Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - China Executive Education Corp | ex32x2.htm |

| EX-31.1 - EXHIBIT 31.1 - China Executive Education Corp | ex31x1.htm |

| EX-32.1 - EXHIBIT 32.1 - China Executive Education Corp | ex32x1.htm |

| EX-31.2 - EXHIBIT 31.2 - China Executive Education Corp | ex31x2.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

x QUARTERLY REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the

quarterly period ended: March

31, 2010

OR

o TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from _______________to ________________

Commission File Number: 333-153574

CHINA

EXECUTIVE EDUCATION CORP.

(Exact

Name of Registrant as Specified in Its Charter)

|

NEVADA

|

75-3268300

|

|

(State

or Other jurisdiction of Incorporation or Organization)

|

(I.R.S.

Employer Identification No.)

|

|

Hangzhou

MYL Business Administration Consulting Co. Ltd.

Room

307, Hualong Business Building

110

Moganshan Road, Hangzhou, P.R. China

|

310005

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

+86-571-8880-8109

(Registrant’s

Telephone Number, Including Area Code)

On

Demand Heavy Duty, Corp.

9916

Elbow Drive SW, Calgary Alberta, Canada T2V 1M5

(Former

Name, Former Address and Former Fiscal Year, if Changed Since Last

Report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes o No

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definitions of “large accelerated filer”, “accelerated

filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act. (Check one)

Large

accelerated filer o

Accelerated filer o

Non-accelerated filer o

Smaller reporting company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes

o No

x

As of May

13, 2010, there were 22,050,000 shares of Common Stock of the Company

outstanding.

|

TABLE OF

CONTENTS

|

|

|

Page

|

|

|

PART

I - FINANCIAL INFORMATION

|

1 |

|

Item

1. Financial Statements.

|

1 |

|

Item

2. Management’s Discussion and Analysis of Financial Condition and Results

of Operations.

|

21 |

|

Item

3. Quantitative and Qualitative Disclosures About Market

Risk.

|

32 |

|

Item

4. Controls and Procedures.

|

32 |

|

PART

II - OTHER INFORMATION

|

33 |

|

Item

1. Legal Proceedings.

|

33 |

|

Item

1A. Risks Factors.

|

33 |

|

Item

2. Unregistered Sales of Equity Securities and Use of

Proceeds.

|

33 |

|

Item

3. Defaults Upon Senior Securities.

|

33 |

|

Item

5. Other Information.

|

33 |

|

Item

6. Exhibits.

|

34 |

|

SIGNATURES

|

35 |

Use

of Certain Defined Terms

In this

Form 10-Q, unless indicated otherwise, references to:

|

·

|

“Securities

Act” refers to the Securities Act of 1933, as amended, and “Exchange Act”

refer to the Securities Exchange Act of 1934, as

amended;

|

|

·

|

“China”

and “PRC” refer to the People’s Republic of China, and “BVI” refers to the

British Virgin Islands;

|

|

·

|

“RMB”

refers to Renminbi, the legal currency of China;

and

|

|

·

|

“U.S.

dollar,” “$” and “US$” refer to the legal currency of the United

States. For all U.S. dollar amounts reported, the dollar amount

has been calculated on the basis that $1 = RMB6.8282 for its December 31,

2009 audited balance sheet, and $1 = RMB6.8259 for its March 31, 2010

unaudited balance sheet, which were determined based on the currency

conversion rate at the end of each respective period. The

conversion rates of $1 = RMB6.8259 is used for the condensed consolidated

statement of income and other comprehensive income and consolidated

statement of cash flows for the first fiscal quarter of 2010, and $1=

RMB6.8282 is used for the condensed consolidated statement of income and

other comprehensive income and consolidated statement of cash flows for

the first fiscal quarter of 2009; both of which were based on the average

currency conversion rate for each respective

quarter.

|

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

TABLE

OF CONTENTS

March

31, 2010

(Stated

in US dollars)

| CONDENSED CONSOLIDATED BALANCE SHEETS AS OF MARCH 31, 2010 (UNAUDITED) AND DECEMBER 31, 2009 | 1 |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME FOR THE THREE MONTHS ENDED MARCH 31, 2010 AND 2009 (UNAUDITED) | 2 |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE THREE MONTHS ENDED MARCH 31, 2010 AND 2009 (UNAUDITED) | 3 |

| NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) | 4 - 20 |

|

PART

I

|

|

ITEM 1. FINANCIAL

STATEMENTS.

|

CHINA EXECUTIVE EDUCATION CORP.

AND SUBSIDIARIES

(FORMERLY ON DEMAND HEAVY DUTY,

CORP)

CONDENSED CONSOLIDATED BALANCE

SHEETS

|

March

31,

2010

|

December

31,

2009

|

|||||||

|

(Unaudited)

|

||||||||

|

CURRENT

ASSETS

|

||||||||

|

Cash

and cash equivalents

|

$ | 3,784,855 | $ | 6,381,770 | ||||

|

Accounts

receivable, net of allowance

|

29,095 | 33,324 | ||||||

|

Other

receivables

|

2,748,801 | 1,008,565 | ||||||

|

Advances

to vendors

|

986,199 | 731,365 | ||||||

|

Total

current assets

|

7,548,950 | 8,155,024 | ||||||

|

PROPERTY

AND EQUIPMENT, NET

|

79,346 | 87,369 | ||||||

|

OTHER

ASSET

|

91,533 | 91,505 | ||||||

|

TOTAL

ASSETS

|

7,719,829 | 8,333,898 | ||||||

|

CURRENT

LIABILITIES

|

||||||||

|

Advance

from customers

|

2,841,047 | 3,628,810 | ||||||

|

Taxes

payable

|

443,155 | 537,541 | ||||||

|

Payroll

payable

|

90,449 | 90,419 | ||||||

|

Other

payables and accrued liabilities

|

1,905 | 592,788 | ||||||

|

Total

current liabilities

|

3,376,556 | 4,849,558 | ||||||

|

STOCKHOLDERS'

EQUITY

|

||||||||

|

Common

Stock, $0.0001 par value 70,000,000 shares authorized,

|

||||||||

|

22,050,000

shares and 21,560,000 shares issued and outstanding

|

||||||||

|

at

March 31, 2010 and December 31, 2009, respectively

|

22,050 | 21,560 | ||||||

|

Additional

paid-in capital

|

170,821 | 66,311 | ||||||

|

Statutory

reserve

|

358,026 | 358,026 | ||||||

|

Retained

earnings

|

3,901,440 | 3,131,806 | ||||||

|

Accumulated

other comprehensive income

|

3,032 | 1,591 | ||||||

|

Total

stockholders' equity

|

4,455,369 | 3,579,295 | ||||||

|

Non-controlling

interest

|

(112,096 | ) | (94,955 | ) | ||||

|

Total

equity

|

4,343,273 | 3,484,340 | ||||||

|

TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY

|

$ | 7,719,829 | $ | 8,333,898 | ||||

The accompanying notes are an intergral part of

these condensed consolidated financial statements

1

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(UNAUDITED)

|

For

the three months ended March 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

Revenues

|

$ | 4,445,631 | $ | - | ||||

|

Cost

of revenue

|

1,514,745 | - | ||||||

|

Gross

profit

|

2,930,886 | - | ||||||

|

Operating

expenses

|

||||||||

|

Selling

expenses

|

719,101 | - | ||||||

|

General

and administrative expenses

|

1,163,282 | - | ||||||

|

Total

operating expenses

|

1,882,383 | - | ||||||

|

Income

from operations

|

1,048,503 | - | ||||||

|

Other

income (expenses)

|

238 | - | ||||||

|

|

||||||||

|

Income

before income taxes

|

1,048,741 | - | ||||||

|

Provision

for income taxes

|

296,169 | - | ||||||

|

Net

income

|

752,572 | - | ||||||

|

Less:

net income attributable to non-controlling interest

|

(17,062 | ) | - | |||||

|

Net

income attributable to the Company

|

769,634 | - | ||||||

|

Comprehensive

income

|

||||||||

|

Net

income

|

752,572 | - | ||||||

|

Foreign

currency translation gain

|

1,441 | - | ||||||

|

Total

comprehensive Income

|

754,013 | - | ||||||

|

Less:

net income attributable to non-controlling interest

|

(17,062 | ) | ||||||

|

Comprehensive

income attributable to the Company

|

$ | 771,075 | $ | - | ||||

|

Basic

and diluted income per common share

|

$ | 0.03 | $ | - | ||||

|

Basic

and diluted weighted average common shares outstanding

|

21,795,222 | 21,560,000 | ||||||

The accompanying notes are an intergral part of

these condensed consolidated financial statements

2

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY ON

DEMAND HEAVY DUTY, CORP)

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOW

(UNAUDITED)

|

For

the three months ended March 31,

|

||||||||

|

2010

|

2009

|

|||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net income

|

$ | 752,572 | $ | - | ||||

|

Adjustments to reconcile net income to net cash

|

||||||||

|

provided by operating activities:

|

||||||||

|

Depreciation and amortization

|

9,620 | - | ||||||

|

Stock issued for services

|

105,000 | |||||||

|

(Increase) decrease in -

|

||||||||

|

Accounts receivable

|

4,240 | - | ||||||

|

Other receivables

|

(1,733,070 | ) | - | |||||

|

Advances to vendors

|

(254,588 | ) | - | |||||

|

Due from related party

|

- | - | ||||||

|

Increase (decrease) in -

|

||||||||

|

Advance from customers

|

(788,985 | ) | - | |||||

|

Taxes payable

|

(97,726 | ) | - | |||||

|

Other payables and accrued liabilities

|

(583,628 | ) | - | |||||

|

Net

cash used in operating activities

|

(2,586,565 | ) | - | |||||

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Acquisition of property & equipment

|

(1,567 | ) | - | |||||

|

Net

cash used in investing activities

|

(1,567 | ) | - | |||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

- | - | ||||||

|

EFFECT

OF EXCHANGE RATE CHANGE ON CASH & CASH EQUIVALENT

|

(8,781 | ) | - | |||||

|

NET

DECREASE IN CASH & CASH EQUIVALENTS

|

(2,596,914 | ) | - | |||||

|

CASH

& CASH EQUIVALENTS, BEGINNING OF PERIOD

|

6,381,770 | - | ||||||

|

CASH

& CASH EQUIVALENTS, END OF PERIOD

|

$ | 3,784,855 | $ | - | ||||

|

SUPPLEMENTAL

DISCLOSURES OF CASH FLOW INFORMATION

|

||||||||

|

Income tax paid

|

$ | 404,125 | $ | - | ||||

|

Interest paid

|

$ | - | $ | - | ||||

|

NONCASH

INVESTING AND FINANCING ACTIVITIES

|

||||||||

|

Common stock issued for services

|

$ | 105,000 | $ | - | ||||

The accompanying notes are an intergral part of

these condensed consolidated financial statements

3

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

1. ORGANIZATION AND BASIS OF PRESENTATION

China

Executive Education Corp (the “Company”), formerly known as On Demand Heavy

Duty, Corp, is a corporation organized under the laws of the State of

Nevada.

On

February 12, 2010, the Company acquired all of the outstanding capital stock of

Surmounting Limit Marketing Adviser Limited (“SLM”), a Hong Kong

Corporation, through China Executive Education Corp., a Nevada

corporation (the “Merger Sub”) wholly owned by the Company. SLM is a holding

company whose only asset, held through a subsidiary, is 100% of the registered

capital of Hangzhou MYL Business Administration Consulting Co., Ltd. (“MYL

Business”), a limited liability company organized under the laws of the People’s

Republic of China (“PRC”). Substantially all of SLM's operations are conducted

in China through MYL Business, and through contractual arrangements with several

of MYL Business’s affiliated entities in China, including Hangzhou MYL

Commercial Services Co., Ltd. (“MYL Commercial”) and its subsidiaries. MYL

Commercial is a fast-growing executive education company with dominant operation

in Shanghai, the commercial center of China, providing comprehensive consulting

services such as business administration, marketing strategy, designing of

enterprise image, corporate investment and commerce, business conference as well

as professional training programs designed to fit the needs of Chinese

entrepreneurs to improve their leadership, management and marketing

skills.

In

connection with the acquisition, the Merger Sub issued 20 shares of the common

stock of the Merger Sub which constituted no more than 10% ownership interest in

the Merger Sub to the shareholders of SLM, in exchange for all the shares of the

capital stock of SLM (the “Share Exchange” or “Merger”). The 20 shares of the

common stock of the Merger Sub were converted into approximately 21,560,000

shares of the common stock of the Company so that upon completion of the Merger,

the shareholders of SLM own approximately 98% of the common stock of the

Company.

4

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

1. ORGANIZATION AND BASIS OF PRESENTATION

(continued)

As part

of the Merger, pursuant to a stock purchase agreement (the “Stock Purchase

Agreement”), the Company transferred all of the outstanding capital of its

subsidiary, On Demand Heavy Duty Holdings, Inc. (“Holdings”) to certain of its

shareholders in exchange for the cancellation of 3,000,000 shares of

the Company’s common stock (the “Split Off Transaction”). In

addition, an aggregate of 3,070,000 shares were returned to the transfer agent

for cancellation by other shareholders of the Holdings. Following the

Merger and the Split-Off Transaction, the Company discontinued its former

business and is now engaged in the executive education business.

Upon

completion of the Merger, there were 22,000,000 shares of the Company’s common

stock issued and outstanding.

As a

result of these transactions, persons affiliated with the SLM and MYL Business

now own securities that in the aggregate represent approximately 98% of the

equity in the Company. In addition, in connection with the change of control

contemplated by the Share Exchange, the directors and officers of the Company

resigned from their positions and new directors and officers affiliated with MYL

Business controlled the Board of Directors of the Company ten days after the

notice pursuant to Rule 14F-1 has been mailed to the shareholders of

record.

Consequently,

the Company’s name was changed from “On Demand Heavy Duty, Corp.” to the Merger

Sub’s name “China Executive Education Corp.” in order to more effectively

reflect the Company’s business and communicate the Company’s brand identity to

customers.

The above

mentioned merger transaction has been accounted for as a reverse merger under

the purchase method of accounting since there was a change of control.

Accordingly, SLM will be treated as the continuing entity for accounting

purposes.

5

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

1. ORGANIZATION AND BASIS OF PRESENTATION

(continued)

SLM does

not conduct any substantive operations of its own. Instead, through its

subsidiary, MYL Business, it had entered into certain exclusive contractual

agreements with MYL Commercial on March 25, 2009. Pursuant to certain

agreements, SLM is obligated to absorb a majority of the risk of loss from MYL

Commercial’s activities and entitled it to receive a majority of its expected

residual returns. In addition, MYL Commercial’s shareholders have pledged their

equity interest in MYL Commercial to SLM, irrevocably granted SLM an exclusive

option to purchase, to the extent permitted under PRC Law, all or part of the

equity interests in MYL Commercial and agreed to entrust all the rights to

exercise their voting power to the persons appointed by MYL Commercial. Through

these contractual arrangements, the Company and SLM hold all the variable

interests of MYL Commercial. Therefore, the Company is the primary beneficiary

of MYL Commercial.

Based on

these contractual arrangements, the Company believes that MYL Commercial should

be considered as Variable Interest Entity (“VIE”) under ASC 510 “Consolidation

of Variable Interest Entities, and Interpretation of ARB No. 51”. Accordingly,

the Company consolidates MYL Commercial and its subsidiary’s results, assets and

liabilities.

The

accompanying unaudited condensed consolidated financial statements have been

prepared in accordance with generally accepted accounting principles for interim

financial information. Accordingly, they do not include all of the information

and footnotes required by generally accepted accounting principles for complete

financial statements. In the opinion of the management, all adjustments

(consisting only of normal recurring accruals) considered necessary for a fair

presentation have been included. Operating results for the three months ended

March 31, 2010 and 2009 are not necessarily indicative of the results that may

be expected for the full years.

6

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Basis

of presentation and consolidation

The

consolidated financial statements of the Company reflect the principal

activities of the following subsidiaries. All material intercompany transactions

have been eliminated.

| Name of the entity | Place of Incorporation | Ownership Percentage | |||

| Summouting Limited Marketing Advisor Limited ("SLM") | Hong Kong, China | 100% | |||

| Hangzhou MYL Business Administration Co., Ltd ("MYL Business") | Hangzhou, China | 100% | |||

| Shanghai MYL Consulting Co., Ltd. ("MYL Consulting") | Shanghai, China | 100% | |||

| Hangzhou MYL Commerical Service., Ltd. ("MYL Commerical") | Hangzhou, China | VIE | |||

The

accompanying consolidated financial statements have been prepared in accordance

with the accounting principles generally accepted in the United States of

America and include the accounts of all directly and indirectly owned

subsidiaries listed above.

Non-controlling

interest

Non-controlling

interest represents two minority shareholders’ 5% proportionate share of the

results of the Company’s subsidiary Hangzhou MYL Commercial Services Co., Ltd.,

based on the contractual arrangements between the Company, MYL Commercial and

its shareholders.

Use

of estimates

The

preparation of financial statements in conformity with U.S. GAAP requires

management to make estimates and assumptions that affect the amounts reported in

the financial statements and accompanying notes, and disclosure of contingent

liabilities at the date of the consolidated financial statements. Estimates are

used for, but not limited to, the selection of the useful lives of property and

equipment, provision necessary for contingent liabilities, taxes and other

similar charges. Management believes that the estimates utilized in preparing

its consolidated financial statements are reasonable and prudent. Actual results

could differ from these estimates.

7

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 2. SUMMARY OF

SIGNIFICANT ACCOUNTING POLICIES (Continued)

Fair

value of financial instruments

The

Company adopted ASC 820, Fair Value Measurements and Disclosures. ASC 820

clarifies the definition of fair value, prescribes methods for measuring fair

value, and establishes a fair value hierarchy to classify the inputs used in

measuring fair value as follows:

Level

1-Inputs are unadjusted quoted prices in active markets for identical assets or

liabilities available at the measurement date.

Level

2-Inputs are unadjusted quoted prices for similar assets and liabilities in

active markets, quoted prices for identical or similar assets and liabilities in

markets that are not active, inputs other then quoted prices that are

observable, and inputs derived from or corroborated by observable market

data.

Level

3-Inputs are unobservable inputs which reflect the reporting entity’s own

assumptions on what assumptions the market participants would use in pricing the

asset or liability based on the best available information.

The

carrying amounts reported in the balance sheets for cash, accounts receivable,

advance to vendors, accounts payable and other accrued expenses, and advances

from customers approximate their fair market value based on the short-term

maturity of these instruments. The Company did not identify any assets or

liabilities that are required to be presented on the consolidated balance sheets

at fair value in accordance with ASC 820.

Accounts

receivable

Accounts

receivable consists of balances due from the enterprises for the education

services provided. Accounts receivable are recorded at net realizable value

consisting of the carrying amount less an allowance for uncollectible

amounts.The Company does periodical reviews as to whether the carrying values of

accounts have become impaired. The assets are considered to be

impaired if the collectability of the balances become doubtful, accordingly, the

management estimates the valuation allowance for anticipated uncollectible

receivable balances. When facts subsequently become available to indicate that

the allowance provided requires an adjustment, then the adjustment will be

classified as a change in estimate. The Company determined that no

reserve was necessary at March 31, 2010 and December 31, 2009.

8

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

Advances

to vendors

Advances

to vendors consist of payments made and recorded in advance for featured

lectures that have not been provided to or received by the Company from invited

foreign speakers. Such advances are expensed through cost of revenue

as the speeches are performed. Advances to vendors are reviewed periodically to

determine whether their carrying value has become impaired. Advances to vendors

as of March 31, 2010 and December 31, 2009 amounted to $986,199 and $731,365,

respectively.

Property

and equipment

Property

and equipment are recorded at cost less accumulated depreciation and any

impairment losses. The cost of an asset comprises of its purchase

price and any directly attributable costs of bringing the asset to its working

condition and location for its intended use. Expenditure incurred

after the fixed assets have been put into operation, such as repairs and

maintenance and overhaul costs, is normally charged to the profit and loss

account in the year in which it is incurred.

Depreciation

is computed using the straight-line method over the estimated useful lives of

the assets, less any estimated residual value. Estimated useful lives

of the assets are as follows:

| Computer electronics equipments | 3 years |

| Other equipments | 3 years |

| Leasehold improvements | 2 years |

Any gain

or loss on disposal or retirement of a fixed asset is recognized in the profit

and loss account and is the difference between the net sales proceeds and the

carrying amount of the relevant asset. When property and equipment are retired

or otherwise disposed of, the assets and accumulated depreciation are removed

from the accounts and the resulting profit or loss is reflected in

income.

9

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

Impairment

of long-lived assets

In

accordance with ASC 360, “Accounting for the Impairment or Disposal of

Long-Lived Assets”, the Company is required to review its long-lived assets for

impairment whenever events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable through the estimated

undiscounted cash flows expected to result from the use and eventual disposition

of the assets. Whenever any such impairment exists, an impairment

loss will be recognized for the amount by which the carrying value exceeds the

fair value. The Company estimates fair value based on the information available

in making whatever estimates, judgments and projections are considered

necessary. There was no impairment of long-lived assets during the

three months ended March 31, 2010 and 2009.

Revenue

recognition

The

Company recognizes revenue in accordance with ASC 605, which requires that

revenue be recognized when it is earned and either realized or realizable. In

general, the Company generates revenue from the delivery of professional

services and records revenues when the services are completed,

already collected or collectability is reasonably assured, there is no future

obligation and there is remote chance of future claim or refund to the

customers. It is reported net of business taxes and refunds.

Income

taxes

The

Company utilizes ASC 740, “Accounting for Income Taxes,” which requires the

recognition of deferred tax assets and liabilities for the expected future tax

consequences of events that have been included in the financial statements or

tax returns. Under this method, deferred income taxes are recognized for the tax

consequences in future years of differences between the tax bases of assets and

liabilities and their financial reporting amounts at each period end based on

enacted tax laws and statutory tax rates applicable to the periods in which the

differences are expected to affect taxable income. Valuation allowances are

established, when necessary, to reduce deferred tax assets to the amount

expected to be realized.

10

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

The

Company adopted the provisions of ASC 740-10-25, "Accounting for Uncertainty in

Income Taxes". ASC 740-10-25 prescribes a more-likely-than-not threshold for

consolidated financial statement recognition and measurement of a tax position

taken (or expected to be taken) in a tax return. This Interpretation also

provides guidance on the recognition of income tax assets and liabilities,

classification of current and deferred income tax assets and liabilities,

accounting for interest and penalties associated with tax positions, accounting

for interest and penalties associated with tax positions, accounting for income

taxes in interim periods and income tax disclosures. The adoption of ASC

740-10-25 has not resulted in any material impact on the Company's financial

position or results.

Foreign

currency translation

The

Company’s financial information is presented in US dollars. The functional

currency of the Company is Renmini (“RMB”), the currency of the

PRC.

The

financial statements of the Company have been translated into U.S. dollars in

accordance with FASB ASC 830-30 “Translation of Financial

Statements”. The financial information is first prepared in RMB and then

is translated into U.S. dollars at period-end exchange rates as to assets and

liabilities and average exchange rates as to revenue and expenses. Capital

accounts are translated at their historical exchange rates when the capital

transactions occurred. The effects of foreign currency translation adjustments

are included as a component of accumulated other comprehensive income in

shareholders’ equity.

|

March

31,

2010

|

December

31,

2009

|

|||||||

| Period end RMB: US$ exchange rate | 6.8259 | 6.8282 | ||||||

| Average RMB: US$ exchange rate | 6.8274 | 6.8341 | ||||||

The RMB

is not freely convertible into foreign currency and all foreign exchange

transactions must take place through authorized institutions. No representation

is made that the RMB amounts could have been, or could be, converted into US

dollars at the rates used in translation.

11

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

Comprehensive

income

In

accordance with FASB ASC 220-10-55, comprehensive income is defined to include

all changes in equity except those resulting from investments by owners and

distributions to owners. The Company’s only components of comprehensive income

during the three months ended March 31, 2010 and 2009 were net income and the

foreign currency translation adjustment. Other comprehensive income for the

three months ended March 31, 2010 and 2009 was $1,441 and $-0-,

respectively.

Earnings

per share

The

Company computes earnings per share (“EPS’) in accordance with ASC 260 “Earnings

per Share” (“ASC 260”), and SEC Staff Accounting Bulletin No. 98 (“SAB

98”). ASC 260 requires companies with complex capital structures to

present basic and diluted EPS. Basic EPS is measured as net income divided

by the weighted average common shares outstanding for the period. Diluted

EPS is similar to basic EPS but presents the dilutive effect on a per share

basis of potential common shares (e.g., convertible securities, options and

warrants) as if they had been converted at the beginning of the periods

presented, or issuance date, if later. Potential common shares that have

an anti-dilutive effect (i.e., those that increase income per share or decrease

loss per share) are excluded from the calculation of diluted EPS.

Statement

of cash flows

In

accordance with ASC 230, "Statement of Cash Flows," cash flows from the

Company's operations is calculated based upon the local currencies. As a result,

amounts related to assets and liabilities reported on the statements of cash

flows will not necessarily agree with changes in the corresponding balances on

the balance sheets.

12

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

Concentration

of credit risk

Financial

instruments that potentially subject the Company to concentration of credit risk

consist primarily of accounts receivables and other receivables. The

Company does not require collateral or other security to support these

receivables. The Company conducts periodic reviews of its clients'

financial condition and customer payment practices to minimize collection risk

on accounts receivables.

Risks

and uncertainties

The

operations of the Company are located in the PRC. Accordingly, the Company’s

operations are subject to special considerations and significant risks not

typically associated with companies in North America and Western Europe. These

include risks associated with, among others, the political, economic and legal

environment and foreign currency exchange. The Company’s results may be

adversely affected by changes in the political and social conditions in the PRC,

and by changes in governmental policies with respect to laws and regulations,

anti-inflationary measures, currency conversion, remittances abroad, and rates

and methods of taxation, among other things.

Recent accounting

pronouncements

In

January 2010, the FASB issued ASU 2010-04, Accounting for Various Topics –

Technical Corrections to SEC Paragraphs. ASU 2010-04 makes technical

corrections to existing SEC guidance, including the following topics: accounting

for subsequent investments, termination of an interest rate swap, issuance of

financial statements - subsequent events, use of residential method to value

acquired assets other than goodwill, adjustments in assets and liabilities for

holding gains and losses, and selections of discount rate used for measuring

defined benefit obligation. The Company does not expect the adoption of ASU

2010-04 to have a material impact on its consolidated financial

statements.

13

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

In

January 2010, the FASB issued new standards in ASC 820, Fair Value Measurements and

Disclosures: Improving Disclosures About Fair Value Measurements. ASU

2010-06 amends Subtopic 820-10 to clarify existing disclosures, require new

disclosures, and include conforming amendments to guidance on employers’

disclosures about postretirement benefit plan assets. ASU 2010-06 is effective

for interim and annual periods beginning after December 15, 2009, except for

disclosures about purchases, sales, issuances, and settlements in the roll

forward of activity in Level 3 fair value measurements. Those disclosures are

effective for fiscal years beginning after December 15, 2010, and for interim

periods within those fiscal years. The Company is currently

evaluating the impact these standards will have on its financial condition,

results of operations, or cash flows and does not expect the adoption of ASU

2010-06 to have a material impact on its consolidated financial

statements.

In

January 2010, the FASB issued ASU No. 2010-01, Equity (ASC 505): Accounting

for distributions to

Shareholders with Components of Stock and Cash (A Consensus of the FASB

Emerging Issues Task Force). This amendment to ASC 505 clarifies the stock

portion of a distribution to shareholders that allow them to elect to receive

cash or stock with a limit on the amount of cash that will be distributed is not

a stock dividend for purposes of applying ASC 505 and 260. Effective for interim

and annual periods ending on or after December 15, 2009, and would be applied on

a retrospective basis. The Company does not expect the provisions of ASU No.

2010-01 to have a material effect on the financial position, results of

operations or cash flows of the Company.

In

February 2010, the FASB issued ASU 2010-08, Technical Corrections to Various

Topics. ASU 2010-08 clarifies guidance on embedded derivatives and

hedging. ASU 2010-08 is effective for interim and annual periods beginning after

December 15, 2009. The Company does not expect the adoption of ASU 2010-08 to

have a material impact on its consolidated financial statements.

14

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(continued)

In

February 2010, FASB issued ASU 2010-09 Subsequent Event (Topic 855) Amendments

to Certain Recognition and Disclosure Requirements. ASU 2010-09 removes the

requirement for an SEC filer to disclose a date through which subsequent events

have been evaluated in both issued and revised financial statements. All of the

amendments in ASU 2010-09 are effective upon issuance of the final ASU, except

for the use of the issued date for conduit debt obligors. That amendment is

effective for interim or annual periods ending after June 15, 2010. The Company

adopted ASU 2010-09 in February 2010 and did not disclose the date through which

subsequent events have been evaluated.

NOTE

3. OTHER RECEIVABLES

Other

receivables represent a short-term contract deposit with a local hotel in order

for the Company to book hotel rooms or conference rooms at negotiated rates to

hold various meetings or provide training courses to students. Other receivables

also include short-term advances made to certain managers, employees and

internal units for business marketing and recruiting purposes. Such advances

will be expensed as general and administrative costs as the planned marketing

and recruiting tasks have been performed. The Company has full

oversight and control over such advanced amounts. As of March 31, 2010, no

allowance for the uncollectible amounts was deemed necessary. The following

table summarizes the balance of other receivables as of March 31, 2010 and

December 31, 2009:

|

As

of

March

31,

2010

(Unaudited)

|

As of

December 31,

2009

|

|||||||

| Marketing and recruiting advances | $ | 2,238,037 | $ | 466,414 | ||||

| Contract deposit | 510,764 | 542,151 | ||||||

| Total | $ | 2,748,801 | $ | 1,008,565 | ||||

15

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

4. PROPERTY, PLANT AND EQUIPMENTS

As of

March 31, 2010 and December 31, 2009, the detail of property, plant and

equipments was as follows:

|

As of

March 31,

2010

(Unaudited)

|

As of

December 31,

2009

|

|||||||

| Computer electronic equipments | $ | 39,468 | $ | 39,170 | ||||

| Other equipments | 9,327 | 8,042 | ||||||

| Leasehold improvements | 47,741 | 47,291 | ||||||

| Sub-total | 95,536 | 94,503 | ||||||

| Less: accumulated depreciation | (17,190 | ) | (7,134 | ) | ||||

| Property, plant and equipment, net | $ | 79,346 | $ | 87,369 | ||||

Depreciation

expense for the three months ended March 31, 2010 and 2009 was $9,620 and $-0-,

respectively.

NOTE

5. OTHER ASSET

In late

2009, one of the students who attended the Company’s professional training

courses went bankrupt and pledged a personal residential property located in

Dalian City, China, to offset the unpaid tuition. The Company acquired the

property and recorded the amount based on the fair market value of the

acquisition date. As of March 31, 2010, other asset totaled

$91,533. Management determined that there was no impairment of this

asset because the book amount approximates its fair market value based on the

short-term nature of this instrument.

NOTE

6. ADVANCE FROM CUSTOMERS

Advance

from customers represent amounts received in advance from students for tuition

paid to attend the Company’s professional training courses and featured

lectures. Advance from customers is refundable if the training doesn’t occur

within the specified time. The Company recognizes these funds as a current

liability until the revenue can be recognized. As of March 31, 2010 and December

31, 2009, the balance of advance from customers totaled $ 2,841,047 and

$3,628,810, respectively.

16

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 7. TAXES

(a) Business sales

tax

The

Company is subject to 5% business sales tax on actual revenue

generated. It is the Company’s continuing practice to accrue 5% of

the sales tax on estimated revenue and file tax return based on the actual

result, as the local tax authority may exercise broad discretion in applying the

tax amount. As a result, the Company’s accrual sales tax may differ

from the actual tax clearance.

(b)

Corporation income tax (“CIT”)

The

Company is governed by the Income Tax Law of the People’s Republic of China

concerning the private-run enterprises, which are generally subject to tax at a

new statutory rate of 25% on income reported in the statutory financial

statements after appropriate tax adjustments. For the three months

ended March 31, 2010 and 2009, the Company incurred income taxes of $296,169 and

$-0-, respectively.

(c)

Taxes payable

As of

March 31, 2010 and December 31, 2009, taxes payable consisted of the

following:

|

As

of

March

31,

2010

(Unaudited)

|

As of

December 31,

2009

|

|||||||

| Corporation income tax | $ | 296,234 | $ | 403,989 | ||||

| Business tax | 130,519 | 124,452 | ||||||

| Other tax and fees | 16,402 | 9,100 | ||||||

| Total tax payable | $ | 443,155 | $ | 537,541 | ||||

17

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

8. STOCKHOLDERS’ EQUITY

|

(a)

|

Common

stock

|

Prior to

the Share Exchange, the Company had 6,510,000 shares of common stock issued

and outstanding at $.001 per share.

Before

the closing of the Share Exchange transaction, the Company retired 3,000,000

shares of common stock in connection with the spin-off of the Company’s

subsidiary, On Demand Heavy Duty Holdings, Inc. In addition, an aggregate

of 3,070,000 shares were returned to the transfer agent for cancellation

by other shareholders of the Holdings. In connection with the

Share Exchange consummated on February 12, 2010, the Company issued 21,560,000

shares of its common stock to SLM shareholder, so that upon completion of the

Merger, the shareholders of SLM own approximately 98% of the common stock of the

Company.

Upon

completion of the Merger, there were 22,000,000 shares of the Company’s common

stock issued and outstanding.

On March

29, 2010, the Company issued 50,000 common shares to a consulting firm for

services rendered and recorded the fair value of $105,000 at the grant

date.

As of

March 31, 2010, there were a total of 22,050,000 shares of the Company’s common

stock issued and outstanding.

|

(b)

|

Statutory

reserve

|

The

Company is required to make appropriations to certain reserve funds, comprising

the statutory surplus reserve and discretionary surplus reserve, based on

after-tax net income determined in accordance with generally accepted accounting

principles of the PRC (“PRC GAAP”). Appropriations to the statutory surplus

reserve is required to be at least 10% of the after tax net income determined in

accordance with PRC GAAP until the reserve is equal to 50% of the entities’

registered capital. Appropriations to the discretionary surplus reserve are made

at the discretion of the Board of Directors.

18

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

8. STOCKHOLDERS’ EQUITY (continued)

The

statutory surplus reserve fund is non-discretionary other than during

liquidation and can be used to fund previous years’ losses, if any, and may be

utilized for business expansion or converted into share capital by issuing new

shares to existing shareholders in proportion to their shareholding or by

increasing the par value of shares currently held by them, provided that the

remaining statutory surplus reserve balance after such issue is not less than

25% of the registered capital before the conversion.

Pursuant

to the Company’s articles of incorporation, the Company is to appropriate 10% of

its net profits as statutory surplus reserve. As of March 31, 2010, the balance

of statutory surplus reserve was $358,026.

The

discretionary surplus reserve may be used to acquire fixed assets or to increase

the working capital to expend on production and operation of the business. The

Company’s Board of Directors decided not to make an appropriation to this

reserve for the quarter ended March 31, 2010.

NOTE

9. COMMITMENTS AND CONTINGENCIES

From time

to time, the Company leases office spaces in Shanghai and Hangzhou in China to

conduct its normal business activities, such as business administration,

recruiting students, holding the business conferences and providing professional

training courses or featured lectures to students. The Company also

has several rental arrangements which provide residential units to house key

employees. These lease agreements are short-term in nature and will expire

before October 2012.

Rent

expenses for the above rental arrangements total $210,133 for the three months

ended March 31, 2010.

19

CHINA

EXECUTIVE EDUCATION CORP. AND SUBSIDIARIES

(FORMERLY

ON DEMAND HEAVY DUTY, CORP)

NOTES

TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE

9. COMMITMENTS AND CONTINGENCIES (continued)

The

minimum obligations under such commitments (unless otherwise stated) for the

years ended December until their expiration are summarized below:

| 2010 | $ | 546,732 | ||

| 2011 | 588,491 | |||

| 2012 | 29,172 | |||

| Total | $ | 1,164,395 |

NOTE

10. WEIGHTED AVERAGE NUMBER OF SHARES

In

February 2010, the Company entered into a share exchange transaction which has

been accounted for as a reverse merger under the purchase method of accounting

since there has been a change of control. The Company computes the

weighted-average number of common shares outstanding in accordance with ASC 805,

Business Combinations, which states that in calculating the weighted average

shares when a reverse merger takes place in the middle of the year, the number

of common shares outstanding from the beginning of that period to the

acquisition date shall be computed on the basis of the weighted-average number

of common shares of the legal acquiree (the accounting acquirer) outstanding

during the period multiplied by the exchange ratio established in the merger

agreement. The number of common shares outstanding from the acquisition date to

the end of that period shall be the actual number of common shares of the legal

acquirer (the accounting acquiree) outstanding during that period.

20

|

ITEM

2.

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS.

|

Forward

Looking Statements

You

should read the following discussion and analysis of our financial condition and

results of operations in conjunction with our consolidated financial statements

and the related notes included elsewhere in this document. The following

discussion contains forward-looking statements. China Executive Education Corp.

is referred to herein as “we”, “us”, “our”, the “Registrant” or the

“Company.”

The

words or phrases “would be,” “will allow,” “expect to”, “intends to,” “will

likely result,” “are expected to,” “will continue,” “is anticipated,”

“estimate,” or similar expressions are intended to identify forward-looking

statements. Such statements include, among others, those statements concerning

our expected financial performance, our corporate strategy and operational

plans. Actual results could differ materially from those projected in the

forward-looking statements as a result of a number of risks and uncertainties,

including, among others: (a) those risks and uncertainties related to general

economic conditions in China, including regulatory factors that may affect such

economic conditions; (b) whether we are able to manage our planned growth

efficiently and operate profitable operations, including whether our management

will be able to identify, hire, train, retain, motivate and manage required

personnel or that management will be able to successfully manage and exploit

existing and potential market opportunities; (c) whether we are able to generate

sufficient revenues or obtain financing to sustain and grow our operations; and

(d) whether we are able to successfully fulfill our primary requirements for

cash which are explained below under “Liquidity and Capital Resources”. Unless

otherwise required by applicable law, we do not undertake, and we specifically

disclaim any obligation, to update any forward-looking statements to reflect

occurrences, developments, unanticipated events or any other circumstances after

the date of such statement unless required by law. For additional information

regarding these risks and uncertainties, see “Risk Factors”. Our consolidated

financial statements have been prepared in accordance with U.S. GAAP. In

addition, our consolidated financial statements and the financial data included

in this document reflect the Merger and have been prepared as if our current

corporate structure had been in place throughout the relevant

periods.

Overview

We are a

fast-growing executive education company in China and mainly operate through MYL

Business. We operate comprehensive business training programs through

our controlled affiliates and subsidiaries in Hangzhou and Shanghai, which are

two prosperous and commercial cities of China. Our executive training

programs are designed to fit the needs of Chinese entrepreneurs, and to improve

their leadership skill, management skills and marketing skills, as well as

bottom-line results. Our comprehensive business training initiatives

integrate research-based, proprietary content with processes that are

specifically and explicitly connected to the critical business issues that most

private Chinese companies are facing. This allows the trainees to

better achieve their potentials and better align individual goals and

competencies with organizational objectives of their employers or

business. We have developed 22 training courses which include a core

course, named “Seven Essential Classes for Business Executives”.

We derive

our sales revenue from selling our proprietary training courses. We

also generate sales revenue from our “Featured Lectures” events which are

organized by us periodically with the presence of world masters or well-known

keynote speakers.

Our

open-enrollment training programs include our proprietary training courses and

featured lectures. Our proprietary training courses include one

package of 7 courses for CEO and C-Level managers, as well as 21 leadership and

personal development courses, which are on the topic of management skills,

negotiation skills, leadership skills, public speaking skills,

etc. Featured Lectures are delivered by world masters invited by

us. Those world masters are experts or well-known speakers in each

relevant field. Lectures are delivered to a large

audience. MYL Business’s network of speaking professionals is a

leading platform in China at inspiring audiences to new levels of motivation and

commitment.

Since the

formal launching of our operation in April 2009, we have provided our training

programs to 2,874 of Chinese business owners and executives. They

come from different provinces and from different industries. And,

they also represent different sizes of business. Some of our top

corporation clients have millions of dollars in sales, such as Tieniu Group,

Jiangsu Shenhua Real Estate Co., Ltd., Beijing Holliland Enterprise Investment

Management Co., Ltd., WanLong Ski Resort, and Shenzhen Baoan Fenda Industrial

Co., Ltd.

21

Our

principal executive offices are located at Hangzhou MYL Business Administration

Consulting Co. Ltd., Room 307, Hualong Business Building, 110 Moganshan Road,

Hangzhou, P.R.China 310005 and our telephone number is (86)

0571-8880-8109.

Since our

business inception, our client base and sales revenue have been continuing to

climb from time to time. As of March 31, 2010 and December 31, 2009, we have

generated sales revenue of RMB30.35 million (equivalent to approximately USD

4.44 million) and RMB 62.44 million (equivalent to approximately USD 9.14

million), respectively. Our net income for the above periods was

approximately $0.76 and $3.31 million, respectively.

Our

management plans to continue the execution of our business expansion strategy

that will result in increased market penetration of our educational services and

expanded revenue growth in our 2010 fiscal year and beyond. Part of

this strategy involves increasing and improving our marketing activities,

strengthening our sales force, and solidifying our client

network.

Our

management believes that our emphasis on further commercializing and broadening

our professional training courses and service scope, enhanced sales and

marketing efforts shall continue to yield significant increases in our revenue

in 2010 and beyond.

Our

Industry

We

operate in China’s professional training industry, which is one of the fastest

growing sectors in China’s education industry. According to the China Education

Yearbook, China’s total educational expenditures were approximately RMB 214.8

billion in 2007 (approximately $178.6 billion), representing a compound annual

growth rate, or CAGR, of approximately 15.4%, since 2000, as illustrated in the

following chart. The school system run by the State and local government

accounts for over 60% of the funding and expenditure.

According

to the Report of Investment Analysis and Prospect of China Training Industry

2010-2015, as of the end of 2007, the estimated size of the vocational training

and professional training market was around RMB 300 billion

(approximately USD 44 billion). And as one of the major segments of the

professional training industry, China’s executive training has emerged and grown

rapidly in the last few years. The market was estimated with a size about RMB 2

billion (approximately $294 million) in 2002; then was increased to over RMB 16

billion (approximately 2.35 billion) in 2004, and jumped to RMB 30 billion

(approximately $4.41 billion) in 2006.

China’s

professional training industry has also been further divided in more

sub-segments, such as, career development training, foreign language training,

technique and skills training, and executive training. As Chinese companies and

working force confront competition in the global market, the needs for steady

improvement of the skills and efficiency on different levels will stimulate

continuing growth in demand for specialized professional education services in

different fields.

22

Executive

training is a special business segment. The target clients for executive

training business are corporation executives, C-level managers and private

business owners. The training programs mainly include leadership development,

corporation strategy, decision making and other personal skill development.

China’s executive education sector is characterized with the following

nature:

|

(1)

|

Young

and in early development stage. In comparison with other professional

training segments, China’s executive training industry is young and just

has 10 years history. It was first introduced by foreign education

institute to top Chinese business schools in late 1990s, then expanded to

the private sector with many active

participants.

|

|

(2)

|

Strong

market demand. Driven by the booming Chinese economy and spirit of

entrepreneurism in the private business sector, demand for open-enrollment

and easy access high-level education program from more than 6 million of

Chinese private business owners and over 10 million business executives in

China is strong.

|

|

(3)

|

Fragmented

market. Because low entry barrier, now there are thousands of executive

training providers in China. There is no dominant player in the national

market yet. According to the study conducted by China Investment &

Industry Research Center, there were more than 70,000 training companies

nationwide, of which more than 10,000 located in Beijing and Shanghai, But

quite few of them have generated RMB 10 million or more of sales revenue

annually.

|

Corporate

History & Background

China

Executive Education Corp (the “Company”), formerly known as On Demand Heavy

Duty, Corp. is a corporation organized under the laws of the State of

Nevada.

We were

incorporated under the laws of the State of Nevada, U.S. on May 9, 2008, under

the name of On Demand Heavy Duty, Corp. From our inception until our

reverse acquisition of Surmounting Limit Marketing Adviser Limited, a Hong Kong

corporation (“SLM”) on February 12, 2010, we were in the development stage as

defined under Statement on Financial Accounting Standards No. 7, Development

Stage Enterprises (“SFAS No.7”) and intended to commence business operations by

purchasing and distributing eco-friendly building supplies for sale throughout

Europe and North America.

On

February 12, 2010, we acquired all of the outstanding capital stock of

Surmounting Limit Marketing Adviser Limited (“SLM”), a Hong Kong

Corporation, through China Executive Education Corp., a Nevada

corporation (the “Merger Sub”) wholly owned by the Company. SLM is a holding

company whose only asset, held through a subsidiary, is 100% of the registered

capital of Hangzhou MYL Business Administration Consulting Co., Ltd. (“MYL

Business”), a limited liability company organized under the laws of the People’s

Republic of China (“China” or “PRC”). Substantially all of SLM's operations are

conducted in China through MYL Business, and through contractual arrangements

with several of MYL Business affiliated entities in China, including Hangzhou

MYL Commercial Services Co., Ltd. (“MYL Commercial”) and its subsidiaries. MYL

Commercial is a fast-growing executive education company with dominant operation

in Shanghai, the commercial center of China, providing comprehensive consulting

services such as business administration, marketing strategy, designing of

enterprise image, corporate investment and commerce, business conference as well

as professional training programs designed to fit the needs of Chinese

entrepreneurs to improve their leadership, management and marketing

skills.

In

connection with the acquisition, the Merger Sub issued 20 shares of the common

stock of the Merger Sub which constituted no more than 10% ownership interest in

the Merger Sub to the shareholders of SLM, in exchange for all the shares of the

capital stock of SLM (the “Share Exchange” or “Merger”). The 20 shares of the

common stock of the Merger Sub were converted into approximately 21,560,000

shares of the common stock of the On Demand so that upon completion of the

Merger, the shareholders of SLM own approximately 98% of the common stock of the

Company.

As part

of the Merger, pursuant to a stock purchase agreement (the “Stock Purchase

Agreement”), the Company transferred all of the outstanding capital of its

subsidiary, On Demand Heavy Duty Holdings, Inc. (“Holdings”) to certain of its

shareholders in exchange for the cancellation of 3,000,000 shares of the

Company’s common stock (the “Split Off Transaction”). In addition, an

aggregate of 3,070,000 shares were returned to the transfer agent for

cancellation by other shareholders of the Holdings. Following the

Merger and the Split-Off Transaction, the Company discontinued its former

business and is now engaged in the executive education business.

Upon

completion of the Merger, there were 22,000,000 shares of the Company’s common

stock issued and outstanding.

23

As a

result of these transactions, persons affiliated with the SLM and MYL Business

now own securities that in the aggregate represent approximately 98% of the

equity in the Company. In addition, in connection with the change of control

contemplated by the Share Exchange, the directors and officers of the Company

resigned from their positions and new directors and officers affiliated with MYL

Business controlled the Board of Directors of the Company ten days after the

notice pursuant to Rule 14f-1 has been mailed to the shareholders of

record.

Consequently,

our name was changed from “On Demand Heavy Duty, Corp.” to the Merger Sub’s name

“China Executive Education Corp.” in order to more effectively reflect the

Company’s business and communicate the Company’s brand identity to

customers.

The above

mentioned merger transaction has been accounted for as a reverse merger under

the purchase method of accounting since there was a change of control.

Accordingly, SLM will be treated as the continuing entity for accounting

purposes.

On April

9, 2010, Company received approval from FINRA clearing Company’s name change

from “On Demand Heavy Duty, Corp.” to “China Executive

Education Corp.” in connection with the merger of the Company on February 12,

2010. According to FINRA’s approval, the name change took effect on

April 12, 2010. Company’s new trading symbol on April 12, 2010 was

changed from “ODHD. OB” to “CECX.OB” to effect the name change.

SLM does

not conduct any substantive operations of its own. Instead, through its

subsidiary, MYL Business, it had entered into certain exclusive contractual

agreements with Hangzhou MYL Commercial on March 25, 2009. Pursuant

to these agreements, SLM is obligated to absorb a majority of the risk of loss

from MYL Commercial’s activities and entitled it to receive a majority of its

expected residual returns. In addition, MYL Commercial’s shareholders have

pledged their equity interest in MYL Commercial to SLM, irrevocably granted SLM

an exclusive option to purchase, to the extent permitted under PRC Law, all or

part of the equity interests in MYL Commercial and agreed to entrust all the

rights to exercise their voting power to the persons appointed by MYL

Commercial. Through these contractual arrangements, the Company and SLM hold all

the variable interests of MYL Commercial. Therefore, the Company is the primary

beneficiary of MYL Commercial.

Based on

these contractual arrangements, we believe that MYL Commercial should be

considered as Variable Interest Entity (“VIE”) under ASC 510 “Consolidation of

Variable Interest Entities, and Interpretation of ARB No. 51”. Accordingly, the

Company consolidates MYL Commercial and its subsidiary’s results, assets and

liabilities.

24

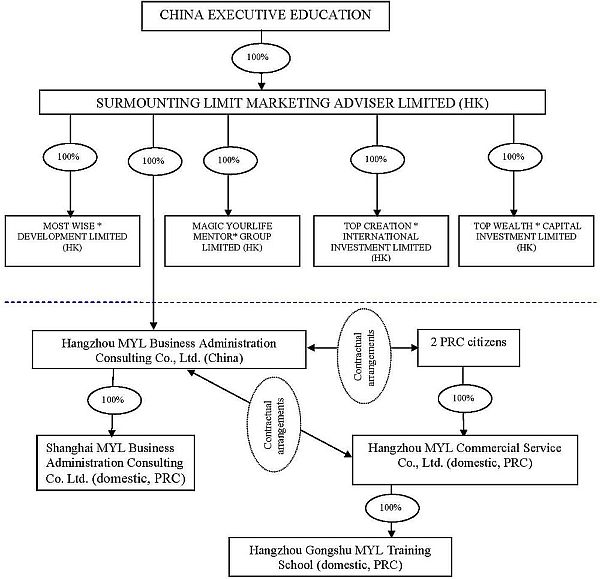

Corporate

Structure

We

conduct our operations in China through MYL Business and through contractual

arrangements with several of MYL Business’s consolidated affiliated entities in

China, including Hangzhou MYL Commercial and its subsidiaries. The

following chart reflects our current organizational structure:

*non-active subsidiaries with

no operations.

Competition

We face

the competition on two different fronts. First is from the major

Chinese university and business schools. They provide EMBA program

targeting on corporation executives and entrepreneurs. The most

popular EMBA programs available in China are from Euro-China International

Business College in Shanghai, Cheung Kong Graduate School of Business, Tsinghua

University and Shanghai Jiaotong University, etc. These universities’

EMBA programs provide their students with approximately 300 hours of formal

in-class training programs in the curriculum and issue degree certificates to

students at graduation. The tuition ranges from RMB 60,000

(approximately USD 9,000) to RMB 568,000 (approximately USD 85,000) for the

entire program. The top business schools enroll 400–600 students

annually. Due to the strict admission requirements, many young and

less qualified candidates are turned away. This increases the market

opportunities for Company’s programs.

Open-enrollment

programs provided by private education institutions, like ours, have emerged and

constituted serious competition to the top business schools that provide formal

executive training programs. These peer companies also constitute

direct competition with us. Jucheng Group (founded in 2003 in

Shenzhen), Action Success International Education Group (founded in 2001 in

Shanghai), and Sparta Group (founded in 2002 in Beijing) are the most prominent

companies in our business sector. We compete with them primarily on

the basis of training courses, lecturers, prices, effectiveness of training

execution and our brand name. Since those three companies have been

in business longer than us and they have cross-region presence, they possess

their strength in market coverage and pricing. We believe that we

have a competitive advantage in our international network and broad

offering.

25

Factors

Affecting Our Results of Operation

The

increase in our operating results was attributable to a number of factors, which

include the strong market demand for quality executive training programs in

China, and our effective execution of our business formation plan in Hangzhou

and Shanghai. We believe that our business model and quick

establishment in the target market have given us a considerable advantage over

our competitors. We expect our business will continue its growth in

the years to come, and our future growth will depend primarily on the following

factors:

Increasing

Domestic Spending in Executive Training in China

The

demand for our training program is directly related to the training spending in

China. The increase in training spending is largely determined by the

economic conditions in our country. According to the data released by

National Bureau of Statistics of China on January 21, 2010, China’s economy has

expanded by 8.7% in 2009, and its annual growth rate has been in the range of 8%

to 13% in the recent decade. We believe the fast growing economy is

going to generate more demand for professional training, including business

executive training programs. We expect the training spending in China

will maintain its double-digit growth in the years to come. However,

we cannot give you any assurance that post growth will continue or stay the

same.

Increasing

Numbers of Private Businesses

According

to the Report of Investment

Analysis and Prospect of China Training Industry 2010-2015 by China

Investment & Industry Research Center in January 2010, there were

approximately 31.5 million of small and middle-sized business in China in 2006,

increased by 11.2% compared to 2005, and in the coming three years, the number

of small and middle-sized company is expected to keep growing at annual growth

rate of 7%-8%. It is estimated that by 2012, the number of small and

middle-sized company will reach approximately 50 million. The

business owners and executives are eager to improve their skills of management,

leadership, marketing, negotiating and investment skills.

Promotion

of Our Brand Name to Attract More Clients Cross the Country

We plan

to promote our brand name, Magic Your LifeTM in

China. We believe that the enhancement of public awareness to our

brand name will help to broaden our client base all over China.

Network

with and Retain More Featured Lecturers

Since

Featured Lectures are one of the major revenue generating venues for us, we need

to expand business networking and retain more top talent to our lecturer and

guest speaker team. In 2010, we intend to host more Featured Lectures

or large session events to attract more enrollments and sell our programs to

more clients.

New

Training Program Offered for the Affluent Second Generation

As China

becomes the country with the second largest number of billionaires and its

number of highly affluent people increases, the inheritance of the wealth and

business has become a big concern in the nation and for families. We

intend to develop and launch our special training programs for the children of

the most affluent Chinese. The program will help this specific group

of clients to improve their business management skills and personal

skills. We believe that this business initiative will help to further

expand our business in the coming years.

Intellectual

Property

MYL

Business has officially filed with the respective trademark offices in the PRC,

Hong Kong, and the U.S. the application for registration of  (FORBOSS Business Mentor Group) as a registered

trademark. Such application is subject to review and authorization by

the respective trademark offices. In Hong Kong, the said application

is pending as it has been challenged by third parties. Ms. Chiayeh

LIN, one of the management of MYL, has officially filed with the trademark

office of the PRC the application for registration of

(FORBOSS Business Mentor Group) as a registered

trademark. Such application is subject to review and authorization by

the respective trademark offices. In Hong Kong, the said application

is pending as it has been challenged by third parties. Ms. Chiayeh

LIN, one of the management of MYL, has officially filed with the trademark

office of the PRC the application for registration of  (Magic You Life) as registered trademark. Such

application is subject to review and authorization by the trademark office of

the PRC.

(Magic You Life) as registered trademark. Such

application is subject to review and authorization by the trademark office of

the PRC.

(FORBOSS Business Mentor Group) as a registered

trademark. Such application is subject to review and authorization by

the respective trademark offices. In Hong Kong, the said application

is pending as it has been challenged by third parties. Ms. Chiayeh

LIN, one of the management of MYL, has officially filed with the trademark

office of the PRC the application for registration of

(FORBOSS Business Mentor Group) as a registered

trademark. Such application is subject to review and authorization by