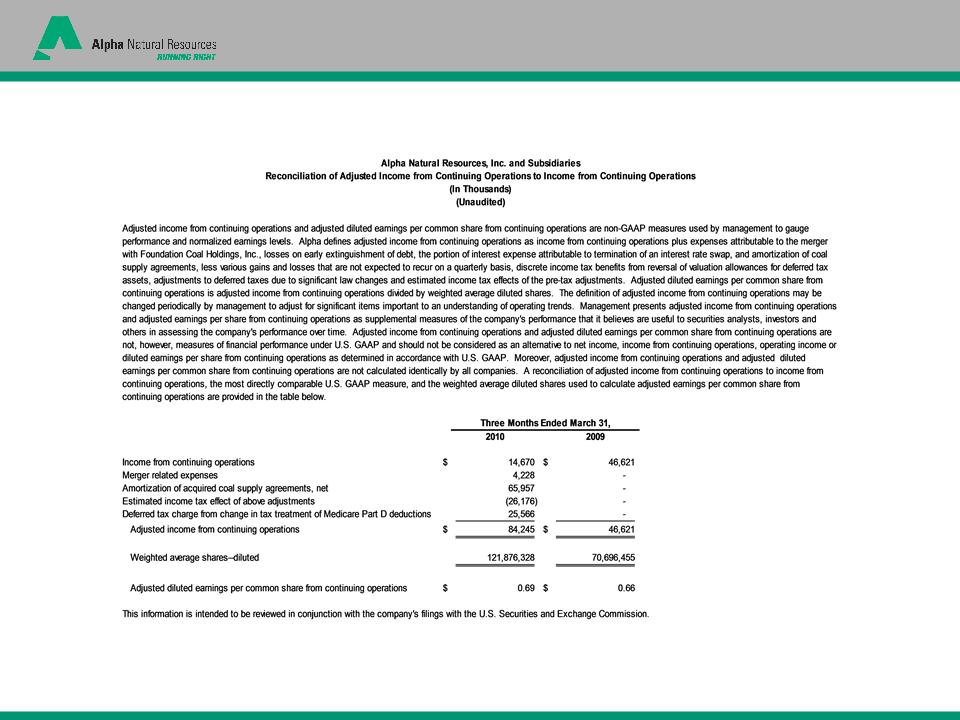

1Q10 Reconciliation of Adjusted Income

30

www.alphanr.com