Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - China Carbon Graphite Group, Inc. | f10q0612ex32i_chinacarbon.htm |

| EX-31.1 - CERTIFICATION - China Carbon Graphite Group, Inc. | f10q0612ex31i_chinacarbon.htm |

| EX-31.2 - CERTIFICATION - China Carbon Graphite Group, Inc. | f10q0612ex31ii_chinacarbon.htm |

| EX-32.2 - CERTIFICATION - China Carbon Graphite Group, Inc. | f10q0612ex32ii_chinacarbon.htm |

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (D) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2012

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission File Number: 333-114564

(Exact Name of Registrant as specified in its charter)

|

Nevada

|

98-0550699

|

|

|

(State or other jurisdiction of

incorporation of organization) |

(I.R.S. Employer Identification No.)

|

c/o Xinghe Yongle Carbon Co., Ltd.

787 Xicheng Wai

Chengguantown

Xinghe County

Inner Mongolia, China

(Address of principal executive offices)

(86) 474-7209723

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

(Do not check if smaller reporting company)

|

o |

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date: 24,231,708 shares of common stock are issued and outstanding as of August 14, 2012.

CHINA CARBON GRAPHITE GROUP, INC. AND SUBSIDIARIES

FORM 10-Q

June 30, 2012

TABLE OF CONTENTS

|

PART I - FINANCIAL INFORMATION

|

Page No.

|

|

|

Item 1.

|

Financial Statements:

|

1

|

|

Condensed Consolidated Balance Sheets at June 30, 2012 (unaudited) and December 31, 2011

|

1

|

|

|

Unaudited Condensed Consolidated Statements of Income and Comprehensive Income for the Three and Six months ended June 30, 2012 and 2011

|

2

|

|

|

Unaudited Condensed Consolidated Statements of Cash Flows for the Six months ended June 30, 2012 and 2011

|

3

|

|

|

Notes to Unaudited Condensed Consolidated Financial Statements

|

4

|

|

|

Item 2.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

26

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

44

|

|

Item 4.

|

Controls and Procedures

|

44

|

|

PART II - OTHER INFORMATION

|

||

|

Item 1.

|

Legal Proceedings

|

45

|

|

Item 1A.

|

Risk Factors

|

46

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

46

|

|

Item 3.

|

Defaults Upon Senior Securities

|

47

|

|

Item 4.

|

Mine Safety Disclosures

|

47

|

|

Item 5.

|

Other Information

|

47

|

|

Item 6.

|

Exhibits

|

47

|

|

Signatures

|

48

|

|

|

Item 1.

|

Financial Statements.

|

China Carbon Graphite Group, Inc. and subsidiaries

Condensed Consolidated Balance Sheets

|

June 30,

2012 |

December 31,

2011 |

|||||||

|

(Unaudited)

|

(Audited)

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$ | 1,350,890 | $ | 521,450 | ||||

|

Restricted cash

|

10,703,200 | 11,694,820 | ||||||

|

Accounts receivable, Net

|

13,095,700 | 12,541,321 | ||||||

|

Notes receivable

|

444,895 | 188,880 | ||||||

|

Advance to suppliers

|

2,410,409 | 5,921,970 | ||||||

|

Inventories

|

44,151,224 | 37,430,248 | ||||||

|

Prepaid expenses

|

234,917 | 452,730 | ||||||

|

Other receivables, net of allowance of $24,397

|

544,646 | 513,000 | ||||||

|

Total current assets

|

72,935,881 | 69,264,419 | ||||||

|

Property And Equipment, Net

|

35,742,753 | 36,719,595 | ||||||

|

Construction In Progress

|

7,518,640 | 6,220,451 | ||||||

|

Land Use Rights, Net

|

10,359,654 | 10,699,059 | ||||||

|

Total Assets

|

$ | 126,556,928 | $ | 122,903,524 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 3,866,990 | $ | 1,340,498 | ||||

|

Advance from customers

|

1,552,654 | 1,360,989 | ||||||

|

Short term bank loans

|

38,720,400 | 45,488,600 | ||||||

|

Notes payable

|

17,786,200 | 16,763,100 | ||||||

|

Other payables

|

2,951,364 | 3,032,671 | ||||||

|

Loan from unrelated parties

|

185,610 | - | ||||||

|

Dividends payable

|

37,742 | 28,099 | ||||||

|

Total current liabilities

|

65,100,960 | 68,013,957 | ||||||

|

Amount Due To A Related Party

|

5,432,675 | 5,542,855 | ||||||

|

Long term bank loan

|

4,690,520 | - | ||||||

|

Warrant Liabilities

|

208,605 | 174,805 | ||||||

|

Total Liabilities

|

75,432,760 | 73,731,617 | ||||||

|

Redeemable convertible series B preferred stock,$0.001 par value;

|

||||||||

|

3,000,000 shares authorized; 305,810 and 426,110 shares issued

|

||||||||

|

and outstanding at June 30, 2012 and December 31, 2011, respectively.

|

366,972 | 511,332 | ||||||

|

Stockholders' Equity

|

||||||||

|

Common stock, $0.001 par value; 100,000,000 shares authorized

|

||||||||

|

24,231,708 and 22,981,408 shares issued and outstanding at

|

||||||||

|

June 30, 2012 and December 31, 2011, respectively

|

24,231 | 22,981 | ||||||

|

Additional paid-in capital

|

18,044,688 | 17,054,045 | ||||||

|

Accumulated other comprehensive income

|

7,933,485 | 7,943,542 | ||||||

|

Retained earnings

|

24,754,792 | 23,640,007 | ||||||

|

Total stockholders' equity

|

50,757,196 | 48,660,575 | ||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 126,556,928 | $ | 122,903,524 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

|

China Carbon Graphite Group, Inc and subsidiaries

|

|||||||||||

|

Condensed Consolidated Statements of Operations and Comprehensive Income

|

|||||||||||

|

For the Three Months and Six Months Ended June 30, 2012 and 2011

|

|||||||||||

|

(Unaudited)

|

|

Three months ended June 30,

|

Six months ended June 30,

|

|||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

|||||||||||||

|

Sales

|

$ | 11,877,543 | $ | 12,145,024 | $ | 21,938,753 | $ | 23,608,359 | ||||||||

|

Cost of Goods Sold

|

8,985,125 | 9,456,762 | 16,128,731 | 18,340,023 | ||||||||||||

|

Gross Profit

|

2,892,418 | 2,688,262 | 5,810,022 | 5,268,336 | ||||||||||||

|

Operating Expenses

|

||||||||||||||||

|

Selling expenses

|

29,152 | 57,312 | 75,950 | 107,175 | ||||||||||||

|

General and administrative

|

1,170,462 | 1,049,666 | 2,021,861 | 2,603,728 | ||||||||||||

|

Depreciation and amortization

|

46,826 | 47,152 | 103,830 | 93,754 | ||||||||||||

|

Total operating expenses

|

1,246,440 | 1,154,130 | 2,201,641 | 2,804,657 | ||||||||||||

|

Operating Income Before Other Income (Expense)

|

1,645,978 | 1,534,132 | 3,608,381 | 2,463,679 | ||||||||||||

|

Other Income (Expense)

|

||||||||||||||||

|

Interest expense

|

(1,220,173 | ) | (693,274 | ) | (2,449,918 | ) | (1,406,804 | ) | ||||||||

|

Interest income

|

21 | - | 43 | - | ||||||||||||

|

Other expense

|

(215,468 | ) | (765 | ) | (215,468 | ) | (766 | ) | ||||||||

|

Other income, net

|

215,190 | 15,670 | 215,190 | 76,550 | ||||||||||||

|

Change in fair value of warrants

|

445,763 | 26,540 | (33,800 | ) | 82,692 | |||||||||||

|

Total other expense

|

(774,667 | ) | (651,829 | ) | (2,483,953 | ) | (1,248,328 | ) | ||||||||

|

Net Income

|

$ | 871,311 | $ | 882,303 | $ | 1,124,428 | $ | 1,215,351 | ||||||||

|

Dividend Distribution

|

(4,625 | ) | (6,985 | ) | (9,643 | ) | 17,882 | |||||||||

|

Net Income Available To Common Shareholders

|

$ | 866,686 | $ | 875,318 | $ | 1,114,785 | $ | 1,233,233 | ||||||||

|

Other Comprehensive Income (Loss)

|

||||||||||||||||

|

Foreign currency translation gain (loss)

|

(433,954 | ) | 553,200 | (10,057 | ) | 821,448 | ||||||||||

|

Total Comprehensive Income

|

$ | 437,357 | $ | 1,435,503 | $ | 1,114,371 | $ | 2,036,799 | ||||||||

|

Share Data

|

||||||||||||||||

|

Basic earnings per share

|

$ | 0.04 | $ | 0.04 | $ | 0.05 | $ | 0.05 | ||||||||

|

Diluted earnings per share

|

$ | 0.04 | $ | 0.04 | $ | 0.05 | $ | 0.05 | ||||||||

|

Weighted average common shares outstanding,

|

||||||||||||||||

|

basic

|

23,948,851 | 22,350,263 | 23,632,248 | 21,993,435 | ||||||||||||

|

Weighted average common shares outstanding,

|

||||||||||||||||

|

diluted

|

24,254,661 | 23,194,542 | 23,938,058 | 22,671,285 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

China Carbon Graphite Group, Inc. and subsidiaries

Condensed Consolidated Statements of Cash Flows

For the Six Months Ended June 30, 2012 and 2011

(Unaudited)

|

Six months ended June 30,

|

||||||||

|

2012

|

2011

|

|||||||

|

Cash flows from operating activities

|

||||||||

|

Net Income

|

$ | 1,124,428 | $ | 1,215,351 | ||||

|

Adjustments to reconcile net cash provided by operating activities

|

||||||||

|

Depreciation and amortization

|

1,360,692 | 870,310 | ||||||

|

Related party interest expenses contribution

|

222,860 | - | ||||||

|

Stock compensation

|

374,333 | 623,450 | ||||||

|

Change in fair value of warrants

|

33,800 | (82,692 | ) | |||||

|

Change in operating assets and liabilities

|

||||||||

|

Accounts receivable

|

(557,196 | ) | (4,308,178 | ) | ||||

|

Notes receivable

|

(257,316 | ) | 173,556 | |||||

|

Other receivable

|

(31,808 | ) | (1,107,235 | ) | ||||

|

Advance to suppliers

|

3,529,409 | (889,008 | ) | |||||

|

Inventories

|

(6,755,136 | ) | (4,121,825 | ) | ||||

|

Prepaid expenses

|

(2,719 | ) | 226,703 | |||||

|

Accounts payable and accrued liabilities

|

2,684,917 | (141,785 | ) | |||||

|

Advance from customers

|

192,640 | 2,807,114 | ||||||

|

Taxes payable

|

(444,341 | ) | 1,476,262 | |||||

|

Other payables

|

353,241 | 90,132 | ||||||

|

Net cash provided by (used in) operating activities

|

1,827,804 | (3,167,845 | ) | |||||

|

Cash flows from investing activities

|

||||||||

|

Acquisition of property and equipment

|

(37,756 | ) | (27,088 | ) | ||||

|

Construction in progress

|

(1,109,403 | ) | (2,459,521 | ) | ||||

|

Net cash used in investing activities

|

(1,147,159 | ) | (2,486,609 | ) | ||||

|

Cash flows from financing activities

|

||||||||

|

Proceeds from issuing common stock

|

472,000 | - | ||||||

|

Proceeds from warrants exercise

|

- | 371,714 | ||||||

|

Dividends paid for series B preferred stock

|

- | (32,996 | ) | |||||

|

Proceeds from short-term bank loans

|

11,074,000 | 11,176,300 | ||||||

|

Payment to short-term bank loans

|

(17,876,600 | ) | (6,047,450 | ) | ||||

|

Proceeds from long-term bank loans

|

4,714,360 | |||||||

|

Proceeds from loans from unrelated parties

|

9,162,944 | - | ||||||

|

Payment of loans from unrelated parties

|

(9,162,944 | ) | ||||||

|

Payments to an related party

|

(142,380 | ) | - | |||||

|

Proceeds from an related party

|

31,640 | - | ||||||

|

Proceeds from stock not yet issued

|

(145,000 | ) | - | |||||

|

Restricted cash

|

996,660 | (6,491,440 | ) | |||||

|

Proceeds from notes payable

|

17,876,600 | 10,410,800 | ||||||

|

Payment to notes payable

|

(16,848,300 | ) | - | |||||

|

Net cash provided by financing activities

|

152,980 | 9,386,928 | ||||||

|

Effect of exchange rate fluctuation

|

(4,185 | ) | 42,368 | |||||

|

Net increase in cash

|

829,440 | 3,774,842 | ||||||

|

Cash and cash equivalents at beginning of period

|

521,450 | 296,312 | ||||||

|

Cash and cash equivalents at end of period

|

$ | 1,350,890 | $ | 4,071,154 | ||||

|

Supplemental disclosure of cash flow information

|

||||||||

|

Interest paid

|

$ | 1,643,371 | $ | 1,406,804 | ||||

|

Non-cash activities:

|

||||||||

|

Preferred stock conversion to common stock

|

$ | 144 | $ | 753 | ||||

|

Reclassfication of warrant liability with equity

|

$ |

-

|

$ | 14,993 | ||||

|

Issuance of common stock for compensation

|

$ | 153,800 | $ | 1,787,600 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

China Carbon Graphite Group, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

For The Three and Six Months Ended June 30, 2012

(Unaudited)

(1) Organization and Business

China Carbon Graphite Group, Inc. (the “Company”), through its subsidiaries, is engaged in the manufacture of graphite-based products in the People’s Republic of China (“China” or the “PRC”). The Company’s products are used in the manufacturing process of other products, particularly non-ferrous metals and steel, and are incorporated in various types of products or processes, such as atomic reactors. The Company manufactures and sells three types of products throughout China and internationally: graphite electrodes; fine grain graphite; and high purity graphite.

The Company was incorporated on February 13, 2003 in Nevada under the name Achievers Magazine Inc. In connection with the reverse merger transaction described below, the Company’s corporate name was changed to China Carbon Graphite Group, Inc. on January 30, 2008.

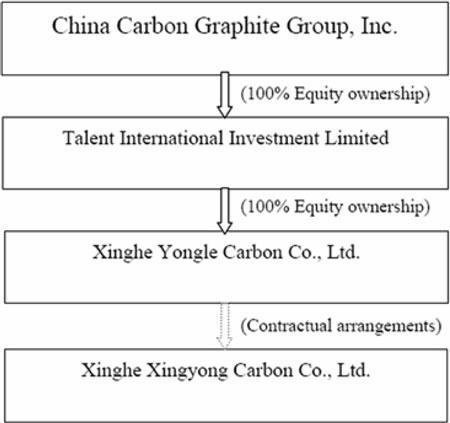

On December 17, 2007, the Company completed a share exchange pursuant to a share exchange agreement with Sincere Investment (PTC), Ltd. (“Sincere”), a British Virgin Islands corporation. Sincere was the sole stockholder of Talent International Investment Limited (“Talent”), a British Virgin Islands corporation, which is the sole stockholder of Xinghe Yongle Carbon Co., Ltd. (“Yongle”), a company organized under the laws of the PRC. Pursuant to the share exchange agreement, the Company issued 9,388,172 shares of common stock to Sincere in exchange for all of the outstanding common stock of Talent, and Talent became a wholly-owned subsidiary of the Company. Upon completion of the reverse merger, the Company’s business became the business of Talent, its subsidiaries and its affiliated variable interest entities.

Talent owns 100% of the stock of Yongle, which is a wholly foreign-owned enterprise organized under the laws of the PRC. Yongle is party to a series of contractual agreements with Xinghe Xingyong Carbon Co., Ltd. (“Xingyong”), a corporation organized under the laws of the PRC. These agreements allow the Company to operate its business in the PRC and to control the management of Xingyong and receive economic remuneration from Xingyong’s business. As a result, Xingyong is a variable interest entity and the operations of Xingyong are consolidated with those of the Company for financial reporting purposes. Xingyong’s principal stockholder is Mr. Denyong Jin, the General Manager of the Company’s China operations.

4

The relationship among the above companies is as follows:

ASC 810-10-45-25 calls for balance sheet disclosure of (a) assets of a consolidated variable interest entity (VIE) that can be used only to settle obligations of the consolidated VIE, and (b) liabilities of a consolidated VIE for which creditors (or beneficial interest owners) do not have recourse to the general credit of the primary beneficiary. The entire operating business of the Company is conducted by Xingyong and the balance sheet of the Company reflects Xingyong’s balance sheet. There are no such assets or liabilities on the balance sheet of Xingyong. The Operating Agreement dated December 7, 2007 provides that Yongle is a full-recourse guarantor of all obligations of Xingyong, and Xingyong has pledged all of its assets to Yongle. The Consulting Agreement of that date includes an assignment of all of the revenues of Xingyong to Yongle. Yongle is 100% owned by Talent and Talent is 100% owned by the Company. Accordingly, there are no assets or liabilities of Xingyong that in which the Company does not share.

The financial statements presented herein consolidate the financial statements of China Carbon Graphite, Inc. with the financial statements of its subsidiaries, Talent and Yongle. Also consolidated are the financial statements of an entity, Xingyong. The financial statements of Xingyong are consolidated with our financial statements because Xingyong is a variable interest entity. The entire operating business operations of the Company are located in the VIE, therefore the financial position and results of operations and cash flows are significantly influenced by the results of Xingyong, the VIE. Talent is party to 4 agreements dated December 7, 2007 with the owners of the registered equity of Xingyong .The agreements transfer to Talent benefits and all of the risk arising from the operations of Xingyong, as well as complete managerial authority over the operations of Xingyong.

5

The following paragraphs briefly describe the key provisions of each contractual agreement that proscribes our relationship with Xingyong:

Exclusive Technical Consulting and Services Agreement. Technical consulting and services agreement entered into on December 7, 2007 between Xinghe Yongle Carbon Co., Ltd. (also referred to as Yongle) and Xinghe Xingyong Carbon Co., Ltd. (also referred to as Xingyong), Yongle has agreed to provide technical and consulting services related to the business operations of Xingyong. As consideration for such services, Xingyong has agreed to pay to Yongle a service fee equal to 80% to 100% of the profits of Xingyong. The exact fee is calculated and paid on a quarterly basis, and is determined based on a number of factors, including but not limited to the complexity of the services provided and the commercial value of the services provided. The term of the exclusive technical consulting and services agreement is 10 years from the date thereof. Yongle may extend the term of such agreement. The parties may terminate the agreement, prior to its expiration, upon the mutual consent of Yongle and Xingyong.

Business Operations Agreement. Pursuant to the business operations agreement entered into on December 7, 2007 between Yongle, Xingyong, and the shareholders of Xingyong, Xingyong has agreed not to conduct any material transaction or corporate action without obtaining the prior written consent of Yongle. Furthermore, Xingyong and its shareholders have agreed to implement proposals made by Yongle with respect to the operations of Xingyong’s business and the appointment of directors and officers of Xingyong. Yongle may terminate the business operations agreement at any time. The term of the business operations agreement is indefinite.

Option Agreement. Yongle entered into an option agreement on December 7, 2007 with each of the shareholders of Xingyong, as well as Xingyong itself, pursuant to which Yongle has an exclusive option to purchase, or to designate another qualified person to purchase, to the extent permitted by PRC law and foreign investment policies, part or all of the equity interests in Xingyong owned by the shareholders of Xingyong. To the extent permitted by the PRC laws, the purchase price for the entire equity interest shall equal the actual price designated by Yongle to the extent permitted by relevant laws and regulations. The option agreement has a 10 year term. Upon the request of Yongle, the parties shall extend the term of the option agreement.

Equity Pledge Agreement. Pursuant to an equity pledge agreement, dated December 7, 2007, each of the shareholders of Xingyong pledged his equity interest in Xingyong to Yongle to secure Xingyong’s obligations under the VIE agreements described above. In addition, the shareholders of Xingyong agreed not to transfer, sell, pledge, dispose of or create any encumbrance on any equity interests in Xingyong that would affect Yongle’s interests. The equity pledge agreement will expire when Xingyong fully performs its obligations under the various VIE agreements described above.

Because the relationship between Xingyong and Yongle is entirely contractual, our interest in Xingyong depends on the enforceability of those agreements under the laws of the PRC. We are not aware of any judicial decision as to the enforceability of similar agreements under PRC law. However, as the owner of the registered equity of Xingyong is Mr. Jin, our major shareholder and our General Manager, we do not believe that there is a significant risk that Xingyong will seek to terminate the relationship or otherwise breach the agreements. Accordingly, we believe that consolidation of the financial statements of Xingyong with those of the Company is appropriate. The shareholders of Xingyong do not have any kick-back rights.

6

Liquidity and Working Capital Deficit

For the past two fiscal years, the Company has managed to operate the business with a low net working capital. The Company’s low working capital is primarily due to substantial short-term loans from banks, notes payables to banks and borrowings from an unrelated party. The Company is able to operate with a low net working capital as discussed under land use rights, because of the continued support from local community and governments in Inner Mongolia. The Company is one of the largest manufactures in the area. Additionally, the length of time from purchase order to delivery our products to customers is on average three to nine months. Because of this length of the time it takes to complete purchase orders and the Company’s average collection time of 90 days based on historical experience, the Company is able to reasonably predict future operating cash flow needs six to twelve months in advance. The Company believes also its historical ability to roll over short-term debt and obtain additional financing when needed, taken together, provide adequate resources to fund ongoing operations in the foreseeable future. If the Company’s short-term cash flows decrease significantly and the Company is unable to rollover or pay its short-term liabilities, the Company’s business, financial condition and results of operations could be materially affected.

The Company Law of the PRC applicable to Chinese companies provides that net after tax income should be allocated by the following rules:

|

|

1.

|

10% of after tax income to be allocated to a statutory surplus reserve until the reserve amounts to 50% of the company’s registered capital.

|

|

|

2.

|

If the accumulate balance of statutory surplus reserve is not enough to make up the Company’s cumulative prior years’ losses, the current year’s after tax income should be first used to make up the losses before the statutory surplus reverse is drawn.

|

|

|

3.

|

Allocation can be made to the discretionary surplus reserve, if such a reserve is approved at the meeting of the equity owners.

|

Therefore, the Company is required to maintain a statutory reserve in China that limits any equity distributions to its shareholders. The maximum amount of the shareholders has not been reached. The company has never distributed earnings to shareholders and has no intentions to do so.

(2) Basis for Preparation of the Financial Statements

Management acknowledges its responsibility for the preparation of the accompanying interim condensed consolidated financial statements which reflect all adjustments, consisting of normal recurring adjustments, considered necessary in its opinion for a fair statement of its condensed consolidated financial position and the results of its operations for the interim period presented. These condensed consolidated financial statements should be read in conjunction with the summary of significant accounting policies and notes to consolidated financial statements included in the Company’s Form 10-K annual report for the year ended December 31, 2011. The condensed consolidated balance sheet as of December 31, 2011 has been derived from the audited financial statements. The results of the six-months ended June 30, 2012 are not necessarily indicative of the results to be expected for the full fiscal year ending December 31, 2012.

7

The accompanying unaudited condensed consolidated financial statements for China Carbon Graphite Group, Inc. and its subsidiaries and variable interest entity, have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X.

The Company maintains its books and accounting records in Renminbi (“RMB”), but its reporting currency is U.S. dollars.

The financial statements have been prepared in order to present the financial position and results of operations of the Company, its subsidiaries and Xingyong, a variable interest entity whose financial condition is consolidated with the Company pursuant to ASC Topic 810-10, Consolidation, in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). All significant intercompany accounts and transactions have been eliminated.

(3) Summary of Significant Accounting Policies

The accompanying condensed consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying condensed consolidated financial statements and notes.

Use of estimates

The preparation of these financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of net sales and expenses during the reporting period. Some of the significant estimates include values and lives assigned to acquired property, equipment and intangible assets, reserves for customer returns and allowances, uncollectible accounts receivable, slow moving, obsolete and/or damaged inventory and stock warrant valuation. Actual results may differ from these estimates.

Cash and cash equivalents

The Company considers all highly liquid debt instruments purchased with maturity periods of three months or less to be cash equivalents. The carrying amounts reported in the accompanying balance sheet for cash and cash equivalents approximate their fair value. Most of the Company’s cash is held in bank accounts in the PRC and is not protected by FDIC insurance or any other similar insurance. The Company’s bank account in the United States is protected by FDIC insurance.

8

Restricted cash

Restricted cash represents amounts held by a bank as security for short-term bank notes payable and therefore is subject to withdrawal restrictions. As of June 30, 2012 and December 31, 2011, these amounts totaled $10,703,200 and $11,694,820, respectively. The restricted cash is expected to be released within the next twelve months after the bank notes have matured.

Accounts receivable

Trade receivables are recognized and carried at the original invoice amount less allowance for any uncollectible amounts. An allowance for doubtful accounts is made when collection of the full amount is no longer probable. Bad debts are written off as incurred. Accounts receivable are recorded at the invoiced amount and do not bear interest. Management reviews the adequacy of the allowance for doubtful accounts on an ongoing basis, using historical collection trends and aging of receivables. Management also periodically evaluates individual customer’s financial condition, credit history, and the current economic conditions to make adjustments in the allowance when it is considered necessary.

Inventory

Inventory is stated at the lower of cost or market. Cost is determined using the weighted average method. Market value represents the estimated selling price in the ordinary course of business less the estimated costs necessary to complete the sale. The Company periodically reviews historical sales activity to determine excess, slow moving items and potentially obsolete items and also evaluates the impact of any anticipated changes in future demand. The Company provides inventory allowances based on excess and obsolete inventories determined principally by customer demand.

As of June 30, 2012 and December 31, 2011, the Company did not record an allowance for obsolete inventories, nor have there been any write-offs.

The cost of inventories comprises all costs of purchases, costs of conversion and other costs incurred in bringing the inventories to their present location and condition. The costs of conversion of inventories include fixed and variable production overhead, taking into account the stage of completion.

Property and equipment

Property and equipment is stated at the historical cost, less accumulated depreciation. Depreciation on property and equipment is provided using the straight-line method over the estimated useful lives of the assets for both financial and income tax reporting purposes as follows:

|

Buildings

|

25 - 40 years

|

|

Machinery and equipment

|

10 - 20 years

|

|

Motor vehicles

|

5 years

|

9

Expenditures for renewals and betterments are capitalized while repairs and maintenance costs are normally charged to the statement of operations in the year in which they are incurred. In situations where it can be clearly demonstrated that the expenditure has resulted in an increase in the future economic benefits expected to be obtained from the use of the asset, the expenditure is capitalized as an additional cost of the asset.

Upon sale or disposal of an asset, the historical cost and related accumulated depreciation or amortization of such asset were removed from their respective accounts and any gain or loss is recorded in the statements of income.

The Company reviews the carrying value of property, plant, and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition and other economic factors. Based on this assessment, there was no impairment recorded during the six months ended at June 30, 2012 and 2011.

Construction in progress

Construction in progress represents the costs incurred in connection with the construction of buildings or additions to the Company’s plant facilities and land improvements to the property adjacent to the plant. No depreciation is provided for construction in progress until such time as the assets are completed and placed into service. The Company has not capitalized any interest expenses for the six months ended at June 30, 2012 and 2011.

Land use rights

The Company has land use rights of 386,853 square meters used for operations in Xinghe County, Inner Mongolia, China. The land use rights have terms of 50 years, with the land use right relating to 130,220 square meters expiring in 2052 and the land use right with respect to 256,633 square meters expiring in 2053. In addition, in 2011, the local Chinese government and the Company agreed on terms for the land use rights of 387,838 square meters of land located adjacent to the Company’s facilities. The Company was not required to sign a land use right agreement or pay a fee. In exchange, the Company will allow public use of this 387,838 square meters of land, provide improvements to the land and keep the land in good condition. The land use right has a term of 50 years, with such term expiring in January 2060. The value of the land is estimated to be $14,000,000. The Company has not accrued the liability or recorded the land use right asset for this property in accordance with ASC 450, Contingencies. Because of the relationship and agreement with the local government to keep provide improvements to the land and keep it in good condition, the Company believes that it is unlikely to have to pay for the land use right. The bank allows, and the Company uses, this land use right as collateral for its short-term bank loans.

10

Stock-based compensation

Stock-based compensation includes (i) common stock awards granted to employees and directors for services which are accounted for under FASB ASC 718, Compensation–Stock Compensation” and (ii) common stock awards granted to consultants which are accounted for under FASB ASC 505-50, Equity–Equity-Based Payments to Non-Employees.

All grants of common stock awards and stock options to employees and directors are recognized in the financial statements based on their grant date fair values. The Company has elected to recognize compensation expense using the straight-line method for all common stock awards and stock options granted with service conditions that have a graded vesting schedule, with a corresponding charge to additional paid-in capital.

Common stock awards are granted to directors for services provided. The vested portions of common stock awards granted but not yet issued are recorded in common stock to be issued.

Common stock awards issued to consultants represent common stock granted to non-employees in exchange for services at fair value. The measurement dates for such awards are set at the dates that the contracts are entered into as the awards are non-forfeitable and vest immediately. The measurement date fair value is then recognized over the service period as if the Company has paid cash for such service.

The Company estimates fair value of common stock awards based on the number of shares granted and the quoted price of the Company’s common stock on the date of grant.

Foreign currency translation

The reporting currency of the Company is the U.S. dollars. The Company uses RMB as its functional currency. The results of operations and cash flows are translated at average exchange rates during the period, and assets and liabilities are translated at the unified exchange rates at the balance sheet dates, and equity is translated at the historical exchange rates. As a result, amounts related to assets and liabilities reported on the statements of cash flows will not necessarily agree with changes in the corresponding accounts on the balance sheets. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statements of stockholders’ equity. Translation adjustments for the three months ended June 30, 2012 and 2011 were $(433,954) and $553,200, respectively. Translation adjustments for the six months ended June 30, 2012 and 2011 were $(10,057) and $821,448, respectively. The cumulative translation adjustment and effect of exchange rate changes on cash for the three months ended June 30, 2012 and 2011 were $(8,005) and $39,436, respectively. The cumulative translation adjustment and effect of exchange rate changes on cash for the six months ended June 30, 2012 and 2011 were $(4,185) and $42,368, respectively. Transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

11

Assets and liabilities were translated at 6.31 RMB to $1.00 at both June 30, 2012 and December 31, 2011. The equity accounts were stated at their historical rates. The average translation rates applied to income statements for the six months ended June 30, 2012 and 2011 were 6.32 RMB and 6.46 RMB to $1.00, respectively. Cash flows are also translated at average translation rates for the period; therefore, amounts reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Revenue recognition

We recognize revenue in accordance with ASC 605-25, Revenue Recognition, which states that revenue should be recognized when the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) the service has been rendered; (3) the selling price is fixed or determinable; and (4) collection of the resulting receivable is reasonably assured. Sales represent the invoiced value of goods, net of value added tax (“VAT”), if any, and are recognized upon delivery of goods and passage of title.

In accordance with ASC 605-25, the Company recognizes revenue when persuasive evidence of an arrangement exists, transfer of title has occurred or services have been rendered, the selling price is fixed or determinable and collectability is reasonably assured.

The Company derives revenues from the manufacturing and distribution of graphite based products. The Company recognizes its revenues net of VAT. The Company is subject to VAT, which is levied on a majority of the products, at a rate ranging from 13% to 17% on the invoiced value of sales. Output VAT is borne by customers in addition to the invoiced value of sales and input VAT is borne by the Company in addition to the invoiced value of purchases to the extent not refunded for export sales.

The Company recognizes revenue upon receipt of the delivery confirmation provided by the customer or distributor. The Company does not provide chargeback or price protection rights to the distributors. The distributor only places purchase orders with the Company once it has confirmed the sale with a third party because this is a specialized business, which dictates that the Company will not manufacture the products until the purchase order is received. The Company allows its customers to return products only if its products are later determined by the Company to be defective. Based on the Company’s historical experience, product returns have been insignificant throughout all of its product lines. Therefore, the Company does not estimate deductions or allowances for sales returns. If sales returns occur, they are taken against revenue when products are returned from customers. Sales are presented net of any discounts given to customers. Interest income is recognized when earned. The Company experienced no returns for the six months ended June 30, 2012 and 2011.

Taxation

Taxation on profits earned in the PRC has been calculated based on the estimated assessable profits for the year at the rates of taxation prevailing in the PRC after taking into account the benefits from any special tax credits or “tax holidays” allowed in the county of operations.

12

The Company does not accrue U.S. income tax since it has no operations in the United States. Its operating subsidiaries are organized and located in the PRC and do not conduct any business in the United States.

The Company recognizes that virtually all tax positions in the PRC are not free from some degree of uncertainty due to tax law and policy changes by the state. The Company cannot reasonably quantify political risk factors and thus must depend on guidance issued by current government officials.

Based on all known facts and circumstances and current tax law, the Company believes that the total amount of unrecognized tax benefits as of June 30, 2012 is not material to its results of operations, financial condition or cash flows. The Company also believes that the total amount of unrecognized tax benefits as of June 30, 2012, if recognized, would not have a material effect on its effective tax rate. The Company further believes that there are no tax positions, including the Enterprise Income Tax holiday from Xing He District Local Tax Authority, for which it is reasonably possible, based on current Chinese tax law and policy, that the unrecognized tax benefits will significantly increase or decrease over the next twelve months producing, individually or in the aggregate, a material effect on the Company’s results of operations, financial condition or cash flows.

Enterprise income tax

The Company has been recognized as a high technology and science company by the Ministry of Science and Technology of the PRC. Therefore, Xing He District Local Tax Authority in the Inner Mongol province granted the Company a 100% tax holiday from the enterprise income tax for 10 years from 2008 through 2017. When the tax holiday ends, based on the present tax law and the Company’s status as a high technology and science company, the Company will be subject to a corporate income tax rate of 15% effective in 2018.

Value added tax

The Provisional Regulations of the PRC Concerning Value Added Tax promulgated by the State Council came into effect on January 1, 1994. Under these regulations and the Implementing Rules of the Provisional Regulations of the PRC Concerning Value Added Tax, value added tax (“VAT”) is imposed on goods sold in or imported into the PRC and on processing, repair and replacement services provided within the PRC.

VAT payable in the PRC is charged on an aggregated basis at a rate of 13% or 17% (depending on the type of goods involved) on the full price collected for the goods sold or, in the case of taxable services provided, at a rate of 17% on the charges for the taxable services provided, but excluding, in respect of both goods and services, any amount paid in respect of VAT included in the price or charges, and less any deductible value added tax already paid by the taxpayer on purchases of goods and services in the same financial year. VAT payable (recoverable), which is included in other payables, was $71,846 and $16,542 as of June 30, 2012 and December 31, 2011, respectively.

13

Fair value of financial instruments

The Company has adopted ASC Topic 820, Fair Value Measurement and Disclosure, which defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value measurements. It does not require any new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used to classify the source of the information. It establishes a three-level valuation hierarchy of valuation techniques based on observable and unobservable inputs, which may be used to measure fair value and include the following:

|

●

|

Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

|

|

●

|

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments.

|

|

●

|

Level 3 inputs to the valuation methodology are unobservable and significant to the fair value.

|

The fair value of the 2007 Warrants to purchase 125,000 shares of common stock was $1,344 and $2,702 at June 30, 2012 and December 31, 2011, respectively. The Company recognized a loss of $19,555 from the change in fair value of these warrants for the three months ended March 31, 2012 and a gain of $20,913 for the three months ended June 30, 2012.

The fair value of the 2009 Warrants to purchase 200,000 shares of common stock was $27,825 and $22,820 at June 30, 2012 and December 31, 2011, respectively. The Company recognized a loss of $70,934 from the change in fair value of these warrants for the three months ended March 31, 2012 and a gain of $65,929 for the three months ended June 30, 2012.

The fair value of the 2009 Series B Warrants to purchase 804,200 shares of common stock was $159,259 and $132,521 at June 30, 2012 and December 31, 2011, respectively. The Company recognized a loss of $345,784 from the change in fair value of these warrants for the three months ended March 31, 2012 and a gain of $319,045 for the three months ended June 30, 2012.

The fair value of 2010 Series B warrants to purchase 100,000 shares of common stock was $20,176 and $16,762 at June 30, 2012 and December 31, 2011, respectively. The Company recognized a loss of $43,290 from the change in fair value of these warrants for the three months ended March 31, 2012 and a gain of $39,876 for the three months ended June 30, 2012.

In summary, the Company recorded a gain of $445,763 and loss of $33,800 of changes in fair value of warrants in the condensed consolidated statement of income and comprehensive income for the three months and six months ended June 30, 2012, respectively. Each reporting period, the change in fair value is recorded into other income (expense).

14

Warrants referred to in the preceding paragraphs do not trade in an active securities market, and as such, the Company estimates the fair value of these warrants using the Black-Scholes option pricing model using the following assumptions:

|

June 30,

2012

(unaudited)

|

December 31,

2011

|

|||||||

|

2007 Warrants

|

||||||||

|

Annual dividend yield

|

-

|

-

|

||||||

|

Expected life (years)

|

0.54

|

1.04

|

||||||

|

Risk-free interest rate

|

0.18

|

%

|

0.18

|

%

|

||||

|

Expected volatility

|

104

|

%

|

90

|

%

|

||||

|

June 30,

2012

(unaudited)

|

December 31,

2011

|

|||||||

|

2009 Warrants

|

||||||||

|

Annual dividend yield

|

-

|

-

|

||||||

|

Expected life (years)

|

2.21

|

2.71

|

||||||

|

Risk-free interest rate

|

0.18

|

%

|

0.18

|

%

|

||||

|

Expected volatility

|

104

|

%

|

90

|

%

|

||||

|

June 30,

2012

(unaudited)

|

December 31,

2011

|

|||||||

|

2009 Series B Warrants

|

||||||||

|

Annual dividend yield

|

-

|

-

|

||||||

|

Expected life (years)

|

2.48

|

2.98

|

||||||

|

Risk-free interest rate

|

0.18

|

%

|

0.18

|

%

|

||||

|

Expected volatility

|

104

|

%

|

90

|

%

|

||||

|

June 30,

2012

(unaudited)

|

December 31,

2011

|

|||||||

|

2010 Series B Warrants

|

||||||||

|

Annual dividend yield

|

-

|

-

|

||||||

|

Expected life (years)

|

2.53

|

3.03

|

||||||

|

Risk-free interest rate

|

0.18

|

%

|

0.18

|

%

|

||||

|

Expected volatility

|

104

|

%

|

90

|

%

|

||||

The carrying amount of restricted cash, other receivables, advance to vendors, advances from customers, other payables, accrued liabilities and short-term loans are reasonable estimates of their fair value because of the short term nature of these items.

15

The following table sets forth by level within the fair value hierarchy of the Company’s financial assets and liabilities that was accounted for at fair value on a recurring basis or for purposes of disclosures as of June 30, 2012:

|

Carrying Value at

June 30, |

Fair Value Measurement at

June 30, 2012

|

|||||||||||||||

|

2012

|

Level 1

|

Level 2

|

Level 3 | |||||||||||||

|

Warrant liability

|

$ | 208,605 | - | - | $ | 208,605 | ||||||||||

|

Notes receivables

|

$ | 444,895 | $ | 444,895 | - | |||||||||||

|

Notes payable

|

$ | 17,786,200 | $ | 17,786,200 | - | |||||||||||

The Company uses the black-scholes valuation method approach when determining fair values of its Level 3 recurring fair value measurements. Certain unobservable units for these assets are offered quotes, lack of marketability and volatility. For Level 3 measurements, significant increases or decreases in either of those inputs in isolation could result in a significantly lower or higher fair value measurement. In general, a significant change in the calculated volatility of the Company’s stock price could negatively affect the fair value of the warrant liability.

Summary of warrants outstanding:

|

Warrants

|

Weighted Average Exercise Price

|

|||||||

|

Outstanding as of December 31, 2011

|

1,229,200

|

$

|

1.51

|

|||||

|

Granted

|

-

|

-

|

||||||

|

Exercised

|

-

|

-

|

||||||

|

Cancelled

|

-

|

-

|

||||||

|

Outstanding as of June 30, 2012

|

1,229,200

|

$

|

1.51

|

|||||

Earnings per share

Basic earnings per share is computed by dividing net income available to common shareholders by the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share is computed by dividing net income available to common shareholders by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during each period. Potentially dilutive shares of common stock consist of the common stock issuable upon the conversion of convertible debt, preferred stock and warrants. The Company has outstanding warrants to purchase 1,229,200 shares of common stock at an exercise price in the range of $1.30 - $2.00 per share. The Company uses if-converted method to calculate the dilutive preferred stock and treasury stock method to calculate the dilutive shares issuable upon exercise of warrants.

16

The following table sets forth the computation of the number of net income per share for the six months ended June 30, 2012 and 2011:

|

June 30,

2012

(unaudited)

|

June 30,

2011

|

|||||||

|

Weighted average shares of common stock outstanding (basic)

|

23,632,248

|

21,993,435

|

||||||

|

Shares issuable upon conversion of Series B Preferred Stock

|

305,810

|

472,160

|

||||||

|

Shares issuable upon exercise of warrants

|

-

|

205,690

|

||||||

|

Weighted average shares of common stock outstanding (diluted)

|

23,938,058

|

22,671,285

|

||||||

|

Net income available to common shareholders

|

$

|

1,114,786

|

$

|

1,233,233

|

||||

|

Net income per shares of common stock (basic)

|

$

|

0.05

|

$

|

0.05

|

||||

|

Net income per shares of common stock (diluted)

|

$

|

0.05

|

$

|

0.05

|

||||

For the six months ended June 30, 2012, the Company excluded the shares of common stock issuable upon exercise of 1,229,200 warrants, because such issuance would be anti-dilutive.

For the six months ended June 30, 2011, the Company excluded the shares of common stock issuable upon exercise of 125,000 warrants, because such issuance would be anti-dilutive.

The following table sets forth the computation of the number of net income per share for the three months ended June 30, 2012 and 2011:

|

June 30,

2012

(unaudited)

|

June 30,

2011

|

|||||||

|

Weighted average shares of common stock outstanding (basic)

|

23,948,851

|

22,350,263

|

||||||

|

Shares issuable upon conversion of Series B Preferred Stock

|

305,810

|

472,160

|

||||||

|

Shares issuable upon exercise of warrants

|

-

|

372,119

|

||||||

|

Weighted average shares of common stock outstanding (diluted)

|

24,254,661

|

23,194,542

|

||||||

|

Net income available to common shareholders

|

$

|

866,687

|

$

|

875,318

|

||||

|

Net income per shares of common stock (basic)

|

$

|

0.04

|

$

|

0.04

|

||||

|

Net income per shares of common stock (diluted)

|

$

|

0.04

|

$

|

0.04

|

||||

For the three months ended June 30, 2012, the Company excluded the shares of common stock issuable upon exercise of 1,229,200 warrants, because such issuance would be anti-dilutive.

For the three months ended June 30, 2011, the Company excluded the shares of common stock issuable upon exercise of 125,000 warrants, because such issuance would be anti-dilutive.

Reclassification

Certain 2011 amounts have been reclassified to conform to the current year’s financial statements presentation. These reclassifications had no impact on the previously reported financial position, results of operations or cash flows.

Recent accounting pronouncements

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements will have a material impact on its financial condition or the results of its operations.

In December 2011, FASB issued ASU 2011-11, Disclosures about Offsetting Assets and Liabilities. The amendments contained in ASU 2011-11 require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. This amendment is effective for annual reporting periods beginning on or after January 1, 2013. The adoption of ASU 2011-11 results in changes to presentation and disclosure only and is not expected to have an impact on the Company’s consolidated results of operations and financial condition.

During June 2011, the FASB issued ASU 2011-05, “Presentation of Comprehensive Income.” ASU 2011-05 eliminates the option to report other comprehensive income and its components in the statement of changes in stockholders’ equity and requires an entity to present the total of comprehensive income, the components of net income and the components of other comprehensive income either in a single continuous statement or in two separate but consecutive statements. The Company has adopted ASU No. 2011-05, which resulted in the components of comprehensive income to be presented within the consolidated statements of operations and comprehensive income (loss).

17

During May 2011, the FASB issued ASU No. 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (“IFRS”).” This pronouncement was issued to provide a consistent definition of fair value and ensure that the fair value measurement and disclosure requirements are similar between U.S. GAAP and IFRS. ASU 2011-04 changes certain fair value measurement principles and enhances the disclosure requirements particularly for level 3 fair value measurements. This pronouncement is effective for reporting periods beginning on or after December 15, 2011. The adoption of ASU 2011-04 did not have an impact to our consolidated financial position or results of operations.

(4) Concentration of Business and Credit Risk

Most of the Company’s bank accounts are in banks located in the PRC and are not covered by any type of protection similar to that provided by the Federal Deposit Insurance Corporation (“FDIC”) on funds held in U.S. banks. The Company’s bank account in the United States is covered by FDIC insurance.

Financial instruments that potentially subject the Company to concentration of credit risk consist principally of cash, trade accounts receivables and inventories, the balances of which are stated on the balance sheet. The Company places its cash in banks located in China. Concentration of credit risk with respect to trade accounts receivables is limited due to the diversity of the Company’s customers who are located in different regions of China. The Company does not require collateral or other security to support financial instruments subject to credit risk.

For the six months ended June 30, 2012, two customers accounted for 10% or more of sales revenues, representing 32.4%, and 24.9%, respectively of the total sales. For the six months ended June 30, 2011, two customers accounted for 10% or more of sales revenues, representing 34.0%, and 24.0%, respectively of the total sales. As of June 30, 2012, there were two customers that constituted 43.2%, and 26.3% of the accounts receivable. As of December 31, 2011, there were two customers that constituted 41.2% and 16.3% of the accounts receivable.

For the six months ended June 30, 2012, four suppliers accounted for 10% or more of our total purchases, representing 35.7%, 15.4%, 14.2% and 10.7%, respectively. For the six months ended June 30, 2011, three suppliers accounted for 10% or more of our total purchases, representing 45.0%, 19.0% and 10.2% of our total purchase, respectively.

(5) Income Taxes

Under the Provisional Regulations of The People’s Republic of China Concerning Income Tax on Enterprises promulgated by the PRC, domestic and foreign companies pay a unified corporate income tax of 25%, except for a 15% corporate income tax rate for qualified high technology and science enterprises. The Company has been granted a 100% tax holiday from enterprise income tax from the Xing He District Local Tax Authority for 10 years from 2008 through 2017.

18

A reconciliation of the provision for income taxes with amounts determined by the PRC statutory income tax rate to income before income taxes is as follows:

|

June 30,

|

||||||||

|

2012

(unaudited)

|

2011

|

|||||||

|

Computed tax at the PRC statutory rate of 15%

|

$

|

298,317

|

$

|

359,760

|

||||

|

Benefit of tax holiday

|

(298,317

|

)

|

(359,760

|

)

|

||||

|

Income tax expenses per books

|

$

|

-

|

$

|

-

|

||||

(6) Accounts Receivable, net

As of June 30, 2012 and December 31, 2011, accounts receivable consisted of the following:

|

June 30,

2012

(unaudited)

|

December 31,

2011

|

|||||||

|

Amount outstanding

|

$

|

15,886,362

|

$

|

15,331,983

|

||||

|

Less: Allowance for doubtful accounts

|

(2,790,662

|

)

|

(2,790,662

|

)

|

||||

|

Net amount

|

$

|

13,095,700

|

$

|

12,541,321

|

||||

As of June 30, 2012 and December 31, 2011, allowance for doubtful accounts consisted of the following:

|

June 30,

2012

(unaudited)

|

December 31,

2011

|

|||||||

|

Beginning balance

|

$

|

2,790,662

|

$

|

2,505,867

|

||||

|

Provision for doubtful accounts

|

-

|

284,795

|

||||||

|

Amounts written off

|

-

|

-

|

||||||

|

Ending balance

|

$

|

2,790,662

|

$

|

2,790,662

|

||||

(7) Inventories

As of June 30, 2012 and December 31, 2011, inventories consisted of the following:

|

June 30,

2012

(unaudited)

|

December 31,

2011

|

|||||||

|

Raw materials

|

$

|

3,902,152

|

$

|

3,299,372

|

||||

|

Work in process

|

38,617,984

|

32,926,480

|

||||||

|

Finished goods

|

1,631,088

|

1,204,396

|

||||||

|

$

|

44,151,224

|

$

|

37,430,248

|

|||||

19

As of June 30, 2012 and December 31, 2011, the Company did not have any provision for inventory in regards to slow moving or obsolete items.

(8) Property and Equipment, net

As of June 30, 2012 and December 31, 2011, property and equipment consisted of the following:

|

June 30,

2012

(unaudited)

|

December 31,

2011

|

|||||||

|

Building

|

$

|

26,259,432

|

$

|

26,241,768

|

||||

|

Machinery and equipment

|

22,690,201

|

22,670,300

|

||||||

|

Motor vehicles

|

33,054

|

33,054

|

||||||

|

48,982,687

|

48,945,122

|

|||||||

|

Less: accumulated depreciation

|

13,239,934

|

12,225,527

|

||||||

|

$

|

35,742,753

|

$

|

36,719,595

|

|||||

For the three months ended June 30, 2012 and 2011, depreciation expenses amounted to $508,984 and $389,802, of which $505,745 and $389,347 was charged to cost of goods sold. For the six months ended June 30, 2012 and 2011, depreciation expenses amounted to $1,019,563 and $776,556, of which $1,013,356 and $775,732 was charged to cost of goods sold. As of June 30, 2012 and December 31, 2011, a net book value of $17,549,101 and $16,694,000, respectively, of property and equipment were used as collateral for the Company’s short-term loans.

Construction in progress consists of two projects as follows:

|

June 30,

2012

|

December 31, 2011

|

Estimated completion time

|

Expected capital needed to complete

|

|||||||||||||

|

(unaudited)

|

||||||||||||||||

|

Construction of factory

|

$ | 3,607,217 | $ | 3,427,962 |

Depends on testing

|

$ | 1,574,000 | |||||||||

|

Land improvements

|

3,911,423 | 2,792,489 | 2012 | 3,148,000 | ||||||||||||

| $ | 7,518,640 | $ | 6,220,451 | $ | 4,722,000 | |||||||||||

20

Construction in progress represents the costs incurred in connection with the construction of buildings or additions to the Company’s plant facilities and land improvements to the property adjacent to our plant. No depreciation is provided for construction in progress until such time as the assets are completed and placed into service. Construction in progress in the amount of $0 was transferred to fixed assets during the six months ended June 30, 2012.

(9) Land Use Rights

Land use rights are amortized over 50 years. As of June 30, 2012 and December 31, 2011, land use rights consisted of the following:

|

June 30, 2012

(unaudited)

|

December 31, 2011

|

|||||||

|

Land Use Rights

|

$

|

11,135,130

|

$

|

11,371,230

|

||||

|

Less: Accumulated amortization

|

775,476

|

672,171

|

||||||

|

$

|

10,359,654

|

$

|

10,699,059

|

|||||

For the three months ended June 30, 2012 and 2011, amortization expenses were $46,826 and $47,153, respectively. For the six months ended June 30, 2012 and 2011, amortization expenses were $103,830 and $93,754, respectively.

As of June 30, 2012, all land use rights were pledged as collateral for short-term bank loans.

(10) Stockholders’ equity

Restated Articles of Incorporation

On January 22, 2008, the Company changed its authorized capital stock to 120,000,000 shares of capital stock, of which 20,000,000 shares are shares of preferred stock, par value $0.001 per share, and 100,000,000 shares are shares of common stock, par value $0.001 per share. The restated articles of incorporation authorizes the board of directors of the Company to issue one or more series of preferred stock and to designate the rights, preferences, privileges and limitation of the holders of such preferred stock. The board of directors has authorized the issuance of two series of preferred stock, Series A Convertible Preferred Stock (“Series A Preferred Stock”) and Series B Convertible Preferred Stock (“Series B Preferred Stock”).

Issuance of Common Stock

(a) Conversion of Series A Preferred Stock

As of June 30, 2012 and December 31, 2011, no shares of Series A Preferred Stock are issued or outstanding.

21

(b) Conversion of Series B Preferred Stock

During the year ended December 31, 2011, the Company issued an aggregate of 736,389 shares of common stock to holders of Series B Preferred Stock upon the conversion of an aggregate of 798,890 shares of Series B Preferred Stock.

During the six months ended June 30, 2012, the Company issued an aggregate of 120,300 shares of common stock to holders of Series B Preferred Stock upon the conversion of an aggregate of 120,300 shares of Series B Preferred Stock. The remaining 305,810 Series B Preferred Stock are redeemable by the holder as of June 30, 2012. The Company has reclassified these shares into Temporary Equity as of June 30, 2012.

(c) Exercise of Warrants

On January 19, 2011, the Company issued 45,833 shares of common stock to First Trust Group, Inc. upon the cashless exercise of 100,000 warrants at an exercise price of $2.34 per share. On January 24, 2011, the Company issued 124,025 shares of common stock to Maxim Group LLC upon exercise of warrants at an exercise price of $1.32 per share. On February 7, 2011, the Company issued 160,000 shares of common stock to Silver Rock II, Ltd. upon exercise of warrants at an exercise price of $1.30 per share.

On March 29, 2010 and April 1, 2010, the Company issued an aggregate of 28,000 shares of common stock to holders of Series B Preferred Stock upon exercise of warrants at an exercise price of $1.30 per share and 100,000 shares of common stock upon exercise of warrants at an exercise price of $1.30 per share.

As of June 30, 2012, there are total 1,229,200 shares warrants outstanding.

(d) Stock Issuances for Cash

On July 14, 2011, the Company issued an aggregate of 250,000 shares of common stock at a price of $0.64 per share to unrelated parties to raise money for the Company’s operations.

On January 12, 2012, the Company issued 320,000 shares of common stock at a price of $0.50 per share to unrelated parties to raise money for the Company’s operations.

On March 8, 2012, the Company issued 100,000 shares of common stock at a price of $0.50 per share to unrelated parties to raise money for the Company’s operations.

On April 10, 2012, the Company issued 200,000 shares of common stock at a price of $0.50 per share to unrelated parties to raise money for the Company’s operations.

On May 9, 2012, the Company issued 200,000 shares of common stock at a price of $0.56 per share to unrelated parties to raise money for the Company’s operations.

22

On May 9, 2012, the Company issued 100,000 shares of common stock at a price of $0.50 per share to unrelated parties to raise money for the Company’s operations.

(e) Stock Issuances to Consultants

In April 2010, the Company issued an aggregate of 420,000 shares of common stock pursuant to three consulting agreements in exchange for consulting and investor relations services. A fair value of $659,400 was recorded. As of June 30, 2012, these consulting expenses were fully amortized.

In December 2010, the Company issued 90,000 shares of common stock to ChangeWave, Inc. in exchange for consulting and investor relations services.

During the first quarter of 2011, the Company issued an aggregate of 620,000 shares of common stock pursuant to three consulting agreements in exchange for consulting and investor relations services. A fair value of $1,240,100 was recorded for the consulting expenses relating to all three agreements, with the consulting expenses being amortized over one year for two agreements and one and a half years for the third agreement. $87,850 and $266,100 was amortized and recognized as a general and administrative expense for the six months ended June 30, 2012 and 2011, respectively. $175,700 and $532,200 was amortized and recognized as a general and administrative expense for the six months ended June 30, 2012 and 2011, respectively. As of June 30, 2012, these consulting expenses were fully amortized.

During the second quarter of 2011, the Company issued 365,000 shares of common stock pursuant to a consulting agreement in exchange for consulting and investor relations services. A fair value of $547,500 was recorded for the consulting expenses and amortized over one and a half years. $91,250 and $91,250 was amortized and recognized as a general and administrative expense for the three months ended June 30, 2012 and 2011, respectively. $182,500 and $91,250 was amortized and recognized as a general and administrative expense for the six months ended June 30, 2012 and 2011, respectively. As of June 30, 2012, $91,250 remained to be amortized and was recorded as a prepaid expense.

In April 2012, the Company issued an aggregate of 110,000 shares of common stock pursuant to a consulting agreement in exchange for investor relations services. A fair value of $96,800 was recorded for the expenses and amortized over one year. $16,133 was amortized and recognized as a general and administrative expense for the three and six months ended June 30, 2012. As of June 30, 2012, $80,667 remained to be amortized and was recorded as a prepaid expense.

In June 2012, the Company issued an aggregate of 100,000 shares of common stock pursuant to a consulting agreement in exchange for investor relations services. A fair value of $57,000 was recorded for the consulting expenses and amortized over four months. $0 was amortized and recognized as a general and administrative expense for the three and six months ended June 30, 2012. As of June 30, 2012, $57,000 remained to be amortized and was recorded as a prepaid expense.

23

(f) Other Stock Issuances

On November 29, 2011, we issued an aggregate of 100,000 shares of common stock to four directors as compensation for services. On November 29, 2011, we issued 60,000 shares of common stock to an employee. The issuance of these shares was recorded at fair market value, or $104,000.

(g) Shares Held in Escrow

In a private placement that closed on December 22, 2009 and January 13, 2010, the Company sold an aggregate of 2,480,500 shares of Series B Preferred Stock and five-year warrants to purchase 992,000 shares of common stock at an exercise price of $1.30 per share, for an aggregate purchase price of $2,976,600. The Company also paid the private placement agent an aggregate of $298,000 and issued five-year warrants to purchase 124,025 shares of common stock at an exercise price of $1.32 per share. In connection with the private placement and pursuant to the transaction agreements, the Company deposited into escrow an aggregate of 1,240,250 shares of common stock, which are to be held in escrow to be returned to the Company or delivered to the investors, depending on whether the Company meets certain financial performance targets for the years ending December 31, 2010 and December 31, 2011.