Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Manitex International, Inc. | d8k.htm |

| EX-99.2 - PRESS RELEASE - Manitex International, Inc. | dex992.htm |

Manitex

International, Inc. (NASDAQ:MNTX) March 2010 Exhibit 99.1 |

Forward Looking

Statements and Non-GAAP Measures Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Non-GAAP Measures: Manitex International from time to time refers to various non-GAAP (generally accepted accounting principles) financial measures in this presentation. Manitex believes that this information is useful to understanding its operating results without the impact of special items. See Manitex’s earnings releases on the Investor Relations section of our website www.manitexinternational.com for a description and/or reconciliation of these measures. |

3 Corporate Overview- Manitex International • Provider of boom trucks, sign cranes, forklifts, and specialized material handling equipment primarily used in commercial, state, local and international government, and military applications. • Major industries served include energy (extraction and processing), utilities, railroads, commercial building, rental fleets, cargo transportation, and infrastructure development – roads and bridges. • Historically serving North American markets; recent international diversification and growth. • Senior Management has over 70 years of collective experience from well- known industrial leaders such as Terex, Manitowoc, Grove, Rolls Royce, and GKN Sinter Metals, Off-Highway and Auto Divisions. • Liftking and Manitex combined have more than 16,000 units operating worldwide spanning equipment dealerships throughout the country. |

Products

Manitex, Manitex Liftking, Badger 4 |

Load

King •Load King Trailers, an Elk

Point, South Dakota-based manufacturer of specialized custom trailers and hauling systems typically used for transporting heavy equipment. •Consideration of $3.0 million; Load King’s last five years average annual revenues were approximately $23 million. •Niche product line, well-recognized quality brand name and accomplished management team. •Government and military relationships. • Outstanding manufacturing capabilities. • Strong distribution network, particularly within the energy, railroad and construction industries. |

6 Company Background • 2002: As a result of Manitowoc’s acquisition of Grove, Manitowoc was required to divest Manitex (their boom truck division). Manitex was acquired in January 2003. • July 2006: Merger of Manitex into Veri-Tek Intl (Amex: VCC). • November 2006: Manitex Acquisition of Liftking (formerly private). • July 2007: Acquisition of Noble forklift product line (formerly private). • August 2007: Sale of assets & closure of legacy VCC business. • May 2008: Refocus brand recognition. Change name to Manitex International, Inc. • May 2008: Change listing from Amex to NASDAQ and change ticker to MNTX. • October 2008: Acquisition of assets of Crane & Machinery and Schaeff Forklift (formerly private). • July 2009: Acquisition of Badger Equipment Company. • December 2009: Acquisition of Load King Trailers. Focused manufacturer of engineered lifting equipment |

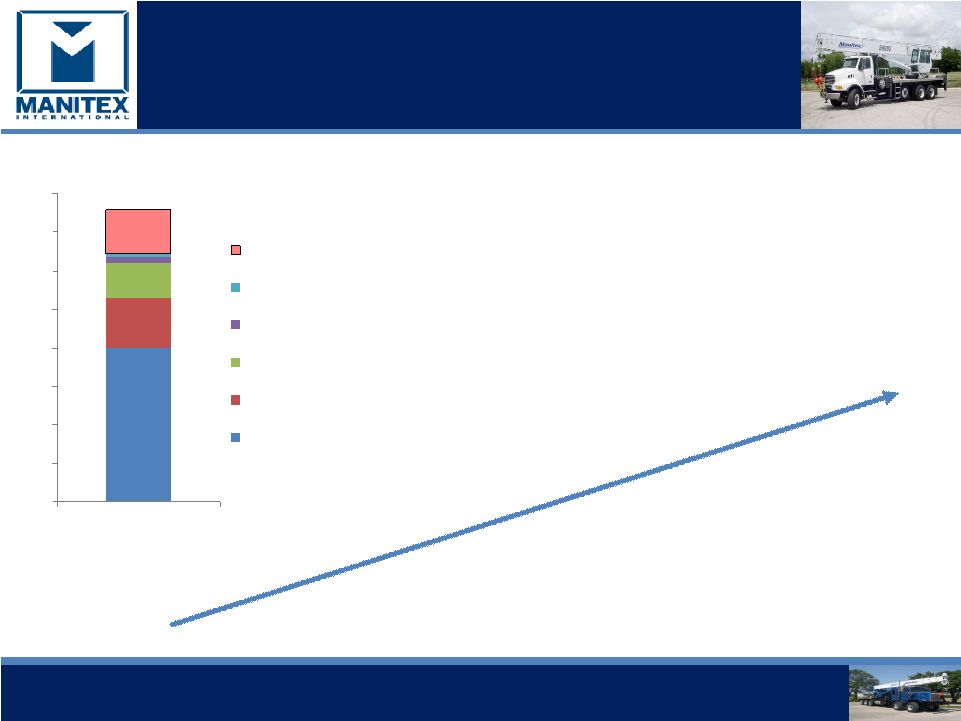

7 Company Timeline Focused manufacturer of engineered lifting equipment 2002 Manitowoc (NYSE:MTW) acquires Grove. Manitowoc divests Manitex (January) December 2009: Acquire Load King Trailers July 2009 Acquire Badger Equipment Co 2009 2006 2007 2008 November 2006: Veri-Tek Acquires LiftKing July 2007: VCC acquires Noble forklift August 2007: Sale of assets and closure of legacy VCC business May 2008: Name changed to Manitex International and listed on Nasdaq (MNTX) October 2008: Crane & Machinery and Schaeff Forklift acquired 2007 Pro-Forma Annual Revenue ($M) $0 $20 $40 $60 $80 $100 $120 $140 $160 FY 2007 Load King Noble Schaeff Crane & Machinery Liftking Manitex July 2006: Manitex merges into Veri-Tek, Intl. (VCC) |

8 Business Strategy • Diversify product offering through R&D and acquisition. • International diversification, focus on growth markets , oil, gas, commodities mining. – Russia / CIS market > double North America – Middle East • Expand margins through commitment to improved sourcing and manufacturing efficiencies. • Pursue cross-sell opportunities and add depth to distribution network. – Manitex – 32 dealers covering all 50 states. – Liftking – Combination of direct sales and dealer network. – Noble Forklifts – Caterpillar distribution. – Crane & Machinery – Direct sales of Manitex products. – International experience. • Increase recurring revenues through replacement parts contracts. • Consolidate through accretive acquisitions of specialized industrial equipment companies. |

9 Replacement Parts & Service - Consistent Recurring Revenue • Recurring revenue of approximately 24% of total sales • Typical margins >40% • Spares relate to swing drives, rotating components, and booms among others, many of which are proprietary – Serve additional brands • Service team for crane equipment |

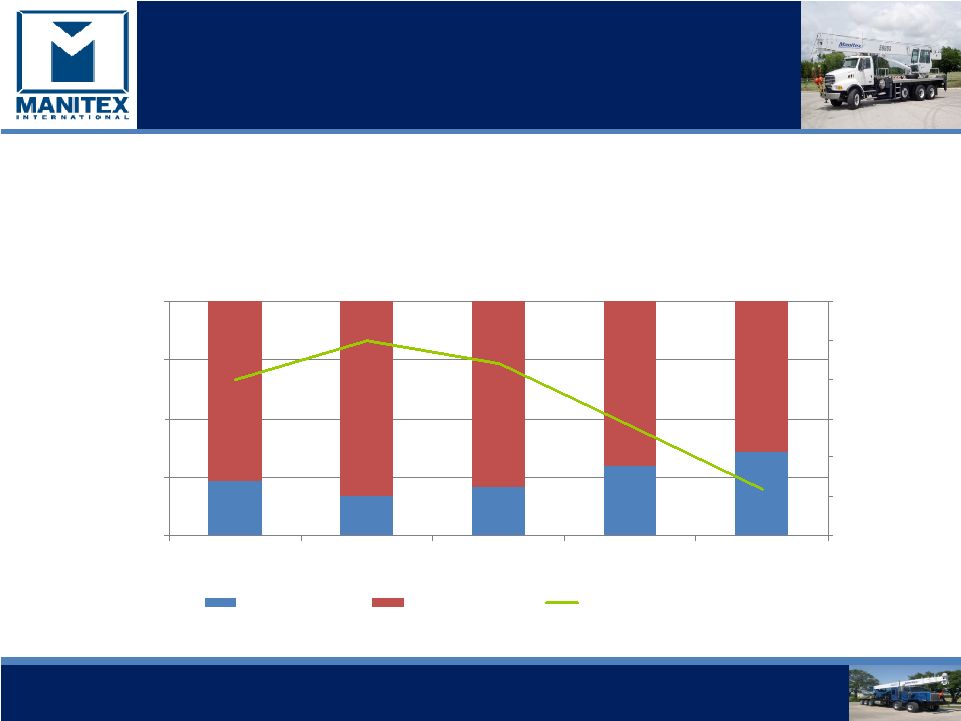

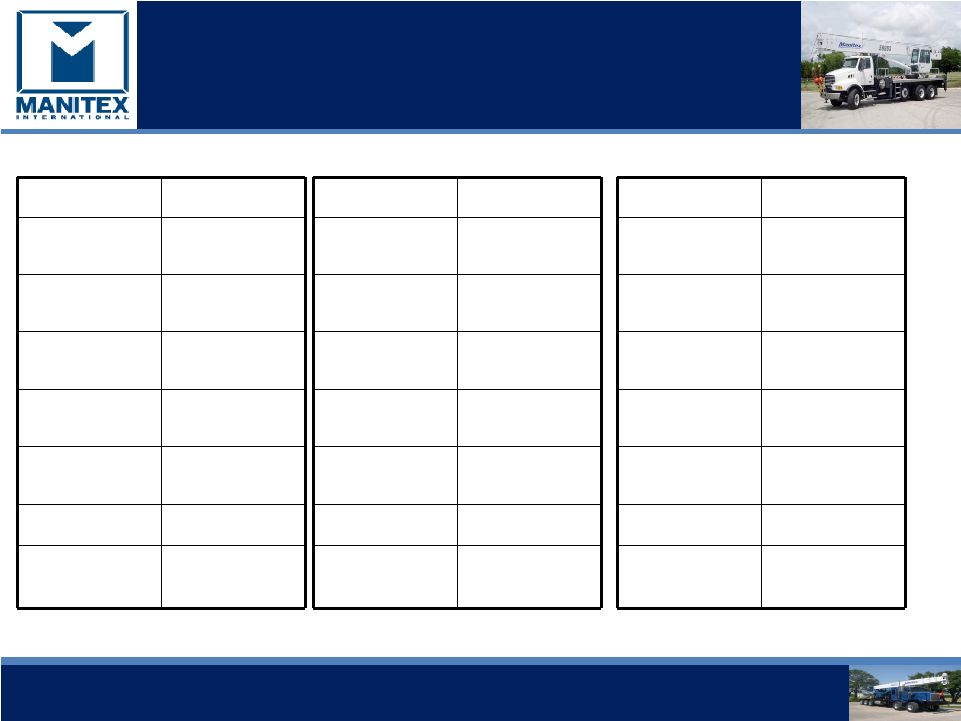

10 Steadily Increasing Market Share Even in Down Cycle Boom Truck Crane Market 23.4% 16.7% 20.8% 29.6% 36.1% 76.6% 83.3% 79.2% 70.4% 63.9% 0% 25% 50% 75% 100% 2005 2006 2007 2008 2009 Market Share 0 500 1000 1500 2000 2500 3000 Units Shipped MNTX Others Total Units Shipped |

Growth Drivers

– 2010 and Beyond • World wide improvements in GDP, economic recovery . • Increased rental market penetration with product developments and innovative distribution. Leverage synergy with railroad industry. • Developed products specifically for the following industries: Oil & Gas, Power Grid

& Wind Power. (Manitex 50155S crane). • Any significant governmental infrastructure spending will be a potential spark to recovery for Manitex. • International expansion. – New dealership agreements reached in Middle East, Russia, & with Caterpillar Global Distribution Network. – Achieved European CE Certification for 50 Ton Cranes in 2009. – Manitex International made its first international sales in 2008 and has identified new markets to accelerate future growth (Russian market potential is estimated to be double that of North

America). – 2009 international orders are over 10%. 11 |

12 Recent Developments • May 27, 2009 – Announced $7.0 million in new orders including $5.0 million for commercial boom truck cranes for the owner-operated and rental markets and $2.0 million for Liftking military container handling forklifts. • July 9, 2009 – Completed extension of maturities of term debt and LOC’s to 2012. • July 10, 2009 – Acquired Badger Equipment Company for $5.1 million; adds another niche product line of rough terrain cranes and expands dealer network. • July 27, 2009 – Announced contract for $12.6 million for specialized forklifts for U.S. armed forces and international agency. • August 3, 2009 – Announced $1.1 million in orders for new 50155S crane. • August 6, 2009 – Announced $3.1 million in orders for boom truck cranes for the Middle East and orders for specialized forklifts for a new African customer. • December 2, 2009 - Announced $7.6 million of orders received for 1 st half of 2010. • December 31, 2009 Acquired Load King Trailers. • February 8, 2010 – Announced $4 million of orders for end of 1 st half 2010. |

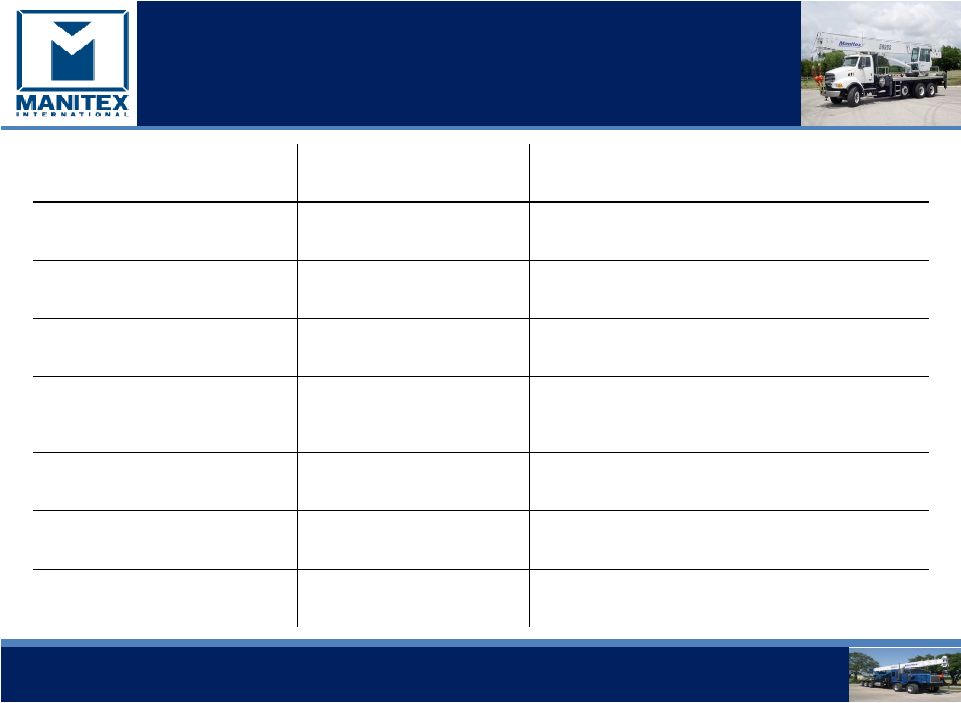

13 Key Management Name Position Experience David Langevin Chairman & CEO 20+ years principally with Terex Andrew Rooke President &COO 20+ years principally with Rolls Royce, GKN Sinter Metals, Off-Highway & Auto Divisions David Gransee CFO & Treasurer Formerly with Arthur Andersen. 15+ years with Eon Labs (formerly listed) Robert Litchev President – Material Handling & SVP International Distribution 10+ years principally with Terex Scott Rolston SVP Sales & Marketing – Manitex International 13+ years principally with Manitowoc Tim Maxson President – Load King 23+ years principally with Genie, Raven & Aveo and USAF David Moravec CTO – Manitex 20+ years principally with Manitowoc |

14 Select Financial Data (Reported) Revenue 106,946 Gross Profit 19,919 Gross Margin 18.6% Operating Expense 13,566 EBITDA 8,461 EBITDA % to sales 7.9% Net Income 956 Cash flow from operations 1,140 Full Year 12/31/07 Full Year 12/31/08 - Continuing operations only. - $ in thousands, except percentages. Revenue 106,341 Gross Profit 17,465 Gross Margin 16.4% Operating Expense 14,057 EBITDA 5,416 EBITDA % to sales 5.1% Net Income 2,198 Cash flow from operations (1,561) Revenue 40,953 Gross Profit 7,713 Gross Margin 18.8% Operating Expense 7,937 EBITDA 1,556 EBITDA % to sales 3.8% Net Income (203) Cash flow from operations 2,403 Nine Months 9/30/09 |

15 Summary Delivering sound operational and financial performance despite historic economic and industry-specific challenges. •Growing market share. •Increased penetration in oil and gas, power grid and rail. •Rebound in military sales. •Penetration into rental markets and networks. •International orders are increasing. •We have successfully scaled our business to perform in the current market conditions

through cost rationalization. •Focused on earnings, cash flow and working capital management.

|