Attached files

Exhibit 10.2

Loan No. 1002012

LOAN AGREEMENT

between

KBSII 350 PLUMERIA, LLC,

KBSII MOUNTAIN VIEW, LLC,

KBSII ONE MAIN PLACE, LLC, and

KBSII PIERRE LACLEDE CENTER, LLC,

as Borrower

and

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as Administrative Agent

and

THE FINANCIAL INSTITUTIONS

NOW OR HEREAFTER SIGNATORIES HERETO

AND THEIR ASSIGNEES PURSUANT TO SECTION 13.13,

as Lenders

Entered into as of April 30, 2010

TABLE OF CONTENTS

| Page | ||||

| ARTICLE 1. | DEFINITIONS | 1 | ||

| 1.1 | DEFINED TERMS | 1 | ||

| 1.2 | SCHEDULES AND EXHIBITS INCORPORATED | 13 | ||

| ARTICLE 2. | LOAN | 13 | ||

| 2.1 | LOAN; REVOLVER | 13 | ||

| 2.2 | LOAN FEES | 13 | ||

| 2.3 | LOAN DOCUMENTS | 14 | ||

| 2.4 | EFFECTIVE DATE | 14 | ||

| 2.5 | MATURITY DATE | 14 | ||

| 2.6 | EXTENSION OPTION | 14 | ||

| 2.7 | INTEREST ON THE LOAN | 15 | ||

| 2.8 | PAYMENTS | 19 | ||

| 2.9 | FULL REPAYMENT AND RECONVEYANCE | 21 | ||

| 2.10 | PARTIAL RELEASE OF PROPERTY | 21 | ||

| 2.11 | LENDERS’ ACCOUNTING | 22 | ||

| 2.12 | SECURED SWAP OBLIGATIONS | 23 | ||

| ARTICLE 3. | DISBURSEMENT | 23 | ||

| 3.1 | CONDITIONS PRECEDENT | 23 | ||

| 3.2 | APPRAISALS | 23 | ||

| 3.3 | INITIAL DISBURSEMENT | 24 | ||

| 3.4 | SUBSEQUENT DISBURSEMENTS | 24 | ||

| 3.5 | FUNDS TRANSFER DISBURSEMENTS | 25 | ||

| 3.6 | BORROWERS REPRESENTATIVES | 26 | ||

| ARTICLE 4. | INTENTIONALLY OMITTED | 26 | ||

| ARTICLE 5. | INSURANCE | 26 | ||

| ARTICLE 6. | REPRESENTATIONS AND WARRANTIES | 26 | ||

| 6.1 | ORGANIZATION; CORPORATE POWERS | 27 | ||

| 6.2 | AUTHORITY | 27 | ||

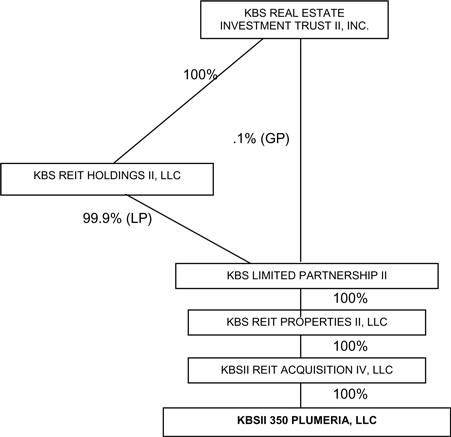

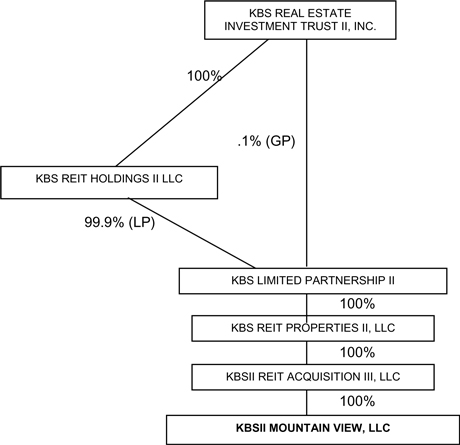

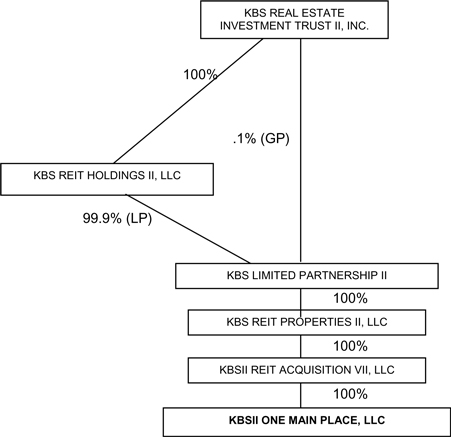

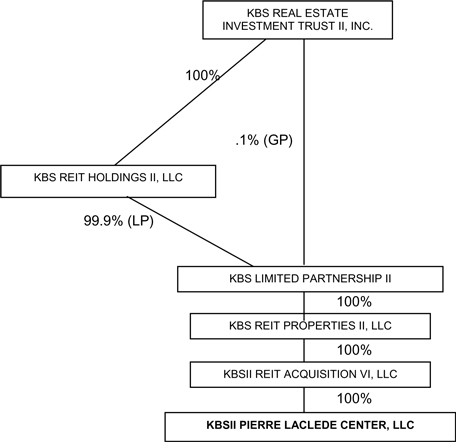

| 6.3 | OWNERSHIP OF BORROWERS | 27 | ||

| 6.4 | NO CONFLICT | 27 | ||

| 6.5 | CONSENTS AND AUTHORIZATIONS | 27 | ||

| 6.6 | GOVERNMENTAL REGULATION | 27 | ||

| 6.7 | PRIOR FINANCIALS | 28 | ||

| 6.8 | FINANCIAL STATEMENTS; PROJECTIONS AND FORECASTS | 28 | ||

| 6.9 | PRIOR OPERATING STATEMENTS | 28 | ||

i

| 6.10 | OPERATING STATEMENTS AND PROJECTIONS | 28 | ||

| 6.11 | LITIGATION; ADVERSE EFFECTS | 28 | ||

| 6.12 | NO MATERIAL ADVERSE CHANGE | 29 | ||

| 6.13 | PAYMENT OF TAXES | 29 | ||

| 6.14 | MATERIAL ADVERSE AGREEMENTS | 29 | ||

| 6.15 | PERFORMANCE | 29 | ||

| 6.16 | FEDERAL RESERVE REGULATIONS | 29 | ||

| 6.17 | DISCLOSURE | 29 | ||

| 6.18 | REQUIREMENTS OF LAW; ERISA | 29 | ||

| 6.19 | ENVIRONMENTAL MATTERS | 29 | ||

| 6.20 | MAJOR AGREEMENTS; LEASES | 30 | ||

| 6.21 | SOLVENCY | 30 | ||

| 6.22 | TITLE TO PROPERTY; NO LIENS | 31 | ||

| 6.23 | USE OF PROCEEDS | 31 | ||

| 6.24 | PROPERTY MANAGEMENT AGREEMENTS | 31 | ||

| 6.25 | SINGLE PURPOSE ENTITY | 31 | ||

| 6.26 | INTENTIONALLY OMITTED | 31 | ||

| 6.27 | ORGANIZATIONAL DOCUMENTS | 31 | ||

| ARTICLE 7. | INTENTIONALLY OMITTED | 31 | ||

| ARTICLE 8. | LOAN CONSTANT COMPLIANCE | 31 | ||

| 8.1 | LOAN CONSTANT COVERAGE | 31 | ||

| 8.2 | REPAYMENT; DEPOSIT | 32 | ||

| 8.3 | SWEPT FUNDS DISBURSEMENT ACCOUNT | 33 | ||

| ARTICLE 9. | OTHER COVENANTS OF BORROWER | 34 | ||

| 9.1 | EXPENSES | 34 | ||

| 9.2 | ERISA COMPLIANCE | 34 | ||

| 9.3 | LEASES; LEASE APPROVAL; LEASE TERMINATION | 34 | ||

| 9.4 | SNDAs | 35 | ||

| 9.5 | SUBDIVISION MAPS | 35 | ||

| 9.6 | OPINIONS OF LEGAL COUNSEL | 36 | ||

| 9.7 | FURTHER ASSURANCES | 36 | ||

| 9.8 | ASSIGNMENT | 36 | ||

| 9.9 | MANAGEMENT OF PROPERTY | 36 | ||

| 9.10 | REQUIREMENTS OF LAW | 36 | ||

| 9.11 | SPECIAL COVENANTS; SINGLE PURPOSE ENTITY | 36 | ||

| 9.12 | LIMITATIONS ON DISTRIBUTIONS, ETC | 37 | ||

| 9.13 | INCURRENCE OF ADDITIONAL INDEBTEDNESS | 37 | ||

ii

| 9.14 | SPECIAL REPRESENTATIONS, COVENANTS AND WAIVERS | 37 | ||

| 9.15 | ENVIRONMENTAL INSURANCE PROCEEDS | 39 | ||

| 9.16 | AMENDMENT OF CONSTITUENT DOCUMENTS | 39 | ||

| 9.17 | OWNERSHIP OF BORROWER | 39 | ||

| 9.18 | LIENS | 39 | ||

| 9.19 | TRANSFERS OF COLLATERAL | 40 | ||

| 9.20 | ADDITIONAL REIT COVENANTS | 40 | ||

| 9.21 | TERMINATION PAYMENTS | 40 | ||

| ARTICLE 10. | REPORTING COVENANTS | 41 | ||

| 10.1 | FINANCIAL STATEMENTS AND OTHER FINANCIAL AND OPERATING INFORMATION (BORROWERS) | 41 | ||

| 10.2 | FINANCIAL STATEMENTS AND OTHER FINANCIAL AND OPERATING INFORMATION (KBS REIT) | 44 | ||

| 10.3 | ENVIRONMENTAL NOTICES | 44 | ||

| 10.4 | CONFIDENTIALITY | 45 | ||

| ARTICLE 11. | DEFAULTS AND REMEDIES | 45 | ||

| 11.1 | DEFAULT | 45 | ||

| 11.2 | ACCELERATION UPON DEFAULT; REMEDIES | 47 | ||

| 11.3 | DISBURSEMENTS TO THIRD PARTIES | 47 | ||

| 11.4 | REPAYMENT OF FUNDS ADVANCED | 47 | ||

| 11.5 | RIGHTS CUMULATIVE, NO WAIVER | 48 | ||

| ARTICLE 12. | THE ADMINISTRATIVE AGENT; INTERCREDITOR PROVISIONS | 48 | ||

| 12.1 | APPOINTMENT AND AUTHORIZATION | 48 | ||

| 12.2 | WELLS FARGO AS LENDER | 49 | ||

| 12.3 | LOAN DISBURSEMENTS | 49 | ||

| 12.4 | DISTRIBUTION AND APPORTIONMENT OF PAYMENTS; DEFAULTING LENDERS | 50 | ||

| 12.5 | PRO RATA TREATMENT | 51 | ||

| 12.6 | SHARING OF PAYMENTS, ETC | 51 | ||

| 12.7 | COLLATERAL MATTERS; PROTECTIVE ADVANCES | 52 | ||

| 12.8 | POST-FORECLOSURE PLANS | 53 | ||

| 12.9 | APPROVALS OF LENDERS | 54 | ||

| 12.10 | NOTICE OF DEFAULTS | 54 | ||

| 12.11 | ADMINISTRATIVE AGENT’S RELIANCE, ETC | 54 | ||

| 12.12 | INDEMNIFICATION OF ADMINISTRATIVE AGENT | 55 | ||

| 12.13 | LENDER CREDIT DECISION, ETC | 55 | ||

| 12.14 | SUCCESSOR ADMINISTRATIVE AGENT | 56 | ||

| ARTICLE 13. | MISCELLANEOUS PROVISIONS | 56 | ||

iii

| 13.1 | INDEMNITY | 56 | ||

| 13.2 | FORM OF DOCUMENTS | 57 | ||

| 13.3 | NO THIRD PARTIES BENEFITED | 57 | ||

| 13.4 | NOTICES | 57 | ||

| 13.5 | ATTORNEY-IN-FACT | 58 | ||

| 13.6 | ACTIONS | 58 | ||

| 13.7 | RIGHT OF CONTEST | 58 | ||

| 13.8 | RELATIONSHIP OF PARTIES | 58 | ||

| 13.9 | DELAY OUTSIDE LENDER’S CONTROL | 58 | ||

| 13.10 | ATTORNEYS’ FEES AND EXPENSES; ENFORCEMENT | 58 | ||

| 13.11 | IMMEDIATELY AVAILABLE FUNDS | 58 | ||

| 13.12 | AMENDMENTS AND WAIVERS | 58 | ||

| 13.13 | SUCCESSORS AND ASSIGNS | 60 | ||

| 13.14 | CAPITAL ADEQUACY | 62 | ||

| 13.15 | LENDER’S AGENTS | 62 | ||

| 13.16 | TAX SERVICE | 62 | ||

| 13.17 | WAIVER OF RIGHT TO TRIAL BY JURY | 62 | ||

| 13.18 | SEVERABILITY | 63 | ||

| 13.19 | TIME | 63 | ||

| 13.20 | HEADINGS | 63 | ||

| 13.21 | GOVERNING LAW | 63 | ||

| 13.22 | USA PATRIOT ACT NOTICE | 63 | ||

| 13.23 | ELECTRONIC DOCUMENT DELIVERIES | 63 | ||

| 13.24 | INTEGRATION; INTERPRETATION | 64 | ||

| 13.25 | JOINT AND SEVERAL LIABILITY | 64 | ||

| 13.26 | COUNTERPARTS | 64 | ||

| 13.27 | LIMITATION ON PERSONAL LIABILITY OF SHAREHOLDERS, PARTNERS AND MEMBERS | 64 | ||

| EXHIBITS AND SCHEDULES |

| SCHEDULE 1.1(A) – PRO RATA SHARES |

| SCHEDULE 1.1(B) – PAR LOAN VALUES |

| SCHEDULE 6.3 – OWNERSHIP OF BORROWER |

| SCHEDULE 6.11–LITIGATION DISCLOSURE |

| SCHEDULE 6.24 – PROPERTY MANAGEMENT AGREEMENTS |

| SCHEDULE 7.1 – ENVIRONMENTAL REPORTS |

| EXHIBIT A – DESCRIPTION OF PROPERTIES |

| EXHIBIT B – DOCUMENTS |

| EXHIBIT C – FORM OF SUBORDINATION NON-DISTURBANCE AND ATTORNMENT AGREEMENT |

| EXHIBIT D – FORM OF ASSIGNMENT AND ASSUMPTION AGREEMENT |

iv

| EXHIBIT E – FORM OF PROMISSORY NOTE |

| EXHIBIT F – FIXED RATE NOTICE |

| EXHIBIT G – TRANSFER AUTHORIZER DESIGNATION |

| EXHIBIT H – BORROWERS’ CERTIFICATE |

| EXHIBIT I – ADDITIONAL DEFINITIONS |

| EXHIBIT J – LOAN CONSTANT CALCULATIONS |

v

LOAN AGREEMENT

(Secured Loan)

THIS LOAN AGREEMENT (“Agreement”) dated as of April 30, 2010 by and among KBSII 350 PLUMERIA, LLC, a Delaware limited liability company, KBSII MOUNTAIN VIEW, LLC, a Delaware limited liability company, KBSII ONE MAIN PLACE, LLC, a Delaware limited liability company and KBSII PIERRE LACLEDE CENTER, LLC, a Delaware limited liability company (each individually “Borrower” and together, “Borrowers”), each of the financial institutions initially a signatory hereto together with their assignees under Section 13.13 (“Lenders”), and WELLS FARGO BANK, NATIONAL ASSOCIATION (“Wells Fargo”) as contractual representative of the Lenders to the extent and in the manner provided in Article 12 (in such capacity, the “Administrative Agent”).

R E C I T A L S

| A. | Borrowers are the owners of certain real properties located in the states of California, New Jersey, Oregon and Missouri (each, a “Property” and collectively, the “Properties”), which Properties are more specifically described on Exhibit A hereto; provided, once a “Property” has been released in accordance with Section 2.10, it shall no longer be deemed a “Property” for purposes of this Agreement; and provided further, that a property shall not be deemed a “Property” hereunder unless and until Administrative Agent (for the benefit of Lenders) has obtained a first priority lien on such property pursuant to a Security Document. |

| B. | Borrowers have requested that Administrative Agent and Lenders make a loan to Borrowers in the original principal amount of $100,000,000 (the “Loan”), which Loan will be secured by first liens on the Properties in favor of Administrative Agent, for the benefit of Lenders. |

| C. | Administrative Agent and Lenders are willing to make the Loan to Borrowers, subject to the terms and conditions contained herein. |

NOW, THEREFORE, Borrowers, Administrative Agent and Lenders agree as follows:

ARTICLE 1. DEFINITIONS

1.1 DEFINED TERMS. The following capitalized terms generally used in this Agreement shall have the meanings defined or referenced below. Certain other capitalized terms used only in specific sections of this Agreement are defined in such sections.

“Accommodation Obligations” – as applied to any Person, means (a) any Indebtedness of another Person in respect of which that Person is liable, including, without limitation, any such Indebtedness directly or indirectly guaranteed, endorsed (otherwise than for collection or deposit in the ordinary course of business), co-made or discounted or sold with recourse by that Person, or in respect of which that Person is otherwise directly or indirectly liable including in respect of any partnership in which that Person is a general partner; and (b) any Contractual Obligations (contingent or otherwise) of such Person arising through any agreement to purchase, repurchase or otherwise acquire such Indebtedness or any security therefor, or to provide funds for the payment or discharge thereof (whether in the form of loans, advances, stock purchases, capital contributions or otherwise), or to maintain solvency, assets, level of income, or other financial condition, or to make payment other than for value received.

“Accountants” – means any “big four” accounting firm or another firm of certified public accountants of national standing, if any, selected by Borrowers and acceptable to Administrative Agent.

“ADA” – means the Americans with Disabilities Act, of July 26, 1990, Pub. L. No. 101-336, 104 Stat. 327, 42 U.S.C. § 12101, et seq., as amended from time to time.

“Adjusted Committed Loan Constant” shall have the meaning given to such term in Exhibit J.

1

“Administrative Agent” – means Wells Fargo Bank, National Association, or any successor Administrative Agent appointed pursuant to Section 12.14.

“Advance Termination Date” means April 18, 2014; provided, however, that if the Option to Extend is validly exercised by Borrowers, then “Advance Termination Date shall mean April 17, 2015.

“Affiliates” as applied to any Person, means any other Person directly or indirectly controlling, controlled by, or under common control with, that Person. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlling”, “controlled by” and “under common control with”), as applied to any Person, means (a) the possession, directly or indirectly, of the power to vote ten percent (10%) or more of all interests having voting power for the election of directors of such Person or otherwise to direct or cause the direction of the management and policies of that Person, whether through the ownership of voting interests or by contract or otherwise, or (b) the ownership of a general partnership interest or a limited partnership interest (or other ownership interest) representing ten percent (10%) or more of the outstanding limited partnership interests or other ownership interests of such Person. In no event shall Administrative Agent or any Lender be an Affiliate of any Borrower.

“Aggregate Commitment” means, the sum of each Lender’s Commitment Amount, initially totaling $100,000,000, and subject to reduction in accordance with the terms of this Agreement.

“Agreement” – shall have the meaning given to such term in the preamble hereto.

“Alternate Rate” – is a rate of interest per annum five percent (5%) in excess of the applicable Effective Rate in effect from time to time.

“Allocated Share” means at any time, and from time to time, an amount expressed as a percentage that is calculated by dividing the cost basis of the Properties by the cost basis of all real property owned directly or indirectly by KBS REIT or the KBS Limited Partnership II.

“Applicable LIBO Rate” – is the rate of interest equal to the sum of: (a) three percent (3.00%) plus (b) the LIBO Rate, which rate is divided by one (1.00) minus the Reserve Percentage:

| Applicable LIBO Rate = 3.00% | + | LIBO Rate | ||

| (1 - Reserve Percentage) |

“Appraisal” – means a written appraisal prepared by an independent MAI appraiser acceptable to Administrative Agent and subject to Administrative Agent’s customary independent appraisal requirements and prepared in compliance with all applicable regulatory requirements, including the Financial Institutions Recovery, Reform and Enforcement Act of 1989, as amended from time to time.

“Appraised Value” – means, with respect to the property being appraised, the fair market value, on an “as-is” basis, as reflected in the then most recent Appraisal of the Property, as adjusted, if applicable, by Administrative Agent based upon its internal review of such Appraisal.

“Approved Fund” means any Fund that is administered or managed by (a) a Lender, (b) an Affiliate of a Lender, or (c) an entity or an Affiliate of any entity that administers or manages a Lender.

“Assignment and Assumption Agreement” – means an Assignment and Assumption Agreement among a Lender, an Assignee and the Administrative Agent, substantially in the form of Exhibit D.

“Bankruptcy Code” – means the Bankruptcy Reform Act of 1978 (11 USC § 101-1330) as now or hereafter amended or recodified.

“Borrower” and “Borrowers” – shall have the meaning given to such term in the preamble hereto.

“Borrowers’ Certificate” – shall have the meaning given to such term in Section 10.1(c).

2

“Business Day” means (a) any day of the week other than Saturday, Sunday or other day on which the offices of Administrative Agent in San Francisco, California are authorized or required to close and (b) with reference to the LIBO Rate, any such day that is also a day on which dealings in Dollar deposits are carried out in the London interbank market. Unless specifically referenced in this Agreement as a Business Day, all references to “days” shall be to calendar days.

“Capital Leases”, as applied to any Person, means any lease of any property (whether real, personal or mixed) by that Person as lessee which, in conformity with GAAP, is or should be accounted for as a lease on the balance sheet of that Person.

“Cash Flow Sweep” – shall have the meaning give to such term in Section 8.1.

“Cash Flow Sweep Commencement Date” shall have the meaning given to such term in Section 8.1.

“Cash Flow Sweep Period” means the period commencing on the Cash Flow Commencement Date and ending on the date on which Borrowers deliver to Administrative Agent a Borrowers’ Certificate confirming that the Net Operating Income from the Properties was sufficient to yield a Loan Constant of not less than fourteen percent (14%) for the previous two consecutive Fiscal Quarters.

“Collateral” – means the Properties and any personal property or other collateral with respect to which a Lien or security interest was granted to Administrative Agent, for the benefit of Lenders, pursuant to the Loan Documents.

“Committed Loan Constant” means a fraction, expressed as a percentage, determined by dividing the Net Operating Income of the Properties by the Aggregate Commitment at the time of determination.

“Commitment” – means, as to each Lender, such Lender’s obligation to make disbursements pursuant to Section 3.3, Section 3.4 and Section 12.3, in an amount up to, but not exceeding the amount set forth for such Lender on Schedule 1.1(A) attached hereto as such Lender’s “Commitment Amount” or as set forth in the applicable Assignment and Assumption Agreement, as the same may be reduced from time to time pursuant to the terms of this Agreement or as appropriate to reflect any assignments to or by such Lender effected in accordance with Section 13.13.

“Concessions” shall mean all above-market amounts paid or foregone by Borrowers directly to or on behalf of any tenant for the purpose of inducing such tenant to enter into a lease, including, without limitation, tenant improvement allowances, moving expenses, free rent periods or abatements, and/or assumptions or buyouts of the tenant’s obligations under other leases. (The term “above-market” shall be understood to mean amounts in excess of those assumed in the then most recent Appraisal for the Property in question, or, with respect to tenant improvement costs, such other amount as may be approved by Administrative Agent in its discretion.) Administrative Agent shall have the right to adjust any Concessions based, in part and as applicable, upon assumptions set forth in the then most current Appraisal for the Property in question. All Concessions shall be amortized over the full lease term with annual amortization only to be deducted for the purpose of determining Net Operating Income. (Example: Concessions in the form of above-market “free rent” for a five year lease total $100,000; the annualized deduction in determining Net Operating Income shall be $20,000.)

“Contaminant” means any pollutant (as that term is defined in 42 U.S.C. 9601(33)) or toxic pollutant (as that term is defined in 33 U.S.C. 1362(13)), hazardous substance (as that term is defined in 42 U.S.C. 9601(14)), hazardous chemical (as that term is defined by 29 CFR Section 1910.1200(c)), toxic substance, hazardous waste (as that term is defined in 42 U.S.C. 6903(5)), radioactive material, special waste, petroleum (including crude oil or any petroleum-derived substance, waste, or breakdown or decomposition product thereof), any constituent of any such substance or waste, including, but not limited to, polychlorinated biphenyls and asbestos, or any other substance or waste deleterious to the environment the release, disposal or remediation of which is now or at any time becomes subject to regulation under any Hazardous Materials Laws, along with all Hazardous Materials.

3

“Contractual Obligation”, as applied to any Person, means any provision of any securities issued by that Person or any indenture, mortgage, lease, contract, undertaking, document or instrument to which that Person is a party or by which it or any of its properties is bound, or to which it or any of its properties is subject (including, without limitation, any restrictive covenant affecting such Person or any of its properties).

“Debit Account” means Wells Fargo Bank account number 4121828040 in the name of KBS REIT Properties II, LLC.

“Default” – shall have the meaning given to such term in Section 11.1.

“Defaulting Lender” – means any Lender which fails or refuses to perform its obligations under this Agreement within the time period specified for performance of such obligation or, if no time frame is specified, if such failure or refusal continues for a period of five (5) Business Days after notice from Administrative Agent.

“Distributions”, with respect to Borrowers, means any distribution of money to any equity owner or Affiliate of Borrowers, whether in the form of earnings, income or other proceeds, repayment of any principal or interest on any loan or other advance made to Borrowers by any such equity owner or Affiliate, or any loan or advance by Borrowers of any funds to any such equity owner or Affiliate.

“Dollars” and “$” – means the lawful money of the United States of America.

“Effective Date” – means the date on which Lenders make the initial disbursement of Loan proceeds hereunder.

“Effective Gross Income” means the sum of (a) total monthly base rent payable, as of the date of determination and at the Net Effective Rental Rate, by tenants (not in default or in bankruptcy) under Leases entered into in compliance with Section 9.3(b) multiplied by twelve, excluding security or other deposits, late fees, lease termination or other similar charges, delinquent rent recoveries, unless previously reflected in reserves, or any other items of a non-recurring nature; plus (b) monthly expense reimbursements payable by such tenants multiplied by twelve.

“Effective Rate” – shall have the meaning given to such term in Section 2.7(e).

“Eligible Assignee” –means (a) a Lender, (b) an Affiliate of a Lender, (c) an Approved Fund and (d) any other Person (other than a natural person) approved by (i) the Administrative Agent and (ii) unless a Default or Potential Default exists, Borrowers (each such approval not to be unreasonably withheld or delayed); provided that notwithstanding the foregoing, “Eligible Assignee” shall not include any of the Borrowers or any of Borrowers’ Affiliates.

“Environmental Laws” – shall have the meaning given to such term in Section 6.19.

“ERISA” – means the Employee Retirement Income Security Act of 1974, as in effect from time to time.

“Exit Fee” – shall have the meaning given to such term in Section 2.8(e).

“Extended Maturity Date” means April 30, 2015.

“Federal Funds Rate” – means, for any period, a fluctuating interest rate per annum equal for each day during such period to the weighted average of the rates on overnight Federal Funds transactions with members of the Federal Reserve System arranged by Federal Funds brokers, as published for such day (or, if such day is not a Business Day, for the next preceding Business Day) by the Federal Reserve Bank of New York, or, if such rate is not so published for any day which is a Business Day, the average of the quotations for such day on such transactions received by Administrative Agent from three Federal Funds brokers of recognized standing selected by Administrative Agent.

4

“Fee Letter” – shall have the meaning given in Section 2.2.

“Fiscal Quarter” – means each of the calendar quarters ending March 31, June 30, September 30 and December 31.

“Fixed Rate” – is the Applicable LIBO Rate as accepted by Borrowers as an Effective Rate for a particular Fixed Rate Period and Fixed Rate Portion.

“Fixed Rate Commencement Date” – means the date upon which the Fixed Rate Period commences.

“Fixed Rate Notice” – is a written notice in the form shown on Exhibit F hereto which requests a Fixed Rate for a particular Fixed Rate Period and Fixed Rate Portion.

“Fixed Rate Period” – is the period or periods of (a) one month; or (b) any other shorter period which ends at the Maturity Date, which periods are selected by Borrower and confirmed in a Fixed Rate Notice; provided that no Fixed Rate Period shall extend beyond the Maturity Date.

“Fixed Rate Portion” – is the portion or portions of the principal balance of the Loan which Borrower selects to have subject to a Fixed Rate, each of which is an amount: (a) equal to the unpaid principal balance of the Loan not subject to a Fixed Rate; and (b) is not less than One Hundred Thousand Dollars ($100,000) and is an even multiple of One Hundred Thousand Dollars ($100,000). In the event Borrower is subject to a principal amortization schedule under the terms and conditions of the Loan Documents, the Fixed Rate Portion(s) from time to time in effect shall in no event exceed, in the aggregate, the maximum outstanding principal balance which will be permissible on the last day of the Fixed Rate Period selected.

“Fixed Rate Price Adjustment” – shall have the meaning given to such term in Section 2.7(h).

“Fixed Rate Taxes” – are, collectively, all withholdings, interest equalization taxes, stamp taxes or other taxes (except income and franchise taxes) imposed by any domestic or foreign Governmental Authority and related in any manner to a Fixed Rate.

“Forsyth” means the Property located at 7701 and 7733 Forsyth Boulevard, Clayton, Missouri.

“Free Cash Flow” means, for a particular period, Gross Operating Income for such period minus (a) debt service on the Loan for such period, (b) any Permitted Operating Expenses actually incurred for such period, (c) the REIT Operating Expense and (d) any other expenses relating to the Properties actually incurred for such period, provided such expenses are approved, in advance, by Administrative Agent, which approval shall not be unreasonably withheld, conditioned or delayed.

“Fund” means any Person (other than a natural person) that is (or will be) engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in the ordinary course of its business.

“Governmental Authority” – means any nation or government, any federal, state, local, municipal or other political subdivision thereof or any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government.

“Gross Operating Income” – shall mean the sum of any and all amounts, payments, fees, rentals, additional rentals, expense reimbursements (including, without limitation, all reimbursements by tenants, lessees, licensees and other users of the Properties) discounts or credits to Borrowers, income, interest and other monies directly or indirectly received by or on behalf of or credited to Borrowers from any person with respect to a Borrower’s ownership, use, development, operation, leasing, franchising, marketing or licensing of the Properties, including, without limitation, from parking operations. Gross Operating Income shall be computed on a cash basis and shall include all amounts actually received in the relevant period whether or not such amounts are attributable to a charge arising in such period.

5

“Gross Rental Income” – means the actual sum of the Net Effective Rental Rates of all tenants in possession at each of the Properties, as of the date of determination.

“Guarantor” – means KBS REIT Properties II, LLC, a Delaware limited liability company, and any other person or entity who, or which, in any manner, is or becomes obligated to Lenders under any guaranty now or hereafter executed in connection with respect to the Loan (collectively or severally as the context thereof may suggest or require).

“Hazardous Materials” – means any oil, flammable explosives, asbestos, urea formaldehyde insulation, radioactive materials, hazardous wastes, toxic or contaminated substances or similar materials, including, without limitation, any substances which are “hazardous substances,” “hazardous wastes,” “hazardous materials,” “toxic substances,” “wastes,” “regulated substances,” “industrial solid wastes,” or “pollutants” under the Hazardous Materials Laws, as described below, and/or other applicable environmental laws, ordinances and regulations.

“Hazardous Materials Indemnity Agreement” – means the Hazardous Materials Indemnity Agreement executed by the Borrowers for the benefit of Administrative Agent and Lenders dated on or about the date hereof, as the same may be amended, modified or replaced from time to time.

“Hazardous Materials Laws” – means all laws, ordinances and regulations relating to Hazardous Materials, including, without limitation: the Clean Air Act, as amended, 42 U.S.C. Section 7401 et seq.; the Federal Water Pollution Control Act, as amended, 33 U.S.C. Section 1251 et seq.; the Resource Conservation and Recovery Act of 1976, as amended, 42 U.S.C. Section 6901 et seq.; the Comprehensive Environment Response, Compensation and Liability Act of 1980, as amended (including the Superfund Amendments and Reauthorization Act of 1986, “CERCLA”), 42 U.S.C. Section 9601 et seq.; the Toxic Substances Control Act, as amended, 15 U.S.C. Section 2601 et seq.; the Occupational Safety and Health Act, as amended, 29 U.S.C. Section 651, the Emergency Planning and Community Right-to-Know Act of 1986, 42 U.S.C. Section 11001 et seq.; the Mine Safety and Health Act of 1977, as amended, 30 U.S.C. Section 801 et seq.; the Safe Drinking Water Act, as amended, 42 U.S.C. Section 300f et seq.; and all comparable state and local laws, laws of other jurisdictions or orders and regulations.

“Indebtedness”, as applied to any Person (and without duplication), means (a) the principal amount of all indebtedness of such Person for borrowed money, whether or not subordinated and whether with or without recourse beyond any collateral security, (b) the principal amount of all indebtedness of such Person evidenced by securities or other similar instruments, (c) all reimbursement obligations and other liabilities of such Person with respect to letters of credit or banker’s acceptances issued for such Person’s account, (d) all obligations of such Person to pay the deferred purchase price of property or services, (e) all obligations in respect of both operating and capital leases of such Person, (f) all Accommodation Obligations of such Person, (g) all indebtedness, obligations or other liabilities of such Person or others secured by a Lien on any asset of such Person, whether or not such indebtedness, obligations or liabilities are assumed by, or are a personal liability of, such Person (including, without limitation, the principal amount of any assessment or similar indebtedness encumbering any property (except for non-delinquent, accrued but unpaid real estate taxes as provided under Section 9.13)), (h) all indebtedness, obligations or other liabilities (other than interest expense liability) in respect of interest rate swap, collar, cap or similar agreements providing interest rate protection and foreign currency exchange agreements, (i) ERISA obligations currently due and payable, and (j) without duplication or limitation, all liabilities and other obligations included in the financial statements (or notes thereto) of such Person as prepared in accordance with GAAP.

“Initial Maturity Date” means April 30, 2014.

“Interest Rate Floor” – means four and one-quarter percent (4.25%).

“KBS REIT” – means KBS Real Estate Investment Trust II, Inc., a Maryland corporation.

“Lease” – means a tenant lease of all or any portion of a Property.

6

“Lender” – means each financial institution from time to time party hereto as a “Lender”, together with its respective successors and permitted assigns. With respect to matters requiring the consent or approval of all Lenders at any given time, all then existing Defaulting Lenders will be disregarded and excluded, and, for voting purposes only, “all Lenders” shall be deemed to mean “all Lenders other than Defaulting Lenders”.

“Liabilities and Costs” – means all claims, judgments, liabilities, obligations, responsibilities, losses, damages (including lost profits), punitive or treble damages, costs, disbursements and expenses (including, without limitation, reasonable attorneys’, experts’ and consulting fees and costs of investigation and feasibility studies), fines, penalties and monetary sanctions, interest, direct or indirect, known or unknown, absolute or contingent, past, present or future.

“LIBO Rate” – is for any Fixed Rate Portion, the rate of interest quoted by Administrative Agent from time to time as the London Inter-Bank Offered Rate for deposits in U.S. Dollars at approximately 9:00 a.m. California time two (2) Business Days prior to a Fixed Rate Commencement Date or a Price Adjustment Date, as appropriate, for purposes of calculating effective rates of interest for loans or obligations making reference thereto for an amount approximately equal to a Fixed Rate Portion and for a period of time approximately equal to a Fixed Rate Period or the time remaining in a Fixed Rate Period after a Price Adjustment Date, as appropriate.

“Lien” – means any mortgage, deed of trust, pledge, hypothecation, assignment, deposit arrangement, security interest, encumbrance (including, but not limited to, easements, rights-of-way, zoning restrictions and the like), lien (statutory or other), preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever, including without limitation any conditional sale or other title retention agreement, the interest of a lessor under a Capital Lease, any financing lease having substantially the same economic effect as any of the foregoing, and the filing of any financing statement or document having similar effect (other than a financing statement filed by a “true” lessor pursuant to Section 9408 (or a successor section) of the Uniform Commercial Code) naming the owner of the asset to which such Lien relates as debtor, under the Uniform Commercial Code or other comparable law of any jurisdiction.

“Loan” – means the cumulative principal amount of up to One Hundred Million Dollars ($100,000,000).

“Loan Constant” means a fraction, expressed as a percentage, determined by dividing the Net Operating Income of the Properties by the outstanding principal amount of the Loan at the time of determination.

“Loan Documents” – means those documents, as hereafter amended, supplemented, replaced or modified, properly executed and in recordable form, if necessary, listed in Exhibit B as Loan Documents.

“Loan Party” – means Borrowers and any other person or entity obligated under the Loan Documents or Other Related Documents.

“Loan-to-Value Percentage” – means the Aggregate Commitment as a percentage of the sum of the Appraised Values of the Properties.

“Main Street” means the Property located at 101 S.W. Main Street, Portland Oregon.

“Major Agreements” – means, at any time, (a) each cross-easement, restrictions or similar agreement encumbering or affecting a Property and any adjoining property, and (b) each property management agreement and leasing agreement with respect to a Property entered into with any Person.

“Major Lease” means any Lease (or collection of Leases to one tenant) (a) which encumbers greater than 10% of the net rentable space of the Properties (as of the date of determination), or (b) under which a Borrower’s obligation as to the cost of tenant improvements exceeds 130% of the estimated tenant improvement allowance (per rentable square foot) as set forth in the then most recent

7

Appraisal, or (c) under which the Net Effective Rental Rate is less than 85% of the amount assumed for such Lease in the then most recent Appraisal.

“Manager” means KBS Capital Advisors LLC.

“Management Agreement” means the Advisory Agreement dated May 21, 2008 between Manager and KBS REIT.

“Material Adverse Effect” means (a) with respect to a Borrower, a material adverse effect upon the condition (financial or otherwise), operations, performance, properties or prospects of such Borrower that could reasonably be expected to impair, to a material extent, such Borrower’s ability to perform its obligations under the Loan Documents; and (b) with respect to a Property, a material adverse effect upon the physical condition of such Property, or upon its operations, performance or prospects, that reduces the Appraised Value of the Property to an amount that is less than eighty percent (80%) of the Appraised Value of the Property as of the date hereof. The phrase “has a Material Adverse Effect” or “will result in a Material Adverse Effect” or words substantially similar thereto shall in all cases be intended to mean “has resulted, or will or could reasonably be anticipated to result, in a Material Adverse Effect”, and the phrase “has no (or does not have a) Material Adverse Effect” or “will not result in a Material Adverse Effect” or words substantially similar thereto shall in all cases be intended to mean “does not or will not or could not reasonably be anticipated to result in a Material Adverse Effect”.

“Maturity Date” – means the Initial Maturity Date or the Extended Maturity Date, as applicable.

“Minimum Applicable Loan Constant” – means a percentage determined in accordance with the following and with reference to the number of Properties remaining encumbered by the Security Documents after giving effect to the requested Property Release:

| Properties Remaining Encumbered | Minimum Applicable Loan Constant | |

| Three (3) |

16.00% | |

| Two (2) |

17.00% | |

| One (1) |

18.00% | |

“Minimum Extension Constant” shall have the meaning given to such term in Section 2.6(vi).

“Minimum Permitted Outstanding Amount” means an amount determined by multiplying (a) the percentage obtained by dividing (i) the then Aggregate Commitment by (ii) $100,000,000 times (b) $55,000,000.

“Mountain View” means the Property located at 120 Mountain View Boulevard, Basking Ridge, New Jersey.

“Net Effective Rental Rate” means the actual recurring contractual base rental payment required to be paid by a tenant under a Lease, taking into account any adjustment regarding Concessions.

“Net Operating Income” shall mean: Gross Operating Income for the immediately preceding Fiscal Quarter multiplied by four; minus the sum of (i) the actual reasonable Operating Expenses for the immediately preceding Fiscal Quarter multiplied by four; and (ii) an amount for reasonable capital reserves equal to $0.25 per square foot of net rentable area of the Properties.

“Non-Pro Rata Advance” – shall mean a Protective Advance or a disbursement under the Loan with respect to which fewer than all Lenders have funded their respective Pro Rata Shares in breach of their obligations under this Agreement.

8

“Note” or “Notes” – means each Secured Promissory Note, collectively in the original principal amount of the Loan, executed by Borrowers and payable to the order of a Lender, together with such other replacement notes as may be issued from time to time pursuant to Section 13.13, as hereafter amended, supplemented, replaced or modified.

“Obligations” means, from time to time, all Indebtedness of Borrowers owing to Lenders, to any Person entitled to indemnification pursuant to Section 13.1, or to any of their respective successors, transferees or assigns, of every type and description, whether or not evidenced by any note, guaranty or other instrument, arising under or in connection with this Agreement or any other Loan Document, whether or not for the payment of money, whether direct or indirect (including those acquired by assignment), absolute or contingent, due or to become due, now existing or hereafter arising and however acquired. The term includes, without limitation, all interest, charges, expenses, fees, reasonable attorneys’ fees and disbursements, reasonable fees and disbursements of expert witnesses and other consultants, and any other sum now or hereinafter chargeable to Borrowers under or in connection with this Agreement or any other Loan Document. (Notwithstanding the foregoing definition of “Obligations”, Borrowers’ obligations under any environmental indemnity agreement constituting a Loan Document, or any environmental representation, warranty, covenant, indemnity or similar provision in this Agreement or any other Loan Document, shall be secured by the Properties only to the extent, if any, specifically provided in the Security Documents).

“One-Month LIBO Rate” is the rate of interest equal to the sum of: (a) three percent (3.00%), plus (b) the rate of interest that is quoted by Administrative Agent from time to time as the London InterBank Offered Rate for deposits in U.S. Dollars, at approximately 9:00 a.m. (California time), for a period of one (1) month (“One-Month Rate”), which rate is divided by one (1.00) minus the Reserve Percentage.

| One-Month LIBO Rate = 3.00% | + | One-Month Rate | ||

| (1 – Reserve Percentage) |

“Operating Expenses” shall mean all actual reasonable operating expenses of the Properties, including, without limitation, those for maintenance, property management (subject to an imputed minimum of three percent (3%) of Effective Gross Income), repairs, annual taxes, bond assessments, ground lease payments (if any), insurance, utilities and other annual expenses (but not costs of tenant retrofit, lease commission, capital improvements or capital repairs) and non-capital reserves that are customary and standard for properties of the same type as the Properties. Operating Expenses shall not include any interest or principal payments on the Loan or any allowance for depreciation; recurring expenses, which are not paid monthly, shall be accounted for monthly, without duplication, on an accrual basis.

“Operating Statement” – shall have the meaning given to such term in Section 10.1.

“Option to Extend” – shall have the meaning given to such term in Section 2.6.

“Other Related Documents” – means those documents, as hereafter amended, supplemented, replaced or modified from time to time, properly executed and in recordable form, if necessary, listed in Exhibit B as Other Related Documents.

“Par Loan Value” means the amount of the Commitment allocable to an individual Property, as more specifically detailed on Schedule 1.1(B) attached hereto.

“Participant” – shall have the meaning given to such term in Section 13.13.

“Permit” – means any permit, approval, authorization, license, variance or permission required from a Governmental Authority under an applicable Requirement of Law.

9

“Permitted Liens” – means:

| (a) | Liens (other than environmental Liens and any Lien imposed under ERISA) for taxes, assessments or charges of any Governmental Authority for claims not yet due; |

| (b) | Any laws, ordinances or regulations affecting the Properties; |

| (c) | Liens imposed by laws, such as mechanics’ liens and other similar liens, arising in the ordinary course of business which secure payment of obligations not more than thirty (30) days past due; |

| (d) | All matters shown on the Title Policies as exceptions to Lender’s coverage thereunder; |

| (e) | Liens in favor of Administrative Agent, for the benefit of Lenders, under the Security Documents; |

| (f) | All existing Leases at the Properties and any future Leases at the Properties entered into in accordance with this Agreement; and |

| (g) | Liens in favor of Wells Fargo Bank, National Association, relating to any Swap Agreement, which liens shall be pari passu with the liens of all other Secured Obligations, as such term is defined in the Security Documents. |

“Permitted Operating Expenses” – shall mean the following expenses to the extent that such expenses are reasonable in amount and customary for properties of the same type as the Properties: (i) taxes and assessments imposed upon the Properties to the extent that such taxes and assessments are required to be paid by Borrowers and are actually paid or reserved for by Borrowers; (ii) bond assessments; (iii) insurance premiums for casualty insurance (including, without limitation, earthquake and terrorism coverage) and liability insurance carried in connection with the Properties to the extent that such premiums are actually paid or reserved for by Borrowers, provided, however, if any, insurance is maintained as part of a blanket policy covering the Properties and other properties, the insurance premium included in this subparagraph shall be the premium fairly allocable to the Properties; and (iv) operating expenses and capital expenditures incurred by Borrowers for the management, operation, cleaning, leasing, maintenance and repair of the Properties in the ordinary course. Permitted Operating Expenses shall not include any interest or principal payments on the Loan or any allowance for depreciation.

“Person” – means any natural person, corporation, limited partnership, general partnership, joint stock company, limited liability company, limited liability partnership, joint venture, association, company, trust, bank, trust company, land trust, business trust or other organization, whether or not a legal entity, or any other nongovernmental entity, or any Governmental Authority.

“Plumeria” means the Property located at 350 E. Plumeria Drive, San Jose, California.

“Potential Default” – means an event, circumstance or condition which, with the giving of notice or the lapse of time, or both, would constitute a Default.

“Price Adjustment Date” – shall have the meaning given to such term in Section 2.7(h).

“Proceedings” means, collectively, all actions, suits, arbitrations and proceedings, at law, in equity or otherwise, before, and investigations commenced or threatened by or before, any court or Governmental Authority with respect to a Person.

“Property” or “Properties” – shall have the meaning given to such term in Recital A.

“Property Release” - shall have the meaning given to such term in Section 2.10.

10

“Pro Rata Share” – means, as to each Lender, the ratio, expressed as a percentage, of (a) the amount of such Lender’s Commitment to (b) the aggregate amount of the Commitments of all Lenders hereunder; provided, however, that if at the time of determination the Commitments have terminated or been reduced to zero, the “Pro Rata Share” of each Lender shall be the Pro Rata Share of such Lender in effect immediately prior to such termination or reduction.

“Protective Advance” – shall mean any advances made by Administrative Agent in accordance with the provisions of Section 12.7(e) to protect the Collateral securing the Loan.

“Regulatory Costs” – are, collectively, future, supplemental, emergency or other changes in Reserve Percentages, assessment rates imposed by the Federal Deposit Insurance Corporation, or similar requirements or costs imposed by any domestic or foreign Governmental Authority and related in any manner to a Fixed Rate.

“REIT Operating Expenses” means the Allocated Share of all actual costs, expenses and/or amounts incurred by, or payable or reimbursable by, KBS REIT or KBS Limited Partnership II for any of the following: (a) charges and fees charged by banks, audit fees, tax preparation fees, legal fees, transfer agent fees, accounting consulting fees related to emerging technical pronouncements, tax consulting fees relating to Real Estate Investment Trust issues, due diligence costs and fees arising from state and local taxes, fees and expenses incurred in connection with annual corporate filings, and local, state and federal income taxes, and (b) professional fees related to corporate structuring and/or filings, consulting fees and filing fees arising from SEC reporting requirements including, without limitation, 10K filings, 10Q filings, and 8k filings, consulting fees and other fees and costs related to Sarbanes- Oxley 404 compliance requirements.

“Release” means the release, spill, emission, leaking, pumping, injection, deposit, disposal, discharge, dispersal, leaching or migration into the indoor or outdoor environment or into or out of any property, including the movement of Contaminants through or in the air, soil, surface water, groundwater or property.

“Release Price” means an amount equal to the Par Loan Value of the relevant Property multiplied by the Release Percentage determined in accordance with the following schedule:

| Property | Release Percentage | |||

| Plumeria |

110% | |||

| Mountain View |

110% | |||

| Main |

120% | |||

| Forsyth |

120% | |||

“Remedial Action” means any action required by applicable Hazardous Materials Laws to (a) clean up, remove, treat or in any other way address Hazardous Materials in the indoor or outdoor environment; (b) prevent the Release or threat of Release or minimize the further Release of Hazardous Materials so they do not migrate or endanger or threaten to endanger public health or welfare or the indoor or outdoor environment; or (c) perform pre-remedial studies and investigations and post-remedial monitoring and care.

“Replacement Rate” is, for any day, a fluctuating rate of interest equal to three percent (3.00%), plus the Federal Funds Rate, plus one and one-half percent (1.5%).

“Requirements of Law” – means, as to any entity, the charter and by-laws, partnership agreement or other organizational or governing documents of such entity, and any law, rule or regulation, Permit, or determination of an arbitrator or a court or other Governmental Authority, in each case applicable to or binding upon such entity or any of its property or to which such entity or any of its property is subject,

11

including without limitation, applicable securities laws and any certificate of occupancy, zoning ordinance, building, environmental or land use requirement or Permit or occupational safety or health law, rule or regulation.

“Requisite Lenders” – means, as of any date, Lenders (which must include the Lender then acting as Administrative Agent) having at least 66-2/3% of the aggregate amount of the Commitments, or, if the Commitments have been terminated or reduced to zero, Lenders holding at least 66-2/3% of the principal amount outstanding under the Loan, provided that (a) in determining such percentage at any given time, all then existing Defaulting Lenders will be disregarded and excluded and the Pro Rata Shares of the Loan of Lenders shall be redetermined, for voting purposes only, to exclude the Pro Rata Shares of the Loan of such Defaulting Lenders, and (b) at all times when two or more Lenders are party to this Agreement, the term “Requisite Lenders” shall in no event mean less than two Lenders.

“Reserve Percentage” – is at any time the percentage announced by Administrative Agent as the reserve percentage under Regulation D for loans and obligations making reference to an Applicable LIBO Rate for a Fixed Rate Period or time remaining in a Fixed Rate Period on a Price Adjustment Date, as appropriate. The Reserve Percentage shall be based on Regulation D or other regulations from time to time in effect concerning reserves for Eurocurrency Liabilities as defined in Regulation D from related institutions as though Administrative Agent were in a net borrowing position, as promulgated by the Board of Governors of the Federal Reserve System, or its successor.

“Secured Swap Obligations” - means all liabilities of Borrowers under any Swap Agreement; provided that any such liabilities under any Swap Agreement with an Affiliate of a Lender shall not constitute “Swap Obligations” hereunder unless and until such liabilities are certified as such in writing to Administrative Agent by Borrowers and such Affiliate of a Lender.

“Security Documents” – means, individually and collectively, each of the deeds of trust and mortgages (including any modifications or amendments thereto) executed by a Borrower in favor of Administrative Agent, for the benefit of Lenders, which recite that they are security for the Loan, as the same may be amended, supplemented, replaced or modified from time to time.

“Single Purpose Entity” means a corporation or other limited liability organization which, at all times since its formation and thereafter, was and will be organized solely for the purpose of acquiring and developing its interest in one or more Properties.

“Solvent” means, as to any Person at the time of determination, that such Person (a) owns property the value of which (both at fair valuation and at present fair salable value and taking into account (i) the value of such Person’s rights of reimbursement, contribution, subrogation and indemnity against any other Person, and (ii) the value of any property, owned by another Person, that secures any liabilities of the Person whose Solvency is being determined) is equal to or greater than the amount required to pay all of such Person’s liabilities (including contingent liabilities and debts); (b) is able to pay all of its debts as such debts mature; and (c) has capital sufficient to carry on its business and transaction and all business and transactions in which it is about to engage.

“Subdivision Map” – shall have the meaning given to such term in Section 9.5.

“Swap Agreement” – means any rate swap, forward rate, cap, floor, collar, exchange, hedge or similar transaction (including, but not limited to, any transaction subject to the terms of any form of master agreement published by the International Swaps and Derivatives Association, Inc., and any related confirmations) entered into between Borrower and any Lender or any Affiliate of any Lender, providing protection against fluctuations in interest rates with respect to the Loan.

“Title Policy” – means each ALTA Lender’s Policy of Title Insurance to be issued by Lawyer’s Title Insurance Company with respect to the Properties, together with any endorsements which Administrative Agent may require. Such policies shall, insure Administrative Agent, for the benefit of Lenders, in the aggregate principal amount of the Loan, of the validity and priority of the liens of the

12

Security Documents on the Properties, subject only to matters approved by Administrative Agent in writing and shall be referred to herein together as the “Title Policies”.

“Unused Fee” – shall have the meaning given to such term in Section 2.2(b).

“Wells Fargo” – shall have the meaning given to such term in the preamble hereto.

1.2 SCHEDULES AND EXHIBITS INCORPORATED. Schedules 1.1(A), 1.1(B), 6.3, 6.11, 6.24, and 7.1 and Exhibits A, B, C, D, E, F, G, H, I and J all attached hereto, are hereby incorporated into this Agreement.

ARTICLE 2. LOAN

2.1 LOAN; REVOLVER.

| (a) | By and subject to the terms of this Agreement, Administrative Agent and Lenders have agreed to make a loan to Borrowers in the aggregate principal sum of One Hundred Million Dollars ($100,000,000), which Loan shall be evidenced by the Notes. The Notes shall be secured, in part, by the Security Documents encumbering certain real property and improvements as legally defined therein. The Loan shall be used to refinance the Properties and for such other purposes as Borrowers may elect. |

| (b) | Except as otherwise provided in any Loan Document, subject to the terms and conditions of this Agreement, including, without limitation, the terms and conditions of Section 3.4, Borrowers may, from time to time through the Advance Termination Date, borrow, partially or wholly repay its outstanding borrowings, and reborrow under the Loan without payment of an Exit Fee; provided, however, in no event shall the outstanding principal balance of the Loan exceed the Aggregate Commitment or be less than Minimum Permitted Outstanding Amount. If at any time the outstanding principal amount of the Loan exceeds the Aggregate Commitment, Borrowers shall immediately repay such portion of the Loan as is required to reduce the outstanding principal amount of the Loan to an amount not greater than the Aggregate Commitment. |

2.2 LOAN FEES.

| (a) | Borrowers shall pay to Administrative Agent, at Loan closing, a loan fee as set forth in a separate letter agreement between Borrowers and Administrative Agent. Additionally, Borrowers shall pay to Administrative Agent for Administrative Agent’s sole benefit certain other fees, each in the amount and at the times as set forth in a separate letter agreement between Borrowers and Administrative Agent dated April 30, 2010 (the “Fee Letter”). |

| (b) | Borrowers shall pay to Administrative Agent, for the benefit of Lenders, on or before the seventh (7th) day of each month, a monthly fee (in arrears and on account of the previous month) (the “Unused Fee”) equal to: |

| (i) | If the average outstanding daily balance of the Loan for the relevant month is greater than 75% of the average daily Aggregate Commitment for such month, then 0.10% of the difference between the average outstanding daily balance of the Loan for such month and the average daily Aggregate Commitment for such month; and |

| (ii) | If the average outstanding daily balance of the Loan for the relevant month is less than or equal to 75% of the average daily Aggregate Commitment for such month, then 0.30% of the difference between the |

13

| average outstanding daily balance of the Loan for such month and the average daily Aggregate Commitment for such month. |

In order to assure timely payment to Administrative Agent, for the benefit of Lenders, of the Unused Fee, Borrowers hereby irrevocably authorize Administrative Agent to directly debit the Debit Account for payment of the Unused Fee payable to Administrative Agent or any Lender. Borrowers represent and warrant to Administrative Agent and Lenders that KBS REIT Properties II, LLC is the legal owner of the Debit Account. Written confirmation of the amount and purpose of any such direct debit shall be given to Borrowers by Administrative Agent not less frequently than monthly. In the event any direct debit hereunder is returned for insufficient funds, Borrowers shall pay Administrative Agent, for the benefit of Lenders, upon demand, in immediately available funds, all amounts and expenses due and owing, including without limitation any late fees incurred, to Administrative Agent or any Lender. Notwithstanding anything to the contrary, Administrative Agent hereby agrees that it shall not auto-debit the Debit Account for the Unused Fee due under the Loan until the seventh (7th) day of each calendar month during the term of the Loan. Notwithstanding anything to the contrary in this Agreement or any of the other Loan Documents, neither Administrative Agent nor Lender have, or shall have, a security interest in the Debit Account.

2.3 LOAN DOCUMENTS. Borrowers shall execute and deliver to Administrative Agent (or cause to be executed and delivered) concurrently with this Agreement each of the documents, properly executed and in recordable form, as applicable, described in Exhibit B as Loan Documents, together with those documents described in Exhibit B as Other Related Documents.

2.4 EFFECTIVE DATE. The date of the Loan Documents is for reference purposes only. The Effective Date of delivery and transfer to Administrative Agent of the security under the Loan Documents and of Borrowers’ and Lenders’ obligations under the Loan Documents shall be the date of the first disbursement by Lenders to Borrowers of Loan proceeds.

2.5 MATURITY DATE. The outstanding balance of the Loan, together with all accrued and unpaid interest and other amounts accrued and unpaid under the Loan Documents, shall be payable in full on the Maturity Date.

2.6 EXTENSION OPTION. Borrowers shall have the right to extend the Maturity Date from the Initial Maturity Date to the Extended Maturity Date (the “Option to Extend”), subject to its satisfaction of the following conditions:

| (i) | Borrowers shall give Administrative Agent written notice of Borrowers’ request for an extension of the Maturity Date not earlier than ninety (90) days, nor later than forty-five (45) days, prior to the Initial Maturity Date; |

| (ii) | As of the date of such notice, and as of the Initial Maturity Date, there shall exist no Default or Potential Default (provided that Borrowers shall have an opportunity to cure such Potential Default prior to the Initial Maturity Date to the extent of applicable cure periods under this Agreement or the applicable Loan Document); |

| (iii) | At Administrative Agent’s request, Borrowers shall have caused to be issued to Lenders, at Borrowers’ sole cost and expense, appropriate endorsements to the Title Policies which confirm the existence and priority of the Liens securing the Obligations in connection with the requested extension; |

14

| (iv) | There shall have been no change in the financial condition of Borrowers, or in the condition of the Properties from that which existed on the Effective Date which change, as determined by Administrative Agent in its reasonable discretion, has a Material Adverse Effect; |

| (v) | The Loan-to-Value Percentage for all of the Properties, in the aggregate, based upon new Appraisals commissioned by Administrative Agent at Borrowers’ sole cost and expense and with valuation dates within sixty (60) days of the Initial Maturity Date, shall not exceed fifty-five percent (55%); |

| (vi) | Borrowers shall have provided to Administrative Agent satisfactory evidence (which evidence shall include, without limitation, a detailed current rent roll and a current historical operating statement for each Property) that the Committed Loan Constant (as of the Initial Maturity Date) is not less than (1) if three (3) or more Properties remain encumbered by the Security Documents, then sixteen percent (16%), (2) if two (2) Properties remain encumbered by the Security Documents, then seventeen percent (17%) and (3) if one (1) Property remains encumbered by the Security Documents, then eighteen percent (18%) (the “Minimum Extension Constant”); |

| (vii) | As of the Initial Maturity Date, (1) not more than thirty percent (30%) of the Gross Rental Income from all Properties remaining encumbered by the Security Documents is to be derived from Leases expiring on or before the Extended Maturity Date, (2) not more than forty percent (40%) of the Gross Rental Income from all Properties remaining encumbered by the Security Documents is to be derived from Leases expiring between the Initial Maturity Date and the date which is twelve (12) months after the Extended Maturity Date and (3) not more than fifty percent (50%) of the Gross Rental Income from all Properties remaining encumbered by the Security Documents is to be derived from Leases expiring between the Initial Maturity Date and the date which twenty-four (24) months after the Extended Maturity Date. Notwithstanding the foregoing, Borrowers shall be deemed to have satisfied the requirements of this clause (vii) even if the percentage of Gross Rental Income derived from the remaining Properties exceeds the applicable thresholds so long as the Adjusted Committed Loan Constant (calculated in accordance with Exhibit J) is greater than or equal to the Minimum Extension Constant; and |

| (viii) | Borrowers shall have paid to Administrative Agent, for the ratable benefit of Lenders, an extension fee in an amount equal to one-quarter of one percent (0.25%) of the Aggregate Commitment as of the Initial Maturity Date. |

Notwithstanding the foregoing provisions of this Section 2.6, Borrowers shall have the right to repay (without paying an Exit Fee) principal outstanding under the Loan (or permanently cancel a portion of the Aggregate Commitment) in such amount as may be required to reduce the Aggregate Commitment pursuant to this Section 2.6, to an amount such that Borrowers are in compliance with subsections (v), (vi) and (vii) above. Any repayment of principal pursuant to this section 2.6 shall reduce the Aggregate Commitment dollar for dollar.

2.7 INTEREST ON THE LOAN.

15

| (a) | Interest Payments. Interest accrued on the outstanding principal balance of the Loan shall be due on the first day, and payable, in the manner provided in Section 2.8, on the first Business Day, of each month commencing with the first month after the Effective Date. |

| (b) | Default Interest. Notwithstanding the rates of interest specified in Sections 2.7(e) below and the payment dates specified in Section 2.7(a), at Requisite Lenders’ discretion at any time following the occurrence and during the continuance of any Default, the principal balance of the Loan then outstanding and, to the extent permitted by applicable law, any interest payments on the Loan not paid when due, shall bear interest payable upon demand at the Alternate Rate. All other amounts due Administrative Agent or Lenders (whether directly or for reimbursement) under this Agreement or any of the other Loan Documents if not paid when due, or if no time period is expressed, if not paid within ten (10) days after demand, shall likewise, at the option of Requisite Lenders, bear interest from and after demand at the Alternate Rate. |

| (c) | Late Fee. Borrowers acknowledge that late payment to Administrative Agent will cause Administrative Agent and Lenders to incur costs not contemplated by this Agreement. Such costs include, without limitation, processing and accounting charges. Therefore, if Borrowers fail timely to pay interest due hereunder within fifteen (15) days after such payment is due, then Borrowers shall at, Administrative Agent’s option, pay a late or collection charge equal to four percent (4%) of the amount of such unpaid interest payment to Administrative Agent (for the benefit of Lenders). Borrowers and Administrative Agent agree that this late charge represents a reasonable sum considering all of the circumstances existing on the date hereof and represents a fair and reasonable estimate of the costs that Administrative Agent and Lenders will incur by reason of late payment. Borrowers and Administrative Agent further agree that proof of actual damages would be costly and inconvenient. Acceptance of any late charge shall not constitute a waiver of the default with respect to the overdue installment, and shall not prevent Administrative Agent from exercising any of the other rights available hereunder or any other Loan Document. Such late charge shall be paid without prejudice to any other rights of Administrative Agent. |

| (d) | Computation of Interest. Interest shall be computed on the basis of the actual number of days elapsed in the period during which interest or fees accrue and a year of three hundred sixty (360) days on the principal balance of the Loan outstanding from time to time. In computing interest on the Loan, the date of the making of a disbursement under the Loan shall be included and the date of payment shall be excluded. Notwithstanding any provision in this Section 2.7, interest in respect of the Loan shall not exceed the maximum rate permitted by applicable law. |

| (e) | Effective Rate. The “Effective Rate” upon which interest shall be calculated for the Loan shall, from and after the Effective Date of this Agreement, be one or more of the following; provided, except with respect to the portion of the outstanding principal balance of the Loan which is subject to a Swap Agreement with an initial term of at least two (2) years, or any shorter term which expires on the Maturity Date, the Effective Rate shall not be less than the Interest Rate Floor. (For clarity, (i) the Effective Rate applicable to any portion of the outstanding principal balance of the Loan which is subject to a Swap Agreement with an initial term of at least two (2) years shall not be subject to the Interest Rate Floor, (ii) the then-current term of the Swap Agreement need not be two (2) years in order to exempt such portion of the Loan from the Interest Rate Floor (i.e., the Interest Rate Floor shall not apply to any portion of the Loan that was subject to qualifying Swap Agreement for the term of such Swap Agreement and any extension thereof) and (iii) if less than two (2) years remains prior to the Maturity Date, then the portion of the outstanding principal |

16

| balance of the Loan which is subject to a Swap Agreement with a term that expires on the Maturity Date shall not be subject to the Interest Rate Floor): |

| (i) | Provided no Default exists under this Agreement: |

| (A) | For those portions of the principal balance of the Notes which are not Fixed Rate Portions, the Effective Rate shall be the One-Month LIBO Rate determined by Administrative Agent, reset daily. |

| (B) | For those portions of the principal balance of the Notes which are Fixed Rate Portions, the Effective Rate for the Fixed Rate Period thereof shall be the Fixed Rate accepted by Borrowers for the Fixed Rate Period selected by Borrowers with respect to each Fixed Rate Portion and set in accordance with the provisions hereof. |

| (C) | With respect to any portion of the Loan then subject to a Swap Agreement, Borrowers may not select a rate of interest, including, without limitation, a Fixed Rate for a Fixed Rate Period, that is inconsistent with the terms of such Swap Agreement. |

| (D) | If any of the transactions necessary for the calculation of interest at any Fixed Rate requested or selected by Borrowers or at the One-Month LIBO Rate determined by Administrative Agent, reset daily, should be or become prohibited or unavailable to Administrative Agent, or, if in Administrative Agent ‘s good faith judgment, it is not possible or practical for Administrative Agent to set a Fixed Rate for a Fixed Rate Portion and Fixed Rate Period as requested or selected by Borrowers or to set a One-Month LIBO Rate on a daily basis, the Effective Rate for the principal balance of the Notes subject to such unavailable interest rate shall be replaced by a floating rate of interest equal to the Replacement Rate. |

| (ii) | During such time as a Default exists under this Agreement; or from and after the date on which all sums owing under the applicable Note becomes due and payable by acceleration or otherwise; or from and after the date on which the Collateral or any portion thereof or interest therein, is sold, transferred, mortgaged, assigned, or encumbered, whether voluntarily or involuntarily, or by operation of law or otherwise, without Administrative Agent’s prior written consent (except as otherwise permitted herein or in any of the Loan Documents) (whether or not the sums owing under the applicable Note becomes due and payable by acceleration); or from and after the Maturity Date, then at the option of Requisite Lenders in each case, the interest rate applicable to the then outstanding principal balance of the Loan shall be the Alternate Rate. |

| (f) | Selection of Fixed Rate. Provided no Default or Potential Default exists under this Agreement, Borrowers, at their option and upon satisfaction of the conditions set forth herein, may request a Fixed Rate as the Effective Rate for calculating interest on the portion of the unpaid principal balance and for the period selected in accordance with and subject to the following procedures and conditions, provided, however, that Borrowers may not have in effect at any one time more than five (5) Fixed Rates: |

17

| (i) | Borrowers shall deliver to the Los Angeles Loan Center, 2120 East Park Place, Suite 100, El Segundo, California, 90245, Attn: Azucena Dela Cruz, with a copy to: Lender, Real Estate Group, Orange County, 2030 Main Street, Suite 800, Irvine, CA 92614, Attention: Irie Dadabhoy, Vice President, or such other addresses as Administrative Agent shall designate, an original or facsimile Fixed Rate Notice no later than 9:00 A.M. (California time), and not less than three (3) nor more than five (5) Business Days prior to the proposed Fixed Rate Period for each Fixed Rate Portion. Any Fixed Rate Notice pursuant to this subsection (i) is irrevocable. |

Administrative Agent is authorized to rely upon the telephonic request and acceptance of Kim Westerbeck, Lori Lewis, Stacie Yamane, Dave Snyder, Ann Marie Watters and Scott Christensen as Borrowers’ duly authorized agents, or such additional authorized agents as Borrowers shall designate in writing to Administrative Agent. Borrowers’ telephonic notices, requests and acceptances shall be directed to such officers of Administrative Agent as Administrative Agent may from time to time designate.

| (ii) | Borrower may, with a timely and complying Fixed Rate Notice, elect (A) to convert all or a portion of the principal balance of the Notes which is accruing interest at the One-Month LIBO Rate determined by Administrative Agent, reset daily, to a Fixed Rate Portion, or (B) to convert a matured Fixed Rate Portion into a new Fixed Rate Portion, provided, however, that the aggregate amount of the advance being converted into or continued as a Fixed Rate Portion shall comply with the definition thereof as to Dollar amount. The conversion of a matured Fixed Rate Portion back to the One-Month LIBO Rate determined by Administrative Agent, reset daily, or to a new Fixed Rate Portion shall occur on the last Business Day of the Fixed Rate Period relating to such Fixed Rate Portion. Each Fixed Rate Notice shall specify (A) the amount of the Fixed Rate Portion, (B) the Fixed Rate Period, and (C) the Fixed Rate Commencement Date. |

| (iii) | Upon receipt of a Fixed Rate Notice in the proper form requesting a Fixed Rate Portion advance under subsections (i) and (ii) above, Administrative Agent shall determine the Fixed Rate applicable to the Fixed Rate Period for such Fixed Rate Portion two (2) Business Days prior to the beginning of such Fixed Rate Period. Each determination by Administrative Agent of the Fixed Rate shall be conclusive and binding upon the parties hereto in the absence of manifest error. Administrative Agent shall deliver to Borrowers and each Lender (by facsimile) an acknowledgment of receipt and confirmation of the Fixed Rate Notice; provided, however, that failure to provide such acknowledgment of receipt and confirmation of the Fixed Rate Notice to Borrowers or any Lender shall not affect the validity of such rate. |

| (iv) | If Borrowers do not make a timely election to convert all or a portion of a matured Fixed Rate Portion into a new Fixed Rate Portion in accordance with this Section 2.7(f) above, such Fixed Rate Portion shall begin to accrue interest at the One-Month LIBO Rate determined by Administrative Agent, reset daily, upon the expiration of the Fixed Rate Period applicable to such Fixed Rate Portion. |

| (g) | Fixed Rate Taxes, Regulatory Costs and Reserve Percentages. Upon Administrative Agent’s demand, Borrower shall pay to Administrative Agent for the account of each |

18

| Lender, in addition to all other amounts which may be, or become, due and payable under this agreement and the other Loan Documents, any and all Fixed Rate Taxes and Regulatory Costs, to the extent they are not internalized by calculation of a Fixed Rate. Further, at Administrative Agent’s option, the Fixed Rate shall be automatically adjusted by adjusting the Reserve Percentage, as determined by Administrative Agent in its prudent banking judgment, from the date of imposition (or subsequent date selected by Administrative Agent) of any such Regulatory Costs. Administrative Agent shall notify the Borrower of any event entitling any Lender to Fixed Rate Taxes or Regulatory Costs (setting forth in reasonable detail the basis of such determination) as promptly as practicable, but in any event within ninety (90) days after Administrative Agent obtains actual knowledge thereof; provided that if Administrative Agent fails to give such notice within ninety (90) days after it obtains actual knowledge of such an event, such Lender shall be entitled to payment only for Fixed Rate Taxes and Regulatory Costs incurred from and after the date ninety (90) days prior to the date that Administrative Agent does give such notice. |

| (h) | Fixed Rate Price Adjustment. Borrowers acknowledge that prepayment or acceleration of a Fixed Rate Portion during a Fixed Rate Period shall result in Lenders incurring additional costs, expenses and/or liabilities and that it is extremely difficult and impractical to ascertain the extent of such costs, expenses and/or liabilities. Therefore, on the date a Fixed Rate Portion is prepaid or the date all sums payable hereunder become due and payable, by acceleration or otherwise (“Price Adjustment Date”), Borrowers will pay Administrative Agent, for the account of each Lender (in addition to all other sums then owing to Lenders) an amount (“Fixed Rate Price Adjustment”) equal to the then present value of (i) the amount of interest that would have accrued on the Fixed Rate Portion for the remainder of the Fixed Rate Period at the Fixed Rate set on the Fixed Rate Commencement Date, less (ii) the amount of interest that would accrue on the same Fixed Rate Portion for the same period if the Fixed Rate were set on the Price Adjustment Date at the Applicable LIBO Rate in effect on the Price Adjustment Date. The present value shall be calculated by the Administrative Agent, for the benefit of the Lenders, using as a discount rate the LIBO Rate quoted on the Price Adjustment Date. |

By initialing this provision where indicated below, Borrowers confirm that Lenders’ agreement to make the Loan at the interest rates and on the other terms set forth herein and in the other Loan Documents constitutes adequate and valuable consideration, given individual weight by Borrowers, for this agreement

Borrower Initials.

Borrower Initials.

Borrower Initials.

Borrower Initials.

| (i) | Purchase, Sale and Matching of Funds. Borrowers understand, agree and acknowledge the following: (a) Lenders have no obligation to purchase, sell and/or match funds in connection with the use of a LIBO Rate as a basis for calculating a Fixed Rate or Fixed Rate Price Adjustment; (b) a LIBO Rate is used merely as a reference in determining a Fixed Rate and Fixed Rate Price Adjustment; and (c) Borrowers have accepted a LIBO Rate as a reasonable and fair basis for calculating a Fixed Rate and a Fixed Rate Price Adjustment. Borrowers further agree to pay the Fixed Rate Price Adjustment, Fixed Rate Taxes and Regulatory Costs, if any, whether or not any Lender elects to purchase, sell and/or match funds. |

2.8 PAYMENTS.

19