Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STRATEGIC HOTELS & RESORTS, INC | d8k.htm |

Exhibit 99.1

|

|

STRATEGIC

Hotels & Resorts

NAREIT Presentation June 2010

|

|

Agenda

I. Company Overview

II. Industry Update

III. BEE Growth Profile

IV. Balance Sheet Review

2

|

|

Investment Highlights

• World-class luxury hotels supported by unique real-estate value

• Luxury segment has historically outperformed the overall industry in a recovery

• Industry leading asset management capabilities

• Experienced management team and recently augmented Board

Fairmont Chicago Lobby and ENO Wine Bar

Four Seasons Punta Mita Coral Suite

Hotel del Coronado Beach Village

3

|

|

Strategic Hotels 2.0

• Plan to exit Europe and focus on North American business strategy

• Pursuing balance sheet initiatives in order to improve capital structure and liquidity

• Disciplined approach to capital allocation

• Initiatives to reduce corporate overhead

• Augmented management organization and Board with industry leaders

– Appointed REIT industry veteran Diane Morefield to CFO

– Appointed Raymond “Rip” Gellein, Jr. to Board of Directors. Former President, Global Development Group of Starwood Hotels and Resorts Worldwide, Inc.

– Appointed Eugene Reilly to Board of Directors. Current President of the Americas for AMB Property Corporation

– Appointed Richard Kincaid to Board of Directors. Former President and CEO of Equity Office Properties Trust

4

|

|

World-Class Hotels in High Barrier to Entry Markets

17 hotels and resorts with 8,002 rooms

WESTIN HOTELS & RESORTS St. Francis

THE RITZ-CARLTON®

Half Moon Bay

LOEWS HOTELS

Santa Monica Beach Hotel

THE RITZ-CARLTON®

Laguna Niguel

HYATT REGENCY

La Jolla

HOTEL DEL CORONADO

FOUR SEASONS Hotels and Resorts

Punta Mita Resort

Fairmont HOTELS & RESORTS Chicago

Fairmont HOTELS & RESORTS Scottsdale

Marriott HOTELS • RESORTS • SUITES

Lincolnshire Resort

INTER-CONTINENTAL

HOTELS AND RESORTS

Chicago

FOUR SEASONS Hotels and Resorts Washington, D.C.

Marriott HOTELS • RESORTS • SUITES

Paris, France

INTER-CONTINENTAL

HOTELS AND RESORTS Miami

Marriott HOTELS • RESORTS • SUITES

London, England

Marriott HOTELS • RESORTS • SUITES

Hamburg, Germany

INTER-CONTINENTAL

HOTELS AND RESORTS

Prague, Czech Republic

5

|

|

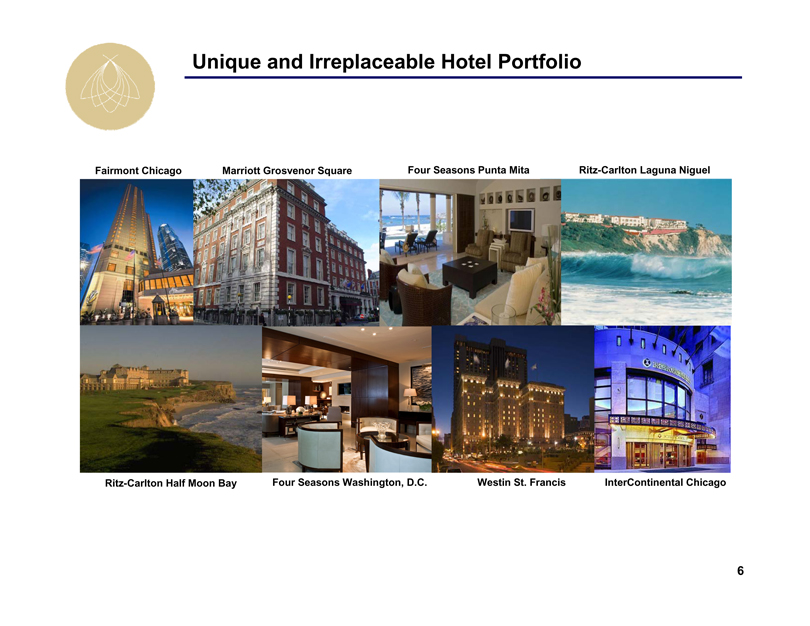

Unique and Irreplaceable Hotel Portfolio

Fairmont Chicago

Marriott Grosvenor Square

Four Seasons Punta

Mita Ritz-Carlton Laguna Niguel

Ritz-Carlton Half Moon Bay

Four Seasons Washington, D.C.

Westin St. Francis

InterContinental Chicago

6

|

|

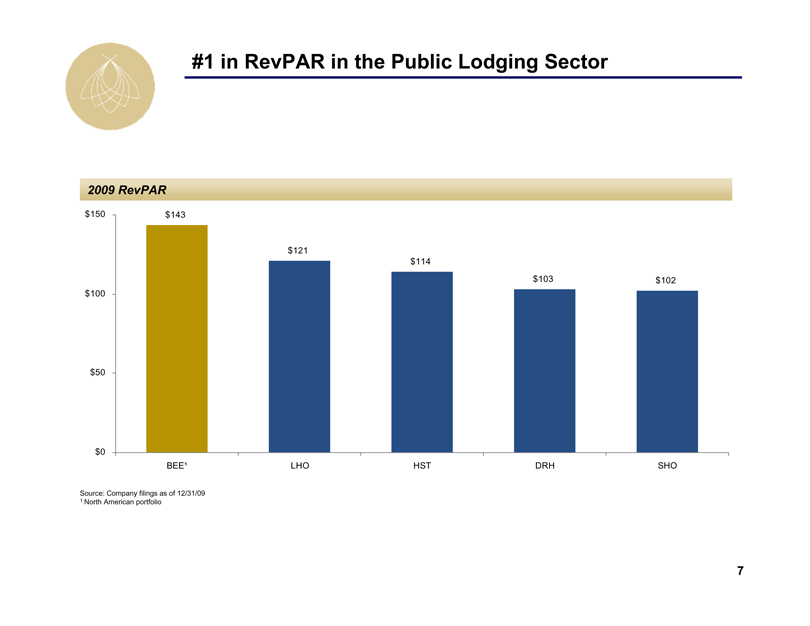

#1 in RevPAR in the Public Lodging Sector

2009 RevPAR

$150 $100 $50 $0

$143 $121 $114 $103 $102

BEE1 LHO HST DRH SHO

Source: Company filings as of 12/31/09

1 North American portfolio

7

|

|

Agenda

I. Company Overview

II. Industry Update

8

|

|

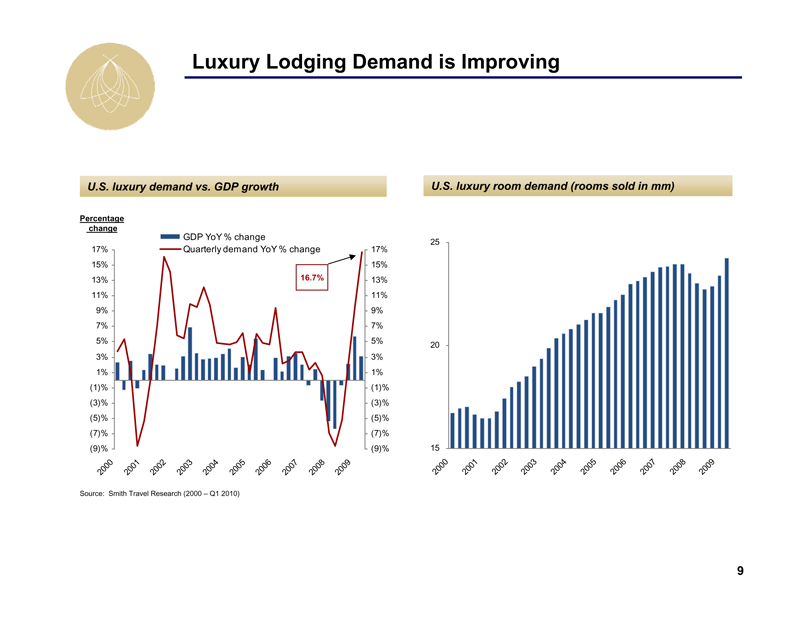

Luxury Lodging Demand is Improving

U.S. luxury demand vs. GDP growth

Percentage change

GDP YoY % change

Quarterly demand YoY % change

16.7%

17% 15% 13% 11% 9% 7% 5% 3% 1% (1)% (3)% (5)% (7)% (9)%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

17% 15% 13% 11% 9% 7% 5% 3% 1% (1)% (3)% (5)% (7)% (9)%

U.S. luxury room demand (rooms sold in mm)

25 20 15

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Source: Smith Travel Research (2000 – Q1 2010)

9

|

|

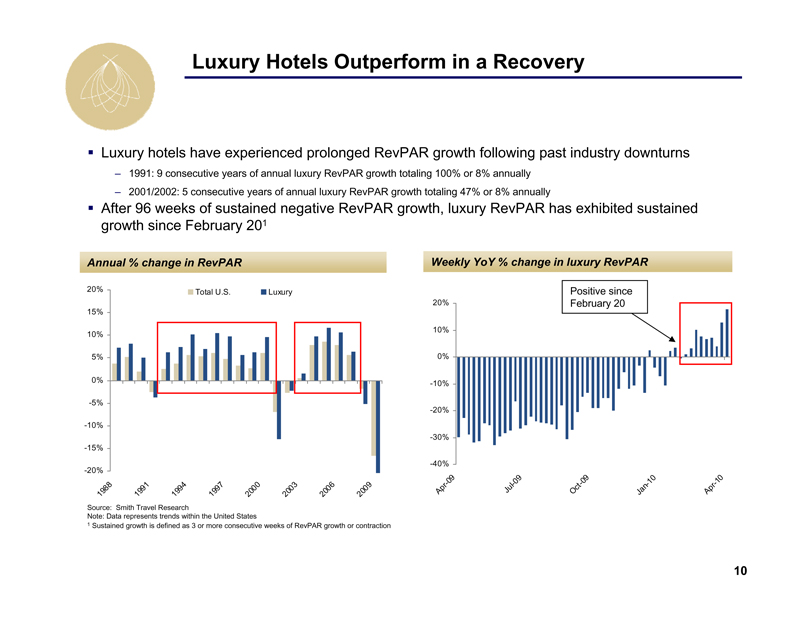

Luxury Hotels Outperform in a Recovery

• Luxury hotels have experienced prolonged RevPAR growth following past industry downturns

– 1991: 9 consecutive years of annual luxury RevPAR growth totaling 100% or 8% annually

– 2001/2002: 5 consecutive years of annual luxury RevPAR growth totaling 47% or 8% annually

• After 96 weeks of sustained negative RevPAR growth, luxury RevPAR has exhibited sustained growth since February 201

Annual % change in RevPAR

Total U.S. Luxury

20% 15% 10% 5% 0% -5% -10% -15% -20%

1988 1991 1994 1997 2000 2003 2006 2009

Weekly YoY % change in luxury RevPAR

Positive since February 20

20% 10% 0% -10% -20% -30% -40%

Apr-09 Jul-09 Oct-09 Jan-10 Apr-10

Source: Smith Travel Research

Note: Data represents trends within the United States

1 Sustained growth is defined as 3 or more consecutive weeks of RevPAR growth or contraction

10

|

|

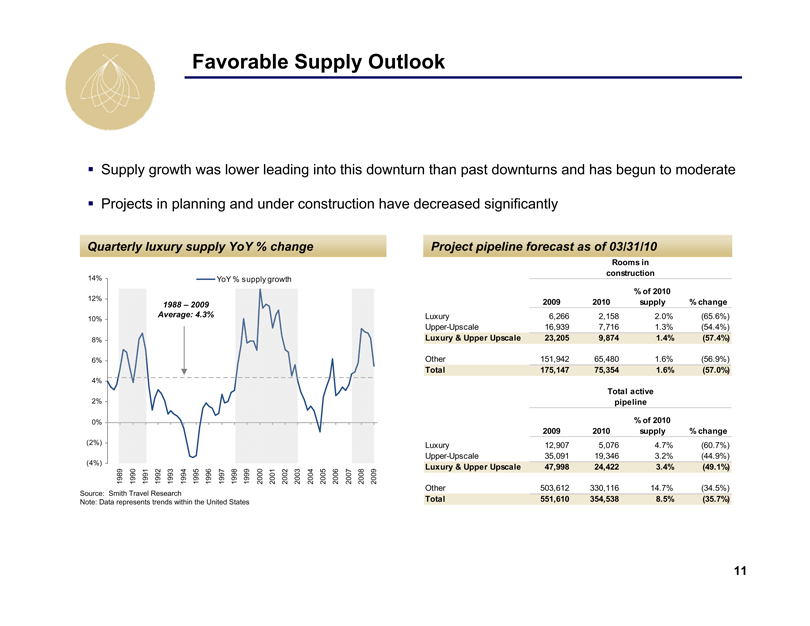

Favorable Supply Outlook

• Supply growth was lower leading into this downturn than past downturns and has begun to moderate

• Projects in planning and under construction have decreased significantly

Quarterly luxury supply YoY % change

YoY % supply growth

1988 – 2009

Average: 4.3%

14% 12% 10% 8% 6% 4% 2% 0% (2%) (4%)

1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Project pipeline forecast as of 03/31/10

Rooms in construction

% of 2010

2009 2010 supply % change

Luxury 6,266 2,158 2.0% (65.6%)

Upper-Upscale 16,939 7,716 1.3% (54.4%)

Luxury & Upper Upscale 23,205 9,874 1.4% (57.4%)

Other 151,942 65,480 1.6% (56.9%)

Total 175,147 75,354 1.6% (57.0%)

Total active pipeline

% of 2010

2009 2010 supply % change

Luxury 12,907 5,076 4.7% (60.7%) Upper-Upscale 35,091 19,346 3.2% (44.9%)

Luxury & Upper Upscale 47,998 24,422 3.4% (49.1%)

Other 503,612 330,116 14.7% (34.5%)

Total 551,610 354,538 8.5% (35.7%)

Source: Smith Travel Research

Note: Data represents trends within the United States

11

|

|

Agenda

I. Company Overview

II. Industry Update

III. BEE Growth Profile

12

|

|

Industry Leading Asset Management Capabilities

• Revenue enhancement through market research based programs

• Exceptional asset management supported by internally developed operating systems

• Aggressive and early cost cutting initiatives implemented in advance of the downturn

• Rigorous oversight of brand managers to ensure alignment of interests

• Evaluation and implementation of value add ROI projects

13

|

|

Portfolio Well-Positioned To Enhance Cash Flow Growth

Notable 2009 capital projects • Four Seasons Washington, D.C. – Lobby renovation, 11-room expansion, new restaurant, 63-room and suite renovation • Westin St. Francis – Clock Bar

Notable 2008 capital projects • Fairmont Chicago – ENO wine tasting room, lobby renovation, guestroom renovation, new spa and fitness center • Four Seasons Punta Mita – New lobby bar • Ritz-Carlton Half Moon Bay – ENO wine tasting room, restaurant and lounge renovation, suite renovation

Notable 2007 capital projects • Four Seasons Punta Mita – 28-room expansion • Ritz-Carlton Laguna Niguel – ENO wine tasting room, 3-room expansion, meeting space renovation

14

|

|

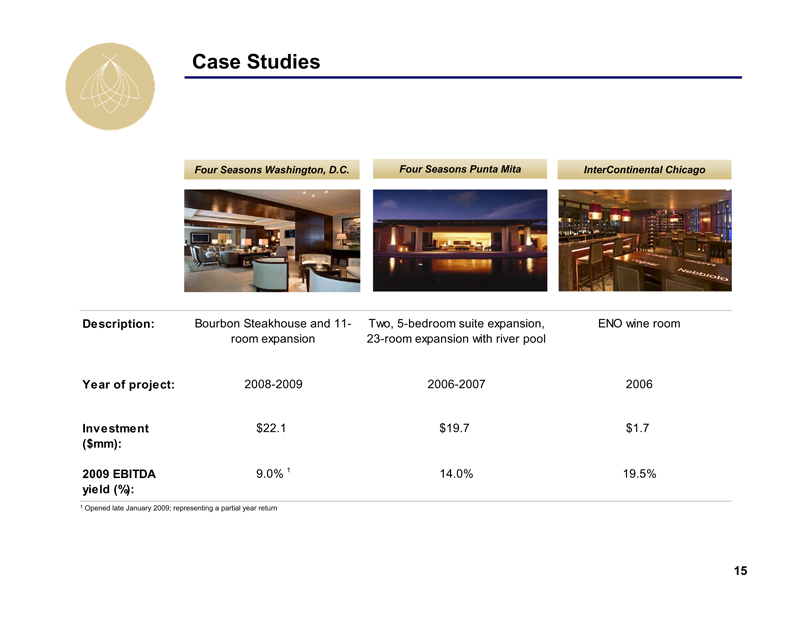

Case Studies

Four Seasons Washington, D.C.

Four Seasons Punta Mita

InterContinental Chicago

Description: Bourbon Steakhouse and 11-room expansion

Two, 5-bedroom suite expansion, 23-room expansion with river pool

ENO wine room

Year of project: 2008-2009 2006-2007 2006

Investment $22.1 $19.7 $1.7

($mm):

2009 EBITDA 9.0% 1 14.0% 19.5%

yield (%):

1 Opened late January 2009; representing a partial year return

15

|

|

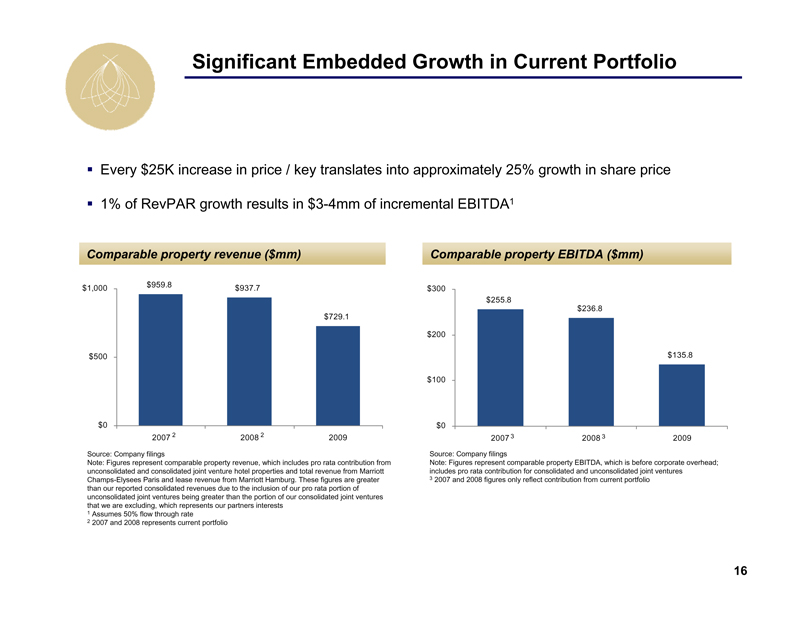

Significant Embedded Growth in Current Portfolio

• Every $25K increase in price / key translates into approximately 25% growth in share price

• 1% of RevPAR growth results in $3-4mm of incremental EBITDA1

Comparable property revenue ($mm)

$1,000 $959.8 $937.7 $729.1

$500

$0

2007 2 2008 2 2009

Source: Company filings

Note: Figures represent comparable property revenue, which includes pro rata contribution from unconsolidated and consolidated joint venture hotel properties and total revenue from Marriott Champs-Elysees Paris and lease revenue from Marriott Hamburg. These figures are greater than our reported consolidated revenues due to the inclusion of our pro rata portion of unconsolidated joint ventures being greater than the portion of our consolidated joint ventures that we are excluding, which represents our partners interests

1 Assumes 50% flow through rate

2 2007 and 2008 represents current portfolio

Comparable property EBITDA ($mm)

$300 $255.8 $236.8 $135.8

$200

$100

$0

2007 3 2008 3 2009

Source: Company filings

Note: Figures represent comparable property EBITDA, which is before corporate overhead; includes pro rata contribution for consolidated and unconsolidated joint ventures

3 2007 and 2008 figures only reflect contribution from current portfolio

16

|

|

Agenda

I. Company Overview

II. Industry Update

III. BEE Growth Profile

IV. Balance Sheet Review

17

|

|

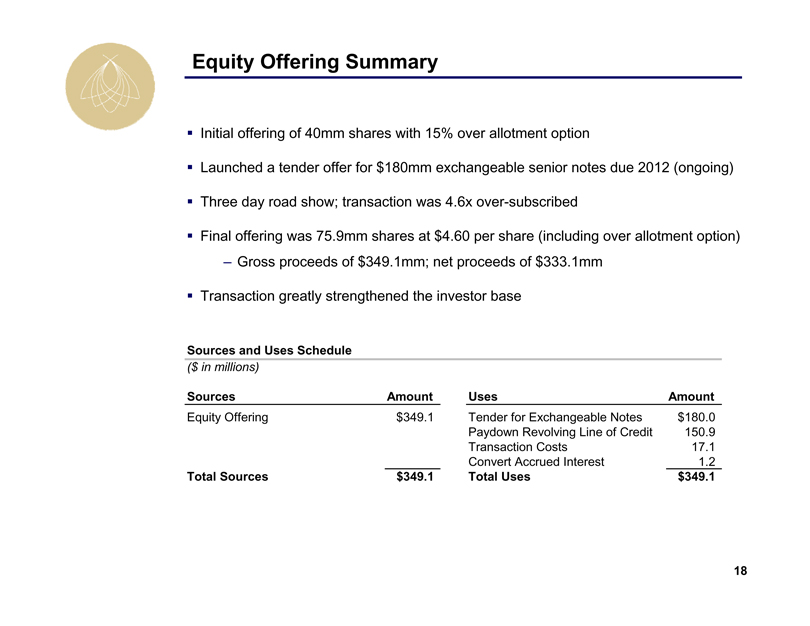

Equity Offering Summary

• Initial offering of 40mm shares with 15% over allotment option

• Launched a tender offer for $180mm exchangeable senior notes due 2012 (ongoing)

• Three day road show; transaction was 4.6x over-subscribed

• Final offering was 75.9mm shares at $4.60 per share (including over allotment option)

– Gross proceeds of $349.1mm; net proceeds of $333.1mm

• Transaction greatly strengthened the investor base

Sources and Uses Schedule

($ in millions)

Sources Amount

Equity Offering $349.1

Total Sources $349.1

Uses Amount

Tender for Exchangeable Notes $180.0

Paydown Revolving Line of Credit 150.9

Transaction Costs 17.1

Convert Accrued Interest 1.2

Total Uses $349.1

18

|

|

Recent Balance Sheet Strengthening Initiatives

• $349mm equity offering and exchangeable note tender offer

• Sold three hotels generating $202mm in gross proceeds

– 12/09: Renaissance Paris Hotel Le Parc Trocodero ($52mm)

– 10/09: Four Seasons Mexico City ($54mm)

– 07/08: Hyatt Regency Phoenix ($96mm)

• Extended certain property level debt

– 01/10: InterContinental Prague – $148mm: Extension until 2015

– 05/10: Westin St. Francis & Fairmont Chicago – $318mm: Extension until 2017

• Credit facility provides access to liquidity through 2012

19

|

|

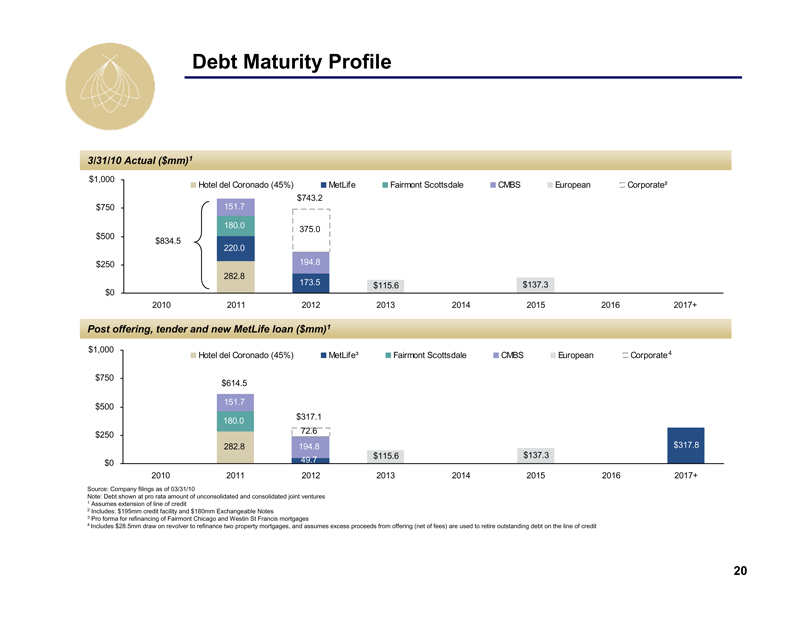

Debt Maturity Profile

3/31/10 Actual ($mm)1

$1,000 $750 $500 $250 $0

Hotel del Coronado (45%) MetLife Fairmont Scottsdale CMBS European Corporate2

$834.5 { 151.7 180.0 220.0 282.8

$743.2 375.0 194.8 173.5

$115.6 $137.3

2010 2011 2012 2013 2014 2015 2016 2017+

Post offering, tender and new MetLife loan ($mm)1

Hotel del Coronado (45%) MetLife3 Fairmont Scottsdale CMBS European Corporate4

$1,000 $750 $500 $250 $0

$614.5 151.7 180.0 282.8

$317.1 72.6 194.8 49.7

$115.6 $137.3 $317.8

2010 2011 2012 2013 2014 2015 2016 2017+

Source: Company filings as of 03/31/10

Note: Debt shown at pro rata amount of unconsolidated and consolidated joint ventures

1 Assumes extension of line of credit

2 Includes: $195mm credit facility and $180mm Exchangeable Notes

3 Pro forma for refinancing of Fairmont Chicago and Westin St Francis mortgages

4 Includes $28.5mm draw on revolver to refinance two property mortgages, and assumes excess proceeds from offering (net of fees) are used to retire outstanding debt on the line of credit

20

|

|

Key Objectives

ü Issue equity

ü Retire the exchangeable notes

• Maximize earnings through organic revenue growth and cost containment

• Exit Europe

• Address debt maturities

• Evaluate ROI capital projects within existing portfolio

21

|

|

STRATEGIC

Hotels & Resorts