Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Heritage-Crystal Clean, Inc. | f8k_032910.htm |

| EX-99 - EXHIBIT 99.1 - Heritage-Crystal Clean, Inc. | exh_991.htm |

EXHIBIT 99.2

HCCI Used Oil Re-Refining March 2010

Heritage - Crystal Clean, Inc. (HCCI)

Used Oil Re-Refining Project

March 2010

HCCI Used Oil Re-Refining March 2010

2

Safe Harbor Statement

This presentation contains forward-looking statements that are based upon current management

expectations. Generally, the words "aim," "anticipate," "believe," "could," "estimate," "expect," "intend,"

"may," "plan,“ "project," "should," "will be," "will continue," "will likely result," "would" and similar

expressions identify forward-looking statements. These forward-looking statements involve known and

unknown risks, uncertainties and other important factors that could cause our actual results, performance

or achievements or industry results to differ materially from any future results, performance or

achievements expressed or implied by these forward-looking statements. These risks, uncertainties and

other important factors include, among others: our ability to comply with the extensive environmental,

health and safety, and employment laws and regulations that our Company is subject to; changes in

environmental laws that affect our business model; competition; claims relating to our handling of

hazardous substances; the demand for our used solvent; our dependency on key employees; our ability

to effectively manage our extended network of branch locations; warranty expense and liability claims;

personal injury litigation; dependency on suppliers; economic conditions and downturns in the business

cycles of automotive repair shops, industrial manufacturing business and small businesses in general;

increased solvent, fuel and energy costs; the control of The Heritage Group over our Company; and the

risks identified in our filings with the Securities and Exchange Commission, including our 10-K filings.

Given these uncertainties, you are cautioned not to place undue reliance on these forward-looking

statements. We assume no obligation to update or revise them or provide reasons why actual results

may differ. The information in this presentation should be evaluated in light of such risks and in

conjunction with the consolidated financial statements and the notes thereto included in our filings with

the SEC and available on our website.

expectations. Generally, the words "aim," "anticipate," "believe," "could," "estimate," "expect," "intend,"

"may," "plan,“ "project," "should," "will be," "will continue," "will likely result," "would" and similar

expressions identify forward-looking statements. These forward-looking statements involve known and

unknown risks, uncertainties and other important factors that could cause our actual results, performance

or achievements or industry results to differ materially from any future results, performance or

achievements expressed or implied by these forward-looking statements. These risks, uncertainties and

other important factors include, among others: our ability to comply with the extensive environmental,

health and safety, and employment laws and regulations that our Company is subject to; changes in

environmental laws that affect our business model; competition; claims relating to our handling of

hazardous substances; the demand for our used solvent; our dependency on key employees; our ability

to effectively manage our extended network of branch locations; warranty expense and liability claims;

personal injury litigation; dependency on suppliers; economic conditions and downturns in the business

cycles of automotive repair shops, industrial manufacturing business and small businesses in general;

increased solvent, fuel and energy costs; the control of The Heritage Group over our Company; and the

risks identified in our filings with the Securities and Exchange Commission, including our 10-K filings.

Given these uncertainties, you are cautioned not to place undue reliance on these forward-looking

statements. We assume no obligation to update or revise them or provide reasons why actual results

may differ. The information in this presentation should be evaluated in light of such risks and in

conjunction with the consolidated financial statements and the notes thereto included in our filings with

the SEC and available on our website.

HCCI Used Oil Re-Refining March 2010

3

Overview

w Description of HCCI re-refining project

w Market size and market share

w Environmental benefits

w HCCI management experience with re-refining

w History of re-refining in U.S.

w Critical success factors in re-refining

w Conclusion

HCCI Used Oil Re-Refining March 2010

4

Used Oil Re-Refining

w Re-Refining = Treating used oil to remove impurities so that it can be

used as a base lube oil for new lubricating oil

used as a base lube oil for new lubricating oil

w Re-Refining prolongs the life of the oil resource indefinitely

w Re-Refining is the preferred environmental option per U.S. EPA

w Modern re-refineries employ two main processing steps borrowed from

the refining industry:

the refining industry:

§ Vacuum distillation to remove the base lube

oil, followed by

§ Hydrotreating to remove trace impurities

from the base lube oil

Sources:

(1) Managing Used Oil: Advice for Small Businesses, U.S. EPA, EPA530-F-96-004,

November 1996.

HCCI Used Oil Re-Refining March 2010

5

Snapshot of HCCI Re-Refining Project

w 50 MM gpy input capacity re-refining plant

w 30 MM gpy capacity base lube oil output

w $40 MM estimated capital cost (0 - 5% annual maint. CapEx)

w 2 year construction period before start-up

w Located in Indiana

w Collection ramp-up expected to depress 2010 EBITDA by $1 MM

w At capacity and assuming current prices, expect:

§ $90 MM annual revenue

§ 20% EBITDA margin

HCCI Used Oil Re-Refining March 2010

6

Oil Re-Refining Success Triangle

Used Oil Collection

Source: J. Chalhoub presentation to

Fifth International Conference on

Recovery and Reuse, November 1983,

Las Vegas, NV.

Fifth International Conference on

Recovery and Reuse, November 1983,

Las Vegas, NV.

Lube Oil and Used Oil Markets

HCCI Used Oil Re-Refining March 2010

8

Lube Oil Demand in the United States

|

U.S. Lube Oil Supply / Composition2 |

|

|

Base Lube Oil |

2.0 BB GPY |

|

Chemical Additives |

0.5 BB GPY |

|

Total Lube Oil Supply |

2.5 BB GPY |

Sources:

(1) Used Oil Re-refining Study to Address Energy Policy Act of 2005, Section

1838, U.S. Department of Energy, Office of Fossil Energy, Office of Oil and Natural Gas,

July 2006, page 2-2.

July 2006, page 2-2.

(2) “Lubricating Oil Quality,” Energy News, Issue 14, page

12-15.

|

U.S. Lube Oil Demand1 |

|

|

Lube Oil Demand - Vehicle Oils |

1.5 BB GPY |

|

Lube Oil Demand - Industrial/Process Oils |

1.0 BB GPY |

|

Total Lube Oil Demand |

2.5 BB GPY |

HCCI Used Oil Re-Refining March 2010

9

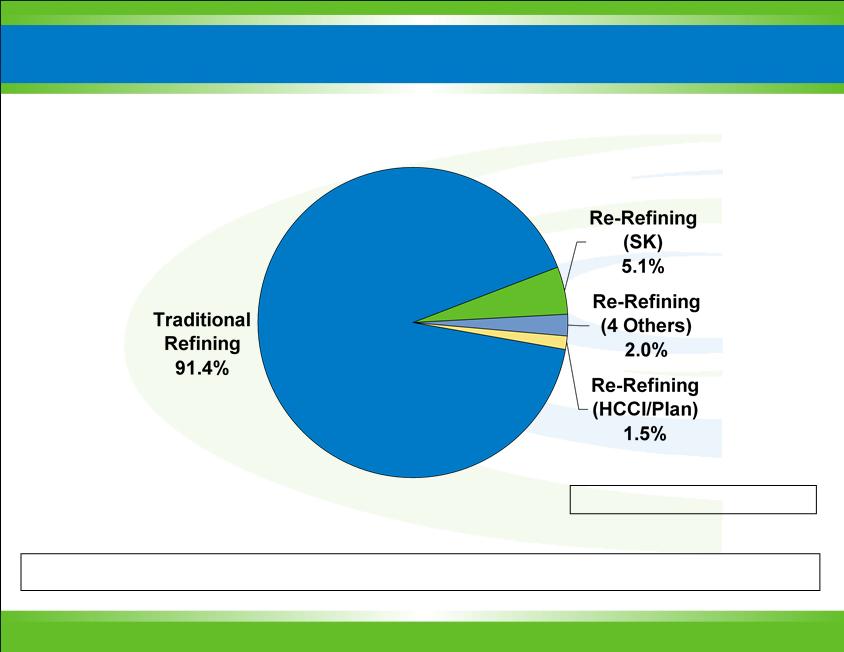

Base Lube Oil Supply by Source

Sources:

(1) Company estimates.

Total Volume: 2 BB GPY

HCCI Used Oil Re-Refining March 2010

10

Used Oil Industry in the United States

Sources:

(1) Used Oil Re-refining Study to Address Energy Policy Act of 2005, Section

1838, U.S. Department of Energy, Office of Fossil Energy, Office of Oil and Natural Gas,

July 2006, page 5-1; “Assessment of Opportunities to Increase the Recovery and Recycling of Waste Oil,” Department of Energy Argonne National Laboratory,

August 1995; and API Used Motor Oil Collection and Recycling 1997 Draft report.

July 2006, page 5-1; “Assessment of Opportunities to Increase the Recovery and Recycling of Waste Oil,” Department of Energy Argonne National Laboratory,

August 1995; and API Used Motor Oil Collection and Recycling 1997 Draft report.

(2) Waste Oil: Reclaiming Technology, Utilization and Disposal, Mueller

Associates Inc., Pollution Technology Review No. 166, published by Noyes Data Corporation

1999, Table 2; and Composition and Management of Used Oil Generated in the United States, William Bider, Franklin Associates Ltd., prepared for the Office of Solid

Waste, 1984.

1999, Table 2; and Composition and Management of Used Oil Generated in the United States, William Bider, Franklin Associates Ltd., prepared for the Office of Solid

Waste, 1984.

(3) Company estimate.

|

U.S. Lubricant Demand |

2.5 BB GPY |

|

Volume Consumed During Use |

1.1 BB GPY |

|

Volume of Used Oil Available for Collection1 |

1.4 BB GPY |

|

Volume of Used Oil Improperly Disposed1 |

0.5 BB GPY |

|

Volume of Used Oil Collected1 |

0.9 BB GPY |

|

Estimated Number of Used Oil Generators (excluding DIYers)2 |

450,000 |

|

Estimated Number of Used Oil Collectors3 |

300-500 |

HCCI Used Oil Re-Refining March 2010

11

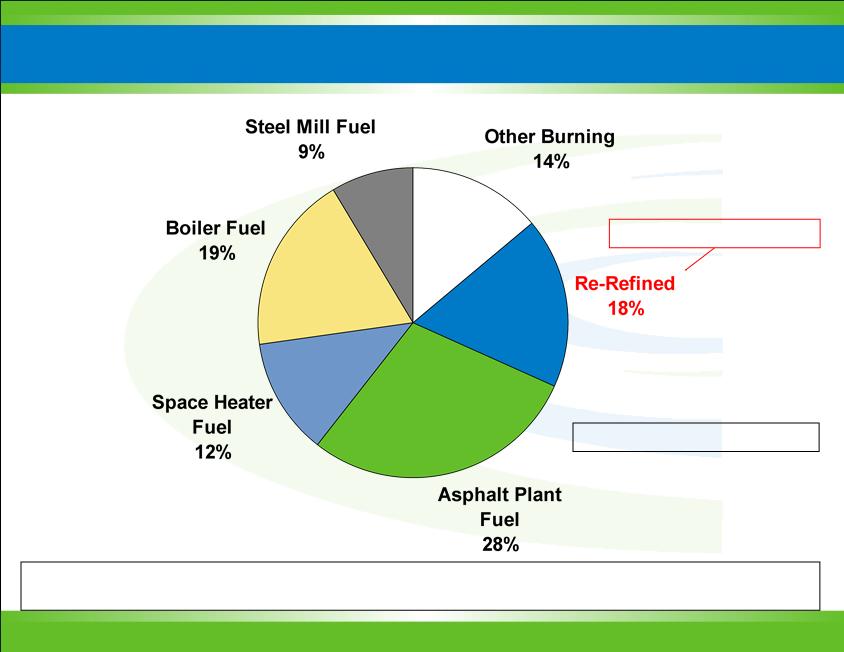

Used Oil Disposition in the United States (MM GPY)

Sources:

Used Oil Re-refining Study to Address Energy Policy Act of 2005, Section 1838, U.S. Department of Energy, Office of Fossil Energy, Office of Oil and Natural Gas, July 2006,

page 5-1 & 5-2.

page 5-1 & 5-2.

Total Volume: 945 MM GPY

High Value Added

Environmental Benefits of Re-Refining

HCCI Used Oil Re-Refining March 2010

13

Environmental Benefits of Re-Refining

w Re-Refining requires 1/3 the energy compared to producing lube oil

from crude oil1

from crude oil1

w 2 ½ quarts of lube oil can be extracted from 42 gallons of crude oil or

from 1 gallon of used oil1

from 1 gallon of used oil1

w Re-Refining meets the federal definition of waste minimization, a goal

of many pollution prevention programs

of many pollution prevention programs

w Re-Refining reduces U.S. dependence on imported crude oil

w Re-Refining reduces air pollution and carbon emissions

Sources:

(1) Managing Used Oil: Advice for Small Businesses, U.S. EPA, EPA530-F-96-004,

November 1996.

HCCI Experience with Re-Refining

HCCI Used Oil Re-Refining March 2010

15

HCCI Management Experience with Re-Refining

w HCCI Management helped create North American re-refining industry

w Designed, built and operated two largest re-refineries in North America

(currently owned by Safety-Kleen) representing 75% of industry

capacity

(currently owned by Safety-Kleen) representing 75% of industry

capacity

w These two re-refineries continue to operate successfully and profitably

HCCI Used Oil Re-Refining March 2010

16

HCCI Experience

w Joe Chalhoub, HCCI President and CEO

§ Chemical Engineer & Entrepreneur

§ 1977 started Breslube Enterprises re-refinery

in Ontario, Canada

§ 1987 sold controlling interest in Breslube

to Safety-Kleen, remained with business

§ 1991 led design and construction of SK

E. Chicago re-refinery

§ Recognized leader in North American re-refining

w Greg Ray, HCCI VP Business Management and CFO

§ 1984 helped start Evergreen Oil re-refining

business in California

§ 1987 oversaw growth of Evergreen’s

used oil collection business

§ 1994 joined Safety-Kleen and took responsibility

for used oil collection, expanding to

create first nationwide used oil service

create first nationwide used oil service

§ Led or managed numerous acquisitions

including #2 and #3 used oil collectors in U.S.

History of Re-Refining in U.S.

HCCI Used Oil Re-Refining March 2010

18

Oil Recycling History in USA

w By 1960’s, the industry claimed more than 160 re-refiners

w Increasing additive content of lubricants and tightening environmental

regulations caused them to exit industry

regulations caused them to exit industry

w Rising crude prices in 1970’s (due to geopolitical events) led to

renewed interest in re-refining

renewed interest in re-refining

w By 1980’s, several modern re-refiners using hydrotreating started in

the U.S. and Canada: Breslube, Evergreen, Mohawk

the U.S. and Canada: Breslube, Evergreen, Mohawk

w In 1990’s, Executive Orders 13101 and 13149 encouraged U.S.

government procurement of re-refined oil products

government procurement of re-refined oil products

HCCI Used Oil Re-Refining March 2010

19

Oil Recycling 2001 to Present

w World crude oil prices climb to $70+/barrel

w Modest capacity additions at existing re-refiners

w Some new entrants to re-refining business:

– Heartland (20 MM gpy)

– Universal (12 MM gpy)

– Bango (initially < 10 MM gpy)

w Re-refining margins are attractive based on current market conditions,

but this remains a complex business requiring competency with

collection, technology, operations, and product sales

but this remains a complex business requiring competency with

collection, technology, operations, and product sales

Oil Re-Refining Success Triangle

HCCI Used Oil Re-Refining March 2010

21

Oil Re-Refining Success Triangle

Used Oil Collection

Source: J. Chalhoub presentation to

Fifth International Conference on

Recovery and Reuse, November 1983,

Las Vegas, NV.

Fifth International Conference on

Recovery and Reuse, November 1983,

Las Vegas, NV.

HCCI Used Oil Re-Refining March 2010

22

Used Oil Collection

w Our goal is to collect enough feedstock to ensure self-sufficient plant

operation

operation

w Used oil can be collected from wide geography but transportation

economics are important; a large branch network is key

economics are important; a large branch network is key

w Operation of many trucks serving thousands of generators requires

significant investment in infrastructure and management

significant investment in infrastructure and management

w Most often, customers are looking for used oil collector to provide a

menu of corollary services, adding complexity to the business

menu of corollary services, adding complexity to the business

HCCI Used Oil Re-Refining March 2010

23

Re-Refining Technology

w Production of marketable lubricating base oil requires hydrotreating, a

process practiced at major refineries that adds significant complexity

and capital cost

process practiced at major refineries that adds significant complexity

and capital cost

w Several EPC firms willing to license re-refining technology and designs

including distillation and hydrotreating

including distillation and hydrotreating

w Critical issues are operability, economies of scale, and capital cost

w Inconsistency of used oil feedstock, including industrial waste

contaminants, creates need for screening and testing programs and

robust process

contaminants, creates need for screening and testing programs and

robust process

w Other firms with less experience have been unable to deliver

acceptable performance in commercial scale plants

acceptable performance in commercial scale plants

HCCI Used Oil Re-Refining March 2010

24

Lube Product Sales

w We expect our re-refinery will produce high quality lubricating base oils

w Product acceptance will require engine sequence testing to

demonstrate API/SAE performance

demonstrate API/SAE performance

w Marketing plan includes base oil sales to independent

blenders/compounders

blenders/compounders

w Longer term opportunities to go downstream and sell blended and

packaged lubricants

packaged lubricants

HCCI Used Oil Re-Refining March 2010

25

Re-Refining Pros and Cons for HCCI

Pros

w Leverages HCCI branch infrastructure

& customer base

& customer base

w HCCI management expertise

w Expected to accelerate HCCI growth in

revenue and earnings

revenue and earnings

w Strengthens quality of HCCI service

offer menu

offer menu

w Potential to add many customers and

address very large market

address very large market

Cons

w Swings in crude and lube market prices

will add volatility to HCCI revenue and

earnings

will add volatility to HCCI revenue and

earnings

w Re-refining is more capital-intensive

than other HCCI service-only

businesses

than other HCCI service-only

businesses

Conclusions

HCCI Used Oil Re-Refining March 2010

27

Conclusions

w We believe that HCCI has an excellent opportunity to leverage its branch network,

customer base, and management expertise through the development of a re-refinery

customer base, and management expertise through the development of a re-refinery

w The HCCI re-refinery is expected to deliver meaningfully accretive growth in revenue

and profits

and profits

w While HCCI will become more sensitive to swings in crude and lube prices, we intend

to report statistics to allow investors to understand the sensitivities and performance

of each component of our business

to report statistics to allow investors to understand the sensitivities and performance

of each component of our business

w It will require approximately two years to build the re-refinery, and we intend to use

that time to expand our used oil collection program

that time to expand our used oil collection program

w Success in re-refining requires competency with all three aspects of the success

triangle - collection, processing, and product sales - and we believe that HCCI has

these capabilities

triangle - collection, processing, and product sales - and we believe that HCCI has

these capabilities

HCCI Used Oil Re-Refining March 2010

28

Contact Information

For more information contact:

Greg Ray

CFO and VP Business Management

Heritage - Crystal Clean

email: Greg.Ray@crystal-clean.com

www.crystal-clean.com