Attached files

| file | filename |

|---|---|

| EX-12 - EXHIBIT 12 - PEP BOYS MANNY MOE & JACK | a2197963zex-12.htm |

| EX-23 - EXHIBIT 23 - PEP BOYS MANNY MOE & JACK | a2197963zex-23.htm |

| EX-31.2 - EXHIBIT 31.2 - PEP BOYS MANNY MOE & JACK | a2197963zex-31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - PEP BOYS MANNY MOE & JACK | a2197963zex-31_1.htm |

| EX-32.2 - EXHIBIT 32.2 - PEP BOYS MANNY MOE & JACK | a2197963zex-32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - PEP BOYS MANNY MOE & JACK | a2197963zex-32_1.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended January 30, 2010 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 1-3381

The Pep Boys—Manny, Moe & Jack

(Exact name of registrant as specified in its charter)

| Pennsylvania (State or other jurisdiction of incorporation or organization) |

23-0962915 (I.R.S. employer identification no.) |

|

3111 West Allegheny Avenue, Philadelphia, PA (Address of principal executive office) |

19132 (Zip code) |

215-430-9000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, $1.00 par value | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No ý

As of the close of business on August 2, 2009 the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $456,221,486.

As of April 2, 2010, there were 52,448,473 shares of the registrant's common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement, which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the Company's fiscal year, for the Company's 2010 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

| |

|

Page | ||

|---|---|---|---|---|

PART I |

||||

Item 1. |

Business |

1 | ||

Item 1A. |

Risk Factors |

10 | ||

Item 1B. |

Unresolved Staff Comments |

13 | ||

Item 2. |

Properties |

13 | ||

Item 3. |

Legal Proceedings |

14 | ||

Item 4. |

(Removed and Reserved) |

15 | ||

PART II |

||||

Item 5. |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

16 | ||

Item 6. |

Selected Financial Data |

19 | ||

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

21 | ||

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

37 | ||

Item 8. |

Financial Statements and Supplementary Data |

38 | ||

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

87 | ||

Item 9A. |

Controls and Procedures |

87 | ||

Item 9B. |

Other Information |

91 | ||

PART III |

||||

Item 10. |

Directors, Executive Officers and Corporate Governance |

91 | ||

Item 11. |

Executive Compensation |

91 | ||

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

91 | ||

Item 13. |

Certain Relationships and Related Transactions and Director Independence |

91 | ||

Item 14. |

Principal Accounting Fees and Services |

91 | ||

PART IV |

||||

Item 15. |

Exhibits and Financial Statement Schedules |

92 | ||

|

Signatures |

95 |

i

GENERAL

The Pep Boys—Manny, Moe & Jack and subsidiaries ("the Company") began operations in 1921 and is the only national chain offering automotive service, tires, parts and accessories. This positioning allows us to streamline the distribution channel and pass the savings on to our customer facilitating our vision of becoming the automotive solutions provider of choice for the value-oriented customer. Our primary operating unit is our Supercenter format, which serves both "do-it-for-me" ("DIFM", which includes service labor, installed merchandise and tires) and "do-it-yourself" ("DIY", or retail) customers with the highest quality service offerings and merchandise. In most of our Supercenters, we also have a commercial sales program that provides commercial credit and prompt delivery of tires, parts and other products to local, regional and national repair shops and dealers.

The Company operates approximately 11,686,000 of gross square feet of retail space, including service bays. The Supercenters average approximately 20,700 square feet, Service & Tire Centers average 6,800 square feet and the Pep Express stores average 9,500 square feet.

In 2009, as part of our long-term strategy to lead with automotive service, we began complementing our existing Supercenter store base with Service & Tire Centers. These Service & Tire Centers are designed to capture market share and leverage our existing Supercenters and support infrastructure. We currently plan to lease Service & Tire Center locations, as we believe that there are sufficient existing available locations with attractive lease terms to enable our expansion. We are targeting a total of 40 new Service & Tire Centers in fiscal 2010, and 80 in fiscal 2011. In fiscal 2009, we opened 24 new Service & Tire Centers including ten locations acquired through our purchase of Florida Tire, Inc. and one new Supercenter.

The following table sets forth the percentage of total revenues from continuing operations contributed by each class of similar products or services for the Company and should be read in conjunction with the Consolidated Financial Statements and Notes thereto included elsewhere herein:

| |

Year ended | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

January 30, 2010 |

January 31, 2009 |

February 2, 2008 |

|||||||

Parts and accessories |

63.9 | % | 65.1 | % | 66.6 | % | ||||

Tires |

16.4 | 16.3 | 15.2 | |||||||

Total merchandise sales |

80.3 | 81.4 | 81.8 | |||||||

Service labor |

19.7 | 18.6 | 18.2 | |||||||

Total revenues |

100.0 | % | 100.0 | % | 100.0 | % | ||||

As of January 30, 2010, the Company operated its stores in 35 states and Puerto Rico. The following table indicates, by state, the number of stores the Company had in operation at the end of

1

each of the last five fiscal years, and the number of stores opened and closed by the Company during each of the last four fiscal years:

NUMBER OF STORES AT END OF FISCALS 2006 THROUGH 2009

State

|

2009 Year End |

Closed | Opened | 2008 Year End |

Closed | Opened | 2007 Year End |

Closed | Opened | 2006 Year End |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Alabama |

1 | — | — | 1 | — | — | 1 | — | — | 1 | |||||||||||||||||||||

Arizona |

22 | — | — | 22 | — | — | 22 | 1 | 1 | 22 | |||||||||||||||||||||

Arkansas |

1 | — | — | 1 | — | — | 1 | — | — | 1 | |||||||||||||||||||||

California |

124 | — | 6 | 118 | — | — | 118 | 3 | — | 121 | |||||||||||||||||||||

Colorado |

7 | — | — | 7 | — | — | 7 | 1 | — | 8 | |||||||||||||||||||||

Connecticut |

7 | — | — | 7 | — | — | 7 | 1 | — | 8 | |||||||||||||||||||||

Delaware |

7 | — | 1 | 6 | — | — | 6 | — | — | 6 | |||||||||||||||||||||

Florida |

53 | — | 10 | 43 | — | — | 43 | — | — | 43 | |||||||||||||||||||||

Georgia |

22 | — | — | 22 | — | — | 22 | 3 | — | 25 | |||||||||||||||||||||

Illinois |

25 | — | 3 | 22 | — | — | 22 | 1 | — | 23 | |||||||||||||||||||||

Indiana |

7 | — | — | 7 | — | — | 7 | 2 | — | 9 | |||||||||||||||||||||

Kansas |

— | — | — | — | — | — | — | 2 | — | 2 | |||||||||||||||||||||

Kentucky |

4 | — | — | 4 | — | — | 4 | — | — | 4 | |||||||||||||||||||||

Louisiana |

8 | — | — | 8 | — | — | 8 | 2 | — | 10 | |||||||||||||||||||||

Maine |

1 | — | — | 1 | — | — | 1 | — | — | 1 | |||||||||||||||||||||

Maryland |

18 | — | — | 18 | — | — | 18 | 1 | — | 19 | |||||||||||||||||||||

Massachusetts |

6 | — | — | 6 | — | — | 6 | 1 | — | 7 | |||||||||||||||||||||

Michigan |

5 | — | — | 5 | — | — | 5 | 2 | — | 7 | |||||||||||||||||||||

Minnesota |

3 | — | — | 3 | — | — | 3 | — | — | 3 | |||||||||||||||||||||

Missouri |

1 | — | — | 1 | — | — | 1 | — | — | 1 | |||||||||||||||||||||

Nevada |

12 | — | — | 12 | — | — | 12 | — | — | 12 | |||||||||||||||||||||

New Hampshire |

4 | — | — | 4 | — | — | 4 | — | — | 4 | |||||||||||||||||||||

New Jersey |

31 | — | 2 | 29 | — | — | 29 | — | 1 | 28 | |||||||||||||||||||||

New Mexico |

8 | — | — | 8 | — | — | 8 | — | — | 8 | |||||||||||||||||||||

New York |

29 | — | — | 29 | — | — | 29 | — | — | 29 | |||||||||||||||||||||

North Carolina |

8 | — | — | 8 | — | — | 8 | 2 | — | 10 | |||||||||||||||||||||

Ohio |

10 | — | — | 10 | — | — | 10 | 2 | — | 12 | |||||||||||||||||||||

Oklahoma |

5 | — | — | 5 | — | — | 5 | 1 | — | 6 | |||||||||||||||||||||

Pennsylvania |

45 | — | 3 | 42 | — | — | 42 | — | — | 42 | |||||||||||||||||||||

Puerto Rico |

27 | — | — | 27 | — | — | 27 | — | — | 27 | |||||||||||||||||||||

Rhode Island |

2 | — | — | 2 | — | — | 2 | 1 | — | 3 | |||||||||||||||||||||

South Carolina |

6 | — | — | 6 | — | — | 6 | — | — | 6 | |||||||||||||||||||||

Tennessee |

7 | — | — | 7 | — | — | 7 | — | — | 7 | |||||||||||||||||||||

Texas |

47 | — | — | 47 | — | — | 47 | 7 | — | 54 | |||||||||||||||||||||

Utah |

6 | — | — | 6 | — | — | 6 | — | — | 6 | |||||||||||||||||||||

Virginia |

16 | — | — | 16 | — | — | 16 | — | — | 16 | |||||||||||||||||||||

Washington |

2 | — | — | 2 | — | — | 2 | — | — | 2 | |||||||||||||||||||||

Total |

587 | — | 25 | 562 | — | — | 562 | 33 | (1) | 2 | 593 | ||||||||||||||||||||

- (1)

- As more fully described in Note 11—Store Closures and Asset Impairments of the notes to the Consolidated Financial Statements included in Item 8, the Company closed 31 stores during the fourth quarter of fiscal 2007.

2

BUSINESS STRATEGY

Our vision for Pep Boys is to take what we believe to be our industry-leading position in automotive services and accessories and become the automotive solutions provider of choice for the value-oriented customer. Our brand positioning—"Pep Boys Does Everything. For Less" is designed to convey to customers the breadth of the automotive services and merchandise that we offer and our value proposition. The four strategies to achieve our vision are to: (i) Earn the trust of our customers every day, (ii) Lead with our service business and grow through our Service & Tire Centers, (iii) Establish a differentiated retail experience by leveraging our Automotive Superstore and (iv) Leverage our Automotive Superstore to provide the most complete offering for our commercial customers.

Earn the TRUST of our Customers every day. We do this by delivering a customer experience that is based on Speed, Expertise, Respect and Value. We start with our associates, focusing on their hiring, training and development, and the conversion of their compensation to performance-based plans. In our stores, we strive to continuously improve the customer experience by providing better looking and easier to shop stores and more consistent execution of our simplified and streamlined operations. We have developed a specific tailored marketing plan for each of our markets to maximize our reach and efficiencies. These marketing programs focus on TV and radio promotions scheduled around traditional shopping holidays that focus on the most frequently needed services. These promotions are supplemented by extensive direct marketing and grass-roots campaigns and occasional print campaigns. And our Rewards program that benefits customers whether they choose to do it themselves or have us do it for them, helps to drive customer count increases and repeat business through discounted towing, free services and rewards points for purchases.

Lead with our Service business and grow through our Service & Tire Centers. We do this by being a full service—tire, maintenance and repair—shop that DOES EVERYTHING. FOR LESS. Our full service capabilities, ASE-certified technicians and continuous investment in training and equipment allow customers to rely on us for all of their automotive service and maintenance needs. We can provide these services at highly-competitive prices because our size and business model allow us to buy quality parts at lower prices and pass those savings onto our customers.

Our store growth plans are centered on a "hub and spoke" model, which calls for adding smaller neighborhood Service & Tire Centers to our existing Supercenter store base in order to further leverage our existing inventories, distribution network, operations infrastructure and advertising spend. We opened 25 new stores in 2009—24 Service & Tire Centers and one smaller prototype Supercenter. Our plans call for 40 more new locations in 2010, followed by 80 in 2011. The typical Service & Tire Center is full service with approximately six service bays and $1 million in expected sales. Our Supercenters were built to be destination stores. Our Service & Tire Centers offer customer convenience, allowing us to be close to our customers' home or work.

Establish a differentiated Retail experience by leveraging our Automotive Superstore. The size of our stores allows us to provide the highest level of replacement parts coverage and the broadest range of maintenance, performance and appearance products and accessories in the industry. As part of our commitment to carry the best assortment of automotive aftermarket merchandise, we make assortment decisions by examining every merchandise category using market and demographic data to assure we have the best product in the right place. This category management process ensures our assortment includes the appropriate coverage for service, retail and commercial consumers as well as allowing us to make good, sound decisions about price, product and promotions.

Leverage our Automotive Superstore to provide the most complete offering for our Commercial customers. To further leverage our inventory and automotive aftermarket expertise, we continue to

3

expand our commercial operations. In addition to offering these customers parts and fluids, we enjoy a competitive advantage of also being able to offer tires, equipment, accessories and services.

STORE IMPROVEMENTS

In fiscal 2009, the Company's capital expenditures totaled $43,214,000 which included the addition of 25 stores and one regional tire and battery distribution center, as well as other store and corporate improvements. Our fiscal 2010 capital expenditures are expected to be approximately $68,000,000 which includes the addition of approximately 40 Service & Tire Centers and other store and corporate improvements. These expenditures are expected to be funded from cash on hand, net cash generated from operating activities and the Company's existing line of credit.

SERVICES AND PRODUCTS

The Company operates a total of 6,027 service bays in 578 of its 587 locations. Each service location performs a full range of automotive repair and maintenance services (except body work) and installs tires, hard parts and accessories.

Each Pep Boys Supercenter and Pep Express store carries a similar product line, with variations based on the number and type of cars in the markets where the store is located, while a Pep Boys Service & Tire Center carries tires and a limited selection of our other products. A full complement of inventory at a typical Supercenter includes an average of approximately 25,000 items, while Service & Tire Centers average approximately 4,000 items. The Company's product lines include: tires (not stocked at Pep Express stores); batteries; new and remanufactured parts for domestic and import vehicles; chemicals and maintenance items; fashion, electronic, and performance accessories; and a limited amount of select non-automotive merchandise that appeals to automotive "Do-It-Yourself" customers, such as generators, power tools, personal transportation products and canopies.

In addition to offering a wide variety of high quality name brand products, the Company sells an array of high quality products under various private label names. The Company sells tires under the names DEFINITY, FUTURA® and CORNELL®, and batteries under the name PROSTART®. The Company also sells wheel covers under the name FUTURA®; water pumps and cooling system parts under the name PROCOOL®; air filters, anti-freeze, chemicals, cv axles, lubricants, oil, oil filters, oil treatments, transmission fluids, wheel rims and wiper blades under the name PROLINE®; alternators, battery booster packs, alkaline type batteries and starters under the name PROSTART®; power steering hoses, chassis parts and power steering pumps under the name PROSTEER®; brakes under the name PROSTOP® and brakes, starters, and ignitions under the name VALUEGRADE. All products sold by the Company under various private label names were approximately 31%, 28%, and 27% of the Company's merchandise sales in fiscal 2009, 2008, and 2007, respectively.

The Company's commercial automotive parts delivery program, branded PEP EXPRESS PARTS®, is designed to increase the Company's market share with the professional installer and to leverage inventory investment. The program satisfies the commercial customer's automotive inventory needs by taking advantage of the breadth and quality of the Company's parts inventory as well as its experience supplying its own service bays and mechanics. As of January 30, 2010, approximately 80% or 451 of the Company's 562 Supercenters and Pep Express stores provided commercial parts delivery as compared to approximately 76% or 428 stores at the end of fiscal 2008.

In May 2009, the Company began a 20-store pilot program designed to fulfill the Company's goal of becoming the automotive solutions provider of choice for mobile electronics and installation services. The Company re-organized our automotive audio product lines to include radios, speakers, amplifiers, remote starters and alarm systems from the most popular brands. The key to this program was the addition of expert sales and installation technicians to service our customers' needs. In November 2009,

4

we added an additional 11 stores to the program and we expect to expand to a total of 150 stores by the end of the second quarter of fiscal 2010.

The Company has a point-of-sale system in all of its stores, which gathers sales and inventory data by stock-keeping unit from each store on a daily basis. This information is then used by the Company to help formulate its pricing, inventory, marketing, and merchandising strategies. The Company has an electronic parts catalog that allows our employees to efficiently look up the parts that our customers need and to provide complete job solutions, advice and information for customer vehicles. The Company has an electronic work order system in all of its service centers. This system creates a service history for each vehicle, provides customers with a comprehensive sales document and enables the Company to maintain a service customer database.

The Company primarily uses an "Everyday Low Price" (EDLP) strategy in establishing its selling prices. Management believes that EDLP provides better value to its customers on a day-to-day basis, helps level customer demand and allows more efficient management of inventories. On a periodic basis, the Company employs a promotional pricing strategy on select items and service offers to drive increased customer traffic.

The Company uses various forms of advertising to promote its service and repair capabilities , merchandise offerings and its commitment to customer service and satisfaction. The Company is committed to an effective promotional schedule with TV and radio promotions that focus on the most frequently needed services and are scheduled around periods of time when automotive repair and preventative maintenance are top of mind and relevant to our customers. These promotions will be supplemented by extensive direct marketing and grass-roots campaigns and occasional print campaigns.

The Company maintains a website located at www.pepboys.com. It serves as an important portal to our Company, allowing consumers the freedom and convenience to access more information about the organization, our stores and our service, tires, parts and accessories offerings online. The site also provides consumers with general and seasonal car care tips, do-it-yourself vehicle maintenance and light repair guidance and safe driving pointers. Exclusive online coupons are available to site visitors who register their e-mail addresses with us. These coupons cover special discounts on services and products at Pep Boys.

In fiscal 2009, approximately 35% of the Company's total revenues were cash transactions with the remainder being co-branded credit card, other credit and debit card transactions and commercial credit accounts.

STORE OPERATIONS AND MANAGEMENT

Most Pep Boys stores are open seven days a week. Each Supercenter has a Retail Manager and Service Manager (Service & Tire Centers only have a Service Manager while Pep Express stores only have a Retail Manager) who report to geographic-specific Area Directors and Division Vice Presidents. The Division Vice Presidents report to the Senior Vice President of Stores who in turn reports to the Chief Executive Officer. As of January 30, 2010, a Retail Manager's and a Service Manager's average length of service with the Company is approximately 9.3 and 6.3 years, respectively.

Supervision and control over individual stores is facilitated by means of the Company's computer system, operational handbooks and regular visits to stores by Area Directors and Divisional Vice Presidents. All of the Company's advertising, accounting, purchasing, information technology, and most of its administrative functions are conducted at its corporate headquarters in Philadelphia, Pennsylvania. Certain administrative functions for the Company's regional operations are performed at various regional offices of the Company. See "Item 2 Properties."

5

INVENTORY CONTROL AND DISTRIBUTION

Most of the Company's merchandise is distributed to its stores from its warehouses by dedicated and contract carriers. Target levels of inventory for each product are established for each warehouse and store based upon prior shipment history, sales trends and seasonal demand. Inventory on hand is compared to the target levels on a weekly basis at each warehouse, potentially triggering re-ordering of merchandise from suppliers. In addition, each Pep Boys store has an automated inventory replenishment system that orders additional inventory, generally from a warehouse, when a store's inventory on-hand falls below the target levels.

The Company also maintains Superhub stores which have a larger assortment of product than our normal Supercenter. Implementation of the Superhub store concept enabled local expansion of our product assortment in a cost effective manner. We are now able to satisfy customer needs for slow moving product by carrying limited amounts of this product at Superhub stores. These Superhubs then deliver this product to requesting Supercenters to fulfill customer demand. Superhub stores are generally replenished from distribution centers multiple times per week.

SUPPLIERS

During fiscal 2009, the Company's ten largest suppliers accounted for approximately 52% of the merchandise purchased by the Company. No single supplier accounted for more than 18% of the Company's purchases. The Company has no long-term contracts under which it is required to purchase merchandise except for a contract to purchase bulk oil for use in the Company's service bays, which is anticipated to expire in 2010. Management believes that the relationships the Company has established with its suppliers are generally good.

In the past, the Company has not experienced difficulty in obtaining satisfactory sources of supply and believes that adequate alternative sources of supply exist, at similar cost, for the types of merchandise sold in its stores.

COMPETITION

The Company operates in a highly competitive environment. The Company encounters competition from nationwide and regional chains and from local independent service provides and merchants. The Company's competitors include general, full range, discount or traditional department stores which carry automotive parts and accessories and/or have automotive service centers, as well as specialized automotive retailers. Generally, the specialized automotive retailers focus on either the "do-it-yourself" or "do-it-for-me" areas of the business. The Company believes that its operation in both the "do-it-for-me" and "do-it-yourself" areas of the business positively differentiates it from most of its competitors. However, certain competitors are larger in terms of sales volume, store size, and/or number of stores. Therefore, these competitors have access to greater capital and management resources and have been operating longer or have more stores in particular geographic areas than the Company. The principal methods of competition in our industry include store location, customer service and product offerings, quality and price.

REGULATION

The Company is subject to various federal, state and local laws and governmental regulations relating to the operation of its business, including those governing the handling, storage and disposal of hazardous substances contained in the products it sells and uses in its service bays, the recycling of batteries, tires and used lubricants, the sale of small engine merchandise and the ownership and operation of real property.

6

EMPLOYEES

At January 30, 2010, the Company employed 17,718 persons as follows:

Description

|

Full-time | % | Part-time | % | Total | % | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Retail |

3,839 | 32.3 | 4,233 | 72.5 | 8,072 | 45.6 | |||||||||||||

Service center |

6,774 | 57.0 | 1,515 | 26.0 | 8,289 | 46.8 | |||||||||||||

Store total |

10,613 | 89.3 | 5,748 | 98.5 | 16,361 | 92.4 | |||||||||||||

Warehouses |

541 | 4.6 | 83 | 1.4 | 624 | 3.5 | |||||||||||||

Offices |

727 | 6.1 | 6 | 0.1 | 733 | 4.1 | |||||||||||||

Total employees |

11,881 | 100.0 | 5,837 | 100.0 | 17,718 | 100.0 | |||||||||||||

The Company had no union employees as of January 30, 2010. At January 31, 2009, the Company employed 12,169 full-time and 6,289 part-time employees.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained herein, including in "Item 1 Business" and "Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations", constitute "forward-looking statements" within the meaning of The Private Securities Litigation Reform Act of 1995. The words "guidance," "expects," "anticipates," "estimates," "forecasts" and similar expressions are intended to identify these forward-looking statements. Forward-looking statements include management's expectations regarding implementation of its long-term strategic plan, future financial performance, automotive aftermarket trends, levels of competition, business development activities, future capital expenditures, financing sources and availability and the effects of regulation and litigation. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be achieved. Our actual results may differ materially from the results discussed in the forward-looking statements due to factors beyond our control, including the strength of the national and regional economies, retail and commercial consumers' ability to spend, the health of the various sectors of the automotive aftermarket, the weather in geographical regions with a high concentration of our stores, competitive pricing, the location and number of competitors' stores, product and labor costs and the additional factors described in our filings with the Securities and Exchange Commission ("SEC"). See "Item 1A Risk Factors." We assume no obligation to update or supplement forward-looking statements that become untrue because of subsequent events.

SEC REPORTING

We electronically file certain documents with, or furnish such documents to, the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, along with any related amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. From time-to-time, we may also file registration and related statements pertaining to equity or debt offerings. You may read and copy any materials we file with the SEC at the SEC's Office of Filings and Information Services at 100 F Street, NE, Washington, DC 20549. You may obtain information regarding the Office of Filings and Information Services by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file or furnish documents electronically with the SEC.

We provide free electronic access to our annual, quarterly and current reports (and all amendments to these reports) on our Internet website, www.pepboys.com. These reports are available on our website as soon as reasonably practicable after we electronically file or furnish such materials

7

with or to the SEC. Information on our website does not constitute part of this Annual Report, and any references to our website herein are intended as inactive textual references only.

Copies of our SEC reports are also available free of charge. Please call our investor relations department at 215-430-9720 or write Pep Boys, Investor Relations, 3111 West Allegheny Avenue, Philadelphia, PA 19132 to request copies.

EXECUTIVE OFFICERS OF THE COMPANY

The following table indicates the name, age, tenure with the Company and position (together with the year of election to such position) of the executive officers of the Company:

Name

|

Age | Tenure with Company as of April 2010 |

Position with the Company and Date of Election to Position | ||||

|---|---|---|---|---|---|---|---|

Michael R. Odell |

46 | 3 years | Chief Executive Officer since September 2008 | ||||

Raymond L. Arthur |

51 |

2 years |

Executive Vice President—Chief Financial Officer since May 2008 |

||||

Joseph A. Cirelli |

51 |

33 years |

Senior Vice President—Business Development since November 2007 |

||||

Troy E. Fee |

41 |

3 years |

Senior Vice President—Human Resources since July 2007 |

||||

William E. Shull III |

51 |

2 years |

Senior Vice President—Stores since September 2008 |

||||

Scott A. Webb |

46 |

3 years |

Senior Vice President—Merchandising & Marketing since September 2007 |

||||

Brian D. Zuckerman |

40 |

11 years |

Senior Vice President—General Counsel & Secretary since March 2009 |

||||

Michael R. Odell was named Chief Executive Officer on September 22, 2008, after serving as Interim Chief Executive Officer since April 23, 2008. Mr. Odell joined the Company in September 2007 as Executive Vice President—Chief Operating Officer, after having most recently served as the Executive Vice President and General Manager of Sears Retail & Specialty Stores. Mr. Odell joined Sears in its finance department in 1994 where he served until he joined Sears operations team in 1998. There he served in various executive operations positions of increasing seniority, including as Vice President, Stores—Sears Automotive Group.

Raymond L. Arthur joined Pep Boys in May 2008 after serving as Executive Vice President and Chief Financial Officer of Toys "R" Us Inc., from 2004 to 2006, where he oversaw its strategic review and restructuring of company-wide operations, as well as managing the leveraged buy-out of the company. During his seven year tenure at Toys "R" Us, Mr. Arthur also served as President and Chief Financial Officer of toysrus.com from 2000 to 2003 and as Corporate Controller of Toys "R" Us from 1999 to 2000. Prior to that, he worked in a variety of roles of increasing responsibility for General Signal, American Home Products, American Cyanamid and in public accounting.

Joseph A. Cirelli was named Senior Vice President—Corporate Development in November 2007. Since March 1977, Mr. Cirelli has served the Company in positions of increasing seniority, including Senior Vice President—Service, Vice President—Real Estate and Development, Vice President—Operations Administration, and Vice President—Customer Satisfaction.

8

Troy E. Fee, Senior Vice President—Human Resources, joined the Company in July 2007, after having most recently served as the Senior Vice President of Human Resources Shared Services for TBC Corporation, then the parent company of Big O Tires, Tire Kingdom and National Tire & Battery. Mr. Fee has over 20 years experience in operations and human resources in the tire and automotive service and repair business.

William E. Shull III joined the Company in September 2008 as Senior Vice President—Stores. Over the last 25 years Mr. Shull has held several senior management positions where his focus was on building and integrating store management teams into successfully profitable and cohesive units. Some of his executive positions include SVP—Sales at The Wiz; SVP—Mall Operations of TransWorld Entertainment; SVP—Operations of Hollywood Entertainment; and in his 13 years at AutoZone he was instrumental in building the foundation of the retail chain in 4 geographic regions and responsible for store communications, training, and served on several strategic initiative committees. He was also a principal and the COO of a small, high-end custom electronics firm in Memphis TN, selling his stake in 2005.

Scott A. Webb, Senior Vice President—Merchandising & Marketing, joined the Company in September 2007 after having most recently served as the Vice President, Merchandising and Customer Satisfaction of AutoZone. Mr. Webb joined AutoZone in 1986 where he began his service in field management before transitioning, in 1992, to the Merchandising function.

Brian D. Zuckerman was named Senior Vice President—General Counsel & Secretary on March 1, 2009 after having most recently served as Vice President—General Counsel & Secretary since 2003. Mr. Zuckerman joined the Company as a staff attorney in 1999. Prior to joining Pep Boys, Mr. Zuckerman practiced corporate and securities law with two firms in Philadelphia.

Each of the executive officers serves at the pleasure of the Board of Directors of the Company.

9

Our business faces significant risks. The risks described below may not be the only risks we face. If any of the events or circumstances described as risks below actually occurs, our business, results of operations and or financial condition could be materially and adversely affected. The following section discloses all known material risks that we face. However, it does not include risks that may arise in the future that are yet unknown nor existing risks that we do not judge material to the presentation of our financial statements.

Risks Related to Pep Boys

We may not be able to successfully implement our business strategy, which could adversely affect our business, financial condition, results of operations and cash flows.

In fiscal 2007, we adopted our long-term strategic plan, which includes numerous initiatives to increase sales, enhance our margins and increase our return on invested capital in order to increase our earnings and cash flow. If these initiatives are unsuccessful, or if we are unable to implement the initiatives efficiently and effectively, our business, financial condition, results of operations and cash flows could be adversely affected.

Successful implementation of our business strategy also depends on factors specific to the retail automotive aftermarket industry, many of which may be beyond our control (See "Risks Related to Our Industry").

If we are unable to generate sufficient cash flows from our operations, our liquidity will suffer and we may be unable to satisfy our obligations.

We require significant capital to fund our business. While we believe we have the ability to sufficiently fund our planned operations and capital expenditures for the next fiscal year, circumstances could arise that would materially affect our liquidity. For example, cash flows from our operations could be affected by changes in consumer spending habits or the failure to maintain favorable vendor payment terms or our inability to successfully implement sales growth initiatives. We may be unsuccessful in securing alternative financing when needed, on terms that we consider acceptable, or at all.

The degree to which we are leveraged could have important consequences to your investment in our securities, including the following risks:

- •

- our ability to obtain additional financing for working capital, capital expenditures, acquisitions or general corporate

purposes may be impaired in the future;

- •

- a substantial portion of our cash flow from operations must be dedicated to the payment of rent and the principal and

interest on our debt, thereby reducing the funds available for other purposes;

- •

- our failure to comply with financial and operating restrictions placed on us and our subsidiaries by our credit facilities

could result in an event of default that, if not cured or waived, could have a material adverse effect on our business or our prospects; and

- •

- if we are substantially more leveraged than some of our competitors, we might be at a competitive disadvantage to those competitors that have lower debt service obligations and significantly greater operating and financial flexibility than we do.

10

We depend on our relationships with our vendors and a disruption of these relationships or of our vendors' operations could have a material adverse effect on our business and results of operations.

Our business depends on developing and maintaining productive relationships with our vendors. Many factors outside our control may harm these relationships. For example, financial difficulties that some of our vendors may face may increase the cost of the products we purchase from them or may interrupt our source of supply. In addition, our failure to promptly pay, or order sufficient quantities of inventory from our vendors may increase the cost of products we purchase or may lead to vendors refusing to sell products to us at all. A disruption of our vendor relationships or a disruption in our vendors' operations could have a material adverse effect on our business and results of operations.

We depend on our senior management team and our other personnel, and we face substantial competition for qualified personnel.

Our success depends in part on the efforts of our senior management team. Our continued success will also depend upon our ability to retain existing, and attract additional, qualified field personnel to meet our needs. We face substantial competition, both from within and outside of the automotive aftermarket to retain and attract qualified personnel. In addition, we believe that the number of qualified automotive service technicians in the industry is generally insufficient to meet demand.

We are subject to environmental laws and may be subject to environmental liabilities that could have a material adverse effect on us in the future.

We are subject to various federal, state and local environmental laws and governmental regulations relating to the operation of our business, including those governing the handling, storage and disposal of hazardous substances contained in the products we sell and use in our service bays, the recycling of batteries, tires and used lubricants, the ownership and operation of real property and the sale of small engine merchandise. When we acquire or dispose of real property or enter into financings secured by real property, we undertake investigations that may reveal soil and/or groundwater contamination at the subject real property. All such known contamination has either been remediated, or is in the process of being remediated. Any costs expected to be incurred related to such contamination are either covered by insurance or financial reserves or provided for in the consolidated financial statements. However, there exists the possibility of additional soil and/or groundwater contamination on our real property where we have not undertaken an investigation. A failure by us to comply with environmental laws and regulations could have a material adverse effect on us.

Risks Related to Our Industry

Our industry is highly competitive, and price competition in some segments of the automotive aftermarket or a loss of trust in our participation in the "do-it-for-me" market, could cause a material decline in our revenues and earnings.

The automotive aftermarket retail and service industry is highly competitive and subjects us to a wide variety of competitors. We compete primarily with the following types of businesses in each segment of the automotive aftermarket:

Do-It-Yourself

- •

- automotive parts and accessories stores;

- •

- automobile dealers that supply manufacturer replacement parts and accessories; and

Retail

11

- •

- mass merchandisers and wholesale clubs that sell automotive products and select non-automotive merchandise that appeals to automotive "Do-It-Yourself" customers, such as generators, power tools and canopies.

- •

- mass merchandisers, wholesalers and jobbers (some of which are associated with national parts distributors or associations).

Commercial

Do-It-For-Me

- •

- regional and local full service automotive repair shops;

- •

- automobile dealers that provide repair and maintenance services;

- •

- national and regional (including franchised) tire retailers that provide additional automotive repair and maintenance

services; and

- •

- national and regional (including franchised) specialized automotive (such as oil change, brake and transmission) repair facilities that provide additional automotive repair and maintenance services.

- •

- national and regional (including franchised) tire retailers; and

- •

- mass merchandisers and wholesale clubs that sell tires.

Service

Tires

A number of our competitors have more financial resources, are more geographically diverse or have better name recognition than we do, which might place us at a competitive disadvantage to those competitors. Because we seek to offer competitive prices, if our competitors reduce their prices we may also be forced to reduce our prices, which could cause a material decline in our revenues and earnings.

With respect to the service labor category, the majority of consumers are unfamiliar with their vehicle's mechanical operation and, as a result, often select a service provider based on trust. Potential occurrences of negative publicity associated with the Pep Boys brand, the products we sell or installation or repairs performed in our service bays, whether or not factually accurate, could cause consumers to lose confidence in our products and services in the short or long term, and cause them to choose our competitors for their automotive service needs.

Vehicle miles driven may decrease, resulting in a decline of our revenues and negatively affecting our results of operations.

Our industry depends on the number of vehicle miles driven. Factors that may cause the number of vehicle miles and our revenues and our results of operations to decrease include:

- •

- the weather—as vehicle maintenance may be deferred during periods of inclement weather;

- •

- the economy—as during periods of poor economic conditions, customers may defer vehicle maintenance or repair,

and during periods of good economic conditions, consumers may opt to purchase new vehicles rather than service the vehicles they currently own and replace worn or damaged parts;

- •

- gas prices—as increases in gas prices may deter consumers from using their vehicles; and

12

- •

- travel patterns—as changes in travel patterns may cause consumers to rely more heavily on mass transportation.

Economic factors affecting consumer spending habits may continue, resulting in a decline in revenues and may negatively impact our business.

Many economic and other factors outside our control, including consumer confidence, consumer spending levels, employment levels, consumer debt levels and inflation, as well as the availability of consumer credit, affect consumer spending habits. A significant deterioration in the global financial markets and economic environment, recessions or an uncertain economic outlook could adversely affect consumer spending habits and can result in lower levels of economic activity. The domestic and international political situation also affects consumer confidence. Any of these events and factors could cause consumers to curtail spending, especially with respect to our more discretionary merchandise offerings, such as automotive accessories, tools and personal transportation products.

During fiscal 2009, there was significant deterioration in the global financial markets and economic environment, which negatively impacted consumer spending and our revenues. If these adverse trends in economic conditions continue or worsen, or if our efforts to counteract the impacts of these trends are not sufficiently effective, our revenues would continue to decline, negatively affecting our results of operations.

Consolidation among our competitors may negatively impact our business.

Our industry has experienced consolidation over time. If this trend continues or if they are able to achieve efficiencies in their mergers, the Company may face greater competitive pressures in the market in which they operate.

ITEM 1B UNRESOLVED STAFF COMMENTS

None.

The Company owns its five-story, approximately 300,000 square foot corporate headquarters in Philadelphia, Pennsylvania and a 60,000 square foot structure in Los Angeles, California. The Company also owns the following administrative regional offices—approximately 4,000 square feet of space in each of Melrose Park, Illinois and Bayamon, Puerto Rico. The Company leases administrative regional offices of approximately 1,700 square feet in Whitemarsh, Maryland and approximately 4,000 square feet in Carrollton, Texas.

Of the 587 store locations operated by the Company at January 30, 2010, 231 are owned and 356 are leased. As of January 30, 2010, 126 of the 231 stores owned by the Company are currently used as collateral under our Senior Secured Term Loan, due October 2013.

13

The following table sets forth certain information regarding the owned and leased warehouse space utilized by the Company to replenish its store locations at January 30, 2010:

Warehouse Locations

|

Products Warehoused |

Approximate Square Footage |

Owned or Leased |

Stores Serviced |

States Serviced | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

San Bernardino, CA |

All | 600,000 | Leased | 167 | AZ, CA, NM, NV, UT, WA | |||||||

McDonough, GA |

All | 392,000 | Owned | 137 | AL, FL, GA, LA, NC, PR, SC, TN, VA | |||||||

Mesquite, TX |

All | 244,000 | Owned | 68 | AR, CO, LA, MO, NM, OK, TX | |||||||

Plainfield, IN |

All | 403,000 | Owned | 68 | IL, IN, KY, MI, MN, OH, PA, TN | |||||||

Chester, NY |

All | 400,400 | Owned | 147 | CT, DE, MA, MD, ME, NH, NJ, NY, PA, RI, VA | |||||||

Philadelphia, PA |

Tires & Batteries | 43,000 | Leased | 47 | DE, NJ, PA | |||||||

McDonough, GA |

All except tires | 30,000 | Leased | — | Auxiliary warehouse space | |||||||

Total |

2,112,400 | |||||||||||

In addition to the distribution centers above, the Company leases four satellite warehouses of approximately 78,700 square feet each. These satellite warehouses stock approximately 36,000 Stock-Keeping Units (SKUs), serve an average of 10-30 stores and have retail capabilities. The Company anticipates that its existing and future warehouse space and its access to outside storage will accommodate inventory necessary to support future store expansion and any increase in SKUs through the end of fiscal 2010.

In September 2006, the United States Environmental Protection Agency ("EPA") requested certain information from the Company as part of an investigation to determine whether the Company had violated, and is in violation of, the Clean Air Act and its non-road engine regulations. The information requested concerned certain generator and personal transportation merchandise offered for sale by the Company. In the fourth quarter of fiscal 2008, the EPA informed the Company that it believed that the Company had violated the Clean Air Act by virtue of the fact that certain of this merchandise did not conform to their corresponding EPA Certificates of Conformity. During the third quarter of fiscal 2009, the Company and the EPA reached a settlement in principle of this matter requiring that the Company (i) pay a monetary penalty of $5 million, (ii) take certain corrective action with respect to certain inventory that had been restricted from sale during the course of the investigation, (iii) implement a formal compliance program and (iv) participate in certain non-monetary emission offset activities. The Company had previously accrued an amount equal to the agreed upon civil penalty and a $3 million contingency accrual with respect to the restricted inventory. During each of the third and fourth quarters of fiscal 2009, the Company reversed approximately $1 million of the inventory accrual as a portion of the subject inventory was released for sale.

The Company is also party to various other actions and claims arising in the normal course of business.

The Company believes that amounts accrued for awards or assessments in connection with all such matters are adequate and that the ultimate resolution of these matters will not have a material adverse effect on the Company's financial position. However, there exists a reasonable possibility of loss in excess of the amounts accrued, the amount of which cannot currently be estimated. While the Company does not believe that the amount of such excess loss could be material to the Company's

14

financial position, any such loss could have a material adverse effect on the Company's results of operations in the period(s) during which the underlying matters are resolved.

15

ITEM 5 MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The common stock of The Pep Boys—Manny, Moe & Jack is listed on the New York Stock Exchange under the symbol "PBY." There were 4,998 registered shareholders as of April 2, 2010. The following table sets forth for the periods listed, the high and low sale prices and the cash dividends paid on the Company's common stock.

MARKET PRICE PER SHARE

| |

Market Price Per Share | |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Cash Dividends Per Share |

|||||||||

| |

High | Low | ||||||||

Fiscal 2009 |

||||||||||

Fourth quarter |

$ | 9.29 | $ | 7.76 | $ | 0.0300 | ||||

Third quarter |

10.69 | 8.40 | 0.0300 | |||||||

Second quarter |

10.83 | 5.87 | 0.0300 | |||||||

First quarter |

8.52 | 2.76 | 0.0300 | |||||||

Fiscal 2008 |

||||||||||

Fourth quarter |

$ | 5.31 | $ | 2.62 | $ | 0.0675 | ||||

Third quarter |

9.49 | 3.00 | 0.0675 | |||||||

Second quarter |

10.36 | 6.40 | 0.0675 | |||||||

First quarter |

12.56 | 8.59 | 0.0675 | |||||||

On September 7, 2006, the Company renewed its share repurchase program and reset the authority back to $100,000,000 for repurchases to be made from time to time in the open market or in privately negotiated transactions. During the first quarter of fiscal 2007, the Company repurchased 2,702,460 shares of Common Stock for $50,841,000. The Company also disbursed during the first quarter of fiscal 2007, $7,311,000 for 494,800 shares of Common Stock repurchased during the fourth quarter of fiscal 2006. This program expired on September 30, 2007.

On March 12, 2009, the Board of Directors reduced the quarterly cash dividend to $0.03 per share. It is the present intention of the Board of Directors to continue to pay this quarterly cash dividend; however, the declaration and payment of future dividends will be determined by the Board of Directors in its sole discretion and will depend upon the earnings, financial condition, and capital needs of the Company and other factors which the Board of Directors deems relevant.

On January 26, 2010, the Company terminated the flexible employee benefits trust (the "Trust") that was established on April 29, 1994 to fund a portion of the Company's obligations arising from various employee compensation and benefit plans. In accordance with the terms of the Trust, upon its termination, the Trust's sole asset, consisting of 2,195,270 shares of the Company's common stock, was transferred to the Company in exchange for the full satisfaction and discharge of all intercompany indebtedness then owed by the Trust to the Company. The termination of the Trust has no impact on the Company's consolidated financial statements, except for the reclassification of the shares from within the shareholders equity section of the Company's Consolidated Balance Sheets.

16

EQUITY COMPENSATION PLANS

The following table sets forth the Company's shares authorized for issuance under its equity compensation plans at January 30, 2010:

| |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column (a)) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by security holders |

2,005,775 | $ | 6.83 | 2,240,075 | ||||||

STOCK PRICE PERFORMANCE

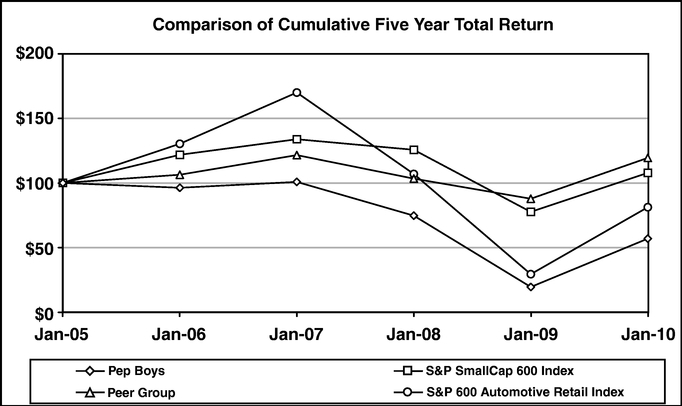

The following graph compares the cumulative total return on shares of Pep Boys stock over the past five years with the cumulative total return on shares of companies in (1) the Standard & Poor's SmallCap 600 Index, (2) the S&P 600 Automotive Retail Index and (3) an index of peer and comparable companies as determined by the Company. The comparison assumes that $100 was invested in January 2005 in Pep Boys Stock and in each of the indices and assumes reinvestment of dividends. The S&P 600 Automotive Retail Index consists of companies in the S&P SmallCap 600 index that meet the definition of the automotive retail classification, and is currently comprised of: Group 1 Automotive, Inc.; Lithia Motors, Inc.; Midas, Inc.; Monro Muffler Brake, Inc.; Sonic Automotive, Inc.; and The Pep Boys—Manny, Moe & Jack. The companies currently comprising the Peer Group are: Aaron's, Inc.; Advance Auto Parts, Inc.; AutoZone, Inc.; Big 5 Sporting Goods Corp.; Cabelas, Inc.; Conn's, Inc.; Dick's Sporting Goods, Inc.; Gander Mountain Co.; HHGregg, Inc.; Midas, Inc.; Monro Muffler Brake, Inc.; O'Reilly Automotive, Inc.; PetSmart, Inc.; RadioShack Corp.; Rent-A-Center, Inc.; Tractor Supply Co.; West Marine, Inc.

17

Company/Index

|

Jan. 2005 | Jan. 2006 | Jan. 2007 | Jan. 2008 | Jan. 2009 | Jan. 2010 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Pep Boys |

$ | 100 | $ | 96.28 | $ | 100.82 | $ | 74.66 | $ | 19.39 | $ | 56.85 | |||||||

S&P SmallCap 600 Index |

$ | 100 | $ | 121.83 | $ | 133.89 | $ | 125.70 | $ | 77.58 | $ | 107.81 | |||||||

Peer Group |

$ | 100 | $ | 106.38 | $ | 121.59 | $ | 103.35 | $ | 87.78 | $ | 119.43 | |||||||

S&P 600 Automotive Retail Index(1) |

$ | 100 | $ | 130.35 | $ | 170.07 | $ | 106.98 | $ | 29.30 | $ | 81.20 | |||||||

- (1)

- The S&P 600 Automotive Retail Index was created in May 2005. Therefore, the total return for January 2006 is for the period from May 2005 through January 2006.

18

ITEM 6 SELECTED FINANCIAL DATA

The following tables set forth the selected financial data for the Company and should be read in conjunction with the Consolidated Financial Statements and Notes thereto included elsewhere herein.

Fiscal Year Ended

|

Jan. 30, 2010 |

Jan. 31, 2009 |

Feb. 2, 2008 |

Feb. 3, 2007 |

Jan. 28, 2006 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(dollar amounts are in thousands, except share and per share data) |

||||||||||||||||

STATEMENT OF OPERATIONS DATA(6) |

|||||||||||||||||

Merchandise sales |

$ | 1,533,619 | $ | 1,569,664 | $ | 1,749,578 | $ | 1,853,077 | $ | 1,830,632 | |||||||

Service revenue |

377,319 | 358,124 | 388,497 | 390,778 | 378,342 | ||||||||||||

Total revenues |

1,910,938 | 1,927,788 | 2,138,075 | 2,243,855 | 2,208,974 | ||||||||||||

Gross profit from merchandise sales(7) |

448,815 | (1) | 440,502 | (3) | 443,626 | (4) | 533,276 | 470,019 | |||||||||

Gross profit from service revenue(7) |

37,292 | (1) | 24,930 | (3) | 42,611 | (4) | 33,004 | 32,276 | |||||||||

Total gross profit |

486,107 | (1) | 465,432 | (3) | 486,237 | (4) | 566,280 | 502,295 | |||||||||

Selling, general and administrative expenses |

430,261 | 485,044 | 518,373 | 546,399 | 519,600 | (5) | |||||||||||

Net gain from disposition of assets |

1,213 | 9,716 | 15,151 | 8,968 | 4,826 | ||||||||||||

Operating profit (loss) |

57,059 | (9,896 | ) | (16,985 | ) | 28,849 | (12,479) | (5) | |||||||||

Non-operating income |

2,261 | 1,967 | 5,246 | 7,023 | 3,897 | ||||||||||||

Interest expense |

21,704 | (2) | 27,048 | (2) | 51,293 | 49,342 | 49,040 | ||||||||||

Earnings (loss) from continuing operations before income taxes, discontinued operations and cumulative effect of change in accounting principle |

37,616 | (1) | (34,977) | (3) | (63,032) | (4) | (13,470 | ) | (57,622) | (5) | |||||||

Earnings (loss) from continuing operations before discontinued operations and cumulative effect of change in accounting principle |

24,113 | (28,838 | ) | (37,438 | ) | (7,071 | ) | (36,595 | ) | ||||||||

Discontinued operations, net of tax |

(1,077) | (1) | (1,591) | (3) | (3,601) | (4) | 4,333 | 1,088 | |||||||||

Cumulative effect of change in accounting principle, net of tax |

— | — | — | 189 | (2,021 | ) | |||||||||||

Net earnings (loss) |

23,036 | (30,429 | ) | (41,039 | ) | (2,549 | ) | (37,528 | ) | ||||||||

BALANCE SHEET DATA |

|||||||||||||||||

Working capital |

$ | 205,525 | $ | 179,233 | $ | 195,343 | $ | 163,960 | $ | 247,526 | |||||||

Current ratio |

1.40 to 1 | 1.33 to 1 | 1.35 to 1 | 1.27 to 1 | 1.43 to 1 | ||||||||||||

Merchandise inventories |

$ | 559,118 | $ | 564,931 | $ | 561,152 | $ | 607,042 | $ | 616,292 | |||||||

Property and equipment-net |

$ | 706,450 | $ | 740,331 | $ | 780,779 | $ | 906,247 | $ | 947,389 | |||||||

Total assets |

$ | 1,499,086 | $ | 1,552,389 | $ | 1,583,920 | $ | 1,767,199 | $ | 1,821,753 | |||||||

Long-term debt, excluding current maturities |

$ | 306,201 | $ | 352,382 | $ | 400,016 | $ | 535,031 | $ | 586,239 | |||||||

Total stockholders' equity |

$ | 443,295 | $ | 423,156 | $ | 470,712 | $ | 567,755 | $ | 594,565 | |||||||

DATA PER COMMON SHARE |

|||||||||||||||||

Basic earnings (loss) from continuing operations before discontinued operations and cumulative effect of change in accounting principle |

$ | 0.46 | $ | (0.55 | ) | $ | (0.72 | ) | $ | (0.13 | ) | $ | (0.67 | ) | |||

Basic earnings (loss) net |

0.44 | (0.58 | ) | (0.79 | ) | (0.05 | ) | (0.69 | ) | ||||||||

Diluted earnings (loss) from continuing operations before discontinued operations and cumulative effect of change in accounting principal |

0.46 | (0.55 | ) | (0.72 | ) | (0.13 | ) | (0.67 | ) | ||||||||

Diluted earnings (loss) net |

0.44 | (0.58 | ) | (0.79 | ) | (0.05 | ) | (0.69 | ) | ||||||||

Cash dividends declared |

0.12 | 0.27 | 0.27 | 0.27 | 0.27 | ||||||||||||

Book value per share |

8.46 | 8.10 | 9.10 | 10.53 | 10.97 | ||||||||||||

Common share price range: |

|||||||||||||||||

High |

10.83 | 12.56 | 22.49 | 16.55 | 18.80 | ||||||||||||

Low |

2.76 | 2.62 | 8.25 | 9.33 | 11.75 | ||||||||||||

OTHER STATISTICS |

|||||||||||||||||

Return on average stockholders' equity(8) |

5.3 | % | (6.8 | )% | (7.9 | )% | (0.4 | )% | (6.0 | )% | |||||||

Common shares issued and outstanding |

52,392,967 | 52,237,750 | 51,752,677 | 53,934,084 | 54,208,803 | ||||||||||||

Capital expenditures |

$ | 43,214 | $ | 151,883 | (9) | $ | 43,116 | $ | 53,903 | $ | 92,083 | ||||||

Number of stores |

587 | 562 | 562 | 593 | 593 | ||||||||||||

Number of service bays |

6,027 | 5,845 | 5,845 | 6,162 | 6,162 | ||||||||||||

- (1)

- Includes

an aggregate pretax charge of $3,110 for asset impairment, of which $2,211 was charged to merchandise cost of sales, $673 was charged to service

cost of sales and $226 (pretax) was charged to discontinued operations.

- (2)

- Fiscal 2009 includes gain from debt retirement of $6,248. Fiscal 2008 includes a gain from debt retirement of $3,460, partially offset by a $1,172 charge for deferred financing costs.

19

- (3)

- Includes

an aggregate pretax charge of $5,353 for asset impairment, of which $2,779 was charged to merchandise cost of sales, $648 was charged to service

cost of sales and $1,926 (pretax) was charged to discontinued operations.

- (4)

- Includes

an aggregate pretax charge of $10,963 for the asset impairment and closure of 31 stores, of which $5,350 was charged to merchandise cost of sales,

$1,849 was charged to service cost of sales and $3,764 (pretax) was charged to discontinued operations. In addition we recorded a pretax $32,803 inventory impairment charge to cost of merchandise

sales for the discontinuance of certain product offerings.

- (5)

- Includes

a pretax charge of $4,200 related to an asset impairment charge reflecting the remaining value of a commercial sales software asset, which was

included in selling, general and administrative expenses.

- (6)

- Statement

of operations data reflects 53 weeks for the fiscal year ended February 3, 2007 while the other fiscal years reflect

52 weeks.

- (7)

- Gross

profit from merchandise sales includes the cost of products sold, buying, warehousing and store occupancy costs. Gross profit from service revenue

includes the cost of installed products sold, buying, warehousing, service payroll and related employee benefits and occupancy costs. Occupancy costs include utilities, rents, real estate and property

taxes, repairs and maintenance and depreciation and amortization expenses. Our gross profit may not be comparable to those of our competitors due to differences in industry practice regarding the

classification of certain costs.

- (8)

- Return

on average stockholders' equity is calculated by taking the net earnings (loss) for the period divided by average stockholders' equity for the year.

- (9)

- Includes the purchase of master lease assets for $117,121.

20

ITEM 7 MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

The following discussion and analysis explains the results of our operations for fiscal 2009 and 2008 and significant developments affecting our financial condition as of January 30, 2010. This discussion and analysis below should be read in conjunction with Item 6 "Selected Consolidated Financial Data," and our consolidated financial statements and the notes included elsewhere in this report. The discussion and analysis contains "forward looking statements" within the meaning of The Private Securities Litigation Reform Act of 1995. Forward looking statements include management's expectations regarding implementation of its long-term strategic plan, future financial performance, automotive aftermarket trends, levels of competition, business development activities, future capital expenditures, financing sources and availability and the effects of regulation and litigation. Actual results may differ materially from the results discussed in the forward looking statements due to a number of factors beyond our control, including those set forth under the section entitled "Item 1A Risk Factors" elsewhere in this report.

Introduction

The Pep Boys-Manny, Moe & Jack is the only national chain offering automotive service, tires, parts and accessories. This positioning allows us to streamline the distribution channel and pass the savings to the customer facilitating our vision of becoming the automotive solutions provider of choice for the value-oriented customer. The majority of our stores are in a Supercenter format, which serves both "do-it-for-me" ("DIFM", which includes service labor, installed merchandise and tires) and "do-it-yourself" ("DIY", or retail) customers with the highest quality service offerings and merchandise. Most of our Supercenters also have a commercial sales program that provides delivery of tires, parts and other products to automotive repair shops and dealers. In 2009, as part of our long-term strategy to lead with automotive service, we began complementing our existing Supercenter store base with Service & Tire Centers. These Service & Tire Centers are designed to capture market share and leverage our existing Supercenter and support infrastructure. During fiscal 2009, we opened 24 new Service & Tire Centers, including ten locations acquired through our purchase of the assets of Florida Tire, Inc., and opened one new prototype Supercenter. We are targeting a total of 40 new Service & Tire Centers in fiscal 2010 and 80 in fiscal 2011. As of January 30, 2010, we operated 553 Supercenters and 25 Service & Tire Centers, as well as nine legacy Pep Express (retail only) stores throughout 35 states and Puerto Rico.

EXECUTIVE SUMMARY

During fiscal 2009, the Company continued to focus on executing its long-term strategic plan and reported its first profitable year since fiscal 2004. For fiscal 2009, earnings from continuing operations before taxes increased by $72,593,000 to $37,616,000, compared to a loss from continuing operations before taxes of $34,977,000 in the prior year. Net earnings for fiscal 2009 increased by $53,465,000 to $23,036,000, compared to a net loss of $30,429,000 in the prior year. Our increase in profitability resulted primarily from increased service revenues, increased gross profit margins and lower selling, general and administrative expenses due to continued disciplined spending control. Our diluted earnings per share for fiscal 2009 was $0.44, a $1.02 improvement over the $0.58 loss per diluted share recorded in fiscal 2008 (see Results of Operations).

For fiscal 2009, our comparable sales (sales generated by locations in operation during the same period of the prior year) decreased by 1.2% compared to a decrease of 8.0% in the prior year. The decrease in comparable sales was comprised of a 4.7% increase in comparable service revenue and a 2.6% decrease in comparable merchandise sales. The difficult macroeconomic environment, including

21

continued high unemployment and tight credit, negatively impacted sales of our discretionary product categories such as accessories and complementary merchandise. Sales of non-discretionary product categories such as service and hard parts have benefited somewhat from this environment, as customers have focused on maintaining their existing vehicles rather than purchasing new vehicles. In addition, our non-discretionary product categories are primarily impacted by miles driven, which stabilized in the second half of 2009 after having declined for the previous year. We believe that the stabilization in miles driven is primarily due to lower gasoline prices.

The Company remains focused on refining and expanding the parts assortment to improve our in stock position, improving execution and the customer experience and utilizing television and radio advertising to communicate our value offerings. In fiscal 2009, we were able to successfully increase customer traffic and sales in our service and commercial businesses.

RESULTS OF OPERATIONS

The following discussion explains the material changes in our results of operations for the years ended January 30, 2010, January 31, 2009 and February 2, 2008.

Analysis of Statement of Operations

The following table presents, for the periods indicated, certain items in the consolidated statements of operations as a percentage of total revenues (except as otherwise provided) and the percentage change in dollar amounts of such items compared to the indicated prior period.

| |

Percentage of Total Revenues | Percentage Change | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Year ended

|

Jan 30, 2010 (Fiscal 2009) |

Jan 31, 2009 (Fiscal 2008) |

Feb 2, 2008 (Fiscal 2007) |

Fiscal 2009 vs. Fiscal 2008 |

Fiscal 2008 vs. Fiscal 2007 |

|||||||||||

Merchandise sales |

80.3 | % | 81.4 | % | 81.8 | % | (2.3 | )% | (10.3 | )% | ||||||

Service revenue(1) |

19.7 | 18.6 | 18.2 | 5.4 | (7.8 | ) | ||||||||||

Total revenues |

100.0 | 100.0 | 100.0 | (0.9 | ) | (9.8 | ) | |||||||||

Costs of merchandise sales(2) |

70.7 | (3) | 71.9 | (3) | 74.6 | (3) | 3.9 | 13.5 | ||||||||

Costs of service revenue(2) |

90.1 | (3) | 93.0 | (3) | 89.0 | (3) | (2.1 | ) | 3.7 | |||||||

Total costs of revenues |

74.6 | 75.9 | 77.3 | 2.6 | 11.5 | |||||||||||

Gross profit from merchandise sales |

29.3 | (3) | 28.1 | (3) | 25.4 | (3) | 1.9 | (0.7 | ) | |||||||

Gross profit from service revenue |

9.9 | (3) | 7.0 | (3) | 11.0 | (3) | 49.6 | (41.5 | ) | |||||||

Total gross profit |

25.4 | 24.1 | 22.7 | 4.4 | (4.3 | ) | ||||||||||

Selling, general and administrative expenses |

22.5 | 25.2 | 24.2 | 11.3 | 6.4 | |||||||||||

Net gain from disposition of assets |

0.1 | 0.5 | 0.7 | (87.5 | ) | (35.9 | ) | |||||||||

Operating profit (loss) |

3.0 | (0.5 | ) | (0.8 | ) | 676.6 | 41.7 | |||||||||

Non-operating income |

0.1 | 0.1 | 0.2 | 14.9 | (62.5 | ) | ||||||||||

Interest expense |

1.1 | 1.4 | 2.4 | 19.8 | 47.3 | |||||||||||

Earnings (loss) from continuing operations before income taxes |

2.0 | (1.8 | ) | (2.9 | ) | 207.5 | 44.5 | |||||||||

Income tax expense (benefit) |

35.9 | (4) | 17.6 | (4) | 40.6 | (4) | (320.0 | ) | (76.0 | ) | ||||||

Earnings (loss) from continuing operations |

1.3 | (1.5 | ) | (1.8 | ) | 183.6 | 23.0 | |||||||||

Discontinued operations, net of tax |

(0.1 | ) | (0.1 | ) | (0.1 | ) | 32.3 | 55.8 | ||||||||

Net earnings (loss) |

1.2 | (1.6 | ) | (1.9 | ) | 175.7 | 25.9 | |||||||||

- (1)

- Service revenue consists of the labor charge for installing merchandise or maintaining or repairing vehicles, excluding the sale of any installed parts or materials.

22

- (2)

- Costs

of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center

payroll and related employee benefits and service center occupancy costs. Occupancy costs include utilities, rents, real estate and property taxes, repairs and maintenance and depreciation and

amortization expenses.

- (3)

- As

a percentage of related sales or revenue, as applicable.

- (4)

- As a percentage of loss from continuing operations before income taxes

Fiscal 2009 vs. Fiscal 2008

Total revenue and comparable sales for fiscal 2009 decreased 0.9% and 1.2%, respectively as compared to the prior year. The 1.2% decrease in comparable store revenues consisted of a 4.7% increase in comparable service revenue offset by a 2.6% decrease in comparable merchandise sales. While our total revenue figures were favorably impacted by our opening of 25 new stores in fiscal 2009, a new store is not added to our comparable store sales base until it reaches its 13th month of operation. Stores are removed from the comparable store sales base upon their relocation or closure. Once a relocated store reaches its 13th month of operation at its new location, it is added back into our comparable store sales base. Square footage increases are immaterial and accordingly, are not considered in our calculations of comparable store sales data.

Total merchandise sales decreased 2.3% to $1,533,619,000 compared to $1,569,664,000 in fiscal 2008. Total service revenue increased 5.4% to $377,319,000 from $358,124,000 in the prior year. The decrease in merchandise sales was primarily due to weaker sales in our retail business stemming from less discretionary spending by our customers and lower DIY customer counts. Excluding sales of discretionary products such as generators, electronics and transportation products, our DIY core automotive sales remained relatively flat year over year. Service revenues increased in fiscal 2009 as compared to fiscal 2008 primarily due to increased customer counts.