Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TELLURIAN INC. /DE/ | d8k.htm |

Financing Review

May, 2010

New York

William H. Hastings

Portland, Maine

Exhibit 99.1 |

Forward-Looking Statements

Forward-Looking Statements

Except

for

historical

information,

this

presentation

contains

forward

looking

statements

and

information

with

respect

to

net

reserve

valuations

and

sums,

gas

sales

in

Australia

and

its

valuation,

oil

and

gas

development

projects,

expense

reduction

plans

and

other

potential

development

projects,

exploration

and

drilling

plans.

These

statements

are

subject

to

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

those

expressed

or

implied

from

such

information.

The

United

States

Securities

and

Exchange

Commission

(SEC)

permits

oil

and

gas

filings

with

the

SEC

to

disclose

only

proved

reserves

that

a

company

has

demonstrated

by

actual

production

or

conclusive

formation

tests

to

be

economically

and

legally

producible

under

existing

economic

and

operating

conditions.

Investors

are

urged

to

consider

closely

the

disclosures

in

Magellan’s

periodic

filings

with

the

SEC

available

from

us

at

the

company’s

website

www.magellanpetroleum.com |

Magellan; publicly listed E&P company

•

$112mm market Cap trading under the symbol : MPET

No Sell-Side Research Coverage

$38mm of Cash and no debt

•

Net of A$15 million spent for recent Evans Shoal property

acquisition Owns onshore gas fields in Australia

•

$20mm of Proved PV-10 as of June 30, 2009

•

Proved reserves understate physical reserves as Gas Contracts with

Darwin are expiring •

If full gas sales are achieved, PV-10 is $70-80 million.

New management installed in 2008

New Strategic investor acquired 27% stake in 2009

Acquired two growth projects,

•

the Poplar Dome fields in Montana

•

the Evans Shoal gas field, offshore Australia

•

Together, the fields have 450 million BOE of net resource

(adjusted for CO2 content) •

220 million BOE is planned for development by 2014

Overview

Key Points |

1954

1954

•

•

MPET listed as exploration-oriented oil company

MPET listed as

exploration-oriented oil

company

-oriented

oil company oriented oil company

1960’s

1960’s

•

•

Amadeus Basin Gas Fields in Central Australia discovered with partner,

Santos. Amadeus Basin Gas Fields in Central Australia discovered

with partner, Santos.

rtner, Santos.

1980’s and 90’s

1980’s and 90’s

•

•

Pipeline completed connecting gas fields and Darwin. Gas

fields Pipeline completed connecting gas fields and

Darwin. Gas fields produce 40 mmcfd

produce 40

mmcfd

mmcfd

gross for more than

gross for more than

25 years.

25 years.

2003

2003

•

•

Amadeus

Amadeus

Basin

Basin

Gas

Gas

Fields

Fields

lose

lose

tender

tender

for

for

renewal

renewal

of

of

25

25

year

year

gas

gas

sales

sales

contract

contract

to

to

Darwin

Darwin

to

to

Eni’s

Eni’

s

’s

s

Black

Black

Tip offshore field to spur development of this undeveloped field

Tip offshore field to spur development of this undeveloped field

December 2008

December 2008

•

•

Bill

Bill

Hastings

Hastings

is

is

hired

hired

as

as

new

new

CEO

CEO

with

with

mandate

mandate

to

to

reposition

reposition

company.

company.

July 2009

July 2009

•

•

YEP

YEP

Energy

Energy

Fund

Fund

completes

completes

$10mm

$10mm

strategic

strategic

investment

investment

and

and

adds

adds

Wilson

Wilson

and

and

Bogachev

Bogachev

to

to

Board

Board

October 2009

October 2009

•

•

Announced

Announced

HOA

HOA

and

and

Exclusivity

Exclusivity

with

with

Major

Major

Global

Global

Methanol

Methanol

producer

producer

October 2009

October 2009

•

•

Acquired

Acquired

control

control

of

of

69%

69%

(57.4%

(57.4%

effective)

effective)

interest

interest

in

in

Poplar

Poplar

Dome

Dome

Fields

Fields

in

in

Montana

Montana

for

for

MPET

MPET

stock

stock

April 2010

April 2010

•

•

Acquired

Acquired

40%

40%

interest

interest

in

in

from

from

6.5

6.5

to

to

8

8

TCF

TCF

(Santos

(Santos

6.6

6.6

TCF)

TCF)

undeveloped

undeveloped

gas

gas

field

field

in

in

Australia

Australia

for

for

$91mm

$91mm

•

•

Announced

Announced

acquisition

acquisition

of

of

an

an

additional

additional

26%

26%

interest

interest

in

in

Poplar

Poplar

Dome

Dome

fields

fields

for

for

$5

$5

mm

mm

cash.

cash.

Background |

Management Team

Management Team

100 years + of oil industry experience (added last

year) •

William Hastings

Joined in 2008, retired in 2007 from Marathon Oil

Corporation after 27 years there. Last 8 years (off/on) involved

with North Sea (Alvheim development) and Africa (EGLNG)

Undergraduate and MBA degrees (Purdue and Indiana)

•

J. Tom Wilson

Founded international group at Apache Corporation; managed

first entry into Australia Board Member representing YEP

Investment Fund CEO of Khanty

Mansysk

Oil (KMOC) sold to Marathon

•

Nikolay

Bogachev

Chairman

and

CEO

of

the

two

Companies

that

developed

Yamal

LNG;

sold

to

GazProm

in

2006

Board Member representing YEP Investment Fund

Founder of Khanty

Mansysk

Oil

•

Hugh Roberts

Commercial Advisor. Retired from Marathon Oil as Manager of

Industry/Regulatory Affairs Past Vice Chairman of Gas Industry

Standards Board •

COO and CFO being recruited

Advisory Roles

•

Les Thomas

•

Currently Group Director, Production Facilities, Wood Group.

Formerly President, Marathon Oil UK Offices in Portland,

Maine; Denver, Colorado; Brisbane, Australia |

|

Elm Coulee Bakken play

“Brigham”

Bakken play

Magellan Poplar Dome

Saskatchewan Power

potential CO2 separation

project

Existing CO2 extraction

and sale plant and

pipeline (shown in solid

red)

Existing , successful CO2

flood properties

Burlington Northern Mainli

(black)

Northern Border Gas Pipeli

(light blue) |

Poplar Dome Plans -

Poplar Dome Plans -

2011

2011

•

Drill Infill wells, Evaluate Bakken JV, Test CO2 factors

Infill

•

Drill up to eight infill wells out of thirty-six infill

locations •

Probable reserves at 600k to 1.2 million barrels per well

•

Capital cost for eight wells will be $12 million

•

Finding and Development costs are $2.50 per barrel

•

Further geophysical work on correlations with emphasis on NW syncline

and southwest nose Bakken

•

Evaluate farm-out and joint venture options for 23,000 ac. Bakken

play •

Existing well penetrations, good reservoir quality,

source shale for other Poplar zones •

Third party engaged to manage the process. Working

partner issues. Target completion August, 2010 CO2

Flood •

Complete three single well tracer operations to test Residual Oil

saturation •

CO2 effectiveness driven by saturation

•

Examine part-scale startup economics for northwest side of the

field. |

Growth Opportunity

Growth Opportunity

2. Gas to Methanol development, offshore Australia

Signed Agreement to acquire a 40% operating interest in the Evans

Shoal field, offshore Australia with estimated gross contingent

resources of 6.5 to 8 TCF (analysis dependent) and

50 mmbbls condensate. •

Resource acquisition cost of $182 million equates to 5.7

cents/mcf in the ground or 33 cents/ barrel equivalent

•

Will pay $91 million to Santos at Closing

•

Contingent $45 million due on development plan approval:

second contingent $45 million due at first gas

•

Partners are Shell (25%), Petronas (25%), and Osaka Gas

(10%) Development plan addresses less than 25% of reserves

•

Significant Capital Project in partnership with large petrochemical

companies •

$3.7 billion gross including field, plant, and pipeline.

$1.5 billion net or $2.00 per mcf •

Methanol value yield $325 per Ton is $10.50/mmbtu at plant inlet

gas (adjusted for plant shrinkage, but using

CO2) Global Methanol demand expected to grow at 8%

•

From 2009 to 2014, demand sources from DME and MEOH fuel additive

growth •

Methanol demand has already increased by 250% since 1995

|

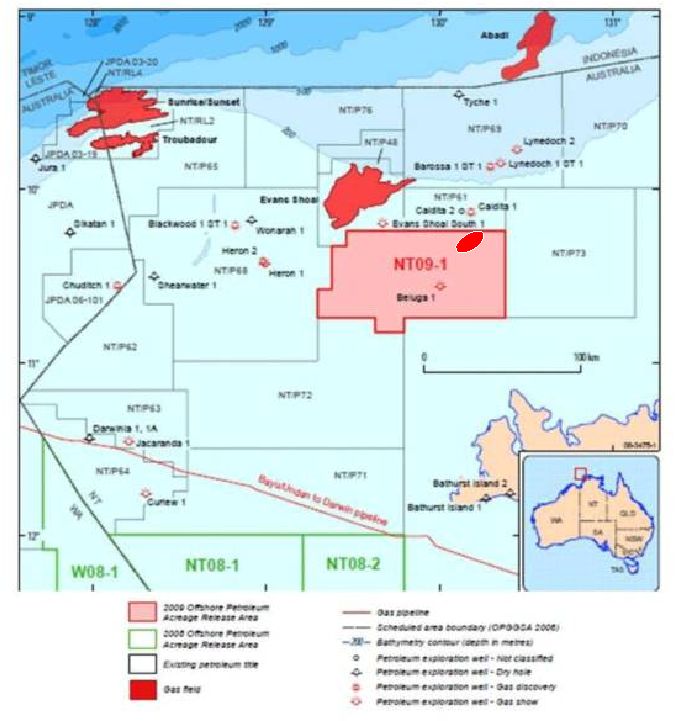

Abadi 10-14.5 TCF

Evans Shoal 8 TCF

Heron /Blackwood 1.5 TCF

Greater Sunrise 6+ TCF

Black Tip 500 BCF

Petrel & Tern 2 TCF

Caldita -

Barossa 6 TCF

Turtle/Barnett (Undeveloped Oil)

Chuditch 700 BCF

Bayu Undan 8 TCF

Ichthys 14 TCF

Kelp 700 BCF

Montara 2 TCF

Saratoga & Prometheus 1.5 TCF

Crux, Padthaway Complex 2 TCF

Brewster 800 BCF

Scott Reef & Brecknock 18 TCF

Darwin

Lynedoch 1 TCF

Vienta, Waggon Creek, Weaber (Gas)

Mapped; 82 TCF

Frigate Deep 500 BCF

Evans Shoal South 500 BCF |

|

Australia Gas to Methanol Overview

Australia Gas to Methanol Overview

•

Development using excess CO2 in process |

Evans Shoal Plans

Evans Shoal Plans

•

Size and Gas quality testing, followed by development

Fiscal 2011 Plan

•

Receive Co-owner vote to become Operator

•

$80 million gross capital expenditure

•

$32 million net

•

Two delineation wells with significant testing component

•

Transition seismic work across shallow shoal zone

•

Further geophysical work on correlations with emphasis on NW syncline

and southwest nose Fiscal 2012 to 2014 Plan

•

Target FID (Final Investment Decision) for

Q3 2012 •

Minimum development plan (field only) ; $560 million gross

•

Nine total production wells

•

Shallow water, subsea tie backs to jackup production platform

•

Water and CO2 separation facilities as needed (Pipeline to

shore requires all water be removed) Production startup, 360

mmcfd minimum, 2015 |

Legacy Projects

Legacy Projects

•

Existing onshore licenses and production

Mereenie Oil Field, onshore Australia

•

$175 million PV-10 gross, Magellan is 35%

•

Additional 70mmboe of contingent resource on the western end (not in

PV) •

Proven reserves of 150BCF and 2 mmbbls

•

Significant Bakken-style drilling technology potential

•

Operator, Santos has their 65% for sale

•

Could sell given positive developments in Santos sale effort

– else, takeover and develop

Palm Valley Gas Field, onshore Australia

•

$45 million PV-10, Magellan is 52% and operates

•

Proven reserves of 50 BCF

•

New gas sales contract for remaining life of reserves

•

Could sell as part of Santos process

United Kingdom drilling development

•

Offset drilling to existing oil production

•

Two or three near-term well candidates, development located in

same basin as Wytch Farm •

Deep Gas potential (farm-out discussions now)

•

Available for sale |

Capital Plan

Capital Plan

•

Financing Requirements

Fiscal 2011 (30th June, 2010 to 30th June, 2011)

Preliminary Budget

Growth Projects

Poplar Dome area, Montana

Drill up to eight infill oil wells

12.0

$

Complete Single Well Tracer program on up to four wells

2.0

$

Evans Shoal Area, Australia

Remaining Acquisition Payment

78.7

$

Drill two delineation wells

23.7

$

Complete Transition Seismic work on shallow shoal

2.0

$

Complete Geophysical correlation studies

1.0

$

Pre FEED work

5.0

$

Legacy Projects

Drill and complete two onshore UK exploration wells

4.9

$

Complete Onshore well test / drilling strategy

2.0

$

Contingency

13.1

$

Total

144.3

$

Cash on Hand

(38.0)

$

2011 to be Financed

106.3

$ |

Comparison; Magellan (MPET) with

Interoil (IOC)

MPET is significantly undervalued

Comparison of Interoil

and Magellan

Company Variables

Interoil

-

IOC

Magellan -

MPET

Shares Outstanding

44.85

51.90

Share Price

68.00

$

2.16

$

Market Capitalization

3,049.8

$

112.1

$

Cash

75.80

38.00

Debt

52.60

0.50

Value of Refinery & Proven Reserves

365.00

97.38

Mereenie/PV only

Remaining Cost of Evans Shoal Acquisition

78.66

EV of Resources

2,661.60

55.88

Identified Net Resources (mmboe)

900

450

net of CO2

Identified Net Resources -

to be developed by 2014

457

220

Location

Papua NG

Montana & Australia

Commercialization

LNG & NGL

Methanol & CO2 flood

EV/ Resource BOE

2.96

$

0.12

$

EV/ Resources to be Developed

5.82

$

0.25

$

|

Additional Documents / Data |

|

Closest Supply

Magellan Business Model

Pacific

Develop “discovered”

resource for Asia

Redevelop underdrilled, existing assets

Reserves Available

Entry costs from US$ .05/mcf and up

(proven undeveloped)

LNG and Methanol technologies usable

Methanol Needed

US$12 per

mmbtu equivalent delivered

Correlated to oil

Methanol is the “Ethanol”

of

China. It is used as vehicle

fuel supplements there by

Government order. There

are no new Pacific Methanol

plants on the “drawing

board”

now |

Browse / Bonaparte Basins

Acquired 40% and Seeking

operating interest Evans

Shoal, 100% interest NT09-1

Contingent Resource 6-8 TCF+

Carnarvon Basin

3C 115 TCF **

Darwin

Alice Springs

Amadeus Basin

40mmcfd production level, two

field, oil ring also in production

Contingent Resource 300BCF and

up to 70mmbbl gross after

significant, successful development

drilling |

Central Darwin

(pop 120,000)

Bayu Undan LNG

(complete)

East Jetty

(offtake connections)

NT Power Plants

Darwin Airport

Methanol Plant Sites |