Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ALLIANCEBERNSTEIN L.P. | Financial_Report.xls |

| EX-32.01 - EXHIBIT 32.01 - ALLIANCEBERNSTEIN L.P. | ex32_01.htm |

| EX-10.03 - EXHIBIT 10.03 - ALLIANCEBERNSTEIN L.P. | ex10_03.htm |

| EX-23.01 - EXHIBIT 23.01 - ALLIANCEBERNSTEIN L.P. | ex23_01.htm |

| EX-10.02 - EXHIBIT 10.02 - ALLIANCEBERNSTEIN L.P. | ex10_02.htm |

| EX-31.02 - EXHIBIT 31.02 - ALLIANCEBERNSTEIN L.P. | ex31_02.htm |

| EX-10.04 - EXHIBIT 10.04 - ALLIANCEBERNSTEIN L.P. | ex10_04.htm |

| EX-12.01 - EXHIBIT 12.01 - ALLIANCEBERNSTEIN L.P. | ex12_01.htm |

| EX-10.01 - EXHIBIT 10.01 - ALLIANCEBERNSTEIN L.P. | ex10_01.htm |

| EX-21.01 - EXHIBIT 21.01 - ALLIANCEBERNSTEIN L.P. | ex21_01.htm |

| EX-31.01 - EXHIBIT 31.01 - ALLIANCEBERNSTEIN L.P. | ex31_01.htm |

| EX-10.05 - EXHIBIT 10.05 - ALLIANCEBERNSTEIN L.P. | ex10_05.htm |

| EX-10.06 - EXHIBIT 10.06 - ALLIANCEBERNSTEIN L.P. | ex10_06.htm |

| EX-32.02 - EXHIBIT 32.02 - ALLIANCEBERNSTEIN L.P. | ex32_02.htm |

| EX-10.07 - EXHIBIT 10.07 - ALLIANCEBERNSTEIN L.P. | ex10_07.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2014

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-29961

ALLIANCEBERNSTEIN L.P.

ALLIANCEBERNSTEIN L.P.

(Exact name of registrant as specified in its charter)

|

Delaware

|

13-4064930

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

1345 Avenue of the Americas, New York, N.Y.

|

10105

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 969-1000

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

|

Title of Class

|

Name of each exchange on which registered

|

|

|

units of limited partnership interest

|

None

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

Non-accelerated filer ☒

|

Smaller reporting company ☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The number of units of limited partnership interest outstanding as of December 31, 2014 was 273,040,452.

DOCUMENTS INCORPORATED BY REFERENCE

This Form 10-K does not incorporate any document by reference.

|

ii

|

||

|

Part I

|

||

|

Item 1.

|

1

|

|

|

Item 1A.

|

15

|

|

|

Item 1B.

|

22

|

|

|

Item 2.

|

22

|

|

|

Item 3.

|

22

|

|

|

Item 4.

|

23

|

|

|

Part II

|

||

|

Item 5.

|

24

|

|

|

Item 6.

|

26

|

|

|

Item 7.

|

27

|

|

|

Item 7A.

|

47

|

|

|

Item 8.

|

49

|

|

|

Item 9.

|

89

|

|

|

Item 9A.

|

89

|

|

|

Item 9B.

|

90

|

|

|

Part III

|

||

|

Item 10.

|

91

|

|

|

Item 11.

|

100

|

|

|

Item 12.

|

116

|

|

|

Item 13.

|

121

|

|

|

Item 14.

|

123

|

|

|

Part IV

|

||

|

Item 15.

|

124

|

|

|

126

|

||

“AB” – AllianceBernstein L.P. (Delaware limited partnership formerly known as Alliance Capital Management L.P., “Alliance Capital”), the operating partnership, and its subsidiaries and, where appropriate, its predecessors, AB Holding and ACMC, Inc. and their respective subsidiaries.

“AB Holding” – AllianceBernstein Holding L.P. (Delaware limited partnership).

“AB Holding Partnership Agreement” – the Amended and Restated Agreement of Limited Partnership of AB Holding, dated as of October 29, 1999 and as amended February 24, 2006.

“AB Holding Units” – units representing assignments of beneficial ownership of limited partnership interests in AB Holding.

“AB Partnership Agreement” – the Amended and Restated Agreement of Limited Partnership of AB, dated as of October 29, 1999 and as amended February 24, 2006.

“AB Units” – units of limited partnership interest in AB.

“AXA” – AXA (société anonyme organized under the laws of France), the holding company for an international group of insurance and related financial services companies engaged in the financial protection and wealth management businesses. AXA’s operations are diverse geographically, with major operations in Europe, North America and the Asia/Pacific regions and, to a lesser extent, in other regions including the Middle East, Africa and Latin America. AXA has five operating business segments: life and savings, property and casualty, international insurance, asset management and banking.

“AXA Equitable” – AXA Equitable Life Insurance Company (New York stock life insurance company), a subsidiary of AXA Financial, and its subsidiaries other than AB and its subsidiaries.

“AXA Financial” – AXA Financial, Inc. (Delaware corporation), a subsidiary of AXA.

“Bernstein Transaction” – on October 2, 2000, AB’s acquisition of the business and assets of SCB Inc., formerly known as Sanford C. Bernstein Inc., and assumption of the liabilities of that business.

“Exchange Act” – the Securities Exchange Act of 1934, as amended.

“ERISA” – the Employee Retirement Income Security Act of 1974, as amended.

“General Partner” – AllianceBernstein Corporation (Delaware corporation), the general partner of AB and AB Holding and a subsidiary of AXA Equitable, and, where appropriate, ACMC, LLC, its predecessor.

“Investment Advisers Act” – the Investment Advisers Act of 1940, as amended.

“Investment Company Act” – the Investment Company Act of 1940, as amended.

“NYSE” – the New York Stock Exchange, Inc.

“Partnerships” – AB and AB Holding together.

“SEC” – the United States Securities and Exchange Commission.

“Securities Act” – the Securities Act of 1933, as amended.

“WPS Acquisition” – on December 12, 2013, AB acquired W.P. Stewart & Co., Ltd. (“WPS”), a concentrated growth equity investment manager.

PART I

The words “we” and “our” in this Form 10-K refer collectively to AB and its subsidiaries, or to its officers and employees. Similarly, the words “company” and “firm” refer to AB.

We use “global” in this Form 10-K to refer to all nations, including the United States; we use “international” or “non-U.S.” to refer to nations other than the United States.

We use “emerging markets” in this Form 10-K to refer to countries included in the Morgan Stanley Capital International (“MSCI”) emerging markets index, which are, as of December 31, 2014, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Malaysia, Mexico, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Taiwan, Thailand and Turkey.

Clients

We provide research, diversified investment management and related services globally to a broad range of clients through three buy-side distribution channels, Institutions, Retail and Private Wealth Management, and our sell-side business, Bernstein Research Services. See “Distribution Channels” in this Item 1 for additional information.

As of December 31, 2014, 2013 and 2012, our client assets under management (“AUM”) were $474 billion, $450 billion and $430 billion, respectively, and our net revenues for the years ended December 31, 2014, 2013 and 2012 were $3.0 billion, $2.9 billion and $2.7 billion, respectively. AXA, our parent company, and its subsidiaries, whose AUM consist primarily of fixed income investments, together constitute our largest client. Our affiliates represented approximately 23%, 23% and 25% of our AUM as of December 31, 2014, 2013 and 2012, respectively, and we earned approximately 5%, 5% and 4% of our net revenues from services we provided to our affiliates in 2014, 2013 and 2012, respectively. See “Distribution Channels” below and “Assets Under Management” and “Net Revenues” in Item 7 for additional information regarding our AUM and net revenues.

Generally, we are compensated for our investment services on the basis of investment advisory and services fees calculated as a percentage of AUM. For additional information about our investment advisory and services fees, including performance-based fees, see “Risk Factors” in Item 1A and “Net Revenues – Investment Advisory and Services Fees” in Item 7.

Research

Our high-quality, in-depth research is the foundation of our business. We believe that our global team of research professionals, whose disciplines include economic, fundamental equity, fixed income and quantitative research, gives us a competitive advantage in achieving investment success for our clients. We also have experts focused on multi-asset strategies, wealth management and alternative investments.

Investment Services

Our broad range of investment services includes:

| Ÿ | Actively managed equity strategies with global and regional portfolios across capitalization ranges and investment strategies, including value, growth and core equities; |

| Ÿ | Actively managed traditional and unconstrained fixed income strategies, including taxable and tax-exempt strategies; |

| Ÿ | Passive management, including index and enhanced index strategies; |

| Ÿ | Alternative investments, including hedge funds, fund of funds and private equity (e.g., direct real estate investing); and |

| Ÿ | Multi-asset services and solutions, including dynamic asset allocation, customized target-date funds and target-risk funds. |

Our services span various investment disciplines, including market capitalization (e.g., large-, mid- and small-cap equities), term (e.g., long-, intermediate- and short-duration debt securities), and geographic location (e.g., U.S., international, global, emerging markets, regional and local), in major markets around the world.

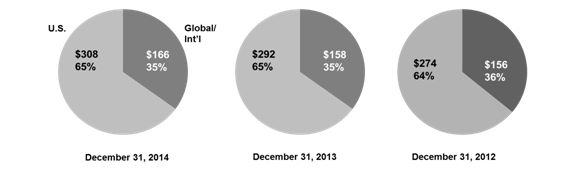

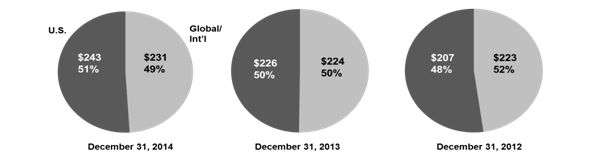

Our AUM by client domicile and investment service as of December 31, 2014, 2013 and 2012 were as follows:

By Client Domicile ($ in billions):

By Investment Service ($ in billions):

Distribution Channels

Institutions

To these clients, which include private and public pension plans, foundations and endowments, insurance companies, central banks and governments worldwide, and various of our affiliates, we offer separately-managed accounts, sub-advisory relationships, structured products, collective investment trusts, mutual funds, hedge funds and other investment vehicles (“Institutional Services”).

We manage the assets of our institutional clients pursuant to written investment management agreements or other arrangements, which generally are terminable at any time or upon relatively short notice by either party. In general, our written investment management agreements may not be assigned without client consent. For information about our institutional investment advisory and services fees, including performance-based fees, see “Risk Factors” in Item 1A and “Net Revenues – Investment Advisory and Services Fees” in Item 7.

AXA and its subsidiaries together constitute our largest institutional client. Their AUM accounted for approximately 32%, 31% and 35% of our institutional AUM as of December 31, 2014, 2013 and 2012, respectively, and approximately 22%, 22% and 17% of our institutional revenues for 2014, 2013 and 2012, respectively. No single institutional client other than AXA and its subsidiaries accounted for more than approximately 1% of our net revenues for the year ended December 31, 2014.

As of December 31, 2014, 2013 and 2012, Institutional Services represented approximately 50%, 50% and 51%, respectively, of our AUM, and the fees we earned from providing these services represented approximately 14%, 15% and 18% of our net revenues for 2014, 2013 and 2012, respectively. Our AUM and revenues are as follows:

Institutional Services Assets Under Management

(by Investment Service)

|

December 31,

|

% Change

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2014-13

|

2013-12

|

||||||||||||||||

|

(in millions)

|

||||||||||||||||||||

|

Equity Actively Managed:

|

||||||||||||||||||||

|

U.S.

|

$

|

9,631

|

$

|

8,438

|

$

|

5,748

|

14.1

|

%

|

46.8

|

%

|

||||||||||

|

Global & Non-US

|

19,522

|

21,100

|

25,797

|

(7.5

|

)

|

(18.2

|

)

|

|||||||||||||

|

Total

|

29,153

|

29,538

|

31,545

|

(1.3

|

)

|

(6.4

|

)

|

|||||||||||||

|

Equity Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

16,196

|

14,111

|

11,494

|

14.8

|

22.8

|

|||||||||||||||

|

Global & Non-US

|

5,818

|

6,555

|

6,131

|

(11.2

|

)

|

6.9

|

||||||||||||||

|

Total

|

22,014

|

20,666

|

17,625

|

6.5

|

17.3

|

|||||||||||||||

|

Total Equity

|

51,167

|

50,204

|

49,170

|

1.9

|

2.1

|

|||||||||||||||

|

Fixed Income Taxable:

|

||||||||||||||||||||

|

U.S.

|

84,079

|

81,823

|

90,727

|

2.8

|

(9.8

|

)

|

||||||||||||||

|

Global & Non-US

|

64,086

|

58,647

|

53,841

|

9.3

|

8.9

|

|||||||||||||||

|

Total

|

148,165

|

140,470

|

144,568

|

5.5

|

(2.8

|

)

|

||||||||||||||

|

Fixed Income Tax-Exempt:

|

||||||||||||||||||||

|

U.S.

|

1,796

|

1,611

|

1,385

|

11.5

|

16.3

|

|||||||||||||||

|

Global & Non-US

|

—

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Total

|

1,796

|

1,611

|

1,385

|

11.5

|

16.3

|

|||||||||||||||

|

Fixed Income Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

67

|

63

|

62

|

6.3

|

1.6

|

|||||||||||||||

|

Global & Non-US

|

185

|

194

|

334

|

(4.6

|

)

|

(41.9

|

)

|

|||||||||||||

|

Total

|

252

|

257

|

396

|

(1.9

|

)

|

(35.1

|

)

|

|||||||||||||

|

Total Fixed Income

|

150,213

|

142,338

|

146,349

|

5.5

|

(2.7

|

)

|

||||||||||||||

|

Other(2):

|

||||||||||||||||||||

|

U.S.

|

2,268

|

1,211

|

471

|

87.3

|

157.1

|

|||||||||||||||

|

Global & Non-US

|

33,393

|

32,237

|

23,829

|

3.6

|

35.3

|

|||||||||||||||

|

Total

|

35,661

|

33,448

|

24,300

|

6.6

|

37.6

|

|||||||||||||||

|

Total:

|

||||||||||||||||||||

|

U.S.

|

114,037

|

107,257

|

109,887

|

6.3

|

(2.4

|

)

|

||||||||||||||

|

Global & Non-US

|

123,004

|

118,733

|

109,932

|

3.6

|

8.0

|

|||||||||||||||

|

Total

|

$

|

237,041

|

$

|

225,990

|

$

|

219,819

|

4.9

|

2.8

|

||||||||||||

|

Affiliated

|

$

|

75,241

|

$

|

69,619

|

$

|

77,569

|

8.1

|

(10.2

|

)

|

|||||||||||

|

Non-affiliated

|

161,800

|

156,371

|

142,250

|

3.5

|

9.9

|

|||||||||||||||

|

Total

|

$

|

237,041

|

$

|

225,990

|

$

|

219,819

|

4.9

|

2.8

|

||||||||||||

| (1) | Includes index and enhanced index services. |

| (2) | Includes multi-asset solutions and services and certain alternative investments. |

Revenues from Institutional Services

(by Investment Service)

|

Years Ended December 31,

|

% Change

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2014-13

|

2013-12

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Equity Actively Managed:

|

||||||||||||||||||||

|

U.S.

|

$

|

54,176

|

$

|

48,328

|

$

|

43,400

|

12.1

|

%

|

11.4

|

%

|

||||||||||

|

Global & Non-US

|

88,777

|

98,552

|

143,108

|

(9.9

|

)

|

(31.1

|

)

|

|||||||||||||

|

Total

|

142,953

|

146,880

|

186,508

|

(2.7

|

)

|

(21.2

|

)

|

|||||||||||||

|

Equity Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

2,841

|

2,720

|

2,334

|

4.4

|

16.5

|

|||||||||||||||

|

Global & Non-US

|

4,333

|

5,359

|

5,533

|

(19.1

|

)

|

(3.1

|

)

|

|||||||||||||

|

Total

|

7,174

|

8,079

|

7,867

|

(11.2

|

)

|

2.7

|

||||||||||||||

|

Total Equity

|

150,127

|

154,959

|

194,375

|

(3.1

|

)

|

(20.3

|

)

|

|||||||||||||

|

Fixed Income Taxable:

|

||||||||||||||||||||

|

U.S.

|

92,250

|

96,125

|

94,679

|

(4.0

|

)

|

1.5

|

||||||||||||||

|

Global & Non-US

|

125,596

|

117,041

|

104,803

|

7.3

|

11.7

|

|||||||||||||||

|

Total

|

217,846

|

213,166

|

199,482

|

2.2

|

6.9

|

|||||||||||||||

|

Fixed Income Tax-Exempt:

|

||||||||||||||||||||

|

U.S.

|

2,250

|

1,993

|

1,742

|

12.9

|

14.4

|

|||||||||||||||

|

Global & Non-US

|

—

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Total

|

2,250

|

1,993

|

1,742

|

12.9

|

14.4

|

|||||||||||||||

|

Fixed Income Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

69

|

76

|

78

|

(9.2

|

)

|

(2.6

|

)

|

|||||||||||||

|

Global & Non-US

|

142

|

227

|

48

|

(37.4

|

)

|

372.9

|

||||||||||||||

|

Total

|

211

|

303

|

126

|

(30.4

|

)

|

140.5

|

||||||||||||||

|

Fixed Income Servicing(2):

|

||||||||||||||||||||

|

U.S.

|

11,468

|

14,051

|

9,172

|

(18.4

|

)

|

53.2

|

||||||||||||||

|

Global & Non-US

|

2,011

|

1,789

|

4,696

|

12.4

|

(61.9

|

)

|

||||||||||||||

|

Total

|

13,479

|

15,840

|

13,868

|

(14.9

|

)

|

14.2

|

||||||||||||||

|

Total Fixed Income

|

233,786

|

231,302

|

215,218

|

1.1

|

7.5

|

|||||||||||||||

|

Other(3):

|

||||||||||||||||||||

|

U.S.

|

18,643

|

11,952

|

46,400

|

56.0

|

(74.2

|

)

|

||||||||||||||

|

Global & Non-US

|

30,551

|

39,895

|

28,722

|

(23.4

|

)

|

38.9

|

||||||||||||||

|

Total

|

49,194

|

51,847

|

75,122

|

(5.1

|

)

|

(31.0

|

)

|

|||||||||||||

|

Total Investment Advisory and Services Fees:

|

||||||||||||||||||||

|

U.S.

|

181,697

|

175,245

|

197,805

|

3.7

|

(11.4

|

)

|

||||||||||||||

|

Global & Non-US

|

251,410

|

262,863

|

286,910

|

(4.4

|

)

|

(8.4

|

)

|

|||||||||||||

|

433,107

|

438,108

|

484,715

|

(1.1

|

)

|

(9.6

|

)

|

||||||||||||||

|

Distribution Revenues

|

340

|

305

|

574

|

11.5

|

(46.9

|

)

|

||||||||||||||

|

Shareholder Servicing Fees

|

634

|

533

|

362

|

18.9

|

47.2

|

|||||||||||||||

|

Total

|

$

|

434,081

|

$

|

438,946

|

$

|

485,651

|

(1.1

|

)

|

(9.6

|

)

|

||||||||||

|

Affiliated

|

$

|

95,231

|

$

|

96,729

|

$

|

82,930

|

(1.5

|

)

|

16.6

|

|||||||||||

|

Non-affiliated

|

338,850

|

342,217

|

402,721

|

(1.0

|

)

|

(15.0

|

)

|

|||||||||||||

|

Total

|

$

|

434,081

|

$

|

438,946

|

$

|

485,651

|

(1.1

|

)

|

(9.6

|

)

|

||||||||||

| (1) | Includes index and enhanced index services. |

| (2) | Fixed Income Servicing includes advisory-related services fees that are not based on AUM, including derivative transaction fees, capital purchase program related advisory services and other fixed income advisory services. |

| (3) | Includes multi-asset solutions and services and certain alternative services. |

Retail

We provide investment management and related services to a wide variety of individual retail investors, both in the U.S. and internationally, through retail mutual funds we sponsor, mutual fund sub-advisory relationships, separately-managed account programs (see below), and other investment vehicles (“Retail Products and Services”).

We distribute our Retail Products and Services through financial intermediaries, including broker-dealers, insurance sales representatives, banks, registered investment advisers and financial planners. These products and services include open-end and closed-end funds that are either (i) registered as investment companies under the Investment Company Act (“U.S. Funds”), or (ii) not registered under the Investment Company Act and generally not offered to United States persons (“Non-U.S. Funds” and, collectively with the U.S. Funds, “AB Funds”). They also include separately-managed account programs, which are sponsored by financial intermediaries and generally charge an all-inclusive fee covering investment management, trade execution, asset allocation, and custodial and administrative services. In addition, we provide distribution, shareholder servicing, transfer agency services and administrative services for our Retail Products and Services. See “Net Revenues – Investment Advisory and Services Fees” in Item 7 for information about our retail investment advisory and services fees. See Note 2 to our consolidated financial statements in Item 8 for a discussion of the commissions we pay to financial intermediaries in connection with the sale of open-end AB Funds.

Fees paid by the U.S. Funds are reflected in the applicable investment management agreement, which generally must be approved annually by the boards of directors or trustees of those funds, including by a majority of the independent directors or trustees. Increases in these fees must be approved by fund shareholders; decreases need not be, including any decreases implemented by a fund’s directors or trustees. In general, each investment management agreement with the U.S. Funds provides for termination by either party at any time upon 60 days’ notice.

Fees paid by Non-U.S. Funds are reflected in investment management agreements that continue until they are terminated. Increases in these fees generally must be approved by the relevant regulatory authority, depending on the domicile and structure of the fund, and Non-U.S. Fund shareholders must be given advance notice of any fee increases.

The mutual funds we sub-advise for AXA and its subsidiaries together constitute our largest retail client. They accounted for approximately 21%, 23% and 20% of our retail AUM as of December 31, 2014, 2013 and 2012, respectively, and approximately 3%, 2% and 3% of our retail net revenues for 2014, 2013 and 2012, respectively.

Certain subsidiaries of AXA, including AXA Advisors, LLC (“AXA Advisors”), a subsidiary of AXA Financial, were responsible for approximately 3%, 2% and 4% of total sales of shares of open-end AB Funds in 2014, 2013 and 2012, respectively. During 2014, UBS AG was responsible for approximately 11% of our open-end AB Fund sales. Neither our affiliates nor UBS AG are under any obligation to sell a specific amount of AB Fund shares and each also sells shares of mutual funds that it sponsors and that are sponsored by unaffiliated organizations. No other entity accounted for 10% or more of our open-end AB Fund sales.

Most open-end U.S. Funds have adopted a plan under Rule 12b-1 of the Investment Company Act that allows the fund to pay, out of assets of the fund, distribution and service fees for the distribution and sale of its shares (“Rule 12b-1 Fees”). The open-end U.S. Funds have entered into such agreements with us, and we have entered into selling and distribution agreements pursuant to which we pay sales commissions to the financial intermediaries that distribute our open-end U.S. Funds. These agreements are terminable by either party upon notice (generally 30 days) and do not obligate the financial intermediary to sell any specific amount of fund shares.

As of December 31, 2014, retail U.S. Fund AUM were approximately $49 billion, or 30% of retail AUM, as compared to $47 billion, or 31%, as of December 31, 2013, and $45 billion, or 31%, as of December 31, 2012. Non-U.S. Fund AUM, as of December 31, 2014, totaled $57 billion, or 36% of retail AUM, as compared to $56 billion, or 36%, as of December 31, 2013, and $60 billion, or 42%, as of December 31, 2012.

Our Retail Services represented approximately 34% of our AUM as of each of December 31, 2014, 2013 and 2012, and the fees we earned from providing these services represented approximately 46%, 47% and 44% of our net revenues for the years ended December 31, 2014, 2013 and 2012, respectively. Our AUM and revenues are as follows:

Retail Services Assets Under Management

(by Investment Service)

|

December 31,

|

% Change

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2014-13

|

2013-12

|

||||||||||||||||

|

(in millions)

|

||||||||||||||||||||

|

Equity Actively Managed:

|

||||||||||||||||||||

|

U.S.

|

$

|

29,449

|

$

|

27,656

|

$

|

17,738

|

6.5

|

%

|

55.9

|

%

|

||||||||||

|

Global & Non-US

|

15,920

|

13,997

|

16,415

|

13.7

|

(14.7

|

)

|

||||||||||||||

|

Total

|

45,369

|

41,653

|

34,153

|

8.9

|

22.0

|

|||||||||||||||

|

Equity Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

21,268

|

21,514

|

16,716

|

(1.1

|

)

|

28.7

|

||||||||||||||

|

Global & Non-US

|

6,600

|

6,615

|

5,491

|

(0.2

|

)

|

20.5

|

||||||||||||||

|

Total

|

27,868

|

28,129

|

22,207

|

(0.9

|

)

|

26.7

|

||||||||||||||

|

Total Equity

|

73,237

|

69,782

|

56,360

|

5.0

|

23.8

|

|||||||||||||||

|

Fixed Income Taxable:

|

||||||||||||||||||||

|

U.S.

|

5,934

|

4,597

|

2,738

|

29.1

|

67.9

|

|||||||||||||||

|

Global & Non-US

|

55,059

|

56,304

|

65,990

|

(2.2

|

)

|

(14.7

|

)

|

|||||||||||||

|

Total

|

60,993

|

60,901

|

68,728

|

0.2

|

(11.4

|

)

|

||||||||||||||

|

Fixed Income Tax-Exempt:

|

||||||||||||||||||||

|

U.S.

|

10,432

|

8,243

|

8,532

|

26.6

|

(3.4

|

)

|

||||||||||||||

|

Global & Non-US

|

14

|

14

|

—

|

—

|

—

|

|||||||||||||||

|

Total

|

10,446

|

8,257

|

8,532

|

26.5

|

(3.2

|

)

|

||||||||||||||

|

Fixed Income Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

4,917

|

4,531

|

2,385

|

8.5

|

90.0

|

|||||||||||||||

|

Global & Non-US

|

4,483

|

4,179

|

4,730

|

7.3

|

(11.6

|

)

|

||||||||||||||

|

Total

|

9,400

|

8,710

|

7,115

|

7.9

|

22.4

|

|||||||||||||||

|

Total Fixed Income

|

80,839

|

77,868

|

84,375

|

3.8

|

(7.7

|

)

|

||||||||||||||

|

Other(2):

|

||||||||||||||||||||

|

U.S.

|

5,349

|

3,208

|

1,981

|

66.7

|

61.9

|

|||||||||||||||

|

Global & Non-US

|

2,072

|

2,132

|

1,676

|

(2.8

|

)

|

27.2

|

||||||||||||||

|

Total

|

7,421

|

5,340

|

3,657

|

39.0

|

46.0

|

|||||||||||||||

|

Total:

|

||||||||||||||||||||

|

U.S.

|

77,349

|

69,749

|

50,090

|

10.9

|

39.2

|

|||||||||||||||

|

Global & Non-US

|

84,148

|

83,241

|

94,302

|

1.1

|

(11.7

|

)

|

||||||||||||||

|

Total

|

$

|

161,497

|

$

|

152,990

|

$

|

144,392

|

5.6

|

6.0

|

||||||||||||

|

Affiliated

|

$

|

34,693

|

$

|

35,194

|

$

|

28,535

|

(1.4

|

)

|

23.3

|

|||||||||||

|

Non-affiliated

|

126,804

|

117,796

|

115,857

|

7.6

|

1.7

|

|||||||||||||||

|

Total

|

$

|

161,497

|

$

|

152,990

|

$

|

144,392

|

5.6

|

6.0

|

||||||||||||

| (1) | Includes index and enhanced index services. |

| (2) | Includes multi-asset solutions and services and certain alternative investments. |

Revenues from Retail Services

(by Investment Service)

|

Years Ended December 31,

|

% Change

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2014-13

|

2013-12

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Equity Actively Managed:

|

||||||||||||||||||||

|

U.S.

|

$

|

182,008

|

$

|

134,311

|

$

|

92,423

|

35.5

|

%

|

45.3

|

%

|

||||||||||

|

Global & Non-US

|

94,491

|

96,338

|

114,220

|

(1.9

|

)

|

(15.7

|

)

|

|||||||||||||

|

Total

|

276,499

|

230,649

|

206,643

|

19.9

|

11.6

|

|||||||||||||||

|

Equity Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

10,066

|

10,957

|

11,952

|

(8.1

|

)

|

(8.3

|

)

|

|||||||||||||

|

Global & Non-US

|

6,924

|

4,670

|

2,162

|

48.3

|

116.0

|

|||||||||||||||

|

Total

|

16,990

|

15,627

|

14,114

|

8.7

|

10.7

|

|||||||||||||||

|

Total Equity

|

293,489

|

246,276

|

220,757

|

19.2

|

11.6

|

|||||||||||||||

|

Fixed Income Taxable:

|

||||||||||||||||||||

|

U.S.

|

20,680

|

16,074

|

13,252

|

28.7

|

21.3

|

|||||||||||||||

|

Global & Non-US

|

429,409

|

483,171

|

405,208

|

(11.1

|

)

|

19.2

|

||||||||||||||

|

Total

|

450,089

|

499,245

|

418,460

|

(9.8

|

)

|

19.3

|

||||||||||||||

|

Fixed Income Tax-Exempt:

|

||||||||||||||||||||

|

U.S.

|

38,317

|

35,993

|

28,906

|

6.5

|

24.5

|

|||||||||||||||

|

Global & Non-US

|

78

|

78

|

—

|

—

|

—

|

|||||||||||||||

|

Total

|

38,395

|

36,071

|

28,906

|

6.4

|

24.8

|

|||||||||||||||

|

Fixed Income Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

2,836

|

2,153

|

1,144

|

31.7

|

88.2

|

|||||||||||||||

|

Global & Non-US

|

8,438

|

8,605

|

7,056

|

(1.9

|

)

|

22.0

|

||||||||||||||

|

Total

|

11,274

|

10,758

|

8,200

|

4.8

|

31.2

|

|||||||||||||||

|

Total Fixed Income

|

499,758

|

546,074

|

455,566

|

(8.5

|

)

|

19.9

|

||||||||||||||

|

Other(2):

|

||||||||||||||||||||

|

U.S.

|

64,452

|

22,819

|

14,306

|

182.4

|

59.5

|

|||||||||||||||

|

Global & Non-US

|

9,277

|

9,785

|

7,424

|

(5.2

|

)

|

31.8

|

||||||||||||||

|

Total

|

73,729

|

32,604

|

21,730

|

126.1

|

50.0

|

|||||||||||||||

|

Total Investment Advisory and Services Fees:

|

||||||||||||||||||||

|

U.S.

|

318,359

|

222,307

|

161,983

|

43.2

|

37.2

|

|||||||||||||||

|

Global & Non-US

|

548,617

|

602,647

|

536,070

|

(9.0

|

)

|

12.4

|

||||||||||||||

|

866,976

|

824,954

|

698,053

|

5.1

|

18.2

|

||||||||||||||||

|

Distribution Revenues

|

440,961

|

461,944

|

406,467

|

(4.5

|

)

|

13.6

|

||||||||||||||

|

Shareholder Servicing Fees

|

89,198

|

89,472

|

88,375

|

(0.3

|

)

|

1.2

|

||||||||||||||

|

Total

|

$

|

1,397,135

|

$

|

1,376,370

|

$

|

1,192,895

|

1.5

|

15.4

|

||||||||||||

|

Affiliated

|

$

|

47,910

|

$

|

43,264

|

$

|

31,089

|

10.7

|

39.2

|

||||||||||||

|

Non-affiliated

|

1,349,225

|

1,333,106

|

1,161,806

|

1.2

|

14.7

|

|||||||||||||||

|

Total

|

$

|

1,397,135

|

$

|

1,376,370

|

$

|

1,192,895

|

1.5

|

15.4

|

||||||||||||

| (1) | Includes index and enhanced index services. |

| (2) | Includes multi-asset solutions and services and certain alternative investments. |

Private Wealth Management

To our private wealth clients, which include high-net-worth individuals and families, trusts and estates, charitable foundations, partnerships, private and family corporations, and other entities (including most institutions for which we manage accounts with less than $25 million in AUM), we offer separately-managed accounts, hedge funds, mutual funds and other investment vehicles (“Private Wealth Services”).

We manage these accounts pursuant to written investment advisory agreements, which generally are terminable at any time or upon relatively short notice by any party and may not be assigned without the consent of the client. For information about our investment advisory and services fees, including performance-based fees, see “Risk Factors” in Item 1A and “Net Revenues – Investment Advisory and Services Fees” in Item 7.

As of December 31, 2014, 2013 and 2012, Private Wealth Services represented approximately 16%, 16% and 15%, respectively, of our AUM, and the fees we earned from providing these services represented approximately 22%, 20% and 21% of our net revenues for 2014, 2013 and 2012, respectively. Our AUM and revenues are as follows:

Private Wealth Services Assets Under Management

(by Investment Service)

|

December 31,

|

% Change

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2014-13

|

2013-12

|

||||||||||||||||

|

(in millions)

|

||||||||||||||||||||

|

Equity Actively Managed:

|

||||||||||||||||||||

|

U.S.

|

$

|

22,842

|

$

|

21,620

|

$

|

16,506

|

5.7

|

%

|

31.0

|

%

|

||||||||||

|

Global & Non-US

|

15,125

|

15,003

|

13,222

|

0.8

|

13.5

|

|||||||||||||||

|

Total

|

37,967

|

36,623

|

29,728

|

3.7

|

23.2

|

|||||||||||||||

|

Equity Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

172

|

83

|

67

|

107.2

|

23.9

|

|||||||||||||||

|

Global & Non-US

|

402

|

397

|

371

|

1.3

|

7.0

|

|||||||||||||||

|

Total

|

574

|

480

|

438

|

19.6

|

9.6

|

|||||||||||||||

|

Total Equity

|

38,541

|

37,103

|

30,166

|

3.9

|

23.0

|

|||||||||||||||

|

Fixed Income Taxable:

|

||||||||||||||||||||

|

U.S.

|

7,396

|

7,468

|

8,962

|

(1.0

|

)

|

(16.7

|

)

|

|||||||||||||

|

Global & Non-US

|

2,871

|

2,128

|

1,755

|

34.9

|

21.3

|

|||||||||||||||

|

Total

|

10,267

|

9,596

|

10,717

|

7.0

|

(10.5

|

)

|

||||||||||||||

|

Fixed Income Tax-Exempt:

|

||||||||||||||||||||

|

U.S.

|

19,401

|

18,843

|

20,835

|

3.0

|

(9.6

|

)

|

||||||||||||||

|

Global & Non-US

|

3

|

2

|

—

|

50.0

|

—

|

|||||||||||||||

|

Total

|

19,404

|

18,845

|

20,835

|

3.0

|

(9.6

|

)

|

||||||||||||||

|

Fixed Income Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

5

|

11

|

31

|

(54.5

|

)

|

(64.5

|

)

|

|||||||||||||

|

Global & Non-US

|

402

|

357

|

355

|

12.6

|

0.6

|

|||||||||||||||

|

Total

|

407

|

368

|

386

|

10.6

|

(4.7

|

)

|

||||||||||||||

|

Total Fixed Income

|

30,078

|

28,809

|

31,938

|

4.4

|

(9.8

|

)

|

||||||||||||||

|

Other(2):

|

||||||||||||||||||||

|

U.S.

|

1,902

|

1,375

|

804

|

38.3

|

71.0

|

|||||||||||||||

|

Global & Non-US

|

4,968

|

4,144

|

2,898

|

19.9

|

43.0

|

|||||||||||||||

|

Total

|

6,870

|

5,519

|

3,702

|

24.5

|

49.1

|

|||||||||||||||

|

Total:

|

||||||||||||||||||||

|

U.S.

|

51,718

|

49,400

|

47,205

|

4.7

|

4.6

|

|||||||||||||||

|

Global & Non-US

|

23,771

|

22,031

|

18,601

|

7.9

|

18.4

|

|||||||||||||||

|

Total

|

$

|

75,489

|

$

|

71,431

|

$

|

65,806

|

5.7

|

8.5

|

||||||||||||

| (1) | Includes index and enhanced index services. |

| (2) | Includes multi-asset solutions and services and certain alternative investments. |

Revenues From Private Wealth Services

(by Investment Service)

|

Years Ended December 31,

|

% Change

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2014-13

|

2013-12

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Equity Actively Managed:

|

||||||||||||||||||||

|

U.S.

|

$

|

250,415

|

$

|

211,927

|

$

|

209,263

|

18.2

|

% |

1.3

|

%

|

||||||||||

|

Global & Non-US

|

169,472

|

153,062

|

149,732

|

10.7

|

2.2

|

|||||||||||||||

|

Total

|

419,887

|

364,989

|

358,995

|

15.0

|

1.7

|

|||||||||||||||

|

Equity Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

695

|

316

|

65

|

119.9

|

386.2

|

|||||||||||||||

|

Global & Non-US

|

1,839

|

1,800

|

1,666

|

2.2

|

8.0

|

|||||||||||||||

|

Total

|

2,534

|

2,116

|

1,731

|

19.8

|

22.2

|

|||||||||||||||

|

Total Equity

|

422,421

|

367,105

|

360,726

|

15.1

|

1.8

|

|||||||||||||||

|

Fixed Income Taxable:

|

||||||||||||||||||||

|

U.S.

|

39,811

|

44,260

|

48,906

|

(10.1

|

)

|

(9.5

|

)

|

|||||||||||||

|

Global & Non-US

|

15,778

|

13,029

|

12,319

|

21.1

|

5.8

|

|||||||||||||||

|

Total

|

55,589

|

57,289

|

61,225

|

(3.0

|

)

|

(6.4

|

)

|

|||||||||||||

|

Fixed Income Tax-Exempt:

|

||||||||||||||||||||

|

U.S.

|

102,509

|

104,867

|

117,035

|

(2.2

|

)

|

(10.4

|

)

|

|||||||||||||

|

Global & Non-US

|

27

|

18

|

—

|

50.0

|

—

|

|||||||||||||||

|

Total

|

102,536

|

104,885

|

117,035

|

(2.2

|

)

|

(10.4

|

)

|

|||||||||||||

|

Fixed Income Passively Managed(1):

|

||||||||||||||||||||

|

U.S.

|

9

|

88

|

26

|

(89.8

|

)

|

238.5

|

||||||||||||||

|

Global & Non-US

|

3,446

|

3,105

|

1,184

|

11.0

|

162.2

|

|||||||||||||||

|

Total

|

3,455

|

3,193

|

1,210

|

8.2

|

163.9

|

|||||||||||||||

|

Total Fixed Income

|

161,580

|

165,367

|

179,470

|

(2.3

|

)

|

(7.9

|

)

|

|||||||||||||

|

Other(2):

|

||||||||||||||||||||

|

U.S.

|

16,566

|

12,699

|

9,592

|

30.5

|

32.4

|

|||||||||||||||

|

Global & Non-US

|

57,600

|

40,872

|

31,919

|

40.9

|

28.0

|

|||||||||||||||

|

Total

|

74,166

|

53,571

|

41,511

|

38.4

|

29.1

|

|||||||||||||||

|

Total Investment Advisory and Services Fees:

|

||||||||||||||||||||

|

U.S.

|

410,005

|

374,157

|

384,887

|

9.6

|

(2.8

|

)

|

||||||||||||||

|

Global & Non-US

|

248,162

|

211,886

|

196,820

|

17.1

|

7.7

|

|||||||||||||||

|

Total

|

658,167

|

586,043

|

581,707

|

12.3

|

0.7

|

|||||||||||||||

|

Distribution Revenues

|

3,669

|

3,175

|

2,447

|

15.6

|

29.8

|

|||||||||||||||

|

Shareholder Servicing Fees

|

2,488

|

2,140

|

1,637

|

16.3

|

30.7

|

|||||||||||||||

|

Total

|

$

|

664,324

|

$

|

591,358

|

$

|

585,791

|

12.3

|

1.0

|

||||||||||||

| (1) | Includes index and enhanced index services. |

| (2) | Includes multi-asset solutions and services and certain alternative investments. |

Bernstein Research Services

We offer high-quality fundamental research, quantitative services and brokerage-related services in equities and listed options to institutional investors, such as pension fund, hedge fund and mutual fund managers, and other institutional investors (“Bernstein Research Services”). We serve our clients, which are based in the United States, Europe, Asia, the Middle East and Canada, through various subsidiaries, including Sanford C. Bernstein & Co., LLC (“SCB LLC”), Sanford C. Bernstein Limited and Sanford C. Bernstein (Hong Kong) Limited (collectively, “SCB”). Our sell-side analysts, who provide fundamental company and industry research along with quantitative research into securities valuation and factors affecting stock-price movements, are consistently among the highest ranked research analysts in industry surveys conducted by third-party organizations.

We earn revenues for providing investment research to, and executing brokerage transactions for, institutional clients. These clients compensate us principally by directing SCB to execute brokerage transactions on their behalf, for which we earn commissions. These services accounted for approximately 16%, 15% and 15% of our net revenues for the years ended December 31, 2014, 2013 and 2012, respectively.

For information regarding trends in fee rates charged for brokerage transactions, see “Risk Factors” in Item 1A.

Our Bernstein Research Services revenues are as follows:

Revenues From Bernstein Research Services

|

Years Ended December 31,

|

% Change

|

|||||||||||||||||||

|

2014

|

2013

|

2012

|

2014-13 | 2013-12 | ||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||

|

Bernstein Research Services

|

$

|

482,538

|

$

|

445,083

|

$

|

413,707

|

8.4

|

%

|

7.6

|

%

|

||||||||||

Custody

SCB LLC acts as custodian for the majority of our Private Wealth Management AUM and some of our Institutions AUM. Other custodial arrangements are maintained by client-designated banks, trust companies, brokerage firms or custodians.

Employees

As of December 31, 2014, our firm had 3,487 full-time employees, representing a 5.8% increase compared to the end of 2013. We consider our employee relations to be good.

Service Marks

We have registered a number of service marks with the U.S. Patent and Trademark Office and various foreign trademark offices, including the mark “AllianceBernstein”. The [A/B] logo and “Ahead of Tomorrow” are service marks of AB.

In January 2015, we established two new brand identities. Although the legal names of our corporate entities have not changed, our company, and our Institutions and Retail businesses, now are referred to as “AB”. Private Wealth Management and Bernstein Research Services now are referred to as “AB Bernstein”. Also, we adopted the [A/B] logo and “Ahead of Tomorrow” service marks described above.

In connection with the Bernstein Transaction, we acquired all of the rights in, and title to, the Bernstein service marks, including the mark “Bernstein”.

In connection with the WPS Acquisition, we acquired all of the rights in, and title to, the WPS service marks, including the logo “WPSTEWART”. See “W.P. Stewart” in this Item 1 for information regarding the WPS Acquisition.

Regulation

Virtually all aspects of our business are subject to various federal and state laws and regulations, rules of various securities regulators and exchanges, and laws in the foreign countries in which our subsidiaries conduct business. These laws and regulations primarily are intended to protect clients and fund shareholders and generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the carrying on of business for failure to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in business for specific periods, the revocation of the registration as an investment adviser or broker-dealer, censures and fines.

AB, AB Holding, the General Partner and five of our subsidiaries (SCB LLC, AllianceBernstein Global Derivatives Corporation (“Global Derivatives”), AB Private Credit Investors LLC, WPS and W.P. Stewart Asset Management LLC) are registered with the SEC as investment advisers under the Investment Advisers Act. Also, AB Holding is an NYSE-listed company and, accordingly, is subject to applicable regulations promulgated by the NYSE. In addition, AB, SCB LLC and Global Derivatives are registered with the Commodity Futures Trading Commission (“CFTC”) as commodity pool operators and commodity trading advisers; SCB LLC also is registered with the CFTC as a futures commissions merchant.

Each U.S. Fund is registered with the SEC under the Investment Company Act and each Non-U.S. Fund is subject to the laws in the jurisdiction in which the fund is registered. For example, our platform of Luxembourg-based funds operates pursuant to Luxembourg laws and regulations, including Undertakings for the Collective Investment in Transferable Securities Directives, and is authorized and supervised by the Commission de Surveillance du Secteur Financier (“CSSF”), the primary regulator in Luxembourg. AllianceBernstein Investor Services, Inc. (“ABIS”), one of our subsidiaries, is registered with the SEC as a transfer and servicing agent.

SCB LLC and another of our subsidiaries, AllianceBernstein Investments, Inc. (“AllianceBernstein Investments”), are registered with the SEC as broker-dealers, and both are members of the Financial Industry Regulatory Authority. In addition, SCB LLC is a member of the NYSE and other principal U.S. exchanges.

Many of our subsidiaries are subject to the oversight of regulatory authorities in the jurisdictions outside the United States where they operate, including the European Securities and Markets Authority, the Financial Conduct Authority in the U.K., the CSSF in Luxembourg, the Financial Services Agency in Japan, the Securities & Futures Commission in Hong Kong, the Monetary Authority of Singapore, the Financial Services Commission in South Korea and the Financial Supervisory Commission in Taiwan. While these regulatory requirements often may be comparable to the requirements of the SEC and other U.S. regulators, they are sometimes more restrictive and may cause us to incur substantial expenditures of time and money in our efforts to comply.

Iran Threat Reduction and Syria Human Rights Act

AB, AB Holding and their global subsidiaries had no transactions or activities requiring disclosure under the Iran Threat Reduction and Syria Human Rights Act (“Iran Act”), nor were they involved in the AXA Group matters described immediately below.

The non-U.S. based subsidiaries of AXA operate in compliance with applicable laws and regulations of the various jurisdictions where they operate, including applicable international (United Nations and European Union) laws and regulations. While AXA Group companies based and operating outside the United States generally are not subject to U.S. law, as an international group, AXA has in place policies and standards (including the AXA Group International Sanctions Policy) that apply to all AXA Group companies worldwide and often impose requirements that go well beyond local law. For additional information regarding AXA, see “Principal Security Holders” in Item 12.

AXA has reported to us that six insurance policies underwritten by one of AXA’s European insurance subsidiaries, AXA France IARD (“AXA France”), that were in-force at times during 2014 and potentially came within the scope of the disclosure requirements of the Iran Act, were terminated during 2014. Each of these insurance policies related to property and casualty insurance (homeowners, auto, accident, liability and/or fraud policies) covering property located in France where the insured is a company or other entity that may have direct or indirect ties to the Government of Iran, including Iranian entities designated under Executive Orders 13224 and 13382. AXA France is a French company, based in Paris, which is licensed to operate in France. The annual aggregate revenue AXA derived from these policies was approximately $6,500 and the related net profit, which was difficult to calculate with precision, is estimated to have been $3,250.

AXA has informed us that AXA Konzern AG (“AXA Konzern”), a subsidiary of AXA organized under the laws of Germany, has a German client designated under Executive Order 13382. This client has a pension savings contract with AXA Konzern with an annual premium of approximately $15,000. The related annual net profit arising from this contract, which is difficult to calculate with precision, is estimated to be $7,500. This contract will end in March 2015. In addition, a subsidiary of the same German client has a life insurance contract (which includes a savings element) with AXA Konzern, with an annual premium of approximately $1,400. The related annual net profit arising from this contract, which is difficult to calculate with precision, is estimated to be $700. AXA Konzern intends to leave these contracts in place as there is no legal basis that would allow a German company to cancel such a contract.

AXA also has informed us that AXA Konzern provides car insurance to two diplomats based at the Iranian embassy in Berlin, Germany. The total annual premium of these policies is approximately $600 and the annual net profit arising from these policies, which is difficult to calculate with precision, is estimated to be $300. These policies were underwritten by a broker who specializes in providing insurance coverage for diplomats. Provision of motor vehicle insurance is mandatory in Germany and cannot be cancelled until the policies expire.

AXA previously informed us that AXA Konzern had taken actions to terminate property insurance provided to Industrial Commercial Services (“ICS”) for an office building in Hamburg, Germany. ICS is a company that some reports suggest may be owned by the Iranian Mines and Mining Industries Development and Renovation Organization, an entity designated as a Specially Designated National and Blocked Person (an “SDN”) by the Office of Foreign Assets Control of the U.S. Department of the Treasury (“OFAC”) with the identifier [IRAN]. As of the date of this report, AXA Konzern has confirmed that this policy has been terminated. The annual premium in respect of this policy was approximately $2,500. The related annual net profit arising from this policy, which was difficult to calculate with precision, is estimated to have been $1,250.

In addition, AXA has informed us that AXA Ireland, an AXA insurance subsidiary, provides statutorily required car insurance under four separate policies to the Iranian Embassy in Dublin, Ireland. AXA has informed us that compliance with the Declined Cases Agreement of the Irish Government prohibits the cancellation of these policies unless another insurer is willing to assume the cover. The total annual premium for these policies is approximately $6,000 and the annual net profit arising from these policies, which is difficult to calculate with precision, is estimated to be $3,000.

Also, AXA has informed us that AXA Sigorta, a subsidiary of AXA organized under the laws of Turkey, provides car insurance coverage for the vehicle pools of the Iranian General Consulate and the Iranian embassy in Istanbul, Turkey. The total annual premium in respect of these policies is approximately $5,100 and the annual net profit, which is difficult to calculate with precision, is estimated to be $2,550. These policies will expire in 2015.

Lastly, AXA has informed us about a pension contract in place between a subsidiary in Hong Kong, AXA China Region Trustees Limited (“AXA CRT”), and Hong Kong Intertrade Ltd (“HKIL”), an entity that OFAC has designated an SDN with the identifier [IRAN]. There is only one employee of HKIL (“Employee”) enrolled in this pension contract, who himself also has been designated an SDN with the identifier [IRAN]. The pension contract with HKIL was entered into, and the enrollment of the Employee took place, in May 2012. HKIL was first designated an SDN in July 2012 and the Employee was first designated an SDN in May 2013. Local authorities have informed AXA CRT that the pension contract cannot be cancelled. The annual pension contributions received under this pension contract total approximately $7,800 and the related net profit, which is difficult to calculate with precision, is estimated to be $3,900.

The aggregate annual premiums for the above-referenced insurance policies and pension contracts is approximately $44,900, representing approximately 0.00003% of AXA’s 2014 consolidated revenues, which are likely to be approximately $100 billion. The related net profit, which is difficult to calculate with precision, is estimated to be $22,450, representing approximately 0.0003% of AXA’s 2014 aggregate net profit.

History and Structure

We have been in the investment research and management business for more than 40 years. Alliance Capital was founded in 1971 when the investment management department of Donaldson, Lufkin & Jenrette, Inc. (since November 2000, a part of Credit Suisse Group) merged with the investment advisory business of Moody’s Investor Services, Inc. Bernstein was founded in 1967.

In April 1988, AB Holding “went public” as a master limited partnership. AB Holding Units, which trade under the ticker symbol “AB”, have been listed on the NYSE since that time.

In October 1999, AB Holding reorganized by transferring its business and assets to AB, a newly-formed operating partnership, in exchange for all of the AB Units (“Reorganization”). Since the date of the Reorganization, AB has conducted the business formerly conducted by AB Holding and AB Holding’s activities have consisted of owning AB Units and engaging in related activities. Unlike AB Holding Units, AB Units do not trade publicly and are subject to significant restrictions on transfer. The General Partner is the general partner of both AB and AB Holding.

In October 2000, our two legacy firms, Alliance Capital and Bernstein, combined, bringing together Alliance Capital’s expertise in growth equity and corporate fixed income investing and its family of retail mutual funds, with Bernstein’s expertise in value equity and tax-exempt fixed income management and its Private Wealth Management and Bernstein Research Services businesses. For additional details about this business combination, see Note 2 to our consolidated financial statements in Item 8.

As of December 31, 2014, the condensed ownership structure of AB is as follows (for a more complete description of our ownership structure, see “Principal Security Holders” in Item 12):

The General Partner owns 100,000 general partnership units in AB Holding and a 1% general partnership interest in AB. Including these general partnership interests, AXA, through certain of its subsidiaries (see “Principal Security Holders” in Item 12), had an approximate 62.7% economic interest in AB as of December 31, 2014.

Competition

We compete in all aspects of our business with numerous investment management firms, mutual fund sponsors, brokerage and investment banking firms, insurance companies, banks, savings and loan associations, and other financial institutions that often provide investment products that have similar features and objectives as those we offer. Our competitors offer a wide range of financial services to the same customers that we seek to serve. Some of our competitors are larger, have a broader range of product choices and investment capabilities, conduct business in more markets, and have substantially greater resources than we do. These factors may place us at a competitive disadvantage, and we can give no assurance that our strategies and efforts to maintain and enhance our current client relationships, and create new ones, will be successful.

In addition, AXA and its subsidiaries provide financial services, some of which compete with those we offer. The AB Partnership Agreement specifically allows AXA and its subsidiaries (other than the General Partner) to compete with AB and to exploit opportunities that may be available to us. AXA, AXA Financial, AXA Equitable and certain of their respective subsidiaries have substantially greater financial resources than we do and are not obligated to provide resources to us.

To grow our business, we must be able to compete effectively for AUM. Key competitive factors include:

| Ÿ | our investment performance for clients; |

| Ÿ | our commitment to place the interests of our clients first; |

| Ÿ | the quality of our research; |

| Ÿ | our ability to attract, motivate and retain highly skilled, and often highly specialized, personnel; |

| Ÿ | the array of investment products we offer; |

| Ÿ | the fees we charge; |

| Ÿ | Morningstar/Lipper rankings for the AB Funds; |

| Ÿ | our operational effectiveness; |

| Ÿ | our ability to further develop and market our brand; and |

| Ÿ | our global presence. |

Competition is an important risk that our business faces and should be considered along with the other risk factors we discuss in “Risk Factors” in Item 1A.

Available Information

We file or furnish annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, amendments to such reports, and other reports (and amendments thereto) required to comply with federal securities laws, including Section 16 beneficial ownership reports on Forms 3, 4 and 5, registration statements and proxy statements. We maintain an Internet site (http://www.abglobal.com) where the public can view these reports, free of charge, as soon as reasonably practicable after each report is filed with, or furnished to, the SEC. In addition, the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

W.P. Stewart

On December 12, 2013, we acquired WPS, an equity investment manager that managed, as of December 12, 2013, approximately $2.1 billion in U.S., Global and Europe, Australasia (Australia and New Zealand) and Far East (“EAFE”) concentrated growth equity strategies for its clients, primarily in the U.S. and Europe. On the date of the WPS Acquisition, each of approximately 4.9 million outstanding shares of WPS common stock (other than certain specified shares, as previously disclosed in Amendment No. 2 to Form S-4 filed by AB on November 8, 2013) was converted into the right to receive $12 per share and one transferable contingent value right (“CVRs”) entitling the holders to an additional $4 per share cash payment if the Assets Under Management (as such term is defined in the Contingent Value Rights Agreement (“CVR Agreement”) dated as of December 12, 2013, a copy of which we filed as Exhibit 4.01 (“Exhibit 4.01”) to our Form 10-K for the year ended December 31, 2013) in the acquired WPS investment services exceed $5 billion on or before December 12, 2016, subject to measurement procedures and limitations set forth in the CVR Agreement. The foregoing description of the CVR Agreement does not purport to be complete and is qualified in its entirety by the full text of the CVR Agreement included as Exhibit 4.01.

As of December 31, 2014, the Assets Under Management are approximately $2.6 billion. As noted above, payment pursuant to the CVRs is triggered if Assets Under Management exceed $5 billion on or prior to December 12, 2016, subject to certain measurement procedures and limitations. See the definition of AUM Milestone in Exhibit 4.01 for additional information regarding the circumstances that trigger payment pursuant to the CVRs.

Management has determined that the AUM Milestone did not occur during the fourth quarter of 2014.

Please consider this section along with the description of our business in Item 1, the competition section immediately above and our financial information contained in Items 6, 7 and 8. The majority of the risk factors discussed below directly affect AB. These risk factors also affect AB Holding because AB Holding’s principal source of income and cash flow is attributable to its investment in AB. See also “Cautions Regarding Forward-Looking Statements” in Item 7.

Business-related Risks

Our revenues and results of operations depend on the market value and composition of our AUM, which can fluctuate significantly based on various factors, including many factors outside of our control.

We derive most of our revenues from investment advisory and services fees, which typically are calculated as a percentage of the value of AUM as of a specified date, or as a percentage of the value of average AUM for the applicable billing period, and vary with the type of investment service, the size of the account and the total amount of assets we manage for a particular client. The value and composition of our AUM can be adversely affected by several factors, including:

| Ÿ | Our Investment Performance. Our ability to achieve investment returns for clients that meet or exceed investment returns for comparable asset classes and competing investment services is a key consideration when clients decide to keep their assets with us or invest additional assets, and when a prospective client is deciding whether to invest with us. Poor investment performance, both in absolute terms and/or relative to peers and stated benchmarks, may result in clients withdrawing assets and in prospective clients choosing to invest with competitors. |