Attached files

| file | filename |

|---|---|

| 8-K - COMMUNITY FINANCIAL CORP /MD/ | v188207_8k.htm |

Tri-County Financial Corporation

June 2010

Ticker: TCFC

Tri-County Financial Corporation

1

Those who use the recession to

enhance their competitive position,

rather than retrench to survive,

typically outperform their peers

over

the recovery …

the recovery …

Bain & Co

Survey

2

The oldest financial institution

headquartered in Southern Maryland (est. 1950)

Converted from a mutual thrift to a

stock form thrift in 1986 with a capital raise of

$2.8mm

$2.8mm

Formed a Thrift Holding Company in

1989

Formed a Federal Reserve Member Bank

Holding Company in 1997

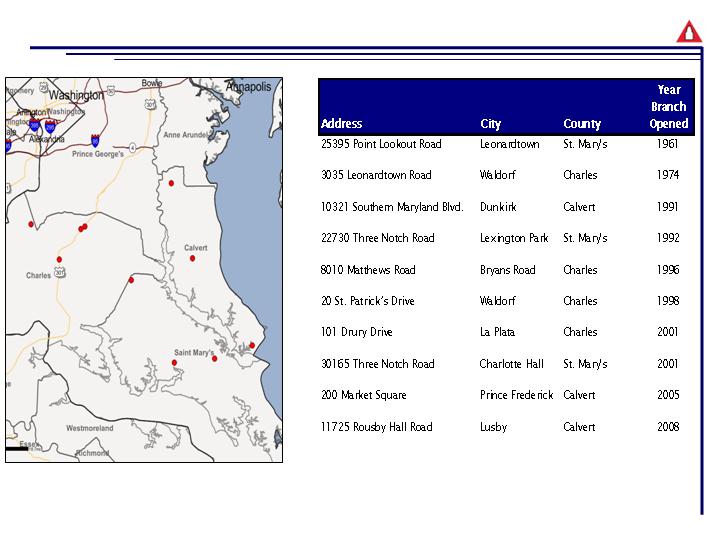

Operate ten branches in the Southern

Maryland counties of Charles, Calvert and St.

Mary’s

Mary’s

The largest bank headquartered in

Southern Maryland; # 1 market share in Charles

County and #3 overall in its markets

County and #3 overall in its markets

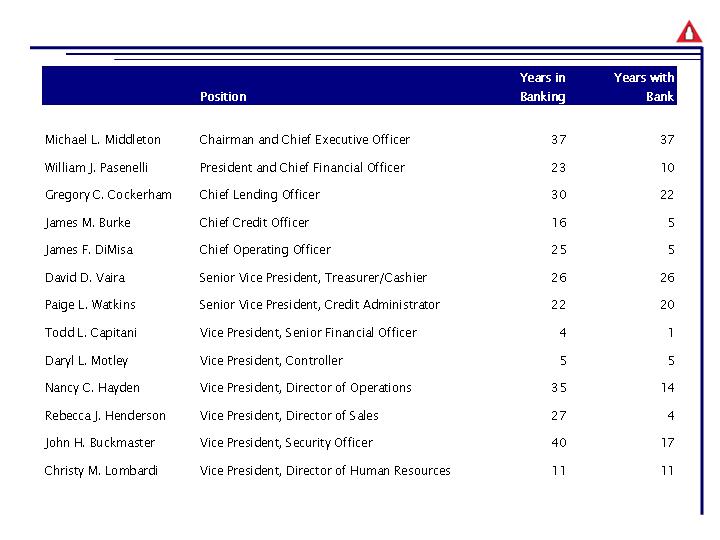

Experienced senior management team

with an average of 23 years in banking and

14 years with the Company

14 years with the Company

Issued $16.3mm of preferred stock in

2008 with participation in U.S. Treasury

Capital Purchase Program (“CPP”)

Capital Purchase Program (“CPP”)

Company History

3

Company Overview

Tri–County Financial Corporation

(TCFC) is a commercial bank Holding Company

headquartered in Waldorf, Maryland

headquartered in Waldorf, Maryland

$819 million in assets, focused on

Southern Maryland with ten branches

Commercially oriented business model

with community focus and long-term

customer relationships

customer relationships

6th largest Maryland bank holding

company headquartered and operating in

Maryland

Maryland

Double digit asset growth due to

successful customer acquisition and retention

strategies

strategies

Niche positioning, offering the size

and scale of products of regional / money

center banks while maintaining a community bank feel

center banks while maintaining a community bank feel

Sales and service focus has resulted

in consistent organic growth

Relationship banking with customer

access to decision-makers with local market

knowledge

knowledge

Largest deposit market share in

Southern Maryland of any locally-based bank and

3rd largest deposit share of all banks

3rd largest deposit share of all banks

Note: Financial data at June 30,

2009; deposit market share data as of June 30, 2009, adjusted for all M&A

activity through August 26, 2009

4

Summary Statistics – March 31,

2010

Assets

$819mm

Loans

$608mm

Deposits

$662mm

Headquarters Waldorf, MD

Branches

10

Shares Outstanding 2,990,520

CPP TARP

$16.3mm

Tangible Common Equity $53.1mm

Tangible Common Book Value per

Share $17.8

Market

Capitalization 35.9mm

Price/Tangible

Book 67.6%

Insider Ownership % 26.0%

Market data as of May 7, 2010;

Financial data as of March 31, 2010; Insider ownership per Annual Proxy

Statement as of May 12, 2010, excluding 244,041 available

options

5

Branch Locations

6

Naval Air Station Patuxent River, St.

Mary’s County

22,000 jobs; annual county economic

impact $2.3 billion

Indian Head Naval Service Warfare

Center, Charles County

20 miles south of DC; National

Energetics Center for U.S Military

Calvert Cliff Nuclear Power Plant,

Calvert County

Third Nuclear plant approved- 4,000

construction jobs, 500

permanent jobs expected

Cove Point Terminal- Dominion

Resources, Calvert County

One of the nation’s largest

liquefied natural gas (LNG) import and

transportation facilities

Andrews Air Force Base, Prince

George’s County

Fourteen miles from Waldorf,

Maryland; Home of Air Force One

Economic Drivers

7

Economic Drivers

Source: Maryland Department of Labor,

Licensing and Regulation, Division of Workforce Development and Adult

Learning and Bureau of Labor

Statistics

8

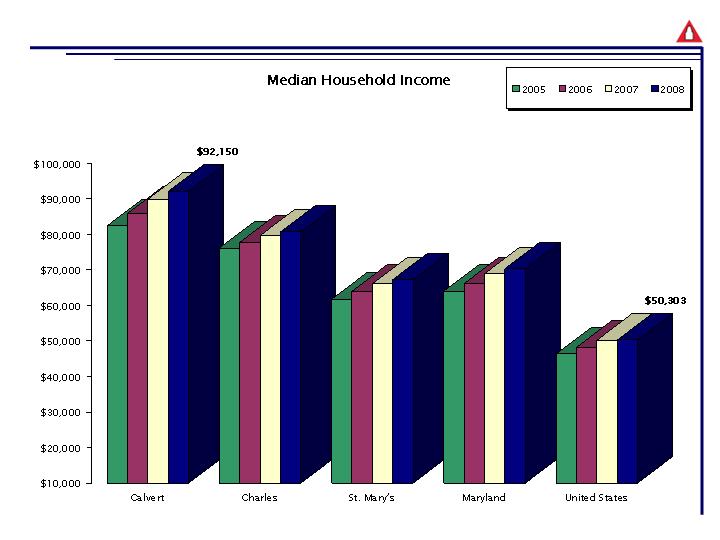

Economic Drivers

Source: US Census Bureau and the

Maryland Department of Planning, Planning Data Services

9

10

Maryland Regional Labor Force Growth

1990-2030

Source: Maryland Department of

Planning, February 2009

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

Experienced Senior Management Team

Note: Position titles listed are for

Community Bank of Tri-County

11

Key Financial

Statistics

(1)

Peers include publicly traded banks

in Maryland with assets between $420 million and $2.0 billion. Median values and

percentages of peer group utilized.

(2)

Excludes restructured loans

(3)

Restructured Loans/Assets average was

1.6% for peer group

Note: Dollars in thousands

Source: SNL

Financial

12

Capital Ratios

Source: Company

Documents

(to avg. assets)

(to risk-weighted

assets)

(tier 1 & tier 2 to risk-weighted

assets)

13

Consistent Balance Sheet

Growth

(1)

Peers include publicly traded banks

in Maryland with assets between $420 million and $2.0 billion. Median values and

percentages of peer group utilized.

Note: Dollars in thousands

Source: SNL Financial

14

Net Income

$1,364

(1)

Peers include publicly traded banks

in Maryland with assets between $420 million and $2.0 billion. Median values and

percentages of peer group utilized.

Note: Dollars in thousands

Source: SNL Financial

15

Pre-Tax, Pre-Provision

Income

(1)

Peers include publicly traded banks

in Maryland with assets between $420 million and $2.0 billion. Median values and

percentages of peer group utilized.

Note: Dollars in thousands

Source: SNL Financial

16

Loan Portfolio

Composition

Dollars in thousands

Note: At March 31, 2010

Loan Portfolio by

Type

Total Gross Loans: $616.2

million

Over 83% of loans are in three

counties of Calvert, Charles and St. Mary’s counties

Out of market loans are concentrated

in DC Metro area. Loans outside of DC

Metro area are generally with existing in-market customers

Metro area are generally with existing in-market customers

A&D loans represent 5.5% of

total loans

Loan Portfolio

Geography

17

Geographic Detail of Loan

Portfolio

100% of A&D and Builder lines

are for projects in Maryland

Concentration in quality markets:

Charles, St Mary’s, and Calvert counties

Low levels of exposure to markets

hit hardest by real estate downturn

Dollars in thousands

Note: At March 31, 2010

18

Data as of March 31,

2010

Total: $274.3 million

Total: $29.1 million

Detail of CRE Loan

Portfolio

Owner Occupied

and Income

Producing

Commercial

Construction

The commercial office or office

condo category is 69% owner occupied

19

Credit Quality

Note: Dollars values in

thousands

95% of TDRs of $12.4mm at March 31,

2010 were current

100% of non-current TDRs at March

31, 2010 were less than 90 days outstanding

20

The Tri-County Deposit Market

Share

Continue to take market share from

competitors

21

Deposit Geography

Note: Dollars in

thousands

22

Commercial focus drives growth of

noninterest bearing demand accounts

Favorable pricing while increasing

market share from regional/super-regional

banks

banks

Deposit Composition

Note: Dollars in

thousands

23

Why Invest in TCFC?

Note: Dollars in

thousands

Long-Term Value

Fastest growing franchise in our

market

Fastest growing market in Maryland

with many regional economic

drivers

drivers

The preferred provider in the

markets we serve

Consistently capture profitable

market share from competitors

Focused on ROE and superior asset

quality

Experienced and committed senior

management team with an

average of 23 years in banking and 14 years with TCFC

average of 23 years in banking and 14 years with TCFC

24

Appendix

25

Top 10 Loan

Relationships

Note: Dollars in

Thousands

Top ten loan relationships represent

10.0% of outstanding loans of $616.2 million

at March 31, 2010

at March 31, 2010

Greater than 99% of outstanding loan

balances for top ten loan relationships are in

Tri-County markets of Charles, Calvert and St. Mary’s counties

Tri-County markets of Charles, Calvert and St. Mary’s counties

100% of top ten loan relationships

are performing

26

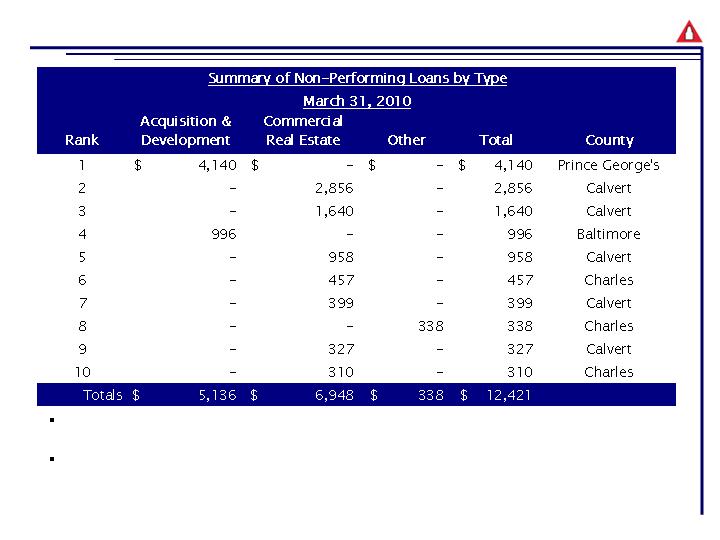

Top 10 Non-Performing

Loans

Top ten non-performing loans

represent 87.9% of non-performing loans of $14.1

million at March 31, 2010

million at March 31, 2010

Top ten non-performing loans

represent six customer relationships

Note: Dollars in Thousands.

27

Top 10 Classified Loans

Note: Dollars in Thousands.

28

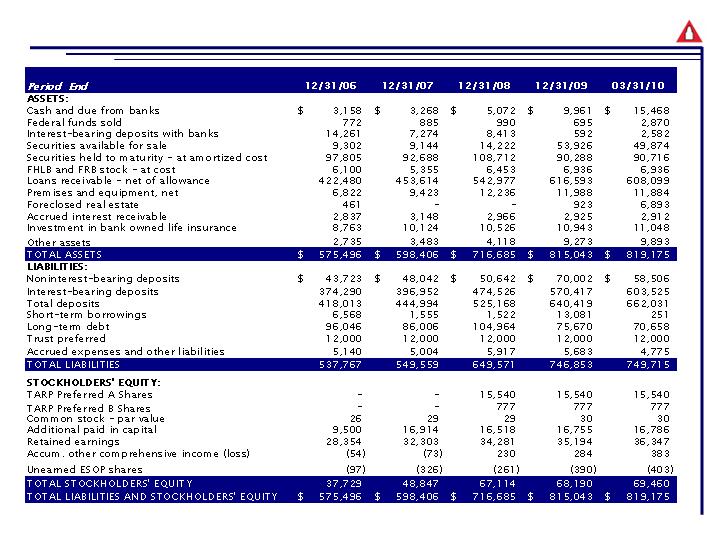

Historical Financials – Balance

Sheets

Note: Dollars in

Thousands

29

Historical Financials – Income

Statements

Note: Dollars in Thousands; FDIC

insurance included in Other Expenses for 2006 and 2007

30

Michael L. Middleton - Chairman And Chief Executive Officer

Career Track: KPMG – Baltimore 1969 to 1973;

Joined Tri-County Savings and Loan in 1973; President and CEO in

1979; Conducted IPO in 1986, secondary offering 2007; Appointed Chairman of Board in 1986

1979; Conducted IPO in 1986, secondary offering 2007; Appointed Chairman of Board in 1986

Education: Bellarmine University, BA in

Accounting; University of Maryland Robert Smith School, MBA, Finance

Concentration; Harvard School of Business Program on Negotiation

Concentration; Harvard School of Business Program on Negotiation

Affiliations: Elected director FHLB Atlanta in

1996-2004 - Finance Chair, Board Chairman 2004; Appointed director

Council of FHLBanks 1998-2004; Appointed director Federal Reserve Bank of Richmond’s Baltimore Board 2004-

2009; Appointed director of Advisory Board to Smith School’s Center for Financial Policy 2009; Member of the

American Institute of Certified Public Accountants ; Director of Maryland Bankers Association Board

Council of FHLBanks 1998-2004; Appointed director Federal Reserve Bank of Richmond’s Baltimore Board 2004-

2009; Appointed director of Advisory Board to Smith School’s Center for Financial Policy 2009; Member of the

American Institute of Certified Public Accountants ; Director of Maryland Bankers Association Board

Experienced Management

Team

William J. Pasenelli - President And Chief Financial

Officer

Career Track: Chief Financial Officer of

Community Bank since 2000; 1987-2000 Chief Financial Officer of Acacia

Federal Savings Bank, Annandale, VA; 2010 President and CFO of Community Bank of Tri-County

Federal Savings Bank, Annandale, VA; 2010 President and CFO of Community Bank of Tri-County

Education: Graduated Magna Cum Laude from

Duke University with a Bachelor of Arts degree in Management

Science; Graduate of the National School of Banking; Harvard School of Business Program on Negotiation

Science; Graduate of the National School of Banking; Harvard School of Business Program on Negotiation

Affiliations: Member of the American Institute

of Certified Public Accountants; Member of DC Institute of Certified

Public Accountants

Public Accountants

Gregory C. Cockerham - Chief Lending Officer

Career Track: Executive Vice President and Chief

Lending Officer for Community Bank of Tri-County; Joined

Community Bank in 1988; Retail Center and regional Lending officer, Maryland National Bank; Over 30 years of

banking experience, concentration in commercial lending

Community Bank in 1988; Retail Center and regional Lending officer, Maryland National Bank; Over 30 years of

banking experience, concentration in commercial lending

Education: Associate of Arts from the College

of Southern Maryland; Bachelor of Science degree in Business

Management from West Virginia University; Graduate of the Maryland Bankers School; Harvard School of Business

Program on Negotiation

Management from West Virginia University; Graduate of the Maryland Bankers School; Harvard School of Business

Program on Negotiation

Affiliations: Vice Chair of the Board of

Directors for the College of Southern Maryland Foundation; President of the

Rotary Foundation Board; Member of the Maryland Chamber Board of Directors

Rotary Foundation Board; Member of the Maryland Chamber Board of Directors

Note: Position titles listed are for

Community Bank of Tri-County

31

Experienced Management

Team

James M. Burke - Chief Credit Officer

Career Track: Executive Vice President, Chief

Credit Officer for Community Bank of Tri-County; Joined Community

Bank of Tri-County in December 2005; Previously the Executive Vice President and Senior Loan Officer at

Mercantile- Southern Maryland Bank

Bank of Tri-County in December 2005; Previously the Executive Vice President and Senior Loan Officer at

Mercantile- Southern Maryland Bank

Education: Bachelor of Arts in Political

Science from High Point College; Graduate of the; Maryland Bankers School;

Graduate of the East Carolina Advanced School of Commercial Lending; Harvard School of Business Program on

Negotiation

Graduate of the East Carolina Advanced School of Commercial Lending; Harvard School of Business Program on

Negotiation

Affiliations: Chairman of Civista Health, Inc.;

President of Archbishop Neale School Board

James F. DiMisa - Chief Operating Officer

Career Track: Executive Vice

President, Chief Operating Officer of Community Bank ; Joined Community Bank in

2005; Previously, Mr. DiMisa served as Executive Vice President for; Mercantile-Southern Maryland Bank; Has over 25

years of banking experience

2005; Previously, Mr. DiMisa served as Executive Vice President for; Mercantile-Southern Maryland Bank; Has over 25

years of banking experience

Education: Associate of Arts from the College

of Southern Maryland; Bachelor of Science degree in Business

Management from George Mason University, Fairfax, VA; Master of Business Administration from Mount St. Mary’s

College; Graduate of the ABA Stonier Graduate School of Banking; Harvard School of Business Program on Negotiation

Management from George Mason University, Fairfax, VA; Master of Business Administration from Mount St. Mary’s

College; Graduate of the ABA Stonier Graduate School of Banking; Harvard School of Business Program on Negotiation

Affiliations: Chairman of the Board of Trustees

for the Maryland Bankers School; Director and past President and

Founder of the La Plata Business Association; Charles County Rotary Club past president

Founder of the La Plata Business Association; Charles County Rotary Club past president

David D. Vaira - Senior Vice

President, Treasurer/Cashier

Career Track: Treasurer of Community Bank of

Tri-County since 2006; Senior Vice President since 1996; Vice

President and Controller of Community Bank 1984 to 2005

President and Controller of Community Bank 1984 to 2005

Education: Bachelors of Science, University of

Maryland

Affiliations: Vice President of the Catholic

Business Association of Charles County

Note: Position titles listed are for

Community Bank of Tri-County

32

Paige L. Watkins - Senior Vice President, Credit

Administrator

Career Track:1990 to present lending

administration, Community Bank of Tri-County; 1988-1990 Residential

Underwriter, New England Savings Bank

Underwriter, New England Savings Bank

Education: Graduated from University of

Maryland, University College with a Bachelor of Science in Business

Management; Harvard School of Business Program on Negotiation

Management; Harvard School of Business Program on Negotiation

Affiliations: Member of the Zonta Club of Charles

County

Experienced Management

Team

Todd L. Capitani - Vice President, Senior Financial

Officer

Career Track: Vice President and Senior Financial

Officer of Community Bank in 2009; 2005-2009 Controller/Senior

Finance Manager for Bearing Point Inc. & Deloitte Consulting; 2002-2004 Finance Consultant, Washington, DC

1998-2001 – Chief Financial Officer of Ruesch International, Inc, Washington, DC; 1989-1998 – External Auditor with

Bertorelli & Company and Ernst & Young, San Francisco, CA

Finance Manager for Bearing Point Inc. & Deloitte Consulting; 2002-2004 Finance Consultant, Washington, DC

1998-2001 – Chief Financial Officer of Ruesch International, Inc, Washington, DC; 1989-1998 – External Auditor with

Bertorelli & Company and Ernst & Young, San Francisco, CA

Education: Bachelor of Arts in Business

Economics, University of California

Affiliations: Certified Public Accountant, State

of California; Treasurer St. Peter’s of Waldorf Home and School

Association

Association

Daryl L. Motley

- Vice President, Controller

Career Track: Controller for Community Bank since

2006; Accounting Manager in 2005; Previously employed as

Assistant Controller/Controller for Mills Corporation 2003 to 2005

Assistant Controller/Controller for Mills Corporation 2003 to 2005

Education: Bachelor of Science in Accounting

from Towson University; Attending Maryland Bankers School

Affiliations: Member of American Institute of

Certified Public Accountants; Member of Maryland Association of

Certified Public Accountants

Certified Public Accountants

Note: Position titles listed are for

Community Bank of Tri-County

33

Nancy C. Hayden - Vice President, Director of

Operations

Career Track: Vice President and Director of

Operations March 2010 to present; Since 1996, served in various roles

with the Bank including Director of Information Technology, Branch Coordinator and Branch Manager; Vice President

and Branch Manager, Maryland National Bank/Nations Bank 1975 to 1996

with the Bank including Director of Information Technology, Branch Coordinator and Branch Manager; Vice President

and Branch Manager, Maryland National Bank/Nations Bank 1975 to 1996

Education: Graduated with Honors from Computer

Learning Center; Graduate of Maryland Bankers School

Affiliations: Board of Director for Southern

Maryland Chapter of the American Red Cross; Prior terms/memberships

with St. Mary’s County Chamber of Commerce Board and the Mechanicsville Volunteer Rescue Squad and Fire

Department

with St. Mary’s County Chamber of Commerce Board and the Mechanicsville Volunteer Rescue Squad and Fire

Department

Rebecca J. Henderson - Vice President, Director of Sales

Career Track: 2006 to present, Director of Sales

and Vice President of Community Bank of Tri-County; 1983 – 2006

employed at Bank of Southern Maryland/Mercantile Southern Maryland Bank holding various positions in lending and

sales

employed at Bank of Southern Maryland/Mercantile Southern Maryland Bank holding various positions in lending and

sales

Education: Graduate of Maryland Bankers School;

Completed Omega Consumer Lending Course; Completed RMA

Lending Academy Program

Lending Academy Program

Affiliations: Southern Maryland Association of

Realtors Affiliate Committee Member

Experienced Management

Team

John H. Buckmaster -

Vice President, Security Officer

Career Track: Served in various roles with

Community Bank of Tri-County including security, lending and collections

since 1993; Previously the Vice President, CRA Officer/Coordinator for 1st Virginia Bank in Maryland; forty years of

banking experience focused in lending and collections

since 1993; Previously the Vice President, CRA Officer/Coordinator for 1st Virginia Bank in Maryland; forty years of

banking experience focused in lending and collections

Education: Graduate of Maryland Bankers

School; Certificate from the American Institute of Banking

Note: Position titles listed are for

Community Bank of Tri-County

Christy M. Lombardi - Vice President, Director of Human

Resources

Career Track: 2010 Director of Human Resources and

Vice President, served as HR Manager since 2006; 1999 – 2005

Executive Assistant for Community Bank of Tri-County

Executive Assistant for Community Bank of Tri-County

Education: Maryland Bankers School, expected

graduation 08/2010; Working towards a dual Masters in Business

Administration and Human Resources Management, University of Maryland University College; Harvard School of

Business Program on Negotiation for Senior Executives; B.A. in Human Resources Management & an Associates in

Management Development

Administration and Human Resources Management, University of Maryland University College; Harvard School of

Business Program on Negotiation for Senior Executives; B.A. in Human Resources Management & an Associates in

Management Development

34

Board of Directors

H. Beaman Smith

Lead Director of the Board of

Directors. He is founder and President of Accoware, a computer software company

established in 1986. He served as Vice President of Fry Plumbing & Heating Company in Washington, D.C. from

1988 until his retirement in October 2008. Mr. Smith holds a Masters Degree and BS from the University of

Maryland. Mr. Smith serves on the boards of the Maryland 4-H Foundation and Charles County Habitat for

Humanity. Age 64. Director since 1986.

established in 1986. He served as Vice President of Fry Plumbing & Heating Company in Washington, D.C. from

1988 until his retirement in October 2008. Mr. Smith holds a Masters Degree and BS from the University of

Maryland. Mr. Smith serves on the boards of the Maryland 4-H Foundation and Charles County Habitat for

Humanity. Age 64. Director since 1986.

Herbert N. Redmond, Jr.

Chairperson of the Audit Committee.

He is the President of D.H. Steffens Company. Mr. Redmond has been

associated with the company since 1959 and deals in all aspects of the surveying and land development process,

including working with clients and approval agencies. He is a licensed Maryland Professional Land Surveyor who has

served as President of the Maryland Society of Surveyors as well as the Chairman of the Ethics Committee. He was

selected as Surveyor of the Year in 1992. He is a member of the Maryland Society of Surveyors, the American

Congress on Surveying and Mapping, the American Planning Association and the Urban Land Institute. He currently

serves as a Director of the Maryland Society of Surveyors Education Trust. Age 70. Director since 1997.

associated with the company since 1959 and deals in all aspects of the surveying and land development process,

including working with clients and approval agencies. He is a licensed Maryland Professional Land Surveyor who has

served as President of the Maryland Society of Surveyors as well as the Chairman of the Ethics Committee. He was

selected as Surveyor of the Year in 1992. He is a member of the Maryland Society of Surveyors, the American

Congress on Surveying and Mapping, the American Planning Association and the Urban Land Institute. He currently

serves as a Director of the Maryland Society of Surveyors Education Trust. Age 70. Director since 1997.

Michael L. Middleton

Chairman, President and Chief

Executive Officer of the Company. He is Chairman and Chief Executive

Officer of the

Bank. Mr. Middleton joined the Bank in 1973 and served in various management positions until 1979 when he

became President of the Bank until April 1, 2010. Mr. Middleton is a Certified Public Accountant and holds an MBA.

From 1996 to 2004, Mr. Middleton served on the Board of Directors of the Federal Home Loan Bank of Atlanta,

serving as Chairman of the Board in 2004. He also served as its Board Representative to the Council of Federal Home

Loan Banks. Mr. Middleton has served on the Board of Directors of the Federal Reserve Bank, Baltimore Branch, since

2004. He also serves on several philanthropic and civic boards. He is a trustee for the College of Southern Maryland,

serves on the Advisory Board of the Robert H. Smith School of Business Center for Financial Policy and is Chairman of

the Board of the Energetics Technology Corporation. Age 62. Director since 1979.

Bank. Mr. Middleton joined the Bank in 1973 and served in various management positions until 1979 when he

became President of the Bank until April 1, 2010. Mr. Middleton is a Certified Public Accountant and holds an MBA.

From 1996 to 2004, Mr. Middleton served on the Board of Directors of the Federal Home Loan Bank of Atlanta,

serving as Chairman of the Board in 2004. He also served as its Board Representative to the Council of Federal Home

Loan Banks. Mr. Middleton has served on the Board of Directors of the Federal Reserve Bank, Baltimore Branch, since

2004. He also serves on several philanthropic and civic boards. He is a trustee for the College of Southern Maryland,

serves on the Advisory Board of the Robert H. Smith School of Business Center for Financial Policy and is Chairman of

the Board of the Energetics Technology Corporation. Age 62. Director since 1979.

Louis P. Jenkins, Jr.

Chairperson of the Governance

Committee. He is the principal of Jenkins Law Firm, LLC, located in LaPlata,

Maryland.

Before entering private practice, Mr. Jenkins served as an Assistant State’s Attorney in Charles County, Maryland

from 1997 to 1999. In addition to his private practice, Mr. Jenkins serves as Court Auditor for the Circuit Court for

Charles County, Maryland and attorney for the Charles County Board of Elections. Mr. Jenkins currently serves on

the Board of Directors of Civista Medical Center and has served as a board member of several other public service

organizations including the Southern Maryland Chapter of the American Red Cross, Charles County Chamber of

Commerce and the Charles County Bar Association. Age 38. Director since 2000.

Before entering private practice, Mr. Jenkins served as an Assistant State’s Attorney in Charles County, Maryland

from 1997 to 1999. In addition to his private practice, Mr. Jenkins serves as Court Auditor for the Circuit Court for

Charles County, Maryland and attorney for the Charles County Board of Elections. Mr. Jenkins currently serves on

the Board of Directors of Civista Medical Center and has served as a board member of several other public service

organizations including the Southern Maryland Chapter of the American Red Cross, Charles County Chamber of

Commerce and the Charles County Bar Association. Age 38. Director since 2000.

35

Board of Directors

Philip T. Goldstein

Governance Committee member. He has

owned and operated Philip T. Goldstein Real Estate Appraisals, a

full-

service real estate appraisal and consulting firm, located in Prince Frederick, Maryland, since 1975. He currently

serves as a director of: Asbury Communities, Inc., a non-profit continuing care retirement community

headquartered in Gaithersburg, Maryland; Calvert County Nursing Center, Prince Frederick, Maryland; and Calvert

Farmland Trust, Prince Frederick, Maryland. Age 61. Director since 2006.

service real estate appraisal and consulting firm, located in Prince Frederick, Maryland, since 1975. He currently

serves as a director of: Asbury Communities, Inc., a non-profit continuing care retirement community

headquartered in Gaithersburg, Maryland; Calvert County Nursing Center, Prince Frederick, Maryland; and Calvert

Farmland Trust, Prince Frederick, Maryland. Age 61. Director since 2006.

Austin J. Slater, Jr.

Audit Committee member. He

is the President and CEO of the

Southern Maryland Electric Cooperative, which is one

of the ten largest electrical distribution cooperatives in the country. Mr. Slater also serves as Vice Chairman of the

Board of the Maryland Chamber of Commerce and numerous other civic organizations. He also serves on the Board

of Trustees for the College of Southern Maryland. Mr. Slater holds an MBA in Finance from George Washington

University and a BS in Accounting from Shepherd University. Age 56. Director since 2003.

of the ten largest electrical distribution cooperatives in the country. Mr. Slater also serves as Vice Chairman of the

Board of the Maryland Chamber of Commerce and numerous other civic organizations. He also serves on the Board

of Trustees for the College of Southern Maryland. Mr. Slater holds an MBA in Finance from George Washington

University and a BS in Accounting from Shepherd University. Age 56. Director since 2003.

C. Marie Brown

Associated with the Bank for over 35

years and served as its Chief Operating Officer before her retirement in

February 2008. Ms. Brown is an alumna of Charles County Community College with an Associates of Arts degree in

Management Development. She is a supporter of the Handicapped and Retarded Citizens of Charles County, a

member of the Zonta Club of Charles County and serves on various administrative committees of the Hughesville

Baptist Church. Age 67. Director since 1991.

February 2008. Ms. Brown is an alumna of Charles County Community College with an Associates of Arts degree in

Management Development. She is a supporter of the Handicapped and Retarded Citizens of Charles County, a

member of the Zonta Club of Charles County and serves on various administrative committees of the Hughesville

Baptist Church. Age 67. Director since 1991.

James R. Shepherd

Audit Committee member. He is the

Senior Business Development Specialist for the Calvert County Department of

Economic Development. Mr. Shepherd holds an MS degree in Management from the University of Maryland and a BA

from Roanoke College. Mr. Shepherd serves in numerous civic and charitable organizations. Age 65. Director since

2003.

Economic Development. Mr. Shepherd holds an MS degree in Management from the University of Maryland and a BA

from Roanoke College. Mr. Shepherd serves in numerous civic and charitable organizations. Age 65. Director since

2003.

Joseph V. Stone, Jr.

Audit Committee member. He has owned

and operated Joe Stone Insurance Agency, which provides multi-line

insurance services to clients in Maryland and Virginia since 1981. He has served as a director for the Southern

Maryland Electric Cooperative since 1996 and currently serves as Chairman of the Board. He has also served as a

director for ACES Power Marketing since 2006. Age 55. Director since 2006.

insurance services to clients in Maryland and Virginia since 1981. He has served as a director for the Southern

Maryland Electric Cooperative since 1996 and currently serves as Chairman of the Board. He has also served as a

director for ACES Power Marketing since 2006. Age 55. Director since 2006.

36