SECURITIES AND EXCHANGE COMMISSION

| (Mark One) | ||

|

þ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2009 | ||

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from to |

|

|

PERFORMANCE TECHNOLOGIES, | |

| INCORPORATED |

| Delaware | 16-1158413 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

|

205 Indigo Creek Drive

Rochester, New York |

14626 (Zip Code) | |

|

(Address of principal executive offices) |

(585) 256-0200

|

Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, par value $.01 per share | The Nasdaq Stock Market, LLC |

| 1 |

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company þ |

The information called for by Items 10-14 of Part III of Form 10-K, except for the equity plan information required by Item 12, which is set forth herein, is incorporated by reference from the definitive Proxy Statement for the Annual Meeting of Stockholders of the Company to be held on May 20, 2010, which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2009.

2

3

PART I

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

The Private Securities Litigation Reform Act of 1995 (the “Reform Act”) provides a “safe harbor” for forward-looking statements. Certain written and oral statements made by management of Performance Technologies, Incorporated and its subsidiaries (collectively “PT”) include forward-looking statements intended to qualify for the safe harbor from liability established by the Reform Act. These forward-looking statements generally can be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “foresees,” “forecasts,” “estimates” or other words or phrases of similar import. Words such as the “Company,” “PT,” “management,” “we,” “us,” or “our,” mean Performance Technologies, Incorporated and its subsidiaries. All statements herein that describe PT’s business strategy, outlook, objectives, plans, intentions, goals or similar projections are also forward-looking statements within the meaning of the Reform Act.

All such forward-looking statements are subject to certain risks and uncertainties and should be evaluated in light of important risk factors. These risk factors include, but are not limited to, the following as well as those that are described in “Risk Factors” under Item 1A and elsewhere in this Annual Report on Form 10-K: business and economic conditions, rapid technological changes accompanied by frequent new product introductions, competitive pressures, dependence on key customers, inability to gauge order flows from customers, fluctuations in quarterly and annual results, the reliance on a limited number of third party suppliers, limitations of the Company’s manufacturing capacity and arrangements, the protection of the Company’s proprietary technology, the effects of pending or threatened litigation, the dependence on key personnel, changes in critical accounting estimates, potential impairments related to investments, foreign regulations, and potential material weaknesses in internal control over financial reporting. In addition, during weak or uncertain economic periods, customers’ visibility deteriorates causing delays in the placement of their orders. These factors often result in a substantial portion of the Company’s revenue being derived from orders placed within a quarter and shipped in the final month of the same quarter.

Any of these factors could cause PT’s actual results to differ materially from its anticipated results. For a more detailed discussion of these factors, see the "Risk Factors" discussion in Item 1A in this Annual Report on Form 10-K. The Company cautions readers to carefully consider such factors. Many of these factors are beyond the Company’s control. In addition, any forward-looking statements represent the Company’s estimates only as of the date they are made, and should not be relied upon as representing the Company’s estimates as of any subsequent date. While the Company may elect to update forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so, even if its estimates change.

Available Information

The Company’s website address is www.pt.com. The Company makes available free of charge via a hypertext link on its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (“SEC”). The Company will provide this information upon written request to the attention of the Chief Financial Officer, Performance Technologies, Incorporated, 205 Indigo Creek Drive, Rochester, New York 14626. Materials we provide to the SEC are also available for the public to read and copy through the SEC website at www.sec.gov or at the SEC Public Reference Room at 100 F Street, N.E. Washington, D.C. 20549 or by calling 1-800-SEC-0330.

4

Table of contentsITEM 1 – Business

Overview

Performance Technologies, Incorporated (“PT”), a Delaware corporation founded in 1981, is a global supplier of advanced network communications solutions to carrier, government and OEM markets.

PT’s product portfolio includes IP-centric network solutions, elements and applications designed for high availability, scalability, and long life cycle deployments. The Company’s entire line of offerings is anchored by IPnexus®, PT’s own IP-native, highly integrated platforms and element management systems. OEMs and application developers, including PT itself, leverage the carrier grade Linux® development environment and suite of communications protocols (PT’s Nexusware®) of IPnexus Application-Ready Systems as a cornerstone component of their end product value proposition. PT’s SEGway™ Signaling Solutions provide low cost, high density signaling, advanced routing, IP migration, gateway capabilities, SIP bridge, and core-to-edge distributed intelligence.

PT is headquartered in Rochester, New York and maintains direct sales and marketing offices in the U.S. in Raleigh, Chicago, Dallas, and San Jose and international offices in London, England and Shanghai, China, and has centers of engineering excellence in San Diego and San Luis Obispo, California, and Kanata, Ontario, Canada, in addition to Rochester, New York.

As used in this report, unless otherwise indicated, the terms “Company,” “PT,” “management,” “we,” “our,” and “us” refer to Performance Technologies, Incorporated and its subsidiaries.

Strategy

The Company strategy is to maximize the value proposition of its products by leveraging its field-proven systems, software and hardware technologies. Management believes the tightly integrated combination of these technologies results in considerable benefits to its customers including a compelling return-on-investment proposition, significant development risk mitigation and a substantially accelerated time-to-market opportunity.

As outlined in our 2008 Annual Report as filed on Form 10-K, management is concentrating on four network communications focused initiatives to construct a solid foundation for long-term growth. These initiatives include further strengthening our SEGway Signaling Systems product line, continued evolution and enhancement of our IPnexus Application-Ready Systems for mission critical communications applications, intensifying our market diversification efforts in government systems and defense markets, and identifying forward-looking network communications growth opportunities, such as our Xpress™ portfolio of SIP-based applications and enabling infrastructure, that we can pursue with our own end product solutions. The following highlights our progress on these multi-year initiatives in 2009.

From a product perspective, the capabilities and features of our SEGway Signaling product line increased dramatically during 2009. We believe we now offer the highest capacity signaling solution available when viewed from the very critical telecommunications plant parameters of footprint and power consumption. In addition, the Company’s SEGway signaling solution set now covers a wide breadth of network requirements – everything from link transport replacements, signaling gateways, cost effective edge solutions and core network STP deployment. With regard to our IPnexus product line, we appreciably moved the market bar when it comes to the clear advantages that a true application-ready system provides to OEMs and other end application developers. PT’s highly integrated combination of hardware - coupled with our NexusWare development tools, communications software, distributed management support and our own carrier grade Linux – all provided by a single supplier – results in a compelling platform proposition for firms building the next wave of network communications solutions.

5

With specific regard to IPnexus in the government systems and defense market, PT enhanced the value proposition of its radar and sensor communications solutions in 2009. Finally, in the third quarter 2009, PT acquired an unlimited license to productize a substantial set of technology building blocks centered on SIP (Session Initiation Protocol) which is the predominant signaling methodology for IP-based communications networks. Since that time our engineering team has been diligently working on combining those building blocks with our existing core technologies and targeting the combination on an evolving set of revenue generating application solutions for communications service providers. As a result of these efforts, on February 12, 2010, PT introduced its newest product line, Xpress™, a portfolio of SIP-based applications and enabling infrastructure built upon its IPnexus Application-Ready Systems foundation and targeted towards wireless and wireline carriers deploying next-generation network (NGN) architectures.

A second area of substantial progress in 2009 was that of our overall organization. During the year, we completed our transformation from a product group approach to a functional discipline-based structure. With regard to our engineering efforts, all corporate product development and related product management now report to one senior vice president of products and technology. Our sales organization has been chartered with a market focus, rather than a product focus, and is supported by newly structured company-wide commercial marketing and customer service teams. All of these functions are now reporting to one senior vice president of sales, marketing and service. Within the overall sales organization, we established a dedicated Government Systems sales team, handling our complete product portfolio. It has been tasked with leveraging existing relationships and targeting new opportunities in both direct government agencies as well as major government prime contractors. On the manufacturing front, we spent the major part of the year taking a fresh look at our manufacturing requirements and related core competencies – especially from the perspective of our strategic plan and the focus of our evolving product portfolio. Near year end, after a careful evaluation and analysis, we concluded that we should outsource our printed circuit board assembly and selected a world-class manufacturing organization, Mack Technologies, as our partner in this endeavor. Upon its completion in 2010, this move will make our product costs more predictable, reduce our capital expenditure requirements and enhance our ability to continue to offer the cutting-edge technologies implemented by our hardware development team without sacrificing our high standards of quality. We believe these organizational changes offer a greater focus, efficiency and flexibility to our business as we move forward with solutions based upon a common set of core technologies.

Our ongoing corporate evolution was the third major area of progress in 2009. PT underwent a significant corporate evolution built upon the fundamental premise that the combination of our historical hardware roots, our acquired technologies, and our ongoing organic development provide us with the ability to directly satisfy a meaningful portion of end product design requirements in the network communications arena. We have re-focused the Company on highly integrated products. The software component of our product portfolio has been elevated as a key element in our product value proposition. We have substantially added to our product portfolio from a solutions perspective and now view ourselves – first and foremost – as a solutions provider. It is the essence of this corporate evolution, underpinned by the elements of our strategic plan, which we believe positions us for long term, profitable growth.

Beginning in the fourth quarter 2009, management proactively undertook several steps, to further position PT for growth as business conditions improve. The timing of this decision is based upon recent forward-looking market data that we expect will drive opportunities for our technologies. At a high level, a sampling of these opportunity indicators includes: forecasted mobile handset growth in 2010, wireless growth opportunities in emerging markets and increasing government-driven communications infrastructure expenditures.

6

Table of contentsIn order for PT to be properly positioned to take advantage of these projected market dynamics, management believes it must make an additional level of investment in three focused areas in advance of potential offsetting revenues.

First, we are hiring ten additional direct sales people to bolster our newly aligned sales organization. Management strongly believes our product portfolio has broad applicability to a larger array of customers and that a larger direct sales force can result in increased profitable revenues. Most of these new hires will be focused globally on tier-one and growing tier-two telecom equipment manufacturers, and on the expansion of our presence in the Europe/Middle East/Africa (“EMEA”) and Central/Latin America (“CALA”) market areas, which are undergoing substantial mobile telecom growth.

Second, management is undertaking the addition of several positions to our research and development team to further productize the SIP technology we licensed in the third quarter 2009 and thereby continue to build out our Xpress product line.

Third, PT will be expanding its product management team. Throughout 2010, we will be announcing substantial expansion of the elements and attributes of our product portfolio. In order to maximize the return on the product development investment underlying this portfolio expansion, it will be vital that we have sufficient product management resources to properly launch and fully shepherd new product introductions as they occur.

While external business conditions may to some extent throttle the near-term ramp-up of these endeavors, management is fully committed to this course and is enthusiastic about the future opportunities that can be addressed.

There are identifiable risks associated with PT’s strategy in the current economic climate. While management believes that its network communications market focus offers growth in the long term, some elements of the customer base in this market are experiencing very challenging economic conditions which are impacting business prospects. Management expects to realize measurable progress in 2010 on the strategic initiatives it established in 2009. However, based on the current economic environment, which may involve new risks not currently identifiable, management believes that realizing meaningful profitability in the near-term is likely to be very difficult.

Market Overview

PT’s business addresses one industry segment – Communications, and globally targets two primary vertical markets for its network communications products: telecommunications and government systems and defense. The telecommunications market, historically our largest vertical market, is fundamentally driven by investments in network infrastructure by carriers and service providers. Telecommunications market revenues derived from our IPnexus Application-Ready Systems products depend primarily on broad, multi-year deployments of next-generation telecommunications infrastructure. Telecommunications market revenues generated from end user solutions, such as our SEGway and Xpress product lines, are governed by investments necessary to support existing and evolving service demands such as the ongoing worldwide explosive growth in text messaging and the transition to Internet-based communications networks. Sales into the government systems and defense market are typically to prime contractors and system integrators that reflect investment levels by various government agencies and military branches in specific programs and projects requiring enhanced communications capabilities.

We expect that the economic climate in 2010 will remain very challenging. Although market interest and activity related to our product portfolio remains strong, actual sales visibility is quite low. In light of these conditions, staffing reductions were initiated in January and July 2009 to further reduce our expense levels. As the Company moves into 2010, management is strategically making targeted investments in sales, marketing and research and development in order to position PT for growth as business conditions improve.

7

Products

PT’s product portfolio includes SEGway Signaling Solutions which provide low cost, high density signaling, advanced routing, IP migration, gateway capabilities, SIP bridge, and core-to-edge distributed intelligence and our IPnexus Application-Ready Systems which anchors a growing portfolio of PT solutions. These products are built on PT’s own U.S. manufactured hardware combined with PT’s NexusWare Carrier Grade Linux operating system and software development environment.

SEGway Signaling Solutions: PT’s premier suite of IP-centric STPs, gateways, edges, and network applications, permits service providers to cost effectively deliver revenue generating features in next-generation networks. SEGway solutions have been deployed in numerous world-class carrier networks around the globe because of their high density and unparalleled price-to-performance ratio. This, together with SEGway’s flexibility in edge-to-core deployments, small footprint, and ease of use, has earned the portfolio its reputation as "Simply Smarter Signaling®.”

Deployed for over ten years, PT’s SEGway Signaling solutions, which are built on our IPnexus Application-Ready systems, provide a full suite of signaling capabilities that seamlessly operate in both circuit-switched and IP-based networks to address the signaling needs of wireless and wireline carriers and service providers.

IPnexus Application-Ready Systems: PT’s IPnexus Application-Ready Systems are designed for high availability, scalability, and long life cycle deployments. These systems are PT’s own IP-native, highly integrated platforms and element management systems. OEMs and application developers, including PT itself, leverage PT’s carrier grade Linux development environment and suite of communications protocols (PT’s Nexusware) as a cornerstone component of their end product value proposition.

Management believes that the tightly integrated combination of systems, hardware and software technologies found in the Company’s IPnexus Systems provides measurable benefits to our customers through development risk mitigation and substantially accelerated time-to-market metrics. Furthermore, the IPnexus product line is built upon a fundamental premise of long life-cycle deployment that is fully supported by PT, as opposed to offerings from some of our competitors.

Xpress SIP Applications: On February 12, 2010, PT introduced their newest product line, Xpress, a portfolio of SIP-based applications and enabling infrastructure for next-generation network (NGN) architectures. The adoption of voice-over-packet architectures by wireless and wireline carriers, and the emergence of SIP (Session Initiation Protocol) as the predominant signaling protocol on these networks have presented new opportunities for service providers to market media-rich and web-friendly applications to their subscribers. PT’s Xpress product line is a new approach for delivering these capabilities in the most cost effective manner. Based on a pure IP implementation, new service offerings can be quickly developed and readily deployed, network-wide, on IMS enabled, converged TDM/IP and VoIP networks.

Sales, Marketing and Distribution

PT markets its products worldwide to a variety of customers through its direct sales force and various channels including OEMs, Value Added Resellers (VARs), distributors and systems integrators. The majority of PT's business is sold through PT's direct sales force.

8

Due to the highly technical nature of PT's products, it is essential that PT's salespeople are technically oriented and are knowledgeable in the communications, networking and embedded systems fields. To supplement its sales force, PT has customer engineers who assist prospective customers in determining if PT’s products will meet their requirements.

At year end 2009, PT had a total of 50 sales, marketing and sales support personnel located in various U.S. offices including: Rochester, New York; Raleigh, North Carolina; Chicago, Illinois; Dallas, Texas; San Jose, California and internationally in London, England and Shanghai, China.

In the fourth quarter of 2009, PT announced that it would add ten additional experienced sales and marketing people to its direct sales organization over the next few quarters in order to gain greater market penetration for its products. In addition, a number of new independent sales representatives and agents covering selected geographic areas internationally have been added.

PT executes various ongoing marketing strategies designed to attract new customers and to stimulate additional business with existing customers. These strategies include web-based activities, technology seminars, direct mail and email campaigns, telemarketing, active participation in technical standards groups, participation in regional, national and international trade shows, placement of selected trade press advertisements and the authoring of technical articles.

Sales to customers outside of the United States represented 51%, 60% and 48% of PT's revenue in 2009, 2008 and 2007, respectively. In 2009 and 2008, export shipments to the United Kingdom represented 15% and 18% of sales, respectively. International sales are subject to risks of import and export controls, transportation delays and foreign governmental regulations. Payments for shipments from the United States to outside the United States are generally made in U.S. dollars.

Customers

PT has approximately 125 customers worldwide in the telecommunications and government systems and defense markets. Many of PT’s major customers are Fortune 1000 companies in the United States or companies of similar stature in Europe, Israel, and Asia. In 2009, PT’s two traditionally largest customers, Metaswitch Networks (formerly Data Connection Limited) and Alcatel-Lucent, represented 15% and 8% of sales, respectively, and PT’s four largest customers (Metaswitch Networks, Alcatel-Lucent, Leap “Cricket” Wireless, and Raytheon) together represented 36% of sales. In 2008, PT’s two largest customers, Metaswitch Networks and Alcatel-Lucent, represented 17% and 11% of sales, respectively, and PT’s four largest customers (Metaswitch Networks, Alcatel-Lucent, Alltel Communications and Bakcell Ltd.) together represented 40% of sales. In 2007, PT’s two largest customers, Metaswitch Networks and Alcatel-Lucent, represented 11% and 10% of sales, respectively, and PT’s four largest customers (Metaswitch Networks, Alcatel-Lucent, Alltel Communications and Motorola) together represented 34% of sales.

In 2009, approximately 83% of PT’s revenue came from the telecommunications industry and 17% from government systems and defense market.

SEGway Signaling Solutions Customers: Announced customers for our SEGway Signaling Solutions include Alcatel-Lucent, Alltel Communications, Bakcell Ltd., Cable and Wireless Guernsey, Comfone, Elephant Talk, Ericsson, GeoLink, Hawaiian Telcom, Leap Wireless, Pocket Communications, Primus Telecommunications, Siemens, Telefonica Moviles Espana, Tata Communications (formerly Teleglobe) and VeriSign.

9

IPnexus Application-Ready Systems Customers: Announced customers for our IPnexus Application-Ready Systems include: Alcatel-Lucent, Aviat Networks (formerly Harris Stratex Networks), AudioCodes, Metaswitch Networks, FAA, General Dynamics, Hewlett Packard, Lockheed Martin, Motorola, Nokia Siemens, Northrup Grumman, Raytheon, Rockwell Collins, Sun Microsystems, Stratus and Vados Systems.

The loss of one or more of our larger customers, the reduction, delay or cancellation of orders, or a delay in shipment of our products to such customers, would have a material adverse effect on our revenue and operating results.

Backlog

The scheduled backlog of orders amounted to $4.8 million and $6.6 million at February 1, 2010 and February 2, 2009, respectively. The year-over-year decrease is due in large part to a $1.0 million increase in January 2010 shipments as compared with January 2009. Backlog amounts for 2010 are expected to be shipped prior to the end of the year. Orders are subject to postponement of delivery or cancellation in the normal course of business. A substantial portion of PT’s revenue in each quarter results from orders placed within the quarter and shipped in the final month of the same quarter. Due to the global economic climate, forward-looking visibility on customer orders is very challenging. (See Management's Discussion & Analysis included elsewhere in this report).

Seasonality

PT's business is not generally subject to large seasonal swings but business is frequently slower during the summer months due to the European and United States vacation seasons. Some of PT’s customers have seasonal swings in their business which are reflected in their orders with PT. Much of PT’s business is project-related, which can cause quarterly fluctuations in revenue.

Environmental Matters

PT complies with U.S. federal, state and local laws relating to the protection of the environment and believes that environmental matters do not have any material effect on its capital expenditures, earnings or competitive position. Further, PT complies with national laws relating to the protection of the environment in all end country markets served by export sales.

If the products that we produce in the future do not comply with a country’s laws relating to the protection of the environment, we would be unable to sell our products into those markets and our operating results would be harmed.

Competition

PT’s SEGway Signaling solutions satisfy a wide range and scale of signaling requirements, most of which typically involve some component of utilizing Internet Protocol (IP) to carry signaling traffic. PT’s SEGway Signaling Solutions currently compete with products from Alcatel-Lucent, Tekelec, Huawei, Ericsson, Nokia-Siemens and Cisco Systems.

Embedded purpose-built computer systems are either based on proprietary technology or are based on open standards. PT’s IPnexus Application-Ready Systems are standards-based, which is the smaller portion of this market. A key differentiating factor of PT’s IPnexus Systems products is PT’s internally developed NexusWare Carrier Grade Linux operating system and software development environment. We believe this is a key competitive advantage in our marketplace because many of PT’s competitors provide third party operating systems with their products.

10

The OEM communications equipment market is characterized by rapid technological change and frequent introduction of products based on new technologies. Competitive factors in this market include price, product performance, functionality, product quality and reliability, customer service and support, marketing capability, corporate reputation and brand recognition, and changes in relative price/performance ratios. PT’s IPnexus Application-Ready Systems compete in certain standards-based markets, specifically AdvancedMC/µTCA and CompactPCI 2.16.

Competitors providing some level of systems offerings include Emerson, Radisys, GE Fanuc, Kontron and Continuous Computing. Management believes that PT’s capability to deliver fully integrated, system level solutions with a substantial software component including its NexusWare is a key differentiating factor for PT’s products.

We cannot guarantee that we will be able to compete successfully with our existing or new competitors or that the competitive pressures faced by us will not have a material adverse effect on our revenue and operating results.

Research and Development

PT's research and development expenses were approximately $7.8 million, $9.0 million and $9.9 million in 2009, 2008, and 2007, respectively, and were net of capitalized software development costs of $2.3 million, $2.1 million and $2.1 million, respectively. These expenses consist primarily of personnel costs, material consumed in developing and designing new products, and amounts expended for software licenses/tools. PT expects to continue to invest heavily in research and development in order to create innovative next-generation products and maintain competitive advantages in the communications markets we serve.

During the third quarter 2009, PT paid a one-time license fee of $.9 million to acquire certain software technologies, which PT plans to use in synergistic combination with its captive technologies to develop new end market products. Of this amount, $.8 million has been recorded in capitalized software development costs and $.1 million has been allocated to property, equipment and improvements, based on the estimated respective fair values of the technologies acquired.

PT has significant core competencies associated with advanced network communications and control solutions. PT provides remotely manageable, IP-centric network solutions, elements and applications specifically engineered for high availability, scalability, and long life cycle deployments. Its products are built upon our own U.S. manufactured hardware combined with PT’s NexusWare Carrier Grade Linux operating system and software development environment plus a broad suite of communications protocols and high availability middleware.

Proprietary Technology

PT's success depends in part upon retaining and maximizing our proprietary technologies. To date, PT has relied principally upon trademark, copyright and trade secret laws to protect its proprietary technology. PT generally enters into confidentiality or license agreements with its customers, distributors and potential customers that contain confidentiality provisions, and limits access to, and distribution of, the source code to its software and other proprietary information. All of PT’s employees are subject to PT's employment policy regarding confidentiality. PT’s software products are provided to customers under license, generally in the form of object code, which to date has provided a high degree of confidentiality with respect to the underlying intellectual property.

11

Table of contents SuppliersIn a fast-paced technology environment, product life cycles generally extend for two to four years. The obsolescence by manufacturers of individual electronic components used by PT is occurring more rapidly than ever before. In addition, industry consolidation is resulting in fewer manufacturers offering electronic components. In many situations, PT is utilizing sole or limited source components on its products. PT obtains components on a purchase order basis and generally does not have long-term contracts with its suppliers. PT does not have a large total procurement budget in relation to the overall market which results in a continuous challenge for PT to obtain adequate supplies of components, even compared to a number of years ago. Lack of availability of components can cause delays in shipments. In addition, the costs and time delays caused by redesigning specific products when components are not available has become a challenging factor in several cases.

There can be no assurance that future supplies will be adequate for our needs or will be available on prices and terms acceptable to us. Our inability in the future to obtain sufficient limited-source components, or to develop alternative sources, could result in delays in product introduction or shipments; and increased component prices could negatively affect our gross margins, either of which would have a material adverse effect on our revenue and operating results.

Manufacturing

PT performs in-house printed circuit board (PCB) based electronic assembly, system integration and product testing in its Rochester, New York headquarters facility. PT does not maintain significant amounts of long-lived assets outside of the United States.

Many of PT’s products are produced in low volumes and have high software content, and PT has historically utilized an in-house manufacturing capability to build its products.

In December 2009, PT announced its decision to outsource manufacturing of the printed circuit board assembly for the hardware elements of PT’s products. In management’s judgment, this decision will bring tangible benefits to PT, which includes more predictable product costs, a significant reduction in capital expenditure requirements, and an enhanced ability to continue to offer cutting-edge technologies in PT’s product lines without sacrificing PT’s high standards of quality. In management’s judgment, these benefits outweigh the risks inherent in utilizing a third party contract manufacturer.

In the event of an interruption of production at PT’s outsourcing vendors or its Rochester manufacturing facility, PT's ability to deliver products in a timely fashion would be compromised, which could have a material adverse effect on PT’s results of operations.

Employees

As of December 31, 2009, PT had 196 full-time, five part-time and contract employees, and one engineering cooperative education student. Management believes its relations with its employees are generally good. PT’s employees are not subject to collective bargaining agreements.

| The Company’s full-time employees work in the following areas: | ||||

| Research and Development | 71 | |||

| Sales and Marketing | 50 | |||

| Manufacturing | 56 | |||

| General and Administrative | 19 | |||

| Total | 196 | |||

12

Management believes that PT's future success will depend on its ability to continue to attract and retain qualified personnel.

ITEM 1A – Risk Factors

Our global growth is subject to a number of economic risks.

Our revenue and profitability depend on the overall demand for our products and related services and the successful implementation of our strategy. As widely reported, the financial markets in the United States, Europe and Asia have experienced extreme disruption, including, among other things, extreme volatility in investment valuations, severely diminished liquidity and credit availability, rating downgrades of certain investments and declining valuations of others. Governments have taken unprecedented actions intended to address extreme market conditions that include severely restricted credit and declines in real estate values. While currently these conditions have not impaired our ability to finance our operations, there can be no assurance that there will not be a further deterioration in financial markets and confidence in major economies. These economic developments affect businesses such as ours in a number of ways. Tightening of credit in financial markets adversely affects the ability of our customers to obtain financing for significant purchases and operations and could result in a decrease in or cancellation of orders for our products and services as well as impact the ability of our customers to make payments. Similarly, this tightening of credit may adversely affect our supplier base and increase the potential for one or more of our suppliers to experience financial distress or bankruptcy.

Our global business is also adversely affected by decreases in the general level of economic activity, such as decreased capital expenditures by telecommunications service providers, decreases in general business and consumer spending, and government procurement. Many carriers/service providers have been cautious of making investments in infrastructure during difficult economic times, which customarily results in reduced budgets and spending. This can impact us through reduced revenues, elongated selling cycles, delays in product implementation and increased competitive margin pressure. Fluctuations in the rate of exchange for the U.S. Dollar against certain major currencies such as the Euro, the Pound Sterling, the Canadian Dollar and other currencies also have an effect of making our products more or less costly for foreign customers and can adversely affect our results. We are unable to predict the likely duration and severity of the current disruption in financial markets and adverse economic conditions in the U.S. and other countries, and are unable to fully anticipate the effect that the current economic conditions will have on our business.

If we do not respond adequately to technological change, our competitive position will decline.

The market for our products is generally characterized by rapid technological change and frequent introduction of products based on new technologies. Additionally, application of our IPnexus Application-Ready Systems, especially as targeted at the telecommunications industry, is volatile as the effects of new technologies, new standards, and new products contribute to changes in the market and the performance of industry participants. Our future revenue will depend upon our ability to anticipate technological changes and to develop and introduce enhanced products on a timely basis that meet customer requirements and comply with industry standards. New product introductions, or the delays thereof, could contribute to quarterly fluctuations in operating results as orders for new products commence and orders for existing products decline. Moreover, significant delays can occur between a product introduction and commencement of volume production. The inability to develop and manufacture new products in a timely manner, the existence of reliability, quality or availability problems in our products or their component parts, or the failure to achieve market acceptance for our products would have a material adverse effect on our revenue and operating results. Further, current technologies may become obsolete before being replaced by new technologies, which would have a material adverse effect on our revenue and operating results.

13

We operate in an extremely competitive industry and our revenues and operating results will suffer if we do not compete effectively.

The communications marketplace we are focused on is extremely competitive. We face a number of large and small competitors. Many of our principal competitors have established brand name recognition and market positions and have substantially greater experience and financial resources than we do to deploy on promotion, advertising, research and product development. In addition, we expect to face competition from new competitors. Companies in related markets could offer products with functionality similar or superior to that offered by our products. Increased competition could result in price reductions, reduced margins and loss of market share, all of which would materially and adversely affect our revenue and operating results. Several of our competitors have recently been acquired. These acquisitions are likely to permit our competition to devote significantly greater resources on the development and marketing of new competitive products and the marketing of existing competitive products to their larger installed bases. We expect that competition will increase substantially as a result of these and other industry consolidations and alliances, as well as the emergence of new competitors. We cannot guarantee that we will be able to compete successfully with our existing or new competitors or that the competitive pressures faced by us will not have a material adverse effect on our revenue and operating results.

We depend on a number of key customers, the loss of any of which, or the substantially decreased demand from which, would harm our revenues and operating results.

We cannot assure that our principal customers will continue to purchase products from us at current levels. Customers typically do not enter into long-term volume purchase contracts with us and customers have certain rights to extend or delay the shipment of their orders. The loss of one or more of our major customers, the reduction, delay or cancellation of orders, or a delay in shipment of our products to such customers, would have a material adverse effect on our revenue and operating results.

Carriers and service providers in our target markets are experiencing consolidation which could delay or cancel ongoing network infrastructure expansion and upgrade programs.

The global telecommunications industry is experiencing consolidation. While these activities may strengthen the industry in the long term, they are often disruptive to ongoing capital programs and projects in the short term. These disruptions and delays can have a material adverse effect on our revenue and operating results.

Our annual and quarterly results can fluctuate greatly, which can have a disproportionate effect on net income and the price of our common stock.

Our future annual and quarterly operating results can fluctuate significantly depending on factors such as the timing and shipment of significant orders, new product introductions by us and our competitors, market acceptance of new and enhanced versions of our products, changes in pricing policies by us and our competitors, inability to obtain sufficient supplies of sole or limited source components for our products, and general economic conditions. Our expense levels are based, in part, on our expectations as to future revenue. Since a substantial portion of our revenue in each quarter results from orders placed within the quarter and often shipped in the final weeks of that quarter, revenue levels are difficult to predict. If revenue levels are below expectations, operating results will be adversely affected. Net income would be disproportionately affected by a reduction in revenue because only a small portion of our net expenses varies with our revenue. In addition, our common stock is thinly traded and fluctuations in operating results can cause significant fluctuations in the price of our common stock.

14

We depend on a limited number of third-party suppliers to provide us with important components for our products. If we were unable to obtain components from these suppliers, our revenue and operating results would suffer.

In a fast-paced technology environment, product life cycles extend for approximately two to four years and the obsolescence by manufacturers of individual electronic components used by the Company is occurring more rapidly than ever before. Certain components used in our products are currently available to us from only one or a limited number of sources. There can be no assurance that future supplies will be adequate for our needs or will be available on prices and terms acceptable to us. Our inability in the future to obtain sufficient limited-source components, or to develop alternative sources, could result in delays in product introduction or shipments, and increased component prices could negatively affect our gross margins, either of which would have a material adverse effect on our revenue and operating results.

Potential limitations in our manufacturing arrangements could impair our ability to meet our customers’ expectations.

In order to fulfill orders for customers in the most optimal manner for a volume and mix of business, we have historically manufactured the majority of our products at our Rochester, New York facility. However, beginning in 2010, we will outsource manufacturing of printed circuit boards assemblies for our products to an outside contract manufacturer. In addition, certain elements of these products, such as platform chassis, are manufactured by contract manufacturers. We do not have significant alternative manufacturing capabilities, either internally or through third parties, to perform manufacturing of our products. Even if we were able to identify alternative third-party contract manufacturers, we cannot assume that we would be able to retain their services on terms and conditions acceptable to us. In the event of an interruption in production or damage to our manufacturing facility from a natural disaster or other catastrophic event, either of which would cause interruptions or delays in our manufacturing process, we would not be able to deliver products on a timely basis, which would have a material adverse effect on our revenue and operating results. Although we currently have business interruption insurance, we cannot be assured that such insurance would adequately cover our lost business as a result of such an interruption.

If we do not adequately protect our proprietary technology, or if we infringe on the intellectual property rights of others, our revenues and operating results would suffer.

Our success, in part, depends upon our proprietary technologies. To date, we have relied principally upon trademark, copyright and trade secret laws to protect our proprietary technologies. We generally enter into confidentiality or license agreements with our customers, distributors and potential customers and limit access to, and distribution of, the source code to our software and other proprietary information. Our employees are subject to our employment policy regarding confidentiality. We cannot assure that the steps taken by us in this regard will be adequate to prevent misappropriation of our technologies or to provide an effective remedy in the event of a misappropriation by others.

Because of the existence of an extremely large number of patents in the communications industry and the rapid rate of new patents granted or new standards or new technology developed, we may have to obtain technology licenses from others. We do not know whether these third party technology licenses will be available to us on commercially reasonable terms. The loss of, or inability to obtain, any of these technology licenses could result in delays or reductions in our product shipments. Any such delays or reductions in product shipments would have a material adverse effect on our revenue and operating results. Furthermore, although we believe that our products do not intentionally infringe on the proprietary rights of third parties, we cannot assure that infringement claims will not be asserted, resulting in costly litigation in which we may not ultimately prevail. Adverse determinations in such litigation could result in the loss of our proprietary rights, subject us to significant liabilities, and require us to seek licenses from third parties or prevent us from manufacturing or selling our products, any of which would have a material adverse effect on our revenue and operating results.

15

A third party competitor has initiated a claim that we are infringing upon their intellectual property rights. While we believe that the claim is without merit, defending ourselves against this claim is expected to be time consuming and costly, and may distract management’s attention and resources. Such claims of intellectual property infringement also might require us to redesign affected products, enter into costly settlement or license agreements or pay costly damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our products. In the event of an adverse outcome, if we were to be unable to not license the alleged infringed intellectual property, license the technology on reasonable terms or substitute similar technology from another source, our revenue and earnings could be adversely impacted.

We depend on a number of key personnel. The loss of these people, or delays in replacing them, would harm our operating results.

Our success depends on the continued contributions of our personnel, many of whom would be difficult to replace, if they left us. Changes in personnel could adversely affect our operating results. In addition, although our employees are subject to our employment policy regarding confidentiality and ownership of inventions, employees are generally not subject to employment agreements or non-competition covenants and thus they could compete with us if they left our employment.

We may hold investments in companies from time to time. These investments or other future investments are subject to potential impairment.

We hold investments in privately held companies from time to time. We may make additional investments in the future in these or other companies. Depending upon the future fortunes of these companies in meeting their operating goals, an impairment charge or reserves could be recorded in the future. The occurrence of a future impairment or additional reserve could adversely affect our results of operations.

We are subject to certain foreign regulations that restrict the distribution of products containing certain substances. Failure to comply with these foreign regulations would harm our operating results.

Foreign and domestic governmental agencies periodically issue directives pertaining to the distribution of products which contain certain substances. While we believe we are in full compliance with all such existing directives, if in the future the products that we produce do not comply with existing or similar directives, we would be unable to sell our products into those markets and our operating results would be harmed.

Errors or defects in our products could result in disputes, litigation and product liability claims by our customers and could diminish demand for our products, injure our reputation and adversely affect our operating results.

Our products are very complex and may contain errors or defects that could be detected at any point in the life of the product. While we have rigorous quality control and testing procedures for our products, we can provide no absolute assurances that errors or defects will not be found in our products until deployment or long after a product has been deployed. Our products, even if error-free, must interoperate with other vendors’ equipment in our customers’ networks and such operation could result in technical problems with our products. A warranty or product liability claim brought against us could result in costly, highly disruptive and time-consuming litigation, which could harm our business. Although our agreements with our customers contain provisions designed to limit our exposure to potential warranty and product liability claims, it is possible that these limitations may not be effective to cover all claims.

16

Although we maintain product liability insurance, it may not be sufficient to cover all claims to which we may be subject. Errors and defects or failures to properly interoperate, could cause diminished demand for our products, delays in market acceptance and sales, diversion of development resources, injury to our reputation, increased service and warranty costs or could result in disputes, litigation and product liability losses with our customers. If any of these were to occur, there would be a material adverse effect to our revenue and operating results.

In future periods, we may experience material weaknesses in our internal control over financial reporting, which could adversely affect our ability to report our financial condition and results of operations accurately and on a timely basis.

Material weaknesses in our internal control over financial reporting could adversely impact our ability to provide timely and accurate financial information. If we identify material weaknesses, we may not be able to timely or accurately report our financial condition, results of operations or cash flows or maintain effective disclosure controls and procedures. If we are unable to report financial information timely and accurately or to maintain effective disclosure controls and procedures, we could be subject to, among other things, regulatory or enforcement actions, securities litigation, and a general loss of investor confidence, any one of which could adversely affect our business prospects and the valuation of our common stock.

ITEM 1B – Unresolved Staff Comments

None.

ITEM 2 - Properties

PT’s corporate headquarters is located in 57,000 square feet of leased office and manufacturing space in Rochester, New York. This lease expires in 2012. Corporate headquarters includes executive offices, along with sales, marketing, engineering and manufacturing operations. There is sufficient space for growth in this facility and it is capable of accommodating a variety of expansion options. PT owns land adjacent to this facility to accommodate future expansion, if necessary. PT has a center for engineering excellence located in 8,600 square feet of office space in San Luis Obispo, California and this lease expires in August 2010. PT also leases sales and engineering office space in San Diego, California under a lease which expires in November 2010. PT’s Signaling Systems Group is located in 16,000 square feet of office space located in Kanata Ontario (Canada), a suburb of Ottawa. This lease expires in October 2011. PT’s European, Middle East and Africa marketing group occupies leased office space near London, England. The lease for this space expires in March 2012. In addition, PT leases a sales/marketing office in Connecticut.

ITEM 3 - Legal Proceedings

From time to time, PT is involved in litigation relating to claims arising out of its operations in the normal course of business.

In December 2009, the Company became aware that Tekelec, a California corporation headquartered in Morrisville, North Carolina, had filed but not served a complaint against the Company in the U.S. District Court for the Eastern District of North Carolina. The complaint alleges that certain of the Company’s signaling systems products infringe three of Tekelec’s issued patents and seeks a determination of infringement, a preliminary and permanent injunction from further infringement and an unspecified amount of damages. On March 4, 2010, an amended complaint was served on the Company through its designated agent in North Carolina. The amended complaint contains the same allegations as the original complaint but adds two patents to the number of patents which Tekelec alleges the Company’s signaling systems products infringe. The Company believes that the basis for Tekelec's infringement claims is without merit and will vigorously defend against those claims. No liability has been recorded relating to this matter because of the uncertainty of its eventual outcome and the inability to estimate the amount of damages that may be assessed, if any.

17

PT is not presently a party to any other legal proceedings, the adverse outcome of which, individually or in the aggregate, would have a material adverse effect on PT’s results of operations, financial condition or cash flows.

PART II

ITEM 5 - Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

PT's common stock is traded on NASDAQ under the trading symbol "PTIX." The following table sets forth the high and low closing prices of the common stock for each quarter during the two most recent years, as reported on NASDAQ. These prices represent quotations among securities dealers without adjustments for retail markups, markdowns or commissions and may not represent actual transactions.

| 2009 | High | Low | ||||||

| First Quarter | $ | 3.60 | $ | 2.55 | ||||

| Second Quarter | 3.04 | 2.50 | ||||||

| Third Quarter | 3.09 | 2.71 | ||||||

| Fourth Quarter | $ | 3.02 | $ | 2.66 | ||||

| 2008 | High | Low | ||||||

| First Quarter | $ | 5.50 | $ | 4.38 | ||||

| Second Quarter | 5.97 | 4.46 | ||||||

| Third Quarter | 5.41 | 4.38 | ||||||

| Fourth Quarter | $ | 4.30 | $ | 3.11 |

Stock Performance Graph

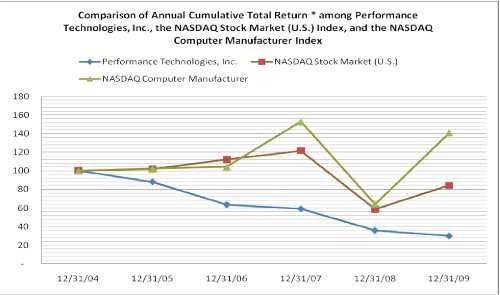

The following graph compares the cumulative total return of our common stock at the end of each calendar year since December 31, 2004 to the NASDAQ Stock Market (U.S.) Index, and the NASDAQ Computer Manufacturer Index. The stock performance shown in the graph below is not intended to forecast or be indicative of future performance.

18

As of March 5, 2010, there were 168 stockholders of record of the Company's common stock.

To date, PT has not paid cash dividends on its common stock and has no expectation to do so for the foreseeable future. PT has not sold any securities during the past three years, other than shares of common stock issued pursuant to stock option exercises. Reference is made to Item 12 for PT’s equity plan information.

ITEM 6 - Selected Financial Data (in thousands, except per share amounts)

The following selected financial data are derived from our consolidated financial statements:

| For the Year Ended December 31: | 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| Sales | $ | 29,491 | $ | 40,517 | $ | 40,319 | $ | 48,405 | $ | 49,633 | ||||||

| Net (loss) income | (10,112 | ) | 1,663 | 1,814 | 1,483 | 3,045 | ||||||||||

| Basic (loss) earnings per share: | ||||||||||||||||

| Net (loss) income | $ | (0.91 | ) | $ | 0.14 | $ | 0.14 | $ | 0.11 | $ | 0.24 | |||||

| Weighted average common shares | 11,130 | 11,601 | 12,581 | 13,202 | 12,885 | |||||||||||

| Diluted earnings per share: | ||||||||||||||||

| Net income | $ | 0.14 | $ | 0.14 | $ | 0.11 | $ | 0.23 | ||||||||

| Weight average common and | ||||||||||||||||

| common equivalent shares | 11,611 | 12,626 | 13,344 | 13,167 | ||||||||||||

| At December 31: | 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||

| Working capital (1) | $ | 32,326 | $ | 41,220 | $ | 40,307 | $ | 47,700 | $ | 46,848 | ||||||

| Total assets | $ | 48,889 | $ | 59,318 | $ | 59,520 | $ | 64,261 | $ | 62,943 | ||||||

| Total stockholders' equity | $ | 43,616 | $ | 53,447 | $ | 52,896 | $ | 58,267 | $ | 55,287 | ||||||

| (1) – defined as current assets less current liabilities | ||||||||||||||||

See “Financial Overview” of Management's Discussion and Analysis of Financial Condition and Results of Operations for additional information.

19

ITEM 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations

PT's annual operating performance is subject to various risks and uncertainties. The following discussion should be read in conjunction with the Consolidated Financial Statements and related notes, included elsewhere herein, as well as the risk factors described in Item 1A of this Form 10-K. PT's future operating results may be affected by various trends and factors, which are beyond PT's control. These risks and uncertainties include, among other factors, business and economic conditions, rapid technological changes accompanied by frequent new product introductions, competitive pressures, dependence on key customers, inability to gauge order flows from customers, fluctuations in quarterly and annual results, the reliance on a limited number of third party suppliers, limitations of PT’s manufacturing capacity and arrangements, the protection of PT’s proprietary technology, the effects of pending or threatened litigation, the dependence on key personnel, changes in critical accounting estimates, potential impairments related to goodwill and investments, foreign regulations, and potential material weaknesses in internal control over financial reporting. In addition, during weak or uncertain economic periods, customers’ visibility deteriorates causing delays in the placement of their orders. These factors often result in a substantial portion of PT’s revenue being derived from orders placed within a quarter and shipped in the final month of the same quarter.

Matters discussed in Management's Discussion and Analysis of Financial Condition and Results of Operations, and elsewhere in this Form 10-K, include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. PT's actual results could differ materially from those discussed in the forward-looking statements.

Critical Accounting Estimates and Assumptions

In preparing the financial statements in accordance with the accounting principles generally accepted in the United States (GAAP), estimates and assumptions are required to be made that have an impact on the assets, liabilities, revenue and expense amounts reported. These estimates can also affect supplemental information disclosures, including information about contingencies, risk and financial condition. The Company believes that given the current facts and circumstances, these estimates and assumptions are reasonable, adhere to GAAP, and are consistently applied. Inherent in the nature of an estimate or assumption is the fact that actual results may differ from estimates, and estimates may vary as new facts and circumstances arise. Management’s judgment in making these estimates and relying on these assumptions may materially impact amounts reported for any period.

The critical accounting policies, judgments and estimates that we believe have the most significant effect on our financial statements are set forth below:

- Revenue Recognition

- Software Development Costs

- Valuation of Inventories

- Income Taxes

- Product Warranty

- Stock-Based Compensation

- Restructuring Costs

- Investments

- Carrying Value of Goodwill

- Carrying Value of Long-Lived Assets

20

Revenue Recognition: Revenue is recognized from product sales in accordance with SEC Staff Accounting Bulletin No. 104, "Revenue Recognition." Product sales represent the majority of our revenue and include both hardware products and hardware products with embedded software. Revenue is recognized from these product sales when persuasive evidence of an arrangement exists, delivery has occurred or services have been provided, the sale price is fixed or determinable, and collectibility is reasonably assured. Additionally, products are sold on terms which transfer title and risk of loss at a specified location, typically the shipping point. Accordingly, revenue recognition from product sales occurs when all factors are met, including transfer of title and risk of loss, which typically occurs upon shipment. If these conditions are not met, revenue recognition is deferred until such time as these conditions have been satisfied.

For the sale of multiple-element arrangements whereby equipment is combined with other elements, such as software and maintenance, PT allocates to, and recognizes revenue from, the various elements based on their fair value. Revenue from software requiring significant production, modification, or customization is recognized using the percentage of completion method of accounting. Anticipated losses on contracts, if any, are charged to operations as soon as such losses are determined. If all conditions of revenue recognition are not met, revenue recognition is deferred and revenue will be recognized when all obligations under the arrangement are fulfilled. Revenue from software maintenance contracts is recognized ratably over the contractual period.

Revenue from consulting and other services is recognized at the time the services are rendered. Certain products are sold through distributors who are granted limited rights of return. Potential returns are accounted for at the time of sale.

The accounting estimate related to revenue recognition is considered a “critical accounting estimate” because terms of sale can vary, and judgment is exercised in determining whether to defer revenue recognition. Such judgments may materially affect net sales for any period. Judgment is exercised within the parameters of GAAP in determining when contractual obligations are met, title and risk of loss are transferred, sales price is fixed or determinable and collectibility is reasonably assured.

Software Development Costs: All software development costs incurred in establishing the technological feasibility of computer software products to be sold are charged to expense as research and development costs. Software development costs incurred subsequent to the establishment of technological feasibility of a computer software product to be sold and prior to general release of that product are capitalized. Amounts capitalized are amortized commencing after general release of that product over the estimated remaining economic life of that product, generally three years, using the straight-line method or using the ratio of current revenues to current and anticipated revenues from such product, whichever provides greater amortization. If the technological feasibility for a particular project is judged not to have been met or recoverability of amounts capitalized is in doubt, project costs are expensed as research and development or charged to cost of goods sold, as applicable. The accounting estimate related to software development costs is considered a “critical accounting estimate” because judgment is exercised in determining whether project costs are expensed as research and development or capitalized as an asset. Such judgments may materially affect expense amounts for any period. Judgment is exercised within the parameters of GAAP in determining when technological feasibility has been met and recoverability of software development costs is reasonably assured.

21

Valuation of Inventories: Inventories are stated at the lower of cost or market, using the first-in, first-out method. Inventory includes purchased parts and components, work in process and finished goods. Provisions for excess, obsolete or slow moving inventory are recorded after periodic evaluation of historical sales, current economic trends, forecasted sales, estimated product lifecycles and estimated inventory levels. Purchasing practices, electronic component obsolescence, accuracy of sales and production forecasts, introduction of new products, product lifecycles, product support and foreign regulations governing hazardous materials are the factors that contribute to inventory valuation risks. Exposure to inventory valuation risks is managed by maintaining safety stocks, minimum purchase lots, managing product end-of-life issues brought on by aging components or new product introductions, and by utilizing certain inventory minimization strategies such as vendor-managed inventories. The accounting estimate related to valuation of inventories is considered a “critical accounting estimate” because it is susceptible to changes from period-to-period due to the requirement for management to make estimates relative to each of the underlying factors, ranging from purchasing, to sales, to production, to after-sale support. If actual demand, market conditions or product lifecycles differ from estimates, inventory adjustments to lower market values would result in a reduction to the carrying value of inventory, an increase in inventory write-offs and a decrease to gross margins.

Income Taxes: PT provides deferred income tax assets and liabilities based on the estimated future tax effects of differences between the financial and tax bases of assets and liabilities based on currently enacted tax laws. A valuation allowance is established for deferred tax assets in amounts for which realization is not considered more likely than not to occur. The accounting estimate related to income taxes is considered a “critical accounting estimate” because judgment is exercised in estimating future taxable income, including prudent and feasible tax planning strategies, and in assessing the need for any valuation allowance. If it should be determined that all or part of a net deferred tax asset is not able to be realized in the future, an adjustment to the valuation allowance would be charged to income in the period such determination was made. Likewise, in the event that it should be determined that all or part of a deferred tax asset in the future is in excess of the net recorded amount, an adjustment to the valuation allowance would increase income to be recognized in the period such determination was made.

PT operates within multiple taxing jurisdictions worldwide and is subject to audit in these jurisdictions. These audits can involve complex issues, which may require an extended period of time for resolution. Although management believes that adequate provision has been made for such issues, there is the possibility that the ultimate resolution of such issues could have an adverse effect on the earnings of PT. Conversely, if these issues are resolved favorably in the future, the related provisions would be reduced, thus having a positive impact on earnings.

In addition, the calculation of PT’s tax liabilities involves dealing with uncertainties in the application of complex tax regulations. PT recognizes liabilities for uncertain tax positions based on a two-step process. The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes, if any. The second step requires PT to estimate and measure the tax benefit as the largest amount that is more than 50% likely of being realized upon ultimate settlement. It is inherently difficult and subjective to estimate such amounts, as this requires PT to determine the probability of various possible outcomes. PT re-evaluates these uncertain tax positions on a quarterly basis. This evaluation is based on factors including, but not limited to, changes in facts or circumstances, changes in tax law, effectively settled issues under audit, and new audit activity. Such a change in recognition or measurement would result in the recognition of a tax benefit or an additional charge to the tax provision in the period.

Finally, the value of PT’s deferred tax assets is dependent upon PT’s ability to generate future taxable income in the jurisdictions in which PT operates. These assets consist of research credit carry-forwards, capital and net operating loss carry-forwards, and the future tax effect of temporary differences between balances recorded for financial statement purposes and for tax return purposes. It will require future pre-tax earnings of in excess of $10 million in order to fully realize the value of the Company's deferred tax assets. Of this amount, approximately $650,000 of capital gains must be realized in 2010 in order to fully realize PT’s deferred tax assets relating to capital loss carryforwards. Due to the uncertainty of PT’s ability to realize its deferred tax assets, a valuation allowance was recorded in 2009 against substantially the full value of its deferred tax assets.

22

Product Warranty: Warranty obligations are generally incurred in connection with the sale of PT’s products. The warranty period for these products is generally one year. The costs incurred to provide for these warranty obligations are estimated and recorded as an accrued liability at the time of sale. Future warranty costs are estimated based on historical performance rates and related costs to repair given products. The accounting estimate related to product warranty is considered a “critical accounting estimate” because judgment is exercised in determining future estimated warranty costs. Should actual performance rates or repair costs differ from estimates, revisions to the estimated warranty liability would be required.

Stock-Based Compensation: PT’s board of directors approves grants of stock options to employees to purchase our common stock. Stock compensation expense is recorded based upon the estimated fair value of the stock option at the date of grant. The accounting estimate related to stock-based compensation is considered a "critical accounting estimate" because estimates are made in calculating compensation expense including expected option lives, forfeiture rates and expected volatility. Expected option lives are estimated using vesting terms and contractual lives. Expected forfeiture rates and volatility are calculated using historical information. Actual option lives and forfeiture rates may be different from estimates and may result in potential future adjustments which would impact the amount of stock-based compensation expense recorded in a particular period.

Restructuring Costs: Restructuring costs may consist of employee-related severance costs, lease termination costs and other facility-related closing expenses. Employee-related severance benefits are recorded either at the time an employee is notified or, if there are extended service periods, is estimated and recorded pro-rata over the period of each planned restructuring activity. Lease termination costs are calculated based upon fair value considering the remaining lease obligation amounts and estimates for sublease receipts. The accounting estimate related to restructuring costs is considered a "critical accounting estimate" because estimates are made in calculating the amount of employee-related severance benefits that will ultimately be paid and the amount of sublease receipts that will ultimately be received in future periods. Actual amounts paid for employee-related severance benefits can vary from these estimates depending upon the number of employees actually receiving severance payments. Actual sublease receipts received may also vary from estimates.

Investments: We recognize realized losses when declines in the fair value of our investments, below their cost basis, are judged to be other-than-temporary. In determining when a decline in fair value is other than temporary, we consider various factors including market price (if available), investment ratings, the financial condition and near-term prospects of the investee and the underlying collateral, the length of time and the extent to which the fair value has been less than our cost basis, the extent to which the investment is guaranteed, the financial health of the guarantor (if any), and our ability and intent to hold the investment until maturity or for a sufficient period of time to allow for any anticipated recovery in market value. We make significant judgments in considering these factors. If it were judged that a decline in fair value is other-than-temporary, the investment is valued as the current fair value and a realized loss equal to the decline is reflected as an adjustment to net income. Such adjustments could materially adversely affect our operating results.

Carrying Value of Goodwill: Tests for impairments of goodwill are conducted annually at year end, or more frequently if circumstances indicate that the asset might be impaired. PT employs a two-step method for determining goodwill impairment where step one is to compare the fair value of the reporting unit with the unit’s carrying amount, including goodwill. If this test indicates that the fair value is less than the carrying value, then step two is required to compare the implied fair value of the reporting unit’s goodwill with the carrying amount of the reporting unit’s goodwill. An impairment loss is then recognized to the extent that the goodwill’s carrying amount exceeds its fair value. PT is considered to consist of being only one reporting unit.

23

The quoted market capitalization of PT was less than PT’s book value at December 31, 2009. PT used a discounted cash flow valuation model applied to a five-year projection of future cash flows in its evaluation of goodwill. This cash flow valuation model necessarily involves considerable judgment in the estimation of inputs and assumptions used in this cash flow valuation model. As a result of its analysis, PT recorded an impairment charge against the full recorded value of goodwill. The accounting estimate related to impairment of goodwill is considered a "critical accounting estimate" because PT’s impairment tests include estimates of future cash flows that are dependent upon subjective assumptions regarding future operating results including revenue growth rates, expense levels, discount rates, capital requirements and other factors that impact estimated future cash flows and the estimated implied fair value of PT.