Attached files

| file | filename |

|---|---|

| 8-K - SHARING ECONOMY INTERNATIONAL INC. | v175752_8k.htm |

| EX-99.2 - SHARING ECONOMY INTERNATIONAL INC. | v175752_ex99-2.htm |

| EX-99.1 - SHARING ECONOMY INTERNATIONAL INC. | v175752_ex99-1.htm |

Corporate Presentation

February 2010

1

Safe Harbor Statement

Safe Harbor Statement Under the Private Securities Litigation Reform Act

of 1995: Any statements set forth in this presentation that are not

historical facts are forward-looking statements that involve risks and

uncertainties that could cause actual results to differ materially from

those in the forward-looking

statements, which may include, but are not

limited to, such factors as unanticipated changes in product demand,

increased competition, downturns in the economy, failure to comply with

specific regulations pertaining to government projects, fluctuation

of

revenue due to the nature of project lifecycles, and other information

detailed from time to time in the Company filings and future filings with

the United States Securities and Exchange Commission. The forward-

looking statements contained

in this presentation are made only of this

date, and the Company is under no obligation to revise or update these

forward-looking statements.

2

Wind Industry Dynamics In China

There is the potential for China to invest $200 billion in wind turbine components and

projects through 2020

The Chinese government has substantially increased its goal for installed wind

energy capacity by 2020, during the past two years. Since 2008, the goal has

increased from 20 GW to 30 GW to 120 GW and,

most recently in July 2009, to 150 GW

China is expected to surpass the United States as the world’s largest market for wind

turbines

The Chinese government recently announced the $17.6 billion, 20 GW “Three Gorges

Wind Power” project in Northwest China

China’s wind power industry is expected to reach 30 GW of capacity by 2010

China’s current renewable energy usage rate is 16% and the Chinese government

recently increased its goal for 2020 to 23%, which is similar to European targets

The Chinese government will offer bank loans with subsidized interest rates to wind

farm operators

3

Wind Power Propels Our Business Model

China needs to add nearly 9x the amount

of electricity generation as the United

States does

-International Energy Agency

Chinese investment in coal-fired power

projects declined by 11% while

investment in wind power increased by

44% in 2009

-National Energy Administration

(China)

“Total power generation in China is on

track to pass the United States in 2012.”

-The New York Times, January 2010

5MW wind turbine by REpower

4

Forged Steel

Components

Where We Fit in Wind Power

China is a world leader in the advancement of wind power

The Chinese government invested approximately $111 billion in power construction

projects in 2009

Wind turbines contain highly technical components that are creating a supply

bottleneck

China Wind Systems has demonstrated solid execution of its business plan by

becoming a key supplier of many wind-power components, in which end users are

international wind power players

Fabrication

Assembly

Yaw Bearings, Blades,

Gearbox and Other Parts

Wind Turbine

Grid Connection

End User

Wind Farm

5

Interior of Wind Turbine Unit

Source: U.S. Department of Energy

% Cost Breakdown of A Windmill

Component

Percent

Blade

19%

Electrical Control System

16%

Gearbox

15%

Tower (flanges)

9%

Generator

8%

Hub

7%

Yaw System

5%

Spare Parts

5%

Nacelle

4%

Main Shaft

4%

Central Monitoring/Control System

3%

General Assembly

3%

Hydraulic System

2%

Source: Morgan Stanley Research

*We supply forged products for wind power components

6

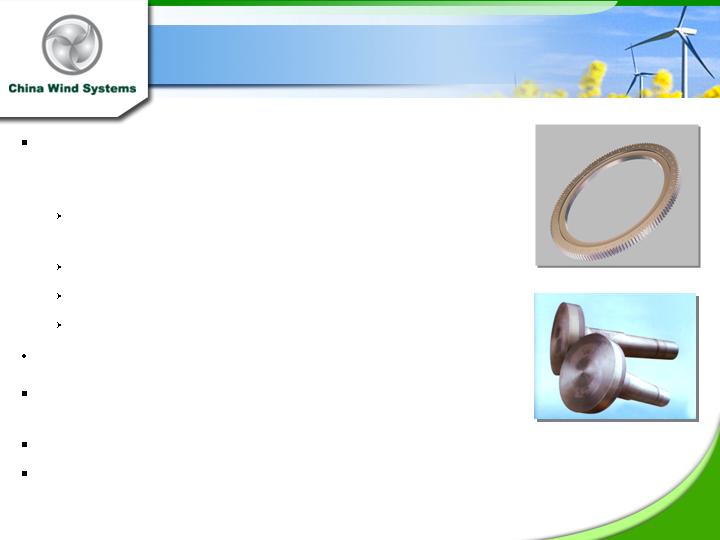

Began in-house manufacturing of shafts, flanges, shafts

and forged rolled rings for gear rims and other applications

in March 2009

Rings =6.3 meters in diameter, for use in wind turbines up to

5 MW

Shafts used in 1MW-3MW wind turbine units

Gear rims for use in gearboxes

Flanges for tower

Mature industrial equipment and forged product

manufacturer

Quality metal fabricator of components for heavy machinery

industries

Time-tested innovative engineers and skilled technicians

State-of-the-art (108,000 SF) forging facility focused on wind

industry commenced operations in March 2009

Company Overview

Gear Rim

gear rim

unfinished shaft

7

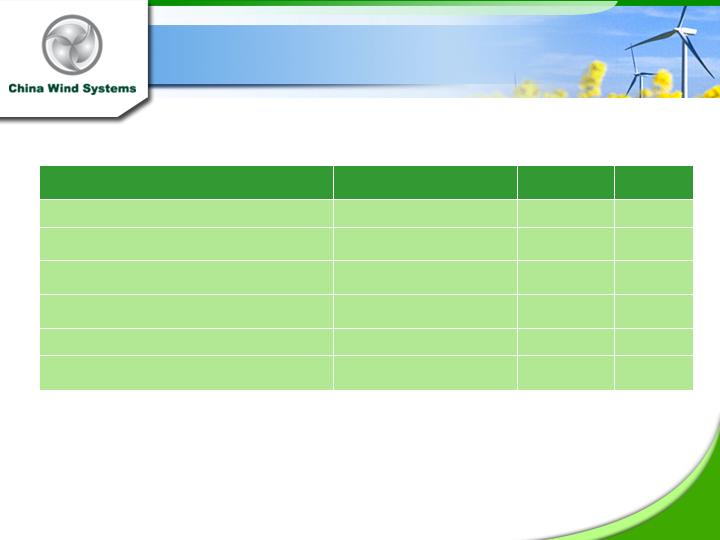

Leveraging Growth on the Wind Power

Industry

Original Facility

Forged Products Facility

Upgrades to Forged

Product Facility

Products

Rolled rings up to 3 meters

diameter

Rolled rings up to 6.3 meters

diameter rolled rings, flanges,

shafts, and gear rims

Electro-slag Re-

melted forged

products

Equipment Installation

None

Jan 08 - Feb 09

Oct 2009- March 2010

Production Start

April 2007

March 2009

March 2010

Design Capacity

8,500 tons of rolled rings

40,000 tons of rolled rings,

flanges, shafts and gear rims

6,000 tons

Expected Gross Margins

22%

28%-30%

35%-40%

Actual Capacity @

Design Capacity (Annual in tons) *

45,000

100%

50%

ESR forged products 100%

Total Tonnage Output

40,000

20,000

6,000

Average Price/Tonnage (2008 RMB)

10,000

10,000

25,000-30,000

Revenue (RMB)

400,000,000

200,000,000

180,000,000

Exchange Rate

6.8

6.8

6.8

Revenue (in USD)

58,823,529

29,411,765

26,354,319

Average Gross Margin %

30%

28%

37%

Gross Profit (in USD)

17,647,058

8,235,294

9,751,098

8

First Mover Advantage Keeps Us Ahead of the Curve

Competitive Advantages:

Employ axial-close die forging technology to produce

high precision products that reduces material

consumption by 35% leading to surface flatness,

excellent mechanical strength, high flexibility,

and full

automatic operation

Prime location in Jiangsu Province near major

transportation routes enables cost-savings

Growing national network of customers

Strong management capability to accelerate company’s

leadership role in the industry and leverage 15 years of

manufacturing expertise

Received ISO9001 in July 2009, covering machining and

related service of shaft-shaped forging, ring forging,

tubular forging and component assembly

9

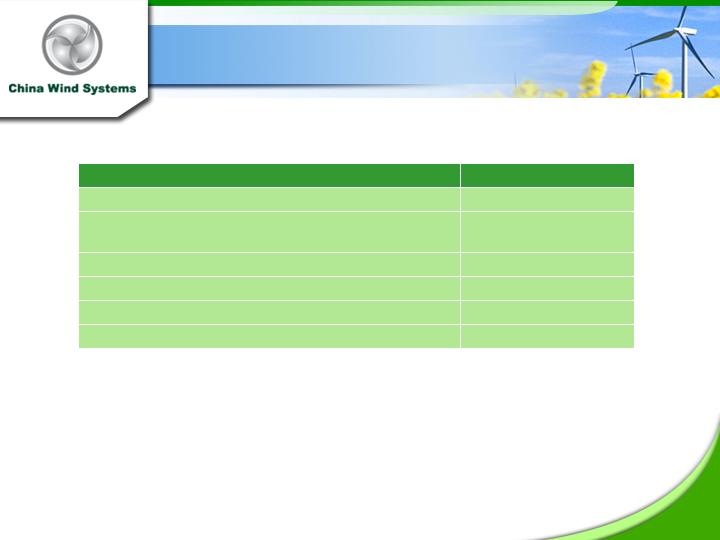

Leveraging Existing Wind Customer Base

Name of Company

Product

End

Product

Chengxi Shipyard Co., Ltd

2009 New Customer

Flanges

Wind tower

Shenyang Heavy Machinery

2009 New Customer

Gear rim, shaft,

Flanges

Power

plants

Zhongxin Heavy Machinery Group

2009 New Customer

Rolled rings

Flanges

Wuxi Lida Gear Manufacturing Co., Ltd

2009 New Customer

Rolled Rings

Yaw

bearing

Hangzhou Advance Gearbox Group Co., Ltd

2009 New Customer

Gear rims

Gearbox

Gansu Keyao Electrical Manufacturing Co., Ltd

2009 New Customer

Flanges

Flanges for

wind tower

6 New Wind Customers In 2009

10

Strategic Move to Focus on Electro-Slag Remelted

(ESR) Forged Products

ESR technology is used to increase the durability and quality of

steel material used particularly for components in high precision

yaw bearings

Inadequate supply of high quality precision forged products in the

large-sized wind turbine sector in China has created an industry

bottleneck

Well positioned to reap the high margin opportunity supplying

superior quality, high performance forged products starting March

2010

At full manufacturing capacity of 6,000 tons per year, gross

margin is expected to reach 37%

Signed preliminary agreement to supply 12,000 tons of ESR

forged products over 2.5 years

11

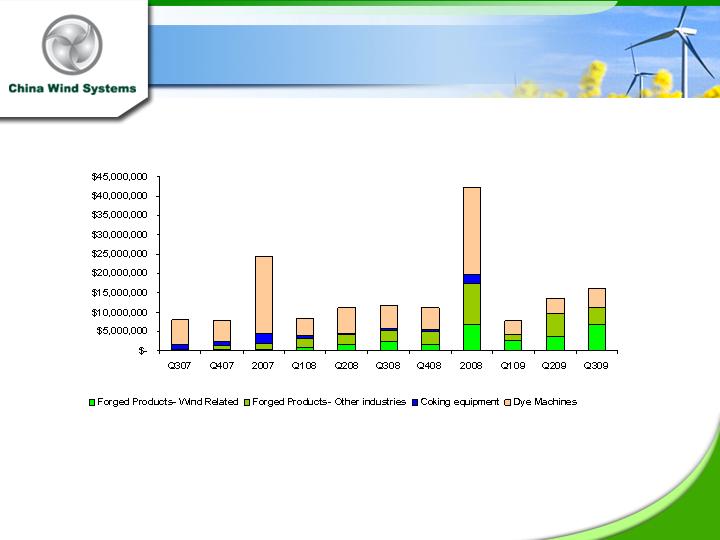

Revenue Breakdown

12

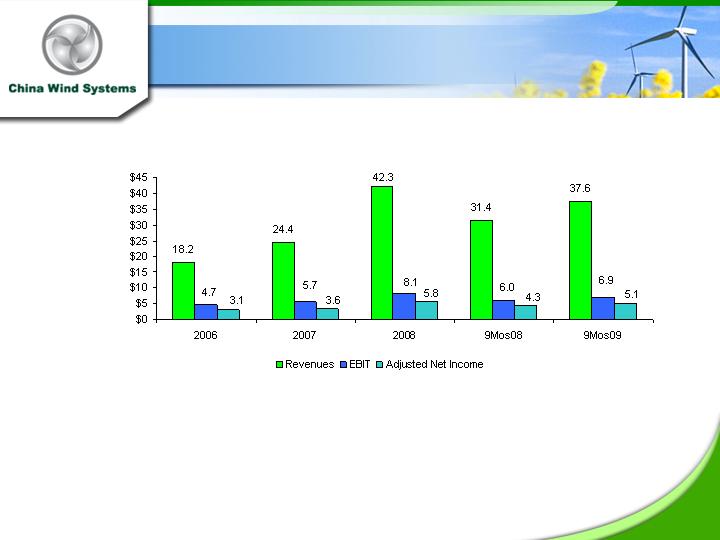

Strong Annual Growth

Notes: $ figures in millions

Income tax rate: 33%, 2005-2007; 25%, 2008

2007 net income before and after-tax exclude, $6.7 MM in one-time tax benefit, Q3, 2007

2008 net income before and after tax net income exclude non-cash charges of $2.3M related to amortization of debt discount to interest expense and non-

cash charge of $2.9 MM, related to deemed preferred dividend

related to issuance of stock warrants upon conversion of convertible debt to series A

preferred stock in Q1 08.

2009 net income before and after tax exclude non-cash charges of $0.2 MM related to amortization of debt discount and interest expense and a non cash

charge of $0.5 MM related to deemed preferred dividend related

to issuance of stock warrants upon conversion of convertible debt to series A in preferred

stock

13

One of the few Chinese wind industry players publicly

traded in the U.S.

Potential to capitalize on China’s projected $200 billion

wind industry components market

Excellent industry dynamics where installed wind power is

targeted by the Chinese government to grow from 20 GW in

2009 to 150 GW by 2020

Transforming into a leading supplier of wind power

components to address the rapidly growing wind industry

in China and the world.

State-of-the-art manufacturing facility focuses on

manufacturing forged products for wind power industry

Experienced management team with successful track

record to build China Wind Systems into a world-class

organization

Investment Highlights

Hydraulic press

wind turbine

14

Experienced Executive Team

Mr. Jianhua Wu, Chairman / CEO

Mr. Wu is the Founder and CEO of the Huayang Companies and has more than 20 years of machinery manufacturing experience. He holds a certificate in Mechanical Engineering and

is a founding member of the China

Wind Association.

Ms. Teresa Zhang, CFO

Prior to joining China Wind Systems Ms. Zhang served as an auditing manager since July 2005 at GC Alliance HK CPA, an international accounting, taxation and advisory services firm

in Beijing. From January 2003

to June 2005, Ms. Zhang served as a liaison officer for the Australian-Chinese Friendship Business Association. From July 2000 to September 2002, Ms.

Zhang was an auditor at Ernst & Young in Beijing, China. Ms. Zhang is a Certified Practising Accountant

in Australia. She earned her bachelor’s degree in international accounting from

Renmin University in China and her master’s degree in accounting from Macquarie University in Australia

Mr. Adam Wasserman, CPA, Vice President of Financial Reporting

Mr. Wasserman is the CEO of CFO Oncall, Inc., an accounting consulting firm. Mr. Wasserman holds CFO titles for Transax International Ltd, since May 2005, Lotus Pharmaceuticals,

Inc. since October

2006 and Gold Horse Intl. Inc. since July 2007. He earned a B.S. in Accounting from the State University of New York, Albany.

Mr. Ryan Hua, VP / Operations

Prior to joining China Wind Systems Mr. Hua was a Partner at Wuxi Zhong Qiang Heavy Machinery, Inc. Previously, he was a General Manager at Zhong Qiang Heavy Machinery Inc.

and Assistant Electrical

Engineer at Huayang Companies. Mr Hua holds a B.S. from Nanjing University of Science and Technology.

Mr. Chen Yao Hong, Chief Engineer

Mr. Hong has previous experience in optical Instrument design and radar design and holds a certificate of Mechanical Engineering and a BS in Mechanical Design.

Mr. Bo Xiong Shen, Director / Business Development

Mr. Shen has 28 years experience with progressive responsibilities including Technician Technology Innovation Manager, Director of External Economic Affairs, and General Manager

of Import and Export at Nanjing

Machine Tools Corp. He has in-depth experience in manufacturing large size mechanical bearings and gearbox; Mr. Shen holds a certificate as a Sr.

Mechanical Engineer and received a B.S. from Beijing University in Mechanical Technology.

Drew Bernstein, Independent Director

Mr. Bernstein serves as Chairman of the Audit Committee of China Wind Systems. He co-founded Bernstein & Pinchuk LLP (B&P) in 1983. His early recognition of the global

marketplace and his extensive

travel in the People's Republic of China (“PRC”) resulted in the aggressive expansion of the firm’s services to the PRC. Mr. Bernstein received his BS

degree from the University of Maryland Business School, is licensed in the State of New

York, Connecticut, California, Texas and Maryland and is a member of the AICPA, the

NYSSCPA and the NSA.

Megan Penick, Independent Director

Ms. Penick serves on the Company’s audit and compensation committees. Ms. Penick is an attorney, licensed to practice in New York State, and the owner of Penick & Associates

LLC, which provides

corporate governance consulting. She focuses on working with United States and China-based companies and their boards to develop corporate governance best

practices. She received her J.D. from New York Law School and is fluent in both Mandarin and English.

15

Contact

Company Contact:

China Wind Systems, Inc

Teresa Zhang, Chief Financial Officer

No. 9 Yanyu Middle Road

Quinzhou Village, Huishan District,

Wuxi City, Jiangsu Province, PRC

Tel: (86) 138 1194 8079

E-mail: teresa.zhang@chinawindsystems.com

Investor Relations:

CCG Investor Relations, Inc

Crocker Coulson, President

1325 Avenue of Americas

Suite 2800

New York, NY 10019

Tel: (646) 213-1915

E-mail: crocker.coulson@ccgir.com

Legal Contact:

Asher S. Levitsky P.C.

Sichenzia Ross Friedman Ference LLP

61 Broadway

New York, NY 10006

Telephone: (212) 981-6767

E-mail: ALevitsky@srff.com

External Auditors:

Sherb & Company, LLP

1900 NW Corporate Boulevard

Suite E210

Boca Raton, FL 33431

Tel: (561) 886-4200

16

Appendix I: Equity Snapshot

Ticker (NASDAQ): CWS

Price (2/16/2010): $5.63

Market Cap: $86.7 mil

Revenues (ttm): $48.5 mil

Net Income (ttm)*: $6.5 mil

Diluted Shares Outstanding**: 15.4 mil

Diluted EPS (ttm)*: $0.30

P/E (ttm)**: 18.8x

P/S (ttm): 1.8x

*TTM net income and diluted eps exclude non-cash charges of $0.2 MM related to amortization of debt discount and interest expense and a non cash charge

of $0.5 MM related to deemed preferred dividend related to issuance of stock warrants upon conversion of convertible debt to series A in preferred stock Q3 2009

*Diluted weighted average shares for the 9 months ended Sept 30, 2009, adjusted for a one-for-three reverse stock split

17

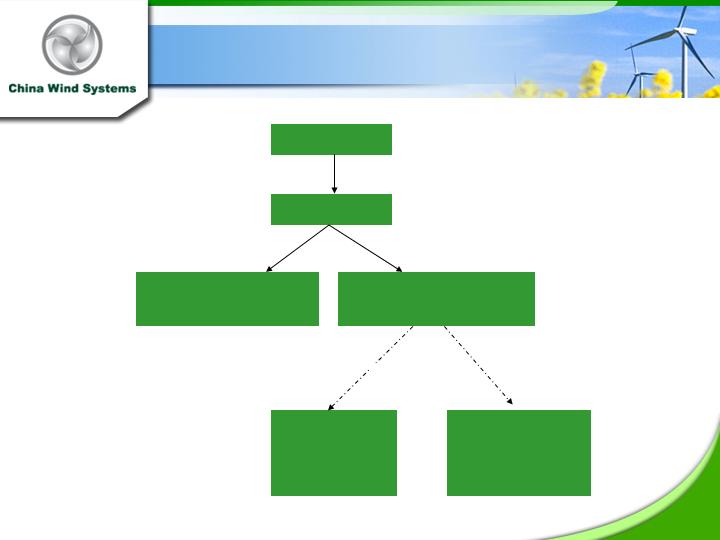

Appendix II: Corporate Structure

CWS

Fulland Ltd.

Green Power Environmental

Technologies Co., Ltd

(“Green Power”)

Wuxi Fulland Wind Energy

Equipment Co., Ltd

(“Wind Power”)

100%

100%

100%

Wuxi Huayang Dye

Machine Co., Ltd.

(“Huayang Dye

Machine”)

Contractual

Arrangement

WFOE

WFOE

Wuxi Huayang

Electrical Power

Equipment Co., Ltd

(Huayang Electrical

Power Equipment)

Contractual

Arrangement

18

3,061,903

Shares issuable upon exercise of warrants at $1.70

Share Type

Number of Shares

Common shares issued and outstanding

15,406,842

Common shares issuable upon conversion of series A

preferred stock

4,819,696

Shares issuable upon exercise of warrants at $1.20

2,243,599

Shares issuable upon exercise of warrants at $1.50

133,333

Total

25,665,373

*As of September 30, 2009. All amounts adjusted for a 1 for 3 reverse split.

Appendix III: Capitalization Structure*

19

Appendix IV: Summary Balance Sheet

($ in thousands) 9/30/09 12/31/08

(Unaudited) (Audited)

Cash and Cash Equivalents $1,159 $329

Current Assets 10,967 7,586

Total Assets 45,972 37,332

Current Debt 1,359 1,021

Total Liabilities 6,277 4,406

Total Stockholders’ Equity 39,695 32,925

20

Appendix V: Summary Income Statement

Source: Company’s SEC filings

^Net income, EPS excludes $0.5 MM in non-cash deemed preferred dividend related to issuance of 1.1 million preferred shares in Q309

* Net income, EPS exclude $2.3 million in non-cash interest expenses, amortization of debt issuance cost and non-cash $2.9 million

deemed preferred dividend

** Net income, EPS exclude one-time income net of $6.7 million related to forgiveness of VAT and income taxes, Q3, 2007

($ in thousands, except per share data) FYE, Dec 31

(audited)

Q3 09 Q3 08 YoY% 2008 2007 YoY%

Revenues $16,132 $11,770 37.1% $42,285 $24,418 73.2%

Gross Profit 3,889 2,954 31.7% 10,545 7,052 49.5%

Operating Income 3,420 2,470 38.5% 8,063 5,662 42.4%

Net Income 2,498^ 1,861 34.3% 5,829* 3,603** 61.8

Diluted EPS $0.09^ $0.08 $0.09* $0.09**

Gross Margin 24% 25% 24.9% 28.9%

Operating Margin 21% 21% 19.1% 23.2%

21

Weighted average diluted shares, 23,506,936 for three months ended September 30,2009 and 22,396,370 for three months ended

September 30, 2008

$ 0.08

$ 1,860,862

$ 0.11

$ 2,498,437

Adjusted Amount of Net Income available to Common Shareholders

-

-

0.02

462,000

Deemed dividend to preferred stockholders

Adjustment

$ 0.08

$ 1,860,862

$ 0.09

$ 2,036,437

Amount per consolidated statement of operations

Diluted

EPS

Net Income

Diluted EPS

Net Income

2008

2009

For the Three Months ended September 30,

`

Weighted average diluted shares, 21,969,692 for nine months ended September 30,2009 and 12,878,103 for three months ended

September 30, 2008

$ 0.33

$ 4,307,614

$ 0.23

$ 5,085,030

Adjusted Amount of Net Income available to Common Shareholders

-

0.01

128,000

Non-cash interest from debt conversion

-

21,429

-

-

Amortization of debt issuance costs

0.18

2,264,000

32,000

Non-cash interest from amortization of debt discount

0.22

2,884,062

0.02

462,000

Deemed dividend to preferred stockholders

Adjustment

$ (0.07)

$ (861,877)

$ 0.20

$ 4,463,030

Amount per consolidated statement of operations

Diluted

EPS

Net Income

Diluted EPS

Net Income

2008

2009

For the Nine Months ended September 30,

Appendix VI: Adjusted Financial

Reconciliation Data

22