Attached files

| file | filename |

|---|---|

| EX-32 - American Wenshen Steel Group, Inc. | exhibit32.htm |

| EX-31.1 - American Wenshen Steel Group, Inc. | exhibit311.htm |

| EX-31.2 - American Wenshen Steel Group, Inc. | exhibit312.htm |

U. S. Securities and Exchange Commission

Washington, D. C. 20549

FORM 10-Q

|

[X] |

QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2009

|

[ ] |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission File No. 0-30058

AMERICAN WENSHEN STEEL GROUP, INC.

(Name of Registrant as Specified in its Charter)

|

Delaware |

04-2621506 |

|

(State or Other Jurisdiction of incorporation or organization) |

(I.R.S. Employer I.D. No.) |

c/o Warner Technology & Investment Corp., 100 Wall Street, 15 th Floor, New York,

NY 10005

(Address of Principal Executive Offices)

Issuer's Telephone Number: (212) 232-0120

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No __

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files.) Yes ___ No _____

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes __ No X

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ___ Accelerated filer ___Non-accelerated filer ___ Smaller reporting company X

Indicate the number of shares outstanding of each of the Registrant's classes of common stock, as of the latest practicable date:

February 11, 2010

Common Stock: 20,478,400 shares

ITEM 1. FINANCIAL STATEMENTS

|

AMERICAN WENSHEN STEEL GROUP, INC. AND SUBSIDIARIES |

||||||||

|

CONSOLIDATED BALANCE SHEETS |

||||||||

|

(Unaudited) |

||||||||

|

December 31, 2009 |

September 30, 2009 |

|||||||

|

ASSETS |

||||||||

|

Current Assets |

||||||||

|

Cash and cash equivalents |

$ | 34,932 | $ | 39,480 | ||||

|

Accounts receivable, net |

26,214 | 43,476 | ||||||

|

Other receivable, net |

230,313 | 231,757 | ||||||

|

Inventory, net of reserve for obsolescence |

223,247 | 222,381 | ||||||

|

Total Current Assets |

514,706 | 537,094 | ||||||

|

Property, Plant & Equipment, net |

425,886 | 447,792 | ||||||

|

Intangible Assets, net |

438,776 | 460,688 | ||||||

|

Total Assets |

$ | 1,379,368 | $ | 1,445,574 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT |

||||||||

|

Current Liabilities |

||||||||

|

Accounts payable and accrued expense |

$ | 249,562 | $ | 246,212 | ||||

|

Other payable |

85,940 | 79,487 | ||||||

|

Tax payable |

151,071 | 152,341 | ||||||

|

Due to related party |

977,063 | 989,086 | ||||||

|

Total Current Liabilities |

1,463,636 | 1,467,126 | ||||||

|

Stockholders' Equity / (Defiicit) |

||||||||

|

Preferred stock |

||||||||

|

Class A, authorized shares 1,000,000 $0.001 par value; none outstanding |

- | - | ||||||

|

Class B, authorized shares 20,000,000, no par value; none outstanding |

- | - | ||||||

|

Common stock |

||||||||

|

$0.001 par value, 100,000,000 shares authorized 20,478,400 shares issued and outstanding |

20,478 | 20,478 | ||||||

|

Additional paid-in capital |

9,029,886 | 9,029,610 | ||||||

|

Other comprehensive income |

890,262 | 890,252 | ||||||

|

Accumulated deficit |

(10,024,894 | ) | (9,961,892 | ) | ||||

|

Total Stockholders' deficit |

(84,268 | ) | (21,552 | ) | ||||

|

Total Liabilities and Stockholders' Deficit |

$ | 1,379,368 | $ | 1,445,574 | ||||

|

The accompanying notes are an integral part of these consolidated financial statements |

||||||||

2

|

AMERIAN WENSHEN STEEL GROUP, INC. AND SUBSIDIARIES |

||||||||

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||||

|

(UNAUDITED) |

||||||||

|

For the three months ended |

||||||||

|

December 31, |

||||||||

|

2009 |

2008 |

|||||||

|

Net sales |

$ | 3,511 | $ | 73,022 | ||||

|

Cost of sales |

2,809 | 82,007 | ||||||

|

Gross profit (loss) |

702 | (8,985 | ) | |||||

|

Operating expenses |

||||||||

|

Selling and marketing |

13 | 6,848 | ||||||

|

General and administrative |

63,687 | 611,645 | ||||||

|

Total operating expenses |

63,701 | 618,493 | ||||||

|

Loss from operations |

(62,998 | ) | (627,478 | ) | ||||

|

Non-operating expenses |

||||||||

|

Other expenses |

3 | 27 | ||||||

|

Net loss from continuing operations before income tax |

(63,002 | ) | (627,505 | ) | ||||

|

Income tax |

- | - | ||||||

|

Net loss from continuing operations |

(63,002 | ) | (627,505 | ) | ||||

|

Loss from the opertaion of the entity spun off |

- | (153,381 | ) | |||||

|

Net Loss |

(63,002 | ) | (780,886 | ) | ||||

|

Other Comprehensive Income (loss) |

||||||||

|

Foreign currency translation gain (loss) |

10 | (9,409 | ) | |||||

|

Net comprehensive loss |

$ | (62,992 | ) | $ | (790,295 | ) | ||

|

Net loss per share from continuing operations |

$ | (0.00 | ) | $ | (0.03 | ) | ||

|

Net loss per share from entity spun off |

$ | 0.00 | $ | (0.01 | ) | |||

|

Basic & Diluted Loss per share* |

$ | (0.00 | ) | $ | (0.04 | ) | ||

|

Basic and dilutive weighted average shares outstanding* |

20,478,400 | 20,477,835 | ||||||

|

*Basic and diluted shares are the same because there are no anti dilutive effect |

||||||||

|

The accompanying notes are an integral part of these unaudited consolidated financial statements |

||||||||

3

|

AMERICAN WENSHEN STEEL GROUP, INC. |

||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||

|

FOR THE THREE MONTHS ENDED DECEMBER 31, 2009 AND 2008 |

||||||||

|

(UNAUDITED) |

||||||||

|

2009 |

2008 |

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||

|

Net Loss |

$ | (63,002 | ) | $ | (780,886 | ) | ||

|

Adjustments to reconcile net loss from operations to net cash |

||||||||

|

provided by (used in) operating activities: |

||||||||

|

Depreciation and amortization |

44,503 | 44,221 | ||||||

|

Bad debt |

- | 567,735 | ||||||

|

Reserve for inventory |

- | - | ||||||

|

Stock option expenses |

276 | 276 | ||||||

|

Impairment of goodwill |

- | - | ||||||

|

Changes in assets and liabilities: |

||||||||

|

(Increase) / decrease in assets: |

||||||||

|

Accounts receivable |

17,268 | 47,130 | ||||||

|

Other receivable |

1,458 | (816 | ) | |||||

|

Inventories |

(853 | ) | (34,366 | ) | ||||

|

Other current assets |

- | 2,771 | ||||||

|

Increase / (decrease) in current liabilities: |

||||||||

|

Accounts payable and accrued expenses |

3,337 | 2,880 | ||||||

|

Other payable |

6,449 | (1,342 | ) | |||||

|

Tax payable |

(1,279 | ) | (3,059 | ) | ||||

|

Net cash provided by (used in) operating activities from continuing operations |

8,157 | (155,456 | ) | |||||

|

Net cash provided by operating activities of the entity spun off |

- | 272,781 | ||||||

|

Net cash provided by operating activities |

8,157 | 117,324 | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES |

||||||||

|

Purchase of property, plant and equipment |

(625 | ) | - | |||||

|

Net cash used in investing activities from continuing operations |

(625 | ) | - | |||||

|

Net cash provided by (used in) investing activities of the entity spun off |

- | (119,400 | ) | |||||

|

Net cash used in investing activities |

(625 | ) | (119,400 | ) | ||||

|

CASH FLOWS FROM FINANCING ACTIVITIES |

||||||||

|

Payment (to) / Proceed (from) return loans from related parties |

(12,083 | ) | 19,470 | |||||

|

Net cash provided by financing activities from continuing operations |

(12,083 | ) | 19,470 | |||||

|

Effect of exchange rate on cash & cash equivalent |

3 | (460 | ) | |||||

|

Net increase/(decrease) in cash & cash equivalents |

(4,548 | ) | 16,934 | |||||

|

Cash & cash equivalents - beginning of year |

39,480 | 105,719 | ||||||

|

Cash & cash equivalents - end of year |

$ | 34,932 | $ | 122,653 | ||||

|

SUPPLEMENTAL DISCLOSURES: |

||||||||

|

Cash paid during the year for: |

||||||||

|

Interest |

$ | - | $ | - | ||||

|

Income taxes |

$ | - | $ | - | ||||

|

The accompanying notes are an integral part of these consolidated financial statements |

||||||||

4

AMERICAN WENSHEN STEEL GROUP, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1. ORGANIZATION AND DESCRIPTION OF BUSINESS

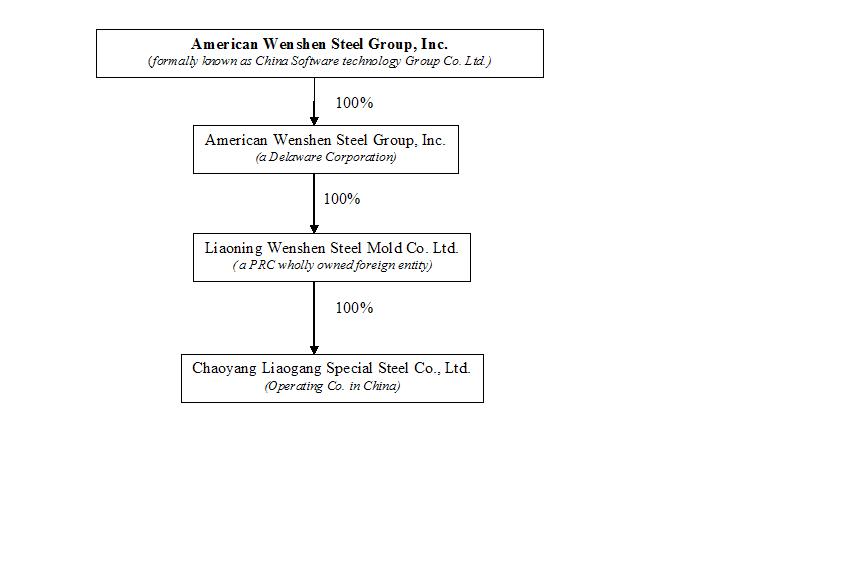

American Wenshen Steel Group, Inc. (formally known as China Software Technology Group Co. Ltd.) ("we", "us", or the "Company") through its operating subsidiary, Chaoyang Liaogang Special Steel Co., Ltd. ("Chaoyang Liaogang"), a corporation organized under the laws of The

People's Republic of China, is engaged in the business of manufacturing tungsten carbide steel, stainless steel, and die steel. All of Chaoyang Liaogang's business is currently in China. On October 9, 2007, the Company changed its name to American Wenshen Steel Group, Inc.

American Wenshen Steel Group, Inc., (“American Wenshen”), a wholly owned subsidiary of the Company was incorporated on August 29, 2006 in the state of Delaware. It currently has no operations. American Wenshen owns all of the registered capital of Liaoning Wenshen Steel Mold Co. Ltd. (“Liaoning Wenshen”). Liaoning

Wenshen is a wholly owned foreign entity incorporated in Shenyang, Liaoning Province, China in January, 2007.

Liaoning Wenshen owns all the registered capital of Chaoyang Liaogang Special Steel Co., Ltd. (“Chaoyang Liaogang Steel Co.”) which is established in Chaoyang City, Shenyang Province, China in October 2004

On July 30, 2007 China Software acquired 100% of the equity in American Wenshen pursuant to a merger agreement dated June 29, 2007 (“American Wenshen Merger”). Pursuant to the acquisition of American Wenshen, it became the wholly owned subsidiary of China Software. The former shareholders of American Wenshen received 434,377

shares of Series A Preferred Stock of China software, which were convertible into 19,305,645 shares of common stock in exchange for all the issued and outstanding shares of American Wenshen. The Series A Preferred stock represented 97.58% of the voting power of the Company.

The acquisition of American Wenshen was accounted for as a reverse acquisition under the purchase method of accounting since the shareholders of American Wenshen obtained control of the consolidated entity. Accordingly, the merger of the two companies was recorded as a recapitalization of American Wenshen, with American Wenshen being

treated as the continuing operating entity. The continuing entity retained September 30 as its fiscal year end.

Subsequent to the American Wenshen Merger, the organization chart is as follows:

5

Prior to the American Wenshen Merger, China Software assigned all of its pre-Merger business and assets to HXT Holdings, Inc., its wholly-owned subsidiary, and HXT Holdings assumed responsibility for all of the liabilities of China Software that existed prior to the Merger. It was also agreed that HXT Holdings, Inc. would file a

registration statement with the Securities and Exchange Agreement that would, when declared effective, permit China Software to distribute all of the outstanding shares of HXT to the holders of its common stock.

On May 10, 2007, the Company approved a plan to spin-off HXT Holdings to the shareholders as a tax-free distribution. The spin-off became effective in March 2009 and all shares of HXT Holdings were distributed to the Company’s shareholders on March 31, 2009. As part of this plan, the advances the Company made to HXT Holdings

were offset against the amounts due to the Company, the net amount was converted to additional paid-in-capital of the Company (note 13).

GOING CONCERN

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles, which contemplate continuation of the Company as a going concern. This basis of accounting contemplates the recovery of the Company's assets and the satisfaction of its liabilities in the normal course of business. Through

December 31, 2009, the Company had incurred cumulative losses of $10,024,894 including net losses from continuing operations of $63,002 for the three months ended December 31, 2009.

In view of the matters described in the preceding paragraph, recoverability of a major portion of the recorded asset amounts shown in the accompanying balance sheet is dependent upon continued operations of the Company, which in turn is dependent upon the Company’s ability to raise additional capital, obtain financing and to succeed

in its future operations. The financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Management has taken the following steps to revise its operating and financial requirements, (i) The Company plans to raise additional capital by selling more shares to current shareholders and potential investors with a discount price (ii) The Company also plans to borrow money from current shareholders and potential investors with and

attractive interest rate (iii) The Company plans to reduce overhead and expenses by reducing unnecessary marketing and advertisement expenses, improving efficiency on distribution channel, freezing salary increase and laying off administrative staffs.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America. All significant inter-company transactions and accounts have been eliminated in the consolidation. The functional currency is the Chinese Renminbi (CNY); however the accompanying

financial statements have been translated and presented in United States Dollars (USD).

The consolidated condensed interim financial statements included herein have been prepared by the Company, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting

principles have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading. It is suggested that these consolidated condensed financial statements be read in conjunction with the financial statements and notes thereto included in the Company’s annual report on Form 10-KSB for the year ended September 30, 2009. The Company follows the same accounting policies in preparation of

interim reports. Results of operations for the interim periods are not indicative of annual results.

6

Principles of consolidation

The consolidated financial statements include the accounts of the Company, its wholly-owned subsidiaries American Wenshen, Liaoning Wenshen and Chaoyang Liaogang Steel Co. All significant inter-company accounts and transactions have been eliminated.

Foreign currency translation

The reporting currency is the U.S. dollar. The functional currency of the Company is the local currency, the Chinese Renminbi (“CNY”). The financial statements of the Company are translated into United States dollars in accordance with Statement of Financial Accounts Standards (“SFAS”) No. 52, “Foreign Currency

Translation”, using year-end rates of exchange for assets and liabilities, and average rates of exchange for the period for revenues, costs, and expenses and historical rates for the equity. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. At December 31, 2009 and September 30, 2009, the cumulative translation adjustment of $890, 262 and $890,252, respectively, was classified as an

item of other comprehensive income in the stockholders’ deficit section of the consolidated balance sheet. For the three months ended December 31, 2009 and 2008, accumulated other comprehensive income (loss) was $10 and $(9,409), respectively.

Use of estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated

financial statements and the amount of revenues and expenses during the reporting periods. Management makes these estimates using the best information available at the time the estimates are made. However, actual results could differ materially from those results.

Risks and uncertainties

The Company is subject to substantial risks from, among other things, intense competition associated with the industry in general, other risks associated with financing, liquidity requirements, rapidly changing customer requirements, limited operating history, foreign currency exchange rates and the volatility of public markets.

Cash and cash equivalents

Cash and cash equivalents include cash in hand and cash in time deposits, certificates of deposit and all highly liquid debt instruments with original maturities of three months or less.

Accounts and other receivable

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves.

Reserves are recorded primarily on a specific identification basis. Allowance for doubtful debts of Accounts and other receivable amounted to $354,821 and $354,801 as of December 31, 2009 and September 30, 2009, respectively.

On September 30, 2009, the company evaluated the adequacy of reserve for advance to suppliers, and the allowance for doubtful debts of advance to suppliers amounted to 892,329.

7

Inventories

Inventories are valued at the lower of cost (first-in, first-out) or market value. Management compares the cost of inventories with market value and an allowance is provided for the difference between recorded and market values. At December 31, 2009 and September 30, 2009, management accounted an obsolescence reserve on inventories of $0

and 985,556, respectively.

Property and Equipment

Property and equipment are stated at cost. Expenditures for maintenance and repairs are charged to earnings as incurred; additions, renewals and betterments are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain

or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method for substantially all assets with estimated lives of: 40 years for building, 5 years for machinery, equipments and vehicles.

Intangible Assets

The Company evaluates intangible assets for impairment on an annual basis and whenever events or changes in circumstances indicate that the carrying value may not be recoverable from its estimated future cash flows. Recoverability of intangible assets, other long-lived assets and, goodwill is measured by comparing their net book value to

the related projected undiscounted cash flows from these assets, considering a number of factors including past operating results, budgets, economic projections, market trends and product development cycles. If the net book value of the asset exceeds the related undiscounted cash flows, the asset is considered impaired, and a second test is performed to measure the amount of impairment loss.

Impairment of Long-Lived Assets

The Company adopted Statement of Financial Accounting Standards No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets" (ASC 360), which addresses financial accounting and reporting for the impairment or disposal of long-lived assets and supersedes SFAS No. 121, "Accounting for the Impairment of Long-Lived Assets and for

Long-Lived Assets to be Disposed Of," and the accounting and reporting provisions of APB Opinion No. 30, "Reporting the Results of Operations for a Disposal of a Segment of a Business." The Company periodically evaluates the carrying value of long-lived assets to be held and used in accordance with SFAS 144. SFAS 144 requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets

are less than the assets' carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair market values are reduced for the cost of disposal.

Fair Value of Financial Instruments

Statement of Financial Accounting Standard No. 107 (ASC 825), "Disclosures about Fair Value of Financial Instruments", requires that the Company disclose estimated fair values of financial instruments.

The Company's financial instruments primarily consist of cash and cash equivalents, accounts receivable, other receivables, advances to suppliers, accounts payable, other payable, tax payable, and related party advances and borrowings.

As of the balance sheet dates, the estimated fair values of the financial instruments were not materially different from their carrying values as presented on the balance sheet. This is attributed to the short maturities of the instruments and that interest rates on the borrowings approximate those that would have been available for loans

of similar remaining maturity and risk profile at respective balance sheet dates.

8

Basic and Diluted Earnings Per Share

Earnings per share is calculated in accordance with the Statement of financial accounting standards No. 128 (ASC 260), Basic net loss per share is based upon the weighted average number of common shares outstanding. Diluted net loss per share is based on the assumption that all dilutive convertible shares and stock options were converted

or exercised. Dilution is computed by applying the treasury stock method. Under this method, options and warrants are assumed to be exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period.

Revenue Recognition

In accordance with SAB 104(ASC 605), revenue is recognized at the date of shipment to customers when a formal arrangement exists, the price is fixed or determinable, the delivery is completed, no other significant obligations of the Company exist and collectibility is reasonably assured. Payments received before all of the relevant criteria

for revenue recognition are satisfied are recorded as advances from customers.

Income Taxes

The Company utilizes SFAS No. 109(ASC 740), "Accounting for Income Taxes," which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred income taxes are recognized for the tax consequences

in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized

Statement of Cash Flows

In accordance with Statement of Financial Accounting Standards No. 95(ASC 230), "Statement of Cash Flows," cash flows from the Company's operations is calculated based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding

balances on the balance sheet.

Segment Reporting

Statement of Financial Accounting Standards No. 131 (ASC 280"), "Disclosure about Segments of an Enterprise and Related Information" requires use of the "management approach" model for segment reporting. The management approach model is based on the way a company's management organizes segments within the company for making operating decisions

and assessing performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner in which management disaggregates a company. SFAS 131(ASC 280) has no effect on the Company’s consolidated financial statements as the Company consists of one reportable business segment. All revenue is from customers in People’s Republic of China. All of the Company’s assets are located in People’s Republic of China.

9

Recently Issued Accounting Standards

In June 2009, the FASB issued ASC 105 (previously SFAS No. 168, The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles ("GAAP") - a replacement of FASB Statement No. 162), which will become the source of authoritative accounting principles generally accepted in the United States recognized

by the FASB to be applied to nongovernmental entities. The Codification is effective in the third quarter of 2009, and accordingly, the Quarterly Report on Form 10-Q for the quarter ending September 30, 2009 and all subsequent public filings will reference the Codification as the sole source of authoritative literature. The Company does not believe that this will have a material effect on its consolidated financial statements.

In June 2009, the FASB issued ASC 855 (previously SFAS No. 165, Subsequent Events), which establishes general standards of accounting for and disclosures of events that occur after the balance sheet date but before the financial statements are issued or available to be issued. It is effective for interim and annual periods ending after

June 15, 2009. There was no material impact upon the adoption of this standard on the Company’s consolidated financial statements.

In June 2009, the FASB issued ASC 860 (previously SFAS No. 166, “Accounting for Transfers of Financial Assets”) , which requires additional information regarding transfers of financial assets, including securitization transactions, and where companies have continuing exposure to the risks related to transferred financial

assets. SFAS 166 eliminates the concept of a “qualifying special-purpose entity,” changes the requirements for derecognizing financial assets, and requires additional disclosures. SFAS 166 is effective for fiscal years beginning after November 15, 2009. The Company does not believe this pronouncement will impact its financial statements.

In June 2009, the FASB issued ASC 810 (previously SFAS No. 167) for determining whether to consolidate a variable interest entity. These amended standards eliminate a mandatory quantitative approach to determine whether a variable interest gives the entity a controlling financial interest in a variable interest entity in favor of

a qualitatively focused analysis, and require an ongoing reassessment of whether an entity is the primary beneficiary. These amended standards are effective for us beginning in the first quarter of fiscal year 2010 and we are currently evaluating the impact that adoption will have on our consolidated financial statements.

In August 2009, the FASB issued Accounting Standards Update (“ASU”) 2009-05, which amends ASC Topic 820, Measuring Liabilities at Fair Value, which provides additional guidance on the measurement of liabilities at fair value. These amended standards clarify that in circumstances in which a quoted price in an active market for

the identical liability is not available, we are required to use the quoted price of the identical liability when traded as an asset, quoted prices for similar liabilities, or quoted prices for similar liabilities when traded as assets. If these quoted prices are not available, we are required to use another valuation technique, such as an income approach or a market approach. These amended standards are effective for us beginning in the fourth quarter of fiscal year 2009 and did not have a significant impact

on our consolidated financial statements.

In October 2009, the FASB issued ASU No. 2009-13, Revenue Recognition – Multiple Deliverable Revenue Arrangements (“ASU 2009-13”). ASU 2009-13 updates the existing multiple-element revenue arrangements guidance currently included in FASB ASC 605-25. The revised guidance provides for two significant changes to the

existing multiple-element revenue arrangements guidance. The first change relates to the determination of when the individual deliverables included in a multiple-element arrangement may be treated as separate units of accounting. This change will result in the requirement to separate more deliverables within an arrangement, ultimately leading to less revenue deferral. The second change modifies the manner in which the transaction consideration is allocated across the separately identified deliverables. Together,

these changes will result in earlier recognition of revenue and related costs for multiple-element arrangements than under previous guidance. This guidance also expands the disclosures required for multiple-element revenue arrangements. The Company does not believe that this will have a material effect on its consolidated financial statements.

10

NOTE 3. CURRENT VULNERABILITY DUE TO CERTAIN CONCENTRATIONS

The Company's operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC, and by the general state of the PRC's economy.

The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in the North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s

results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

The Company does not maintain fire, theft or liability insurance. The Company is exposed to various risks of loss related to torts; theft of, damage to and destruction of assets; error and omissions and natural disasters.

NOTE 4. INVENTORY

Inventories as of December 31, 2009 and September 30, 2009 consist of the following:

|

December 31, 2009 |

September 30, 2009 |

|||||||

|

Raw Material |

$ | 215,600 | $ | 514,057 | ||||

|

Finished Goods |

7,674 | 349,260 | ||||||

|

Work in progress |

- | 344,620 | ||||||

| 223,247 | 1,207,938 | |||||||

|

Less: Reserve for obsolescence |

- | (985,556 | ) | |||||

|

Total |

$ | 223,247 | $ | 222,381 | ||||

NOTE 5.OTHER RECEIVABLE

Other Receivables as of December 31, 2009 and September 30, 2009 are as summarized below:

|

December 31,2009 |

September 30, 2009 |

|||||||

|

Loans receivable (interest free, unsecured and due on demand) |

$ | 239,864 | $ | 254,088 | ||||

|

Deposits |

16,834 | 16,833 | ||||||

|

Others |

233,385 | 220,590 | ||||||

| 490,083 | 491,511 | |||||||

|

Less : Allowance for Doubtful Debts |

(259,770 | ) | (259,754 | ) | ||||

|

Total |

$ | 230,313 | $ | 231,757 | ||||

11

NOTE 6. PROPERTY AND EOUIPMENT

The balance of Company property and equipment as of December 31, 2009 and September 30, 2009 is summarized as follows:

|

December 31, 2009 |

September 30, 2009 |

|||||||

|

Office Equipment |

$ | 21,025 | $ | 21,023 | ||||

|

Building |

373,150 | 373,128 | ||||||

|

Production Equipment |

217,001 | 216,363 | ||||||

|

Vehicles |

164,140 | 164,131 | ||||||

| 775,316 | 774,645 | |||||||

|

Less: Accumulated depreciation |

(349,430 | ) | (326,854 | ) | ||||

|

Property and equipment, net |

$ | 425,886 | $ | 447,791 | ||||

The Company incurred depreciation expenses for the three months ended December 31, 2009 and 2008 of $22,561 and $22,291, respectively.

NOTE 7. INTANGIBLE ASSETS - PATENTS

There are five patents that have been acquired from third parties in 2005. The Patents are being amortized over a 12 year period. At December 31, 2009, the net amount of the Patents was $438,776 after considering the accumulated amortization of $438,776. At September 30, 2009, the net amount of the Patents was $460,688

after considering the accumulated amortization of $416,813. The amortization expense was $21,943 & $21,930 and for the three months ended December 31, 2009 and 2008 respectively.

Amortization expense for the Company’s intangible assets over the next five years after December 31, 2009 is estimated to be:

| Amount | ||||

| 2010 | $ | 87, 755 | ||

| 2011 | 87, 755 | |||

| 2012 | 87, 755 | |||

| 2013 | 87, 755 | |||

| 2014 | 87, 755 | |||

12

NOTE 8. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts Payable and Accrued expenses as of December 31, 2009 and September 30, 2009 are as follows:

|

December 31, 2009 |

September 30, 2009 |

|||||||

|

Accounts payable |

$ | 229,850 | $ | 226,500 | ||||

|

Accrued Expenses |

19,712 | 19,712 | ||||||

|

Total |

$ | 249,562 | $ | 246,212 | ||||

NOTE 9. DUE TO RELATED PARTIES

Due to Related Parties was $977,063 and $989,086 as of December 31, 2009 and September 30, 2009, respectively. The loan is interest free, due on demand and unsecured.

NOTE 10. SHAREHOLDERS’ EQUITY

On July 30, 2007 China Software acquired 100% of the equity in American Wenshen pursuant to a merger agreement dated June 29, 2007 (“American Wenshen Merger”). Pursuant to the acquisition of American Wenshen, it became the wholly owned subsidiary of China Software. The former shareholders of American Wenshen received 434,377

shares of Series A Preferred Stock of China software, which were convertible into 19,305,645 shares of common stock in exchange for all the issued and outstanding shares of American Wenshen.

The acquisition of American Wenshen is accounted for as a reverse acquisition under the purchase method of accounting since the shareholders of American Wenshen obtained control of the consolidated entity. Accordingly, the merger of the two companies is recorded as a recapitalization of American Wenshen, with American Wenshen being

treated as the continuing operating entity. The historical financial statements presented herein will be those of American Wenshen. The continuing entity retained September 30 as its fiscal year end.

Prior to the Merger, China Software assigned all of its pre-Merger business and assets to HXT Holdings, Inc., its wholly-owned subsidiary, and HXT Holdings assumed responsibility for all of the liabilities of China Software that existed prior to the Merger.

13

On October 12, 2007 the Company announced a 1:45 reverse split of its outstanding common stocks. All actions were approved by the Board of Directors and the majority shareholders of the Company during Special Meeting of Shareholders held on October 9, 2007.

During the year ended September 30, 2008, the Company cancelled the preferred stock of 434,377 shares issued upon the reverse acquisition. The company issued 20 million shares of common stock in exchange for the preferred stock.

On May 10, 2007, the Company approved a plan to spin-off HXT Holdings to the shareholders as a tax-free distribution. The spin-off became effective in March 2009 and all shares were distributed to the above parties on March 31, 2009. As part of this plan, the advances the

Company made to HXT Holdings were offset against the amounts due to the Company, the net amount was converted to additional paid-in-capital of the Company (Note 13).

NOTE 11. STOCK OPTIONS

The stock options summary for the three months ended December 31, 2009 is as follows (has been stated to retroactively effect a 45:1 reverse stock split in October 2007) :

|

Options outstanding |

Weighted Average Exercise Price |

Aggregate Intrinsic Value |

||||||||||

|

Outstanding, September 30, 2009 |

240 | $ | 43.20 | $ | - | |||||||

|

Granted |

- | - | - | |||||||||

|

Forfeited |

- | - | - | |||||||||

|

Exercised |

- | - | - | |||||||||

|

Outstanding, December 31, 2009 |

240 | $ | 43.20 | $ | - | |||||||

Following is a summary of the status of options outstanding at December 31, 2009:

|

Outstanding Options |

Exercisable Options |

|||||

|

Exercise Price |

Options |

Weighted Average Remaining Life |

Weighted Average Exercise Price |

Exercisable Options |

Weighted Average Exercise Price |

|

|

$43.20 |

240 |

0.44 |

$43.20 |

240 |

$43.20 |

|

The Company recognized $276 in share-based compensation expense for the three months ended December 31, 2009 in accordance with SFAS No. 123R(ASC 505),. The impact of this share-based compensation expense on the Company’s basic and diluted earnings per share was $0.00 per share. The fair value of our stock options was estimated

using the Black-Scholes option pricing model.

14

NOTE 12. STATUTORY RESERVES

As stipulated by the Company Law of the People's Republic of China (PRC), net income after taxation can only be distributed as dividends after appropriation has been made for the following:

|

1. |

Making up cumulative prior years' losses, if any; |

|

2. |

Allocations to the "Statutory surplus reserve" of at least 10% of income after tax, as determined under PRC accounting rules and regulations, until the fund amounts to 50% of the Company's registered capital; |

|

3. |

Allocations to the discretionary surplus reserve, if approved in the shareholders' general meeting. |

In accordance with the Chinese Company Law, the Company reserved $0 to the Statutory surplus reserve for the three months ended December 31, 2009 and 2008 on account of net loss in the three months ended December 31, 2009 and 2008.

NOTE 13. ENTITY SPUN OFF

On May 10, 2007, the Company approved a plan to spin-off HXT Holdings to the shareholders as a tax-free distribution. Under the plan, each stockholder of the Company received one share of HXT Holdings common stock for every 2.157 shares of common stock held as of the record date

of March 31, 2009.

On March 31, 2009, the Company completed the spin-off of HXT Holdings.

As a part of the spin off transaction of HXT Holdings, the net assets of HXT Holdings amounting $132,043 were adjusted to Additional paid in capital.

The components of loss from operations related to the entity spun off for the three months ended December 31, 2009 and 2008 are shown below.

|

2009 |

2008 |

|||||||

|

Net sales |

$ | - | $ | 154,232 | ||||

|

Cost of sales |

- | 275 | ||||||

|

Gross profit |

- | 153,957 | ||||||

|

Operating expenses |

||||||||

|

Selling expenses |

- | 77,253 | ||||||

|

Research & development expenses |

- | 115,862 | ||||||

|

General and administrative |

- | 114,689 | ||||||

|

Total operating expenses |

- | 307,804 | ||||||

|

Loss from operations |

- | (153,847 | ) | |||||

|

Non-operating expenses |

||||||||

|

Other income(loss) |

- | 323 | ||||||

|

Interest income |

- | 144 | ||||||

|

Net Loss before income tax |

- | (153,381 | ) | |||||

|

Provision for Income tax |

- | - | ||||||

|

Net loss from entity spun off |

$ | - | $ | (153,381 | ) | |||

15

NOTE 14. INCOME TAXES

The Company through its subsidiary: Chaoyang Liaogang, is governed by the Income Tax Laws of the PRC. Operations in the United States of America have incurred net accumulated operating losses for income tax purposes. The Company believes that it is more likely than not that these net accumulated operating losses will

not be utilized in the future and hence the Company has not recorded any deferred assets as of December 31, 2009.

Pursuant to the PRC Income Tax Laws, the Enterprise Income Tax (“EIT”) is at a statutory rate of 33%, which is comprises of 30% national income tax and 3% local income tax. Beginning January 1, 2008, the new Enterprise Income Tax (EIT) law replace d the existing laws for Domestic Enterprises (DES) and Foreign Invested

Enterprises (FIEs). The new standard EIT rate of 25% replaced the 33% rate previously applicable to both DES and FIEs.

|

The following is a reconciliation of income tax expense: |

||||||||||||

|

September 30, 2009 |

U.S. |

PRC |

Total |

|||||||||

|

Current |

$ |

- |

$ |

- |

$ |

- |

||||||

|

Deferred |

- |

- |

- |

|||||||||

|

Total |

$ |

- |

$ |

- |

$ |

- |

||||||

|

December 31, 2009 |

U.S. |

PRC |

Total |

|||||||||

|

Current |

$ |

- |

$ |

- |

$ |

- |

||||||

|

Deferred |

- |

- |

- |

|||||||||

|

Total |

$ |

- |

$ |

- |

$ |

- |

||||||

|

Reconciliation of the differences between the statutory U.S. Federal income tax rate |

||||||||||||

|

and the effective rate is as follows: |

||||||||||||

|

12-31-2009 |

09-30-2009 |

|||||||||||

|

US statutory tax rate |

34 |

% |

34 |

% |

||||||||

|

Foreign income not recognized in US |

(34 |

%) |

(34 |

%) |

||||||||

|

PRC income tax |

25 |

% |

25 |

% |

||||||||

|

Effects of Temporary Differences (Bad debts) |

- |

% |

- |

% |

||||||||

|

Income tax exemption due to loss |

(25 |

%) |

(25 |

%) |

||||||||

|

Effective rate |

- |

% |

- |

% |

||||||||

16

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward Looking Statements

This Report contains certain forward-looking statements regarding American Wenshen Steel Group, Inc. , its business and its financial prospects. These statements represent Management’s present intentions and its present belief regarding the Company’s future. Nevertheless, there are numerous risks and uncertainties

that could cause our actual results to differ from the results suggested in this Report. A number of those risks are set forth in Section 1A : “Risk Factors” in the Company’s Annual Report on Form 10-Q for the year ended September 30, 2009.

Because these and other risks may cause American Wenshen’s actual results to differ from those anticipated by Management, the reader should not place undue reliance on any forward-looking statements that appear in this Report. Readers should also take note that American Wenshen will not necessarily make any public announcement

of changes affecting these forward-looking statements, which should be considered accurate on this date only.

Entity Spun Off

American Wenshen Steel Group currently owns only one operating subsidiary: Chaoyang Liaogang, which carries on its specialty steel operations. Until March 31, 2009, the Company also owned HXT Holdings, Inc. However, on May 10, 2007, the Company approved

a plan to spin-off HXT Holdings, Inc. to the shareholders as a tax-free distribution. The spin-off became effective in March 2009 and all shares were distributed to the shareholders on March 31, 2009. As part of this plan, the advances the Company made to HXT Holdings were offset against the amounts due to the Company; and the net amount was converted to additional paid-in-capital of the Company. For that reason, on the Statements of Operations and Statements of Cash Flows for the period

ended December 31, 2008, HXT Holdings and its subsidiaries have been categorized as an “entity spun off.” The remainder of the financial statements reflects the assets and liabilities and results of operations of Chaoyang Liaogang.

Results of Operations

Chaoyang Liaogang commenced substantial production activity in the fall of 2006. Through March 31, 2007 its revenues consisted only of sales of small amounts of steel incidental to its development activities. Most of the $1,162,555 in revenue that Chaoyang Liaogang recorded

for the year ended September 30, 2007 were realized from one large sale of special steel and one variety of die steel to one distributor, Shenyang Geshite Special Steel Co., Ltd., which is located nearby in the capital of Liaoning Province. In fiscal 2008, we developed several other customers for our products. For the year ended September 30, 2008 we realized $2,253,816 in revenue, compared to $ 1,162,555 that we realized in the year ended June 30, 2007.

Our growth was reversed during the year ended September 30, 2009. As a result of the global recession, construction activities in China have diminished, and so demand for our products waned. In addition we have negative working capital, which prevents us from financing

large orders for our products. As a result, during the year ended September 30, 2009 we realized only $264,924 in revenue, an 88% reduction from the prior fiscal year. This situation continued in the quarter ended December 31, 2009, when our net sales totaled only $3,511, compared to $73,022 in the quarter ended December 31, 2008. At present we cannot predict when our revenues will begin to grow again.

17

Since our sales for the past quarter were insignificant, our gross profit was negligible. The gross profit surpassed the first quarter of the prior fiscal year, however, when we lost money on our sales. Our negative gross margin in the earlier period was primarily

attributable to (a) our low sales volume, which leads to inefficiencies in the allocation of overhead expenses, and (b) the fact that we are using scrap steel for our primary raw material. In recent years the international market price for scrap steel has increased several-fold, making the reworking of scrap steel less substantially less profitable than it was at the beginning of the current decade.

If we are able to obtain the financing necessary to support an expansion of sales, we expect our profit margins to increase significantly in the future, due to:

|

· |

increased sales volume, which will lead to more efficient use of our facilities; |

|

· |

introduction of tungsten carbide steel into our sales, which we will be able to market at a higher mark-up over cost than our other steel products; and |

|

· |

acquisition of sources of iron ore, which will lower our cost of raw materials. |

Due to the reduction in our operations, our general and administrative expenses for the quarter ended December 31, 2009 were only $63,687, compared to $611,645 in the first quarter of fiscal year 2009. In the future, if we are properly funded, we expect that our overall efficiencies will enable us to increase our sales

volume at a rate that will be substantially greater than the accompanying increase in our general and administrative expenses. Sales and marketing expense, however, will increase as we expand our marketing program In addition, as noted below, we intend to raise money for capital investment: purchase of additional smelting equipment and development of an iron mining facility. To the extent that we obtain those funds as loans, our general and administrative expenses

will be increased by (a) interest expense and (b) depreciation expense.

The Company’s net loss from continuing operations for the first quarter of fiscal year 2010 was $63,002. In the first quarter of fiscal year 2009 we lost $627,505 in our continuing operations. The operations of HXT Holdings, Inc., which are accounted for as an “entity spun off,” realized

a net loss of $153,381 during the first quarter of the 2009 fiscal year. Our company, therefore, reported a consolidated net loss of $780,886 for the quarter ended December 31, 2008.

Our business operates entirely in Chinese Renminbi, but we report our results in our SEC filings in U.S. Dollars. The conversion of our accounts from RMB to Dollars results in translation adjustments, which are reported as a middle step between net income/loss and net comprehensive gain/loss. The net income/loss is added

to the retained earnings on our balance sheet; while the translation adjustment is added to a line item on our balance sheet labeled “other comprehensive income,” since it is more reflective of changes in the relative values of U.S. and Chinese currencies than of the success of our business. During the first quarter of the2010 fiscal year the unrealized loss on foreign currency translations increased our accumulated other comprehensive income by $10. In the first quarter of the

prior fiscal year, when the exchange rate was more volatile, our accumulated other comprehensive income was reduced by $9,409.

Liquidity and Capital Resources

The development and operations of Chaoyang Liaogang have been funded to date primarily by capital contributions and loans from its shareholders, primarily Yang Kuidong. As a result, at December 31, 2010 Chaoyang Liaogang had $977,063 in debt, most of which was owed to Mr. Yang. Until we obtain a source of outside financing,

we remain dependent on Mr. Yang as our primary source of working capital.

18

At December 31, 2009 the Company had a working capital deficit of $948,930, representing a $18,897 decrease of working capital since our last fiscal year ended on September 30, 2009. Since our current obligation to our Chairman exceeds our working capital deficit, the deficit does not imperil

our existence. The deficit does, however, prevent us from aggressively marketing our products, resulting in our recent low level of operations.

Chaoyang Liaogang currently has sufficient capital resources to carry on its business as it is currently constituted, particularly as we can rely on the capital resources of our Chairman. However, our business plan calls for substantial capital investment over the next twelve months. We

intend to expand the capacity of our factory by investing approximately $4.5 million in new capital equipment, specifically:

|

· |

a 30 ton arc furnace - $2.5 million |

|

· |

a 30 ton heavy duty electric dregs furnace - $1.3 million |

|

· |

a 5 ton free-going hammer - $0.7 million |

At the present time, we have received no commitments for the funds required to increase our marketing efforts and for our planned capital investments. Obtaining those funds, if we can do so, will require that we issue substantial amounts of equity securities or incur significant debts. We

believe that the expected return on those investments will justify the cost. However, our plan, if accomplished, will significantly increase the risks to our liquidity.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Not applicable.

Evaluation of Disclosure Controls and Procedures .

Our Chief Executive Officer and Chief Financial Officer carried out an evaluation of the effectiveness of our disclosure controls and procedures as of December 31, 2009. Pursuant to Rule13a-15(e) promulgated by the Securities and Exchange Commission pursuant

to the Securities Exchange Act of 1934, “disclosure controls and procedures” means controls and other procedures that are designed to insure that information required to be disclosed by American Wenshen Steel Group, Inc. in the reports that it files with the Securities and Exchange Commission is recorded, processed, summarized and reported within the time limits specified in the Commission’s rules. “Disclosure controls and procedures” include, without limitation, controls

and procedures designed to insure that information American Wenshen Steel Group is required to disclose in the reports it files with the Commission is accumulated and communicated to our Chief Executive Officer and Chief Financial Officer as appropriate to allow timely decisions regarding required disclosure. Based on their evaluation, our Chief Executive Officer and Chief Financial Officer concluded that American Wenshen Steel Group’s system of disclosure controls and procedures

was effective as of December 31, 2009 for the purposes described in this paragraph.

Changes in Internal Controls . There was no change in internal controls over financial reporting (as defined in Rule 13a-15(f) promulgated under the Securities Exchange Act or 1934) identified

in connection with the evaluation described in the preceding paragraph that occurred during American Wenshen Steel Group’s first fiscal quarter that has materially affected or is reasonably likely to materially affect American Wenshen Group’s internal control over financial reporting.

19

ITEM 1. LEGAL PROCEEDINGS

The company is not party to any material legal proceeding.

ITEM 1A. RISK FACTORS

During the period addressed in this Report, there were no material changes in the risk factors set forth in Item 1A: “Risk Factors” in the Annual Report on Form 10-K for the year ended September 30, 2009.

|

CHANGES IN SECURIT IES AND REGISTRANT PURCHASE OF EQUITY SECURITIES |

(c) Unregistered sales of equity securities

None.

(e) Purchases of equity securities

The Company did not repurchase any of its equity securities that were registered under Section 12 of the Securities Exchange Act during the 1st quarter

of fiscal 2010.

None.

None.

None.

|

32 |

Rule 13a-14(b) Certification |

20

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

|

AMERICAN WEHNSHEN STEEL GROUP, INC. |

|

Date: February 11, 2010 |

By: /s/ Yang Kuidong |

| Yang Kuidong, Chief Executive Officer | |

|

By: /s/ Zhang Liwei | |

| Zhang Liwei, Chief Financial Officer |

21