Attached files

| file | filename |

|---|---|

| 8-K - ALLIANCEBERNSTEIN L.P. 8-K 6-3-2010 - ALLIANCEBERNSTEIN L.P. | form8k.htm |

| EX-99.02 - EXHIBIT 99.02 - ALLIANCEBERNSTEIN L.P. | ex99_02.htm |

Exhibit 99.01

June 3, 2010

David A. Steyn

Chief Operating Officer

AllianceBernstein L.P.

2010 KBW Diversified Financial Services Conference

2010 KBW Diversified Financial Services Conference

1

AllianceBernstein.com

Certain statements provided by management in this presentation are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to

risks, uncertainties, and other factors that could cause actual results to differ materially from future results

expressed or implied by such forward-looking statements. The most significant of these factors include, but are not

limited to, the following: the performance of financial markets, the investment performance of sponsored investment

products and separately-managed accounts, general economic conditions, industry trends, future acquisitions,

competitive conditions, and current and proposed government regulations, including changes in tax regulations and

rates and the manner in which the earnings of publicly-traded partnerships are taxed. AllianceBernstein cautions

readers to carefully consider such factors. Further, such forward-looking statements speak only as of the date on

which such statements are made; AllianceBernstein undertakes no obligation to update any forward-looking

statements to reflect events or circumstances after the date of such statements. For further information regarding

these forward-looking statements and the factors that could cause actual results to differ, see “Risk Factors” and

“Cautions Regarding Forward-Looking Statements” in AllianceBernstein’s Form 10-K for the year ended December

31, 2009 and Form 10-Q for the quarter ended March 31, 2010. Any or all of the forward-looking statements made

in this presentation, Form 10-K, Form 10-Q, other documents AllianceBernstein files with or furnishes to the SEC,

and any other public statements issued by AllianceBernstein, may turn out to be wrong. It is important to remember

that other factors besides those listed in “Risk Factors” and “Cautions Regarding Forward-Looking Statements”, and

those listed above, could also adversely affect AllianceBernstein’s financial condition, results of operations and

business prospects.

meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to

risks, uncertainties, and other factors that could cause actual results to differ materially from future results

expressed or implied by such forward-looking statements. The most significant of these factors include, but are not

limited to, the following: the performance of financial markets, the investment performance of sponsored investment

products and separately-managed accounts, general economic conditions, industry trends, future acquisitions,

competitive conditions, and current and proposed government regulations, including changes in tax regulations and

rates and the manner in which the earnings of publicly-traded partnerships are taxed. AllianceBernstein cautions

readers to carefully consider such factors. Further, such forward-looking statements speak only as of the date on

which such statements are made; AllianceBernstein undertakes no obligation to update any forward-looking

statements to reflect events or circumstances after the date of such statements. For further information regarding

these forward-looking statements and the factors that could cause actual results to differ, see “Risk Factors” and

“Cautions Regarding Forward-Looking Statements” in AllianceBernstein’s Form 10-K for the year ended December

31, 2009 and Form 10-Q for the quarter ended March 31, 2010. Any or all of the forward-looking statements made

in this presentation, Form 10-K, Form 10-Q, other documents AllianceBernstein files with or furnishes to the SEC,

and any other public statements issued by AllianceBernstein, may turn out to be wrong. It is important to remember

that other factors besides those listed in “Risk Factors” and “Cautions Regarding Forward-Looking Statements”, and

those listed above, could also adversely affect AllianceBernstein’s financial condition, results of operations and

business prospects.

Cautions Regarding Forward-Looking Statements

2010 KBW Diversified Financial Services Conference

2

AllianceBernstein.com

Investment Performance

ü

Operating Leverage

ü

Sellside Research Leadership

ü

Asset Flow Trends

ü

Agenda

2010 KBW Diversified Financial Services Conference

3

AllianceBernstein.com

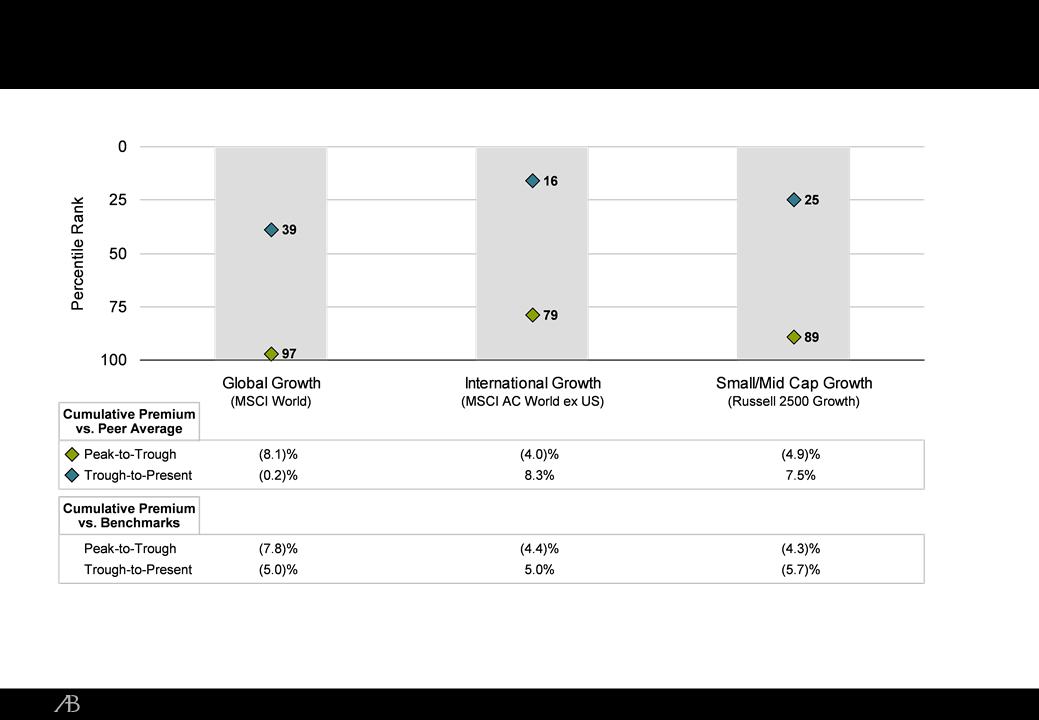

As of March 31, 2010

Past Performance is no guarantee of future results. The returns and rankings presented are net of mutual fund A-share expense ratios. Peak-to-Trough time period is defined as October 9, 2007

through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. The Value Fund is part of the Bernstein Diversified Value (Russell 1000 Value). Global Value Fund

is in the Lipper Global Large-Cap Value Universe; International Value Fund is in the International Large Cap Value Funds Universe; Value Fund is in the Lipper Large Cap Value Funds Universe

through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. The Value Fund is part of the Bernstein Diversified Value (Russell 1000 Value). Global Value Fund

is in the Lipper Global Large-Cap Value Universe; International Value Fund is in the International Large Cap Value Funds Universe; Value Fund is in the Lipper Large Cap Value Funds Universe

Composite. Source: Lipper and AllianceBernstein

Lipper Percentile Ranks

Improved Competitive Performance: Value Equities

2010 KBW Diversified Financial Services Conference

4

AllianceBernstein.com

As of March 31, 2010

Past Performance is no guarantee of future results. The returns and rankings presented are net of mutual fund A-share total expense ratios. Peak-to-Trough time period is defined as October 9,

2007 through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. Global Growth Fund is part of the Alliance Global Research Growth composite and is

measured against the Lipper Global Large Cap Growth Category; International Growth Fund is part of the Alliance International Research Growth All Country composite and is part of the Lipper

International Large Cap Growth Category. Small/Mid Cap Growth Fund is part of the Mid Cap Growth Category. Source: Lipper and AllianceBernstein

2007 through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. Global Growth Fund is part of the Alliance Global Research Growth composite and is

measured against the Lipper Global Large Cap Growth Category; International Growth Fund is part of the Alliance International Research Growth All Country composite and is part of the Lipper

International Large Cap Growth Category. Small/Mid Cap Growth Fund is part of the Mid Cap Growth Category. Source: Lipper and AllianceBernstein

Lipper Percentile Ranks

Improved Competitive Performance: Growth Equities

2010 KBW Diversified Financial Services Conference

5

AllianceBernstein.com

As of March 31, 2010

*33% Barclays Capital US High Yield 2% Constrained Index, 33% JPMorgan EMBI Global, 33% JPMorgan GBI-EM

Past Performance is no guarantee of future results. The returns and rankings presented are net of mutual fund A-share total expense ratios. Peak-to-Trough time period is defined as October 9,

2007 through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. Global Bond Fund is part of Lipper Global Income Funds Category; High Income Fund is part

of Lipper High-Current Yield Funds Category; Intermediate Diversified Municipal Bond Fund is part of Lipper Intermediate Municipal Debt Funds Category. Source: Lipper and AllianceBernstein

2007 through March 9, 2009. Trough-to-Present is defined as March 9, 2009 through March 31, 2010. Global Bond Fund is part of Lipper Global Income Funds Category; High Income Fund is part

of Lipper High-Current Yield Funds Category; Intermediate Diversified Municipal Bond Fund is part of Lipper Intermediate Municipal Debt Funds Category. Source: Lipper and AllianceBernstein

Lipper Percentile Ranks

Improved Competitive Performance: Fixed Income

2010 KBW Diversified Financial Services Conference

6

AllianceBernstein.com

Percentages are calculated using AUM rounded to the nearest million. 2009 average is based on an average of the four quarterly figures.

Asset Flow Trends have Improved: Private Client

2010 KBW Diversified Financial Services Conference

7

AllianceBernstein.com

Asset Flow Trends have Improved: Retail

2010 KBW Diversified Financial Services Conference

8

AllianceBernstein.com

Percentages are calculated using AUM rounded to the nearest mill

ion. 2009 average is based on an average of the four quarterly figures

Asset Flows

($19)

($17)

($15)

($13)

($11)

($9)

($7)

($5)

($3)

($1)

$1

$3

$5

2009 Avg

1Q10

Gross Sales

Gross Outflows

Net Flows

Asset Flows

($19)

($17)

($15)

($13)

($11)

($9)

($7)

($5)

($3)

($1)

$1

$3

$5

2009 Avg

1Q10

Gross Sales

Gross Outflows

Net Flows

Billions

<

Net outflows have improved due primarily to

decreased terminations

<

Pipeline of awarded but unfunded mandates

increased 86% to $5.2 billion from 2009 trough;

continued growth 2Q10 QTD

<

Consultant relations have improved as

consultants regain comfort with AB stability

<

Sales activity:

=

Solid sales of Global Fixed Income to global

clients due to strong performance

=

Strong performance has lead to sales in

emerging markets and regional value equities

services

=

Defined Contribution heating up

-

recent

increase in Target Date RFP activity

Asset Flows

($19)

($17)

($15)

($13)

($11)

($9)

($7)

($5)

($3)

($1)

$1

$3

$5

2009 Avg

1Q10

Gross Sales

Gross Outflows

Net Flows

Asset Flows

4.1

3.5

(18.5)

(12.1)

(14.4)

(8.6)

($19)

($17)

($15)

($13)

($11)

($9)

($7)

($5)

($3)

($1)

$1

$3

$5

2009 Avg

1Q10

Gross Sales

Gross Outflows

Net Flows

<

Net outflows have improved due primarily to

decreased terminations

<

Pipeline of awarded but unfunded mandates

increased 86% to $5.2 billion from 2009 trough;

continued growth 2Q10 QTD

<

Consultant relations have improved as

consultants regain comfort with AB stability

<

Sales activity:

=

Solid sales of Global Fixed Income to global

clients due to strong performance

=

Strong performance has lead to sales in

emerging markets and regional value equities

services

=

Defined Contribution heating up

-

recent

increase in Target Date RFP activity

Asset Flow Trends have Improved: Institutions

2010 KBW Diversified Financial Services Conference

9

AllianceBernstein.com

Engaging to Become a Trusted Partner

2010 KBW Diversified Financial Services Conference

10

AllianceBernstein.com

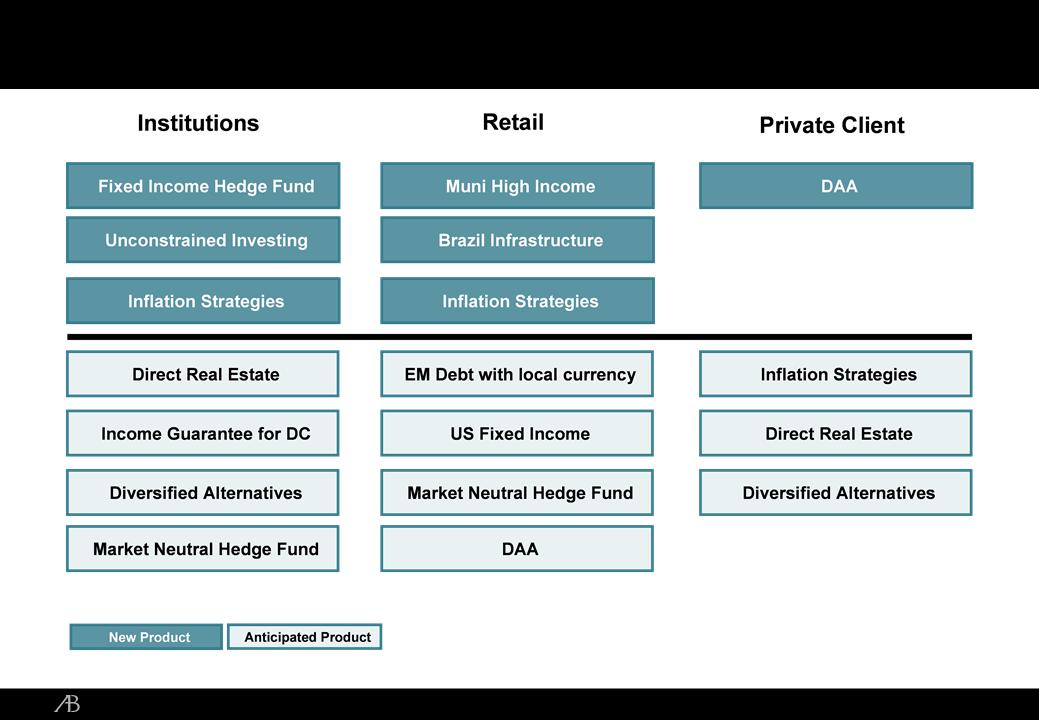

New Product Initiatives Add Flexibility

2010 KBW Diversified Financial Services Conference

11

AllianceBernstein.com

Dynamic Asset Allocation Is Responsive to Client Needs

2010 KBW Diversified Financial Services Conference

12

AllianceBernstein.com

Sellside Research Leadership being Leveraged

2010 KBW Diversified Financial Services Conference

13

AllianceBernstein.com

Sellside Research Leadership being Leveraged

2010 KBW Diversified Financial Services Conference

14

AllianceBernstein.com

Operating Leverage has Increased

2010 KBW Diversified Financial Services Conference

15

AllianceBernstein.com

Global Research and Distribution Platform