Attached files

| file | filename |

|---|---|

| 8-K - REHABCARE GROUP INC | eightk1q2010presentation.htm |

Investor Presentation

First Quarter 2010

Exhibit 99

n Headquartered in St. Louis, MO

n Established in 1982

n Largest contract manager of rehabilitation services; fourth largest post-acute hospital

operator, third largest long-term acute care hospital provider

operator, third largest long-term acute care hospital provider

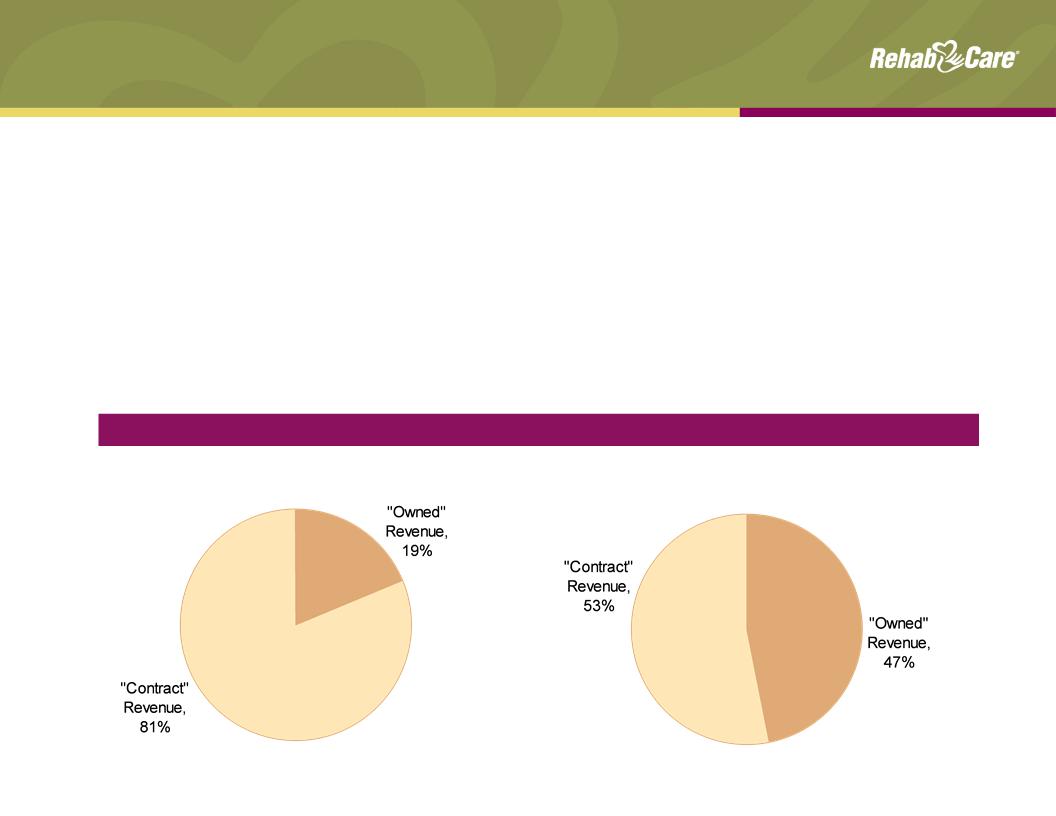

n Triumph HealthCare merger created more diversified business lines, reducing reliance on

management contracts for revenue and EBITDA streams

management contracts for revenue and EBITDA streams

1

FYE 2009 “Owned” Revenue vs. “Contract” Revenue

RehabCare ex. Triumph

Pro Forma w/Triumph

Company Overview

Division Overviews

Skilled Nursing Rehabilitation

Services (SRS)

Services (SRS)

n $499 mm - 39% of pro forma

revenue

revenue

n 1,125 SNF/long-term care

programs in 37 states

programs in 37 states

n 8.1 mm annual patient visits

n Polaris Group - consulting for

long-term care facilities

long-term care facilities

n VTA Management Services -

therapy and nurse staffing for

New York

therapy and nurse staffing for

New York

$1.3 billion pro forma operating revenues for LTM 3/31/10

Hospital Rehabilitation

Services (HRS)

n $178 mm - 14% of pro forma

revenue

revenue

n 144 hospital-based programs

in 32 states

in 32 states

n 43,000 IRF discharges/year

n 1.2 mm annual outpatient

visits

visits

n $594 mm - 47% of pro forma

revenue

revenue

n 29¹ LTACHs, 6 IRFs; 13 states

n 20 FS LTACHs, 9 HIHs; 4 FS

IRFs, 2 HIHs

IRFs, 2 HIHs

n 1,593 licensed LTACH beds;

243 IRF beds

243 IRF beds

n 410,000 annual patient days

LTACHs = Long-Term Acute Care Hospitals

IRFs = Inpatient Rehabilitation Facilities

SNFs = Skilled Nursing Facilities

FS = Freestanding

HIH = Hospital in Hospital

Hospital Division

2

1Includes Triumph Hospital-The Heights, which opened in April

13%

Patient Discharge Destination1

LTACH / SNF

IRF

No post-

acute care

acute care

Hospice/Home Health

65%

Acute care

hospital

hospital

3

Market Overview

2MedPAC Data Book, June 2009; does not include Home Health or

Medicare Advantage

Medicare Advantage

3Avalere Health LLC, April 2009; does not include Home Health or

Medicare Advantage

Medicare Advantage

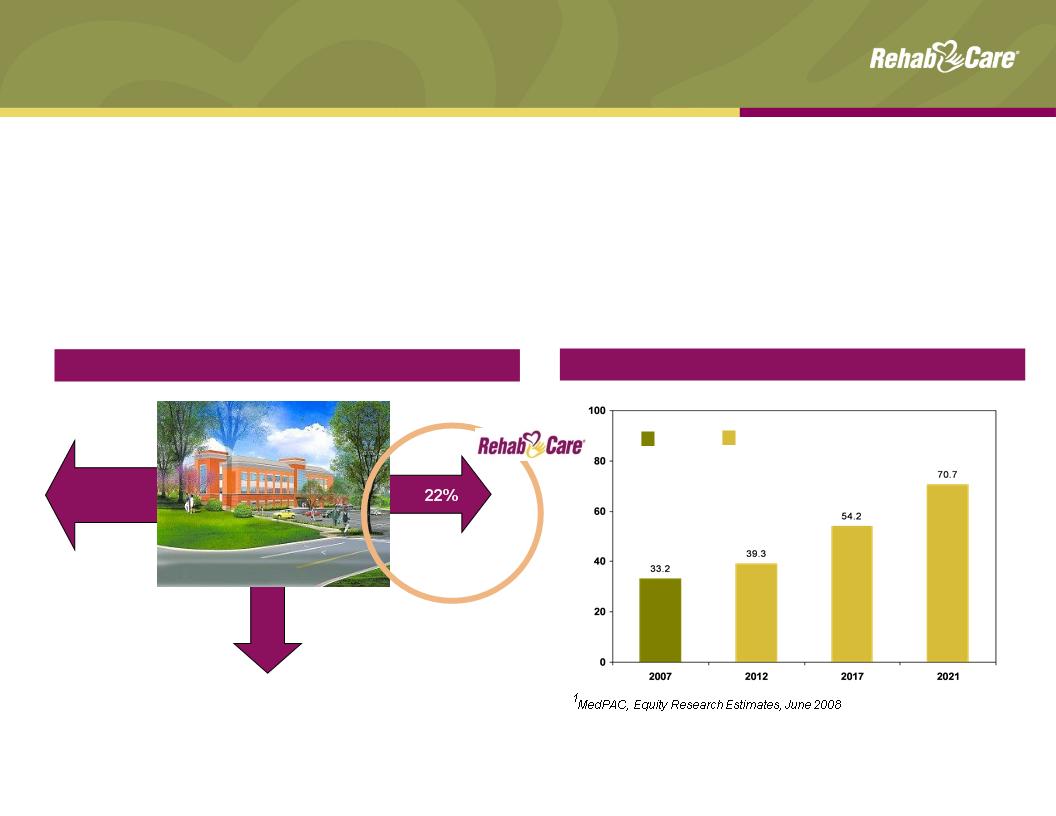

Medicare Post-Acute Spending (in billions)

$

n Large, growing and highly fragmented market

n Positive demographic trends, with first wave of Baby Boomers entering Medicare in 2011

n Medicare expenditures for post-acute services (excluding home health) projected to

increase 113% from 2007 to 2021

increase 113% from 2007 to 2021

n RehabCare delivers services across the post-acute continuum of care, providing

the most appropriate discharge destination for acute patients

the most appropriate discharge destination for acute patients

Projected3

Actual2

Hospital Division

Overview

Overview

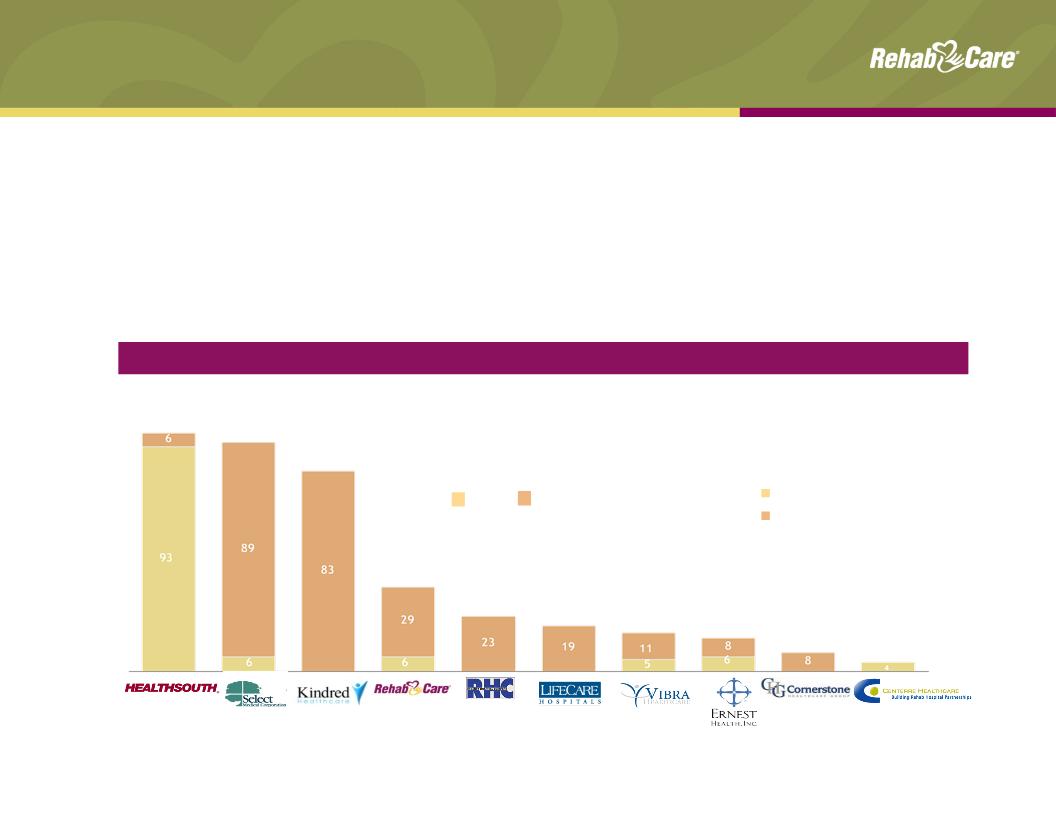

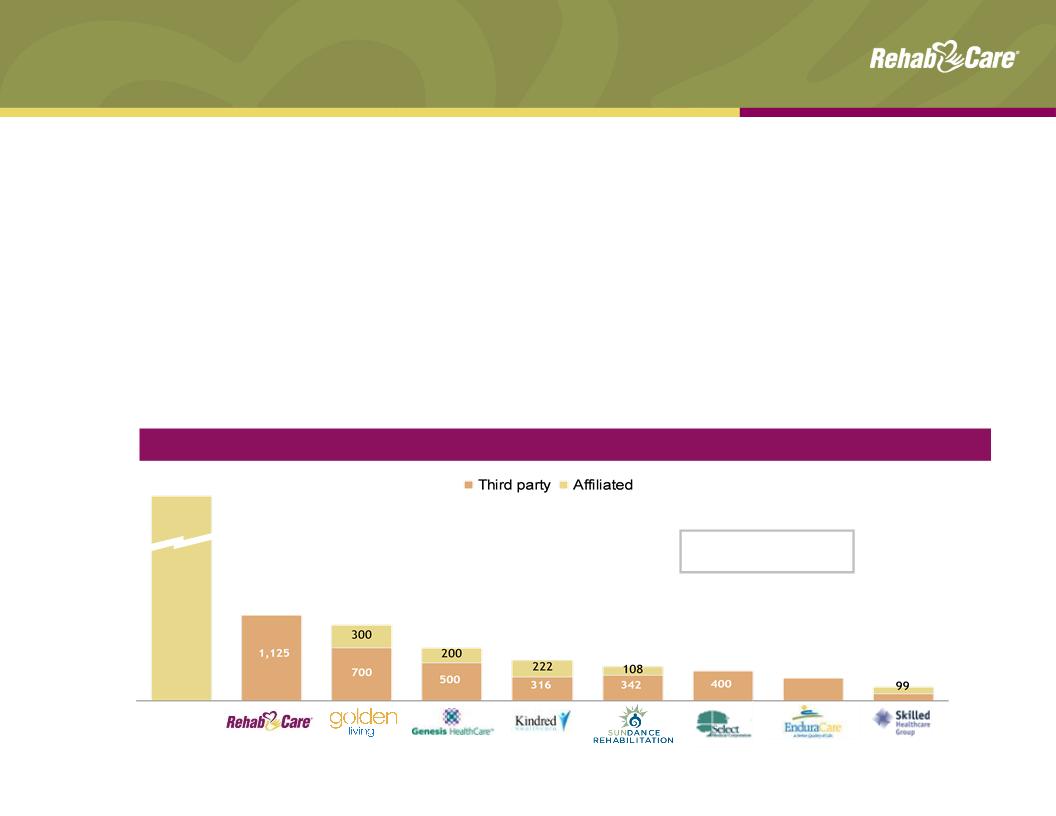

Competitive Landscape

1MedPAC, March 2010 Report to the Congress

2Includes Triumph Hospital-The Heights, which opened in April

n RehabCare pursues joint venture hospital partnerships (nine currently,

representing 15 locations) with market-leading acute care providers and physician

groups, in addition to its wholly owned facilities

representing 15 locations) with market-leading acute care providers and physician

groups, in addition to its wholly owned facilities

Market Size1: 221 IRFs

(Freestanding and HIHs)

Market Size1: 386 LTACHs

IRFs

LTACHs

4

Source: Information available from public filings or

from company websites

from company websites

99

95

83

35

23

19

16

14

8

4

2

n Division historically has been impacted by de novo start-up losses and infrastructure

investments; Triumph merger provides level of critical mass as well as ability to adopt

proven operational strengths

investments; Triumph merger provides level of critical mass as well as ability to adopt

proven operational strengths

n Triumph integration and expected synergies on track; early results from incorporating

Triumph’s case management and census development methodologies are positive

Triumph’s case management and census development methodologies are positive

n In Q1 10, Triumph reported 17.7% EBITDA1 margin after slow start; legacy hospitals

sequentially improved operating loss by $3.1 mm, excluding transaction costs

sequentially improved operating loss by $3.1 mm, excluding transaction costs

Hospital Division

Performance

Performance

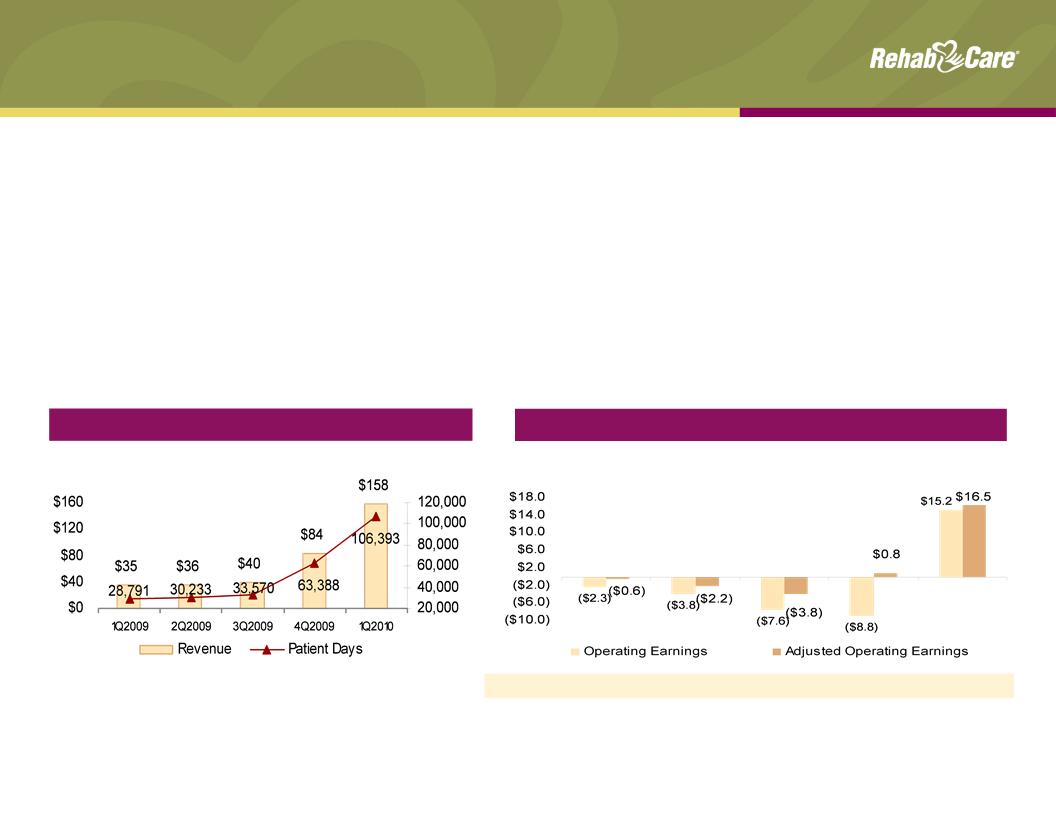

Operating Earnings ($ in millions)

1 See Appendix for Reconciliation to GAAP

2Includes $39.7 million in revenue and operating earnings of $3.7 million generated by Triumph

from 11/25/09 - 12/31/09

from 11/25/09 - 12/31/09

New Hospitals: 0 1 1 21 0

5

Revenue ($ in millions) and Patient Days

2

3

3

2

1Q2009 2Q2009 3Q2009 4Q2009 1Q2010

4

3Includes $112.6 million in revenue and operating earnings of $16.2 million from Triumph for

the three months ended March 31, 2010

the three months ended March 31, 2010

4 Operating earnings excluding start-up & ramp-up losses and transaction and severance

related costs, see Appendix for reconciliation to GAAP

related costs, see Appendix for reconciliation to GAAP

n Expect FY2010 revenue of $650 - $675 mm

n Anticipate EBITDA of $90 - $100 mm for FY2010

n Reflects the impact of:

n Market basket reductions for IRFs and LTACHs effective Apr. 1 and Oct. 1, 2010

n RY2011 proposed LTACH rule

n Reaffirm breakeven operating earnings run rate for 13 legacy hospitals by the end of

Q2 10 and breakeven operating earnings for FY2010

Q2 10 and breakeven operating earnings for FY2010

n Dallas LTACH anticipated to be accretive by end of Q2 10

n Triumph hospitals expected to achieve 18% to 20% EBITDA margins for FY2010

n Net income attributable to noncontrolling interests expected to approximate $3 million

for FY2010

for FY2010

n Patient Protection and Affordable Care Act (PPACA) extended LTACH provisions

contained in the 2007 Medicare, Medicaid and SCHIP Extension Act (MMSEA)

through the end of 2012 (see Appendix for summary of PPACA impact)

contained in the 2007 Medicare, Medicaid and SCHIP Extension Act (MMSEA)

through the end of 2012 (see Appendix for summary of PPACA impact)

Hospital Division

Outlook

Outlook

6

Skilled Nursing Rehabilitation Services (SRS)

Division overview

Division overview

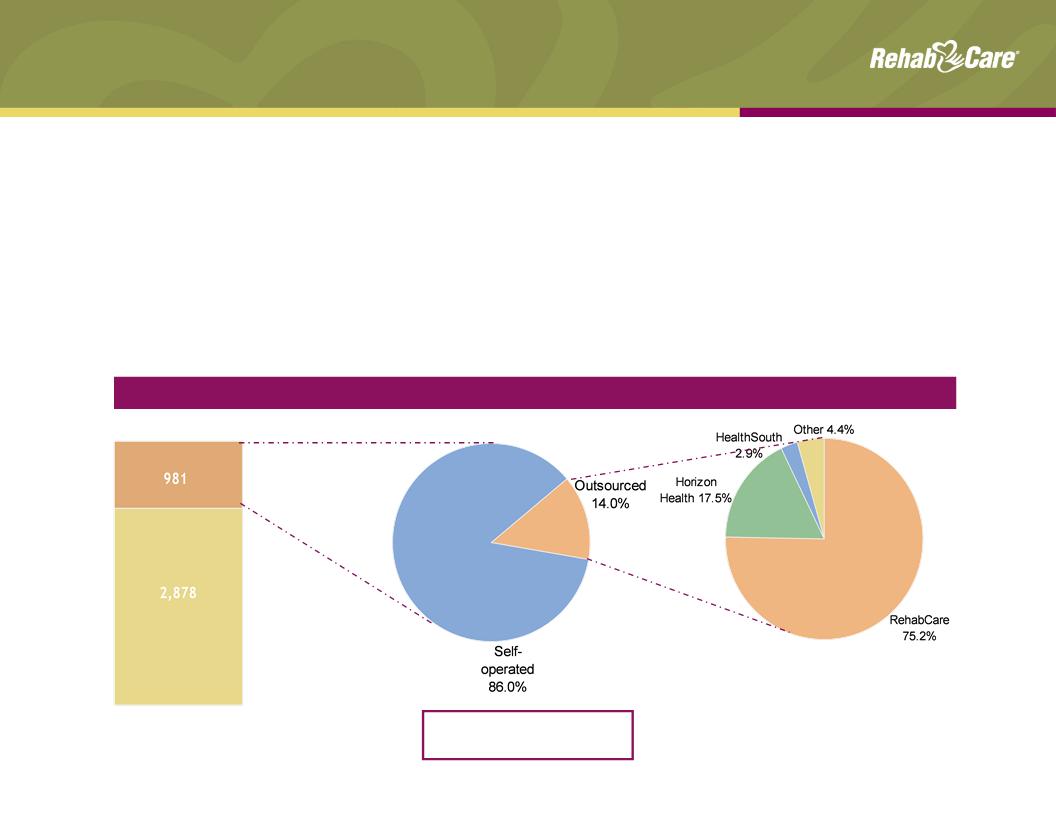

n Manages rehab programs for SNFs

n Each Medicare-certified SNF is required to provide physical, speech and occupational therapy,

but many lack the know-how and/or scale to effectively manage a program

but many lack the know-how and/or scale to effectively manage a program

n RehabCare provides a compelling value proposition to its SNF partners

n Access to advanced technology platform

n Broader array of clinical programming

n Better access to scarce therapist labor pool

n Reimbursement expertise and denials management

Source: Information available from public filings or from company websites

¹Source: MedPAC Report to Congress, March 2010

Competitive Landscape — # of facilities served

Self-

operated

11,000+

1,125

1,000

700

538

450

400

300

188

Market Size1: 15,000+

Medicare-certified SNFs

Medicare-certified SNFs

7

SRS Division

Advanced technology platform

Advanced technology platform

8

n Rolling out next generation point-of-service

(iTouch) technology and upgraded therapy

management platform to all programs by year

end

(iTouch) technology and upgraded therapy

management platform to all programs by year

end

n Increases speed and accuracy of data input

to maximize therapist productivity, reduce

billing errors and subsequent denials

to maximize therapist productivity, reduce

billing errors and subsequent denials

n Tracks real-time patient outcome data,

including discharge location and hospital

readmissions

including discharge location and hospital

readmissions

n Integrated Resource Utilization Group (RUG)

planner ensures appropriate RUG category

placement and appropriate payment

planner ensures appropriate RUG category

placement and appropriate payment

n Benchmarking reports provide national

comparative data and ability to track common

metrics across venues of care

comparative data and ability to track common

metrics across venues of care

SRS Division

Performance

Performance

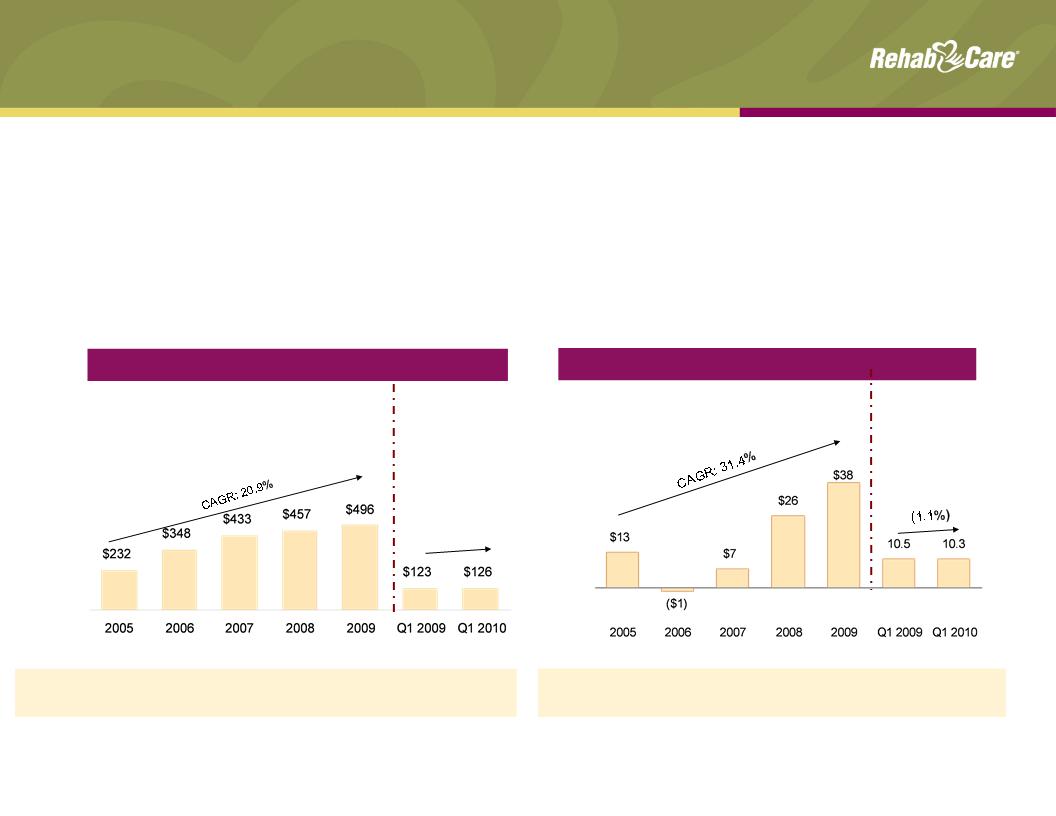

Note: Includes Symphony acquisition as of July 1, 2006

1Same store analysis does not include Symphony

% Margin: 5.5% (0.3%) 1.7% 5.6% 7.6% 8.5% 8.2%

Operating Earnings ($ in millions)

9

YOY growth: 35.5% 49.9% 24.4% 5.6% 8.5% 9.5% 2.6%

Same store: 8.4% 1.0%¹ 7.1%1 12.4% 8.8% 11.5% (0.6%)

n Significant same store revenue and margin growth since completion of Symphony

integration in 2007

integration in 2007

n Achieved 8.2% operating earnings margin in Q1 10, offsetting the impact of Part B

therapy caps through higher productivity and Part A volumes and better leveraging

of SG&A as a result of integrating Triumph

therapy caps through higher productivity and Part A volumes and better leveraging

of SG&A as a result of integrating Triumph

Revenue ($ in millions)

2.6%

SRS Division

Outlook

Outlook

10

n Expect 7% - 8% operating earnings margins for FY2010, driven by mid-single digit year

-over-year same store revenue growth

-over-year same store revenue growth

n Reflects the estimated impact of:

n New concurrent therapy rules that go into effect Oct. 1, 2010

n MDS 3.0 / RUGs IV implementation Oct. 1, 2010 or Oct. 1, 2011???

n Rollout of new technologies

n Pricing pressures

n Wage rate increases during the year

n Anticipate 50 to 75 net new units in 2010

n PPACA extended the Part B therapy cap exceptions process through 2010

Competitive Landscape

Have IRF

No IRF

n Manages hospital-based IRFs and outpatient therapy programs on a contract basis,

providing our partners with:

providing our partners with:

n Improved internal patient flow

n Ability to attract ≈ 30% admissions from external sources

n Successful clinical outcomes and broader clinical programming (brain, stroke, spinal dysfunction)

n Regulatory compliance (60% rule, RAC, 3-hour rule)

n Recruiting and labor management

3,8592 short-term acute

care hospitals

care hospitals

137 outsourced

Hospital Rehabilitation Services (HRS)

Division overview

Division overview

Market Size1: 981 hospital

-based IRFs

-based IRFs

Source: Information available from public filings or from

company websites

company websites

1MedPAC March 2010 Report to Congress

²American Hospital Directory

11

12

HRS Division

Performance

Performance

n Improved same store revenues and discharges in Q1 10 and achieved 16%

operating earnings margin; net unit count declined by one sequentially

operating earnings margin; net unit count declined by one sequentially

¹Includes $1.2 mm pretax charge from a bad debt write-down related to an

outpatient transaction

outpatient transaction

YOY growth: (0.5%) (5.3%) (8.7%) 0.9% 7.6% 7.2% 0.4%

IRFs: 120 115 107 113 106 113 103

Operating Earnings ($ in millions)

% Margin: 11.9% 13.2% 14.0% 13.3% 16.6% 14.6% 16.0%

1

Revenue ($ in millions)

CAGR: (1.6%)

0.4%

9.9%

HRS Division

Outlook

Outlook

n Expect 15% - 17% operating earnings margin for FY2010

n Anticipate 2 - 4% year-over-year growth in IRF same store discharges for

FY2010

FY2010

n Unit count expected to decrease in first half of year with recovery in second,

resulting in flat unit growth for year

resulting in flat unit growth for year

n 12 known unit openings YTD 2010 vs. 6 openings for TY2009

n Enhancing client value proposition through expanded

product offerings that better serve the needs of the

market

product offerings that better serve the needs of the

market

n Applying enabling technology, including:

n Electronic pre-screen to increase speed of admissions,

drive volumes

drive volumes

n Point-of-service technology to improve productivity and

regulatory compliance

regulatory compliance

n Upgraded inpatient outcomes management system to

enhance patient data tracking and provide benchmarking

capabilities

enhance patient data tracking and provide benchmarking

capabilities

|

Openings

|

YTD 2010

|

TY 2009

|

|

IRF

|

6

|

5

|

|

Skilled Nursing

|

4

|

0

|

|

Outpatient

|

2

|

1

|

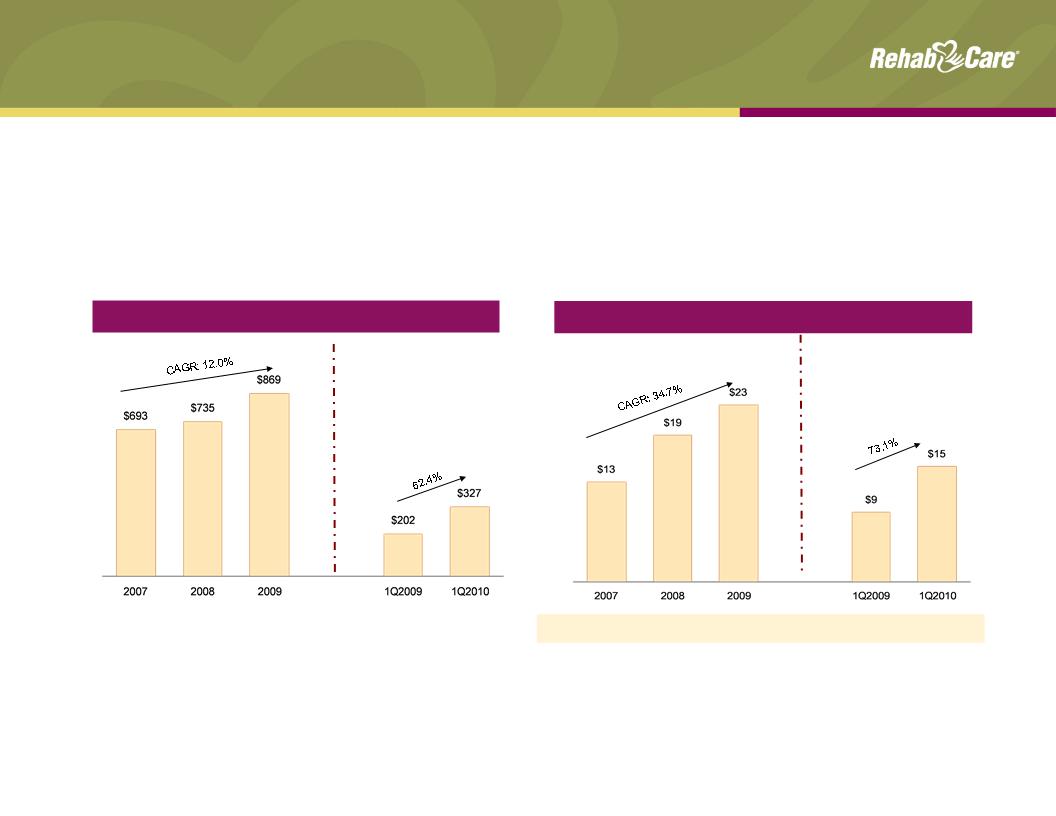

Revenue ($mm)

Net Earnings ($mm)

EPS: $0.732 $1.05³ $ 1.224 $0.48 $0.61

14

Consolidated Financial Summary

1RehabCare 2009 historical includes $39.7 million in revenue generated by Triumph

2Includes $0.17 per diluted share impairment charge on an intangible asset

3Includes $0.09 per diluted share in charges related to a bad debt write-down of an

outpatient transaction and cancellation of a planned acquisition and development project

outpatient transaction and cancellation of a planned acquisition and development project

4Includes transaction and severance related charges related to Triumph of $0.38 per

diluted share.

diluted share.

¹

n Anticipate strong consolidated revenue and net earnings growth for the full year

15

Consolidated Balance Sheet

n Cash flow from operations was $8.5 mm for three months ended Mar. 31,

2010 compared with $9.4 mm in the prior year period

2010 compared with $9.4 mm in the prior year period

n Days sales outstanding was 61.8 days at Mar. 31, 2010 compared to 60.2 days at

Dec. 31, 2009

Dec. 31, 2009

n Expect continued strong operating cash flow with DSO of approximately 60 -

63 days

63 days

n Capital expenditures anticipated to be $32 mm in 2010, consisting of $12.5

mm of information system investments; $12.5 mm in expansion projects and

$7 mm related to maintenance

mm of information system investments; $12.5 mm in expansion projects and

$7 mm related to maintenance

Cash and Cash Equivalents

Total Assets

Total Debt

Stockholders’ Equity

Noncontrolling Interests

Percent of Debt to Total Capital¹

($mm)

$ 27.4

1,124.9

453.8

453.6

22.6

49%

3/31/10

1Total capital represents the sum of debt, stockholders’ equity and noncontrolling interests

16

Safe Harbor

Forward-looking statements have been provided pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Such statements

are based on the Company’s current expectations and could be affected by

numerous factors, risks and uncertainties discussed in the Company’s filings with

the Securities and Exchange Commission, including its most recent report on

Form 10-K, subsequent reports on Form 10-Q and current reports on Form 8-K.

Do not rely on forward looking statements as the Company cannot predict or

control many factors that affect its ability to achieve the results estimated. The

Company makes no promise to update any forward looking statements whether as

a result of changes in underlying factors, new information, future events or

otherwise.

provisions of the Private Securities Litigation Reform Act of 1995. Such statements

are based on the Company’s current expectations and could be affected by

numerous factors, risks and uncertainties discussed in the Company’s filings with

the Securities and Exchange Commission, including its most recent report on

Form 10-K, subsequent reports on Form 10-Q and current reports on Form 8-K.

Do not rely on forward looking statements as the Company cannot predict or

control many factors that affect its ability to achieve the results estimated. The

Company makes no promise to update any forward looking statements whether as

a result of changes in underlying factors, new information, future events or

otherwise.

Appendix

17

Impact of Healthcare Reform

n Extends LTACH provisions of MMSEA through Dec 2012

n Maintains existing status related to 25% Rule and short-stay outliers

n Delays one-time budget neutrality adjustment (estimated at 3.75%)

n Continues moratorium on new LTACH beds while facility criteria is established

n Extends auto exception process for Part B therapy caps through Dec. 31, 2010

n Delays implementation of RUGs IV until Oct. 1, 2011

n Establishes reductions in market basket updates for IRFs and LTACHs

n Productivity (negative) adjustments for SNFs, IRFs and LTACHs beginning in 2012

n Prohibits physician ownership of hospitals, effective Dec. 31, 2010, and creates

new transparency, reporting and expansion requirements for “grandfathered”

hospitals

new transparency, reporting and expansion requirements for “grandfathered”

hospitals

18

|

|

Apr. 1, 2010

|

RY 2011

|

RY 2012-13

|

RY 2014

|

RY 2015-16

|

RY 2017-19

|

|

IRF

|

0.25

|

0.25

|

0.10

|

0.30

|

0.20

|

0.75

|

|

LTACH

|

0.25

|

0.50

|

0.10

|

0.30

|

0.20

|

0.75

|

Impact of Healthcare Reform

n Beginning in 2012, allows providers organized as Accountable Care Organizations

that voluntarily meet quality thresholds to share in cost savings achieved in

Medicare program

that voluntarily meet quality thresholds to share in cost savings achieved in

Medicare program

n Establishes a national pilot program by 2013 to study effectiveness of bundled

payment system for hospital+physician+post-acute services delivered three days

prior to hospitalization through 30 days post-discharge

payment system for hospital+physician+post-acute services delivered three days

prior to hospitalization through 30 days post-discharge

n In 2015, establishes Medicare Independent Payment Advisory Board (IPAB); IRFs

and LTACHs exempt from any binding proposals of IPAB

and LTACHs exempt from any binding proposals of IPAB

19

20

Primary Post-Acute Settings

Overview

Overview

|

|

Long-Term Acute Care Hospitals

|

Skilled Nursing Facilities

|

Inpatient Rehab Facilities

|

|

Medicare

Spending 2009 |

$4.6 billion

|

$25.5 billion

(est. $6 billion rehab) |

$5.8 billion

|

|

Patients Served

2008 |

130,869 Medicare discharges

|

2.6 million Medicare admissions

|

370,048 Medicare discharges

|

|

Type of Patient

|

High acuity, at least 25 days

|

Low to moderate acuity, may

require some rehab |

High acuity, requires extensive

rehab (min 3 hrs/day) |

|

Avg. Length of

Stay |

At least 25 days

|

27 days

|

13.2 days

|

|

Medicare

Reimbursement |

LTACH PPS - Receive a single payment

when Medicare beneficiary is discharged for all services rendered |

SNF PPS - Receive a per diem

payment under both Medicare Part A and state Medicaid programs |

IRF PPS- Receive a single

payment when Medicare beneficiary is discharged for all services rendered |

|

Medicare

Requirements |

• Patients must have an average length

of stay of >25 days • 25% rule: no more than 25% of

patients may be referred from a single source (fixed at 50% through 2012) • Moratorium on new LTACH beds until

2013 |

Medicare covers up to 100 days

of SNF care following an acute hospital stay of at least 3 days |

60% Rule: 60% of patients

must satisfy one of 13 defined conditions |

Source: MedPAC

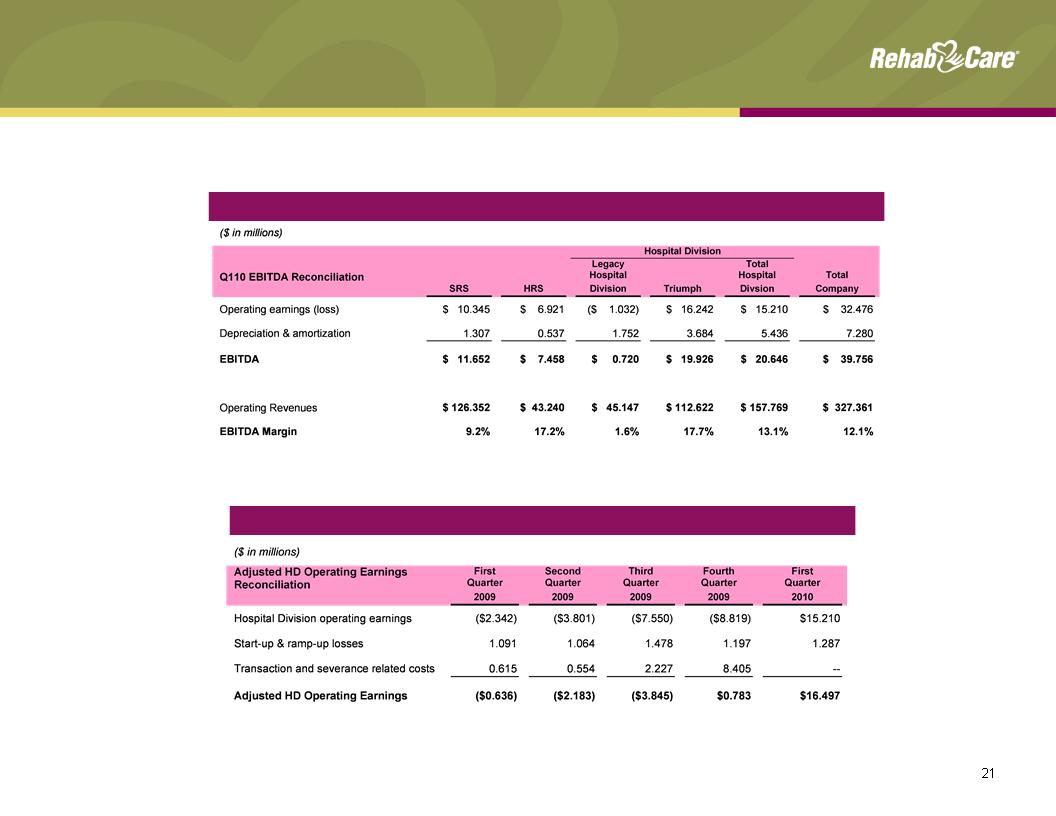

Q110 EBITDA and Hospital Division Adjusted

Operating Earnings Reconciliations

Operating Earnings Reconciliations

Hospital Division Adjusted Operating Earnings

Q110 EBITDA Reconciliation