Attached files

| file | filename |

|---|---|

| 8-K - SELECT COMFORT 8-K 1-13-2010 - Sleep Number Corp | form8k.htm |

Exhibit 99.1

Select

Comfort

12th Annual ICR

XChange

January 13, 2010

2

Forward

Looking Statements

Statements used in

this presentation that relate to future plans, events, financial results or

performance are

forward-looking statements that are subject to certain risks and uncertainties including, among others, such

factors as general and industry economic trends; uncertainties arising from global events; consumer

confidence; effectiveness of our advertising and promotional efforts; our ability to fund our operations through

cash flow from operations or availability under our bank line of credit or other sources, and the cost of credit or

other capital resources necessary to finance operations; the risk of non-compliance with financial covenants

under our bank line of credit, and the potential need to obtain additional capital through the issuance of debt

or equity securities; our ability to attract and retain qualified sales professionals and other key employees;

consumer acceptance of our products, product quality, innovation and brand image; our ability to continue to

expand and improve our product line; industry competition; warranty expenses; risks of pending or potential

litigation; our dependence on significant suppliers, and the vulnerability of any suppliers to commodity

shortages, inflationary pressures, labor negotiations, liquidity concerns or other factors; rising commodity

costs; the capability of our information systems to meet our business requirements and our ability to upgrade

our systems on a cost-effective basis without disruptions to our business; and increasing government

regulations, including new flammability standards for the bedding industry, which have added product cost

pressures and have required implementation of systems and manufacturing process changes to ensure

compliance. Additional information concerning these and other risks and uncertainties is contained in our

filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, and other

periodic reports filed with the SEC. The company has no obligation to publicly update or revise any of the

forward-looking statements that may be in today’s presentation.

forward-looking statements that are subject to certain risks and uncertainties including, among others, such

factors as general and industry economic trends; uncertainties arising from global events; consumer

confidence; effectiveness of our advertising and promotional efforts; our ability to fund our operations through

cash flow from operations or availability under our bank line of credit or other sources, and the cost of credit or

other capital resources necessary to finance operations; the risk of non-compliance with financial covenants

under our bank line of credit, and the potential need to obtain additional capital through the issuance of debt

or equity securities; our ability to attract and retain qualified sales professionals and other key employees;

consumer acceptance of our products, product quality, innovation and brand image; our ability to continue to

expand and improve our product line; industry competition; warranty expenses; risks of pending or potential

litigation; our dependence on significant suppliers, and the vulnerability of any suppliers to commodity

shortages, inflationary pressures, labor negotiations, liquidity concerns or other factors; rising commodity

costs; the capability of our information systems to meet our business requirements and our ability to upgrade

our systems on a cost-effective basis without disruptions to our business; and increasing government

regulations, including new flammability standards for the bedding industry, which have added product cost

pressures and have required implementation of systems and manufacturing process changes to ensure

compliance. Additional information concerning these and other risks and uncertainties is contained in our

filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, and other

periodic reports filed with the SEC. The company has no obligation to publicly update or revise any of the

forward-looking statements that may be in today’s presentation.

3

Second largest

U.S. mattress retailer and specialty bedding

company, with clear competitive advantages.

company, with clear competitive advantages.

5% market share

(revenue) with 10%-15% share in lead markets

Restructuring of

business substantially complete - significant

improvement in cash flow and profitability achieved and projected

improvement in cash flow and profitability achieved and projected

Ø Restored positive

cash flow

Ø Debt free compared

to $79 million outstanding just 12 months ago

Ø Growth in gross

margin through efficiencies, in-store “trade up”

Ø Returned to

positive same store growth in Q3 2009 (9%)

Highly

leverageable profit model that has produced strong cash flow

Ø Excellent gross

margins

Ø Minimal

inventory

Ø Self-fund growth,

negative working capital

Leader in

personalized comfort air segment and positioned for

market share gains and operating margin improvement

market share gains and operating margin improvement

Ø 2010 emphasis

shifts back to growth

Ø Economic recovery

at some point important opportunity

Investment

Highlights

4

– Ability to

customize to sleep partners’

individual sleep numbers

individual sleep numbers

– Dynamic system can

be adjusted for life

changes (pregnancy, weight change, etc.)

changes (pregnancy, weight change, etc.)

Proven

benefits

– 20+ years proven

technology

– Third-party

studies show improved sleep

quality and reduced back pain

quality and reduced back pain

– 9 out of 10

couples prefer different

firmness settings

firmness settings

Innerspring

Mattress

Sleep

Number Bed

Differentiated

Product that Satisfies Consumer Needs

Sleep

Number Bed Series & Models

Classic

Series

c2

$999

c3

$1,249

c4

$1,499

Performance

Series

p5

$1,999

p6

$2,499

p7

$2,599

Innovation

Series

i8

$2,999

i9

$3,999

i10

$4,299

Clinically

proven product, affordable for a broad range of consumers

Durable and

competitive value

– Queen-sized sets

list from $999

to $4,299

to $4,299

– 20-year limited

warranty

– Promotional

activity features

$699 mattress-only value

$699 mattress-only value

5

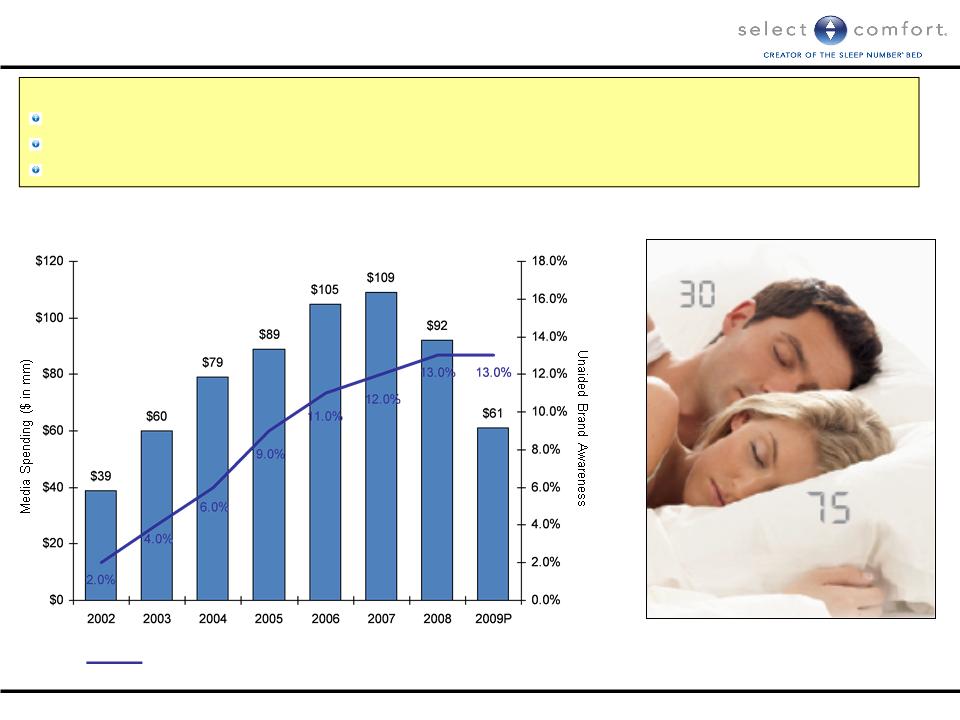

Strong

“Sleep Number” Brand Equity…Young Brand With

Opportunity to Grow

Opportunity to Grow

Sleep

Number Brand Awareness

Marketing

has historically driven awareness and consideration of new

technology

Sleep

Number →

individualized comfort

Couples

no longer need to compromise

Multi-channel

call to action: 800#,

web, retail stores

6

Customer contact

at

sale, delivery, and

service

sale, delivery, and

service

Advantaged

Business Model

Design

Selling

Referral

Cash-Advantaged

Full control of

the

customer experience

customer experience

Immediate input

into

quality and product

design

quality and product

design

Air segment

experience

and share, along with

vertical integration, are

significant barriers to

entry

and share, along with

vertical integration, are

significant barriers to

entry

Minimal

inventory

requirements

requirements

Negative

working

capital model

capital model

New store payback

<

2 years

2 years

Significant

leverage

potential

potential

Cash

and profit leverage, provides direct customer feedback

7

YoY

Growth

7%

5%

(2%)

16%

6%

7%

9%

8%

2%

0%

3%

8%

8%

9%

5%

5%

8%

11%

9%

5%

0%

4%

8%

12%

12%

5%

1%

(9%)

(13%)

7%

10%

Consistent

Industry Growth until 2008

Source:

ISPA reports

Recession

The

mattress industry has shown consistent long-term revenue growth,

particularly during post-recessionary periods

particularly during post-recessionary periods

Recession

Recession

Recession

8

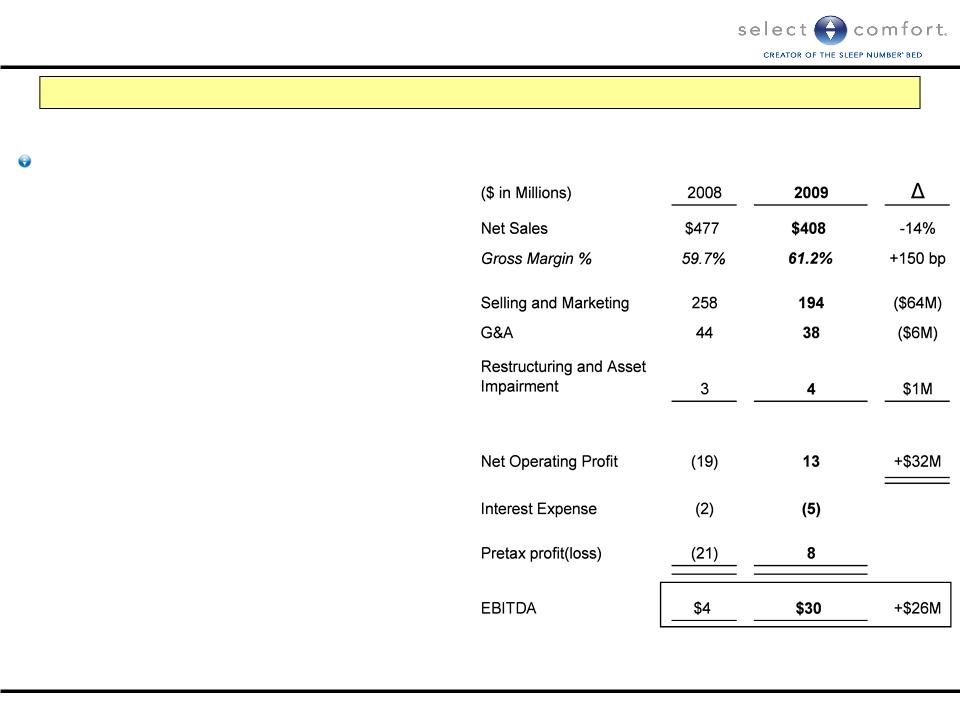

Cost

Restructuring Substantially Complete Following Period of

Industry Contraction…Positioned for Margin Expansion

Industry Contraction…Positioned for Margin Expansion

$130 million of

aggregate annualized

cost reductions realized from

initiatives executed in 2008 and 2009

cost reductions realized from

initiatives executed in 2008 and 2009

– Manufacturing:

4 Product redesign

($10M*)

4 Shift/staffing

reductions ($6M*)

4 Closure of a

warehouse and 3

hubs ($3M)

hubs ($3M)

– Selling and

Marketing:

4 Store closures: 25

in 2008, 70 in

2009 ($26M), 408 total stores in

2009

2009 ($26M), 408 total stores in

2009

4 Media reduced:

$18M in 2008,

$30M in 2009

$30M in 2009

4 Other fixed and

discretionary

>$20M

>$20M

– General and

Administrative:

4 Headcount

reduction: 16% in

2008, 22% in 2009 ($17M)

2008, 22% in 2009 ($17M)

Summary

P&L (Q3 YTD)

$30 million profit improvement on 14% revenue

decline, breakeven lowered 30%

*Based on 2009

sales levels

9

Solid

Balance Sheet

to Support Operations and Future Growth

Summary

Balance Sheet

*Includes net

proceeds from Sterling Partners investment and net proceeds from a $20 million

equity raise

Cost

Structure aligned with no significant

need to add costs with growth

need to add costs with growth

— Leverage stores

as showrooms.

Stores

draw from larger trade area,

sales/store

increases with reduced

store

count

— More efficient

media to drive sales and

leverage

bottom line

Cash

needs limited

— New store -

$300,000/store, <24 month

payback

— Negative working

capital model generates

cash in

growth environment

*Store profit

excluding depreciation, national media and

field

support

Business

Model Supports Strong Margin and Cash Expansion

on Modest Sales Growth

on Modest Sales Growth

11

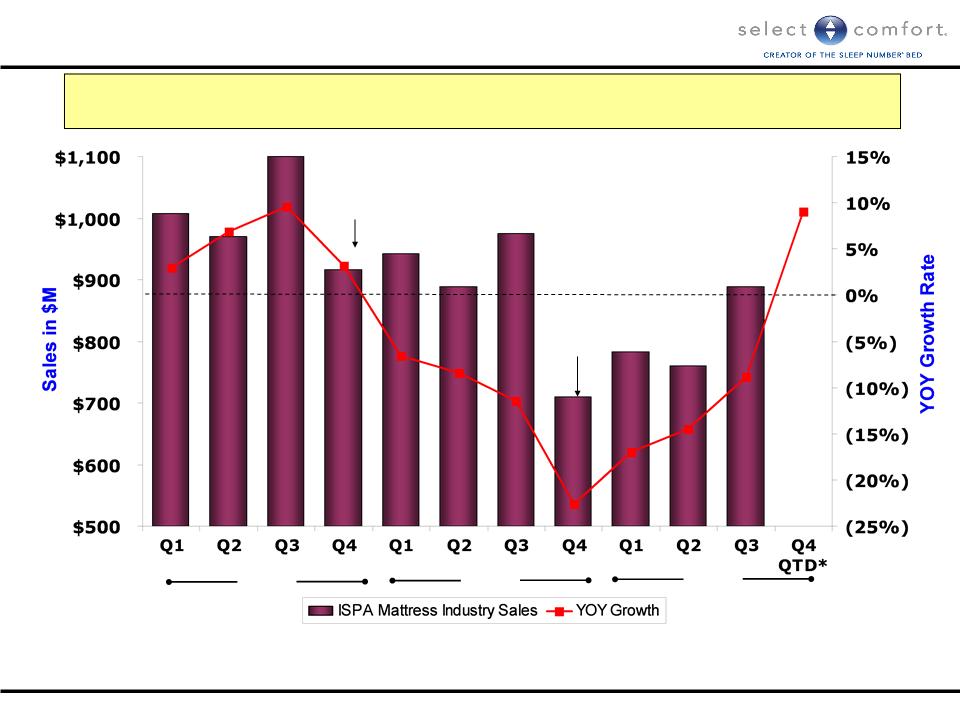

Macro

Headwinds Led to Lower Mattress Demand - Recent

Months Indicate Return to Industry Growth

Months Indicate Return to Industry Growth

Source: ISPA

sales trends based on reporting company results (approximately 56% of U.S.

mattress industry sales)

*Through November

2009

Housing

Decline

Banking

Crisis

2007

Mattress

industry started declining in Q4 2007 - rate of decline has

improved

in each sequential quarter of 2009

2009

2008

12

(1)

Adjusted for deferred tax impairments in 2001 and 2002. Tax rate of 38%

used in 2001 and 2002.

used in 2001 and 2002.

(1)

(1)

Net

Sales

($ in mm)

($ in mm)

|

Operating

Profit % |

(1%)

|

6.3%

|

9.3%

|

8.9%

|

9.9%

|

9.0%

|

From

2002 to 2006, Select Comfort achieved significant organic growth

and

earnings leverage

*EBITDA

- CapEx

Earnings Per

Share/Free Cash Flow*

Select

Comfort Delivered Profitable Growth Coming Out of The

Last Recession

Last Recession

13

Product

and Marketing Strategies Refined to Manage Economic

Downturn and Take Advantage of Economic Recovery and Restore Growth

Downturn and Take Advantage of Economic Recovery and Restore Growth

Value

messaging

– Entry level queen

sets below $1,000

– Promotion

structure with entry level draw plus incentive to trade-up

– Renamed product

line positioned around key price points

Back to

Basics

– Focused on Sleep

Number unique personal and dual comfort benefit

– 80% baseline,

every day message (Product Benefits)

– 20% create urgency

during key shopping periods (Value Message)

Product

– Introduced memory

foam with Sleep Number

– Pillowology and

other accessories to drive traffic (accessories 10% of sales and

growing)

growing)

Selling

– Quality experience

and increased conversion of traffic

14

Increase operating

margin while assuming continued macro

challenges - opportunity to accelerate as recovery materializes

challenges - opportunity to accelerate as recovery materializes

– Zero

infrastructure growth, savings from annualization of cost takeouts

– Same store growth

offset by annualization of 2009 store closures (68), 2010

planned closures (20-25) and Q3 2009 exit of retail partner locations

planned closures (20-25) and Q3 2009 exit of retail partner locations

– Elimination of

one-time consulting and financing costs ($6M) and interest expense

Advance core

advantages, prepare to accelerate growth

– Continue value and

media refinement and testing

– Product,

personalization and customer experience

– Integrated sales

process, digital strategy

– Market development

program; profit maximization and sales growth

Debt free with

positive cash balance for flexibility and future

expansion

expansion

2010

Initiatives

Improve

Profitability, Position for Growth and Economic

Recovery

15

Diverse,

Experienced Management Team - Demonstrated

Turnaround and Growth Track Record

Turnaround and Growth Track Record

|

Name

|

Position

|

Previous

Experience

|

#

of Years with

Select Comfort |

|

Bill

McLaughlin

|

President

& CEO

|

PepsiCo/Frito

Lay,

Pillsbury

|

9

|

|

Jim

Raabe

|

CFO

|

ValueRx,

KPMG

|

12

|

|

Shelly

Ibach

|

Sales

|

Macy’s/Marshall

Fields

|

2

|

|

Tim

Werner

|

Marketing

|

L. L.

Bean

|

13

|

|

Kathy

Roedel

|

Global

Operations

|

General

Electric

|

4

|

|

Wendy

Schoppert

|

IT

|

US

Bancorp,

America West

Airlines

|

4

|

|

Karen

Richard

|

Human

Resources

|

TCF

Mortgage

|

13

|

|

Mark

Kimball

|

Legal &

Tax

|

Oppenheimer

Wolff &

Donnelly |

10

|

16

Proven success with

key strategic assets

– Unique

product

– Strong

brand

– Advantaged business

model

– Growing

industry

Unique time and

opportunity for the company

– Restructured to

essential core

– Raised

capital

– Now able to build on

2009 success and refocus on accelerating profit

growth

growth

– Positioned to take

advantage of recovery when it comes

Summary

Positioned

to Perform in New Economy

Q4

Release February 10, 2010

17