Attached files

| file | filename |

|---|---|

| 8-K - REHABCARE 3Q09 IR PRESENTATION - REHABCARE GROUP INC | eightk3q09presentation.htm |

Investor

Presentation

JP

Morgan Conference

January 13, 2010

January 13, 2010

Exhibit

99

Company

Overview

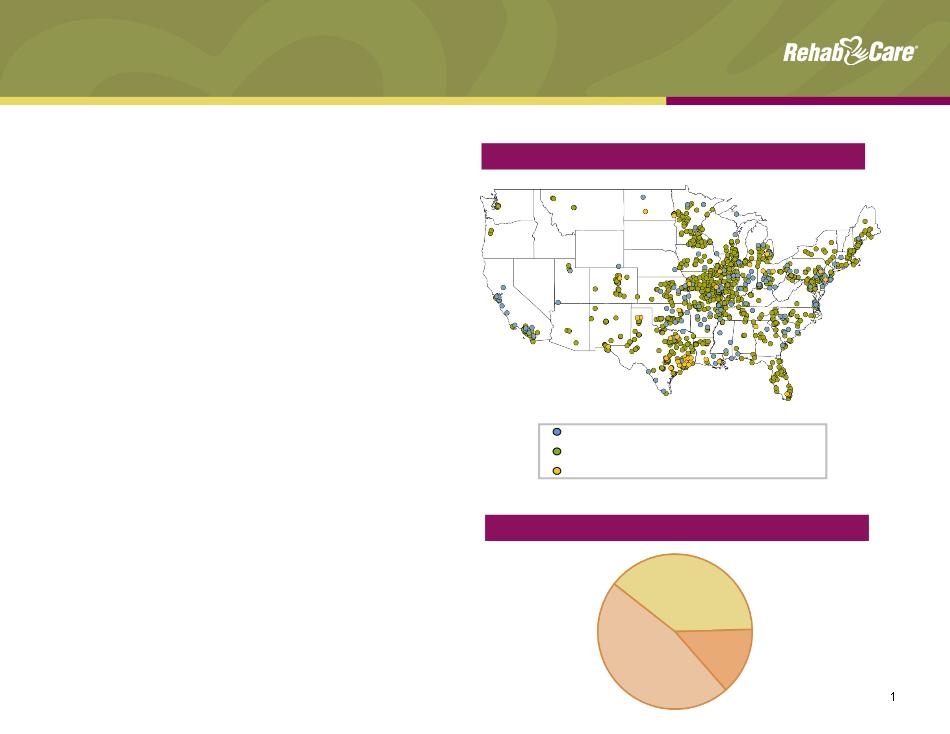

n Headquartered in

St. Louis, Missouri

n Established in

1982

n Largest contract

manager of

rehabilitation services in hospitals and

long-term care settings, with over

1,280 locations in 41 states

rehabilitation services in hospitals and

long-term care settings, with over

1,280 locations in 41 states

n Completed

acquisition of Triumph

HealthCare, a leading provider of long-

term acute care hospitals (LTACHs),

on Nov. 24, 2009

HealthCare, a leading provider of long-

term acute care hospitals (LTACHs),

on Nov. 24, 2009

n Acquisition makes

RehabCare the

fourth largest post-acute hospital

operator and third largest LTACH

provider in U.S.

fourth largest post-acute hospital

operator and third largest LTACH

provider in U.S.

n YTD 9/30/09 pro

forma revenues of

$943 mm

$943 mm

Hospital

Rehabilitation Services (HRS) Division

Skilled

Nursing Rehabilitation Services (SRS) Division

Hospital

Division

Geographic

Presence

Revenue

Breakdown - YTD pro forma as of 9/30/09

Skilled

Nursing

39%

Nursing

39%

Hospital

Rehab

Services

14%

Services

14%

Hospitals

47%

47%

13%

Patient

Discharge Destination1

LTACH

/ SNF

IRF

No

post-

acute care

acute care

Hospice/Home

Health

65%

Acute

care

hospital

hospital

2

Market

Overview

13%

2 MedPAC

Data Book, June 2009; does not include Home Health or

Medicare Advantage

Medicare Advantage

3 Avalere

Health LLC, April 2009; does not include Home Health or

Medicare Advantage

Medicare Advantage

Medicare

Post-Acute Spending (in billions)

LTACHs

= Long-Term Acute Care Hospitals IRFs

= Inpatient Rehabilitation Facilities SNFs =

Skilled Nursing Facilities

= Inpatient Rehabilitation Facilities SNFs =

Skilled Nursing Facilities

$

n Large,

growing and highly fragmented market

n Positive

demographic trends, with first wave of Baby Boomers entering Medicare in

2011

n Medicare

expenditures for post-acute services (excluding home health) projected to

increase 113% from

2007 to 2021

2007 to 2021

n RehabCare

delivers services across the post-acute continuum of care, providing

the

most appropriate discharge destination for acute patients

most appropriate discharge destination for acute patients

Projected3

Actual2

94

6

5

6

89

82

28

23

19

11

8

8

Hospital

Division

Overview

Overview

Competitive

Landscape

1 See Appendix for

reconciliation to GAAP

2 MedPAC, March 2009

Report to the Congress

3 MedPAC Data Book, June

2009

4 Does not include

additional Triumph facility scheduled to open April 2010

n Triumph HealthCare

was purchased for $558.7 mm, 6.2x LTM

9/30/09 Adjusted EBITDA1

9/30/09 Adjusted EBITDA1

n Triumph is the

third largest LTACH operator in the U.S. by

revenue, operating 21 facilities in 7 states. It is the largest

provider of long-term acute care in Houston and the dominant

provider of LTACH services in 9 of its 13 markets.

revenue, operating 21 facilities in 7 states. It is the largest

provider of long-term acute care in Houston and the dominant

provider of LTACH services in 9 of its 13 markets.

n RehabCare pursues

joint venture hospital partnerships (nine

currently) with market-leading acute care providers and

physician groups, in addition to its wholly owned facilities

currently) with market-leading acute care providers and

physician groups, in addition to its wholly owned facilities

Market

Size2: 219

IRFs

(Freestanding and

HIHs)

Market

Size3: 409

LTACHs

IRFs

LTACHs

100

93

82

34

23

19

16

14

8

6

4

3

Combined

Profile

n 28 long-term acute

care hospitals

(LTACHs), 6 inpatient rehabilitation

facilities (IRFs)

(LTACHs), 6 inpatient rehabilitation

facilities (IRFs)

n 13

states

n 1,838 licensed

beds

n 18,000 annual

patient discharges

4

Source:

Information available from public filings or

from company websites

from company websites

4

4

Triumph

Acquisition

Strategic rationale - operational

Strategic rationale - operational

n Combination

provides immediate economies of scale

n Ability to adopt

Triumph’s operational strengths, which have produced a consistent record

of

strong earnings performance compared to major competitors

strong earnings performance compared to major competitors

n Creates stronger,

more comprehensive continuum of care, better positioning RehabCare for

potential changes in reimbursement (e.g., bundling)

potential changes in reimbursement (e.g., bundling)

n Builds out

RehabCare’s continuum of care in 12 markets where there is overlap with SRS

and

HRS services, creating opportunities for synergies and improved patient flow

HRS services, creating opportunities for synergies and improved patient flow

n New management

structure in the Hospital division

n Brock Hardaway

leads the combined LTACH operations

n Joined Triumph in

2005

n 21 years industry

experience, including operational leadership positions at Select

Medical and Kindred Healthcare

Medical and Kindred Healthcare

n Retained key

Triumph operators

n Additional growth

potential through LTACH and IRF development

opportunities

Admission

Volumes

n Strong admission

volumes

n ADC has grown

consistently since 2005

Commercial

Volume Growth

Non-Medicare Patient

Mix

n Strategic approach

to managed care/commercial

payors has yielded higher volumes, higher rates and a

more diversified referral base

payors has yielded higher volumes, higher rates and a

more diversified referral base

n Strength in

managing length of stay (case

management) has resulted in significant growth in

NRPPD

management) has resulted in significant growth in

NRPPD

Triumph

Operational Strengths

1

1

1

1

1 Through

9/30/09

5

16%

20%

22%

26%

27%

6

n Meaningfully

accretive to 2010 EPS

n Immediately brings

the Hospital division to profitability ($59 mm pro forma Adjusted

EBITDA YTD 9/30/09 versus a loss of $7 mm)1

EBITDA YTD 9/30/09 versus a loss of $7 mm)1

n Strong cash flow

and ability to quickly deleverage

n Cost savings

through senior management and back-office overhead reductions

n More diversified

business lines, reducing reliance on third party contracts for revenue

and

EBITDA streams

EBITDA streams

Triumph

Acquisition

Strategic rationale - financial

Strategic rationale - financial

YTD

9/30/09 “Owned” Revenue vs. “Contract” Revenue

RehabCare

Pro

Forma

1 Adjusted

EBITDA Reconciliation: $66.5 mm (Triumph) - $7.1 mm (Legacy Hospital division) =

$59.4 mm; see Appendix for reconciliation to GAAP

n Division has

struggled to maintain traction while absorbing start-up losses,

infrastructure

investments and the impact of various operational issues across a small base of hospitals

investments and the impact of various operational issues across a small base of hospitals

n Expect total year

2009 operating losses of $25.5 - $26.5 mm (including ≈ $11.0 mm in merger

&

acquisition and integration related costs) and revenue of approximately $154.0 mm for full year

acquisition and integration related costs) and revenue of approximately $154.0 mm for full year

n Expect breakeven

operating earnings run rate by the end of the second quarter of 2010

and

breakeven operating earnings for FY2010

breakeven operating earnings for FY2010

n Final rule for

FY2010 Medicare reimbursement, effective 10/1/09, resulted in a 2.8% rate

increase

for RehabCare IRFs and a 1.4% increase for its legacy LTACHs

for RehabCare IRFs and a 1.4% increase for its legacy LTACHs

Legacy

Hospital Division

Historical performance

Historical performance

Revenue

($ in millions) and Discharges

Operating

Earnings & Start-up Losses ($ in millions)

1Includes a $1.5 million

pretax charge related to the cancellation of a planned

acquisition and development project

acquisition and development project

¹

New

Hospitals: 1 0 1 0 1 1

2Q2008 3Q2008 4Q2008 1Q2009 2Q2009 3Q2009

7

Skilled

Nursing Rehabilitation Services (SRS)

Division overview

Division overview

n Manages rehab

programs for SNFs

n Each

Medicare-certified SNF is required to provide

physical, speech and occupational therapy, but many

lack the know-how and/or scale to effectively manage a

program

physical, speech and occupational therapy, but many

lack the know-how and/or scale to effectively manage a

program

n RehabCare provides

a compelling value proposition to its

SNF partners

SNF partners

n Access to advanced

technology platform

n Broader array of

services

n Better access to

scarce therapist labor pool

Source:

Information available from public filings or from company websites

¹

Source: MedPAC Data Book, June 2009

Competitive

Landscape — # of facilities served

Self-

operated

11,000+

1,098

1,000

700

571

450

400

300

188

Market

Size1:

15,000+

Medicare-certified SNFs

Medicare-certified SNFs

8

Profile

n 1,098 skilled

nursing facility (SNF)

programs in 37 states

programs in 37 states

n 7.9 million annual

patient visits

n Polaris Group -

consulting for long-

term care facilities

term care facilities

n VTA Management

Services - therapy

and nurse staffing for New York

and nurse staffing for New York

n Significant same

store revenue and margin growth since completion of Symphony integration in

2007

n Expect 6.5% - 7.5%

operating earnings margins for the remainder of 2009 and in 2010, driven by

mid

single digit year-over-year same store revenue growth; modest unit growth in 4Q09 and in 2010

single digit year-over-year same store revenue growth; modest unit growth in 4Q09 and in 2010

n SNF final rule for

FY2010 Medicare reimbursement, effective 10/1/09, resulted in a net 1.1%

rate

decrease for RehabCare clients; auto exception process for Part B therapy caps expired 12/31/09,

healthcare reform bills include extension through either 2010 or 2011

decrease for RehabCare clients; auto exception process for Part B therapy caps expired 12/31/09,

healthcare reform bills include extension through either 2010 or 2011

n Focused on

implementing next generation of therapist point-of-care devices and value-added

solutions

for clients through information technology

for clients through information technology

SRS

Division

Performance/outlook

Performance/outlook

YOY

growth: 30.9% 35.5% 49.9% 24.4% 5.6% 6.8% 4.1% 9.2%

Same

store: 9.9% 8.4% 1.0%¹ 7.1%1 12.4% 10.6% 11.8% 10.3%

Revenue

($ in millions)

Note:

Includes Symphony acquisition as of July 1, 2006

1Same store analysis

does not include Symphony

%

Margin: 6.0% 5.5% (0.3%) 1.7% 5.6% 7.8% 5.0% 7.9%

Operating

Earnings ($ in millions)

9

RehabCare,

9.1%

Horizon

Health, 1.9%

Other,

0.9%

Hospital-based:

Self-op,

69.9%

Other,

9.9%

RehabCare,

0.5%

HealthSouth,

7.8%

Source:

Information available from public filings or from

company websites

company websites

1 MedPAC March 2009

Report to the Congress

Horizon

Health

15.6%

15.6%

Other

9.8%

9.8%

RehabCare

74.6%

74.6%

Freestanding

Hospital-Based

3rd Party

3rd Party

HealthSouth

42.9%

42.9%

Other

54%

RehabCare

3.1%

3.1%

18.2%

11.9%

Hospital

Rehabilitation Services (HRS)

Division overview

Division overview

n Manages

hospital-based IRFs and outpatient therapy programs

on a contract basis, providing its partners with:

on a contract basis, providing its partners with:

n Improved clinical

outcomes

n Ability to attract

≈ 30% admissions from external sources

n Broader clinical

programming (brain, stroke, spinal

dysfunction)

dysfunction)

n Better access to

scarce therapist labor pool

n Better compliance

(60% rule, RAC, 3-hour rule)

Market

Size1:

1,202

hospital-based and

freestanding IRFs

hospital-based and

freestanding IRFs

10

Profile

n 154 hospital-based

programs in 32

states

states

n 47,500 inpatient

rehabilitation facility

(IRF) and skilled nursing unit

discharges/year

(IRF) and skilled nursing unit

discharges/year

n 1.2 million annual

outpatient visits

11

HRS

Division

Performance/outlook

Performance/outlook

n Revenue and

earnings declined due to implementation of 75% Rule in 2004; freeze of rule

at

60% in January 2008 gave clear runway for same store growth

60% in January 2008 gave clear runway for same store growth

n Expect 15% - 17%

operating earnings margin, 2 - 4% year-over-year growth in IRF same

store

discharges, lower units in 4Q09 and flat unit growth in 2010

discharges, lower units in 4Q09 and flat unit growth in 2010

n Focused on

enhancing client value through information technology, achieving larger

system

sales and becoming the post-acute solution for providers under bundled payment scenario

sales and becoming the post-acute solution for providers under bundled payment scenario

¹Includes

$1.2 mm pretax charge from a bad debt write-down related to an

outpatient transaction

outpatient transaction

Revenue

($ in millions)

CAGR:

(1.6%)

YOY

growth: 2.6% (0.5%) (5.3%) (8.7%) 0.9% 10.1% (2.7%) 9.2%

IRFs: 113 120 115 107 113 110 110 110

Operating

Earnings ($ in millions)

%

Margin: 17.3% 11.9% 13.2% 14.0% 13.3% 15.8% 13.3% 16.6%

Standalone

and Pro Forma

Historical Key Financials

Historical Key Financials

Pro

Forma

RehabCare

Diluted

Earnings Per Share2

1 See Appendix for

reconciliation to GAAP

2 Represents net

earnings per share from continuing operations, attributable to

RehabCare

Historical

Operating Revenue ($mm)

12

Historical

Adjusted EBITDA1

($MM)

Historical

Adjusted EBITDA Margin (%)

9/30/09

13

Consolidated

Pro Forma

Balance Sheet

Balance Sheet

n Cash flow from

operations improved to $47 mm for YTD Q309 compared to $49 mm for

fiscal year 2008

fiscal year 2008

n Days sales

outstanding improved from 66 days at 12/31/08 to 61 days at 9/30/09

n Expect continued

strong operating cash flow with DSO of approximately 60 - 65 days

Cash

and Cash Equivalents

Total

Assets

Total

Debt1

Stockholders’

Equity2

Noncontrolling

Interests

Percent

of Debt to Total Capital3

Debt

to Annualized Adjusted EBITDA4

($mm)

$ 19.2

1,101.9

456.7

428.2

14.5

51%

2.9x

Pro

Forma

9/30/09

9/30/09

1Includes a $441.0 mm

term loan B, net of $9.0 mm in original issue discount; $11.1 mm in capital

leases and $4.6 mm in mortgage debt

2Includes $140.6 mm

related to a secondary equity offering for 6.2 mm shares of common

stock

3Total capital

represents the sum of debt, stockholders’ equity and noncontrolling

interests

4Represents YTD 9/30/09 Adjusted EBITDA

annualized; see Appendix for reconciliation

Strategic

Direction

n Enhance focus on

clinical outcomes through cutting-edge technology and

commitment to excellence

commitment to excellence

n Expand reach in

post-acute space through both organic growth and

development opportunities in existing businesses

development opportunities in existing businesses

n Leverage unique

continuum model to facilitate opportunities under bundled

payment system

payment system

n Utilize IT to

optimize performance and create distinction in the marketplace

Helping

People Regain Their Lives

14

15

Safe

Harbor

Forward-looking

statements have been provided pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Such statements

are based on the Company’s current expectations and could be affected by

numerous factors, risks and uncertainties discussed in the Company’s filings with

the Securities and Exchange Commission, including its most recent annual report

on Form 10-K, subsequent quarterly reports on Form 10-Q and current reports on

Form 8-K. Do not rely on forward looking statements as the Company cannot

predict or control many factors that affect its ability to achieve the results estimated.

The Company makes no promise to update any forward looking statements

whether as a result of changes in underlying factors, new information, future events

or otherwise.

provisions of the Private Securities Litigation Reform Act of 1995. Such statements

are based on the Company’s current expectations and could be affected by

numerous factors, risks and uncertainties discussed in the Company’s filings with

the Securities and Exchange Commission, including its most recent annual report

on Form 10-K, subsequent quarterly reports on Form 10-Q and current reports on

Form 8-K. Do not rely on forward looking statements as the Company cannot

predict or control many factors that affect its ability to achieve the results estimated.

The Company makes no promise to update any forward looking statements

whether as a result of changes in underlying factors, new information, future events

or otherwise.

Appendix

16

17

Primary

Post-Acute Settings

Overview

Overview

|

|

Long

Term Acute Care Hospitals

|

Skilled

Nursing Facilities

|

Inpatient

Rehab Facilities

|

|

Medicare

Spending 2008 |

$4.5

billion

|

$24.2

billion

(est. $6 billion rehab) |

$5.8

billion

|

|

Patients

Served

2007 |

129,202

Medicare discharges

|

2.5 million

Medicare admissions

|

370,048

Medicare discharges

|

|

Type of

Patient

|

High acuity,

at least 25 days

|

Low to

moderate acuity, may

require some rehab |

High acuity,

requires extensive

rehab (min 3 hrs/day) |

|

Avg. Length

of

Stay |

At least 25

days

|

27

days

|

13.2

days

|

|

Medicare

Reimbursement |

LTACH

PPS - Receive a

single payment

when Medicare beneficiary is discharged for all services rendered |

SNF

PPS - Receive a

per diem

payment under both Medicare Part A and state Medicaid programs |

IRF

PPS- Receive a

single

payment when Medicare beneficiary is discharged for all services rendered |

|

Medicare

Requirements |

• Patients must

have an average length

of stay of >25 days • 25% rule: no

more than 25% of

patients may be referred from a single source (fixed at 50% through 2010) • Moratorium on

new LTACH beds until

2011 |

Medicare

covers up to 100 days

of SNF care following an acute hospital stay of at least 3 days |

60% Rule: 60%

of patients

must satisfy one of 13 defined conditions |

Source:

MedPAC

Standalone

and Pro Forma Historical

Financial Reconciliations

Financial Reconciliations

RehabCare

Adjusted EBITDA

Pro

Forma Adjusted EBITDA

Triumph

LTM1 Adjusted

EBITDA/Purchase Price Multiple

1Last twelve

months

2Subject to adjustment

2Subject to adjustment

Triumph

Adjusted EBITDA

18