Attached files

Exhibit 99.2

411 N. Sam Houston Parkway East, Suite 400, Houston, Texas 77060-3545, USA

T + 1 281 448 6188 F +1 281 448 6189 W www.rpsgroup.com/energy

March 3, 2010

APCO Oil and Gas International Inc.

Av. Libertador 498, piso 26

C1001ABR Buenos Aires, ArgentinaUSA

|

RE:

|

Reserve Audit of Acambuco Field, of December 31, 2009

|

Gentlemen:

As per your request, RPS has conducted the reserves Audit of the Acambuco field in the Republic of Argentina, which APCO has 1.5% working interest (WI) participation. The field is operated by Pan American Energy LLC (PAE). The results of the hydrocarbon reserves evaluation are presented in the Acamabuco Reserves Report completed on February 6, 2010 (attached). The reserves effective date is December 31, 2009, and they have been estimated for the entire concessions life.

RPS has conducted an evaluation of the information provided by PAE for each field, estimating the Proved, Probable, and Possible hydrocarbon liquids and natural gas reserves. In the preparation of this audit RPS had relied upon the information furnished by APCO and by PAE, including reservoir and reserves data, production, development and operating costs, product prices, agreements relating to current and future operations and sale of production, and various other information and data that were accepted as represented. Following data review RPS proceeded with tests, procedures review, and adjustments that were considered necessary for validating the reserves. All questions and clarifications that RPS was faced with during the audit evaluation process were responded by APCO and PAE to RPS’ satisfaction.

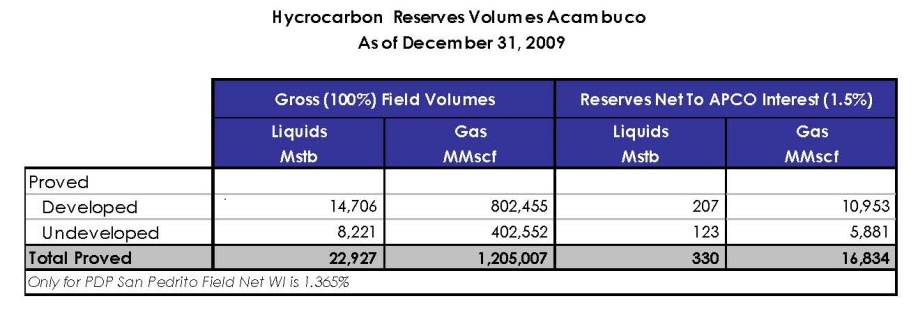

Based on the information provided, the Net Proved, Probable and Possible APCO reserves in this field were estimated, and the corresponding certification statement is included in the attached report. The table below summarizes APCO’s Net Proved liquids hydrocarbon and natural gas reserves for this field.

Hydrocarbon liquids are crude oil, condensate and gasoline. The Condensate and Gasoline estimates, which are reported in stock tank barrels, are volumes captured during field separation and gas plants treating in the field. The natural gas reserves reported include gas sales and fuel gas. These volumes are reported in Million cubic feet (MMcf) at standard conditions of 14.7 psia and 600 Fahrenheit.

Proved natural gas sales estimates are based on existing gas contracts, and on the reasonable expectation that such gas sales contracts, will be extended to the entire life of the concession.

RPS considers that the Proved hydrocarbon liquids and gas reserves estimates presented herein are reasonable. They have been prepared in accordance with the definitions for Proved hydrocarbon reserves set out in the Rule 4-10 of Regulations S-X of the United States Securities and Exchange Commission (SEC). The reserves audit procedure followed for the evaluation of hydrocarbon Proved, Probable and Possible reserves conform to the “Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information” which was approved by the SPE Board in 2001 and revised as of February 19, 2007. Reserves categorization and determination methodology followed the “Petroleum Resources Management System” (PRMS) guidelines which were approved by SPE in 2007.

Economic test runs were completed for individual reserves category. Prevailing gas contract prices were used. The crude oil reserves economic validation was based on annual average WTI price for 2009, corrected for crude quality, royalty, provincial taxes and retention taxes. Also included in the runs were capital costs associated with the entire development programs planned by PAE for each field. The operating cost estimates were derived from historical data. Consideration was given for the “non-consent” position of APCO for the well San Pedrito X-1. No Cash Flow numbers have been provided for the Macueta Sur field due to reserves immateriality.

As indicated above, this study was based on data supplied by APCO and PAE. The supplied information was reviewed for reasonableness from a technical perspective. As is common in oil field situations, basic physical measurements taken over time cannot be verified independently in retrospect. As such, beyond the application of normal professional judgment, such data must be accepted as representative. While we are not aware of any falsification of records or data pertinent to the results of this study, RPS does not warrant the accuracy of the data and accepts no liability for any losses from actions based upon reliance on data, which is subsequently shown to be falsified or erroneous. RPS personnel who prepared this report are degreed professionals with the appropriate qualifications and experience to complete the audit work. RPS and its staff do not claim expertise in accounting, legal and environmental matters, and opinions on such matters do not form part of this report.

This report has been prepared on a best efforts basis to address the requirement of the brief specified by PAE. The results and conclusions represent informed professional judgments based on the data available and time frame allowed to perform this work. No warranty is implied or expressed that actual results will conform to these estimates. RPS accepts no liability for actions or losses derived from reliance on this report or the data on which it was based.

Very truly yours,

RPS

Luis V. Bacigalupo

Senior Vice President

Ref:Lvb/sd/L01005

United Kingdom | Australia | USA | Canada | Russia | Malaysia