Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2009

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-33755

SuccessFactors, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 7372 | 94-3398453 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1500 Fashion Island Blvd., Suite 300

San Mateo, CA 94404

(Address of Principal Executive Offices)

(650) 645-2000

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.001 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10 K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | þ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant at June 30, 2009, based on the closing price of such stock on the NASDAQ Global Market on such date, was approximately $426 million.

The number of shares of the registrant’s common stock outstanding on February 19, 2010, was 71,990,566.

Portions of the registrant’s Proxy Statement relating to the registrant’s 2010 Annual Meeting of Stockholders to be held on or about May 21, 2010 are incorporated by reference into Part III of this Report.

Table of Contents

2009 ANNUAL REPORT ON FORM 10-K

| PART I | ||||

| Item 1. |

3 | |||

| Item 1A. |

17 | |||

| Item 1B. |

29 | |||

| Item 2. |

29 | |||

| Item 3. |

30 | |||

| Item 4. |

30 | |||

| PART II | ||||

| Item 5. |

31 | |||

| Item 6. |

35 | |||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

37 | ||

| Item 7A. |

50 | |||

| Item 8. |

50 | |||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

50 | ||

| Item 9A. |

51 | |||

| Item 9B. |

51 | |||

| PART III | ||||

| Item 10. |

52 | |||

| Item 11. |

52 | |||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

52 | ||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

52 | ||

| Item 14. |

52 | |||

| PART IV | ||||

| Item 15. |

53 | |||

| 80 | ||||

“SuccessFactors,” the SuccessFactors logo, “People Performance,” “SuccessCloud,” “SuccessFactory,” “IdeaFactory,” “SuccessConnect,” and “SuccessFactors University” are trademarks of SuccessFactors. Other service marks, trademarks and tradenames referred to in this report are the property of their respective owners.

2

Table of Contents

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements. All statements contained in this Annual Report on Form 10-K other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors.” In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Annual Report on Form 10-K may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

We cannot guarantee future results, levels of activity, performance or achievements. We are under no duty and do not intend to update any of these forward-looking statements after the date of this Annual Report on Form 10-K to conform these statements to actual results or revised expectations.

Except where the context requires otherwise, in this report “company,” “SuccessFactors,” “we,” “us” and “our” refer to SuccessFactors, Inc., a Delaware corporation, and where appropriate, its subsidiaries.

| Item 1. | Business |

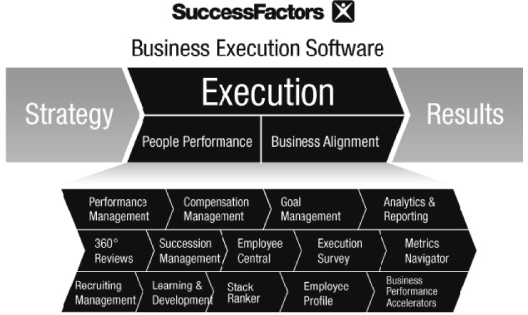

Our Mission

Execution is the difference. It is the critical success factor. But for most companies there is a significant execution deficit. While every company has a strategy, most companies do not execute on their strategy as well as they can or should, for one simple reason: It is just not that easy to get everyone in an organization to take the right actions, at the right time, to produce the right results, every day. That’s where SuccessFactors comes in. We help companies execute effectively on their strategy in two important ways: by making sure everyone in the organization is completely aligned and working on the right things (Business Alignment), and by ensuring every employee is working to his or her full potential (People Performance). We are on a remarkable mission—to help companies close the gap between strategy and execution and help them drive breakthrough business results each and every day.

Our Solution

SuccessFactors is the leading provider of cloud-based Business Execution Software (BizX) solutions to organizations of all sizes, with more than 6 million users across multiple industries and geographies. We strive to delight our customers by delivering innovative solutions, a broad range of content, process expertise and best practices knowledge gained from serving our large and varied customer base. Today we have more than 3,100 customers across more than 60 industries in more than 185 countries using our application suite in 32 languages. Our customer base includes organizations with as few as three and as many as 420,000 end users.

3

Table of Contents

Compared to traditional approaches, our solution offers customers rapid benefits and return on investment, enabling them to:

Key benefits of our solution include:

| • | Tangible Business Impact. Our solutions enable our customers to bridge the execution gap between strategy and achieving results by systematically aligning human resources to organizational strategy and optimizing workforce performance. By optimizing workforce performance and ensuring the collective efforts of their people are aligned to business strategy, we help customers achieve superior business results by: |

| • | communicating strategy changes more quickly; |

| • | increasing time spent on strategic priorities; |

| • | increasing the rate of project completion; |

| • | increasing the number of high performers and decreasing the number of low performers; and |

| • | increasing overall productivity. |

| • | Core Performance Management and Goal Management to Drive Business Results. We designed our solution around our core Goal Management and Performance Management modules because we believe they serve as the foundation for the two key components of effective business execution: Business Alignment and People Performance. |

| • | Organically Built, Not Just Functionally Integrated, Modular Suite. We built our modules organically using the same code base so that customers can provide their employees with a common user experience, leverage common data and processes, and easily add modules over time. |

| • | Continuous Customer-Driven Development. We capture and incorporate best practices knowledge we gain from interactions with our customer base. Our customer-centric development focus, together with our cloud-based model, have enabled us to release significant enhancements several times a year over the past seven years. |

| • | Ease-of-Use Drives Adoption. Our user interface is designed to be highly intuitive, requiring limited training for end users. |

4

Table of Contents

| • | Relentless User-Centric Innovation. We focus on end users across all business functions and strive to deliver business applications that are as engaging as popular consumer web applications by incorporating features and content such as real-time coaching, goal and performance review writing assistants, personal dashboards and best-practice wizards. |

| • | Highly Configurable Cloud-based Application Suite. Our cloud-based application suite requires no installation of software or equipment on premises, which significantly reduces the costs and risks of traditional enterprise software. Our scalable solution is highly configurable, allowing customers to tailor their deployment to reflect their identity, unique business processes, and existing forms and templates. We believe our architecture allows us to offer a more flexible, scalable, and secure service offering at a lower cost than other cloud-based vendors. |

| • | Broad Applicability Within Organizations of All Sizes and Industries. Our solution is designed to be used by all employees at all levels within an organization, and we offer multiple editions to meet the needs of organizations of all sizes. |

| • | Integration with Third-Party Applications through the Cloud. Our SuccessCloud initiative allows third-party applications and data from other business systems to connect and integrate with the SuccessFactors Business Execution Software Suite. This enables customers to get the most from their existing technology investments and tap a broad ecosystem of SuccessFactors partners to enable effective business execution. |

Our Application Suite

We offer a suite of Business Execution Software applications, delivered over the Internet, that enable organizations to optimize business alignment and the performance of their people to drive business results. Our modules utilize a single code base and reside on a multi-tenant architecture. To address the varied needs of different-sized organizations, we market different editions of our application suite:

| • | Enterprise. For organizations with 2,500 or more employees, we offer Enterprise Edition. Enterprise Edition is our most fully-featured offering, providing functionality and configurability that can scale to support the complex needs of large, global enterprises with tens to hundreds of thousands of employees. |

| • | Mid-Sized Business. For organizations with 501 to 2,499 employees, we offer SuccessPractices. Mid-sized organizations typically need a robust solution but may not require the advanced functionality of our Enterprise Edition. Each of the SuccessPractices modules is pre-configured with best-practice workflows, form templates and other content tailored for the needs of mid-sized organizations and designed to allow for rapid implementations. |

| • | Small Business. For organizations with 50 to 500 employees, we offer Professional Edition. Small businesses typically need an automated solution but may not require the more advanced functionality of our other editions. Professional Edition includes modules pre-configured with the best practices of smaller organizations. |

| • | Emerging Business. For organizations with fewer than 50 employees, we offer our Express Edition, an out-of-the-box performance review solution. Express Edition is a web-based, user-friendly system that can be rolled out instantly, without implementation support. |

We offer the following modules as part of our application suite:

Performance Management. Our Performance Management module streamlines the performance appraisal process and transforms the often rushed and tedious performance review process into an ongoing method of tying employee performance to business results. The module is highly configurable, allowing customers to design performance review templates and workflows that best meet their needs. Performance Management also delivers

5

Table of Contents

rich content that enables managers to provide meaningful and productive feedback to their subordinates. Performance Management is tightly integrated with our other modules, allowing organizations to:

| • | assess performance accurately, allowing for goal adjustments in real time; |

| • | set relevant development goals based on accurate competency assessments; |

| • | compensate employees based on objective performance evaluations; |

| • | assess key performance data as part of the succession planning process; and |

| • | understand characteristics of strong performance to optimize recruiting. |

Goal Management. Our Goal Management module supports the process of creating, monitoring and assessing employee goals across the organization. Goal Management allows executives and managers to align employee goals to the priorities of the organization. Customers can improve overall employee performance and agility by using Goal Management to focus employees on shared goals as these goals evolve. Goal Management can continually track progress against high-level strategic goals across the organization. Goal Management is tightly integrated with our other modules, allowing organizations to:

| • | design competency development programs based on skills needed to achieve key goals; |

| • | evaluate individual performance against agreed upon goals; |

| • | make merit increase and bonus distribution decisions based on accomplishment of goals; |

| • | make informed succession planning decisions based on historical goal attainment data; and |

| • | expedite on-boarding of newly-hired employees with clearly articulated goals. |

Compensation Management. Our Compensation Management module helps our customers establish a pay-for-performance culture. Compensation Management facilitates the processes of merit pay adjustments, bonus allocations and distribution of stock-based awards. It also includes a variable pay management component that takes overall organizational and department performance into account in making individual compensation decisions. Compensation Management supports multiple currency conversion capabilities, which is particularly critical for customers with a global presence. Compensation Management is tightly integrated with our other modules, allowing organizations to:

| • | influence employee engagement and thereby goal attainment by supporting a pay-for-performance culture; |

| • | directly link compensation distribution decisions to tracked performance; |

| • | access compensation history to inform succession management decisions; |

| • | allocate compensation based on skill development and anticipated performance; and |

| • | design hiring requisitions based on compensation guidelines. |

Succession Management. Our Succession Management module provides real-time visibility into an organization’s talent pool from senior executives to individual contributors. This allows customers to plan for staffing changes by identifying key contributors throughout the organization and providing current profiles and readiness rankings for each candidate. This process enables customers to proactively develop and assure the readiness of employee talent at all levels. Succession Management is tightly integrated with our other modules, allowing organizations to:

| • | improve talent readiness in anticipation of evolving business goals and strategies; |

| • | incorporate employee development activities into the succession planning process; |

| • | view history of employee performance and assessments of potential as part of succession planning decisions; |

6

Table of Contents

| • | adjust compensation based on succession planning decisions; and |

| • | identify gaps in internal talent to optimize external recruiting. |

Learning and Development. Our Learning and Development module aligns learning activities with an employee’s competency gaps required to achieve key goals. This allows customers to avoid costly, non-strategic training programs while facilitating the attainment of skills required for current and future job requirements. Learning and Development is tightly integrated with our other modules, allowing organizations to:

| • | consider development accomplishments as part of compensation decisions; |

| • | link employee career development goals with succession planning activities; |

| • | take organizational competency data into account when planning for external hiring; |

| • | include competency assessments and development plans in performance reviews; and |

| • | ensure that employees have the skills required to execute on strategic objectives. |

Recruiting Management. Our Recruiting Management module streamlines the process of identifying, screening, selecting, hiring and on-boarding job applicants. Hiring managers can identify talent gaps and initiate the process of creating hiring requisitions based on organizational needs. These detailed hiring requisitions can automatically be passed through a customer’s internal approval process and routed to the appropriate internal or external recruiters. Recruiting Management is tightly integrated with our other modules, allowing organizations to:

| • | improve hiring effectiveness for better execution of organizational goals; |

| • | identify performance expectations for newly-hired employees; |

| • | predefine compensation benchmarks for employees in newly-hired positions; |

| • | expose hiring needs as part of periodic succession planning sessions; and |

| • | predefine development programs for newly-hired employees. |

Employee Central. Our Employee Central module provides the single point to manage HR-related employee information, enable employees to collaborate and share information across the organization, and empower business leaders to leverage key talent insights to make better business decisions. Some key capabilities include robust core HR data management and process automation, HR reporting and compliance, rich aggregate employee profile information, collaboration tools like tagging, badges and directory search, and talent search, which puts key talent information at the fingertips of managers and executives.

Our application suite also includes:

Analytics and Reporting. Our Analytics and Reporting capability provides visibility into key performance and talent data across the organization. Executives can access global views of the entire organization’s performance data, including goal status, performance review ratings and compensation in real time. This capability offers insights to critical performance management trends through clear and easy-to-understand dashboards that summarize results while also linking to underlying data. All data can be seamlessly exported to spreadsheets for additional offline analysis.

Employee Profile. Our Employee Profile capability aggregates employee profile information, such as work experience and educational background, and stores it in a centralized, master data repository that can be accessed at any time by authorized personnel. When more of our modules are used, the richness of data on each employee builds in the Employee Profile, making it increasingly robust and valuable. Each employee’s information can easily be accessed via an intuitive employee directory search capability. Employee Profile allows users to create relevant tags making it easier for anyone to identify them based on work-related activities or functions.

7

Table of Contents

360-Degree Review. Our 360-Degree Review capability supports the collection of feedback from an employee’s peers, subordinates and superiors. Once collected, the feedback can be aggregated, providing a comprehensive view of an employee’s strengths, weaknesses and areas of improvement. This capability allows for an insightful and comprehensive assessment of employees, resulting in a better understanding of competency gaps and development needs.

Employee Survey. Our Employee Survey capability provides management with actionable insights to help them separate the perception from the reality of what matters most to employees. It provides managers with a fast and efficient way to fine-tune initiatives, solidify workgroup alignment, take the pulse of their teams or quickly gain perspective on employee engagement, satisfaction, and other relevant employee data. Our Business Transformation Services team often works with customers to help them interpret survey results and recommend actions to ensure overall organizational success.

Stack Ranker. Our Stack Ranker capability lets managers quickly assess and create a visual and intuitive stack ranking of their teams across detailed criteria—in real time—to identify top and lower performers. Whether performing talent reviews or ad hoc assessments, Stack Ranker gives managers a powerful tool to optimize their teams by, for example, enabling them to target limited rewards to top employees that deserve extra recognition, or quickly identify low performers to let go when faced with difficult layoff decisions.

Business Performance Accelerators. Our Business Performance Accelerators offering helps organizations get the most out of their people to drive business performance by ensuring effective interactions with employees at key inflection points throughout the employee lifecycle. Customers can take advantage of one or more of the components that make up our Business Performance Accelerator offering that, in aggregate, facilitate effective on-boarding and off-boarding, ensure compliance with company and industry regulations, and enable managers to take swift corrective action and optimize their teams.

Proprietary and Third-Party Content. Our application suite incorporates proprietary and third-party content that is tailored to a wide range of business roles and industries. This content provides customers with valuable insights and information to increase the effectiveness of their performance and talent management. For example, we have proprietary libraries for competencies, goals, job descriptions, skills, surveys and wage data, and other content such as:

| • | Writing Assistant for performance and 360-degree reviews, which helps eliminate “writer’s block” and facilitates creating concise, meaningful feedback for employees; |

| • | Coaching Advisor, which enables managers to proactively provide relevant coaching and support for their subordinates based on identified competency gaps; |

| • | SuccessFactors Coach, which integrates coaching and mentoring into an employee’s daily routine; and |

| • | Interview Question Library, which helps hiring managers interview effectively and facilitates a standard approach to talent assessment and selection. |

Professional Services

Our professional services team’s mission is to deliver on the Business Execution solutions value proposition by helping our customers rapidly achieve the best results from our solution. With our cloud-based model, we have eliminated the need for lengthy and complex technology-focused tasks such as customizing code, deploying equipment, and managing unique network and application environments for each customer. Instead, we focus on business and HR best practices and business process review. Our implementation consultants are experienced performance management and HR professionals, rather than computer programmers, and many of them hold PhDs, MBAs and other advanced degrees.

Implementation Services. Our implementation services consultants, who are aligned by market segment, use our proprietary implementation methodology to implement our solution quickly and effectively. For small and mid-sized customers, our solution can be configured in a matter of days or weeks. Our implementation approach

8

Table of Contents

is based upon best practice templates that give customers flexibility within a proven configuration framework. For our larger customers, implementations typically take a few months. Our experienced project managers partner with customers to successfully manage projects using our proven project methodology. Most of our projects are priced on a fixed-fee basis, which reduces the risk of implementation cost overruns often associated with on-premise software. We also provide follow-on services, including end-user training and business transformation services.

SuccessFactors University. SuccessFactors University provides training to enhance the end-user experience and drive business results for our customers. We offer a variety of packaged training content, such as course curricula, training guides and reference materials. We offer courses online or in person at customer locations. Our training professionals will also work with customers to develop tailored curricula and materials to suit their specific needs.

Business Transformation Services. We leverage our understanding of business and HR best practices to help customers gain additional business value from our solution. Example services include developing and implementing change management programs, defining metrics-based processes for performance and talent management, and guiding executive teams on goal setting and goal cascading.

Customer Support

We relentlessly pursue customer success and satisfaction. We believe this has significantly contributed to our maintaining a greater than 90% customer retention rate during 2008 and through 2009.

At the center of our customer success effort is our Customer Success Organization. Staffed with skilled SuccessFactors product professionals, this team provides post-implementation support services that assist customers by answering functionality questions and resolving issues they may encounter. Our focus is on ensuring effective and successful use of SuccessFactors’ suite of Business Execution solutions.

Customers can choose between our Standard and Platinum support program options. Our Standard support program is included as part of the basic subscription fee. This includes assistance from our knowledgeable support staff during normal business hours, as well as access to many online resources. Our Platinum support program provides enhanced support services, including 24x7x365 access to our support staff, and offers a proactive relationship with planning and review meetings, demonstration of new product functionality, and proactive alignment with our customers’ business execution objectives.

To ensure we deliver consistent and reliable support services, we leverage sophisticated technology systems for customer and case management, performance analytics, online service, and telephone response. In addition, we have developed proprietary customer adoption and usage monitoring mechanisms that help us proactively engage with customers to ensure they are getting value from our solutions. We provide our customers an online platform to reliably submit, update, and manage service requests. Our support services offerings are global and leverage phone, email, and online communication channels. Customer satisfaction surveys and key performance metrics are reviewed regularly to ensure that we maintain a high level of responsiveness and satisfaction.

9

Table of Contents

Customers

As of December 31, 2009, we had approximately 3,100 end customers of all sizes in over 60 industries. The following table sets forth a representative list of some of our largest end customers by industry category, based on number of end users:

| Consumer |

Energy |

Financial Services | ||

| Cadbury Schweppes Plc Coca-Cola Enterprises Inc. LG Electronics PepsiCo Whirlpool Corporation |

American Electric Power Services Corp. Duke Energy Republic Services United States Steel Vale Inco Technical Services Limited |

Mellon Bank N.A MetLife Insurance Company Morgan Stanley & Co. Incorporated The Toronto—Dominion Bank Wachovia (a Wells Fargo company) | ||

| Government and Education |

Healthcare |

Life Sciences | ||

| Corinthian Colleges Inc. Jet Propulsion Laboratory Kaplan Inc. Montgomery County Maryland United Nations Development Programme |

Baylor Health Care System GGNSC Administrative Services LLC Henry Ford Health System Inova Health System Sutter Health |

Allergan, Inc. Becton, Dickinson Pfizer, Inc. Sanofi-Aventis U.S. LLC Takeda Pharmaceutical Company Limited | ||

| Manufacturing |

Retail |

Telecommunications and Technology | ||

| Baker Hughes Flextronics International USA Inc. General Motors Corporation Ingersoll Rand Company Textron Inc. |

Harris Teeter Inc. LensCrafters, Inc. Pep Boys-Manny, Moe & Jack Sears, Roebuck and Co. The Gap Inc. |

EMC Corporation Nokia Siemens Networks Oy Orange Personal Communication Services Rogers Communications Inc. Symantec Corporation | ||

Sales and Marketing

We sell our application suite primarily through our global direct sales organization. Our sales force is organized by geographic regions, including North America, Latin America, Europe and the Middle East, and Asia Pacific. We further organize our sales force into teams focused on selling to specific customer segments, based on the size of our prospective customers, such as small, mid-sized and enterprise, as well as vertical industry, to provide a higher level of service and understanding of our customers’ unique needs. We work with channel partners, including leading global human resources outsourcing vendors, such as Ceridian Corporation and International Business Machines Corp., or IBM, who resell our application suite. For 2008 and 2009, revenue through third-party resellers grew from $7.9 million to $9.4 million and accounted for approximately 7% and 6% of our total revenue respectively.

We generate customer leads, accelerate sales opportunities and build brand awareness through our marketing programs. Our marketing programs target HR executives, technology professionals, senior line-of-business leaders, and corporate or institutional executives. Like our sales teams, our marketing team and programs are organized by geography, company size and industry segment to focus on the unique needs of customers within the target markets. Our principal marketing programs include:

| • | field marketing events for customers and prospects; |

| • | participation in, and sponsorship of, user conferences, trade shows and industry events; |

| • | customer programs, including user meetings and our online customer community; |

| • | online marketing activities, including direct email, online web advertising, pay-per-click, blogs and webinars; |

| • | public and analyst relations; |

| • | cooperative marketing efforts with partners, including joint press announcements, joint trade show activities, channel marketing campaigns and joint seminars; |

10

Table of Contents

| • | use of our website to provide product and company information, as well as learning opportunities for potential customers; and |

| • | inbound lead generation representatives who respond to incoming leads to convert them into new sales opportunities. |

We host SuccessConnect user conferences globally, where customers both participate in and deliver a variety of programs designed to help accelerate business performance through the use of our application suite. The conferences feature a variety of prominent keynote and customer speakers, panelists and presentations focused on businesses of all sizes, across a wide range of industries. The events also bring together partners, customers and other key participants in the human resources area to exchange ideas and best practices for improving business performance. Attendees gain insight into our product plans and participate in interactive sessions that give them the opportunity to express opinions on new features and functionality.

Strategic Relationships

An important element of our strategy is establishing deep relationships with key industry leaders to enable the widespread adoption of our application suite. We have established a network of relationships that expand our capabilities in multiple areas, such as: distribution of our solution through resellers and referral partners; implementation and consulting services through professional services and consulting organizations; and expanded features and functionality through content and product partners. This approach enables us to focus on our core competencies while, at the same time, providing additional value to our customers.

Outsourcing and Distribution Relationships

We have a network of third parties that resell our application suite directly, refer customer prospects to us and assist our internal sales force. These include leading global human resource outsourcing vendors such as Ceridian, Hewitt Associates and IBM. Outsourcing partners allow customers that desire to outsource multiple HR processes to leverage the benefits of our solution.

Consulting and Implementation Relationships

We work with leading human resources consulting firms to expand our delivery capabilities as well as to offer additional value-added services. These include relationships with industry leaders such as Hewitt Associates, IBM, Mercer Human Resources Consulting LLC, Aasonn, LLC, and Learn2Perform, Inc. dba SystemLink, and PriceWaterhouseCoopers Japan.

Content and Product Relationships

We have relationships with leading content and product companies that complement our solution by making specialized content and functionality available to our customers. These include competency vendors such as Development Dimensions International, Inc., ITG Competency Group, LLC, Lominger International (a Korn/Ferry company), and Personnel Decisions International Corp. We also have integration relationships with vendors of complementary products, such as eQuest LLC, GeoLearning, Inc., HireRight Inc. and Xactly Corporation, that provide additional functionality, such as job boards, learning management systems, background check services, and sales incentive compensation solutions.

Technology

Our solution was architected from the outset to be cloud-based multi-tenant, highly scalable, highly secure, highly configurable and high performance, in order to rapidly deliver value to our customers. Customers can access our solution via a standard web browser without requiring any changes in their network or IT infrastructure.

11

Table of Contents

In designing our solution, we set out to achieve a number of goals. First, the technology had to be highly scalable to accommodate customer growth while continuing to provide high application availability. Second, the data and transactions had to be highly secure, using advanced security technologies and protocols. Third, the solution architecture had to be multi-tenant, allowing us to maintain only one current release that all of our customers use, eliminating the overhead associated with software upgrades or migrations common to many on-premise or other hosted software environments. Fourth, the solution had to allow for rapid response times during heavy usage.

Our solution is architected to deliver a user experience that feels highly customized without requiring custom code changes. Many customers can be configured in a few days or weeks as compared to the months that may be required for traditional enterprise software implementations, allowing the customer to quickly start using our solution. Since our solution is easy to configure, our professional services personnel are not programmers but rather performance and talent management specialists who can focus on providing value to customers.

Our solution is also designed to satisfy strict security requirements. In addition to including extensive roles and permissions capabilities and audit histories of transactions, our architecture segregates each customer’s data from other customers’ data. This data segregation also allows our solution to easily scale horizontally at the database level by load balancing customer instances across database servers.

We use a hybrid approach to our multi-tenant database architecture, which we believe is unique compared to other cloud-based, multi-tenant applications. While the core of the approach is multi-tenant with identical database table schemas for each customer, we leverage the self-describing attributes of XML to abstract many of the unique customer data requirements into an object model. While all of the data is stored in a standard RDBMS, the table structure itself is simplified, with all of the core entity data self-described within an XML-based object model. This approach allows for a highly-configurable user experience, allowing customers to provide their users with a web-based performance and talent management system that is familiar and easy to adopt because it can mimic the layout of a prior paper-based system. Users can also enter goals, tasks, targets and milestones into different goal plan templates and layouts, all while leveraging a common permission control model for access to public and private goals within their organization. This approach also allows us to interface with services across a service oriented architecture, or SOA, environment. With our approach, we are able to retain the scalability advantages of a multi-tenant model with identical schemas while still offering customers the ability to benefit from a highly configurable application. As a result, customers can benefit from lower costs as compared to on-premise software, while at the same time achieving higher levels of configurability than we believe are achievable with other cloud-based architectures.

Another key feature of our application architecture is its ability to understand the hierarchical structure of employee relationships within an organization. This is essential for a performance and talent management application, but difficult to accomplish using traditional flat table-based database software applications, which must traverse the entire employee hierarchy in order to effectively query across the dataset using standard SQL. Our proprietary implementation of a “Left/Right Algorithm” allows our solution to optimize these queries and quickly search and retrieve hierarchical data. This approach allows managers to cascade goals to team members and allows each team member to personalize these goals for their particular goal plan, all while the system seamlessly maintains the relationship between the original and cascaded goals in the employee hierarchy.

We are standardized on the J2EE technology stack with the majority of our software written in industry-standard software programming languages, such as Java. We also make extensive use of Web 2.0 technologies, such as AJAX and Flash, for improved usability and performance and to deliver a rich and highly interactive experience. Our hardware consists primarily of industry standard web servers, application servers, database servers and storage and networking equipment. We support recent versions of major web browsers on major operating systems.

12

Table of Contents

Development

We work closely with our customers and user community to continually improve and enhance our existing offerings and develop new modules and features. Our overall SuccessFactory development approach focuses on rapid innovation and development in order to quickly deliver the features most desired by our customers. SuccessFactory emphasizes collaboration with customers and throughout all areas of our organization in the development process. A key part of this focus is our IdeaFactory, which resides on our web-based Customer Community portal and allows customers and employees to suggest, collaborate on and vote on new features and functionality. This input drives many of the development plans and priorities of our engineering team. We also conduct frequent user meetings, maintain a customer advisory board, and offer other events to provide customers with the opportunity to provide ideas and feedback in our collaborative development process.

Our engineering process is based on a combination of three methodologies: traditional “waterfall” for long-term product release planning; a SCRUM development methodology for agility—supporting our frequent release process and fast reaction to urgent customer and market needs; and the “Extreme Programming” methodology to focus on rapid development, tight connection to business requirements, and quality. Leveraging our multi-tenant platform architecture, we can quickly introduce new features across our entire customer base without the need for customers to install or implement any software.

Our research and development expenses were $16.7 million in 2007, $23.1 million in 2008 and $24.4 million in 2009.

Operations

We serve our customers and end users from four secure data centers—two located in the United States and two in Europe. Physical security features at these facilities include a 24x7x365 manned security station and biometric and man-trap access controls. The systems at these facilities are protected by firewalls and encryption technology. Operational redundancy features include redundant power, on-site backup generators, and environmental controls and monitoring.

We employ a wide range of security features, including two-factor authentication, data encryption, encoded session identifications and passwords. We contract with specialized security vendors to conduct regular security audits of our infrastructure. We also employ outside vendors for 24x7x365 managed network security and monitoring. Every page we serve is delivered encrypted to the end user via a Secure Socket Layer, or SSL, transaction. We also use encryption technology in our storage systems and backup tapes.

We continuously monitor the performance of our application suite using a variety of automated tools. We designed our infrastructure with built-in redundancy for key components. Our network includes firewalls, switches and intrusion detection systems, and incorporates failover backup for maximum uptime. We load balance at each tier in the network infrastructure. We also designed our application server clusters so that servers can fail without interrupting the user experience, and our database servers are clustered for failover. We regularly back up and store customer data on-site and off-site in secure locations to minimize the risk of data loss at any facility.

Competition

The overall market for business execution solutions is nascent and therefore fragmented, rapidly evolving and highly competitive, with relatively low barriers to entry in some segments.

Within the business execution market, the most common type of competitive solution consists of paper-based processes or desktop software tools that are not specifically designed for performance and talent management. We also face competition from custom-built software that is designed to support the needs of a single organization, and from third-party human resource application providers. These software vendors include, Authoria, Inc., Cornerstone OnDemand, Inc., Halogen Software Inc., Kenexa Corporation, Oracle Corporation, Plateau Systems, Ltd., Salary.com, Inc., SAP AG, Softscape, Inc., StepStone Solutions, SumTotal Systems Inc., Taleo Corporation, and Workday, Inc.

13

Table of Contents

We expect that the competitive landscape will change as the market for performance and talent management software and services consolidates and matures.

We believe the principal competitive factors in our industry include the following:

| • | total cost of ownership; |

| • | breadth and depth of product functionality; |

| • | brand awareness and reputation; |

| • | ease of deployment and use of solutions; |

| • | level of integration, configurability, security, scalability and reliability of solutions; |

| • | ability to innovate and respond to customer needs rapidly; |

| • | size of customer base and level of user adoption; |

| • | ability to integrate with third-party applications; and |

| • | the level of sales, marketing and financial resources. |

We believe we compete favorably with respect to most of these factors. However, some of our competitors and potential competitors have substantially greater name recognition, longer operating histories, larger marketing budgets and significantly greater resources. They may be able to devote greater resources to the development, promotion and sale of their products and services than we can to ours, which could allow them to respond more quickly and effectively to new technologies and changes in customer needs. Additionally, our competitors may offer or develop products or services that are superior to ours or that achieve greater market acceptance.

Intellectual Property

We rely upon a combination of patent, copyright, trade secret and trademark laws and contractual restrictions, such as confidentiality agreements and licenses, to establish and protect our proprietary rights. We currently have one issued U.S. patent. Although we rely on patent, copyright, trade secret and trademark laws to protect our technology, we believe that factors such as the technological and creative skills of our personnel, creation of new modules, features and functionality and frequent enhancements to our solution are more essential to establishing and maintaining a technology leadership position.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or obtain and use our technology to develop products with the same functionality as our solution. Policing unauthorized use of our technology is difficult. The laws of other countries in which we market our application suite may offer little or no effective protection of our proprietary technology. Our competitors could also independently develop technologies equivalent to ours, and our intellectual property rights may not be broad enough for us to prevent competitors from selling products incorporating those technologies. Reverse engineering, unauthorized copying or other misappropriation of our proprietary technology could enable third parties to benefit from our technology without paying us for it, which would significantly harm our business.

We expect that software in our industry may be subject to third-party infringement claims as the number of competitors grows and the functionality of products in different industry segments overlaps. Such competitors could make a claim of infringement against us with respect to our application suite and underlying technology. Third parties may currently have, or may eventually be issued, patents upon which our current solution or future technology infringe. Any of these third parties might make a claim of infringement against us at any time.

Employees

We utilize our application suite to recruit and manage our team throughout our entire organization, which we believe has significantly helped us build a team with superior skills, competencies and aptitude. As of December 31, 2009, we had 664 employees. None of our employees is represented by a labor union or is covered by a collective bargaining agreement. We consider our relations with our employees to be good.

14

Table of Contents

Executive Officers

The following table provides information regarding our executive officers and key employees as of February 26, 2010:

| Name |

Age | Position(s) | ||

| Lars Dalgaard |

42 | Founder, Chief Executive Officer, President and Director | ||

| Bruce C. Felt, Jr |

51 | Chief Financial Officer | ||

| Paul L. Albright |

47 | General Manager, Small and Mid-Sized Business Unit and Chief Marketing Officer | ||

| Luen Au |

36 | Chief Technology Officer | ||

| James B. Larson |

51 | Vice President, Global Enterprise Sales | ||

| Julian K. Ong |

43 | Vice President, General Counsel and Secretary | ||

| Randall J. Womack |

45 | Chief Information Officer and Vice President, Operations | ||

| Victoria A. Bernholz |

56 | Chief People Officer |

Lars Dalgaard founded SuccessFactors in May 2001 and has served as a director and our President and Chief Executive Officer since May 2001. From 1994 to 1998, Mr. Dalgaard served in various general management positions at Unilever N.V., a global packaged consumer and industrial goods company, in the Netherlands, Germany and Denmark. From 1991 until 1993, Mr. Dalgaard held various positions at Novartis (formerly known as Sandoz), a pharmaceutical company, including Sales Representative, Product Manager and Corporate Finance Controller, in the United States and Switzerland. Mr. Dalgaard holds a B.A. from Copenhagen Business School, Denmark and an M.S. from Stanford University Graduate School of Business as a Sloan Fellow.

Bruce C. Felt, Jr. has served as our Chief Financial Officer since October 2006. From February 2005 through August 2006, Mr. Felt served as Chief Financial Officer of LANDesk Software, Inc., a security and systems management software company. Mr. Felt’s responsibilities at LANDesk included financial management. Subsequent to LANDesk’s acquisition by Avocent Corp. in August 2006, Mr. Felt was retained by Avocent through February 2007 on a transitional basis to manage certain matters. From April 1999 to February 2005, Mr. Felt served as Chief Financial Officer of Integral Development Corporation, an on-demand software company. Mr. Felt holds a B.S. in accounting from the University of South Carolina and an M.B.A. from Stanford University Graduate School of Business.

Paul L. Albright has served as our General Manager, Small and Mid-sized Business Unit and Chief Marketing Officer since July 2007. From September 2004 to February 2007, Mr. Albright served as Senior Vice President, Worldwide Marketing at Network Appliance, Inc., a data management solutions company. Mr. Albright’s responsibilities at Network Appliance included marketing management. From January 2004 to September 2004 and from 1995 to 1998, Mr. Albright was Executive Vice President, Channel Sales and Chief Marketing Officer at Informatica Corporation, an enterprise data software company. From January 2003 to December 2003, Mr. Albright was CEO-in-Residence at Greylock Partners, a venture capital firm. From October 1998 to December 2002, Mr. Albright served as President, Chief Executive Officer and Chairman of the Board of Directors at SeeCommerce, a performance management software company. Mr. Albright holds a B.S. in information (computer) sciences and a B.A. in management from James Madison University.

Luen Au has served as our Chief Technology Officer since February 2009 and was our Vice President, Engineering since September 2006. From May 2001 to September 2006, Mr. Au served in a number of engineering roles, including Director of Engineering and Senior Director of Engineering. Mr. Au holds a B.A. in computer science from the University of California, Berkeley.

James B. Larson has served as our Vice President, Global Enterprise Sales since September 2007. From June 2000 until January 2007, Mr. Larson served in various positions at Mercury Interactive Corporation, an

15

Table of Contents

enterprise software company, most recently as Senior Vice President of Worldwide Field Operations, including following the acquisition of Mercury Interactive by Hewlett-Packard Company. Mr. Larson’s responsibilities at Mercury Interactive included sales management. Prior to Mercury Interactive, Mr. Larson held various sales and management positions at various technology companies, including Siebel Systems, Inc. and Oracle Corporation. Mr. Larson holds a B.A. in economics from Harvard College and an M.B.A. from the Anderson School of Management at the University of California, Los Angeles.

Julian K. Ong has served as our Vice President, General Counsel and Secretary since August 2006. From September 2002 to July 2006, Mr. Ong served in various capacities in the legal department of salesforce.com, inc., an on-demand customer relationship management application company, most recently as Deputy General Counsel. Mr. Ong’s responsibilities at salesforce.com included legal support. From January 2000 to August 2002, Mr. Ong was an associate at the law firm of Skadden, Arps, Slate, Meagher & Flom LLP. Mr. Ong holds a B.S. and an M.S. in electrical engineering from Stanford University and a J.D. from Boalt Hall School of Law at the University of California, Berkeley.

Randall J. Womack has served as our Chief Information Officer and Vice President, Operations since April 2003. From May 2000 to April 2003, Mr. Womack served as a partner in the Fast Forward Group at Greylock Partners, a venture capital firm. Prior to that, from 1997 to May 2000, Mr. Womack served as Chief Information Officer of Digital River, Inc., an e-commerce ASP company. Mr. Womack attended the University of Texas at Austin.

Victoria A Bernholz has served as our Chief People Officer since September 2009. From December, 2005 to August, 2009, Ms. Bernholz was with Gap, Inc. as the VP of HR Operations and the VP of Field HR. Ms. Bernholz’s responsibilities at Gap included human resources management. Prior to that, Ms. Bernholz was with Wild Oats, Inc. and held various business and human resources positions at the early stages of Blockbuster Video, Boston Market, and Waldo’s Dollar Mart de Mexico. Ms. Bernholz holds a B.S. in psychology from the University of Houston and an M.B.A. from the University of Dallas.

AVAILABLE INFORMATION

You can access financial and other information at our Investor Relations website. Our website is located at www.successfactors.com/investor. We make available free of charge on our web site our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file them with or furnish them to the SEC. Information contained on our web site is not part of this Annual Report on Form 10-K or our other filings with the SEC.

The charters of our Audit Committee, our Compensation Committee, and our Nominating and Corporate Governance Committee, as well as our Code of Business Conduct and Ethics, are available on the Investor Relations section of our website under Corporate Governance. This information is also available by writing to us at the address on the cover of this Annual Report on Form 10-K.

16

Table of Contents

| Item 1A. | Risk Factors |

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this annual report, including the consolidated financial statements and the related notes included elsewhere in this annual report. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects could be materially and adversely affected. In that event, the market price of our common stock could decline and you could lose part or even all of your investment.

The risks and uncertainties described below are not the only ones facing us. Other events that we do not currently anticipate or that we currently deem immaterial also may affect our results of operations and financial condition.

We have a history of losses and we may not achieve or sustain profitability in the future.

We have incurred significant losses in each fiscal period since our inception in 2001. We experienced a net loss of $12.6 million for the year ended December 31, 2009. At December 31, 2009, we had an accumulated deficit of $218.9 million. The losses and accumulated deficit were due to the substantial investments we made to grow our business and acquire customers. Despite recent moderation in spending, we still expect to incur significant operating expenses in the future due to our investment in sales and marketing, research and development expenses, and operations costs, expenses related to stock-based compensation and acquisition related charges arising from the purchase of Inform Business Impact (“Inform”) and therefore we may continue to incur losses for the foreseeable future. In pursuing acquisitions, it is also likely that our operating expenses will increase. Furthermore, to the extent we are successful in increasing our customer base, we could also incur increased losses because costs associated with generating customer agreements are generally incurred up front, while revenue is generally recognized ratably over the term of the agreement. You should not consider our historic revenue growth as indicative of our future performance. Accordingly, we cannot assure you that we will achieve profitability in the future or that, if we do become profitable, we will sustain profitability.

Current uncertainty in global economic conditions makes it particularly difficult to predict demand and other related matters and makes it more likely that our actual results could differ materially from expectations.

Our operations and performance depend on worldwide economic conditions, which have deteriorated significantly in the United States and other countries, and may remain depressed for the foreseeable future. These conditions make it difficult for our customers and potential customers to accurately forecast and plan future business activities, and are causing our customers and potential customers to slow or reduce spending on our application suite. Furthermore, during these challenging economic times, our customers face issues gaining timely access to sufficient credit and decreasing cash flow, which are impacting their willingness to make purchases and their ability to make timely payments to us. We cannot predict the timing, strength or duration of the economic slowdown or any subsequent economic recovery, worldwide, in the United States, or in our industry. These and other economic factors are having an adverse effect on demand for our application suite, including new bookings and renewal and upsell rates, on our ability to predict future operating results, and on our financial condition and operating results.

Because we recognize revenue from our customers over the term of their agreements, downturns or upturns in sales may not be immediately reflected in our operating results.

We recognize revenue over the terms of our customer agreements, which typically range from one to three years, with some up to five years. As a result, most of our quarterly revenue results from agreements entered into during previous quarters. Consequently, a shortfall in demand for our application suite in any quarter may not significantly reduce our revenue for that quarter, but could negatively affect revenue in future quarters. In

17

Table of Contents

particular, if such a shortfall were to occur in our fourth quarter, it may be more difficult for us to increase our customer sales to recover from such a shortfall as we have historically entered into a significant portion of our customer agreements during the fourth quarter. In addition, we may be unable to adjust our cost structure to reflect this potential reduction in revenue. Accordingly, the effect of significant downturns in sales of our application suite may not be fully reflected in our results of operations until future periods. Our subscription model also makes it difficult for us to rapidly increase our revenue through additional sales in any period, as revenue from new customers must be recognized over the applicable subscription term.

Because we recognize revenue from our customers over the term of their agreements but incur most costs associated with generating customer agreements upfront, rapid growth in our customer base will result in increased losses.

Because the expenses associated with generating customer agreements are generally incurred up front, but the resulting revenue is recognized over the life of the customer agreement, increased growth in the number of customers will result in our recognition of more costs than revenue in the earlier periods of the terms of our agreements even though the customer is expected to be profitable for us over the term of the agreement.

Our business depends substantially on customers renewing their agreements and purchasing additional modules or users from us. Any decline in our customer renewals would harm our future operating results.

In order for us to improve our operating results, it is important that our customers renew their agreements with us when the initial contract term expires and also purchase additional modules or additional users. Our customers have no obligation to renew their subscriptions after the initial subscription period, and we cannot assure you that customers will renew subscriptions at the same or higher level of service, if at all. Although our renewal rates have been high historically and above 90% for 2009, some of our customers have elected not to renew their agreements with us, and some are declining to renew as a result of the global economic slowdown. Moreover, under some circumstances, some of our customers have the right to cancel their agreements prior to the expiration of the term. Our customers’ renewal rates may decline or fluctuate as a result of a number of factors, including their satisfaction or dissatisfaction with our application suite, pricing, the prices of competing products or services, mergers and acquisitions affecting our customer base, the effects of economic downturns, including the current global economic recession, and global economic conditions, or reductions in our customers’ spending levels. If our customers do not renew their subscriptions, renew on less favorable terms or fail to purchase additional modules or users, our revenue may decline, and we may not realize significantly improved operating results from our customer base.

We have recently launched our business execution strategy and this strategy may not result in additional customers or revenues.

We recently launched our business execution product and marketing strategy in order to expand our reach beyond the People Performance solutions market. We did this in part, because we believe that the market for business execution software presents a significantly larger potential market opportunity than the market for People Performance solutions. This belief is based on a number of assumptions that may vary materially from actual future results. These assumptions include user adoption by a substantial majority of the estimated current worldwide work force, with estimated long-term per user rates that are significantly higher than the current average per user rates. The business execution solutions market is an emerging market, and therefore, its ultimate size and any share of this new market that we might obtain is inherently unpredictable and will likely be impacted by, among other factors, the breadth and depth of our solutions, the productivity enhancements realized by customers using these solutions and emergence of competitive solutions. It is possible that our assumptions and estimates as to market size could be incorrect and inaccurate or otherwise not come to fruition, in which case we may not realize the benefits of this anticipated market opportunity. Accordingly, you should not place undue reliance on these estimates.

18

Table of Contents

We are still developing a full suite of business execution solutions, and we will need to develop or acquired additional software solutions as well as content and best practices knowledge. Accordingly, we intend to continue to invest heavily in sales and marketing and product development and intend to pursue acquisitions to implement and execute on this strategy. These activities have required significant time and attention of our management and employees. We expect to incur significant expenses to pursue this strategy. We cannot assure you that these efforts will result in significant additional customers, revenues or profitability. Moreover, these efforts may adversely impact our existing business by diverting management attention and other resources. If we are not successful in these efforts, or if the market does not develop as we anticipate, our business will not grow as we expect and our future operating results could be negatively affected.

The market in which we participate is intensely competitive, and if we do not compete effectively, our operating results could be harmed.

The market for business execution applications is fragmented, rapidly evolving and highly competitive, with relatively low barriers to entry in some segments. Many of our competitors and potential competitors are larger and have greater name recognition, much longer operating histories, larger marketing budgets and significantly greater resources than we do, and with the introduction of new technologies and market entrants, we expect to intensify in the future. If we fail to compete effectively, our business will be harmed. Some of our principal competitors offer their products or services at a lower price, which has resulted in pricing pressures. If we are unable to achieve our target pricing levels, our operating results would be negatively impacted. In addition, pricing pressures and increased competition generally could result in reduced sales, reduced margins, losses or the failure of our application suite to achieve or maintain more widespread market acceptance, any of which could harm our business.

We face competition from paper-based processes and desktop software tools. We also face competition from custom-built software that is designed to support the needs of a single organization, and from third-party human resources application providers. These software vendors include, without limitation, Authoria, Inc., Cornerstone OnDemand, Inc., Halogen Software Inc., Kenexa Corporation, Oracle Corporation, Plateau Systems, Ltd., Salary.com, Inc., SAP AG, Softscape, Inc., StepStone Solutions, SumTotal Systems Inc., Taleo Corporation and Workday, Inc.

Many of our competitors are able to devote greater resources to the development, promotion and sale of their products and services. In addition, many of our competitors have established marketing relationships, access to larger customer bases and major distribution agreements with consultants, system integrators and resellers. Moreover, many software vendors could bundle human resources products or offer them at a low price as part of a larger product sale. In addition, some competitors may offer software that addresses one or a limited number of strategic human resource functions at lower prices or with greater depth than our application suite. As a result, our competitors might be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or customer requirements. Further, some potential customers, particularly large enterprises, may elect to develop their own internal solutions. For all of these reasons, we may not be able to compete successfully against our current and future competitors.

We recently entered into an agreement to acquire a company and expect to acquire other companies or technologies, which could divert our management’s attention, result in additional dilution to our stockholders and otherwise disrupt our operations and harm our operating results.

We recently entered into an agreement to acquire Inform, and we expect to acquire or invest in other businesses, products or technologies that we believe could complement or expand our application suite, enhance our technical capabilities or otherwise offer growth opportunities. The pursuit of potential acquisitions may divert the attention of management and cause us to incur various expenses in identifying, investigating and pursuing suitable acquisitions, whether or not they are consummated.

19

Table of Contents

There are inherent risks in integrating and managing corporate acquisitions, and the Company has limited experience with acquisitions. If we acquire additional businesses, we may not be able to integrate the acquired personnel, operations and technologies successfully, or effectively manage the combined business following the acquisition. We also may not achieve the anticipated benefits from the acquired business due to a number of factors, including:

| • | unanticipated costs or liabilities associated with the acquisition; |

| • | incurrence of acquisition-related costs, which would be recognized as a current period expense under FASB Accounting Standards Codification (“ASC”) 805-20, Business Combinations; |

| • | diversion of management’s attention from other business concerns; |

| • | harm to our existing business relationships with business partners and customers as a result of the acquisition; |

| • | the potential loss of key employees; |

| • | use of resources that are needed in other parts of our business; and |

| • | use of substantial portions of our available cash to consummate the acquisition. |

In addition, a significant portion of the purchase price of companies we acquire may be allocated to goodwill and other indefinite lived intangible assets, which must be assessed for impairment at least annually. In the future, if our acquisitions do not yield expected returns, we may be required to take charges to our operating results based on this impairment assessment process, which could harm our results of operations.

Acquisitions could also result in dilutive issuances of equity securities or the incurrence of debt, which could adversely affect our operating results. In addition, if an acquired business fails to meet our expectations, our operating results, business and financial condition may suffer.

Although we have entered into an agreement to acquire Inform, the closing of this acquisition is subject to a number of closing conditions, including an audit of Inform’s financial statements. Accordingly, we cannot assure you as to when this acquisition will be completed. In addition, we cannot assure you that we will realize the anticipated benefits of this acquisition.

If our security measures are breached or unauthorized access to customer data is otherwise obtained, our application suite may be perceived as not being secure, customers may curtail or stop using our application suite, and we may incur significant liabilities.

Our operations involve the storage and transmission of our customers’ confidential information, and security breaches could expose us to a risk of loss of this information, litigation, indemnity obligations and other liability. If our security measures are breached as a result of third-party action, employee error, malfeasance or otherwise, and, as a result, someone obtains unauthorized access to our customers’ data, including personally identifiable information regarding users, our reputation will be damaged, our business may suffer and we could incur significant liability. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed and we could lose potential sales and existing customers.

Because our application suite collects, stores and reports personal information of job applicants and employees, privacy concerns could result in liability to us or inhibit sales of our application suite.

Many federal, state and foreign government bodies and agencies have adopted or are considering adopting laws and regulations regarding the collection, use and disclosure of personal information. Because many of the features of our application suite collect, store and report on personal information, any inability to adequately address privacy concerns, even if unfounded, or comply with applicable privacy laws, regulations and policies, could result in liability to us, damage our reputation, inhibit sales and harm our business.

20

Table of Contents

Furthermore, the costs of compliance with, and other burdens imposed by, such laws, regulations and policies that are applicable to the businesses of our customers may limit the use and adoption of our application suite and reduce overall demand for it. Privacy concerns, whether or not valid, may inhibit market adoption of our application suite in certain industries.

We have experienced rapid changes in our organization in recent periods. If we fail to manage these changes effectively, we may be unable to execute our business plan, maintain high levels of service or adequately address competitive challenges.

We have experienced rapid changes in our headcount and operations in recent periods. For example, we grew from 188 employees at December 31, 2005 to 664 employees as of December 31, 2009. We have increased the size of our customer base from 341 customers at December 31, 2005 to approximately 3,100 customers at December 31, 2009. In addition, Inform has approximately 120 employees and locations in Australia, the UK and the U.S. The growth in our customer base has placed, and any future growth will place, a significant strain on our management, administrative, operational and financial infrastructure. Our success will depend in part on our ability to manage these changes effectively. We will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. Failure to effectively manage organizational changes could result in difficulty in implementing customers, declines in quality or customer satisfaction, increases in costs, difficulties in introducing new features or other operational difficulties, and any of these difficulties could adversely impact our business performance and results of operations.

Failure to adequately expand and ramp our direct sales force and develop and expand our indirect sales channel will impede our growth.

We will need to continue to optimize our sales and marketing infrastructure in order to grow our customer base and our business. We plan to continue to expand and ramp our direct sales force and engage additional third-party channel partners, both domestically and internationally. Identifying and recruiting these people and entities and training them in the use of our application suite require significant time, expense and attention. This expansion will require us to invest significant financial and other resources. We typically have no long-term agreements or minimum purchase commitments with any of our channel partners, and our agreements with these channel partners do not prohibit them from offering products or services that compete with ours. Our business will be seriously harmed if our efforts to expand and ramp our direct sales force and expand our indirect sales channels do not generate a corresponding significant increase in revenue. In particular, if we are unable to hire, develop and retain talented sales personnel or if new direct sales personnel are unable to achieve desired productivity levels in a reasonable period of time, whether due to the global economic slowdown or for other reasons, we may not be able to significantly increase our revenue and grow our business.

The market for our application suite depends on widespread adoption of business execution.