Attached files

| file | filename |

|---|---|

| EX-10.4 - EX-10.4 - ENERNOC INC | a2196609zex-10_4.htm |

| EX-10.3 - EX-10.3 - ENERNOC INC | a2196609zex-10_3.htm |

| EX-10.18 - EX-10.18 - ENERNOC INC | a2196609zex-10_18.htm |

| EX-10.20 - EX-10.20 - ENERNOC INC | a2196609zex-10_20.htm |

| EX-10.19 - EX-10.19 - ENERNOC INC | a2196609zex-10_19.htm |

| EX-32.1 - EX-32.1 - ENERNOC INC | a2196609zex-32_1.htm |

| EX-23.1 - EX-23.1 - ENERNOC INC | a2196609zex-23_1.htm |

| EX-21.1 - EX-21.1 - ENERNOC INC | a2196609zex-21_1.htm |

| EX-31.2 - EX-31.2 - ENERNOC INC | a2196609zex-31_2.htm |

| EX-31.1 - EX-31.1 - ENERNOC INC | a2196609zex-31_1.htm |

| EX-10.23 - EX-10.23 - ENERNOC INC | a2196609zex-10_23.htm |

Use these links to rapidly review the document

Table of Contents

APPENDIX A EnerNOC, Inc.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2009 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number 001-33471

EnerNOC, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

87-0698303 (IRS Employer Identification No.) |

|

101 Federal Street Suite 1100 Boston, Massachusetts (Address of Principal Executive Offices) |

02110 (Zip Code) |

|

Registrant's telephone number, including area code: (617) 224-9900 |

||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, $0.001 par value | The NASDAQ Stock Market LLC | |

| (The NASDAQ Global Market) |

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one).

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the Registrant's common stock held by non-affiliates of the Registrant as of June 30, 2009, the last business day of the Registrant's second quarter of fiscal 2009, was approximately $267.4 million based upon the last sale price reported for such date on The NASDAQ Global Market.

The number of shares of the Registrant's common stock (the Registrant's only outstanding class of stock) outstanding as of March 8, 2010 was 24,459,170.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive proxy statement for its 2010 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the Registrant's fiscal year ended December 31, 2009, are incorporated by reference into this Annual Report on Form 10-K.

EnerNOC, Inc.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. For this purpose, any statements contained herein regarding our strategy, future operations, financial condition, future revenues and profit margins, projected costs, market position, prospects, plans and objectives of management, other than statements of historical facts, are forward-looking statements. The words "anticipates," "believes," "estimates," "expects," "intends," "may," "plans," "projects," "will," "would" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we actually will achieve the plans, intentions or expectations expressed or implied in our forward-looking statements. Matters subject to forward-looking statements involve known and unknown risks and uncertainties, including economic, regulatory, competitive and other factors, which may cause actual results, levels of activity, performance or the timing of events to be materially different than those exposed or implied by forward-looking statements. Important factors that could cause or contribute to such differences include the factors set forth under the caption "Risk Factors" in Item 1A of Part I of this Annual Report on Form 10-K. Although we may elect to update forward-looking statements in the future, we specifically disclaim any obligation to do so, even if our estimates change, and readers should not rely on those forward-looking statements as representing our views as of any date subsequent to March 12, 2010.

Our trademarks include: EnerNOC, ENERBLOG, Get More from Energy, Energy for Education, Capacity on Demand, PowerTrak, PowerTalk, Celerity Energy, The Cleanest kWh is the One Never Used, The Greenest Kilowatt-hour is the One Never Used, One-Click Curtailment, Clean Green California and CarbonTrak.

Other trademarks or service marks appearing in this Annual Report on Form 10-K are the property of their respective holders.

We use the terms "EnerNOC," the "Company," "we," "us" and "our" in this Annual Report on Form 10-K to refer to the business of EnerNOC, Inc. and its subsidiaries.

Company Overview

We are a leading provider of clean and intelligent energy solutions, which include demand response services, energy efficiency, or monitoring-based commissioning, services, energy procurement services and emissions tracking and trading support services. These solutions help optimize the balance of electric supply and demand, provide cost-efficient alternatives to traditional power generation, transmission and distribution resources, and drive significant cost-savings for our customers. Our customers are commercial, institutional and industrial end-users of energy, as well as electric power grid operators and utilities.

We believe that we are the largest demand response service provider in the United States for commercial, institutional and industrial customers. As of December 31, 2009, we managed over 3,550 megawatts, or MW, of demand response capacity across an end-use customer base of approximately 2,800 accounts and 6,500 customer sites throughout multiple electric power grids. Demand response is an alternative to traditional power generation and transmission infrastructure projects that enables grid operators and utilities to reduce the likelihood of service disruptions, such as brownouts and blackouts, during periods of peak electricity demand, and otherwise manage the electric power grid during short-term imbalances of supply and demand. We use our Network Operations Center, or NOC, and PowerTrak enterprise software platform to remotely manage and reduce electricity consumption across a growing network of commercial, institutional and industrial customer sites, making demand response capacity available to grid operators and utilities on demand while helping end-users of electricity achieve energy savings, environmental benefits and improved financial results. To date, we have received substantially all of our revenues from grid operators and utilities, who make recurring payments to us for managing demand response capacity that we share with end-users of electricity in exchange for such end-users reducing their power consumption when called upon.

We build on our position as a leading demand response services provider by using our NOC and scalable PowerTrak technology platform to sell additional energy management solutions to new and existing end-use customers. These additional solutions include our monitoring-based commissioning services, energy procurement services and emissions tracking and trading support services. Our monitoring-based commissioning services combine advanced metering, building management systems, and energy analytics software applications to identify energy efficiency opportunities in large buildings. Our energy procurement services provide our commercial, institutional and industrial customers located in restructured or deregulated markets throughout the United States with the ability to more effectively manage the energy supplier selection process, including energy supply product procurement and implementation. Our emissions tracking and trading support services include a comprehensive, software-based accounting system for our commercial, institutional and industrial customers to effectively monitor, mitigate and monetize their greenhouse gas emissions in response to existing and pending greenhouse gas reporting requirements.

Since inception, our business has grown substantially. We began by providing demand response services in one state in 2003 and expanded nationally to 31 states and the District of Columbia in eight regions, as well as internationally in Canada and the United Kingdom, by December 31, 2009. From our start in one open market in 2003 to our current contracts and open market programs with grid operators and utilities, we have continually increased our demand response capacity under management with commercial, institutional and industrial customers from approximately 1,112 MW at the end of 2007 to 2,050 MW at the end of 2008 and over 3,550 MW at the end of 2009. Our total revenues

1

increased from $60.8 million to $106.1 million to $190.7 million for the years ended December 31, 2007, 2008 and 2009, respectively.

Significant Recent Developments

In February 2010, Dr. Susan F. Tierney was elected to serve as a member of our board of directors.

In December 2009, we acquired all of the outstanding capital stock of Cogent Energy, Inc., or Cogent, a company specializing in comprehensive energy consulting, engineering and building commissioning solutions for commercial, institutional and industrial customers. The purchase price was equal to approximately $11.2 million consisting of both cash and shares of our common stock. By integrating Cogent's extensive commissioning and engineering experience into our monitoring-based commissioning energy efficiency application, we believe that we will be able to deliver even more value to our rapidly growing customer base.

In November 2009, we appointed Kevin J. Bligh as our chief accounting officer. Prior to his appointment, Mr. Bligh served as our vice president of finance from October 2007 to November 2009.

In August 2009, we completed an underwritten public offering of an aggregate of 3,963,889 shares of our common stock at an offering price of $27.00 per share, which included the sale of 709,026 shares by certain selling stockholders. After deducting underwriting discounts and commissions and offering expenses payable by us, we received net proceeds of approximately $83.4 million from the offering.

In July 2009, we and Neal C. Isaacson, our then-current chief financial officer and treasurer, agreed that Mr. Isaacson would resign as chief financial officer and treasurer effective as of the close of business on July 30, 2009. Also in July 2009, we entered into an employment offer letter to hire and retain Timothy Weller as our chief financial officer and treasurer. Mr. Weller's employment with us commenced on July 31, 2009.

In June 2009, we acquired substantially all of the assets of eQuilibrium Solutions Corporation, or eQ, a software company specializing in the development of enterprise sustainability management products and services. The purchase price was equal to approximately $0.8 million consisting of both cash and shares of our common stock. We believe that the acquisition of eQ strengthens our position in a nascent yet growing market committed to helping energy and sustainability leaders develop their own plans to achieve energy efficiency and emissions goals.

In May 2009, the United States District Court for the District of Massachusetts dismissed without leave to replead the consolidated securities class action lawsuit filed against us and certain of our officers and directors. In June 2009, following dismissal of the securities class action lawsuit, the plaintiff in a derivative lawsuit filed against certain of our officers and directors and certain of the underwriters of our November 2007 follow-on public offering voluntarily dismissed the lawsuit without prejudice.

Industry Background

The Electric Power Industry

Historically, electric utility companies were formed in North America as regulated monopolies to manage the capital intensive, mission critical service of delivering electricity to end-use customers. Each local utility was vertically integrated, with responsibility for owning, managing and delivering all components of the electric power industry: generation, transmission, distribution and retail sales. Each utility was also responsible for maintaining reliability standards based on avoiding service disruptions, commonly known as blackouts. In about half of North America, the industry continues to operate in this vertically integrated fashion.

2

In the rest of North America, including New England, New York, the Mid-Atlantic, the Midwest, Texas, California and Canada, the electric power industry has been restructured to foster a competitive environment. In these restructured markets, utilities continue to operate and maintain transmission and distribution lines, delivering electricity to consumers as they had before, but power generators and electricity suppliers are now allowed to openly compete for business. Independent system operators, referred to as ISOs, or regional transmission organizations, referred to as RTOs, have been formed in these restructured markets to take control of the operation of the regional power system, coordinate the supply of electricity, and establish fair and efficient markets. ISOs and RTOs are collectively referred to as grid operators. These grid operators are responsible for maintaining Federal reliability standards designed to avoid service disruptions.

Increasingly, grid operators and utilities in both restructured markets and in traditionally regulated markets are challenged to reliably provide electricity during periods of peak demand. Clean and intelligent energy solutions can provide a lower cost, reliable and environmentally sound alternative to building additional supply infrastructure in both traditionally regulated and restructured markets.

Challenges Facing the Electric Power Industry

The electric power industry in North America faces enormous challenges to keep pace with the expected increase in demand for electricity and to manage the increased amount of intermittent renewable energy resources that are expected to be connected to the power grid in the future. Because electricity cannot be economically stored using commercially available technology today, it must be generated, delivered and consumed at the moment that it is needed by end-use customers. Maintaining a reliable electric power grid therefore requires real-time balancing between supply and demand. Power generation, transmission and distribution facilities are built to capacity levels that can service the maximum amount of anticipated demand plus a reserve margin intended to serve as a buffer to protect the system in critical periods of peak demand or unexpected events such as failure of a power plant or major transmission line. However, under-investment in generation, transmission and distribution infrastructure in recent years in key regions, coupled with a dramatic growth in electricity consumption over that same time period, has led to an increased frequency of voltage reductions—commonly known as brownouts—and blackouts, which are collectively estimated to cost the United States $80 billion per year, primarily in lost productivity, according to a United States Department of Energy 2005 study. These challenges are exacerbated by environmental concerns and stringent regulatory environments that make it increasingly difficult to find suitable sites, obtain permits, and construct generation, transmission and distribution facilities where they are needed most, often in densely populated areas. Although the economic slowdown in the United States in late 2008 and 2009 has resulted in declining industrial demand for electricity, mid-range and longer-term expectations of capacity shortfalls continue. In addition, existing power generation facility construction has slowed.

According to the North American Electric Reliability Corporation, demand for electricity is expected to increase over the next 10 years by approximately 19% in the United States, but generation capacity is expected to increase by only approximately 12% in the United States during that same period. As a result, in North America, the margin between electric supply and demand is projected to drop below minimum target levels in certain regions in the next two to three years. According to the International Energy Agency, North America is expected to add 698,000 MW of additional capacity at a cost of $2.4 trillion between 2008 and 2030 to reliably meet expected annual growth in demand. Worldwide, the International Energy Agency expects 4,799,000 MW of additional capacity to be required over the same period at a total cost of $13.7 trillion. This presents enormous economic, environmental and logistical challenges.

In addition to the challenges arising from the need to build additional generation capacity in North America, under-investment in the transmission and distribution infrastructure required to deliver power from centralized power plants to end-use customers has resulted in an overburdened electric power

3

grid. This periodically prevents the transport of power to constrained areas during periods of peak demand, which can affect reliability and cause significant economic impacts.

As the electric power industry confronts these challenges, demand response has emerged as an important solution to help address the imbalance in electric supply and demand. For example, the Energy Policy Act of 2005 declared it the official policy of the United States to encourage demand response and the adoption of devices that enable it. In addition, the Energy Independence and Security Act of 2007 ordered the Federal Energy Regulatory Commission, or FERC, to conduct a nationwide assessment of demand response potential and create a national action plan to promote demand response at the federal level and support individual states in their own demand response initiatives. As more renewable energy sources come on line, we believe that our demand side management offerings to grid operators and utilities will provide additional value as grid operators and utilities seek additional means to manage fluctuations in the amount of power generated by intermittent power generation sources, such as wind and solar.

Our Market Opportunity

According to the International Energy Agency, electric power infrastructure expenditures in North America are expected to exceed $2.4 trillion between 2008 and 2030. Worldwide, the International Energy Agency expects 4,799,000 MW of additional capacity to be required over the same period at a total cost of $13.7 trillion. We estimate that over 10% of the electric power infrastructure in North America has been constructed in order to meet peaks in electricity demand that occur less than 1% of the time, or approximately 88 hours per year. Based on these estimates, we believe that the market in North America for reducing demand during these critical peak hours, in place of building supply infrastructure, is $10.6 billion per year, if the need to build-out infrastructure were to occur on an equal annual basis. Using the same assumptions, we estimate that the market for eliminating the top 1% of peak demand hours for electricity worldwide during this same period could be over $59.4 billion per year.

We are a pioneer in the development, implementation and broader adoption of technology-enabled demand response solutions. Our technology enables us to send control signals to, and receive bi-directional communications from, an Internet-enabled network of broadly dispersed end-use customer sites in order to initiate, monitor and terminate demand response activity. Our robust and scalable technology and proprietary operational processes have the ability to automate demand response and simplify end-use customer participation. These solutions are designed for the commercial, institutional and industrial market, which represents approximately 60% of the United States electricity consumption. We provide demand response capacity by contracting with these end-use customers of grid operators and utilities to reduce their electricity usage on demand. We receive most of our revenues from grid operators and utilities and we make payments to end-users of electricity for both contracting to reduce electricity usage and actually doing so when called upon.

Our demand response technology enables us to remotely reduce electricity usage in a matter of minutes, or send curtailment instructions to our end-use customers to be implemented on site. We believe that our solutions address extreme peaks in demand for electricity more efficiently than building additional electric generation, transmission and distribution infrastructure because over 10% of this supply-side infrastructure is typically built to meet peaks in demand that occur less than 1% of the time. We believe that we are well positioned as a market leader to address this substantial market opportunity for demand response. In addition, our PowerTrak enterprise software platform enables us to deliver to our end-use customer base an expanding portfolio of additional energy management solutions, including our monitoring-based commissioning services, energy procurement services and emissions tracking and trading support services. We believe that the market opportunity for our monitoring-based commissioning services, energy procurement services and emissions tracking and trading support services is significant and will remain so as operational efficiency and energy savings

4

are given increased priority by commercial, institutional and industrial end-users of electricity, and as energy market prices remain volatile.

We provide our demand response solutions to grid operators and utilities under long-term contracts and pursuant to open market bidding programs. Our long-term contracts generally have terms of three to 10 years and predetermined capacity commitment and payment levels. In open market programs, grid operators and utilities generally seek bids from companies such as ours to provide demand response capacity based on prices offered in competitive bidding. These opportunities are generally characterized by energy and capacity obligations with shorter commitment periods and prices that may vary by hour, day, month or bidding period.

In our demand response business we match obligation, in the form of MW that we agree to deliver to our utility and grid operator customers, with supply, in the form of MW that we are able to curtail from the electric power grid. We increase, and occasionally decrease, our obligation through open market programs, supplemental demand response programs, auctions or other similar capacity arrangements, open program registrations and bilateral contracts to account for changes in supply and demand forecasts in order to achieve more favorable pricing opportunities. We increase our ability to curtail demand from the electric power grid by deploying a sales team to contract with our commercial, institutional and industrial customers and by installing our equipment at these customers' sites to connect them to our network. When we are called upon by our utility or grid operator customers to deliver MW, we use our software application to dispatch this network to meet the demands of these utility and grid operator customers. We refer to the above activities as managing our portfolio of demand response capacity.

We began providing demand response services in one state in 2003 and expanded nationally to 31 states and the District of Columbia in eight regions, as well as internationally in Canada and the United Kingdom by December 31, 2009. From our start in one open market in 2003 to our current contracts and open market programs with grid operators and utilities, we have increased our demand response capacity under management with commercial, institutional and industrial customers to over 3,550 MW as of December 31, 2009. As indicated in the table below, we have substantial opportunities to continue expanding our MW under management in the regions in which we already provide our demand response services, as well as in other regions. The table depicts, as of December 31, 2009, each of our geographic markets currently served, the length of time we have operated in that region, the contracts and programs in each region from which we generate revenues, the demand response capacity in MW that we currently manage in the region, and our estimate of the market potential in MW for our demand response services. We expect to increase over time our MW under management, and thereby increase our revenues, in most of the geographic regions we serve.

5

Our Geographic Regions, Contracts and Markets

As of December 31, 2009

Region(1) (Years of Operation In Region) |

Type of Contract/Open Market Program (OMP) |

Date of Contract/ Initial Enrollment IN OMP |

Contract/OMP Expiration Date |

Demand Response Capacity Under Management 12/31/2009 (MW) |

Regional All-Time Peak Demand (MW)(1) |

Demand Response Potential Market Opportunity (MW)(2) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| New England | Reliability-Based OMP | Mar 2003 | Open-Ended | ||||||||||||||

| (7 Years) | Price-Based OMP | Jul 2003 | May 2010 | ||||||||||||||

| Price-Based OMP | Jul 2006 | May 2010 | 933 | 28,130 | 2,813 | ||||||||||||

| Reliability-Based Contract | Jun 2008 | Dec 2012 | |||||||||||||||

| Ancillary Services OMP | Oct 2006 | May 2010 | |||||||||||||||

|

|

|||||||||||||||||

| New York | Reliability-Based OMP | Aug 2004 | Open-Ended | 235 | 33,939 | 3,394 | |||||||||||

| (5.5 Years) | Reliability-Based OMP | Aug 2007 | Open-Ended | ||||||||||||||

|

|

|||||||||||||||||

| California | Reliability-Based Contract | May 2006 | Dec 2017 | ||||||||||||||

| (5 Years) | Reliability-Based OMP | Mar 2007 | Open-Ended | ||||||||||||||

| Reliability-Based OMP | May 2007 | Open-Ended | |||||||||||||||

| Reliability-Based Contract | Feb 2007 | Dec 2011 | 215 | 50,270 | 5,027 | ||||||||||||

| Reliability-Based Contract | Feb 2007 | Dec 2012 | |||||||||||||||

| Reliability-Based Contract | Oct 2009 | Sep 2019 | |||||||||||||||

| Reliability-Based Contract | Sep 2009 | Oct 2024 | |||||||||||||||

|

|

|||||||||||||||||

| PJM | Ancillary Services OMP | Aug 2006 | Open-Ended | ||||||||||||||

| (3.5 Years) | Price-Based OMP | Aug 2006 | Open-Ended | 1,598 | 144,644 | 14,464 | |||||||||||

| Reliability-Based OMP | Jun 2007 | Open-Ended | |||||||||||||||

|

|

|||||||||||||||||

| Southwest | Reliability-Based Contract | Feb 2007 | Dec 2017 | 63 | 36,519 | 3,652 | |||||||||||

| (3 Years) | Reliability-Based Contract | Dec 2008 | May 2012 | ||||||||||||||

|

|

|||||||||||||||||

| Southeast | Reliability-Based Contract | Aug 2007 | Dec 2011 | 251 | 237,100 | 23,710 | |||||||||||

| (2.5 Years) | Reliability-Based Contract | Jun 2008 | Sept 2011 | ||||||||||||||

|

|

|||||||||||||||||

| Northwest | Reliability-Based Contract | Nov 2007 | Apr 2011 | ||||||||||||||

| (2 Years) | Reliability-Based Contract | May 2009 | Feb 2014 | 68 | 40,298 | 4,030 | |||||||||||

| Reliability-Based Contract | Jan 2009 | Dec 2016 | |||||||||||||||

|

|

|||||||||||||||||

| Texas | Reliability-Based OMP | Feb 2008 | Open-Ended | 114 | 62,500 | 6,250 | |||||||||||

| (2 Years) | |||||||||||||||||

|

|

|||||||||||||||||

| Ontario | Reliability-Based Contract | Mar 2008 | May 2013 | 74 | 27,005 | 2,701 | |||||||||||

| (2 Years) | |||||||||||||||||

|

|

|||||||||||||||||

| United Kingdom | Ancillary Services OMP | Oct 2009 | Open-Ended | 15 | 59,880 | 5,988 | |||||||||||

| (.5 Years) | |||||||||||||||||

| Total | 3,566 | 720,285 | 72,029 | ||||||||||||||

- (1)

- US

Regions and Regional All-Time Peak Demands based on FERC Electric Power Market Classifications and Data. UK All-Time Peak Demand

based on National Grid's Operational Demand Data.

- (2)

- Calculated as 10% of regional peak demand, estimated to occur during 1% of annual hours.

The column above labeled Demand Response Capacity Under Management reflects demand response capacity under our management pursuant to definitive contracts with our commercial, institutional and industrial customers.

The column above labeled Type of Contract/Open Market Program (OMP) describes, on a region by region basis, how we provide our demand response solutions to electric power grid operators and utilities under long-term contracts and in open market programs. Our long-term contracts generally have terms of three to 10 years and predetermined capacity commitment and payment levels. Our open market program opportunities are generally characterized by flexible capacity commitments and prices

6

that vary by hour, day, month, bidding period or supplemental, new or modified demand response programs. Within these contracts and open market programs we offer the following solutions to serve the needs of grid operators and utilities:

- •

- reliability-based demand response, which requires a level of demand response capacity to be available for dispatch on call

by grid operators and utilities;

- •

- price-based demand response, which enables commercial, institutional and industrial customers to monitor and respond to

electricity market price signals by reducing electricity usage; and

- •

- ancillary services, which include resources utilized as a reserve pool of quick-start resources to provide short-term support for grid operators and utilities, including operating reserves, called upon by grid operators and utilities during short-term events such as the loss of a transmission line or a power plant.

The EnerNOC Solution

We have developed a proprietary suite of technology applications and operational processes that enable us to make demand response capacity and energy available to grid operators and utilities on demand and remotely manage electricity consumption at commercial, institutional and industrial customer sites. Our solution provides the following benefits:

Compelling Value Proposition to Grid Operators and Utilities. On the supply side, grid operators and utilities deploy our technology-enabled demand response solutions to supplement, avoid or defer costly investments in generation, transmission and distribution facilities and to enhance the reliability of the electric power grid system. Our demand response solutions help grid operators and utilities achieve their capacity and capacity reserve margin goals quickly and economically and allow them to diversify their portfolio of resources, without requiring the installation of any hardware or software at their facilities. Whereas it typically takes years to site, permit and construct a power plant and the associated transmission and distribution infrastructure, demand response capacity can generally be enabled within months, in densely populated, constrained areas, exactly where the new capacity is needed most and with no need for new transmission or distribution infrastructure. We either enter into long-term contracts to sell our demand response capacity to grid operators and utilities, or participate in the open market opportunities for demand response that they establish. Together with these demand response solutions, our energy management solutions enhance the reliability of regional electric power grids by providing grid operators and utilities the ability to measure, manage, shift and reduce energy consumption in specific distribution areas within minutes.

Compelling Value Proposition To End-Use Customers. On the demand side, our turnkey, outsourced demand response and energy management solutions create new streams of recurring cash flows, reduce energy costs and simplify energy management for our commercial, institutional and industrial customers. Our offerings typically involve no up-front capital investment on the part of our end-use customer. We share demand response payments, called capacity payments, that we receive from grid operators and utilities with our end-use customers for agreeing to reduce their electrical consumption whether or not they are actually called upon to do so. We also generally make additional payments, called energy payments, when they actually reduce their consumption from the electric power grid.

Energy Management Solutions for End-Use Customers. Our demand response solutions position us to deliver additional energy management solutions to our commercial, institutional and industrial customers. These end-use customers are increasingly focused on efficiently managing their energy consumption and reducing costs. The real-time energy consumption data that we gather in our PowerTrak enterprise software platform empowers our monitoring-based commissioning services to identify savings opportunities in our end-use customers' energy costs across departments and throughout those customers' operations on an enterprise-wide basis. The devices that we have installed

7

in connection with our demand response solutions enable us to implement our monitoring-based commissioning services. In addition, the data that we gather in our CarbonTrak enterprise software platform enables our end-use customers to track their greenhouse gas emissions and develop carbon management plans to achieve reduction targets. Overall, by delivering a recurring cash stream for our end-use customers, we are often viewed by them as a trusted partner who can help address their increasingly complex energy challenges.

Open, Scalable and Secure Architecture. Our NOC is supported by our PowerTrak enterprise software platform, which is built on an open and scalable Web services architecture. PowerTrak is able to interface with energy management and building automation systems at commercial, institutional and industrial customer sites, thereby enabling us to cost-effectively leverage existing technology for remote monitoring and control from our NOC. PowerTrak's analytical tools enable a single NOC operator to supervise hundreds of end-use metering and control points and simultaneously optimize demand response performance and energy savings measures across numerous end-use customer sites and geographic regions. We have built a comprehensive security infrastructure, including firewalls, intrusion detection systems and data encryption, and have established fail-over redundancy for our information technology systems.

Reduced Environmental Impact. By reducing electricity consumption during periods of peak demand and other system emergencies, our demand response solutions can displace older, inefficiently-used power plants, and defer new generation, transmission and distribution development, resulting in reduced emissions and land use benefits. These environmental benefits are particularly clear when demand response capacity qualifies under regional regulations as operating reserves. In these areas, grid operators and utilities call on demand response when contingencies such as power plant or transmission outages occur, which can offset the need to keep centralized peaking power plants running on idle for thousands of hours per year. Dispatchable demand response capacity therefore allows grid operators and utilities to meet reserve requirements with significantly less environmental impact than conventional supply-side alternatives. In addition, we believe that growing participation in demand response by commercial, institutional and industrial organizations will lead to an increased focus on energy management efforts, including energy efficiency and conservation, through which end-use customers can significantly reduce air emissions.

Management of Intermittent Renewable Power Source Shortfalls. We expect that the electric power industry in North America will face challenges in managing an increased amount of intermittent renewable energy resources that are expected to be connected to the power grid in the future. Although these numbers will be smaller initially, as grid operators and utilities move to meet increased regulatory requirements for renewable energy sources at the state level and look ahead to possible Federal renewable energy portfolio standards, we believe our demand response solutions will offer additional value to grid operators and utilities trying to address some of the risks inherent in renewable energy sources that are less predictable than traditional baseload energy generation sources. Some of the primary current candidates for large-scale renewable energy sources such as wind and solar power provide fluctuating amounts of power based on external factors such as weather and atmospheric conditions. Accordingly, grid operators and utilities must plan for the risk that these kinds of renewable resources will not be available on a consistent basis. This means that reserve margins, or excess capacity available during normal operations, must be higher. We believe that our demand response solutions offer a more cost-effective solution for providing a wide variety of reserve capacity than traditional peaking power plants, which require significant infrastructure expenditures for capacity that is infrequently used, and that this cost benefit gives us an additional competitive advantage when pursuing demand response opportunities from grid operators and utilities.

Competitive Strengths

Our competitive strengths position us for continued leadership and rapid expansion in the clean and intelligent energy solutions sector.

8

Leading Provider with a Diversified Product Suite and Nationwide Presence. We are a pioneer in the development, implementation and broader adoption of technology-enabled demand response solutions to commercial, institutional and industrial customers on a national scale. With over 3,550 MW under management as of December 31, 2009 and an end-use customer base of approximately 2,800 accounts across 6,500 customer sites throughout multiple electric power grids as of December 31, 2009, we believe that we are the largest demand response service provider in the United States for commercial, institutional and industrial customers. We leverage our leadership role in the demand response market to cross-sell additional energy management solutions to our end-use customers, including our monitoring-based commissioning services, energy procurement services and emissions tracking and trading support services. In addition, we believe our national presence is a key differentiator that enables us to offer a single platform for our customers who have national operations to participate in our diversified suite of solutions across different geographic regions with different market rules and conditions.

Established Track Record of Reliable Performance and Demonstrated Growth. We have an established track record of reliably delivering demand response capacity when called to do so by grid operators and utilities. Specifically, in 2008 and 2009, we delivered performance that averaged over 100%, based on nominated versus delivered capacity. Our substantial base of operating experience in successfully delivering demand response solutions has enabled us to rapidly and significantly grow our base of grid operator and utility customers. In 2009, we increased our MW under management by 1,500 MW to more than 3,550 MW as of December 31, 2009. For the year ended December 31, 2009, our revenues increased by 80% as compared to revenues for the year ended December 31, 2008.

Highly Scalable Business Model with Increasing Operating Leverage. The dynamics of the commercial, institutional and industrial market enable us to rapidly scale our business in existing and new geographies. Once a demand response market is established in a region, the marginal cost of acquiring and servicing commercial, institutional and industrial customers is relatively low compared to traditional supply-side capacity resources. In addition, the large size of our target end-use customers significantly lowers our acquisition cost per unit of capacity compared to the acquisition cost of residential customers. Commercial, institutional and industrial customers also often have one decision maker who controls multiple sites, thereby accelerating our acquisition of new capacity under management, lowering our cost to expand our network of managed sites and providing more opportunities to cross-sell our suite of energy management solutions. In addition, our NOC and scalable PowerTrak technology platform create operating leverage, enabling us to significantly grow MW under management and revenue without adding significant employee resources. For example, since inception, our productivity has improved with MW under management per full time employee increasing from 4.1 MW as of December 31, 2006 to 8.5 MW as of December 31, 2009.

Recurring and Visible Revenues. We enter into long-term contracts and participate in open market bidding programs with grid operators and utilities under which we are paid recurring payments, typically on a monthly basis, for the capacity that we make available, whether or not we are called upon to reduce our end-use customers' electricity consumption from the electric power grid. These long-term contracts generally range between three and 10 years in duration and these recurring payments significantly increase the visibility and predictability of our future revenues. In addition, we enter into long-term contracts that generally range between three and five years in duration with commercial, institutional and industrial customers who provide us with demand response capacity.

Differentiated Technology Platform. Our scalable, proprietary technology platform, in addition to our established track record and experience, creates a significant competitive advantage for us. We communicate via the Internet using advanced metering applications and automation equipment that we or third parties install at end-use customer sites to make demand response participation viable for a wide range of commercial, institutional and industrial organizations. The open architecture design of

9

our proprietary technology platform enables us to interface with existing and new energy management and building automation systems which use a variety of protocol languages. Once an end-use customer is enabled in our network, we collect real-time energy consumption data. This data enables our software to perform demand response measurement and verification, and also provides the underlying information to conduct further energy management analysis and provide decision-making support. We further strengthened our differentiated technology platform in 2009 by successfully launching and deploying PowerTalk, the industry's first standards-based presence-enabled smart grid communications technology, at over 750 customer sites. In addition, rather than being limited to curtailing electricity used by a specific type of equipment, such as air-conditioning units, our platform enables us to manage a wide array of equipment and systems to implement appropriate demand response solutions on an end-user by end-user basis.

Strategy

Our strategy is to capitalize on our established track record, substantial operating experience and scalable and proprietary technology platform, as well as our leading market position in the United States, to continue providing clean and intelligent energy solutions to commercial, institutional and industrial customers, grid operators, and utilities. Our aim is to become the leading outsourced demand response and energy management solutions provider for commercial, institutional and industrial customers worldwide. Key elements of our strategy include:

Strengthen Presence by Growing in Existing and New Regions in the United States. We will continue to pursue opportunities to provide demand response capacity to grid operators and utilities in markets in the United States through additional long-term contracts and open market opportunities for demand response capacity. To provide this demand response capacity, we expect to enter into contracts with new commercial, institutional and industrial customers. We will also seek to cross-sell additional energy management solutions, such as our monitoring-based commissioning services, energy procurement services and emissions tracking and trading support services, to these end-use customers. Our sales force will primarily focus their efforts on the following seven vertical markets: technology, education, food sales and storage, government, healthcare, manufacturing/industrial and commercial real estate. We believe that our full-service demand response and energy management solutions, the recurring payments that we provide and our national presence will enable us to continue to pursue rapid growth of our end-use customer base.

Expand Sales of our Growing Portfolio of Technology-Enabled Energy Management Solutions. We believe that our demand response solutions have uniquely positioned us to deliver additional energy management solutions to our growing network of commercial, institutional and industrial customers. We will continue to develop our technology, including our PowerTrak enterprise software platform. This platform enables us to measure, manage, benchmark and optimize end-use customers' energy consumption and facility operations. We will continue through our monitoring-based commissioning services to use real-time and historical energy data to help end-use customers analyze and reduce their consumption of electricity, forecast demand, continuously monitor building management equipment to optimize system operation, model rates and tariffs and create energy scorecards to benchmark similar facilities. In addition, we offer our energy procurement services to our end-use customers, which enable them to mitigate risk through competitive energy supply contracts and achieve energy cost savings. We also offer our end-use customers emissions tracking and trading support services through our CarbonTrak enterprise software platform, which enables them to more effectively monitor, mitigate and monetize their greenhouse gas emissions in response to existing and pending greenhouse gas reporting requirements. We believe that our end-use customers will become increasingly aware of their energy costs and consumption and will look to advanced analytics and trusted third-party providers to help them better manage their overall energy expenditures.

10

Actively Pursue Targeted Strategic Acquisitions. We intend to actively pursue selective acquisitions to reinforce our leadership position in the expanding clean and intelligent energy solutions sector. This sector consists of a number of companies with technology offerings or customer relationships that present attractive acquisition opportunities. We intend to look for opportunities to acquire technologies that would support and enhance our current technology platform with a particular focus on growing our energy management solutions. Customer relationship acquisitions will focus on expansion into new geographic regions both in the United States and internationally. We have a strong track record of successfully integrating acquired companies to increase our customer base, entering new geographic regions, improving our product offering and enhancing our technology. In June 2009, we acquired substantially all of the assets of eQ, a software company specializing in the development of enterprise sustainability management products and services, to strengthen our position in a nascent yet growing market committed to helping energy and sustainability leaders develop their own plans to achieve energy efficiency and emissions goals. In December 2009, we acquired Cogent, a company specializing in comprehensive energy consulting, engineering and building commissioning solutions to commercial, institutional and industrial customers.

Target Expansion by Entering International Markets. We also intend to expand our addressable market by pursuing demand response and energy management opportunities in international markets. We are a pioneer in the development, implementation and broader adoption of clean and intelligent energy solutions and have built a national footprint in the United States We believe we can achieve a similar significant first mover advantage internationally, principally in Canada, the United Kingdom and Europe. We believe that our scalable technology platform and proprietary operational processes are readily adaptable to the international markets we are targeting. We believe that entering new international markets will provide a significant opportunity to grow our customer base and provide a differentiated offering to customers with international operations. For example, during the third quarter of 2009, we commenced operations in the United Kingdom by enrolling MW in National Grid's Short-Term Operating Reserve program.

Our Clean and Intelligent Energy Solutions

Demand Response Solutions

Demand response is achieved when end-use customers reduce their consumption of electricity from the electric power grid in response to a market signal. End-use customers can reduce their consumption of electricity by reducing demand (for example, by dimming lights, resetting air conditioning set-points or shutting down production lines) or they can self-generate electricity with onsite generation (for example, by means of a back-up generator or onsite cogeneration). Our demand response capacity provides a more timely, cost-effective and environmentally sound alternative to building conventional supply-side resources, such as natural gas-fired peaking power plants, to meet infrequent periods of peak demand.

Although electric power utilities have offered less technology-enabled forms of demand response to their largest electricity consumers for decades in the form of interruptible tariffs—a mechanism that allows utilities to call on customers to reduce consumption during periods of peak demand in exchange for lower rates—these programs typically lack an affordable means of real-time data communication and adequate automation technologies to make demand response participation viable for most commercial, institutional and industrial organizations. We believe that the widespread adoption of the Internet, as well as cost-effective and robust metering and control technologies, have created a new opportunity for technology-enabled demand response solutions to drive significant benefits for all stakeholders.

We have pursued this opportunity by building our proprietary technologies and operational processes that make demand response participation possible for a wider range of electricity consumers.

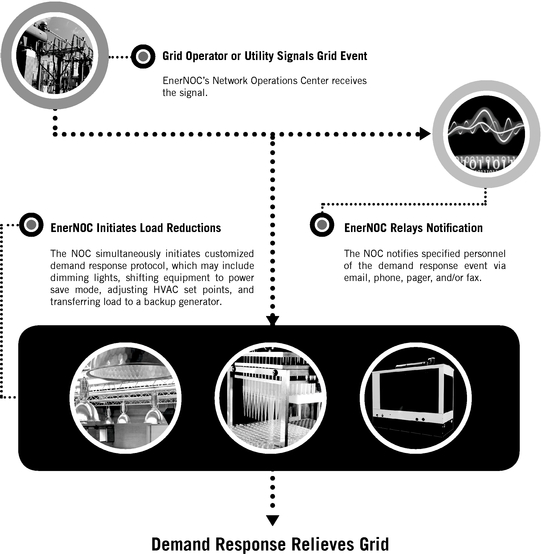

11

The devices that we install at our commercial, institutional and industrial customer sites transmit to us via the Internet electrical consumption data on a 1-minute, 5-minute, 15-minute and hourly basis, which is referred to in the electric power industry as near real-time data. Our proprietary software applications analyze the data from individual sites and aggregate data for specific regions. When a demand response event occurs, our NOC automatically processes the notification coming from the grid operator or utility. Our NOC operators then begin activating procedures to curtail demand from the grid at our commercial, institutional and industrial customer sites. Our one-click curtailment activation sends signals to all registered sites in the targeted geography where the event is occurring. Upon activation of remote demand reduction, our technology, which is receiving near real-time data from each site, is able to determine on a near real-time basis whether the location is performing as expected. Signals are relayed to our NOC operators when further steps are needed to achieve demand reductions at any given location. Each end-use customer site is monitored for the duration of the demand response event and operations are restored to normal when the event ends.

We offer the following three distinct demand response solutions to serve the needs of grid operators and utilities: (i) reliability-based demand response, (ii) price-based demand response, and (iii) short-term reserve resources referred to in the electric power industry as ancillary services.

Reliability-Based Demand Response. We receive recurring capacity payments from grid operators and utilities for being on call, which means having available previously registered demand response capacity that we have aggregated from our commercial, institutional and industrial customers, regardless of whether we receive a signal to reduce consumption. When we receive a signal from a grid operator or utility customer, which we refer to as a dispatch signal, our proprietary software applications automatically notify our end-use customers that a demand reduction is needed and initiate processes that reduce electrical consumption by certain of our commercial, institutional and industrial customers in the targeted area. When we are called to implement a demand reduction, we typically receive an additional payment for the energy that we reduce. Our commercial, institutional and industrial customers will then receive a payment from us. We are called upon to perform by grid operators and utilities during periods of high demand or supply shortfalls, otherwise known as capacity deficiency events. By aggregating a large number of end-use customers to participate in these reliability-based programs, we believe that we have played a significant role over the past several years in helping to prevent brownouts and blackouts in some of the most capacity constrained regions in the United States. We currently provide reliability-based demand response solutions to ISO New England, Inc., or ISO-NE, PJM Interconnection, or PJM, the New York Independent System Operator, or New York ISO, San Diego Gas and Electric Company, or SDG&E, Southern California Edison Company, Electric Reliability Council of Texas, or ERCOT, and Pacific Gas and Electric Company, among others.

Price-Based Demand Response. Our price-based demand response solutions enable commercial, institutional and industrial customers to monitor and respond to wholesale electricity market price signals when it is cost-effective for them to do so. We register a "strike price" with respect to each end-use customer using this solution, above which it may be economical for that customer to reduce its consumption of electricity. We receive an energy payment in the amount of the wholesale market price for the electricity that the end-use customer does not consume and share this payment with that customer. If prices in a given market approach a given strike price, our solutions automatically notify the end-use customer and initiate processes that reduce electrical consumption from the electric power grid. We currently participate in price response programs in the Mid-Atlantic and New England.

Ancillary Services. Demand response is utilized for short-term reserve requirements, referred to in the electric power industry as ancillary services, including operating reserves. This solution is called upon by grid operators and utilities during short-term contingency events such as the loss of a transmission line or large power plant. Through our technology, certain end-use customers are able to

12

provide near instantaneous response for these numerous short-term system events, and often do so with negligible impact on their business operations. Grid operators and utilities rely on a reserve pool of these quick-start resources to step in and provide short-term support as needed during these contingency events. The goal of grid operators and utilities is to get these resources back into standby mode as quickly as possible after they are dispatched so that the reserve pool of available capacity is replenished. Examples of ancillary services markets in which we participate include PJM's Synchronized Reserves Market, in which we were the first provider of demand response capacity, and ISO-NE's Demand Response Reserves Pilot program.

Energy Management Solutions

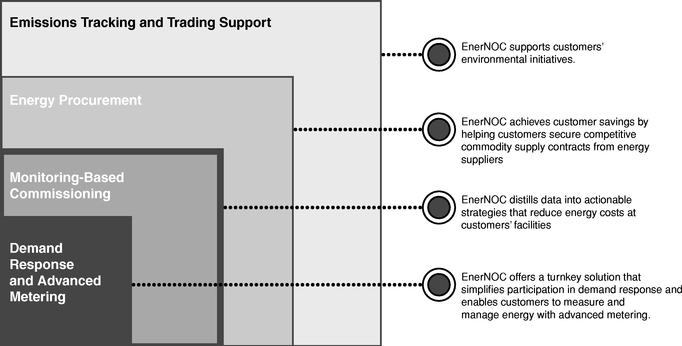

We have an expanding portfolio of additional energy management solutions. We believe that our demand response solutions have positioned us to deliver additional energy management solutions to our growing network of commercial, institutional and industrial customers. By collecting and reporting real-time energy consumption data and by delivering a stream of recurring payments to our end-use customers through demand response solutions, we hope to be viewed as a trusted partner who can help address their increasingly complex energy challenges. Our energy management solutions are aimed at helping address these challenges and at expanding our customer relationships. The diagram below provides an overview of these solutions.

In September 2007, we acquired Mdenergy, LLC, or MDE, an energy procurement services provider, to augment our expanding portfolio of additional energy management solutions. The MDE acquisition included the addition of hundreds of new commercial, institutional and industrial customers to whom we were providing energy procurement services as of December 31, 2009. In May 2008, we acquired South River Consulting, LLC, or SRC, an energy procurement and risk management services provider, which acquisition strengthened our position in a growing energy procurement services market and provides a local presence for us in the PJM service region. In June 2009, we acquired eQ, a software company specializing in the development of enterprise sustainability management products and services. In December 2009, we acquired Cogent, a company specializing in comprehensive energy consulting, engineering and building commissioning solutions to commercial, institutional and industrial customers. We intend to pursue and have pursued opportunities to provide demand response solutions to a substantial number of the new end-use customers derived from these acquisitions.

13

We currently offer the following technology-enabled energy management solutions to our commercial, institutional and industrial customers:

- •

- Monitoring-Based Commissioning

Services. Our monitoring-based commissioning services are a technology-based energy analytics service designed to help optimize the way

buildings operate, measure the impact of key energy and environmental decisions, and enhance the comfort of occupants. Our PowerTrak application integrates data from disparate energy management

systems with utility metering to gather data on an end-use customer's overall energy usage. Our analysts then use analysis tools, filters, and applications to monitor and review this data, and provide

distilled information and recommendations designed to optimize performance; reduce energy consumption; reduce carbon emissions; prioritize maintenance needs; and enhance occupant comfort.

- •

- Energy Procurement

Services. We offer to our end-use commercial, institutional and industrial customers various services related to procuring

and managing commodity supply contracts from competitive energy suppliers. We use our market knowledge and industry relationships, along with actual customer energy usage data that we track and manage

through PowerTrak, to achieve savings for customers. We bring customers strategic advice to help them capture favorable energy procurement contracts from competitive electricity and natural gas

suppliers. We take no position in the commodities market and assume no associated risk.

- •

- Emissions Tracking and Trading Support Services. Our emissions tracking and trading support services include a comprehensive, software-based accounting system for our commercial, institutional and industrial customers to effectively monitor, mitigate and monetize their greenhouse gas emissions in response to existing and pending greenhouse gas reporting requirements.

Technology and Operations

Technology

Since inception, we have focused on delivering industry-leading, technology-enabled demand response and energy management solutions. Our proprietary technology has been developed to be highly reliable and scalable and to provide a platform on which to design, customize, and implement demand response and energy management solutions. Our proprietary technology infrastructure is built on Linux, Java and Oracle and supports an open web services architecture. Our PowerTrak enterprise software platform enables us to efficiently scale our demand response offerings in new geographic regions and rapidly grow the end-use customers in our network. PowerTrak leverages web services that connect applications directly with other applications. They do this through a form of "loose coupling" which allows connections to be established across applications without customization. As a result, these connections can be established without regard to technology platform or programming language, making it easy to share technology across a broad range of users and companies. Web services enable business collaboration at the process level. Process-level collaboration requires software that is architected for communication across firewalls. We believe that business process collaboration over the Internet has wide-reaching implications for the ways in which energy transactions will be performed.

Our technology can be broken down into five primary components: the Network Operations Center, the EnerNOC Site Server, PowerTrak, PowerTalk and CarbonTrak.

Network Operations Center

Our technology enables our NOC to automatically respond to signals sent by grid operators and utilities to deliver demand reductions within targeted geographic regions. We can customize our technology to receive and interpret many types of dispatch signals sent directly from a grid operator or

14

utility to our NOC. Following the receipt of such a signal, our NOC automatically notifies specified end-use customer personnel of the demand response event. After relaying this notification to our commercial, institutional and industrial customers, we initiate processes that reduce their electricity consumption from the electric power grid. These processes may include dimming lights, shifting equipment to power save mode, adjusting heating and cooling set points and activating a back-up generator. Demand reduction is monitored remotely with real-time data feeds, the results of which are displayed in our NOC through various data presentment screens. Each end-use customer site is monitored for the duration of the demand response event and operations are restored to normal when the event ends. We currently participate in demand response programs across North America and in the United Kingdom, some of which require demand reductions within 10 minutes or less. We have built a comprehensive security infrastructure, including firewalls, intrusion detection systems, and encryption for transmissions over the Internet, and have established fail-over redundancy for the information technology systems that support our NOC. The following diagram illustrates how we use our NOC to reduce electricity consumption from the electric power grid.

Our Technology Platform and Operational Processes

15

The EnerNOC Site Server

We work directly with end-use customers to ensure that they are able to respond quickly and completely to demand reduction instructions. We install a hardware device, called an EnerNOC Site Server, or ESS, at each end-use customer site to collect and communicate real-time electricity consumption data and, in many cases, enable remote control. The ESS communicates to our NOC through the customer's LAN or other internet connection. The ESS is an open, integrated system consisting of a central hardware device residing inside a standard electrical box.

The ESS serves as a gateway to connect our NOC with a variety of data collection systems and equipment at end-use customer sites. The ESS is typically installed in the electrical room at an end-use customer's site and is equipped to read and record voltage, current, power and other power quality electrical data of certain customer-owned electrical equipment, along with other important energy usage parameters, including natural gas, chilled water, steam and compressed air. It includes PowerTalk software which enables the secure, bi-directional transfer of data across firewalls and over the Internet. The ESS is used to locally connect into many types of building management equipment and systems that support a range of communications protocols and interfaces such as LonWorks, BACnet/IP, Modbus RTU, Modbus TCP/IP, and SNMP. The ESS also provides protocol translation so that data from legacy building management systems can be connected directly to our NOC. This advanced connectivity allows us to use a customer's existing infrastructure investment, lowering our overall cost of enablement and making data available to corporate networks and the Internet through industry standard communication protocols.

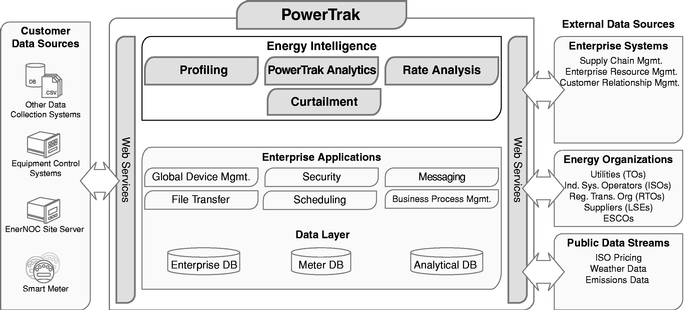

PowerTrak

PowerTrak is our web-based enterprise software platform used for power measurement, load control and energy analysis, and is the underlying software that runs our NOC. It utilizes a modular web services architecture that is designed to allow application modules to be easily integrated into the platform. We believe that a key factor to successfully offering clean and intelligent energy solutions is integrating data from disparate sources and utilizing it to deliver customer-focused solutions utilizing open protocols. The following diagram and description provide an overview of our system architecture.

- •

- Energy Intelligence. This proprietary suite of web-enabled modules delivers demand response and energy management capabilities by processing near real-time and historical data from our data warehouse. Energy intelligence provides actionable energy information to users and offers a way

16

- •

- Enterprise

Applications. This Java-based middle layer of the application is where we have defined and implemented our business

processes, business rules, and business logic that pertain to global device management, security, messaging, file transfer, scheduling and business process management. These enterprise components

provide the core web services that coordinate the near real-time exchange of data between devices, people, external data sources, and other enterprise applications.

- •

- Data Layer. The data layer is a relational database that is designed for query, analysis and transaction processing and data collection, processing, aggregation and validation. It contains historical energy data and data from other sources. It separates analysis workload from transaction workload and enables us to consolidate data from several sources. These records include customer demographics, interval energy information (for example, 1-minute, 5-minute and 15-minute), as well as weather, emissions, pricing and aggregated summary data.

for users to view and manipulate this data. Modules include: Profiling, which enables usage tracking; PowerTrak Analytics, which enables users to conduct asset performance and emissions tracking, load forecasting, benchmarking and scorecard reporting; Rate Analysis, which enables users to compare utility tariffs with competitive supply offers; and Curtailment, which enables us to curtail electricity consumption and dispatch generators based on signals from grid operators.

Currently, PowerTrak collects facility consumption data on a 1-minute, 5-minute, 15-minute and hourly basis and integrates that data with near real-time, historical and forecasted market variables. We use PowerTrak to measure, manage, benchmark and optimize end-use customers' energy consumption and facility operations. We use this data to help end-use customers analyze consumption patterns, forecast demand, measure real-time performance during demand response events, continuously monitor building management equipment to optimize system operation, model rates and tariffs and create energy scorecards to benchmark similar facilities. In addition, CarbonTrak enables us to track each end-use customer's greenhouse gas emissions by mapping their energy consumption with the fuel mix used for generation in their location, such as the proportion of coal, nuclear, natural gas, fuel oil and other sources used.

We have generally provided basic PowerTrak functionality as part of the overall service offering to the end-use customers who participate in our demand response programs. As part of our monitoring-based commissioning services, we use PowerTrak to identify and deliver energy efficiency strategies for our customers. We believe that end-use customers will become increasingly aware of their energy costs and consumption and will look to advanced analytics and trusted third-party providers to help them better manage their overall energy expenditures.

PowerTalk

In 2009, we announced the deployment of PowerTalk, the industry's first presence-enabled smart grid technology, at certain of our commercial, institutional, and industrial customer sites. PowerTalk enables real-time communication through open, standards-based presence technology between most Internet-enabled smart meters or devices and our NOC. The always-on, two-way presence-based connection created by PowerTalk significantly enhances visibility into our demand response network. PowerTalk also streamlines the site enablement process, allowing us to more efficiently equip end-use customers to participate in demand response programs. PowerTalk-enabled devices are "firewall friendly" and can leverage existing end-use customer networks to facilitate secure, authenticated and encrypted communication, without the need to establish a virtual private network.

CarbonTrak

CarbonTrak is our web-based enterprise software platform used to enable end-use customers to track their greenhouse gas emissions and develop carbon management plans to achieve reduction targets. CarbonTrak utilizes a highly flexible and scalable data model, which allows the end-use

17

customer to input a variety of fuel and emissions sources and automatically translate the resulting data in light of the requirements of various mandatory and voluntary carbon accounting and carbon reporting programs. In addition, CarbonTrak provides templates for common energy efficiency measures, such as lighting upgrades, allowing end-use customers to model potential energy savings projects and examine cost effectiveness and margin carbon cost. As a result of existing and pending greenhouse gas reporting requirements, we believe that end-use customers will become increasingly aware of their greenhouse gas emissions and will look to third-party providers to help them better calculate, track, report and manage their carbon emissions.

Sales and Marketing

As of December 31, 2009, our sales team consisted of 113 employees. We organize our sales efforts by customer type. Our utility sales group sells to grid operators and utilities, while our commercial and industrial sales group sells to commercial, institutional and industrial customers. Our utility sales group is responsible for securing additional long-term contracts from grid operators and utilities for our demand response and energy management solutions. These sales typically take 12 to 18 months to complete and, when successful, typically result in multi-million dollar contracts with terms that generally range between three and 10 years. We actively pursue long-term contracts in both restructured markets and in traditionally regulated markets. Our commercial and industrial sales group sells our demand response and energy management solutions to commercial, institutional and industrial customers. These sales typically take two to four months to complete and have terms that generally range between three and five years. Our commercial and industrial sales group is located in major electricity regions throughout North America, including New England, New York, the Mid-Atlantic, Texas, Florida, California, and internationally in Canada and the United Kingdom.

Our marketing organization consisted of 33 employees as of December 31, 2009. This group is responsible for influencing all market stakeholders including customers, energy users and policymakers, attracting prospects to our business, enabling the sales engagement process with messaging, training and sales tools, and sustaining and expanding relationships with existing customers through renewal and retention programs and by identifying cross-selling opportunities. This group researches our current and future markets and leads our strategies for growth, competitiveness, profitability and increasing market share.

Customers

End-Use Customers

As of December 31, 2009, we managed over 3,550 MW of technology-enabled demand response capacity from over 2,800 commercial, institutional and industrial customers in our demand response network across approximately 6,500 customer sites. The following table lists some of our end-use customers as of December 31, 2009 in each of the seven key vertical markets that our commercial and industrial sales group primarily targets for demand response and energy management opportunities:

| Technology | Education | Food Sales and Storage | Commercial Real Estate | |||

|---|---|---|---|---|---|---|

| AT&T | University of San Diego | Albertsons | Beacon Properties | |||

| Level 3 Communications | The California State University | Raley's | Morguard Investments Limited | |||

| General Electric | Southern Connecticut State University | Pathmark | Washington Realty Investment Trust | |||

| Adobe Systems | Western Connecticut State University | Stop & Shop | Westcor | |||

| New Haven Public Schools | Shop Rite |

| Government | Healthcare | Manufacturing/Industrial | |

|||

|---|---|---|---|---|---|---|

| State of Vermont | Partners Healthcare | O&G Industries | ||||

| State of Connecticut | Stamford Hospital | Pfizer | ||||

| City of Boston, MA | Greenwich Hospital | Verso Paper | ||||

| State of Rhode Island | Hartford Hospital | Cascades | ||||

| City of New Haven, CT | UMass Memorial Health Care |

18

Supermarkets are a good example of how our technology and solutions function to deliver demand response capacity to grid operators and utilities while delivering significant value to the end-use customer. Supermarkets operate with thin margins, and energy savings can significantly impact financial results. It has been calculated that a 10% reduction in energy costs for the average supermarket is equivalent to increasing net profit margins by 16%. Because the profit margins of supermarkets are so thin, on the order of 1%, the U.S. Environmental Protection Agency estimates that $1.00 in energy savings is equivalent to increasing sales by $59.00.

Supermarkets have a number of measures that can be taken to reduce their electrical demand from the grid. Most supermarkets have a natural gas-fired emergency generator to ensure that shoppers who are in the checkout line can pay for products in the event of a power disruption. In many regions, these can be activated at times when a supermarket is called on to reduce demand. Supermarkets also have the option to curtail non-critical electrical loads that do not interfere with shopping. Lighting in many supermarkets is separated into different circuits and curtailing approximately one-third of the lights does not impact business continuity. Additionally, air handlers, anti-sweat heaters, and other ancillary loads can be curtailed. On average, our supermarket customers are able to achieve 70 kW of demand reduction from the grid for each supermarket location by implementing these types of demand response strategies.