Attached files

| file | filename |

|---|---|

| 8-K - THE BODY OF OUR CURRENT REPORT ON FORM 8K - PROASSURANCE CORP | bodyoffiling.htm |

Forward

Looking Statements

This

presentation contains Forward Looking Statements and other information

designed

to convey our projections and expectations regarding future results. There are a number

of factors which could cause our actual results to vary materially from those projected in

this presentation. The principal risk factors that may cause these differences are

described in various documents we file with the Securities and Exchange Commission,

such as our current reports on Form 8-K, and our regular reports on Forms 10-Q and 10-

K, particularly in “Item 1A, Risk Factors.” Please review this presentation in

conjunction with a thorough reading and understanding of these risk factors.

to convey our projections and expectations regarding future results. There are a number

of factors which could cause our actual results to vary materially from those projected in

this presentation. The principal risk factors that may cause these differences are

described in various documents we file with the Securities and Exchange Commission,

such as our current reports on Form 8-K, and our regular reports on Forms 10-Q and 10-

K, particularly in “Item 1A, Risk Factors.” Please review this presentation in

conjunction with a thorough reading and understanding of these risk factors.

This

presentation contains Non-GAAP measures, and we may reference

Non-GAAP measures in our remarks. A reconciliation of these measures to GAAP

measures is available in our latest quarterly news release, which is available in the

Investor Relations section of our website, www.ProAssurance.com, and in

the related Current Reports on Form 8K disclosing that release.

Non-GAAP measures in our remarks. A reconciliation of these measures to GAAP

measures is available in our latest quarterly news release, which is available in the

Investor Relations section of our website, www.ProAssurance.com, and in

the related Current Reports on Form 8K disclosing that release.

1

Non-GAAP

Measures

ProAssurance:

Quick Facts

2

1 9/30/2009

Statutory Filings

2009

Highlights

Three

M&A transactions completed

Provides

potential premium growth of

approximately $100 million on an annualized basis

approximately $100 million on an annualized basis

GROWING the top

line

Existing

markets grew modestly through Q3 2009

Maintaining

our profitability

Outstanding

performance in a challenging

financial market and a demanding line of

insurance

financial market and a demanding line of

insurance

3

Outstanding

Performance: Stock Price

|

Share

Price Growth

|

||

|

|

Cumulative

|

CAGR

|

|

10

year

|

149%

|

10%

|

|

5

year

|

35%

|

7%

|

|

1

year

|

2%

|

2%

|

|

Measured

through Year-End 2009

|

||

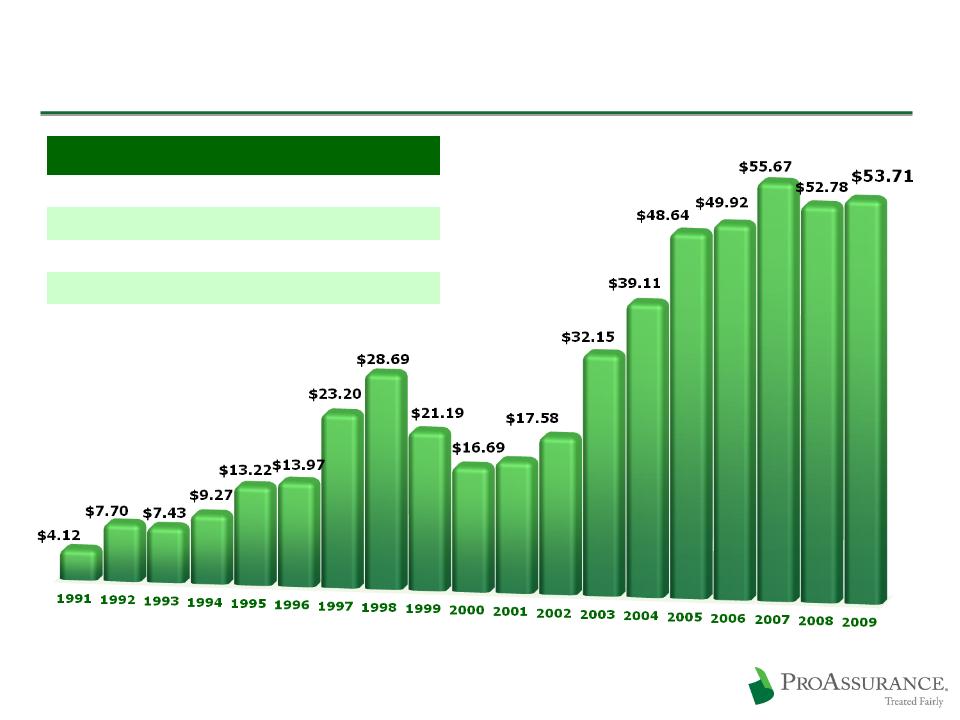

4

Share

Price at Year End Since Inception

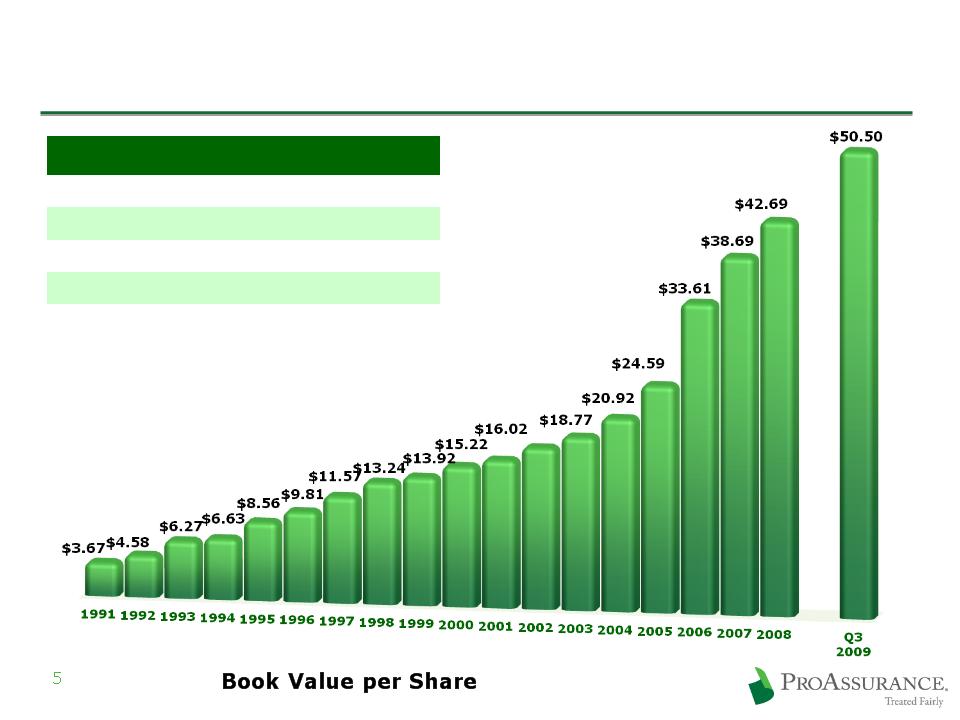

Outstanding

Performance: Book Value

|

Book

Value Growth

|

||

|

|

Cumulative

|

CAGR

|

|

10

year

|

222%

|

12%

|

|

5

year

|

127%

|

18%

|

|

1

year

|

10%

|

10%

|

|

Measured

through Q3 2009

|

||

Outstanding

Performance vs Industry

Moody’s

rankings of the top 100 P&C

insurance companies by premium volume

insurance companies by premium volume

6

1 by Direct Written

Premium Source:

2008 Data from Moody’s

Statistical Handbook

October

2009

2009

|

Category

|

Ranking

|

|

Direct

Written Premiums

|

95

|

|

Operating

Ratio

|

1

|

|

Combined

Ratio

|

2

|

|

Loss

Ratio

|

5

|

|

ROE

|

5

|

Recent

Business Highlights

Third

straight year as one of the

50 top performing property casualty

insurance companies

50 top performing property casualty

insurance companies

Top 3% of

all P&C companies

Upgrade to

“A” (Excellent)

by A. M. Best

by A. M. Best

Positive

outlook

assigned by S & P

assigned by S & P

7

2009:

Consolidation of:

Mid-Continent General Agency

Mid-Continent General Agency

2009:

Consolidation of:

Mid-Continent General Agency

Mid-Continent General Agency

Georgia

Lawyers Insurance Co.

Georgia

Lawyers Insurance Co.

2004: Purchased

Selected Renewal Rights from:

OHIC Insurance Company

OHIC Insurance Company

2004: Purchased

Selected Renewal Rights from:

OHIC Insurance Company

OHIC Insurance Company

Success

Through M&A

We’ve

built a leading platform through M&A

8

1994: Consolidation

of:

West Virginia Hosp. Ins Co.

West Virginia Hosp. Ins Co.

1994: Consolidation

of:

West Virginia Hosp. Ins Co.

West Virginia Hosp. Ins Co.

1995: Consolidation

of;

1995: Consolidation

of;

Physicians

Ins Co of Indiana

Physicians

Ins Co of Indiana

Assumed

business of:

Physicians Ins Co of Ohio

Physicians Ins Co of Ohio

Assumed

business of:

Physicians Ins Co of Ohio

Physicians Ins Co of Ohio

1996:

Consolidation

of:

1996:

Consolidation

of:

Missouri

Medical Ins Co

Missouri

Medical Ins Co

1995: Assumed

business of:

Associated Physicians Ins Co. (IL)

Associated Physicians Ins Co. (IL)

1995: Assumed

business of:

Associated Physicians Ins Co. (IL)

Associated Physicians Ins Co. (IL)

1998: Consolidation

of:

Physicians Protective Trust Fund (FL)

Physicians Protective Trust Fund (FL)

1998: Consolidation

of:

Physicians Protective Trust Fund (FL)

Physicians Protective Trust Fund (FL)

1996: Assumed

business of:

American Medical Ins Exchange (IN)

American Medical Ins Exchange (IN)

1996: Assumed

business of:

American Medical Ins Exchange (IN)

American Medical Ins Exchange (IN)

Founding

in the

1970’s

Founding

in the

1970’s

1999: Assumed

business of:

Medical Defense Associates (MO)

Medical Defense Associates (MO)

1999: Assumed

business of:

Medical Defense Associates (MO)

Medical Defense Associates (MO)

Mutual

Assurance

Physicians

Ins. Co. of

Michigan

Professionals

Group

Creation

of:

Creation

of:

2005: Consolidation

of:

NCRIC Group

NCRIC Group

2005: Consolidation

of:

NCRIC Group

NCRIC Group

2006:

Consolidation of:

PIC Wisconsin Group

PIC Wisconsin Group

2006:

Consolidation of:

PIC Wisconsin Group

PIC Wisconsin Group

2007: PRI

renewal rights deal

2002: SERTA

renewal rights deal

2001: OUM

renewal rights deal

2000: DPM

Merger

1999: PACO

Acquisition

2009

M

& A

Transactions

9

2008

Premium: $98 million

Significant growth

in our core business

Nationwide

geographical expansion

2008

Healthcare Premium: $20 million

Extends our core

business

Broadens our medically-related range

Geographical expansion

Broadens our medically-related range

Geographical expansion

2008

Premium: $5.7 million

Adds

to our lawyers’ book

Geographical

expansion

Affirms our

interest in this line

Responding

to Changes in HealthCare

Projected

sector growth through 20181

Podiatrists 9%

Physician’s

Assistants 39%

Physicians

and Surgeons 22%

Chiropractors 31%

Medical

Assistants 36%

Licensed

Nurses 34%

1Bureau of Labor

Statistics 2008 to 2018 Projections

Our

Focus in 2010

Maintain

Profitability

Ensure

pricing discipline

Rates

based on loss data across multiple years

Not unduly

influenced by current market

conditions

conditions

Using

credits allows us to maintain existing

rate filings

rate filings

Rates on

renewing physician business down

less than 12% from peak pricing in 2006

less than 12% from peak pricing in 2006

12

Spread

Risk

Broad

geographic diversification provides an

unmatched spread of risk

unmatched spread of risk

13

Our spread

of risk provides

better market awareness and

more data points to gauge

loss trends

better market awareness and

more data points to gauge

loss trends

Our

internal

actuarial

depth

allows us to assess emerging

trends and respond quickly

allows us to assess emerging

trends and respond quickly

Corporate

Headquarters

Corporate

Headquarters

Claims

Offices

Claims

Offices

Claims

/ Underwriting Offices

Claims

/ Underwriting Offices

PICA

and/or E&S States

PICA

and/or E&S States

(Birmingham)

Claims

Trends Drive the Business

Frequency

Stabilized in

2009

After

Three Years of Decline

Our

operational plans leverage our financial strength,

spread of risk and expertise to address potential changes

spread of risk and expertise to address potential changes

Severity

Rising at 4%-5%

per Year

An Expected, Manageable Level

An Expected, Manageable Level

Driven

by:

Unexpected

outcomes

Patient

frustration

Influenced

by:

Tort

reform

Driven

by:

Medical

Costs

Jury

Awards

Tort

Reform

Damage

Caps

Differentiate

In Claims Management

Claims

management has always set us apart

We combine

financial strength with deep expertise

Give our

insureds the option of an uncompromising

defense of their claim

defense of their claim

Allows us

to defend our insureds at trial more often

than any other company in our line

than any other company in our line

Provides

long-term financial and marketing

advantages

advantages

A key

differentiating factor in the market

as claims data becomes public

as claims data becomes public

15

Keep

an Eye on Washington

Health

care reform is in limbo

We expect

no major changes in the tort system

Demonstration

projects do not provide meaningful

reform or immediate data

reform or immediate data

Signals a

desire to leave the tort system in

the hands of each state

the hands of each state

16

Prepare

for State Changes

Tort

reforms under attack in many states

We are

prepared, operationally and financially,

if reforms are struck down in our states

if reforms are struck down in our states

We set

prices and reserves as if there is no tort

reform, until results reflect otherwise

reform, until results reflect otherwise

17

Financial

Highlights

2009

YTD Income Statement Highlights

19

in

millions, except per share data

Gross

Premiums Written $ 435

$ 374 $ 472

Net

Investment Income 113 122 158

Total

Revenue

489 431 567

Total

Expenses

295 294 470

Operating

Income $ 136 $ 127 207

Net

Income (Includes Investment Losses) $ 137 $ 101 178

Operating

Income/Diluted Share $ 4.08 $ 3.73 $ 6.07

September

30,

Year-End

2009 2008

2008

Premium is growing

with new business from

PICA, Mid-Continent and Georgia Lawyers

PICA, Mid-Continent and Georgia Lawyers

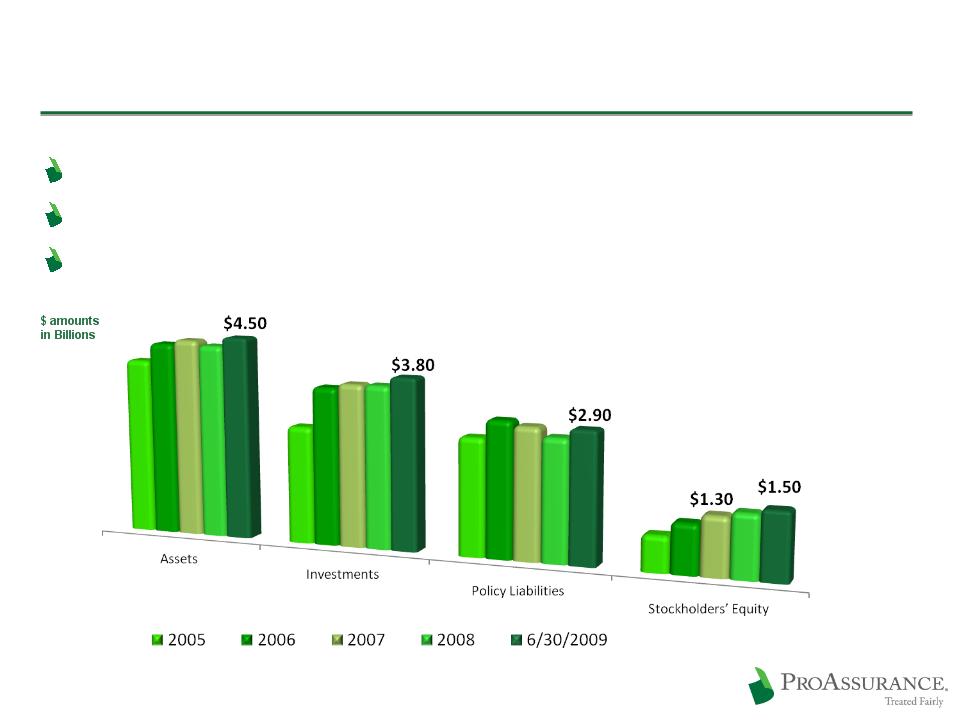

Strategy:

Enduring Financial Strength

20

Emphasizing

an appropriate balance of risk vs. return

Committed

to enduring balance sheet strength

Responding

to the low interest rate environment

Stockholder’s

Equity Up

Over 16% Since 12/31/07

Over 16% Since 12/31/07

Strategy:

Use Capital Prudently

Using

capital to build through M&A

Preserving

capital for future opportunities

Enhancing

shareholder value by repurchasing shares

at prices that build Book Value

at prices that build Book Value

21

Source: SNL

Financial

Our

Strong Capital/Low Leverage Position

22

(in

millions)

Prepared

for an

improving market

improving market

Prudent

capital

management

management

Premiums to

Surplus

for Each year

for Each year

$567

$

96 (PICA

pro

forma)

$471

Excess

Capital vs. Excess Capacity

23

Conceptual

Model of Projected

A. M. Best BCAR Scores if

A. M. Best BCAR Scores if

Premiums

Increase

Surplus

is Reduced

Strategy:

Balance Risk vs. Return

Key

Investment Actions in Q3 09

Reduced

cash and short-term

balances

balances

Added to

corporate bonds

CUSIP-level

portfolio disclosure

on our website:

www.proassurance.com/investorrelations/supplemental.aspx

on our website:

www.proassurance.com/investorrelations/supplemental.aspx

$3.9

Billion

Portfolio

Portfolio

$3.9

Billion

Portfolio

Portfolio

Fixed

Income: 91%

Short

Term: 4%

Short

Term: 4%

Equity

and Other Investments: 3%

Equity

and Other Investments: 3%

BOLI:

2%

BOLI:

2%

24

9/30/09

25

Little

Dependence on Debt

Low Debt

to Cap Ratio

Little

strain on cash flow

9/30/2009

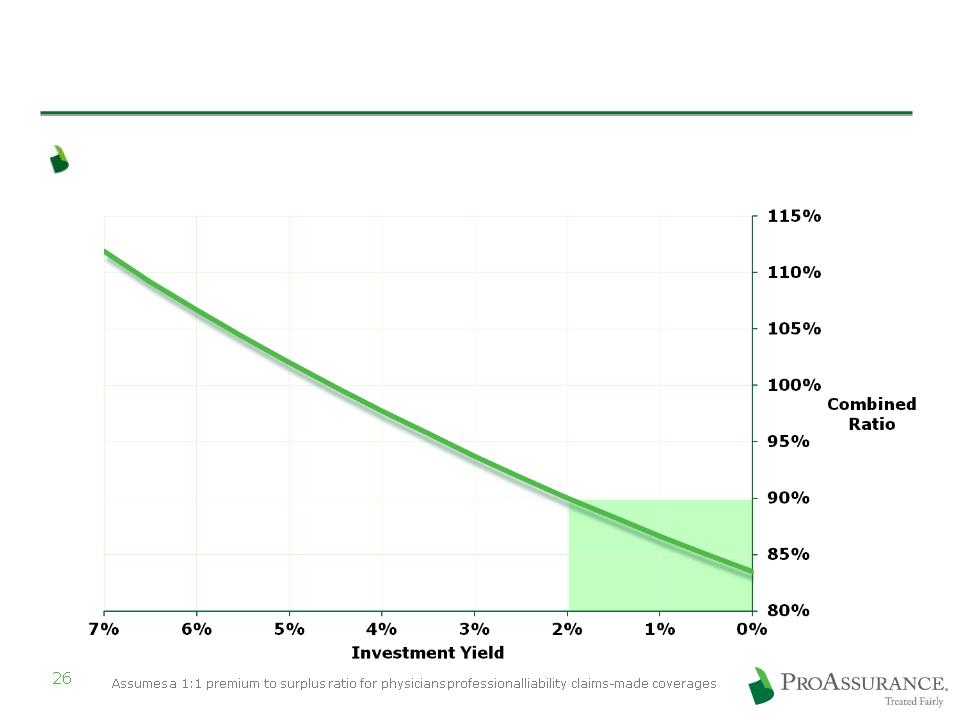

The

Importance of Investment Income

Pricing

discipline is even more critical

Combined

Ratio

required to generate

a 13% after-tax ROE

required to generate

a 13% after-tax ROE

The

Importance of Investment Income

Year

1

1

Year

2

2

Year

3

3

Year

4

4

Year

5

5

Year

6

6

Year

7

7

Year

8

8

Incident

Occurs

Occurs

Discovery

and

Preparation

and

Preparation

Claim

Reported

Reported

Trial

and

Appeals

Appeals

Resolution

5-6

Years

After

Claim

Reported

After

Claim

Reported

Life

Cycle of a Typical Claim

The

Importance of Investment Income

Typical

Claims Payout Pattern

Fixed

Income: $3.6 Billion

29

9/30/09

Summary

ProAssurance

Producing

sustainable shareholder value

Growing

Book Value per Share

Finding

the right M & A opportunities

Significant

share ownership at all levels

Focusing

on long-term

Preparing

for a changing market

Leveraging

financial strength

Protecting

the balance sheet

Maintain

our leading market position

Building

strength for the next cycle turn

31

Appendix:

Market Conditions

The

State of the Market

Prices

have been falling yet profitability remains high

Continued

low interest rates must enforce discipline

sooner or later

sooner or later

Frequency

is no longer declining

Only a

matter of time before frequency moves higher

But

when?

Severity

is trending upward at expected, manageable

rates (4%-5%) in most states

rates (4%-5%) in most states

The

State of the Market

34

Appendix:

Claims

Claims

Trends Remain Favorable

Frequency

trends are

stable after declining

since 2005/2006

stable after declining

since 2005/2006

The result

is fewer

cases to try

cases to try

Severity

trends also

stable

stable

Trends are

much the

same in states with or

without Tort Reform

same in states with or

without Tort Reform

36

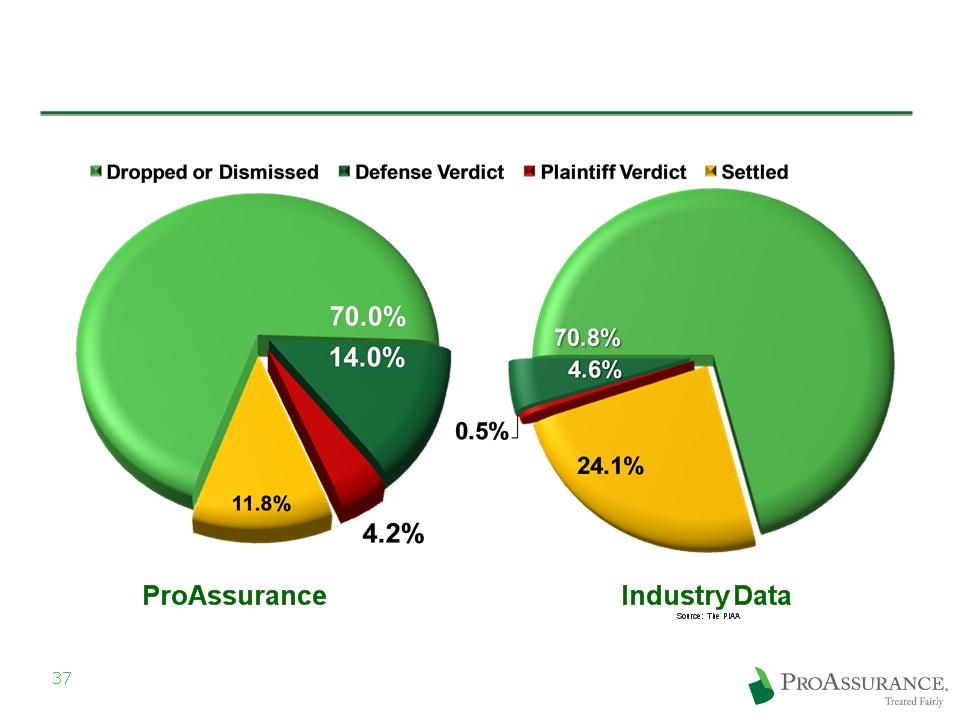

ProAssurance

Claims Tried

to a Verdict

to a Verdict

Why

Claims Strategy Matters

Favorable

Outcomes:

84.0%

Outcomes:

84.0%

Favorable

Outcomes:

84.0%

Outcomes:

84.0%

Five

Year Average

2004 - 2008

2004 - 2008

Favorable

Outcomes:

75.4%

Outcomes:

75.4%

Favorable

Outcomes:

75.4%

Outcomes:

75.4%

Why

Claims Strategy Matters

Our

ability and willingness to defend claims

allows us to achieve better results

allows us to achieve better results

ProAssurance

vs. Industry

Average Statutory Loss Ratio

Average Statutory Loss Ratio

2003-2008

Legal

Payments

Payments

Loss

Payments

Payments

Trend

for ProAssurance

Stand Alone Statutory Loss Ratio

Stand Alone Statutory Loss Ratio

2006

- 2008

76.0%

*Source: A. M. Best

Aggregates & Averages, Medical Malpractice Predominating

64.3%

80.8%

76.9%

44.2%

Appendix:

Underwriting/Actuarial

Enforce

Actuarial Conservatism

|

$

2.4

|

|

|

$

2.6

|

|

|

$

2.6

|

|

|

$

2.2

|

|

|

$

1.8

|

|

Rate

Change History

41

Appendix:

Moody’s Rankings

Moody’s

Top 100 Ranking Data

Appendix:

Investments

Equities

& Other: $136 Million

45

9/30/09

Represents

3.5% of our Total Investments

Return

by Quarter: Equities & Other

46

Growth

in Investment vs. Reserves

47

Cumulative

Return: Equities & Other

48

Strategy:

Investment Discipline

The

choice: Chase yield or extend duration

We are

maintaining duration, looking for opportunities

49

Loss

in value assuming a 100 basis point shift in the yield curve

Yields based on

Single A composite corporate debt

Municipals:

$1.5 Billion

50

9/30/09

Investment

policy has always

required

investment grade rating prior to applying the

effect of insurance

investment grade rating prior to applying the

effect of insurance

Asset

Backed: $805 Million

Weighted

average rating: “AAA”

Bloomberg

Data

9/30/09

9/30/09

Alt-A

LTV 63%

LTV 63%

Prime

MBS

LTV 56%

LTV 56%

Further Details

Provided

on Sub-Prime and CMBS

on following pages

on Sub-Prime and CMBS

on following pages

51

Sub-Prime

Detail

52

$6.7

million market value in AFS portfolio

$4.2

million unrealized loss

$9.6

million market value in

high-yield LP rated B

high-yield LP rated B

LP’s focus

is distressed ABS

|

At

9/30/09

|

Vintage

|

|

$4.8

Mln

|

2004 &

Prior

|

|

$1.9

Mln

|

2005

|

Quality &

Vintage information only on direct holdings at 9/30/09

|

At

9/30/09

|

Type

|

Quality

|

|

$2.9

Mln

|

Mortgage-Backed

|

AA avg -

LTV 68%

|

|

$3.8

Mln

|

Home

Equity

|

A+

avg

|

CMBS

Detail

Vintages

2005 &

Prior- $136 million

2006- $23

million

2007- $3

million

Top

Property Types

Retail-Anchored:

45% of CMBS portfolio

Exposure:

19% - 44% of underlying occupancies

Office:

44% of CMBS portfolio

Exposure:

23% - 49% of

underlying occupancies

Multi

Family: 4% of CMBS portfolio

Mixed Use:

3% of CMBS portfolio

Other: 4%

of CMBS Portfolio

53

CMBS

Detail

$162

million Fair Value in non-agency CMBS

Book

Value: $164 million

5% of

fixed income portfolio

54

|

At

9/30/09

|

Quality

|

|

$160

Mln

|

AAA

|

|

$ 2.0

Mln |

AA

|

|

At

9/30/09

|

Wtd

Avg LTV

|

|

24%

|

<65%

|

|

43%

|

=65-70%

|

|

21%

|

<70-75%

|

|

12%

|

=75-85%

|

|

At

9/30/09

|

Credit

Support

|

|

26%

|

>30%

|

|

52%

|

20% -

30%

|

|

20%

|

10% -

20%

|

|

2%

|

Less than

10%

|

|

At

9/30/09

|

Deal

Cumulative Delinquencies

|

|

27%

|

0.0% - 0.5%

|

|

3%

|

0.5%

- 1.0%

|

|

32%

|

1.0% - 2.0%

|

|

4%

|

2.0% - 3.0%

|

|

22%

|

3.0% - 5.0%

|

|

12%

|

5.0% - 9.0%

|

|

At 9/30/09

|

Debt

Service Coverage

|

|

69%

|

=>1.5x

|

|

25%

|

1.4x-1.5x

|

|

6%

|

1.3x-1.4x

|

AT

9/30/09

9/30/09

CMBS

Since September 30, 2009

Since

9/30/09:

Sold $50.0

million CMBS

Paydowns

of $8.0 million

As of

November 30, 2009 CMBS:

Market

value: $108

million

Book

value: $110

million

Expecting

pay down of $19 million

by year-end 2009

by year-end 2009

Projecting

~$90 million exposure at year-end

55

Corporates:

$1.0 Billion

56

9/30/09

Corporate:

Detail on Financials

Top 20

Largest Banks/Financials: $ 294 million

$75 mm

FDIC backing

|

BA $44

($23)

|

BNY Mellon

$10

|

|

MS $27

($6)

|

Credit

Suisse $9

|

|

BP Cap

$25

|

Eurohypo

$8

|

|

GECC $25

($8)

|

KEY $6

($6)

|

|

JPM $24

($14)

|

NRUC

$6

|

|

CITI $20

($7)

|

Deutsche

Bank $5

|

|

Wells

$20

|

FMCC

$5

|

|

GS $16

($2)

|

NY Commt’y

Bank $5 ($5)

|

|

PNC $15

($2)

|

Depfa ACS

Covered $5

|

|

Amex

$14

|

John Deere

Cap $5 ($2)

|

|

FDIC backed

amounts listed in parentheses

|

|

57

9/30/2009

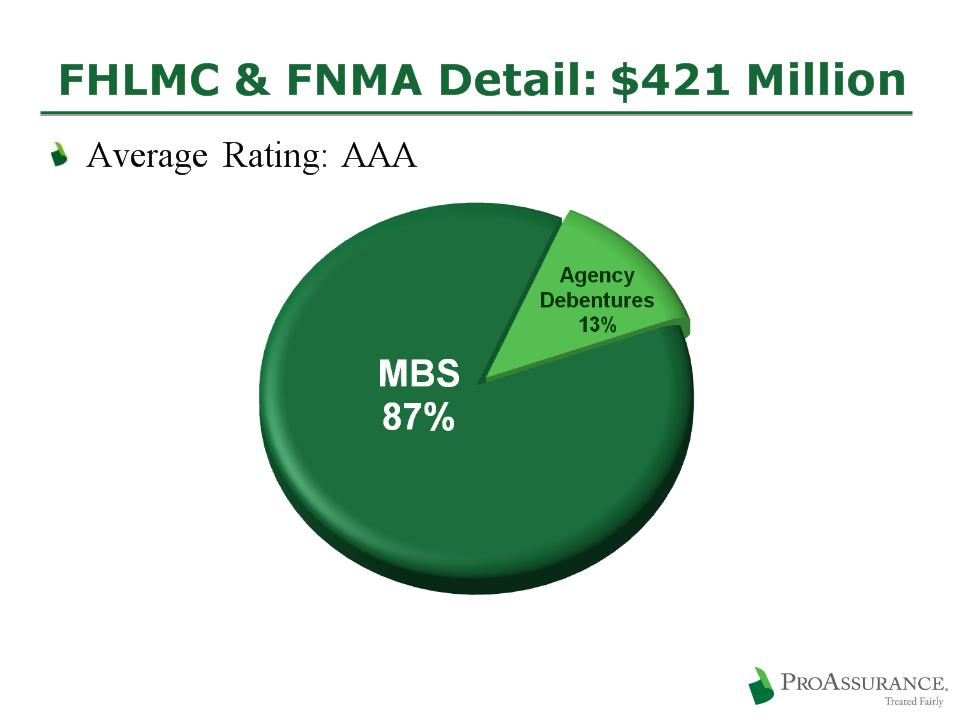

Treasury/GSE:

$228 Million

9/30/09

59

9/30/09

Portfolio

Overview: Short Term

$138

Million

Rated

A1/P1 or better

Money

Markets:

Moody’s:

Aaa

S&P:

AAA

60

BOLI:

$65 Million

Weighted

average rating

Moody’s:

AA3

S&P:

AA

A. M.

Best: A+

61