Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Beneficial Mutual Bancorp Inc | t67083_8k.htm |

Exhibit 99.1

|

Investor

Presentation

Beneficial

Mutual Bancorp, Inc. (MHC)

NASDAQ:

BNCL

May

14, 2010

|

|

Safe

Harbor Statement

This

presentation may contain projections and other “forward-looking

statements”

This

presentation may contain projections and other forward looking

statements

within

the meaning of the federal securities laws. These statements are not

historical

facts,

rather statements based on the current expectations of Beneficial

Mutual

Bancorp,

Inc. (the “Company”) regarding its business strategies, intended results

and

future

performance. Forward-looking statements are preceded by terms such

as

future

performance. Forward looking statements are preceded by terms such

as

“expects,”

“believes,” “anticipates,” “intends” and similar expressions.

Management’s

ability to predict results or the effect of future plans or strategies

is

inherently

uncertain. Factors that could affect actual results include interest

rate

trends

the general economic climate in the market area in which the

Company

trends,

the general economic climate in the market area in which the

Company

operates,

as well as nationwide, the Company’s ability to control costs and

expenses,

competitive

products and pricing, loan delinquency rates, changes in federal and

state

legislation

and regulation and other factors that may be described in the

Company’s

filings

with the Securities and Exchange Commission including its Annual Reports

on

filings

with the Securities and Exchange Commission, including its Annual Reports

on

Form

10-K and Quarterly Reports on Form 10-Q and other required filings.

These

factors

should be considered in evaluating the forward-looking statements and

undue

reliance

should not be placed on such statements. The Company assumes

no

obligation

to update any forward-looking statements

obligation

to update any forward looking statements.

This

presentation includes interim and unaudited financials, which are subject

to

further

review by the Company’s independent

accountants.

|

|

Beneficial

Mutual Bancorp, Inc.

•

Holding Company for Beneficial Bank

–

Founded in 1853

Founded

in 1853

–

Oldest and largest bank headquartered in Philadelphia

–

68 branches

•

37 in Pennsylvania

•

31 in New Jersey, including 2 new Cherry Hill campuses opening on May 15,

2010

•

IPO Date: Julyy 2007

•

Ticker: BNCL

•

Website: www.thebeneficial.com

•

4th largest publicly traded MHC in U.S.

–

Market Capitalization: $812 million

A

D V 101 318 101,318 shhares

Average

Dail ily Vollume:

–

–

–

•

Balance Sheet Strength (March 31, 2010)

–

Assets: $4.7 billion

–

Deposits: $3.6 billion

–

Loans: $2.8 billion

Eit

$646$646 million

Equity:

illi

–

TARP: $0

•

Relationships

–

Deposit Accounts: 281 thousand

–

Loan Accounts: 63 thousand

AAssetts

under managementt: $150 illi

d

$150 million

|

|

Our

Philosophy

“Vacere

Comptus Verus” – Do what’s right

Education

Company

Vacere

Comptus Verus Do what s right

•

Educate our customers to do the right thing financially

Educate

our customers to do the right thing financially

•

Educate ourselves to understand the situation, goals and

needs

of our customers

Invest

in tools and resources for our customers

•

FinanceWorks

•

Small Business FinanceWorks

•

BankThanks Reward Program

•

Mobile Banking

Mobile

Banking

|

|

•5th

largest metropolitan region in the United States

Our

Market -Greater Philadelphia Area

•

The Philadelphia MSA is a resilient market that has experienced

consistent

growth

over the past decade

railroads•

92 colleges and universities

•

Philadelphia is Amtrak’s third busiest station in the country and home to

three

major

shipping ports including one of the very few directly served by three

Class I

railroads

–

Median household income of $64,422 versus a nationwide median of

$54,719

–

Projected household income growth of approximately 4% between 2009 and

2014

•

The region’s unemployment picture has fared well in the face of the

current

recession

–

March 2010 unemployment of 9.4% versus a nationwide unemployment rate of

9.9%

in

April

•

March pending home sales in the eight-county Philadelphia region were up

35%

comppared

to the same period in 2009;; nationally pendingg sales were upp

21%

p

yp

Sources:

U.S. Census Bureau, 2008 Population Estimates. 2009 Q1 ACCRA. Bureau of

Economic Analysis, 2009. The Role of Metro Areas in the U.S. Economy. The

U.S. Conference of

Mayors,

2006. National Association of Home Builders/Wells Fargo Bank, March 2009.

Studley Report, 4Q 2005. Grubb and Ellis, March 2009. Global Insights

-Spring 2009 Forecast.

|

|

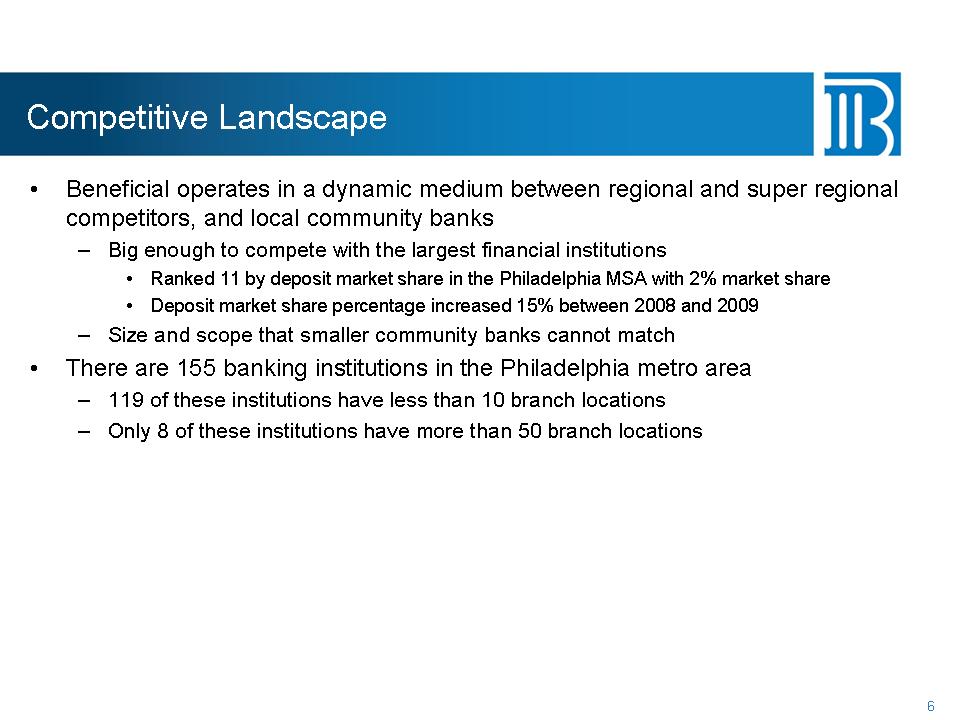

Competitive

Landscape

•

Beneficial operates in a dynamic medium between regional and super

regional

competitors,

and local community banks

–

Big enough to compete with the largest financial institutions

•

Ranked 11 by deposit market share in the Philadelphia MSA with 2% market

share

•

Deposit market share percentage increased 15% between 2008 and

2009

Deposit

market share percentage increased 15% between 2008 and 2009

–

Size and scope that smaller community banks cannot match

•

There are 155 banking institutions in the Philadelphia metro

area

–

119 of these institutions have less than 10 branch locations

–

Only 8 of these institutions have more than 50 branch

locations

|

|

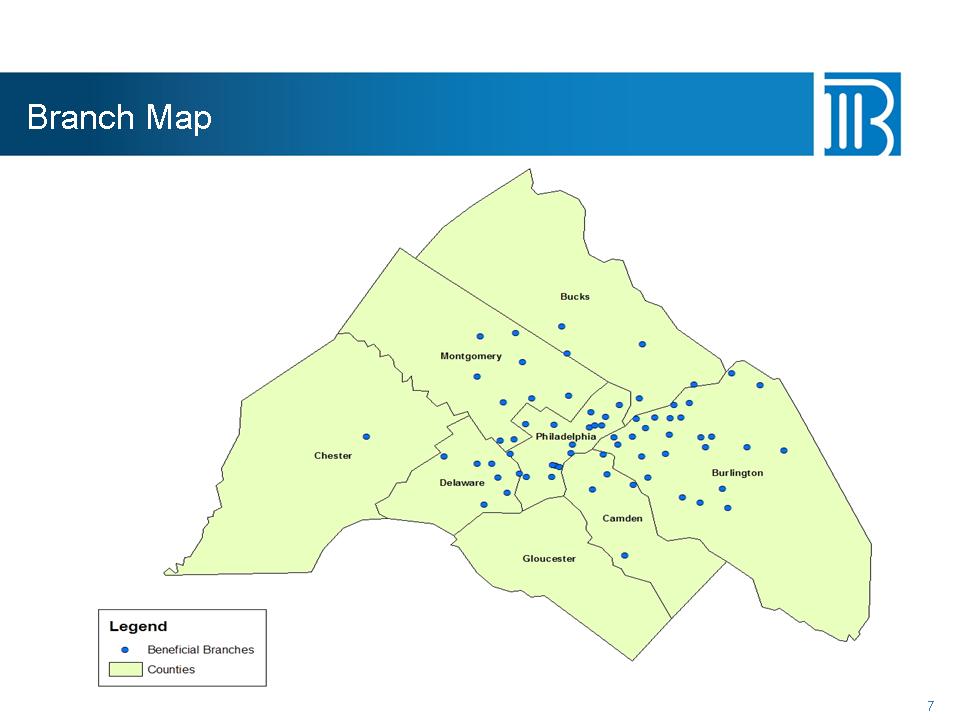

Branch

Map

7

|

|

Management

Team

Name

Position

•

Gerard Cuddy Chief Executive Officer Gerard Cuddy Chief Executive

Officer

•

Robert Bush Advisory Services

•

Cecile Colonna Human Resources

•

Amy Hannigan Chief Accounting Officery g g

•

Denise Kassekert Relationship Banking

•

Robert Maines Enterprise Risk Management

•

Andrew Miller Lending

•

Joanne Ryder Brand and Strategy

8

|

|

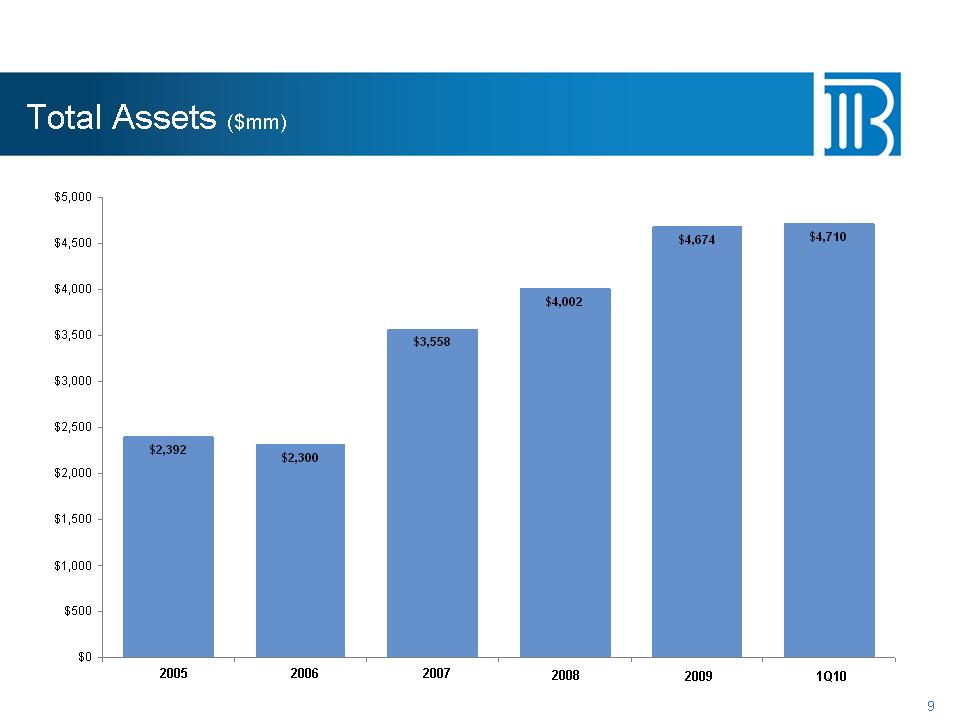

Total

Assets ($mm)

$5,000

$4,002

$4,674

$4,710

$4,000

$4,500

$3,558

$500

$1,000

9

$0

2005

2006 2007 2008 2009 1Q10

$2,300

$2,392

$3,000

$3,500

$2,500

$1

500

$2,000

$1,500

|

|

Deposit

Gathering

•

Education-based sales environment

•

Enhanced bundled product offerings to grow and

strengthen

targeted relationships

strengthen

targeted relationships

•

Focused and consistent business development

activities

•

Expanded cash management services to attract

larger

commercial relationships

•

Concentration on anchoring relationships through

g

p g

cross

referrals

10

|

|

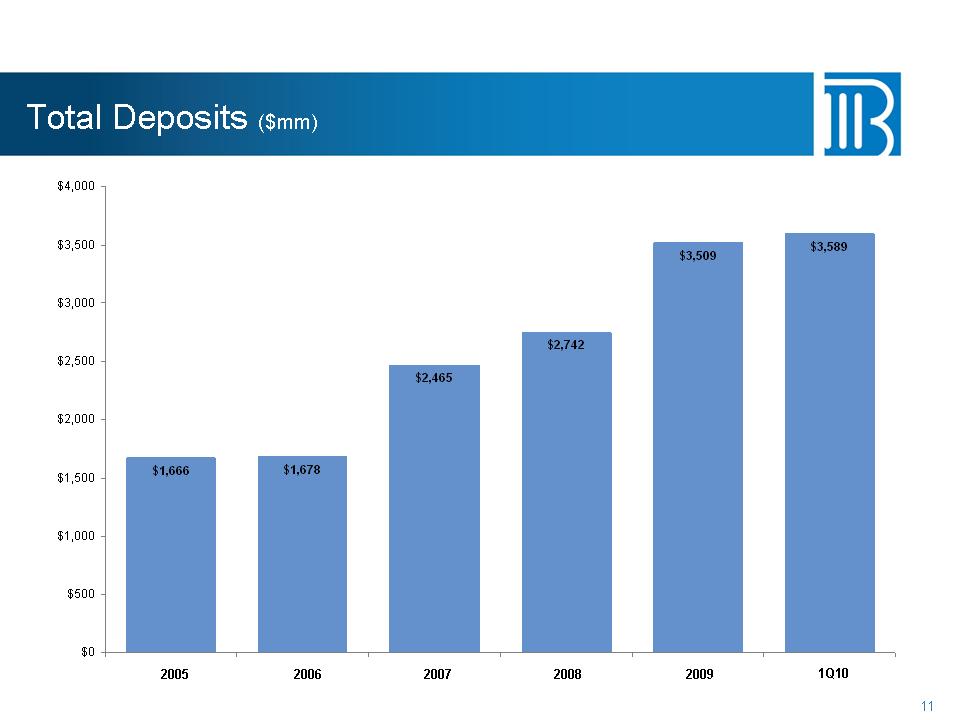

Total

Deposits ($mm)

$4,000

$3,509

$3,589

$3,000

$3,500

$2,742

$2,500

$1,500

$2,000

$500

$1,000

11

$0

2005

2006 2007 2008 2009 1Q10

$2,465

$1,678

$1,666

|

|

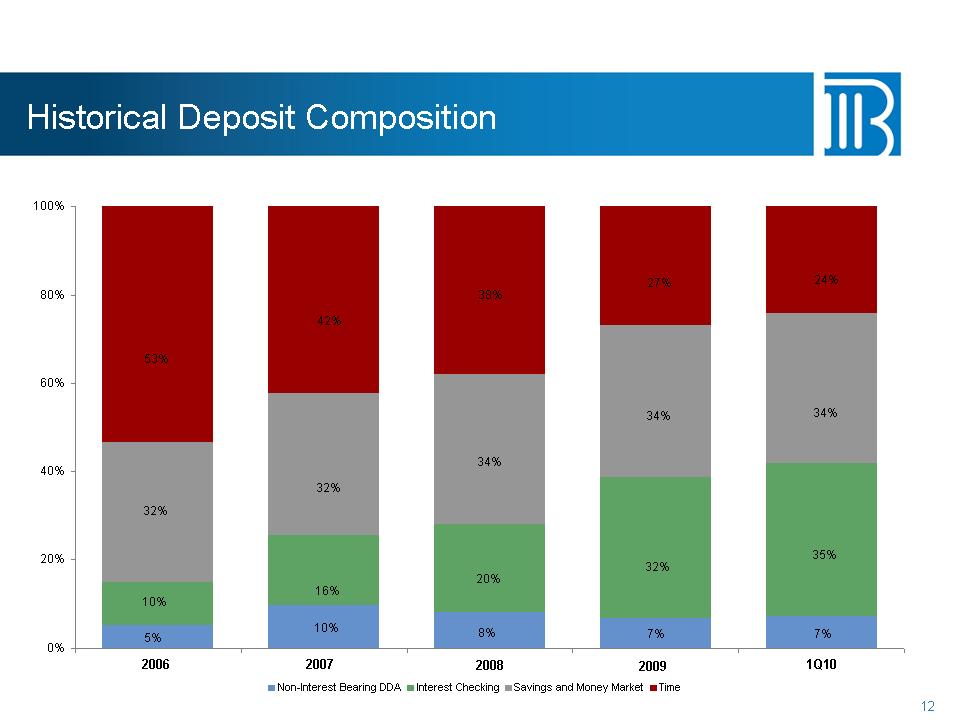

Historical

Deposit Composition

100%

80%

100%

38%

27%

24%

60%

53%

42%

34%

40%

32%

32%

34%

34%

34%

20%

10%

32%

16%

20%

32%

35%

12

0%

Non-Interest

Bearing DDA Interest Checking Savings and Money Market Time

2006

2007 2008 2009 1Q10

5%

10%

8% 7% 7%

|

|

Credit

Culture

•

In market lender and local decision maker

•

In-market lender and local decision maker

•

Disciplined underwriting through all credit cycles

•

No subprime lending

•

Portfolio lender

•

Diverse portfolio

–

Commercial

–

Consumer

–

Residential

•

Proactive risk management

Proactive

risk management

•

Enhanced credit infrastructure

•

Credit officers

•

Enhanced workout capability

Enhanced

workout capability

|

|

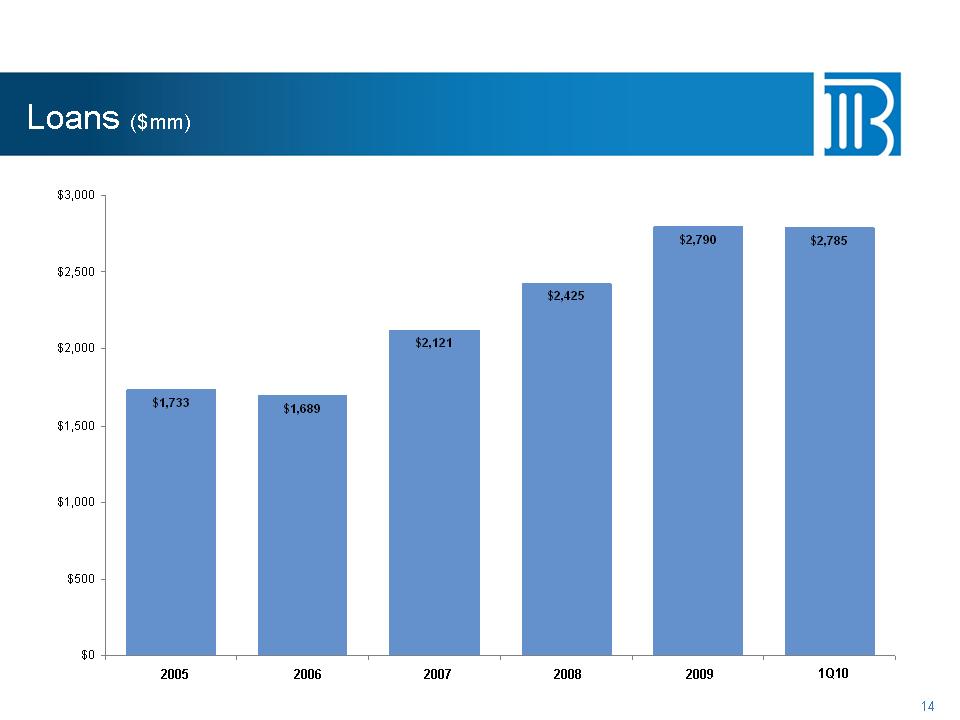

Loans

($mm)

$3,000

$2,425

$2,790

$2,785

$2,500

$2,121

$2,000

$1,000

$1,500

$500

14

$0

2005

2006 2007 2008 2009 1Q10

$1,689

$1,733 $1,689

|

|

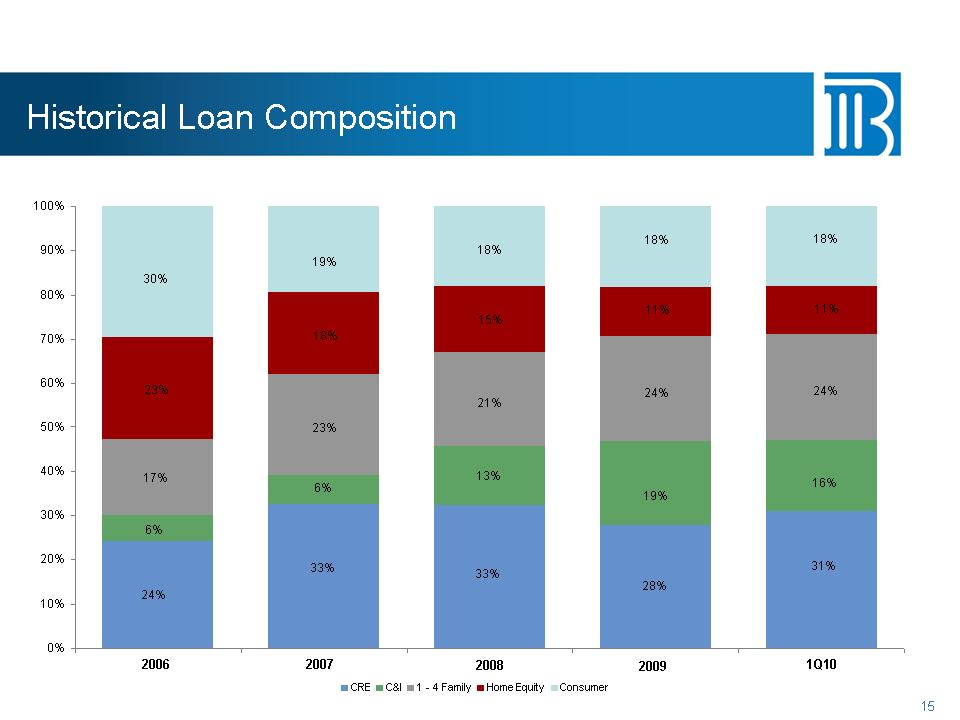

Historical

Loan Composition

100%

80%

90%

100%

11%

11%

30%

19%

18%

18%

18%

60%

70%

23%

18%

21%

15%

24%

11%

24%

11%

30%

40%

50%

17%

6%

23%

13%

19%

16%

10%

20%

30%

24%

6%

33%

33%

28%

31%

15

0%

CRE

C&I 1 -4 Family Home Equity Consumer

2006

2007 2008 2009 1Q10

|

|

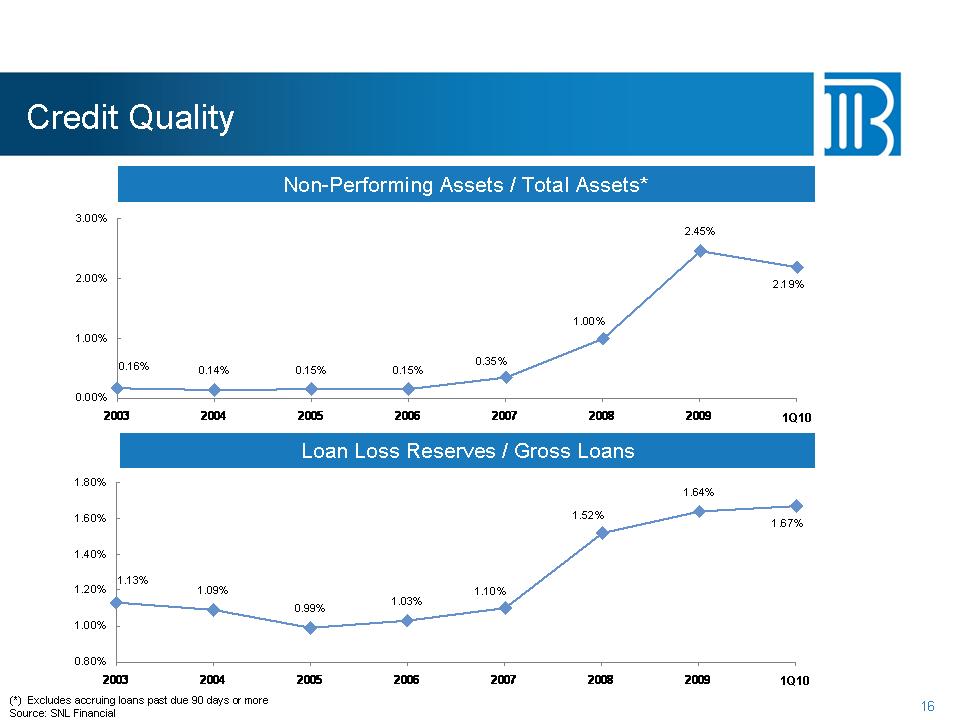

Credit

Quality

Non-Performing

Assets / Total Assets*

2.45%

2.19%

2.00%

3.00%

0.14%

0.15% 0.15%

1.00%

0.35%

0.16%

0.00%

1.00%

2003

2004 2005 2006 2007 2008 2009 2010

Loan

Loss Reserves / Gross Loans

2003

2004 2005 2006 2007 2008 2009 1Q10

1.64%

152%

160%

1.80%

1.09%

0.99%

1.03%

1.67%

1.52%

1.10%

1.13%

1.20%

1.40%

1.60%

16(*)

Excludes accruing loans past due 90 days or more

Source:

SNL Financial

0.80%

1.00%

2003

2004 2005 2006 2007 2008 2009 1Q10

|

|

Beneficial

Advisors, LLC

•

Long term trusted advisor model

•

14 advisors and retirement plan specialists

•

Client centered and solution driven consultative

process

–

Life events approach

Life

events approach

•

401(k) and retirement plan initiatives

•

Open architecture investment management platform

–

Independent non-biased offerings

•

Integrated sales model designed to grow core

deposits

17

deposits

|

|

Beneficial

Insurance Services, LLC

Long

term insurance advocate and business advisor

•

Long term insurance advocate and business advisor

model

•

$100 million in ppremium volume

•

Diverse lines of business, products and insurance

providers

–

C ilP dC l

Commercial

Property and Casualty

–

Life, Health and Employee Benefits

–

Professional Liability

–

Personal Lines for High Net Worth Individuals

•

Niche marketer with exclusive programs

•

FFormali lized cross refferrall process with ith other

sttrattegiic

d

th

areas

of the Bank

|

|

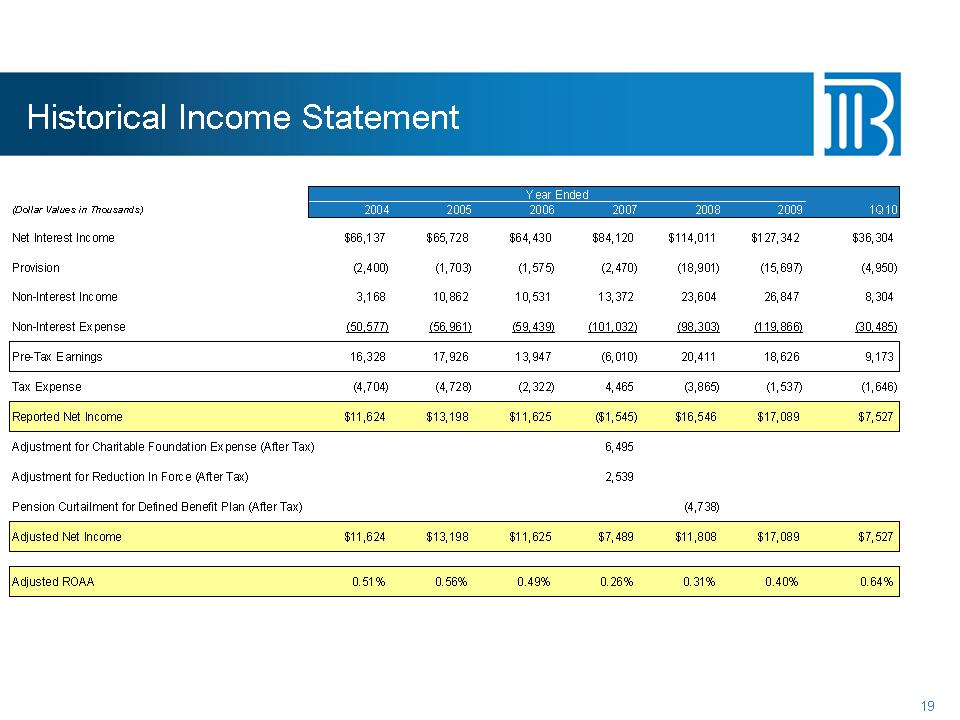

Historical

Income Statement

Year

Ended

(D

ll V l i Th d )(Dollar Values in Thousands) 2004 2005 2006 2007 2008 2009

1Q10

Net

Interest Income $66,137 $65,728 $64,430 $84,120 $114,011 $127,342

$36,304

Provision

(2,400) (1,703) (1,575) (2,470) (18,901) (15,697) (4,950)

Non-Interest

Income 3,168 10,862 10,531 13,372 23,604 26,847 8,304

Non-Interest

Expense (50,577) (56,961) (59,439) (101,032) (98,303) (119,866)

(30,485)

Pre-Tax

Earnings 16,328 17,926 13,947 (6,010) 20,411 18,626 9,173

Tax

Expense (4,704) (4,728) (2,322) 4,465 (3,865) (1,537) (1,646)

$

$ $ $ $ $ $Reported Net Income $11,624 $13,198 $11,625 ($1,545) $16,546

$17,089 $7,527

Adjustment

for Charitable Foundation Expense (After Tax) 6,495

Adjustment

for Reduction In Force (After Tax) 2,539

Pension

Curtailment for Defined Benefit Plan (After Tax) (4,738)

Adjusted

Net Income $11,624 $13,198 $11,625 $7,489 $11,808 $17,089

$7,527

Adjusted

ROAA 0.51% 0.56% 0.49% 0.26% 0.31% 0.40% 0.64%

19

|

|

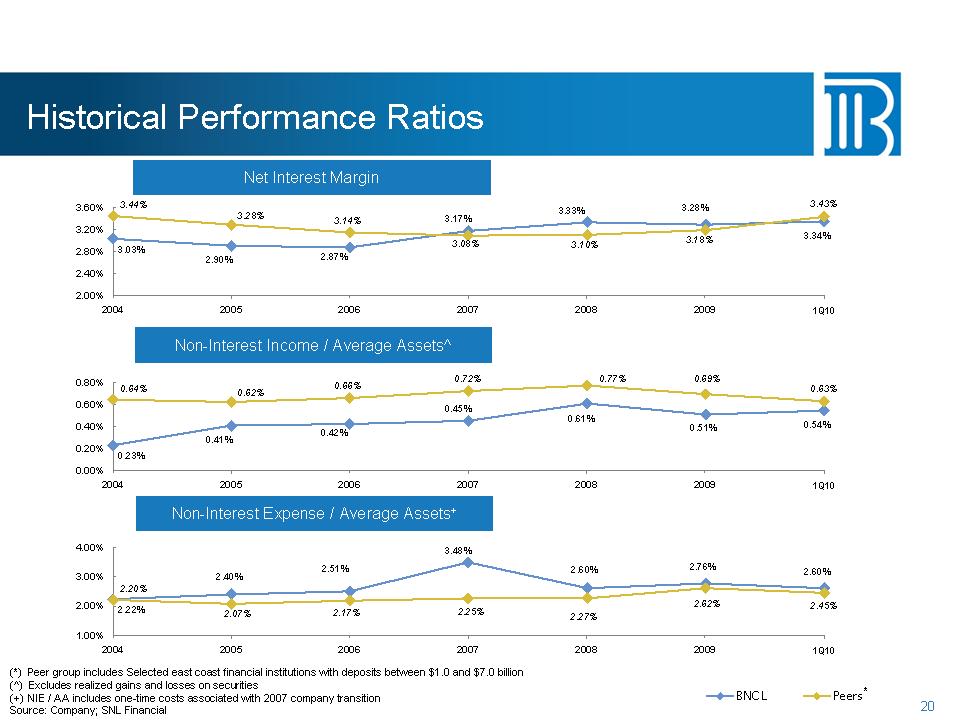

Historical

Performance Ratios

Net

Interest Margin

328%

3 44% 343% 360%

3.03%

2.90%

2.87%

3.33%

3.28%

3.17%

3.34%

3.08%

3.14%

3.44%

3.28%

3.10%

3.18%

3.43%

2.00%

2.40%

2.80%

3.20%

3.60%

2004

2005 2006 2007 2008 2009 20101Q10

Non-Interest

Income / Average Assets^

2004

2005 2006 2007 2008 2009 1Q10

0.45%

0.72%

0.66%

0.64% 0.62%

0.77%

0.69%

0.63%

0.60%

0.80%

Non

Interest Expense / Average Assets+

0.23%

0.41%

0.42%

0.61%

0.51%

0.45%

0.54%

0.00%

0.20%

0.40%

2004

2005 2006 2007 2008 2009 1Q10

Non-Interest

Expense / Average Assets

2.22%

2.40%

2.51%

2.60% 2.76%

3.48%

2.60%

2.25%

2.17%

2.20%

2.07%

2 27%

2.62%

2.45% 2.00%

3.00%

4.00%

20

BNCL

Peers

(*)

Peer group includes Selected east coast financial institutions with

deposits between $1.0 and $7.0 billion

(^)

Excludes realized gains and losses on securities

(+)

NIE / AA includes one-time costs associated with 2007 company

transition

Source:

Company; SNL Financial

*

2.07%

2.27%

1.00%

2004

2005 2006 2007 2008 2009 1Q10

|

|

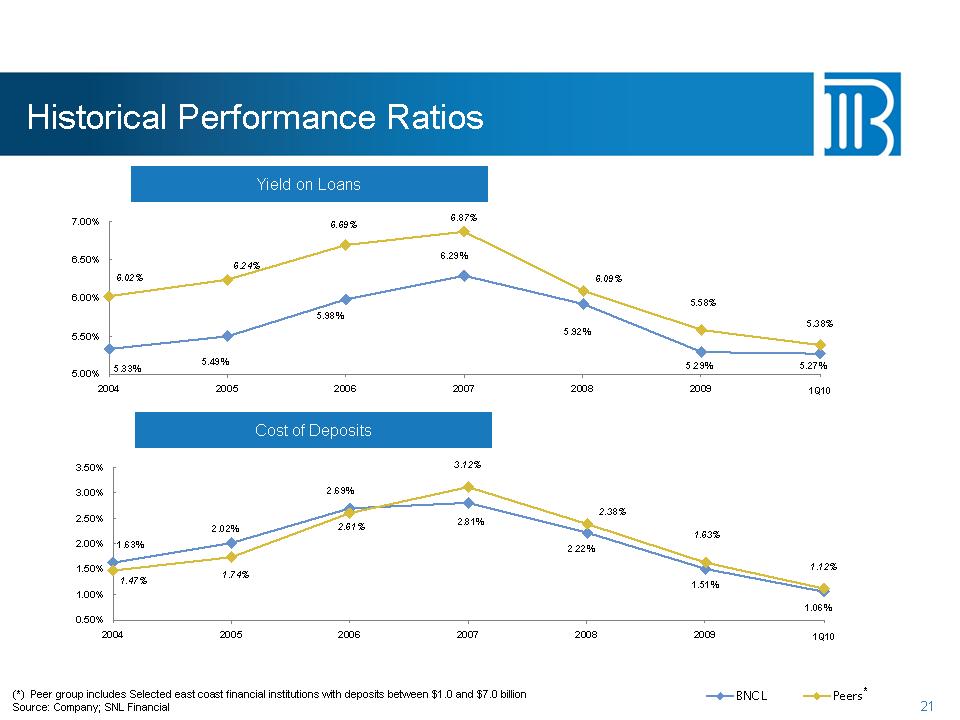

Historical

Performance Ratios

Yield

on Loans

6.29%

6.87%

6.69%

6.02%

6.24%

6.09%

5.58%

6.00%

6.50%

7.00%

5.33%

5.49%

5.98%

5.92%

5.29%

5.27%

5.38%

5.00%

5.50%

2004

2005 2006 2007 2008 2009 1Q10

Cost

of Deposits

2.69%

3.12%

238%

20%

3.00%

3.50%

1.63%

2.02%

2.22%

1.51%

2.81%

1.06%

2.61%

1.47%

1.74%

2.38%

1.63%

1.12%

050%

1.00%

1.50%

2.00%

2.50%

21

BNCL

Peers (*) Peer group includes Selected east coast financial institutions

with deposits between $1.0 and $7.0 billion

Source:

Company; SNL Financial

0.50%

2004

2005 2006 2007 2008 2009 1Q10

*

|

|

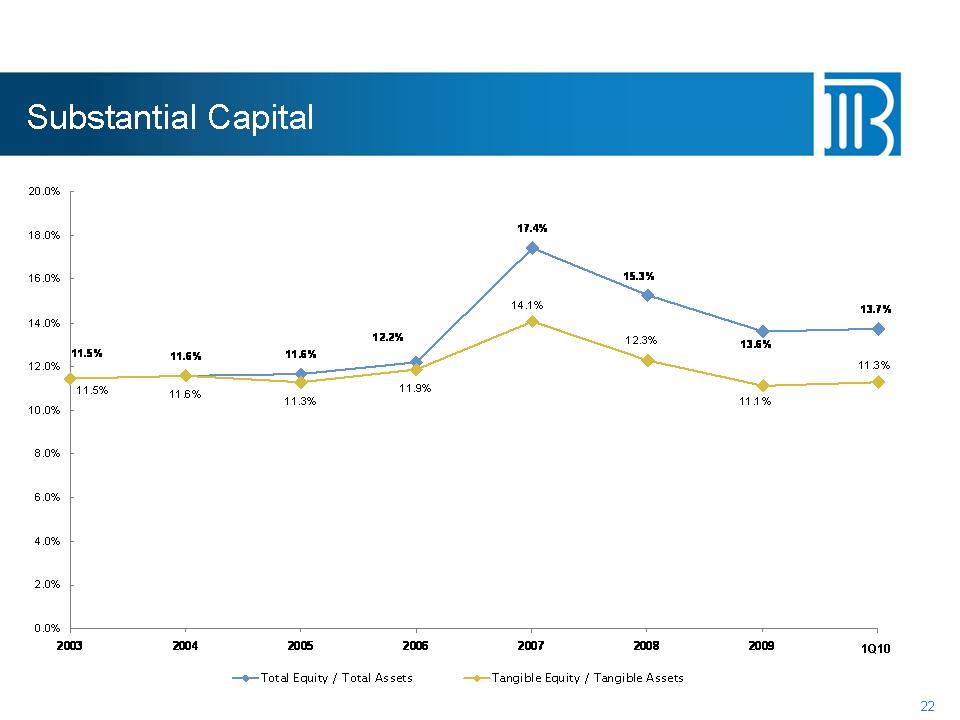

Substantial

Capital

20.0%

17.4%

13

7%

15.3%

14.1%

16.0%

18.0%

11.6%

11.6%

13.7%

11.6%

11.3%

11.9%

12.2%

13.6%

11.5%

11.3%

11.1%

12.3%

11.5%

10

0%

12.0%

14.0%

6.0%

8.0%

10.0%

2.0%

4.0%

22

0.0%

2003

2004 2005 2006 2007 2008 2009

Total

Equity / Total Assets Tangible Equity / Tangible Assets

1Q10

|

|

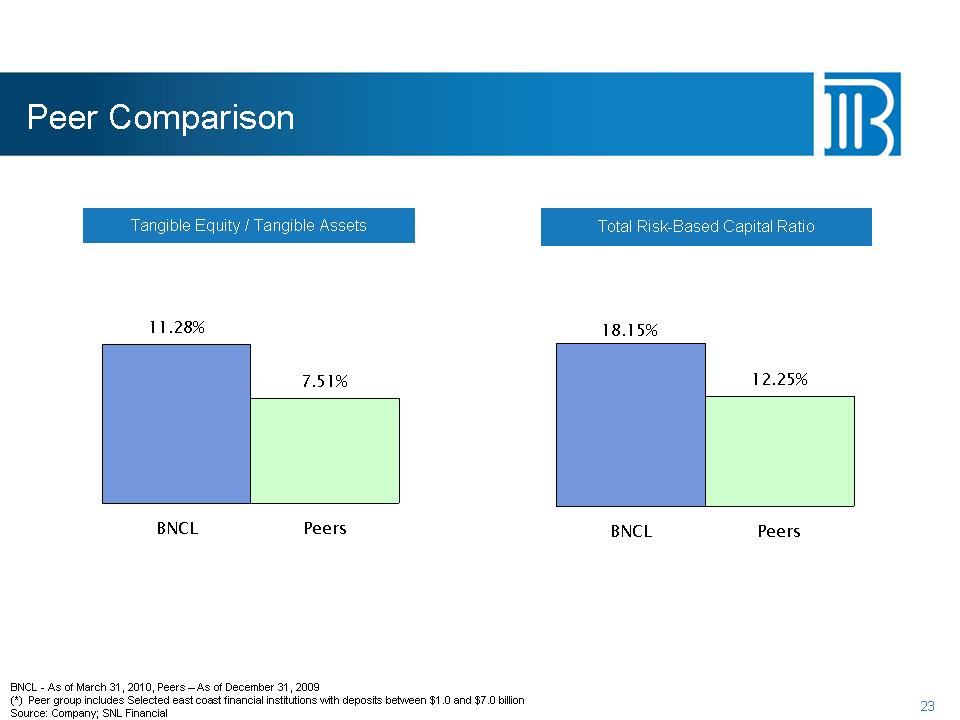

Peer

Comparison

Tangible

Equity / Tangible Assets Total Risk-Based Capital Ratio

11.28%

7.51%

12.25%

18.15%

BNCL

Peers BNCL Peers

23

BNCL

-As of March 31, 2010, Peers – As of December 31, 2009

(*)

Peer group includes Selected east coast financial institutions with

deposits between $1.0 and $7.0 billion

Source:

Company; SNL Financial

|

|

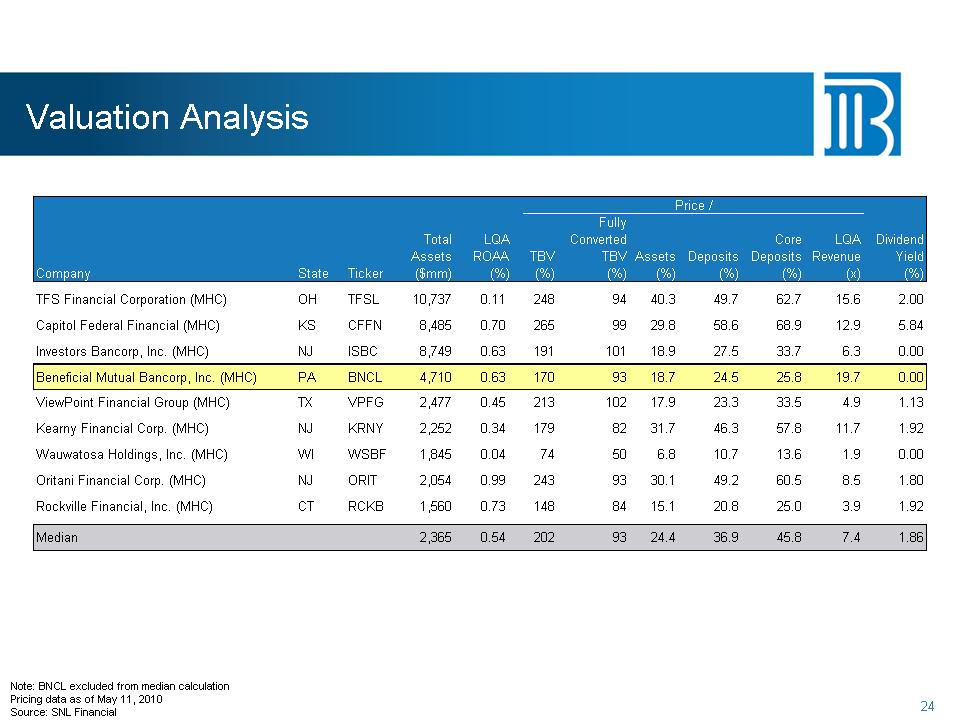

Valuation

Analysis

Price

/Price /

Fully

Total

LQA Converted Core LQA Dividend

Assets

ROAA TBV TBV Assets Deposits Deposits Revenue Yield

Company

State Ticker ($mm) (%) (%) (%) (%) (%) (%) (x) (%)

TFS

Financial Corporation (MHC) OH TFSL 10,737 0.11 248 94 40.3 49.7 62.7 15.6

2.00

Capitol

Federal Financial (MHC) KS CFFN 8,485 0.70 265 99 29.8 58.6 68.9 12.9

5.84

Investors

Bancorp, Inc. (MHC) NJ ISBC 8,749 0.63 191 101 18.9 27.5 33.7 6.3

0.00

Beneficial

Mutual Bancorp, Inc. (MHC) PA BNCL 4,710 0.63 170 93 18.7 24.5 25.8 19.7

0.00

ViewPoint

Financial Group (MHC) TX VPFG 2,477 0.45 213 102 17.9 23.3 33.5 4.9

1.13

Kearny

Financial Corp. (MHC) NJ KRNY 2,252 0.34 179 82 31.7 46.3 57.8 11.7

1.92

Wauwatosa

Holdings, Inc. (MHC) WI WSBF 1,845 0.04 74 50 6.8 10.7 13.6 1.9

0.00

Oritani

Financial Corp. (MHC) NJ ORIT 2,054 0.99 243 93 30.1 49.2 60.5 8.5

1.80

Rockville

Financial, Inc. (MHC) CT RCKB 1,560 0.73 148 84 15.1 20.8 25.0 3.9

1.92

Median

2,365 0.54 202 93 24.4 36.9 45.8 7.4 1.86

24

Note:

BNCL excluded from median calculation

Pricing

data as of May 11, 2010

Source:

SNL Financial

|

|

Independent

Rankings

•

BauerFinancial, Inc. has been a source for unbiased,

independent

bank and credit union ratings since 1983

–

Beneficial continues to receive Bauer’s highest, five-star

rating

–

Beneficial has earned a Bauer recommendation rating for the

past

78

consecutive quarters

•

Bank Director is the premier magazine written for directors of Bank

Director is the premier magazine written for directors of

financial

companies and has become recognized as an

essential

source for the top decision makers in the industry

Scorecard–

The Bank Performance Scorecard is compprised of six

pperformance

categories

that measure profitability, capitalization, and assetquality

–

Beneficial was ranked 66th in the annual Bank Performance

Scorecard

|

|

Independent

Rankings

•

BauerFinancial, Inc. has been a source for unbiased,

independent

bank and credit union ratings since 1983

–

Beneficial continues to receive Bauer’s highest, five-star

rating

–

Beneficial has earned a Bauer recommendation rating for the

past

78

consecutive quarters

•

Bank Director is the premier magazine written for directors of Bank

Director is the premier magazine written for directors of

financial

companies and has become recognized as an

essential

source for the top decision makers in the industry

Scorecard–

The Bank Performance Scorecard is compprised of six

pperformance

categories

that measure profitability, capitalization, and assetquality

–

Beneficial was ranked 66th in the annual Bank Performance

Scorecard

|

|

2010

Priorities

•

Education Company

–

Educating customers to do the right thing financially

•Cappital

Allocation

–

Continued fundamental organic growth

–

Opportunistic acquisitions

•

Enhanced Risk Managgement

–

Continue credit and loss prevention discipline

–

Enterprise control self-assessments

Educating

Cross•

Branch Network Opptimization Opppp ortunities

•

Relationship Banking

–

Align our customers’ needs with our products and services

•

Cross-Educating

|

|

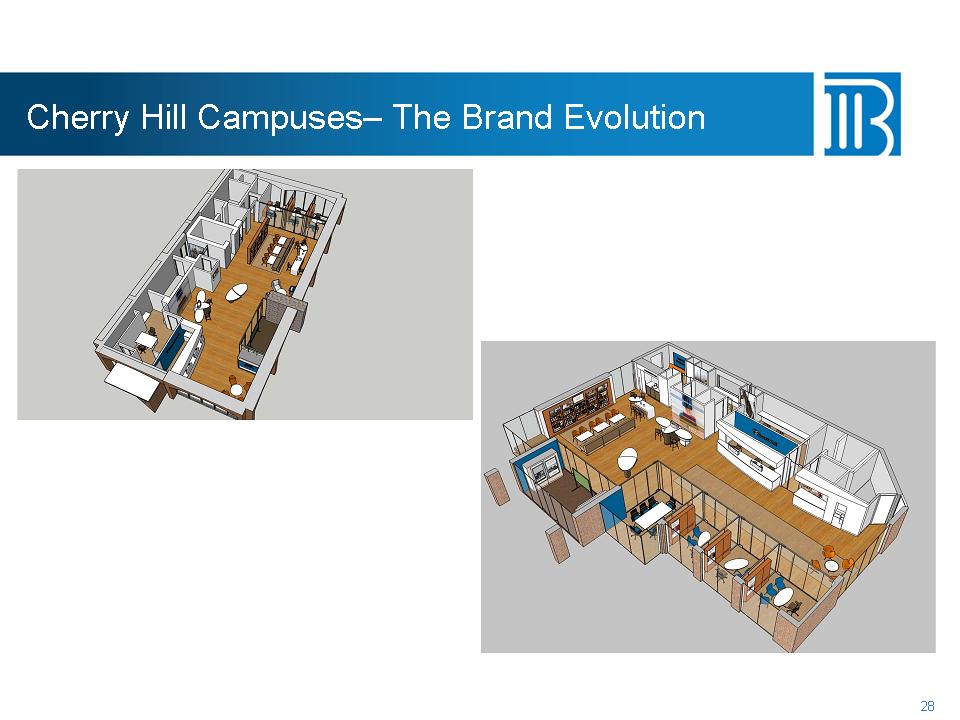

Cherry

Hill Campuses– The Brand Evolution

28

|

|