Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - SPARE BACKUP, INC. | ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - SPARE BACKUP, INC. | ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - SPARE BACKUP, INC. | ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2010

or

o TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ________

Commission File Number: 000-30587

SPARE BACKUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

23-3030650

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

72757 Fred Waring Drive, Palm Desert, CA 92260

(Address of principal executive offices)

(760) 779-0251

(Registrant’s telephone number, including area code)

na

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss. 232.405 of this chapter) during the preceding 12 (or for such shorter period that the registrant was required to submit and post such files).Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

Indicated the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date, 169,055,970 shares of common stock are issued and outstanding as of August 23, 2010.

OTHER PERTINENT INFORMATION

When used in this report, the terms “Spare Backup,” the Company”, “ we”, “our”, and “us” refers to Spare Backup, Inc., a Delaware corporation formerly known as Newport International Group, Inc., and our subsidiary. The information which appears on our web site is not part of this report.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this report contain or may contain forward-looking statements that are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to, our ability to raise sufficient capital to fund our ongoing operations and satisfy our obligations as they become due, including approximately $2.6 million of accrued payroll taxes and approximately $3,006,000 of past due notes, our ability to generate any meaningful revenues, our ability to compete within our market segment, our ability to implement our strategic initiatives, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, as well as our annual report on Form 10-K for the year ended December 31, 2009 including the risks described in Part I. Item 1A. Risk Factors of that report. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

SPARE BACKUP, INC.

INDEX

|

Page

|

||

|

PART I – FINANCIAL INFORMATION:

|

||

|

Item 1.

|

Financial Statements

|

F-1

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

16

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

28

|

|

Item 4.

|

Controls and Procedures

|

28

|

|

PART II – OTHER INFORMATION

|

||

|

Item 1.

|

Legal Proceedings

|

28

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

28

|

|

Item 3.

|

Defaults Upon Senior Securities

|

29

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

29

|

|

Item 5.

|

Other Information

|

29

|

|

Item 6.

|

Exhibits

|

29

|

|

Signatures

|

29

|

|

|

SPARE BACKUP, INC. AND SUBSIDIARY

|

||||||||

|

CONSOLIDATED BALANCE SHEETS

|

||||||||

|

June 30,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

(Unaudited)

|

(1) | |||||||

|

Current Assets:

|

||||||||

|

Accounts receivable

|

- | 51,371 | ||||||

|

Prepaid expenses

|

24,386 | 17,487 | ||||||

|

Total current assets

|

24,386 | 68,858 | ||||||

|

Property and equipment, net of accumulated depreciation of $629,263 and $2,384,638 at

|

||||||||

|

June 30, 2010 and December 31, 2009, respectively

|

424,395 | 528,639 | ||||||

|

Other assets

|

82,202 | 161,104 | ||||||

|

Total assets

|

$ | 530,983 | $ | 758,601 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 2,534,875 | $ | 2,546,236 | ||||

|

Overdraft liability

|

19,794 | 43,489 | ||||||

|

Accrued payroll taxes

|

2,614,913 | 2,027,378 | ||||||

|

8% convertible promissory notes, net of debt discount

|

||||||||

|

of $26,777 and $96,865 at June 30, 2010 and December 31, 2009, respectively

|

3,203,223 | 3,276,135 | ||||||

|

10% convertible promissory notes, net of debt discount

|

||||||||

|

of $0 and $0 at June 30, 2010 and December 31, 2009, respectively

|

456,000 | 581,000 | ||||||

|

Accrued interest on convertible promissory notes

|

130,021 | 125,829 | ||||||

|

Notes payable

|

695,000 | - | ||||||

|

Derivative liabilities

|

257,130 | 246,973 | ||||||

|

Deferred revenue

|

8,153 | 621,127 | ||||||

|

Due to stockholder

|

15,000 | 15,000 | ||||||

|

Total current liabilities

|

9,934,109 | 9,483,167 | ||||||

|

8% convertible promissory notes, net of debt discount

|

||||||||

|

of $0 and $24,846 at June 30, 2010 and December 31, 2009, respectively

|

- | 71,154 | ||||||

|

Total liabilities

|

9,934,109 | 9,554,321 | ||||||

|

Stockholders' Deficit:

|

||||||||

|

Preferred stock, $0.001 par value, 5,000,000 shares authorized:

|

||||||||

|

50,000 issued and outstanding

|

50 | 50 | ||||||

|

Common stock; $.001 par value; 300,000,000 shares authorized;

|

||||||||

|

162,572,358 and 134,036,062 issued and outstanding

|

||||||||

|

at June 30, 2010 and December 31, 2009, respectively

|

162,572 | 134,036 | ||||||

|

Additional paid-in capital

|

96,239,920 | 90,886,623 | ||||||

|

Accumulated deficit

|

(105,805,668 | ) | (99,816,429 | ) | ||||

|

Total stockholders’ deficit

|

(9,403,126 | ) | (8,795,720 | ) | ||||

|

Total liabilities and stockholders’ deficit

|

$ | 530,983 | $ | 758,601 | ||||

|

(1) Derived from audited financial statements

|

||||||||

|

See Notes to Unaudited Consolidated Financial Statements.

|

||||||||

F-1

|

SPARE BACKUP, INC. AND SUBSIDIARY

|

||||||||||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS

|

||||||||||||||||

|

For the Three Months Ended

|

For the Six Months Ended

|

|||||||||||||||

|

June 30,

|

June 30,

|

|||||||||||||||

|

2010

|

2009

|

2010

|

2009

|

|||||||||||||

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

(Unaudited)

|

|||||||||||||

|

Net Revenues

|

$ | 227,351 | $ | 631,749 | $ | 773,593 | $ | 1,087,338 | ||||||||

|

Operating expenses:

|

||||||||||||||||

|

Research and development

|

989,087 | 284,710 | 1,500,172 | 526,495 | ||||||||||||

|

Selling, general and administrative

|

2,348,549 | 2,231,575 | 4,554,074 | 5,047,472 | ||||||||||||

|

Total operating expenses

|

3,337,636 | 2,516,285 | 6,054,246 | 5,573,967 | ||||||||||||

|

Operating loss

|

(3,110,285 | ) | (1,884,536 | ) | (5,280,653 | ) | (4,486,629 | ) | ||||||||

|

Other income (expense):

|

||||||||||||||||

|

Change in fair value of derivative liabilities

|

117,588 | 161,228 | (82,619 | ) | 17,725 | |||||||||||

|

Gain from debt settlements

|

- | - | 295,727 | 297,799 | ||||||||||||

|

Interest expense

|

(455,366 | ) | (398,287 | ) | (921,694 | ) | (599,951 | ) | ||||||||

|

Total other income (expense)

|

(337,778 | ) | (237,059 | ) | (708,586 | ) | (284,427 | ) | ||||||||

|

Net loss

|

$ | (3,448,063 | ) | $ | (2,121,595 | ) | $ | (5,989,239 | ) | $ | (4,771,056 | ) | ||||

|

Basic and diluted loss per common share

|

$ | (0.02 | ) | $ | (0.02 | ) | $ | (0.04 | ) | $ | (0.04 | ) | ||||

|

Basic and diluted weighted average common

|

||||||||||||||||

|

shares outstanding

|

153,895,574 | 111,481,835 | 146,689,129 | 109,161,814 | ||||||||||||

|

See Notes to Unaudited Consolidated Financial Statements.

|

||||||||||||||||

F-2

|

SPARE BACKUP, INC. AND SUBSIDIARY

|

||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

||||||||

|

For the Six Months Ended

|

||||||||

|

June 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

(Unaudited)

|

(Unaudited)

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net loss

|

$ | (5,989,239 | ) | $ | (4,771,056 | ) | ||

|

Adjustments to reconcile net loss to net cash used in

|

||||||||

|

operating activities:

|

||||||||

|

Change in fair value of derivative liabilities

|

82,619 | (17,725 | ) | |||||

|

Fair value of options and warrants issued to employees

|

533,341 | 543,998 | ||||||

|

Fair value of options and warrants issued to consultants

|

234,572 | 126,444 | ||||||

|

Fair value of option and warrant modifications

|

721,464 | - | ||||||

|

Fair value of warrants issued to convertible promissory note holder

|

12,160 | - | ||||||

|

Fair value of warrants issued for accrued interest

|

11,568 | 2,695 | ||||||

|

Fair value of common stock issued in connection with service rendered

|

618,365 | 225,800 | ||||||

|

Fair value of common stock issued in connection with convertible

|

||||||||

|

promissory notes modifications

|

79,167 | - | ||||||

|

Fair value of convertible promissory notes modifications

|

125,128 | - | ||||||

|

Fair value of common stock issued in connection with note payable issuance

|

184,200 | - | ||||||

|

Fair value of common stock issued in connection with debt settlement

|

20,000 | - | ||||||

|

Fair value of common stock issued in connection with the conversion

|

||||||||

|

of convertible promissory notes

|

(328 | ) | - | |||||

|

Depreciation

|

151,976 | 467,131 | ||||||

|

Amortization of debt discount

|

247,996 | 331,498 | ||||||

|

Amortization of prepaid expenses

|

20,601 | 233,221 | ||||||

|

Amortization of deferred financing costs

|

81,964 | 88,147 | ||||||

|

Gain from debt settlement

|

(295,727 | ) | (297,799 | ) | ||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

51,371 | (452,764 | ) | |||||

|

Prepaid expense and other current assets

|

(30,562 | ) | (696,719 | ) | ||||

|

Accounts payable, accrued expense and accrued payroll taxes

|

871,901 | 657,287 | ||||||

|

Deferred revenues

|

(612,974 | ) | 1,261,964 | |||||

|

Accrued interest on convertible promissory notes

|

157,663 | 177,409 | ||||||

|

Net cash used in operating activities

|

(2,722,774 | ) | (2,120,469 | ) | ||||

|

Cash flows used in investing activities:

|

||||||||

|

Capital expenditures

|

(47,732 | ) | (219,016 | ) | ||||

|

Net cash used in investing activities

|

(47,732 | ) | (219,016 | ) | ||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from issuance of convertible promissory notes

|

- | 1,383,000 | ||||||

|

Proceeds from issuance of notes payable

|

1,100,000 | - | ||||||

|

Repayment of notes payable

|

(405,000 | ) | ||||||

|

Net proceeds from issuance of common stock for cash

|

1,547,475 | 914,000 | ||||||

|

Cash overdraft

|

(23,695 | ) | 175,883 | |||||

|

Proceeds from exercise of stock options

|

6,368 | - | ||||||

|

Proceeds from exercise of warrants

|

545,358 | - | ||||||

|

Payment of deferred financing costs

|

- | (125,351 | ) | |||||

|

Net cash provided by financing activities

|

2,770,506 | 2,347,532 | ||||||

|

Net increase in cash

|

- | 8,047 | ||||||

|

Cash, beginning of period

|

- | 18,946 | ||||||

|

Cash, end of period

|

$ | - | $ | 26,993 | ||||

|

Supplemental disclosures of cash flow information:

|

||||||||

|

Cash paid for interest

|

$ | - | $ | - | ||||

|

Cash paid for income taxes

|

$ | - | $ | - | ||||

|

Non-cash investing and financing activities:

|

||||||||

|

Write off of fully depreciated propery and equipment

|

$ | 1,907,351 | $ | - | ||||

|

Fair value of warrants and embedded conversion features issued in

|

||||||||

|

connection with the issuance of convertible promissory notes and

|

||||||||

|

corresponding debt discount

|

$ | 153,062 | $ | 1,361,750 | ||||

|

Conversion of convertible promissory notes and accrued interest

|

||||||||

|

into shares of common stock

|

$ | 383,873 | $ | 216,520 | ||||

|

Fair value of shares of common stock issued for payment of

|

||||||||

|

accrued interest

|

$ | 133,270 | $ | 148,719 | ||||

|

See Notes to Unaudited Consolidated Financial Statements.

|

||||||||

F-3

SPARE BACKUP, INC. AND SUBSIDIARY

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 - ORGANIZATION, BASIS OF PRESENTATION AND GOING CONCERN

Spare Backup, Inc., (the "Company") was incorporated in Delaware in December 1999. The Company sells on-line backup solutions software and services to individuals, business professionals, small office and home office companies, and small to medium sized businesses.

The balance sheet presented as of June 30, 2010 has been derived from our audited financial statements. The unaudited financial statements have been prepared pursuant to the rules and regulations of the SEC. Certain information and footnote disclosures normally included in the annual financial statements prepared in accordance with accounting principles generally accepted in the United States of America, have been omitted pursuant to those rules and regulations, but we believe that the disclosures are adequate to make the information presented not misleading. The financial statements and notes included herein should be read in conjunction with the annual financial statements and notes for the year ended December 31, 2009 included in our Annual Report on Form 10-K filed on April 15, 2010. The results of operations for the six-month period ended June 30, 2010 are not necessarily indicative of the results for the year ending December 31, 2010.

The accompanying unaudited consolidated financial statements have been prepared on a going concern basis. The Company has incurred net losses of approximately $6 million during the six-month period ended June 30, 2010. The Company's ability to continue as a going concern is dependent upon its ability to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due, and to generate profitable operations in the future. Management plans to continue to provide for its capital requirements by issuing additional equity securities and debt. The outcome of these matters cannot be predicted at this time and there are no assurances that if achieved, the Company will have sufficient funds to execute its business plan or generate positive operating results.

These matters, among others, raise substantial doubt about the ability of the Company to continue as a going concern. These financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should the Company be unable to continue as a going concern.

The accompanying consolidated financial statements include the accounts of Spare Backup and its wholly-owned subsidiary. All material inter-company balances and transactions have been eliminated in consolidation.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Significant estimates made by management include, but are not limited to share-based payments and useful life of property and equipment. Actual results will differ from these estimates.

Cash and Cash Equivalents

The Company considers all highly liquid temporary cash investments with an original maturity of three months or less when purchased, to be cash equivalents.

Concentration of Credit Risks

The Company is subject to concentrations of credit risk primarily from cash and cash equivalents.

F-4

The Company’s cash and cash equivalents accounts are held at financial institutions and are insured by the Federal Deposit Insurance Corporation, or the FDIC, up to $250,000. During the six-month period ended June 30, 2010, the Company has reached bank balances exceeding the FDIC insurance limit. To reduce its risk associated with the failure of such financial institutions, the Company periodically evaluates the credit quality of the financial institutions in which it holds deposits.

The Company's accounts receivable were due from two customers, both of which are located in the United Kingdom. One of the Company’s customers accounted for 98% of its accounts receivables at December 31, 2009. There are no accounts receivables at June 30, 2010.

Accounts Receivable

The Company has a policy of reserving for uncollectible accounts based on its best estimate of the amount of probable credit losses in its existing accounts receivable. The Company periodically reviews its accounts receivable to determine whether an allowance is necessary based on an analysis of past due accounts and other factors that may indicate that the realization of an account may be in doubt. Account balances deemed to be uncollectible are charged to the bad debt expense after all means of collection have been exhausted and the potential for recovery is considered remote. At June 30, 2010 and December 31, 2009, management has determined that an allowance is not necessary.

Property and Equipment

Property and equipment, which primarily consists of office equipment and computer software, are recorded at cost and are depreciated on a straight-line basis over their estimated useful lives of three to five years. Maintenance and repairs are charged to expense as incurred. Significant renewals and betterments are capitalized. At the retirement or other disposition of property and equipment, the cost and accumulated depreciation are removed from the accounts and any resulting gain or loss is reflected in other income (expense) in the accompanying statements of operations.

Revenue Recognition

The Company follows the guidance of the FASB ASC 605-10-S99 "Revenue Recognition Overall – SEC Materials". The Company records revenue when persuasive evidence of an arrangement exists, on-line back-up services have been rendered, the sales price to the customer is fixed or determinable, and collectability is reasonably assured.

The Company has collected annual fees related to online back-up services. Online back up service fees received in advance or collected up front are reflected as deferred revenue on the accompanying balance sheet. Deferred revenue as of June 30, 2010 and December 31, 2009 amounted to $8,153 and $621,127, respectively, and will be recognized as revenue over the respective subscription period.

Revenue consists of the gross value of billings to clients. The Company reports this revenue gross in accordance with Generally Accepted Accounting Pronouncements (“GAAP”) because it is responsible for fulfillment of the service, has substantial latitude in setting price and assumes the credit risk for the entire amount of the sale, and it is responsible for the payment of all obligations incurred for sales marketing and commissions.

Customer Concentration

One of the Company's customers accounted for approximately 85% of its revenues during the six-month period ending June 30, 2010. One of the Company’s customers accounted for 87% of the Company’s revenue during the six-month period ending June 30, 2009.

Product Concentration

The Company offers subscriptions to online and software backup products to assist individuals, small businesses and home business users.

F-5

Fair Value of Financial Instruments

Effective January 1, 2008, the Company adopted FASB ASC 820, “Fair Value Measurements and Disclosures” (“ASC 820”), for assets and liabilities measured at fair value on a recurring basis. ASC 820 establishes a common definition for fair value to be applied to existing generally accepted accounting principles that require the use of fair value measurements, establishes a framework for measuring fair value and expands disclosure about such fair value measurements. The adoption of ASC 820 did not have an impact on the Company’s financial position or operating results, but did expand certain disclosures.

ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Additionally, ASC 820 requires the use of valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. These inputs are prioritized below:

|

Level 1:

|

Observable inputs such as quoted market prices in active markets for identical assets or liabilities

|

|

|

Level 2:

|

Observable market-based inputs or unobservable inputs that are corroborated by market data

|

|

|

Level 3:

|

Unobservable inputs for which there is little or no market data, which require the use of the reporting entity’s own assumptions.

|

The Company did not have any Level 2 or Level 3 assets or liabilities as of June 30, 2010 and December 31, 2009, with the exception of its convertible promissory notes. The carrying amount of the convertible promissory notes at June 30, 2010 and December 31 2009, approximate their respective fair value based on the Company’s incremental borrowing rate.

Cash and cash equivalents include money market securities that are considered to be highly liquid and easily tradable as of June 30, 2010 and December 31, 2009, respectively. These securities are valued using inputs observable in active markets for identical securities and are therefore classified as Level 1 within our fair value hierarchy.

In addition, FASB ASC 825-10-25 Fair Value Option was effective for January 1, 2008. ASC 825-10-25 expands opportunities to use fair value measurements in financial reporting and permits entities to choose to measure many financial instruments and certain other items at fair value. The Company did not elect the fair value option for any of its qualifying financial instruments.

Software Development Costs

Costs incurred in the research and development of software products are expensed as incurred until technological feasibility has been established. After technological feasibility is established, any additional costs are capitalized in accordance with FASB ASC 985-20, “Costs of Software to be Sold, Leased, or Marketed.” The Company believes that the current process for developing software is essentially completed concurrently with the establishment of technological feasibility. Accordingly, no software development costs have been capitalized as of June 30, 2010. Instead, such amounts are included in the statement of operations under the caption "Research and development".

Foreign Currency Transactions

The Company periodically engages in transactions in countries outside the United States which may result in foreign currency transaction gains or losses. Gains and losses resulting from foreign currency transactions are recognized as foreign currency gain (loss) in the statement of operations of the period incurred.

Income Taxes

Income taxes are accounted for in accordance with the provisions of FASB ASC-740 – Income Taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amounts expected to be realized, but no less than quarterly.

F-6

Share-based Payments

The Company accounts for stock-based compensation in accordance with ASC Topic 718, Compensation-Stock Compensation (“ASC 718”) for all the stock awards granted after December 31, 2005, and granted prior to but not yet vested as of December 31, 2005. Under the fair value recognition provisions of this topic, stock-based compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense on a straight-line basis over the requisite service period, which is the vesting period. See Note 7 for further information regarding the Company’s stock-based compensation assumptions and expenses. The Company elected to use the modified prospective transition method as permitted by ASC 718.

Effective January 1, 2006, the Company changed its method of attributing the value of stock-based compensation to expense from the accelerated multiple-option approach to the straight-line single option method. Compensation expense for all share-based payment awards granted prior to January 1, 2006 will continue to be recognized using the accelerated multiple-option approach while compensation expense for all share-based payment awards granted on or subsequent to January 1, 2006 has been and will continue to be recognized using the straight-line single-option approach.

The Company has elected to use the Black-Scholes-Merton (“BSM”) option-pricing model to estimate the fair value of its options, which incorporates various subjective assumptions including volatility, risk-free interest rate, expected life, and dividend yield to calculate the fair value of stock option awards. Compensation expense recognized in the consolidated statements of operations is based on awards ultimately expected to vest and reflects estimated forfeitures. ASC 718 requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates.

Recent Accounting Pronouncements

In October 2009, the FASB issued guidance for amendments to FASB Emerging Issues Task Force on EITF Issue No. 09-1 “ Accounting for Own-Share Lending Arrangements in Contemplation of a Convertible Debt Issuance or Other Financing” ( Subtopic 470-20 ) “Subtopic”. This accounting standards update establishes the accounting and reporting guidance for arrangements under which own-share lending arrangements issued in contemplation of convertible debt issuance.

This Statement is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2009. Earlier adoption is not permitted. Management believes this Statement will have no impact on the financial statements of the Company once adopted.

Basic and Diluted Earnings per Share

Basic earnings per share is calculated by dividing income available to stockholders by the weighted-average number of common shares outstanding for each period. Diluted earnings per share is computed using the weighted-average number of common and dilutive common share equivalents outstanding during the period. Dilutive common share equivalents consist of shares issuable upon the exercise of stock options and warrants (calculated using the reverse treasury stock method). The outstanding options, warrants and shares equivalent issuable pursuant to convertible promissory notes amounted to 116,379,937 and 91,361,841 at June 30, 2010 and 2009, respectively. Accordingly, these common share equivalents at June 30, 2010 and 2009 are excluded from the loss per share computation for that period due to their antidilutive effect.

F-7

The following sets forth the computation of basic and diluted earnings per share for the six-month periods ended June 30, 2010 and 2009:

|

For the six-month periods ended

|

||||||||

|

June 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

Numerator:

|

||||||||

|

Net loss attributable to common stock

|

$

|

(5,989,239

|

)

|

$

|

(4,771,056

|

)

|

||

|

Denominator:

|

||||||||

|

Denominator for basic earnings per share-

|

||||||||

|

Weighted average shares outstanding

|

146,689,129

|

109,161,814

|

||||||

|

Denominator for diluted earnings per share-

|

||||||||

|

Weighted average shares outstanding

|

146,689,129

|

109,161,814

|

||||||

|

Basic earnings per share

|

$

|

(0.04

|

)

|

$

|

(0.04

|

)

|

||

|

Diluted earnings per share

|

$

|

(0.04

|

)

|

$

|

(0.04

|

)

|

||

NOTE 3 - PREPAID EXPENSES

Prepaid expenses generally is compromised of marketing and sales commissions paid to sales agents for the 1 year prepaid subscriptions related to the Company's online back-up services. The prepaid marketing expense is being amortized over the term of the respective subscription sold in accordance with GAAP whereby incremental direct costs are recognized in earnings in the same pattern as revenue is recognized. During the six-month periods ended June 30, 2010 and 2009, amortization of prepaid expenses amounted to $20,601 and $233,221, respectively and was recorded as sales, general and administrative expense in the accompanying statement of operations. On June 30, 2010 and December 31, 2009, prepaid expenses amounted to $24,386 and $17,487, respectively

NOTE 4 - PROPERTY AND EQUIPMENT

Property and equipment consisted of the following:

|

June 30,

|

December 31,

|

||||||||

|

Estimated life

|

2010

|

2009

|

|||||||

|

Computer and office equipment

|

3 to 5 years

|

$ | 851,360 | $ | 2,710,979 | ||||

|

Leasehold improvements

|

5 years

|

202,298 | 202,298 | ||||||

| 1,053,658 | 2,913,277 | ||||||||

|

Less: Accumulated depreciation

|

(629,263 | ) | (2,384,638 | ) | |||||

| $ | 424,395 | $ | 528,639 | ||||||

During the six-month period ended June 30, 2010, the Company wrote-off $1,907,351 of fully depreciated computer equipment. Depreciation expense amounted to $151,976 and $467,131 during the six-month periods ended June 30, 2010 and 2009, respectively.

NOTE 5 - OTHER ASSETS

Other assets generally consists of deferred financing costs related to the issuance of convertible promissory notes and is amortized on the terms of such notes. Amortization of other assets- deferred financing costs amounted to $81,964 and $88,147 during the six-months ended June 30, 2010 and 2009, respectively and is included in interest expense.

NOTE 6 - CONVERTIBLE PROMISSORY NOTES-CURRENT

Convertible promissory notes consist of the following as of:

F-8

| June 30, |

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

8% Convertible promissory notes, bearing interest at 8% per annum, maturing between August 2009 and February 2010. Interest payable commencing the quarter ended December 31, 2007, payable within thirty (30) days of the end of the quarter. Interest may be paid in cash or common stock at the option of the Company. Interest paid in common stock will be calculated at ninety percent (90%) of the average closing price for the common stock for the five (5) trading days preceding the interest payment date. The promissory notes are convertible at any time at the option of the holder, into shares of common stock at an effective conversion rate ranging from $0.12 to $0.25

|

$ | 3,230,000 | $ | 3,373,000 | ||||

|

Less: unamortized discount

|

(26,777 | ) | (96,865 | ) | ||||

|

Convertible promissory notes- short-term

|

$ | 3,203,223 | $ | 3,276,135 | ||||

During the six-month period ended June 30, 2009, the Company classified $100,000 8% convertible promissory notes from long-term to short-term, along with the debt discount of $31,960.

During the six-month period ended June 30, 2010, the Company modified certain 8% convertible promissory notes agreements with principals aggregating $333,000, repricing the conversion rate from $0.16 to $0.12 per share and the warrant exercise price from $0.20 to $0.16. As a result of these modifications, the Company recognized a $125,128 increase in additional paid-in capital and an increase in interest expense. In connection with these modifications, the Company issued 416,666 shares of common stock at a fair value of $79,167.

During the six-month period ended June 30, 2010, the Company classified $96,000 8% convertible promissory note from long-term to short-term along with the debt discount of $24,846.

During the six-month period ended June 30, 2010, the Company issued 1,828,457 shares of common stock in connection with the conversion of 8% convertible promissory notes with an aggregate principal of $239,000 and accrued interest of $20,201. The fair value of such shares issued amounted to $259,201, or $0.14 per share.

|

June 30,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

10% Convertible promissory notes, bearing interest at 10% per annum, maturing between August 2008 and January 2010. Interest payable commencing the quarter ended September 30, 2008, payable within thirty (30) days of the end of the quarter. Interest may be paid in cash or common stock at the option of the Company. Interest paid in common stock will be calculated at the volume weighted average price for the common stock for the ten (10) trading days preceding the interest payment date. The promissory notes are convertible at any time at the option of the holder, into shares of common stock at a rate ranging from $0.16 to $0.25

|

$ | 456,000 | $ | 581,000 | ||||

|

Less: unamortized discount

|

(- | ) | (- | ) | ||||

|

Convertible promissory notes- short-term

|

$ | 456,000 | $ | 581,000 | ||||

During the six-month period ended June 30, 2009, the Company issued 375,000 shares of common stock in connection with the conversion of 10% convertible promissory notes with an aggregate principal of $60,000. The fair value of such shares issued amounted to approximately $60,000, or an average of $0.16.

During the six-month period ended June 30, 2009, the Company modified certain 10% convertible promissory notes agreements with principals aggregating $336,000, repricing the conversion rate from $0.30 to $0.16 and $0.12 per share and the warrant exercise price to $0.20.

During the six-month period ended June 30, 2010, the Company issued 725,000 shares of common stock in connection with the conversion of 10% convertible promissory notes with an aggregate principal of $125,000. The fair value of such shares issued amount to $125,000, or an average of $0.17 per share.

F-9

|

At June 30, 2010

|

||||

|

Principal- 8% convertible promissory notes past due

|

$ | 2,550,000 | ||

|

Principal- 10% convertible promissory notes past due

|

$ | 456,000 | ||

In accordance with FASB ASC 740 Debt- Debt with Conversion Options, the Company recorded a beneficial conversion feature related to the Convertible promissory notes. Under the terms of these notes, the intrinsic value of the beneficial conversion feature was calculated assuming that the conversion date was the same as the issue date. During the six-month periods ended June 30, 2010 and 2009, respectively, the beneficial conversion feature amounted to $153,062 and $0. This beneficial conversion feature is reflected in the accompanying financial statements as additional paid-in capital and corresponding debt discount.

Total amortization of debt discounts for the convertible promissory notes - current amounted to $247,996 and $71,173 for the six-month periods ended June 30, 2010 and 2009, respectively, and is included in interest expense.

NOTE 7 – NOTES PAYABLE

During the six-month period ended June 30, 2010, the Company issued $1,100,000 notes payable that are due over the next 6 months. In connection with these notes payable, the Company issued 980,000 shares of common stock that have a fair value of $184,200, which was allocated to interest expense. At June 30, 2010, the Company has repaid $405,000.

NOTE 8 - DERIVATIVE LIABILITIES

The adoption of ASC 815 will affect accounting for convertible instruments and warrants with provisions that protect holders from declines in the stock price ("round-down" provisions). Warrants with such provisions will no longer be recorded in equity. The Issue is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Earlier application by an entity that has previously adopted an alternative accounting policy is not permitted.

Instruments with round-down protection are not considered indexed to a company's own stock under GAAP, because neither the occurrence of a sale of common stock by the company at market nor the issuance of another equity-linked instrument with a lower strike price is an input to the fair value of a fixed-for-fixed option on equity shares. The appendix to the Consensus contains an example (example 8) of warrants with round-down provisions that concludes they are not indexed to the company's owned stock. A round-down provision may be viewed by some as a form of guarantee provided to the holder of the instrument, which is inconsistent with equity classification.

GAAP’s guidance is to be applied to outstanding instruments as of the beginning of the fiscal year in which the Issue is applied. The cumulative effect of the change in accounting principle shall be recognized as an adjustment to the opening balance of retained earnings (or other appropriate components of equity) for that fiscal year, presented separately. The cumulative-effect adjustment is the difference between the amounts recognized in the statement of financial position before initial application of this Issue and the amounts recognized in the statement of financial position at initial application of this Issue. The amounts recognized in the statement of financial position as a result of the initial application of this Issue shall be determined based on the amounts that would have been recognized if the guidance in this Issue had been applied from the issuance date of the instrument.

Since the Company did not previously account for warrants with round-down provisions as a liability in previously issued financial statements earlier application of GAAP is not permitted.

The Company recorded a cumulative effect of a change in accounting principle as of January 1, 2009 in the amount of the estimated fair value of such warrants and embedded conversion features and will record future changes in fair value in results of operations. Based on fair value computations of estimated fair value, using a $0.18 closing stock price on December 31, 2008 there would be a cumulative effect of approximately $467,000 as of January 1, 2009, which would be recorded as a credit to derivative liability and debit to accumulated deficit.

The variation in fair value of the derivative liabilities between measurement dates amounted to an increase of $82,619 and a decrease of $17,725 during the six-month periods ended June 30, 2010 and 2009, respectively. The decrease in fair value of the derivative liabilities has been recognized as other income/expense.

NOTE 9 - CONVERTIBLE PROMISSORY NOTES - LONG TERM

F-10

Convertible promissory notes consist of the following as of:

|

June 30,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

8% Convertible promissory notes, bearing interest at 8% per annum, maturing between February 2010 and December 2010. The promissory notes are convertible at any time at the option of the holder, into shares of common stock at an effective conversion rate of $0.16.

|

$ | - | $ | 96,000 | ||||

|

Less: unamortized discount

|

(- | ) | (24,846 | ) | ||||

|

Convertible promissory notes- long-term

|

$ | - | $ | 71,154 | ||||

During the six-month period ended June 30, 2009, the Company issued $1,048,000 of 8% convertible promissory notes. In connection with the issuance of these convertible promissory notes, upon maturity or conversion, the Company shall issue 6,550,000 warrants at an exercise price of $0.20. The warrants expire two years from the date of grant. The Company recognized a debt discount of $1,043,292 in connection of the issuance of 8% convertible promissory notes. In connection with this issuance, the Company paid commissions of $125,350 and issued five year warrants to purchase 774,750 shares of common stock at an exercise price of $0.20. These warrants were valued using utilizing the Black-Scholes options pricing model at an average of $0.16 or $124,338 and was recorded as an increase in additional-paid in capital and an increase in other assets.

During the six-month period ended June 30, 2009, the Company classified $100,000 8% convertible promissory notes from long-term to short-term, along with the debt discount of $31,960.

During the six-month period ended June 30, 2010, the Company classified $96,000 8% convertible promissory note from long-term to short-term along with the debt discount of $24,846.

|

June 30,

|

December 31,

|

|||||||

|

2010

|

2009

|

|||||||

|

10% Convertible promissory notes, bearing interest at 10% per annum, maturing between October 2010 and January 2011. The promissory notes are convertible at any time at the option of the holder, into shares of common stock at a effective conversion rate of $0.16

|

$ | - | $ | - | ||||

|

Less: unamortized discount

|

(- | ) | (- | ) | ||||

|

Convertible promissory notes- long-term

|

$ | - | $ | - | ||||

During the six-month period ended June 30, 2009, the Company issued $335,000 of 10% convertible promissory notes. In connection with the issuance of these convertible promissory notes, upon maturity or conversion, the Company shall issue 2,093,750 warrants at an exercise price of $0.20. The warrants expire two years from the date of grant. The Company recognized a debt discount of $318,458 in connection of the issuance of 10% convertible promissory notes.

In accordance with FASB ASC 740 Debt- Debt with Conversion Options, the Company recorded a beneficial conversion feature related to the Convertible promissory notes. Under the terms of these notes, the intrinsic value of the beneficial conversion feature was calculated assuming that the conversion date was the same as the issue date. During the six-month periods ended June 30, 2010 and 2009, respectively, the beneficial conversion feature amounted to $0 and $1,361,750. This beneficial conversion feature is reflected in the accompanying financial statements as additional paid-in capital and corresponding debt discount.

Total amortization of debt discounts for the convertible promissory notes – long term amounted to $0 and $260,325 during the six-month periods ended June 30, 2010 and 2009, respectively, and is included in interest expense.

NOTE 10 - STOCKHOLDERS' DEFICIT

F-11

On August 15, 2008, the Company increased the authorized common shares from 150,000,000 to 300,000,000 shares of common stock at $0.001 par value and approval for a 1-for-10 reverse stock split of its issued and outstanding common stock.

The Company filed a Certificate of Amendment to its certificate of incorporation increasing the number of authorized shares of its common stock to 300,000,000 shares. Additionally, the stockholders granted the Company's Board of Directors the authority to decide within six months from the date of the special meeting to implement a reverse stock split, set the timing for such split, and select a ratio for the reverse split up to a maximum of a one for ten (1:10). The Company did not implement a reverse stock split during 2009.

The issuance of common stock during the six-month period ended June 30, 2009 is summarized in the table below:

|

Number of Shares of Common Stock

|

Fair Value at Issuance

|

Fair Value at Issuance

(per share)

|

||||||||||

|

Accrued interest payment for 8% and 10% convertible promissory notes

|

844,020 | $ | 148,719 | $ | 0.17 | |||||||

|

Services performed- Investor Relations

|

600,000 | 134,000 | 0.22 - 0.24 | |||||||||

|

Services performed- Legal

|

450,000 | 81,000 | 0.18 | |||||||||

|

Services performed- Payroll

|

60,000 | 10,800 | 0.18 | |||||||||

|

Conversion of 8% convertible promissory notes

|

978,254 | 156,520 | 0.15 | |||||||||

|

Conversion of 10% convertible promissory notes

|

375,000 | 60,000 | 0.16 | |||||||||

|

Private placement, net of finder’s fee of $82,000

|

6,225,000 | 914,000 | 0.16 | |||||||||

| 9,532,274 | $ | 1,505,039 | ||||||||||

The issuance of common stock during the six-month period ended June 30, 2010 is summarized in the table below:

|

Number of Shares of Common Stock

|

Fair Value at Issuance

|

Fair Value at Issuance

(per share)

|

||||||||||

|

Accrued Interest Payment for 8% and 10% convertible promissory notes

|

972,944 | $ | 133,270 | $ | 0.14 | |||||||

|

Services performed- Investor relations

|

2,450,000 | 393,500 | 0.159 - 0.165 | |||||||||

|

Services performed- Legal expense

|

175,398 | 28,941 | 0.165 | |||||||||

|

Services performed- Project management expense

|

110,677 | 22,799 | 0.20 - 0.21 | |||||||||

|

Services performed- Business development

|

900,000 | 169,000 | 0.145 - 0.20 | |||||||||

|

Services performed- Strategy consulting

|

25,000 | 4,125 | 0.165 | |||||||||

|

Exercised stock options

|

636,752 | 6,368 | 0.01 | |||||||||

|

Exercised warrants

|

5,453,595 | 545,358 | 0.10 | |||||||||

|

Conversion of 8% convertible promissory notes

|

1,828,457 | 258,873 | 0.14 | |||||||||

|

Conversion of 10% convertible promissory notes

|

725,000 | 125,000 | 0.17 | |||||||||

|

Private placement, net of finder’s fee of $39,000

|

13,761,807 | 1,547,475 | 0.10 - 0.20 | |||||||||

|

Debt settlement agreement

|

100,000 | 20,000 | 0.20 | |||||||||

|

Convertible note repricing

|

416,666 | 79,167 | 0.19 | |||||||||

|

Interest associated with issuance of notes payable

|

980,000 | 184,200 | 0.16 - 0.22 | |||||||||

| 28,536,296 | $ | 3,518,076 | ||||||||||

NOTE 11 - STOCK OPTIONS AND WARRANTS

Warrants

During the six-month period ended June 30, 2009, in connection with a general business and marketing advisory agreement, the Company issued warrants to purchase 993,528 shares of Common Stock at price of $0.20 per share during 2009. The Company valued these warrants utilizing the Black-Scholes options pricing model at $0.06 per share or $59,612 and was recorded as an increase in additional-paid in capital and an increase in stock-based consulting expense.

F-12

During the six-month period ended June 30, 2009, in connection with the private placements the Company issued warrants to purchase 6,225,000 shares of common stock at an exercise price of $0.20 per share. The warrants expire three years from the date of grant. In addition, the Company issued warrants to purchase 106,250 shares of common stock at an exercise price of $0.20 as finder’s fees. The warrants expire three years from the date of grant.

During the six-month period ended June 30, 2009, in connection with the issuance of 8% convertible promissory notes, the Company issued warrants to purchase 6,550,000 shares of common stock at an exercise price of $0.20 per share. The warrants expire two years from the date of grant. In addition, the Company issued warrants to purchase 774,750 shares of common stock at an exercise price of $0.20 as finder’s fees. The warrants expire five years from the date of grant. These warrants were valued using utilizing the Black-Scholes options pricing model at an average of $0.16 or $124,338 and was recorded as an increase in additional-paid in capital and an increase in other assets.

During the six-month period ended June 30, 2009, in connection with the issuance of 10% convertible promissory notes, the Company issued warrants to purchase 2,093,750 shares of common stock at an exercise price of $0.20 per share. The warrants expire two year from the date of grant.

During the six-month period ended June 30, 2009, in connection with the conversion of 8% convertible promissory notes issued warrants to purchase 40,754 shares of common stock at an exercise price range of $0.20 per share for accrued interest. The warrants expire in 2011. The warrants were valued at $2,695 using the Black-Scholes option pricing model.

During the six-month period ended June 30, 2010, the Company issued warrants to purchase 200,000 shares of common stock at an exercise price of $0.20 per shares. The warrants expire three years from the date of grant. The Company valued the warrants at $12,160 using the Black-Scholes option pricing model, increasing additional paid-in capital, and increase to interest expense.

During the six-month period ended June 30, 2010, in connection with the modifications to certain 8% convertible promissory notes, the Company also repriced 1,335,222 warrants from an exercise price of $0.20 to $0.16. As a result of this modification, the Company recognized $15,585 as an increase in additional paid-in capital and an increase in interest expense.

During the six-month period ended June 30, 2010, the Company extended the maturity dates of 2,210,195 warrants for a certain investor for an additional five years from the original maturity dates. As a result of the extension, the Company recognized an expense of $235,944 as an increase in additional paid-in capital and an increase in consulting expense.

During the six-month period ended June 30, 2010, the Company repriced 5,453,595 warrants from an exercise price ranging from $0.20 to $1.00, to $0.10. As a result of this modification, the Company recognized $230,114 as an increase in additional paid-in capital and an increase in modification expense. As a result of this repricing, the warrant holders exercised their 5,453,595 warrants for common stock.

During the six-month period ended June 30, 2010, in connection with the private placements the Company issued warrants to purchase 11,136,807 shares of common stock at an exercise price range of $0.12 to $0.20 per share. The warrants expire three years from the date of grant.

During the six-month period ended June 30, 2010, in connection with the conversion of 8% convertible promissory notes issued warrants to purchase 1,828,457 shares of common stock at an exercise price range of $0.16 to $0.20 per share. The warrants expire in 2012. Of these warrants, 140,958 warrants were issued for accrued interest, were valued at $11,568 using the Black-Scholes option pricing model.

During the six-month period ended June 30, 2010, the Company issued warrants to purchase 500,000 shares of common stock to a consultant. The warrants have an exercise price of $0.12 and expire between three years from grant. The warrants were valued at $57,100 utilizing the Black-Scholes options pricing model and was recorded as an increase in additional-paid in capital and an increase in consulting fees.

The fair value of the warrants granted during the six-month period ended June 30, 2010 and 2009 is based on the Black Scholes Model using the following assumptions:

F-13

|

June 30, 2010

|

June 30, 2009

|

|||||||

|

Exercise price:

|

$0.10 - $0.32 | $0.01 - $0.40 | ||||||

|

Market price at date of grant:

|

$0.145 $0.225 | $0.10 - $0.21 | ||||||

|

Expected volatility:

|

64.25% - 168.64% | 69% - 110% | ||||||

|

Term:

|

2 – 9 years

|

3 – 5 years

|

||||||

|

Risk-free interest rate:

|

0.34% - 3.59% | 0.75% - 2.72% | ||||||

Stock Options

In 2002, the Company adopted the 2002 Stock Plan under which stock awards or options to acquire shares of the Company's common stock may be granted to employees and non-employees of the Company. The Company has authorized 12,000,000 shares of the Company's common stock for grant under the 2002 Plan.

In May 2006, the Board increased the authorized amount to 27,000,000. The 2002 Plan is administered by the Board of Directors and permits the issuance of options for the purchase of up to the number of available shares outstanding. Options granted under the 2002 Plan vest in accordance with the terms established by the Company's stock option committee and generally terminates ten years after the date of issuance.

In February 2009, the Company entered into a 1 year marketing agreement with Cydcor Inc. whereby Cydcor will market the Company's services and perform marketing campaigns as it may determine from time to time. Cydcor will be paid on a commission basis on all customer orders that has an authorization for customer payment received via the efforts of Cydcor. In addition, Cydcor will receive volume bonuses based on total number of sales generated in any given calendar month. In addition, the Company granted 250,000 three-year stock options to purchase common stock to Cydcor at an exercise price of $0.20. The Company valued these options utilizing the Black-Scholes options pricing model at $0.09 per share or $22,500 and recorded marketing expense for the six-month period ended June 30, 2009.

In February 2009, the Company issued in aggregate 700,000 five-year stock options to purchase common stock for legal services with a vesting period of 12 months at an exercise price of $0.20. The Company valued these options utilizing the Black-Scholes options pricing model at $0.19 per share or $133,000. For the six-month period ended June 30, 2009, total stock-based legal expense charged to operations amounted to $44,332. At June 30, 2009, there was $88,668 of total unrecognized legal expense related to non-vested option-based compensation arrangements.

For the six-month period ended June 30, 2009, the Company granted 3,725,000 five-year stock options to purchase common stock to employees at exercise prices ranging from $0.15 to $0.21 per share. For the six-month period ended June 30, 2009, total stock-based compensation charged to operations for option-based arrangements amounted to $543,998. At June 30, 2009, there was $349,481 of total unrecognized compensation expense related to non-vested option-based compensation arrangements under the Qualified Stock Option Plan and Non Qualified Stock Option Plan.

In March 2010, the Company issued in aggregate 671,428 five-year stock options to purchase common stock for legal services that vest immediately at an exercise price of $0.01. The Company valued these options utilizing the Black-Scholes options pricing model at $0.22 per share or $146,438. For the six-month period ended June 30, 2010, total stock-based legal and consulting expense charged to operations amounted to $168,605 and $8,867, respectively. At June 30, 2010, there was no unrecognized legal and consulting expense related to non-vested option-based compensation arrangements.

During the six-month period ended June 30, 2010, the Company modified the exercise price of certain options aggregating 15,825,342 to $0.18 exercise price. As a result of the modification, the Company recognized an expense of $239,821 as an increase in additional paid-in capital and an increase in selling, general & administrative expense.

For the six-month period ended June 30, 2010, the Company granted 2,956,252 five-year stock options to purchase common stock to employees at exercise prices ranging from $0.16 to $0.21 per share. For the six-month period ended June 30, 2010, total stock-based compensation charged to operations for option-based arrangements amounted to $533,341. At June 30, 2010, there was $497,798 of total unrecognized compensation expense related to non-vested option-based compensation arrangements under the Qualified Stock Option Plan and Non Qualified Stock Option Plan.

F-14

The fair value of stock options granted was estimated at the date of grant using the Black-Scholes options pricing model. The Company used the following assumptions for determining the fair value of options granted under the Black-Scholes option pricing model:

|

June 30, 2010

|

June 30, 2009

|

|||||||

|

Exercise Price

|

$0.01 - $ 0.20 | $0.15- $ 0.20 | ||||||

|

Market price at date of grant

|

$0.16 - $ 0.225 | $0.13 -$ 0.25 | ||||||

|

Expected volatility

|

78.2% - 100.4% | 75% - 199% | ||||||

|

Risk-free interest rate

|

1.39% - 2.47% | 1.40% - 3.87% | ||||||

NOTE 12 - COMMITMENTS AND CONTINGENCIES

Litigation

In January 2009, the Company filed a declaratory relief in connection with an investment banking agreement entered into fiscal 2008 against Merriman Curhan Ford & Co. in the Supreme Court of California - County of Riverside Case No. 083346. In February 2009, the Company received a notice of petition for order compelling arbitration in the Superior Court California- San Francisco County, Case No. CFP 09-509186, which was filed on January 28, 2009 by a placement agent, Merriman Curhan Ford & Co., for failure to pay fees for services associated with an investment banking agreement. The placement agent is seeking for the reimbursement for out of pocket fees of approximately $31,000, payment of notes payable with principal amount of $161,200 and 370,370 shares of the Company. The case is set for arbitration in September 2010, and mediation will be completed by July 2010. The Company contends that the agreement was obtained by misrepresentations and concealment and that it is unenforceable and void. If the case proceeds, the Company intends to respond aggressively to the arbitration and believes that there is a very low likelihood of an unfavorable outcome.

NOTE 13 - RELATED PARTY TRANSACTIONS

The Company made rental payments for property owned by the Chief Executive Officer of the Company during the six-month periods ended June 30, 2010 and 2009 amounting $10,000 and $15,000, respectively. The rental property was used for temporary employee housing during such periods.

NOTE 14 - ACCRUED PAYROLL TAXES

As of June 30, 2010, the Company recorded a liability related to unpaid payroll taxes for the period from May 16, 2008 to June 30, 2010 for $2,614,913, of which, $469,000 is relates to accrued interest and penalty.

NOTE 15 - SEGMENTS

During the six-months ended June 30, 2010 and 2009, the Company operated in one business segment. The percentages of sales by geographic region for the six-month periods ended June 30, 2010 and 2009 were approximately:

|

2010

|

2009

|

|||||||

|

United States

|

15% | 13% | ||||||

|

Europe

|

85% | 87% | ||||||

NOTE 16 - SUBSEQUENT EVENTS

During July 2010, a consultant exercised 250,000 warrants with a fair value of $30,000, or $0.12 per share.

During July and August 2010, the Company issued 2,316,946 shares of common stock in connection with the conversion of various 8% convertible promissory notes with principals aggregating $277,000 and accrued interest of $27,206. The fair value of such shares issued amounted to $304,206, or $0.13 per share. In connection with the conversion, the Company also granted warrants to purchase 2,316,946 shares of common stock, of these warrants, 200,279 were for accrued interest.

During July 2010, the Company issued 8% convertible promissory note of $60,000, which matures in May 2011.

During July and August 2010, the Company issued 3,916,666 shares of common stock pursuant to a private placement which generated gross proceeds of $392,000. In connection with the private placement, the Company issued 3,916,666 warrants exercisable at $0.12 per share. The warrants expire three years from the date of grant.

During July 2010, the Company secured a $10 million line of credit which bears interest at a rate of 10% on the unpaid principal balance and at a rate of 4% on the unfunded balance. The interest is payable monthly commencing October 1, 2010. The line of credit is secured by the Company's accounts receivable and matures in July 2013.

The line of credit is convertible by the holder at anytime prior to maturity as follows:

If the unpaid principal balance is

|

·

|

up to $1 million $0.20

|

|

·

|

between $1 and 2 million $0.25

|

|

·

|

between $2 and 7 million $0.30

|

|

·

|

between $7 and 10 million $0.35

|

The Company may convert the line of credit prior to maturity if the ten day average closing price per share of the Company’s common stock exceeds $0.60.

Additionally, the Company issued 15,000,000 warrants to the lender. The warrants are exercisable at a price of $0.30 per share. The warrants expire in July 2015.

Finally, the Company issued 50,000 shares of Series B Preferred Stock. The Series B Preferred Stock has the following rights: each share of Series B Preferred entitles the holder to 400 votes and dividend distributions declared by the Corporation to or for the holders of its common stock.

F-15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview

Our flagship product is Spare Backup, a fully-automated remote backup solution designed and developed especially for the small office or home environment which automatically and efficiently backs up all data on selected laptop or desktop computers, as well as mobile devices. As a result, we believe small companies can ensure file safety in PCs and laptops for backup and retrieval. We launched our Spare Back-up service and software product version 1.0 in March 2005 and we are currently offering version 6.0 of the product. Our Spare Switch software enables users to complete the transfer of personal files from one personal computer (PC) to another via a high speed Internet connection. We focus on owners and executives of businesses that use technology to support their businesses, but do not have an IT (information technology) department, as well as consumers who desire to secure available files and documents vital to the continuity of their operations, business, or personal information. Our concept is to develop a suite of complementary products and services which are designed for use by technical and non-technical users featuring a user interface that can cross both sets of users. Our software has unique characteristics of additional coding that enables easy to scale infrastructure and support elements which we believe provides a competitive advantage over other providers whose products require large investments in hardware, as well as professional installation, training and support.

In 2009 Spare formed its Enterprise division, as we have successfully launched our product with Sony Corp.

During 2009, we introduced our new advertising division, which has the ability to sell or cross market products to our data base of clients. We can partner with our exiting clients and or solicit new customers to cross market products based on the end users behavior.

Currently, our services include the following:

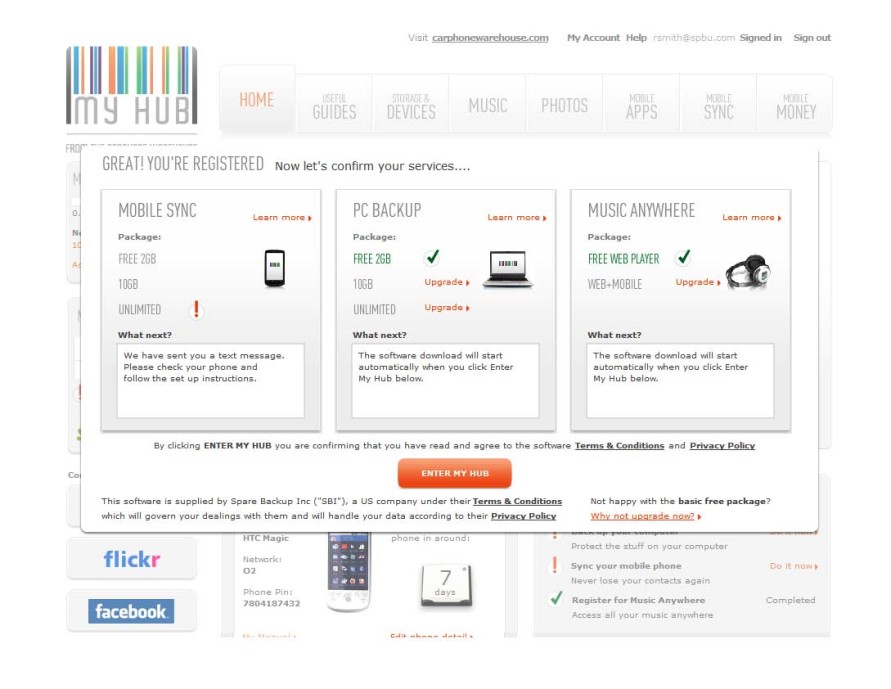

· My Hub - offers 2 GB of free storage to all customers from the web-site and at point of sale. We are now also offering the option to purchase monthly and annual plans for multiple devices. My Hub offers Mobile Sync, which provides customers with the ability to sync their mobile phones, including data, contacts and photos, allowing them to be accessed online. My Hub also includes PC Backup and Music Anywhere, which allows our customer to access all of their music from anywhere in the world.

Link: http://www.carphonewarehouse.com/my-hub

· Wirefly Mobile Backup/Contact Mover – provides backup for mobile devices’ contacts, photos, music and videos, as well as DATA transfer service, allowing the transfer of contacts between the customers old and new phone. We plan on launching this service shortly with our partner.

Link: http://www.wirefly.com/backup

· Comet on Call File Safe – offered in Europe providing back up services in retail stores. This product is being sold on the shelf and bundled with promotions

· Spare Backup – unlimited storage for $59.99 a year. Link: www.sparebackup.com

· My Memory Center (Sony) – backup with Viao Care warranty support service from Sony for Viao products, as well as a 90 day free trial.

· Spare backup Enterprise – offering backup services for corporate clients with varying needs, from clients with 5 PCs to 100 PCs, ranging in prices.

Link: http://my.sparebackup.com/product_wizard.asp?source=SPBU

During the six-month period ended June 30, 2010 we have been developing various new product lines, such as Spare Mobile and Spare Sync/Collaborate, as well as improving our already existing products such as Spare Backup and Spare Switch. Spare Mobile focuses on mobile phones, ensuring users that their contacts, photos and data are securely backed up and can be accessed from anywhere in the world. Spare Sync/Collaborate allows our customers to move date effortlessly between devices. We have worked on ensuring that our products are compatible with all of the newest technologies, allowing connection between laptops, cameras, televisions, mobile phones and other mobile devices. We have improved our photo storage along with our mobile storage. New to our products, we now provide the back up of apps, games, movies, books, calendar and mail. Customers can now also remotely control their various devices from other devices, making sharing content and moving files and data with a single touch. Our customers now have the ability to find their mobile phones and remotely control it, providing them with the opportunity to get the location, lock the device and wipe the date via a browser.

The following is an example of our website, showing the different device and information that our products cover, as well as an example of what a user will see when managing their devices and information.

16

17

18

We have generated minimal revenue since our inception on September 12, 2002, and have incurred net losses of approximately $102 million from cash and non-cash activity since inception through March 31, 2010. Our current operations are not an adequate source of cash to fund our current operations and we have relied on funds raised from the sale of our securities to provide sufficient cash to operate our business. We have secured a line of credit of $10 million; at June 30, 2010 we drew down a small amount of the line. We plan to draw down more over the remainder of fiscal 2010 and use portions of it to pay off liabilities.

Financing:

We have negotiated down our liabilities and have settled numerous lawsuits in favorably. We have notified the IRS on our tax issue and have scheduled a payment at the end of July. The financing we have announced will enable the company to eliminate its debt, and furnish the company with the necessary working capital to carry the company until it is cash flow positive. The current financing environment has been challenging but we are encouraged to have the current plans in place so we can focus on growing the business and executing on our business model.

Second Generation Software:

We have currently completed the enhancement of software and have successfully deployed it “My Hub” for Car Phone Warehouse. Training started in the third quarter, where trainers are going to all stores to explain the offering. This has been possible through feedback from the initial user base, as well, comments from focus groups. We completely redesigned the user experience. We have established a simple sign up process that automatically downloads to both the mobile client through an “sms” message, as well, backs up onto the client’s computer. We are marketing this new software with an upfront one-year subscription fee. This will accelerate the company’s path to cash flow growth, and is easily deployed by the sales person at the retail point of purchase.

19

Even though the company has worked to complete the development of its second generation software, it has also succeeded in making significant progress in reducing costs. The company anticipates that it will see the benefits of our R&D outsourcing throughout the remainder of the year. As our products gain market acceptance and our roll-outs continue with our current and future partners we anticipate significant improvement in both revenues and profitability. We have placed a great deal of emphasis on our mobile platforms, and specifically mobile phones, as we have completed the deployment of our software so that it is compatible for all phones varities. The following lists the mobile operating systems we support: Blackberry OS v4.6, 4.7 and 5.0, Android OS v1.5, 1.6 and 2.1, WinMobile OS v6.1 and 6.5, Java S60 Phones with MIDP 2.0 and 2.1, iPhone OS v3.0, 3.1 and 4.0.

New business relationships:

We have replaced DSGI with Comet stores and the Car Phone Warehouse group, which includes Best Buy Europe, and their affiliates throughout Europe, providing them, with custom applications designed specifically for them. The process of back filing DSGI has taken almost three quarters to complete, as we have gone from providing back up service, to expanding our offerings to cloud service, mobile backup, syncing and a suite of other services as previously discussed. We now expect to start seeing improvement throughout the rest of the year, as we did last year when we launched DSGI.

We are continuing to expand our current distribution partners with scheduled launches throughout the remanding part of the year. We are adding new partners, along with previously announced partners, such as Wirefly/Simplexity and Comet that will soon begin selling the custom solutions that we developed. We are also looking into and negotiating licensing deals where potential partners can license our software for a flat fee as they incur all costs associated, such as storage and customer support. It is still to early to tell if our cloud offerings are going to be successful, however, we believe very strongly in its potential. We believe that our technology is already proven with our box sales product at retail and as the mobile phone market, specifically smart phones, continues to grow. We believe our offerings will adopt to the customers as our cloud system provides smart phones with the ability to link into our cloud and connect to multiple devices.

We are working on providing our partners with real time data analytics from their consumers via Spare's subsidiary company SMA, which will provide them with behavioral pattern matching and market research.