Attached files

| file | filename |

|---|---|

| EX-31.1 - ZCO LIQUIDATING Corp | v185858_ex31-1.htm |

| EX-23.2 - ZCO LIQUIDATING Corp | v185858_ex23-2.htm |

| EX-23.1 - ZCO LIQUIDATING Corp | v185858_ex23-1.htm |

| EX-31.2 - ZCO LIQUIDATING Corp | v185858_ex31-2.htm |

| EX-32.1 - ZCO LIQUIDATING Corp | v185858_ex32-1.htm |

| EX-14.1 - ZCO LIQUIDATING Corp | v185858_ex14-1.htm |

| EX-10.33 - ZCO LIQUIDATING Corp | v185858_ex10-33.htm |

| EX-10.31 - ZCO LIQUIDATING Corp | v185858_ex10-31.htm |

| EX-10.32 - ZCO LIQUIDATING Corp | v185858_ex10-32.htm |

United

States

Securities

And Exchange Commission

Washington,

D.C. 20549

Form

10-K

(Mark

One)

|

x

|

Annual

Report

Pursuant

To

Section

13 Or

15(D) Of

The

Securities

Exchange

Act

Of 1934

For

the fiscal year ended February 28,

2010

|

OR

|

¨

|

Transition

Report

Pursuant

To

Section

13 Or

15(D) Of

The

Securities

Exchange

Act Of 1934

|

For

the transition period

from

to

.

Commission

file number 000-53633

OCZ

Technology Group, Inc.

(Exact

name of Registrant as specified in its charter)

|

Delaware

|

04-3651093

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

6373 San Ignacio Avenue

San Jose, California

|

95119

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s

telephone number, including area code: (408) 733-8400

Securities

registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Common

stock, $0.0025 par value

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes x No ¨

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past

90 days. Yes x No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained herein, and will

not be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. x

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes ¨ No x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

One):

|

Large

Accelerated Filer

|

¨

|

Accelerated

Filer

|

¨

|

|

Non-Accelerated

Filer

|

x

|

Smaller

reporting company

|

¨

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange

Act). Yes ¨ No x

The

aggregate market value of voting stock held by non-affiliates of the Registrant

was approximately $14.3 million as of August 31, 2009, the last business day of

the Registrant’s most recently completed second fiscal quarter. This

calculation does not reflect a determination that certain persons are affiliates

of the Registrant for any other purpose.

21,278,643

shares of the Registrant’s common stock, $0.0025 par value, and 60,990 shares of

Registrant’s Series A preferred stock, $0.0025 par value, were outstanding as of

the fiscal year ended February 28, 2010.

Documents Incorporated By

Reference

None.

OCZ

Technology Group, Inc.

Form

10-K

Index

|

Page

|

||

|

Forward

Looking Statements

|

3

|

|

|

Part

I

|

||

|

Item

1.

|

Business

|

3

|

|

Item

1A.

|

Risk

Factors

|

15

|

|

Item

1B.

|

Unresolved

Staff Comments

|

29

|

|

Item

2.

|

Properties

|

29

|

|

Item

3.

|

Legal

Proceedings

|

30

|

|

Item

4.

|

(Removed

and Reserved)

|

31

|

|

Part

II

|

||

|

Item

5.

|

Market

for Registrant’s Common Equity. Related Stockholder Matters and

Issuer Purchases of Equity Securities

|

32

|

|

Item

6.

|

Selected

Financial Data

|

36

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

37

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures about Market Risk

|

48

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

49

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

71

|

|

Item

9A(t).

|

Controls

and Procedures

|

71

|

|

Item

9B.

|

Other

Information

|

72

|

|

Part

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

73

|

|

Item

11.

|

Executive

Compensation

|

78

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

91

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

92

|

|

Item

14

|

Principal

Accounting Fees and Services

|

93

|

|

Item

15

|

Exhibits,

Financial Statement Schedules

|

94

|

|

Part

IV

|

||

|

Signatures

|

95

|

|

2

Forward

Looking Statements

This

annual report on Form 10-K, including the following sections, contains

forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995, particularly, our expectations regarding results

of operations, our ability to expand our market penetration, our ability to

expand our distribution channels, customer acceptance of our products, our

ability to meet the expectations of our customers, product demand and revenue,

cash flows, product gross margins, our expectations to continue to develop new

products and enhance existing products, our expectations regarding the amount of

our research and development expenses, our expectations relating to our selling,

general and administrative expenses, our efforts to achieve additional operating

efficiencies and to review and improve our business systems and cost structure,

our expectations to continue investing in technology, resources and

infrastructure, our expectations concerning the availability of products from

suppliers and contract manufacturers, anticipated product costs and sales

prices, our expectations that we have sufficient capital to meet our

requirements for at least the next twelve months, and our expectations regarding

materials and inventory management. These forward-looking statements

involve risks and uncertainties, and the cautionary statements set forth below

and those contained in the section entitled “Risk

Factors” identify important factors that could cause actual results to

differ materially from those predicted in any such forward-looking

statements. We caution investors that actual results may differ

materially from those projected in the forward-looking statements as a result of

certain risk factors identified in this Form 10-K and other filings we have made

with the Securities and Exchange Commission. More information about

potential factors that could affect our business and financial results is set

forth under “Risk

Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.”

Part

I

|

Item

1.

|

Business

|

General

OCZ

Technology Group, Inc., a Delaware corporation (“OCZ”) was

formed in 2002. OCZ has two subsidiaries, OCZ Canada, Inc., a

Canadian corporation, and OCZ Technology Ireland Limited, an Irish corporation.

Unless the context requires otherwise, references in this document to “us” or

“we” are to OCZ on a consolidated basis.

Overview

We are a

leading provider of high performance solid state drives (“SSDs”) and

memory modules for computing devices and systems. Founded in 2002,

OCZ is incorporated in Delaware with headquarters in San Jose, California and

offices in Canada, the Netherlands, and Taiwan. Our fiscal year ends

on the last day of February.

Historically,

we primarily sold high performance memory modules to individual computing

enthusiasts through catalog and online retail channels. However, SSDs

have emerged as a strong market alternative to conventional disk drive

technology and SSDs are rooted in much of the same basic technological concepts

as our legacy memory module business. Today, as part of a

diversification strategy which began in fiscal year 2009, our product mix is

significantly more weighted toward the sale of SSDs and the SSD product line has

become central to our business. As a result, our target customers are

increasingly enterprises and original equipment manufacturers (or “OEMs”).

In

addition to our SSD and Memory Module product lines, we design, develop,

manufacture and distribute other high performance components for computing

devices and systems, including thermal management solutions and AC/DC switching

power supply units (“PSUs”). We

offer our customers flexibility and customization by providing a broad array of

solutions which are interoperable and can be configured alone or in combination

to make computers run faster, more reliably, efficiently and cost

effectively. Through our diversified and global distribution channel,

we offer more than 450 products to 376 customers, including leading retailers,

on-line retailers (“etailers”),

OEMs and computer distributors.

3

Our ten

largest customers measured by net revenue for our fiscal year ended February 28,

2010 are listed as follows in alphabetical order:

|

|

§

|

Amazon.com;

|

|

|

§

|

ASK

Corporation;

|

|

|

§

|

BAS

Group;

|

|

|

§

|

D&H

Distribution Company;

|

|

|

§

|

Maxcom

Memory GmbH;

|

|

|

§

|

Memoryworld

GmbH & Co., KG;

|

|

|

§

|

Micro

Center Corporation;

|

|

|

§

|

Micro

Peripherals LTD;

|

|

|

§

|

NewEgg.com,

operated by Magnell Associate Inc.;

and

|

|

|

§

|

SYX

Distribution, Inc.

|

These ten

customers represented approximately 51% our net revenue for the period set forth

above. Our largest customer is NewEgg.com, which represented

approximately 19% of our revenue. No other customer was responsible

for 10% or more of our net revenue.

We

develop flexible and customizable component solutions quickly and efficiently to

meet the ever changing market needs and provide superior customer

service. We believe our high performance computer components offer

the speed, density, size and reliability necessary to meet the special demands

of:

|

|

§

|

industrial

equipment and computer systems;

|

|

|

§

|

computer

and computer gaming and

enthusiasts;

|

|

|

§

|

mission

critical servers and high end

workstations;

|

|

|

§

|

personal

computer (“PC”)

upgrades to extend the useable life of existing

PCs;

|

|

|

§

|

high

performance computing and scientific

computing;

|

|

|

§

|

video

and music editing;

|

|

|

§

|

home

theatre PCs and digital home convergence products;

and

|

|

|

§

|

digital

photography and digital image manipulation

computers.

|

We

perform the majority of our research and development efforts in-house, which

increases communication and collaboration between design teams, streamlines the

development process and reduces time-to-market.

4

We

commenced operations in 2002 and shares of our common stock began trading on the

Alternative Investment Market (“AIM”) of

the London Stock Exchange in June 2006. On April 28, 2006, we amended

our certificate of incorporation to, among other matters, affect a 3-for-1

forward stock split. In May 2007, we acquired PC Power and Cooling,

Inc., a privately-held manufacturer of PSUs that was based in San Diego,

California. We now offer both PC Power and Cooling, Inc. and OCZ

branded PSUs. In October 2007, we acquired substantially all of the

assets of Silicon Data Inc., doing business as Hypersonic PC Systems, a

privately-held manufacturer of high performance gaming PCs and laptops aimed at

the computer gaming community that was based in Great Neck, New

York. In March 2009, we amended our certificate of incorporation

primarily to increase the number of authorized shares and eliminate a number of

provisions which required us to comply with various United Kingdom laws in the

case of, among other things, takeovers and tender offers. On April 1,

2009, following appropriate stockholder approval, we voluntarily delisted our

common stock from trading on AIM. From January 14, 2010 to April 22,

2010 our common stock was quoted on the Over-the-Counter Bulletin Board (“OTCBB”). Since

April 23, 2010, our common stock has been quoted on The NASDAQ Capital

Market.

Currently,

our products are purchased by 376 customers, most of which are distributors or

etailers in 69 countries. For our fiscal years ended February 28,

2010, February 28, 2009 and February 29, 2008, our net sales were $144 million,

$156 million and $118.3 million, respectively, and our net income (loss) was

$(13.5) million, $(11.7) million and $1.4 million, respectively.

In

September 2009, we sold all inventory, patents and other assets related to our

Neural Impulse Actuator product line to BCInet, Inc., a Delaware corporation, in

exchange for notes with principal amounts in the aggregate of $895,415 and

shares of BCInet, Inc.’s Series A preferred stock, representing a 27%

equity stake in BCInet, Inc. Also in September 2009, we amended our

certificate of incorporation to affect a 1 for 2.5 reverse stock

split. All share amounts in this report have been adjusted for the

effect of this reverse split.

Under the

terms of our certificate of incorporation with respect to our Series A preferred

stock, each share of Series A preferred stock was to be automatically converted

into shares of common stock on the sixtieth (60th)

trading day following the commencement of trading of our common shares on a

public stock exchange, including OTCBB (“Mandatory

Conversion”). The trading of our common shares commenced on

OTCBB on February 10, 2010, and the 60th trading

day following the commencement of trading was May 4, 2010. The number

of shares of our common stock issued upon Mandatory Conversion was determined by

dividing $5.00 by the Denominator Price, which was determined as

follows: If the sixty (60) day per share average closing price of our

common stock on such public stock exchange (the “60 Day

Average”) is between $3.00 and $5.00, then the Denominator Price will be

the 60 Day Average. Based on the 60 Day Average of $4.86, and after

taking into account fractional shares, on May 4, 2010, 60,990 shares of our

Series A preferred stock were converted into 62,733 shares of our common stock,

and warrants to purchase 140,520 shares of our Series A preferred stock were

converted into warrants to purchase 144,541 shares of our common

stock.

Industry

Overview

PCs and

other industrial and consumer electronics products and systems are increasingly

complex and require additional functionality and processing power to allow more

effective gaming, high performance computing, scientific computing, video and

music editing, virtual home theatres, digital home convergence products, digital

photography and digital image manipulation. As these products and

systems increase in complexity, functionality and processing power, demand for

high performance components and solutions increases.

Anatomy

of the Computing Environment

A PC is

most often considered to be a desktop computer, a laptop computer, or a netbook

solution. PCs are most often utilized by consumers for work and

entertainment purposes. A typical PC contains the following key

components:

5

|

1.

|

Visual

Display Unit (Monitor)

|

|

2.

|

Motherboard

|

|

3.

|

Central

Processing Unit (CPU)

|

|

4.

|

Memory

|

|

5.

|

Graphics

Processing Unit (Video Card)

|

|

6.

|

Power

Supply and Chassis

|

|

7.

|

Optical

Drive (DVD-ROM, DVD Writer,

Blue-Ray)

|

|

8.

|

Storage

Drive (Traditional Hard Drive or Solid State

Drive)

|

|

9.

|

Keyboard

|

|

10.

|

Mouse

|

Corporations

or “enterprises”, in addition to deploying PCs for individual employee use,

perform a substantial amount of computing in “server rooms” housed in local

offices or “data centers” where computing resources are consolidated on a

regional or global basis. In both the server room and data center,

the computing resources are comprised of high performance servers

(which can be thought of as special purpose PCs often comprised of only a

motherboard, power supply and memory), storage arrays (banks of independently

housed storage drives with a power unit), and other network equipment

(infrastructure that facilitates communication between network

resources).

PCs are

primarily built by OEMs (such as Dell, Lenovo, and HP), valued-added resellers

(“VARs”) and

technically advanced consumers who prefer to assemble customized systems rather

than purchase pre-assembled computers. PC performance enhancements

are often necessary in order to take advantage of the latest applications and

increase the useable life of the PC. Historically, we have been

supplying high-performance memory (#4 above) for VARs and after-market

installation. Our product mix is now more heavily weighted toward

providing SSDs (#8) and power supply units (#6) for use in PCs and laptops with

an increasing emphasis for sales to OEM and enterprise customers.

Memory

Market

Memory is

a critical component of electronic products and systems and is used in a wide

variety of end markets, such as PCs and other industrial and consumer electronic

markets and is a key component in a variety of applications. As these

products and systems increase in complexity, functionality and processing power,

they require increasing amounts and densities of memory. Key drivers

of the demand for memory are both the increasing number and variety of

electronic products and systems and the increasing amount of memory they require

by such electronic products and systems. Demand for memory is also

fueled by a shift toward higher data rates, new operating systems that require

higher levels of memory, greater storage content in high-end computing, and

higher IT hardware replacement cycle and general corporate IT

spending.

6

Memory

semiconductors can be divided into two types, volatile and non-volatile

memory. Volatile memory, consisting of Dynamic Random Access Memory

(“DRAM”) and

Static Random Access Memory (“SRAM”),

maintains stored data only when connected to a power

source. Non-volatile memory, consisting principally of flash memory

(which are used to make SSDs), is able to maintain stored data even when the

power source is removed.

Solid

State Drives

SSDs use

flash memory chips, rather than the rotating platters used by hard disk drives

(“HDDs”), to

store data. Flash memory is a type of non-volatile memory, meaning

that it can continue to store information even when the power is turned

off. It also allows information to be erased and

rewritten. SSDs based on flash memory have a number of unique

advantages over conventional hard disk drive technology and represent the next

step in the evolution of storage technology:

|

|

§

|

faster

start-up because, unlike HDDs, there is no spinning

disk;

|

|

|

§

|

at

least 10x faster than HDDs, allowing quicker access to the stored data,

because no read/write head is

required;

|

|

|

§

|

high

mechanical reliability and durability due to lack of moving

parts;

|

|

|

§

|

far

more resistant to the failure due to shock, high altitude, vibration,

humidity, and extreme temperature;

|

|

|

§

|

less

failure while writing or erasing data, which translates into lower chance

of irrecoverable data damage; and

|

|

|

§

|

require

less power to operate and generate less heat than that of conventional

hard disk drives, resulting in decreased power consumption specifically in

data centers, which reduces operating costs significantly for data center

operators. The reduced power consumption also makes SSDs ideal

for use in laptop computers and appliances where battery life is a

consideration.

|

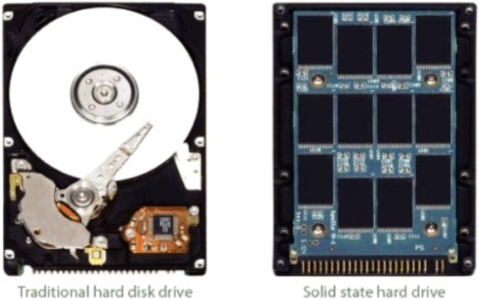

Note the

numerous mechanical parts included in the traditional hard disk drive shown

above on the left picture. Solid state drives, pictured on the right,

have no moving parts.

7

According

to International Data Corporation (“IDC”) and

Web-Feet Research, Inc., the SSD market grew from approximately $400 million in

2007 to $700 million in 2008. According to IDC, the SSD market was

projected to have grown to $1.1 billion in 2009. In addition, the SSD

market is projected to grow from $1.8 billion in 2010 to $2.8 billion in

2011, to $3.9 billion in 2012 and to $5.3 billion by 2013. A

significant portion of this growth will be driven by penetration of SSDs into

the laptop and netbook markets.

We

believe the advantages of SSD technology are particularly beneficial to at least

five distinct market segments:

|

|

§

|

enterprise

storage and video-on-demand (VoD)

applications;

|

|

|

§

|

military

and industrial applications;

|

|

|

§

|

servers

and workstations;

|

|

|

§

|

portable,

ULPC and desktop PCs; and

|

|

|

§

|

consumer

related markets.

|

According

to IDC, these market segments are all expected to grow substantially in the near

and medium term.

Enterprise

SSDs

The

enterprise segment is comprised of high performance servers (a form of

specialized computer), storage arrays (banks of independently housed hard drives

or SSDs) and network equipment. Performance is paramount to this

segment of the market. Traditional enterprise storage solutions make

use of HDDs, whose ability to input and output data is limited by the maximum

speed of about 15,000 RPM with which the disk can rotate. To work

around the speed limitations of HDDs, existing solutions employ complex

strategies to speed up access to data on disk such as “striping” or

“short-stroke”. Although such strategies increase the speed with

which data can be read from and written to the disk they also reduce the usable

capacity of each disk. Less capacity per disk creates a need for

additional disks to achieve a desired total capacity. SSDs also have

faster read and write speeds, at least 10x that of HDDs, according to

LaptopAdvisor and Gartner, an independent analysis firm. Also, while

HDDs are highly economic on a cost per amount of storage basis at the time of

purchase, the total cost of ownership of an enterprise storage solution is

heavily influenced by the power consumption and heat

generation. Without moving parts, SSDs require significant less power

to operate compared to HDDs. This means less heat generation, which

in turn means lower power requirement for cooling at the system

level. Reduced power consumption and cooling requirements for the

datacenter translate into lower datacenter operating costs.

We have

focused on gaining market-share within the enterprise segment of the SSD market,

which we believe will be the highest margin segment of the

market. Our solutions are designed to address what we believe to be

the key challenges enterprises currently face with regard to high performance

storage solutions: performance, reliability, power consumption, and cooling

requirements. At this time we believe OCZ, STEC, Toshiba and Fusion

I/O are the only vendors currently shipping enterprise-ready SSD

products.

DRAM

DRAM is

the most common type of memory semiconductor. iSuppli Corporation, an

independent market research firm, projects DRAM to have a market size of

$31.9 billion in 2010, representing more than a 40% increase from the 2009

market size.

8

Flash

and Solid State Drive Technology

Flash

memory is a type of non-volatile memory, meaning that it can continue to store

information when the power to a particular device is turned off. It

also allows information to be erased and rewritten. Flash is the

largest segment of the non-volatile memory market according to Web-Feet

Research, Inc., an independent research firm. Many consumers are

familiar with a flash technology known as “NAND Flash,” which is typically used

in USB “memory sticks,” digital cameras and mobile phones. Flash

drives are increasing in density and capacity and are becoming alternatives to

traditional hard disk drives in certain devices such as personal MP3

players. According to In-Stat, an independent market research firm,

worldwide NAND flash revenues are expected to grow at a compound annual growth

rate (“CAGR”) of

29.7% during 2007-2012 and to reach $61 billion annually by 2012.

Memory

Modules

Memory

modules are compact circuit board assemblies consisting of DRAM or other

semiconductor memory devices and related circuitry. The use of memory

modules enables systems to be easily configured with a variety of different

levels of memory, thus increasing their flexibility to address multiple price

points or applications with a single base system design. In addition,

the use of memory modules provides a relatively easy path for upgradeability of

PCs or workstation, a feature of system design that is increasingly required by

end users. To achieve this flexibility and upgradeability, systems

are designed to use memory modules as a “daughter card,” reducing the need to

include memory devices on the motherboard. This design structure

frees up space on the motherboard and enables a single motherboard to be a

common central element for a variety of different systems, resulting in

significant cost savings.

The

market for memory modules includes both standard and specialty

modules. The high volume standard memory module market includes

modules that can be sourced from many module suppliers, and are designed to be

incorporated into a wide variety of equipment. These modules employ

designs meeting widely used industry specifications and are available with a

variety of options to address the needs of multiple users. Standard

memory modules are typically used in desktop PCs and printers and are sold to

OEMs and through computer resellers and directly to end users.

Specialty

memory modules include both custom and application specific

modules. The varying requirements of different electronic systems and

the increased number of memory device options have resulted in a market for

specialized memory modules that are designed to enhance the performance of a

particular system or a set of applications. These modules are based

on DRAM technologies and may include additional control

circuitry. Specialty memory modules are typically sourced from a

limited number of suppliers. Application specific and custom memory

modules are used in PCs, mobile computers and workstations for computer gaming,

video editing, and generally any area where higher performance and/or

reliability is a customer requirement.

Opportunity

for Manufacturers of Memory Modules

As the

variety of memory devices available to address specific high-performance

applications has expanded, the design and manufacture of memory modules have

increasingly become areas of opportunity for independent memory module

manufactures such as OCZ.

There are

two main types of suppliers of memory modules: memory semiconductor

manufacturers and independent “third party” memory module

manufacturers. The world’s largest memory semiconductor manufacturers

focus on industry standard memory modules for high volume applications such as

desktop PCs. Some independent memory module manufacturers also focus

on high volume industry standard applications; however, most independent memory

module manufacturers, including OCZ, focus on providing broad product portfolios

that cover a variety of type, density, data rate, voltage, packaging and other

increasingly complex features.

Power

Supply Units

Power

supply units are the main source of conversion between main alternating current

and the direct current used by computers and other electronic

devices. As modern electronics, computers, servers and workstations

become more complicated, the increased power handling and efficiency of AC/DC

conversion become paramount. Key drivers in the power supply unit

industry are the release of new PCs and industry standards, as well as growing

regulatory requirements in the European Union, North America and Japan for

increased power consumption. According to Databeans, an independent

marketing research firm, the global market for power management products for

2009 is estimated at $15.4 billion, and is expected to grow at 10% for

2010.

9

Thermal

Management

A

computer system’s components produce large amounts of heat during operation,

including integrated circuits such as central processing units (“CPUs”),

chipset and graphics cards, along with hard drives. This heat must be

dissipated in order to keep these components within their safe operating

temperatures. This is done mainly using heat sinks to increase the

surface area which dissipates heat, and, separately, fans to speed up the

exchange of air heated by the computer parts for cooler

ambient air. According to BCC Research, an independent market

research firm, the global market for thermal management technologies increased

from approximately $6.8 billion in 2008 to approximately $11.1 billion by 2013,

a compound annual growth rate of approximately 10.3%. Thermal

management hardware accounts for more than 80% of the total thermal management

market. The largest end-markets for thermal management technologies

in 2007 were the computer industry (57% of total revenues) and

telecommunications (16% of total revenue). By 2013, medical and

office electronics are expected to increase to 12% of total revenue, tying the

expected telecommunications market.

The

OCZ Approach

We

design, develop, manufacture and distribute high performance components for

computing devices and systems, including SSDs, other flash memory storage,

memory modules, thermal management solutions and PSUs. We believe our

primary competitive advantages arise from how we use our internal research and

development team to develop the intellectual property used in our component

solutions. These have enabled us to incorporate advanced

functionality and capabilities and to quickly and efficiently develop new

component solutions that are optimized for our customers’

requirements.

Flexible

and Customizable Component Solutions

We

provide flexible and customizable component solutions to address the specific

application needs of our end users. Our design principles allow us to

develop proprietary components to deliver a broad range of products with

superior features. As of our fiscal year ended February 28, 2010 we

offered over 450 SKUs including SKUs for memory, SSDs, laptop computers and

power supplies.

Rapid

Time to Market

We strive

to reduce the design and development time required to incorporate the latest

technologies and to deliver the next generation of products and

solutions. Our in-house design competencies and control of the design

of many of the pieces used within our component solutions enable us to rapidly

develop, build and test components.

Extensive

Distribution Channels

We have

built a diverse and extensive distribution network reaching a wide range of

customers in 69 countries. This network includes traditional

retailers and etailers, as well as OEMs, systems integrators and

distributors.

Strategic

Relationship

We have

engineering and marketing relationships (for example, being a nominated

“solutions partner” or “certified supplier”) with certain motherboard

manufacturers and integrated circuit manufacturers and chipset/platform

providers such as ATI Technologies, Inc., Advanced Micro Devices, Inc., NVIDIA

Corporation, DFI USA, MSI Computer Corporation and First International Computer,

Inc. We believe that these relationships enable us to respond to

changing consumer needs, to develop product ranges which are compatible with

multiple platforms and to develop other products designed to obtain optimum

performance from a specific platform.

10

Customer

Service

We seek

to build brand loyalty by offering product warranties, comprehensive return and

replacement policies and accessible technical support. Members of our

customer service staff have technical expertise which we believe supports us in

maintaining our reputation for technical expertise and attentive customer

care.

Strategy

Our goal

is to be a worldwide leader in the design, manufacture and distribution of SSDs

and other high performance computer components and solutions. The following are

key elements of our strategy:

|

|

§

|

increase

our penetration of the international consumer electronics and OEM markets

by expanding our sales and marketing

efforts;

|

|

|

§

|

expand

and broaden our product line by leveraging our technology and design

expertise;

|

|

|

§

|

build

strong supplier relationships with our primary component

vendors;

|

|

|

§

|

identify

new applications and customers for our

technology;

|

|

|

§

|

increase

our manufacturing efficiencies; and

|

|

|

§

|

pursue

acquisitions of complementary businesses and

technologies.

|

Our

Products and Services

We

provide our customers with a variety of advanced technological products,

including:

Solid

State Storage and Other Flash Memory Based Products

We design

and manufactures flash memory products in a broad variety of forms and

capacities. Our wide range of flash storage products come in a

variety of formats and interfaces. Our SSD products are predominantly

used in computers, servers and industrial equipment that require increased

speed, lower power consumption and or increased reliability. Our

Solid State storage products are available with a variety of interfaces

including PCIe, SATA, PATA, USB, IE 1394, SAS and mini PCIe and in various form

factors, including 3.5 inch, 2.5 inch as well as card based and external (pen

drive based formats). We also manufacture Secure Digital (“SD”) cards

meant for use primarily in consumer applications, such as digital

photography.

The

following table summarizes certain of our SSDs and other flash product

offerings:

|

Product

|

Density

|

Features

|

Applications

|

|||

|

MLC-

Based Solid State Disk Drives

|

Up

to 2TB

|

Low

power consumption Read/write speeds up to 1.3GB/s

|

Mobile

computing, PCs, RAID controllers

|

|||

|

SLC-Based

Solid State Disk Drives

|

Up

to 512GB

|

Low

power consumption Read/write speeds up to 1.3GB/s, Lower

latency

|

Enterprise,

Servers, workstations, storage area networks, high performance

computing

|

|||

|

USB

Key Drives

|

128MB

-64GB

|

18MB

per second read/write

|

Mobile

computing, PCs

|

|||

|

Normal

and High Capacity SD and Micro SD Cards

|

128MB-16GB

|

Speeds

up to 25Mbs

|

Notebooks,

networking, communications,

photography

|

|||

11

DRAM

Modules

We offer

a comprehensive lineup of DRAM memory modules utilizing a wide range of DRAM

technologies from legacy DDR SDRAM (double data rate synchronous dynamic random

access memory) to leading-edge high performance DDR3 SDRAM devices, the

evolutionary improvements over DDR SDRAM. These modules encompass a

broad range of form factors and functions including dual in-line memory modules

(“DIMMs”),

small outline dual in-line memory modules (“SODIMMs”),

and very low profile (“VLP”)

DIMMs and mini-DIMMs for space-constrained blade server, or 1.75 inch thin

computing server, and networking applications. These memory modules

come in configurations of up to 244 pins, which is the number of pins that plug

into a motherboard, and densities of up to 8GB. We also accommodate

custom module designs based on specific OEM requirements. Our modules

are tested at-speed on high-end proprietary functional testers utilizing

comprehensive test suites, enabling these modules to meet the

stringent requirements of our focus markets.

The

following table summarizes certain of our DRAM memory product

offerings:

|

DDR3

|

Density

|

Speed (MHz)

|

Applications

|

|||

|

High

Speed / Low Latency DIMMs

|

512MB-8GB

|

533-2133Mhz

|

Overclocking,

gaming, home theater, 3d modeling and audio/video editing computers and

workstations

|

|||

|

High

Speed / Low Latency SODIMMs

|

256MB-4GB

|

533-1600Mhz

|

High

performance notebooks, sub-notebooks

|

|||

|

Industry

Standard Unbuffered DIMM

|

256MB-4GB

|

400-1600Mhz

|

PCs

|

|||

|

Registered

DIMMs

|

512MB-8GB

|

400/533/667

|

Servers,

workstations, storage area networks, high performance

computing

|

|||

|

Industry

Standard SODIMMs

|

256MB-4GB

|

533/667

|

Notebooks,

sub-notebooks

|

|||

Power

Supply

We

manufacture power supplies that are designed to power computers and industrial

devices while maintaining interoperability, adhering to industry standards and

increasing output efficiency through design. Our power supplies are

designed to operate at higher temperatures and under more demanding internal

conditions with stricter load regulation than is required under normal

circumstances.

The

following table contains some of our power supply product

offerings:

|

Product

|

Density

|

Features

|

Applications

|

|||

|

High

Wattage Power Supplies

|

Up

to 1200 watts

|

50

C operation, 80%+ efficiency and 1% load regulation, multiple

formats

|

OEM

applications servers, workstations, storage area networks, high

performance computing

|

|||

|

Low

Noise Power Supplies

|

Up

to 750 watts

|

Low

audible noise

|

Overclocking,

PCs and video/audio workstations

|

|||

|

Modular

PSUs

|

Up

to 1000 watts

|

Removable

reconfigurable cables

|

End-user

upgrades, gaming computers and home theater PCs

|

|||

|

High

Efficiency PSUs

|

Up

to 1000 watts

|

Green

friendly with 85% plus efficiency

|

End-user

upgrades, gaming computers and home theater

PCs

|

|||

Thermal

Management

We

design, manufacture and sell various computer related thermal management

products that sell through substantially the same sales channel as other OCZ

products. These products take advantage of OCZ developed technology

and concepts in order to deliver products that our customer base requests or

that we believe they will have interest in.

12

Suppliers

We do not

have any long term supplier contracts or obligations to purchase raw

materials.

Manufacturing

We

believe that one of the keys to our product development and manufacturing is our

speed testing and sorting of components, which enables us to grade components

and select the highest speed memory, and allows us to sell such memory at

premium prices. Our products are built to our requirements and

specifications in our own facilities as well as at several

contract-manufacturing facilities in the United States and Taiwan. In

order to maintain quality control, products are tested when they reach the point

of final assembly at our premises. Certain items are purchased

from several manufacturers with final assembly, testing and packaging completed

in our in-house manufacturing facilities.

In

September 2007, we established our own testing and manufacturing facilities in

Taiwan, followed by the addition, in August 2008, of our own surface mount

assembly equipment. The establishment of our manufacturing facilities

has helped improve and expand our ability to manufacture certain key components

and products, such as memory modules, in-house.

Research

and Development

We

believe that the timely development of new products is essential to maintaining

our competitive position. Our research and development activities are

focused primarily on new high-speed SSDs memory modules, flash technology, power

supplies and ongoing improvement in manufacturing processes and technologies and

continual improvement in test routines and software. We plan to

continue to devote research and development efforts to the design of new

products which address the requirements of our end users.

Our

engineering staff continually explores practical applications of new

technologies, works closely with our customers and provides services throughout

the product life cycle, including architecture definition, component selection,

schematic design, layout, manufacturing and test engineering. We

design our products to be compatible with existing industry standards and, where

appropriate, develop and promote new standards. An important aspect

of our research and development effort is to understand the challenges presented

by our customers’ requirements and satisfy them by utilizing our industry

knowledge, proprietary technologies and technical expertise.

Our

research and development expenses totaled $5.3 million, $2.6 million and $1.6

million in the fiscal years ended February 28, 2010, February 28, 2009 and

February 29, 2008, respectively.

Intellectual

Property

We

attempt to protect our intellectual property rights through a variety of

measures, including non-disclosure agreements, trade secrets and to a lesser

extent, patents and trademarks. We have three issued patents in the

United States that will expire between 2024 and 2025, and fifteen patent

applications pending in the United States. We expect to file new

patent applications where appropriate to protect our proprietary technologies;

however, we believe that our continued success depends primarily on factors such

as the know-how, technological skills and innovation of our personnel rather

than on patent protection.

Competition

The

market for our products is highly competitive, rapidly evolving and subject to

new technological developments, changing customer needs and new product

introductions. We compete primarily with large vendors of computer

components, and to a lesser extent, large vendors of PCs. In

addition, we also compete with a number of smaller vendors who specialize in the

sale of high performance products and computer systems and

components.

13

We

believe our principal competitors include:

|

|

§

|

specialized

solid state storage makers such as STEC, Inc., Fusion I/O and Mtron

Storage Technology Co., Ltd.;

|

|

|

§

|

global

technology vendors such as Intel Corporation and Samsung Electronics Co.,

Ltd.;

|

|

|

§

|

specialized

memory module and flash product vendors such as Kingston Technology

Corporation, SanDisk Corporation, Crucial Technology, the consumer brand

of Micron Technology, Inc., and Corsair Memory, Inc.;

and

|

|

|

§

|

specialized

power supply chassis and cooling manufacturers such as Antec, Inc.,

Thermaltake Technology Inc. USA and Enermax Technology

Corporation.

|

We

believe that the principal competitive factors in our market include the

following:

|

|

§

|

first

to market with new emerging

technologies;

|

|

|

§

|

flexible

and customizable products to fit customers’

objectives;

|

|

|

§

|

high

product performance reliability;

|

|

|

§

|

early

identification of emerging

opportunities;

|

|

|

§

|

cost-effectiveness;

|

|

|

§

|

interoperability

of products;

|

|

|

§

|

scalability;

and

|

|

|

§

|

localized

and responsive customer support on a worldwide

basis.

|

We

believe that we compete favorably with respect to most of these

factors. However, most of our competitors have longer operating

histories, significantly greater resources and greater name

recognition. They may be able to devote greater resources to the

development, promotion and sale of their products than we can, which could allow

them to respond more quickly to new technologies and changes in customer

needs.

Backlog

Sales of

our products are generally made pursuant to purchase orders. We

include in backlog only those customer orders for which we have accepted

purchase orders and to which we expect to ship within

45 days. Since orders constituting our current backlog are

subject to changes in delivery schedules or cancellation with only limited or no

penalties, we believe that the amount of our backlog is not necessarily an

accurate indication of our future net sales.

Employees

As of our

fiscal year ended February 28, 2010, we employed 312 full-time employees, of

which 202 were in general and administration (including operations, finance,

administration, information technology, quality assurance, procurement and

materials work), 76 were in research and development, and 34 were in sales and

marketing. Our employees are not represented by any collective

bargaining agreements and we have never experienced a work

stoppage. Our employees are located in San Jose and Carlsbad,

California; Ontario, Canada; the Netherlands and Taiwan.

Environmental

Matters

Our

business involves purchasing finished goods as components from different vendors

and then assembly of these components into finished products at our

facilities. Accordingly, we are not involved in the actual

manufacturing of components, which can often involve significant environmental

regulations with respect to the materials used, as well as work place safety

requirements. Our operations and properties, however, do remain

subject in particular to domestic and foreign laws and regulations governing the

storage, disposal and recycling of computer products. For example,

our products may be subject to the European Union’s Directive 2002/96/EC Waste

Electrical and Electronic Equipment and Directive 2002/95/EC on Restriction on

the Certain Hazardous Substances in Electrical and Electronic

Equipment. To date, we have not been the subject of any material

investigation or enforcement action by either U.S. or foreign environmental

regulatory authorities. Further, because we do not engage in primary

manufacturing processes like those performed by our suppliers who are industrial

manufacturers, we believe that costs related to our compliance with

environmental laws should not materially adversely affect us.

14

|

Item

1A.

|

Risk

Factors

|

In

addition to the other information described elsewhere in this Annual Report, you

should carefully consider the following risk factors, which could materially

adversely affect our business, financial condition and results of

operations. The risks described below are not the only risks facing

OCZ. Additional risks and uncertainties not currently known to us or

that we currently deem to be immaterial may materially adversely affect our

business, financial condition and results of operations.

Risks

Related to Our Business

We

are subject to the cyclical nature of the markets in which we compete and a

continued downturn could adversely affect our business.

The

markets in which we compete, including SSDs, flash, memory, thermal management

and power supply markets, are highly cyclical and characterized by constant and

rapid technological change, rapid product obsolescence and price erosion,

evolving standards, short product life cycles and wide fluctuations in product

supply and demand. These markets have experienced significant

downturns often connected with, or in anticipation of, maturing product cycles

of both manufacturers’ and their customers’ products and declines in

general economic conditions. These downturns have been characterized

by diminished product demand, production overcapacity, high inventory levels and

accelerated erosion of average selling prices.

Our

historical operating results have been subject to substantial fluctuations and

we may experience substantial period-to-period fluctuations in future operating

results. A downturn in these markets could have a material adverse

effect on the demand for our products and therefore a material adverse effect on

our business, financial condition and results of

operations. Moreover, changes in end-user demand for the products

sold by any individual customer can have a rapid and disproportionate effect on

demand for our products from that customer in any given period,

particularly if the customer has accumulated excess inventories of products

purchased from us. There can be no assurance that our net sales and

results of operations will not be materially and adversely affected in the

future due to changes in demand from individual customers or cyclical changes in

the industries utilizing our products.

We

have experienced quarterly and annual losses in the past and may experience

losses in the future.

We have

experienced losses on a quarterly and annual basis in the past. We

have expended, and will continue to expend, substantial funds to pursue

engineering, research and development projects, enhance sales and marketing

efforts and otherwise operate our business. There can be no assurance

that we will be profitable on a quarterly or annual basis in the

future.

Declines

in our average selling prices of DRAM may result in declines in our net sales

and gross profit.

Our

average selling prices may decline due to several factors. Over the

last few years, overcapacity in the DRAM memory component market resulted in

significant declines in component prices, which negatively impacted our average

selling prices and net sales. During periods of overcapacity, our net

sales may decline if we do not increase unit sales of existing products or fail

to introduce and sell new products in quantities sufficient to offset declines

in selling prices. Our efforts to increase unit sales, reduce costs

and develop new products to offset the impact of further declines in average

selling prices may not be successful. Declines in DRAM prices, which

represent a significant component of our memory sales could also (as they have

in the past) affect our gross profit and the valuation of our inventory, which

could harm our financial results.

Declines

in average selling prices would enable OEMs to pre-install higher capacity based

memory into new systems at existing price points and thereby reduce the demand

for future memory upgrades. Further, our net sales and gross profit

may be negatively affected by shifts in our product mix during periods of

declining average selling prices.

15

In

addition, the continued transition to smaller design geometries and the use of

300 millimeter wafers by existing memory manufacturers could lead to a

significant increase in the worldwide supply of DRAM. Increases in

the worldwide supply of memory components could also result from manufacturing

capacity expansions. If not offset by increases in demand, these

increases would likely lead to further declines in the average selling

prices of our products and have a material adverse effect on our business,

financial condition and results of operations. Furthermore, even if

supply remains constant, if demand were to decrease, it would harm our average

selling prices.

Sales

to a limited number of customers represent a significant portion of our net

sales, and the loss of any key customer would materially harm our

business.

Our

dependence on a limited number of customers means that the loss of a major

customer or any reduction in orders by a major customer would materially reduce

our net sales and adversely affect our results of operations. We

expect that sales to relatively few customers will continue to account for a

significant percentage of our net sales for the foreseeable

future. However, there can be no assurance that any of these

customers or any of our other customers will continue to utilize our products at

current levels, if at all. We have no firm, long-term volume

commitments from any of our major customers and we generally enter into

individual purchase orders with our customers, in certain cases under master

agreements that govern the terms and conditions of the

relationship. We have experienced cancellations of orders and

fluctuations in order levels from period to period and expect that we will

continue to experience such cancellations and fluctuations in the

future. Customer purchase orders may be cancelled and order volume

levels can be changed, cancelled or delayed with limited or no

penalties. The replacement of cancelled, delayed or reduced purchase

orders with new orders cannot be assured.

For our

fiscal years ended February 28, 2010, February 28, 2009 and February 29, 2008,

our ten largest customers accounted for 51%, 49% and 47% of net sales,

respectively. For our fiscal years ended February 28, 2010, February

28, 2009 and February 29, 2008, NewEgg accounted for 19%, 19% and 12% of our net

sales, respectively. During these periods, no other customers

accounted for more than 10% of our net sales.

If

a standardized memory solution which addresses the demands of our customers is

developed, our net sales and market share may decline.

Many of

our memory subsystems are specifically designed for our OEM customers’ high

performance systems. In a drive to reduce costs and assure supply of

their memory module demand, our OEM customers may endeavor to design JEDEC

standard DRAM modules into their new products. This trend could

reduce the demand for our higher priced customized memory solutions which in

turn would have a negative impact on our financial results. In addition,

customers deploying custom memory solutions today may in the future choose to

adopt a JEDEC standard, and the adoption of a JEDEC standard module instead of a

previously custom module might allow new competitors to participate in a share

of our customers’ memory module business.

If our

OEM customers were to adopt JEDEC standard modules, our future business may be

limited to identifying the next generation of high performance memory demands of

OEM customers and developing solutions that addresses such

demands. Until fully implemented, this next generation of products

may constitute a much smaller market, which may reduce our net sales and market

share.

Our

customers are primarily in the computing markets and fluctuations in demand in

these markets may adversely affect sales of our products.

Sales of

our products are dependent upon demand in the computing markets. We

may experience substantial period-to-period fluctuations in future operating

results due to factors affecting the computing markets. From time to

time, these markets have experienced downturns, often in connection with, or in

anticipation of, declines in general economic conditions. A decline

or significant shortfall in demand in any one of these markets could have a

material adverse effect on the demand for our products and therefore a material

adverse effect on our business, financial condition and results of

operations.

16

Customer

demand is difficult to accurately forecast and, as a result, we may be unable to

optimally match production to customer demand.

We make

significant decisions, including determining the levels of business that we will

seek and accept, production schedules, component procurement commitments,

personnel needs and other resource requirements, based on our estimates of

customer’s future requirements. The short-term nature of commitments

by many of our customers and the possibility of unexpected changes in demand for

their products reduces our ability to accurately estimate future customer

requirements. On occasion, customers may require rapid increases in

production, which can challenge our resources and can reduce

margins. We may not have sufficient capacity at any given time to

meet our customers’ demands. Conversely, downturns in the markets in

which our customers compete can, and have, caused our customers to significantly

reduce the amount of products ordered from us or to cancel existing orders

leading to lower-utilization of our facilities. Because many of our

costs and operating expenses are relatively fixed, reduction in customer demand

would have an adverse effect on our gross margins, operating income and cash

flow.

During an

industry downturn, there is also a higher risk that our trade receivables would

be uncollectible, which would be materially adverse to our cash flow and

business.

Order

cancellations or reductions, product returns and product obsolescence could

result in substantial inventory write-downs.

To the

extent we manufacture products in anticipation of future demand that does not

materialize, or in the event a customer cancels or reduces outstanding orders,

we could experience an unanticipated increase in our

inventory. Slowing demand for our products may lead to product

returns which would also increase our inventory. In the past, we have had to

write-down inventory due to obsolescence, excess quantities and declines in

market value below our costs.

We

may be less competitive if we fail to develop new or enhanced products and

introduce them in a timely manner.

The

markets in which we compete are subject to rapid technological change, product

obsolescence, frequent new product introductions and enhancements, changes in

end-user requirements and evolving industry standards. Our ability to

successfully compete in these markets and to continue to grow our business

depends in significant part upon our ability to develop, introduce and sell new

and enhanced products on a timely and cost-effective basis, and to anticipate

and respond to changing customer requirements.

The

markets for our products are characterized by frequent transitions in which

products rapidly incorporate new features and performance

standards. A failure to develop products with required feature sets

or performance standards or a delay as short as a few months in bringing a new

product to market could significantly reduce our net sales for a substantial

period, which would have a material adverse effect on our business, financial

condition and results of operations.

We have

experienced, and may in the future experience, delays in the development and

introduction of new products. These delays could provide a competitor

a first-to-market opportunity and allow a competitor to achieve greater market

share. Defects or errors found in our products after commencement of

commercial shipment could result in delays in market acceptance of these

products. Lack of market acceptance for our new products will

jeopardize our ability to recoup research and development expenditures, hurt our

reputation and harm our business, financial condition and results of

operations. Accordingly, there can be no assurance that our future

product development efforts will result in future profitability or market

acceptance.

17

Our

dependence on a small number of suppliers for components, including integrated

circuit devices, and inability to obtain a sufficient supply of these components

on a timely basis could harm our ability to fulfill orders and therefore

materially harm our business.

Typically,

integrated circuit (“IC”)

devices represent a significant majority of our component costs for our memory

and SSD products. We are dependent on a small number of suppliers

that supply key components used in the manufacture of our

products. Since we have no long-term supply contracts, there is no

assurance that our suppliers will agree to supply the quantities of components

we may need to meet our production goals. Samsung, Toshiba and Intel

currently supply substantially all of the IC devices used in our Flash

memory products. Micron, Elpida and PSC (Powerchip) currently supply

substantially all of the DRAM IC devices used in our DRAM products.

Additionally,

because of constraints on working capital, we have delayed payments to a number

of vendors which could have an adverse effect on our ability to source

product. Moreover, from time to time, our industry experiences shortages

in IC devices and foundry services which have resulted

in foundries putting their customers, ourselves included, on component

allocation. While to date neither delayed payment nor component

shortages has disrupted our business in a material way, in the future,

we may not be able to obtain the materials that we need to fill orders in a

timely manner or at competitive prices. As a result, our reputation could

be harmed, we may lose business from our customers, our revenues may decline,

and we may lose market share to our competitors.

The

markets in which we compete are constantly evolving and competitive, and we may

not have rights to manufacture and sell certain types of products utilizing

emerging formats, or we may be required to pay a royalty to sell products

utilizing these formats.

The

markets in which we compete are constantly undergoing rapid technological change

and evolving industry standards. For example, many consumer devices,

such as digital cameras, PDAs and smartphones, are transitioning to emerging

flash memory formats, such as the Memory Stick and xD Picture Card formats,

which we do not currently manufacture and do not have rights to manufacture, and

which could result in a decline in demand, on a relative basis, for other

products that we manufacture such as CompactFlash and secured digital USB

drives. If we decide to manufacture products utilizing emerging

formats such as those mentioned, we will be required to secure licenses to give

us the right to manufacture such products which may not be available at

reasonable rates or at all. If we are not able to supply formats at

competitive prices or if we were to have product shortages, our net sales could

be adversely impacted and our customers would likely cancel orders or seek other

suppliers to replace us.

Our

growth strategy includes expanding our presence in the SSD and high performance

memory markets both of which are highly competitive.

SSD and

high performance memory markets are highly competitive. Certain of

our competitors are more diversified than us and may be able to sustain lower

operating margins in their SSD and high performance memory businesses based on

the profitability of their other businesses. We expect competition in

these markets to increase as existing manufacturers introduce new products and

process technologies, new manufacturers enter the market, industry-wide

production capacity increases and competitors aggressively price products to

increase market share. We only have limited experience competing in

these markets. Our growth strategy includes expanding our presence in these

markets, and there can be no assurance that we will be successful in doing

so.

The

market for enterprise Flash-based SSD products is relatively new and evolving,

which makes it difficult to forecast end user adoption rates and customer

demand, for our products.

The

enterprise Flash-based SSD market is new and rapidly evolving. As a

result, we may encounter risks and uncertainties related to our business and

future prospects. It is difficult to predict, with any precision, end

user adoption rates, customer demand for our products or the future growth rate

and size of this market. The rapidly evolving nature of the markets

in which we sell our products, as well as other factors that are beyond our

control, reduce our ability to accurately evaluate our future outlook and

forecast quarterly or annual performance. Furthermore, our ability to

predict future sales is limited and our SSD product may never reach mass

adoption.

18

Industry

consolidation could adversely affect our business by reducing the number of our

potential significant customers and increasing our reliance on our existing key

customers.

Many

significant participants in our customers’ industries are merging and

consolidating as a result of competitive pressures and we expect this trend to

continue. Consolidation will likely decrease the number of potential

significant customers for our products and services. Fewer

significant customers will increase our reliance on key customers and, due to

the increased size of these companies, may negatively impact our bargaining

position and profit margins. Consolidation in some of our customers’

industries may result in increased customer concentration and the potential loss

of customers. The loss of, or a reduced role with, key customers due

to industry consolidation could negatively impact our business.

We

may make acquisitions which involve numerous risks. If we are not

successful in integrating the acquisition, our operations may be adversely

affected.

As part

of our business and growth strategy, we expect to acquire or make significant

investments in businesses, products or technologies that allow us to complement

our existing product offering, expand our market coverage, increase our

engineering workforce or enhance our technological capabilities. For

example, in 2007, we acquired PC Power and Cooling, Inc., a producer of PC

thermal management products, and substantially all the assets of Silicon Data

Inc., doing business as Hypersonic PC Systems, a manufacturer of boutique high

performance gaming PCs and laptops. We stopped the manufacture and

sale of certain Hypersonic PC products in our fiscal year ended February 28,

2010. Any future acquisitions or investments would expose us to the

risks commonly encountered in acquisitions of businesses. Such risks

include, among others:

|

|

§

|

lower

than anticipated sales and

profitability;

|

|

|

§

|

problems

integrating the purchased operations, technologies or

products;

|

|

|

§

|

costs

associated with the acquisition;

|

|

|

§

|

negative

effects on profitability resulting from the

acquisition;

|

|

|

§

|

adverse

effects on existing business relationships with suppliers and

customers;

|

|

|

§

|

risks

associated with entering markets in which we have no or limited prior

experience;

|

|

|

§

|

loss

of key employees of the acquired business;

and

|

|

|

§

|

litigation

arising from the acquired company’s operations before the

acquisition.

|

Our

inability to overcome problems encountered in connection with any acquisition

could divert the attention of management, utilize scarce corporate resources and

otherwise harm our business. In addition, we are unable to predict whether

or when any prospective acquisition candidate will become available or the

likelihood that any acquisition will be completed. Even if we do find

suitable acquisition opportunities, we may not be able to consummate the

acquisitions on commercially acceptable terms or realize the anticipated

benefits of any acquisitions we do undertake.

We

may make acquisitions that are dilutive to existing stockholders, result in

unanticipated accounting charges or otherwise adversely affect our results of

operations.

We may

grow our business through business combinations or other acquisitions of

businesses, products or technologies that allow us to complement our existing

product offerings, expand our market coverage, increase our engineering

workforce or enhance our technological capabilities. If we make any

future acquisitions, we could issue stock that would dilute our stockholders’

percentage ownership, incur substantial debt, reduce our cash reserves or assume

contingent liabilities. Furthermore, acquisitions may require

material charges and could result in adverse tax consequences, substantial

depreciation, deferred compensation charges, in-process research and development

charges, the amortization of amounts related to deferred compensation and