Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 906 - MAKO Surgical Corp. | mako101092_ex32-2.htm |

| EX-99.1 - REGISTRATION RIGHTS AGREEMENT BY AND BETWEEN REGISTRANT AND Z-KAT, INC. - MAKO Surgical Corp. | mako101092_ex99-1.htm |

| EX-23 - CONSENT OF ERNST & YOUNG LLP - MAKO Surgical Corp. | mako101092_ex23.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - MAKO Surgical Corp. | mako101092_ex31-2.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - MAKO Surgical Corp. | mako101092_ex31-1.htm |

| EX-32.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 906 - MAKO Surgical Corp. | mako101092_ex32-1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

Commission file number: 001-33966

MAKO SURGICAL CORP.

(Exact

Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

|

20-1901148 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

2555 Davie Road, Fort Lauderdale, FL |

|

33317 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

|

|

|

(954) 927-2044 |

||

|

(Registrant’s telephone number, including area code) |

||

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

||

|

|

|

|

|

Title of Class |

|

Name of Exchange on Which Registered |

|

|

|

|

|

Common stock, $0.001 par value per share |

|

The NASDAQ Global Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

(the “Exchange Act”) during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

Large accelerated filer o |

Accelerated filer þ |

Non-accelerated filer o |

Smaller reporting company o |

|

|

(Do not check if a smaller reporting company) |

||

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act)

Yes o No þ

The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2009 was approximately $134,589,080 (based on a closing price of $9.02 per share on The NASDAQ Global Market as of such date).

As of March 1, 2010, the registrant had outstanding 33,632,696 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s definitive proxy statement for the 2010 annual meeting of stockholders will be incorporated by reference into Part III of this Annual Report on Form 10-K when filed with the Securities and Exchange Commission.

MAKO Surgical Corp.

INDEX TO FORM 10-K

We have received or applied for trademark registration of and/or claim trademark rights, including in the following marks that appear in this report: “MAKOplasty®,” “RIO®,” “RESTORIS®,” “Tactile Guidance System” and “TGS,” as well as in the MAKO Surgical Corp. “MAKO” logo, whether standing alone or in connection with the words “MAKO Surgical Corp.” All other trademarks, trade names and service marks appearing in this report are the property of their respective owners. Unless the context requires otherwise, the terms “registrant,” “company,” “we,” “us” and “our” refer to MAKO Surgical Corp.

2

This report contains forward-looking statements within the meaning of the U.S. federal securities laws. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements include statements generally preceded by, followed by or that include the words “believe,” “could,” “expect,” “intend,” “may,” “anticipate,” “plan,” “predict,” “potential,” “estimate” or similar expressions. These statements include, but are not limited to, statements related to:

|

|

|

|

|

|

• |

the nature, timing and number of planned new product introductions; |

|

|

|

|

|

|

• |

market acceptance of the MAKOplasty solution; |

|

|

|

|

|

|

• |

the effect of anticipated changes in the size, health and activities of population on the demand for our products; |

|

|

|

|

|

|

• |

assumptions and estimates regarding the size and growth of certain market segments; |

|

|

|

|

|

|

• |

our ability and intent to expand into international markets; |

|

|

|

|

|

|

• |

the timing and anticipated outcome of clinical studies; |

|

|

|

|

|

|

• |

assumptions concerning anticipated product developments and emerging technologies; |

|

|

|

|

|

|

• |

the future availability from third-party suppliers, including single source suppliers, of implants for and components of our RIO® Robotic Arm Interactive Orthopedic system; |

|

|

|

|

|

|

• |

the viability of maintaining our licensed intellectual property or our ability to obtain additional licenses necessary to our growth; |

|

|

|

|

|

|

• |

the anticipated adequacy of our capital resources to meet the needs of our business; |

|

|

|

|

|

|

• |

our continued investment in new products and technologies; |

|

|

|

|

|

|

• |

the ultimate marketability of newly launched products and products currently being developed; |

|

|

|

|

|

|

• |

the ability to implement new technologies successfully; |

|

|

|

|

|

|

• |

our goals for sales and earnings growth; |

|

|

|

|

|

|

• |

our ability to sustain sales and earnings growth; |

|

|

|

|

|

|

• |

our success in achieving timely approval or clearance of products with domestic and foreign regulatory entities; |

|

|

|

|

|

|

• |

the stability of certain domestic and foreign economic markets; |

|

|

|

|

|

|

• |

the impact of anticipated changes in the U.S. healthcare industry and the medical device industry and our ability to react to and capitalize on those changes; |

|

|

|

|

|

|

• |

future declarations of cash dividends; and |

|

|

|

|

|

|

• |

the impact of any managerial changes. |

Forward-looking statements reflect our current expectations and are not guarantees of performance. These statements are based on management’s beliefs and assumptions, which in turn are based on currently available information. Important assumptions relating to these forward-looking statements include, among others, assumptions regarding demand for our products, expected pricing levels, raw material costs, the timing and cost of planned capital expenditures, competitive conditions and general regulatory and economic conditions. You are cautioned that reliance on any forward-looking statement involves risks and uncertainties. Although we believe that the assumptions on which the forward-looking statements contained herein are based are reasonable, any of those assumptions could prove to be inaccurate given the inherent uncertainties as to the occurrence or nonoccurrence of future events. There can be no assurance that the forward-looking statements contained in this

3

report will prove to be accurate. The inclusion of a forward-looking statement in this report should not be regarded as a representation by us that our objectives will be achieved.

Forward-looking statements also involve risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Many of these factors are beyond our ability to control or predict and could, among other things, cause actual results to differ from those contained in forward-looking statements made in this report. Such factors, among others, may have a material adverse effect on our business, financial condition and results of operations and may include, but are not limited to, factors discussed under Item 1A, “Risk Factors,” and the following:

|

|

|

|

|

|

• |

a continued economic downturn or delayed economic recovery that may have a significant adverse effect on the ability of our customers to secure adequate funding, including access to credit, for the purchase of our products or that may cause our customers to delay a purchasing decision; |

|

|

|

|

|

|

• |

changes in general economic conditions and interest rates; |

|

|

|

|

|

|

• |

changes in the availability of capital and financing sources, for our company and our customers; |

|

|

|

|

|

|

• |

changes in competitive conditions and prices in our markets; |

|

|

|

|

|

|

• |

changes in the relationship between supply of and demand for our products; |

|

|

|

|

|

|

• |

fluctuations in costs of raw materials and labor; |

|

|

|

|

|

|

• |

changes in other significant operating expenses; |

|

|

|

|

|

|

• |

unanticipated issues related to intended product launches; |

|

|

|

|

|

|

• |

decreases in sales of our principal product lines; |

|

|

|

|

|

|

• |

slow downs or inefficiencies in our product research and development efforts; |

|

|

|

|

|

|

• |

increases in expenditures related to increased or changing government regulation or taxation of our business; |

|

|

|

|

|

|

• |

unanticipated issues associated with any healthcare reform legislation that may be enacted; |

|

|

|

|

|

|

• |

unanticipated changes in reimbursement to our customers for our products; |

|

|

|

|

|

|

• |

unanticipated issues in securing regulatory clearance or approvals for new products or upgrades or changes to our products; |

|

|

|

|

|

|

• |

developments adversely affecting our potential sales activities outside the United States; |

|

|

|

|

|

|

• |

increases in cost containment efforts by group purchasing organizations; |

|

|

|

|

|

|

• |

loss of key management and other personnel or inability to attract such management and other personnel; |

|

|

|

|

|

|

• |

increases in costs of retaining a direct sales force and building a distributor network; |

|

|

|

|

|

|

• |

unanticipated issues related to, or unanticipated changes in or difficulties associated with, the recruitment of agents and distributors of our products; |

|

|

|

|

|

|

• |

unanticipated expenditures related to any future litigation; and |

|

|

|

|

|

|

• |

unanticipated intellectual property expenditures required to develop, market and defend our products. |

We caution you not to place undue reliance on these forward-looking statements, as they speak only as of the date they were made. We do not undertake any obligation to release any revisions to these forward-looking statements publicly to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events.

4

|

|

|

|

BUSINESS |

Overview

We are an emerging medical device company that markets our advanced robotic arm solution and orthopedic implants for minimally invasive orthopedic knee procedures. We offer MAKOplasty, an innovative, restorative surgical solution that enables orthopedic surgeons to consistently, reproducibly and precisely treat patient specific, early to mid-stage osteoarthritic knee disease.

We were incorporated in Delaware in November 2004. In February 2008, our common stock began trading on The NASDAQ Global Market under the ticker symbol “MAKO” in connection with the closing of our initial public offering, or IPO.

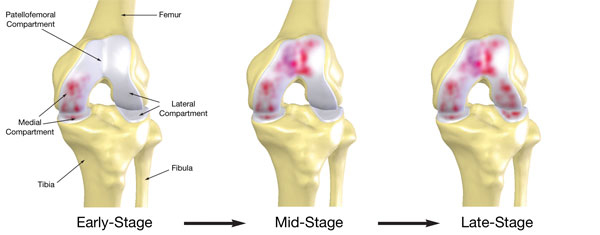

MAKOplasty is performed using our proprietary RIO® Robotic Arm Interactive Orthopedic system, or RIO, and proprietary RESTORIS® unicompartmental and RESTORIS® MCK multicompartmental knee implant systems. The RIO is a technology platform that we believe has potential future application for other orthopedic procedures beyond the knee. The RIO utilizes tactile guided robotic arm technology and patient specific visualization to prepare the knee joint for the insertion and alignment of our resurfacing implants through a small incision in a minimally invasive, bone preserving and tissue sparing procedure. Our RESTORIS family of knee implants is designed to enable minimally invasive restoration of one or two of the diseased compartments of the knee joint. We believe MAKOplasty will empower physicians to address the needs of the large and growing, yet underserved population of patients with early to mid-stage osteoarthritic knee disease who desire a restoration of quality of life and reduction of pain, but for whom current surgical treatments are not appropriate or desirable due to the highly invasive nature of such procedures, the slow recovery and the substantial costs of rehabilitation, medication and hospitalization.

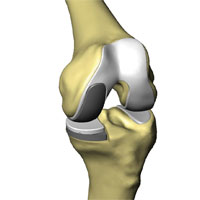

Unlike conventional knee replacement surgery, which requires extraction and replacement of the entire joint, MAKOplasty enables resurfacing of one or two specific diseased compartments of the joint, preserving significantly more soft tissue and healthy bone of the knee. We believe localized resurfacing can be optimized using our robotic arm technology, which offers consistently reproducible precision to surgeons to achieve optimal implant placement and alignment for smaller, more easily inserted modular implant components. We believe that the tissue sparing and bone conserving techniques enabled with MAKOplasty can offer substantial advantages to patients, surgeons and healthcare providers. Because of the minimally invasive nature of the procedure, smaller incisions are possible, which lead to less tissue damage and faster recoveries, thereby reducing the overall costs of rehabilitation, medication and hospitalization. In addition, because more of the patient’s natural anatomy is preserved and less trauma is inflicted on the knee, we believe that patients who undergo MAKOplasty have the potential to experience better functionality and more natural knee movements, thereby achieving an improved post-operative quality of life. Significantly, the expansion of our RESTORIS family of implants for use in single and bicompartmental knee resurfacing procedures provides the ability to address a broader range of the patient population suffering from early to mid-stage osteoarthritis. Finally, because our RIO system is easy to use, we believe that our MAKOplasty solution makes resurfacing procedures accessible to orthopedic surgeons with a broad range of training and skills and has the potential to lead to greater adoption of knee resurfacing solutions for early to mid-stage osteoarthritis of the knee.

In May 2005, we obtained 510(k) marketing clearance from the U.S. Food and Drug Administration, or FDA, for a haptic imageless surgical guidance system. In November 2005, we obtained 510(k) marketing clearance from the FDA for version 1.0 of our Tactical Guidance System, or TGS, a CT based patient specific visualization system with a robotic arm, which was the predecessor device to our RIO system and enabled MAKOplasty for a single compartment of the knee joint using a standard unicompartmental implant. In January 2008, we received 510(k) marketing clearance from the FDA for version 1.2 of our TGS, which allowed for MAKOplasty using an alternative standard unicompartmental knee implant and incorporated several software upgrades developed and introduced since the commercial introduction of version 1.0. We commercially launched

5

version 1.2 in the first quarter of 2008. In the third quarter of 2008, we commercially launched version 1.3 of our TGS (the modifications to which did not require 510(k) marketing clearance).

In the fourth quarter of 2008, we received 510(k) marketing clearance from the FDA for our RIO system, which is version 2.0 of our TGS, which we commercially launched in the first quarter of 2009. In the third quarter of 2009, we commercially launched version 2.1 of our RIO system (the modifications to which did not require 510(k) marketing clearance), which reflected further refinement of the RIO platform and knee application. In the fourth quarter of 2009, we commercially launched version 2.2 of our RIO system (the modifications to which did not require 510(k) marketing clearance), which enabled surgeons to treat lateral compartment knee arthritis.

In the first quarter of 2006, we received 510(k) marketing clearance for our tibial inlay knee implant system and in the fourth quarter of 2007 we received 510(k) marketing clearance for our tibial onlay knee implant system and for our combined inlay and onlay system, branded as RESTORIS. In the second quarter of 2008, we received 510(k) marketing clearance for our novel unicompartmental knee implant and 510(k) marketing clearance for our patellofemoral knee implant, predecessor components of our proprietary multicompartmental knee implant system. In the fourth quarter of 2008, we received 510(k) marketing clearance from the FDA for our multicompartmental knee implant system, branded as RESTORIS MCK. We commercially launched the RESTORIS MCK multicompartmental knee implant system in the second quarter of 2009.

As part of the original TGS sales contracts, TGS customers were entitled to receive an upgrade of their TGS unit to a RIO system at no additional charge, with the exception of one customer who had the right to receive it at a discounted price. During the first half of 2009, we upgraded all seventeen TGS units to RIO systems. In 2009, we commercially installed nineteen new RIO systems, bringing the total number of commercial MAKOplasty sites to 36 as of December 31, 2009. A total of 1,602 MAKOplasty procedures were performed in 2009 and as of December 31, 2009, 2,384 MAKOplasty procedures had been performed since commercial introduction in June 2006. As of March 1, 2010, we have 39 post-market studies of MAKOplasty, either recently completed or in progress, which are aimed at demonstrating the accuracy of the placement and alignment of our knee implants and the clinical value of the MAKOplasty procedure. To date, the results of these studies have been presented as peer-reviewed presentations at conferences in the United States and abroad. As of March 1, 2010, we have an intellectual property portfolio of more than 300 licensed or owned patents and patent applications relating to the areas of computer assisted surgery, robotics, haptics and implants.

We generate revenue from unit sales of our RIO system, sales of our implants and disposable products and the sale of extended warranty service contracts.

Industry Background

The Growing Osteoarthritis Problem

Osteoarthritis is a common medical condition that leads to the degeneration of joints from aging and repetitive stresses, resulting in a loss of the flexibility, elasticity and shock-absorbing properties of the joints. As osteoarthritis disease progresses, the cartilage and other soft tissues protecting the surfaces of key joints in the body, including knees, hips and shoulders, deteriorate, resulting in substantial and chronic joint pain, numbness and loss of motor function. This pain can be overwhelming for patients and can have significant physical, psychological, quality of life and financial implications. According to estimates by the National Institutes of Health, or NIH, 27 million people in the U.S., age 25 and older, suffer from osteoarthritis.

Compelling demographic trends, such as the growing, aging and more active population and rising obesity rates are expected to be key drivers in the continued growth of osteoarthritis. The NIH projects that by 2030, 20% of Americans, or approximately 72 million people, will be 65 years or older and will be at high risk of developing osteoarthritis. According to The Journal of the American Medical Association, it is estimated that of the U.S. population over the age of 20 approximately 68% was overweight and 34% was obese in 2007-2008. The Orthopaedic Industry Annual Report for the year ended June 15, 2009 reports that being overweight

6

significantly increases the risk of developing knee osteoarthritis and that obese women had nearly four times the risk of suffering from osteoarthritis of the knee as non-obese women, and obese men had nearly five times the risk of suffering from osteoarthritis of the knee as non-obese men.

For the most severe cases of osteoarthritis, in which patients suffer from extreme pain, reconstructive joint surgery may be required. Reconstructive joint surgery involves the removal of the bone area surrounding the affected joint and the insertion of one or more manufactured implants as a replacement for the affected bone. According to The Orthopaedic Industry Annual Report, global sales of joint replacement products in 2008, including knees, hips, elbows, wrists, digits and shoulders, were $12.7 billion, an increase in sales of nearly 9% over 2007, of which sales in the United States represented $6.7 billion. According to Frost & Sullivan, the joint implant market is expected to grow to approximately $9.7 billion by 2013, with knee and hip implant systems representing the two largest sectors.

Market for Osteoarthritis of the Knee

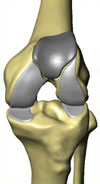

The knee joint consists of the medial, patellofemoral and lateral compartments. As depicted below by the shaded diseased areas of the knee joint, osteoarthritis of the knee usually begins with the deterioration of the soft tissue and cartilage in the medial (inner) compartment and progresses to either or both the patellofemoral (sub-kneecap) and lateral (outer) compartments. The progression of osteoarthritis of the knee can take many years, and even in the early stages, it can result in substantial pain for the patient and a reduction in the quality of life.

According to the Centers for Disease Control, there are currently more than 15 million people in the U.S. with osteoarthritis of the knee. According to a 2006 Duke University Survey of published literature, the growth of osteoarthritis of the knee among the U.S. population is expected to accelerate as the increasingly active population ages and obesity rates increase. As a result of this substantial clinical need, the market for orthopedic knee procedures in the U.S. has experienced tremendous growth over the past decade. According to data compiled by Orthopedic Network News, the U.S. knee implant market was greater than $3.7 billion in 2008, which represents growth of 9.2% from 2007 to 2008. In addition to the substantial costs of the procedure itself, total knee replacement and resurfacing procedures represent significant incremental costs to the healthcare system. These include costs associated with rehabilitation, medication, hospitalization and, over the long-term, costs incurred as a result of replacements or revisions that may be required due to wear and tear or improper placement.

Current Orthopedic Knee Arthroplasty Approaches

Arthroplasty options for treating osteoarthritis of the knee have historically been limited to either total knee replacement surgery or knee resurfacing procedures.

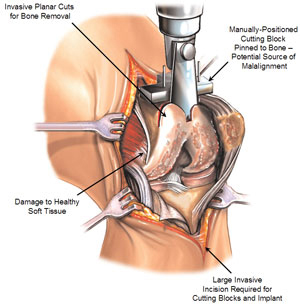

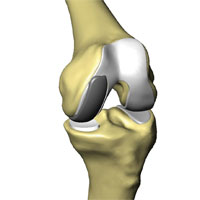

Total Knee Replacement. Currently, most people who choose to surgically address osteoarthritis of the knee elect to undergo total knee replacement surgery. Total knee replacement is a highly invasive surgical procedure in which a patient’s diseased knee joint is removed and replaced with a manufactured replacement knee joint comprised of several components that attempt to mimic the normal function of the knee joint. The procedure requires a large incision ranging from 4 to 12 inches to accommodate the complex scaffold of cutting blocks and jigs required to execute the blunt, planar cuts involved in total knee replacement surgery and to prepare the knee for insertion of the large implants. Both internal and external soft tissue damage is significant in this procedure as the entire knee joint is fully exposed and much of the bone and tissue surrounding it are removed. The bone cuts are also extensive, presenting a large surface area for bone bleeding. The implants are typically manufactured out of metal, ceramic or polymers and have an approximate useful life of between 15 and 20 years before they usually are revised or replaced.

7

The figures below illustrate a conventional total knee replacement surgery and implant:

|

|

|

|

|

|

|

|

|

Total Knee Replacement Surgery |

|

Total Knee Implant |

Despite its long history as an established and effective orthopedic procedure, total knee replacement surgery is not an ideal option for many patients suffering from early to mid-stage, unicompartmental or multicompartmental degeneration of the knee. Some of the principal limitations of total knee replacement surgeries include:

|

|

|

|

|

|

• |

highly invasive nature of the surgical procedure, which requires a large incision ranging from 4 to 12 inches to prepare and implant the large implants; |

|

|

|

|

|

|

• |

significant damage to the bone and tissue surrounding the joint; |

|

|

|

|

|

|

• |

substantial bone bleeding; |

|

|

|

|

|

|

• |

required removal of all three compartments of the knee, regardless of which compartments are actually diseased; |

|

|

|

|

|

|

• |

extended and often painful recovery time and rehabilitation; |

|

|

|

|

|

|

• |

reduced mobility and range of motion; and |

|

|

|

|

|

|

• |

likely implant replacement or revision in approximately 15 to 20 years when the implant reaches the end of its useful life. |

For these and other reasons, many people who are eligible for total knee replacement surgery elect not to undergo or postpone the procedure, choosing instead to suffer significant pain and limited mobility.

Unicompartmental and Bicompartmental Knee Resurfacing. Unicompartmental and bicompartmental knee resurfacing is a less invasive arthroplasty procedure in which only the arthritic region of the knee is removed and a small implant is inserted to resurface the diseased compartment of the knee. Unicompartmental and bicompartmental knee resurfacing procedures are ideal for patients with early to mid-stage osteoarthritis and are aimed at sparing the healthy bone, cartilage and other soft tissues typically removed in a conventional total knee replacement procedure. Today, these procedures are generally performed manually and require a level of training, expertise and precision that significantly exceeds what is required for the typical total knee replacement surgery. Orthopedic Network News has estimated that 49,400 unicompartmental knee resurfacing procedures were performed in 2008 in the United States, which represents a 6.9% increase from the estimated 46,200 such procedures performed in 2007 in the United States.

Unicompartmental and bicompartmental knee resurfacing are potentially more desirable procedures than total knee replacement surgery for patients suffering from early to mid-stage degeneration of the knee because they preserve more of the patient’s natural anatomy and result in less trauma to the patient. As a result, patients experience less tissue loss and faster recoveries. However, despite the potential clinical, quality of life and cost benefits of these procedures, they have achieved only limited adoption to date, in part, as a result of the following limitations that make performing these procedures very difficult:

|

|

|

|

|

|

• |

the restricted room to maneuver and impeded line of sight due to the smaller incision and minimally invasive nature of the procedures which make it difficult to insert, place and align the implant properly; and |

|

|

|

|

|

|

• |

the complex process of removing portions of the bone and resurfacing the knee joint in preparation for the implant. |

8

The difficulties in manually executing unicompartmental or bicompartmental knee resurfacing procedures can result in inaccurate implant alignment, which can lead to reduced range of motion and premature implant failure. In light of the difficulties, many physicians choose not to recommend these procedures and many patients choose either to live with the osteoarthritic pain or to undergo total knee replacement surgery. We currently believe that up to 20% of patients who underwent total knee replacement surgeries had osteoarthritis in only one or two compartments of the knee, which we believe may qualify them as appropriate candidates for a either a unicompartmental or bicompartmental implant.

Introduction of Minimally Invasive Surgery

Over the past thirty years, one of the most significant medical trends has been the development of minimally invasive methods of performing surgical procedures. Compared to traditional, open surgical techniques, minimally invasive techniques that employ image guided surgical systems offer potentially superior benefits for patients, surgeons and hospitals. For patients, these techniques result in reduced procedure related pain and less scarring at the incision site leading to faster recovery times and shorter post-operative hospital stays, as well as better aesthetic outcomes. For the surgeon, these techniques reduce procedure related complications and have the potential to reduce risks associated with more invasive procedures. For the hospital, these procedures can result in reduced hospital stays from faster recovery times and lower rates of complications.

Despite the many benefits of minimally invasive techniques, however, they also present several notable limitations due to the restricted surgical space, including:

|

|

|

|

|

|

• |

restricted vision at the anatomical site; |

|

|

|

|

|

|

• |

cumbersome handling of surgical instruments; |

|

|

|

|

|

|

• |

difficult hand eye coordination; and |

|

|

|

|

|

|

• |

limited tactile feedback. |

Minimally invasive approaches have seen substantial adoption in various surgical fields where procedures can be performed within existing anatomical cavities of the human body. However, because of the limitations of minimally invasive techniques, they have been less successful for complex surgical procedures requiring cutting and replacement of large anatomical parts that nevertheless require precision and control.

Introduction of Robotics into Other Surgical Fields

We believe that the application of robotics technologies in minimally invasive surgical procedures represents the next generation in the evolution of the surgical technique. These technologies are being developed to provide surgeons with a more precise, repeatable and controlled ability to perform complex procedures by offering increased visual acuity and greatly improved tactile feedback. These characteristics empower surgeons to better control their surgical technique and limit the margin of error.

With the assistance of robotics technology, an increasing number of surgeons have been able to perform procedures previously limited to a small subset of highly skilled surgeons. In addition, robotics technology has allowed these procedures to be performed in a more minimally invasive manner, requiring only small incisions, which result in reduced procedure related trauma, fewer infections and post-procedure complications and reduced recovery and hospitalization periods.

Robotics technology has been successfully applied in a variety of diverse fields including urology, gynecology, cardiothoracic surgery and catheter based interventional cardiology and radiology. The success of robotics technologies in these applications has led to the growing adoption and commercialization of these technologies in the medical world.

9

The Use of Robotics in Orthopedic Surgical Procedures

Despite the success of robotics technology in other medical fields, only limited applications have been commercialized in the field of orthopedics to date, although we are aware of current orthopedic robotic development by other companies. Some orthopedic companies have introduced instruments that are smaller than their predecessors, which are marketed as “minimally invasive,” but these instruments still require large incisions, trauma to the soft tissue and removal of large portions of the bone to perform the surgical procedure. Orthopedic companies have also introduced computer assisted surgical, or CAS, systems that are designed for use in open procedures. However, while these systems do provide a minimally invasive means of viewing the anatomical site, their benefits are marginal because they do not improve a surgeon’s ability to make consistently reproducible and precise surgical movements through a small incision.

We believe that the limitations of currently available surgical options for knee disease have created a sizeable market for treatment of a large, growing and underserved population of patients with early to mid-stage osteoarthritis of the knee. We believe that robotics technology is the key to enabling surgeons to perform the kind of minimally invasive knee surgery that results in restoration of function and improved post-operative outcomes for such patients.

The MAKO Solution

We have designed our MAKOplasty solution to provide the consistently reproducible precision, accuracy and dexterity necessary for a surgeon to successfully perform minimally invasive orthopedic arthroplasty procedures on the knee despite a limited field of vision in a confined anatomical space. Our MAKOplasty solution is composed of two critical components: the RIO system, which consists of the proprietary tactile robotic arm and our patient specific visualization system that provides both pre-operative and intra-operative guidance to the surgeon, and the RESTORIS family of knee implant systems that are designed for minimally invasive restoration of the diseased compartments of the joint. By integrating robotic arm and patient specific visualization technology with the touch and feel of the surgeon’s skilled hand, MAKOplasty is designed to enable a level of surgical precision and accuracy that is beyond the scope of the typical surgeon’s freehand capabilities, which we believe will result in broad adoption of our technologies by orthopedic surgeons and better outcomes for patients. We believe knee MAKOplasty offers the following key benefits to patients, surgeons and hospitals:

|

|

|

|

|

|

• |

Minimally Invasive Targeted Knee Arthroplasty. MAKOplasty enables surgeons to isolate and resurface just the diseased compartment or compartments of the knee joint through a minimally invasive incision, rather than replacing the entire joint. The precision of our RIO system robotic arm technology makes such minimally invasive targeted treatment possible by eliminating the complex scaffold of cutting blocks and jigs that would otherwise be required to execute the blunt, planar bone cuts and insert the large implants involved in conventional total knee replacement surgery or a manually executed resurfacing procedure. We believe that our solution will make minimally invasive orthopedic procedures, like unicompartmental and bicompartmental knee resurfacing, a viable option for a greatly expanded pool of patients and physicians. |

|

|

|

|

|

|

• |

Consistently Reproducible Precision. We believe that MAKOplasty reduces the variability of procedure outcomes and increases efficacy through the consistently reproducible precision provided by our computer assisted and tactile robotic arm technology. We believe that the precision of our cutting process and placement and alignment of implants leads to significantly improved and reliable results, compared to conventional, manually executed unicompartmental and bicompartmental resurfacing procedures. The surgeon retains control of the actual movements of the robotic arm within a pre-established volume of space, the tactile “safety zone,” which is tracked and bounded by the RIO system. We believe that the tactile safety zone enables improved placement and alignment of the resurfacing implant, while the visualization enables the procedure to be performed through a small incision without direct visualization. We believe that this consistently reproducible precision enables physicians to be trained in the use of |

10

|

|

|

|

|

|

|

MAKOplasty in a relatively short period of time and also will increase the number of physicians who are willing and able to perform unicompartmental and bicompartmental resurfacing procedures. |

|

|

|

|

|

|

• |

Proprietary Implants. We believe that our proprietary knee resurfacing implants allow surgeons to customize a knee resurfacing solution for individual patients facing early to mid-stage osteoarthritis in one or two compartments of the knee joint. Our original RESTORIS unicompartmental implant system allows for a choice of tibial implant based on patient bone quality. Our RESTORIS MCK implant system provides for this same choice for medial or lateral unicompartmental disease and allows for the resurfacing of the patellofemoral compartment as well, either independently or in combination with the medial compartment in a bicompartmental knee MAKOplasty. Because all implants are sized and planned for based on patient-specific anatomical indications, the potential for favorable clinical outcomes is enhanced. |

|

|

|

|

|

|

• |

Ease of Use. We believe that our RIO system leverages and complements the surgical skills and techniques already familiar to the surgeon, while providing substantial incremental control and precision that has not previously been possible. The customized, patient specific visualization system guides the surgeon through each step of the surgical procedure, while the tactile “safety zone” ensures that the surgeon does not apply the bone cutting instrument beyond the intended area of the knee joint. We believe that the RIO’s ease of use makes resurfacing procedures accessible to orthopedic surgeons with a broad range of training and skills and has the potential to lead to greater adoption of knee resurfacing solutions for early to mid-stage osteoarthritis of the knee. We also believe that the ease of use provided by the RIO can enable physicians to shorten operating room time and potentially increase the number of procedures performed. |

|

|

|

|

|

|

• |

Improved Restorative Post-Operative Outcomes. Due to the minimally invasive nature of the procedure, we believe that patients who undergo knee MAKOplasty are likely to experience less tissue loss, less visible scarring and a faster recovery, thereby reducing the cost of rehabilitation, physical therapy, medication and hospitalization. In addition, because more of the patient’s natural anatomy is preserved and less trauma is inflicted on the knee, patients who undergo MAKOplasty have the potential to experience better mobility, comfort, range of motion and more natural knee movements to achieve an improved post-operative quality of life. |

|

|

|

|

|

|

• |

Reduced Costs for Patients and Hospitals. The minimally invasive nature of the knee MAKOplasty solution aids hospitals and patients in reducing costs by shortening hospital stays and recovery periods and reducing the amount of rehabilitation and medication. |

The comprehensive nature of the MAKOplasty solution also provides hospitals with the implants and disposable products necessary to perform the procedures. We believe that our complete knee arthroplasty solution represents a substantial improvement over currently available approaches.

The figure below illustrates a MAKOplasty knee resurfacing procedure.

Our Strategy

Our goal is to continue to drive sales of the RIO system and generate recurring revenue through sales of implants, disposable products and service contracts by establishing MAKOplasty as the preferred surgical procedure for patients with early to mid-stage, unicompartmental and multicompartmental degeneration of the knee. We believe that we can achieve this objective by working with hospitals to demonstrate key benefits of MAKOplasty, such as consistently reproducible surgical precision, improved post-operative outcomes and reduced healthcare costs. Our strategy includes the following key elements:

11

|

|

|

|

|

|

• |

Focus on key physicians and thought leaders to encourage adoption of our MAKOplasty solution. We plan to continue to focus our marketing efforts on key orthopedic surgeons who currently perform the majority of unicompartmental and bicompartmental knee procedures or who are actively involved in the development of minimally invasive orthopedic approaches. We also plan to continue to focus our marketing efforts on the hospitals with which these key surgeons are affiliated and engage them to promote the benefits of MAKOplasty. Our strategy is to convince hospitals that through early adoption of MAKOplasty and acquisition of our RIO system, they can reinforce their reputations as leading institutions for the treatment of early to mid-stage osteoarthritis of the knee. |

|

|

|

|

|

|

• |

Drive volume sales of our RESTORIS family of knee implant systems and the disposable products for installed RIO systems. We intend to increase the number of orthopedic surgeons who use our RIO system and work with the hospitals and their surgeons to promote patient education about the benefits of knee MAKOplasty. Our goal is to increase usage per RIO system to drive higher volume sales of our RESTORIS family of knee implant systems and disposable products. |

|

|

|

|

|

|

• |

Expand the market for multicompartmental knee resurfacing. We plan to expand the market for multicompartmental knee resurfacing procedures by encouraging use of the MAKOplasty procedure for patients who, given only conventional surgical alternatives, would have opted for total knee replacement surgery or no surgery at all. Our current FDA cleared application of MAKOplasty is for unicompartmental and bicompartmental knee resurfacing procedures using the RESTORIS family of knee implant systems, allowing us the potential of accommodating varied patient profiles and surgeon preferences. We believe that the potential benefits of our MAKOplasty solution and the combination of these product offerings will facilitate our efforts to expand and capture the market for multicompartmental knee resurfacing. |

|

|

|

|

|

|

• |

Demonstrate the clinical and financial value proposition of MAKOplasty. We intend to continue to collaborate with leading surgeons and early adopting hospitals through such programs as our MAKOplasty Center of Excellence to build clinical and financial data that support the benefits of MAKOplasty. The MAKOplasty Center of Excellence is a program developed in conjunction with participating hospitals to educate surgeons and patients regarding the benefits of MAKOplasty. As part of the collaborative program, participating hospitals maintain and provide us with certain clinical and financial data that we use to support the business case for the MAKOplasty solution. Our goal is to obtain clinical data further supporting the value of MAKOplasty knee resurfacing procedures, as well as the accuracy and longevity of such implant placements, while demonstrating to hospitals the top and bottom line financial benefits of our MAKOplasty solution. Furthermore, if we are able to commercialize additional applications to our RIO system, we believe that we would be able to further demonstrate the financial value proposition of MAKOplasty to hospitals. |

Our Products

MAKOplasty knee resurfacing procedures are enabled through our proprietary technology consisting of two components: our RIO system and our RESTORIS family of knee implant systems.

The MAKO RIO Robotic Arm Interactive Orthopedic System

The centerpiece of MAKOplasty is the RIO system, our proprietary robotic arm, interactive, orthopedic system, that provides both pre-operative and intra-operative guidance to the orthopedic surgeon, enabling minimally invasive, tissue sparing bone removal and knee implant insertion. The RIO system consists of two elements: a tactile robotic arm utilizing an integrated bone cutting instrument and a patient specific visualization component.

12

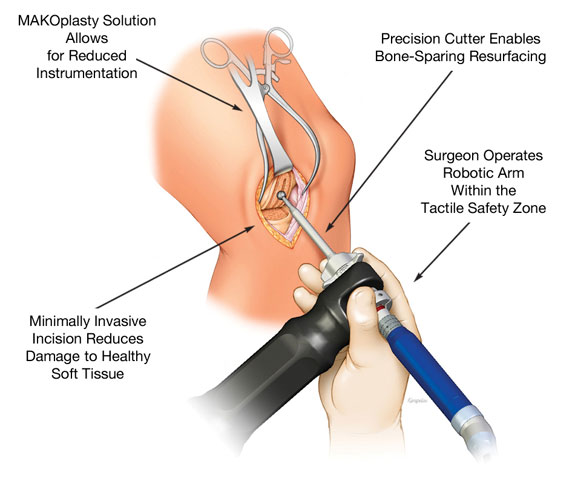

The figures below identify the key components of the RIO system’s tactile robotic arm, stereo tracking system and instruments:

Tactile Robotic Arm System. The tactile robotic arm system consists of the key components identified in the figures above and incorporates the following specifications, features and benefits:

|

|

|

|

|

|

• |

Tactile Robotic Arm — The tactile robotic arm is designed to respond fluidly to movements initiated by the surgeon operating the bone cutting instrument. We have designed the robotic arm to achieve substantial dexterity and range of movement. The robotic arm helps enforce a tactile safety zone that is established by the patient specific visualization system by providing tactile resistance when the boundaries of the tactile safety zone are reached. This tactile resistance helps ensure that the surgeon does not apply the bone cutting instrument beyond the intended area of the knee joint. |

|

|

|

|

|

|

• |

Controller — The controller is the electronic hardware and firmware component of our computing system which interfaces with our proprietary surgical planning and execution software to allow the surgeon to safely guide the tactile robotic arm. The controller governs the basic, low-level functions of the tactile robotic arm, such as the tactile constraints and the safety circuit. |

|

|

|

|

|

|

• |

Stereo Tracking System Camera and Instruments — During a MAKOplasty procedure, the location of the tactile safety zone is updated continuously based on bone tracking data supplied to the computer system by an infrared stereo tracking system, which consists of a special camera that is directed toward a series of spheres and arrays attached to the patient’s anatomy by bone pins. The tracking system assists the robotic arm system in locating and physically tracking the patient’s anatomy and coordinating its real time position with the cutting instrument of the robotic arm. It has a sufficient refresh rate to provide the robotic arm system with an adequate flow of information regarding movements by both the patient and the robotic arm to ensure optimal cutting and placement. Using the system, the surgeon can freely move the robotic arm within the defined space, but encounters tactile resistance as the boundaries of such space are reached. |

|

|

|

|

|

|

• |

End Effector — The end effector is the mechanical component by which the bone cutting instrument is attached to the tactile robotic arm. It is designed to ensure the secure placement of the bone cutting instrument, while providing the flexibility necessary for the surgeon to manipulate the instrument. |

|

|

|

|

|

|

• |

Bone Cutting Instrument with Disposable Cutting Tip — The bone cutting instrument is integrated into the tactile robotic arm at the end effector. This instrument is composed of a high speed motor and a component that houses a variety of single use bone cutting tips. The design of the bone cutting instrument allows the surgeon to grip it in a manner similar to holding a pen-like cutting tool, making it easy to manipulate the instrument in the patient’s anatomy. The cutting tip is the disposable end tip of the bone cutting instrument that makes contact with the knee joint and actually removes the bone for placement of the implant in accordance with the pre-operative plan. In combination with our tactile robotic arm, the bone cutting instrument enables the smooth precision and accuracy necessary for resurfacing procedures. |

|

|

|

|

|

|

• |

Portable Base Console — The base component of our tactile robotic arm is a mobile unit that enables the portability of the tactile robotic arm from one operating room to another. The base console houses the controller and various electrical and mechanical components that help power the tactile robotic arm. Its design enables the console to be situated next to the patient during surgery and the tactile robotic arm to be conveniently positioned over the patient’s anatomy. |

The figure below identifies the key components of the RIO system’s patient specific visualization system:

13

Patient Specific Visualization System. Our patient specific visualization system is a vital part of our ability to deliver minimally invasive surgical procedures for the knee. The surgical team uses our system pre-operatively to plan and intra-operatively to guide the surgical procedure. It consists of the key components identified in the figure above and incorporates the following specifications, features and benefits:

|

|

|

|

|

|

• |

Surgical Planning and Execution Software — Our surgical planning and execution software, which is integrated into our patient specific visualization system, is used during the pre-operative surgical planning process to visualize and map the exact portion of bone to be removed and resurfaced, define the anatomical boundaries of the tactile safety zone and plan the optimal placement and alignment of our implants. During the procedure, the visualization system guides the surgeon through each specific, well defined surgical technique and displays in real time each current and planned surgical activity. |

|

|

|

|

|

|

• |

Tactile Safety Zone — While the robotic arm enforces a tactile safety zone by providing tactile resistance when the boundaries of the tactile safety zone are reached, our patient specific visualization system provides a visual representation of the tactile safety zone and provides additional visual and auditory cues when the boundaries of such tactile safety zone are reached. The combination of this tactile resistance and patient specific visualization helps ensure that the surgeon does not apply the bone cutting instrument beyond the intended area of the knee joint. |

|

|

|

|

|

|

• |

Instrument Locator — The instrument locator provides visual guidance on the position of the bone cutting instrument and other surgical instruments in relation to the patient’s anatomy. |

|

|

|

|

|

|

• |

Monitors — Prior to surgery, patients undergo a conventional CT scan that captures an image of the diseased knee joint. This CT image is uploaded to the patient specific visualization system, where a MAKOplasty Specialist processes the image for display as a 3-D volume in space corresponding to the implant shape and placement overlaid onto the CT image of the patient’s knee joint. This patient specific visualization of our implant overlaid onto an image of the patient’s actual knee joint helps the surgeon to plan the procedure pre-operatively, by providing information which enables the surgeon to determine the optimal placement, alignment and sizing of the implant and establishing the boundaries of the tactile safety zone. During surgery, each monitor projects an active 3-D computer graphics visualization of the patient’s knee joint, showing the areas of the bone that are actually removed as the procedure progresses. The user can also change the viewpoint and zoom level of the visualization as the procedure progresses to focus on different portions of the anatomy. |

|

|

|

|

|

|

• |

Mobile Base — The base component of our patient specific visualization system is a mobile unit that enables the portability of the patient specific visualization system from one operating room to another. It houses our computer hardware and our surgical planning and execution software and various electrical and mechanical components that help power the visualization system. |

Early Versions of the Tactile Guidance System

In November 2005, we obtained 510(k) marketing clearance from the FDA for version 1.0 of our TGS for use with an inlay knee implant system, as described below. We subsequently developed and introduced several upgrades to our TGS, including improvements to our surgical planning software as well as changes to certain instrumentation to make the device easier to use. We determined that these modifications, embodied in version 1.1 of our TGS, did not require the submission of a new 510(k) application.

In January 2008, we obtained 510(k) marketing clearance from the FDA for version 1.2 of our TGS, which became commercially available in the first quarter of 2008. Version 1.2 reflected further refinement of the basic instrumentation set and featured a customized bone cutting instrument and new surgical planning software applications necessary to support unicompartmental resurfacing procedures using a tibial onlay knee implant system. In the third quarter of 2008, we launched version 1.3 of our TGS, which enabled integration of components of both our tibial inlay and tibial onlay knee implant systems into a single MAKO-branded

14

RESTORIS unicompartmental knee implant system, for use with the TGS. These modifications did not require the submission of a new 510(k) application.

The RIO System

The RIO system, version 2.0 of the TGS, represents an important expansion from our first generation TGS, enabling and expanding application of MAKOplasty to multicompartmental resurfacing procedures, allowing orthopedic surgeons to treat degenerative osteoarthritis from early-stage, unicompartmental degeneration through mid-stage, multicompartmental degeneration with a modular knee implant system. In addition, the RIO system incorporates the following improvements, which we believe allow us to offer the benefits of knee MAKOplasty to more patients:

|

|

|

|

|

|

• |

improved dexterity and range of motion in the robotic arm to allow additional degrees of freedom in the movement of the robotic arm; |

|

|

|

|

|

|

• |

more efficient physical configuration of the patient specific visualization system, robotic arm, customized bone cutting instruments and electronic components; |

|

|

|

|

|

|

• |

support for the RESTORIS MCK knee implant system to enable bicompartmental knee procedures; |

|

|

|

|

|

|

• |

intelligent implant planning features to aid surgeon efforts to achieve optimal patient specific alignments; |

|

|

|

|

|

|

• |

redesign of system components to reduce operating room set up times; |

|

|

|

|

|

|

• |

modular design of certain components for ease of manufacturability and assembly and to make them more accessible for service repairs; and |

|

|

|

|

|

|

• |

sophisticated industrial design and state-of-the art user interface. |

In the fourth quarter of 2008, we received 510(k) marketing clearance for the RIO system, which we commercially launched in the first quarter of 2009. In the third quarter of 2009, we launched version 2.1 of our RIO system, which reflected further refinement of the RIO platform and knee application. In the fourth quarter of 2009, we launched version 2.2 of our RIO system, which enabled surgeons to treat lateral compartment knee arthritis. The modifications present in versions 2.1 and 2.2 did not require the submission of new 510(k) applications. The RIO System was approved for CE Marking in December 2009.

The RESTORIS Family of Knee Implant Systems

The second component of MAKOplasty is the knee implant system that is designed for insertion and cementation in a minimally invasive manner. Prior to the development and commercialization of the MAKO-branded, RESTORIS family of knee implant systems in late 2008, we purchased off-the-shelf unicompartmental tibial inlay and tibial onlay implants from third-party suppliers. Currently, we offer the RESTORIS unicompartmental knee implant system and the RESTORIS MCK multicompartmental knee implant system, for use with the RIO system.

The RESTORIS family of knee implant systems allows an orthopedic surgeon to treat early through mid-stage degenerative osteoarthritis of the knee with a modular implant system. We believe that modular components are key to the successful execution of minimally invasive knee surgeries because they can be more easily inserted into the knee joint through smaller incisions than a single, complete device. They can also be positioned independently to better accommodate the specific contours of the patient’s anatomy. Because of the technical design and programming, only the RESTORIS family of knee implant systems may be used effectively with our RIO systems. In addition, users of the RIO system are contractually required to purchase all implants and disposable products used in MAKOplasty procedures from us.

15

The RESTORIS Unicompartmental Knee Implant System

The classic RESTORIS unicompartmental knee implant system is designed to be used in MAKOplasty procedures for preserving critical tissue and bone to achieve improved outcomes. This RESTORIS system is composed of a rounded, anatomically shaped femoral component that attaches to the sculpted surface of the femur and either a flat tibial inlay polymer component that fits into a “pocket” that has been sculpted in the tibial bone or a tibial onlay insert and baseplate consisting of a flat polymer component that is backed by a metal support. Both the femoral and tibial components are offered in multiple sizes to best accommodate the size and shape of the patient’s knee.

Patients with relatively good tibial bone quality, including a sufficiently thick and appropriately located bed of hardened sclerotic tibial bone, are generally candidates for our RESTORIS inlay implant system. The RESTORIS onlay implant system is designed to accommodate patients who lack tibia sclerotic bone beds of sufficient quality. The metal support is placed horizontally on a planar surface prepared on the tibia using the RIO system, supported by the tibial cortical rim, rather than fitted into a pocket of the tibia. Some surgeons also prefer to utilize the tibial cortical rim support in all cases. In the first quarter of 2006, we received 510(k) marketing clearance for our tibial inlay knee implant system, and in the fourth quarter of 2007, we received 510(k) marketing clearance for our tibial onlay knee implant system and on our combined inlay and onlay system, branded as RESTORIS. Our classic RESTORIS onlay unicompartmental knee implant system was approved for CE marking in January 2010.

|

|

|

|

|

|

|

|

|

Inlay Implant |

|

Onlay Implant |

|

|

|

|

|

|

|

|

|

Post-operative |

|

Post-operative |

|

Inlay Implant |

|

Onlay Implant |

|

Placement |

|

Placement |

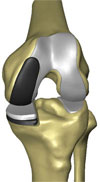

The RESTORIS MCK Multicompartmental Knee Implant System

The RESTORIS MCK multicompartmental knee implant system offers an implant geometry to support the tissue and bone sparing goals of MAKOplasty. Free from the limitations of manual instrumentation, RESTORIS MCK is designed to accurately mimic human anatomy, providing better coverage of diseased compartments while requiring less bone removal and tissue trauma than with traditional treatments.

The RESTORIS MCK system enables surgeons to treat patients suffering from osteoarthritis in any single compartment of the knee joint: the medial (inner), lateral (outer), or patellofemoral (sub-kneecap). The RESTORIS MCK system also enables bicompartmental treatment of the patellofemoral compartment in combination with the medial compartment. Utilizing a modular, bicompartmental system, a surgeon can use the pre- and intra-operative planning software in the RIO system to produce a patient specific implant plan, the result of which is the retention of a greater portion of the knee anatomy than patients treated with a total knee arthroplasty procedure. Surgeons are able to offer inlay and onlay implants medial configurations for both their unicompartmental and bicompartmental procedures. The product offering of the RESTORIS MCK multicompartmental knee implant system also features a patellofemoral component (under the kneecap), which is inset into the knee compartment between the medial and lateral (outer) compartments. Additionally, the surgeon has an array of patella “buttons” to affix to the back of the kneecap to replace the worn surface. In the second quarter of 2008, we received a 510(k) marketing clearance for our novel unicompartmental knee implant and a 510(k) marketing clearance for our patellofemoral knee implant, predecessor components of our proprietary RESTORIS MCK multicompartmental knee implant system. In the fourth quarter of 2008, we received 510(k) marketing clearance from the FDA for our RESTORIS MCK system. The CE marking certification process for the RESTORIS MCK onlay unicompartmental knee implant system is currently ongoing, with approval anticipated in 2010.

16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disposable Products

The RIO system utilizes disposable products such as bone pins and the spheres on the arrays used in our tracking system, irrigation clips and tubes that cool the cutting instruments, drapes to cover the robotic arm and other items that require disposal after each use. Disposables are not only a potential source of recurring revenue, but also an opportunity to differentiate our product platform from those of less comprehensive solutions offered by competitors.

Potential Future Applications

Hip MAKOplasty

We believe that the RIO system has the potential to add clinical and economic value in arthoplasty procedures in the hip joint, and we have directed resources to research and development activities in this area.

Market for Osteoarthritis of the Hip. Similar to the knee joint, osteoarthritis of the hip typically begins with degeneration of the hip joint caused by a local tear in the soft tissue surrounding the acetabulum (hip socket) of the hip or an excessive load on the cartilage caused by impingement conditions between the femur and the acetabulum. The progression of osteoarthritis of the hip can take years, but even in the early stages, it can result in substantial pain for the patient and a reduction in the quality of life. According to iData Data Research, Inc., the total hip replacement market in the U.S. in 2010 is estimated to be greater than 360,000 procedures.

Current Treatment Options for Osteoarthritis of the Hip. The current treatments available for osteoarthritis in the hip joint consist of early intervention, sports medicine procedures to treat soft tissue damage as well as more invasive procedures to treat impingement conditions. Conventional treatment for the replacement of the joint consists of a partial hip replacement where only one side of the joint is replaced (normally utilized for hip fractures), hip resurfacing, which is primarily indicated for male patients under the age of 65, and in late stage conditions, total hip arthroplasty. Total hip arthroplasty is a highly invasive surgical procedure in which a patient’s diseased hip joint is removed and replaced with a manufactured replacement hip joint comprised of several components that attempt to mimic the normal function of the hip joint. The procedure requires a large incision ranging from 6 to 12 inches, which often results in significant pain and an extended recovery time. Unlike the knee joint, the hip joint is covered with significant muscle and fat tissue, preventing direct access to the joint without a large incision.

The traditional total hip replacement implant consists of three main components:

|

|

|

|

|

|

• |

a metal cup and a plastic liner that together replace the acetabulum; |

|

|

|

|

|

|

• |

a metal stem inserted into the femoral canal that replaces the femoral neck; and |

17

|

|

|

|

|

|

• |

a highly polished metal ball that attaches onto the metal stem and replaces the femoral head. |

Despite its history as an established and effective orthopedic procedure, we believe that are several limitations of traditional total hip arthroplasty including malalignment of implant components, dislocation, differences in leg length, implant loosening, femoro-acetabular impingement and the eventual need for implant replacement or revision.

Dislocation, where the ball comes completely out of the replacement cup, is the most common reason for revision total hip surgery. According to The Journal of Bone and Joint Surgery, the national average for dislocation of the hip joint within six months of the primary hip replacement procedure is approximately four percent, or approximately 14,000 procedures, annually.

The current methodologies for measuring a patient’s leg length can result in a discrepancy in the length of a patient’s legs. Clinical studies show that leg length discrepancies may result in back pain, increased risk of nerve injury, dislocation, poor patient satisfaction, and the need for revision surgery. According to a study published in Physiotherapy, a leg length discrepancy of ten millimeters or more is associated with a significantly poorer outcome in terms of the clinical benefits of surgery as well as more than twice the incidence of limping than patients with a leg length discrepancy of ten millimeters or less. One methodology currently used by surgeons to measure leg length involves using a ruler to measure anatomical landmarks on the hip before surgery to assess the patient’s preoperative leg length and then measuring the leg length with the implants in place following surgery to assess the change in the patient’s leg length. Another popular methodology used by surgeons requires the surgeon to line the patient’s legs up on the operating room table to assess the leg length before surgery and then to do the same thing with the hip implants in place after surgery. This method requires the legs to be in the exact same position at the time of both measurements and uses only the surgeon’s eyes and sense of touch to assess the change in leg length. We believe that limitations exist with respect to both of these methodologies.

The MAKOplasty Solution. In February 2010, we received 510(k) marketing clearance from the FDA for an application that assists a surgeon in performing all components of a total hip arthroplasty using the RIO system. We believe a hip MAKOplasty application has the potential to provide a surgeon with the same consistently reproducible precision, accuracy, and dexterity as our knee MAKOplasty solution. The hip application would allow the surgeon to preoperatively plan the placement of the hip implants on a three dimensional image CT scan. The RIO system’s robotic arm would then assist the surgeon in preparing the bone accurately to the surgical plan as well as in the positioning of the hip implant, as opposed to the current method of implant placement which involves the use of mechanical jigs and visual alignment by the surgeon, which we believe may potentially decrease the likelihood and severity of leg length discrepancy.

In the same way that the cutting system of the RIO robotic arm allows for the precise resection of bone in the knee joint, we believe that surgeons will use the robotic arm to accurately prepare the patient’s acetabulum for the metal cup. During the insertion of the final implant, the robotic arm will help the surgeon position the cup at the orientation that was planned by the surgeon on the preoperative CT scan. A study at Massachusetts General Hospital, which was presented at the 39th Annual Course, Advances in Arthoplasty in October 2009, found that sixty percent of the acetabular cups placed by the surgeons in the study using commonly used mechanical jigs were placed outside of the optimal zone for avoiding post-operative dislocation. We believe that a hip MAKOplasty application would provide the surgeon with an accurate preoperative surgical plan, knowledge of the patient’s position on the operating room table and accurate implant sizing. This information would allow the surgeon to seat the implants to a final placement following the plan at a level of accuracy that we believe is extremely difficult to accomplish manually, resulting in placement of the implants in the best position to resist dislocation.

We are currently researching our hip MAKOplasty application and we anticipate that our pre-commercialization research and development efforts will continue through at least 2010.

18

Other Potential Applications

We believe that with further research and development, our robotic arm technology has the potential to serve as a platform technology with applications in other areas of the body, such as the shoulder and spine, and we are currently conducting initial research and development to test the viability of MAKOplasty outside of the knee and hip. Should we elect to commercialize additional potential applications of MAKOplasty outside of the knee and hip, we would seek the appropriate marketing clearance from the FDA and any other required regulatory approvals for such applications.

Sales and Marketing

We continue to expand the size of our sales and marketing organization, which is comprised of a direct sales force to sell RIO systems and to commercialize and market MAKOplasty in the U.S. and independent orthopedic product agents and distributors, who primarily generate RIO system sales leads for us. As of March 1, 2010, our sales and marketing group had a total of 79 employees, including 49 direct sales representatives, who are responsible for sales and marketing activity throughout the U.S and 2 global market and sales development employees, who are responsible for defining and executing our global commercialization strategy. We intend to continue to increase the number of sales and marketing personnel as we expand our business. We are currently developing a global market strategy and we believe that our entry into global markets may include the use of independent distributors to market, sell, and support our products.

A portion of our customers acquire our RIO system through a leasing arrangement with a third-party leasing company. In these instances, we typically sell the RIO system to the leasing company, and our customer enters into an independent leasing arrangement with the leasing company. We treat these leasing transactions the same as sales transactions for purposes of recognizing revenue for the sale.

Our sales and marketing goals are to continue to drive capital equipment sales of the RIO system and generate recurring revenue through sales of implants, disposable products and service contracts. To achieve these goals, we must continue to promote adoption of knee MAKOplasty by leading surgeons and hospitals and build demand for the procedure among patients through the following sales and marketing strategy:

|

|

|

|

|

|

• |

Target High Volume Orthopedic Facilities. Our sales representatives actively target hospitals with strong orthopedic reputations and significant knee replacement and resurfacing practices. We believe that adoption by such leading hospitals helps us to seed the market for MAKOplasty and provides the validation and visibility necessary for more widespread adoption. |

|

|

|

|

|

|

• |

Target Facilities with a Strong Strategic Commitment to Grow an Orthopedic Surgery Service Line. Our sales representatives actively target hospitals that have demonstrated a commitment to expand their orthopedic surgery service line. We believe that these hospitals will benefit from the growth in service associated with treating a large number of patients who, given only conventional surgical alternatives, would have delayed surgery or opted for no surgery at all. |

|

|

|

|

|

|

• |

Establish and Promote MAKOplasty Centers of Excellence. The MAKOplasty Center of Excellence is a joint marketing program that we promote in collaboration with participating hospitals to educate surgeons and patients regarding the benefits of MAKOplasty and to coordinate our public relations strategy. As part of the program, hospitals agree to maintain and provide us with certain clinical and financial data that we use in support of our business case for the MAKOplasty solution. As of December 31, 2009, we entered into 32 co-marketing agreements with hospitals to establish MAKOplasty Centers of Excellence. |

|

|

|

|

|

|

• |

Drive Patient Demand for MAKOplasty. During 2009, we continued our marketing efforts to directly educate patients on the benefits of MAKOplasty. We believe that patients are becoming increasingly more involved in the healthcare decision making process and have the potential to influence the adoption |

19

|

|

|

|

|

|

|

of new procedures such as MAKOplasty. Currently, our representatives primarily support hospitals participating in the MAKOplasty Center of Excellence program in their efforts to publicize the benefits of MAKOplasty and educate patients. |

The generation of recurring revenue through sales of our implants, disposable products and service contracts is an important part of the MAKOplasty business model. We anticipate that recurring revenue will constitute an increasing percentage of our total revenue as we leverage each new installation of the RIO system to generate recurring sales of implants and disposable products. We have designed our products so that our RIO system only works with our implant products and we contractually require purchasers of the RIO system to use only our implants in connection with providing MAKOplasty. We also offer a four-year supplemental service contract that provides enhanced levels of maintenance and support services related to the RIO system beyond the basic warranty period.