Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K CHINA HGS REAL ESTATE - CHINA HGS REAL ESTATE INC. | form8k.htm |

Exhibit 99.1

China

HGS Real Estate Inc.

(OTC

BB: CAHS)

January

2010

2

Forward

Looking Statement

CAUTIONARY

STATEMENT REGARDING

FORWARD

- LOOKING STATEMENTS

This

presentation includes or incorporates by reference statements that constitute

forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future

events or to our future financial performance, and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, levels of activity, performance, or achievements

to be materially different from any future results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements and therefore refer you to a more detailed

discussion of the risks and uncertainties in the Company’s filings with the Securities & Exchange

Commission. In some cases, you can identify forward-looking statements by the use of words such

as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “continue,” or the negative of these terms or other comparable terminology. You should

not place undue reliance on forward-looking statements since they involve known and unknown

risks, uncertainties and other factors which are, in some cases, beyond our control and which could

materially affect actual results, levels of activity, performance or achievements. The forward-looking

statements contained in this presentation are made only as of this date and CAHS is under no

obligation to revise or update these forward-looking statements.

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future

events or to our future financial performance, and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, levels of activity, performance, or achievements

to be materially different from any future results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements and therefore refer you to a more detailed

discussion of the risks and uncertainties in the Company’s filings with the Securities & Exchange

Commission. In some cases, you can identify forward-looking statements by the use of words such

as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “continue,” or the negative of these terms or other comparable terminology. You should

not place undue reliance on forward-looking statements since they involve known and unknown

risks, uncertainties and other factors which are, in some cases, beyond our control and which could

materially affect actual results, levels of activity, performance or achievements. The forward-looking

statements contained in this presentation are made only as of this date and CAHS is under no

obligation to revise or update these forward-looking statements.

3

Equity

Snapshot

|

OTC

BB Listed

|

CAHS

|

|

Share

Price (01/20/2010)

|

$3.98

|

|

52

Week Range

|

$0.02

- $4.00

|

|

Market

Cap

|

$179.5

Million

|

|

Shares

Outstanding*

|

45.1

Million

|

|

Revenue

(ttm)

|

$28.5

Million

|

|

Net

Income (ttm)

|

$11.1

Million

|

|

EPS

|

$0.28

|

|

Gross

Margin

|

47.0%

|

|

Net

Margin

|

38.9%

|

|

P/E

(ttm)

|

14.2x

|

* As of

December 24, 2009

4

|

§ Rapidly

growing real estate market in the tier II and tier III cities in

China

|

|

§ Strong project

pipelines under development and planning with 459,614 sq m GFA

(Gross Floor Area) |

|

§ Largest

property developer in Hanzhong (3.8 m population)

|

|

§ Standardized,

scalable model that emphasizes rapid asset turnover, efficient

capital management and strict cost control |

|

§ Experienced

management team

|

|

§ Strong

financial position

|

|

|

Investment

Highlights

5

§ No.1 real estate

developer with 47%

market share in Hanzhong, a third-tier city

in Shaanxi province with 3.8 million

population

market share in Hanzhong, a third-tier city

in Shaanxi province with 3.8 million

population

§ Real estate

properties offered include:

multi-layer, sub-high-rise, and high-rise

apartment buildings

multi-layer, sub-high-rise, and high-rise

apartment buildings

§ Majority of recent

projects completed with

gross margin in the range of 40% to 55%

gross margin in the range of 40% to 55%

§ 150,000 ㎡ of average

annual area

developed in the past 14 years

developed in the past 14 years

§ National grade II

real estate qualification

Company

Overview

Business

Overview

A

branch company in Yangxian was

established

established

Hanzhong

Guangsha Real Estate

Development Co., Ltd. was founded

Development Co., Ltd. was founded

A

branch company in Weinan was

established

established

Shaanxi

Guangsha Investment and

Development Group Co., Ltd. was

registered with RMB160.7 million

Development Group Co., Ltd. was

registered with RMB160.7 million

Goal:

To become the leading

residential property developer

focused on China’s Tier III cities

residential property developer

focused on China’s Tier III cities

2008

2007

1995

2001

August

2009

2009

Became

public and listed on OTCBB

under ticker symbol “CAHS”

under ticker symbol “CAHS”

6

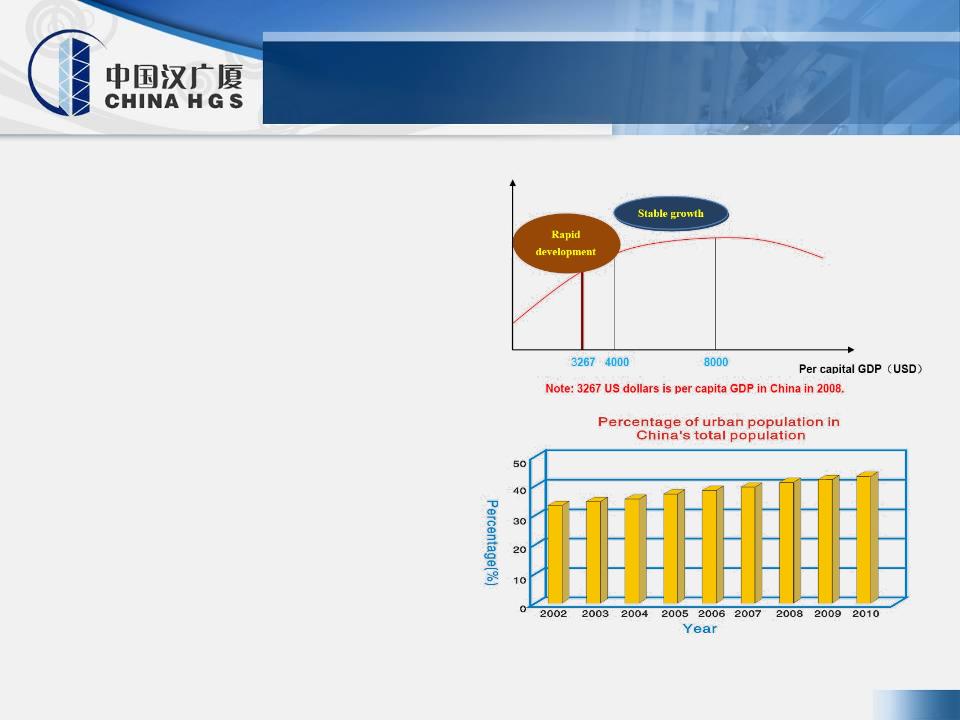

§ Increasing

urbanization rate drives

demand for real estate

demand for real estate

§ Less significant and

small-scale

property bubbles in tier II and tier III

cities relative to tier I cities

property bubbles in tier II and tier III

cities relative to tier I cities

§ Attractive growth in

resident disposable

income boost demand for real estate

income boost demand for real estate

§ Significantly lower

competition in tier III

cities

cities

Promising

Real Estate Opportunity

in

Tier II and Tier III cities

Urban

population expected to increase from 43% to 47% by 2010

Source:

State Statistical Bureau, the 11th Tenth Five-Year Plan

7

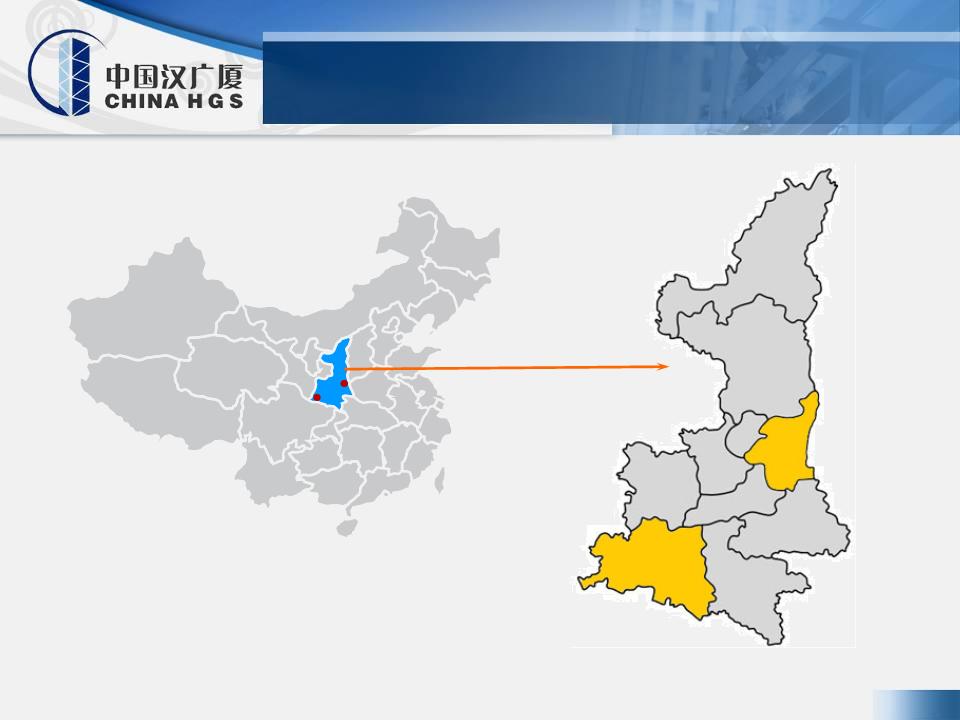

Hanzhong’s

Geographic Significance

Weinan

Hanzhong

ü Located

in the southwestern part of Shaanxi

Province, Hangzhong is historically a strategic

passageway liking northwest to southwest

Province, Hangzhong is historically a strategic

passageway liking northwest to southwest

ü Located

in the southeastern part of Shaanxi

Province, Weinan the “Eastern Gate” connecting

northwest to central China

Province, Weinan the “Eastern Gate” connecting

northwest to central China

8

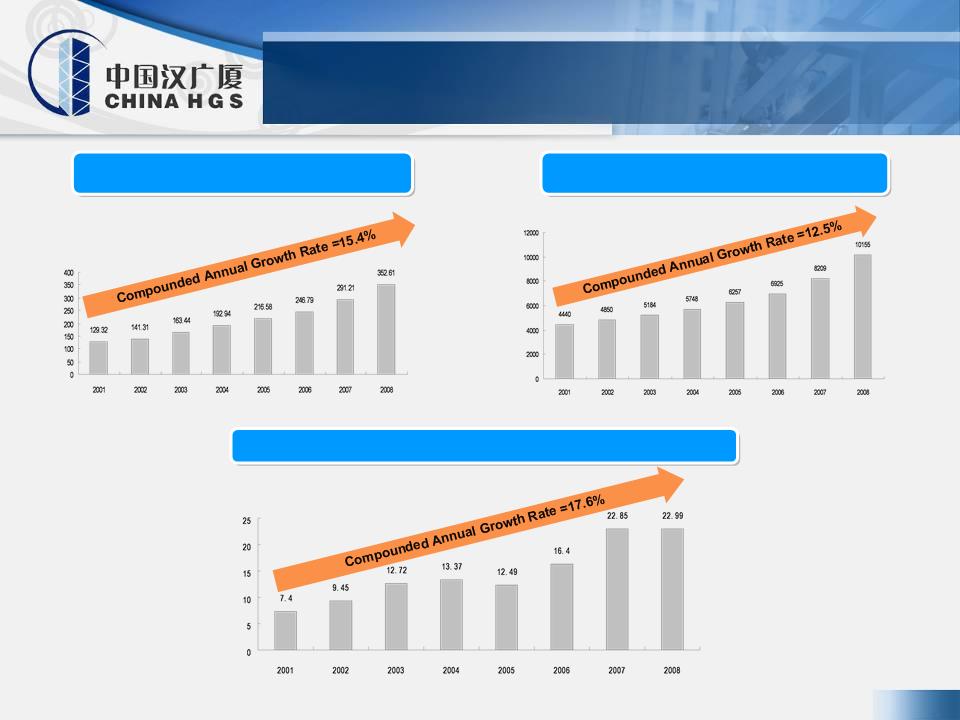

Hanzhong

- Culture Center in Central China

Source:

Shaanxi Statistical Bureau

GDP

(Hundred Million RMB)

Average

Disposal Income (RMB)

Real

Estate Investment (Hundred Million RMB)

9

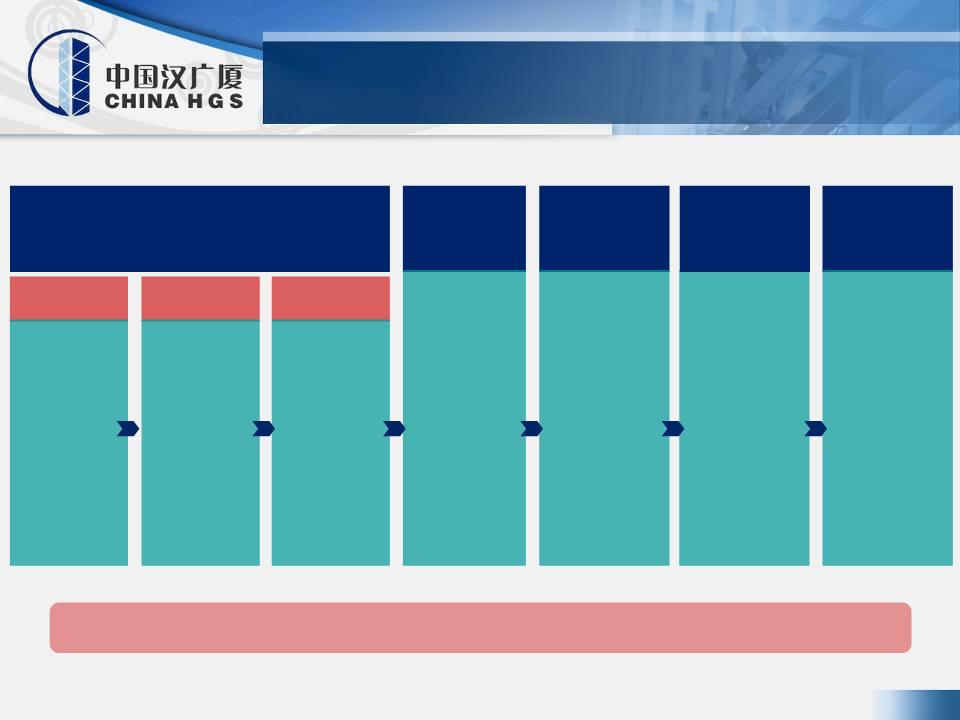

• Pre-sale

• Customer

Financing

Financing

A

systematic and standardized process to project development, which is implemented

through

several well-defined phases

several well-defined phases

Opportunity

Identification

Initial

Planning

Planning

Land

Acquisition

Acquisition

• Strategic

Planning

Planning

• Geographic

and Market

Analysis

and Market

Analysis

• Auction

Opportunity

Study

Opportunity

Study

• Feasibility

• Preliminary

Design

Design

• Costing

and

Financial

Evaluation

Financial

Evaluation

• Financial

Projection

Projection

• Internal

Approval

Approval

• Biding

Process

Process

Project

Planning &

Design

Planning &

Design

Project

Construction

&

Management

Construction

&

Management

Pre-sale,

sale

& Marketing

& Marketing

After-sale,

Service

Service

• Architectural

&

Engineering

Design

&

Engineering

Design

• Design

Management

Management

• Arrange

Financing

Financing

• Construction

• Construction

Supervision

Supervision

• Quality

Control

Control

• Completion

Inspection

Inspection

• Landscaping

& Fixture

Installation

& Fixture

Installation

• Registration

Assistance

Assistance

• Feedback

Collection

Collection

• Advertising

• Property

Management

Management

• Heating

System

System

Land

Acquisition Process

Systematic

& Standardized Project

Development Process

Development Process

10

Solid

Track Record of Completed Projects

All

data as of September 30, 2009

* The

amounts for “total GFA” in this table are the amounts of total saleable

residential GFA

|

|

Location

|

Type

of

Projects |

Completion

Date |

Total

GFA

(sq m) |

%

of Units

Sold |

|

Weinan

Lijing Garden - Project I

|

Weinan

City

|

M

|

April

2005

|

44,373

|

100%

|

|

Weinan

Lijing Garden - Project II

|

Weinan

City

|

M

|

December

2006

|

55,390

|

100%

|

|

Weinan

Lijing Garden - Project III

|

Weinan

City

|

M

|

June

2008

|

3,964

|

100%

|

|

Yangzhou

Pearl Garden - Project I

|

Yang

County

|

M

|

September

2009

|

34,348

|

59.3%

|

|

Mingzhu

Garden - Project I & II

|

Hanzhong

City

|

M

|

September

2009

|

28,666

|

100%

|

|

Total

|

|

|

|

166,741

|

91.9%

|

11

Under

Construction and Planned Projects

|

|

Location

|

Type

of

Projects

|

Expected

Completion Date |

Total

GFA*

(sq m)

|

%

of Units

Pre-sold |

|

Projects

under Construction

|

|

|

|

|

|

|

Yangzhou

Pearl Garden

|

Yang

County

|

M

|

December

2010

|

72,476

|

8.8%

|

|

Mingzhu

Xinju - Project I

|

Hanzhong

City

|

M/S

|

December

2010

|

42,476

|

62.5%

|

|

Mingzhu

Real Estate

|

Hanzhong

City

|

M/S/H

|

December

2010

|

37,015

|

100%

|

|

Subtotal

|

|

|

|

151,967

|

26.1%

|

|

Projects

under Planning

|

|

|

|

|

|

|

Yangzhou

Pearl Garden -

Project IV |

Yang

County

|

M/S/H

|

|

246,471

|

0.0%

|

|

Mingzhu

Xinju - Project II

|

Hanzhong

City

|

M/S/H

|

|

61,176

|

0.0%

|

|

Subtotal

|

|

|

|

307,647

|

0.0%

|

|

Total

|

|

|

|

459,614

|

|

All

data as of September 30, 2009

•The amounts for

“total GFA” in this table are the amounts of total saleable residential

GFA

• M = Multi-layer ; S

= Sub-high-rise; H = High-rise

12

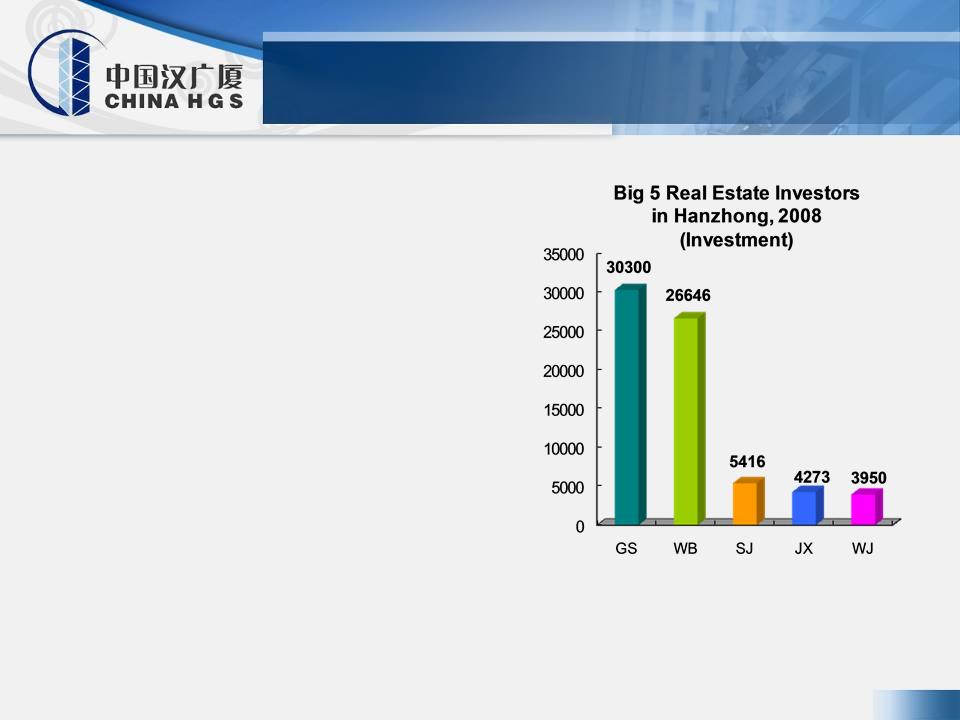

§ Dominant residential

real estate

development company in Hanzhong

development company in Hanzhong

§ Primary competitors

include local and

regional property developers

regional property developers

§ No direct

competition from the increasing

number of large national players in Tier II

cities as HGS focuses on small to medium

-size projects

number of large national players in Tier II

cities as HGS focuses on small to medium

-size projects

Competition

(in

Ten Thousand RMB)

WB-

Wanbang Real Estate

13

• Recognized

as "AAA Enterprise in Shaanxi Construction Industry" by Credit

Association of Agricultural Bank of China, Shaanxi Branch

Association of Agricultural Bank of China, Shaanxi Branch

• Disciplined

bidding process

• Senior

management closely supervises management and planning process

Forward

looking land acquisition strategy focuses on locations with

promising

development potential

Competitive

Strengths

Captures

over 80% of the resident real estate market in Hanzhong

Awards

received include:

“3.15

Trustworthy Enterprise in China” by China Credibility Alliance

“Trustworthy

Enterprise” by Shanxi Banking Association

Insignificant

amount of debt and no long term bank loans

High

Standard Quality

Control

Land

Acquisition Strategy

Leading

Market Position

High

Market Recognition

Conservative

Cap Structure

14

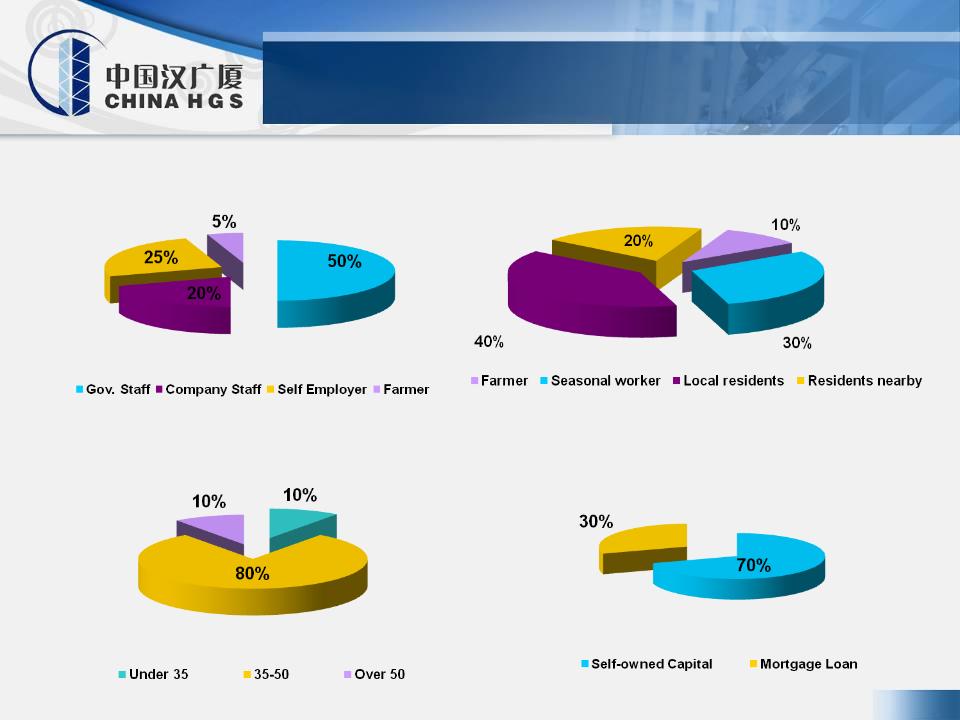

Target

Customer Profile

Occupation

Region

Age

Payment

15

Marketing

Strategies

Key

Marketing Strategies

Advance

sales

- Pre sale of units

when new buildings made available for trading

Internal

improvement

- Enhanced designs for

residential areas

- Supporting

infrastructure (roads, heating system, schools and hospitals)

Other

Marketing Initiatives

Advertisements

- Television,

newspaper, broadcasting, etc

Sales

promotion

- Interest

concessions, preferential offers and non-periodical lucky

draws

Agents

- For large-scale

development of buildings, a professional corporate agent is

engaged

- Improve sales and

enhance brand influence

16

Zhu

Xiaojun, President, CEO and Chairman

- More than 20 years

of experience in the real estate industry in China and a well-known industry

leader

- Rated as one of “Top

100 Management Elites in China’s Building Industry 2005”

Ma

Haizhu, Deputy General Manager

- Solid background in

China’s construction and real estate industry

- Management

experience in state-owned enterprises and government agencies

Shi

Jiachuan, Manager of Marketing

- Significant sales

experience in the real estate development industry

Li

Shumin, Manager of Engineering

- Over 20 years of

engineering work experience and 10 years of management

experience

- Strong technical and

consulting skills

Luo

Shenghui, Manager of Finance

- Over 15 years of

accounting and finance background with 10 years of management

experience

Gordon

Silver, Independent Director

- Strong background in

the financial services industry

- Received his MBA and

Law degree from Harvard University

David

Sherman, Independent Director

- Extensive experience

as a board member and industry expertise in the health care and financial

services sector

- Received his

Doctorate and MBA degree from Harvard Business Schooland is a U.S. Certified

Public Accountant

Yuankai

Wen, Independent Director

- Extensive experience

working in China managing investments

- Received his

Bachelor's degree in Chemistry from Nanjing University

Experienced

Management Team

17

Large-scale

Real

Estate

Development

• Enormous

market

opportunity

opportunity

• Very low

land

acquisition cost

acquisition cost

Strict

Cost Control

• Long term

construction partners

construction partners

• Supervision

system

• Efficient

sales

expenses

expenses

Product

Innovation

• Design

• Project

management

management

• Heating

Services

Pricing

strategy

• High

quality

• Moderate

pricing

• Targeting

middle

income group

income group

China

HGS Goal

To

become the leading

residential property developer

focused on China’s Tier III

cities

residential property developer

focused on China’s Tier III

cities

18

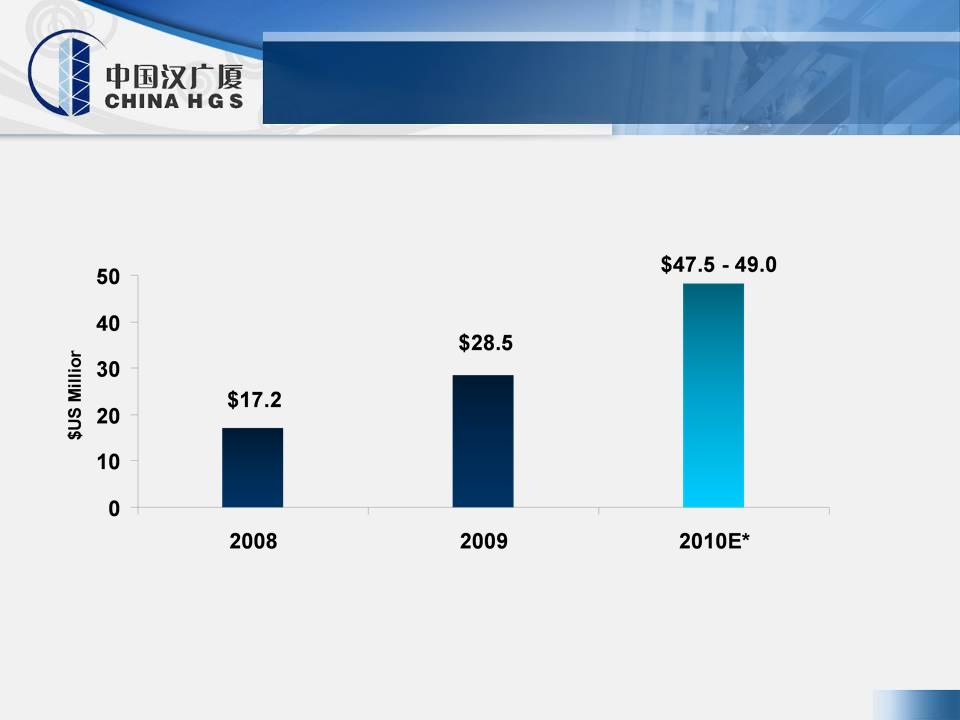

Strong

Revenue Growth

*

Management Estimates

19

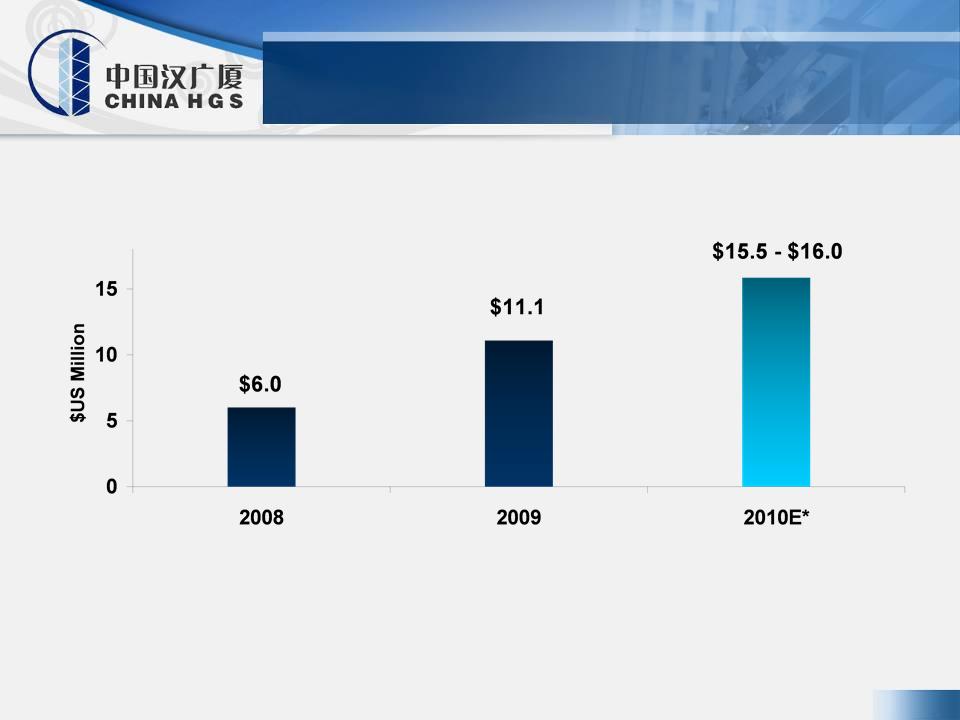

Attractive

Net Income Growth

*

Management Estimates

20

Selected

Income Statement

|

|

Fiscal

Year

Ended September

30

|

|

|

|

2009

|

2008

|

|

Real

estate sales, net of sales taxes

|

28,459,176

|

17,249,539

|

|

Gross

profit

|

13,375,159

|

8,087,591

|

|

Gross

margin

|

47.0%

|

46.9%

|

|

Operating

income (loss)

|

11,402,326

|

6,289,037

|

|

Operating

margin

|

40.1%

|

36.5%

|

|

Net

income (loss)

|

$11,057,550

|

$6,019,731

|

|

Net

margin

|

38.9%

|

34.9%

|

21

Selected

Balance Sheet

|

|

Fiscal

Year

Ended September

30

|

|

|

|

2009

|

2008

|

|

ASSETS

|

|

|

|

Current

assets:

|

|

|

|

Cash & cash equivalents

|

$820,783

|

$2,121,060

|

|

Restricted cash

|

412,373

|

596,258

|

|

Real estate property development completed

|

2,392,003

|

13,657,042

|

|

Real

estate property under development

|

42,522,287

|

22,699,749

|

|

Total

current assets

|

47,981,453

|

39,320,615

|

|

Property,

plant and equipment, net

|

713,008

|

401,635

|

|

Total

Assets

|

$48,694,461

|

$39,722,250

|

|

LIABILITIES

AND SHAREHOLDERS' EQUITY

|

|

|

|

Total

current liabilities

|

18,831,506

|

21,414,759

|

|

Total

shareholders' equity

|

29,862,955

|

18,307,491

|

|

Total

Liabilities and Shareholders' Equity

|

$48,694,461

|

$39,722,250

|

22

|

§ Rapidly

growing real estate market in the tier II and tier III cities in

China

|

|

§ Strong project

pipelines under development and planning with 459,614

GFA

|

|

§ Largest

property developer in Hanzhong (3.8 m population)

|

|

§ Standardized,

scalable model that emphasizes rapid asset turnover, efficient

capital management and strict cost control |

|

§ Experienced

management team

|

|

§ Strong

financial position

|

|

|

Investment

Highlights

23

Company

Contact

China

HGS Real Estate Inc.

Mr. Ran

Xiong, Deputy GM

China

HGS Real Estate Inc.

Tel:

+86-916-2622612

Email:

xr968@163.net

Investor

Relations

CCG

Investor Relations

Crocker

Coulson, President

Tel: +1-646-213-915

Email:

crocker.coulson@ccgir.com

Legal

Counsel

The

Crone Law Group

Independent

Auditor

Friedman

LLP

Contact