Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - China TransInfo Technology Corp. | exh312.htm |

| EX-32.2 - EXHIBIT 32.2 - China TransInfo Technology Corp. | exh322.htm |

| EX-31.1 - EXHIBIT 31.1 - China TransInfo Technology Corp. | exh311.htm |

| EX-32.1 - EXHIBIT 32.1 - China TransInfo Technology Corp. | exh321.htm |

| EX-23.1 - EXHIBIT 23.1 - China TransInfo Technology Corp. | exhibit231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K/A

(Amendment No.

2)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2008

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ____________

Commission File Number: 001-34134

CHINA TRANSINFO TECHNOLOGY CORP.

(Exact name of registrant as specified in its

charter)

| Nevada | 87-0616524 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

Floor 9, Vision Building,

No. 39 Xueyuanlu,

Haidian District

Beijing, China 100083

(Address of principal

executive office and zip code)

(86 10) 82671299

(Registrant’s

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, Par Value $0.001 | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨

No x

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨

No x

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes x

No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes ¨

No x

As of June 30, 2008, the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported on the Over-the-Counter Bulletin Board) was approximately $35.9 million. Shares of the Registrant’s common stock held by each executive officer and director and each by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 23, 2009, there were 22,187,314 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

EXPLANATORY NOTE

This Amendment No. 2 on Form 10-K/A (the “Amendment”) hereby amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2008, previously filed with the Securities and Exchange Commission (the “Commission’) on March 25, 2009, as amended by Amendment No.1 on Form 10-K/A filed with the Commission on December 28, 2009 (the “Original Filing”). This Amendment is being filed mainly to:

1)

revise the disclosures under the heading “ Liquidity and Capital Resources” to reflect the uncertainty with respect to our liquidity as a result of the dividend restrictions in China;

2)

revise the advertising revenue recognition policy to clarify that we recognize advertising revenue ratably over the period in which the advertisement is to be published; and

3)

include the cooperation agreement between Beijing PKU Chinafront High Technology Co., Ltd. and Peking University, Earth and Space College in the exhibit list.

This Amendment does not reflect events occurring after the filing of the Original Filing or modify or update those disclosures, including the exhibits to the Original Filing affected by subsequent events.

In addition, as required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Amendment contains new certifications pursuant to Rules 13a-14 and 15d-14 under the Exchange Act and Section 302 of the Sarbanes-Oxley Act of 2002.

i

PART I

ITEM 1. BUSINESS

Overview

We are a leading provider of public transportation information systems technology and related comprehensive technology solutions in China. Our goal is to become the largest transportation information product and related comprehensive technology solutions provider, as well as the largest integrated transportation information platform and commuter traffic media platform builder and operator in China. Substantially all of our operations are conducted through our variable interest entities (the “VIE Entities”) that are companies formed in the People’s Republic of China (“PRC”) and owned principally or completely by our PRC affiliates. Through our VIE Entities, we are involved in developing multiple applications in transportation, digital city, and land and resource filling systems based on Geographic Information Systems (“GIS”) technologies which are used to service the public sector.

Our main focus is on providing transportation solutions. Our major products and services include:

-

Transportation Planning Information System,

-

Pavement Maintenance System,

-

Electronic toll collection (“ETC”),

-

Traffic Information Service System,

-

Taxi Security Monitoring, Commanding and Dispatching Platform,

-

GIS-T (Transportation) Middleware,

-

Traffic Flow Surveying Systems,

-

Intelligent Parking System,

-

Red Light Violation Snapshot System,

-

Intelligent Highway Vehicle Monitoring System,

-

Intelligent Public Transport System,

-

Palmcity Navigation Engine,

-

Comprehensive Location Based Service Platform,

-

Digital City,

-

2-D and 3-D GIS.

We also offer full range solutions for transportation oriented GIS (“GIS-T”) covering transportation planning, design, construction, maintenance and operation.

1

History and Corporate Structure

Corporate History

We were originally incorporated in Nevada on August 3, 1998 under the name R & R Ranching, Inc. to breed bison. On December 10, 2003, we executed an agreement and plan of reorganization (the “Intra-Asia Agreement”) with Intra-Asia Entertainment Corporation, a Delaware corporation (“Intra-Asia Delaware”), whereby Intra-Asia Delaware became our wholly-owned subsidiary and we amended our articles of incorporation to change our name to “Intra-Asia Entertainment Corporation.” From the first half of 2006 until May 14, 2007 when we completed a reverse acquisition transaction with Cabowise International Ltd. (“Cabowise”), a British Virgin Islands (“BVI”) company, we were a blank check company and did not engage in active business operations other than our search for, and evaluation of, potential business opportunities for acquisition or participation.

On May 14, 2007, we acquired Cabowise through a share exchange transaction pursuant to which we issued to the shareholders of Cabowise 10,841,492 shares of our common stock in exchange for all of the issued and outstanding capital stock of Cabowise. Cabowise thereby became our wholly-owned subsidiary and the former shareholders of Cabowise became our controlling stockholders. On the same day, our indirect Chinese subsidiary, Oriental Intra-Asia Entertainment (China) Limited (“Oriental Intra-Asia”), acquired eighty-five percent (85%) equity interest in Beijing PKU Chinafront High Technology Co., Ltd. (“PKU”), which commenced its businesses in October 2000. As a result, PKU became a majority-owned subsidiary of Oriental Intra-Asia.

VIE Restructuring

Current Chinese laws restrict companies with foreign ownership to operate in three business segments that we recently entered into: online services, taxi advertising, and security and surveillance related business. In order to comply with the applicable Chinese laws, we determined to restructure our subsidiaries and enter into a series of commercial arrangements to allow the Company to operate in these restricted business segments (“Restructuring”).

On February 3, 2009, as described below, through our indirect Chinese subsidiary, Oriental Intra-Asia and Oriental Intra-Asia’s former subsidiary, PKU, we entered into a series of equity transfer agreements with China TransInfo Technology Group Co., Ltd., a company formed under Chinese law (the “Group Company”), pursuant to which we transferred all of our indirect equity interests in PKU and PKU’s subsidiaries to the Group Company. Established in China on May 26, 2008, the Group Company is wholly owned by four Chinese affiliates of the Company, Shudong Xia, our Chairman, CEO and President and the beneficial owner of approximately 43% of the Company’s outstanding capital stock, Zhiping Zhang, the Company’s Vice President of Research and Development, Zhibin Lai, the Company’s Vice President and Wei Gao, the designee of SAIF Partners III L.P., a 11% shareholder of the Company (the “Group Company Shareholders”).

Through Oriental Intra-Asia and PKU, we entered into the following specific agreements to transfer all of its equity interests in its respective Chinese subsidiaries to the Group Company (the “Equity Transfer”):

-

Pursuant to an equity transfer agreement (the “PKU Equity Transfer Agreement”), entered into by and between Oriental Intra-Asia and the Group Company, Oriental Intra-Asia transferred all of its 97% equity interests in PKU to the Group Company;

-

Pursuant to an equity transfer agreement (the “Beijing Tian Hao Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of its 100% equity interests in Beijing Tian Hao Ding Xin Science and Technology Co., Ltd. to the Group Company;

-

Pursuant to an equity transfer agreement (the “China TranWiseway Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of its 70% equity interests in China TranWiseway Information Technology Co., Ltd. to the Group Company;

-

Pursuant to an equity transfer agreement (the “Zhangcheng Culture Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of its 100% equity interests in Zhangcheng Culture and Media Co., Ltd. to the Group Company;

2

-

Pursuant to an equity transfer agreement (the “Zhangcheng Science Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of the 100% equity interests in Beijing Zhangcheng Science and Technology Co., Ltd. to the Group Company; and

-

Pursuant to an equity transfer agreement (the “Shanghai Yootu Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of its 100% equity interests in Shanghai Yootu Information Technology Co., Ltd. to the Group Company.

In connection with the Equity Transfer, on February 3, 2009, the following contractual arrangements were also made among relevant parties, which have given us contractual rights to control and manage the business of the Group Company and the Group Company’s subsidiaries (the “Contractual Arrangement” and together with the Equity Transfer, the “Restructuring”):

-

Pursuant to an exclusive technical consulting and services agreement (the “Service Agreement”), entered into by and among Oriental Intra-Asia, the Group Company and the Group Company’s subsidiaries, Oriental Intra-Asia agreed to provide certain technical and consulting services to the Group Company and the Group Company’s subsidiaries (each a “VIE Entity” and collectively, the “VIE Entities”) in exchange for the payment by each VIE Entity of an annual development and consulting services fee that is to be determined solely by Oriental Intra-Asia;

-

Pursuant to an equity pledge agreement (the “Pledge Agreement”), entered into by and among Oriental Intra-Asia and each of the Group Company Shareholders, the Group Company Shareholders agreed to pledge all of their equity interests in the Group Company (the “Equity Interests”), to Oriental Intra-Asia as collateral security for Oriental Intra-Asia’s collection of the fees under the Service Agreement;

-

Pursuant to an option agreement (the “Option Agreement”), entered into by and among Oriental Intra-Asia and each of the Group Company Shareholders, the Group Company Shareholders agreed to grant to Oriental Intra-Asia an option to purchase, from time to time, all or a part of the Equity Interests, at the exercise price equal to the lowest possible price permitted by Chinese laws;

-

Pursuant to separate powers of attorney (the “Powers of Attorney”), each Group Company Shareholder agreed to grant to Oriental Intra-Asia a power to excise on his or her behalf all voting rights as a shareholder at the shareholders’ meetings of the Group Company that have been given to him or her by law and by the Articles of Association of the Group Company; and

-

Pursuant to an operating agreement, entered into by and among Oriental Intra-Asia, the VIE Entities and the Group Company Shareholders, (a) Oriental Intra-Asia agreed to act as the guarantor for the VIE Entities in the contracts, agreements or transactions in connection with the VIE Entities’ operation between the VIE Entities and any other third parties and to provide full guarantee for the VIE Entities in performing such contracts, agreements or transactions, subject to applicable laws, in exchange for which the VIE Entities agreed to mortgage the receivables of their operation and all of their assets which have not been mortgaged to any third parties to Oriental Intra-Asia, and (b) the VIE Entities and the Group Company Shareholders agreed to accept the provision of the corporate policies and guidance by Oriental Intra-Asia at any time in respect of the appointment and dismissal of the VIE Entities’ employees, the VIE Entities’ daily operation and administration as well as financial administrative systems, including the appointment of senior managers recommended by Oriental Intra-Asia (the “Operating Agreement” and together with the Service Agreement, Pledge Agreement, Option Agreement, Powers of Attorney, the PKU Equity Transfer Agreement, the Beijing Tian Hao Equity Transfer Agreement, the China TranWiseway Equity Transfer Agreement, the Zhangcheng Culture Equity Transfer Agreement, the Zhangcheng Science Equity Transfer Agreement, and the Shanghai Yootu Equity Transfer Agreement, the “Restructuring Documents”).

3

The main purpose of the Restructuring is to allow us to engage in the above three restricted business segments in China. As a result of the Restructuring, we transferred all of our indirect equity interests in PKU and PKU’s subsidiaries to the affiliated Group Company and accordingly, PKU and PKU’s subsidiaries became direct and indirect subsidiaries of the Group Company, which is wholly owned by the Group Company Shareholders who are all Chinese citizens. At the same time, through the Contractual Arrangement, we maintain substantial control over the VIE Entities’ daily operations and financial affairs, election of their senior executives and all matters requiring shareholder approval. Under FASB Interpretation No. 46R “Consolidation of Variable Interest Entities” (“FIN 46R”), we are required to consolidate the VIE Entities into our financial statements because the Contractual Arrangement provides us with the risks and rewards associated with equity ownership, even though we do not own any of the outstanding equity interests in any of the VIE Entities. As a result the Restructuring, we are able to engage in these three restricted business segments through the VIE Entities and derive the economic benefits that we would otherwise have as the owner of VIE Entities while still complying with Chinese laws.

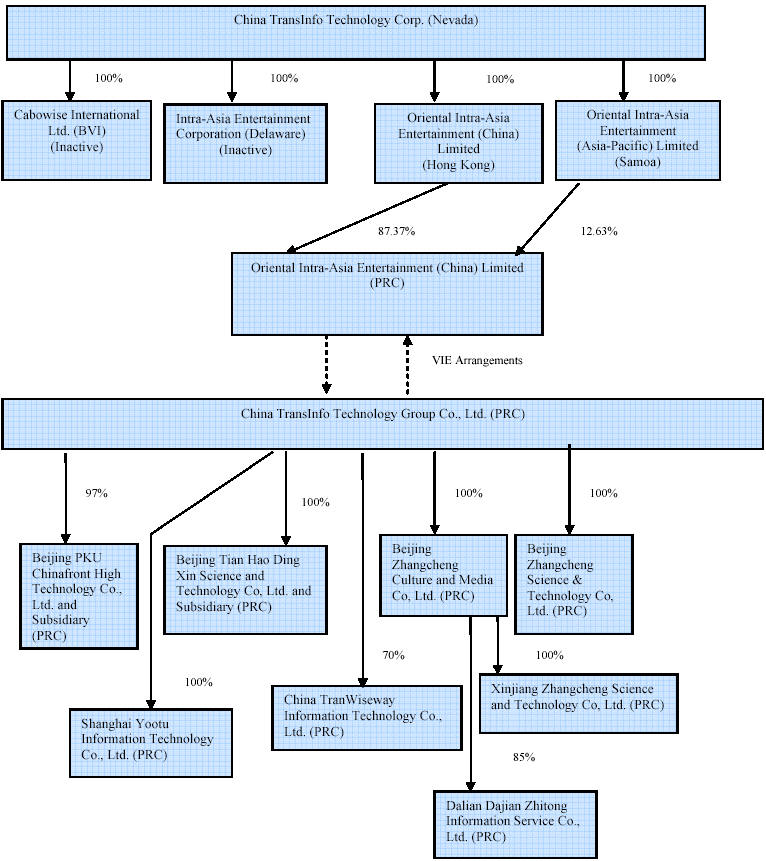

The following chart reflects our organizational structure as of March 23, 2009:

4

5

Our Industry

Transportation in China

Over the past two decades, China has completed series of large-scale highway infrastructure projects. As a result, according to the Ministry of Communication, China now has the second longest highway network in the world with a total length of approximately 53,800 kilometers at the end of 2007. In addition, China has approximately 70% of the world’s toll highways according to highway management department of the Ministry of Communication. According to the China’s 11th 5-Year Plan, it is estimated that the total mileage of urban rapid transit projects in China will exceed 1,862 kilometers by 2010, with total new investment of nearly $74 billion from 2006 to 2010.

China has a population of about 1.33 billion, which accounts for about 20% of the world’s population and makes it the most populous country in the world. With rapid economic development and urbanization, car ownership has increased dramatically, leading to unprecedented transportation challenges in many cities of China. According to Traffic Management Bureau of Ministry of Public Security, at the end of 2008 China had over 129 million private vehicles. The number is estimated to grow at least 5% over the next several years. Given the current conditions, the Chinese government intends to improve transportation management using advanced information technology solutions. At the same time, motorists are also eager to have access to real time traffic information. This strong demand from the private and public sectors is creating an unprecedented market opportunity for transportation information products and services.

The Ministry of Communication is the country’s highest level transportation regulator. In December 2004, the Ministry of Communication announced a development plan for Chinese national highway system. Under this plan, China will expand its highway network to 65,000 kilometers by 2010, and to 85,000 kilometers by 2020. After its completion, the Chinese national highway network will connect all provincial capitals and cities with populations of at least half-a-million. Under the plan, the total investment in the national highway network will be about $300 billion for the period from 2005 to 2020. From 2005 to 2010, the annual investment in the plan is expected to be approximately $22 billion, with an additional $14.5 billion to be invested annually between 2010 to 2020. Along with the new $584 billion of a new investment included in the recently announced Chinese economy stimulus plan, the Ministry of Communication in November 2008 submitted its new budget to the Chinese central government with the total investments in the transportation sector at about $730 billion for the next 3 to 5 years.

Intelligent Transportation Systems in China

Intelligent Transportation Systems (“ITS”) provide information and data tools for different types of transportation infrastructure by deploying solutions such as communication, monitoring, tolling and planning. The 14th World Congress on ITS, defined ITS as comprehensive systems that integrate and apply advanced information, communication, control, sensor, and computer technology to effectively coordinate people, vehicles, and roads/rails to realize real-time information transfer, as well as on-time, highly efficient, safe, and energy-efficient transportation.

China’s ITS industry is still at its early stage in terms of developments. Although China’s rapid economic growth over the past decade and accelerating urbanization have led to development of its transportation infrastructure, China has also recognized a need to use nationwide transportation networks more efficiently and effectively. China began its ITS efforts in early 1990s with goals to enhance transportation management efficiency, to improve network throughput, and to reduce the negative effect of transportation to the economy and environment. In terms of highways, China has been investing heavily in building up the ITS. However, compared to an average proportion of 7%-10% of ITS investment to total highway investment in developed countries, China has only reached about 1%. Also, almost all highways are toll highways in China, which means ITS is a necessity. Given that China is ranked second in total highway length and first in total toll highway mileage in the world, a larger-scale, more advanced ITS is needed. The increasing urban and highway traffic density also drives continued developments for ITS applications in communication and planning. As increasingly more urban and highway ITS gets deployed, the ITS market will shift towards focusing on specialized information solutions and value-added information services in the future. The urban ITS market is also still at a very initial development stage, comparable to that of the highway ITS market 10 years ago. On the other hand, this is a large but fragmented market with great potential.

6

Despite being at an early stage, the overall ITS market in China is highly attractive due to rapidly developing transportation infrastructure and increasing demand for ITS applications to manage it. The unique characteristics of China’s ITS industry mentioned above and the current low penetration level underline the large market potential. China’s expanding transportation network, along with its need for more effective and efficient transportation networks, has led to the need for better ITS. As a result of this and support provided by recent central government policies, investment in the ITS industry has increased significantly. According to the Chinese government’s 11th 5-year Plan, the Chinese government is estimated to spend approximately $7.3 billion on IT spending in the segments of transportation. Even though there is no current breakdown of IT spending from the new $730 billion budget by the Ministry of Communication, we estimated that it would not go below 5% of the total spending.

Our Growth Strategy

Our objective is to be the largest provider of transportation information products and comprehensive solutions, as well as the largest operator and provider of real time transportation information platform in China. Our strategy for achieving these objectives includes the following key elements:

-

Expand geographic footprint to cover all major markets in China - Based on our successful track record and reputation, management sees significant opportunities to grow revenues from existing clients by winning follow-on contracts for subsequent phases of project implementation, and by capitalizing on our first mover advantage and the high cost of switching to other vendors. In addition to our executive offices in Beijing, we have offices established in Shanghai, Chongqing, Taiyuan (Shanxi Province), Chengdu (Sichuan Province), Hangzhou (Zhejiang Province), Huhhot (Inner Mongolia), Urumqi (Xinjiang) and Dalian (Liaoning Province). We currently provide our products and services in over twenty provinces in China. Our long-term plan is to manage our national operations through different offices and identify potential expansion opportunities.

-

Strengthen R&D capability to enhance and expand core products and further penetrate customer base – We expect to provide additional value-added services and add-ins to our current platform through continuous research and development, enhancement of our product and service offerings and maintenance of our technological leadership position in our core areas of focus. We believe the continuous refinement of our offerings will make the overall platform more attractive to potential customers.

-

Continue to enhance our leadership position in the rapidly growing transportation information technology market – We plan to leverage our strong brand recognition and maintain a high contract bid/win ratio and follow on orders with our transportation information products and services by expanding our sales channels, increasing our product offerings and focusing on customer satisfaction and our other competitive strengths to gain additional market shares.

-

Pursue strategic acquisitions to support strong internal growth – We expect that strategic acquisitions will enable our geographic expansion, enhance our technological capabilities or competitive advantages, enrich product and service lines, provide recurring revenue opportunities and propel our expansion into high growth enterprise class markets.

-

Explore Opportunities in the large China consumer Market – We believe the Chinese consumer represents a large growth opportunity for us. The number of vehicles is expected to continue to grow. As a result, traffic congestion is becoming a serious concern in many Chinese cities. We provide real-time traffic information on our real-time traffic website. Our real-time traffic software for mobile devices, is pre-installed in some cell phones and can also be downloaded from our website. The growth of automobiles in China and 3G build out will enable the Chinese consumer to make more use of its mobile device and applications such as those that provide real time traffic data.

7

Our Products and Services

Our core business is developing the Intelligent Transportation Systems, or ITS, in the transportation sector utilizing GIS application software and technologies. We also develop GIS applications in digital city and land & resource areas. When providing services to customers for GIS application software, some of our customers require us to purchase necessary hardware and provide system integration for them. Our major products and services include:

Transportation Planning Information System

Our transportation planning information system is a software system utilized by traffic management engineers to plan roads and water transportation, safety monitoring and conduct strategic planning. The system facilitates the comprehensive management of different information and data required for traffic planning such as national economic data, road and waterway data and digital mapping data. The system provides planners with information search tools, statistical analysis and models to serve planning and organizing needs. We have been providing this system to the Ministry of Communication of PRC for their nationwide transportation planning and analysis purposes.

Pavement Maintenance System

Our pavement maintenance system is a practical business application system developed specifically for pavement data collection and operations management. Based on field data collected by PDA devices and with the support of a backend data center, the system provides multiple functional modules, such as data acquisition, project management, quality management, equipment management, materials management, assessment analysis, business reports and public travel information inquiries. Our pavement maintenance system can quickly identify pavement issues, efficiently process related data, and maintain information in a scientific manner for timely and accurate support. It solves problems arising from the inefficiency of traditional manual operations by allowing complex information from various sources to be easily processed. By the end of 2008, this application was still under development.

Electronic Toll Collection

Electronic Toll Collection, or ETC, is a technology that allows for electronic payment of tolls. An ETC system is able to determine if a car is registered in a toll payment program, alert enforcers of toll payment violations, and debit the participating account. With ETC, these transactions can be performed without the need for vehicles to stop or slow down. We have been continuously enhancing the functionality of our ETC system, which had not been launched into the market by the end of 2008.

Traffic Information Service System

Our Traffic Information Service System is a software system that provides the public with real time road conditions and related information. The system continuously transmits transportation data gathered from sensory devices and displays the results on an e-map interface. The system also supports web based search and analysis applications. The system has been widely applied and integrated into our solutions provided to various governmental agencies.

Taxi Security Monitoring, Commanding and Dispatching Platform

Our Taxi LED GPS Monitoring and Coordinating System is a highly integrated technological system operated with wireless satellite communication. The system can be used to increase safety and oversight in the taxi industry as well as remote supervision and management of public transportation. The system is composed of a GPS monitoring management center, imbedded GIS, an information transmitting center and onboard monitoring terminal modules. The system platform provides taxi authorities with basic information such as the location of an accident, incident time and images from within a taxi. The system also allows for better coordination with emergency services. The system was used in the cities of Urumqi and Huhhot as of December 31, 2008.

8

GIS-T (Transportation) Middleware

Our GIS-T middleware is based on China’s mainstream traffic GIS platform. The user of our middleware can quickly establish its own application systems without significant customizations. This product has strong applicability in traffic information management, model analysis and visual expression. Our product supports efficient integration of various traffic information models and systems. GIS-T middleware has been widely utilized as technological foundation of many of our transportation information solutions designed for public sector clients.

Traffic Flow Surveying Solutions

We provide transportation management authorities at provincial and municipal levels with traffic flow surveying solutions. These solutions include coil traffic flow detectors, microwave traffic flow detectors and video traffic flow detectors for base stations as well as traffic flow intelligent data centers. We have been providing this solution to multiple provinces in China.

Intelligent Parking System

Our Intelligent Parking System, or IPS, obtains information about available parking spaces, process that information and then presents it to drivers by means of variable message signs. Our system guides drivers in congested areas to the nearest parking facility with available parking spaces and it guides drivers within parking facilities to empty spaces. IPS reduces time and fuel otherwise wasted while searching for empty spaces and helps the parking facilities operate more efficiently. We are one of the first companies in China deploying IPS to serve public and private sector clients.

Red Light Violation Snapshot System

The red light violation snapshot system is used to photograph and record red light violations automatically. The camera captures the violating vehicle, including its license plate number, as it passes through the monitored area. The system also interlinks with a panorama camera to continue photographing the moving vehicle in order to provide comprehensive evidentiary data to authorities. We have been providing this solution to local governmental authorities of transportation.

Intelligent Highway Vehicle Monitoring System

Our highway vehicle monitoring system is used for image snapshot, license plate identification, speed recording, and blacklist database verification of vehicles passing through monitored areas along a given highway. The system consists of a front-end testing unit (camera, video testing module, vehicle tester and LED light) and main control unit (industrial control computer, system management software and communications module). The front-end system uploads images and related data to the command center on real time basis. The central communications server, database server and PC workstation then analyze and manage the uploaded data. The system can be used for automatic vehicle speed testing. The system also assists with traffic flow testing by providing traffic control authorities with relevant traffic data. We have been providing this solution to multiple provinces in China.

Intelligent Traffic Management Platform

Our intelligent traffic management platform is a comprehensive GIS based traffic management platform specially developed for urban traffic command centers. This platform functions as an interface for all ITS subsystems and is the integral element for our intelligent traffic management system. The intelligent traffic management platform allows for the capture of visual images from monitored roads, provides evidence of traffic violations at monitored intersections and records the number of vehicles passing through major urban entrances and exits, among other things. In 2008, we successfully provided real time traffic management solution based on the intelligent traffic management platform to serve the 2008 Olympic Games in Beijing.

9

Dynamic Traffic Information Service Platform

Our dynamic traffic information service platform collects, processes and distributes traffic information. By utilizing arithmetic models based on moving vehicles, the system provides complete dynamic road traffic flow information. The platform also collects, processes and distributes traffic event information. The system can be used to distribute data through several different communication channels, including GPRS, EDGE, CDMA, 3G, RDS-TMC, DAB/DMB, CMMB, Internet and call centers. Our platform captures dynamic traffic information that then can be used for in-car GPS equipment, personal navigation devices (PND), intelligent handsets (Windows Mobile/S60/KJAVA), UMPC, Internet and other terminals. By the end of 2008, we had been continuously enhancing the accuracy rate of current version of the platform and in the process of adding forensic features to the existing version.

Intelligent Public Transport System

Our intelligent bus traffic system inserts information technology into traditional bus traffic systems. Our system optimizes bus traffic routes and helps to improve service levels and management of urban bus traffic. The objective of our intelligent bus system is to realize efficiency in urban public transportation systems and to ensure the safe operation of bus systems while increasing the quality of bus transportation. By the end of 2008, we had been continuously enhancing the functionalities of this system.

Palmcity Navigation Engine

Our PalmCity Explore Navigation Engine is an internet and mobile application based open navigation system, which integrates mapping and navigation into Windows CE (Windows Mobile) and internet applications. By integrating map data, point of interest data storage and management, navigation application development and navigation application framework, PalmCity Explorer Navigation Engine helps navigation application developers and navigation system manufacturers develop unique products and services. We offered our navigation engine in our cell phone real time traffic software mapping add-ons to cell phone manufacturers in 2008.

Comprehensive Location Based Service Platform

Our comprehensive location based service platform is a comprehensive transportation information service platform based on GIS, GPS, ITS and communication technologies. By integrating the latest e-maps of China, highway and city road information, vacant parking spaces, environment and weather information, the system enables real time traffic information, collection, transmission and reporting so as to provide navigation, bus transfers, real time road conditions and location search tools. By the end of 2008, we had been continuously enhancing the functionalities of this system.

Digital City

We provide a full range digital services to many cities in China using a Plan-Construct-Operate model. We analyze different requirements of different regions or cities and design specific information technology systems and digital construction based on a city’s unique requirements. Our typical clients in this segment are local governments, public service departments and enterprises.

2-D and 3-D GIS

We provide software platforms that utilize two-dimensional GIS. Two-dimensional GIS defines and presents special data utilizing an “X” and “Y” axis. Beginning in the 1960s, two-dimensional GIS was widely applied in a variety of sectors, including land management, power, telecommunications and city planning. We also provide software platforms that utilize three-dimensional GIS. Three-dimensional GIS defines and presents special data utilizing an “X”, “Y” and “Z” axis. Compared with two-dimensional GIS, three-dimensional GIS defines special data in a more accurate manner, and can present both the plane and the vertical spatial relation. Moreover, three-dimension GIS can present and analyze more complicated spatial objectives than Computer Aided Design (CAD) and other visualized software. Three-dimensional GIS is better suited for exploration, resource assessment, disaster warning, and production management. It is widely applied in many sectors such as in natural resources (i.e. mineral resources, water resources, etc.) and geology.

10

The Markets for Our Products and Services

We have been marketing and selling our products and services to four main submarkets within the government and regulated sectors in China. These segments are Highway Information Systems; Urban Intelligent Transportation Systems; Digital City, and Land & Resources. Having built a customer base over the years, our strategy is to not only deliver high quality products, but also to provide ongoing value-added services so as to take advantage of any maintenance requirements or technology upgrades that may become necessary in the future. We continue to penetrate these submarkets and believe that we can take advantage of our experience by widening our scope of products and services to include data collection and application service operation.

Highway Information Systems

Our specially designed systems process and store national highway network data and travelers’ information, such as highway information management systems, which perform functions of archiving and retrieving highway data and provide transportation analysis tools. Decision support, predictive information, and performance monitoring are some of ITS applications enabled by highway ITS information management systems. In addition, ITS information management systems can assist in transportation planning, research, and safety management. Our major clients in this segment include the Ministry of Communication, traffic management bureaus, highway management bureaus, and municipal construction committees.

Urban Intelligent Transportation Systems

Key ITS applications for urban traffic management include incident management, signal control, traveler information, and traffic surveillance, intelligent parking indication system. Urban ITS is a combination of basic traffic data, electronic technology, wireless and wire communication technologies, which relies on computer and communication technologies to improve safety and efficiency of urban traffic networks. Traffic surveillance provides monitoring functions in the urban ITS. Most metropolitan areas use loop detectors for traffic surveillance, and many use closed circuit televisions. There are also other types of surveillance tools, such as radar, lasers, or video image processing equipments. The use of vehicles equipped with toll tags or global positioning systems as probes, to determine travel times and locations, is also growing in use. Incident management provides real time incident reporting functions in urban ITS, and it is commonly used by traffic management centers in large metropolitan areas and cities. In some large cities, such as Los Angeles, traffic signal control is also centralized in the traffic management center. In many situations, traffic signal control systems use traffic responsive signals to manage the traffic within urban areas. Such responsive signals can be single signals or a group of interconnected signals. Urban traffic management centers utilize all traffic condition information collected from their ITS to give feedbacks and suggestions to travelers. Such information may be provided directly to the public or to organizations who provide it to users through radio broadcast, internet, or other means. Some major types of traveler information include pre-trip information, en-route driver information, en-route transit information and route guidance.

Digital City

Digital City sector is designed to aid the Chinese government’s initiative to outfit all major cities with broadband, wireless internet access, and information technology infrastructure. Many cities in China, especially in southern China, have experienced rapid economic developments since early 90s. However, the information infrastructures construction in these cities does not match their economy developments. We are one of the pioneers to develop the “Digital City” concept in China . We provide full range digital services to many cities in China with the model of “Planning-Construction-Operation”. We analyze different requirements of different regions or cities and designs specific information technology systems based on unique requirements. Typical clients include local governments, public service departments and enterprises.

11

Land & Resources

The average IT spending in city geographical and land resources managements for each city in China is about RMB 60 million (approximately $8.8 million). Based on China’s 11th 5-year Plan, there are about 100 cities planning to complete GIS construction, which will lead to a RMB6 billion (approximately $880 million) market in China. Land resources systems cover planning, analysis, statistics and construction management for mineral resources. In this business line, we have developed a city geological information analysis system that provides tools to analyze the geological environment based on the integration of a variety of geological information, such as determining the underground structure for city planning and construction. In addition, we have created a disaster forecast system and a mineral resources assessment system that provides a platform to assess the reserves and then help to make decisions regarding the development of the mineral resources by setting up assessment models of mineral resources.

Our Intellectual Property

The following table illustrates the title of different copyrights that we own, their registration numbers, first publication dates, issuance dates, and durations, as well as the significance levels of such copyrights. The significance levels of the copyrights are divided into A, B, C three levels. “A” represents “Frequently Used in our products and services”, “B” represents “Occasionally Used in our products and services”, and “C” represents “Rarely Used in our products and services”.

|

Copyright Title |

Certificate Number | Registration Number | First

Publication Date |

Issue Date |

Expiration Date |

Materiality

Level |

|

|

||||||

|

Computer Software Copyright Registered Certificate (JTLWeb V1.0) |

028661 | 2004SR10260 | 09.08.2004 | 10.21.2004 | 12.31.2054 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate ( Land & Resources and House Affairs Information System V1.0) |

027924 | 2004SR09523 | 06.15.2004 | 09.29.2004 | 12.31.2054 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate (GeoPad V1.0) |

002827 | 2002SR2827 | 09.01.2002 | 09.24.2002 | 12.31.2052 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate (Command System of Meeting Urgent Need for Urban Public Emergencies V1.0) |

009303 | 2003SR4212 | 05.10.2003 | 06.9.2003 | 12.31.2053 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate (GeoWeb V1.0) |

006881 | 2003SR1790 | 09.05.2002 | 03.19.2003 | 12.31.2053 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate (EnvMonitor 1.0) |

004358 | 2002SR4358 | 05.18.2002 | 12.6.2002 | 12.31.2052 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate (TranPlan 1.0) V1.0 |

003664 | 2002SR3664 | 06.18.2002 | 11.11.2002 | 12.31.2052 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate ( (e-Gov.Suite 1.0) V 1.0) |

000823 | 2002SR0823 | 05.23.2002 | 07.04.2002 | 12.31.2052 | B |

12

|

Computer Software Copyright Registered Certificate (Sm@rtOA 1.0) V 1.0 |

000824 | 2002SR0824 | 09.28.2001 | 07.04.2002 | 12.31.2052 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate (WebMap Engine) V 1.0 |

0009123 | 2001SR2190 | 07.08.2001 | 07.30.2001 | 12.31.2051 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate (Environment Geo V 1.0) |

062877 | 2006SR15211 | 11.30.2005 | 10.31.2006 | 12.31.2056 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate (Environment Protection Emergency Conduct System V 1.0) |

062879 | 2006SR15213 | 11.30.2005 | 10.31.2006 | 12.31.2056 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate (Land and Resources Files’ Collection System V 1.0) |

063008 | 2006SR15342 | 06.30.2006 | 11.02.2006 | 12.31.2056 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Embed-3D-GIS V1.0) |

071603 | 2007SR05608 | 01.30.2007 | 04.17.2007 | 12.31.2057 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Environment Protection Emergency Conduct System V 1.0) |

063509 | 2006SR15843 | 04.30.2006 | 11.13.2006 | 12.31.2056 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Environment Information System V 1.0) |

063510 | 2006SR15844 | 04.30.2006 | 11.13.2006 | 12.31.2056 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Land and Resources Information Management System V 1.0) |

063508 | 2006SR15842 | 06.30.2006 | 11.13.2006 | 12.31.2056 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(GeoWeb For Linux) V1.0 |

086634 | 2007SR20639 | 05.10.2007 | 12.24.2007 | 12.31.2057 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate (Water Carriage Information System) V1.0 |

BJ10658 | 2008SRBJ035 2 | 06.25.2006 | 02.03.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Intelligent Parking Guide System) V1.0 |

BJ10662 | 2008SRBJ035 6 | 06.30.2007 | 02.03.2008 | 12.31.2058 | B |

13

|

Computer Software Copyright Registered Certificate(Urban Geological Information Management and Services System) V1.0 |

BJ10679 | 2008SRBJ037 3 | 10.10.2007 | 02.03.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Exploiter Navigation Software V1.0) |

BJ10485 | 2008SRBJ017 9 | 11.20.2007 | 01.16.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Location Services Platform System V 1.0) |

088919 | 2008SR01740 | 11.15.2007 | 01.24.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Taxi Security Alarm System Certificate (V1.0) |

BJ16618 | 2008SRBJ631 2 | 11.22.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(City One Card Solution Consumption Real Time Transaction System) V1.0 |

BJ16638 | 2008SRBJ633 2 | 09.12.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Taxi Monitoring Management System v1.0) |

BJ16626 | 2008SRBJ632 0 | 11.18.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Taxi Calling System V1.0) |

BJ16653 | 2008SRBJ634 7 | 09.18.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Advertisement Contract Management System V1.0) |

BJ16612 | 2008SRBJ630 6 | 10.21.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Advertisement Business Information Processing System V1.0) |

BJ16639 | 2008SRBJ633 3 | 09.26.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Media Call Center Business Management System V1.0) |

BJ16620 | 2008SRBJ631 4 | 10.27.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Real Time Information Broadcasting System V1.0) |

BJ16615 | 2008SRBJ630 9 | 09.30.2008 | 12.13.2008 | 12.31.2058 | A |

14

|

Computer Software Copyright Registered Certificate(Electronic Project Management System V1.0) |

BJ16795 | 2008SRBJ648 9 | 10.20.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Data Collection System V1.0) |

BJ16796 | 2008SRBJ649 0 | 09.18.2008 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Employee Information Management System V1.0) |

BJ16809 | 2008SRBJ650 3 | 11.20.2008 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Digitalization Assets Management System V1.0) |

BJ16797 | 2008SRBJ649 1 | 06.10.2008 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Logistics Information System V1.0) |

BJ16793 | 2008SRBJ648 7 | 01.20.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Students Archive Management System V1.0) |

BJ16808 | 2008SRBJ650 2 | 12.10.2007 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Product Selling Monitoring System V1.0) |

BJ16792 | 2008SRBJ648 6 | 01.20.2007 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered Certificate(E-business Shopping System V1.0) |

BJ16794 | 2008SRBJ648 8 | 08.16.2007 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Expressway ETC System V1.0) |

BJ16694 | 2008SRBJ638 8 | 10.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(GIS-T Expressway Equipment Management System V1.0) |

BJ16771 | 2008SRBJ646 5 | 10.21.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Highway Data Collection and Distribution System V1.0) |

BJ16770 | 2008SRBJ646 4 | 10.29.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Highway Transportation Indication System V1.0) |

BJ16769 | 2008SRBJ646 3 | 08.20.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Expressway Emergency Command and Monitoring System V1.0) |

BJ16699 | 2008SRBJ639 3 | 09.10.2008 | 12.13.2008 | 12.31.2058 | A |

15

|

Computer Software Copyright Registered Certificate(Traffic Information Service System V1.0) |

BJ16751 | 2008SRBJ644 5 | 10.22.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Urban Intelligent Traffic Management System V1.0) |

BJ16906 | 2008SRBJ660 0 | 12.20.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Urban Traffic Information Decision-making and Analysis System V1.0) |

BJ16926 | 2008SRBJ662 0 | 11.18.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Appropriative GIS V1.0) |

BJ16928 | 2008SRBJ662 2 | 12.10.2007 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Highway Information Total Solution and Decision-analysis System V1.0) |

BJ16927 | 2008SRBJ662 1 | 05.18.2007 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Red Light Violation Snapshot System V1.0) |

BJ16905 | 2008SRBJ659 9 | 09.20.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Highway Vehicles Intelligent Testing and Recording System V1.0) |

BJ16876 | 2008SRBJ657 0 | 11.20.2007 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Public Sanitation Quality Monitoring and Alarm System V1.0) |

BJ16457 | 2008SRBJ615 1 | 10.30.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Human Resource Management System V1.0) |

BJ16428 | 2008SRBJ612 2 | 10.20.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Local Sanitation Information Platform V1.0) |

BJ16450 | 2008SRBJ614 4 | 10.10.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Management Competition Imitation Platform V1.0) |

BJ16424 | 2008SRBJ611 8 | 10.14.2008 | 12.13.2008 | 12.31.2058 | B |

16

|

Computer Software Copyright Registered Certificate(Disabled Association Job Information Management System V1.0) |

BJ16473 | 2008SRBJ616 7 | 09.08.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Message Service Platform V1.0) |

BJ16423 | 2008SRBJ611 7 | 09.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Telecom Value-added Service System V1.0) |

BJ16422 | 2008SRBJ611 6 | 10.25.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Emergency Command and Prevention System V1.0) |

BJ16472 | 2008SRBJ616 6 | 10.22.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Palmcity WebGIS Engine V1.0) |

BJ16589 | 2008SRBJ628 3 | 04.10.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Mobile Map Software V1.0) |

BJ16591 | 2008SRBJ628 5 | 05.10.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Multiple-source Traffic Information Integration System V1.0) |

BJ16629 | 2008SRBJ632 3 | 08.26.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Palmcity Traffic information collection System V1.0) |

BJ16605 | 2008SRBJ629 9 | 10.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(PalmCity Floating Car Data Processing System V1.0) |

BJ16628 | 2008SRBJ632 2 | 05.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(PalmCity Information Exchange Platform V1.0) |

BJ16631 | 2008SRBJ632 5 | 06.21.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(PalmCity In-car PND Comprehensive Information System V1.0) |

BJ16617 | 2008SRBJ631 1 | 10.31.2007 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Super GIS Data Comprehensive Integration System V1.0) |

BJ16604 | 2008SRBJ629 8 | 10.26.2008 | 12.13.2008 | 12.31.2058 | A |

17

|

Computer Software Copyright Registered Certificate(Water Transportation Flow Investigation VTS System V1.0) |

BJ16641 | 2008SRBJ633 5 | 11.12.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Highway Traffic Flow Investigation Data Center V1.0) |

BJ16507 | 2008SRBJ620 1 | 09.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Highway Traffic Flow GIS System V1.0) |

BJ16476 | 2008SRBJ617 0 | 10.27.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Highway Traffic Flow Investigation Equipment Long-distance Monitoring Platform V1.0) |

BJ16557 | 2008SRBJ625 1 | 09.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Coil Traffic Flow Data Collection System V1.0) |

BJ16621 | 2008SRBJ631 5 | 10.28.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Video Traffic Flow Data Collection System V1.0) |

BJ16643 | 2008SRBJ633 7 | 11.20.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Video Traffic Flow Investigation - Digital Image Processing System V1.0) |

BJ16622 | 2008SRBJ631 6 | 11.06.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Video Traffic Flow Investigation Watching-dog System V1.0) |

BJ16627 | 2008SRBJ632 1 | 10.10.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate(Yootu Real-Time Road Condition Information Processing and Releasing Software V1.0) |

77504 | 2007SL11509 | 05.01.2007 | 08.01.2007 | 12.31.2057 | A |

Research and Development

In 2008 and 2007, our research and development expenses amounted to approximately $2.60 million and $0.96 million, respectively. These expenses were mainly composed of staff costs and research and development equipment purchasing expenses.

18

Our Research and Development (R&D) Department consists of two departments, one is internal and the other is external, which involves our strategic relationship with the GeoSIS Laboratory at Peking University.

Internal R&D Department

Our internal R&D department consists of 140 researchers with extensive experience in the GIS and transportation information industry. Many of these researchers have worked at multinational corporations.

The primary focus of the internal R&D department is to analyze customer demands and develop application software products, with the use of the most highly advanced software development tools available today.

Our research department is also responsible for monitoring developments in the market for our services so that they can develop new products or improve upon existing products by adopting new technologies and skills.

In addition, the department is responsible for creating training and support manuals and creating new processes for implementation of our software products.

Strategic R&D Partnership with Peking

University

PKU was established in connection with the Peking University’s GeoSIS Laboratory in order to provide university researchers with real life opportunities to test and implement the discoveries created at the University. On August 6, 2005, PKU entered into a cooperation agreement (the “Cooperation Agreement”), with Earth and Space College of Peking University, pursuant to which PKU obtained the access to the university’s GeoSIS Research Lab, which houses over thirty PhDs and researchers to support PKU’s research and development initiatives. Under the Cooperation Agreement, we pay for all R&D expenses of the GeoSIS Laboratory. The Cooperation Agreement has a three-year term that has been automatically renewed for an additional three year.

Our Major Customers

The following table provides information on our most significant clients in fiscal year 2008.

|

TOP TEN CLIENTS IN 2008 |

||||||||

| No. | Name | Description of Client | Sales

(in thousands of US dollars) |

Percentage of | ||||

| 1 | Beijing Zhongjiaokeruan Technology Co., Ltd. | High-tech company in transportation information application development | 3,209 | 10.93% | ||||

| 2 | United Real Estate Development Co., Ltd. | A real estate development company | 1,919 | 6.53% | ||||

| 3 | Transportation Planning & Research Institute | An institute under Ministry of Communication | 1,826 | 6.22% | ||||

| 4 | Beijing Feiwu Technology Co., Ltd. | High-tech company in telecom and electronic products | 1,661 | 5.66% | ||||

| 5 | Beijing Municipal Bureau of Land & Resources | City-level governmental land and resource department | 1,593 | 5.42% | ||||

| 6 | Beijing Xiangxian Technology Co., Ltd. | High-tech company in environmental application development | 1,515 | 5.16% | ||||

19

| 7 | China Construction 1st Division Group Construction & Development Co., Ltd. | A state-owned construction company | 1,489 | 5.07% | ||||

| 8 | Beijing Aoran High-tech Industrial Co., Ltd. | High-tech company in electronic products | 1,338 | 4.55% | ||||

| 9 | Beijing Transportation Information Center | City-level governmental transportation department | 1,282 | 4.36% | ||||

| 10 | Beijing Transportation Committee | City-level governmental transportation department | 1,107 | 3.77% | ||||

| TOTAL | 16,939 | 57.67% |

Regulation

Because our operating VIE entities are located in the PRC, our business are regulated by the national and local laws of the PRC. There are no specific rules or regulations for a company engaged in software development other than mapping which is highly regulated in China.

In addition, we and our PRC subsidiaries are considered foreign persons or foreign-invested enterprises under PRC laws, and therefore subject to foreign ownership restrictions in connection with our online services, advertising in taxies, and security and surveillance related businesses:

Online Service

On December 11, 2001, the State Council of China promulgated the Regulations on the Administration of Foreign Invested Telecommunication Enterprises (the “FITE Regulations”) , which became effective on January 1, 2002. Under the FITE Regulations, a foreign entity is prohibited from owning more than 50% of equity of a provider of value-added telecommunications services in China, which include internet content provision services. In addition, the current Catalogue of Industries for Guiding Foreign Investment (Revised 2007) prohibits a foreign investor from investing in businesses such as news websites and web streaming audio-visual services. As a result, if we or our former Chinese subsidiaries had invested directly in the value-added telecommunications services in China, we would have had at most 50% of the ownership of the business and thus only consolidated no more than 50% of the revenues generated from such business.

Taxi Advertising

For an advertising business involving foreign investment, there have been rigid overseas operation requirements on the foreign investors under the current Chinese laws. Pursuant to the Provisions on Administration of Foreign Invested Advertising Enterprises promulgated by the State Administration for Industry & Commerce and the Ministry of Commerce of China on March 2, 2004, for a wholly foreign owned advertising enterprise, the foreign investors must have at least three years of direct operations in the advertising business outside of China. In case of a joint venture, foreign investors must have at least two years of direct operations in the advertising business outside of China. However, a domestic company without direct foreign investment is not subject to any of these restrictions.

Security and Surveillance Related Business

While there is no Chinese law or regulation specifically prohibiting foreign investment in the security and surveillance related business in China, the nature of this business implies that a vast majority of the customers of this business are governmental entities. Maintaining the confidentiality of sensitive information about national security and other various governmental affairs is one of the most important concerns of these government customers. Therefore, as a practicable matter, governmental entities are more willing to have business relations with purely domestic companies than a company involving foreign investment where confidential governmental information is concerned.

20

In order to comply with these legal restrictions, on February 3, 2009, we conducted the Restructuring and entered into the Contractual Arrangement with the VIE Entities. These arrangements enable us to operate these restricted businesses through these VIE Entities in which we do not hold a direct equity interest. For more information on the regulatory and other risks associated with our contractual agreements related to our VIE Entities, please see the discussion below Item 1A, “Risk Factors.”

We are also subject to PRC’s foreign currency regulations. The PRC government has controlled Renminbi reserves primarily through direct regulation of the conversion of Renminbi into other foreign currencies. Although foreign currencies, which are required for “current account” transactions, can be bought freely at authorized PRC banks, the proper procedural requirements prescribed by PRC law must be met. At the same time, PRC companies are also required to sell their foreign exchange earnings to authorized PRC banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the PRC government.

Our Competition

Competition in China’s transportation information industry is very fragmented and consists of a combination of a few foreign competitors and many domestic transportation information technology companies. Whereas most international competitors seek to provide component software for the industry, our focus is on developing application software and services for the Chinese government and regulated sectors.

We believe that the following competitive strengths enable us to compete effectively in the transportation information industry:

-

Leading-Edge R&D Team - Our research and development team has a strong and extensive technology background and was an early entrant into the three-dimensional Geographic Information System, or GIS, market. The head of our research and development team was the lead engineering architect of the first three-dimensional GIS platform software in China (Chinese Excellence Software Award, 1995).

-

R&D Affiliation with Peking University – Through our early alliance with Peking University, we developed a strong and extensive technology background and we have access to the university’s research labs and PhDs. Under the cooperation agreement between our VIE Entity, PKU and Earth and Space College of Peking University, we have access to the university’s GeoSIS Research Lab and its team of over 30 PhDs and researches who support our R&D initiatives. Peking University is a 3% owner of PKU.

-

Award Winning Technology - Since inception, we have won over nine product awards, including the National Transportation Planning System and Digital City Program award. The awards are indicative of the technological leadership of our Intelligent Transportation System, or ITS and give customers a sense of security that they are purchasing a quality product.

-

Brand Image - We have built a valuable brand image through our track record of successful execution of projects for customers in various sectors. We provide products and services, including value-added services to meet maintenance and technology upgrade requirements, to our governmental and other customers. Our customers include central, provincial and municipal government agencies, construction, real estate development and high-tech companies. We plan to leverage our brand image to obtain new and recurring business.

-

Superior Management - Three members of our executive management team were the first GIS software developers in China. Collectively, they have more than 34 years of experience with GIS, and each has been with PKU since its early days. They are complemented by two executives with extensive finance and corporate financial reporting experience.

21

- Operational and Quality Management - We are ISO9000 certified and conduct internal performance assessments three times per year. Being in close proximity to two of China’s top universities, we have many qualified candidates to choose from for our hiring needs. We subject our potential hires to a rigorous review of their academic and technical skills. We also screen each candidate’s background for potential conflicts of interest and in order to avoid the possible appearance of impropriety in our dealings with government agencies.

We experience competition from both foreign and domestic Chinese competitors. The following is a description of some of our major competitors:

Foreign Competitors

- Image Sensing System, Inc. (ISS) -ISS is headquartered in St. Paul, Minnesota, a technology company focused in infrastructure productivity improvement through the development of software-based detection solutions for the Intelligent Transportation Systems (ITS) sector and adjacent overlapping markets. ISS’s industry leading computer-enabled detection (CED) products combine embedded software signal processing with sensing technologies for use in transportation, environmental and safety/surveillance management.

With more than 90,000 instances sold in over 60 countries worldwide, its products position to the traffic, security and environmental management markets.

-

Satellic Traffic Management GmbH - Satellic Traffic Management GmbH (Satellic) is a global technology service provider for the setup and operation of progressive toll and traffic management systems. Satellic is a wholly-owned subsidiary of T-Systems, the business customers segment of Deutsche Telekom. The company, which was founded in 2005, has its headquarters in Berlin. Satellic advises governments, companies and associations and is breaking new ground, together with industrial partners on site, in the implementation of traffic infrastructure projects. The company develops new concepts (public private partnership) for financing, traffic management and for emissions protection.

-

Vehicle Information and Communication System Center - Vehicle Information and Communication System Center, founded in 1995 in Tokyo, Japan, is involving of the business of systematical gathering, processing , and editing road traffic information, and managing and operating traffic information system by using communication and broadcasting media, and in turn transmitting accurate traffic information to drivers via in-vehicle navigation devices.

-

Organization for Road System Enhancement - Organization for Road System Enhancement (ORSE), was founded in 1999 in Japan. ORSE’s business is about all hand business of ETC system in Japanese market including disclosing standard for data security in ETC systems, providing processed data for identical ETC systems and developed ETC related technologies.

-

Navteq - Navteq is a world leader in premium-quality digital map data. Its data has been widely applied in-vehicle navigation systems in North America and Europe. Founded in California in 1985, this company has been acquired by Nokia in 2008. Currently, NAVTEQ has more than 4,000 employees worldwide located in 196 offices in 36 countries.

The products offered by our foreign competitors are priced higher than our products. In addition, their software cannot be applied in China without significant modification due to differing industry standards and background. For these reasons, we do not foresee much competition from these international competitors in the area of transportation information application software.

Domestic Chinese Competitors

- Beijing E-Hualu Info Technology Co., Ltd. (E-Hualu) - Founded in 2001, based in Beijing, E-hualu is involved in the business of design and construction of intelligent traffic projects, and the urban traffic command center software development and system integration technology. E-Hualu has developed a series of traffic management application software & hardware systems with independent intellectual property and cooperated with police departments for urban public security and traffic command center constructions.

22

-

Beijing Rhytech Co., Ltd. (Rhytech) - Based in Beijing, Rhytech is focusing on intelligent traffic sector including inter-city intelligent traffic management system, police intelligent traffic management system, railway and tunnel intelligent traffic management system and other value-added intelligent traffic service. Currently, the company has 3 offices throughout China.

-

BOCO Inter-Telecom Holding Co., Ltd. (BOCO Inter-Telecom) - BOCO Inter-Telecom has been listed in Shanghai stock market of A-Share with ticker 600289 since 2000. Affiliated with Beijing University of Posts and Telecommunications, BOCO Inter-Telecom’s main business includes telecom operation support systems, information security systems and intelligent traffic systems. Its intelligent traffic systems are mainly highway management systems, highway maintenance systems and electronic toll collection systems.

-

Qingdao Hisense TransTech Co., Ltd.( QHNTC) - QHNTC was founded in October 1998. It is a subsidiary of Hisense Co., Ltd. QHNTC engages itself in the development and service of intelligent traffic systems (ITS). Focusing on urban traffic, public transport, logistics and commercial service, the company has developed several proprietary rights in traffic light control systems and urban public security & traffic comprehensive information platforms and other public transportation systems.

-

Beijing Stone Intelligent Transportation System Integration Co., Ltd. - This company focuses on intelligent transportation System, traffic engineering technical system, traffic information system and other serial traffic products.

-

Guangzhou Heartly Teamgo Information System Engineering Co., Ltd. (Heartly Teamgo) - Based in Guanzhou, Guandong Province, founded in 1997, Heartly Teamgo is engaging in intelligent traffic products development, solution and system integration. Mainly dedicated in Guangdong province, this company has developed city intelligent public transportation system, public media information display system, electronic bulletin boards and GPS in-car platform, etc. The company has completed Guangzhou parking systems, public transportation sensor dispatch system and related projects.

-

CenNavi Technologies Co., Ltd (CenNavi) - Founded in 2005, CenNavi collects, processes, distributes and optimizes dynamic traffic information technologies. This company provides real-time traffic information services for vehicle terminals, PND terminals, mobiles phones and internets as well as supports traffic information display and optimal route query to above terminals. Acquired by China's largest navigable e-map manufacturer—NavInfo, this company’s products are mainly sold in vehicle market currently.

-

Shenzhen GENVICT Technologies Co., Ltd. (GENVICT) - GENVICT is a high-tech corporation specialized in developing, designing, manufacturing, supplying and technical services of Intelligent Transportation System (ITS) devices, IC card readers, embedded intelligent terminals and related hardware products. The company is headquartered in Shenzhen, with major customers as expressway, public security, traffic control, finance, urban traffic authorities.

-

NAVINFO - This company is a navigable map and dynamic content service provider in China with over 10-year history in navigation map production. It is the first map producer in China that supports dynamic traffic information release and navigation application.