Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - SPARE BACKUP, INC. | ex31-1.htm |

| EX-4.16 - SPARE BACKUP, INC. | ex4-16.htm |

| EX-4.18 - SPARE BACKUP, INC. | ex4-18.htm |

| EX-4.15 - SPARE BACKUP, INC. | ex4-15.htm |

| EX-32.1 - EXHIBIT 32.1 - SPARE BACKUP, INC. | ex32-1.htm |

| EX-4.17 - SPARE BACKUP, INC. | ex4-17.htm |

| EX-31.2 - EXHIBIT 31.2 - SPARE BACKUP, INC. | ex31-2.htm |

| EX-4.13 - SPARE BACKUP, INC. | ex4-13.htm |

| 10-Q - SPARE BACKUP, INC. | spbu_10q-033110.htm |

EXHIBIT 4.14

Memorandum No:

SPARE BACKUP INC.,

PRIVATE PLACEMENT MEMORANDUM

OFFERED TO ACCREDITED INVESTORS ONLY

| Minimum Offering: | 20,000 Units at $1.50 per Unit ($30,000) (1) |

| Maximum Offering: | 1,000,000 Units at $1.50 per Unit ($1,500,000) (2) |

| Minimum Investment: | 20,000 Units ($30,000) |

This Confidential Private Placement Memorandum and exhibits attached hereto (collectively, the “Memorandum”) describes the private offering (the “Offering”) by Spare Backup Inc., Inc., a Delaware corporation, (the “Company”) of a minimum of 20,000 and a maximum of 1,000,000 units of the Company’s securities (the “Units” or “Securities”) at a price of $1.50 per unit (the “Offering Price”) subject to a 15% overallotment provision. Each Unit shall consist of nine shares of the Company’s common stock (the “Common Stock” or the “Shares”) and nine warrants (“Investor Warrants”), each to purchase one share of the Company’s Common Stock exercisable for a period of two years at an exercise price of $0.20 (the “Warrant Shares”). The terms and conditions of the Shares and Investor Warrants are further described in the sections entitled “The Offering Summary” and “Description of Securities.” The Units are being offered to accredited investors only on a “best efforts” basis.

THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, (THE “ACT”) OR APPLICABLE STATE SECURITIES LAWS, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR ANY STATE REGULATORY AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY OF THIS MEMORANDUM OR ENDORSED THE MERITS OF THIS OFFERING AND REPRESENTATION TO THE CONTRARY IS UNLAWFUL. THE SECURITIES ARE OFFERED PURSUANT TO EXEMPTIONS FROM REGISTRATION UNDER THE ACT AND UNDER VARIOUS STATE SECURITIES LAWS AND CERTAIN RULES AND REGULATIONS PROMULGATED THERE UNDER. THE SECURITIES WILL BE OFFERED AND SOLD SOLELY TO “ACCREDITED INVESTORS” (AS THAT TERM IS DEFINED IN RULE 501(a) OF REGULATION D UNDER THE ACT).

THE SECURITIES ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE ACT AND APPLICABLE STATE SECURITIES LAWS, PURSUANT TO REGISTRATION OR EXEMPTION THERE FROM. AN INVESTMENT IN THE SECURITIES IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 6. INVESTORS MUST BE PREPARED TO BEAR THE ECONOMIC RISK OF THE INVESTMENT FOR AN INDEFINITE PERIOD AND BE ABLE TO WITHSTAND THE LOSS OF THEIR ENTIRE INVESTMENT.

|

Offering Price (3)

|

Managing Dealer/ “Finder’s Fees(4)

|

Proceeds to Company(5)

|

|

|

Per Unit

|

$1.50

|

$0.15

|

$1.35

|

|

Minimum Purchase (20,000 Units)

|

$30,000

|

$3,000

|

$27,000

|

|

Total Minimum

|

$30,000

|

$3,000

|

$27,000

|

|

Total Maximum

|

$1,500,000

|

$150,000

|

$1,350,000

|

|

See Footnotes - Next Page

|

1

Managing Dealer/Company

THE DATE OF THIS MEMORANDUM IS

May 7, 2009

(1) The Company may sell up to an additional 333,333 Units pursuant to overallotments.

(2) The Units will be offered on a minimum purchase basis of $30,000; however the Company will have the option to accept subscriptions for smaller amounts. Additional Units may be purchased in increments of $15,000 (10,000 Units).

(3) The Offering Price for the Units has been determined solely by negotiation between the Company and the Managing Dealer or “Finder”, and such price should not be considered to be an indication of the actual value of the Company.

(4) The Company will pay the Managing Dealer or “Finder” a retail sales commission of 8% and a due diligence allowance of 1% and a non-accountable expense allowance of 1%. The Managing Dealer or “Finder” will also receive (i) warrants to purchase the number of shares of Common Stock equal to 10% of the number of Shares sold by the Company and issuable at each closing (the “Placement Agent Warrants”); (ii) a cash commission of 5% of the total funds received by the Company upon any exercise of the Investor Warrants; and (iii) warrants to purchase the number of shares of Common Stock of the Company equal to 5% of the total number of shares of Common Stock issued by the Company upon exercise of Investor Warrants (the “Exercise Warrants”). The Placement Agent Warrants and the Exercise Warrants shall have an exercise price of $0.20 per Share and shall expire two years after the date of issuance. The Managing Dealer or “Finder” may allocate its Placement Agent Warrants and Exercise Warrants among the members of its selling group and its brokers in its sole discretion. See “Plan of Distribution.”

(5) Before deduction of other expenses of this Offering, including, but not limited to, legal fees, accounting fees, printing costs and other related expenses payable by the Company. See “Use of Proceeds.”

2

Table of Contents

|

INVESTOR INFORMATION

|

4

|

|

RESTRICTIONS ON TRANSFERABILITY

|

7

|

|

OVERVIEW OF THE COMPANY

|

8

|

|

THE OFFERING SUMMARY

|

17

|

|

RISK FACTORS

|

22

|

|

ESTIMATED USE OF PROCEEDS

|

35

|

|

CAPITALIZATION

|

36

|

|

DETERMINATION OF OFFERING PRICE

|

37

|

|

DESCRIPTION OF SECURITIES

|

38

|

|

PLAN OF DISTRIBUTION

|

42

|

|

INVESTOR SUITABILITY STANDARDS

|

43

|

|

EXHIBIT A

|

46

|

|

Confidential Private Offering memorandum and Subscription Agreement

|

54

|

|

Purchaser Questionnaire

|

62

|

|

EXHIBIT B

|

68

|

3

INVESTOR INFORMATION

THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. PLEASE READ THIS ENTIRE MEMORANDUM AND THE DOCUMENTS TO WHICH WE HAVE REFERRED YOU. THEY CONTAIN INFORMATION YOU SHOULD KNOW BEFORE PURCHASING ANY SECURITIES UNDER THIS OFFERING. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE COMPANY AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED, APPROVED OR DISAPPROVED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT PASSED UPON OR CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE SECURITIES ARE BEING OFFERED ONLY TO INDIVIDUALS AND BUSINESS ENTITIES THAT MEET CERTAIN QUALIFICATIONS. THE COMPANY RESERVES THE RIGHT TO REJECT ANY SUBSCRIPTION IN WHOLE OR IN PART IN ITS SOLE DISCRETION. SEE "PLAN OF DISTRIBUTION.”

THESE SECURITIES ARE BEING OFFERED SUBJECT TO ACCEPTANCE, PRIOR SALE, WITHDRAWAL, CANCELLATION OR MODIFICATION OF THE OFFER AT ANY TIME WITHOUT NOTICE.

THE INFORMATION CONTAINED IN THIS MEMORANDUM IS PROPRIETARY TO THE COMPANY AND IS BEING SUBMITTED TO PROSPECTIVE INVESTORS SOLELY FOR SUCH INVESTORS' USE WITH THE EXPRESS UNDERSTANDING THAT, WITHOUT PRIOR EXPRESS WRITTEN PERMISSION OF THE COMPANY, SUCH PERSONS WILL NOT RELEASE THIS DOCUMENT OR DISCUSS THE INFORMATION CONTAINED HEREIN OR MAKE REPRODUCTIONS OF OR USE THIS MEMORANDUM FOR ANY PURPOSE OTHER THAN EVALUATING A POTENTIAL INVESTMENT IN THE SECURITIES. ANY OFFEREE ACCEPTING DELIVERY OF THIS MEMORANDUM AGREES TO KEEP STRICTLY CONFIDENTIAL THE CONTENTS OF THIS MEMORANDUM AND SUCH OTHER MATERIAL AND TO RETURN THIS MEMORANDUM AND ALL RELATED DOCUMENTS TO THE COMPANY IF THE OFFEREE DOES NOT SUBSCRIBE TO PURCHASE ANY OF THE SECURITIES OFFERED, THE OFFEREE’S SUBSCRIPTION IS NOT ACCEPTED, OR THIS OFFERING IS TERMINATED OR WITHDRAWN.

OFFEREES ARE NOT TO CONSTRUE THE CONTENTS OF THE MEMORANDUM AS LEGAL, BUSINESS, INVESTMENT OR TAX ADVICE. EACH OFFEREE SHOULD CONSULT HIS OR HER OWN COUNSEL, ACCOUNTANT AND OTHER ADVISORS AS TO LEGAL, TAX, BUSINESS, OR INVESTMENT ADVICE AND RELATED MATTERS CONCERNING THE INVESTMENT DESCRIBED HEREIN AND IT’S SUITABILITY.

THIS MEMORANDUM INCLUDES CERTAIN STATEMENTS, ESTIMATES AND PROJECTIONS OF THE COMPANY WITH RESPECT TO THE ANTICIPATED FUTURE BUSINESS AND PERFORMANCE OF THE COMPANY. SUCH STATEMENTS,

4

ESTIMATES AND PROJECTIONS REFLECT VARIOUS ASSUMPTIONS OF MANAGEMENT, WHICH ASSUMPTIONS MAY OR MAY NOT PROVE TO BE CORRECT. CERTAIN INFORMATION PRESENTED IN THIS MEMORANDUM CONSTITUTES “FORWARD-LOOKING STATEMENTS” WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995, WHICH CAN BE IDENTIFIED BY THE USE OF FORWARD-LOOKING TERMINOLOGY SUCH AS “MAY,” “EXPECT,” “BELIEVE,” “ANTICIPATE,” “ESTIMATE,” “PLAN,” OR “CONTINUE,” OR THE NEGATIVE THEREOF OR OTHER VARIATIONS THEREON OR COMPARABLE TERMINOLOGY. SUCH FORWARD-LOOKING STATEMENTS REPRESENT THE SUBJECTIVE VIEWS OF THE MANAGEMENT OF THE COMPANY AND MANAGEMENT’S CURRENT ESTIMATES OF FUTURE PERFORMANCE ARE BASED ON ASSUMPTIONS WHICH MANAGEMENT BELIEVES ARE REASONABLE BUT WHICH MAY OR MAY NOT PROVE TO BE CORRECT. THERE CAN BE NO ASSURANCE THAT MANAGEMENT’S VIEWS ARE ACCURATE OR THAT MANAGEMENT’S ESTIMATES WILL BE REALIZED, AND NOTHING CONTAINED HEREIN IS OR SHOULD BE RELIED ON AS A PROMISE AS TO THE FUTURE PERFORMANCE OR CONDITION OF THE COMPANY. INDUSTRY EXPERTS MAY DISAGREE WITH THESE ASSUMPTIONS AND WITH MANAGEMENT’S VIEW OF THE MARKET AND THE PROSPECTS OF THE COMPANY.

PRIOR TO MAKING AN INVESTMENT DECISION RESPECTING THE SECURITIES OFFERED HEREBY, A PROSPECTIVE INVESTOR SHOULD CAREFULLY REVIEW AND CONSIDER THE CONTENTS OF THE ENTIRE MEMORANDUM AND THE DOCUMENTS TO WHICH WE HAVE REFERRED YOU. PROSPECTIVE INVESTORS ARE URGED TO MAKE ARRANGEMENTS WITH THE COMPANY TO INSPECT ANY DOCUMENT REFERRED TO IN THIS MEMORANDUM AND OTHER DATA RELATING TO THIS OFFERING. THE PRESIDENT OF THE COMPANY IS AVAILABLE TO DISCUSS WITH PROSPECTIVE INVESTORS ANY MATTER SET FORTH IN THIS MEMORANDUM OR ANY OTHER MATTER RELATING TO THE SECURITIES OFFERED HEREBY IN ORDER THAT PROSPECTIVE INVESTORS AND THEIR REPRESENTATIVES MAY HAVE AVAILABLE TO THEM ALL INFORMATION, FINANCIAL AND OTHERWISE, RELATING TO THIS INVESTMENT. THE COMPANY UNDERTAKES (1) TO MAKE AVAILABLE TO EVERY OFFEREE AND ITS REPRESENTATIVES, DURING THE COURSE OF THIS TRANSACTION AND PRIOR TO THE SALE, ANY REASONABLY AVAILABLE INFORMATION REQUESTED BY THEM REGARDING THE CORPORATION OR ITS MANAGEMENT, (2) TO GIVE EACH INVESTOR THE OPPORTUNITY TO ASK QUESTIONS OF AND RECEIVE ANSWERS FROM THE COMPANY CONCERNING ALL TERMS AND CONDITIONS OF THIS OFFERING, AND (3) TO OBTAIN ANY ADDITIONAL INFORMATION NECESSARY TO VERIFY THE ACCURACY OF INFORMATION MADE AVAILABLE HEREIN.

NO PERSON HAS BEEN AUTHORIZED IN CONNECTION WITH THIS OFFERING TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS MEMORANDUM, EXCEPT AS IS MADE AVAILABLE BY THE COMPANY PURSUANT TO THE ABOVE UNDERTAKINGS. THE COMPANY’S ADVERTISEMENTS AND WEBSITE ARE NOT PART OF THE MEMORANDUM. NO OFFERING LITERATURE OR ADVERTISING IN ANY FORM IS AUTHORIZED FOR USE IN CONNECTION WITH THIS OFFERING EXCEPT FOR THIS MEMORANDUM, THE EXHIBITS ATTACHED HERETO, AND ANY AMENDMENTS HERETO. ONLY THOSE REPRESENTATIONS SET FORTH IN THIS MEMORANDUM MAY BE RELIED UPON IN CONNECTION WITH THIS OFFERING.

EXCEPT AS OTHERWISE INDICATED, THIS MEMORANDUM SPEAKS AS OF THE DATE HEREOF. NEITHER THE DELIVERY OF THIS MEMORANDUM NOR ANY SALE MADE HEREUNDER SHALL, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY AFTER THE DATE HEREOF.

THIS MEMORANDUM DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES IN ANY STATE OR OTHER JURISDICTION OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION.

5

RESTRICTIONS ON TRANSFERABILITY

The Securities being sold in this Offering are subject to restrictions on transfer and resale. Investors are cautioned that the Securities offered hereby are “restricted,” as that term is defined by Rule 144 of the Act, and have substantial restrictions upon their sale or transferability. By purchasing any Securities, investors represent and agree to all of those restrictions. Investors may have to bear the financial risk of investing in the Securities for an indefinite period of time and must be able to bear the loss of their entire investment.

All Securities to be issued in connection with the Offering shall bear a legend substantially as follows:

| “THE SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT BE SOLD, TRANSFERRED, ASSIGNED OR HYPOTHECATED UNLESS THERE IS AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH ACT COVERING SUCH SECURITIES, THE SALE IS MADE IN ACCORDANCE WITH RULE 144 UNDER SUCH ACT OR THE ISSUER RECEIVES AN OPINION OF COUNSEL FOR THE HOLDER OF THESE SECURITIES REASONABLY SATISFACTORY TO THE ISSUER, STATING THAT SUCH SALE, TRANSFER, ASSIGNMENT OR HYPOTHECATION IS EXEMPT FROM THE REGISTRATION AND PROSPECTUS DELIVER REQUIREMENTS OF SUCH ACT.” |

By accepting this Memorandum, investors agree that they will keep permanently confidential all of the information contained herein and will use this information only for the purpose of evaluating an investment in the Securities. In the event investors elect not to purchase Securities or their purchase is rejected, investors agree to immediately return this Memorandum and all related documents to the Company.

We reserve the right to withdraw this Offering at any time and reserve the right to reject any commitment to subscribe for the Securities, in whole or in part, to allot to investors less than the full amount of Securities subscribed for by them, or to sell less than the full amount of Securities offered in this Memorandum. This Offering is specifically made subject to the terms described in this Memorandum. This Memorandum is personal to the offeree, has been prepared solely for use in connection with this Offering and does not constitute an offer to any other person or to the public generally to subscribe for or otherwise acquire the Securities.

6

OVERVIEW OF THE COMPANY

The following is a selective summary of certain information contained in this Memorandum and is qualified in its entirety by the more detailed information appearing elsewhere in this Memorandum and the exhibits attached hereto. In this Memorandum, the terms “Company,” “we,” “us,” and “our” refer to Spare Backup Inc., Inc. The Company files periodic and current reports, proxy statements and other information with the Securities and Exchange Commission. These filings are incorporated into this Memorandum by this reference and should be carefully reviewed in conjunction with this Memorandum.

Overview

We were incorporated in Delaware on December 27, 1999 under the name First Philadelphia Capital Corp. to serve as a vehicle to effect a merger, exchange of common stock, asset acquisition or other business combination with domestic or foreign private business. On October 30, 2000, we completed a business combination with Conservation Anglers Manufacturing, Inc., a real estate holding and development company that was originally organized in Florida on February 7, 2000. The combination was a stock-for-stock merger that was accounted for as a "pooling-of-interests." In connection with the merger, we issued 235,000 shares of our Common Stock in exchange for all the outstanding stock of Conservation Anglers Manufacturing, Inc. In January 2001 we changed our name to Newport International Group Inc. In June of 2006 we changed our name to Spare Backup Inc., to better reflect and describe our then current strategic direction.

Operational Focus

We are a developer and marketer of a line of software products specifically designed for the small business, home business users and consumers. Our products are designed and developed so that technical competence is not necessary to use or manage the software. Our Spare line of software products includes our Spare Backup software and our Spare Switch file transfer software.

Our flagship product is Spare Backup, a fully automated backup solution designed and developed especially for the small office or home environment. Once installed, our product automatically and efficiently backs up all selected data on the laptop or desktop computer. As a result, we believe consumers and small companies can ensure that all files protected by our service will be available in the event they experience data loss. All files that have been backed up are immediately available for retrieval. We launched Spare Backup product version 1.0 in March 2005 and are currently offering version 5.0 of the product to all new customers. Our Spare Switch software enables users to complete the transfer of selected files from one PC to another via a high speed Internet connection. Our software has unique characteristics which enable us to leverage a scalable infrastructure and embedded support elements which we believe provides us with a competitive advantage over other service providers whose products require large investments in Hardware, as well as professional installation, training and support.

7

Spare Backup offers:

|

|

·

|

An automatic installation process that requires absolutely no user interaction

|

|

|

·

|

Simple file selection - Spare Backup scans the user's computer and has a number of pre selected file types and locations (Presets) which it backs up automatically, such as:

|

|

|

·

|

All contacts, email messages and attachments, address book, contacts, folders and contents, signature files from Microsoft Outlook

|

|

|

·

|

Microsoft Word, Microsoft Excel, Microsoft PowerPoint files, templates and settings from Microsoft Office

|

|

|

·

|

My Documents, My Music, My Pictures, Quicken, QuickBooks, Microsoft Money, Turbo Tax and Tax Cut

|

|

|

·

|

All desktop files and folders

|

|

|

·

|

The ability to manually include any files that are not within a present group

|

|

|

·

|

Simple, fast data recovery of individual files or the complete computer

|

|

|

·

|

Open file backup, giving the user the ability to back up while the file is still in use

|

|

|

·

|

Embedded reports which are automatically updated and available to users within the in Spare Backup client software

|

|

|

·

|

File revisions – Spare Backup provides the ability to select and restore from the last five revisions of a file included within the backup

|

|

|

·

|

Provides files security via file encryption using 256 Rijndael AES 256 block cipher with unique user encryption key “Spare Key”

|

|

|

·

|

Online file retrieval from an Internet connection anywhere in the world – Recovery is only possible when using your “Spare Key”

|

|

|

·

|

A secure decryption process. Our “Spare Key” management protects the process. The user is protected and able to recover all files that have been backed up in the event of a total system failure or loss of the computer

|

|

|

·

|

Secure Online transactions. Our web site displays the VeriSign/Starfield Technology high assurance certificates, which provide authenticity for all web-based transactions.

|

8

An overview of customer benefits includes:

Ease-of-use - Spare Backup provides fast, easy and fully automated data protection. Users benefit from automated data file selection, which distinguishes user data files from operating system and application files. As a result, users do not have to remember where all of their data files are stored. Spare Backup allows users to quickly and easily retrieve either a single file or multiple past versions of a file, not just the most recently backed-up version.

Impenetrable Security and Protection of Corporate Data - Spare Backup ensures that all data is encrypted with advanced 256-bit encryption on the user's machine using a user provided "key" or password. The encryption we use for ensuring privacy is the 256 Rijndael AES, a block cypher adopted as an encryption standard by the U.S. Government. The data is protected in transit and communication via Secure Sockets Layer (SSL), a cryptographic protocol that provides secure communications over the public Internet.

SSL Support - SSL based protocol enhancements to address security parameters during: registration, upgrade, backup and retrieve. The data is encrypted a second time using SSL, or secure sockets layer, while it is being transmitted and a third time before it is stored on the RAID, or redundant array of independent disc, servers using a strong private key.

Spare Backup software comes with the both a monthly and annual service option and enables users to also back up to local storage devices with or without using the online service.

Our service offers vary depending on partnerships, in some cases, we offer new users a free 14-day trial, and other’s could be an allocation of space of 1 gigabyte. Spare Backup services cost $6.99 per month for up to 50 gigabytes of data storage bought directly from the Company, along with annual plans that are available.

Spare Switch® enables users to complete the transfer of personal files from an old personal computer (PC) to a new one via a high speed Internet connection. Spare Switch locates packs and transfers files securely without the need for transfer cables or other accessories. Spare Switch, designed for both individual and business use, ensures that not only the files transfer easily, but that they will look, feel and work on the new computer in the same manner with all the personal settings and layouts built into them. We launched Spare Switch in August 2005.

9

Spare Switch is used by either downloading the software from the Internet or by inserting an installation CD into the old computer. Spare Switch then scans the hard drive and inventories of personal directories, giving the user a detailed report of the documents and other files. From that inventory, the user can then select the exact files that he or she wishes to transfer to the new PC. Spare Switch avoids the need for PC-to-PC transfer cable by compacting, encrypting and the transferring the files via the Internet. Spare Switch's data center can then hold the data for as long as a week, giving the user the flexibility to choose when to download the files to the new PC. The files are downloaded from our secure Spare Switch data center using the Spare Switch CD. Spare Switch uses a 256-bit encryption cipher with non-algorithmic key to ensure that the information is impervious to hackers at every step of the process.

We develop new products, and integrated new feature functionality into our Spare Backup® software. The new offerings in our Spare line of software products include: Spare Room, Spare Mobile and Spare Sync. Below provide certain information regarding our new line of products and features:

Spare Room® is designed to complement the Spare Backup® software. We are currently in the development and anticipate launching this product in the second quarter of fiscal year 2009. This is a first step to digital content management and cloud computing for Spare Backup users. This feature will be distributed and available to our active Spare backup users by downloading and installing the software which will be obtainable from our website.

The Spare Backup software easily and automatically backs up a user’s files from the user’s desktop to the Spare Backup’s cloud. Once files are stored securely in the cloud, the Spare Room application allows a user to take advantage of a wide range of sharing and social networking tools. The solution allows the user to get the most out of available tools and services on the Internet while providing the security of online backup. Spare Backup is the start, cloud computing and services are the goal.

The first version of the Spare Room application will include the Photo Page where users can manage and share photos as well as photo processing and retouching. Future versions of Spare Room will include additional features beyond photo sharing to include Video, Contact Management, Synchronization, Mobile, and Calendar management. These features will be displayed on the Spare Room Dashboard allowing a user to easily navigate Spare Room and manage their digital data stored in the Spare cloud from a variety of devices.

10

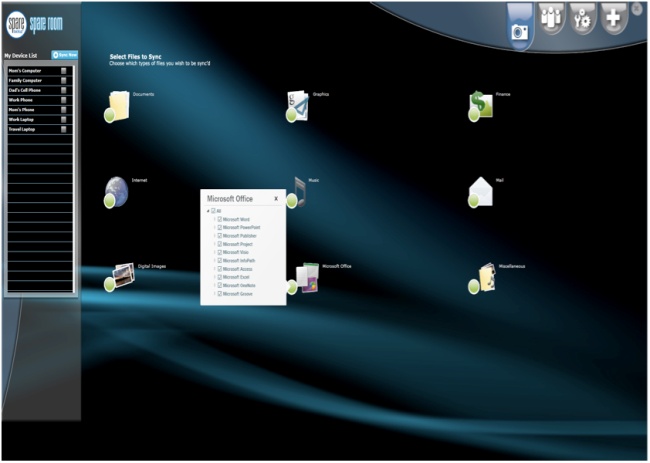

Spare Room® User Interface

Spare Mobile® was launched in the beginning of second quarter of fiscal 2009 in a limited beta form with a full version expected to launch in the second quarter of fiscal year 2009. For the initial phase of Spare Mobile, a user must first have an active Spare Backup account and have access to Spare Room®. The installation will be readily available to anyone from the Spare room and or the Spare Mobile® website. We are currently in the development stage for the last six months on this version along with Spare Room.

Spare Mobile will provide a user with the ability to backup data and settings from their phone to the Spare cloud without the need to connect the mobile device to a PC via a cable.

|

|

·

|

Backup will be performed via the users mobile network.

|

|

|

o

|

Mobile network usage charges may apply.

|

|

|

·

|

Backup will capture data stored both on the Mobile devices onboard memory as well as any add on memory devices such as a memory card.

|

|

|

·

|

Backup will capture all pertinent user data and configuration if feasible

|

|

|

·

|

A user will have the ability to configure the frequency that backups occur

|

|

|

·

|

The Spare Mobile software will detect files that should be backed up automatically

|

|

|

·

|

Users will have the ability to customize which files will be backed up.

|

|

|

·

|

A user will have the ability to recover a backed up file(s) to their mobile device

|

11

If a user also has a Spare Backup account, the user will have the ability to retrieve mobile files to their desktop PC.

Spare Mobile® User Interface

12

|

|

·

|

Spare Mobile will support the following Mobile device operating systems:

|

|

|

o

|

Windows Mobile

|

|

|

o

|

Java

|

|

|

o

|

RIM

|

|

|

o

|

Apples iPhone

|

|

|

o

|

Carry specific OS platforms

|

|

***NOTE: Due to differences in OS functionality the Spare Mobile application may differ slightly in appearance between each supported OS. The functionality however shall remain static

|

Spare Mobile will work in conjunction with a users Spare Backup and Spare Room account. Spare Room will provide an interface for a user to manage their mobile device and the files contained on their mobile device.

Spare Sync®. was developed in order to take advantage of the synchronization functionality, the user must first possess an active Spare Backup account with Spare Room. Synchronization will be an add-on product to a users standard Family Pack account. We are currently in the development stage for the last six months on this feature along with Spare Room and the Spare family of products. Spare Sync is defined as the mirroring or synchronization of content across multiple machines. Spare Backup defines synchronization rules based on file types. A user who chooses to synchronize pictures will synchronize all pictures that exist on two machines. Photos on both machines will be replicated between the two machines so that when the synchronization process is complete the same files will exist on both machines.

The user will configure their Synchronization preferences from within Spare Room. Each machine that is to be synchronized must have the Spare Backup client software installed and have an active connection to the Internet.

13

The user will not need to make any configuration changes to their existing Spare Backup client. However the client software will provide the user a link to Spare Room from the client software. If the user chooses this link from within the Spare Backup client software the user will be re-directed to the Spare Room website and automatically logged in.

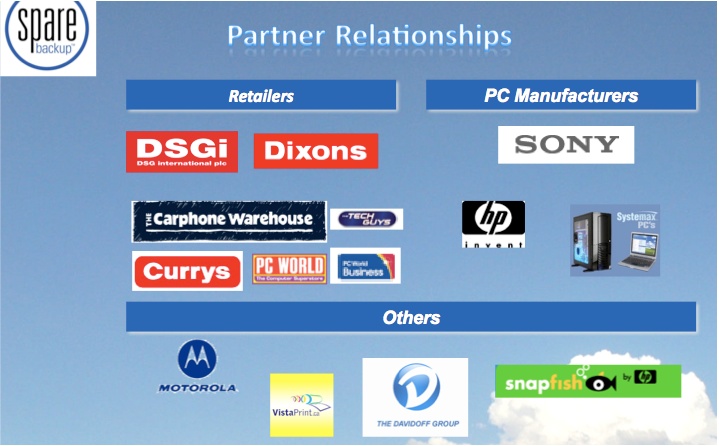

Our Partners

14

Our partner list includes:

|

·

|

DSGi

|

|

o

|

PC World

|

|

o

|

Currys

|

|

o

|

Dixions

|

|

o

|

The Tech Guys

|

|

·

|

The Car Phone Warehouse / Best Buy Europe

|

|

·

|

Hewlett Packard

|

|

·

|

Sony (Viao North America)

|

15

DSGi – European Distribution Partner

Current Programs

|

|

·

|

In store The Tech Guys Branded 1 year Subscription of Online Backup

|

|

|

·

|

Inclusion within PCW product warranty - PC Performance Package UK

|

|

|

·

|

Online distribution through The Tech Guys (TTG’s) websites

|

16

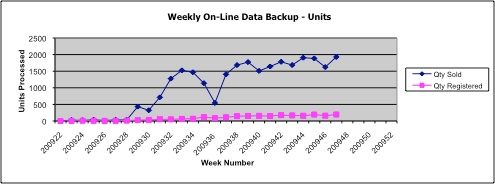

The following graph represents the current sales volumes from the 1 Yr in store program within the 100+ PC World stores within the UK. Further distribution of the product began April 1st within 500+ Currys locations within the UK.

* Product is sold for 29.99 (GBP)

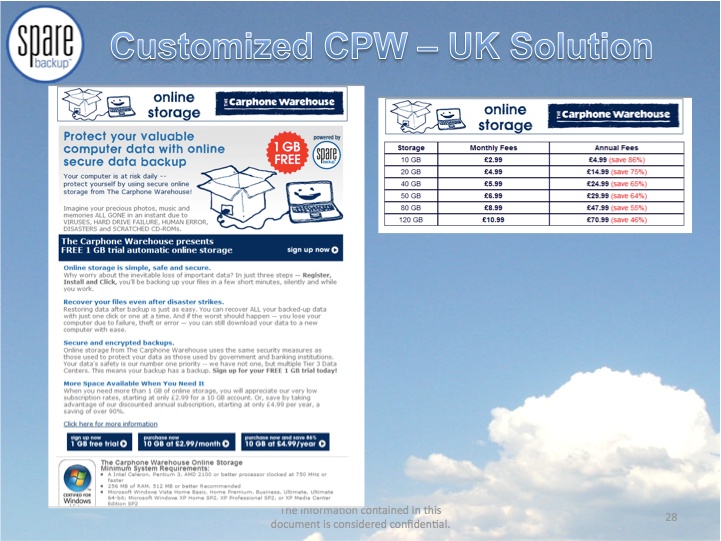

Car Phone Warehouse

Current Programs

|

|

·

|

Co – Branded solution

|

|

|

·

|

Included as an icon on the desktop within all laptops sold by Car Phone Warehouse.

|

17

Sony

|

|

·

|

Private Label branding on Viao Computers– My Memory Center

|

|

|

·

|

Corporate Sony with Enterprise solution

|

|

|

·

|

Data migration and Backup offered as a part of the Out Of Box Experience (OOBE)

|

18

19

OFFERING SUMMARY

|

Title of Security:

|

Spare Backup Inc., Inc. Common Stock and warrants to purchase Common Stock

|

|

Type of Security:

|

Units of the Company’s securities (the “Units”), each Unit consisting of (9)nine shares of the Company’s Common Stock (the “Shares”) and (9)nine, two-year warrants, each to purchase one share of the Company’s Common Stock exercisable at $0.20 per share (the “Investor Warrants”).

|

|

Issue Price:

|

$1.50 per Unit.

|

|

Minimum Subscription:

|

20,000 Units for $30,000

|

|

Investors:

|

Accredited Investors only as that term is defined in Rule 501(a) under the Securities Act of 1933, as amended (collectively the “Investors” or individually an “Investor”).

|

|

Use of Proceeds:

|

Payment of Debt, Taxes, General corporate purposes, infrastructure, marketing, staff, business development, and general working capital.

|

|

Aggregate Amount:

|

A minimum of $30,000 (the “Minimum Offering”) and a maximum of $1,500,000 (the “Maximum Offering”). In the event this Offering is fully subscribed, the Managing Dealer or Company has the right to increase the Maximum Offering to $500,000.

|

|

Shares Outstanding:

|

Prior to this Offering, there are 108,033,262 shares of Common Stock outstanding as of March 24, 2009 and 50,000 shares of newly created Series A Preferred stock.

|

|

Investor Warrants:

|

Included in each Unit are nine (9) two-year warrants, each to

purchase one share of Common Stock (“Warrant Shares”) exercisable at $0.20 per share and callable by the Company the first date after the 10 trading day average price of the Common Stock exceeds $0.50 per share (the “Investor Warrants”).

|

|

Rule 144 Rights:

|

Within 6 months and 5 days of the Final Closing, the Company shall provide an opinion letter (the “Opinion Letter”) covering the public sale of Covered Securities (defined below), and the Company will cause such shares to be Covered under the blanket opinion letter provided by the company authorizing the transfer agent to remove restrictive legends for all securities holders within 5 days of the 6 month anniversary of the final closing of the offering pursuant to the Securities Act of 1933 (the “Act”) and continue to keep the blanket opinion effective for a period of one year. For every business day that the Company is late in providing the blanket opinion letter beyond the 5 days and continuing for up to 100 business days, the Company will issue to the Investors on a pro rata basis additional shares of Common Stock in whole share increments equal to 1% of the Shares purchased in this Offering. “Covered Securities” will include the Shares, the Warrant Shares, the Placement Agent Warrant Shares (as defined below) and the Exercise Warrant Shares (as defined below). The Company shall bear the expenses (exclusive of underwriting discounts and commissions), including the reasonable fees and expenses of one counsel for the holders of Covered Securities not to exceed $30,000.

|

20

|

Managing Dealer or “Finders” Compensation:

|

|

|

Commissions:

|

The Company shall provide The Managing Dealer or “Finder” a retail sales commission of 8% of the total funds received by the Company at each closing and a due diligence fee of 1% and a non-accountable expense allowance of 1% of the total funds received by the Company at each closing. The Company shall also provide the Managing Dealer or “Finder” a cash commission of 5% of the total funds received by the Company upon exercise of the Investor Warrants. The Managing Dealer or “Finder” may allocate its cash commission among the members of the selling group and its brokers in its sole discretion.

|

|

Warrants:

|

The Company shall provide The Managing Dealer or “Finder” with 10% warrant coverage (the “Placement Agent Warrants”) based on the total number of Shares sold by the Company at each closing. The Company shall also provide The Managing Dealer or “Finder” with 5% warrant coverage (the “Exercise Warrants”) based on the total number of Shares issued by the Company. Upon exercise of the Investor Warrants. The Managing Dealer or “Finder” may allocate its Placement Agent Warrants and Exercise Warrants among the members of the selling group and its brokers in its discretion. The Placement Agent Warrants and Exercise Warrants shall have an exercise price of $0.20 per share and shall expire no less than two years after the date of issuance. The Placement Agent Warrants and Exercise Warrants may be assigned at the Managing Dealer or ““Finder””’s discretion.

|

RISK FACTORS

A purchase of the Units involves various risks, including, but not limited to, the risks set forth below. Prospective Investors should consider these risk factors in addition to the other information contained in this Memorandum and the exhibits attached hereto or incorporated by reference in this Memorandum and consult with their personal tax and investment advisors before making a decision to purchase the Units.

21

Risks Related to the Company

An investment in our common stock involves a significant degree of risk. You should not invest in our common stock unless you can afford to lose your entire investment. You should consider carefully the following risk factors and other information in this annual report before deciding to invest in our common stock. If any of the following risks and uncertainties develops into actual events, our business, financial condition or results of operations could be materially adversely affected and you could lose your entire investment in our company.

WE HAVE A HISTORY OF LOSSES AND AN ACCUMULATED DEFICIT. WE ANTICIPATE CONTINUING LOSSES MAY RESULT IN SIGNIFICANT LIQUIDITY AND CASH FLOW PROBLEMS. THE REPORT ON OUR FINANCIAL STATEMENTS FOR FISCAL 2008 CONTAINS AN EXPLANATORY PARAGRAPH REGARDING OUR ABILITY TO CONTINUE AS A GOING CONCERN.

Our net losses for the fiscal years ended December 31, 2008 and 2007 were $15,132,558 and $26,084,897, respectively. We have never generated sufficient revenues to fund our ongoing operations. Our operating losses for fiscal 2008 and fiscal 2007 were $10,625,232 and $18,765,117, respectively, and these losses are primarily attributable to our sales, general and administrative expense. The report of our independent registered public accounting firm on our financial statements for the year ended December 31, 2008 contains an explanatory paragraph regarding our ability to continue as a going concern based upon our net losses, cash used in operations and working capital deficit. Our ability to continue as a going concern is dependent upon our ability to raise additional capital as described below. The financial statements included in this annual report do not include any adjustments to reflect future adverse effects on the recoverability and classification of assets or amounts and classification of liabilities that may result if we are not able to continue as a going concern.

OUR REVENUES ARE NOT SUFFICIENT TO FUND OUR OPERATING EXPENSES AND WE WILL NEED TO RAISE ADDITIONAL CAPITAL.

While our operating expenses have decreased approximately 40% for fiscal 2008 over fiscal 2007, we will need to significantly increase our revenues to fund these costs. At December 31, 2008 we had approximately $19,000 of cash on hand and a working capital deficit of approximately $6.86 million. We have raised subsequent to December 31, 2008, approximately $50,000 from the sale of our common stock, and borrowed an aggregate of $803,000 under an 18-month note. The proceeds are being used for working capital purposes. However, our current working capital is not sufficient to pay our operating expenses, our obligations as they become due or certain tax liabilities nor is our working capital sufficient to fund any expansion of our company.

22

While we are constantly evaluating our cash needs and existing burn rate in order to make appropriate adjustments in operating expenses, we need to raise additional debt or equity capital to provide funding for ongoing and future operations and to satisfy our obligations as they become due. While we have historically been able to raise capital, the current capital markets are very challenging and there are no assurances that we will be successful in obtaining additional capital, or that such capital will be available on terms acceptable to us. Our continued existence is dependent upon, among other things, our ability to raise capital and to market and sell our products successfully. If we are unable to raise capital as needed, it is possible that we would be required to cease operations in which event you would lose your entire investment in our company.

WE CANNOT PREDICT OUR FUTURE REVENUES OR WHETHER OUR PRODUCTS WILL BE ACCEPTED. IF THE MARKETS FOR OUR PRODUCTS AND SERVICES DO NOT DEVELOP, OUR FUTURE RESULTS OF OPERATIONS WILL BE ADVERSELY AFFECTED.

Net revenues from the sales of our Spare Backup line of products have been limited and insufficient to fund our ongoing operations. We reported net revenues of $1,381,443 and $260,350, respectively, for the fiscal years ended December 31, 2008 and 2007. While our net revenues significantly increased for fiscal 2008 over fiscal 2007, our net revenues will need to significantly increase if we are to provide cash to fund our operating expenses. We cannot guarantee either that the demand for our Spare Backup line of software products will develop, that such demand will be sustainable or that we will ever effectively compete in our market segment. In addition, we cannot predict what impact, if any; the reduction in discretionary spending will have on future sales of our products. If we are unable to generate any significant net revenues from our products and services our business, operating results, and financial condition in future periods will be materially and adversely affected and we may not be able to continue our business as presently operated, if at all.

WE HAVE APPROXIMATELY $170,000 OF DEBT WHICH IS PRESENTLY PAST DUE AND AN ADDITIONAL $3,121,000 WHICH BECOME DUE DURING 2009 AND WE DO NOT HAVE THE FUNDS NECESSARY TO PAY THESE OBLIGATIONS.

In addition to funding our operating expenses, we need capital to pay various debt obligations totaling approximately $3,291,000 which are either current past due or which are due in the current fiscal year. Currently, there are $170,000 principal amount of the 10% notes which have already become due in September 2008, $436,000 principal amount of the 10% notes which due dates have been extended between August 2009 and September 2009, the remaining $185,000 of the 10% notes and $2,500,000 of the 8% notes of short term debts becomes due between February 2009 to August 2009. The Company has not redeemed the required monthly redemption beginning in September 2008 in connection with the 10% Convertible Senior Unsecured promissory notes amounting to $195,000. Additionally, there are $560,000 principal amount of the 8% long-term notes which becomes due between February 2010 and July 2010. Under the terms of various of the short-term notes in the aggregate principal amount of $2,500,000, we have the right to force a conversion of those obligations into equity providing that we have registered the shares of common stock issuable upon such conversions prior to the maturity dates of the notes. We have not filed the requisite registration statement and unless we are successful in extending the maturity dates of these obligations it is not likely we will be able to avail our company of this opportunity before the notes become due. The existence of these obligations provide additional challenges to us in our efforts to raise capital to fund our operations. If we are unable to restructure these notes and we are unable to raise the capital necessary to satisfy the obligations, it is possible we will be forced to cease operations.

23

WE WILL NEED ADDITIONAL FINANCING WHICH WE MAY NOT BE ABLE TO OBTAIN ON ACCEPTABLE TERMS. IF WE ARE UNABLE TO RAISE ADDITIONAL CAPITAL AS NEEDED, OUR CONTINUED OPERATIONS WILL BE ADVERSELY AFFECTED AND THE FUTURE GROWTH OF OUR BUSINESS AND OPERATIONS WILL BE SEVERELY LIMITED.

Historically, our operations have been financed primarily through the issuance of equity and debt. Because we have a history of losses and have never generated sufficient revenue to fund our ongoing operations, we are dependent on our continued ability to raise working capital through the issuance of equity or debt to fund our present operations. Because our operating expenses have continued to grow and we do not know if our net revenues will grow at a pace sufficient to fund our current operations, the continuation of our operations and any future growth will depend upon our ability to raise additional capital, possibly through the issuance of long-term or short-term indebtedness or the issuance of our equity securities in private or public transactions. While the actual amount of our future capital requirements, however, depend on a number of factors, including our ability to grow our net revenues and manage our business, it is likely we will need to raise a significant amount of capital during fiscal 2009 if we are to continue our current operations and satisfy our obligations as they become due. In addition to the challenges facing the capital markets today which make raising equity capital much more difficult for a company such as our than in prior years, the existence of a number of short term notes which are either currently past due or which will become due in 2009, together with the pending litigation facing our company and the piggy-back registration rights we have granted a number of investors serve to also make it harder to raise the capital we need. There can be no assurance that acceptable financing can be obtained on suitable terms, if at all. If we are unable to raise additional working capital as needed, our ability to continue our current business will be adversely affected and may be forced to curtail some or all of our operations.

WE ARE DEPENDENT ON OUR RELATIONSHIP WITH DSG INTERNATIONAL FOR A MAJORITY OF OUR REVENUES.

During 2008 approximately 77% of our net revenues were derived by sales through our relationship with DSG International. While we are materially dependent upon the continued effort of that company to sell our products, we have no control direct control over the efforts of its sales force on our behalf. A reduction in the revenues generated through our relationship with DSG International until such time as we broaden our distribution base to remove this dependence, assuming we are successful in those efforts, will materially adversely affect our results of operations in future periods.

24

WE ARE PAST DUE IN THE PAYMENT OF PAYROLL TAXES.

At December 31, 2008 we had $665,000 of accrued but unpaid payroll taxes due the federal government and since that date through March 15, 2009 the amount has increased to $903,000. We do not have the funds necessary to satisfy this obligation. If we are unable to raise the funds necessary, it is possible that we will be subject to significant additional fines and penalties, Mr. Perle, our President, could be personally subject to a 100% penalty on the amount of unpaid taxes and the government could file liens against our company and our bank accounts until such time as the amounts have been paid.

OUR PRICING MODEL FOR OUR PRODUCTS AND SERVICES IS UNPROVEN AND MAY BE LESS THAN ANTICIPATED, WHICH MAY HARM OUR GROSS MARGINS.

The pricing model of our products and services may be lower than expected as a result of competitive pricing pressures, promotional programs and customers who negotiate price reductions in exchange for longer term purchase commitments or otherwise. Our pricing model depends on the duration of the agreement, the specific requirements of the order, purchase volumes, the sales and service support and other contractual agreements. We expect to experience pricing pressure and anticipate that the average selling prices and gross margins for our products may decrease over product life cycles. We may not be successful in developing and introducing on a timely basis new products with enhanced features and services that can be sold at higher gross margins.

WE ARE A DEFENDANT IN A NUMBER OF LAWSUITS.

We are currently a defendant in five separate lawsuits in which the plaintiffs are seeking approximately $900,000 together with attorney’s fees, costs and prejudgment interest. We are also incurring additional legal fees in our efforts to defend these actions. While we believe our defenses are meritorious in each of these cases, should we not prevail in one or more of the actions we could be forced to pay significant amounts which, given our current cash position and need for working capital, could materially adversely affect our ability to continue as a going concern.

25

THE EXERCISE OF OUTSTANDING WARRANTS AND THE CONVERSION OF OUTSTANDING NOTES WILL BE DILUTIVE TO OUR EXISTING STOCKHOLDERS.

As of March 25, 2009 the following securities which are convertible or exercisable into shares of our common stock were outstanding:

|

|

·

|

common stock purchase warrants to purchase a total of 46,466,879 shares of our common stock at prices ranging between $0.20 to $1.30 per share;

|

|

|

·

|

21,468,750 shares of our common stock issuable upon the possible conversion of the outstanding $4,344,000 principal amount 8% and 10% convertible promissory notes due between September 2008 and July 2010, and

|

|

|

·

|

21,456,930 shares of our common stock issuable upon exercise of outstanding options with exercise prices ranging from $0.001 to $1.75.

|

The exercise of these warrants and the conversion of the notes may materially adversely affect the market price of our common stock and will have a dilutive effect on our existing stockholders.

OUR QUARTERLY FINANCIAL RESULTS WILL CONTINUE TO FLUCTUATE MAKING IT DIFFICULT TO FORECAST OUR OPERATING RESULTS.

Our quarterly operating results have fluctuated in the past and we expect our net revenues and operating results may vary significantly from quarter to quarter due to a number of factors, many of which are beyond our control, including:

|

|

·

|

the announcement or introduction of new services and products by us and our competitors;

|

|

|

·

|

our ability to upgrade and develop our products in a timely and effective manner;

|

|

|

·

|

our ability to retain existing customers and attract new customers at a steady rate, and maintain customer satisfaction;

|

|

|

·

|

the amount and timing of operating costs and capital expenditures relating to expansion of our business and operations;

|

|

|

·

|

government regulation; and

|

|

|

·

|

general economic conditions and economic conditions specific to development and marketing of software products, the market acceptance of new products offered by us, our competitors and potential competitors.

|

Our limited operating history and unproven business model further contribute to the difficulty of making meaningful quarterly comparisons. Our current and future levels of expenditures are based primarily on our growth plans and estimates of expected future net revenues. Such expenditures are primarily fixed in the short term and our sales cycle can be lengthy. Accordingly, we may not be able to adjust spending or generate new revenue sources timely to compensate for any shortfall in net revenues. If our operating results fall below the expectations of investors, our stock price will likely decline significantly.

26

BECAUSE WE EXPECT TO CONTINUE TO INCUR NET LOSSES, WE MAY NOT BE ABLE TO IMPLEMENT OUR BUSINESS STRATEGY AND THE PRICE OF OUR STOCK MAY DECLINE.

We have incurred net losses quarterly from inception through December 31, 2008, and at December 31, 2008 we had an accumulated deficit of approximately $89 million. We expect to continue to incur net losses for the foreseeable future absent a significant increase in our revenues, of which there are no assurances. Accordingly, our ability to operate our business and implement our business strategy may be hampered by negative cash flows in the future, and the value of our stock may decline as a result. Our capital requirements may vary materially from those currently planned if, for example, we incur unforeseen capital expenditures, unforeseen operating expenses or investments to maintain our competitive position. If this is the case, we may have to delay or abandon some or all of our development plans or otherwise forego market opportunities. We will need to generate significant additional net revenues to be profitable in the future and we may not generate sufficient net revenues to be profitable on either a quarterly or annual basis in the future.

To address the risks and uncertainties facing our business strategy, we must, among other things:

|

|

·

|

Achieve broad customer adoption and acceptance of our products and services;

|

|

|

·

|

Successfully raise additional capital in the future;

|

|

|

·

|

Successfully integrate, leverage and expand our product distribution;

|

|

|

·

|

Successfully scale our current operations;

|

|

|

·

|

Implement and execute our business and marketing strategies;

|

|

|

·

|

Address intellectual property rights issues that affect our business;

|

|

|

·

|

Develop and maintain strategic relationships to enhance the and marketing of our existing and new products and services; and

|

|

|

·

|

Respond to competitive developments in the software industry.

|

We might not be successful in achieving any or all of these business objectives in a cost-effective manner, if at all, and the failure to achieve these could have a serious adverse impact on our business, results of operations and financial position. Each of these objectives may require significant additional expenditures on our part. Even if we ultimately do achieve profitability, we may not be able to sustain or increase profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

27

WE HAVE NOT VOLUNTARILY IMPLEMENTED VARIOUS CORPORATE GOVERNANCE MEASURES, IN THE ABSENCE OF WHICH, STOCKHOLDERS MAY HAVE MORE LIMITED PROTECTIONS AGAINST INTERESTED DIRECTOR TRANSACTIONS, CONFLICTS OF INTEREST AND SIMILAR MATTERS.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002,has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or The Nasdaq Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors' independence, audit committee oversight, and the adoption of a code of ethics. Although we have adopted a Code of Ethics, we have not yet adopted any of these other corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do so. We have not adopted corporate governance measures such as an audit or other independent committees of our board of directors as we presently have only two independent directors. If we expand our board membership in future periods to include additional independent directors, we may seek to establish an audit and other committees of our board of directors. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our senior officers and recommendations for director nominees may be made by a majority of directors who have an interest in the outcome of the matters being decided. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

WE CANNOT BE CERTAIN THAT WE WILL BE ABLE TO PROTECT OUR INTELLECTUAL PROPERTY, AND WE MAY BE FOUND TO INFRINGE ON PROPRIETARY RIGHTS OF OTHERS, WHICH COULD HARM OUR BUSINESS

Our intellectual property is critical to our business, and we seek to protect our intellectual property through copyrights, trademarks, patents, trade secrets, confidentiality provisions in our customer, supplier, potential investors, and strategic relationship agreements, nondisclosure agreements with third parties, and invention assignment agreements with our employees and contractors. We cannot assure you that measures we take to protect our intellectual property will be successful or that third parties will not develop alternative solutions that do not infringe upon our intellectual property.

28

In addition, we could be subject to intellectual property infringement claims by others. Claims against us, and any resultant litigation, should it occur in regard to any of our services and applications, could subject us to significant liability for damages including treble damages for willful infringement. In addition, even if we prevail, litigation could be time-consuming and expensive to defend and could result in the diversion of our time and attention. Any claims from third parties may also result in limitations on our ability to use the intellectual property subject to these claims. Further, we plan to offer our services and applications to customers worldwide including customers in foreign countries that may offer less protection for our intellectual property than the United States. Our failure to protect against misappropriation of our intellectual property, or claims that we are infringing the intellectual property of third parties could have a negative effect on our business, revenues, financial condition and results of operations.

COMPETITION MAY DECREASE OUR MARKET SHARE, NET REVENUES, AND GROSS MARGINS.

We face intense and increasing competition in the web-base backup solutions market. If we do not compete effectively or if we experience reduced market share from increased competition, our business will be harmed. In addition, the more successful we are in the emerging market for web-based storage solutions, the more competitors are likely to emerge. We believe that the principal competitive factors in our market include:

|

|

·

|

Service functionality, quality and performance;

|

|

|

·

|

Ease of use, reliability and security of services;

|

|

|

·

|

Establish a significant base of customers and distribution partners;

|

|

|

·

|

Ability to introduce new services to the market in a timely manner;

|

|

|

·

|

Customer service and support; and

|

|

|

·

|

Pricing.

|

Our primary competitors are various Internet-based backup providers broadcasters, such as Connected.com, Novastar, Livevault, firstbackup.com, Carbonate, EMC/Mozy and Norton 360 a product of Symantac. These companies provide services similar to ours and each have to various degrees a market presence. We also compete with providers of traditional backup technologies, such as EMC and VERITAS along with CommVault Systems.

Substantially all of our competitors may have more capital, longer operating histories, greater brand recognition, larger customer bases and significantly greater financial, technical and marketing resources than we do. These competitors may also engage in more extensive development of their technologies, adopt more aggressive pricing policies and establish more comprehensive marketing and advertising campaigns than we can. Our competitors may develop products and service offerings that we do not offer or that are more sophisticated or more cost effective than our own. For these and other reasons, our competitors' products and services may achieve greater acceptance in the marketplace than our own, limiting our ability to gain market share and customer loyalty and to generate sufficient net revenues to achieve a profitable level of operations. Our failure to adequately address any of the above factors could harm our business and operating results.

29

PROVISIONS OF OUR CERTIFICATE OF INCORPORATION AND BYLAWS MAY DELAY OR PREVENT A TAKEOVER WHICH MAY NOT BE IN THE BEST INTERESTS OF OUR STOCKHOLDERS. WE RECENTLY ISSUED OUR CEO A SERIES OF SUPER VOTING PREFERRED STOCK, WHICH INCREASED HIS ABILITY TO CONTROL THE OUTCOME OF STOCKHOLDER VOTES.

Provisions of our certificate of incorporation and bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our stockholders may be called, and may delay, defer or prevent a takeover attempt. In addition, certain provisions of Delaware law also may be deemed to have certain anti-takeover effects which include that control of shares acquired in excess of certain specified thresholds will not possess any voting rights unless these voting rights are approved by a majority of a corporation's disinterested stockholders.

In addition, our certificate of incorporation authorizes the issuance of up to 5,000,000 shares of preferred stock with such rights and preferences as may be determined by our board of directors. Our board of directors may, without stockholder approval, issue preferred stock with dividends, liquidation, conversion or voting rights that could adversely affect the voting power or other rights of our common stockholders. In January 2008 we created a series of 50,000 shares of Series A Preferred Stock which carries super voting rights of 400 votes per share which were issued to our CEO as additional compensation. Prior to the issuance of the shares of Series A Preferred Stock to Mr. Perle he controlled the vote of approximately 10% of our outstanding voting securities.

As a result of the issuance of these securities, Mr. Perle now controls the vote of approximately 22.5% of our outstanding voting securities. This action was approved by our Board of Directors of which Mr. Perle is a member in accordance with the provisions of our certificate of incorporation.

OUR COMMON STOCK IS CURRENTLY QUOTED ON THE OTCBB, BUT TRADING IN OUR STOCK IS LIMITED. BECAUSE OUR STOCK CURRENTLY TRADES BELOW $5.00 PER SHARE, AND IS QUOTED ON THE OTC BULLETIN BOARD, OUR STOCK IS CONSIDERED A "PENNY STOCK" WHICH CAN ADVERSELY EFFECT ITS LIQUIDITY.

30

The market for our common stock is extremely limited and there are no assurances an active market for our common stock will ever develop. Accordingly, purchasers of our common stock cannot be assured any liquidity in their investment. In addition, the trading price of our common stock is currently below $5.00 per share and we do not anticipate that it will be above $5.00 per share in the foreseeable future. Because the trading price of our common stock is less than $5.00 per share, our common stock is considered a "penny stock," and trading in our common stock is subject to the requirements of Rule 15g-9 under the Securities Exchange Act of 1934. Under this rule, broker/dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. SEC regulations also require additional disclosure in connection with any trades involving a "penny stock," including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. These requirements severely limit the liquidity of our securities in the secondary market because few broker or dealers are likely to undertake these compliance activities.

Dependence on content providers and other service providers and effect of interruptions. Our operations also depend on receipt of timely feeds from our content providers, and any failure or delay in the transmission or receipt of such feeds could disrupt our operations. We also depend on Web browsers, ISPs and online service providers to provide access over the Internet to our product and service offerings. Many of these providers have experienced significant outages or interruptions in the past, and could experience outages, delays and other difficulties due to system failures unrelated to our systems. These types of interruptions could continue or increase in the future.

Our digital distribution activities are managed by sophisticated software and computer systems. We must continually develop and update these systems over time as our business and business needs grow and change, and these systems may not adequately reflect the current needs of our business. We may encounter delays in developing these systems, and the systems may contain undetected errors that could cause system failures. Any system error or failure that causes interruption in availability of products or content or an increase in response time could result in a loss of potential or existing business services customers, users, advertisers or content providers. If we suffer sustained or repeated interruptions, our products, services and Web sites could be less attractive to such entities or individuals and our business could be harmed.

Significant portions of our business are dependent on providing customers with efficient and reliable services to enable customers to broadcast content to large audiences on a live or on-demand basis. Our operations are dependent in part upon transmission capacity provided by third-party telecommunications network providers. Any failure of such network providers to provide the capacity we require may result in a reduction in, or interruption of, service to our customers. If we do not have access to third-party transmission capacity, we could lose customers and, if we are unable to obtain such capacity on terms commercially acceptable to us our business and operating results could suffer.

Our computer and communications infrastructure is located at a single leased facility in California. We do not have fully redundant systems, and we may not have adequate business interruption insurance to compensate us for losses that may occur from a system outage. Despite our efforts, our network infrastructure and systems could be subject to service interruptions or damage and any resulting interruption of services could harm our business, operating results and reputation.

31

Performance Dependent on Executive Officers. Our performance is highly dependent on the continued services of our executive officers and other key personnel, the loss of any of whom could materially affect our business, results of operations and financial condition.

Absence of Public Market for Warrants. There is no public trading market for the Warrants. We do not intend to list the Warrants on any national securities exchange or to seek the admission thereof to trading in the National Association of Securities Dealers Automated Quotation System or any other quotation system. Investors have no right to cause us to redeem, repurchase or prepay their Warrants. Accordingly, Investors will not be able to liquidate their investment in the Warrants in the event of an emergency or for any other reason and the Warrants will not be readily accepted as collateral for loans. The Units should be purchased only by persons who have no need for liquidity in their investment.

Minimum Funding. We have an immediate need for the proceeds from this Offering to be utilized in financing operations. See “Use of Proceeds.” As a result of our need for immediate funding, we have established a Minimum Offering that will allow us to access the proceeds from this Offering even if we are only able to sell 50,000 Units for $75,000. Despite our ability to access such proceeds, if only the Minimum Offering is generated through the sale of the Units, we will not be able to meet our working capital needs for 2009. Accordingly, early Investors will be at much greater risk since we will have less working capital available to finance operations.

Discretion as to Use of Proceeds. We will have discretion with respect to the use of the proceeds of this Offering. The proceeds will be used primarily for funding working capital needs and the repayment of indebtedness. The Investors must depend upon our management and their judgment as to the use of proceeds. If we fail to apply these funds effectively, our business, results of operations and financial condition may be materially and adversely affected. Investors will not participate in these decisions and must evaluate this risk.

Speculative Investment. Our business must be considered speculative and there is no assurance that we will satisfy any of its business goals. Because an investment in the Units involves a high degree of risk, no assurance can be given that the Investors will realize any return on their investment, or that they will not lose their entire investment altogether.

Purchase Price of Units. The purchase price for the Units does not necessarily bear any relationship to our assets, book value, earnings or other established criteria of value. Among factors considered in determining the purchase price are the history of, and prospects for, our business, an assessment of our management, our past and present operations and development.

Immediate and Substantial Dilution. The Offering Price per Unit is substantially higher than the net tangible book value of each outstanding share of Common Stock. Purchasers of Units in this Offering will suffer immediate and substantial dilution.

32

No Dividends. We anticipate that we will retain all future earnings and other cash resources for the future operation and development of our business and we do not intend to declare or pay any cash dividends in the foreseeable future. Future payment of cash dividends will be at the discretion of our Board of Directors after taking into account many factors, including our operating results, financial condition and capital requirements. Corporations that pay dividends may be viewed as a better investment than corporations that do not.

Insider Control. Our principal shareholders, directors and executive officers and entities affiliated with them beneficially own approximately 23% of the outstanding shares of our Common Stock. As a result, these shareholders, if they act together, would be able to significantly influence or even control matters requiring approval by our shareholders, including the election of directors and the approval of mergers or other extraordinary transactions. They may also have interests that differ from our remaining shareholders and may vote in a way with which those shareholders disagree and which may be adverse to their interests. The concentration of ownership may have the effect of delaying, preventing or deterring a change in control of our Company, could deprive our shareholders of an opportunity to receive a premium for their Common Stock as part of a sale of our Company and might ultimately affect the market price of our Common Stock.

Securities sold in this Offering will be “restricted.” The Securities sold in this Offering will be “restricted” securities, which have not been registered under federal or state securities laws and will not be freely transferable. While we will undertake to file a registration statement to register the shares of Common Stock underlying the Shares and the Warrants to be issued in the Offering, there can be no assurances that such registration statement will ever be filed, or if filed, will ever be declared effective by the Securities and Exchange Commission. As such, Investors must be prepared to bear the economic risks of investment for an indefinite period of time since the Securities cannot be sold unless they are subsequently registered or an exemption from registration is available.

33

ESTIMATED USE OF PROCEEDS

The maximum net proceeds the Company will realize from this Offering will be approximately $2,700,000, provided the Maximum Offering of 2,000,000 Units is achieved, after deducting the Managing Dealer or “Finder’s” commissions and fees. The minimum net proceeds the Company will realize from this Offering will be approximately $27,000, provided the Minimum Offering of 20,000 Units is achieved, after deducting the Managing Dealer or “Finder’s” commissions and fees. The net proceeds to the Company do not reflect the payment of printing and other miscellaneous expense fees in connection with this Offering estimated to be $25,000.

The Company’s management anticipates the proceeds will generally be used as detailed below based upon the total proceeds raised from this Offering. The estimated use of proceeds set forth below is not intended to represent the order of priority in which the proceeds may be applied.

Estimated Net Proceeds of $2,700,000 from a Maximum Offering

|

Use

|

Estimated Amount

|

|

Capital Equipment

|

$75,000

|

|

Pay down Taxes

|

$925,000

|

|

Additional Licensing

|

$ 10,000

|

|

Legal/Accounting

|

$25,000

|

|

Working Capital

|

$315,000

|

|

Total

|

$1,350,000

|

Estimated Net Proceeds of $27,000 from a Minimum Offering

|

Use

|

Estimated Amount

|

|

Taxes

|

$27,000

|

|

Total

|

$27,000

|

The foregoing represents our best estimate of the application of the net proceeds of the Offering based upon present plans and current business conditions. Unforeseen events, changed business conditions and a number of other factors that are beyond our control, could necessitate changes in the application of proceeds. We reserve the right to reallocate the net proceeds of the Offering among the various uses described above or for such other purposes, as we, at our sole discretion, deem necessary or desirable. In the event that we change the use of proceeds of the Offering, we may require debt or equity financing to meet our business plan. There can be no assurance that we will be able to obtain additional funding when it is needed, or that such funding, if available, will be obtainable on terms favorable to and affordable by us.

34

CAPITALIZATION

The following table sets forth our capitalization as of March 31, 2009, as adjusted to give effect to the issuance and sale of the Units offered hereby by this Memorandum and the application of the estimated net proceeds from this Offering.

|

Proforma as of

|

Projected as of

|

||

|

the closing of a

|

the closing of a

|

||

|

As of

|

Min. Offering

|

Max. Offering

|

|

|

March 31, 2009

|

($ 30,000)

|

($ 1,500,000)

|

|

|

Short-Term Debt

|

$ 3,291,000

|

$ 3,291,000

|

$ 3,291,000

|

|

Long-Term Debt

|

1,053,000

|

1,053,000

|

xx

|

|

Long-Term Debt

|

1,053,000

|

1,053,000

|

xx

|

|

Shareholders’ Equity (Deficit)

|

||||||||||||

|

Common Stock, $.001 par value, 300,000,000 shares authorized, issued and outstanding: 108,033,262

|

108,033 | 108,533 | 111,408 | |||||||||

|

Preferred Stock. $.0001 par value 5,000,000 shares authorized, Issued and outstanding: 50,000

|

50 | 50 | 50 | |||||||||

|

Additional Paid in Capital

|

83,318,621 | 83,818,121 | 86,690,246 | |||||||||

|

Retained Deficit

|

(90,144,524 | ) | (90,144,524 | ) | (90,144,524 | ) | ||||||

|

Income Total Shareholder’s Equity (Deficit)

|

(6,717,820 | ) | (6,217,820 | ) | (3,342,820 | ) | ||||||

|

Total Capitalization

|

$ | (2,373,820 | ) | $ |

(xx)

|

(xx) Calculated by deducting shareholder deficit less the total short term and long-term debt above.

|

||||||

35

DETERMINATION OF OFFERING PRICE

The Offering Price of the Units in this Offering has been arbitrarily determined and bears no relationship to the Company’s assets, earnings, book value, net tangible value, or other generally accepted criteria of value for investment. The Offering Price does not reflect market forces and should not be regarded as an indicator of any future market price of the Company’s securities.

36

DESCRIPTION OF SECURITIES

|

|

The following is a brief summary of certain provisions of the Company’s securities and is qualified in its entirety by the terms in all respects by reference to the actual text of the documents establishing such rights.

|

|

|

We are authorized to issue 300,000,000 shares of Common Stock, par value $.001 per share, and 5,000,000 shares of preferred stock, par value $.001 per share. Prior to this Offering we have 108,433,262 shares of Common Stock and 50,000 shares of Series A Preferred stock issued as of March 24, 2009

|

Common Stock