Attached files

| file | filename |

|---|---|

| 8-K - 8-K 01/07/2010 - NORTHWESTERN CORP | ek_010710.htm |

Transmission

Seminar

Hosted

by Shields & Company and

Berenson & Company

Berenson & Company

January

7, 2010

2

forward-looking

statement…

During

the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

Except

as noted herein, the information in this presentation is based upon

our current expectations as of the date hereof unless otherwise noted.

Our actual future business and financial performance may differ

materially and adversely from those expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

our current expectations as of the date hereof unless otherwise noted.

Our actual future business and financial performance may differ

materially and adversely from those expressed in any forward-looking

statements. We undertake no obligation to revise or publicly update our

forward-looking statements or this presentation for any reason. Although

our expectations and beliefs are based on reasonable assumptions, actual

results may differ materially. The factors that may affect our results are

listed in certain of our press releases and disclosed in the Company’s

public filings with the SEC.

3

who we

are…

(1) As

of 9/30/09

(2) Book

capitalization calculated as total debt, excluding capital leases, plus

shareholders’ equity.

¾ 656,000

customers

» 392,000

electric

» 264,000

natural gas

¾ Approximately

123,000 square

miles of service territory in

Montana, Nebraska and South Dakota

miles of service territory in

Montana, Nebraska and South Dakota

¾ Total

generation (mostly

base load coal)

» MT

- 222 MW - regulated beginning 1/1/09

» SD

- 312 MW - regulated

¾ Total

Assets: $2,754 MM (1)

¾ Total

Capitalization: $1,666 MM (1)(2)

¾ Total

Employees: 1,385

Located

in states with relatively stable economies with potential grid

expansion to support renewables.

expansion to support renewables.

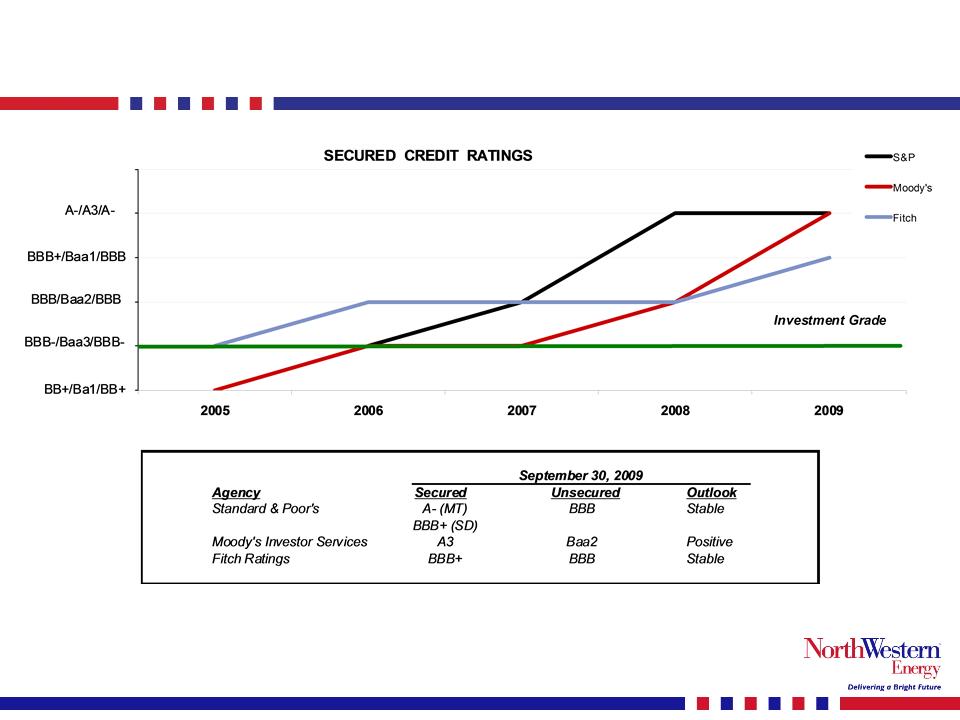

¾ Solid

operations

» Cost

competitive

» Above-average

reliability

» Award-winning

customer service

¾ Improving

credit ratings and strong balance sheet and liquidity

» Secured

and unsecured investment grade ratings

» Moody’s

has us on “positive” outlook

¾ Positive

earnings and ROE trend

» Colstrip

Unit 4 into rates effective January 1, 2009

» Delivery

services rate cases for Montana electric and natural gas

¾ Strong

cash flows

» NOLs

and repair tax deduction provide an effective tax shield until likely

2014

¾ Competitive

dividend

» Current

yield approximately 5.1%

¾ Improving

regulatory environment

¾ Realistic

growth prospects

4

NorthWestern’s

attributes…

improving credit

ratings…

5

6

strong

balance sheet and liquidity…

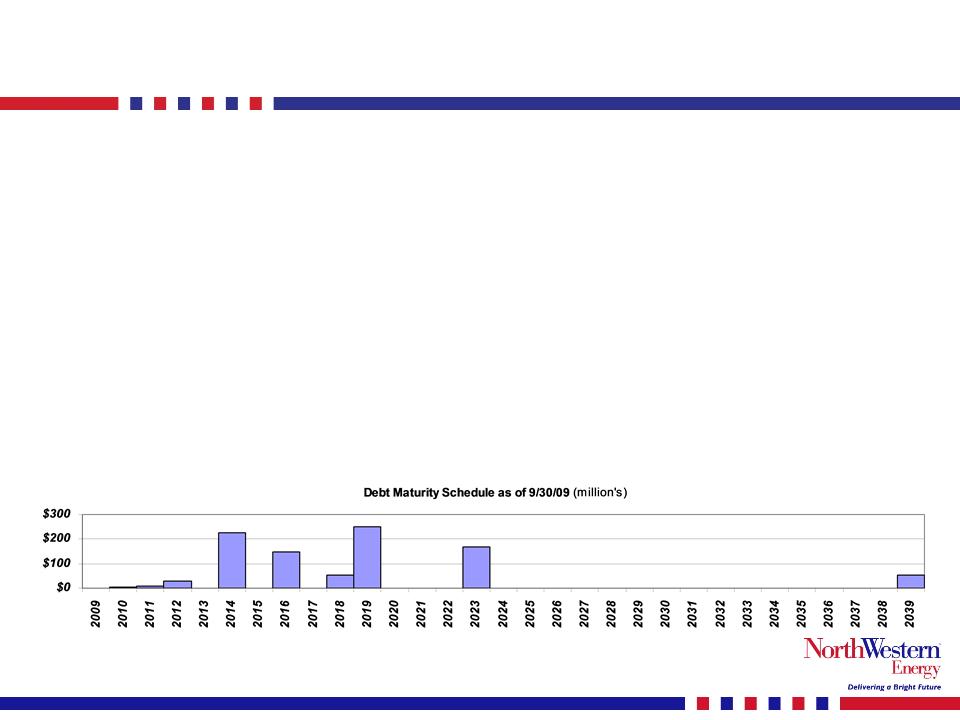

¾ Debt

/ Total capitalization of 53.4% (9/30/09)

¾ October

2009

» $55

million, 30 year First Mortgage Bonds issued at 5.71%

¾ June

2009

» Extended

unsecured revolver maturity to June 30, 2012

» Increased

size from $200 million to $250 million

¾ March

2009

» $250

million, 10 year First Mortgage Bonds issued at 6.34%

¾ Total

liquidity currently in the $190 million range

¾ Nearly

all long-term debt matures 2014 or later

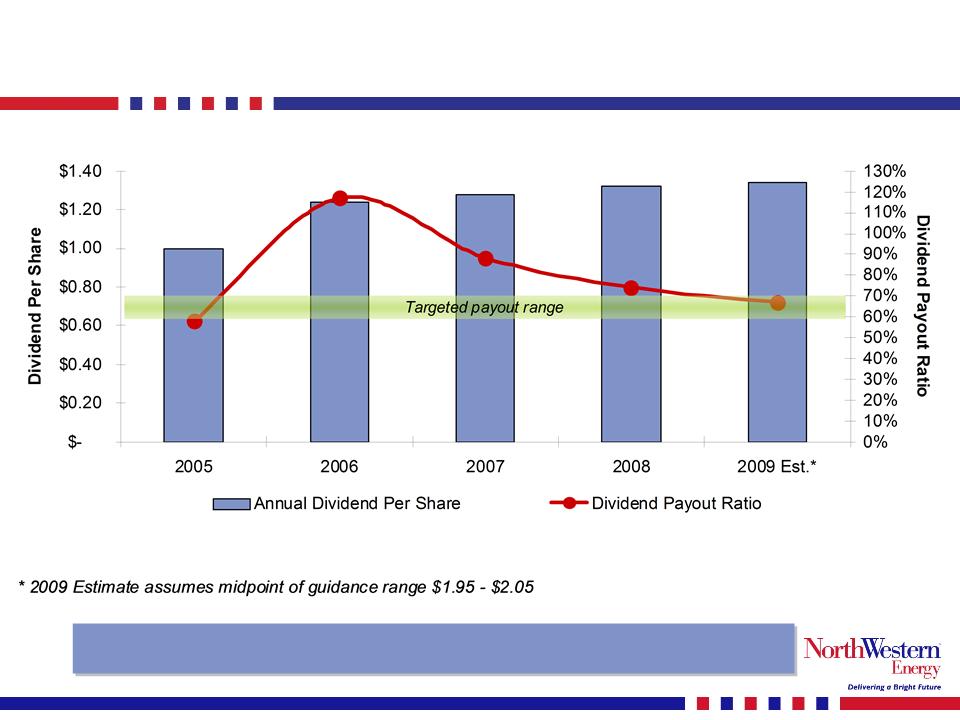

competitive

dividend…

7

Goal

for dividend payout ratio of 60% - 70%.

Current dividend yield about 5.1%.

Current dividend yield about 5.1%.

8

near-term potential

earnings drivers…

¾ 2010

» Expecting

flat volumes

♦ Due

to higher mix of residential/commercial vs. industrial customers as

compared to other utilities

compared to other utilities

● Electric:

67% Residential & Commercial, 33% Industrial

● Natural

Gas: 99% Residential & Commercial, 1% Industrial

» Montana

rate adjustment expected to take effect second half of 2010

¾ 2011

» Full

year effect of Montana rate adjustment

» South

Dakota and Nebraska natural gas rate adjustments expected

» Mill

Creek in rate base

♦ Approximately

$10 million annualized contribution to net income

Near-term

earnings drivers independent of transmission projects.

longer-term

potential earnings drivers …

¾ Distribution

system enhancements

» Exploring

incremental rate based investment (early

stages)

¾ Energy

supply

» Mill

Creek Generation Station

» South

Dakota peaking generation

» Natural

gas reserves (early

stages)

» Wind

projects and other renewable projects (early

stages)

¾ Transmission

projects

» Colstrip

500 kV upgrade

» 230

kV Renewable Collector System

» Mountain

States Transmission Intertie (MSTI)

» Electric

Transmission America (ETA) (early

stages)

» Green

Power Express (ITC) (early

stages)

9

Balanced

growth opportunities across the business.

10

10

transmission network

summary…

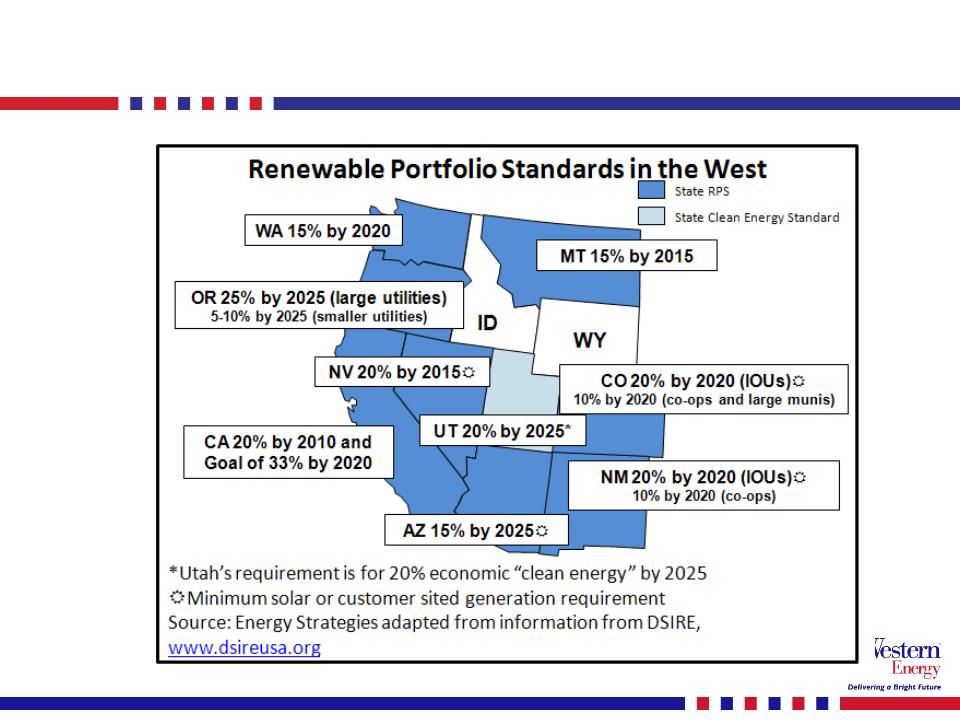

¾ Requests

to perform

new functions

new functions

¾ Help

meet RPS and

other environmental

goals

other environmental

goals

» Transmission

investment driven by

demand for

renewables

investment driven by

demand for

renewables

¾ Investments

with

externality and

coordination

challenges

externality and

coordination

challenges

¾ State,

regional national

interests

interests

11

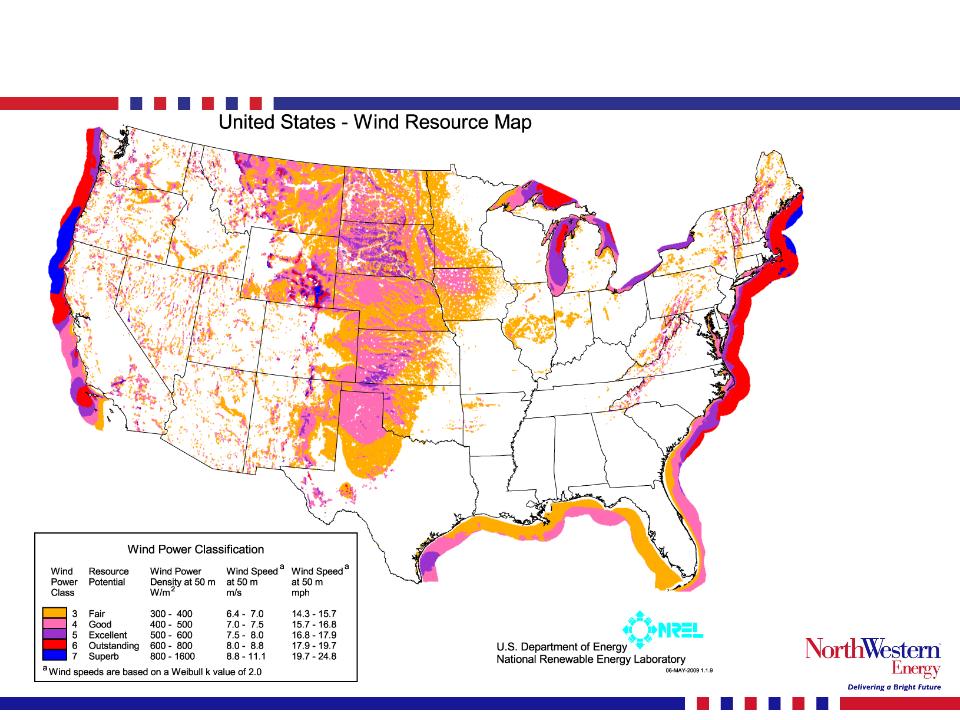

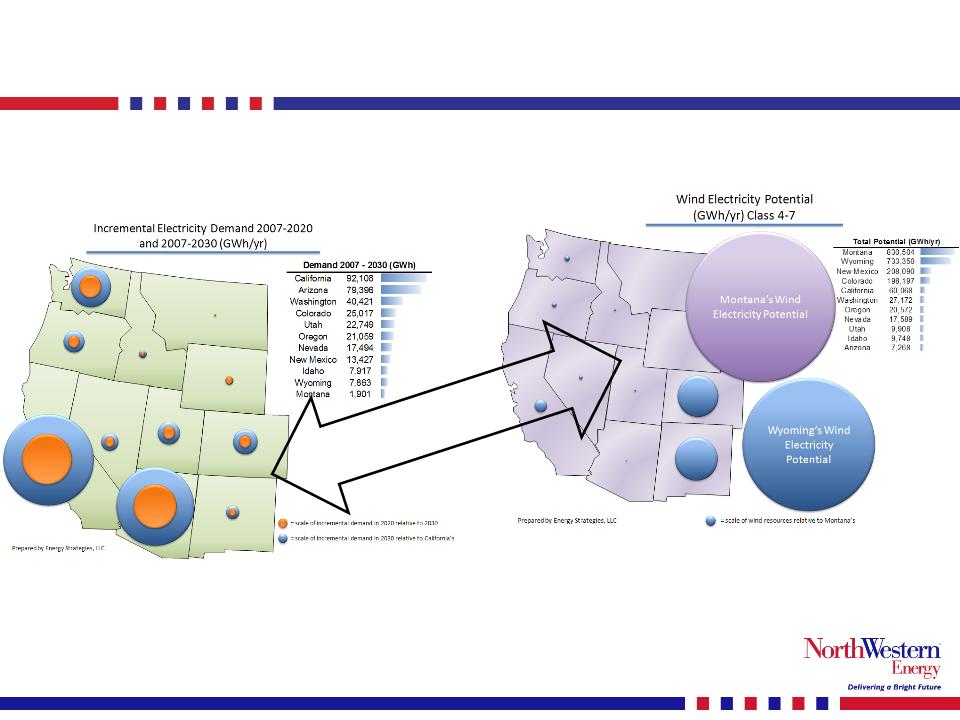

wind

potential in our service territory…

demand

for renewables increasing…

12

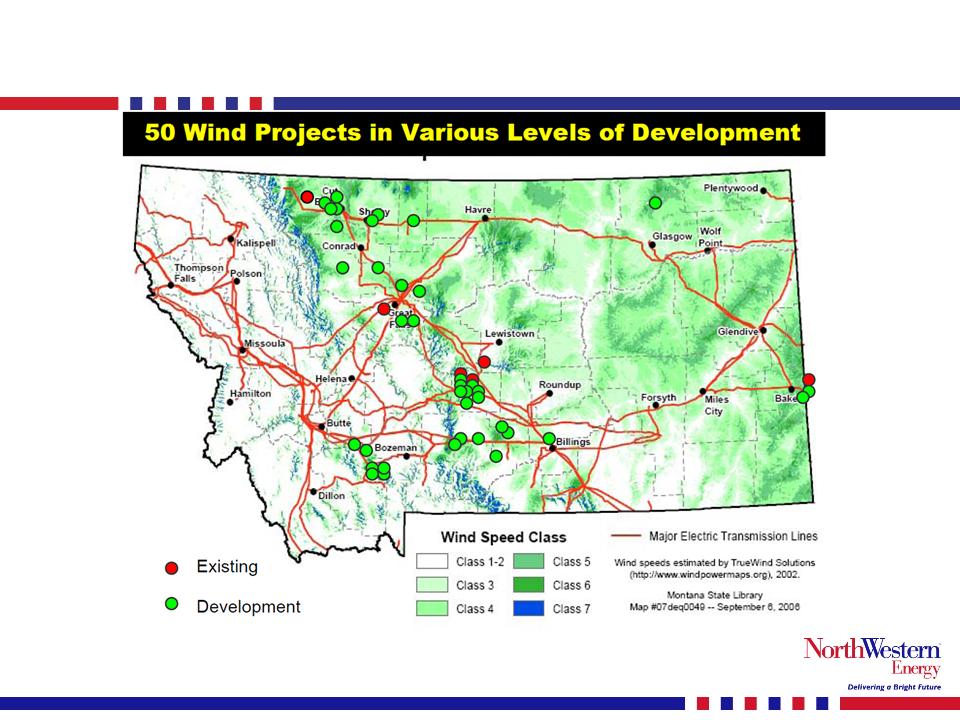

Montana

wind development…

13

Xx

x

14

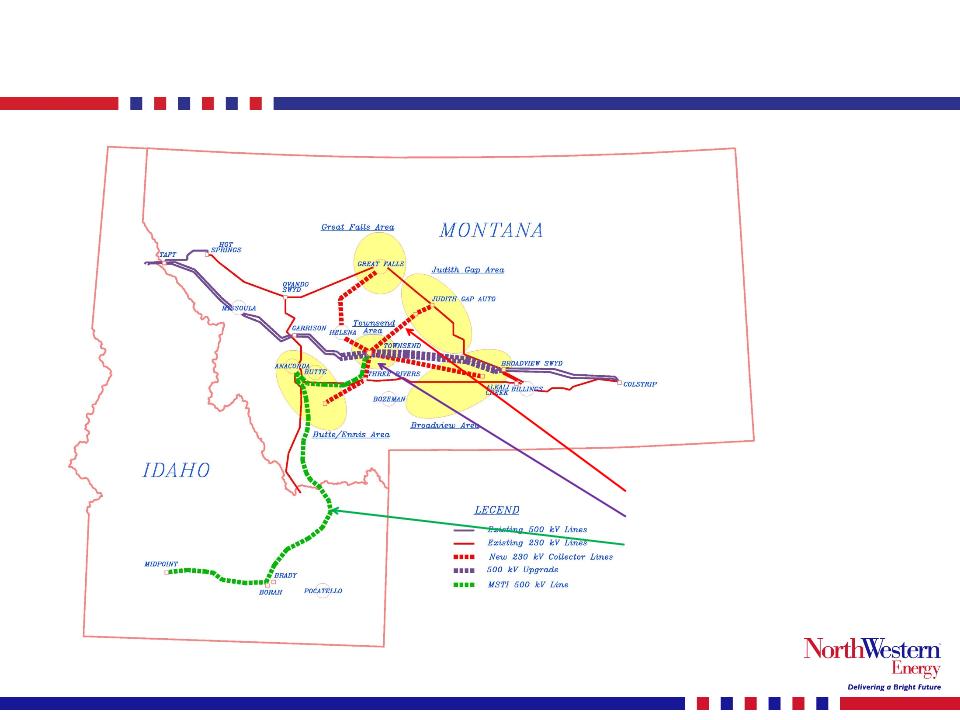

Montana

is between resources & loads…

NWE

proposed transmission projects…

Collector

System

Colstrip

Upgrade

MSTI

15

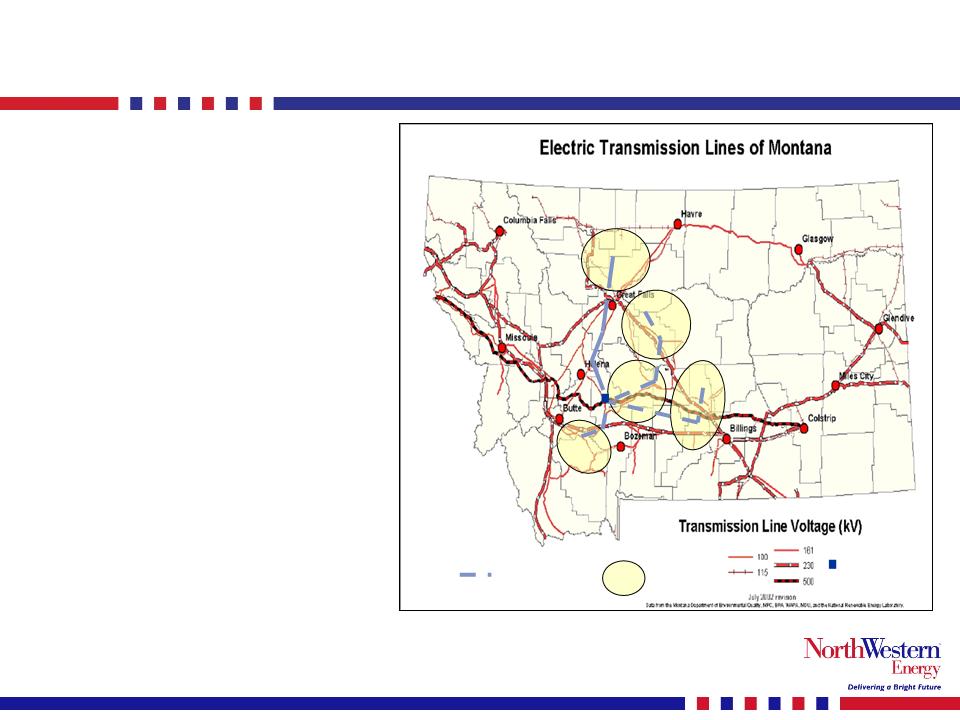

Colstrip 500 kV

upgrade…

16

¾ NWE,

other Colstrip Transmission owners and BPA

¾ Upgrade

existing 500 kV lines from Colstrip MT to Mid C

¾ Provide

additional access to Northwest markets

¾ May

Add 500-700 MW capacity

¾ In

service 2012

Garrison

Sub

Colstrip

Gen

Bozeman

Missoula

Billings

Great

Falls

Helena

Broadview

Sub

Existing CTS 500

kV

New

500/230 Substation

Existing BPA 500

kV

Butte

Mountain States

Transmission Intertie…

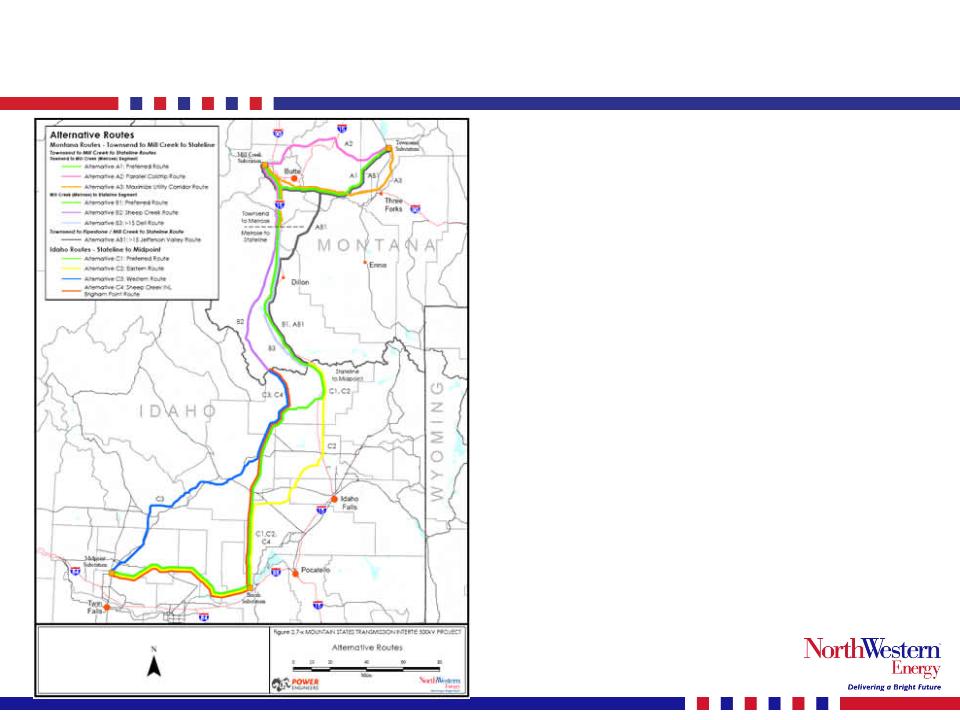

¾ 500

kV AC line from Townsend

MT to Midpoint Substation near

Twin Falls ID

MT to Midpoint Substation near

Twin Falls ID

¾ Approximately

430 miles

depending on final route

depending on final route

¾ 2

major substations in MT; 1

interconnection in Idaho

interconnection in Idaho

¾ Advanced

stages of public

siting and review - began in

2007

siting and review - began in

2007

¾ 1500

MW path rating capacity

expected

expected

¾ Current

project cost is $1

billion

billion

17

18

Collector

project…

¾ Currently

3,700 MW in

generation interconnection

queue

generation interconnection

queue

¾ Provides

a radial gathering

system for new generation

to access MSTI and the ‘grid’

system for new generation

to access MSTI and the ‘grid’

¾ Informational

meeting with

customers in early 2010

customers in early 2010

¾ The

actual project defined

through an Open Season in

early 2010

through an Open Season in

early 2010

¾ Current

project cost is up to

$220 million per line

$220 million per line

¾ The

target in service date is

late 2014

late 2014

New

Townsend

Substation

Townsend

Substation

High

Wind

Area

Wind

Area

Potential

Collector

Lines

Collector

Lines

19

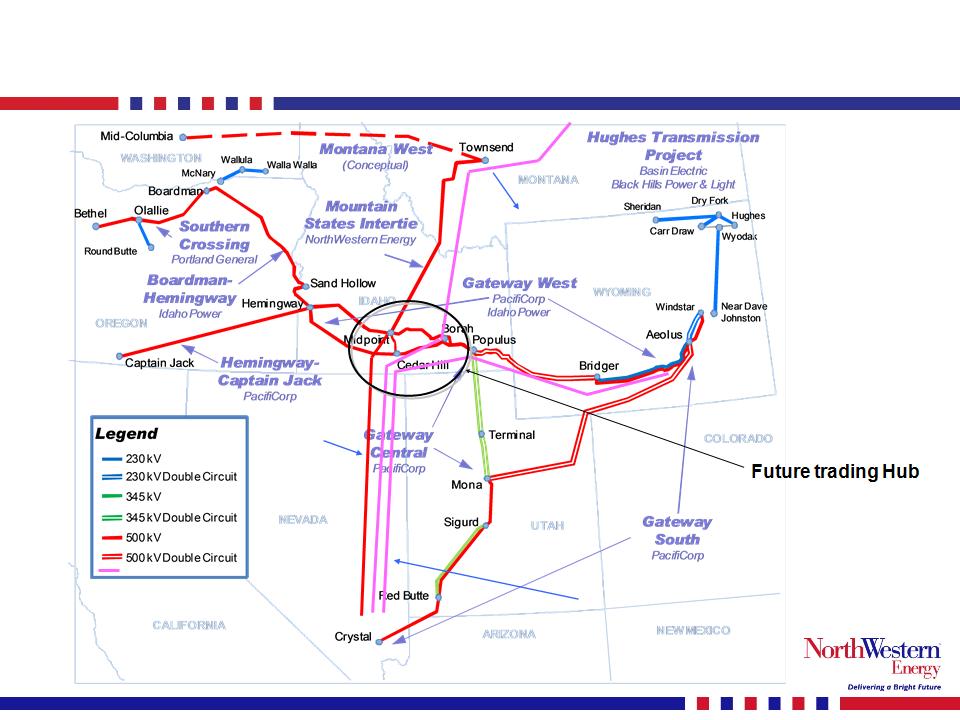

other

proposed transmission projects…

HVDC

Zephyr

TransCanada

SWIP

LS

Power

Chinook

TransCanada

capex

spending - next few years…

We

will move forward with

the funding of these projects

only when they make

economic sense.

the funding of these projects

only when they make

economic sense.

Additional

equity not

anticipated until we proceed

with MSTI or other major

investments.

anticipated until we proceed

with MSTI or other major

investments.

MSTI

project is now slated for

early 2015 and capex has

been modified accordingly.

Capital still shown at 100%

but still evaluating partners.

early 2015 and capex has

been modified accordingly.

Capital still shown at 100%

but still evaluating partners.

Utility

Maintenance

Capex is funded 100%

by free cash flow.

Capex is funded 100%

by free cash flow.

21

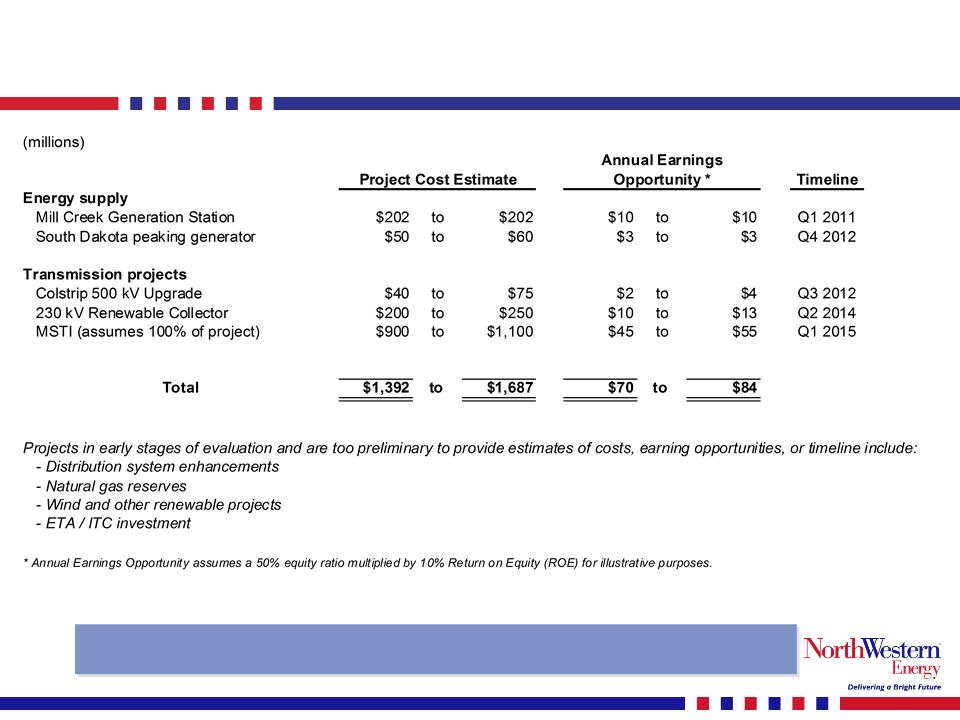

growth

project potential…

Opportunity

to double and diversify earnings as compared with our existing

$1.5 billion rate base.

$1.5 billion rate base.

22

in

summary…

¾ Solid

operations

¾ Improving

credit ratings and strong balance

sheet and liquidity

sheet and liquidity

¾ Positive

earnings and ROE trend

¾ Strong

cash flows

¾ Competitive

dividend

¾ Improving

regulatory environment

¾ Realistic

growth prospects