Attached files

A

Valuable, Unique & Stable Bridge from Mixed C4 to Purity Products

Ruth Dreessen

Executive Vice President & Chief Financial Officer

Wells Fargo NGL Summit

May 26, 2010

A Service-Based Intermediary

with Strong Infrastructure

& Logistics Network

Exhibit 99.1 |

Forward-Looking Statements & Non-GAAP Financial Measures

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

securities

laws.

These

statements

include

assumptions,

expectations,

predictions,

intentions

or

beliefs

about

future

events,

particularly statements that may relate to future operating results, existing and

expected competition, financing and refinancing sources and availability,

and plans related to strategic alternatives or future expansion activities

and capital expenditures. Although TPC Group believes that such statements are

based on reasonable assumptions, no assurance can be given that such statements

will prove to have been

correct.

A

number

of

factors

could

cause

actual

results

to

vary

materially

from

those

expressed

or

implied in any forward-looking statements, including risks and uncertainties

such as volatility in the petrochemicals industry, limitations on the

Company’s access to capital, the effects of competition, leverage and

debt service, general economic conditions, litigation and governmental investigations, and

extensive

environmental,

health

and

safety

laws

and

regulations.

More

information

about

the

risks

and

uncertainties relating to TPC Group and the forward-looking statements are

found in the Company’s SEC filings, including the Registration

Statement on Form 10, as amended, which are available free of charge

on

the

SEC’s

website

at

http://www.sec.gov

.

TPC

Group

expressly

disclaims

any

obligation

to

update

any

forward-looking statements contained herein to reflect events or circumstances

that may arise after the date of this presentation.

This presentation may also include non-GAAP financial information. A

reconciliation of non-GAAP financial measures to the most directly

comparable GAAP financial measures, as well as additional detail regarding

the utility of such non-GAAP financial information, is included in the

Appendix. 2

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

Investment Highlights

3

Wells

Fargo

NGL

Summit

-

May

26,

2010

Attractive

Market Position in

Consolidated Industry

Substantial

and Strategic

Asset Value

Significant and

Stable Free

Cash Flow

Differentiated

Business Model

Positioned for

Margin Expansion

and Growth

Valuation

Upside |

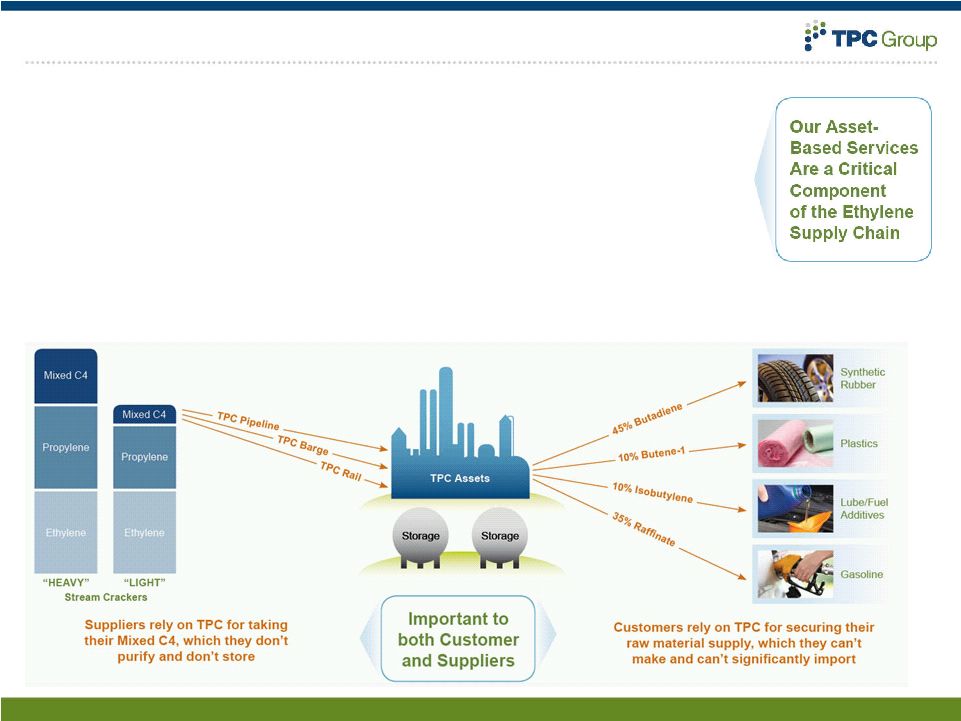

Differentiated Business Model

TPC Group: a C4 processor, logistics provider & marketer

•

C4: four carbon hydrocarbon by-products of ethylene production

•

Ethylene

produced

by

cracking

“heavy”

(naphtha)

or

“light”

(NGL’s)

–

Cracking “heavy”

produces significantly more C4 than cracking “light”

–

“Heavy”

crackers: integrated with their own C4 processing

–

“Light”

crackers: non-integrated and therefore outsource to TPC

•

Long-standing, service-based contracts mitigate exposure to commodity

prices –

TPC receives processing fees from its suppliers

–

TPC receives service fees from its customers

•

Key drivers of profitability are unit margins, volume & production

efficiency 4

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

Substantial & Strategic Asset Value

5

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

Business

Segments

–

C4

Processing

&

Performance

Products

6

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

C4

Processing – Attractive Market Position

7

•

Products: Butadiene, Butene-1, Raffinates

•

Suppliers: Dow, Formosa, Nova, CP Chem,

Others (15 different ethylene plants)

•

Customers: Goodyear, Firestone, Lanxess,

Invista, Dow, Motiva, Valero, Others

•

Market leader with 35% of overall North American C4 processing capacity

•

Approximately 65% market share of non-integrated C4 processing

•

Contractually aligned with cost-advantaged ethylene producers

•

Profitability model: fixed margin and index-based contracts

•

Best-in-class logistical system and operational reliability

•

Bringing diverse C4 supplies together

•

Integral to ethylene value chain

Wells

Fargo

NGL

Summit

-

May

26,

2010

FY 07

FY 08

FY 09

LTM

3/10

Volume (MMlbs)

2,905

2,832

2,295

2,486

Gross Profit ($ MM)

(1)

$170

$177

$121

$197

Gross Profit (¢/lb)

5.9

6.2

5.3

8.0

(1) Includes insurance recovery proceeds |

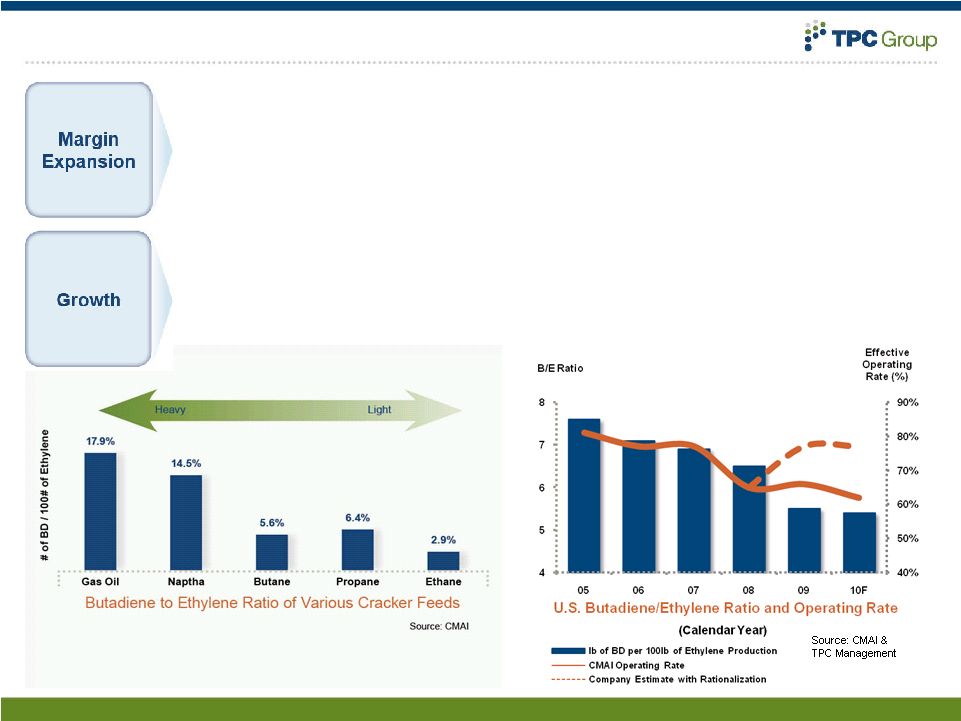

C4

Processing – Attractive Market Position

8

•

C4 markets remain tight, allowing margin increase opportunities

•

Raffinates

margin is a percentage of gasoline price

•

Service fees for use of our logistical network

•

Any industry movement toward heavier feeds increases mixed C4 volumes

•

Light cracking may lead integrated producers to outsource C4 handling

•

Butene-1 demand continues to increase faster than plastic demand

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

C4

Processing – Logistics, Credibility, Competency

9

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

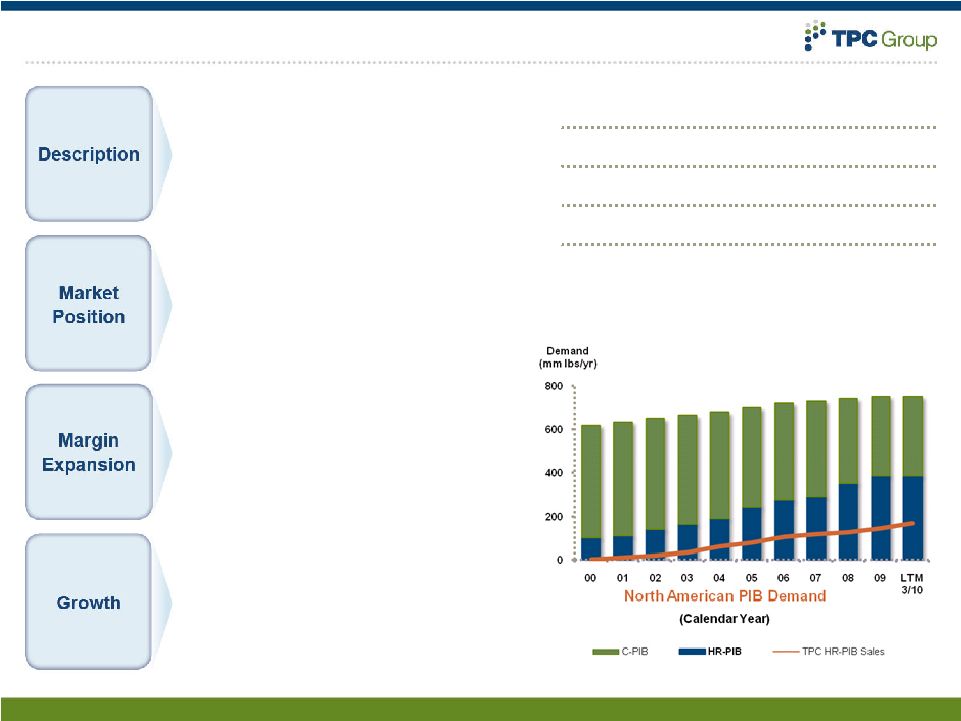

Performance Products –

Poised for Growth

10

•

Products: PIB, HPIB, DIB, Nonene, Tetramer

•

Suppliers: C4 Processing, LyondellBasell, BP, Others

•

Customers: Afton, SI Group, Lanxess, Others

•

Profitability model: index-based contracts

•

Only merchant producer of HR-PIB in North America

•

Patent protected technology (PIB)

•

Second largest merchant HPIB producer,

90+% market share of DIB market

•

Only dedicated Nonene

& Tetramer production

plant in North America

•

Merchant HPIB player exited market

•

Strong alternative value for Isobutylenes

•

Operating ramp-up & efficiency gains for

Nonene

plant

•

Second HR-PIB plant on-line in early 2009,

with market expanding

•

Increasing HPIB & Nonene

sales

•

Additional product lines from upgrading

by-products

Wells

Fargo

NGL

Summit

-

May

26,

2010

FY 07

FY 08

FY 09

LTM

3/10

Volume (MMlbs)

528

788

602

572

Gross Profit ($ MM)

$65

$80

$62

$58

Gross Profit (¢/lb)

(1)

12.4

10.7

11.1

11.3

(1) Does not contain propane volume |

Butane Dehydrogenation

World-scale Units

•

Two 12,500 BPD butane to butylene

Catofin

dehydrogenation units

•

Successfully operated for many years; idled in 2007

•

Operate on normal butane or isobutane

Tight Product Markets

•

Gasoline

components

–

MTBE,

ETBE

•

Petrochemicals

–

Butadiene,

Butene-1,

Isobutylene

Attractive Margins

•

Butane

feedstock

is

NGL

–

tracking

natural

gas

•

Butylene

based products track gasoline & crude oil

•

Light cracking creating shortage of all C4 olefins

Associated Equipment in Place

•

Butadiene extraction, butene-1 purification, & MTBE

production units

•

All necessary utilities & logistics network

11

Wells Fargo NGL Summit -

May 26, 2010 |

TPC

Business Model

12

Wells Fargo NGL Summit -

May 26, 2010

Component

Cost Basis

Product

Sale Basis

Butadiene

-

55%

Benchmark –

Processing Fee

Butadiene

Benchmark Posting

Butylenes

-

32%

Butene-1

Isobutylene

Butene-2

Gasoline

Butene-1

MTBE

HPIB

Raffinates

Gasoline + Fixed Factor

Market Based

Iso-butane

Gasoline

Butanes -

13%

Normal Butane

Raffinates

Gasoline

Isobutylene

Normal Butane

PIB

DIB

Iso-butane

Iso-butane

Propylene

Propylene

Nonene

Tetramer

Propylene + Fixed Factor

Propylene + Fixed Factor

All feedstocks

and products are purchased and sold at prices based on, and highly correlated to

prices for WTI, Unleaded Gasoline, and Normal Butane

C4 Processing

Performance

Products |

Financials –

Past Performance

Wells

Fargo

NGL

Summit

-

May

26,

2010

13

(1)

2007 CapEx

for Propylene Derivatives facility

(2)

2008 CapEx

for second HR-PIB plant

(3)

See Appendix for reconciliation

4-year

Average

Maintenance Cap Ex |

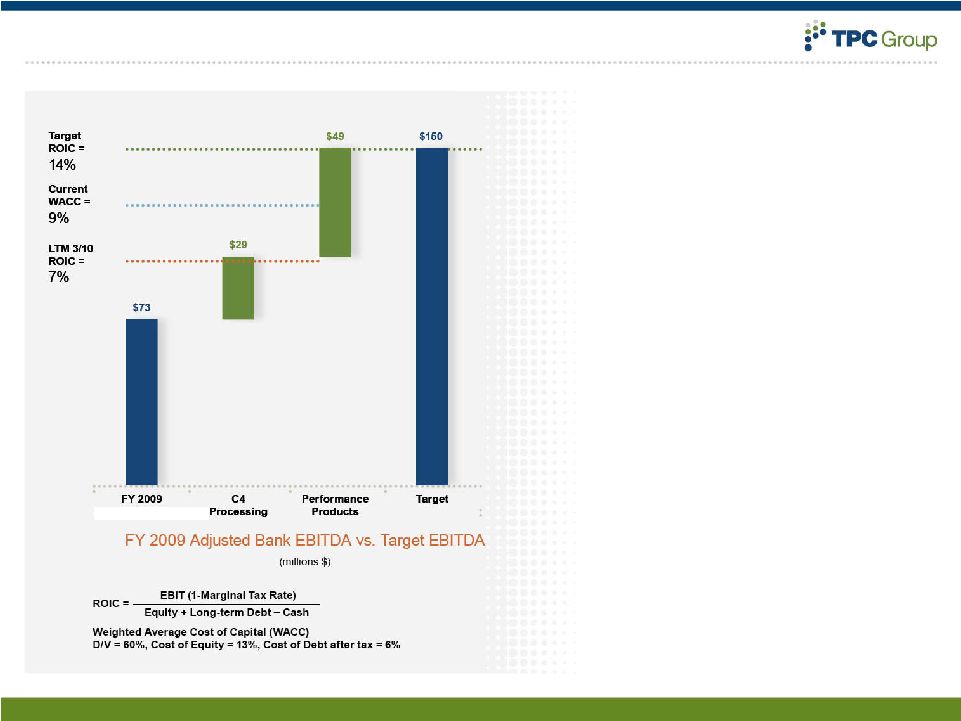

Financials –

Target

14

•

Target EBITDA levels allow the

company to earn in excess of WACC

•

C4 processing driven by margin

expansion from favorable market

conditions and reliable supply

•

Performance products driven by

volume and margin expansion

–

Recent capital investments

in Polyisobutylene and

Propylene Derivatives

Wells

Fargo

NGL

Summit

-

May

26,

2010

Adj. Basic EBITDA

(a)

(a) Please refer to slide 18 for a reconciliation of Adj. Basic EBITDA to Net

Income |

Significant & Stable Free Cash Flow

A Valuable, Unique and Stable Bridge

15

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

Why

TPC Group? Why Now? Differentiated Business Model

•

Service-based intermediary with strong infrastructure & logistics

network •

Long-standing, service-based contracts limit exposure to commodity

prices Substantial and Strategic Asset Value

•

TPC asset-based services are a critical component of the ethylene supply

chain •

High replacement value is strong barrier to entry

Attractive Market Position in Consolidated Industry

•

#1 position in BD, B-1, DIB and HR-PIB

•

Contractually

aligned

with

cost-advantaged

“light”

ethylene

producers

Positioned for Margin Expansion and Growth

•

Market dynamics allow for increased margins

•

Increased usage of highly reactive Polyisobutylene

•

Recent capital investment projects now complete

Significant and Stable Free Cash Flow

•

Minimal maintenance CapEx

& cost-efficient capital structure

•

Strong cash generation throughout cycle (average of $3.00/share over last four

years) •

Strong focus on operational excellence and cost management

TPCG Valuation Upside

•

Business model stabilizes unit margins

16

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

Investor Presentation –

May 2010

Appendix

17 |

Reconciliation of Adjusted Basic EBITDA to Net Income

18

Wells

Fargo

NGL

Summit

-

May

26,

2010

($ millions)

Fiscal year ended June 30,

LTM ended

2007

2008

2009

March 31, 2010

Adjusted Basic EBITDA

(a)

$ 88.8

$ 97.3

$ 72.6

$ 97.8

Reconciliation to Adjusted EBITDA as reported

Non-Core MTBE

(1)

(2.7)

6.2

-

-

BI Insurance / Hurricane, net

(2)

-

-

(37.0)

26.1

Freight payment recovery

(3)

-

-

4.7

-

Turnaround adjustments

(4)

-

-

-

(4.3)

Hypothetical net service-based fees

(5)

-

-

-

(19.6)

Adjusted EBITDA (as reported)

$ 86.1

$ 103.5

$ 40.3

$ 100.0

Reconciliation to Net Income (Loss)

Income taxes

(13.7)

(14.6)

11.7

(15.3)

Interest expense, net

(17.0)

(18.9)

(16.8)

(14.6)

Depreciation and amortization

(29.1)

(35.9)

(41.9)

(40.5)

Loss on sale of assets

-

(1.1)

-

Asset impairment

-

-

(6.0)

(6.0)

Non-cash stock-based compensation

(5.3)

(6.5)

(6.3)

(2.3)

Unrealized gain (loss) on derivatives

0.1

0.1

(3.7)

2.7

Net Income (Loss)

$ 21.2

$ 26.6

$ (22.8)

$ 24.0

(a)

Please refer to slides 20-21 contained in this Appendix for discussion of

notes Source: Company Data |

Reconciliation of Cash Flows

19

Adjusted

Basic

Cash

Flow

from

Operations

to

Net

Cash

Provided

by

Operating

Activities

Wells

Fargo

NGL

Summit

-

May

26,

2010

($ millions)

Fiscal year ended June 30,

LTM ended

2007

2008

2009

March 31, 2010

Adjusted

Basic

Cash

Flow

from

Operations

(a)

$ 79.0

$ 51.6

$ 82.5

$ 53.9

Reconciliation to Net Cash From Operating Activities as reported

Non-Core MTBE

(1)

17.9

6.2

-

-

Port Neches Acquisition

(3.3)

-

-

-

BI

Insurance

/

Hurricane,

net

(2)

-

-

(37.0)

26.1

Freight

payment

recovery

(3)

-

-

4.7

-

Turnaround

adjustments

(4)

-

-

-

(4.3)

Hypothetical

net

service-based

fees

(5)

-

-

-

(19.6)

Net cash provided by operating activities

$ 93.6

$ 57.8

$ 50.2

$ 56.1

(a)

Please refer to slides 20-21 contained in this Appendix for discussion of

notes Source: Company Data |

Notes to EBITDA and Cash Flow Reconciliations

Adjusted Basic EBITDA is included in this presentation to provide investors with a

view of the TPC Group’s financial performance as adjusted to exclude

certain items that might affect the comparability of results, and to

hypothetically reflect recent financial improvements in results for prior periods. Adjusted Basic EBITDA is

not reflective of actual results, and therefore should not be unduly relied upon.

Adjusted Basic EBITDA is not a measure computed in accordance with GAAP.

Accordingly it does not represent cash flow from operations, nor is it

intended to be presented herein as a substitute to operating income or net income as indicators of our

operating performance. The reconciliation provided above is to Adjusted EBITDA (as

reported), another non- GAAP measure. Adjusted EBITDA is reconciled to

net income, the most directly comparable GAAP financial measure,

on

slide

18.

Adjusted

Basic

EBITDA

is

not

calculated

in

accordance

with

the

definition

of

“Consolidated EBITDA”

in the credit facilities.

1.In the first quarter of fiscal 2008, TPC idled its Houston dehydrogenation units

and stopped production of MTBE from those units. Subsequent to the

dehydrogenation units being idled, MTBE has been produced only from

TPC’s C4 processing activities at significantly reduced volumes, and is

used either as a feedstock to the Performance

Products

segment

or

sold

opportunistically

into

overseas

markets.

From

third

quarter

of

fiscal

2008 forward, MTBE revenues and operating results are included in the C4 Processing

segment category for reporting purposes. The Non-core MTBE adjustments

reflect the exclusion from prior years of the now idled dehydrogenation

units. 2.Based on total net business insurance claim of $47.0 million,

comprised of (a) $19.5 million deductible, (b) $10.0 million cash recovery

received in June 2009 and (c) $17.5 million cash recovery received in

December 2010. Adjustment of $37.0 million in FY2009 period reflects total net

business insurance claim of $47.0 million less $10.0 million cash recovery

received in June 2009. Negative adjustment of $26.1 million in LTM period

ending 3/31/10 reflects $10.0 million cash recovery received in June 2009 plus $17.1 cash

recovery (net of fees) received in December 2010 less $1.0 million of

hurricane-related repairs completed during the period. This adjustment

has been made to enhance the comparability of operating results by excluding

items that are nonrecurring or for which the timing and/or amount cannot reasonably be estimated.

20

Wells

Fargo

NGL

Summit

-

May

26,

2010 |

Notes to EBITDA and Cash Flow Reconciliations

(continued) 21

Wells

Fargo

NGL

Summit

-

May

26,

2010

In 3

rd

Quarter Fiscal Year 2010, TPC’s

average monthly net service-based fees increased relative to

3.

Adjustment reflects recovery of $4.7 million from restitution of freight payments. This adjustment has

been made to enhance the comparability of operating results by excluding items that are

nonrecurring or for which the timing and/or amount cannot reasonably be estimated.

4.

Adjustment adds back $4.3 million of Adjusted EBITDA (or Adjusted Cash Flow from Operations)

estimated to have resulted from reduced contracted sales volumes and feedstock processing fees

due to a turnaround at our Houston facility in February 2010. This adjustment has been made to

illustrate what TPC’s operating performance might have been had the turnaround not been

undertaken; note, however, that turnarounds typically occur every three to four years at

TPC’s facilities, and their exclusion from this calculation is not intended to suggest

that they will not occur again in future periods. prior months in the LTM period, in order to hypothetically illustrate what TPC’s performance

would have been had these higher average fees actually been achieved throughout the period. The

adjustment by nine (for the nine months from and including April 2009 to December 2009), less (b) $12.7 million,

the actual amount of service-based fees for the April - December 2009 period (which was

already included in estimated Adjusted EBITDA). This adjustment has been made to illustrate the

effect of TPC’s recently improved service-based fees on Adjusted EBITDA in prior

periods, but it is not intended to suggest that these fees were achieved or could have been

achieved in prior periods, or will continue to be achieved in future periods. The adjustment is

for illustrative purposes only and is not reflective of actual results; accordingly, you are

cautioned not to place undue reliance upon it.

prior months.

This

adjustment

applies

the

higher

average

fees

from

3

rd

Quarter

Fiscal

Year

2010

to

5.

is

calculated

as

(a)

$32.3

million,

reflecting

the

actual

3

rd

Quarter

Fiscal

Year

2010 average multiplied |