Attached files

| file | filename |

|---|---|

| EX-31.1 - ARK RESTAURANTS CORP | c59798_ex31-1.htm |

| EX-32 - ARK RESTAURANTS CORP | c59798_ex32.htm |

| EX-31.2 - ARK RESTAURANTS CORP | c59798_ex31-2.htm |

| EX-23 - ARK RESTAURANTS CORP | c59798_ex23.htm |

| EX-21 - ARK RESTAURANTS CORP | c59798_ex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTIONS 13 AND 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 3, 2009

or,

[ ] TRANSITION

REPORT PURSUANT TO SECTIONS 13 AND 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 1-09453

|

|

|

ARK RESTAURANTS CORP. |

|

(Exact Name of Registrant as Specified in Its Charter) |

|

|

|

|

|

New York |

|

13-3156768 |

|

|

||

|

(State or Other Jurisdiction of |

|

(IRS Employer Identification No.) |

|

Incorporation or Organization) |

|

|

|

|

|

|

85 Fifth Avenue, New York, NY |

10003 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (212) 206-8800

Securities registered pursuant to section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

|

|

Title of each class |

|

Name of each exchange on which registered |

||

|

|

||||

|

Common Stock, par value $.01 per share |

|

The NASDAQ Stock Market LLC |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes __ No X

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes __ No X

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No __

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes __ No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. [ x ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer ____ |

Accelerated filer _____ |

|

Non-accelerated filer ____ (Do not check if a smaller reporting company) |

Smaller Reporting Company X |

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes __ No X

As of March 27, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of voting and non-voting stock held by non-affiliates of the registrant was $19,244,632.

At December 28, 2009, there were outstanding 3,489,845 shares of the Registrant’s Common Stock, $.01 par value.

DOCUMENTS INCORPORATED BY REFERENCE

(1) In accordance with General Instruction G (3) of Form 10-K certain information required by Part III hereof will either be incorporated into this Form 10-K by reference to the registrant’s definitive proxy statement for the registrant’s 2009 Annual Meeting of Stockholders filed within 120 days of October 3, 2009 or will be included in an amendment to this Form 10-K filed within 120 days of October 3, 2009.

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

On one or more occasions, we may make statements in this Annual Report on Form 10-K regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. All statements, other than statements of historical facts, included or incorporated by reference herein relating to management’s current expectations of future financial performance, continued growth and changes in economic conditions or capital markets are forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Words or phrases such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “hopes,” “will continue” or similar expressions identify forward looking statements. Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed. We caution that while we make such statements in good faith and we believe such statements are based on reasonable assumptions, including without limitation, management’s examination of historical operating trends, data contained in records and other data available from third parties, we cannot assure you that our projections will be achieved. Factors that may cause such differences include: economic conditions generally and in each of the markets in which we are located, the amount of sales contributed by new and existing restaurants, labor costs for our personnel, fluctuations in the cost of food products, adverse weather conditions, changes in consumer preferences and the level of competition from existing or new competitors.

We have attempted to identify, in context, certain of the factors that we believe may cause actual future experience and results to differ materially from our current expectation regarding the relevant matter of subject area. In addition to the items specifically discussed above, our business, results of operations and financial position and your investment in our common stock are subject to the risks and uncertainties described in “Item 1A Risk Factors” of this Annual Report on Form 10-K.

From time to time, oral or written forward-looking statements are also included in our reports on Forms 10-K, 10-Q and 8-K, our Schedule 14A, our press releases and other materials released to the public. Although we believe that at the time made, the expectations reflected in all of these forward-looking statements are and will be reasonable, any or all of the forward-looking statements in this Annual Report on Form 10-K, our reports on Forms 10-Q and 8-K, our Schedule 14A and any other public statements that are made by us may prove to be incorrect. This may occur as a result of inaccurate assumptions or as a consequence of known or unknown risks and uncertainties. Many factors discussed in this Annual Report on Form 10-K, certain of which are beyond our control, will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from forward-looking statements. In light of these and other uncertainties, you should not regard the inclusion of a forward-looking statement in this Annual Report on Form 10-K or other public communications that we might make as a representation by us that our plans and objectives will be achieved, and you should not place undue reliance on such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent periodic reports filed with the Securities and Exchange Commission on Forms 10-Q and 8-K and Schedule 14A.

Unless the context requires otherwise, references to “we,” “us,” “our,” “ARKR” and the “Company” refer specifically to Ark Restaurants Corp. and its subsidiaries and predecessor entities.

3

|

|

|

|

Item 1. |

Business |

Overview

We are a New York corporation formed in 1983. As of the fiscal year ended October 3, 2009, we owned and/or operated 20 restaurants and bars, 30 fast food concepts and catering operations through our subsidiaries. Initially our facilities were located only in New York City. As of the fiscal year ended October 3, 2009, seven of our restaurant and bar facilities are located in New York City, four are located in Washington, D.C., five are located in Las Vegas, Nevada, two are located in Atlantic City, New Jersey, one is located at the Foxwoods Resort Casino in Ledyard, Connecticut and one is located in the Faneuil Hall Marketplace in Boston, Massachusetts.

In addition to the shift from a Manhattan-based operation to a multi-city operation, the nature of the facilities operated by us has shifted from smaller, neighborhood restaurants to larger, destination restaurants intended to benefit from high patron traffic attributable to the uniqueness of the restaurant’s location. Most of our restaurants which are in operation and which have been opened in recent years are of the latter description. As of the fiscal year ended October 3, 2009, these include the restaurant operations at the 12 fast food facilities in Tampa, Florida and Hollywood, Florida, respectively (2004); the Gallagher’s Steakhouse and Gallagher’s Burger Bar in the Resorts Atlantic City Hotel and Casino in Atlantic City, New Jersey (2005); The Grill at Two Trees at the Foxwoods Resort Casino in Ledyard, Connecticut (2006); Durgin Park Restaurant and the Black Horse Tavern in the Faneuil Hall Marketplace in Boston, Massachusetts (2007); Yolos, at the Planet Hollywood Resort and Casino (formerly known as the Aladdin Resort and Casino) in Las Vegas, Nevada (2007); and five fast food facilities at MGM Grand Casino at the Foxwoods Resort Casino in Ledyard, Connecticut (2008). Also in 2008, we entered into an agreement to lease space for the restaurant Robert at the Museum of Arts & Design at Columbus Circle in Manhattan.

The names and themes of each of our restaurants are different except for our two America restaurants, two Sequoia restaurants, two Gonzalez y Gonzalez restaurants and two Gallagher’s Steakhouse restaurants. The menus in our restaurants are extensive, offering a wide variety of high quality foods at generally moderate prices. The atmosphere at many of the restaurants is lively and extremely casual. Most of the restaurants have separate bar areas. A majority of our net sales are derived from dinner as opposed to lunch service. Most of the restaurants are open seven days a week and most serve lunch as well as dinner.

While decor differs from restaurant to restaurant, interiors are marked by distinctive architectural and design elements which often incorporate dramatic interior open spaces and extensive glass exteriors. The wall treatments, lighting and decorations are typically vivid, unusual and, in some cases, highly theatrical.

4

The following table sets forth the facilities we lease and operate as of October 3, 2009:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Location |

|

Year |

|

Restaurant Size |

|

Seating |

|

Lease Expiration(3) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gonzalez y |

|

Broadway |

|

1989 |

|

6,000 |

|

|

250 |

|

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

America(5) |

|

Union Station |

|

1989 |

|

10,000 |

|

|

400 |

(50) |

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Center Café(5) |

|

Union Station |

|

1989 |

|

4,000 |

|

|

200 |

|

|

2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sequoia |

|

Washington Harbour |

|

1990 |

|

26,000 |

|

|

600 |

(400) |

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sequoia |

|

South Street Seaport |

|

1991 |

|

12,000 |

|

|

300 |

(100) |

|

2010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canyon Road |

|

First Avenue |

|

1984 |

|

2,500 |

|

|

130 |

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bryant Park |

|

Bryant Park |

|

1995 |

|

25,000 |

|

|

180 |

(820) |

|

2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

America(7) |

|

New York-New York |

|

1997 |

|

20,000 |

|

|

450 |

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gallagher’s Steakhouse(7) |

|

New York-New York |

|

1997 |

|

5,500 |

|

|

260 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gonzalez y Gonzalez(7) |

|

New York-New York |

|

1997 |

|

2,000 |

|

|

120 |

|

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Village Eateries (7)(8) |

|

New York-New York |

|

1997 |

|

6,300 |

|

|

400 |

(*) |

|

2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Grill Room |

|

World Financial Center |

|

1997 |

|

10,000 |

|

|

250 |

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Red |

|

South Street Seaport |

|

1998 |

|

7,000 |

|

|

150 |

(150) |

|

2013 |

5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Location |

|

Year |

|

Restaurant Size |

|

Seating |

|

Lease Expiration(3) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thunder Grill |

|

Union Station |

|

1999 |

|

10,000 |

|

|

500 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Venetian Food Court(9) |

|

Venetian Casino Resort |

|

1999 |

|

3,980 |

|

|

300 |

(*) |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V-Bar |

|

Venetian Casino Resort |

|

2000 |

|

3,000 |

|

|

100 |

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gallagher’s Steakhouse |

|

Resorts Atlantic City |

|

2005 |

|

6,280 |

|

|

196 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gallagher’s Burger Bar |

|

Resorts Atlantic City |

|

2005 |

|

2,270 |

|

|

114 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Grill at Two Trees |

|

Two Trees Inn |

|

2006 |

|

3,359 |

|

|

101 |

|

|

2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Durgin Park Restaurant and the Black Horse Tavern |

|

Faneuil Hall Marketplace |

|

2007 |

|

7,000 |

|

|

500 |

|

|

2032 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yolos |

|

Planet Hollywood |

|

2007 |

|

4,100 |

|

|

206 |

|

|

2027 |

|

|

|

|

|

|

(1) |

Restaurants are, from time to time, renovated, renamed and/or converted from or to managed or owned facilities. “Year Opened” refers to the year in which we, or an affiliated predecessor of us, first opened, acquired or began managing a restaurant at the applicable location, notwithstanding that the restaurant may have been renovated, renamed and/or converted from or to a managed or owned facility since that date. |

|

|

|

|

(2) |

Seating capacity refers to the seating capacity of the indoor part of a restaurant available for dining in all seasons and weather conditions. Outdoor seating capacity, if applicable, is set forth in parentheses and refers to the seating capacity of terraces and sidewalk cafes which are available for dining only in the warm seasons and then only in clement weather. |

|

|

|

|

(3) |

Assumes the exercise of all our available lease renewal options. |

|

|

|

|

(4) |

The lease for this location expires December 31, 2009. It is anticipated that this location will remain open on a month-to-month basis with the consent of the landlord for this facility. |

6

|

|

|

|

(5) |

The leases for these locations expired prior to October 3, 2009 and have been operating on a month-to-month basis with the consent of the landlord for these facilities. |

|

|

|

|

(6) |

The lease governing a substantial portion of the outside seating area of this restaurant expires on April 30, 2012. |

|

|

|

|

(7) |

Includes two five-year renewal options exercisable by us if certain sales goals are achieved during the two year period prior to the exercise of the renewal option. Under the America lease, the sales goal is $6.0 million. Under the Gallagher’s Steakhouse lease the sales goal is $3.0 million. Under the lease for Gonzalez y Gonzalez and the Village Eateries, the combined sales goal is $10.0 million. Each of the restaurants is currently operating at a level in excess of the minimum sales level required to exercise the renewal option for each respective restaurant. |

|

|

|

|

(8) |

We operate eight small food court restaurants in the Village Eateries food court at the New York-New York Hotel & Casino. We also operate that hotel’s room service, banquet facilities and employee cafeteria. |

|

|

|

|

(9) |

We operate three small food court restaurants in a food court at the Venetian Casino Resort. |

|

|

|

|

(*) |

Represents common area seating. |

The following table sets forth the facilities managed by us as of October 3, 2009:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Location |

|

Year |

|

Restaurant Size |

|

Seating |

|

Lease Expiration(3) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

El Rio Grande |

|

Third Avenue |

|

1987 |

|

4,000 |

|

|

160 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tampa Food |

|

Hard Rock Hotel and |

|

2004 |

|

4,000 |

|

|

250 |

(*) |

|

2029 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hollywood |

|

Hard Rock Hotel and |

|

2004 |

|

5,000 |

|

|

250 |

(*) |

|

2029 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lucky Seven(6) |

|

Foxwoods Resort |

|

2006 |

|

4,825 |

|

|

4,000 |

(**) |

|

2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MGM Grand |

|

MGM Grand at |

|

2008 |

|

8,300 |

|

|

256 |

(84)(*) |

|

2028 |

|

|

|

|

|

|

(1) |

Restaurants are, from time to time, renovated, renamed and/or converted from or to managed or owned facilities. “Year Opened” refers to the year in which we, or an affiliated predecessor of us, first opened, |

7

|

|

|

|

|

acquired or began managing a restaurant at the applicable location, notwithstanding that the restaurant may have been renovated, renamed and/or converted from or to a managed or owned facility since that date. |

|

|

|

|

(2) |

Seating capacity refers to the seating capacity of the indoor part of a restaurant available for dining in all seasons and weather conditions. Outdoor seating capacity, if applicable, is set forth in parentheses and refers to the seating capacity of terraces and sidewalk cafes which are available for dining only in the warm seasons and then only in clement weather. |

|

|

|

|

(3) |

Assumes the exercise of all our available lease renewal options. |

|

|

|

|

(4) |

Management fees earned are based on a percentage of cash flow of the restaurant. |

|

|

|

|

(5) |

We own a 19% interest in the partnership that owns El Rio Grande. |

|

|

|

|

(6) |

Management fees earned are based on a percentage of gross sales of the restaurant. |

|

|

|

|

(7) |

We own a 67% interest in the partnership that owns the MGM Grand Food Market. |

|

|

|

|

(*) |

Represents common area seating. |

|

|

|

|

(**) |

Represents number of seats in the Bingo Hall. |

Revenues from facilities managed by us are not included in our consolidated sales, with the exception of El Rio Grande and the MGM Grand Food Market which are consolidated and are included in our financial statements.

Restaurant Expansion

During the fiscal year ended October 3, 2009, we began construction of the restaurant Robert at the Museum of Arts & Design at Columbus Circle in Manhattan. This restaurant opened on December 15, 2009. We are the majority owner and managing member of the limited liability company which operates this restaurant.

The opening of a new restaurant is invariably accompanied by substantial pre-opening expenses and early operating losses associated with the training of personnel, excess kitchen costs, costs of supervision and other expenses during the pre-opening period and during a post-opening “shake out” period until operations can be considered to be functioning normally. The amount of such pre-opening expenses and early operating losses can generally be expected to depend upon the size and complexity of the facility being opened. We incurred $15,000 in pre-opening expenses in fiscal 2009, which is the cumulative total pre-opening expenses of this restaurant for the 2009 fiscal year.

Our restaurants generally do not achieve substantial increases in revenue from year to year, which we consider to be typical of the restaurant industry. To achieve significant increases in revenue or to replace revenue of restaurants that lose customer favor or which close because of lease expirations or other reasons, we would have to open additional restaurant facilities or expand existing restaurants. There can be no assurance that a restaurant will be successful after it is opened, particularly since in many instances we do not operate our new restaurants under a trade name currently used by us, thereby requiring new restaurants to establish their own identity.

8

Leases

Apart from these agreements, we are not currently committed to any projects. We may take advantage of opportunities we consider to be favorable, when they occur, depending upon the availability of financing and other factors.

Recent Restaurant Dispositions and Charges

During the first fiscal quarter of 2008, we discontinued the operation of our Columbus Bakery retail and wholesale bakery located in New York City. Columbus Bakery was originally intended to serve as the bakery that would provide all of our New York restaurants with baked goods as well as being a retail bakery operation. As a result of the sale and closure of several of our restaurants in New York City during the last several years, this bakery operation was no longer profitable. During the second fiscal quarter of 2008 we opened, along with certain third party investors, a new concept at this location called “Pinch & S’Mac” which features pizza and macaroni and cheese. We contributed Columbus Bakery’s net fixed assets and cash into this venture and received an ownership interest of 37.5%. These operations are not consolidated in the Company’s financial statements.

Effective June 30, 2008, the lease for our Stage Deli facility at the Forum Shops in Las Vegas, Nevada expired. The landlord for this facility offered to renew the lease at this location prior to its expiration at a significantly increased rent. The Company determined that it would not be able to operate this facility profitably at this location at the rent offered in the landlord’s renewal proposal. As a result, the Company discontinued these operations during the third fiscal quarter of 2008 and took a charge for the impairment of goodwill of $294,000 and a loss on disposal of $19,000. The impairment charge and disposal loss are included in discontinued operations.

Restaurant Management

Each restaurant is managed by its own manager and has its own chef. Food products and other supplies are purchased primarily from various unaffiliated suppliers, in most cases by our headquarters’ personnel. Our Columbus Bakery in Las Vegas supplies bakery products to most of our Las Vegas restaurants in addition to operating a wholesale bakery. Each of our restaurants has two or more assistant managers and sous chefs (assistant chefs). Financial and management control is maintained at the corporate level through the use of automated systems that include centralized accounting and reporting.

Purchasing and Distribution

We strive to obtain quality menu ingredients, raw materials and other supplies and services for our operations from reliable sources at competitive prices. Substantially all menu items are prepared on each restaurant’s premises daily from scratch, using fresh ingredients. Each restaurant’s management determines the quantities of food and supplies required and orders the items from local, regional and national suppliers on terms negotiated by our centralized purchasing staff. Restaurant-level inventories are maintained at a minimum dollar-value level in relation to sales due to the relatively rapid turnover of the perishable produce, poultry, meat, fish and dairy commodities that are used in operations.

We attempt to negotiate short-term and long-term supply agreements depending on market conditions and expected demand. However, we do not contract for long periods of time for our fresh commodities such as produce, poultry, meat, fish and dairy items and, consequently, such commodities can be subject to unforeseen supply and cost fluctuations. Independent foodservice distributors deliver most food and supply items daily to restaurants. The financial impact of such supply agreements would not have a material adverse effect on our financial position.

9

Employees

At December 16, 2009, we employed 1,856 persons (including employees at managed facilities), 1,374 of whom were full-time employees, 482 of whom were part-time employees, 31 of whom were headquarters personnel, 180 of whom were restaurant management personnel, 506 of whom were kitchen personnel and 1,098 of whom were restaurant service personnel. A number of our restaurant service personnel are employed on a part-time basis. Changes in minimum wage levels may affect our labor costs and the restaurant industry generally because a large percentage of restaurant personnel are paid at or slightly above the minimum wage. Our employees are not covered by a collective bargaining agreement.

Government Regulation

We are subject to various federal, state and local laws affecting our business. Each restaurant is subject to licensing and regulation by a number of governmental authorities that may include alcoholic beverage control, health, sanitation, environmental, zoning and public safety agencies in the state or municipality in which the restaurant is located. Difficulties in obtaining or failures to obtain the required licenses or approvals could delay or prevent the development and openings of new restaurants, or could disrupt the operations of existing restaurants.

Alcoholic beverage control regulations require each of our restaurants to apply to a state authority and, in certain locations, county and municipal authorities for licenses and permits to sell alcoholic beverages on the premises. Typically, licenses must be renewed annually and may be subject to penalties, temporary suspension or revocation for cause at any time. Alcoholic beverage control regulations impact many aspects of the daily operations of our restaurants, including the minimum ages of patrons and employees consuming or serving such beverages; employee alcoholic beverages training and certification requirements; hours of operation; advertising; wholesale purchasing and inventory control of such beverages; seating of minors and the service of food within our bar areas; and the storage and dispensing of alcoholic beverages. State and local authorities in many jurisdictions routinely monitor compliance with alcoholic beverage laws. The failure to receive or retain, or a delay in obtaining, a liquor license for a particular restaurant could adversely affect our ability to obtain such licenses in jurisdictions where the failure to receive or retain, or a delay in obtaining, a liquor license occurred.

We are subject to “dram-shop” statutes in most of the states in which we have operations, which generally provide a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to such person. We carry liquor liability coverage as part of our existing comprehensive general liability insurance. A settlement or judgment against us under a “dram-shop” statute in excess of liability coverage could have a material adverse effect on our operations.

Various federal and state labor laws govern our operations and our relationship with employees, including such matters as minimum wages, breaks, overtime, fringe benefits, safety, working conditions and citizenship requirements. We are also subject to the regulations of the Immigration and Naturalization Service (INS). If our employees do not meet federal citizenship or residency requirements, this could lead to a disruption in our work force. Significant government-imposed increases in minimum wages, paid leaves of absence and mandated health benefits, or increased tax reporting, assessment or payment requirements related to employees who receive gratuities could be detrimental to our profitability.

Our facilities must comply with the applicable requirements of the Americans With Disabilities Act of 1990 (“ADA”) and related state statutes. The ADA prohibits discrimination on the basis of disability with

10

respect to public accommodations and employment. Under the ADA and related state laws, when constructing new restaurants or undertaking significant remodeling of existing restaurants, we must make them more readily accessible to disabled persons.

The New York State Liquor Authority must approve any transaction in which a shareholder of the licensee increases his holdings to 10% or more of the outstanding capital stock of the licensee and any transaction involving 10% or more of the outstanding capital stock of the licensee.

Seasonal Nature Of Business

Our business is highly seasonal. The second quarter of our fiscal year, consisting of the non-holiday portion of the cold weather season in New York and Washington (January, February and March), is the poorest performing quarter. We achieve our best results during the warm weather, attributable to our extensive outdoor dining availability, particularly at Bryant Park in New York and Sequoia in Washington, D.C. (our largest restaurants) and our outdoor cafes. However, even during summer months these facilities can be adversely affected by unusually cool or rainy weather conditions. Our facilities in Las Vegas generally operate on a more consistent basis through the year.

Terrorism and International Unrest

The terrorist attacks on the World Trade Center in New York and the Pentagon in Washington, D.C. on September 11, 2001 had a material adverse effect on our revenues. As a result of the attacks, one of our restaurants, The Grill Room, located at 2 World Financial Center, which is adjacent to the World Trade Center, experienced some damage. The Grill Room was closed from September 11, 2001 and reopened in early December 2002.

Our restaurants in New York, Las Vegas, Washington D.C. and Florida benefit from tourist traffic. Though the Las Vegas market has shown resiliency, the sluggish economy and the lingering effects of September 11, 2001 have had an adverse effect on our restaurants. Recovery depends upon a general improvement in economic conditions and the public’s willingness and inclination to resume vacation and convention travel. Additional acts of terrorism in the United States or substantial international unrest may have a material adverse effect on our business and revenues.

|

|

|

|

Item 1A. |

Risk Factors. |

The following are the most significant risk factors applicable to us:

RISKS RELATED TO OUR BUSINESS

The recent disruptions in the overall economy and the financial markets may adversely impact our business.

The restaurant industry has been affected by current economic factors, including the deterioration of national, regional and local economic conditions, declines in employment levels, and shifts in consumer spending patterns. The recent disruptions in the overall economy and volatility in the financial markets have reduced, and may continue to reduce, consumer confidence in the economy, negatively affecting consumer restaurant spending, which could be harmful to our financial position and results of operations. As a result, decreased cash flow generated from our business may adversely affect our financial position and our ability to fund our operations. In addition, macro economic disruptions, as well as the

11

restructuring of various commercial and investment banking organizations, could adversely affect our ability to access the credit markets. The disruption in the credit markets may also adversely affect the availability of financing for our expansions and operations, and could impact our vendors’ ability to meet supply requirements. There can be no assurance that government responses to the disruptions in the financial markets will restore consumer confidence, stabilize the markets, or increase liquidity and the availability of credit.

Failure of our restaurants to achieve expected results could have a negative impact on our revenues and performance results.

Performance results currently achieved by our restaurants may not be indicative of longer term performance or the potential market acceptance of restaurants in new locations. We cannot be assured that new restaurants that we open will have similar operating results as existing restaurants. New restaurants take several months to reach expected operating levels due to inefficiencies typically associated with new restaurants, including lack of market awareness, inability to hire sufficient staff and other factors. The failure of our existing or new restaurants to perform as predicted could negatively impact our revenues and results of operations.

Our unfamiliarity with new markets may present risks, which could have a material adverse effect on our future growth and profitability.

Due to higher operating costs caused by temporary inefficiencies typically associated with expanding into new regions and opening new restaurants, such as lack of market awareness and acceptance and limited availability of experienced staff, continued expansion may result in an increase in our operating costs. New markets may have different competitive conditions, consumer tastes and discretionary spending patterns than our existing markets, which may cause our restaurants in these new markets to be less successful than our restaurants in our existing markets. We cannot assure you that restaurants in new markets will be successful.

Our ability to open new restaurants efficiently is subject to a number of factors beyond our control, including:

|

|

|

|

|

-- Selection and availability of suitable restaurant sites; |

|

|

|

|

|

-- Negotiation of acceptable lease or purchase terms for such sites; |

|

|

|

|

|

-- Negotiation of reasonable construction contracts and adequate supervision of construction; |

|

|

|

|

|

-- Our ability to secure required governmental permits and approvals for both construction and operation; |

|

|

|

|

|

-- Availability of adequate capital; |

|

|

|

|

|

-- General economic conditions; and |

|

|

|

|

|

-- Adverse weather conditions. |

We may not be successful in addressing these factors, which could adversely affect our ability to open new restaurants on a timely basis, or at all. Delays in opening or failures to open new restaurants could cause our business, results of operations and financial condition to suffer.

Terrorism and war may have material adverse effect on our business.

Terrorist attacks, such as the attacks that occurred in New York and Washington, D.C. on September 11, 2001, and other acts of violence or war in the United States or abroad, may affect the markets in which we operate and our business, results of operations and financial conditions. The potential near-term and long-

12

term effects these events may have on our business operations, our customers, the markets in which we operate and the economy is uncertain. Because the consequences of any terrorist attacks, or any armed conflicts, are unpredictable, we may not be able to foresee events that could have an adverse effect on our markets or our business.

Increases in the minimum wage may have a material adverse effect on our business and financial results.

Many of our employees are subject to various minimum wage requirements. Many of our restaurants are located in states where the minimum wage was recently increased. There likely will be additional increases implemented in jurisdictions in which we operate or seek to operate. These minimum wage increases may have a material adverse effect on our business, financial condition, results of operations or cash flows.

Future changes in financial accounting standards may cause adverse unexpected operating results and affect our reported results of operations.

Changes in accounting standards can have a significant effect on our reported results and may affect our reporting of transactions completed before the change is effective. New pronouncements and varying interpretations of pronouncements have occurred and may occur in the future.

Changes to existing rules or differing interpretations with respect to our current practices may adversely affect our reported financial results.

Rising insurance costs could negatively impact profitability.

The cost of insurance (workers compensation insurance, general liability insurance, property insurance, health insurance and directors and officers liability insurance) has risen significantly over the past few years and is expected to continue to increase. These increases, as well as potential state legislation requirements for employers to provide health insurance to employees, could have a negative impact on our profitability if we are not able to negate the effect of such increases with plan modifications and cost control measures or by continuing to improve our operating efficiencies.

Compliance with existing and new regulations of corporate governance and public disclosure may result in additional expenses.

Compliance with changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002, new SEC regulations and NASDAQ Stock Market rules, has required an increased amount of management attention and external resources. We are committed to maintaining high standards of corporate governance and public disclosure. This investment required to comply with these changing regulations may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

Intense competition in the restaurant industry could prevent us from increasing or sustaining our revenues and profitability.

The restaurant industry is intensely competitive with respect to food quality, price-value relationships, ambiance, service and location, and many restaurants compete with us at each of our locations. There are a number of well-established competitors with substantially greater financial, marketing, personnel and

13

other resources than ours, and many of our competitors are well established in the markets where we have restaurants, or in which we intend to locate restaurants. Additionally, other companies may develop restaurants that operate with similar concepts.

Any inability to successfully compete with the other restaurants in our markets will prevent us from increasing or sustaining our revenues and profitability and result in a material adverse effect on our business, financial condition, results of operations or cash flows. We may also need to modify or refine elements of our restaurant system to evolve our concepts in order to compete with popular new restaurant formats or concepts that may develop in the future. We cannot assure you that we will be successful in implementing these modifications or that these modifications will not reduce our profitability.

Our profitability is dependent in large measure on food, beverage and supply costs which are not within our control.

Our profitability is dependent in large measure on our ability to anticipate and react to changes in food, beverage and supply costs. Various factors beyond our control, including climatic changes and government regulations, may affect food and beverage costs. Specifically, our dependence on frequent, timely deliveries of fresh beef, poultry, seafood and produce subjects us to the risks of possible shortages or interruptions in supply caused by adverse weather or other conditions, which could adversely affect the availability and cost of any such items. We cannot assure you that we will be able to anticipate or react to increasing food and supply costs in the future. The failure to react to these increases could materially and adversely affect our business, results of operations and financial condition.

The restaurant industry is affected by changes in consumer preferences and discretionary spending patterns that could result in a reduction in our revenues.

Consumer preferences could be affected by health concerns or by specific events such as the outbreak of or scare caused by “mad cow disease”, the popularity of the Atkins diet and the South Beach diet and changes in consumer preferences, such as “carb consciousness”. If we were to have to modify our restaurants’ menus, we may lose customers who would be less satisfied with a modified menu, and we may not be able to attract a new customer base to generate the necessary revenues to maintain our income from restaurant operations. A change in our menus may also result in us having different competitors. We may not be able to successfully compete against established competitors in the general restaurant market. Our success also depends on various factors affecting discretionary consumer spending, including economic conditions, disposable consumer income, consumer confidence and the United States participation in military activities. Adverse changes in these factors could reduce our customer base and spending patterns, either of which could reduce our revenues and results of operations.

Our geographic concentrations could have a material adverse effect on our business, results of operations and financial condition.

We currently operate in seven regions, New York City, Washington, D.C., Las Vegas, Nevada, Tampa and Hollywood, Florida, Atlantic City, New Jersey, Ledyard, Connecticut, and Boston, Massachusetts and our Las Vegas, Florida, Atlantic City, and Connecticut operations are all located in casinos. As a result, we are particularly susceptible to adverse trends and economic conditions in these markets, including its labor market, and the casino market in general, which could have a negative impact on our profitability as a whole. In addition, given our geographic concentration, negative publicity regarding any of our restaurants could have a material adverse effect on our business, results of operations and financial condition, as could other regional occurrences such as acts of terrorism, local strikes, natural disasters or changes in laws or regulations.

14

Our operating results may fluctuate significantly due to seasonality and other factors beyond our control.

Our business is subject to seasonal fluctuations, which may vary greatly depending upon the region of the United States in which a particular restaurant is located. In addition to seasonality, our quarterly and annual operating results and comparable unit sales may fluctuate significantly as a result of a variety of factors, including:

|

|

|

|

|

-- The amount of sales contributed by new and existing restaurants; |

|

|

|

|

|

-- The timing of new openings; |

|

|

|

|

|

-- Increases in the cost of key food or beverage products; |

|

|

|

|

|

-- Labor costs for our personnel; |

|

|

|

|

|

-- Our ability to achieve and sustain profitability on a quarterly or annual basis; |

|

|

|

|

|

-- Adverse weather; |

|

|

|

|

|

-- Consumer confidence and changes in consumer preferences; |

|

|

|

|

|

-- Health concerns, including adverse publicity concerning food-related illness; |

|

|

|

|

|

-- The level of competition from existing or new competitors; |

|

|

|

|

|

-- Economic conditions generally and in each of the market in which we are located; and |

|

|

|

|

|

-- Acceptance of a new or modified concept in each of the new markets in which we could be located. |

These fluctuations make it difficult for us to predict and address in a timely manner factors that may have a negative impact on our business, results of operations and financial condition.

Any expansion may strain our infrastructure, which could slow restaurant development.

Any expansion may place a strain on our management systems, financial controls, and information systems. To manage growth effectively, we must maintain the high level of quality and service at our existing and future restaurants. We must also continue to enhance our operational, information, financial and management systems and locate, hire, train and retain qualified personnel, particularly restaurant managers. We cannot predict whether we will be able to respond on a timely basis to all of the changing demands that any expansion will impose on management and those systems and controls. If we are not able to effectively manage any one or more of these or other aspects of expansion, our business, results of operations and financial condition could be materially adversely affected.

Our inability to retain key personnel could negatively impact our business.

Our success will continue to be highly dependent on our key operating officers and employees. We must continue to attract, retain and motivate a sufficient number of qualified management and operating personnel, including general managers and chefs. The ability of these key personnel to maintain consistency in the quality and atmosphere of our restaurants is a critical factor in our success. Any failure to do so may harm our reputation and result in a loss of business.

We could face labor shortages, increased labor costs and other adverse effects of varying labor conditions.

The development and success of our restaurants depend, in large part, on the efforts, abilities, experience and reputations of the general managers and chefs at such restaurants. In addition, our success depends in part upon our ability to attract, motivate and retain a sufficient number of qualified employees, including restaurant managers, kitchen staff and wait staff. Qualified individuals needed to fill these positions are in short supply and the inability to recruit and retain such individuals may delay the planned openings of

15

new restaurants or result in high employee turnover in existing restaurants. A significant delay in finding qualified employees or high turnover of existing employees could materially and adversely affect our business, results of operations and financial condition. Also, competition for qualified employees could require us to pay higher wages to attract sufficient qualified employees, which could result in higher, labor costs. In addition, increases in the minimum hourly wage, employment tax rates and levies, related benefits costs, including health insurance, and similar matters over which we have no control may increase our operating costs.

Unanticipated costs or delays in the development or construction of future restaurants could prevent our timely and cost-effective opening of new restaurants.

We depend on contractors and real estate developers to construct our restaurants. Many factors may adversely affect the cost and time associated with the development and construction of our restaurants, including:

|

|

|

|

|

-- Labor disputes; |

|

|

|

|

|

-- Shortages of materials or skilled labor; |

|

|

|

|

|

-- Adverse weather conditions; |

|

|

|

|

|

-- Unforeseen engineering problems; |

|

|

|

|

|

-- Environmental problems; |

|

|

|

|

|

-- Construction or zoning problems; |

|

|

|

|

|

-- Local government regulations; |

|

|

|

|

|

-- Modifications in design; and |

|

|

|

|

|

-- Other unanticipated increases in costs. |

Any of these factors could give rise to delays or cost overruns, which may prevent us from developing additional restaurants within our anticipated budgets or time periods or at all. Any such failure could cause our business, results of operations and financial condition to suffer.

We may not be able to obtain and maintain necessary federal, state and local permits which could delay or prevent the opening of future restaurants.

Our business is subject to extensive federal, state and local government regulations, including regulations relating to:

|

|

|

|

|

-- Alcoholic beverage control; |

|

|

|

|

|

-- The purchase, preparation and sale of food; |

|

|

|

|

|

-- Public health and safety; |

|

|

|

|

|

-- Sanitation, building, zoning and fire codes; and |

|

|

|

|

|

-- Employment and related tax matters. |

All of these regulations impact not only our current operations but also our ability to open future restaurants. We will be required to comply with applicable state and local regulations in new locations into which we expand. Any difficulties, delays or failures in obtaining licenses, permits or approvals in such new locations could delay or prevent the opening of a restaurant in a particular area or reduce operations at an existing location, either of which would materially and adversely affect our business, results of operations and financial condition.

16

The restaurant industry is affected by litigation and publicity concerning food quality, health and other issues, which can cause guests to avoid our restaurants and result in liabilities.

Health concerns, including adverse publicity concerning food-related illness, although not specifically related to our restaurants, could cause guests to avoid our restaurants, which would have a negative impact on our sales. We may also be the subject of complaints or litigation from guests alleging food-related illness, injuries suffered on the premises or other food quality, health or operational concerns. A lawsuit or claim could result in an adverse decision against us that could have a material adverse effect on our business and results of operations. We may also be subject to litigation which, regardless of the outcome, could result in adverse publicity. Adverse publicity resulting from such allegations may materially adversely affect us and our restaurants, regardless of whether such allegations are true or whether we are ultimately held liable. Such litigation, adverse publicity or damages could have a material adverse effect on our competitive position, business, results of operations and financial condition and results of operations.

Many of our operations are located in casinos and much of our success will be dependent on the success of those casinos.

The success of the business of our restaurants located in Las Vegas, Nevada, Atlantic City, New Jersey, Tampa and Hollywood, Florida, and Ledyard, Connecticut will be substantially dependent on the success of the casinos in which the company operates in these locations to attract customers for themselves and for our restaurants. The successful operation of the casinos in these locations is subject to various risks and uncertainties including:

|

|

|

|

|

|

-- |

The risk associated with governmental approvals of gaming; |

|

|

|

|

|

|

-- |

The risk of a change in laws regulating gaming operations; |

|

|

|

|

|

|

-- |

Operating in a limited market; |

|

|

|

|

|

|

-- |

Competitive risks relating to casino operations; and |

|

|

|

|

|

|

-- |

Risks of terrorism and war. |

RISKS RELATED TO OUR COMMON STOCK

The fact that a relatively small number of investors hold our publicly traded common stock could cause our stock price to fluctuate.

The market price of our common stock could fluctuate as a result of sales by our existing stockholders of a large number of shares of our common stock in the market or the perception that such sales could occur. A large number of shares of our common stock is concentrated in the hands of a small number of individual and institutional investors and is thinly traded. An attempt to sell by a large holder could adversely affect the price of our stock.

Ownership of a substantial majority of our outstanding common stock by a limited number of stockholders will limit your ability to influence corporate matters.

A substantial majority of our capital stock is held by a limited number of stockholders. Accordingly, such stockholders will likely have a strong influence on major decisions of corporate policy, and the outcome of any major transaction or other matters submitted to our stockholders or board of directors, including potential mergers or acquisitions, and amendments to our Amended and Restated Certificate of

17

Incorporation. Stockholders other than these principal stockholders are therefore likely to have little influence on decisions regarding such matters.

The price of our common stock may fluctuate significantly.

The price at which our common stock will trade may fluctuate significantly. The stock market has from time to time experienced significant price and volume fluctuations. The trading price of our common stock could be subject to wide fluctuations in response to a number of factors, including:

|

|

|

|

|

-- Fluctuations in quarterly or annual results of operations; |

|

|

|

|

|

-- Changes in published earnings estimates by analysts and whether our actual earnings meet or exceed such estimates; |

|

|

|

|

|

-- Additions or departures of key personnel; and |

|

|

|

|

|

-- Changes in overall stock market conditions, including the stock prices of other restaurant companies. |

In the past, companies that have experienced extreme fluctuations in the market price of their stock have been the subject of securities class action litigation. If we were to be subject to such litigation, it could result in substantial costs and a diversion of our management’s attention and resources, which may have a material adverse effect on our business, results of operations, and financial condition.

|

|

|

|

Item 1B. |

Unresolved Staff Comments. |

Not applicable.

|

|

|

|

Item 2. |

Properties |

Our restaurant facilities and our executive offices are occupied under leases. Most of our restaurant leases provide for the payment of base rents plus real estate taxes, insurance and other expenses and, in certain instances, for the payment of a percentage of our sales at such facility. As of October 3, 2009, these leases (including leases for managed restaurants) have terms (including any available renewal options) expiring as follows:

|

|

|

|

|

Years Lease |

|

Number of |

|

|

|

|

|

2009-2010 |

|

2 |

|

2011-2015 |

|

5 |

|

2016-2020 |

|

8 |

|

2021-2025 |

|

2 |

|

2026-2030 |

|

6 |

|

2031-2035 |

|

1 |

Our executive, administrative and clerical offices are located in approximately 8,500 square feet of office space at 85 Fifth Avenue, New York, New York. Our lease for this office space expires in 2015.

Our lease for office space related to our Washington, D.C. catering operations expires in 2012.

For information concerning our future minimum rental commitments under non-cancelable operating leases, see Note 10 of the Consolidated Financial Statements.

18

See also “Item 1. Business – Overview” for a list of restaurant properties.

|

|

|

|

Item 3. |

Legal Proceedings |

In the ordinary course of our business, we are a party to various lawsuits arising from accidents at our restaurants and workers’ compensation claims, which are generally handled by our insurance carriers.

Our employment of management personnel, waiters, waitresses and kitchen staff at a number of different restaurants has resulted in the institution, from time to time, of litigation alleging violation by us of employment discrimination laws. We do not believe that any of such suits will have a materially adverse effect upon us, our financial condition or operations.

|

|

|

|

Item 4. |

Submission of Matters to a Vote of Security Holders |

There were no matters submitted to a vote of security holders during the fourth quarter.

Executive Officers of the Registrant

The following table sets forth the names and ages of our executive officers and all offices held by each person:

|

|

|

|

|

|

|

|

|

Name |

|

Age |

|

Positions and Offices |

|

|

|

|

|

|

|

|

|

Michael Weinstein |

|

66 |

|

Chairman and

Chief Executive |

|

|

Vincent Pascal |

|

66 |

|

Senior Vice President |

|

|

Robert Towers |

|

62 |

|

President,

Chief Operating Officer |

|

|

Paul Gordon |

|

58 |

|

Senior Vice President |

|

|

Robert Stewart |

|

53 |

|

Chief Financial Officer |

Each of our executive officers serves at the pleasure of the Board of Directors and until his successor is duly elected and qualifies.

Michael Weinstein has been our Chief Executive Officer and a director since our inception in January 1983. During the past five years, Mr. Weinstein has been an officer, director and 25% shareholder of Easy Diners, Inc., RSWB Corp. and BSWR Corp. (since 1998). Mr. Weinstein is the owner of 24% of the membership interests in each of Dockeast, LLC and Dockwest, LLC. These companies operate four restaurants in New York City, and none of these companies is a parent, subsidiary or other affiliate of us. Mr. Weinstein spends substantially all of his business time on Company-related matters.

Vincent Pascal was elected our Vice President, Assistant Secretary and a director in October 1985. Mr. Pascal became a Senior Vice President in 2001.

Robert Towers has been employed by us since November 1983 and was elected Vice President, Treasurer and a director in March 1987. Mr. Towers became an Executive Vice President and Chief Operating Officer in 2001 and was elected President in 2007.

Paul Gordon has been employed by us since 1983 and was elected as a director in November 1996 and a Senior Vice President in 2001. Mr. Gordon is the manager of our Las Vegas operations. Prior to

19

assuming that role in 1996, Mr. Gordon was the manager of our operations in Washington, D.C. since 1989.

Robert Stewart has been employed by us since June 2002 and was elected Chief Financial Officer effective as of June 24, 2002. For the three years prior to joining us, Mr. Stewart was a Chief Financial Officer and Executive Vice President at Fortis Capital Holdings. For eleven years prior to joining Fortis Capital Holdings, Mr. Stewart held senior financial and audit positions in Skandinaviska Enskilda Banken in their New York, London and Stockholm offices.

20

PART II

|

|

|

|

Item 5. |

Market For The Registrant’s Common Equity, Related Stockholder Matters and Issuer |

Market for Our Common Stock

Our Common Stock, $.01 par value, is traded in the over-the-counter market on the Nasdaq National Market under the symbol “ARKR.” The high and low sale prices for our Common Stock from September 29, 2007 through October 3, 2009 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar 2007 |

|

High |

|

Low |

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

|

Fourth Quarter |

|

$ |

37.00 |

|

|

$ |

34.42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar 2008 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

37.32 |

|

|

|

29.10 |

|

|

|

|

Second Quarter |

|

|

29.00 |

|

|

|

25.13 |

|

|

|

|

Third Quarter |

|

|

26.25 |

|

|

|

18.03 |

|

|

|

|

Fourth Quarter |

|

|

17.03 |

|

|

|

8.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter |

|

|

12.20 |

|

|

|

8.91 |

|

|

|

|

Second Quarter |

|

|

14.09 |

|

|

|

9.30 |

|

|

|

|

Third Quarter |

|

|

18.94 |

|

|

|

12.05 |

|

|

Dividend Policy

A quarterly cash dividend in the amount of $0.44 per share was declared on October 12, 2007 and January 11, April 11, July 11 and October 10, 2008. On September 16, 2009, our Board of Directors declared a special cash dividend in the amount of $1.00 per share. On December 1, 2009, our Board of Directors declared a quarterly cash dividend in the amount of $0.25 per share. We intend to continue to pay such quarterly cash dividend for the foreseeable future, however, the payment of future dividends is at the discretion of our Board of Directors and is based on future earnings, cash flow, financial condition, capital requirements, changes in U.S. taxation and other relevant factors.

Issuer Purchases of Equity Securities

The following table sets forth information regarding purchases of our common stock by us and any affiliated purchasers during the three months ended October 3, 2009. Stock repurchases may be made in the open market or in private transactions at times and in amounts that we deem appropriate. However, there is no guarantee as to the exact number of additional shares that may be repurchased, and we may terminate or limit the stock repurchase program at any time prior to its expiration. We will cancel the repurchased shares.

21

|

|

|

|

|

|

|

|

|

|

|

|

Period |

|

(a) Total |

|

(b) |

|

(c) Total Number |

|

(d) Maximum Number |

|

|

Month #1 |

|

|

|

|

|

|

|

|

|

|

June 28, 2009 |

|

|

|

|

|

|

|

|

|

|

through |

|

0 |

|

Not Applicable |

|

0 |

|

393,046 |

|

|

July 28, 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month #2 |

|

|

|

|

|

|

|

|

|

|

July 29, 2009 |

|

|

|

|

|

|

|

|

|

|

through |

|

0 |

|

Not Applicable |

|

0 |

|

393,046 |

|

|

August 28, 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month #3 |

|

|

|

|

|

|

|

|

|

|

August 29, 2009 |

|

|

|

|

|

|

|

|

|

|

through |

|

0 |

|

Not Applicable |

|

0 |

|

393,046 |

|

|

October 3, 2009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

0 |

|

Not Applicable |

|

0 |

|

393,046 |

|

(1) On March 25, 2008, our Board of Directors authorized a stock repurchase program under which up to 500,000 shares of our common stock may be acquired in the open market over the two years following such authorization at our discretion. In periods prior to the fourth fiscal quarter of 2009 we purchased an aggregate 106,954 shares of our common stock.

Securities Authorized for Issuance Under Equity Compensation Plans

The following is a summary of the securities issued and authorized for issuance under our 2004 Stock Option Plan at October 3, 2009:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan Category |

|

|

(a) Number of |

|

|

(b) Weighted - |

|

|

(c) Number of securities |

|

||

|

Equity compensation plans approved by |

|

|

|

422,100 |

|

|

$22.86 |

|

|

|

400 |

|

|

Equity compensation plans not approved by |

|

|

|

None |

|

|

N/A |

|

|

|

None |

|

|

Total |

|

|

|

422,100 |

|

|

$22.86 |

|

|

|

400 |

|

Of the 422,100 options outstanding on October 3, 2009, 300,500 were held by the Company’s officers and directors.

|

|

|

|

(1) |

The 2004 Stock Option Plan, which was approved by shareholders, is the Company’s only equity compensation plan currently in effect. |

|

|

|

|

(2) |

The Company has no equity compensation plan that was not approved by shareholders. |

22

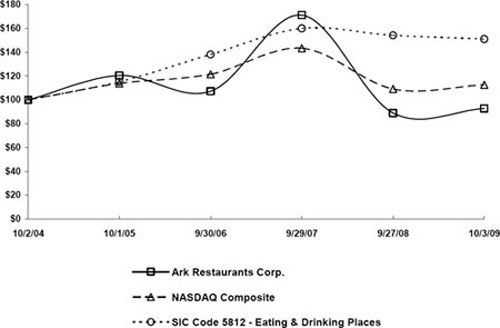

Stock Performance Graph

The graph set forth below compares the yearly percentage change in cumulative total shareholder return on the Company’s Common Stock for the five-year period commencing October 2, 2004 and ending October 3, 2009 against the cumulative total return on the NASDAQ Market Index and a peer group comprised of those public companies whose business activities fall within the same standard industrial classification code as the Company. This graph assumes a $100 investment in the Company’s Common Stock and in each index on October 2, 2004 and that all dividends paid by companies included in each index were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL

RETURN*

Among Ark Restaurants Corp., The NASDAQ Composite Index

And SIC Code 5812 - Eating & Drinking Places

|

|

|

|

|

*$100 invested on 10/2/04 in

stock or 9/30/09 in index, including reinvestment of dividends. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative Total Return |

||||||||||

|

|

|

|||||||||||

|

|

|

10/2/04 |

|

10/1/05 |

|

9/30/06 |

|

9/29/07 |

|

9/27/08 |

|

10/3/09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ark Restaurants Corp. |

|

100.00 |

|

120.46 |

|

107.31 |

|

171.06 |

|

89.04 |

|

92.78 |

|

NASDAQ Composite |

|

100.00 |

|

113.78 |

|

121.50 |

|

143.37 |

|

109.15 |

|

112.55 |

|

SIC Code 5812 - Eating & Drinking Places |

|

100.00 |

|

115.24 |

|

138.10 |

|

159.96 |

|

154.17 |

|

151.03 |

23

|

|

|

|

Item 6. |

Selected Consolidated Financial Data |

Not applicable.

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Accounting period

Our fiscal year ends on the Saturday nearest September 30. We report fiscal years under a 52/53-week format. This reporting method is used by many companies in the hospitality industry and is meant to improve year-to-year comparisons of operating results. Under this method, certain years will contain 53 weeks. The fiscal year ended September 27, 2008 included 52 weeks and the fiscal year ended October 3, 2009 included 53 weeks.

Revenues

Total revenues decreased by 8.3% from fiscal 2008 to fiscal 2009.