Attached files

| file | filename |

|---|---|

| EX-5.1 - OPINION OF HOLLAND & HART LLP - China Carbon Graphite Group, Inc. | fs10210ex5_chinacarbon.htm |

| EX-23.1 - CONSENT OF BERNSTEIN & PINCHUK LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - China Carbon Graphite Group, Inc. | fs10210ex23i_chinacarbon.htm |

| EX-22.2 - CONSENT OF AGCA, INC., AN INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - China Carbon Graphite Group, Inc. | fs10210ex23ii_chinacarbon.htm |

As filed

with the Securities and Exchange Commission on February 5, 2010

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

____________________________

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

CHINA CARBON GRAPHITE GROUP,

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

2721

|

98-0550699

|

|

(State

or other jurisdiction of

|

(Primary

Standard Industrial

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Classification

Code Number)

|

Identification

No.)

|

c/o

Xinghe Xingyong Carbon Co., Ltd.

787

Xicheng Wai

Chengguantown

Xinghe

County

Inner

Mongolia, China

(+86)

474-7209723

(Address,

including zip code, and telephone number, including area code, of registrant’s

principal executive offices)

Resident

Agents of Nevada, Inc.

711

S. Carson Street, Suite 4

Carson

City, Nevada 89701

(Name,

address, including zip code, and telephone number, including area code, of agent

for service)

Copies

to:

Christopher

S. Auguste, Esq.

Bill

Huo, Esq.

Ari

Edelman, Esq.

Kramer

Levin Naftalis & Frankel LLP

1177

Avenue of Americas

New

York, New York 10036

(212)

715-9100

___________________________

Approximate

date of commencement of proposed sale to the public: From time to time after the

effective date of this Registration Statement.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration

statement for the same offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

Accelerated Filer o

|

Accelerated

Filer

o

|

|

Non-Accelerated

Filer o

(Do

not check if a smaller reporting company)

|

Smaller

reporting company x

|

CALCULATION

OF REGISTRATION FEE

|

Title

of each Class of

Securities

to be Registered

|

Amount

to be

Registered(1)

|

Proposed

Maximum

Offering

Price Per

Unit

|

Proposed

Maximum

Aggregate

Offering

Price

|

Amount

of

Registration

Fee

|

|||||||||||

|

Common

Stock, par value $0.001 per share

|

2,480,500 | $ | 1.45(2) | $ | 3,596,725.00 | $ | 256.45 | ||||||||

|

Common

Stock, par value $0.001 per share

|

992,200 | $ | 1.30(3) | $ | 1,289,860.00 | $ | 91.95 | ||||||||

|

Common

Stock, par value $0.001 per share

|

124,025 | $ | 1.32(3) | $ | 163,713.00 | $ | 11.67 | ||||||||

|

Total

|

3,596,725 | $ | 5,050,298.00 | $ | 360.07 | ||||||||||

(1)

Pursuant to Rule 416 under the Securities Act of 1933, as amended, or the

Securities Act, this registration statement includes an indeterminate number of

shares as may become necessary to adjust the number of shares issued by the

registrant and resold by the selling stockholders resulting from stock splits,

stock dividends or similar transactions involving our common stock.

(2)

Estimated pursuant to Rule 457(c) of the Securities Act solely for the purpose

of computing the amount of the registration fee based on the average bid and

asked prices on the OTC Bulletin Board on February 1, 2010.

(3)

Calculated in accordance with Rule 457(g) based upon the price at which the

warrants may be exercised.

The

Registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said section 8(a),

may determine.

PROSPECTUS

Subject

to completion, dated February 5, 2010

CHINA

CARBON GRAPHITE GROUP, INC.

3,596,725

Shares of Common Stock

This prospectus relates to an aggregate of 3,596,725 shares of common stock,

par value $0.001 per share, of China Carbon Graphite Group, Inc., a Nevada

corporation, that may be sold from time to time by the selling stockholders

named in this prospectus, which includes:

|

·

|

2,480,500

shares of our common stock issuable upon the conversion of the Series B

Convertible Preferred Stock issued to the selling stockholders named in

this prospectus; and

|

|

·

|

1,116,225

shares of our common stock issuable upon the exercise of the warrants

issued to the selling stockholders named in this

prospectus.

|

We will

not receive any proceeds from the sales of any shares of common stock by the

selling stockholders. We may, however, receive proceeds of up to $1,453,573 from

the exercise of warrants held by the selling stockholders if and when such

warrants are exercised in exchange for cash.

Our

common stock is quoted on the OTC Bulletin Board, or OTC, under the symbol

“CHGI.OB”. The closing price for our common stock on February 2, 2010 was $1.45

per share, as reported on the OTC.

Investing

in our common stock involves a high degree of risk. See the section entitled

“Risk Factors” beginning on page 8 to read about factors you should consider

before buying shares of our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has

approved or disapproved of these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a criminal

offense.

The

information in this prospectus is not complete and may be changed. No person may

sell the securities described in this document until the registration statement

filed with the Securities and Exchange Commission is declared effective. This

prospectus is not an offer to sell these securities and no person named in this

prospectus is soliciting offers to buy these securities in any state where the

offer or sale is not permitted.

The date

of this prospectus is ,

2010

PROSPECTUS

SUMMARY

The

following summary highlights some of the information contained in this

prospectus, and it may not contain all of the information that is important to

you in making an investment decision. You should read the following summary

together with the more detailed information regarding our company and the common

stock being sold by the selling stockholders in this offering, including the

“Risk Factors” and our consolidated financial statements and related notes,

included elsewhere in this prospectus.

The

Company

Overview

of Our Business

We are engaged in the manufacture of

graphite products in the People’s Republic of China. Based on

information we receive about our industry in the course of our business, we

believe that we are the largest wholesale supplier of fine grain graphite and

high purity graphite in China and one of China’s largest producers and suppliers

of graphite products.

We manufacture three types of products:

graphite electrodes, fine grain graphite products and high purity graphite

products.

Graphite electrodes are conducting

materials used for electric arc furnaces in the manufacture of steel and in

smelting of products such as alloy steel, brown alumina, yellow phosphorus and

other metals. Fine grain graphite is widely used in smelting colored

metals and rare-earth metals as well as in the manufacture of molds. High purity

graphite is used in, among others, the metallurgy, mechanical, aviation,

electronic, atomic energy, chemical and food industries.

Our product types are differentiated

based upon qualities such as density, thermal conductivity, electrical

resistivity, thermal expansion and strength. With respect to each of

our product types, we sell products that vary in size and purity, depending on

the particular specifications requested by our distributors. We also

customize our products in various shapes. We regularly upgrade each

of our products by increasing their size, density and purity, in accordance with

customer demands.

We plan

to expand our business by internal growth over the next several years. Our

short-term growth strategy is to increase our production capacity from 15,000

metric tons to 26,000 metric tons annually, assuming that we are able to obtain

the necessary funds. We are currently manufacturing at full

capacity. Once we increase our production capacity, we expect to

increase sales of our products, in particular our higher margin fine grain

graphite and high purity products.

Our long-term strategy is to expand our

product offerings by manufacturing nuclear graphite used as a reflector or

moderator in nuclear reactors in China, assuming that we are able to obtain the

necessary funds. The profit margin on these products would be significantly

higher than the profit margin on our current line of products.

Organizational

Structure

We were incorporated in Nevada on

February 13, 2003 as Achievers Magazine, Inc. On December 14, 2007,

we completed a reverse merger transaction with Talent International Investment

Limited, or Talent, a company incorporated in the British Virgin Islands, on

February 1, 2007. Following the reverse merger, our name was changed

to China Carbon Graphite Group, Inc.

5

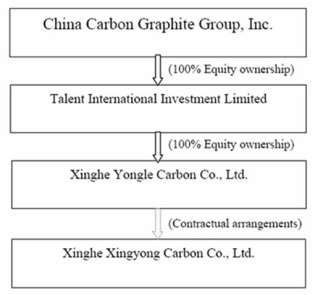

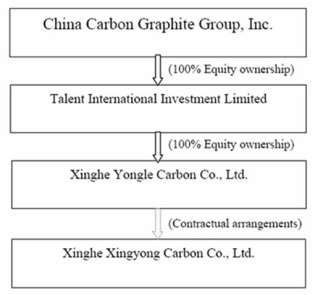

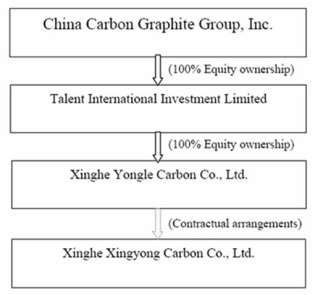

As a result of the reverse merger, we

wholly own Talent. Talent wholly owns Xinghe Yongle Carbon Co., Ltd.,

or Yongle, a wholly foreign owned enterprise organized under the laws of the PRC

on September 18, 2007. On December 14, 2007, Yongle executed a series

of exclusive contractual agreements with Xinghe Xingyong Carbon Co., Ltd., or

Xingyong, an operating company organized under the laws of the PRC in December

2001, pursuant to which we have the ability to substantially influence

Xingyong’s daily operations and affairs. These agreements are

described below under “Our Business – Organizational Structure.”

Below is a chart depicting our

organizational structure:

Summary

of the Offering

|

Summary of the

Offering

|

|

|

Common

stock offered by selling stockholders

|

The

selling stockholders are offering an aggregate of 2,480,500 shares of our

common stock, par value $0.001 per share, issuable upon the conversion of

shares of Series B Convertible Preferred Stock, par value $0.001 per share

and an aggregate of 1,116,225 shares of our common stock issuable upon the

exercise of warrants held by the selling stockholders. This number

represents in the aggregate approximately 16.3% of the outstanding shares

of our common stock as of the date of this prospectus. (1)

|

|

Common

stock to be outstanding immediately after this offering

|

18,406,661 shares(2)

|

|

Proceeds

to us

|

We

will not receive any of the proceeds from the sale of shares of our common

stock by the selling stockholders. However, we may receive up

to an aggregate of $1,453,573 from the exercise of warrants held by the

selling stockholders if and when such warrants are exercised in exchange

for cash. We will use any such proceeds for general working

capital purposes.

|

(1) Based on 18,406,661 shares of common

stock outstanding as of February 1, 2010 and the

issuance of 2,480,500 shares of our common stock upon the conversion of all

Series B Preferred Stock held by the selling stockholders, and the issuance of

1,116,225 shares of our common stock upon the exercise of all the warrants

issued to the selling stockholders in a recent financing

transaction.

(2) Does

not include 1,441,225 shares of our common stock issuable upon the exercise of

outstanding warrants and 125,000 shares of our

common stock issuable upon the conversion of shares of Series A Preferred

Stock.

6

Risks

Affecting Our Business

We are

subject to a number of risks, which you should be aware of before deciding to

purchase the securities in this offering. These risks, which are

summarized below and are described in more detail below under the heading “Risk

Factors,” include, but are not limited to, the following:

|

·

|

Inability

to raise capital or make acquisitions to fuel our

growth;

|

|

·

|

Inability

to pay off loans if payment is demanded at

maturity;

|

|

·

|

The

current global economic and financial

crisis;

|

|

·

|

Credit

risk with respect to our accounts

receivable;

|

|

·

|

Potential

inability to secure necessary raw materials in sufficient quantities, and

fluctuations in raw material

prices;

|

|

·

|

Inability

to effectively manage rapid growth;

|

|

·

|

Potential

loss of key members of our senior management;

and

|

|

·

|

Potential

failure to have complied with PRC regulations regarding our

restructuring.

|

Any of

the above risks could materially and adversely affect our business, financial

position and results of operations. An investment in our common stock involves

risks. You should read and consider the information set forth below in the

section entitled “Risk Factors” and all other information set forth in this

prospectus before investing in our common stock.

Corporate

Information

Our executive offices are located at

c/o Xinghe Xingyong Carbon Co., Ltd., 787 Xicheng Wai, Chengguantown, Xinghe

County, Inner Mongolia, China, and our telephone number is +(86) 474-7209723. We

maintain a website at http://www.chinacarboninc.com. Information

contained in our website shall not be deemed to be a part of this

prospectus.

7

RISK

FACTORS

An

investment in our common stock is speculative and involves a high degree of risk

and uncertainty. You should carefully consider the risks described below,

together with the other information contained in this prospectus, including the

consolidated financial statements and notes thereto, before deciding to invest

in our common stock. Additional risks not presently known to us or that we

presently consider immaterial may also adversely affect our company. If any of

the following risks occur, our business, financial condition and results of

operations, and the value of our common stock, could be materially and adversely

affected.

Risks

Related to Our Business

We

will require additional financing to maintain and develop our business, which

funds may not be available to us on favorable terms, or at

all. Without additional funds, we may not be able to maintain or

expand our business.

We plan

to expand our business by internal growth over the next several years. Our

short-term growth strategy is to increase our production capacity from 15,000

metric tons to 26,000 metric tons annually, assuming that we are able to obtain

the necessary funds. We are currently manufacturing at full

capacity. Once we increase our production capacity, we expect to

increase sales of our products, in particular our higher margin fine grain

graphite and high purity products.

Our long-term strategy is to expand our

product offerings by manufacturing nuclear graphite used as a reflector or

moderator in nuclear reactors in China, assuming that we are able to obtain the

necessary funds. The profit margin on these products would be significantly

higher than the profit margin on our current line of products.

In order for us to increase the

production capacity of our current products and to develop a product line that

manufactures nuclear graphite that meets the minimum requirements for nuclear

power reactors in China, we plan to purchase new equipment and machinery, such

as new machinery for our graphitization and molding processes and larger baking

ovens, and to hire additional employees. We recently raised approximately $3

million pursuant to an equity offering to the selling stockholders, which funds

are being used to increase the production capacity of our current products, in

particular fine grain graphite and high purity graphite. In order to

further increase the production capacity of these products and to expand our

products offerings, we will need to raise a substantial amount of additional

capital from equity or debt markets or to borrow additional funds from local

banks. We currently have no commitments from any financing

source. The low price and low trading volume of our common stock and

the reluctance of many investors to make significant investments in Chinese

companies, together with the global economic downturn make it increasingly

difficult for us to raise funds. There is no assurance that we will

be able to raise any funds on terms favorable to us, or at all. In

the event that we issue shares of equity or convertible securities, holdings of

our existing stockholders would be diluted. In addition, there is no

assurance that we will successfully manage and integrate the production and sale

of additional or new products.

We

plan to expand our business by acquiring one or more companies. Any

such acquisition may disrupt, or otherwise have a negative impact on, our

business operations.

We intend

to expand our business through acquisitions. In the event that we make

acquisitions, we could have difficulty integrating the acquired companies’

personnel and operations with our own. In addition, the key personnel of the

acquired business may not be willing to work for us. We cannot predict the

effect that any such expansion may have on our core business. Regardless of

whether we are successful in making an acquisition, the negotiations for

potential acquisitions could disrupt our ongoing business, distract our

management and employees and cause us to incur significant expenses. In addition

to the risks described above, acquisitions are accompanied by a number of

inherent risks, including, without limitation, the following:

8

|

·

|

the

difficulty of integrating acquired products, services or

operations;

|

|

·

|

the

potential disruption of the ongoing businesses and distraction of our

management and the management of acquired

companies;

|

|

·

|

the

difficulty of incorporating acquired rights or products into our existing

business;

|

|

·

|

difficulties

in disposing of the excess or idle facilities of an acquired company or

business and expenses in maintaining such

facilities;

|

|

·

|

difficulties

in maintaining uniform standards, controls, procedures and policies,

including disclosure controls and financial

controls;

|

|

·

|

the

potential impairment of relationships with employees and customers as a

result of any integration of new management

personnel;

|

|

·

|

the

potential inability or failure to achieve additional sales and enhance our

customer base through cross-marketing of the products to new and existing

customers;

|

|

·

|

the

acquisition strategy will likely require additional equity or debt

financing, resulting in additional leverage or dilution of

ownership;

|

|

·

|

the

effect of any government regulations which relate to the business

acquired, including any additional costs resulting from the failure of the

acquired company to comply with governmental regulations;

and

|

|

·

|

potential

unknown liabilities associated with acquired businesses or product lines,

or the need to spend significant amounts to retool, reposition or modify

the marketing and sales of acquired products or the defense of any

litigation, whether of not successful, resulting from actions of the

acquired company prior to our

acquisition.

|

Our

business could be severely impaired if and to the extent that we are unable to

succeed in addressing any of these risks, and our results of operations could be

adversely affected.

If

our lenders demand payment when our loans are due, we may have difficulty in

making payments, which could impair our ability to continue operating our

business.

At

September 30, 2009, we had short-term bank loans of approximately $8.5

million. These bank loans, which are secured by a lien on our fixed

assets and land use rights, are due in June 2010. In the past, these

banks extended our loans. However, we cannot assure you that our

lenders will not demand payment on the maturity date of these

loans. If the lenders demand payment when due, we may not be able to

obtain the necessary funds to pay off these loans. Our cash reserves,

which at September 30, 2009 were $6,047,977, are insufficient to pay off such

loans when due.

Our

income has suffered from bad debt charges resulting from customers’ inability to

pay us as a result of the economic downturn.

In the

fourth quarter of 2008, we incurred a net loss of approximately $300,000. This

loss was largely the result of an increase in our bad debt expense of

approximately $200,000 and an increase in our allowance for bad debts of

$860,000. One customer accounted for approximately $450,000 of these charges.

This customer was not one of our top three customers in 2008. Furthermore, the

economic downturn has also affected our accounts receivable, as we have

experienced delays in collection of accounts receivable. This is

reflected in the increase in accounts receivable from $4.2 million at December

31, 2008 to $6.2 million at September 30, 2009, despite a decline in sales

during the nine months ended September 30, 2009. Of the outstanding accounts

receivable at September 30, 2009, approximately $437,000 were also outstanding

at December 31, 2008. In particular, our graphite electrodes are sold mainly to

steel manufacturers, who have been significantly affected by the global economic

downturn. There has been a downturn in the graphite electrode market which has

impacted our business. We cannot predict when or whether the economic downturn

will cease to affect our business.

9

A large percentage of our revenues

depends on a limited number of distributors, the loss of one or more of which

could materially adversely affect our operations and

revenues.

Our

revenue is dependent in large part on significant orders from a limited number

of distributors, who may vary from period to period. During the nine months

ended September 30, 2009, two distributors accounted for approximately $6.4

million, or 52.5% of our revenue, and during the year ended December 31, 2008,

three distributors accounted for approximately $11.5 million, or 42.1% of our

revenue. One distributor was a principal distributor in both the nine months

ended September 30, 2009 and the year ended December 31, 2008 and accounted for

approximately $3.1 million, or 25.1%, of our sales for the nine months ended

September 30, 2009 and $4.1 million, or 14.9%, of our sales for the year ended

December 31, 2008. No other distributor accounted for 10% of our sales in either

period. We do not have long-term contracts with these distributors. Demand for

our products depends on a variety of factors including, but not limited to, the

financial condition of our distributors, the end users of our products and their

customers, and general economic conditions. For instance, our graphite

electrodes are sold mainly to steel manufacturers, who have been significantly

affected by the global economic downturn. As a result, there has been

a downturn in the graphite electrode market which has impacted our business. We

cannot predict when or whether the economic downturn will cease to affect our

business. If sales to any of our large distributors are substantially

reduced for any reason, such reduction may have a material adverse effect on our

business, financial condition and results of operations.

Since

the payments we receive from Xingyong are subject to annual negotiation, we may

not be entitled to receive all of Xingyong’s net income in the

future.

Pursuant

to the business operations agreement between Yongle and Xingyong, Xingyong is

obligated to pay between 80% and 100% of its net income to Yongle, subject to

annual negotiation. While Xingyong has agreed to pay 100% of its net

income to Yongle for 2009 and 2010, there is no assurance that it will continue

to do so in subsequent years. Dengyong Jin, our former chief

executive officer, owns Xingyong. Mr. Jin and his family members also

control Sincere Investment (PTC), Ltd., or Sincere, our controlling

stockholder. Our profitability would be affected if the percentage of

Xingyong’s net income that is payable to us would be decreased.

Our

business and operations are experiencing a downturn following a period of rapid

growth. If we fail to manage our business effectively, our operating results

could be harmed.

Until the

third quarter of 2008, we experienced rapid growth in our operations, which has

placed, and will continue to place, significant demands on our management,

operational and financial infrastructure. Since the fourth quarter of 2008,

however, as a result of the global economic crisis, our business has slowed, our

collection of receivables has slowed and our expense for bad debts has increased

significantly. To manage our business effectively, we need to continue to

improve our operational, financial and management controls. These system

enhancements and improvements may require significant capital expenditures and

management resources. Failure to implement these improvements could impair our

ability to manage our business and could result in a further deterioration of

our financial position and the results of our operations.

If

the PRC government closes our facilities in the future, even temporarily, our

financial condition may be materially affected.

The

Chinese government closed our facilities for a period of almost two months

during the third quarter of 2008 as part of the Chinese government’s program to

reduce air pollution during the Olympics. This shutdown reduced our sales in the

first quarter of 2009 because it takes about three months to six months to

produce graphite products. If the PRC government closes our

facilities in the future, even temporarily, our financial condition may be

materially affected.

Our principal stockholder has the

power to control our business, whose interest may differ from other stockholders.

Our

principal stockholder, Sincere, owns 51.0% of our common stock as of February 1,

2010. As a result, Sincere has the ability to elect all of our directors and to

approve any action requiring stockholder action, without the vote of any other

stockholders, including the outcome of corporate transactions submitted to the

stockholders for approval such as mergers, consolidations and the sale of all or

substantially all of our assets. Sincere has the power to cause or

prevent a change of control. The interest of our principal stockholder may

differ from the interests of other stockholders. Sincere is controlled by Mr.

Jin, who is our former chief executive officer and the principal shareholder and

chief executive officer of Xingyong, and his relatives.

10

If

our competitors sell higher quality products or similar products at a lower

price, or if they are otherwise more successful in penetrating the market, our

financial condition would be affected.

We face

competition from both Chinese and international companies, many of which are

better known and have greater financial resources than us. Many of the

international companies, in particular, have longer operating histories and have

more established relationships with customers and end users. If our competitors

are successful in providing similar or better graphite products or provide

graphite products at a lower price than we offer our products, or if they are

otherwise more successful in penetrating the market, we could experience a

decline in demand for our products, which would negatively impact our sales and

results of operations.

Because

the end users of graphite products seek products that incorporate the latest

technological development, including increased purity, our failure to offer such

products could impair our ability to market our products.

Our

products are either used in the manufacturing process for other products,

particularly metals, or for incorporation in various types of products or

processes. The end users typically view both the purity of the graphite and the

bend strength, compression strength, resistivity, bulk density and porosity of

graphite as key factors in making a decision as to which products to purchase.

Accordingly, our failure or inability to offer products manufactured with the

most current manufacturing technology could adversely affect our

sales.

An

increase in the cost of raw materials will affect our revenues.

We purchase all of our raw materials

from domestic Chinese suppliers. Because we do not have any long-term

contracts with our suppliers, any increase in the prices of our raw materials

would affect the price at which we can sell our products. If we are

not able to raise our prices to pass on increased costs to our customers, we

would be unable to maintain our profit margins. Similarly, in times

of decreasing prices, we may have to sell our products at prices which are lower

than the prices at which we purchased our raw materials. Furthermore,

PRC regulations grant broad powers to the government to adjust prices of raw

materials and manufactured products. Although the government has not

imposed price controls on our raw materials or our products, it is possible that

price controls may be implemented in the future, thereby affecting our results

of operations and financial condition.

Our

intellectual property rights are valuable, and any inability to protect them

could reduce the value of our products.

Our trade

secrets and patents are important assets for us. Our intellectual property

consists of one patent, trade secrets relating to the design and manufacture of

graphite products and our customer lists. Various events outside of our control

pose a threat to our intellectual property rights as well as to our products.

Effective intellectual property protection may not be available in China and

other countries in which our products are sold. Intellectual property rights in

China are still developing, and there are uncertainties involved in the

protection and the enforcement of such rights.

Also, the

efforts we have taken to protect our intellectual property rights may not be

sufficient or effective. Any significant impairment of our intellectual property

rights could harm our business or our ability to compete.

We

depend on third party distributors over whom we have no control to market our

products to end users in international markets.

Although

the market for graphite products is international and many of the end users of

our products are located outside of the PRC, most of our direct sales are made

to distributors and customers in the PRC. We do not have any offices outside of

the PRC, and we depend on distributors based in the PRC, over whom we have no

control, to sell our products in the international market. Any problems

encountered by these third parties, including potential violations of laws of

the PRC or other countries, may affect their ability to sell our products which

would, in turn, affect our net sales.

11

Because

our contracts are made pursuant to individual purchase orders, and not long-term

agreements, the results of our operations can vary significantly from quarter to

quarter.

We sell

our products pursuant to purchase orders and, with the exception of one

customer, whose purchases are not material to our overall revenues, we do not

have long-term contracts with any distributors or customers. As a result, we

must continually seek new customers and new orders from existing customers. As a

result, we cannot assure you that we will have a continuing stream of revenue

from any customer. Our failure to generate new business on an ongoing basis

would materially impair our ability to operate profitably.

We

rely on highly skilled personnel and, if we are unable to hire or retain

qualified personnel, we may not be able to grow effectively.

Our

performance largely depends on the talents and efforts of highly skilled

individuals, including our executive officers and Mr. Denyong Jin, the chief

executive officer of Xingyong and our former chief executive officer. We do not

have employment agreements with any of our executive officers or with Mr. Jin.

Our future success depends on our continuing ability to retain these individuals

and to hire, develop, motivate and retain other highly skilled personnel for all

areas of our organization.

Because

we consume significant amounts of electricity, any failure or interruption in

electricity services could harm our ability to operate our

business.

Our

systems are heavily reliant on the availability of electricity. If we were to

experience a major power outage, we would have to rely on back-up generators.

These back-up generators may not operate properly and their fuel supply could be

inadequate during a major power outage. This could result in a disruption of our

business.

If

we fail to obtain all required licenses, permits, or approvals, we may be unable

to expand our operations.

Before we

develop certain new products, we must obtain a variety of approvals from local

and municipal governments in the PRC. Our products may also be

required to comply with the regulations of foreign countries into which they are

ultimately sold. There is no assurance that we will be able to obtain

all required licenses, permits, or approvals from these government authorities.

If we fail to obtain all required licenses, permits or approvals, we may be

unable to expand our operations.

Compliance

with existing and future environmental laws and regulations could have a

material adverse effect on our operations and financial condition.

As a

manufacturer, we are subject to various Chinese environmental laws and

regulations on air emission, waste water discharge, solid wastes, noise and

safety. We cannot assure you that we are able to comply with these regulations

at all times, as the Chinese environmental legal requirements are evolving and

becoming more stringent. If the Chinese national government or local governments

impose more stringent regulations in the future, we may have to incur

additional, and potentially substantial, costs and expenses in order to comply

with such regulations, which may negatively affect our results of

operations. For instance, during 2009, we incurred significant

expenditures for environmental improvements required by new government

regulations. In addition, if we fail to comply with any of the

present or future environmental regulations in any material aspects, we may

suffer from negative publicity and be subject to claims for damages that may

require us to pay substantial fines or have our operations suspended or even be

forced to cease operations.

Risks

Related to Doing Business in the People’s Republic of China

Our business operations take place

primarily in the People's Republic of China. Because Chinese laws,

regulations and policies are changing, our Chinese operations face several risks

summarized below.

12

Limitations

on Chinese economic market reforms may discourage foreign investment in Chinese

businesses.

The value of investments in Chinese

businesses could be adversely affected by political, economic and social

uncertainties in China. The economic reforms in China in recent years are

regarded by China's central government as a way to introduce economic market

forces into China. Given the overriding desire of the central government

leadership to maintain stability in China amid rapid social and economic changes

in the country, the economic market reforms of recent years could be slowed, or

even reversed.

Any

change in policy by the Chinese government could adversely affect investments in

Chinese businesses.

Changes in policy could result in

imposition of restrictions on currency conversion, imports or the source of

supplies, as well as new laws affecting joint ventures and foreign-owned

enterprises doing business in China. Although China has been pursuing economic

reforms, events such as a change in leadership or social disruptions that may

occur upon the proposed privatization of certain state-owned industries, could

significantly affect the government's ability to continue with its

reform.

We

face economic risks in doing business in China because the Chinese economy is

more volatile than other countries.

As a developing nation, China's economy

is more volatile than those of developed Western industrial economies. It

differs significantly from that of the U.S. or a Western European country in

such respects as structure, level of development, capital reinvestment, legal

recourse, resource allocation and self-sufficiency. Only in recent years has the

Chinese economy moved from what had been a command economy through the 1970s to

one that during the 1990s encouraged substantial private economic activity. In

1993, the Constitution of China was amended to reinforce such economic reforms.

The trends of the 1990s indicate that future policies of the Chinese government

will emphasize greater utilization of market forces. For example, in 1999 the

Government announced plans to amend the Chinese Constitution to recognize

private property, although private business will officially remain subordinate

to state-owned companies, which are the mainstay of the Chinese economy.

However, we cannot assure you that, under some circumstances, the government's

pursuit of economic reforms will not be restrained or curtailed. Actions by the

central government of China could have a significant adverse effect on economic

conditions in the country as a whole and on the economic prospects for our

Chinese operations.

PRC

regulations relating to acquisitions of PRC companies by foreign entities may

limit our ability to acquire PRC companies and adversely affect the

implementation of our strategy as well as our business and

prospects.

The PRC

State Administration of Foreign Exchange, or SAFE, issued a public notice in

January 2005 concerning foreign exchange regulations on mergers and acquisitions

in China. The public notice states that if an offshore company controlled by PRC

residents intends to acquire a PRC company, such acquisition will be subject to

strict examination by the relevant foreign exchange authorities. The public

notice also states that the approval of the relevant foreign exchange

authorities is required for any sale or transfer by the PRC residents of a PRC

company’s assets or equity interests to foreign entities, such as us, for equity

interests or assets of the foreign entities.

In April

2005, SAFE issued another public notice further explaining the January notice.

In accordance with the April notice, if an acquisition of a PRC company by an

offshore company controlled by PRC residents has been confirmed by a Foreign

Investment Enterprise Certificate prior to the promulgation of the January

notice, the PRC residents must each submit a registration form to the local SAFE

branch with respect to their respective ownership interests in the offshore

company, and must also file an amendment to such registration if the offshore

company experiences material events, such as changes in the share capital, share

transfer, mergers and acquisitions, spin-off transactions or use of assets in

China to guarantee offshore obligations.

On May

31, 2007, SAFE issued another official notice known as “Circular 106,” which

requires the owners of any Chinese company to obtain SAFE’s approval before

establishing any offshore holding company structure for foreign financing as

well as subsequent acquisition matters in China.

13

If we

decide to acquire a PRC company, we cannot assure you that we or the owners of

such company, as the case may be, will be able to complete the necessary

approvals, filings and registrations for the acquisition. This may restrict our

ability to implement our acquisition strategy and adversely affect our business

and prospects. In addition, if such registration cannot be obtained, our company

will not be able to receive dividends declared and paid by our subsidiaries in

the PRC and may be forbidden from paying dividends for profit distribution or

capital reduction purposes.

Fluctuation

in the value of the RMB may have a material adverse effect on your

investment.

The

change in value of the RMB against the United States dollar and other currencies

is affected by, among other things, changes in China’s political and economic

conditions. On July 21, 2005, the Chinese government changed its decade-old

policy of pegging the value of the RMB to the U.S. dollar. Under the new policy,

the RMB is permitted to fluctuate within a narrow and managed band against a

basket of certain foreign currencies. This change in policy has resulted in the

appreciation of the RMB against U.S. dollar. While the international reaction to

the RMB revaluation has generally been positive, there remains significant

international pressure on the Chinese government to adopt an even more flexible

currency policy, which could result in a further and more significant

appreciation of the RMB against the U.S. dollar. As approximately 90% of our

costs and expenses is denominated in RMB, the revaluation in July 2005 and

potential future revaluation has and could further increase our costs. In

addition, as we rely entirely on dividends paid to us by our operating

subsidiaries, any significant revaluation of the RMB may have a material adverse

effect on our revenues and financial condition, and the value of, and any of our

dividends payable on our ordinary shares in foreign currency terms.

Capital

outflow policies in the PRC may hamper our ability to remit income to the United

States.

The PRC

has adopted currency and capital transfer regulations. These regulations may

require that we comply with complex regulations for the movement of capital and

as a result we may not be able to remit all income earned and proceeds received

in connection with our operations or from the sale of our operating subsidiary

to the United States or to our stockholders.

China’s foreign currency control

policies may impair the ability of our Chinese operating company to pay dividends to

us.

Since our

operations are conducted through our Chinese operating company, we rely on

dividends and other distributions from our Chinese operating company to provide

us with cash flow to pay dividends or meet our other obligations. Any dividend

payment will be subject to foreign exchange rules governing such repatriation.

Any liquidation is subject to the relevant government agency’s approval and

supervision as well as the foreign exchange control. Current regulations in

China would permit our operating company to pay dividends to us only out of

accumulated distributable profits, if any, determined in accordance with Chinese

accounting standards and regulations. In addition, our operating company will be

required to set aside at least 10% (up to an aggregate amount equal to half of

our registered capital) of its accumulated profits each year for employee

welfare. Such cash reserve may not be distributed as cash dividends. In

addition, if our operating company in China incurs debt on its own behalf in the

future, the instruments governing the debt may restrict its ability to pay

dividends or make other payments to us. The inability of our operating company

to pay dividends or make other payments to us may have a material adverse effect

on our financial condition.

Because

our funds are held in banks that do not provide insurance, the failure of any

bank in which we deposit our funds could affect our ability to continue in

business.

Banks and

other financial institutions in the PRC do not provide insurance for funds held

on deposit. As a result, in the event of a bank failure, we may not have access

to funds on deposit. Depending upon the amount of money we maintain in a bank

that fails, our inability to have access to our cash could impair our

operations, and, if we are not able to access funds to pay our suppliers,

employees and other creditors, we may be unable to continue in

business.

14

Since

we may not be able to obtain business insurance in the PRC, we may not be

protected from risks that are customarily covered by insurance in the United

States.

Business

insurance is not readily available in the PRC. To the extent that we suffer a

loss of a type which would normally be covered by insurance in the United

States, such as product liability and general liability insurance, we would

incur significant expenses in both defending any action and in paying any claims

that result from a settlement or judgment. We have not obtained fire, casualty

and theft insurance, and there is no insurance coverage for our raw materials,

goods and merchandise, furniture and buildings in China. Any losses incurred by

us will have to be borne by us without any assistance, and we may not have

sufficient capital to cover material damage to, or the loss of, our production

facility due to fire, severe weather, flood or other cause, and such damage or

loss would have a material adverse effect on our financial condition, business

and prospects.

The

Chinese legal and judicial system may negatively impact foreign investors

because the Chinese legal system is not yet comprehensive.

In 1982, the National Peoples Congress

amended the Constitution of China to authorize foreign investment and guarantee

the "lawful rights and interests" of foreign investors in China. However,

China's system of laws is not yet comprehensive. The legal and judicial systems

in China are still under development , and enforcement of existing laws is

inconsistent. Many judges in China lack the depth of legal training and

experience that would be expected of a judge in a more developed country.

Because the Chinese judiciary is relatively inexperienced in enforcing the laws

that exist, anticipation of judicial decision-making is more uncertain than

would be expected in a more developed country. It may be impossible to obtain

swift and equitable enforcement of laws that do exist, or to obtain enforcement

of the judgment of one court by a court of another jurisdiction. China's legal

system is based on written statutes; a decision by one judge does not set a

legal precedent that is required to be followed by judges in other cases. In

addition, the interpretation of Chinese laws may shift to reflect domestic

political changes. The

promulgation of new laws, changes to existing laws and the pre-emption of local

regulations by national laws may adversely affect foreign investors. However,

the trend of legislation over the last 20 years has significantly enhanced the

protection of foreign investment and allowed for more control by foreign parties

of their investments in Chinese enterprises. We cannot assure you that a change

in leadership, social or political disruption, or unforeseen circumstances

affecting China's political, economic or social life, will not affect the

Chinese government's ability to continue to support and pursue these reforms.

Such a shift could have a material adverse effect on our business and

prospects.

15

The practical effect of the People’s

Republic of China’s legal system on our business operations in China can be

viewed from two separate but intertwined considerations. First, as a matter of

substantive law, the Foreign Invested Enterprise laws provide significant

protection from government interference. In addition, these laws guarantee the

full enjoyment of the benefits of corporate articles and contracts to Foreign

Invested Enterprise participants. These laws, however, do impose standards

concerning corporate formation and governance, which are not qualitatively

different from the general corporation laws of the several states. Similarly,

the accounting laws and regulations of the People’s Republic of China mandate

accounting practices which are not consistent with U.S. Generally Accepted

Accounting Principles. China's accounting laws require that an annual "statutory

audit" be performed in accordance with People’s Republic of China’s accounting

standards and that the books of account of Foreign Invested Enterprises are

maintained in accordance with Chinese accounting laws. Article 14 of the

People’s Republic of China Wholly Foreign-Owned Enterprise Law requires a Wholly

Foreign-Owned Enterprise to submit certain periodic fiscal reports and

statements to designated financial and tax authorities, at the risk of business

license revocation. Second, while the enforcement of substantive rights may

appear less clear than United States procedures, Foreign Invested Enterprises

and Wholly Foreign-Owned Enterprises are Chinese registered companies, which

enjoy the same status as other Chinese registered companies in

business-to-business dispute resolution. Generally, the Articles of Association

provide that all business disputes pertaining to Foreign Invested Enterprises

are to be resolved by the Arbitration Institute of the Stockholm Chamber of

Commerce in Stockholm, Sweden, applying Chinese substantive law. Any award

rendered by this arbitration tribunal is, by the express terms of the respective

Articles of Association, enforceable in accordance with the "United Nations

Convention on the Recognition and Enforcement of Foreign Arbitral Awards

(1958)." Therefore, as a practical matter, although no assurances can be given,

the Chinese legal infrastructure, while different in operation from its United

States counterpart, should not present any significant impediment to the

operation of Foreign Invested Enterprises.

Because our principal assets are

located outside of the United States and some of our directors and all of our

executive officers reside outside of the United States, it may be difficult for

you to enforce your rights based on the United States Federal securities laws

against us and our officers and directors in the United States or to enforce

judgments of United States courts against us or them in the People's Republic of

China.

It

may be difficult for our stockholders to affect service of process against our

subsidiaries or our officers and directors.

Our operating subsidiaries and

substantially all of our assets are located outside of the United States. You

will find it difficult to enforce your legal rights based on the civil liability

provisions of the United States Federal securities laws against us in the courts

of either the United States or the People's Republic of China and, even if civil

judgments are obtained in courts of the United States, to enforce such judgments

in the courts of the People's Republic of China. In addition, it is unclear if

extradition treaties in effect between the United States and the People's

Republic of China would permit effective enforcement against us or those of our

officers and directors that reside outside the United States of criminal

penalties, under the United States Federal securities laws or

otherwise.

The

Chinese economy is evolving and we may be harmed by any economic

reform.

Although the Chinese government owns

the majority of productive assets in China, during the past several years the

government has implemented economic reform measures that emphasize

decentralization and encourage private economic activity. Because

these economic reform measures may be inconsistent or ineffectual, we are unable

to assure you that:

|

·

|

We

will be able to capitalize on economic reforms;

|

|

|

·

|

The

Chinese government will continue its pursuit of economic reform

policies;

|

|

|

|

·

|

The

economic policies, even if pursued, will be successful;

|

|

·

|

Economic

policies will not be significantly altered from time to time;

and

|

|

|

·

|

Business

operations in China will not become subject to the risk of

nationalization.

|

Since 1979, the Chinese government has

reformed its economic systems. Because many reforms are unprecedented

or experimental, they are expected to be refined and improved. Other political,

economic and social factors, such as political changes, changes in the rates of

economic growth, unemployment or inflation, or in the disparities in per capita

wealth between regions within China, could lead to further readjustment of the

reform measures. This refining and readjustment process may negatively affect

our operations.

16

Inflation

in China may inhibit our ability to conduct business profitably in

China.

Over the last few years, China's

economy has registered a high growth rate. Recently, there have been indications

that rates of inflation have increased. In response, the Chinese government

recently has taken measures to curb this excessively expansive economy. These

measures have included revaluations of the Chinese currency, the Renminbi (RMB),

restrictions on the availability of domestic credit, and limited

re-centralization of the approval process for purchases of some foreign

products. These austerity measures alone may not succeed in slowing down the

economy's excessive expansion or control inflation, and may result in severe

dislocations in the Chinese economy. The Chinese government may adopt additional

measures to further combat inflation, including the establishment of freezes or

restraints on certain projects or markets.

To date, reforms to China's economic

system have not adversely impacted our operations and are not expected to

adversely impact operations in the foreseeable future; however, there can be no

assurance that the reforms to China's economic system will continue or that we

will not be adversely affected by changes in China's political, economic, and

social conditions and by changes in policies of the Chinese government, such as

changes in laws and regulations, measures which may be introduced to control

inflation, changes in the rate or method of taxation, imposition of additional

restrictions on currency conversion and remittance abroad, and reduction in

tariff protection and other import restrictions.

Failure

to comply with the United States Foreign Corrupt Practices Act could subject us

to penalties and other adverse consequences.

We are

subject to the United States Foreign Corrupt Practices Act, which generally

prohibits United States companies from engaging in bribery or other prohibited

payments to foreign officials for the purpose of obtaining or retaining

business. Foreign companies, including some that may compete with us, are not

subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft

and other fraudulent practices may occur from time to time in the PRC. We can

make no assurance, however, that our employees or other agents will not engage

in such conduct for which we might be held responsible. If our employees or

other agents are found to have engaged in such practices, we could suffer severe

penalties and other consequences that may have a material adverse effect on our

reputation or our business, financial condition and results of

operations.

Risks

Related to our Common Stock

If

we fail to maintain an effective system of internal controls, we may not be able

to accurately report our financial results or prevent fraud.

The SEC,

as required by Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules

requiring every public company to include a management report on such company’s

internal controls over financial reporting in its annual report, which contains

management’s assessment of the effectiveness of our internal controls over

financial reporting. In addition, an independent registered public accounting

firm must attest to and report on management’s assessment of the effectiveness

of our internal controls over financial reporting. Our management may conclude

that our internal controls over our financial reporting are not effective.

Moreover, even if our management concludes that our internal controls over

financial reporting are effective, our independent registered public accounting

firm may still decline to attest to our management’s assessment or may issue a

report that is qualified if it is not satisfied with our controls or the level

at which our controls are documented, designed, operated or reviewed, or if it

interprets the relevant requirements differently from us.

During

our assessment of the effectiveness of internal control over financial reporting

as of September 30, 2009, we identified significant deficiencies related to (i)

the U.S. GAAP expertise of our internal accounting staff, (ii) our internal

audit functions and, and (iii) a lack of segregation of duties within accounting

functions. Although we believe that these deficiencies do not amount to a

material weakness, we cannot assure you that, when our independent auditors are

required to attest to our internal controls, that they will agree with our

analysis or will not have identified other material weaknesses in our internal

controls or disclosure controls.

17

Our

reporting obligations as a public company will place a significant strain on our

management, operational and financial resources and systems for the foreseeable

future. Effective internal controls, particularly those related to revenue

recognition, are necessary for us to produce reliable financial reports and are

important to prevent fraud. As a result, our failure to achieve and maintain

effective internal controls over financial reporting could result in the loss of

investor confidence in the reliability of our financial statements, which in

turn could harm our business and negatively impact the trading price of our

stock. Furthermore, we anticipate that we will continue to incur considerable

costs and use significant management time and other resources in an effort to

comply with Section 404 and other requirements of the Sarbanes-Oxley

Act.

There

is a limited market for our common stock, which may make it difficult for you to

sell your stock.

Our

common stock trades on the OTC Bulletin Board under the symbol

CHGI.OB. There is a limited trading market for our common stock and

there is frequently no trading in our common stock. Accordingly, there can be no

assurance as to the liquidity of any markets that may develop for our common

stock, the ability of holders of our common stock to sell our common stock, or

the prices at which holders may be able to sell our common stock. Further, many

brokerage firms will not process transactions involving low price stocks,

regardless of whether they come within the definition of a “penny stock.” If we

cease to be quoted, holders would find it more difficult to dispose of, or to

obtain accurate quotations as to the market value of our common stock, and the

market value of our common stock would likely decline.

If

a more active trading market for our common stock develops, the market price of

our common stock is likely to be highly volatile and subject to wide

fluctuations, and you may be unable to resell your shares at or above the price

at which you acquired them.

The

market price of our common stock is likely to be highly volatile and could be

subject to wide fluctuations in response to a number of factors that are beyond

our control, including:

|

·

|

quarterly

variations in our revenues and operating

expenses;

|

|

·

|

developments

in the financial markets and worldwide

economies;

|

|

·

|

announcements

of innovations or new products or services by us or our

competitors;

|

|

·

|

announcements

by the PRC government relating to regulations that govern our

industry;

|

|

·

|

significant

sales of our common stock or other securities in the open

market.

|

|

·

|

variations

in interest rates;

|

|

·

|

changes

in the market valuations of other comparable companies;

and

|

|

·

|

changes

in accounting principles.

|

If a

stockholder were to file any such class action suit against us following a

period of volatility in the price of our securities, we would incur substantial

legal fees and our management’s attention and resources

would be diverted from operating our business to respond to such litigation,

which could harm our business and reputation.

We

have not paid dividends in the past and do not expect to pay dividends for the

foreseeable future, and any return on investment may be limited to potential

future appreciation on the value of our common stock.

We

currently intend to retain any future earnings to support the development and

expansion of our business and do not anticipate paying cash dividends in the

foreseeable future. The certificate of designation for the Series A Preferred

Stock prohibits us from paying dividends to the holders of our common stock

while the Series A Preferred Stock is outstanding. There are currently 125,000

shares of Series A Preferred Stock outstanding. To the extent that we

do not pay dividends, our stock may be less valuable because a return on

investment will only occur if and to the extent our stock price appreciates,

which may never occur. In addition, investors must rely on sales of their common

stock after price appreciation as the only way to realize their investment, and

if the price of our stock does not appreciate, then there will be no return on

investment. Investors seeking cash dividends should not purchase our common

stock.

18

The

rights of the holders of common stock may be impaired by the potential issuance

of preferred stock.

Our board

of directors has the right to create new series of preferred stock. As a result,

the board of directors may, without stockholder approval, issue preferred stock

with voting, dividend, conversion, liquidation or other rights that could

adversely affect the voting power and equity interest of the holders of common

stock. Preferred stock, which could be issued with the right to more than one

vote per share and could be utilized as a method of discouraging, delaying or

preventing a change of control. The possible impact on takeover attempts could

adversely affect the price of our common stock. Without the consent of the

holders of 75% of the outstanding shares of Series A Preferred Stock, we may not

alter or change adversely the rights of the holders of the Series A Preferred

Stock or increase the number of authorized shares of Series A Preferred Stock,

create a class of stock which is senior to or on a parity with the Series A

Preferred Stock, amend our certificate of incorporation in breach of these

provisions or agree to any of the foregoing. Although we have no present

intention to issue any additional shares of preferred stock or to create any new

series of preferred stock and the certificate of designation relating to the

Series A Preferred Stock restricts our ability to issue additional series of

preferred stock, we may issue such shares in the future.

Transactions

engaged in by our principal stockholder may have an adverse effect on the price

of our stock.

We do not

know what plans, if any, Sincere has with respect to its ownership of our stock.

In the event that Sincere sells a substantial number of shares of our common

stock, such sales could have the effect of lowering our stock price. The

perceived risk associated with the possible sale of a large number of shares by

this stockholder, or the adoption of significant short positions by hedge funds

or other significant investors, could cause some of our stockholders to sell

their stock, thus causing the price of our stock to further

decline.

Risks

Related To the Offering

When

the registration statement of which this prospectus forms a part becomes

effective, there will be a significant number of shares of our common stock

eligible for sale, which could depress the market price of our

stock.

Following the effectiveness of the

registration statement of which this prospectus forms a part, an aggregate of

3.6 million shares of our common stock underlying shares of Series B Preferred

Stock and warrants which are currently restricted will be eligible for resale to

the public market without restriction, which could harm the market price of our

stock. Furthermore, the selling stockholders may be eligible to sell

their shares of our common stock even if the registration statement of which

this prospectus forms a part is not then effective, pursuant to Rule 144, and

such sales may harm the market price of our stock.

The

exercise of outstanding shares of preferred stock and warrants issuable for

shares of our common stock may cause dilution to existing

shareholders.

There are currently outstanding 125,000

shares of Series A Preferred Stock and 2,480,500 shares of Series B Preferred

Stock, which are convertible, in the aggregate, into 2,605,500 shares of our

common stock. There are currently warrants outstanding to purchase up

to an aggregate of 1,441,225 shares of our common stock. The

expiration dates of these warrants range from December 2012 to January

2015. The exercise price of these warrants ranges from $1.30 to $3.00

per share, subject to adjustment. If holders of these shares of

preferred stock or warrants convert or exercise such securities in exchange for

shares of our common stock, such transactions may have a dilutive effect on the

stock ownership of existing shareholders and may harm the market price of our

stock. Furthermore, if we were to attempt to obtain additional

financing during the term of these warrants, the terms on which we obtain such

financing may be adversely affected by the existence of these

warrants.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

19

This prospectus contains

forward-looking statements. The forward-looking statements are contained

principally in the sections entitled “Prospectus Summary,” “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and “Business.” These statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results, performance

or achievements to be materially different from any future results, performances

or achievements expressed or implied by the forward-looking statements. These

risks and uncertainties include, but are not limited to, the factors described

in the section captioned “Risk Factors” above.

In some cases, you can identify

forward-looking statements by terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “would” and similar expressions intended to identify

forward-looking statements. Forward-looking statements reflect our current views

with respect to future events and are based on assumptions and are subject to

risks and uncertainties. Given these uncertainties, you should not place undue

reliance on these forward-looking statements.

Also, forward-looking statements

represent our estimates and assumptions only as of the date of this prospectus.

You should read this prospectus and the documents that we reference in this

prospectus, or that we filed as exhibits to the registration statement of which

this prospectus is a part, completely and with the understanding that our actual

future results may be materially different from what we expect.

Except as required by law, we assume no

obligation to update any forward-looking statements publicly, or to update the

reasons actual results could differ materially from those anticipated in any

forward-looking statements, even if new information becomes available in the

future.

USE

OF PROCEEDS

We

will not receive any proceeds from the sales of any shares of common stock by

the selling stockholders. However, we may receive up to $1,453,573 from the

exercise of warrants held by the selling stockholders if and when those warrants

are exercised in exchange for cash. Any such proceeds would be used

for general working capital purposes.

DIVIDEND

POLICY

While we

will be required to pay dividends on the shares of our Series A and Series

B Preferred Stock, we have never declared or paid cash dividends on our common

stock and have no present plans to do so in the foreseeable future. The

certificate of designation for our outstanding Series A Preferred Stock

prohibits us from paying dividends on our common stock or redeeming common stock

while any shares of Series A Preferred Stock are outstanding. There are

currently 125,000 shares of our Series A Preferred Stock

outstanding. Any future decisions regarding dividends will be made by

our board of directors. We currently intend to retain and use any future

earnings for the development and expansion of our business and do not anticipate

paying any cash dividends in the foreseeable future.

20

MARKET

FOR OUR COMMON STOCK

Our common stock is quoted on the OTC

Bulletin Board, or OTC, under the symbol “CHGI.OB”. As of February 2,

2010, the closing price for our common stock was $1.45 per share. The

bid prices set forth below reflect inter-dealer quotations, do not include

retail markups, markdowns or commissions and do not necessarily reflect actual

transactions.

The

following table sets forth, for the periods indicated, the high and low bid

prices of our common stock.

|

Bid

Prices

|

||||||||

|

High

|

Low

|

|||||||

|

Fiscal

Year Ended December 31, 2010

|

||||||||

|

First

Quarter (through February 2, 2010)

|

$ | 1.75 | $ | 1.41 | ||||

|

Fiscal

Year Ended December 31, 2009

|

||||||||

|

First

Quarter

|

$ | 0.64 | $ | 0.10 | ||||

|

Second

Quarter

|

0.70 | 0.07 | ||||||

|

Third

Quarter

|

1.76 | 0.61 | ||||||

|

Fourth

Quarter

|

1.65 | 1.30 | ||||||

|

Fiscal

Year Ended December 31, 2008

|

||||||||

|

First

Quarter

|

$ | 3.36 | $ | 0.25 | ||||

|

Second

Quarter

|

2.16 | 1.01 | ||||||