Attached files

| file | filename |

|---|---|

| 8-K - TRI VALLEY CORP | tv621108k.htm |

Annual Meeting of

Shareholders

Shareholders

NYSE Amex: TIV

Four Points Hotel - Bakersfield, CA

June 18, 2010

June 18, 2010

1

Forward Looking Statements

This presentation contains forward-looking statements that involve risks

and uncertainties. Actual results, events and performance could vary

materially from those contemplated by these forward-looking statements

which includes such words and phrases as exploratory, wildcat, prospect,

speculates, unproved, prospective, very large, expect, potential, etc.

Among the factors that could cause actual results, events and

performance to differ materially are risks and uncertainties discussed in

"Item IA. Risk Factors" and "Item 7. Management's Discussion and

Analysis of Financial Condition" contained in the company's Annual

Report on SEC Form 10-K for the year ended December 31, 2009, and

similar information contained in the company’s Quarterly Report on SEC

Form 10Q for the quarter ended March 31, 2010.

and uncertainties. Actual results, events and performance could vary

materially from those contemplated by these forward-looking statements

which includes such words and phrases as exploratory, wildcat, prospect,

speculates, unproved, prospective, very large, expect, potential, etc.

Among the factors that could cause actual results, events and

performance to differ materially are risks and uncertainties discussed in

"Item IA. Risk Factors" and "Item 7. Management's Discussion and

Analysis of Financial Condition" contained in the company's Annual

Report on SEC Form 10-K for the year ended December 31, 2009, and

similar information contained in the company’s Quarterly Report on SEC

Form 10Q for the quarter ended March 31, 2010.

2

The New Tri-Valley is…

• A California oil producer with more than 9 million barrels of net

reserves¹, and over 5 million barrels contingent resources²

reserves¹, and over 5 million barrels contingent resources²

• Positioned to become the largest oil sands producer in

• Focused on generating cash flow from operations

• Significantly building production volume and revenue

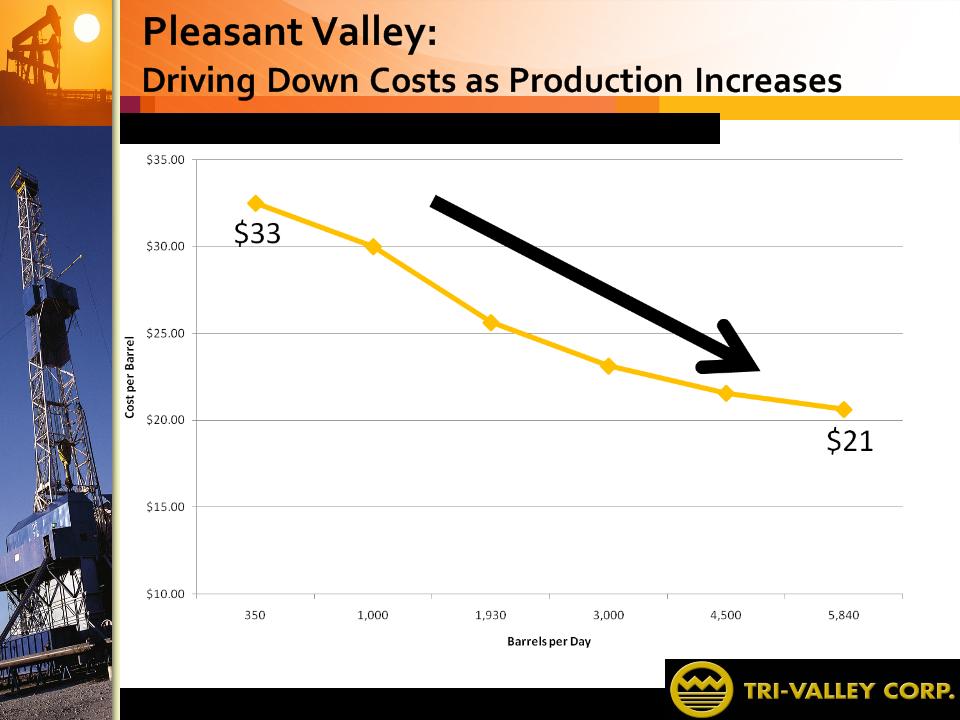

• Significantly reducing operating costs

• Positioned to define a large porphyry gold, copper, and

molybdenum system in Alaska

molybdenum system in Alaska

• Led by a proven management team

¹based on new SEC rules for reserves disclosure

²not yet classifiable as “reserves” per SPE PRMS definitions

3

Where We Are Going

• Increase daily gross oil production from 300 to 1,000 barrels by

year end

year end

• Reduce per barrel production costs by 15% by year end

• Reduce G&A expenses by 10% versus 2009

• Achieve cash flow from operations breakeven by year end

• Capitalize on our Oxnard Tar Sands Project opportunity

• Initiate first SAGD oil sands production in California

• Maximize shareholder value of Select Resources subsidiary

4

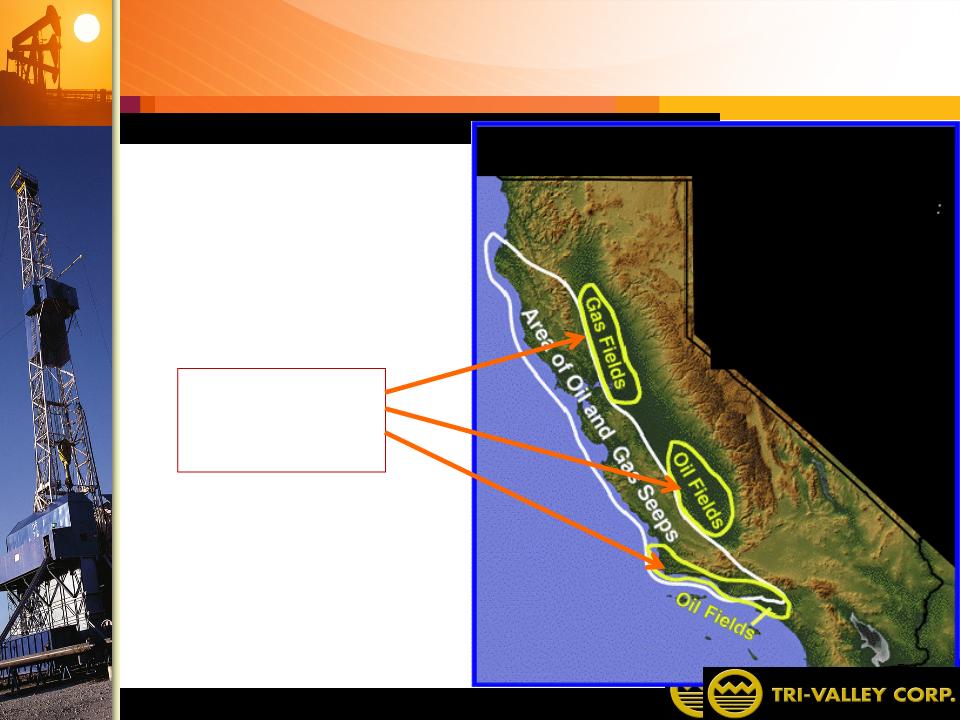

TVOG

Operations

Operations

California Oil and Gas Fields

California Oil and Gas Fields

5

Pleasant Valley - Oxnard, CA

PLEASANT VALLEY

6

Steam Assisted Gravity Drainage Diagram

7

Pleasant Valley

• An “unconventional” heavy oil project to exploit 128 MMB OOIP¹

from the Upper Vaca Tar Sands in the Oxnard Oilfield (3 leases):

from the Upper Vaca Tar Sands in the Oxnard Oilfield (3 leases):

• Confirmed in October 2009 by an independent evaluation

performed by AJM Petroleum Consultants (Calgary, AB)

performed by AJM Petroleum Consultants (Calgary, AB)

• Upper Vaca Tar is analogous to the Canadian Athabasca Oil Sands

• Oxnard Oilfield, discovered in 1937, has 400 MMB OOIP in the

Upper Vaca Tar as estimated by CA Dept of Oil & Gas

Upper Vaca Tar as estimated by CA Dept of Oil & Gas

• TIV is first operator to produce heavy oil from horizontal wells

drilled into the Upper Vaca Tar formation

drilled into the Upper Vaca Tar formation

• Maximum recovery up to 60% of OOIP will require deployment of

latest Canadian technologies such as Steam-Assisted, Gravity-

Drainage (SAGD)

latest Canadian technologies such as Steam-Assisted, Gravity-

Drainage (SAGD)

¹original oil in place

8

Pleasant Valley (Cont.)

Tri Valley Ownership Interests:

– 25.00% working interest¹

– 18.75% net revenue interest

– 5.11% overriding royalty interest

OPUS Partners Ownership Interests:

– 75.00% working interest

– 56.25% net revenue interest

¹TIV has been carried by OPUS for its share of capital

costs.

costs.

9

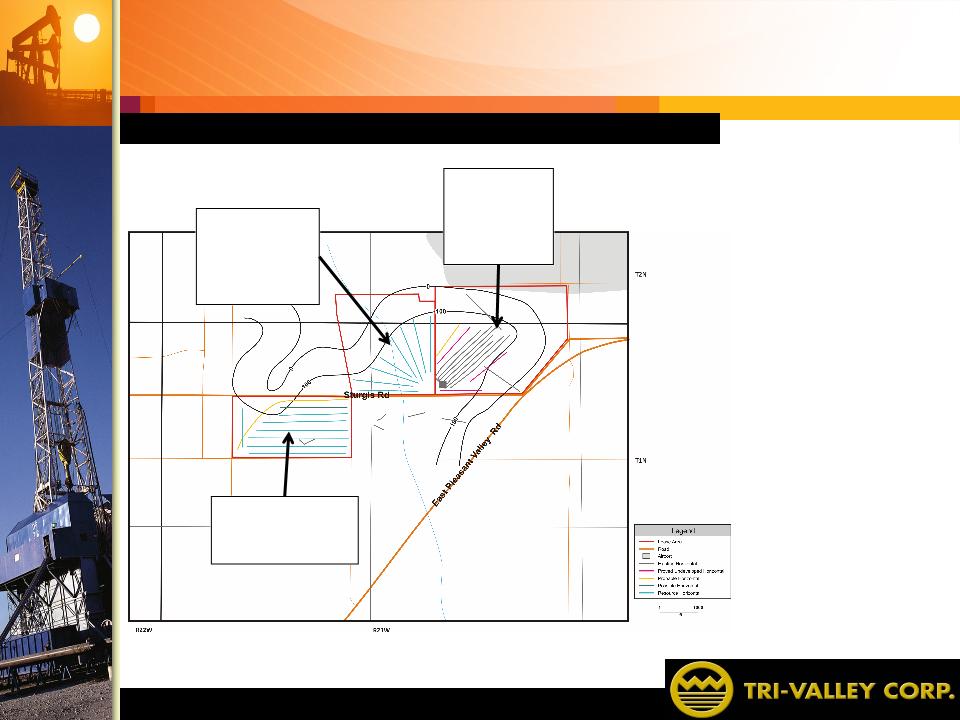

Oxnard Project

Pleasant

Valley

Lease

Scholle -

Livingston

Lease

Lenox Ranch

Lease

Three Leases

• Pleasant Valley

(in production)

• Scholle-Livingston

• Lenox Ranch

Original Oil in Place

= 128 million barrels

10

|

|

Oxnard Vaca

|

Foster Creek

|

Christina Lake

|

Firebag

|

|

Average Depth

|

1,900’

|

1,640’

|

1,150’

|

1,050’

|

|

Gross Pay

|

250’

|

30’ to 100’

|

60’ to 115’

|

115’ to 130’

|

|

Porosity

|

32 to 36%

|

33 to 34%

|

30 to 36%

|

21 to 36%

|

|

Oil Saturation

|

70%

|

80%

|

70 to 85%

|

80 to 95%

|

|

Temperature

|

100˚F

|

54˚F

|

52˚F

|

46˚F

|

|

Oil Viscosity

|

380,000cp

|

200,000cp

|

300,000cp

|

10,000,000cp

|

|

Oil Gravity

|

4 to 7˚API

|

12˚API

|

8˚API

|

7˚API

|

|

Recovery Factor

|

20 to 60%

|

70%

|

65%

|

75%

|

Vaca Tar Sands vs. Canada’s Oil Sands

11

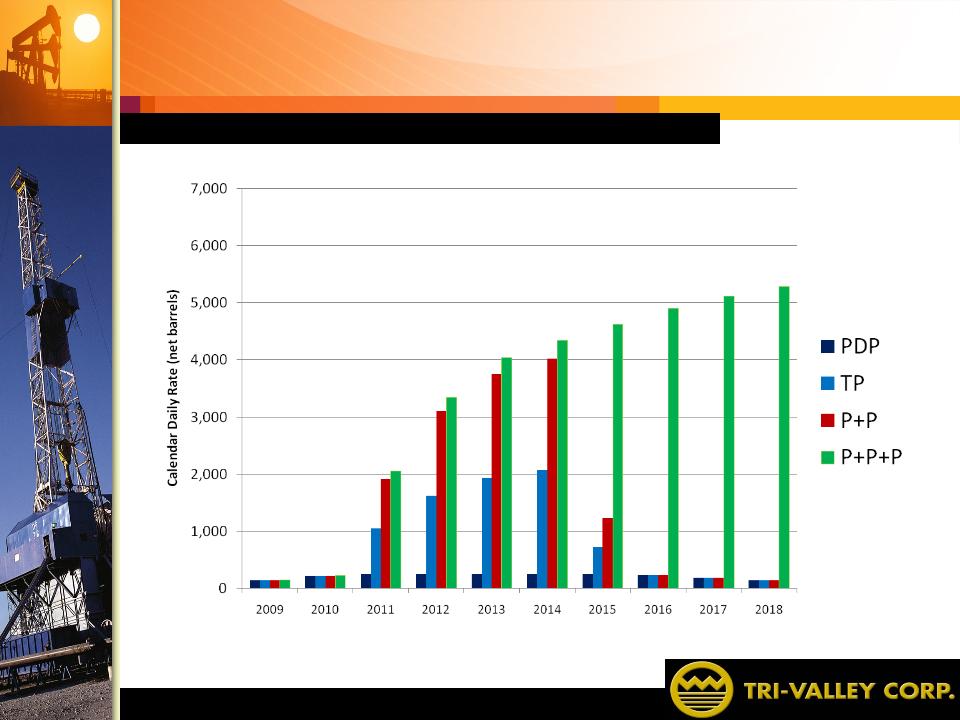

Production Profile - Reserves

12

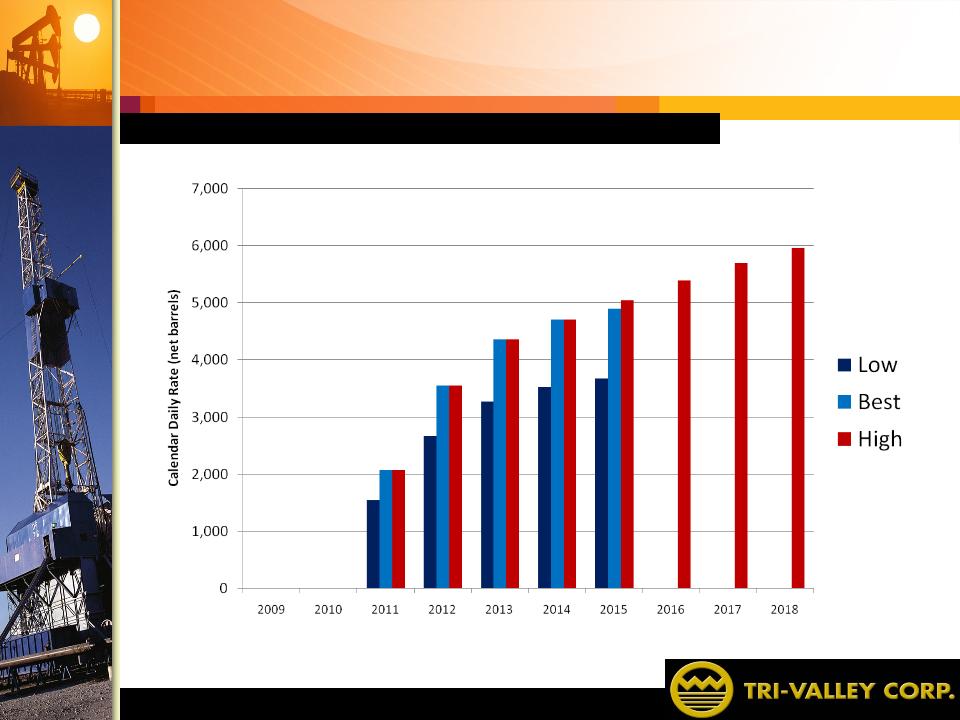

Production Profile - Contingent Resources

13

14

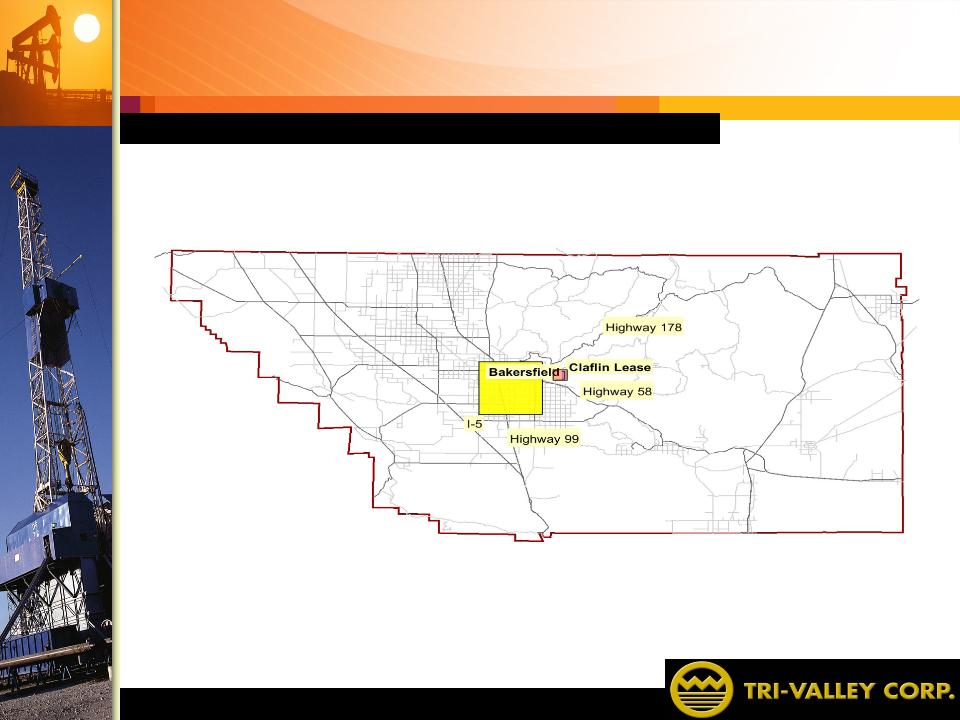

Claflin Project - Bakersfield, CA

15

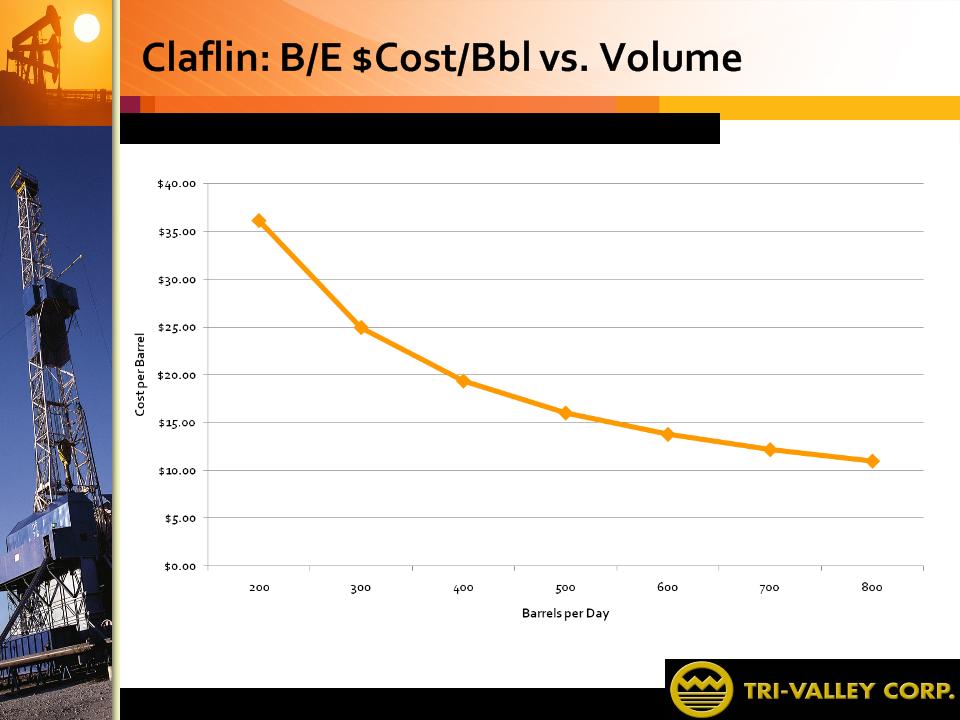

Claflin Project

• TIV Ownership:

• 100% working interest

• 87.5% net revenue interest

• 2.0 MMB net proved reserves (SEC)

• 29 Wells to be Drilled and Equipped during 2010-2011

• Peak production is estimated at 800 BOPD in 2011

• Average of 62,800 Barrels of Oil Produced Annually for

15 years

15 years

• Generate $3.0 Million of Average Annual Net Operating

Profit for 15 years

Profit for 15 years

• TIV has acquired a second similar adjoining property

16

$25

$10

17

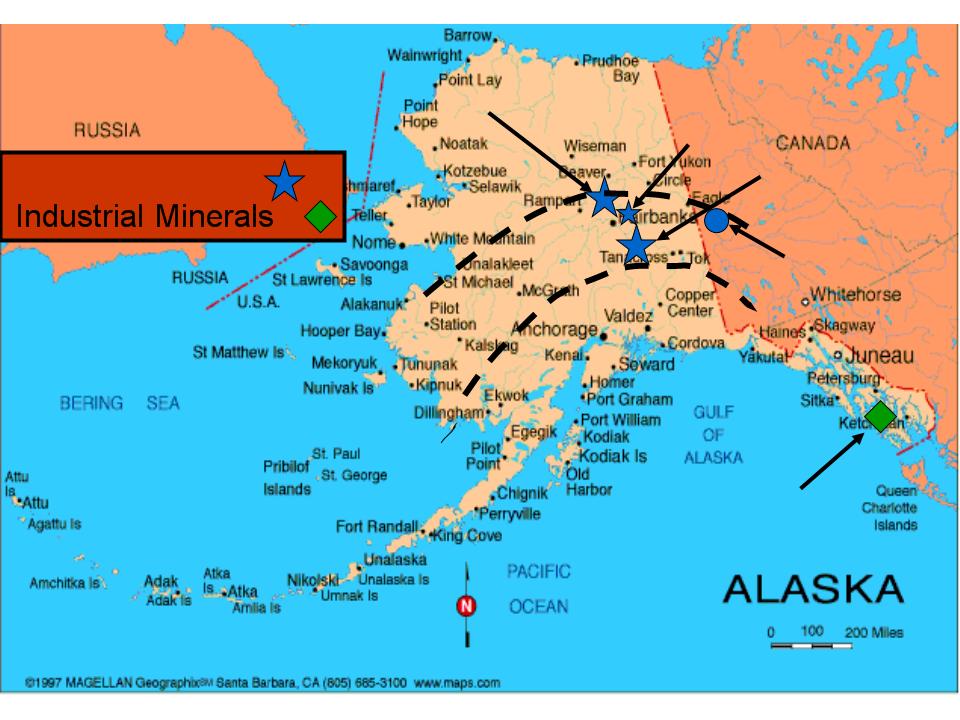

Select Resources

18

Shorty Creek

Richardson

Admiral Calder

Precious Metals

Dawson City and

The Klondike River

Fort Knox and True North Gold

Mines

Mines

19

20

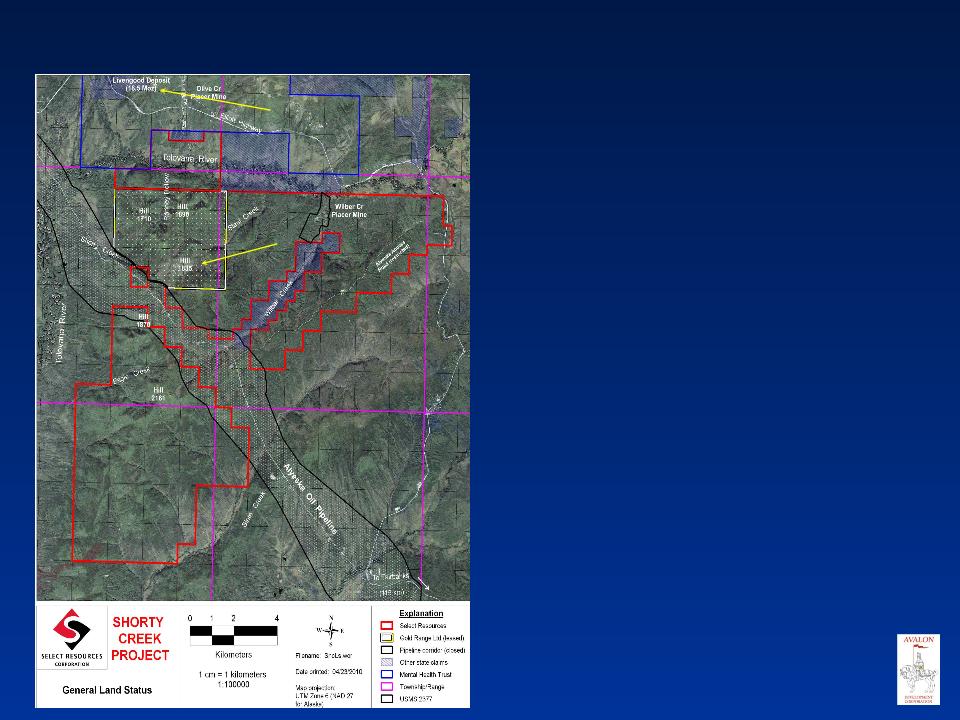

Shorty Creek Land Status

Ø Original leased lands cover

4,480 acres

4,480 acres

Ø Select-staked lands cover

26,400 acres

26,400 acres

Ø One-mile wide Trans-Alaska

O&G pipeline corridors are

closed to mineral entry

O&G pipeline corridors are

closed to mineral entry

Ø ITH Livengood 18.5 million oz

gold (.30 g/t cutoff) deposit is

adjacent to the north

gold (.30 g/t cutoff) deposit is

adjacent to the north

Ø Asarco drilled 8 holes with

gold intercepts on Hill 1835

from .53 to 4.5 g/t (1988-89)

gold intercepts on Hill 1835

from .53 to 4.5 g/t (1988-89)

Hill 1835

Livengood

21

Shorty Creek

• Shorty Creek is a potential world class porphyry deposit

• Recent 43-101 report indicates large porphyry gold, copper

and molybdenum system up to 8 miles in diameter

and molybdenum system up to 8 miles in diameter

• Offsets ITH’s Livengood property containing 18.5 million

oz of gold resource @ 0.3 g/t cut-off (heap leach quality)

oz of gold resource @ 0.3 g/t cut-off (heap leach quality)

• 6 anomalies have been identified for further exploration

work in the 43-101 report evaluation

work in the 43-101 report evaluation

• Asarco had multiple intercepts during 1988-89 program:

• Drilled 20 holes, 8 had gold intercepts ranging from

0.53 g/t to 4.5 g/t on Hill 1835

0.53 g/t to 4.5 g/t on Hill 1835

22

Top Management has Diversified Experience

with Major Oil Companies

with Major Oil Companies

Maston N. Cunningham, Chief Executive Officer and President

Mr. Cunningham became CEO in March 2010 after serving as President & Chief Operating Officer since May 2009. He joined the

Company in early 2009 as VP Corporate Development following a distinguished 22-year international career with Occidental

Petroleum Corporation (Oxy), including 15 years of senior assignments in Pakistan, Peru and Ecuador. Under his leadership as

President & GM of Oxy’s Ecuadorian subsidiary, he led a successful restructuring of the company and renegotiation of its Block 15

contract that led to increased oil production from 16,000 to over 100,000 barrels per day (bopd), following new exploration and

development investments by Oxy and completion of the new $1 billion privately owned and operated 450,000 bopd heavy oil

pipeline system, Oleoducto de Crudos Pesados (OCP). Mr. Cunningham has an M.B.A. from the University of Texas at Austin and

is a graduate of Trinity University. He is a CPA and also fluent in Spanish.

Company in early 2009 as VP Corporate Development following a distinguished 22-year international career with Occidental

Petroleum Corporation (Oxy), including 15 years of senior assignments in Pakistan, Peru and Ecuador. Under his leadership as

President & GM of Oxy’s Ecuadorian subsidiary, he led a successful restructuring of the company and renegotiation of its Block 15

contract that led to increased oil production from 16,000 to over 100,000 barrels per day (bopd), following new exploration and

development investments by Oxy and completion of the new $1 billion privately owned and operated 450,000 bopd heavy oil

pipeline system, Oleoducto de Crudos Pesados (OCP). Mr. Cunningham has an M.B.A. from the University of Texas at Austin and

is a graduate of Trinity University. He is a CPA and also fluent in Spanish.

John E. Durbin, Chief Financial Officer

Mr. Durbin joined as Chief Financial Officer in October 2009. The majority of Mr. Durbin’s 30-year career was spent in various

senior management positions in finance and treasury with subsidiaries of Conoco Inc., and The DuPont Company. During his

career, he has worked internationally from assignments in Bermuda, Switzerland, and Brazil. Most recently at ConocoPhillips, he

was Assistant Treasurer for Risk Management in Houston, and was involved in the design and implementation of an Enterprise

Risk Management Program across the corporation. He holds a BS in Finance from Montana State University and an M.B.A. in

International Financial Management from Thunderbird School of Global Management. He is multilingual with abilities in Arabic,

French, German, Italian, Portuguese, Russian, and Spanish.

senior management positions in finance and treasury with subsidiaries of Conoco Inc., and The DuPont Company. During his

career, he has worked internationally from assignments in Bermuda, Switzerland, and Brazil. Most recently at ConocoPhillips, he

was Assistant Treasurer for Risk Management in Houston, and was involved in the design and implementation of an Enterprise

Risk Management Program across the corporation. He holds a BS in Finance from Montana State University and an M.B.A. in

International Financial Management from Thunderbird School of Global Management. He is multilingual with abilities in Arabic,

French, German, Italian, Portuguese, Russian, and Spanish.

Joseph R. Kandle, Sr. Vice President of Corporate Development, President Tri-Valley Oil & Gas Co.

Mr. Kandle joined in June 1998 and has over 45 years of experience in drilling, production, and operations. He commenced his

professional career with Mobil in 1965 where he specialized in deep drilling. After a long career with Mobil, he joined Atlantic Oil

Company and held positions of V.P. & Chief Engineer of Great Basins Petroleum, V.P. Engineering with Star Resources and V.P.-

Engineering. He received his Petroleum Engineering from the Montana School of Mines.

Mr. Kandle joined in June 1998 and has over 45 years of experience in drilling, production, and operations. He commenced his

professional career with Mobil in 1965 where he specialized in deep drilling. After a long career with Mobil, he joined Atlantic Oil

Company and held positions of V.P. & Chief Engineer of Great Basins Petroleum, V.P. Engineering with Star Resources and V.P.-

Engineering. He received his Petroleum Engineering from the Montana School of Mines.

James C. Kromer, Vice President of Operations

Mr. Kromer became Vice President of Operations in October 2009 after joining Tri-Valley in May 2009 as Operations Manager,

and has over 44 years of experience in drilling, production, reservoir engineering, and operations. Prior to Tri-Valley, he has held

engineering and management positions at Conoco, Exxon, Amerada Hess, Omni Exploration, Damson Oil, Ely and Associates,

Stream Energy, Matris Exploration, and Delta Petroleum; and his experience includes 7 years in foreign assignments in Libya

and Abu Dhabi. Mr. Kromer is a graduate of The Pennsylvania State University where he received a B. S. degree in Petroleum

and Natural Gas Engineering.

and has over 44 years of experience in drilling, production, reservoir engineering, and operations. Prior to Tri-Valley, he has held

engineering and management positions at Conoco, Exxon, Amerada Hess, Omni Exploration, Damson Oil, Ely and Associates,

Stream Energy, Matris Exploration, and Delta Petroleum; and his experience includes 7 years in foreign assignments in Libya

and Abu Dhabi. Mr. Kromer is a graduate of The Pennsylvania State University where he received a B. S. degree in Petroleum

and Natural Gas Engineering.

23

Top Management has Diversified Experience

with Major Oil Companies (cont.)

with Major Oil Companies (cont.)

Michael P. Stark, Vice President of Exploration

Mr. Stark has over 35 years with leading oil and gas producers and was most recently Vice President of Exploration and Land for

Ivanhoe Energy (USA) for 12 years where he led a successful California exploration program that resulted in three discoveries.

Prior to Ivanhoe, Mr. Stark had a 20 year successful career with Occidental Petroleum Corporation (Oxy) that included positions

in the U.S. and abroad including the United Kingdom and Pakistan. As Oxy’s Regional Exploration Manager for Europe, the

Middle East and the CIS, he directed an exploration team that discovered over 500 million barrels of oil. He received his BS in

Geology from the University of California at Los Angeles and his Masters of Science in Geology from Iowa State University.

James G. Bush, President, Select Resources Corporation

Mr. Bush has over 30 years in the natural resource industry previously working 10 years with the DOE’s Pacific Northwest National

Laboratory and 10 years with ICF Kaiser Engineers. Earlier in his career he worked for Atlantic Richfield (on and off-shore Alaska

and Texas), Aspen Exploration, and the Anaconda Copper Co. His particular expertise in gold placer exploration is very valuable

to Tri-Valley and was the finding geologist for Alaska’s recent Valdez Creek gold mine. He received his BS in Geology from Ohio

State University and his Masters of Science from the South Dakota School of Mines and Technology.

24