Attached files

EARN-IN AGREEMENT

between

AFRICAN PRECIOUS MINERALS LIMITED

and

THE AL FAIRUZ BROTHERS

and

AL FAIRUZ MINING COMPANY LLC

Page 2

TABLE OF CONTENTS

1.

DEFINITIONS AND INTERPRETATION

4

2.

SUSPENSIVE CONDITIONS

7

3.

EARN IN

8

4.

FUNDING AFTER THE END OF THE EXPLORATION PERIOD

9

5.

OPERATIONAL MANAGEMENT

10

6.

STRATEGIC OVERSIGHT

11

7.

EXPLORATION PROGRAM AND BUDGET

11

8.

PROVISION OF ASSISTANCE

12

9.

DISPOSAL OF PARTICIPATING INTEREST

12

10.

WITHDRAWAL BY APM

12

11.

ACCESS TO INFORMATION

13

12.

ASSISTANCE AND CO-OPERATION

13

13.

CONFIDENTIALITY

13

14.

DISPUTES

14

15.

BREACH

15

16.

NOTICES

15

17.

FORCE MAJEURE

16

18.

ENTIRE AGREEMENT

16

19.

SEVERABILITY

17

20.

COUNTERPARTS

17

21.

GOVERNING LAW AND JURISDICTION

17

22.

VARIATION OR AMENDMENT

17

23.

ASSIGNMENT

17

24.

COSTS

17

25.

INDEMNITY

17

26.

MISCELLANEOUS

18

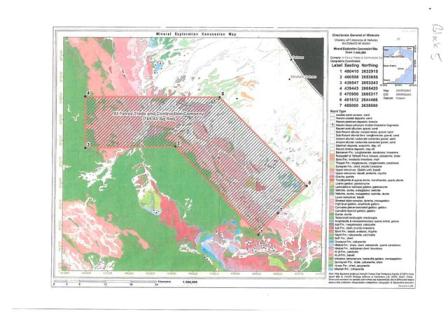

ANNEXURE “A” MAP OF EXPLORATION AREA

20

ANNEXURE “B” MATTERS TO BE COVERED IN SHAREHOLDER'S AGREEMENT

21

Page 3

THIS AGREEMENT made on the Tuesday, 27 October 2009,

Between:

AFRICAN PRECIOUS MINERALS LIMITED ("APM"), a company incorporated under the laws of the British Virgin Islands with registration number 599062;

And:

1)

Adil Bin Salim Bin Sulaituan Al Fairuz, an Omani national with identification number 01496038;

2)

Sadiq Bin Salim Bin Sulaiman Al Fairuz, an Omani national with identification number 01671419; and

3)

Yasser Bin Salim Bin Sulaiman Al Fairuz, an Omani national with identification number 02885875; and

4)

Sulaiman Bin Salim Bin Sulaiman Al Fairuz, an Omani national with identification number 6028958; and

5)

Mahmood Bin Salim Bin Sulaiman Al Fairuz, an Omani national with identification number 06028944; and

(together the "AFM Shareholder"), being the shareholders of Al Fairuz Mining;

And:

AL FAIRUZ MINING COMPANY LLC ("AL FAIRUZ MINING") a company incorporated under the laws of the Sultanate of Oman with registration number 1044741,

(collectively hereinafter referred to as the "Parties" and "Party" shall mean any one of them).

RECITALS:

A.

WHEREAS Al Fairuz Mining has been granted the Exploration Licence in respect of the Exploration Area;

B.

AND WHEREAS APM has considerable technical and financial expertise and capabilities in conducting mineral exploration activities;

C.

AND WHEREAS the Parties wish to formally record the terms and conditions pursuant to which APM will earn a 50% (fifty percent) Participating Interest in the Block 5 Project and Al Fairuz Mining subject to and in accordance with the terms of this Agreement.

Page 4

NOW THEREFORE THE PARTIES HEREBY AGREE AS FOLLOWS:

1.

DEFINITIONS AND INTERPRETATION:

1.1

In this Agreement (including the recitals) the following words and expressions shall, unless the context otherwise requires, have the following meanings:

"Affiliate" - means with reference to a person, any other natural or juristic person that directly or indirectly through one or more intermediaries Controls, is Controlled by or is under common control with the first person;

"Agreement" - means this agreement and the annexures attached hereto, as it may be amended from time to time in accordance with its terms;

"Best Commercial Endeavours" - means, in respect of a Party doing any act or thing or signing or executing any document or instrument, using all means reasonably necessary or desirable to do such act or thing or sign or execute such document or instrument.

"BFS" - means a JORC compliant bank feasibility study or internationally recognised equivalent to be prepared by an internationally recognised independent consulting firm (for example SRK Consulting), reflecting the feasibility, financial viability and proposed plan for mining a prospective ore body or deposit of Minerals and other minerals within the Exploration Area and will include such information that may be required to enable a banking or other financial institution or investor to determine whether or not to advance funds in order to establish a mine;

"BFS Date" - means the date on which the internationally recognised independent consulting firm delivers the completed BFS to the Management Committee;

"Block 5 Project" - means all Exploration Activities and development and mining activities in respect of the Exploration Area undertaken by APM pursuant to the terms of this Agreement.

"Business Day" - means any day on which banks in the Sultanate of Oman are generally

open for the transaction of normal banking business;

"Control" - means the ability, by virtue of ownership, rights of appointment, voting rights, management agreement, or other agreement of any kind, to control or direct, directly or indirectly, the appointment of the majority of the board or the majority of any other executive body or to control or direct, directly or indirectly, any decision making process or the management of any company or entity or appointee, and Controlled" shall have a corresponding meaning;

"Effective Date" - means the date on which all suspensive conditions are fulfilled; or waived as the case may be;

"Encumbrance" - means an encumbrance or other security interest of any nature whatsoever including but not limited to a lien, charge, mortgage or pledge;

Page 5

"Expenditure" - means the funding to be provided by APM pursuant to the Exploration Program and Budget and to be used for the Exploration Activities;

"Exploration Area" or "Block 5" - means the mineral exploration area named Block 5 situated in the Batinah Region of Oman, having the coordinates set out on the map attached hereto as Annexure "A";

"Exploration Activities" - means the exploration and/or development work to be carried out on the Exploration Area including, but not limited to, airborne geophysical surveys, remote sensing techniques, ground geophysical and geochemical surveys, geological mapping, exploration and resource drilling and activities similar to those reflected in the Kenex Model;

"Exploration License" - means the exploration license granted to Al Fairuz Mining in respect of the Exploration Area;

"Exploration Period" - means the period starting on the Effective Date and ending on the day on which, after the BFS, APM acquires a 50% (fifty percent) Participating Interest in Al Fairuz Mining or such other date as may be agreed between the Parties;

"Exploration Program and Budget" - means the program and budget to be prepared and approved annually in respect of the JV;

"Initial Expenditure" - means all costs relating, to the Kenex Model, data and exploration program in an agreed amount of Rials 15,000 (Omani Rials Fifteen Thousand) and an amount equal to 50% (fifty percent) of the land lease rental from October 2009 to June 2010 in connection with the Exploration Area being Rials 14,437,490 (Omani Rials Fourteen Thousand Four Hundred and Thirty-Seven and Four Hundred and Ninety Baisas);

"JV" or "Joint Venture" - means the joint venture between the Parties as contemplated by this Agreement for the purpose of exploring, developing and mining the Exploration Area;

"Kenex Model" - means a report and all associated digital data prepared by Kenex pertaining to the Exploration Area, which was provided to Al Fairuz Mining on 16 March 2009;

"Management Committee" - means, during the Exploration Period, a committee to be formed comprising representatives of each of the Parties for the purposes of undertaking the Exploration Activities which, following APM's acquisition of a 50% (fifty percent) Participating Interest in Al Fairuz Mining, will be replaced by a duly constituted Board of Directors established in accordance with the terms of the SHA and commensurate with the principles of representation and voting rights of the Management Committee;

"Minerals" - means all minerals, including but not limited to copper, lead, zinc, gold, silver, molybdenum, tungsten, tin, cobalt, chromite and platinum group metals (as referred to in the Exploration License);

Page 6

"Mining License" - means any mining licence that may be granted to Al Fairuz Mining in respect of the Exploration Area as may be renewed from time to time;

"Mining Period" - means the period starting on the day immediately following the last day of the Exploration Period and ending on the earlier of the day on which this Agreement expires or is terminated in accordance with its terms;

"Net Smelter Return Royalty" - means a royalty that may be payable to APM and/or a third party, as the case may be, each calendar quarter from the date that APM or the third party as the case may be becomes eligible to receive it, namely a royalty of 2% (two percent) of gross revenues received by Al Fairuz Mining from the sale of end products produced from mining activities over that part of the Exploration Area as specified in the BFS, (including but not limited to ore, concentrate and metal and mineral products of any kind derived from ore), after deduction of all of the following:

(a)

smelting and refining costs including sampling, assaying, treatment charges and penalties incurred;

(b)

marketing costs including sales commissions;

(c)

handling and transportation costs;

(d)

any taxes based on sales or production (but not income taxes);

(e)

insurance and security costs;

(f)

any related shipping agency fees and demurrage;

(g)

government charges on all related banking transactions; and

(h)

applicable government royalties.

"Offtake Agreement" - means an agreement that may be executed by the Parties with a third party in accordance with Clause 4.4.2 hereof, which agreement shall set out the terms and conditions pursuant to which that third party shall, in consideration of providing funding to Al Fairuz Mining, be entitled to purchase the end products produced from mining activities over the Exploration Area

"Participating Interest" - means, during the Exploration Period, a Party's interest in the Block 5 Project or JV and, during the Mining Period, the shares in Al Fairuz Mining to which a Party is entitled hereunder, expressed as a percentage of all the issued shares of Al Fairuz Mining held by the Parties;

"Profit Royalty" - means such royalty, expressed as a percentage of all profits generated by Al Fairuz Mining, as may be agreed between the Parties and a third party pursuant to the provisions of Clause 4.4.2;

"Project Manager" - means, initially APM until such time as the Management Committee decides otherwise;

"Rial" - means Omani Rial or the lawful currency from time to time of the Sultanate of Oman.

"SHA" - means the Shareholders Agreement to be entered into by the AFM Shareholder and APM at the time of APM's acquisition of a 50% (fifty percent) Participating Interest in Al Fairuz Mining in accordance with Clause 3.1.3 and which will reflect, among other things, the Parties' agreement to the matters contained in Annexure "B".

Page 7

"Signature Date" - means the date on which the last Party appends his signature hereto;

"Sunken Costs" - means those costs incurred by .APM in respect of the Exploration Activities and during the Exploration Period as specified in quarterly reports submitted by APM in Management Committee meetings as contemplated by Clauses 6 and 7 of this Agreement.

1.2

In the interpretation of this Agreement, the following rules shall apply unless the context requires otherwise:

1.2.1

Headings are for convenience only and do not affect interpretation. The singular includes the plural and conversely. A gender includes all genders. A reference to a Clause is a reference to a Clause of this Agreement;

1.2.2

If an event must occur on a specified day which is not a Business Day, then the specified day will be taken to be the next Business Day;

1.2.3

Where amounts are referred to in figures and in words, if there is any conflict between the two, the figures shall prevail.

2.

SUSPENSIVE CONDITIONS:

2.1

This Agreement is subject to the fulfilment of the following suspensive conditions within 7 business Days, in the case of only those conditions specified in 2.1.1 and 2.1.3, of the Signature Date or such other dates as the Parties may agree:

2.1.1

APM having provided to Al Fairuz Mining he following documents each in form and substance satisfactory to Al ,Fairuz Mining:

(a)

A copy of its constitutional documents duly notarised, consularised and attested;

(b)

A specimen of the signature of each person authorised on its behalf to enter into or witness the entry into of this Agreement or to sign or send any document or notice in connection with this Agreement;

(c)

A copy of a resolution of its board of directors (or equivalent) duly notarised, consularised and attested:

(i)

approving the terms of, and the transactions contemplated by this Agreement and resolving that it execute this Agreement;

(ii)

authorising a specified person or persons to execute this Agreement on its behalf, and

Page 8

(iii)

authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it under or in connection with this Agreement.

2.1.2

That this Agreement be registered within 3 (three) months of the Signature Date with the appropriate authority in Oman (be it the Ministry of Industry and Commerce or the Court or otherwise or otherwise in compliance with Omani law).

2.1.3

A letter from the auditors of Al Fairuz Mining confirming the assets and liabilities of Al Fairuz Mining.

2.2

In the event that the suspensive conditions are not fulfilled timeously or waived by APM, then this Agreement, save for the provisions of Clauses 1, 2 and13-24, which shall remain of full force and effect, shall automatically terminate and shall be null and void and of no further force or effect and (a) to the extent that this. Agreement may have been partially implemented, the Parties shall be restored to the status quo ante, and (b) no Party shall have any claim against the other arising out of or in connection with this Agreement save for the right of the AFM Shareholder to be reimbursed by APM for any reasonable costs or expenses incurred by the AFM Shareholder or Al Fairuz Mining up to the date of termination.

2.3

The Parties hereby undertake to use all reasonable commercial efforts to procure the fulfillment of the suspensive conditions as soon as possible after the Signature Date.

3.

EARN-IN:

3.1

On and from the Effective Date, APM shall be entitled to earn a 50% (fifty percent) Participating Interest in the Block 5 Project on the following basis:

3.1.1

APM shall, within 3 (three) Business Days of the Effective Date, pay to Al Fairuz Mining the Initial Expenditure in full; and

3.1.2

APM shall proceed with the Exploration Activities and, at the end of the Exploration Period and upon completion of the BFS, APM will be granted a 50% (fifty percent) Participating Interest in the Block 5 Project / JV.

3.2

When APM has earned a 50% (fifty percent) Participating Interest in the Block 5 Project / JV during the Exploration. Period, APM shall, within 30 Business Days of the last day of the Exploration Period, acquire a 50% (fifty percent) Participating Interest in the shareholding in Al Fairuz Mining at no additional cost save for those incurred in connection with increasing the capitalisation of Al Fairuz Mining in accordance with Omani laws. Al Fairuz Mining shall provide reasonable assistance in respect of the regulatory and administrative arrangements in connection with the issue and offer of new shares in Al Fairuz Mining.

3.3

Following the acquisition by APM of a 50% (fifty percent) Participating Interest in the Block 5 Project / JV, and in respect of the contribution by APM of any Sunken Costs:

Page 9

3.3.1

Sunken Costs, shall be regarded as loans by APM to Al Fairuz Mining (the "Anti Loans") which will be repaid in two annual instalments respectively on the first and second anniversary of the first day of the. Mining Period from any annual profits generated by Al Fairuz Mining and before the payment of any dividends to the Parties.

3.3.2

If for any reason any Sunken Costs remain outstanding after repayment of the APM Loans as contemplated by Clause 3.3.1, such outstanding amount shall be paid in three equal annual instalments on the third, fourth and fifth anniversary of the first day of the Mining. Period from any annual profits generated by Al Fairuz Mining. If such profits in any year exceed the annual instalment payable in that year, the excess amount shall be paid to the Parties as dividends in proportion to their respective shareholding in Al Fairuz Mining.

3.3.3

At any time during the Mining Period the Parties may discuss and agree in good faith an alternative structure to that reflected in Clauses 3.3.1 and 3.3.2 where, among other things, the profitability of the Block 5 Project / Al Fairuz Mining so reasonably warrants.

3.4

It is agreed that an internationally recognised independent consulting firm (for example SRK Consulting) will be appointed by APM for the preparation and completion of the BFS, and APM undertakes to consult with the AFM Shareholder prior to making such appointment.

4.

FUNDING AFTER THE END OF THE EXPLORATION PERIOD

4.1

For the avoidance of doubt, it is specifically recorded that the AFM Shareholder shall not be required to contribute any funding to Al Fairuz Mining prior to completion of the BFS.

4.2

The AFM Shareholder will not be required to contribute any funding during the Mining Period (and after completion of the BFS), although the AFM Shareholder may, in its sole discretion, elect to do so.

4.3

In respect of the AFM Shareholder's election in Clause 4.2, APM shall use its Best Commercial Endeavours to itself fund or arrange funding required by Al Fairuz Mining in order to commission a mine on the Exploration Area, in each case within six months of the date of the BFS ("Relevant Period") and at no cost to the AFM Shareholder, If APM elects to arrange funding through a bank, financial institution ("Financier") or other third party, .APM shall use its Best Commercial Endeavours to ensure and procure that such Financier shall, within the Relevant Period, have completed its legal, commercial and technical due diligence in respect of the Block 5 Project and agreed in, principle to provide such funding subject only to execution of the financing agreements and any relevant project agreements. If for any reason APM fails to fund or arrange such funding within the Relevant Period, it shall use its Best Commercial Endeavours to source a replacement investor and ensure and procure that such replacement investor shall, subject to the provisions of Clause 9, itself fund or arrange such, funding from a Financier no later than 90 (ninety) calendar days of the end of the Relevant Period.

Page 10

4.4

It is agreed that the AFM Shareholder can elect not to contribute any funding to Al Fairuz Mining, provided that:

4.4.1

in the event that a Financier provides debt funding to Al Fairuz Mining, the AFM Shareholder agrees that security may be provided to such third party by means of an Encumbrance over the Exploration License or Mining License as the case may be; and

4.4.2

in the event that another third party is prepared to provide cash funding to Al Fairuz Mining, the AFM Shareholder agrees that, if so required by the third party, and in consideration for such Funding, such third party shall be entitled, at its sole discretion, to either a Net Smelter Return Royalty or a Profit Royalty or to enter into an Offtake Agreement, in each case on such terms as may be agreed between that third party and Al Fairuz Mining.

5.

OPERATIONAL MANAGEMENT:

5.1

Within 7 (seven) days after the formation of the Management Committee in terms of Clause 6.1 blow, the Management Committee will appoint APM as the initial Project Manager, and it is agreed that APM will continue to be the Project Manager until such time as the. Management Committee decides otherwise.

5.2

APM shall, with such assistance from the AFM Shareholder as may reasonably be required, obtain and maintain all permits, consents, approvals or other authorisations necessary or desirable for the performance of the Joint Ventures obligations during the Exploration Period under or in connection with this Agreement provided that any and all costs associated with the obtaining or maintaining of such permits, consents, approvals or other authorisations shall be borne solely by APM.

5.3

For the purposes of carrying out the Exploration Activities during the Exploration Period, APM shall, in its sole discretion, be entitled to appoint such other persons as it deems necessary for the Joint Venture, including, inter alia, the appointment of an internationally recognised independent consulting firm to carry out a BFS, a construction manager, plant manager, exploration manager and the like, and APM undertakes to consult with the AFM Shareholder before making any such appointments.

5.4

As and when APM earns a Participating Interest in the Block 5 Project in terms of this Agreement (and at the end of the Exploration Period after completion of the BFS), APM acknowledges that it shall be responsible for all costs and expenses in connection with any increase in the share capital of Al Fairuz Mining (including the minimum capitalisation requirements for a foreign participation in an LLC, any equity funding necessary or desirable for the purposes of carrying out the activities contemplated by this Agreement), the allotment and registration of shares reflecting at all times (notwithstanding any increase in such share capital or equity funding at the sole cost of APM) an equal 50% (fifty percent) shareholding in Al Fairuz Mining by each of the AFM Shareholder and APM.

Page 11

6.

STRATEGIC OVERSIGHT:

6.1

The Parties shall form a Management Committee within 10 (ten) Business Days of the Effective Date comprising representatives appointed by the Parties.

6.2

APM and the AFM Shareholder shall each be entitled to appoint 2 (two) representatives to the Management Committee, and at least 1 (one) representative of each Party shall be required to attend meetings of the Committee to constitute a quorum.

6.3

Each Party undertakes to promptly notify the other Party in writing of its proposed Management Committee representatives.

6.4

All decisions of the Management Committee shall be decided upon by a majority vote, and in the event of a deadlock among the Parties, a Dispute over any decision (save for any Dispute of a technical nature which shall be settled in accordance with Clause 6.5 below) shall be settled in accordance with the provisions of Clause 14 hereof.

6.5

In the event of a Dispute of a technical nature, either Party may refer the Dispute to a geologist duly qualified in either the United Kingdom, Australia, Canada or of similar standing and registered and in good standing with the applicable professional body (the "Independent Geologist") who will provide an independent written opinion on the Dispute, and whose opinion will be final and binding on the Parties.

6.6

Either Party may call a meeting of the Management Committee at any time upon providing the other Party with 14 (fourteen) Business Days prior written notice thereof.

6.7

Subject to Clause 6.4, the APM shall have overall supervision of the technical operations of the Joint Venture.

6.8

Subject to providing APM with 1 (one) Business Day's prior written notice, the AFM Shareholder will have an ongoing right of access to the Exploration Area.

7.

EXPLORATION PROGRAM AND BUDGET:

7.1

As soon as possible after the Effective Date, an initial Exploration Program and Budget will be prepared by APM in consultation with the AFM Shareholder and the Exploration Program and Budget will then be jointly submitted to the Management Committee for approval.

7.2

The procedure described in Clause 7.1 will be repeated, annually after the expiry of the period of the initial Exploration Program and Budget for the duration of the Exploration Activities.

7.3

Information and reporting requirements to be shared and undertaken at Management Committee meetings shall include reports prepared on a quarterly basis by APM on and from the Effective Date specifying all Sunken Costs incurred up to the date of each such report.

Page 12

8.

PROVISION OF ASSISTANCE:

8.1

During the Exploration Period, the AFM Shareholder may in its sole discretion and without incurring any cost, provide such assistance to APM as it, may reasonably require in order to perform its obligations which may include (at the AFM Shareholder's sole discretion), certain administrative support, services and facilities for APM in Oman, such as office facilities, support staff, accommodation and vehicles for APM personnel, and assistance in sourcing plant and machinery that may be required during the Exploration Activities, and the provision of any such services as agreed by the Parties at a meeting of the Management Committee.

8.2

In respect of any services that may reasonably be expected to be provided by an independent exploration or mining contractor (including the provision of plant, machinery and equipment) to the Joint Venture in order to undertake the activities contemplated by this Agreement, APM agrees that it shall give first priority to Al Fairuz Mining to provide any such service providing that such service is priced on terms at least equal to those sourced by APM from any other providers of a similar standing in the local Omani market.

9.

DISPOSAL OF PARTICIPATING INTEREST:

9.1

A Party may not sell, lease, sublease or otherwise dispose of part or the whole of its Participating Interest without the prior written consent of the other Party.

9.2

Any Party that wishes to sell, lease, sublease or otherwise dispose of all or, part of its Participating Interest (the "Selling Party") must first offer said Participating Interest to the other Party (the "Offer") and the other Party shall have a period of 30 (thirty) days within which to accept the Offer.

9.3

In the event that the other Party wishes to accept the Offer, it shall provide the Selling Party with written notification thereof.

9.4

Upon the expiry of the 30 (thirty) day period referred to above, the Selling Party may proceed to dispose of all or part of its Participating Interest to any third party but not on terms more favourable than those offered to the other Party.

10.

WITHDRAWAL BY APM:

10.1

If APM withdraws from the Block 5 Project at any time during the Exploration. Period (and before completion of the BFS), it shall give at least 90 (ninety) Business Days' notice to Al Fairuz Mining and the AFM Shareholder of its intention to so withdraw and it acknowledges and confirms that in such event no monies of any nature whatsoever shall be paid or payable to it by any other Party.

10.2

If APM withdraws from the Block 5 Project for any reason at any time after completion of the BFS or at any time during the Mining Period, it shall give at least 30 (thirty) Business Days' prior written notice to the AFM Shareholder and Al Fairuz Mining of its intention to so withdraw. In the case of such withdrawal, APM shall be entitled to receive any Net Smelter Royalty until such time as the aggregate amounts of all Net Smelter Royalties paid to APM is equal to the aggregate amount of all Sunken Costs.

Page 13

10.3

Within 10 (ten) Business Days of APM notifying Al Fairuz Mining and the AFM Shareholder of its withdrawal from the Block 5 Project, APM shall return to Al Fairuz Mining and the ARM Shareholder all records, information or other documentation (the "Records") in its possession pertaining to the Block 5 Project.

10.4

It is agreed that upon the return of all Records to Al Fairuz Mining and the AFM Shareholder, the AFM Shareholder shall, subject to the provisions of Clause 9 above, be entitled to approach or enter into negotiations with any third party for the purpose of executing an agreement with such third party on terms similar to those contained in this Agreement.

10.5

If APM chooses to withdraw from the Block 5 Project, APM shall be entitled to sell or otherwise dispose of its Participating interest to any third party subject to the provisions of Clauses 4.3, 9 and 10.

11.

ACCESS TO INFORMATION:

As soon as possible after the Effective Date, Al Fairuz Mining shall make available to APM all relevant records and data in its possession pertaining to the Exploration License and the Exploration Area, and authorises APM to make such other enquiries as APM may deem, in its sole reasonable opinion, to be necessary.

12.

ASSISTANCE AND CO-OPERATION

The Parties undertake to assist and co-operate with each other at all times during the term of this Agreement.

13.

CONFIDENTIALITY:

13.1

Subject to the terms and conditions of this Agreement, neither Party shall release or disclose any information or data in respect of the Exploration License or Mining License (as the case may be) obtained under the terms of this Agreement or by virtue of participating in the Block 5 Project except for the purposes of undertaking the Block 5 Project ("Confidential Information").

13.2

Confidential Information will include but not be limited to this Agreement, the Exploration License or the Mining License as the case may be, as well as all trade secrets, know-how, data, proprietary information or other non-public information relating directly or indirectly to the Block 5 Project.

13.3

Notwithstanding Clause 13.2, Confidential Information shall not include any part of any information that (a) is in or comes into the public domain without any breach of any confidentiality obligation by the disclosing Party or any Affiliate thereof; (b) was in the possession of or was known by the recipient prior to its disclosure or receipt; (c) is disclosed to the receiving Party on an unrestricted basis from any third party who is not under any obligation of confidentiality to the Party claiming that such information constitutes Confidential Information; or (d) is required to be disclosed by law or legal process.

Page 14

13.4

No Party may make any public statements or announcements about the subject matter of this Agreement or the Block 5 Project without first consulting with the other Party.

13.5

The Parties shall each take such steps as are necessary to ensure and procure that their respective officers and employees are under confidentiality obligations commensurate with those of the Parties under this Agreement (whether pursuant to a separate undertaking, agreement or other) as though each such officer or employee were an original party to this Agreement and shall ensure that any Confidential Information that is or may be disclosed to any of them is of such a nature as is necessary to enable that Party to perform its obligations under this. Agreement.

14.

DISPUTES:

14.1

If there shall be any dispute, controversy or claim (a "Dispute") between the Patties arising out of, relating to, or connected with this Agreement, the breach, termination or invalidity hereof, or the provisions contained herein or omitted herefrom, a Party shall notify the other Parties in writing thereof and such notification shall request that the Parties promptly meet in order to attempt to negotiate and settle such Dispute.

14.2

Such meeting will take place in good faith at such time and place as agreed to by the Parties, or failing agreement, within 7 (seven) Business Days after the Parties were duly notified of such Dispute in the Sultanate of Oman, or at an alternative place by written mutual consent.

14.3

If the Parties are unable to resolve the Dispute referred to herein within 40 (forty) Business Days after a Party giving written notice of a Dispute to the other Party, such Dispute shall be finally settled, in accordance with Article 7 of the Mining Law (Royal Decree No.27/2003), by arbitration by three arbitrators appointed and proceeding in accordance with the Rules of Arbitration (the "Rules") of the International Chamber of Commerce (the 'ICC") in force at the time, of such Dispute as the exclusive means of resolving such Dispute.

14.4

All submissions and awards in relation to arbitration under this Agreement, all arbitration proceedings and all pleadings shall be conducted in the English language.

14.5

The arbitration proceedings shall be held in Muscat, Sultanate of Oman.

14.6

For purposes of appointing such arbitrators, each of the Parties hereto shall appoint one arbitrator and the third arbitrator shall be selected by the two Party-appointed arbitrators or, failing agreement between the two Party-appointed arbitrators within 10 (ten) Business Days after the appointment or the two Party-appointed arbitrators have been confirmed, by the ICC in accordance with the Rules.

14.7

The decision of the arbitration panel shall include a statement of the reasons for such decision and shall be final and conclusively binding upon the Parties and shall be enforceable against them in any court having jurisdiction over them or any of their assets. The Parties further agree, subject to applicable law, to obtain the arbitration

Page 15

panel's agreement to preserve the confidentiality of the entire arbitration process, and any award made in respect of the Dispute. Nothing in this Clause shall prevent any Party from applying to an Omani court having jurisdiction on an urgent basis in

connection with any interim relief.

15.

BREACH:

The Parties agree that the cancellation of this Agreement in the event of a breach would be an inappropriate and insufficient remedy. It is accordingly agreed that the aggrieved Party shall be entitled, (without prejudice to any other rights it may have in law other than its right to cancel the Agreement) to initiate arbitration proceedings in accordance with Clause 14 above on an urgent basis to obtain such award as may be deemed appropriate by the arbitration panel.

16.

NOTICES:

16.1

A notice given under this Agreement:

16.1.1

shall be in writing in the English language (or be accompanied by a properly prepared translation into English);

16.1.2

shall be sent for the attention of the person, and to the address, or fax number, given in this Clause. 16 (or such other address or person as the relevant Party may notify to the other Party, such notice to take effect (five) days from the notice being received); and

16.1.3

shall be:

(a)

delivered personally; or

(b)

delivered by commercial courier; or

(c)

sent by pre-paid registered post.

16.2

The addresses for service of notice are as follows:

16.2.1

Al Fairuz Mining Company LLC and the Al Fairuz Brothers:

Physical and Postal Address:

P.O. Box 330, Postal Code 113, Muscat,

Sultanate of Oman.

(For the attention of the Managing Director)

16.2.2

African Precious Minerals Limited:

Physical and Postal Address:

Ground Floor, Block C, Little Fourways

Office Park, 1 Leslie Avenue East, Fourways

(For the attention of: the Managing Director)

Page 16

16.3

A notice is deemed to have been received:

16.3.1

if delivered personally, at the time of delivery; or

16.3.2

if delivered by commercial courier, at the time of signature of the courier's receipt; or

16.3.3

if sent by pre-paid registered post, 48 hours from the date of posting; and

16.3.4

if a notice is received outside of normal business hours (meaning 8.00 am to 5:30 pm on a Business Day), then the notice will be deemed to have been received on the next following Business Day.

17.

FORCE MAJEURE:

17.1

Subject to Clause 17.4 below, neither Party shall be liable for failure to perform or delay in performance of any duty or obligation that said Party may have where such failure or delay has been occasioned by force majeure which shall include any act of God, fire, strike, accident, war or any other cause outside the reasonable control of the Party ("Force Majeure Event") who had the obligation or duty to perform and provided that the said Party notifies the other Party in writing within seventy-two hours of the occurrence of the Force Majeure Event giving the description and forecast for the removal or remedy of the Force Majeure Event

17.2

Any Party invoking Force Majeure shall use its best endeavors to mitigate or remove the circumstances giving rise to Force Majeure and upon mitigation or removal of the circumstances giving rise thereto, forthwith give written notice thereof to the other Parties.

17.3

If the full and proper implementation of this Agreement is precluded by any of the events or a combination of the events contemplated in Clause 17.1 for a period of more than 3 (three) consecutive months at any one time, then either Party may terminate this agreement or the Parties may mutually agree new arrangements equitable to both of them.

17.4

Any failure, or any cause of any failure (in each case whether claimed or not), by APM to fulfill its obligations to fund the Initial Expenditure and Expenditure or to make any other Monetary payment under this Agreement shall not constitute a Force Majeure Event.

18.

ENTIRE AGREEMENT:

This Agreement encompasses the entire agreement between the Parties and supersedes all prior agreements, understandings, negotiations and discussions, whether oral or written and there are no warranties or representations between the Parties except as specifically set forth herein.

Page17

19.

SEVERABILITY:

If any provision hereof is held to be illegal, invalid or unenforceable for any reason. such provision shall be deemed to be pro non script°, but without affecting, impairing or invalidating any of the remaining provisions of this Agreement which shall continue to be of full force and effect.

20.

COUNTERPARTS:

This Agreement may be executed in any number of counterparts, each of which is an original and which together have the same effect as if each party had signed the same document.

21.

GOVERNING LAW AND JURISDICTION:

This Agreement shall be governed by and construed in accordance with the laws of the Sultanate of Oman. Any disputes or claims arising out of or in connection with the subject matter of this Agreement shall be settled by binding arbitration in accordance with Clause 14.

22.

VARIATION OR AMENDMENT:

No addition to or variation, deletion or agreed cancellation of all or any clauses or provisions of this Agreement will be of any force or effect unless in writing and signed by all the Parties.

23.

ASSIGNMENT:

It is expressly recorded that, subject to the prior written approval of Al Fairuz Mining. which approval shall not be unreasonably withheld, APM shall, at any given time during the term, of this Agreement, be entitled to assign its rights and obligations under this Agreement to an Affiliate thereof.

24.

COSTS:

Each Party will bear and pay its own legal costs and expenses of and incidental to the negotiation, drafting, preparation and implementation of this Agreement.

25.

INDEMNITY:

APM shall indemnify and keep indemnified the AFM Shareholder and Al Fairuz Mining for any and all losses, damages, costs and expenses suffered or incurred by them in connection with the performance by APM of this Agreement or any transaction contemplated by it including, without limitation, any and all fines or liabilities arising in connection with the violation of any applicable law (including any applicable environmental law), any term or condition of the Exploration Licence, any other relevant licence during the Exploration Period, any rule, regulation, permit, approval, consent or other authorisation or in connection with any third party claim.

Page 18

26.

MISCELLANEOUS:

26.1

APM acknowledges, confirms and agrees that it has reviewed and been independently advised in respect of any and all information, documents, laws, regulations, rules, licences, other authorisations and any other matters relating to the performance of this Agreement and the transactions contemplated by it and it has entered into this Agreement as a sophisticated investor and at all times on an arms' length commercial basis in all its dealings with Al Fairuz Mining and the AFM Shareholder.

26.2

APM further acknowledges, confirms and agrees that it shall at all times comply with, and ensure and procure that the Joint Venture and Al Fairuz Mining shall at all times comply with, all provisions of the Exploration Licence, the Mining Law (Royal Decree No 27/2003), any related or other Executive Regulations that may be issued from time to time and any and all other applicable laws, rules and regulations. In this regard and during the term of this Agreement, APM shall, and shall ensure and procure that Al Fairuz Mining shall, take all such action as may be necessary or desirable to among other things, preserve the environment and employ and train Omani citizens in undertaking the activities contemplated by this Agreement.

Signed at Muscat on this 27th Tuesday of October, 2009

/s/Yasser Bin Salim Bin Sulaiman Al Fairuz

___________________________________

for and on behalf of AL FAIRUZ MINING COMPANY LLC who warrants he is duly auhtorised thereto

Signed at Muscat on this 27th Tuesday of October, 2009

/s/Rudolph De Bruin

___________________________________

RUDOLPH DE BRUIN for and on behalf of AFRICAN PRECIOUS MINERALS LIMITED who warrants he is duly auhtorised thereto

Signed at Muscat on this 27th Tuesday of October, 2009

/s/David Twist

___________________________________

DAVID TWIST for and on behalf of AFRICAN PRECIOUS MINERALS LIMITED who warrants he is duly auhtorised thereto

Page 19

Signed at Muscat on this 27th Tuesday of October, 2009

/s/ Adil Bin Salim Bin Sulaituan Al Fairuz

___________________________________

Adil Bin Salim Bin Sulaituan Al Fairuz

Signed at Muscat on this 27th Tuesday of October, 2009

/s/ Sadiq Bin Salim Bin Sulaiman Al Fairuz

___________________________________

Sadiq Bin Salim Bin Sulaiman Al Fairuz

Signed at Muscat on this 27th Tuesday of October, 2009

/s/ Yasser Bin Salim Bin Sulaiman Al Fairuz

___________________________________

Yasser Bin Salim Bin Sulaiman Al Fairuz

Signed at Muscat on this 27th Tuesday of October, 2009

/s/ Sulaiman Bin Salim Bin Sulaiman Al Fairuz

___________________________________

Sulaiman Bin Salim Bin Sulaiman Al Fairuz

Signed at Muscat on this 27th Tuesday of October, 2009

/s/Mahmood Bin Salim Bin Sulaiman Al Fairuz

___________________________________

Mahmood Bin Salim Bin Sulaiman Al Fairuz

Page 20

ANNEXURE “A”

MAP OF EXPLORATION AREA

Page 21

ANNEXURE “B”

MATTERS TO BE COVERED IN SHAREHOLDERS' AGREEMENT

The following matters agreed by the Parties to be covered in the SHA upon APM's acquisition of a fifty percent (50%) Participating Interest in Al Fairuz Mining (the “Company”) shall at all times be subject to the terms of the Agreement:

1.

Structure

1.1

The Parties shall structure, operate and manage the Company as an independent and separate entity having its own office facilities, personnel and administrative structure.

1.2

The Parties will act so as to ensure that the Company will establish proper systems of control, expenditure and budgetary controls and regular reporting to the Management Committee on its operations and state of affairs.

1.3

The Parties agree to cooperate with each other in the best interests of the Company.

2.

Business

2.1

The business of the Company shall include the exploration and mining of minerals found on and in the Exploration Area and the sale and disposal of the minerals derived from such mining activities, as permitted by the relevant licences issued in favour of the Company by the relevant Omani authorities.

2.2

The business of the Company shall further include such other activities and business as the Management Committee and/or shareholders (“Shareholders”) may, from time to time, agree in accordance with the Company's constitutive documents (“Constitutive Contract”) and applicable laws.

3.

Share Capital

3.1

The share capital shall be divided into ordinary par value shares and shall be fully paid up in cash by the Parties. APM and AFM Shareholders shall each hold fifty percent (50%) of the shares in the Company.

3.2

Each share shall entitle the holder thereof to one (1) vote on each matter coming before the Shareholders of the Company, and each Shareholder shall share equally with each other Shareholder in the profits of the Company.

3.3

If the Company increases its share capital, the Parties shall procure that the Company shall first offer such Shares to its then current Shareholders in such proportion that will preserve their relative proportionate ownerships on a fully diluted basis, unless otherwise mutually agreed in writing by the Parties.

Page 22

3.4

In case the Company requires additional financing, loans may be made available to the Company by way of shareholder loans, subject to the. Shareholders' prior written consent. Such loans shall be contributed or loaned by the Parties in proportion to the number of shares then held by each Party. The Management Committee shall be authorised to request contributions or loans from the Parties in respect of the shareholder loans in proportion to the number of shares then held by each Party, in form and amounts sufficient to satisfy the needs of the Company, and on such terms and conditions as may be determined from time to time by the Management Committee.

4.

Management Committee and Shareholders Related Matters

4.1

Subject to limitations on the duties and authority of the Management Committee set forth under the Constitutive Contract, the Commercial Companies Law Royal Decree 4/74, the SHA or other applicable laws, (i) the Management Committee shall have the final and ultimate authority to manage the business and affairs of the Company, and (ii) all authority and power to act on behalf of the Company shall derive from the Management Committee and may be delegated, withheld or withdrawn by the Management Committee in its sole discretion. All persons employed by the Company and all committees and sub-committees, whether formal or informal, of the Company shall be subordinate and ultimately responsible to the Management Committee. A quorum will be validly constituted by two (2) members present in person or proxy.

4.2

The Management Committee shall consist of four (4) members, APM and AFM shall have the right to nominate two (2) members each A Chairman shall be appointed from amongst its members.

4.3

Subject to the Constitutive Contract of the Company, the Management Committee shall endeavour to meet at least once each quarter and at such other times as the Management Committee shall deem necessary, provided that any one (1) member shall have the right to require the Chairman to convene a meeting of the Management Committee.

4.4

Each member is entitled to one (1) vote. Unless otherwise required by law, no resolution of the Management Committee shall be valid unless a simple majority of the votes validly cast on such resolution at the meeting are in favour thereof In the event of a deadlock between the Parties, a Dispute over any decision (including a Dispute of a technical nature) shall be settled in a manner commensurate with that reflected in the Agreement.

4.5

Profits and losses of the Company shall be shared by the Shareholders in proportion to their respective shares in the capital. The profits of the Company, if any., available for distribution after making provision for the statutory reserve or for other established reserves shall be distributed in full within thirty (30) days after the date on which the Shareholders approve the financial statements for the immediately preceding fiscal year, unless the Shareholders decide to form other reserves or to carry forward the profit balance, totally or partially, to the following fiscal year and, the losses shall be borne by the Shareholders up to a maximum of their respective shares in the capital of the Company.

4.6

Except as otherwise required by applicable law, resolutions of the Shareholders shall only be valid if issued upon the affirmative vote of a simple majority of the Shareholders, except for the following matters which shall require the affirmative vote of Shareholders representing at least seventy five percent (75%) of the share capital of the Company:

Page 23

(a)

amendment to the Constitutive Contract;

(b)

increase or reduction of the share capital of the Company;

(c)

merger, consolidation or reorganization of the Company with or into any other person or company under the 100% control of the Shareholders or any decision in respect of an initial public offering (“IPO”);

(d)

liquidation of the Company;

(e)

sale of a substantial part of the Company’s assets;

(f)

approval of change in the capital structure of the Company.

5.

Management and Reporting

5.1

The Shareholders, acting through the Management Committee, shall appoint qualified individuals to act as the General Manager and. Finance Manager of the Company. The General Manager shall manage the day-today operations of the Company in accordance with the specific powers delegated to him by the Management Committee and the decisions, budgets and guidelines established by the Management Committee from time to time.

5.2

All books of account and the annual financial statements shall be prepared and maintained by the Company in Rials. The Shareholders shall appoint a firm of accountants of international repute established in Muscat that shall audit, within ninety (90) days after the end of each financial year, the annual financial statements of the Company for such financial year.

5.3

The financial statements shall be prepared in accordance with international accounting standards issued by Omani regulations, the International Accounting Standards Committee and the International Financial Reporting Standard (IFRS) and shall include the Company's audited balance sheet and audited statements of income and cash flows, and audit reports.

5.4

The Shareholders shall cause the Management Committee to adopt internal regulations including in respect of a business plan , annual budget, annual finance plan:

6.

Transfer of Shares

6.1

Unless otherwise agreed in writing by the Parties, no Party shall do, or agree to, do, any of the following:

(a)

pledge, mortgage, charge or otherwise encumber any share or any interest in any share;

(b)

grant an option over any share or any interest in any share; or

(c)

enter into any agreement in respect of the votes attached to any share, held directly or indirectly by such Party, nor shall it permit its Affiliates to do any of the same.

Page 24

6.2

No Party shall sell, assign, transfer or otherwise dispose of in any manner, directly or indirectly, any interest in any or all of the Shares (the “Sale/Transfer”) held directly or indirectly by such Party, nor shall it permit its Affiliates at any time to do so, unless such Sale/Transfer is in compliance with the provisions of the SHA. which shall include notice requirements, period of prohibition on sale or transfer of shares, calculation of a party's shareholding and valuation of shares.

7.

Confidentiality

Confidentiality obligations commensurate with those in the Agreement shall be reflected in the SHA.

8.

Public Listing of Company

8.1

By agreement between the Shareholders at the relevant time, the Shareholders shall have the right to transfer or sell a percentage of their Shares by way of an IPO, provided that:

(a)

the proposed IPO has been approved by the Shareholders in advance;

(b)

that the timing of the IPO has been approved by the Management Committee;

(c)

each of the Shareholders hereby waives any and all rights of pre-emption in respect of any such transfer or sale of the shares of the other Shareholders; and

(d)

such IPO shall not take place before such date as agreed between the Parties,

8.2

In the event of an IPO occurring, the Shareholders shall use their best endeavours to take such action as shall be necessary or desirable to amend the Constitutive Contract and any relevant agreement in all respects reasonably required to enable an IPO to occur, while ensuring that all rights and obligations under relevant agreements are preserved and having due regard to the Constitutive Contract in force at the date thereof and to agree upon a procedure for implementing the IPO that ensures the IPO is undertaken in such a manner so as to mitigate the disruption and disturbance to the Company.

9.

Non-competition

Non-competition terms to be agreed between the Parties and reflected in the SHA including the relevant periods.

10.

Governing Law and Arbitration

The SHA shall be governed by and construed in accordance with the laws of the Sultanate of Oman.

11.

Arbitration

As per 4.4 above.