Attached files

| file | filename |

|---|---|

| 8-K - GREENLIGHT CAPITAL RE LTD - GREENLIGHT CAPITAL RE, LTD. | form8k.htm |

2010 Investor Meeting

May 18, 2010

May 18, 2010

“Rethinking Reinsurance”

Page 2

Forward Looking Statements

This presentation contains forward-looking statements within the meaning

of the U.S. federal securities laws. We intend these forward-looking

statements to be covered by the safe harbor provisions for forward-looking

statements in the U.S. Federal securities laws. These statements involve

risks and uncertainties that could cause actual results to differ materially

from those contained in forward-looking statements made on behalf of the

Company. These risks and uncertainties include the impact of general

economic conditions and conditions affecting the insurance and reinsurance

industry, the adequacy of our reserves, our ability to assess underwriting

risk, trends in rates for property and casualty insurance and reinsurance,

competition, investment market fluctuations, trends in insured and paid

losses, catastrophes, regulatory and legal uncertainties and other factors

described in our most recent annual report on Form 10-K and Form 10-Q

filed subsequent thereto and other documents on file with the Securities

Exchange Commission. The Company undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

of the U.S. federal securities laws. We intend these forward-looking

statements to be covered by the safe harbor provisions for forward-looking

statements in the U.S. Federal securities laws. These statements involve

risks and uncertainties that could cause actual results to differ materially

from those contained in forward-looking statements made on behalf of the

Company. These risks and uncertainties include the impact of general

economic conditions and conditions affecting the insurance and reinsurance

industry, the adequacy of our reserves, our ability to assess underwriting

risk, trends in rates for property and casualty insurance and reinsurance,

competition, investment market fluctuations, trends in insured and paid

losses, catastrophes, regulatory and legal uncertainties and other factors

described in our most recent annual report on Form 10-K and Form 10-Q

filed subsequent thereto and other documents on file with the Securities

Exchange Commission. The Company undertakes no obligation to publicly

update or revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

Page 3

Today’s Agenda

§ Overview Len Goldberg, Chief Executive Officer

§ Underwriting Bart Hedges, President and Chief Underwriting Officer

§ Investments David Einhorn, Chairman of the Board

§ Financials Tim Courtis, Chief Financial Officer

§ Summary Len Goldberg, Chief Executive Officer

§ Q&A

§ Cocktails

Page 4

Who We Are

§ Cayman Islands based specialist Property and Casualty

Reinsurer with an A- rating from A.M. Best

Reinsurer with an A- rating from A.M. Best

§ Our “dual-engine” reinsurance and investment strategy is

fundamentally different from other reinsurance companies

fundamentally different from other reinsurance companies

§ We seek to earn an economic profit on every reinsurance

contract and every investment in all market conditions

contract and every investment in all market conditions

§ We selectively offer customized reinsurance solutions in

markets where capacity and alternatives are limited

markets where capacity and alternatives are limited

§ We measure our progress by growth in book value per share

over the long-term

over the long-term

Page 5

Our Core Principles

§ We capitalize on inefficiencies in the reinsurance

market

market

§ We employ “symmetric” and complementary

reinsurance and investment strategies

reinsurance and investment strategies

§ We seek out and value long-term relationships

with our client base

with our client base

§ Our compensation structure focuses on the

economics of the business, aligning our

underwriting team with our shareholders

economics of the business, aligning our

underwriting team with our shareholders

Page 6

Greenlight Re’s Dual Engine Approach

Underwriting

Investment

Concentrated portfolios

Best risk-adjusted

returns

Deep value

Long / Short

Superior returns

88% of 2009 premium was frequency business Missed major recent disasters: hurricanes Ike and Gustav, Xynthia, Chilean earthquake Returns from both sides of the balance sheet

|

|

Combined Ratio = 95.9% ITD + Float Investment Return = 9.7% annualized Compared to 7.8% Bond Index 3.2% S&P 500 4.1% Nasdaq

|

Page 7

How We Are Different

|

|

% Frequency

(Quota Share)

|

% Top 5 U.S. Clients

To Total

|

|

88%

|

77%

|

|

|

Platinum

Underwriters |

27%

|

26%

|

|

Everest Re

|

71%

|

14%

|

|

Partner Re

|

65%

|

23%

|

|

Transatlantic Re

|

70%

|

26%

|

Sources: Company 10k, SNL data, 2009 Figures

Page 8

Focused on Profitability

§ Keep expenses low to increase flexibility

§ 2009 expenses were 3.2% of 2009 average capital

§ 15 total staff after 4+ years of operation

§ Judiciously utilize our underwriting capital

§ Premium to capital ratio was 43.7% in 2009

§ Good results in difficult markets

§ Well positioned for the next hardening market.

We continue to wait patiently!

We continue to wait patiently!

Page 9

Our Overall Program

§ Concentrated Portfolio

§ Focus on best ideas

§ Top 5 clients by premium in 2009 = 73%

§ Top 5 long investments (April 2010) = 32%

§ Thoughtfully Manage Risk

§ Top 5 clients by capital usage in 2009 = 41%

§ Average net long equity exposure in 2009 = 10%

§ Mark to market entire investment portfolio

§ Reserve point estimates of every contract quarterly

§ Comfortable with more volatility in our results due to

increased transparency

increased transparency

Page 10

Our Team: Highly Skilled and Focused Generalists

Len Goldberg

CEO

Bart Hedges

President & CUO

Tim Courtis

CFO

Brendan Barry

SVP

Sherry Diaz

Controller

Kerry Berchem

General Counsel

(Partner, Akin Gump)

Faramarz Romer

Reporting and Compliance

Parker Boone

VP

Claude Wagner

VP

Jordan Camacchio

Analyst

Nadia Dilbert

Underwriting Assistant

Andie Welsch

VP

Isaac Espinoza

Senior Analyst

Tom Curnock

VP

Underwriting

Finance

Administration

Hellen Ebanks

Office Administrator

Mandy Vodak-Marotta

Operations Manager

Page 11

How We Are Different

|

|

Employees

|

GWP / Employee

$ millions

|

|

15

|

$17.3

|

|

|

Platinum

Underwriters |

146

|

$6.3

|

|

Everest Re

|

864

|

$4.8

|

|

Partner Re

|

1406

|

$2.8

|

|

Transatlantic Re

|

620

|

$6.8

|

Select Multiline Reinsurers 2009. Sources: Company 10k, SNL data

Bart Hedges, President and Chief Underwriting Officer

Page 13

Underwriting Agenda

§ Our underwriting strategy

§ Why do brokers and clients want to work with us?

§ Opportunities we like now

§ Sample deal

Page 14

Underwriting Strategy

§ Seeking profitability under all market conditions

§ Lead underwriter for majority of transactions

§ Generalist with a flexible approach

§ Create long-term business relationships from select opportunities

§ Concentrated portfolio

§ Rigorous modeling combined with practical underwriting

experience

experience

§ Focus on transaction economics rather than on earnings or

premium growth

premium growth

§ Incorporate risk-aversion into pricing

§ Deep knowledge of each transaction: Cradle-to-grave

administration

administration

Page 15

Frequency Oriented Portfolio

§ Frequency Business

§ Potentially large number of relatively

smaller losses from multiple events

smaller losses from multiple events

§ Greater predictability and less volatility

§ Tool for clients to increase their own

underwriting capacity

underwriting capacity

§ Frequency business is our emphasis

§ Severity Business

§ Potential for significant losses from one or

multiple events

multiple events

§ Volatile results from period to period

§ Generates higher profit margins and return

on equity over the long-term

on equity over the long-term

§ Tool for clients to remove volatility from

their balance sheets

their balance sheets

Severity

Frequency

Greenlight Re’s

2009 Reinsurance Business

Page 16

Lines of Business

2009 Gross Written Premium

2009 Gross Written Premium

Page 17

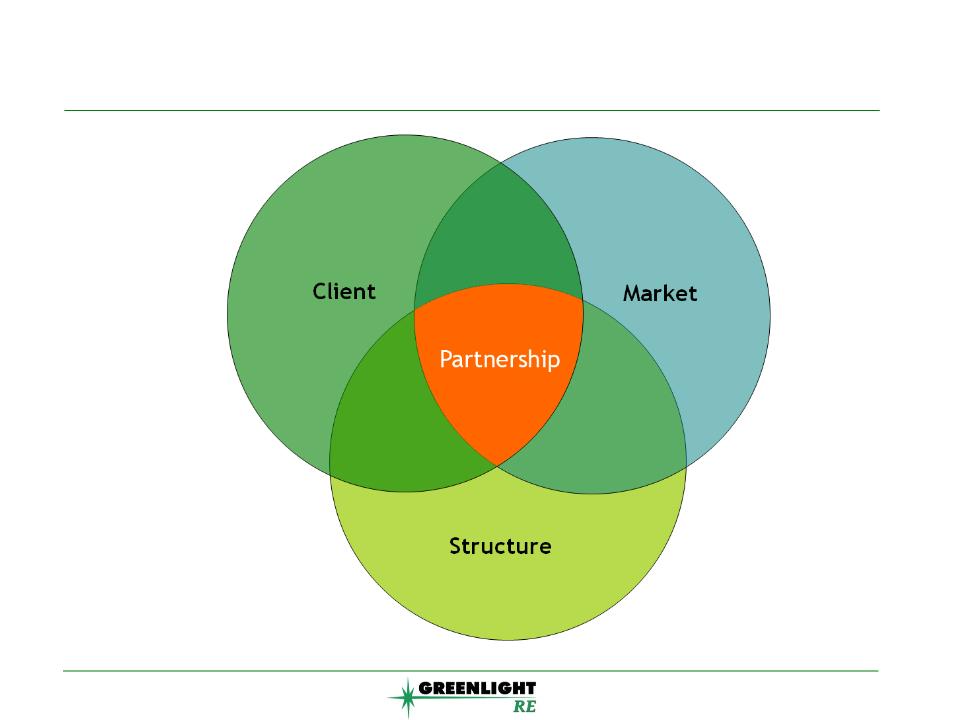

Our Business Model

All three of these

elements are

important to

every contract

we write

elements are

important to

every contract

we write

Page 18

Greenlight Re is an Attractive Partner

§ Strategic vs. Commoditized buyers

§ We seek out strategic buyers

§ We value long-term relationships

§ Quick decision making

§ We employ senior, highly skilled staff

§ Streamlined approval process

§ Creating more value for our clients

§ Understanding our clients needs

§ “Making the pie bigger”

§ Providing more value by trading off issues of less importance to the client

§ Creating customized structures

Page 19

Business Development

Broker Distribution 2009

Gross Written Premium

§ Hired head of Business Development

in June 2009

in June 2009

§ 2010 Opportunities

§ 15 targeted brokers - knowledge intensive

process

process

§ 20 targeted clients - data intensive

process

process

§ Keeping track of quality clients in

difficult markets - preparing for

better times

difficult markets - preparing for

better times

§ Targeted markets

§ Quality over quantity

§ Feedback loop from Underwriting to

Business Development

Business Development

§ Result: The market knows us better

Page 20

Our Thoughts on the Current Market

§ Overall market pricing is very weak

§ Too much capital chasing too little risk

§ Hard to know when the turn will come

§ But, the reinsurance business is not monolithic

and there are businesses we like now:

and there are businesses we like now:

§ Florida Homeowners

§ Employer Stop Loss

§ Small Account Workers Compensation, General Liability

and Commercial Auto

and Commercial Auto

§ Property Catastrophe Retrocessional (Cat Retro)

Property Catastrophe Retro

§ We participate fairly high up

§ Small number of long-term clients

§ Clients are reinsurers and Lloyd’s

syndicates: Need for capital management

or Realistic Disaster Scenario analysis

syndicates: Need for capital management

or Realistic Disaster Scenario analysis

§ Will shrink if pricing comes down

Small Account Workers

Compensation, General Liability

and Commercial Auto

Compensation, General Liability

and Commercial Auto

§ New opportunities here

§ Less price sensitive than large accounts

§ Strategic reinsurance purchasers

§ Long-term based business

Page 21

Opportunities We Like Now

Employer Stop Loss

§ Countercyclical to property casualty cycle

§ Total market - $6 billion in premium

§ Pricing has been in excess of loss trend

§ Margins have been better than expected

§ Healthcare reform could impact this

business

business

Florida Homeowners - Ex Wind

§ Turmoil in the market: We like that

§ Clients are small specialist companies

§ Capital is needed - strategic reinsurance

purchase

purchase

§ Pricing is increasing

§ There is political risk if regulations change

Page 22

Underwriting - Sample Deal

§ No two deals are alike as each client has unique issues

and risks

and risks

§ Today’s example: Florida Homeowners

§ Market Environment

§ Florida is characterized by a large number of small participants

§ Current turmoil - More than 6 companies have been forced to

stop writing due to capital concerns . . . and there hasn’t been a

hurricane in Florida in over 4 years!

stop writing due to capital concerns . . . and there hasn’t been a

hurricane in Florida in over 4 years!

§ So, price of Florida homeowners coverage is increasing

§ Challenge: Find smart operators in an inefficient market place

who will have a big opportunity at an improving price

who will have a big opportunity at an improving price

§ Our client-based approach is made for this type of market

Page 23

Underwriting - Sample Deal

§ How do we find smart operators

§ Preference for real companies, not virtual companies

§ Evaluation of claims management

§ Evaluation of coastal exposure and sinkhole exposure

§ Management alignment of interest

§ Triangulate with others we respect in the market

§ We select the companies we like

§ We find the right broker contact

§ We offer a frequency oriented product that the market

doesn’t generally offer - “ex-wind quota share”

doesn’t generally offer - “ex-wind quota share”

Page 24

Underwriting - Sample Deal

§ Why do clients want ex-wind quota share?

§ Traditional markets want the windstorm cover -- Margins are

better, but hurricane risk can create big losses

better, but hurricane risk can create big losses

§ In Florida, clients can write $3 of premium for every $1 of net

premium. The quota share reduces net premium.

premium. The quota share reduces net premium.

§ Clients write more premium without adding hard capital

§ They view our quota share as strategic capital replacement

Page 25

Underwriting - Sample Deal

§ How to Proceed?

§ We want:

§ A reasonable profit margin

§ Investable cash

§ Limit to our downside

§ Client wants:

§ Upside if the business runs well

§ Capital support for their business plan

§ Approval from the Florida Office of Insurance

§ Starting point:

§ Traditional capped quota share with a combined ratio of 125%

§ Profit sharing to the client of 60% after our margin of 7%

§ Loss corridor of 3 points

David Einhorn, Chairman of the Board

Page 27

Investment Approach

§ Our business model combines underwriting

economics and cash flows with a non-traditional

investment approach

economics and cash flows with a non-traditional

investment approach

§ Achieve higher rates of return over the long term than

traditional, fixed-income strategies

traditional, fixed-income strategies

§ Maximize total risk-adjusted return with a focus on

capital preservation

capital preservation

§ Value-oriented philosophy drives the investment

portfolio

portfolio

§ Take long positions in perceived undervalued securities and

short positions in securities we believe are overvalued

short positions in securities we believe are overvalued

§ Investment portfolio managed by DME Advisors, an affiliate

of Greenlight Capital

of Greenlight Capital

Page 28

Investment Approach

§ Deep value, long/short equity and distressed debt

§ Historically approximately 80-100% long and 20-70% short

§ Higher returns with less volatility than the major stock indices

over the last 14 years*

over the last 14 years*

§ Constraints on leverage, liquidity and concentration risks

§ Fees are 1.5% of assets under management and 20% of

investment profits with a modified high water mark

investment profits with a modified high water mark

§ As of 30 April 2010, the largest disclosed long positions in our

investment portfolio are Arkema, CIT Group, gold, Lanxess

and Vodafone Group

investment portfolio are Arkema, CIT Group, gold, Lanxess

and Vodafone Group

* 14 years of the Greenlight Capital strategy (GLRE for 6 years)

Page 29

Current Investment Environment

§ Worst of the last crisis has passed

§ Economy has improved

§ Wide disparity of values

§ Wide range of possible equity outcomes

§ Trying to add alpha on both sides of the portfolio with

modest long bias

modest long bias

§ Overlaying macro hedges due to questionable fiscal and

monetary policies

monetary policies

Page 30

Our Compensation Structure

§ A key differentiator is aligning management with

shareholders

shareholders

§ Compensates for actual increase in economic value -

not for premium growth, GAAP accounting, irrational

exuberance or “fully deploying capital”

not for premium growth, GAAP accounting, irrational

exuberance or “fully deploying capital”

§ Cash Bonus Program:

§ Track economics of every contract individually

§ Assume risk free return on float

§ No bonus when underwriting ROE less than risk free return

§ Target bonus when ROE = target ROE (risk free plus a premium)

§ Upside when ROE is in excess of target

§ First bonus payment after three years with continuous roll-forward

Tim Courtis, Chief Financial Officer

Page 32

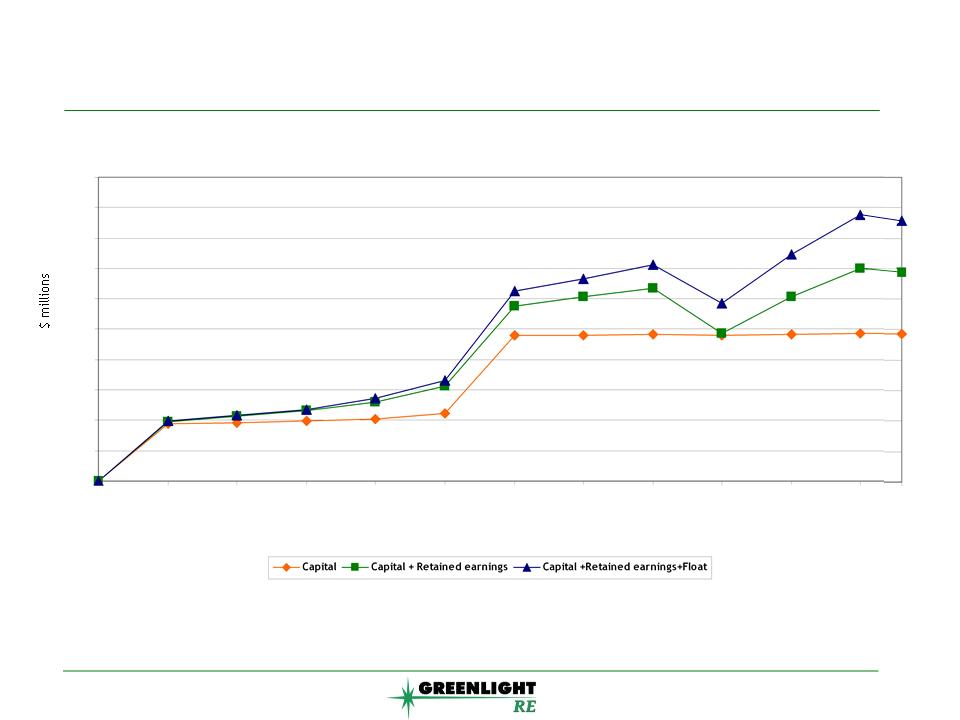

Float

§ We only write transactions that we believe

create positive economics on their own

create positive economics on their own

§ As a consequence of writing these contracts,

we generate investable funds or float

§ In reinsurance, premium is usually collected before

claims are paid

claims are paid

§ The claim payment duration for our current portfolio

averages between 2 - 4 years

averages between 2 - 4 years

§ We invest our entire capital base plus our float

(less a reserve for ongoing expenses) into a

portfolio managed by DME Advisors

(less a reserve for ongoing expenses) into a

portfolio managed by DME Advisors

Net Invested Assets

Page 33

1,000

900

800

700

600

500

400

300

200

100

0

Jul - 04 Dec - 04 Jun - 05 Dec - 05 Jul - 06 Dec - 06 Jun - 07 Dec - 07 Jul - 08 Dec - 08 Jun - 09 Dec - 09 Mar - 10

Page 34

Amount of Float

|

|

Float

($ millions)

|

Float as a %

of Capital |

|

December

2005 |

0

|

0

|

|

December

2006 |

18

|

6

|

|

December

2007 |

61

|

10

|

|

December

2008 |

129

|

20

|

|

December

2009 |

178

|

26

|

|

March 2010

|

172

|

25

|

2009 increase in fully-diluted adjusted

book value per share:

§ Investment Return on Capital = 32%

§ GAAP Underwriting Profit = 1%

§ Investment Return on Float = 8%

Total Return = 41%

Page 35

2009 Return on Capital

Our Measure of Performance

Growth in Fully Diluted Adjusted Book

Value Per Share Over the Long-Term

11.6% CAGR in

fully diluted adjusted

book value per share

since inception

book value per share

since inception

Page 36

Page 37

Earned Premium = 35% of capital Invested Assets = 125% of capital

Superior Potential Return on Equity

From our Dual Engine Model

|

|

80%

|

90%

|

100%

|

110%

|

120%

|

|

5%

|

13

|

10

|

6

|

3

|

-1

|

|

10%

|

20

|

16

|

13

|

9

|

6

|

|

15%

|

26

|

22

|

19

|

15

|

12

|

|

20%

|

32

|

29

|

25

|

22

|

18

|

|

25%

|

38

|

35

|

31

|

28

|

24

|

The Numbers: 2009

Underwriting Return: Combined Ratio

Page 38

Superior Potential Return on Equity

From our Dual Engine Model

|

|

80%

|

90%

|

100%

|

110%

|

120%

|

|

5%

|

19

|

14

|

9

|

4

|

-1

|

|

10%

|

28

|

23

|

18

|

13

|

8

|

|

15%

|

36

|

31

|

26

|

21

|

16

|

|

20%

|

45

|

40

|

35

|

30

|

25

|

|

25%

|

54

|

49

|

44

|

39

|

34

|

Underwriting Return: Combined Ratio

The Numbers: Potential Future Results

Earned Premium = 50% of capital Invested Assets = 175% of capital

Len Goldberg, Chief Executive Officer

Page 40

Greenlight Reinsurance: Summary

§ We set out in 2004 to create a reinsurance company

with a superior business model

with a superior business model

§ Our vision then is exactly what you see now

§ We continue to find ways to create value in a

difficult market - we are anxious to see what we

can do in a favorable market

difficult market - we are anxious to see what we

can do in a favorable market

§ Focus for 2010 and beyond is to keep our focus

§ More of the same

§ Deploy more underwriting capital in favorable markets

§ One contract at a time, one investment at a time

Page 41

Our Commitment to Communities and Causes

Page 42

The Blue Iguana Recovery Project

§ We funded the first

edition of “The Little

Blue Book”

edition of “The Little

Blue Book”

§ The Grand Cayman

Blue Iguana only exists

on Grand Cayman

Blue Iguana only exists

on Grand Cayman

§ An amazing story of

one man’s quest to

save a functionally

extinct species

one man’s quest to

save a functionally

extinct species

Page 43

Thank You for Your Continued Support of Greenlight Re