Attached files

| file | filename |

|---|---|

| 10-Q - FORM 10-Q - CENTENE CORP | form10q.htm |

| EX-12.1 - RATIO OF EARNINGS TO FIXED CHARGES - CENTENE CORP | exhibit121.htm |

| EX-32.1 - CERTIFICATION - CENTENE CORP | exhibit321.htm |

| EX-31.1 - CERTIFICATION - CENTENE CORP | exhibit311.htm |

| EX-32.2 - CERTIFICATION - CENTENE CORP | exhibit322.htm |

| EX-31.2 - CERTIFICATION - CENTENE CORP | exhibit312.htm |

Exhibit 10.1

EXPLANATORY NOTE: “***” INDICATES THE PORTION OF THIS EXHIBIT THAT HAS BEEN OMITTED AND SEPARATELY FILED WITH THE SECURITIES AND EXCHANGE COMMISSION PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT.

HHSC Contract No. 529-06-0280-00014-N

Version 1.14

|

Part 1: Parties to the Contract: | |

|

This Contract Amendment (the “Amendment”) is between the Texas Health and Human Services Commission (HHSC), an administrative agency within the executive department of the State of Texas, having its principal office at 4900 North Lamar Boulevard, Austin, Texas 78751, and Superior HealthPlan,

Inc. (HMO) a corporation organized under the laws of the State of Texas, having its principal place of business at: 2100 South IH-35, Suite 202, Austin, Texas 78704. HHSC and HMO may be referred to in this Amendment individually as a “Party” and collectively as the “Parties.”

The Parties hereby agree to amend their original contract, HHSC contract number 529-06-0280-00014 (the “Contract”) as set forth herein. The Parties agree that the terms of the Contract will remain in effect and continue to govern except to the extent modified in this Amendment.

This Amendment is executed by the Parties in accordance with the authority granted in Attachment A to the HHSC Managed Care Contract document, “HHSC Uniform Managed Care Contract Terms & Conditions,” Article 8, “Amendments and Modifications.” | ||

|

Part 2: Effective Date of Amendment: |

Part 3: Contract Expiration Date |

Part 4: Operational Start Date: |

|

December 1, 2009 |

August 31, 2010 |

STAR and CHIP HMOs: September 1, 2006

STAR+PLUS HMOs: February 1, 2007

CHIP Perinatal HMOs: January 1, 2007 |

|

Part 5: Project Managers: | ||

|

HHSC:

Scott Schalchlin

Director, Health Plan Operations

11209 Metric Boulevard, Building H

Austin, Texas 78758

Phone: 512-491-1866

Fax: 512-491-1969

HMO:

Stacey Hull

Vice President of Regulatory Affairs

2100 South IH-35, Suite 202

Austin, Texas 78704

Phone: 512-692-1465

Fax: 512-692-1474

E-mail: shull@centene.com | ||

|

Part 6: Deliver Legal Notices to: | ||

|

HHSC:

General Counsel

4900 North Lamar Boulevard, 4th Floor

Austin, Texas 78751

Fax: 512-424-6586

HMO:

Superior HealthPlan

2100 South IH-35, Suite 202

Austin, Texas 78704

Fax: 512-692-1435 | ||

|

Part 7: HMO Programs and Service Areas: |

|

This Contract applies to the following HHSC HMO Programs and Service Areas (check all that apply). All references in the Contract Attachments to HMO Programs or

Service Areas that are not checked are superfluous and do not apply to the HMO.

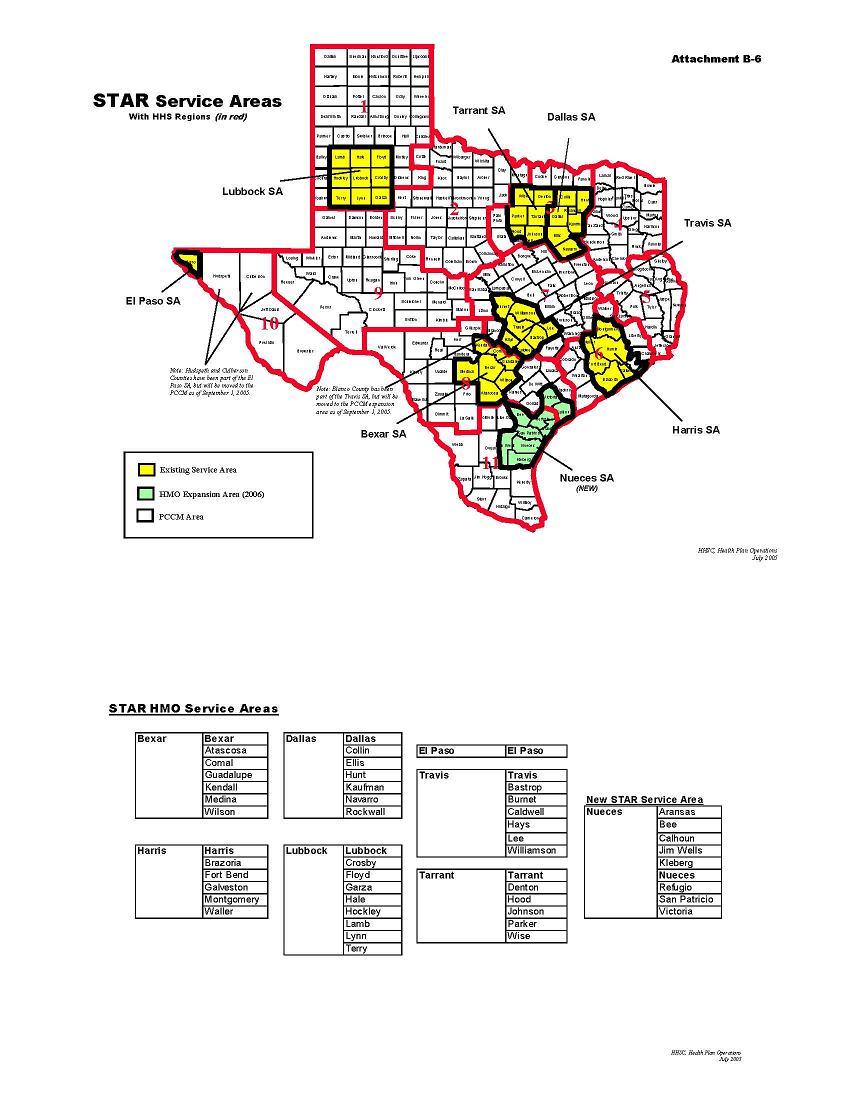

x Medicaid STAR HMO Program

Service Areas:

x Bexar x Lubbock

o Dallas x Nueces

x El Paso o Tarrant

o Harris x Travis

See Attachment B-6, “Map of Counties with HMO Program Service Areas,” for listing of counties included within the STAR Service Areas. |

|

x Medicaid STAR+PLUS HMO Program

Service Areas:

xBexar x Nueces

oHarris oTravis

See Attachment B-6.1, “Map of Counties with STAR+PLUS HMO Program Service Areas,” for listing of counties included within the STAR+PLUS Service Areas. |

|

xCHIP HMO Program

Core Service Areas:

x Bexar x Nueces

o Dallas oTarrant

x El Paso x Travis

o Harris o Webb

x Lubbock

Optional Service Areas:

x Bexar x Lubbock

x El Paso xNueces

o Harris xTravis

See Attachment B-6, “Map of Counties with HMO Program Service Areas,” for listing of counties included within the CHIP Core Service Areas and CHIP Optional Service Areas. |

|

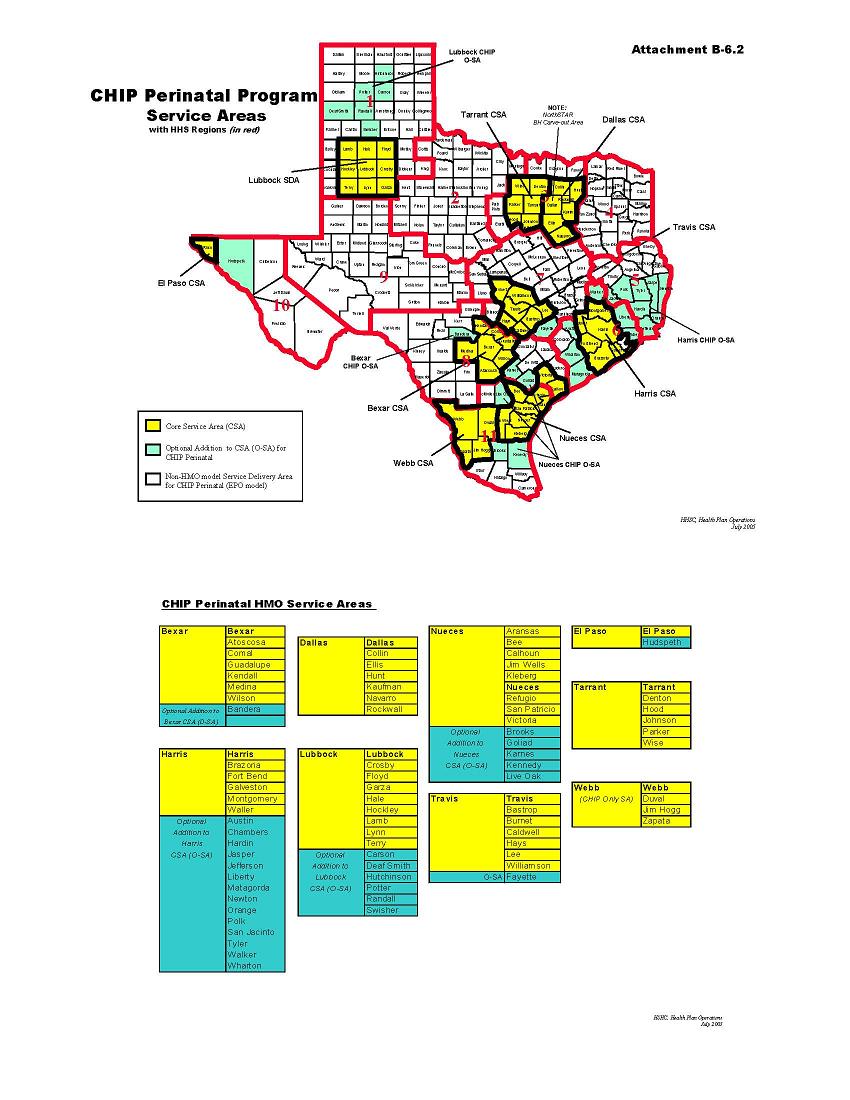

xCHIP Perinatal Program

Core Service Areas:

xBexar x Nueces

o Dallas oTarrant

xEl Paso x Travis

oHarris oWebb

xLubbock

Optional Service Areas:

xBexar x Lubbock

xEl Paso xNueces

oHarris xTravis

See Attachment B-6.2, “Map of Counties with CHIP Perinatal HMO Program Service Areas,” for a list of counties included within the CHIP Perinatal Service Areas. |

|

Part 8: Payment |

|

Part 8 of the HHSC Managed Care Contract document, “Payment,” is modified to add the capitation rates for Rate Period 4. |

xMedicaid STAR HMO PROGRAM

Capitation: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the Capitation Rate-setting methodology and the Capitation Payment

requirements for the STAR Program. The following Rate Cells and Capitation Rates will apply to Rate Period 4:

***

STAR SSI Administrative Fee: HHSC will pay a STAR HMO a monthly Administrative Fee of $14.00 per SSI Beneficiary who voluntarily enrolls in the HMO in accordance with Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article

10.

Delivery Supplemental Payment: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the methodology for establishing

the Delivery Supplemental Payment for the STAR Program.

xMedicaid STAR+PLUS HMO Program

Capitation: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the Capitation Rate-setting methodology and the Capitation Payment requirements for the STAR+PLUS Program. The following

Rate Cells and Capitation Rates will apply to Rate Period 4:

***

Bariatric Supplemental Payment: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the methodology for establishing the Bariatric Supplemental Payment for the STAR+PLUS Program.

xCHIP HMO PROGRAM

Capitation: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the Capitation Rate-setting methodology and the Capitation Payment requirements for the CHIP Program. The following Rate Cells

and Capitation Rates will apply to Rate Period 4:

***

Delivery Supplemental Payment: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the methodology for establishing

the Delivery Supplemental Payment for the CHIP Program. The CHIP Delivery Supplemental Payment is $3,100.00 for all Service Areas.

xCHIP Perinatal Program

Capitation: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the Capitation Rate-setting methodology and the Capitation Payment requirements for the CHIP Perinatal Program.

***

Delivery Supplemental Payment: See Attachment A, “HHSC Uniform Managed Care Contract Terms and Conditions,” Article 10, for a description of the methodology for establishing the Delivery Supplemental Payment for the CHIP

Perinatal Program. The CHIP Perinatal Delivery Supplemental Payment is $3,100.00 for Perinates between 186% and 200% of the Federal Poverty Level for all Service Areas.

|

Part 9: Contract Attachments: |

Modifications to Part 9 of the HHSC Managed Care Contract document, “Contract Attachments,” are italicized below:

A: HHSC Uniform Managed Care Contract Terms & Conditions - Version 1.13 is replaced with Version 1.14

B: Scope of Work/Performance Measures – Version 1.13is replaced with Version 1.14 for all attachments, except if noted.

B-1: HHSC RFP 529-04-272, Sections 6-9

B-2: Covered Services

B-2.1 STAR+PLUS Covered Services

B-2.2 CHIP Perinatal Program Covered Services

B-3: Value-added Services

B-3.1 STAR+PLUS Value-added Services

B-3.2 CHIP Perinatal Program Value-added Services

B-4: Performance Improvement Goals

B-4.1 SFY 2008 Performance Improvement Goals

B-5: Deliverables/Liquidated Damages Matrix

B-6: Map of Counties with STAR and CHIP HMO Program Service Areas

B-6.1 STAR+PLUS Service Areas

B-6.2 CHIP Perinatal Program Service Areas

B-7: STAR+PLUS Attendant Care Enhanced Payment Methodology

C: HMO’s Proposal and Related Documents

C-1: HMO’s Proposal

C-2: HMO Supplemental Responses

C-3: Agreed Modifications to HMO’s Proposal

|

Part 10: Special Provision for Nueces Service Area |

Attachment A, Section 10.04 is amended to include sub-part (b) as follows:

(b) In addition to the reasons set forth in Section 10.04(a), the Parties expressly understand and agree that HHSC may, at any time, unilaterally adjust the Rate Period 2 STAR Program Capitation Rates for the Nueces Service Area. HHSC is entitled to unilaterally adjust such rates, prospectively and/or retrospectively, if it determines that:

(1) the cumulative Rate Period 2 Encounter Data for all HMOs in the Nueces Service Area does not support the Capitation Rates; or (2) economic factors in the Nueces Service Area significantly and measurably impact providers or the delivery of Covered Services to Members. For adjustments made pursuant to this Section 10.04(b), HHSC will provide written notice at least ten (10) Business Days before: (1) the effective date of a prospective adjustment; (2) offsetting Capitation Payments to recover retrospective adjustments.

Any adjustments to the Rate Period 2 Capitation Rates must meet the actuarial soundness requirements of Attachment A, Section 10.03, “Certification of Capitation Rates.”

|

Part 11: Signatures: |

|

The Parties have executed this Contract Amendment in their capacities as stated below with authority to bind their organizations on the dates set forth by their signatures. By signing this Amendment, the Parties expressly understand and agree that this Amendment is hereby made part of the Contract as though it were set out word

for word in the Contract.

Texas Health and Human Services Commission

/s/ Charles E. Bell, M.D.

Charles E. Bell, M.D.

Deputy Executive Commissioner for Health Services

Date: 11/23/09

Superior HealthPlan, Inc.

/s/ Thomas Wise

By: Thomas Wise

Title: President and CEO

Date: 11/9/09 |

Responsible Office: HHSC Office of General Counsel (OGC)

Subject: Attachment A -- HHSC Uniform Managed Care Contract Terms & Conditions Version 1.11

Texas Health & Human Services Commission

Uniform Managed Care Contract Terms & Conditions

Version 1.14

DOCUMENT HISTORY LOG

|

STATUS1 |

DOCUMENT REVISION2 |

EFFECTIVE DATE |

DESCRIPTION3 |

|

Baseline |

n/a |

Initial version of the Uniform Managed Care Contract Terms & Conditions | |

|

Revision |

1.1 |

June 30, 2006 |

Revised version of the Uniform Managed Care Contract Terms & Conditions that includes provisions applicable to MCOs participating in the STAR+PLUS Program.

Article 2, “Definitions,” is amended to add or modify the following definitions: 1915(c) Nursing Facility Waiver; Community-based Long Term Care Services; Court-ordered Commitment; Default Enrollment; Dual Eligibles; Eligibles; Functionally Necessary Covered Services; HHSC Administrative Services Contractor; HHSC HMO

Programs or HMO Programs; Medicaid HMOs; Medical Assistance Only; Member; Minimum Data Set For Home Care (MSD-HC); Nursing Facility Cost Ceiling; Nursing Facility Level of Care; Outpatient Hospital Service; Qualified and Disabled Working Individual (QDWI); Qualified Medicare Beneficiary; Service Coordination; Service Coordinator; Specified Low-income Medicare Beneficiary (SMBL); STAR+PLUS or STAR+PLUS Program; STAR+PLUS HMO; Supplemental Security Income (SSI).

Article 4, “Contract Administration and Management,” is amended to add Sections 4.02(a)(12) and 4.04.1, relating to the STAR+PLUS Service Coordinator.

Article 8, “Amendments and Modifications,” Section 8.06 is amended to clarify that CMS must approve all amendments to STAR and STAR+PLUS HMO contracts.

Article 10, “Terms and Conditions of Payment,” Section 10.05.1 is added to include the Capitation Rate structure provisions relating to STAR+PLUS. Section 10.11 is modified to apply only to STAR and CHIP. Section 10.11.1 is added to include the Experience Rebate provisions relating to STAR+PLUS. |

|

Revision |

1.2 |

September 1, 2006 |

Revised version of the Uniform Managed Care Contract Terms & Conditions that includes provisions applicable to MCOs participating in the STAR and CHIP Programs.

Section 4.04(a) is amended to change the reference from “Texas Board of Medical Examiners” to “Texas Medical Board”.

Article 5 is amended to clarify the following sections: 5.02(e)(5), regarding disenrollment of Members; 5.02(i), regarding disenrollment of foster care children; and 5.04(b), regarding CHIP eligibility and enrollment for babies of CHIP Members |

|

STATUS1 |

DOCUMENT REVISION2 |

EFFECTIVE DATE |

DESCRIPTION3 |

|

Article 10 is amended to clarify the following sections: 10.01(d), regarding the fixed monthly Capitation Rate components; 10.10(c), regarding updating the state system for Members who become eligible for SSI. Section 10.17 is added regarding recoupment for federal disallowance.

Article 17 is amended to clarify the following section: 17.01, naming HHSC as an additional insured. | |||

|

Revision |

1.3 |

September 1, 2006 |

Article 2 is amended to modify and add the following definitions to include the CHIP Perinatal Program- Appeal, CHIP Perinatal Program, CHIP Perinatal HMO, CHIP Perinate, CHIP Perinate Newborn, Covered Services, Complaint, Delivery Supplemental Payment, Eligibles, Experience Rebate, HHSC Administrative Services Contractor, Major Population

Group, Member, Optional Service Area, and Service Management.

Article 5 is amended to add the following sections: 5.04.1 CHIP Perinatal eligibility and enrollment; 5.05(c) CHIP Perinatal HMOs.

Article 10 is amended to apply to the CHIP Perinatal Program. Section 10.06(a) is amended to add the Capitation Rates Structure for CHIP Perinates and CHIP Perinate Newborns. Section 10.06(e) is added to include a description of the rate-setting methodology for the CHIP Perinatal Program. 10.09(b) is modified to include CHIP Perinatal

Program; Section 10.11 is amended to add the CHIP Perinatal Program to the STAR and CHIP Experience Rebate. Section 10.12(c) amended to clarify cost sharing for the CHIP Perinatal Program. |

|

Revision |

1.4 |

September, 1 2006 |

Contract amendment did not revise Attachment A HHSC Uniform Managed Care Terms and Conditions |

|

Revision |

1.5 |

January 1, 2007 |

Revised version of the Uniform Managed Care Contract Terms & Conditions that includes provisions applicable to MCOs participating in the STAR, STAR+PLUS, CHIP, and CHIP Perinatal Programs.

Section 5.04(a) is amended to clarify the period of CHIP continuous coverage.

Section 5.04.1 is amended to clarify the process for a CHIP Perinatal Newborn to move into CHIP at the end of the 12month CHIP Perinatal Program eligibility.

Section 5.08 is added to include STAR+PLUS special default language.

Section 10.06.1 is amended to correct the FPL percentages for CHIP Perinates and CHIP Perinate Newborns.

Section 17.01 is amended to clarify the insurance requirements for the HMOs and Network Providers and to remove the insurance requirements for Subcontractors. |

|

STATUS1 |

DOCUMENT REVISION2 |

EFFECTIVE DATE |

DESCRIPTION3 |

|

Section 17.02(b) is added to clarify that a separate Performance Bond is not needed for the CHIP Perinatal Program. | |||

|

Revision |

1.6 |

February 1, 2007 |

Contract amendment did not revise Attachment A HHSC Uniform Managed Care Terms and Conditions |

|

Revision |

1.7 |

July 1, 2007 |

Article 2 is modified to correct and align definition for “Clean Claim” with the UMCM.

Section 4.08(c) is modified to add a cross-reference to new Attachment B-1, Section 8.1.1.2.

Section 5.05(a), Medicaid HMOs, is amended to clarify provisions regarding enrollment into Medicaid Managed Care from Medicaid Fee-for-Service while in the hospital, changing HMOs while in the hospital, and addressing which HMO is responsible for professional and hospital charges during the hospital stay.

New Section 10.05.1 (c) is added to clarify capitation payments (delays in payment and levels of capitation) for Members certified to receive STAR+PLUS Waiver Services.

Section 10.06.1 is modified to include the CHIP Perinatal pass through for delivery physician services for women under 185% FPL.

Section 10.11 is modified to include treatment of the new Incentives and Disincentives (within the Experience Rebate determination); additionally, several clarifications are added with respect to the continuing accrual of any unpaid interest, etc.

Section 10.11.1 is modified to include treatment of the new Incentives and Disincentives (within the Experience Rebate determination); additionally, several clarifications are added with respect to the continuing accrual of any unpaid interest, etc. |

|

Revision |

1.8 |

September 1, 2007 |

Article 2 is modified to add definitions for Migrant Farmworker and FWC as a result of the Frew litigation corrective action plans.

Article 2 is modified to reflect legislative changes required by SB 10 to the definition for Value-added Services.

New Section 5.03.1 is added to clarify the enrollment process for infants born to pregnant women in STAR+PLUS.

Section 5.04 is modified to reflect legislative changes required by HB 109.

Section 10.18 is added to clarify the required pass through of physician rate increases for all programs to comply with HHSC directives. |

|

STATUS1 |

DOCUMENT REVISION2 |

EFFECTIVE DATE |

DESCRIPTION3 |

|

Revision |

1.9 |

December 1, 2007 |

Section 10.11(d) is modified to increase the Experience rebate loss carry forward from 1 year to 2 years.

Section 10.11(e) is modified to eliminate the plan's responsibility to submit the actuarial certification on the 90 day FSR.

Section 10.11.1 (d) is modified to increase the Experience rebate loss carry forward from 1 year to 2 years.

Section 10.11.1 (e) is modified to eliminate the plan's responsibility to submit the actuarial certification on the 90 day FSR. |

| Revision | 1.10 | March 1, 2008 |

Article 2 is modified to remove the word “administrative” from the definition for Allowable Expenses”.

Article 2 is modified to update the definition for Affiliate.

Section 4.08 is modified to provide consistency of language in sections 4.08(b)(3), and to obligate the HMOs to provide HHSC with copies of amended Subcontracts.

Section 7.05 is modified to update the requirements regarding with state and federal anti-discrimination laws.

Section 10.06.1 is modified to clarify the CHIP Perinatal pass through for delivery physician services for women under 185% FPL.

Section 10.11 (b) is modified to change the heading in the table from Experience Rebate as a % of Revenues to Pre-tax Income as a % of Revenues

Section 10.11 (c) (1) is modified to remove the word “administrative” from the title of UMCM chapter reference.

Section 10.11 (e) (4) is modified to remove the word “administrative” from the title of UMCM chapter reference.

Section 10.11.1 (b) is modified to establish new STAR+PLUS rebate brackets for Rate Period 2 and after.

Section 10.11.1 (c) (1) is modified to remove the word “administrative” from the title of UMCM chapter reference. |

| Revision | 1.11 | September 1, 2008 |

Article 2 is modified to add definitions for Discharge and Transfer.

Article 2 is modified to remove the “Pediatric and Family” qualifier from Advanced Practice Nurses in the definition for PCP.

Section 5.02 is modified to clarify that only Medicaid HMOs have a limited right to request that a Member be disenrolled.

Section 5.03 is modified to clarify that newborns must remain in their mother’s Medicaid HMO for at least 90 days following the date of birth, unless the mother request s a plan change.

Section 5.05(a), is modified to clarify provisions regarding enrollment into Medicaid Managed Care from Medicaid Fee-for-Service while in the hospital and changing HMOs while in the hospital.

Section 5.05(c) is modified to clarify the span of coverage for CHIP Perinate Newborns who are in the hospital on the effective date of disenrollment.

Section 05.07.1 is added to establish a special temporary STAR default process for service areas with HMOs that did not contract with HHSC prior to September 1, 2006.

Section 05.08.1 is added to establish a special temporary STAR+PLUS default process for service areas with HMOs that did not contract with HHSC prior to September 1, 2006.

Section 09.06 is added to require the HMOs to notify HHSC of legal and other proceedings, and related events.

Section 10.11 (e) is modified to clarify the settlement process.

Section 10.11 (f) is modified to require the payment of interest on any Experience Rebate unpaid 35 days after the due date for the 90-day FSR Report.

Section 10.11.1 (e) is modified to reference the process defined in Sections 10.11 (e) and (f).

Section 10.11.1 (f) is deleted as part of the Section 10.11.1 (e) alignment with the process defined in Sections 10.11 (e) and (f).

Section 10.11.2 is added to institute the STAR, CHIP, CHIP Perinatal, and STAR+PLUS Administrative Expense Cap.

Section 10.12 (b) is modified to address federal CHIP regulations.

Section 11.07 is modified to remove extraneous word. |

| Revision | 1.12 | March 1, 2009 |

Article 2 is modified to add the definitions for Bariatric Supplemental Payment and TP 13; and to clarify the definitions for Migrant Farmworker, TP 40, and TP 45.

Section 5.05 is modified to add item (a)(6) to clarify movement from STAR+PLUS to STAR Health; add item (a)(7) regarding movement from STAR, STAR+PLUS, or FFS due to SSI status; clarify item (c); and add item (d) regarding effective date of SSI status. These ratifications of existing policies and processes are effective 9/1/08. Any future

change to such policies or processes will require adjustments to the capitation payments.

Section 5.07.1 is modified to include the Harris Expansion Service Area.

Section 10.06.1(a) is modified to accurately reflect the percentage breakdown.

Section 10.09(b) is modified to accurately reflect the percentage breakdown.

Section 10.10(c) is modified to conform to clarifications in Section 5.05(d).

Section 10.11.2 is modified to add Bariatric Supplemental Payments.

Section 10.11.2(d) is modified to correct a contract reference.

Section 10.19, Bariatric Supplemental Payment for STAR and STAR+PLUS HMOs is added. |

| Revision | 1.13 | September 1, 2009 |

All references to “THSteps” are changed to “Texas Health Steps”

Article 2 is amended to add the definitions for Rate Period 3, and Rate Period 4.

Section 5.05 is amended to clarify that Hospital facility charges for inpatient mental health Covered Services will be paid by the STAR+PLUS HMO.

Section 5.09 Default Methodology for Frew Incentives and Disincentives is added.

Section 7.02 is modified to add references to 1 T.A.C. Part 15, Chapter 371 and the Frew Consent Decree and Alberto N. Partial Settlement Agreements

Section 10.11(a) is amended to change “Rate Year” to “Rate Period”

Section 10.11(b) is amended to reflect the change in the SFY 2010 sharing tier structure for the Experience Rebate.

Section 10.11(d) is amended to clarify the two year loss carry forward.

Section 10.11(e) is amended to clarify the required documentation for non-scheduled payments.

Section 10.11.1(a) is amended to change “Rate Year” to “Rate Period” and to clarify when the HMO must pay an Experience Rebate.

Section 10.11.1(b) is amended to reflect the change in the SFY 2010 sharing tier structure for the Experience Rebate.

Section 10.11.1(d) is amended to clarify the two year loss carry forward.

Section 10.12 is modified to include CHIP enrollees in prohibition against liability for payment (Balance Billing).

Section 12.15 is added to establish a pre-termination process.

Section 17.01(a) is modified to provide clarification of required insurance coverage, including deletion of Standard Worker’s

Section 17.01(b) is modified to correctly identify the type of professional liability coverage required.

Section 17.01(c)(4) is modified to require that HHSC is named as loss payee of insurance coverage.

Section 17.01(c)(5) is modified to require continuous coverage during Term of Contract.

Section 17.01(c)(6) is modified to require notification prior to reduction in coverage and to add provision to insurance policy

requiring 30-day notice prior to reduction in, cancellation, or non-renewal of, the policy.

Section 17.02(a) is modified to align the performance bond requirements with insurance practices by requiring one bond per MCO with a defined term and amount and to require annual renewal of the bond.

Section 17.02(c) is added to establish a process for release of previous performance bonds received by HHSC. |

| Revision | 1.14 | December 1, 2009 | Section 17.02 (a) is modified to require the single bond per MCO with a defined term and amount beginning in SFY2010. |

|

1 Status should be represented as “Baseline” for initial issuances, “Revision” for changes to the Baseline version, and “Cancellation” for withdrawn versions 2 Revisions

should be numbered in accordance according to the version of the issuance and sequential numbering of the revision—e.g., “1.2” refers to the first version of the document and the second revision. 3 Brief description of the changes to the document made in the revision. | |||

Responsible Office: HHSC Office of General Counsel (OGC) Subject: Attachment A -- HHSC Uniform Managed Care Contract Terms & Conditions Version 1.14

TABLE OF CONTENTS

Article 1. Introduction................................................................................................................................... 2

Section 1.01 Purpose...................................................................................................................................... 2

Section 1.02 Risk-based contract. .................................................................................................................. 2

Section 1.03 Inducements............................................................................................................................... 2

Section 1.04 Construction of the Contract. ..................................................................................................... 2

Section 1.05 No implied authority. .................................................................................................................. 3

Section 1.06 Legal Authority. .......................................................................................................................... 3

Article 2. Definitions ..................................................................................................................................... 3

Article 3. General Terms & Conditions.......................................................................................................15

Section 3.01 Contract elements.....................................................................................................................15

Section 3.02 Term of the Contract. ................................................................................................................15

Section 3.03 Funding. ....................................................................................................................................15

Section 3.04 Delegation of authority. .............................................................................................................16

Section 3.05 No waiver of sovereign immunity. .............................................................................................16

Section 3.06 Force majeure...........................................................................................................................16

Section 3.07 Publicity.....................................................................................................................................16

Section 3.08 Assignment. ..............................................................................................................................16

Section 3.09 Cooperation with other vendors and prospective vendors. .......................................................16

Section 3.10 Renegotiation and reprocurement rights. ..................................................................................17

Section 3.11 RFP errors and omissions.........................................................................................................17

Section 3.12 Attorneys’ fees. .........................................................................................................................17

Section 3.13 Preferences under service contracts.........................................................................................17

Section 3.14 Time of the essence..................................................................................................................17

Section 3.15 Notice........................................................................................................................................17

Article 4. Contract Administration & Management ..................................................................................17

Section 4.01 Qualifications, retention and replacement of HMO employees. ................................................17

Section 4.02 HMO’s Key Personnel...............................................................................................................17

Section 4.03 Executive Director.....................................................................................................................18

Section 4.04 Medical Director. .......................................................................................................................18

Section 4.04.1 STAR+PLUS Service Coordinator .........................................................................................19

Section 4.05 Responsibility for HMO personnel and Subcontractors.............................................................19

Section 4.06 Cooperation with HHSC and state administrative agencies. .....................................................19

Section 4.07 Conduct of HMO personnel.......................................................................................................20

Section 4.08 Subcontractors..........................................................................................................................20

Section 4.09 HHSC’s ability to contract with Subcontractors. ........................................................................21

Section 4.10 HMO Agreements with Third Parties.........................................................................................21

Article 5. Member Eligibility & Enrollment.................................................................................................22

Section 5.01 Eligibility Determination.............................................................................................................22

Section 5.02 Member Enrollment & Disenrollment.........................................................................................22

Section 5.03 STAR enrollment for pregnant women and infants....................................................................22

Section 5.04 CHIP eligibility and enrollment. .................................................................................................23

Section 5.05 Span of Coverage .....................................................................................................................23

Section 5.06 Verification of Member Eligibility. ..............................................................................................24

Section 5.07 Special Temporary STAR Default Process ...............................................................................24

Section 5.08 Special Temporary STAR+PLUS Default Process....................................................................25

Article 6. Service Levels & Performance Measurement ...........................................................................25

Section 6.01 Performance measurement.......................................................................................................25

Article 7. Governing Law & Regulations....................................................................................................25

Section 7.01 Governing law and venue. ........................................................................................................25

Section 7.02 HMO responsibility for compliance with laws and regulations...................................................25

Section 7.03 TDI licensure/ANHC certification and solvency.........................................................................26

Section 7.04 Immigration Reform and Control Act of 1986. ...........................................................................26

Section 7.05 Compliance with state and federal anti-discrimination laws. .....................................................26

Section 7.06 Environmental protection laws. .................................................................................................27

Section 7.07 HIPAA. ......................................................................................................................................27

Article 8. Amendments & Modifications.....................................................................................................28

Section 8.01 Mutual agreement. ....................................................................................................................28

Section 8.02 Changes in law or contract........................................................................................................28

Section 8.03 Modifications as a remedy. .......................................................................................................28

Section 8.04 Modifications upon renewal or extension of Contract................................................................28

Section 8.05 Modification of HHSC Uniform Managed Care Manual. ............................................................28

Section 8.06 CMS approval of Medicaid amendments ..................................................................................28

Section 8.07 Required compliance with amendment and modification procedures. ......................................28

Article 9. Audit & Financial Compliance ....................................................................................................28

Section 9.01 Financial record retention and audit..........................................................................................28

Section 9.02 Access to records, books, and documents................................................................................29

Section 9.03 Audits of Services, Deliverables and inspections......................................................................29

Section 9.04 SAO Audit .................................................................................................................................29

Section 9.05 Response/compliance with audit or inspection findings. ...........................................................30

Section 9.06 Notification of Legal and Other Proceedings, and Related Events............................................30

Article 10. Terms & Conditions of Payment...............................................................................................30

Section 10.01 Calculation of monthly Capitation Payment.............................................................................30

Section 10.02 Time and Manner of Payment.................................................................................................30

Section 10.03 Certification of Capitation Rates..............................................................................................31

Section 10.04 Modification of Capitation Rates..............................................................................................31

Section 10.05 STAR Capitation Structure......................................................................................................31

Section 10.05.1STAR+PLUS Capitation Structure. .......................................................................................31

Section 10.06 CHIP Capitation Rates Structure.............................................................................................32

Section 10.07 HMO input during rate setting process....................................................................................33

Section 10.08 Adjustments to Capitation Payments. .....................................................................................33

Section 10.09 Delivery Supplemental Payment for CHIP, CHIP Perinatal and STAR HMOs. .......................33

Section 10.10 Administrative Fee for SSI Members.......................................................................................34

Section 10.11 STAR, CHIP, and CHIP Perinatal Experience Rebate............................................................34

Section 10.11.1 STAR+PLUS Experience Rebate.........................................................................................36

Section 10.12 Payment by Members. ............................................................................................................39

Section 10.13 Restriction on assignment of fees. ..........................................................................................40

Section 10.14 Liability for taxes. ....................................................................................................................40

Section 10.15 Liability for employment-related charges and benefits. ...........................................................40

Section 10.16 No additional consideration.....................................................................................................40

Section 10.17 Federal Disallowance.............................................................................................................40

Section 10.18 Required Pass Through of Physician Rate Increases .............................................................41

Article 11. Disclosure & Confidentiality of Information ...........................................................................41

Section 11.01 Confidentiality..........................................................................................................................41

Section 11.02 Disclosure of HHSC’s Confidential Information.......................................................................42

Section 11.03 Member Records.....................................................................................................................42

Section 11.04 Requests for public information...............................................................................................42

Section 11.05 Privileged Work Product..........................................................................................................42

Section 11.06 Unauthorized acts. ..................................................................................................................43

Section 11.07 Legal action.............................................................................................................................43

Article 12. Remedies & Disputes ................................................................................................................43

Section 12.01 Understanding and expectations.............................................................................................43

Section 12.02 Tailored remedies. ..................................................................................................................43

Section 12.03 Termination by HHSC. ............................................................................................................45

Section 12.04 Termination by HMO...............................................................................................................47

Section 12.05 Termination by mutual agreement...........................................................................................47

Section 12.06 Effective date of termination....................................................................................................47

Section 12.07 Extension of termination effective date. ..................................................................................47

Section 12.08 Payment and other provisions at Contract termination............................................................47

Section 12.09 Modification of Contract in the event of remedies. ..................................................................48

Section 12.10 Turnover assistance................................................................................................................48

Section 12.11 Rights upon termination or expiration of Contract. ..................................................................48

Section 12.12 HMO responsibility for associated costs. ................................................................................48

Section 12.13 Dispute resolution. ..................................................................................................................48

Section 12.14 Liability of HMO.......................................................................................................................49

Article 13. Assurances & Certifications .....................................................................................................49

Section 13.01 Proposal certifications. ............................................................................................................49

Section 13.02 Conflicts of interest..................................................................................................................49

Section 13.03 Organizational conflicts of interest. .........................................................................................49

Section 13.04 HHSC personnel recruitment prohibition.................................................................................50

Section 13.05 Anti-kickback provision............................................................................................................50

Section 13.06 Debt or back taxes owed to State of Texas.............................................................................50

Section 13.07 Certification regarding status of license, certificate, or permit. ................................................50

Section 13.08 Outstanding debts and judgments...........................................................................................50

Article 14. Representations & Warranties..................................................................................................50

Section 14.01 Authorization. ..........................................................................................................................50

Section 14.02 Ability to perform. ....................................................................................................................50

Section 14.03 Minimum Net Worth. ...............................................................................................................50

Section 14.04 Insurer solvency......................................................................................................................51

Section 14.05 Workmanship and performance. .............................................................................................51

Section 14.06 Warranty of deliverables. ........................................................................................................51

Section 14.07 Compliance with Contract. ......................................................................................................51

Section 14.08 Technology Access .................................................................................................................51

Article 15. Intellectual Property ..................................................................................................................52

Section 15.01 Infringement and misappropriation..........................................................................................52

Section 15.02 Exceptions...............................................................................................................................52

Section 15.03 Ownership and Licenses.........................................................................................................52

Article 16. Liability .......................................................................................................................................53

Section 16.01 Property damage.....................................................................................................................53

Section 16.02 Risk of Loss.............................................................................................................................53

Section 16.03 Limitation of HHSC’s Liability. .................................................................................................53

Article 17. Insurance & Bonding.................................................................................................................53

Section 17.01 Insurance Coverage................................................................................................................53

Section 17.02 Performance Bond. .................................................................................................................55

Section 17.03 TDI Fidelity Bond.....................................................................................................................55

Article 1. Introduction

Section 1.01 Purpose.

The purpose of this Contract is to set forth the terms and conditions for the HMO’s participation as a managed care organization in one or more of the HMO Programs administered by HHSC. Under the terms of this Contract, HMO will provide comprehensive health care services to qualified Program recipients through a managed care

delivery system.

Section 1.02 Risk-based contract.

This is a Risk-based contract.

Section 1.03 Inducements.

In making the award of this Contract, HHSC relied on HMO’s assurances of the following:

(1) HMO is an established health maintenance organization that arranges for the delivery of health care services, is currently licensed as such in the State of Texas and is fully authorized to conduct business in the Service Areas;

(2) HMO and the HMO Administrative Service Subcontractors have the skills, qualifications, expertise, financial resources and experience necessary to provide the Services and Deliverables described in the RFP, HMO’s Proposal, and this Contract in an efficient, cost-effective manner, with a high degree of quality and responsiveness, and

has performed similar services for other public or private entities;

(3) HMO has thoroughly reviewed, analyzed, and understood the RFP, has timely raised all questions or objections to the RFP, and has had the opportunity to review and fully understand HHSC’s current program and operating environment for the activities that are the subject of the Contract and the needs and requirements of the State during

the Contract term;

(4) HMO has had the opportunity to review and understand the State’s stated objectives in entering into this Contract and, based on such review and understanding, HMO currently has the capability to perform in accordance with the terms and conditions of this Contract;

(5) HMO also has reviewed and understands the risks associated with the HMO Programs as described in the RFP, including the risk of non-appropriation of funds.

Accordingly, on the basis of the terms and conditions of this Contract, HHSC desires to engage HMO to perform the Services and provide the Deliverables described in this Contract under the terms and conditions set forth in this Contract.

Section 1.04 Construction

of the Contract.

(a) Scope of Introductory Article.

The provisions of any introductory article to the Contract are intended to be a general introduction and are not intended to expand the scope of the Parties’ obligations under the Contract or to alter the plain meaning of the terms and conditions of the Contract.

(b) References to the “State.” References in the Contract to the “State” shall mean the State of Texas unless otherwise specifically indicated and shall be interpreted, as appropriate, to mean or include HHSC and other agencies of the State of Texas that may participate in the administration of the HMO Programs, provided,

however, that no provision will be interpreted to include any entity other than HHSC as the contracting agency.

(c) Severability. If any provision of this Contract is construed to be illegal or invalid, such interpretation will not affect the legality or validity of any of its other provisions. The illegal or invalid provision will be deemed stricken and deleted to the same extent and effect as if never incorporated

in this Contract, but all other provisions will remain in full force and effect.

(d) Survival of terms. Termination or expiration of this Contract for any reason will not release either Party from any liabilities or obligations set forth in this Contract that:

(1) The Parties have expressly agreed shall survive any such termination or expiration; or

(2) Arose prior to the effective date of termination and remain to be performed or by their nature would be intended to be applicable following any such termination or expiration.

(e) Headings. The article, section and paragraph headings in this Contract are for reference and convenience only and may not be considered in the interpretation of this Contract.

(f) Global drafting conventions.

(1) The terms “include,” “includes,” and “including” are terms of inclusion, and where used in this Contract, are deemed to be followed by the words “without limitation.”

(2) Any references to “sections,” “appendices,” “exhibits” or “attachments” are deemed to be references to sections, appendices, exhibits or attachments to this Contract.

(3) Any references to laws, rules, regulations, and manuals in this Contract are deemed references to these documents as amended, modified, or supplemented from time to time during the term of this Contract.

Section 1.05 No implied authority.

The authority delegated to HMO by HHSC is limited to the terms of this Contract. HHSC is the state agency designated by the Texas Legislature to administer the HMO Programs, and no other agency of the State grants HMO any authority related to this program unless directed through HHSC. HMO may not rely upon implied authority, and

specifically is not delegated authority under this Contract to:

(1) make public policy;

(2) promulgate, amend or disregard administrative regulations or program policy decisions made by State and federal agencies responsible for administration of HHSC Programs; or

(3) unilaterally communicate or negotiate with any federal or state agency or the Texas Legislature on behalf of HHSC regarding the HHSC Programs.

HMO is required to cooperate to the fullest extent possible to assist HHSC in communications and negotiations with state and federal governments and agencies concerning matters relating to the scope of the Contract and the HMO Program(s), as directed by HHSC.

Section 1.06 Legal Authority.

(a) HHSC is authorized to enter into this Contract under Chapters 531 and 533, Texas Government Code; Section 2155.144, Texas Government Code; and/or Chapter 62, Texas Health & Safety Code. HMO is authorized to enter into this Contract pursuant to the authorization of its governing board or controlling owner or officer.

(b) The person or persons signing and executing this Contract on behalf of the Parties, or representing themselves as signing and executing this Contract on behalf of the Parties, warrant and guarantee that he, she, or they have been duly authorized to execute this Contract and to validly and legally bind the Parties to all of its terms, performances,

and provisions.

Article 2. Definitions

As used in this Contract, the following terms and conditions shall have the meanings assigned below:

1915(c) Nursing Facility Waiver means the HHSC waiver program that provides home and community based services to aged and disabled adults as cost-effective alternatives to institutional care in nursing homes.

Abuse means provider practices that are inconsistent with sound fiscal, business, or medical practices and result in an unnecessary cost to the Medicaid or CHIP Program, or in reimbursement for services that are not Medically Necessary or that fail to meet

professionally recognized standards for health care. It also includes Member practices that result in unnecessary cost to the Medicaid or CHIP Program.

Account Name means the name of the individual who lives with the child(ren) and who applies for the Children’s Health Insurance Program coverage on behalf of the child(ren).

Action (Medicaid only) means:

(1) the denial or limited authorization of a requested Medicaid service, including the type or level of service;

(2) the reduction, suspension, or termination of a previously authorized service;

(3) the denial in whole or in part of payment for service;

(4) the failure to provide services in a timely manner;

(5) the failure of an HMO to act within the timeframes set forth in the Contract and 42 C.F.R. §438.408(b); or

(6) for a resident of a rural area with only one HMO, the denial of a Medicaid Members’ request to obtain services outside of the Network.

An Adverse Determination is one type of Action.

Acute Care means preventive care, primary care, and other medical care provided under the direction of a physician for a condition having a relatively short duration.

Acute Care Hospital means a hospital that provides acute care services

Adjudicate means to deny or pay a clean claim.

Administrative Services see HMOAdministrative Services.

Administrative Services Contractor see HHSC Administrative Services Contractor.

Adverse Determination means a determination by an HMO or Utilization Review agent that the Health Care Services furnished, or proposed to be furnished to a patient, are not Medically Necessary or not appropriate.

Affiliate means any individual or entity that meets any of the following criteria: 1) owns or holds more than a

five percent (5%) interest in the HMO (either directly, or through one or more intermediaries); 2) in which the HMO owns or holds more than a five percent (5%) interest (either directly, or through one or more intermediaries); 3) any parent entity or subsidiary entity of the HMO, regardless of the organizational structure of the entity; 4) any entity that has a common parent with the HMO (either directly, or through one or more intermediaries); 5) any entity that directly,

or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, the HMO; or, 6) any entity that would be considered to be an affiliate by any Securities and Exchange Commission (SEC) or Internal Revenue Service (IRS) regulation, Federal Acquisition Regulations (FAR), or by another applicable regulatory body.

Agreement or Contract means this formal, written, and legally enforceable contract and amendments thereto between the

Parties.

Allowable Expenses means all expenses related to the Contract between HHSC and the HMO that are incurred during the Contract Period, are not reimbursable or recovered from another source, and that conform with the HHSC Uniform Managed Care Manual’s “Cost

Principles for Expenses.”

AAP means the American Academy of Pediatrics.

Approved Non-Profit Health Corporation (ANHC) means an organization formed in compliance with Chapter 844 of the Texas Insurance Code and licensed by TDI. See also HMO.

Appeal (Medicaid only) means the formal process by which a Member or his or her representative request a review of the HMO’s Action, as defined above.

Appeal (CHIP and CHIP Perinatal Program only) means the formal process by which a Utilization Review agent addresses Adverse Determinations.

Auxiliary Aids and Services includes:

(1) qualified interpreters or other effective methods of making aurally delivered materials understood by persons with hearing impairments;

(2) taped texts, large print, Braille, or other effective methods to ensure visually delivered materials are available to individuals with visual impairments; and

(3) other effective methods to ensure that materials (delivered both aurally and visually) are available to those with cognitive or other Disabilities affecting communication.

Bariatric Supplemental Payments means a one-time per bariatric surgery supplemental payment made by HHSC to STAR and STAR+PLUS HMOs.

Behavioral Health Services means Covered Services for the treatment of mental, emotional, or chemical dependency disorders.

Benchmark means a target or standard based on historical data or an objective/goal.

Business Continuity Plan or BCP means a plan that provides for a quick and smooth restoration of MIS operations after a disruptive event. BCP includes business impact analysis, BCP development, testing, awareness, training, and maintenance. This

is a day-to-day plan.

Business Day means any day other than a Saturday, Sunday, or a state or federal holiday on which HHSC’s offices are closed, unless the context clearly indicates otherwise.

CAHPS means the Consumer Assessment of Health Plans Survey. This survey is conducted annually by the EQRO.

Call Coverage means arrangements made by a facility or an attending physician with an appropriate level of health care provider who agrees to be available on an as-needed basis to provide medically appropriate services for routine, high risk, or Emergency Medical

Conditions or Emergency Behavioral Health Conditions that present without being scheduled at the facility or when the attending physician is unavailable.

Capitation Rate means a fixed predetermined fee paid by HHSC to the HMO each month in accordance with the Contract, for each enrolled

Member in a defined Rate Cell, in exchange for the HMO arranging for or providing a defined set of Covered Services to such a Member, regardless of the amount of Covered Services used by the enrolled Member.

Capitation Payment means the aggregate amount paid by HHSC to the HMO on a monthly basis for the provision of Covered Services to enrolled Members in accordance with the Capitation Rates in the Contract.

Case Head means the head of the household that is applying for Medicaid.

C.F.R. means the Code of Federal Regulations.

Chemical Dependency Treatment means treatment provided for a chemical dependency condition by a Chemical Dependency Treatment facility, chemical dependency counselor or hospital.

Children’s Health Insurance Program or CHIP means the health insurance program authorized

and funded pursuant to Title XXI, Social Security Act (42 U.S.C. §§ 1397aa-1397jj) and administered by HHSC.

Child (or Children) with Special Health Care Needs (CSHCN) means a child (or children) who:

(1) ranges in age from birth up to age nineteen (19) years;

(2) has a serious ongoing illness, a complex chronic condition, or a disability that has lasted or is anticipated to last at least twelve (12) continuous months or more;

(3) has an illness, condition or disability that results (or without treatment would be expected to result) in limitation of function, activities, or social roles in comparison with accepted pediatric age-related milestones in the general areas of physical, cognitive, emotional, and/or social growth and/or development;

(4) requires regular, ongoing therapeutic intervention and evaluation by appropriately trained health care personnel; and

(5) has a need for health and/or health-related services at a level significantly above the usual for the child’s age.

CHIP HMO Program, or CHIP Program, means the State of Texas program in which HHSC contracts with HMOs to provide, arrange for, and coordinate Covered Services for enrolled CHIP Members.

CHIP HMOs means HMOs participating in the CHIP HMO Program.

CHIP Perinatal HMOs means HMOs participating in the CHIP Perinatal Program.

CHIP Perinatal Program means the State of Texas program in which HHSC contracts with HMOs to provide, arrange for, and coordinate Covered Services for enrolled CHIP Perinate and CHIP Perinate Newborn Members. Although the CHIP Perinatal

Program is part of the CHIP Program, for Contract administration purposes it is identified independently in this Contract. An HMO must specifically contract with HHSC as a CHIP Perinatal HMO in order to participate in this part of the CHIP Program.

CHIP Perinate means a CHIP Perinatal Program Member identified prior to birth.

CHIP Perinate Newborn means a CHIP Perinate who has been born alive.

Chronic or Complex Condition means a physical, behavioral, or developmental condition which may have no known cure and/or is progressive and/or can be debilitating or fatal if left untreated or under-treated.

Clean Claim means a claim submitted by a physician or provider for medical care or health care services rendered to a Member, with the data necessary for the MCO or subcontracted claims processor to adjudicate and accurately report the claim. A Clean Claim

must meet all requirements for accurate and complete data as defined in the appropriate 837-(claim type) encounter guides as follows:

(1) 837 Professional Combined Implementation Guide

(2) 837 Institutional Combined Implementation Guide

(3) 837 Professional Companion Guide

(4) 837 Institutional Companion Guide

The HMO may not require a physician or provider to submit documentation that conflicts with the requirements of Texas Administrative Code, Title 28, Part 1, Chapter 21, Subchapters C and T.

CMS means the Centers for Medicare and Medicaid Services, formerly known as the Health Care Financing Administration (HCFA), which is the federal agency responsible for administering Medicare and overseeing state administration of Medicaid and CHIP.

COLA means the Cost of Living Adjustment.

Community-based Long Term Care Services means services provided to STAR+PLUS Members in their home or other community based settings necessary to provide assistance with activities of daily living to allow the Member to remain in the most integrated setting

possible. Community-based Long-term Care includes services available to all STAR+PLUS Members as well as those services available only to STAR+PLUS Members who qualify under the 1915(c) Nursing Facility Waiver services.

Community Resource Coordination Groups (CRCGs) means a statewide system of local interagency groups, including both public and private

providers, which coordinate services for ”multi-need” children and youth. CRCGs develop individual service plans for children and adolescents whose needs can be met only through interagency cooperation. CRCGs address Complex Needs in a model that promotes local decision-making and ensures that children receive the integrated combination

of social, medical and other services needed to address their individual problems.

Complainant means a Member or a treating provider or other individual designated to act on behalf of the Member who filed the Complaint.

Complaint (CHIP and CHIP Perinatal Programs only) means any dissatisfaction, expressed by a Complainant, orally or in writing to the HMO, with any aspect of the HMO’s operation, including, but not

limited to, dissatisfaction with plan administration, procedures related to review or Appeal of an Adverse Determination, as defined in Texas Insurance Code, Chapter 843, Subchapter G; the denial, reduction, or termination of a service for reasons not related to medical necessity; the way a service is provided; or disenrollment decisions. The term does not include misinformation that is resolved promptly by supplying the appropriate information or clearing up the misunderstanding to the satisfaction

of the CHIP Member.

Complaint (Medicaid only) means an expression of dissatisfaction expressed by a Complainant, orally or in writing to the HMO, about any matter related to the HMO other than an Action. As provided by 42 C.F.R. §438.400, possible subjects for Complaints

include, but are not limited to, the quality of care of services provided, and aspects of interpersonal relationships such as rudeness of a provider or employee, or failure to respect the Medicaid Member’s rights.

Complex Need means a condition or situation resulting in a need for coordination or access to services beyond what a PCP would normally provide, triggering the HMO's determination that Care Coordination is required.

Comprehensive Care Program: See definition for Texas Health Steps.

Confidential Information means any communication or record (whether oral, written, electronically stored or transmitted, or in any other form) consisting of:

(1) Confidential Client information, including HIPAA-defined protected health information;

(2) All non-public budget, expense, payment and other financial information;

(3) All Privileged Work Product;

(4) All information designated by HHSC or any other State agency as confidential, and all information designated as confidential under the Texas Public Information Act, Texas Government Code, Chapter 552;

(5) The pricing, payments, and terms and conditions of the Contract, unless disclosed publicly by HHSC or the State; and

(6) Information utilized, developed, received, or maintained by HHSC, the HMO, or participating State agencies for the purpose of fulfilling a duty or obligation under this Contract and that has not been disclosed publicly.

Consumer-Directed Services means the Member or his legal guardian is the employer of and retains control over the hiring, management, and termination of an individual providing personal assistance or respite.

Continuity of Care means care provided to a Member by the same PCP or specialty provider to ensure that the delivery of care to the Member remains stable, and services are consistent and unduplicated.

Contract or Agreement means this formal, written, and legally enforceable contract and amendments thereto between the Parties.

Contract Period or Contract Term means the Initial Contract Period plus any and all Contract extensions.

Contractor or HMO means the HMO that is a party to this Contract and is an insurer licensed by TDI as an HMO or as an ANHC formed in compliance with Chapter 844 of the Texas

Insurance Code.

Core Service Area (CSA) means the core set Service Area counties defined by HHSC for the STAR and/or CHIP HMO Programs in which Eligibles will be required to enroll in an HMO. (See Attachment B-6 to the HHSC Managed Care Contract document for detailed information

on the Service Area counties.)

Copayment (CHIP only) means the amount that a Member is required to pay when utilizing certain benefits within the health care plan. Once the copayment is made, further payment is not required by the Member.

Corrective Action Plan means the detailed written plan that may be required by HHSC to correct or resolve a deficiency or event causing the assessment of a remedy or damage against HMO.

Court-Ordered Commitment means a commitment of a STAR, STAR+PLUS or CHIP Member to a psychiatric facility for treatment ordered by a court of law pursuant to the Texas Health and Safety Code, Title VII Subtitle C.

Covered Services means Health Care Services the HMO must arrange to provide to Members, including all services required by the Contract and state and federal law, and all Value-added Services negotiated by the Parties (see Attachments

B-2, B2.1, B-2.2 and B-3 of the HHSC Managed Care Contract relating to “Covered Services” and “Valueadded Services”). Covered Services include Behavioral Health Services.

Credentialing means the process of collecting, assessing, and validating qualifications and other relevant information pertaining to a health care provider to determine eligibility and to deliver Covered Services.

Cultural Competency means the ability of individuals and systems to provide services effectively to people of various cultures, races, ethnic backgrounds, and religions in a manner that recognizes, values, affirms, and respects the worth of the individuals

and protects and preserves their dignity.

Date of Disenrollment means the last day of the last month for which HMO receives payment for a Member.

Day means a calendar day unless specified otherwise.

Default Enrollment means the process established by HHSC to assign a mandatory STAR, STAR+PLUS, or CHIP Perinate enrollee who has not selected an MCO to an MCO.

Deliverable means a written or recorded work product or data prepared, developed, or procured by HMO as part of the Services under the Contract for the use or benefit of HHSC or the State of Texas.

Delivery Supplemental Payment means a onetime per pregnancy supplemental payment for STAR, CHIP and CHIP Perinatal HMOs.

DADS means the Texas Department of Aging and Disability Services or its successor agency (formerly Department of Human Services).

DSHS means the Texas Department of State Health Services or its successor agency (formerly Texas Department of Health and Texas Department of Mental Health and Mental Retardation).

Discharge means a formal release of a Member from an Inpatient Hospital stay when the need for continued care at an inpatient level has concluded. Movement or Transfer from one Acute Care Hospital or Long Term Care Hospital /facility and readmission to another

within 24 hours for continued treatment is not a discharge under this Contract.

Disease Management means a system of coordinated healthcare interventions and communications for populations with conditions in which patient self-care efforts are significant.

Disproportionate Share Hospital (DSH) means a hospital that serves a higher than average number of Medicaid and other low-income patients and receives additional reimbursement from the State.

Disabled Person or Person with Disability means a person under sixty-five (65) years of age, including a child, who qualifies for Medicaid services because of a disability.

Disability means a physical or mental impairment that substantially limits one or more of an individual’s major life activities, such as caring for oneself, performing manual tasks, walking, seeing,

hearing, speaking, breathing, learning, and/or working.

Disability-related Access means that facilities are readily accessible to and usable by individuals with disabilities, and that auxiliary aids and services are provided to ensure effective communication, in compliance with Title III of the Americans with Disabilities

Act.

Disaster Recovery Plan means the document developed by the HMO that outlines details for the restoration of the MIS in the event of an emergency or disaster.

DSM-IV means the Diagnostic and Statistical Manual of Mental Disorders, Fourth Edition, which is the American Psychiatric Association’s official classification of behavioral health disorders.

Dual Eligibles means Medicaid recipients who are also eligible for Medicare.

ECI means Early Childhood Intervention, a federally mandated program for infants and children under the age of three with or at risk for developmental delays and/or disabilities. The federal ECI regulations are found at 34 §C.F.R. 303.1 et

seq. The State ECI rules are found at 25 TAC §621.21 et seq.

EDI means electronic data interchange.

Effective Date means the effective date of this Contract, as specified in the HHSC Managed Care Contract document.

Effective Date of Coverage means the first day of the month for which the HMO has received payment for a Member.

Eligibles means individuals residing in one of the Service Areas and eligible to enroll in a STAR, STAR+PLUS, CHIP, or CHIP Perinatal HMO, as applicable.

Emergency Behavioral Health Condition means any condition, without regard to the nature or cause of the condition, which in the opinion of a prudent layperson possessing an average knowledge of health and medicine:

(1) requires immediate intervention and/or medical attention without which Members would present an immediate danger to themselves or others, or

(2) which renders Members incapable of controlling, knowing or understanding the consequences of their actions.

Emergency Services means covered inpatient and outpatient services furnished by a provider that is qualified to furnish such services under the Contract and that are needed to evaluate or stabilize an Emergency Medical Condition and/or an Emergency Behavioral

Health Condition, including Post-stabilization Care Services.

Emergency Medical Condition means a medical condition manifesting itself by acute symptoms of recent onset and sufficient severity (including severe pain), such that a prudent layperson, who possesses an average knowledge of health and medicine, could reasonably

expect the absence of immediate medical care could result in:

(1) placing the patient’s health in serious jeopardy;

(2) serious impairment to bodily functions;

(3) serious dysfunction of any bodily organ or part;

(4) serious disfigurement; or

(5) in the case of a pregnant women, serious jeopardy to the health of a woman or her unborn child.

Encounter means a Covered Service or group of Covered Services delivered by a Provider to a Member during a visit between the Member and Provider. This also includes Value-added Services.

Encounter Data means data elements from Fee-for-Service claims or capitated services proxy claims that are submitted to HHSC by the HMO in accordance with HHSC’s required format for Medicaid and CHIP HMOs.

Enrollment Report/Enrollment File means the daily or monthly list of Eligibles that are enrolled with an HMO as Members on the day or for the month the report is issued.

EPSDT means the federally mandated Early and Periodic Screening, Diagnosis and Treatment program contained at 42 U.S.C. 1396d(r). The name has been changed to Texas Health Steps in the State of Texas.

Exclusive Provider Organization (EPO) means the vendor contracted with HHSC to operate the CHIP EPO in Texas.

Expansion Area means a county or Service Area that has not previously provided healthcare to HHSC’s HMO Program Members utilizing a managed care model.

Expansion Children means children who are generally at least one, but under age 6, and live in a family whose income is at or below 133 percent of the federal poverty level (FPL). Children in this coverage group have either elected to bypass TANF

or are not eligible for TANF in Texas.

Experience Rebate means the portion of the HMO’s net income before taxes that is returned to the State in accordance with Section 10.11 for the STAR, CHIP and CHIP Perinatal Programs and 10.11.1 for the STAR+PLUS Program (“Experience Rebate”).

Expedited Appeal means an appeal to the HMO in which the decision is required quickly based on the Member's health status, and the amount of time

necessary to participate in a standard appeal could jeopardize the Member's life or health or ability to attain, maintain, or regain maximum function.

Expiration Date means the expiration date of this Contract, as specified in HHSC’s Managed Care Contract document.

External Quality Review Organization (EQRO) means the entity that contracts with HHSC to provide external review of access to and quality of healthcare provided to Members of HHSC’s HMO Programs.

Fair Hearing means the process adopted and implemented by HHSC in 25 T.A.C. Chapter 1, in compliance with federal regulations and state rules relating to Medicaid Fair Hearings.

Farmworker Child (FWC) means a child under age 21 of a Migrant Farmworker.