Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - China TransInfo Technology Corp. | exhibit21.htm |

| EX-32.2 - EXHIBIT 32.2 - China TransInfo Technology Corp. | exhibit32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - China TransInfo Technology Corp. | exhibit31-2.htm |

| EX-23.1 - EXHIBIT 23.1 - China TransInfo Technology Corp. | exhibit23-1.htm |

| EX-23.2 - EXHIBIT 23.2 - China TransInfo Technology Corp. | exhibit23-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China TransInfo Technology Corp. | exhibit31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - China TransInfo Technology Corp. | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2009

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File No. 001-34134

CHINA TRANSINFO TECHNOLOGY CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 87-0616524 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

9th Floor, Vision Building,

No. 39 Xueyuanlu, Haidian District,

Beijing, China 100191

(Address of principal executive offices)

(86) 10-51691999

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 | NASDAQ GLOBAL MARKET |

Securities registered pursuant to Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | [ ] | Accelerated Filer | [ ] |

| Non-Accelerated Filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [ X ] |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act)

Yes [ ] No [ X ]

As of June 30, 2009 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the shares of the registrant’s common stock held by non-affiliates (based upon the closing sale price of such shares as reported on the NASDAQ Global Market) was approximately $29.85 million. Shares of the registrant’s common stock held by each executive officer and director and each by each person who owns 10% or more of the outstanding common stock have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 24,070,638 shares of the registrant’s common stock outstanding as of March 31, 2010.

DOCUMENTS INCORPORATED BY REFERENCE

None.

| CHINA TRANSINFO TECHNOLOGY CORP. |

| Annual Report on FORM 10-K |

| For the Fiscal Year Ended December 31, 2009 |

| TABLE OF CONTENTS |

| PART I |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 26 |

| Item 1B. | Unresolved Staff Comments | 40 |

| Item 2. | Properties | 40 |

| Item 3. | Legal Proceedings | 41 |

| Item 4. | (Removed and Reserved) | 41 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 41 |

| Item 6. | Selected Financial Data | 42 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 42 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 59 |

| Item 8. | Financial Statements and Supplementary Data | 59 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 59 |

| Item 9A(T). | Controls and Procedures | 59 |

| Item 9B. | Other Information | 60 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 60 |

| Item 11. | Executive Compensation | 65 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 68 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 70 |

| Item 14. | Principal Accounting Fees and Services | 73 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 74 |

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A, “Risk Factors” included herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this report to conform our prior statements to actual results or revised expectations.

Use of Terms

Except where the context otherwise requires and for the purposes of this report only:

-

“China TransInfo,” “the Company,” “we,” “us,” and “our” refer to China TransInfo Technology Corp., its subsidiaries, and, in the context of describing our operations and business, and consolidated financial information, include our VIE Entities;

-

“China,” “Chinese” and “PRC” refer to the People’s Republic of China and do not include Taiwan and special administrative regions of Hong Kong and Macao;

-

“BVI” refers to the British Virgin Islands;

-

“SEC” refers to the United States Securities and Exchange Commission;

-

“Securities Act” refers to the Securities Act of 1933, as amended;

-

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

-

“RMB” refers to Renminbi, the legal currency of China;

-

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; and

-

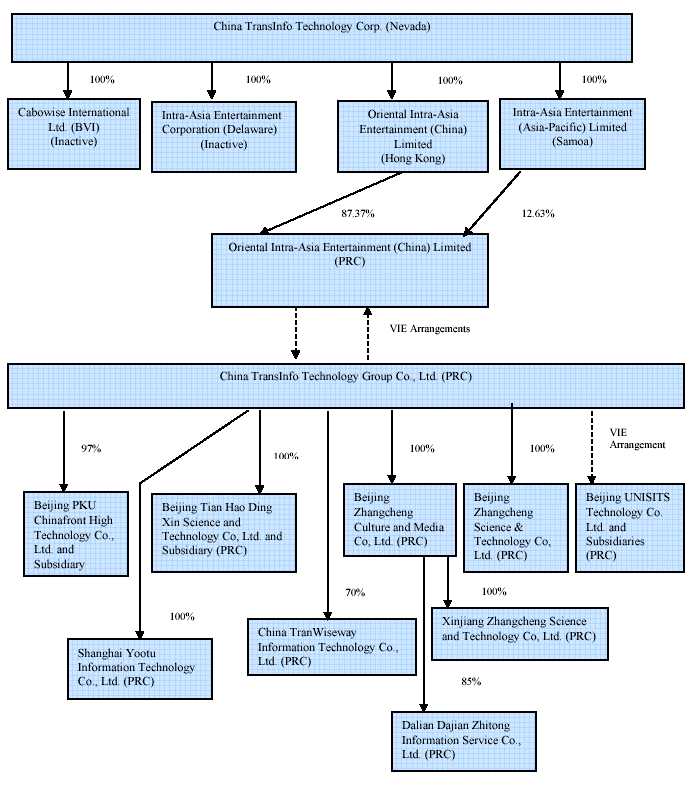

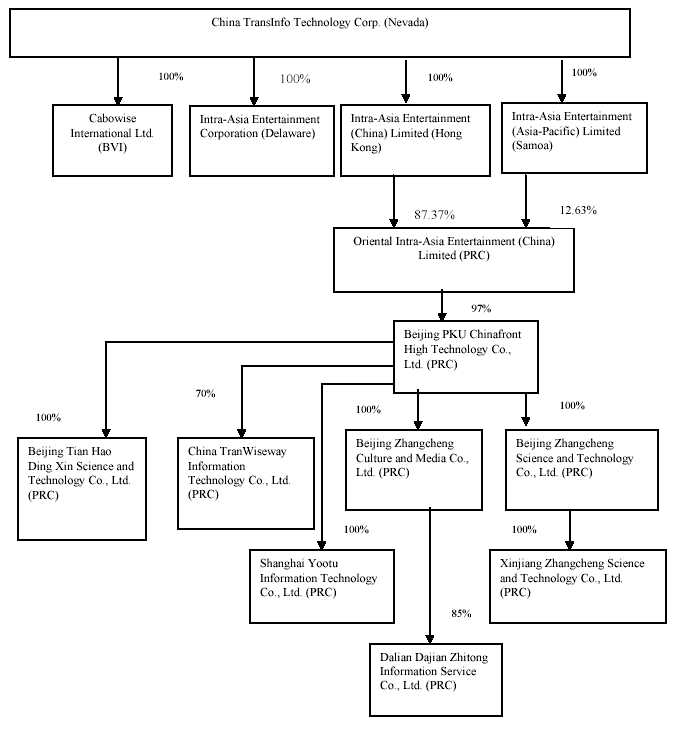

"VIE Entities" means our consolidated variable interest entities, including China TransInfo Technology Group Co., Ltd. and its subsidiaries as depicted in our organization chart on page 5 below.

PART I

ITEM 1. BUSINESS.

Business Overview

We are a leading provider of end-to-end public transportation information technology systems and related comprehensive technology solutions in China. Our goal is to become the largest provider of transportation information products and related comprehensive technology solutions in China, as well as the largest operator and provider of real-time transportation information to consumers in China. Substantially all of our operations are conducted through our VIE Entities that are PRC domestic companies owned principally or entirely by our PRC affiliates. Through our VIE Entities, we are involved in developing multiple applications in transportation, digital city, and land and resource filling systems based on Geographic Information Systems (“GIS”), technologies which are used to service the public sector.

1

Our main focus is on providing transportation solutions. Our major products and services include:

-

Transportation Planning Information System,

-

Pavement Maintenance System,

-

Electronic toll collection (“ETC”),

-

Traffic Information Service System,

-

Taxi Security Monitoring, Commanding and Dispatching Platform,

-

GIS-T (Transportation) Middleware,

-

Traffic Flow Surveying Systems,

-

Intelligent Parking System,

-

Red Light Violation Snapshot System,

-

Intelligent Highway Vehicle Monitoring System,

-

Intelligent Public Transport System,

-

TransPLE Passenger Flow Statistic, Detecting and Analysis System

-

Palmcity Navigation Engine,

-

Comprehensive Location Based Service Platform,

-

Digital City,

-

2-D and 3-D GIS.

We also offer full range solutions for transportation oriented GIS (“GIS-T”), covering transportation planning, design, construction, maintenance and operation.

History and Corporate Structure

Corporate History

We were originally incorporated in Nevada on August 3, 1998 under the name R & R Ranching, Inc. to breed bison. On December 10, 2003, we executed an agreement and plan of reorganization (the “Intra-Asia Agreement”) with Intra-Asia Entertainment Corporation, a Delaware corporation (“Intra-Asia Delaware”), whereby Intra-Asia Delaware became our wholly-owned subsidiary and we amended our articles of incorporation to change our name to “Intra-Asia Entertainment Corporation.” From the first half of 2006 until May 14, 2007 when we completed a reverse acquisition transaction with Cabowise International Ltd. (“Cabowise”), a BVI company, we were a blank check company and did not engage in active business operations other than our search for, and evaluation of, potential business opportunities for acquisition or participation.

On May 14, 2007, we acquired Cabowise through a share exchange transaction pursuant to which we issued to the shareholders of Cabowise 10,841,492 shares of our common stock in exchange for all of the issued and outstanding capital stock of Cabowise. Cabowise thereby became our wholly-owned subsidiary and the former shareholders of Cabowise became our controlling stockholders. On the same day, our indirect Chinese subsidiary, Oriental Intra-Asia Entertainment (China) Limited (“Oriental Intra-Asia”), acquired 85% equity interest in Beijing PKU Chinafront High Technology Co., Ltd. (“PKU”), which commenced its businesses in October 2000. As a result, PKU became a majority-owned subsidiary of Oriental Intra-Asia.

2

VIE Restructuring

Current Chinese laws restrict companies with foreign ownership to operate in three business areas that we recently entered into: online services, taxi advertising, and security and surveillance related business. In order to comply with applicable Chinese laws, we restructured our subsidiaries and entered into a series of commercial arrangements to allow the Company to operate in these restricted business areas.

On February 3, 2009, as described below, through our indirect Chinese subsidiary, Oriental Intra-Asia and Oriental Intra-Asia’s former subsidiary, PKU, we entered into a series of equity transfer agreements with China TransInfo Technology Group Co., Ltd., a company formed under Chinese law (the “Group Company”), pursuant to which we transferred all of our indirect equity interests in PKU and PKU’s subsidiaries to the Group Company. Established in China on May 26, 2008, the Group Company is wholly owned by four Chinese affiliates of the Company, Shudong Xia, our Chairman, CEO and President and the beneficial owner of approximately 43% of the Company’s outstanding capital stock, Zhiping Zhang, the Company’s Vice President of Research and Development, Zhibin Lai, the Company’s Vice President and Wei Gao, the designee of SAIF Partners III L.P., a 17% shareholder of the Company (collectively, the “Group Company Shareholders”).

Through Oriental Intra-Asia and PKU, we entered into the following specific agreements to transfer all of its equity interests in its respective Chinese subsidiaries to the Group Company (the “Equity Transfer”):

-

Pursuant to an equity transfer agreement (the “PKU Equity Transfer Agreement”), entered into by and between Oriental Intra-Asia and the Group Company, Oriental Intra-Asia transferred all of its 97% equity interests in PKU to the Group Company;

-

Pursuant to an equity transfer agreement (the “Beijing Tian Hao Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of its 100% equity interests in Beijing Tian Hao Ding Xin Science and Technology Co., Ltd. to the Group Company;

-

Pursuant to an equity transfer agreement (the “China TranWiseway Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of its 70% equity interests in China TranWiseway Information Technology Co., Ltd. to the Group Company;

-

Pursuant to an equity transfer agreement (the “Zhangcheng Culture Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of its 100% equity interests in Zhangcheng Culture and Media Co., Ltd. to the Group Company;

-

Pursuant to an equity transfer agreement (the “Zhangcheng Science Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of the 100% equity interests in Beijing Zhangcheng Science and Technology Co., Ltd. to the Group Company; and

-

Pursuant to an equity transfer agreement (the “Shanghai Yootu Equity Transfer Agreement”), entered into by and between PKU and the Group Company, PKU transferred all of its 100% equity interests in Shanghai Yootu Information Technology Co., Ltd. to the Group Company.

In connection with the Equity Transfer, on February 3, 2009, the following contractual arrangements were also made among relevant parties, giving us contractual rights to control and manage the business of the Group Company and the Group Company’s subsidiaries (the “Contractual Arrangement” and together with the Equity Transfer, the “Restructuring”):

-

Pursuant to an exclusive technical consulting and services agreement (the “Service Agreement”), entered into by and among Oriental Intra-Asia, the Group Company and the Group Company’s subsidiaries, Oriental Intra-Asia agreed to provide certain technical and consulting services to the VIE Entities in exchange for the payment by each VIE Entity of an annual development and consulting services fee that is to be determined solely by Oriental Intra-Asia. For the fiscal year ended December 31, 2009, such development and consulting services fee was approximately equal to the amount of total income before income taxes of the Group Company and the Group Company’s subsidiaries;

-

Pursuant to an equity pledge agreement (the “Pledge Agreement”), entered into by and among Oriental Intra-Asia and each of the Group Company Shareholders, the Group Company Shareholders agreed to pledge all of their equity interests in the Group Company (the “Equity Interests”), to Oriental Intra-Asia as collateral security for Oriental Intra-Asia’s collection of the fees under the Service Agreement;

3

-

Pursuant to an option agreement (the “Option Agreement”), entered into by and among Oriental Intra-Asia and each of the Group Company Shareholders, the Group Company Shareholders agreed to grant to Oriental Intra-Asia an option to purchase, from time to time, all or a part of the Equity Interests, at the exercise price equal to the lowest possible price permitted by Chinese laws;

-

Pursuant to separate powers of attorney (the “Powers of Attorney”), each Group Company Shareholder agreed to grant to Oriental Intra-Asia a power to excise on his or her behalf all voting rights as a shareholder at the shareholders’ meetings of the Group Company that have been given to him or her by law and by the Articles of Association of the Group Company; and

-

Pursuant to an operating agreement, entered into by and among Oriental Intra-Asia, the VIE Entities and the Group Company Shareholders, (1) Oriental Intra-Asia agreed to act as the guarantor for the VIE Entities in the contracts, agreements or transactions in connection with the VIE Entities’ operation between the VIE Entities and any other third parties and to provide full guarantee for the VIE Entities in performing such contracts, agreements or transactions, subject to applicable laws, in exchange for which the VIE Entities agreed to mortgage the receivables of their operation and all of their assets which have not been mortgaged to any third parties to Oriental Intra-Asia, and (2) the VIE Entities and the Group Company Shareholders agreed to accept the provision of the corporate policies and guidance by Oriental Intra-Asia at any time in respect of the appointment and dismissal of the VIE Entities’ employees, the VIE Entities’ daily operation and administration as well as financial administrative systems, including the appointment of senior managers recommended by Oriental Intra-Asia (the “Operating Agreement” and together with the Service Agreement, Pledge Agreement, Option Agreement, Powers of Attorney, the PKU Equity Transfer Agreement, the Beijing Tian Hao Equity Transfer Agreement, the China TranWiseway Equity Transfer Agreement, the Zhangcheng Culture Equity Transfer Agreement, the Zhangcheng Science Equity Transfer Agreement, and the Shanghai Yootu Equity Transfer Agreement, the “Restructuring Documents”).

The main purpose of the Restructuring is to allow us to engage in the above three restricted business areas in China. As a result of the Restructuring, we transferred all of our indirect equity interests in PKU and PKU’s subsidiaries to the affiliated Group Company and accordingly, PKU and PKU’s subsidiaries became direct and indirect subsidiaries of the Group Company, which is in turn wholly owned by the Group Company Shareholders who are all Chinese citizens. At the same time, through the Contractual Arrangement, we maintain substantial control over the VIE Entities’ daily operations and financial affairs, election of their senior executives and all matters requiring shareholder approval. Under FASB Interpretation No. 46R “Consolidation of Variable Interest Entities” (ASC Topic 810 “Consolidation”), we are required to consolidate the VIE Entities into our financial statements because the Contractual Arrangement provides us with the risks and rewards associated with equity ownership, even though we do not own any of the outstanding equity interests in any of the VIE Entities. As a result the Restructuring, we are able to engage in these three restricted business areas through the VIE Entities and derive the economic benefits that we would otherwise have as the owner of VIE Entities while still complying with Chinese laws.

The following chart reflects our organizational structure as of as of the date of this annual report:

4

5

Our Industry

Transportation in China

Over the past two decades, China has completed series of large-scale highway infrastructure projects. As a result, according to the Ministry of Communication of China, China now has the second largest highway network in the world with a total length of approximately 60,300 kilometers at the end of 2008 based on the National Statistic Yearbook 2009. In addition, China has approximately 70% of the world’s toll highways according to the Highway Management Department of the Ministry of Communication. During the 10th 5 – Year Plan of China, the Chinese government spent approximately $29.3 billion on urban rapid transit. The total mileage of urban rapid transit exceeded 400 kilometers and, according to the 11th 5-Year Plan of China, it is estimated that the total mileage of urban rapid transit projects in China will exceed 1,700 kilometers by 2010, with total new investment of nearly $85 billion from 2006 to 2010. According to each city’s plan, it is estimated that the total mileage of urban rapid transit will exceed 2,500 kilometers by 2016 with total investment of $145.7 billion.

China has a population of about 1.33 billion, which accounts for about 20% of the world’s population and makes it the most populous country in the world. With rapid economic development and urbanization, car ownership has increased dramatically, leading to unprecedented transportation challenges in many cities of China. According to China’s Traffic Management Bureau of the Ministry of Public Security, China had over 180 million vehicles as of August 2009. The number is estimated to grow at least 5% over the next several years. Given the current conditions, the Chinese government intends to improve transportation management using advanced information technology solutions. At the same time, motorists are also eager to have access to real time traffic information. This strong demand from both the private and public sectors is creating an unprecedented market opportunity for transportation information products and services.

The Ministry of Communication of China is the country’s highest level transportation regulator. In December 2004, the Ministry of Communication announced a development plan for the Chinese national highway system. Under this plan, China will expand its highway network to 65,000 kilometers by 2010, and to 85,000 kilometers by 2020. After its completion, the Chinese national highway network will connect all provincial capitals and cities with populations of at least half-a-million. Based on the plan, the total investment in the national highway network will be about $294 billion from 2005 to 2020. From 2005 to 2010, the annual investment according to the plan is expected to be approximately $21 billion, with an additional $14.6 billion to be invested annually from 2010 to 2020.The Ministry of Communication in November 2008 also submitted its new budget to the Chinese central government with the total investments in the transportation sector at about $730 billion for the next 3 to 5 years.

Intelligent Transportation Systems in China

Intelligent Transportation Systems (“ITS”) provide information and data tools for different types of transportation infrastructure by deploying solutions such as communication, monitoring, tolling and planning. The 14th World Congress on ITS, defined ITS as comprehensive systems that integrate and apply advanced information, communication, control, sensor, and computer technology to effectively coordinate people, vehicles, and roads/rails to realize real-time information transfer, as well as on-time, highly efficient, safe, and energy-efficient transportation.

China’s ITS industry is still at its early stage in terms of development. Although China’s rapid economic growth over the past decade and accelerating urbanization have already resulted a significant development of its transportation infrastructure, China has also recognized a need to use nationwide transportation networks more efficiently and effectively. China began its ITS efforts in early 1990s with goals to enhance transportation management efficiency, to improve network throughput, and to reduce the negative effect of transportation to the economy and environment. Given that China is ranked second in total highway length and first in total toll highway mileage in the world, a larger-scale, more advanced ITS is needed. The increasing urban and highway traffic density also drives continued developments for ITS applications in communication and planning. As increasingly more urban and highway ITS gets deployed, the ITS market will shift towards focusing on specialized information solutions and value-added information services in the future. The urban ITS market is also still at a very initial development stage, comparable to that of the highway ITS market 10 years ago. On the other hand, this is a large but fragmented market with great potential.

Despite being at an early stage, the overall ITS market in China is highly attractive due to rapidly developing transportation infrastructure and increasing demand for ITS applications to manage it. The unique characteristics of China’s ITS industry mentioned above and the current low penetration level underline the large market potential. China’s expanding transportation network, along with its need for more effective and efficient transportation networks, has led to the need for better ITS. As a result of this and support provided by recent central government policies, investment in the ITS industry has increased significantly. Even though there is no current breakdown of ITS spending from the new $730 billion budget by the Ministry of Communication, we estimated that it would not go below 5% of the total spending.

6

Our Growth Strategy

Our objective is to become the largest provider of transportation information products and related comprehensive technology solutions in China, as well as the largest operator and provider of real-time transportation information to consumers in China. Our strategy to achieve our objectives includes the following key elements:

-

Expand geographic footprint to cover all major markets in China - Based on our successful track record and reputation, we believe there are significant opportunities to grow revenues from our existing clients by winning follow-on contracts for subsequent phases of project implementation, and by capitalizing on our first mover advantage and the clients’ exposure to higher cost of switching to other vendors. In addition to our executive offices in Beijing, we have offices established in Shanghai, Chongqing, Taiyuan (Shanxi Province), Chengdu (Sichuan Province), Hangzhou (Zhejiang Province), Huhhot (Inner Mongolia), Urumqi (Xinjiang) and Dalian (Liaoning Province). We currently provide our products and services in over twenty provinces in China. Our long-term plan is to manage our national operations through different offices and identify potential expansion opportunities.

-

Strengthen R&D capability to enhance and expand core products and further penetrate customer base – We expect to provide additional value-added services and add-ins to our current platform through continuous research and development, enhancement of our product and service offerings and maintenance of our technological leadership position in our core areas of focus. We believe the continuous refinement of our offerings will make the overall platform more attractive to potential customers.

-

Continue to enhance our leadership position in the rapidly growing transportation information technology market

– We plan to leverage our strong brand recognition and maintain a high contract bid/win ratio and follow on orders with our transportation information products and services by expanding our sales channels, increasing our product offerings and focusing on customer satisfaction and our other competitive strengths to gain additional market shares. -

Pursue strategic acquisitions to support strong internal growth – We intend to pursue strategic acquisitions to enable our geographic expansion, enhance our technological capabilities or competitive advantages, enrich product and service lines, provide recurring revenue opportunities and propel our expansion into high growth enterprise class markets.

-

Leverage existing capabilities – We plan to leverage our GIS-T strength with Beijing UNISITS Technology Co., Ltd. (“UNISITS”), to target our planned expansion into the expressway market. UNISITS is a leader in China’s intelligent transportation systems industry. UNISITS primarily provides traffic engineering E&M (electronic & machinery) systems for expressways in China. Presently, UNISITS provides products and services in over 20 provinces with an accumulated coverage of over 8,000 kilometers of expressways in China. We intend to leverage UNISITS technology and market channels synergistically with our own in order to cover a larger addressable market. By leveraging UNISITS’ large presence in China’s expressway market with our leadership in the urban transportation market, we expect to better penetrate markets for our current products and services. We also expect that through UNISITS we will gain access to expressways real-time traffic information, allowing us to tap China’s expressway information services market.

-

Further penetrate the large China consumer market with new real-time traffic data solutions – We believe the Chinese consumer represents a large growth opportunity for us. China has over 600 million cell phone users and over 180 million motor vehicles. The number of vehicles is expected to continue to grow. As a result, traffic congestion is becoming a serious concern in many Chinese cities. We provide real-time traffic information on our real-time traffic website. Our real-time traffic software for mobile devices is pre-installed in some cell phones and can also be downloaded from our website as well as from the website of China’s telecommunication companies. The growth of automobiles in China and 3G build out will enable the Chinese consumer to make more use of its mobile device and applications such as those that provide real-time traffic data.

7

Our Products and Services

Our core business is developing the ITS, in the transportation sector utilizing GIS application software and technologies. We also develop GIS applications in digital city and land and resource areas. When providing services to customers for GIS application software, some of our customers require us to purchase necessary hardware and provide system integration for them. Our major products and services include:

Transportation Planning Information System

Our transportation planning information system is a software system utilized by traffic management engineers to plan roads and water transportation, safety monitoring and conduct strategic planning. The system facilitates the comprehensive management of different information and data required for traffic planning such as national economic data, road and waterway data and digital mapping data. The system provides planners with information search tools, statistical analysis and models to serve planning and organizing needs. We have been providing this system to the Ministry of Communication of China for their nationwide transportation planning and analysis purposes.

Pavement Maintenance System

Our pavement maintenance system is a practical business application system developed specifically for pavement data collection and operations management. Based on field data collected by PDA devices and with the support of a backend data center, the system provides multiple functional modules, such as data acquisition, project management, quality management, equipment management, materials management, assessment analysis, business reports and public travel information inquiries. Our pavement maintenance system can quickly identify pavement issues, efficiently process related data, and maintain information in a scientific manner for timely and accurate support. It solves problems arising from the inefficiency of traditional manual operations by allowing complex information from various sources to be easily processed. Since the initial development of this system, we have been continuously enhancing its feature.

Electronic Toll Collection

Electronic Toll Collection (“ETC”), is a technology that allows for electronic payment of tolls. An ETC system is able to determine if a car is registered in a toll payment program, alert enforcers of toll payment violations, and debit the participating account. With ETC, these transactions can be performed without the need for vehicles to stop or slow down. Our ETC system had been launched into two provinces by the end of 2009.

Traffic Information Service System

Our Traffic Information Service System is a software system that provides the public with real time road conditions and related information. The system continuously transmits transportation data gathered from sensory devices and displays the results on an e-map interface. The system also supports web based search and analysis applications. The system has been widely applied and integrated into our solutions provided to various governmental agencies.

Taxi Security Monitoring, Commanding and Dispatching Platform

Our Taxi LED GPS Monitoring and Coordinating System is a highly integrated technological system operated with wireless satellite communication. The system can be used to increase safety and oversight in the taxi industry as well as remote supervision and management of public transportation. The system is composed of a GPS monitoring management center, imbedded GIS, an information transmitting center and onboard monitoring terminal modules. The system platform provides taxi authorities with basic information such as the location of an accident, incident time and images from within a taxi. The system also allows for better coordination with emergency services. The system was used in the cities of Urumqi, Huhhot and Dalian as of December 31, 2009.

8

GIS-T (Transportation) Middleware

Our GIS-T middleware is based on China’s mainstream traffic GIS platform. The user of our middleware can quickly establish its own application systems without significant customizations. This product has strong applicability in traffic information management, model analysis and visual expression. Our product supports efficient integration of various traffic information models and systems. GIS-T middleware has been widely utilized as technological foundation of many of our transportation information solutions designed for public sector clients.

Traffic Flow Surveying Solutions

We provide transportation management authorities at provincial and municipal levels with traffic flow surveying solutions. These solutions include coil traffic flow detectors, microwave traffic flow detectors and video traffic flow detectors for base stations as well as traffic flow intelligent data centers. We have been providing this solution to multiple provinces in China.

Intelligent Parking System

Our Intelligent Parking System (“IPS”), obtains information about available parking spaces, process that information and then presents it to drivers by means of variable message signs. Our system guides drivers in congested areas to the nearest parking facility with available parking spaces and it guides drivers within parking facilities to empty spaces. IPS reduces time and fuel otherwise wasted while searching for empty spaces and helps the parking facilities operate more efficiently. We are one of the first companies in China deploying IPS to serve public and private sector clients.

Red Light Violation Snapshot System

The red light violation snapshot system is used to photograph and record red light violations automatically. The camera captures the violating vehicle, including its license plate number, as it passes through the monitored area. The system also interlinks with a panorama camera to continue photographing the moving vehicle in order to provide comprehensive evidentiary data to authorities. We have been providing this solution to local governmental authorities of transportation.

Intelligent Highway Vehicle Monitoring System

Our highway vehicle monitoring system is used for image snapshot, license plate identification, speed recording, and blacklist database verification of vehicles passing through monitored areas along a given highway. The system consists of a front-end testing unit (camera, video testing module, vehicle tester and LED light) and main control unit (industrial control computer, system management software and communications module). The front-end system uploads images and related data to the command center on real time basis. The central communications server, database server and PC workstation then analyze and manage the uploaded data. The system can be used for automatic vehicle speed testing. The system also assists with traffic flow testing by providing traffic control authorities with relevant traffic data. We have been providing this solution to the market covering multiple provinces in China since 2008.

Intelligent Traffic Management Platform

Our intelligent traffic management platform is a comprehensive GIS based traffic management platform specially developed for urban traffic command centers. This platform functions as an interface for all ITS subsystems and is the integral element for our intelligent traffic management system. The intelligent traffic management platform allows for the capture of visual images from monitored roads, provides evidence of traffic violations at monitored intersections and records the number of vehicles passing through major urban entrances and exits, among other things. In 2008, we successfully provided real time traffic management solution based on the intelligent traffic management platform to serve the 2008 Olympic Game in Beijing. Since 2008, the system has been provided to multiple cities in China.

Dynamic Traffic Information Service Platform

Our dynamic traffic information service platform collects, processes and distributes traffic information. By utilizing arithmetic models based on moving vehicles, the system provides complete dynamic road traffic flow information. The platform also collects, processes and distributes traffic event information. The system can be used to distribute data through several different communication channels, including GPRS, EDGE, CDMA, 3G, RDS-TMC, DAB/DMB, CMMB, Internet and call centers. Our platform captures dynamic traffic information that then can be used for in-car GPS equipment, personal navigation devices (PND), intelligent handsets (Windows Mobile/S60/KJAVA), UMPC, Internet and other terminals. In 2009, we applied this platform to Wuhan Transportation Management System project.

9

Intelligent Public Transport System

Our intelligent bus traffic system inserts information technology into traditional bus traffic systems. Our system optimizes bus traffic routes and helps to improve service levels and management of urban bus traffic. The objective of our intelligent bus system is to realize efficiency in urban public transportation systems and to ensure the safe operation of bus systems while increasing the quality of bus transportation. By the end of 2009, we had been continuously enhancing the functionalities of this system.

Palmcity Navigation Engine

Our PalmCity Explore Navigation Engine is an internet and mobile application based open navigation system, which integrates mapping and navigation into Windows CE (Windows Mobile) and internet applications. By integrating map data, point of interest data storage and management, navigation application development and navigation application framework, PalmCity Explorer Navigation Engine helps navigation application developers and navigation system manufacturers develop unique products and services. We offered our navigation engine in our cell phone real time traffic software mapping add-ons to cell phone manufacturers in 2009. This navigation engine technology has also been applied at www.palmcity.cn website.

Comprehensive Location Based Service Platform

Our comprehensive location based service platform is a comprehensive transportation information service platform based on GIS, GPS, ITS and communication technologies. By integrating the latest e-maps of China, highway and city road information, vacant parking spaces, environment and weather information, the system enables real time traffic information, collection, transmission and reporting so as to provide navigation, bus transfers, real time road conditions and location search tools. Since 2009, we have applied this platform to multiple cities in China.

Passenger Flow Statistic, Detecting and Analysis System

Our Passenger Flow Statistic, Detecting and Analysis System (“TransPLE”) mainly consists of one to eight laser scanners, cameras, statistic, detecting and analysis hosts. It realizes data’s seamless coverage and multi-level acquisition in large circumstances and can accurately detects and tracks each passenger of the passenger flow’s trajectory by using distributed multi-modal sensor networks composed by several laser scanners and cameras. It is also applied to the statistics of passenger flows when the channel width is over 10 meters. This product is often used by the government agencies to optimize the pedestrian flow configurations in transportation centers such as bus station, metro station, railway station and airports and to promote public safety through crowd control, emergency response and anti-terrorism activities. We had not been able to monetize this application to the market as of December 31, 2009.

Mobile Police Information System

China TransInfo Mobile Police Information System is a comprehensive wireless application system. It includes vehicles and drivers information system, on-scene traffic violation punishment system, and traffic accident report system. The system can be used to search population information, vehicles and drivers information by specific inquiries as well as has the on-line approval and staff assessments functions, which is suitable for traffic police, criminal police, patrolman and 110 command centers. We have been providing this solution to local governmental authorities of transportation since 2009.

UNISITS Highway Monitoring System

UNISITS Highway Monitoring System mainly consists of information collection sub-system, monitoring center and information providing sub-system, which are used for analyzing traffic conditions quickly and accurately, reporting traffic management information timely to reduce traffic accidents, traffic jams and the damages to road surface. As a result, this system serves to optimize highway functions in terms of rapidness, security, comfort and effectiveness. The system has been widely applied to and integrated into our solutions provided to various governmental agencies.

10

UNISITS Weigh-in-Motion System

The UNISITS Weigh-in-Motion System integrates Automatic Vehicle Identification (AVI) technology, Automatic Vehicle Classification (AVC) technology, Weigh-in-Motion (WIM) technology, and Data Acquisition and Processing (DAP) technology to realize vehicle in motion identification function, vehicles weigh-in-motion function and other accurate vehicles in motion dynamic survey function. The system has been applied to and integrated into our highway solutions provided to various governmental agencies.

UNISISTS Optical Fiber Cable Fire-alarm System

UNISITS Optical Fiber Cable Fire-alarm System, a temperature detection alarm system, is co-developed by UNISITS and Wuhan Technology Optical Limited Corp. By adopting the cutting-edge optical fiber grating sensing technology, the system is applicable for temperature sensing in different severe environments, and can be used in industries, such as petroleum, chemicals, metallurgy, electric power, coal mine, construction and tunnel transportation. The system has been applied to and integrated into our solutions provided to various agencies for highways projects.

Digital City

We provide a full range digital services to many cities in China using a Plan-Construct-Operate model. We analyze different requirements of different regions or cities and design specific information technology systems and digital construction based on a city’s unique requirements. Our typical clients in this segment are local governments, public service departments and enterprises.

2-D and 3-D GIS

We provide software platforms that utilize two-dimensional GIS. Two-dimensional GIS defines and presents special data utilizing an “X” and “Y” axis. Beginning in the 1960s, two-dimensional GIS was widely applied in a variety of sectors, including land management, power, telecommunications and city planning. We also provide software platforms that utilize three-dimensional GIS. Three-dimensional GIS defines and presents special data utilizing an “X”, “Y” and “Z” axis. Compared with two-dimensional GIS, three-dimensional GIS defines special data in a more accurate manner, and can present both the plane and the vertical spatial relation. Moreover, three-dimension GIS can present and analyze more complicated spatial objectives than Computer Aided Design (CAD) and other visualized software. Three-dimensional GIS is better suited for exploration, resource assessment, disaster warning, and production management. It is widely applied in many sectors such as in natural resources, including mineral resources and water resources, and geology.

The Markets for Our Products and Services

We have been marketing and selling our products and services to four main submarkets within the government and regulated sectors in China. These sectors are Highway Information Systems, Urban Intelligent Transportation Systems, Digital City, and Land and Resources. Having built a customer base over the years, our strategy is to not only deliver high quality products, but also to provide ongoing value-added services so as to take advantage of any maintenance requirements or technology upgrades that may become necessary in the future. We continue to penetrate these submarkets and believe that we can take advantage of our experience by widening our scope of products and services to include data collection and application service operation.

Highway Information Systems

Our specially designed systems process and store national highway network data and travelers’ information, such as highway information management systems, which perform functions of archiving and retrieving highway data and provide transportation analysis tools. Decision support, predictive information, and performance monitoring are some of ITS applications enabled by highway ITS information management systems. In addition, ITS information management systems can assist in transportation planning, research, and safety management. Our major clients in this area include the Ministry of Communication, traffic management bureaus, highway management bureaus, and municipal construction committees.

11

Urban Intelligent Transportation Systems

Key ITS applications for urban traffic management include incident management, signal control, traveler information, traffic surveillance, and intelligent parking indication system. Urban ITS is a combination of basic traffic data, electronic technology, wireless and wire communication technologies, which relies on computer and communication technologies to improve safety and efficiency of urban traffic networks. Traffic surveillance provides monitoring functions in the urban ITS. Most metropolitan areas use loop detectors for traffic surveillance, and many use closed circuit televisions. There are also other types of surveillance tools, such as radar, lasers, or video image processing equipments. The use of vehicles equipped with toll tags or global positioning systems as probes, to determine travel times and locations, is also growing in use. Incident management provides real time incident reporting functions in urban ITS, and it is commonly used by traffic management centers in large metropolitan areas and cities. In some large cities, such as Los Angeles, traffic signal control is also centralized in the traffic management center. In many situations, traffic signal control systems use traffic responsive signals to manage the traffic within urban areas. Such responsive signals can be single signals or a group of interconnected signals. Urban traffic management centers utilize all traffic condition information collected from their ITS to give feedbacks and suggestions to travelers. Such information may be provided directly to the public or to organizations who provide it to users through radio broadcast, internet, or other means. Some major types of traveler information include pre-trip information, en-route driver information, en-route transit information and route guidance.

Digital City

Digital City sector is designed to aid the Chinese government’s initiative to outfit all major cities with broadband, wireless internet access, and information technology infrastructure. Many cities in China, especially in southern China, have experienced rapid economic developments since early 1990s. However, the information infrastructures construction in these cities does not match their economy developments. We are one of the pioneers to develop the “Digital City” concept in China . We provide full range digital services to many cities in China with the model of “Planning-Construction-Operation”. We analyze different requirements of different regions or cities and design specific information technology systems based on unique requirements. Typical clients include local governments, public service departments and enterprises.

Land and Resources

Land and resources systems cover planning, analysis, statistics and construction management for mineral resources. In this business line, we have developed a city geological information analysis system that provides tools to analyze the geological environment based on the integration of a variety of geological information, such as determining the underground structure for city planning and construction. In addition, we have created a disaster forecast system and a mineral resources assessment system that provide a platform to assess the reserves and then help to make decisions regarding the development of the mineral resources by setting up assessment models of mineral resources.

Our Intellectual Property

The following table illustrates the title of different copyrights that we own, their registration numbers, first publication dates, issuance dates, and durations, as well as the significance levels of such copyrights. The significance levels of the copyrights are divided into three levels, A, B, and C. “A” represents “Frequently Used in our products and services”, “B” represents “Occasionally Used in our products and services”, and “C” represents “Rarely Used in our products and services”.

12

|

|

Expiration Materiality | |||||

|

Copyright Title |

Certificate Number | Registration Number |

First Publication Date | Issue Date | Date | Level |

|

|

||||||

|

Computer Software Copyright Registered |

028661 | 2004SR10260 | 09.08.2004 | 10.21.2004 | 12.31.2054 | A |

|

|

||||||

|

Certificate (JTLWeb V1.0) |

||||||

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

027924 | 2004SR09523 | 06.15.2004 | 09.29.2004 | 12.31.2054 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

002827 | 2002SR2827 | 09.01.2002 | 09.24.2002 | 12.31.2052 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

009303 | 2003SR4212 | 05.10.2003 | 06.9.2003 | 12.31.2053 | B |

|

|

||||||

|

Computer Software Copyright Registered Certificate

|

006881 | 2003SR1790 | 09.05.2002 | 03.19.2003 | 12.31.2053 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

004358 | 2002SR4358 | 05.18.2002 | 12.6.2002 | 12.31.2052 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

003664 | 2002SR3664 | 06.18.2002 | 11.11.2002 | 12.31.2052 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

000823 | 2002SR0823 | 05.23.2002 | 07.04.2002 | 12.31.2052 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

000824 | 2002SR0824 | 09.28.2001 | 07.04.2002 | 12.31.2052 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

0009123 | 2001SR2190 | 07.08.2001 | 07.30.2001 | 12.31.2051 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

062877 | 2006SR15211 | 11.30.2005 | 10.31.2006 | 12.31.2056 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

062879 | 2006SR15213 | 11.30.2005 | 10.31.2006 | 12.31.2056 | B |

13

|

Computer Software Copyright Registered

Certificate |

063008 | 2006SR15342 | 06.30.2006 | 11.02.2006 | 12.31.2056 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

071603 | 2007SR05608 | 01.30.2007 | 04.17.2007 | 12.31.2057 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

063509 | 2006SR15843 | 04.30.2006 | 11.13.2006 | 12.31.2056 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

063510 | 2006SR15844 | 04.30.2006 | 11.13.2006 | 12.31.2056 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

063508 | 2006SR15842 | 06.30.2006 | 11.13.2006 | 12.31.2056 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

086634 | 2007SR20639 | 05.10.2007 | 12.24.2007 | 12.31.2057 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ10658 | 2008SRBJ035 2 | 06.25.2006 | 02.03.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ10662 | 2008SRBJ035 6 | 06.30.2007 | 02.03.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ10679 | 2008SRBJ037 3 | 10.10.2007 | 02.03.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ10485 | 2008SRBJ017 9 | 11.20.2007 | 01.16.2008 | 12.31.2058 | A |

14

|

Computer Software Copyright Registered

Certificate |

088919 | 2008SR01740 | 11.15.2007 | 01.24.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16618 | 2008SRBJ631 2 | 11.22.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16638 | 2008SRBJ633 2 | 09.12.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16626 | 2008SRBJ632 0 | 11.18.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16653 | 2008SRBJ634 7 | 09.18.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16612 | 2008SRBJ630 6 | 10.21.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16639 | 2008SRBJ633 3 | 09.26.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16620 | 2008SRBJ631 4 | 10.27.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16615 | 2008SRBJ630 9 | 09.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16795 | 2008SRBJ648 9 | 10.20.2008 | 12.13.2008 | 12.31.2058 | B |

15

|

Computer Software Copyright Registered

Certificate |

BJ16796 | 2008SRBJ649 0 | 09.18.2008 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16809 | 2008SRBJ650 3 | 11.20.2008 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16797 | 2008SRBJ649 1 | 06.10.2008 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16793 | 2008SRBJ648 7 | 01.20.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16808 | 2008SRBJ650 2 | 12.10.2007 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16792 | 2008SRBJ648 6 | 01.20.2007 | 12.13.2008 | 12.31.2058 | C |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16794 | 2008SRBJ648 8 | 08.16.2007 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16694 | 2008SRBJ638 8 | 10.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16771 | 2008SRBJ646 5 | 10.21.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16770 | 2008SRBJ646 4 | 10.29.2008 | 12.13.2008 | 12.31.2058 | B |

16

|

Computer Software Copyright Registered

Certificate |

BJ16769 | 2008SRBJ646 3 | 08.20.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16699 | 2008SRBJ639 3 | 09.10.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16751 | 2008SRBJ644 5 | 10.22.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16906 | 2008SRBJ660 0 | 12.20.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16926 | 2008SRBJ662 0 | 11.18.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16928 | 2008SRBJ662 2 | 12.10.2007 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16927 | 2008SRBJ662 1 | 05.18.2007 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16905 | 2008SRBJ659 9 | 09.20.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16876 | 2008SRBJ657 0 | 11.20.2007 | 12.13.2008 | 12.31.2058 | A |

17

|

Computer Software Copyright Registered

Certificate |

BJ16457 | 2008SRBJ615 1 | 10.30.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16428 | 2008SRBJ612 2 | 10.20.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16450 | 2008SRBJ614 4 | 10.10.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16424 | 2008SRBJ611 8 | 10.14.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16473 | 2008SRBJ616 7 | 09.08.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16423 | 2008SRBJ611 7 | 09.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16422 | 2008SRBJ611 6 | 10.25.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16472 | 2008SRBJ616 6 | 10.22.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16589 | 2008SRBJ628 3 | 04.10.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16591 | 2008SRBJ628 5 | 05.10.2008 | 12.13.2008 | 12.31.2058 | A |

18

|

Computer Software Copyright Registered

Certificate |

BJ16629 | 2008SRBJ632 3 | 08.26.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16605 | 2008SRBJ629 9 | 10.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16628 | 2008SRBJ632 2 | 05.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16631 | 2008SRBJ632 5 | 06.21.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16617 | 2008SRBJ631 1 | 10.31.2007 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16604 | 2008SRBJ629 8 | 10.26.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16641 | 2008SRBJ633 5 | 11.12.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16507 | 2008SRBJ620 1 | 09.30.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16476 | 2008SRBJ617 0 | 10.27.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16557 | 2008SRBJ625 1 | 09.30.2008 | 12.13.2008 | 12.31.2058 | A |

19

|

Computer Software Copyright Registered

Certificate |

BJ16621 | 2008SRBJ631 5 | 10.28.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16643 | 2008SRBJ633 7 | 11.20.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16622 | 2008SRBJ631 6 | 11.06.2008 | 12.13.2008 | 12.31.2058 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ16627 | 2008SRBJ632 1 | 10.10.2008 | 12.13.2008 | 12.31.2058 | B |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

77504 | 2007SL11509 | 05.01.2007 | 08.01.2007 | 12.31.2057 | A |

|

|

||||||

|

Computer Software Copyright Registered

Certificate |

BJ24485 | 2009SBRJ7479 | 09.21.2009 | 09.21.2009 | 12.31.2059 | A |

Research and Development

In 2009 and 2008, our research and development expenses amounted to approximately $3.80 million and $2.60 million, respectively. These expenses were mainly composed of staff costs and research and development equipment expenses.

Our Research and Development (R&D) Department consists of two departments, one is internal and the other is external, which involves our strategic relationship with the GeoSIS Laboratory at Peking University.

Internal R&D Department

Our internal R&D department consists of 140 researchers with extensive experience in the GIS and transportation information industry. Many of these researchers have worked at multinational corporations.

The primary focus of the internal R&D department is to analyze customer demands and develop application software products, with the use of the most highly advanced software development tools available today.

20

Our research department is also responsible for monitoring developments in the market for our services so that they can develop new products or improve upon existing products by adopting new technologies and skills.

In addition, the department is responsible for creating training and support manuals and creating new processes for implementation of our software products.

Strategic R&D Partnership with Peking University

PKU was established in connection with the Peking University’s GeoSIS Laboratory in order to provide university researchers with real life opportunities to test and implement the discoveries created at the University. On August 6, 2005, PKU entered into a cooperation agreement (the “Cooperation Agreement”), with Earth and Space College of Peking University, pursuant to which PKU obtained the access to the university’s GeoSIS Research Lab, which houses over thirty PhDs and researchers to support PKU’s research and development initiatives. Under the Cooperation Agreement, we pay for all R&D expenses of the GeoSIS Laboratory. The Cooperation Agreement has a three-year term that has been automatically renewed for an additional three years.

Our Major Customers

The following table provides information on our most significant clients in fiscal year 2009.

TOP TEN CLIENTS IN 2009

| Sales | ||||||||

| (in thousands of | Percentage of | |||||||

| No. | Name | Description of Client | US dollars) | Total Sales | ||||

| 1 | China Mobile Shangxi Co., Ltd. Xinzhou Branch | Local branch of national telecom carrier | 4,155 | 6.53% | ||||

| 2 | Gansu Province High Grade Road Construction Co., Ltd. | A provincial transportation authority owned road construction company | 4,026 | 6.32% | ||||

| 3 | Wuhan Transportation Management Bureau | City-level governmental transportation department | 3,995 | 6.27% | ||||

| 4 | Zhejiang Huangqunan Highway Co., Ltd. | A state-owned highway construction company | 3,051 | 4.79% | ||||

| 5 | Beijing Transportation Information Center | City-level governmental transportation department | 2,661 | 4.18% | ||||

| 6 | Hubei Lurongxi Highway Construction Command Center | Local governmental transportation authority | 2,175 | 3.41% | ||||

| 7 | Hangzhou Construction Committee | City-level governmental department | 1,737 | 2.73% | ||||

| 8 | Beijing Platinum Real Estate Development Co., Ltd. | Local real estate development company | 1,675 | 2.63% | ||||

| 9 | Beijing Xiangxian Technology Co., Ltd. | High-tech company in environmental application development | 1,646 | 2.59% | ||||

| 10 | Beijing Municipal Commission of Economy and Information Technology | City-level governmental department | 1,491 | 2.34% | ||||

|

TOTAL |

26,612 | 41.79% |

21

Regulation

Because our operating VIE Entities are located in the PRC, our business is regulated by the national and local laws of the PRC. There are no specific rules or regulations for a company engaged in software development other than mapping which is highly regulated in China.

In addition, we and our PRC subsidiary, Oriental Intra-Asia, are considered foreign persons or foreign-invested enterprises under PRC laws, and therefore subject to foreign ownership restrictions in connection with our online services, advertising in taxies, and security and surveillance related businesses:

Online Service

On December 11, 2001, the State Council of China promulgated the Regulations on the Administration of Foreign Invested Telecommunication Enterprises (the “FITE Regulations”) , which became effective on January 1, 2002. Under the FITE Regulations, a foreign entity is prohibited from owning more than 50% of equity of a provider of value-added telecommunications services in China, which include internet content provision services. In addition, the current Catalogue of Industries for Guiding Foreign Investment (Revised 2007) prohibits a foreign investor from investing in businesses such as news websites and web streaming audio-visual services. As a result, if we had invested directly in the value-added telecommunications services in China, we would have had at most 50% of the ownership of the business and thus only consolidated no more than 50% of the revenues generated from such business.

Taxi Advertising

For an advertising business involving foreign investment, there have been rigid overseas operational requirements on the foreign investors under the current Chinese laws. Pursuant to the Provisions on Administration of Foreign Invested Advertising Enterprises promulgated by the State Administration for Industry & Commerce and the Ministry of Commerce of China on March 2, 2004, for a wholly foreign owned advertising enterprise, the foreign investors must have at least three years of direct operations in the advertising business outside of China. In case of a joint venture, foreign investors must have at least two years of direct operations in the advertising business outside of China. However, a domestic company without direct foreign investment is not subject to any of these restrictions.

Security and Surveillance Related Business

While there is no Chinese law or regulation specifically prohibiting foreign investment in the security and surveillance related business in China, the nature of this business implies that a vast majority of the customers of this business are governmental entities. Maintaining confidentiality of sensitive information about national security and other various governmental affairs is one of the most important concerns of these government customers. Therefore, as a practicable matter, governmental entities are more willing to have business relations with purely domestic companies than a company involving foreign investment where confidential governmental information is concerned.

In order to comply with these legal restrictions, on February 3, 2009, we conducted the Restructuring and entered into the Contractual Arrangement with the VIE Entities. Such arrangements enabled us to operate these restricted businesses through our VIE Entities in which we do not hold a direct equity interest. For more information on the regulatory and other risks associated with our contractual agreements related to our VIE Entities, please see the discussion below Item 1A, “Risk Factors.”

We are also subject to PRC’s foreign currency regulations. The PRC government has controlled Renminbi reserves primarily through direct regulation of the conversion of Renminbi into other foreign currencies. Although foreign currencies, which are required for “current account” transactions, can be bought freely at authorized PRC banks, the proper procedural requirements prescribed by PRC law must be met. At the same time, PRC companies are also required to sell their foreign exchange earnings to authorized PRC banks and the purchase of foreign currencies for capital account transactions still requires prior approval of the PRC government.

22

Our Competition and Competitive Strenghts

Competition in China’s transportation information industry is very fragmented and consists of a combination of a few foreign competitors and many domestic transportation information technology companies. Whereas most international competitors seek to provide component software for the industry, our focus is on developing application software and services for the Chinese government and regulated sectors.

We believe that the following competitive strengths enable us to compete effectively in China’s transportation information industry:

-

Leading-Edge R&D Team - Our research and development team has a strong and extensive technology background and was an early entrant into the three-dimensional Geographic Information System, or GIS, market. The head of our research and development team was the lead engineering architect of the first three-dimensional GIS platform software in China, which won the Chinese Excellence Software Award in 1995.

-

R&D Affiliation with Peking University – Through our early alliance with Peking University, we developed a strong and extensive technology background. Under the cooperation agreement between our VIE Entity, PKU and Earth and Space College of Peking University, we have access to the university’s GeoSIS Research Lab and its team of over 30 scientists and researchers to support our R&D initiatives. Peking University is a 3% owner of PKU.

-

Award Winning Technology - Since inception, we have won nine product awards, including the National Transportation Planning System and Digital City Program award. The awards demonstrate the technological leadership of our Intelligent Transportation System, or ITS, and give customers a sense of security that they are purchasing a quality product.

-

Brand Image - We have built a valuable brand image through our track record of successful execution of projects for customers in various sectors. We provide products and services, including value-added services to meet maintenance and technology upgrade requirements, to our governmental and other customers. Our customers include central, provincial and municipal government agencies, construction, real estate development and high-tech companies. We plan to leverage our brand image to obtain new and recurring business.

-

Superior Management Team - Three members of our executive management team were among the first GIS software developers in China. Collectively, they have more than 34 years of experience with GIS, and each has been with PKU since its early days. They are complemented by two executives with extensive finance and corporate financial reporting experience.

-

Operational and Quality Management - We are ISO 9000 certified and conduct internal performance assessments three times per year. Being in close proximity to two of China’s top universities, we have a large pool of qualified candidates to choose from for our hiring needs. We hire our employees based on a rigorous review of their academic and technical skills. We also screen each candidate’s background for potential conflicts of interest and in order to avoid the possible appearance of impropriety in our dealings with government agencies.

We experience competition from both foreign and domestic Chinese competitors. The following is a description of some of our major competitors:

Foreign Competitors

- Image Sensing System, Inc. (“ISS”) -ISS is headquartered in St. Paul, Minnesota, a technology company focused in infrastructure productivity improvement through the development of software-based detection solutions for the Intelligent Transportation Systems (ITS) sector and adjacent overlapping markets. ISS’s industry leading computer-enabled detection (CED) products combine embedded software signal processing with sensing technologies for use in transportation, environmental and safety/surveillance management. With more than 90,000 instances sold in over 60 countries worldwide, its products position to the traffic, security and environmental management markets.

23

-