Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Spansion Inc. | d8k.htm |

| EX-99.4 - PRESS RELEASE - Spansion Inc. | dex994.htm |

| EX-99.2 - FINDING OF FACTS, CONCLUSIONS OF LAW - Spansion Inc. | dex992.htm |

| EX-99.3 - DEBTORS' SECOND AMENDED JOINT PLAN OF REORGANIZATION - Spansion Inc. | dex993.htm |

Exhibit 99.1

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| In re: | Chapter 11 Cases | |

| SPANSION INC., et al.1 | Case No. 09-10690 (KJC) | |

| Debtors. | ||

| (Jointly Administered) | ||

SECOND AMENDED DISCLOSURE STATEMENT FOR DEBTORS’ SECOND

AMENDED JOINT PLAN OF REORGANIZATION DATED DECEMBER 16, 2009

| LATHAM & WATKINS LLP Michael S. Lurey Gregory O. Lunt Kimberly A. Posin 355 South Grand Avenue Los Angeles, CA 90071 Telephone: (213) 485-1234 Facsimile: (213) 891-8763

DUANE MORRIS, LLP Michael R. Lastowski Richard W. Riley Sommer L. Ross 1100 North Market Street, Suite 1200 Wilmington, DE 19801 Telephone: (302) 657-4900 Facsimile: (302) 657-4901

Counsel for the Debtors and Debtors in Possession |

| 1 | The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are: Spansion Inc., a Delaware corporation (8239); Spansion Technology LLC, a Delaware limited liability company (3982); Spansion LLC, a Delaware limited liability company (0482); Cerium Laboratories LLC, a Delaware limited liability company (0482), and Spansion International, Inc., a Delaware corporation (7542). The mailing address for each Debtor is 915 DeGuigne Dr., Sunnyvale, California 94085. |

| Docket No. 2034 | ||||||||||

| Dated 12/17/2009 | ||||||||||

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I. INTRODUCTION |

3 | |||||

| A. |

Defined Terms |

3 | ||||

| B. |

Overview |

4 | ||||

| C. |

Purpose of the Plan |

4 | ||||

| D. |

Summary of the Plan |

4 | ||||

| E. |

Debtors’ Principal Assets and Indebtedness |

5 | ||||

| F. |

Treatment of Claims and Interests |

5 | ||||

| G. |

Voting and Confirmation Procedures |

10 | ||||

| 1. |

Who May Vote |

11 | ||||

| 2. |

Certain Risk Factors to Be Considered Prior to Voting |

12 | ||||

| 3. |

Voting Instructions and Voting Deadline |

12 | ||||

| 4. |

Voting Procedures |

13 | ||||

| 5. |

Who to Contact for More Information |

14 | ||||

| 6. |

Acceptance or Rejection of the Plan |

15 | ||||

| 7. |

Time and Place of the Confirmation Hearing |

15 | ||||

| 8. |

Objections to the Plan |

15 | ||||

| ARTICLE II. GENERAL INFORMATION REGARDING THE DEBTORS |

16 | |||||

| A. |

Formation and History of the Debtors |

16 | ||||

| B. |

The Debtors’ Business Operations |

17 | ||||

| 1. |

Products |

17 | ||||

| 2. |

Customers |

21 | ||||

| 3. |

Manufacturing |

21 | ||||

| 4. |

Property Taxes and Assessed Valuations |

22 | ||||

| 5. |

Intellectual Property Portfolio |

22 | ||||

| 6. |

Expressions of Interest in the Debtors’ Businesses |

23 | ||||

| C. |

Employees |

23 | ||||

| D. |

Competitive Factors Affecting the Debtors’ Businesses |

23 | ||||

| E. |

Pre-Petition Capital Structure of the Debtors |

24 | ||||

| 1. |

Secured Credit Facility |

25 | ||||

| 2. |

The FRNs |

25 | ||||

| 3. |

The Senior Notes |

26 | ||||

| 4. |

The Exchangeable Debentures |

27 | ||||

| 5. |

UBS Credit Facility |

28 | ||||

| F. |

Litigation |

28 | ||||

| ARTICLE III. THE CHAPTER 11 CASES |

37 | |||||

| A. |

Events Leading to the Filing of the Chapter 11 Cases |

37 | ||||

| B. |

Spansion Japan’s Corporate Reorganization Proceeding |

39 | ||||

| C. |

Commencement of Chapter 11 Cases |

40 | ||||

| D. |

Corporate Governance of the Debtors During the Chapter 11 Cases |

40 | ||||

| 1. |

Boards of Directors |

40 | ||||

| 2. |

Senior Management |

40 | ||||

| E. |

Significant Developments in the Chapter 11 Cases |

42 | ||||

| 1. |

“First Day” Orders |

42 | ||||

i

| 2. |

Employment of Brincko Associates, Inc. and Retention of Professionals |

43 | ||||

| 3. |

Appointment of the Official Committee of Unsecured Creditors |

45 | ||||

| 4. |

Approval of Employment Agreements with Messrs. Kispert, Furr and Sarkisian |

45 | ||||

| 5. |

Final Authorization to Use Cash Collateral |

45 | ||||

| 6. |

Samsung Settlement and Postpetition Samsung Actions |

46 | ||||

| 7. |

Trading in Spansion Equity Securities and Claims |

47 | ||||

| 8. |

Dissemination of Information About the Chapter 11 Cases |

48 | ||||

| 9. |

Rejection and Assumption of Executory Contracts and Unexpired Leases |

49 | ||||

| 10. |

Key Executive Retention and Incentive Plans |

49 | ||||

| 11. |

Claims Bar Date and Claims Summary |

51 | ||||

| 12. |

WARN Litigation |

51 | ||||

| 13. |

Motion for Appointment of Equity Committee |

52 | ||||

| 14. |

Suzhou Sale |

52 | ||||

| 15. |

Senior Notes Indenture Trustee Complaint |

53 | ||||

| F. |

Business Operations During the Chapter 11 Cases |

53 | ||||

| 1. |

Business Restructuring |

53 | ||||

| 2. |

Business Relationship with Spansion Japan |

53 | ||||

| 3. |

Results of Operations |

59 | ||||

| 4. |

The Debtors’ Business Plan and Forecasts |

60 | ||||

| ARTICLE IV. SUMMARY OF THE PLAN |

63 | |||||

| A. |

Overview of Chapter 11 |

64 | ||||

| B. |

Classification of Claims and Interests |

65 | ||||

| 1. |

Introduction |

65 | ||||

| 2. |

Settlement of Intercompany Claims and Treatment of Claims Generally |

65 | ||||

| 3. |

Treatment of Multiple Claims and Guaranty and Joint Liability Claims Against Multiple Debtors |

66 | ||||

| 4. |

Impairment Controversies |

66 | ||||

| C. |

Treatment of Claims and Interests |

66 | ||||

| 1. |

Class 1 – Secured Credit Facility Claims |

66 | ||||

| 2. |

Class 2 – UBS Credit Facility Claims |

67 | ||||

| 3. |

Class 3 – FRN Claims |

67 | ||||

| 4. |

Class 4 – Other Secured Claims |

68 | ||||

| 5. |

Class 4A – Travis County, Texas Tax Claim |

69 | ||||

| 6. |

Class 5A – Senior Notes Claims |

69 | ||||

| 7. |

Class 5B – General Unsecured Claims |

69 | ||||

| 8. |

Class 5C – Exchangeable Debentures Claims |

70 | ||||

| 9. |

Class 6 – Convenience Class Claims |

70 | ||||

| 10. |

Class 7 – Non-Compensatory Damages Claims |

70 | ||||

| 11. |

Class 8 – Interdebtor Claims |

70 | ||||

| 12. |

Class 9 – Old Spansion Interests |

70 | ||||

| 13. |

Class 10 – Other Old Equity |

70 | ||||

ii

| 14. |

Class 11 – Other Old Equity Rights |

70 | ||||

| 15. |

Class 12 – Securities Claims |

71 | ||||

| 16. |

Class 13 – Non-Debtor Intercompany Claims |

71 | ||||

| 17. |

Preservation of Subordination Rights |

71 | ||||

| D. |

Treatment of Unclassified Claims |

72 | ||||

| 1. |

Generally |

72 | ||||

| 2. |

Unclassified Claims |

72 | ||||

| E. |

Treatment of Executory Contracts and Unexpired Leases |

75 | ||||

| 1. |

Assumption and Cure of Executory Contracts and Unexpired Leases |

75 | ||||

| 2. |

Cure of Defaults of Assumed Executory Contracts and Unexpired Leases |

76 | ||||

| 3. |

Consent Rights |

76 | ||||

| 4. |

Effect of Assumption and/or Assignment |

77 | ||||

| 5. |

Rejection of Executory Contracts and Unexpired Leases |

77 | ||||

| 6. |

Employment Agreements and Other Benefits |

77 | ||||

| 7. |

Insurance Policies |

78 | ||||

| 8. |

Rejection Damages Claims Bar Date; Approval of Rejection |

78 | ||||

| F. |

Means for Implementation of the Plan |

79 | ||||

| 1. |

Continued Corporate Existence and Vesting of Assets in Reorganized Debtors |

79 | ||||

| 2. |

Sources of Cash for Distribution |

79 | ||||

| 3. |

Corporate and Limited Liability Company Action |

80 | ||||

| 4. |

Effectuating Documents; Further Transactions |

80 | ||||

| 5. |

Exemption from Certain Transfer Taxes and Recording Fees |

80 | ||||

| 6. |

Retained Actions |

80 | ||||

| 7. |

Employee Claims |

81 | ||||

| 8. |

Executory Contracts and Unexpired Leases Entered Into, and Other Obligations Incurred After, the Petition Date |

82 | ||||

| 9. |

Operations Between Confirmation Date and the Effective Date |

82 | ||||

| 10. |

Rights Offering |

82 | ||||

| 11. |

New Spansion Debt |

86 | ||||

| 12. |

Cancellation of the FRNs, Senior Notes, and the Exchangeable Debentures |

87 | ||||

| G. |

Corporate Governance of the Reorganized Debtors |

88 | ||||

| 1. |

New Governing Documents |

88 | ||||

| 2. |

Directors and Officers of Reorganized Debtors |

88 | ||||

| 3. |

New Employee Incentive Compensation Programs |

88 | ||||

| 4. |

Authorization and Issuance of New Equity; Securities Laws |

89 | ||||

| 5. |

Holdback from Common Stock Distribution |

89 | ||||

| 6. |

Listing of New Spansion Common Stock |

90 | ||||

| 7. |

Old Spansion Interests |

90 | ||||

iii

| H. |

Distributions |

90 | ||||

| 1. |

Distributions of Cash on Account of Claims Allowed as of the Effective Date |

90 | ||||

| 2. |

Disbursing Agent |

90 | ||||

| 3. |

Distributions of Cash |

90 | ||||

| 4. |

No Interest on Claims or Interests |

91 | ||||

| 5. |

Delivery of Distributions |

91 | ||||

| 6. |

Distributions to Holders of the FRNs, the Senior Notes, and the Exchangeable Debentures |

91 | ||||

| 7. |

Distributions to Holders as of the Record Date |

92 | ||||

| 8. |

Indenture Trustees as Claim Holders |

92 | ||||

| 9. |

Payments and Distributions to Holders of Disputed Claims Which Become Allowed Claims |

92 | ||||

| 10. |

Distributions of Stock to Holders of Allowed Class 5A Claims, Allowed Class 5B Claims and Allowed Class 5C Claims |

93 | ||||

| 11. |

Reserve for Disputed Claims |

93 | ||||

| 12. |

De Minimis Distributions |

94 | ||||

| 13. |

No Fractional Securities; No Fractional Dollars |

94 | ||||

| 14. |

Surrender of Instruments |

94 | ||||

| 15. |

Procedures for Distributions to Holders of Allowed FRN Claims, Allowed Senior Notes Claims, and Allowed Exchangeable Debentures Claims |

95 | ||||

| 16. |

Allocation of Distributions Between Principal and Interest |

95 | ||||

| 17. |

Compliance With Tax Requirements |

95 | ||||

| 18. |

Saturday, Sunday or Legal Holiday |

96 | ||||

| I. |

Procedures for Treating and Resolving Disputed Claims |

96 | ||||

| 1. |

Objections to Claims |

96 | ||||

| 2. |

Authority to Prosecute Objections |

96 | ||||

| 3. |

No Distributions Pending Allowance |

96 | ||||

| 4. |

Estimation of Claims |

96 | ||||

| 5. |

Distributions After Allowance |

97 | ||||

| 6. |

Claims Covered by Insurance Policy |

97 | ||||

| J. |

Conditions Precedent to Confirmation and the Effective Date of the Plan |

97 | ||||

| 1. |

Conditions to Confirmation |

97 | ||||

| 2. |

Conditions to the Effective Date |

98 | ||||

| 3. |

Waiver of Conditions |

99 | ||||

| 4. |

Effect of Failure of Conditions |

100 | ||||

| 5. |

Order Denying Confirmation |

100 | ||||

| 6. |

Revocation of the Plan |

100 | ||||

| K. |

Effect of Plan on Claims and Interests |

100 | ||||

| 1. |

Discharge of Claims and Termination of Interests |

100 | ||||

| 2. |

Cancellation of Claims and Interests |

101 | ||||

| 3. |

Release by Debtors of Certain Parties |

101 | ||||

| 4. |

Release by Holders of Claims and Interests |

103 | ||||

| 5. |

California Civil Code § 1542 Waiver |

104 | ||||

iv

| 6. |

Jurisdiction Related to the Plan |

105 | ||||

| 7. |

Setoffs |

105 | ||||

| 8. |

Exculpation and Limitation of Liability |

105 | ||||

| 9. |

Injunction |

106 | ||||

| 10. |

Effect of Confirmation |

106 | ||||

| L. |

Retention and Scope of Jurisdiction of the Bankruptcy Court |

106 | ||||

| 1. |

Retention of Jurisdiction |

106 | ||||

| 2. |

Final Decree |

109 | ||||

| M. |

Miscellaneous Provisions |

109 | ||||

| 1. |

Modification of the Plan |

109 | ||||

| 2. |

Deadlines |

109 | ||||

| 3. |

Applicable Law |

109 | ||||

| 4. |

Plan Supplement |

109 | ||||

| 5. |

Dissolution of the Creditors’ Committee |

110 | ||||

| 6. |

Preparation of Estates’ Returns and Resolution of Tax Claims |

110 | ||||

| 7. |

Confirmation of Plans for Separate Debtors |

110 | ||||

| 8. |

No Admissions; Objection to Claims |

110 | ||||

| 9. |

No Waiver |

110 | ||||

| 10. |

No Bar to Suits |

111 | ||||

| 11. |

Successors and Assigns |

111 | ||||

| 12. |

Post-Effective Date Effect of Evidence of Claims or Interests |

111 | ||||

| 13. |

Conflicts |

111 | ||||

| 14. |

Exhibits/Schedules |

111 | ||||

| 15. |

No Injunctive Relief |

111 | ||||

| 16. |

Binding Effect |

111 | ||||

| 17. |

Entire Agreement |

112 | ||||

| ARTICLE V. REQUIREMENTS FOR CONFIRMATION OF THE PLAN |

112 | |||||

| A. |

General Information |

112 | ||||

| B. |

Solicitation of Acceptances |

112 | ||||

| C. |

Acceptances Necessary to Confirm the Plan |

112 | ||||

| D. |

Confirmation of Plan Pursuant to Section 1129(b) |

113 | ||||

| E. |

Considerations Relevant to Acceptance of the Plan |

113 | ||||

| ARTICLE VI. FEASIBILITY OF THE PLAN AND BEST INTERESTS TEST |

113 | |||||

| A. |

Feasibility of the Plan |

113 | ||||

| B. |

Best Interest of Creditors Test |

115 | ||||

| C. |

Application of Best Interests of Creditors Test to the Liquidation Analysis and Reorganization Valuation of the Reorganized Debtors |

115 | ||||

| 1. |

Liquidation Analysis |

116 | ||||

| 2. |

The Debtors’ Reorganized Value Analysis |

117 | ||||

| ARTICLE VII. CERTAIN RISK FACTORS TO CONSIDER |

124 | |||||

| A. |

Certain Bankruptcy Law Considerations |

125 | ||||

| B. |

Financial Information; Disclaimer |

127 | ||||

| C. |

Factors Affecting The Value Of The Securities To Be Issued Under The Plan |

130 | ||||

| D. |

Risk Factors Associated With the Business |

130 | ||||

v

| E. |

Factors Affecting the Reorganized Debtors |

133 | ||||

| F. |

Factors Affecting the Proposed Rights Offering and New Spansion Debt |

136 | ||||

| ARTICLE VIII. CERTAIN SECURITIES LAW MATTERS |

138 | |||||

| A. |

Issuance of New Common Stock |

138 | ||||

| B. |

Subsequent Transfers of New Spansion Common Stock |

138 | ||||

| ARTICLE IX. CERTAIN MATERIAL UNITED STATES FEDERAL INCOME TAX CONSEQUENCES |

139 | |||||

| A. |

Introduction |

140 | ||||

| B. |

United States Federal Income Tax Consequences to the Debtors |

140 | ||||

| 1. |

Cancellation of Indebtedness Income and Reduction of Tax Attributes |

140 | ||||

| 2. |

Section 382 Limitations on Net Operating Losses |

142 | ||||

| C. |

United States Federal Income Tax Consequences to Holders of Claims Who Are Entitled to Vote to Accept or Reject the Plan |

144 | ||||

| 1. |

Modifications to the Secured Credit Facility |

145 | ||||

| 2. |

Exchange of FRNs For Cash, New Senior Notes and New Convertible Notes |

146 | ||||

| 3. |

New Secured Credit Facility, New Senior Notes and New Convertible Notes |

148 | ||||

| 4. |

New Spansion Common Stock |

153 | ||||

| 5. |

Exchange of Senior Notes Claims, General Unsecured Claims and Exchangeable Debentures Claims for New Spansion Common Stock |

154 | ||||

| 6. |

Accrued Interest |

155 | ||||

| 7. |

Backup Withholding |

155 | ||||

| ARTICLE X. RECOMMENDATION |

156 | |||||

| EXHIBITS TO DISCLOSURE STATEMENT |

158 | |||||

vi

DISCLAIMER

THIS DISCLOSURE STATEMENT HAS BEEN APPROVED BY ORDER OF THE BANKRUPTCY COURT AS CONTAINING INFORMATION OF A KIND, AND IN SUFFICIENT DETAIL, TO ENABLE HOLDERS OF CLAIMS IN THE VOTING CLASSES TO MAKE AN INFORMED JUDGMENT IN VOTING TO ACCEPT OR REJECT THE PLAN. APPROVAL OF THIS DISCLOSURE STATEMENT DOES NOT, HOWEVER, CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT AS TO THE FAIRNESS OR THE MERITS OF THE PLAN OR A RECOMMENDATION BY THE BANKRUPTCY COURT AS TO WHETHER HOLDERS OF CLAIMS IN VOTING CLASSES SHOULD VOTE TO ACCEPT OR REJECT THE PLAN.

THIS DISCLOSURE STATEMENT CONTAINS A SUMMARY OF, AMONG OTHER THINGS, (i) THE DEBTORS AND THEIR BUSINESSES, ASSETS AND LIABILITIES, (ii) THE EVENTS LEADING UP TO THE CHAPTER 11 CASES AND CERTAIN EVENTS THAT HAVE OCCURRED DURING THE CHAPTER 11 CASES (iii) CERTAIN PROVISIONS OF THE PLAN, (iv) THE EXHIBITS ANNEXED TO THIS DISCLOSURE STATEMENT AND THE PLAN, (v) CERTAIN RISK FACTORS RELATING TO THE PLAN AND THE TRANSACTIONS CONTEMPLATED THEREUNDER AND (vi) CERTAIN FINANCIAL AND OTHER DOCUMENTS AND INFORMATION. ALTHOUGH THE DEBTORS BELIEVE THAT THESE SUMMARIES ARE FAIR AND ACCURATE AND PROVIDE ADEQUATE INFORMATION WITH RESPECT TO THE DOCUMENTS AND INFORMATION SUMMARIZED, SUCH SUMMARIES ARE QUALIFIED TO THE EXTENT THAT THEY DO NOT SET FORTH THE ENTIRE TEXT OF, OR ARE INCONSISTENT WITH, SUCH DOCUMENTS OR INFORMATION. FURTHERMORE, ALTHOUGH THE DEBTORS HAVE MADE EVERY EFFORT TO BE ACCURATE, THE FINANCIAL INFORMATION CONTAINED HEREIN HAS NOT BEEN THE SUBJECT OF AN AUDIT OR OTHER REVIEW BY AN ACCOUNTING FIRM. IN THE EVENT OF ANY CONFLICT, INCONSISTENCY, OR DISCREPANCY BETWEEN THE TERMS AND PROVISIONS OF THE PLAN, ON THE ONE HAND, AND THIS DISCLOSURE STATEMENT, THE EXHIBITS ANNEXED TO THIS DISCLOSURE STATEMENT, OR THE FINANCIAL AND OTHER INFORMATION INCORPORATED HEREIN OR THEREIN BY REFERENCE, ON THE OTHER HAND, THE PLAN SHALL GOVERN FOR ALL PURPOSES. ALL HOLDERS OF CLAIMS IN VOTING CLASSES SHOULD READ THIS DISCLOSURE STATEMENT AND THE PLAN IN THEIR ENTIRETY BEFORE VOTING ON THE PLAN.

THE STATEMENTS AND FINANCIAL INFORMATION CONTAINED HEREIN HAVE BEEN MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. HOLDERS OF CLAIMS AND INTERESTS REVIEWING THIS DISCLOSURE STATEMENT SHOULD NOT INFER AT THE TIME OF SUCH REVIEW THAT THERE HAVE BEEN NO CHANGES IN THE STATEMENTS AND INFORMATION SET FORTH HEREIN, UNLESS EXPRESSLY SPECIFIED HEREIN TO THE CONTRARY. ALTHOUGH THE DEBTORS HAVE ATTEMPTED TO DISCLOSE WHERE CHANGES IN PRESENT CIRCUMSTANCES COULD REASONABLY BE EXPECTED TO AFFECT MATERIALLY THE RECOVERY TO HOLDERS OF

CLAIMS UNDER THE PLAN, THIS DISCLOSURE STATEMENT IS QUALIFIED TO THE EXTENT ANY OF THOSE CIRCUMSTANCES OR ANY OTHER CIRCUMSTANCES OR EVENTS DO OCCUR.

THIS DISCLOSURE STATEMENT CONTAINS CERTAIN PROJECTED FINANCIAL INFORMATION RELATING TO THE REORGANIZED DEBTORS, AS WELL AS CERTAIN OTHER STATEMENTS THAT CONSTITUTE "FORWARD-LOOKING STATEMENTS" WITHIN THE MEANING OF THE FEDERAL PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. SUCH PROJECTIONS AND STATEMENTS ARE BASED ON CERTAIN ESTIMATES AND ASSUMPTIONS MADE BY, AND ON INFORMATION AVAILABLE TO, THE DEBTORS AS OF THE DATE HEREOF OR AS OF SUCH OTHER DATE OR DATES AS SPECIFIED HEREIN. WHEN USED IN THIS DOCUMENT, THE WORDS “ANTICIPATE,” “BELIEVE,” “ESTIMATE,” “EXPECT,” “INTEND,” “PLAN,” “PROJECT,” “FORECAST,” “MAY,” “PREDICT,” “TARGET,” “POTENTIAL,” “PROPOSED,” “CONTEMPLATED,” “WILL,” “SHOULD,” “COULD,” “WOULD” AND SIMILAR EXPRESSIONS, AS THEY RELATE TO THE DEBTORS, THE REORGANIZED DEBTORS, THEIR MANAGEMENT AND THEIR PROFESSIONAL ADVISORS, ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THE DEBTORS INTEND FOR SUCH FORWARD-LOOKING STATEMENTS TO BE COVERED BY THE SAFE HARBOR PROVISIONS FOR FORWARD-LOOKING STATEMENTS CONTAINED IN THE FEDERAL PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995, AND THE DEBTORS SET FORTH THIS STATEMENT AND THE RISK FACTORS CONTAINED HEREIN TO COMPLY WITH SUCH SAFE HARBOR PROVISIONS. SUCH PROJECTED FINANCIAL INFORMATION AND OTHER FORWARD-LOOKING STATEMENTS REFLECT THE CURRENT VIEWS OF THE DEBTORS AND ARE SUBJECT TO CERTAIN RISKS, UNCERTAINTIES AND ASSUMPTIONS. MANY FACTORS COULD CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE DEBTORS AND THE REORGANIZED DEBTORS TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS THAT MAY BE EXPRESSED OR IMPLIED BY SUCH PROJECTED FINANCIAL INFORMATION AND FORWARD-LOOKING STATEMENTS, INCLUDING, BUT NOT LIMITED TO, THE RISKS DISCUSSED IN ARTICLE VII OF THIS DISCLOSURE STATEMENT (ENTITLED "CERTAIN RISK FACTORS TO CONSIDER") AND RISKS, UNCERTAINTIES AND OTHER FACTORS DISCUSSED FROM TIME TO TIME IN FILINGS MADE BY CERTAIN OF THE DEBTORS WITH THE SECURITIES AND EXCHANGE COMMISSION AND OTHER REGULATORY AUTHORITIES. SHOULD ONE OR MORE OF THESE RISKS OR UNCERTAINTIES MATERIALIZE, OR SHOULD ANY ASSUMPTIONS UNDERLYING THE PROJECTED FINANCIAL INFORMATION OR OTHER FORWARD-LOOKING STATEMENTS PROVE INCORRECT, ACTUAL RESULTS COULD VARY MATERIALLY FROM THOSE DESCRIBED HEREIN. THE DEBTORS DO NOT INTEND, AND DO NOT ASSUME ANY DUTY OR OBLIGATION, TO UPDATE OR REVISE THESE FORWARD-LOOKING STATEMENTS, WHETHER AS THE RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE, EXCEPT AS OTHERWISE REQUIRED BY LAW.

2

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND NOT IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER APPLICABLE NON-BANKRUPTCY LAW.

IN ACCORDANCE WITH THE BANKRUPTCY CODE, THIS DISCLOSURE STATEMENT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THE STATEMENTS CONTAINED HEREIN.

THE DEBTORS ARE PROVIDING THE INFORMATION IN THIS DISCLOSURE STATEMENT SOLELY FOR PURPOSES OF INFORMING HOLDERS OF CLAIMS ENTITLED TO VOTE ON THE PLAN. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PERSON FOR ANY OTHER PURPOSE. THIS DISCLOSURE STATEMENT SHALL NOT CONSTITUTE OR BE CONSTRUED AS AN ADMISSION OF ANY FACT, LIABILITY, STIPULATION OR WAIVER BUT RATHER AS A STATEMENT MADE WITHOUT PREJUDICE SOLELY FOR SETTLEMENT PURPOSES, WITH FULL RESERVATION OF RIGHTS. THIS DISCLOSURE STATEMENT SHALL NOT BE USED FOR ANY LITIGATION PURPOSE WHATSOEVER, AND SHALL NOT BE ADMISSIBLE IN ANY PROCEEDING INVOLVING THE DEBTORS, THE REORGANIZED DEBTORS OR ANY OTHER PARTY-IN-INTEREST, NOR SHALL IT BE CONSTRUED TO BE CONCLUSIVE ADVICE REGARDING THE TAX, SECURITIES LAW OR OTHER LEGAL EFFECTS OF THE PLAN AS TO HOLDERS OF CLAIMS AGAINST, OR INTERESTS IN, THE DEBTORS. PERSONS OR ENTITIES HOLDING OR TRADING IN OR OTHERWISE PURCHASING, SELLING, OR TRANSFERRING CLAIMS AGAINST THE DEBTORS SHOULD EVALUATE THIS DISCLOSURE STATEMENT IN LIGHT OF THE PURPOSE FOR WHICH IT WAS PREPARED. INTERESTED PARTIES SHOULD CONSULT WITH THEIR OWN LEGAL COUNSEL AND FINANCIAL ADVISORS IN EVALUATING THIS DISCLOSURE STATEMENT, THE PLAN, THE PROPOSED TREATMENT OF SUCH PARTIES THEREUNDER AND THE POTENTIAL TAX, SECURITIES LAWS AND OTHER LEGAL EFFECTS OF THE PLAN BASED ON THEIR INDIVIDUAL CIRCUMSTANCES.

ARTICLE I.

INTRODUCTION

| A. | Defined Terms |

All capitalized terms used but not defined in this Disclosure Statement shall have the respective meanings ascribed to such terms in the Debtors’ Second Amended Joint Plan of Reorganization Dated December 16, 2009 (as amended or modified, the “Plan”), unless otherwise noted. A copy of the Plan is attached hereto as Exhibit A.

3

| B. | Overview |

Spansion Inc., Spansion Technology LLC, Spansion LLC, Spansion International, Inc. and Cerium Laboratories LLC, the Debtors and Debtors in Possession in the Chapter 11 Cases, hereby submit this Disclosure Statement pursuant to section 1125(b) of the Bankruptcy Code, and Bankruptcy Rule 3017, in connection with the Plan. References in this Disclosure Statement to “Spansion” shall mean Spansion Inc. and its consolidated subsidiaries, unless the context indicates otherwise.

The Board of Directors or Managers of each of the Debtors reserves the right, in the exercise of its fiduciary duties to the applicable Estate, to cause such Debtor to withdraw its support of the Plan. In the event any Debtor withdraws its support of the Plan, the remaining Debtors may proceed to seek Confirmation of the Plan without delay.

The purpose of this Disclosure Statement is to enable you, as a Holder of a Claim in a Voting Class, to make an informed decision in exercising your right to accept or reject the Plan.

Pursuant to the Disclosure Statement Order, the Bankruptcy Court has found that this Disclosure Statement provides adequate information to enable Holders of Claims in Voting Classes to make an informed judgment in exercising their right to vote.

| C. | Purpose of the Plan |

The Plan provides for an equitable Distribution to Holders of Allowed Claims in certain Classes, preserves the value of the Debtors’ businesses as going concerns and preserves many jobs of the Debtors’ employees. Moreover, the Debtors believe that most Holders of Allowed Claims will receive greater and earlier recoveries under the Plan than they would receive in a Chapter 7 liquidation and that all Holders of Allowed Claims will receive at least as much as they would receive in a Chapter 7 liquidation of the Debtors.

The Plan is sponsored by the Debtors and supported by the Ad Hoc Consortium. The Debtors believe that the Plan will lead to reorganization, the satisfaction of billions of dollars of Claims and the preservation of jobs and commercial relationships.

The Creditors’ Committee does not support the Plan and is advising unsecured creditors in Classes 5A, 5B and 5C to vote to reject the Plan for the reasons set forth in the Creditors’ Committee’s letter attached as Exhibit G hereto.

| D. | Summary of the Plan |

Under the Plan, the Debtors will be reorganized through, among other things, the consummation of the following transactions: (i) the Distribution of Cash or Cash and New Senior Notes and/or New Convertible Notes to Holders of FRNs in satisfaction of all Claims arising under the FRNs; (ii) the Distribution of New Spansion Common Stock to Holders of Senior Notes Claims, General Unsecured Claims and, subject to Section 3.17 of the Plan, Exchangeable Debentures Claims, in satisfaction of such Claims; (iii) the cancellation of the Old Spansion Interests; and (iv) the revesting of the Assets of the Debtors in the Reorganized Debtors. In addition, under the Plan, the Debtors in their discretion may consummate the Rights Offering

4

and/or issue or incur the New Spansion Debt. As a result of these transactions, the Reorganized Debtors will have significantly less liabilities and debts than the Debtors had as of the Petition Date.

| E. | Debtors’ Principal Assets and Indebtedness |

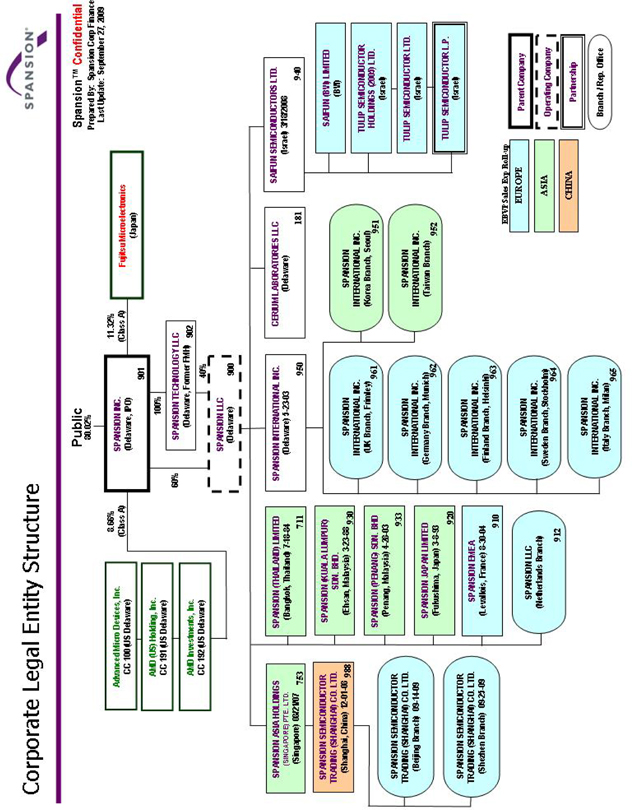

Spansion Inc.’s principal Assets are 100% of the membership interests of Spansion Technology LLC, 60% of the membership interests of Spansion LLC and certain Interdebtor Claims. Spansion Technology LLC’s principal Asset is 40% of the membership interests of Spansion LLC. The principal assets of Spansion LLC include its Flash memory business, intellectual property, the real and personal property assets used in that business and the stock, membership or other equity interests of Spansion International, Inc., Cerium Laboratories LLC and the Non-Debtor Affiliates. The principal assets of Cerium Laboratories LLC includes certain machinery and equipment, leasehold improvements, accounts receivable and Interdebtor Claims. As of the Petition Date, the principal Assets of Spansion International, Inc. included Cash held in banking accounts, deposits paid to utilities, certain miscellaneous equipment, Interdebtor Claims and certain other miscellaneous assets. The operations of the Debtors are described more fully in Article II hereof. An organizational chart of the Debtors and the Non-Debtor Affiliates is set forth in Exhibit B hereto.

The principal indebtedness of the Debtors includes the following: (1) the Secured Credit Facility; (2) the UBS Credit Facility; (3) the FRNs; (4) the Senior Notes; (5) the Exchangeable Debentures; (6) other General Unsecured Claims; (7) Interdebtor Claims; (8) Non-Debtor Intercompany Claims; and (9) Administrative Expense Claims.

| F. | Treatment of Claims and Interests |

The Plan contemplates the reorganization and ongoing business operations of the Debtors, and the resolution of the outstanding Claims against and Interests in the Debtors pursuant to sections 1129(a) and 1123 of the Bankruptcy Code. Section 1123 of the Bankruptcy Code requires that a plan of reorganization classify the claims against and equity interests in a debtor. The Plan classifies all Claims against and Interests in the Debtors into 16 Classes. A brief summary of each of the Classes, including the voting rights and treatment of such Class under the Plan, is set forth in the table below. A more detailed description of the treatment of each Class is set forth in Articles III and IV of the Plan and Section IV.C. of this Disclosure Statement.

| Class | Description | Estimated Aggregate Allowed Amount |

Class Treatment | Impairment | Entitled to Vote | Estimate Recovery % | ||||||

| 1 |

Secured Credit Facility Claims | $7.0 million |

All rights of the Debtors to receive additional loan advances or further credit under the Secured Credit Facility will be cancelled as of the Effective Date. Claims held by the Holders of Class 1

|

Impaired |

Yes |

100% | ||||||

5

| Class |

Description |

Estimated |

Class Treatment |

Impairment |

Entitled |

Estimate | ||||||

| Claims based on any contingent or other obligations shall be extinguished. The Debtors will enter into documentation with the Holder of the Class 1 Claims reflecting the post- Effective Date relationship between such parties, which treatment and documentation hereunder shall be satisfactory to the Ad Hoc Consortium. The obligations of the Reorganized Debtors on account of the Allowed Class 1 Claims will be secured by the Class 1 Collateral. | ||||||||||||

| 2 | UBS Credit Facility Claims |

$68.4 million |

Reinstatement | Unimpaired | No | 100% | ||||||

| 3 | FRN Claims | $633.3 Million |

Each Holder of FRN Claims will be entitled to receive its pro rata share of (i) $158.3 million plus post-petition interest in Cash; (ii) $237.5 million (subject to adjustment pursuant to Section 3.3 of the Plan; see Section IV.C.3 below) of New Senior Notes; and (iii) $237.5 million (subject to adjustment pursuant to Section 3.3 of the Plan; see Section IV.C.3 below) of New Convertible Notes2 (subject to certain election rights set forth in Section 3.3 of the Plan; see Section IV.C.3. below); provided that subject to Sections 6.10(1) and 6.10(10) of the Plan, if, on or prior to

|

Impaired | Yes | 100% | ||||||

| 2 | The New Convertible Notes may be converted into shares of New Spansion Common Stock at a purchase price per share equal to: (i) the Adjusted Plan Equity Value for Conversion Price Calculation; (ii) plus $100 million; (iii) divided by 50 million; (iv) multiplied by 115% (the “Conversion Price”). Based on the valuation set forth in Section VI.C.2. below, the Conversion Price would be $11.61 per share, and the New Convertible Notes could be converted into a total of 20,457,825 shares of New Spansion Common Stock assuming $237.5 million principal amount of New Convertible Notes are issued to Holders of Class 3 Claims on the Effective Date. |

6

| Class |

Description |

Estimated |

Class Treatment |

Impairment |

Entitled |

Estimate | ||||||

| the earlier of (x) the Effective Date and (y) February 12, 2010, the Debtors shall have received New Capital Proceeds, then each Holder of an Allowed Class 3 Claim is entitled to receive as of the Effective Date such Holder’s Pro Rata share of such New Capital Proceeds and the principal amount of New Senior Notes and New Convertible Notes shall be reduced as follows: (i) the first $75 million of the New Capital Proceeds (or all of such proceeds if the amount of the New Capital Proceeds is less than $75 million) shall be applied 50% to reduce the principal amount of the New Senior Notes and 50% to reduce the principal amount of the New Convertible Notes; and (ii) any additional New Capital Proceeds shall be applied, at the option of the Debtors, to reduce either the principal amount of the New Senior Notes or the principal amount of the New Convertible Notes until the New Senior Notes or the New Convertible Notes, as applicable, have been reduced to zero and thereafter to the other of such notes; provided that, unless the principal amount of the New Senior Notes or the New Convertible Notes, as applicable, have been reduced to zero in accordance with clause (ii) above, the minimum principal amount of each of the New Senior Notes facility and the New Convertible Notes facility, as applicable, after giving effect to any such reduction under clause (i) above shall be not less than

|

||||||||||||

7

| Class |

Description |

Estimated Aggregate Allowed Amount |

Class Treatment |

Impairment |

Entitled |

Estimate | ||||||

| $200 million |

||||||||||||

| 4 |

Other Secured Claims | $1.0 million | At option of Debtors: (i) Reinstatement, (ii) Cash in an amount equal to the Allowed Amount of such Claim, or (iii) the collateral securing such Claim | Unimpaired |

No |

100% | ||||||

| 4A |

Travis County, Texas Tax Claims | $6.4 million | Paid in full on or before January 31, 2010 | Unimpaired |

No |

100% | ||||||

| 5A |

Senior Notes Claims | $251.1 million | The Senior Notes Claims are deemed Allowed by the Plan in the aggregate amount of $250 million of principal, plus accrued and unpaid interest (as of the Petition Date) for an aggregate amount of $251,133,413. Subject to Section 3.17 of the Plan, each Holder of an Allowed Class 5A Claim will receive such Holder’s Unsecured Claims Pro Rata share of 46,247,760 shares of New Spansion Common Stock

|

Impaired |

Yes |

31%

to | ||||||

| 3 | This range of recovery percentages for Classes 5A, 5B and 5C does not give effect to, among other things, (i) the potentially dilutive impact of any shares of New Spansion Common Stock issued pursuant to an employee equity incentive plan, (ii) the conversion of the New Convertible Notes into New Spansion Common Stock, (iii) any shares issued pursuant to the Rights Offering; (iv) any incremental value arising from the tax benefits of any net operating loss carry-forwards and similar items that the Reorganized Debtors might be able to assert, and (v) any litigation recoveries. In addition, the range of recovery percentages for Classes 5A and 5C do not give effect, if any, to the subordination provisions of the Exchangeable Debentures Indenture or any other subordination arrangement between Holders of Senior Notes Claims and Holders of Exchangeable Debentures Claims. See Section II.E.4 below and Section 3.17 of the Plan. Finally, this range of recovery percentages does not give effect to any Claim of Spansion Japan (as defined below) or GE Financial Services Corporation that might ultimately be Allowed, because such Claims are classified in Class 13 under the Plan. However, if the Bankruptcy Court determines that the Claims of Spansion Japan or GE Financial Services Corporation should be classified in Class 5B or that Claims in Class 13 are entitled to a Distribution pursuant to the Bankruptcy Code, the inclusion of such Claims in Class 5B or a Distribution to Class 13 Claims, as applicable, would likely have a significantly dilutive impact on the recovery percentages for Classes 5A, 5B and 5C. See Section III.F.2 below and Exhibits E and F. |

8

| Class |

Description |

Estimated Aggregate Allowed Amount |

Class Treatment |

Impairment |

Entitled to Vote |

Estimate Recovery % | ||||||

| 5B |

General Unsecured Claims | $440 million to $841 million4 | Each Holder of an Allowed Class 5B Claim will receive such Holder’s Unsecured Claims Pro Rata share of 46,247,760 shares of New Spansion Common Stock. | Impaired |

Yes |

31% to 45%5 | ||||||

| 5C |

Exchangeable Debentures Claims | $208.0 million | The Exchangeable Debentures Claims are deemed Allowed by the Plan in the aggregate amount of $207 million of principal, plus accrued and unpaid interest (as of the Petition Date) for an aggregate amount of $207,998,036. Subject to Section 3.17 of the Plan, each Holder of an Allowed Class 5C Claim will receive such Holder’s Unsecured Claims Pro Rata share of 46,247,760 shares of New Spansion Common Stock | Impaired |

Yes |

31% to 45%6 | ||||||

| 6 |

Convenience Class Claims | $2 million to $2.5 million | Payment in full in Cash up to $2,000 per Convenience Class Claim | Unimpaired |

No |

100% | ||||||

| 7 |

Non- Compensatory Damages Claims | $0 million | No Distribution | Impaired |

No |

0% | ||||||

| 8 |

Interdebtor Claims | $19.2 |

No Distribution | Impaired |

No |

0% | ||||||

| 4 | At the high end of this estimated range, the Debtors have estimated that Claims filed in unliquidated, unstated or unknown amounts will be Allowed, in the aggregate, for $100 million. At the low end of this estimated range, the Debtors have estimated that these Claims will be Disallowed in their entirety. The estimate of the Allowed amount for unliquidated, unstated or unknown amount Claims does not include any estimate for the rejection damages claim which may be asserted by Spansion Japan Limited. The Debtors understand that Spansion Japan Limited may file a general unsecured claim in the approximate amount of $1 billion. The Debtors dispute the validity of any such Claim. See, infra, Section III.F.2 Samsung Electronics Co., Ltd. (“Samsung”) and certain of its affiliates assert disputed, contingent and unliquidated prepetition Claims that, if Allowed, would be treated as Class 5B General Unsecured Claims under the Plan. Samsung believes that its Claims are substantial and disagrees with the Debtors’ estimate of $100 million for the aggregate liquidated allowable amount for presently unliquidated, unstated or unknown amount Claims. |

| 5 | See footnote 3. |

| 6 | See footnote 3. |

9

| Class |

Description |

Estimated Aggregate Allowed Amount |

Class Treatment |

Impairment |

Entitled to Vote |

Estimate Recovery % | ||||||

| million |

||||||||||||

| 9 |

Old Spansion Interests | N/A |

No Distribution | Impaired | No |

0% | ||||||

| 10 |

Other Old Equity | N/A |

Reinstatement | Unimpaired | No |

100% | ||||||

| 11 |

Other Old Equity Rights | N/A |

No Distribution | Impaired | No |

0% | ||||||

| 12 |

Securities Claims | Unknown |

No Distribution | Impaired | No |

0% | ||||||

| 13 |

Non-Debtor Intercompany Claims | $220 million to $1.2 billion or more7 | No Distribution. | Impaired | No |

0% | ||||||

| G. | Voting and Confirmation Procedures |

Holders of Claims in Voting Classes will receive the Solicitation Materials, which contain: (a) a notice to Holders of Claims in Voting Class of the Confirmation Hearing, the solicitation and voting procedures approved by the Bankruptcy Court in the Disclosure Statement Order, the deadline to File objections to Confirmation and certain other matters; (b) instructions as to how to access the Disclosure Statement, the Plan and certain other materials on the internet and how to obtain paper copies of those materials from the Debtors; and (c) a Ballot to accept or reject the Plan. In addition, Holders of Allowed Class 3 Claims shall receive a special election form to elect the Pro Rata Class 3 Distribution, the Max New Senior Notes Distribution or the Max New Convertible Notes Distribution. If the Debtors decide to pursue the Rights Offering, Rights Offering Participants shall receive the Subscription Form either separately or as part of the Solicitation Materials. The Solicitation Materials are being furnished to Holders of Allowed Claims in the Voting Classes for the purpose of soliciting their votes on the Plan. This Disclosure Statement is also being made available to certain other Creditors, Holders of Interests and other Entities for notice or informational purposes.

If you did not receive a Ballot, and believe that you should have received one, please contact the Claims and Voting Agent, Epiq Bankruptcy Solutions, LLC (“Epiq”). Epiq can be reached at 757 Third Avenue, Third Floor, New York, NY 10017, by facsimile transmission at (646) 282-2501 or by e-mail at Spansion@epiqsystems.com. Alternatively, you can contact counsel to the Debtors, Duane Morris, LLP, at 110 North Market Street, Suite 1200, Wilmington, DE 19801, attn: Stacie Wolfenden, or by facsimile transmission at (302) 657-2901, or Latham & Watkins LLP, at 355 South Grand Avenue, Los Angeles, CA 90071, attn: Kathryn Bowman, or by facsimile transmission at (213) 891-8763.

| 7 | The upper end of this range includes $1 billion in damages asserted by Spansion Japan due to the rejection of the Foundry Agreement. See Section III.F.2. below. |

10

| 1. | Who May Vote |

Pursuant to the provisions of the Bankruptcy Code, only certain Impaired Classes of Claims are entitled to vote to accept or reject the Plan. As set forth in section 1124 of the Bankruptcy Code, a Class is Impaired if the legal, equitable and/or contractual rights attaching to the Claims or Interests of that Class are modified or altered. Under section 1126(g), an Impaired Class is deemed to have rejected the Plan if Holders of Allowed Claims or Interests in that Class are not entitled to receive any Distribution on account of such Claims or Interests. Accordingly, Classes 7, 8, 9, 11, 12 and 13 are deemed to have rejected the Plan and are not entitled to vote on the Plan.

Any Class that is Unimpaired within the meaning set forth in section 1124 of the Bankruptcy Code is not entitled to vote to accept or reject the Plan and is conclusively presumed to have accepted the Plan. Accordingly, Classes 2, 4, 4A, 6 and 10 are deemed to have accepted the Plan and are not entitled to vote on the Plan.

Only Holders of Allowed Claims in the Voting Classes are Impaired and entitled to a Distribution. Thus, only Holders of Allowed Claims in the Voting Classes are entitled to vote on the Plan. Under the Plan, the Voting Classes are Class 1 (Secured Credit Facility Claims), Class 3 (FRN Claims), Class 5A (Senior Notes Claims), Class 5B (General Unsecured Claims) and Class 5C (Exchangeable Debentures Claims).

A Claim in a Voting Class must be “allowed” for purposes of voting in order for the Holder of such Claim to have the right to vote on the Plan. Generally, for voting purposes a Claim is deemed to be “allowed” if (i) a Proof of Claim was timely Filed and was not Filed in an unliquidated or undetermined amount and is not contingent as to amount or liability or, if no Proof of Claim was Filed, the Claim is listed in the Debtors’ Schedules as other than “disputed,” “contingent,” or “unliquidated,” and in an amount greater than $0 (in which case the Claim will be deemed “allowed” for voting purposes in the scheduled amount) and (ii) no objection has been Filed to such Claim or no Order has been entered by the Bankruptcy Court Disallowing such Claim. Generally, if an objection to a Claim is Filed, the Holder of such Claim cannot vote unless the Bankruptcy Court, after notice and hearing, either overrules the objection, or deems the Claim to be “allowed” for voting purposes. See Section I.G.4. below. The Plan provides that the following claims are deemed “allowed” in the amounts described in more detail below: the FRN Claims, the Senior Notes Claims and the Exchangeable Debentures Claims. See Section IV.C.3., Section IV.C.6. and Section IV.C.8. below.

If you did not receive a Ballot and believe that you are entitled to vote on the Plan, you must either (a) obtain a Ballot pursuant to the instructions set forth above and timely submit such Ballot by the Voting Deadline, or (b) file a Motion pursuant to Federal Bankruptcy Rule 3018 with the Bankruptcy Court for the temporary allowance of your Claim for voting purposes by January 7, 2010, at 4:00 p.m. (prevailing Eastern Time) or you will not be entitled to vote to accept or reject the Plan.

11

EXCEPT AS OTHERWISE SET FORTH IN THE PLAN, EACH OF THE CLAIMS AGENT, THE DEBTORS AND THE REORGANIZED DEBTORS IN ALL EVENTS RESERVE THE RIGHT THROUGH THE CLAIM RECONCILIATION PROCESS TO OBJECT TO OR SEEK TO DISALLOW ANY CLAIM FOR DISTRIBUTION PURPOSES UNDER THE PLAN, EVEN IF THE HOLDER OF SUCH CLAIM VOTED TO ACCEPT OR REJECT THE PLAN AND/OR SUCH HOLDER’S CLAIM WAS “ALLOWED” FOR VOTING PURPOSES.

| 2. | Certain Risk Factors to Be Considered Prior to Voting |

HOLDERS OF CLAIMS IN VOTING CLASSES SHOULD CAREFULLY CONSIDER THE RISKS SET FORTH IN ARTICLE VII HEREIN PRIOR TO VOTING ON THE PLAN.

| 3. | Voting Instructions and Voting Deadline |

To vote to accept or reject the Plan, you must use the Ballot enclosed with this Disclosure Statement. No votes other than ones using Ballots will be counted, except to the extent the Bankruptcy Court orders otherwise. The Bankruptcy Court has fixed December 14, 2009 as the Voting Record Date for determining the Holders of Claims who are entitled to (a) receive the Solicitation Materials and (b) vote to accept or reject the Plan. Accordingly, each Holder of a Claim in a Voting Class as of the Voting Record Date that is not deemed to be disallowed for voting purposes shall be entitled to vote to accept or reject the Plan. Any Entity that becomes the Holder of a Claim in a Voting Class after the Voting Record Date shall not be entitled to vote such Claim. After carefully reviewing the Plan and this Disclosure Statement, including the annexed exhibits, please indicate your acceptance or rejection of the Plan on the Ballot and return your Ballot in the enclosed envelope so as to ensure receipt by no later than 4:00 p.m. Eastern Standard Time on February 4, 2010, at 4:00 p.m. (prevailing Eastern Time) which is the Voting Deadline, to Epiq, the Claims and Voting Agent, at the following address:

By first class mail:

Spansion Inc. Ballot Processing Center

c/o Epiq Bankruptcy Solutions, LLC

FDR Station, P.O. Box 5285

New York, NY 10150-5285

By hand delivery or overnight mail:

Spansion Inc. Ballot Processing Center

c/o Epiq Bankruptcy Solutions, LLC

757 Third Avenue, Third Floor

New York, NY 10017

BALLOTS MUST BE COMPLETED AND RECEIVED NO LATER THAN 4:00 P.M. (EASTERN TIME) ON THE VOTING DEADLINE. ANY BALLOT THAT IS NOT EXECUTED BY A DULY AUTHORIZED PERSON SHALL NOT BE COUNTED. ANY BALLOT THAT IS EXECUTED BY THE HOLDER OF AN ALLOWED CLAIM BUT THAT DOES NOT INDICATE AN ACCEPTANCE OR REJECTION OF THE PLAN

12

WILL NOT BE COUNTED. ANY BALLOT THAT IS RECEIVED BY TELECOPIER, FACSIMILE OR OTHER ELECTRONIC COMMUNICATIONS SHALL NOT BE COUNTED IN TABULATING VOTES FOR OR AGAINST THE PLAN, UNLESS THAT BALLOT IS ACCEPTED IN THE DEBTORS’ DISCRETION. IF A HOLDER OF A CLAIM CASTS MORE THAN ONE BALLOT VOTING THE SAME CLAIM PRIOR TO THE VOTING DEADLINE, ONLY THE LAST TIMELY BALLOT RECEIVED BY THE CLAIMS AND VOTING AGENT WILL BE COUNTED. IF A HOLDER OF A CLAIM SIMULTANEOUSLY CASTS MORE THAN ONE BALLOT FOR THE SAME CLAIM WITH INCONSISTENT INSTRUCTIONS (I.E. AT LEAST ONE BALLOT VOTES TO ACCEPT THE PLAN AND ONE BALLOT VOTES TO REJECT THE PLAN), ALL SUCH BALLOTS SHALL NOT BE COUNTED.

| 4. | Voting Procedures |

In the Disclosure Statement Order, the Bankruptcy Court has approved certain procedures regarding temporary allowance of claims for voting purposes only. Specifically, if an objection to a Claim is pending on the Voting Record Date or the proof of Claim for such Claim (i) was Filed after the applicable Bar Date, (ii) was Filed in an unliquidated or undetermined amount or (iii) states that such Claim is contingent as to amount or liability, the Holder of such Claim shall receive the “Notice To Holders Of Claims In Voting Classes That Are Deemed Not To Be Allowed For Voting Purposes Of (A) Hearing To Confirm Debtors’ Second Amended Joint Plan Of Reorganization Dated December 16, 2009, (B) Solicitation And Voting Procedures In Connection With That Plan, (C) Objection And Voting Deadlines, And (D) Certain Other Matters” (the “Disputed Claim Notice”) in lieu of a Ballot. The Disputed Claim Notice shall inform such Entity that it cannot vote absent any of the following taking place prior to the Voting Deadline (each, a “Resolution Event”) (i) an order is entered by the Bankruptcy Court temporarily allowing such Claim for voting purposes pursuant to Bankruptcy Rule 3018(a), after notice and a hearing; (ii) a stipulation or other agreement is executed between the Holder of such Claim and the Debtors resolving such objection and allowing the Holder to vote such Claim in an agreed upon amount; or (iii) the pending objection to such Claim is voluntarily withdrawn by the Debtors. No later than two (2) business days after a Resolution Event, the Voting Agent shall distribute a Ballot to the relevant Holder, which must be received by the Voting Agent by no later than the Voting Deadline, unless such deadline is extended by the Debtors to facilitate a reasonable opportunity for such Holder to vote for or against the Plan after the occurrence of a Resolution Event.

If an objection to a Claim is Filed by the Debtors after the Voting Record Date, the Ballot of the Holder of such Claim will be counted unless the Bankruptcy Court orders otherwise.

Nothing in the solicitation procedures set forth in this Disclosure Statement, the Ballot or the Disclosure Statement Approval Order shall affect the right of the Claims Agent, the Debtors and/or the Reorganized Debtors, as applicable, to object to any proof of Claim on any other ground or for any other purpose. The temporary allowance of any Claim for voting purposes under Bankruptcy Rule 3018(a) shall have no res judicata, collateral estoppel or other preclusive effects and shall be without prejudice to the Holder’s rights with respect to the Allowance or Disallowance of such Claim for purposes of the Holder receiving a Distribution under the Plan.

13

In connection with the solicitation of votes with respect to the Plan, and pursuant to the Disclosure Statement Order, Epiq will, in conjunction with the Debtors, (i) distribute the Solicitation Materials, (ii) receive, tabulate and report on Ballots cast for or against the Plan by holders of Claims against the Debtors, (iii) respond to inquiries from creditors, equity holders, and other parties in interest relating to the Plan, the Plan Supplement, the Disclosure Statement, the Ballots, the solicitation procedures, and all other Solicitation Materials and matters related thereto, including, without limitation, the procedures and requirements for voting to accept or reject the Plan and for objecting to the Plan; provided, however, that the provisions of the notices and the Court’s Orders shall not be modified by any such responses, (iv) solicit votes on the Plan, and (v) if necessary, contact creditors and equity holders regarding the Plan.

The foregoing summary of the voting and solicitation procedures approved in the Disclosure Statement Order is subject in all respects to the actual terms of the Disclosure Statement Order. If there is any conflict between the summary set forth above and the terms of the Disclosure Statement Order, the terms of the Disclosure Statement Order shall control.

| 5. | Who to Contact for More Information |

If you have any questions about the procedure for voting your Claim or the Solicitation Materials, please contact Epiq at the address indicated above or by telephone at (646) 282-2400. Unless certain documents are specifically required to be provided to you by Bankruptcy Rule 3017(d), you may obtain additional copies of the Plan, this Disclosure Statement, or the exhibits to those documents, at your own expense by contacting Epiq at (646) 282-2400. Copies can also be obtained on the website http://chapter11.epiqsystems.com/Spansion.

Spansion Inc. files periodic and current reports, proxy statements and/or other information with the Securities and Exchange Commission. Should you want more information regarding the Debtors, please refer to the reports and other statements filed by Spansion Inc. with the Securities and Exchange Commission. Specifically, you are encouraged to read the following documents, which are incorporated herein by reference:

| • | Annual Report on Form 10-K for the fiscal year ended December 28, 2008; |

| • | Other Reports on Form 8-K filed with the Securities and Exchange Commission on January 5, 2009, January 16, 2009, February 4, 2009, February 5, 2009, February 13, 2009, February 17, 2009, February 20, 2009, February, 24, 2009, March 2, 2009, March 10, 2009, March 11, 2009, March 20, 2009, March 24, 2009, April 8, 2009, April 10, 2009, April 16, 2009, April 20, 2009, April 30, 2009, May 6, 2009, May 13, 2009 (with respect to Item 5.02 only), June 4, 2009, June 29, 2009, July 9, 2009, August 5, 2009, August 25, 2009, August 28, 2009, September 9, 2009, October 2, 2009, October 9, 2009 and October 15, 2009. |

You may read and copy any document Spansion Inc. files with the Securities and Exchange Commission at the Securities and Exchange Commission’s public reference room located at: 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the public reference room and its copy charges. SEC filings for Spansion Inc. are also available to the public on the Securities and Exchange Commission’s website at http://www.sec.gov.

14

| 6. | Acceptance or Rejection of the Plan |

The Bankruptcy Code defines “acceptance” of a plan by a class of claims as acceptance by holders of at least two-thirds in dollar amount and more than one-half in number of the “allowed” claims in that class that cast ballots for acceptance or rejection of the plan. Assuming that at least one Impaired Class votes to accept the Plan, the Debtors will seek to confirm the Plan under section 1129(b) of the Bankruptcy Code, referred to as the “cramdown” provisions, which permits the confirmation of a plan notwithstanding the non-acceptance by one or more Impaired classes of claims or equity interests. Under section 1129(b) of the Bankruptcy Code, the Plan may be confirmed if, among other things, (a) it has been accepted by at least one Impaired Class of Claims and (b) the Bankruptcy Court determines that the Plan does not discriminate unfairly and is “fair and equitable” with respect to the non-accepting Classes. A more detailed discussion of these requirements is provided in Article V of this Disclosure Statement.

| 7. | Time and Place of the Confirmation Hearing |

Section 1128(a) of the Bankruptcy Code requires the Bankruptcy Court, after notice, to hold the Confirmation Hearing on the Plan. Section 1128(b) of the Bankruptcy Code provides that any party-in-interest may object to Confirmation of the Plan.

Pursuant to section 1128 of the Bankruptcy Code and Bankruptcy Rule 3017(c), the Bankruptcy Court has scheduled the Confirmation Hearing to commence on January 28, 2010 at 10:00 a.m. (Eastern time), before the Honorable Kevin J. Carey, of the United States Bankruptcy Court for the District of Delaware, in Courtroom 5, United States Courthouse, 824 Market Street, 5th Floor, Wilmington, Delaware 19801. A notice setting forth the time and date of the Confirmation Hearing has been included in the Solicitation Materials. The Confirmation Hearing may be adjourned from time to time by the Bankruptcy Court without further notice, except for an announcement of such adjourned hearing date by the Bankruptcy Court in open court at such hearing.

| 8. | Objections to the Plan |

Any objection to Confirmation of the Plan must be in writing, must comply with the Bankruptcy Code and the Bankruptcy Rules and must be Filed with the United States Bankruptcy Court for the District of Delaware, 824 Market Street, 5th Floor, Wilmington, DE 19801, and served upon the following parties, so as to be received no later than January 26, 2010 at 4:00 p.m. (Eastern time): (a) Michael S. Lurey and Gregory O. Lunt, Latham & Watkins LLP, 355 S. Grand Avenue, Los Angeles, California 90071 (counsel for Debtors); (b) Michael R. Lastowski, Duane Morris, LLP, 1100 North Market Street, Suite 1200, Wilmington, DE 19801 (counsel for Debtors); (c) Patrick Tinker, Office of the United States Trustee, 844 King Street, Suite 2207, Wilmington, DE 19801; (d) James L. Patton, Jr., Young Conaway Stargatt & Taylor, LLP, The Brandywine Building, 1000 West Street, 17 th Floor, Wilmington, DE 19801 (counsel for the Creditors’ Committee); (e) Luc A. Despins, Paul, Hastings, Janofsky & Walker, LLP, 75 East 55th Street, New York, NY 10022 (counsel for the Creditors’ Committee); (f) Robert J. Stark, Brown Rudnick LLP, Seven Times Square, New York, NY 10036 (counsel to the Ad Hoc Consortium); (g) Steven K. Kortanek, Esq., Womble, Carlyle, Sandridge & Rice PLLC, 222

15

Delaware Avenue, 15th Floor, Wilmington, Delaware 19801 (counsel to the Ad Hoc Consortium); (h) Pamela K. Webster, Buchalter Nemer, 1000 Wilshire Boulevard, Suite 1500, Los Angeles, California, 90017 (counsel for Bank of America, N.A.); (i) Jason Madron, Richards, Layton & Finger PA, One Rodney Square, 920 North King Street, Wilmington, Delaware, 19801 (counsel for Bank of America, N.A.); and (j) Gregory Bray, Neil Wertlieb, Brett Goldblatt, Milbank, Tweed, Hadley & McCloy LLP, 601 S. Figueroa Street, 30th Floor, Los Angeles, California 90017 (counsel for Silver Lake (defined below)).

FOR THE REASONS SET FORTH BELOW, THE DEBTORS AND THE AD HOC CONSORTIUM URGE YOU TO RETURN YOUR BALLOT “ACCEPTING” THE PLAN.

ARTICLE II.

GENERAL INFORMATION REGARDING THE DEBTORS

FOR MORE DETAILED INFORMATION ABOUT THE DEBTORS, PLEASE ALSO

REVIEW THE SECURITIES AND EXCHANGE COMMISSION FILINGS REFERENCED IN

SECTION I.G.5. ABOVE

| A. | Formation and History of the Debtors |

The Debtors are semiconductor device companies which through their worldwide operations are exclusively dedicated to designing, developing, manufacturing, marketing, licensing and selling Flash memory solutions. Their Flash memory is integrated into a broad range of electronic products, including mobile phones, consumer electronics, automotive electronics, networking and telecommunications equipment, servers and computer peripherals. Their Flash memory solutions are incorporated in products from original equipment manufacturers (“OEMs”).

The Debtors are headquartered in Sunnyvale, California, with research and development, manufacturing and assembly operations (some of which are owned and operated by the Non-Debtor Affiliates) in North America, Europe, and Asia. Spansion LLC operates a Flash memory fabrication facility located in Austin, Texas, which has approximately 114,000 square feet of clean room space. This facility produces 200 millimeter wafers, and its process technology is 65 to 110 manometers. Through the Non-Debtor Affiliates, the Debtors also operate two assembly and test facilities. As discussed in greater detail in Section III.B below, Spansion Japan Limited (“Spansion Japan”), a wholly-owned subsidiary of Spansion LLC, owns and operates two Flash memory wafer fabrication facilities in Aizu, Japan.

The Debtors’ predecessor was Fujitsu AMD Semiconductor Limited (“FASL”), which was originally organized as a Flash memory manufacturing venture of Advanced Micro Devices, Inc. (“AMD”) and Fujitsu Limited (“Fujitsu”) in 1993. The primary function of FASL was to manufacture and sell Flash memory wafers to AMD and Fujitsu, who in turn converted the Flash memory wafers into finished Flash memory products and sold them to their customers. AMD and Fujitsu were also responsible for all research and development and marketing activities and provided FASL with various support and administrative services.

16

By 2003, AMD and Fujitsu desired to expand the operations of FASL to: achieve economies of scale; add additional Flash memory wafer fabrication capacity; include assembly, test, mark and pack operations; include research and development capabilities and include various marketing and administrative functions. To accomplish these goals, in 2003, AMD and Fujitsu reorganized FASL’s business as a Flash memory company called FASL LLC, later renamed Spansion LLC (“Former Spansion LLC”), by integrating the manufacturing venture with other Flash memory assets of AMD and Fujitsu. From this reorganization until the beginning of the second quarter of fiscal 2006, Former Spansion LLC manufactured and sold finished Flash memory devices to customers worldwide through its two sole distributors, AMD and Fujitsu. Former Spansion LLC was reorganized into Spansion Inc., a Delaware corporation, in connection with Spansion Inc.’s initial public offering in December 2005.

Spansion Inc. is a holding company and the ultimate parent company of all of the other Debtors and the Non-Debtor Affiliate. Spansion Inc. has four direct or indirect subsidiaries, all of which are Debtors: Spansion Technology LLC, Spansion LLC, Spansion International, Inc. and Cerium Laboratories LLC. Spansion Inc. owns 100% of the membership interests of Spansion Technology LLC and 60% of the membership interests of Spansion LLC. Spansion Technology owns the other 40% of the membership interests of Spansion LLC. Spansion LLC owns all of the stock and membership interests of, respectively Spansion International, Inc. and Cerium Laboratories LLC. Spansion LLC is also the direct or indirect parent of the Non-Debtor Affiliates, which are organized under the laws of various foreign countries. Spansion LLC is the Debtors’ principal operating entity. Attached hereto as Exhibit B is an organization chart showing the ownership structure of the Debtors and their Non-Debtor Affiliates.

| B. | The Debtors’ Business Operations |

| 1. | Products |

Three principal types of integrated circuits are used in most digital electronic systems: processors, logic, and memory.

| • | Processors, which include microprocessors, microcontrollers, and digital signal processors, are typically used for control, central computing tasks, and signal processing; |

| • | Logic is typically used to manage the interchange and manipulation of electronic signals within a system; and |

| • | Memory is used to store programming instructions and data. |

Spansion designs, develops, manufactures, markets and sells NOR Flash memory products and solutions. The memory market can be divided into “volatile” and “non-volatile” sub-segments. Volatile memory loses its contents when the system is powered down, while non-volatile memory retains its contents even after power is shut off, allowing memory contents to be retrieved at a later time. Flash memory is a non-volatile memory solution.

Many familiar products function as non-volatile memory: hard drives on personal computers, digital video discs or DVDs, magnetic tape, vinyl records, punch cards, and even

17

books are all examples of non-volatile storage. Some of these storage technologies continue to be mainstream solutions. Others are largely obsolete, made so by advances in technology. Still others occupy a middle ground increasingly impacted by Flash memory solutions as electromechanical storage solutions are replaced by solid state semiconductor Flash memory solutions.

In the last five to ten years the emergence of non-volatile Flash memory storage for common everyday applications such as Flash memory cards for digital cameras, “memory sticks” for computer files and Flash memory in portable “MP3” music players has made Flash memory a household word. However, Flash memory is also a critical component that has been “embedded” in other less familiar applications for a much longer period, almost two decades. Flash memory is a ubiquitous and necessary technology used in almost all electronic systems. It is this type of embedded Flash memory, specifically NOR Flash memory, that Spansion provides.

Memory solutions are primarily differentiated on the basis of:

| • | performance - how quickly information can be stored and/or accessed; |

| • | price - measured in cost per unit of information stored; |

| • | form factor - size of system relative to amount of information stored; |

| • | ease and flexibility of use; and |

| • | quality and reliability. |

The relative importance of these factors in different applications can vary leading to the development of different types of both volatile and non-volatile memory technology, where the attributes of the memory used depend on the characteristics and requirements of the application and the stored information.

Many electronic systems employ several memory solutions to achieve a balance between all of the intrinsic attributes discussed above. For example, a personal computer usually has a disk drive to store large amounts of information at a relatively low cost, for a long time, but with a relatively large physical space requirement, relatively slow performance, and significant energy consumption. Information stored on the hard disk is mostly “user data” but also includes the operating system software, such as Microsoft Windows or a user’s application software such as a word processor. The amount of time a user has to wait to store or read documents to or from a disk drive (seconds or less) is usually acceptable. However, in order to provide acceptable performance while operating, a computer has to copy parts of the operating system and software applications into a faster memory technology. So personal computers also use Dynamic Random Access Memory, or DRAM, to store programming instructions (“code”) and data that the computer’s processor is actively using for calculations or manipulations. DRAM is a semiconductor integrated circuit, and the dominant volatile memory architecture used in nearly all electronic systems that also contain a microprocessor. The principal advantage of DRAM is its very high performance; to achieve acceptable levels of performance, the processor or controller must be able to read and write code and/or data from memory at very fast rates (millions of “writes” and “reads” per second). However, if the circuit loses power (intentionally or not) the information stored in the DRAM is lost.

18

Most electronic systems do not require the large storage of a hard drive. Their non-volatile memory requirements may be many orders of magnitude smaller and are frequently satisfied by a single Flash memory device. In addition these systems may require the higher performance and reliability that only solid state semiconductor solutions can provide and the lower cost of a memory sub-system sized appropriately for the application. For these systems Flash memory replaces the functionality of the hard drive. The system can boot from Flash memory and then depending on the type of Flash memory used, the operating system and applications may run directly from the Flash memory without requiring contents to be copied first into DRAM, or alternatively and similarly to the example of the PC, code may be copied from Flash memory into DRAM before the processor uses it.

Memory selection for a system is based on a number of criteria. Just as these criteria will determine a choice between storage solutions such as hard drive versus solid state semiconductor storage, the criteria will also determine the choice between different types of semiconductor memory and even the different types of non-volatile semiconductor memory including different types of Flash memory. There are two main types of Flash memory, NOR and NAND. The terms NOR and NAND refer to the architecture of the connections between the memory cells of the device which produce the different characteristics of the two memory types. The largest and fastest growing sub-segment of the Flash memory market is NAND Flash memory. NAND offers a number of desirable attributes: it is relatively inexpensive, a small device can hold a great amount of information, and its performance characteristics are particularly well suited to data storage such as music, pictures, video, etc. The market for NAND Flash memory has grown rapidly in recent years owing to the growing popularity of devices that consumers can use to access their personal media in a portable, battery-powered format. Of all non-volatile memory technologies, NAND Flash memory has had the most obvious impact on the everyday consumer through the use of these types of application.

NOR Flash memory has different characteristics than NAND Flash memory. NOR can, for example, support the operation or execution of software code directly from the device as its read times are very fast and its architecture supports the way software needs to execute, a capability that can enable a more efficient and cost effective design. Though NOR Flash memory is more expensive than NAND for comparable densities, it is also available in much lower densities with lower prices than NAND and for this reason alone is preferred in many applications that do not require the greater storage capacity of NAND. At higher densities similar to NAND, the high reliability and ease of use of NOR, in addition to its ability to support a more efficient and cost effective memory sub-system in certain applications, make it a favored solution. These characteristics continue to drive NOR Flash memory use in embedded applications. For example modern automobiles are dependent on NOR Flash memory for engine control, transmission control, ABS systems, anti roll systems and a multitude of other operations in the vehicle. The majority of cell phones continue to use NOR Flash memory. The telecommunication, networking, consumer electronics, and industrial control industries rely on NOR Flash memory. While NOR applications are not as obvious to the consumer, the modern world is dependent on NOR Flash memory.

Another solution for storing code is various forms of programmable memory devices referred to as “one-time programmable.” One time programmable devices offer the non-volatility, performance, and low error rates of NOR Flash at a lower cost. However, once the device has

19

been loaded with information, it can never be reloaded again with different information. While this is often not an issue for storing code in many applications, it significantly limits the usefulness of the device in other respects. NOR Flash is a suitable platform for storing the code, and, extra capacity on the same device above and beyond what is required to store the code can be used to store user data – permanently and with high quality and without power. Thus NOR Flash can be used to fulfill two functions with one device: 1) storage of the code, and 2) temporary or permanent storage of user data. Accomplishing both functions with one device, versus two, lowers system cost and reduces design complexity.

The total market for memory systems and devices used in electronic systems is quite large, typically in excess of $50 billion per year (ignoring the depressed market conditions of the last year). Large, well-entrenched suppliers compete vigorously within a number of segments and across segments. Technology advances rapidly and suppliers have active development programs to enhance the features and capabilities of their respective product offerings. Thus, the characteristics that divide these segments can dissolve through time as evidenced by the incursion of solid state drives into the hard drive market. In the case of Flash memory, system designers have devised systems where NAND Flash memory can replace traditional NOR Flash memory, which in certain applications yields acceptable reliability and performance at a lower overall cost. These examples illustrate a general characteristic of technology-centric industries and the memory industry in particular: advancing technology creates market share dislocations. Thus, while NOR Flash has well-established positions in certain applications, it may be possible in the future to expand its use into other applications, and, conversely, there is no guarantee that existing positions will endure forever. The challenge for the Debtors, and all of their competitors, is to leverage their existing capabilities in creative ways to create value for their customers.

The Debtors’ current product portfolio ranges from 1-megabit to 2-gigabits in terms of capacity and is offered with a broad array of interfaces and features. Historically the Debtors’ products were based on floating gate technology; however, the majority of the Debtors’ new product designs use MirrorBit technology, a proprietary charge trapping non-volatile memory technology.

On March 18, 2008, Spansion LLC completed the acquisition of all of the outstanding shares of Saifun Semiconductor Ltd. (“Saifun”), a provider of intellectual property solutions for the non-volatile memory market located in Israel. Historically, Saifun licensed its intellectual property to semiconductor manufacturers that used this technology to develop and manufacture memory products. To date, Saifun has provided technology, designs and technology licensing revenues that have contributed to the Debtors’ product portfolio and revenue and in the future may provide a platform for the Debtors to increase their technology licensing business.

In fiscal 2008, the net sales of wireless applications, such as mobile phones, and embedded applications (gaming, set top boxes, DVD players and automotive and industrial electronics) each represented approximately 50% of the Debtors’ total net sales. Sales of MirrorBit technology-based products increased from approximately 71% in fiscal 2007 to approximately 79% in fiscal 2008. The remainder of the Debtors’ sales has been based on floating gate technology.

20

| 2. | Customers |

The Debtors serve their customers worldwide directly or through their distributors, who buy products from the Debtors and resell them to their customers, either directly or through other distributors. Customers for the Debtors’ products consist of OEMs, original design manufacturers (“ODMs”) and contract manufacturers. Among those customers, Nokia Corporation accounted for approximately 18% and 10% of the Debtors’ net sales in fiscal 2008 and fiscal 2007, respectively. For fiscal 2008, fiscal 2007 and fiscal 2006, Fujitsu (as defined below), as a distributor of the Debtors’ products, accounted for approximately 29%, 35% and 36% of the Debtors’ net sales, respectively.

The Debtors sell directly to large multi-national customers, certain larger regional accounts, and targeted customers using a direct sales force and third-party representatives with an expertise in memory circuits and established relationships at important accounts.

Sales to the Debtors’ distributors are typically made pursuant to agreements that provide return rights for discontinued products or for products that are not more than twelve months older than their manufacturing date code. In addition, some of the Debtors’ agreements with distributors may contain standard stock rotation provisions permitting limited levels of product returns. The Debtors currently rely on Fujitsu Microelectronics Limited (“FML”), through its subsidiary Fujitsu Electronics Inc. (“FEI,” together with FML and Fujitsu Limited, “Fujitsu”), to act as the largest distributor of their products to customers in Japan and also as a nonexclusive distributor throughout the rest of the world, other than Europe and the Americas with limited exceptions. See Section III.F.2 below.

The Debtors generally warrant that products sold to their customers and their distributors will, at the time of shipment, be free from defects in workmanship and materials and conform to their approved specifications. Subject to specific exceptions, the Debtors offer a one-year limited warranty.