Attached files

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

[Mark

One]

|

x

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

For

the quarterly period ended September 30, 2009

OR

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES

EXCHANGE ACT OF 1934

|

For

the transition period from ____________ to ____________

Commission

File Number: 333-152760 (1933 Act)

United

Development Funding IV

(Exact

Name of Registrant as Specified in Its Charter)

|

Maryland

|

26-2775282

|

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

1301

Municipal Way, Suite 100, Grapevine, Texas 76051

(Address

of principal executive offices)

(Zip

Code)

Registrant’s

telephone number, including area code: (214) 370-8960

N/A

(Former

name, former address and former fiscal year, if changed since last

report)

Indicate by check mark whether the

Registrant: (1) has filed all reports required to be filed by Section

13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the Registrant was required to file such

reports) and (2) has been subject to such filing requirements for the past 90

days. Yes o No

x

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes o No o

Indicate

by check mark whether the Registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

Large

accelerated filer o Accelerated

filer o

Non-accelerated

filer x (Do not

check if a smaller reporting

company) Smaller

reporting company o

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes o No

x

The

number of shares outstanding of the Registrant’s shares of beneficial interest,

par value $0.01 per share, as of the close of business on December 18, 2009 was

59,610.

UNITED

DEVELOPMENT FUNDING IV

FORM

10-Q

Quarter

Ended September 30, 2009

PART

I

FINANCIAL

INFORMATION

|

Item

1.

|

Financial

Statements.

|

|

|

Balance

Sheets as of September 30, 2009 (Unaudited) and December 31, 2008

(Audited)

|

3

|

|

|

Statements

of Operations for the three months ended September 30, 2009 and 2008 and

the nine months ended September 30, 2009 and for the period from May 28,

2008 (Inception) through September 30, 2008 (Unaudited)

|

4

|

|

|

Statements

of Cash Flows for the nine months ended September 30, 2009 and for the

period from May 28, 2008 (Inception) through September 30, 2008

(Unaudited)

|

5

|

|

|

Notes

to Financial Statements (Unaudited)

|

6

|

|

|

Item

2.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

11

|

|

Item

3.

|

Quantitative

and Qualitative Disclosures About Market Risk.

|

21

|

|

Item

4T.

|

Controls

and Procedures.

|

22

|

PART

II

OTHER

INFORMATION

|

Item

1.

|

Legal

Proceedings.

|

23

|

|

Item

1A.

|

Risk

Factors.

|

23

|

|

Item

2.

|

Unregistered

Sales of Equity Securities and Use of Proceeds.

|

23

|

|

Item

3.

|

Defaults

Upon Senior Securities

|

23

|

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders.

|

23

|

|

Item

5.

|

Other

Information.

|

23

|

|

Item

6.

|

Exhibits.

|

23

|

|

Signatures.

|

24

|

|

2

PART

I

FINANCIAL

INFORMATION

UNITED DEVELOPMENT FUNDING

IV

|

September

30, 2009 (Unaudited)

|

December

31, 2008 (Audited)

|

|||||||

|

Assets:

|

||||||||

|

Cash

and cash equivalents

|

$ | 78,942 | $ | 23,629 | ||||

|

Deferred

offering costs

|

4,889,646 | 1,455,788 | ||||||

|

Total

assets

|

$ | 4,968,588 | $ | 1,479,417 | ||||

|

Liabilities

and Shareholder’s Equity

|

||||||||

|

Liabilities:

|

||||||||

|

Accrued

liabilities – related party

|

$ | 4,768,264 | $ | 1,279,038 | ||||

|

Total

liabilities

|

4,768,264 | 1,279,038 | ||||||

|

Commitments

and contingencies

|

||||||||

|

Shareholder’s

Equity:

|

||||||||

|

Shares

of beneficial interest; $.01 par value; 400,000,000 shares

authorized; 10,000 issued and outstanding

|

100 | 100 | ||||||

|

Additional

paid-in-capital

|

199,900 | 199,900 | ||||||

|

Retained

earnings

|

324 | 379 | ||||||

|

Total

shareholder’s equity

|

200,324 | 200,379 | ||||||

|

Total

liabilities and shareholder’s equity

|

$ | 4,968,588 | $ | 1,479,417 | ||||

See

accompanying notes to financial statements (unaudited).

3

UNITED DEVELOPMENT FUNDING

IV

(Unaudited)

|

Period

from

|

||||||||||||||||

|

May

28, 2008

|

||||||||||||||||

|

Nine

Months

|

(Inception)

|

|||||||||||||||

|

Three

Months Ended

|

Ended

|

Through

|

||||||||||||||

|

September

30,

|

September

30,

|

September

30,

|

||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

|||||||||||||

|

Revenues:

|

||||||||||||||||

|

Interest

income

|

$ | 5 | $ | 619 | $ | 28 | $ | 619 | ||||||||

|

Total

revenues

|

5 | 619 | 28 | 619 | ||||||||||||

|

Expenses:

|

||||||||||||||||

|

General

and administrative

|

67 | 240 | 83 | 240 | ||||||||||||

|

Total

expenses

|

67 | 240 | 83 | 240 | ||||||||||||

|

Net

income (loss)

|

$ | (62 | ) | $ | 379 | $ | (55 | ) | $ | 379 | ||||||

See

accompanying notes to financial statements (unaudited).

4

(Unaudited)

|

Period

from

|

||||||||

|

May

28, 2008

|

||||||||

|

Nine

Months

|

(Inception)

|

|||||||

|

Ended

|

Through

|

|||||||

|

September

30,

|

September

30,

|

|||||||

|

2009

|

2008

|

|||||||

|

Operating

Activities

|

||||||||

|

Net

income (loss)

|

$ | (55 | ) | $ | 379 | |||

|

Net

cash provided by (used in) operating activities

|

(55 | ) | 379 | |||||

|

Financing

Activities

|

||||||||

|

Proceeds

from issuance of shares of beneficial interest

|

- | 200,000 | ||||||

|

Deferred

offering costs

|

(3,433,858 | ) | (1,142,137 | ) | ||||

|

Accrued

liabilities – related party

|

3,489,226 | 966,887 | ||||||

|

Net

cash provided by financing activities

|

55,368 | 24,750 | ||||||

|

Net

increase in cash and cash equivalents

|

55,313 | 25,129 | ||||||

|

Cash

and cash equivalents at beginning of period

|

23,629 | - | ||||||

|

Cash

and cash equivalents at end of period

|

$ | 78,942 | $ | 25,129 | ||||

See accompanying notes to financial statements

(unaudited).

5

UNITED

DEVELOPMENT FUNDING IV

(Unaudited)

A. Nature of

Business

United

Development Funding IV (which may be referred to as the “Trust,” “we,” “our,” or

“UDF IV”) was organized on May 28, 2008 (“Inception”) as a Maryland real estate

investment trust that intends to qualify as a real estate investment trust (a

“REIT”) under federal income tax laws. The Trust is the sole general

partner of and owns a 99.999% partnership interest in United Development Funding

IV Operating Partnership, L.P. (“UDF IV OP”), a Delaware limited

partnership. UMTH Land Development, L.P. (“UMTH LD”), a Delaware

limited partnership and the affiliated asset manager of the Trust, is the sole

limited partner and owner of 0.001% (minority interest) of the partnership

interests in UDF IV OP. At September 30, 2009 and December 31, 2008,

UDF IV OP had no assets, liabilities or equity. The Trust has filed a

registration statement on Form S-11 with the Securities and Exchange Commission

(“Registration Statement”) with respect to a public offering (the “Offering”) of

35,000,000 common shares of beneficial interest.

A maximum

of 25,000,000 shares may be sold to the public. In addition, the

Trust plans to register an additional 10,000,000 shares that will be available

only to shareholders who elect to participate in the Trust’s distribution

reinvestment plan (“DRIP”) under which the Trust’s shareholders may elect to

have their distributions reinvested in additional common shares of beneficial

interest of the Trust at $20.00 per share. The Trust reserves the

right to reallocate the shares being offered between the primary offering and

the DRIP.

The Trust

intends to use substantially all of the net proceeds from the Offering to

originate, purchase, participate in and hold for investment secured loans made

directly by the Trust or indirectly through its affiliates to persons and

entities for the acquisition and development of parcels of real property as

single-family residential lots, and the construction of model and new

single-family homes, including development of mixed-use master planned

residential communities. The Trust also intends to make direct investments in

land for development into single-family lots, new and model homes and portfolios

of finished lots and homes; provide credit enhancements to real estate

developers, home builders, land bankers and other real estate investors; and

purchase participations in, or finance for other real estate investors the

purchase of, securitized real estate loan pools and discounted cash flows

secured by state, county, municipal or other similar assessments levied on real

property. The Trust also may enter into joint ventures with unaffiliated real

estate developers, home builders, land bankers and other real estate investors,

or with other United Development Funding-sponsored programs, to originate or

acquire, as the case may be, the same kind of secured loans or real estate

investments the Trust may originate or acquire directly.

UMTH General

Services, L.P., a Delaware limited partnership (“UMTH GS” or “Advisor”), is the

Trust’s advisor and is responsible for managing the Trust’s affairs on a

day-to-day basis. UMTH GS has engaged UMTH LD as the Trust’s asset

manager. The asset manager will oversee the investing and financing

activities of the affiliated programs managed and advised by the Advisor and

UMTH LD as well as oversee and provide the Trust’s board of trustees

recommendations regarding investments and finance transactions, management,

policies and guidelines and will review investment transaction structure and

terms, investment underwriting, investment collateral, investment performance,

investment risk management, and the Trust’s capital structure at both the entity

and asset level.

The Trust

is in the development stage and has not begun its principal operations as of

September 30, 2009. The Trust has no employees. The

Trust’s offices are located in Grapevine, Texas.

B. Basis of

Presentation

The

accompanying unaudited financial statements were prepared in accordance with

accounting principles generally accepted in the United States of America for

interim financial information, with the instructions to Form 10-Q and with

Regulation S-X. They do not include all information and footnotes

required by accounting principles generally accepted in the United States of

America for complete financial statements. However, except as

disclosed herein, there has been no material change to the information disclosed

in our Registration Statement. The interim unaudited financial

statements should be read in conjunction with those filed financial

statements. In the opinion of management, the accompanying unaudited

financial statements include all adjustments, consisting solely of normal

recurring adjustments, considered necessary to present fairly our financial

position as of September 30, 2009, operating results for the three months ended

September 30, 2009 and 2008, the nine months ended September 30, 2009 and the

period from Inception through September 30, 2008 and cash flows for the nine

months ended September 30, 2009 and the period from Inception through September

30, 2008. Operating results and cash flows for the nine months ended

September 30, 2009 are not necessarily indicative of the results that may be

expected for the year ending December 31, 2009.

6

Organization

and Offering Expenses

Organization

costs will be expensed as incurred in accordance with Statement of Position

98-5, Reporting on the Costs

of Start-up Activities, currently within the scope of Accounting

Standards Code (“ASC”) 720-15. Offering costs related to raising

capital from debt will be capitalized and amortized over the term of such debt.

Offering costs related to raising capital from equity will be offset as a

reduction of capital raised in shareholder’s equity.

Income

Taxes

The Trust

intends to make an election to be taxed as a REIT under Sections 856

through 860 of the Internal Revenue Code of 1986, as amended, commencing with

its taxable year ending December 31, 2009, or the first year in which the

Trust commences material operations. If the Trust qualifies for taxation as a

REIT, the Trust generally will not be subject to federal corporate income tax to

the extent it distributes its REIT taxable income to its shareholders, so long

as it distributes at least 90% of its REIT taxable income. REITs are subject to

a number of other organizational and operational requirements. Even if the Trust

qualifies for taxation as a REIT, it may be subject to certain state and local

taxes on its income and property, and federal income and excise taxes on its

undistributed income.

Impact

of Recently Issued Accounting Standards

In

February 2007, the Financial Accounting Standards Board (“FASB”) issued

Statement of Financial Accounting Standards (“SFAS”) No. 159, The Fair Value Option for Financial

Assets and Financial Liabilities Including an Amendment of FASB Statement No.

115, currently within the scope of ASC 825-10. ASC 825-10

permits entities to choose to measure eligible financial instruments at fair

value at specified election dates. The entity will report unrealized

gains and losses on the items on which it has elected the fair value option in

earnings. The Trust’s adoption of this guidance did not have a

material impact on the Trust’s results of operations or financial

condition.

In

December 2007, the FASB issued SFAS 141 (revised 2007) “Business Combinations,”

currently within the scope of ASC 805-10. ASC 805-10 modifies the accounting and

disclosure requirements for business combinations and broadens the scope of the

previous standard to apply to all transactions in which one entity obtains

control over another business. In addition, it establishes new accounting and

reporting standards for non-controlling interests in

subsidiaries. The Trust’s adoption of this guidance on January 1,

2009 has not had a material impact on the Trust’s financial condition or results

of operations.

In

February 2008, the FASB issued FASB Staff Position FSP 157-2, “Effective Date of FASB Statement No. 157,” currently

within the scope of ASC 820-10. The effective date of ASC 820-10 for all

nonfinancial assets and nonfinancial liabilities, except for items recognized or

disclosed at fair value in the financial statements on a recurring basis (at

least annually), was delayed until the beginning of the first quarter 2009.

Application of ASC 820-10 did not have a material impact on the Trust’s results

of operations and financial condition upon adoption on January 1,

2009.

In April 2009, the FASB issued FASB

Staff Position No. FAS 107-1 and APB 28-1, “Interim Disclosures about Fair Value

of Financial Instruments,” currently within the scope of ASC

825-10. ASC 825-10 requires disclosures about the fair value of

financial instruments whenever a public company issues financial information for

interim reporting periods. ASC 825-10 is effective for interim

reporting periods ending after June 15, 2009. The Trust adopted this

staff position upon its issuance, and it had no material impact on its financial

statements. See note G – “Fair Value Measurements” for these

disclosures.

7

In May

2009, the FASB issued SFAS 165, “Subsequent Events,” currently

within the scope of ASC 855-10. ASC 855-10 establishes general standards of

accounting for and disclosure of events that occur after the balance sheet date

but before financial statements are issued or are available to be issued. This

guidance is effective for interim or annual financial periods ending after

June 15, 2009, and the Trust adopted this guidance during the three months

ended June 30, 2009. The Trust’s adoption of this guidance did not have a

material impact on its financial statements.

In June

2009, the FASB issued SFAS 168, “The FASB Accounting Standards

Codification and the Hierarchy of Generally Accepted Accounting Principles,”

currently within the scope of ASC 105-10. ASC 105-10 identifies the ASC

as the authoritative source of generally accepted accounting principles (“GAAP”)

in the United States. The ASC did not change GAAP but reorganizes the

literature. Rules and interpretive releases of the Securities and

Exchange Commission under federal securities laws are also sources of

authoritative GAAP for Securities and Exchange Commission registrants. This

guidance is effective for financial

statements issued for interim and annual periods ending after September 15, 2009

and the Trust adopted the provisions of this guidance as of September 30,

2009. The Trust’s adoption of this guidance did not have a material

impact on its financial statements.

C. Shareholder’s

Equity

From

inception until July 31, 2008, the Trust was authorized to issue 1,000

common shares of beneficial interest, par value $.01 per share. On June 13,

2008, the Trust sold 1,000 common shares of beneficial interest at $200 per

share to the parent of the Advisor, UMT Holdings, L.P. (“UMTH”), a Delaware

limited partnership. On August 1, 2008, the Trust filed Articles of

Amendment and Restatement with the Department of Assessments and Taxation of the

State of Maryland, which increased to 400,000,000 the number of shares

authorized for issuance. Effective as of August 1, 2008, the Trust effected

a 10-for-1 split of its common shares of beneficial interest, whereby every

common share of beneficial interest was converted and reclassified into 10

common shares of beneficial interest, resulting in UMTH holding 10,000 common

shares of beneficial interest. The increase in the number of authorized shares

and the 10-for-1 split have been retroactively reflected in these financial

statements of the Trust.

D. Deferred

Offering Costs

Various

parties will receive compensation as a result of the Offering, including the

Advisor, affiliates of the Advisor, the dealer manager and soliciting dealers.

The Advisor funds organization and offering costs on the Trust’s behalf and will

be paid by the Trust for such costs in an amount equal to 3% of the gross

offering proceeds raised by the Trust in the Offering less any offering costs

paid by the Trust directly (except that no organization and offering expenses

will be reimbursed with respect to sales under the DRIP). Payments to the dealer

manager include selling commissions (6.5% of gross offering proceeds, except

that no commissions will be paid with respect to sales under the DRIP) and

dealer manager fees (up to 3.5% of gross offering proceeds, except that no

dealer manager fees will be paid with respect to sales under the

DRIP).

E. Operational

Compensation

The

Advisor or its affiliates will receive acquisition and origination fees and

expenses of 3% of the net amount available for investment in secured loans and

other real estate investment assets (after payment of selling commissions,

dealer manager fees and organization and offering expenses) in connection with

the origination, making or investing in secured loans or the purchase,

development or construction of a real estate asset, including, without

limitation, real estate commissions, selection fees, non-recurring management

fees, loan fees, points or any other fees of a similar nature.

The

Advisor will receive advisory fees of 2% per annum of the average of the

aggregate book value of the Trust’s real estate investment assets, including

secured loan assets, before reserves for depreciation or bad debts or other

similar non-cash reserves, computed by taking the average of such values at the

end of each month during a certain period.

8

The

Advisor will receive 1% of the amount made available to the Trust pursuant to

the origination of any line of credit or other debt financing, provided that the

Advisor has provided a substantial amount of services as determined by the

Trust’s independent trustees. On each anniversary date of the origination of any

such line of credit or other debt financing, an additional fee of 0.25% of the

primary loan amount will be paid if such line of credit or other debt financing

continues to be outstanding on such date, or a pro rated portion of such

additional fee will be paid for the portion of such year that the financing was

outstanding.

The Trust

will reimburse the expenses incurred by the Advisor in connection with its

provision of services to the Trust, including the Trust’s allocable share of the

Advisor’s overhead, such as rent, personnel costs, utilities and IT costs. The

Trust will not reimburse the Advisor for personnel costs in connection with

services for which the Advisor or its affiliates receive other

fees.

The

Advisor will receive 15% of the amount by which the Trust’s net income for the

immediately preceding year exceeds a 10% per annum return on aggregate capital

contributions, as adjusted to reflect prior cash distributions to shareholders

which constitute a return of capital. This fee will be paid annually and upon

termination of the advisory agreement.

F. Disposition/Liquidation

Compensation

Upon

successful sales by the Trust of securitized loan pool interests, the Advisor

will be paid a securitized loan pool placement fee equal to 2% of the net

proceeds realized by the Trust, provided the Advisor or an affiliate of the

Advisor has provided a substantial amount of services as determined by the

Trust’s independent trustees.

For

substantial assistance in connection with the sale of properties, the Trust will

pay the Advisor or its affiliates disposition fees of the lesser of one-half of

the reasonable and customary real estate or brokerage commission or 2% of the

contract sales price of each property sold; provided, however, in no event may

the disposition fees paid to the Advisor, its affiliates and unaffiliated third

parties exceed 6% of the contract sales price. The Trust’s independent trustees

will determine whether the Advisor or its affiliate has provided substantial

assistance to the Trust in connection with the sale of a property. Substantial

assistance in connection with the sale of a property includes the Advisor’s

preparation of an investment package for the property (including a new

investment analysis, rent rolls, tenant information regarding credit, a property

title report, an environmental report, a structural report and exhibits) or such

other substantial services performed by the Advisor in connection with a

sale.

Upon

listing the Trust’s common shares of beneficial interest on a national

securities exchange, the Advisor will be entitled to a fee equal to 15% of the

amount, if any, by which (1) the market value of the Trust’s outstanding

shares plus distributions paid by the Trust prior to listing, exceeds

(2) the sum of the total amount of capital raised from investors and the

amount of cash flow necessary to generate a 10% annual cumulative,

non-compounded return to investors.

G. Fair Value

Measurements

In April

2009, the FASB issued FASB Staff Position No. FAS 107-1 and APB 28-1, “Interim Disclosures about Fair Value

of Financial Instruments,” currently within the scope of ASC

825-10. ASC 825-10 requires disclosures about the fair value of

financial instruments whenever a public company issues financial information for

interim reporting periods. ASC 825-10 is effective for interim

reporting periods ending after June 15, 2009. We adopted this staff

position upon its issuance, and it had no material impact on our financial

statements because we believe the financial assets and liabilities as reported

in the Trust’s financial statements approximate their respective fair

values.

H. Commitments

and Contingencies

Litigation

In the

ordinary course of business, the Trust may become subject to litigation or

claims. There are no material pending legal proceedings known to be

contemplated against the Trust.

9

Off-Balance

Sheet Arrangements

In connection with the funding of some

of the Trust’s organization costs, on June 26, 2009, UMTH LD entered into a

$6,300,000 line of credit from Community Trust Bank of Texas. As a

condition to such line of credit, the Trust has guarantied UMTH LD’s obligations

to Community Trust Bank of Texas under the line of credit in an amount equal to

the amount of the Trust’s organization costs funded by UMTH LD. This guaranty

includes pledges of the Trust’s assets to Community Trust Bank of Texas.

However, the amount of the Trust’s guaranty is reduced to the extent that the

Trust reimburses UMTH LD for any of the Trust’s organization costs it has

funded, and the guaranty is subject to the overall limit on the Trust’s

reimbursement of organization and offering expenses, which is set at 3% of the

gross offering proceeds.

I. Economic

Dependency

Under

various agreements, the Trust has engaged or will engage the Advisor and its

affiliates to provide certain services that are essential to the Trust,

including asset management services, asset acquisition and disposition

decisions, the sale of the Trust’s common shares of beneficial interest

available for issue, as well as other administrative responsibilities for the

Trust. As a result of these relationships, the Trust is dependent upon the

Advisor and its affiliates. In the event that these entities were unable to

provide the Trust with the respective services, the Trust would be required to

find alternative providers of these services.

J. Subsequent

Events

We have evaluated

subsequent events through December 22, 2009, which is the date these financial

statements were issued.

On

November 12, 2009, the Trust’s Registration Statement was declared effective

under the Securities Act of 1933, as amended. The shares are being

offered to investors on a reasonable best efforts basis, which means the dealer

manager will use its reasonable best efforts to sell the shares offered, but is

not required to sell any specific number or dollar amount of shares and does not

have a firm commitment or obligation to purchase any of the offered

shares. In general, initial subscriptions for shares were placed in

an account held by the escrow agent and held in trust, pending release to the

Trust upon its receipt and acceptance of subscriptions aggregating a minimum of

$1.0 million. On December 18, 2009, the Trust satisfied this minimum

offering amount. As a result, the Trust’s initial public

subscribers were accepted as shareholders and the subscription proceeds from

such initial public subscribers were released to the Trust from escrow, provided

that residents of New York, Nebraska and Pennsylvania will not be admitted until

the Trust has received and accepted subscriptions aggregating at least

$2,500,000, $5,000,000 and $35,000,000, respectively.

On

December 18, 2009, the Trust entered into two Participation Agreements

(collectively, the “Participation Agreements”) with UMT Home Finance, L.P., a

Delaware limited partnership (“UMTHF”), pursuant to which the Trust purchased a

participation interest in UMTHF’s interim construction loan facilities (the

“Construction Loans”) to Buffington Texas Classic Homes, LLC and Buffington

Signature Homes, LLC, each a Texas limited liability company (collectively,

“Buffington”).

The

Construction Loans provide Buffington, which is a homebuilding group, with

residential interim construction financing for the construction of new homes in

the greater Austin, Texas area. The Construction Loans are evidenced

by promissory notes, are secured by first lien deeds of trust on the homes

financed under the Construction Loans, and are guaranteed by the parent company

and the principals of Buffington.

Pursuant

to the Participation Agreements, the Trust will participate in the Construction

Loans by funding UMTHF's lending obligations under the Construction Loans

up to a maximum amount of $3,500,000. The Participation Agreements

give the Trust the right to receive payment from UMTHF of principal and accrued

interest relating to amounts funded by the Trust under the Participation

Agreements. The interest rate under the Construction Loans is the

lower of 13% or the highest rate allowed by law. The Trust’s

participation interest is repaid as Buffington repays the Construction

Loans. For each loan originated to it, Buffington is required to pay

interest monthly and to repay the principal advanced to it upon the sale of the

home or in any event no later than 12 months following the origination of the

loan. The Participation Agreements provide for a one-year term

commencing on December 18, 2009.

UMTHF

will continue to manage and control the Construction Loans while the Trust owns

a participation interest in the Construction Loans. Pursuant to the

Participation Agreements, the Trust has appointed UMTHF as its agent to act on

its behalf with respect to all aspects of the Construction Loans, including the

control and management of the Construction Loans and the enforcement of rights

and remedies available to the lender under the Construction

Loans.

The Trust’s Advisor

also serves as the advisor for United Mortgage Trust, a Maryland real estate

investment trust, which owns 100% of the interests in UMTHF.

10

Item 2. Management’s Discussion and

Analysis of Financial Condition and Results of Operations.

The

following discussion and analysis should be read in conjunction with our

accompanying financial statements and the notes thereto:

Forward-Looking

Statements

This

section of the quarterly report contains forward-looking statements, including

discussion and analysis of us, our financial condition, amounts of anticipated

cash dividends to common shareholders in the future and other

matters. These forward-looking statements are not historical facts

but are the intent, belief or current expectations of our management based on

their knowledge and understanding of our business and industry. Words

such as “may,” “anticipates,” “expects,” “intends,” “plans,” “believes,”

“seeks,” “estimates,” “would,” “could,” “should” and variations of these words

and similar expressions are intended to identify forward-looking

statements. These statements are not guaranties of future performance

and are subject to risks, uncertainties and other factors, some of which are

beyond our control, are difficult to predict and could cause actual results to

differ materially from those expressed or forecasted in the forward-looking

statements.

Forward-looking

statements that were true at the time made may ultimately prove to be incorrect

or false. We caution you not to place undue reliance on

forward-looking statements, which reflect our management’s view only as of the

date of this Quarterly Report. We undertake no obligation to update

or revise forward-looking statements to reflect changed assumptions, the

occurrence of unanticipated events or changes to future operating

results. Factors that could cause actual results to differ materially

from any forward-looking statements made in this Form 10-Q include changes in

general economic conditions, changes in real estate conditions, development

costs that may exceed estimates, development delays, increases in interest

rates, residential lot take down or purchase rates or inability to sell

residential lots experienced by our borrowers, and the potential need to fund

development costs not completed by the initial borrower or other capital

expenditures out of operating cash flows. The forward-looking

statements should be read in light of the risk factors identified in the “Risk

Factors” section of our Registration Statement, as amended and filed with the

Securities and Exchange Commission.

Overview

We are a

newly organized Maryland real estate investment trust that expects to derive a

significant portion of our income by originating, purchasing, participating in

and holding for investment secured loans made directly by us or indirectly

through our affiliates to persons and entities for the acquisition and

development of parcels of real property as single-family residential lots, and

the construction of model and new single-family homes, including development of

mixed-use master planned residential communities. In addition to our

investments in secured loans, we intend to make direct investments in land for

development into single-family lots, new and model homes and portfolios of

finished lots and homes; provide credit enhancements to real estate developers,

homebuilders, land bankers and other real estate investors; purchase

participations in, or finance for other real estate investors the purchase of,

securitized real estate loan pools and discounted cash flows secured by state,

county, municipal or other similar assessments levied on real

property. When we acquire properties, we most often will do so

through a special purpose entity formed for such purpose or a joint venture

formed with a single-family residential developer, homebuilder, real estate

developer or other real estate investor, with us providing equity and/or debt

financing for the newly-formed entity. In limited circumstances, and

in accordance with the federal tax rules for REITs and the exemptions from

registration under the Investment Company Act of 1940, as amended, we may make

equity investments through special purpose entities in land for development into

single-family lots, new and model homes and finished lots. We also

may enter into joint ventures with unaffiliated real estate developers,

homebuilders, land bankers and other real estate investors, or with other United

Development Funding-sponsored programs, to originate, or acquire, as the case

may be, the same kind of secured loans or real estate investments we may

originate or acquire directly. We also intend to make indirect

investments in properties through secured loans to third party entities

affiliated with single-family residential developers/homebuilders, and we may

seek an increased return by also entering into participation agreements with the

real estate developer or joint venture entity, or by providing credit

enhancements for the benefit of those entities that are associated with

residential real estate financing transactions. The participation

agreements and credit enhancements will come in a variety of forms;

participation agreements may take the form of profit agreements, ownership

interest and participation loans, while credit enhancements may take the form of

guarantees, pledges of assets, letters of credit and tri-party inter-creditor

agreements.

11

We intend

to make an election under Section 856(c) of the Internal Revenue Code of

1986, as amended, to be taxed as a REIT, beginning with the taxable year ending

December 31, 2009, or the first year in which we commence material

operations. If we qualify as a REIT for federal income tax purposes, we

generally will not be subject to federal income tax on income that we distribute

to our shareholders. If we make an election to be taxed as a REIT and later fail

to qualify as a REIT in any taxable year, we will be subject to federal income

tax on our taxable income at regular corporate rates and may not be permitted to

qualify for treatment as a REIT for federal income tax purposes for four years

following the year in which our qualification is denied unless we are entitled

to relief under certain statutory provisions. Such an event could materially and

adversely affect our net income. However, we believe that we are organized and

will operate in a manner that will enable us to qualify for treatment as a REIT

for federal income tax purposes during the year ended December 31, 2009, or

the first year in which we commence material operations, and we intend to

continue to operate so as to remain qualified as a REIT for federal income tax

purposes.

On November

12, 2009, the Trust’s Registration Statement, covering the Offering of up to

25,000,000 common shares of beneficial interest to be offered at a price of $20

per share, was declared effective under the Securities Act of 1933, as

amended. The Offering also covers up to 10,000,000 common shares of

beneficial interest to be issued pursuant to our DRIP for $20 per

share. We reserve the right to reallocate the common shares of

beneficial interest registered in the Offering between the primary offering and

the DRIP. On December 18, 2009, we satisfied the minimum offering of

50,000 common shares of beneficial interest for gross offering proceeds of $1.0

million in connection with the Offering. As a result, our

initial public subscribers were accepted as shareholders and the subscription

proceeds from such initial public subscribers were released to us from escrow,

provided that residents of New York, Nebraska and Pennsylvania will not be

admitted until we have received and accepted subscriptions aggregating at least

$2,500,000, $5,000,000 and $35,000,000, respectively. With the

exception of these New York, Nebraska and Pennsylvania subscribers, subscription

proceeds will be released to us as accepted.

We did

not commence active operations prior to our receipt and acceptance of

subscriptions for a minimum of 50,000 common shares of beneficial interest for

gross offering proceeds of $1.0 million. We will experience a

relative increase in liquidity as additional subscriptions for common shares are

received and a relative decrease in liquidity as offering proceeds are expended

in connection with the origination, purchase or participation in secured loans

or other investments, as well as the payment or reimbursement of selling

commissions and other organizational and offering expenses.

12

Critical Accounting Policies and

Estimates

Management’s

discussion and analysis of financial condition and results of operations are

based upon our financial statements, which have been prepared in accordance with

GAAP. GAAP consists of a set of standards issued by the FASB and other

authoritative bodies in the form of FASB Statements, Interpretations, FASB Staff

Positions, EITF consensuses and AICPA Statements of Position, among

others. The FASB recognized the complexity of its standard-setting process

and embarked on a revised process in 2004 that culminated in the release on July

1, 2009 of the ASC. The ASC does not change how the Trust accounts for its

transactions or the nature of related disclosures made. Rather, the ASC

results in changes to how the Trust references accounting standards within its

reports. This change was made effective by the FASB for periods ending on

or after September 15, 2009. The Trust has updated references to GAAP in

this Quarterly Report on Form 10-Q to reflect the guidance in the ASC. The

preparation of these financial statements requires our management to make

estimates and assumptions that affect the reported amounts of assets,

liabilities, revenues and expenses, and related disclosure of contingent assets

and liabilities. On a regular basis, we evaluate these estimates,

including investment impairment. These estimates are based on management’s

historical industry experience and on various other assumptions that are

believed to be reasonable under the circumstances. Actual results may

differ from these estimates.

Results of

Operations

As of the

date of this report, no significant operations have commenced, as we did not

commence active operations prior to our receipt and acceptance of subscriptions

for a minimum of 50,000 common shares of beneficial interest for gross offering

proceeds of $1.0 million. Our management is not aware of any material

trends or uncertainties, other than national economic conditions affecting real

estate and the debt markets generally, that may reasonably be expected to have a

material impact, favorable or unfavorable, on revenues or income from real

estate-related investments, other than those referred to in this Quarterly

Report and our Registration Statement.

Cash Flow

Analysis

As of the

date of this report, no significant operations have commenced, as we did not

commence active operations prior to our receipt and acceptance of subscriptions

for a minimum of 50,000 common shares of beneficial interest for gross offering

proceeds of $1.0 million. Our principal demands for funds will be for

real estate-related investments, for the payment of operating expenses, and for

the payment of interest on our outstanding indebtedness. Generally,

we expect to meet cash needs for items other than acquisitions from our cash

flow from operations, and we expect to meet cash needs for investments from the

net proceeds of the Offering and from financings.

Liquidity and Capital

Resources

We did not

commence active operations prior to our receipt and acceptance of subscriptions

for a minimum of 50,000 common shares of beneficial interest for gross offering

proceeds of $1.0 million. As a result of our receipt and acceptance

of this minimum offering amount, future subscription proceeds will be released

to us as accepted (with the exception of New York, Nebraska and Pennsylvania

subscribers as noted above). We will experience a relative increase

in liquidity as additional subscriptions for common shares are received and a

relative decrease in liquidity as offering proceeds are expended in connection

with the origination, purchase or participation in secured loans or other

investments, as well as the payment or reimbursement of selling commissions and

other organizational and offering expenses.

There may

be a delay between the sale of our shares and the making of real estate-related

investments, which could result in a delay in our ability to make distributions

to our shareholders. We expect to have little, if any, cash flow from

operations available for distribution until we make investments and intend to

commence monthly distributions when we begin to receive interest and investment

income. However, we have not established any limit on the amount of

proceeds from the Offering that may be used to fund distributions, except that,

in accordance with our organization documents and Maryland law, we may not make

distributions that would (1) cause us to be unable to pay our debts as they

become due in the usual course of business; (2) cause our total assets to be

less than the sum of our total liabilities plus senior liquidation preferences,

if any; or (3) jeopardize our ability to qualify as a REIT. In

addition, to the extent our investments are in development projects or in other

properties that have significant capital requirements and/or delays in their

ability to generate income, our ability to make distributions may be negatively

impacted, especially during our early periods of operation.

13

We intend

to use debt as a means of providing additional funds for the acquisition or

origination of secured loans, acquisition of properties and the diversification

of our portfolio. There is no limitation on the amount we may borrow

for the purchase or origination of a single secured loan, the purchase of any

individual property or other investment. Under our declaration of

trust, the maximum amount of our indebtedness shall not exceed 300% of our net

assets as of the date of any borrowing; however, we may exceed that limit if

approved by a majority of our independent trustees and disclosed in our next

quarterly report to shareholders, along with justification for such

excess. In addition to our declaration of trust limitations, our

board of trustees has adopted a policy to generally limit our fund level

borrowings to 50% of the aggregate fair market value of our assets unless

substantial justification exists that borrowing a greater amount is in our best

interests. We also intend, when appropriate, to incur debt at the

asset level. Asset level leverage will be determined by the

anticipated term of the investment and the cash flow expected by the

investment. Asset level leverage is expected to range from 0% to 90%

of the asset value.

We intend

to utilize leverage at both the asset level and the entity

level. Although we may acquire investments free and clear of

indebtedness, we intend to encumber investments using land acquisition,

development, home and lot indebtedness. We expect that the asset

level indebtedness will be either interest only or be amortized over the

expected life of the asset. We expect this asset indebtedness may be

from a senior commercial lender between 50% and 90% of the fair market value of

the asset. We expect that the entity level indebtedness will be a

revolving credit facility permitting us to borrow up to an agreed-upon

outstanding principal amount. We also expect that the entity-level

indebtedness will be secured by a first priority lien upon all of our existing

and future acquired assets.

Our

advisor may, but is not required to, establish capital reserves from gross

offering proceeds, out of cash flow generated from interest income from loans

and income from other investments or out of non-liquidating net sale proceeds

from the sale of our loans, properties and other

investments. Alternatively, a lender may require its own formula for

escrow of capital reserves.

Potential

future sources of capital include proceeds from secured or unsecured financings

from banks or other lenders, proceeds from repayment of loans, sale of assets

and undistributed funds from operations. If necessary, we may use

financings or other sources of capital in the event of unforeseen significant

capital expenditures.

Material

Trends Affecting Our Business

We are a newly

organized Maryland real estate investment trust that intends to qualify as a

REIT under federal tax law and derive a significant portion of our income by

originating, purchasing, participating in and holding for investment secured

loans made directly by us or indirectly through our affiliates to persons and

entities for the acquisition and development of parcels of real property as

single-family residential lots, and the construction of model and new

single-family homes, including development of mixed-use master planned

residential communities. We intend to concentrate our investments on

single-family lot developers who sell their lots to national, regional, and

local homebuilders for the acquisition of property and the development of

residential lots, as well as homebuilders for the construction of single-family

homes.

We believe that the housing market

reached a bottom in its three-year decline early in 2009 and has since begun to

recover. New single-family home permits, starts, and sales have all

risen dramatically from their lows experienced in January 2009, reflecting a

careful return of demand for new homes. However, concerns remain

regarding the shape and scope of the recovery. The consumer confidence index,

which fell to record lows during the downturn, remains depressed as unemployment

continues to rise, while conventional bank financing remains

limited. We believe these concerns pose significant obstacles to a

robust recovery.

Ongoing credit constriction and

disruption of mortgage markets and price correction have made potential new home

purchasers and real estate lenders very cautious. As a result of

these factors, the national housing market experienced a protracted decline, and

the time that has proven necessary to correct the market may mean a

corresponding slow recovery for the housing industry.

Capital constraints at the heart of the

credit crisis have reduced the number of real estate lenders able or willing to

finance development, construction and the purchase of homes and have increased

the number of undercapitalized or failed builders and

developers. With credit less available and stricter underwriting

standards, mortgages to purchase homes have become harder to

obtain. The liquidity provided in the secondary market by Fannie Mae

and Freddie Mac (“Government Sponsored Enterprises” or “GSEs”) to the mortgage

industry is very important to the housing market, and these entities have

suffered significant losses as a result of deteriorating housing and credit

market conditions. Their losses have reduced their equity, limited

their ability to acquire mortgages, and severely constricted the liquidity of

the mortgage industry. The Federal Housing Finance Agency placed both

Fannie Mae and Freddie Mac into conservatorship, beginning in fall 2008 and with

no specified termination date. This action was taken in concert with

pledges made by the U.S. Department of the Treasury and the Federal Reserve to

purchase residential mortgage-backed securities from these GSEs in order to

ensure stability within the secondary residential mortgage

market. The Federal Reserve has committed to purchase up to $1.25

trillion in residential mortgage-backed securities by the end of the first

quarter in 2010, and, through the third quarter of 2009, the Federal Reserve has

purchased nearly $700 billion of these residential mortgage-backed

securities. Any reduction in the availability of financing or

liquidity provided by the GSEs could adversely affect interest rates, mortgage

availability, and the sales of new homes and mortgage loans.

14

During

this same time period, Congress passed, and then-President Bush signed, the

Emergency Economic Stabilization Act of 2008 in order to inject emergency

capital into financial institutions, ease accounting rules that require such

institutions to show the deflated value of assets on their balance sheets, and

allow banks to clarify their balance sheets. The transparency of bank

balance sheets was seen as necessary to enable financial institutions to raise

capital, while the Federal Reserve’s efforts have been aimed at supporting the

secondary residential market, all intended to help encourage lenders to resume

lending practices critical to the development, construction, and the purchase of

homes. However, financing remains constricted, and we anticipate that

Congress will further overhaul housing policy and financial regulation in a 2010

legislative effort.

Nationally, new single-family home

sales and new home inventory both improved in the third quarter of 2009 from the

second quarter. The U.S. Census Bureau reports that the sales of new

single-family residential homes in September 2009 were at a seasonally adjusted

annual rate of 402,000 units. This number is improved from the second

quarter figure of 399,000 and represents a 22.2% increase off its low in

January, though it is still approximately 7.8% below the September 2008 estimate

of 436,000. The seasonally adjusted estimate of new houses for sale

at the end of September 2009 was 251,000, which represents a supply of 7.5

months at the current sales rate – a reduction from the second quarter supply of

8.4 months. We believe that this drop in the number of new

houses for sale by approximately 144,000 units year-over-year reflects the

homebuilding industry’s extensive efforts to bring the new home market back to

equilibrium by reducing new housing starts and selling existing new home

inventory. Further, the number of new homes developed also has

decreased, which may result in a shortage of new homes and developed lots in

select real estate markets in 2010.

According

to the source identified above, new single-family residential home permits and

starts were reduced month-over-month through 2008 nationally, as a result and in

anticipation of an elevated supply of and decreased demand for new single-family

residential homes. Since January 2009, however, single family permits

and starts have risen significantly from their lows. Single-family

homes authorized by building permits in September 2009 were at a seasonally

adjusted annual rate of 450,000 units. This is 31.6% above the

January 2009 low, though 14.9% below the September 2008 estimate of 529,000

units. Single-family home starts for September 2009 were at a

seasonally adjusted annual rate of 501,000 units. This is 40.3% above

the January 2009 low, though 8.7% below the September 2008 estimate of 549,000

units. We believe that, with these reductions, new home inventory

levels are approaching equilibrium, even at current levels of demand, and that

what is necessary to regain prosperity in housing markets is the return of

healthy levels of demand. The primary factors affecting new home

sales are housing prices, home affordability, and housing

demand. Housing supply may affect both new home prices and demand for

new homes. When new home supplies exceed new home demand, new home

prices may generally be expected to decline. Declining new home

prices may result in diminished new home demand as people postpone a new home

purchase until such time as they are comfortable that stable price levels have

been reached.

The National Association of Home

Builders forecasts average new single-family home annual starts over the

ten-year period 2008-2017 to be 1,267,000, ranging from a low of 650,000 to a

high of 1,550,000, and the average annual new single-family home sales during

that same period to be 1,067,000, ranging between 542,000 and 1,406,000 units

per year.

Long-term demand will be fueled by a

growing population, household formation, population migration and immigration.

The U.S. Census Bureau forecasts that California, Florida and Texas will account

for nearly one-half of the total U.S. population growth between 2000 and 2030

and that the total population of Arizona and Nevada will double during that

period. The U.S. Census Bureau projects that between 2000 and 2030 the total

populations of Arizona and Nevada will grow from approximately 5,000,000 to over

10,700,000 and from approximately 2,000,000 to nearly 4,300,000, respectively;

Florida’s population will grow nearly 80% between 2000 and 2030, from nearly

16,000,000 to nearly 28,700,000; Texas’ population will increase 60% between

2000 and 2030 from nearly, 21,000,000 to approximately 33,300,000; and

California’s population will grow 37% between 2000 and 2030, from approximately

34,000,000 to nearly 46,500,000.

15

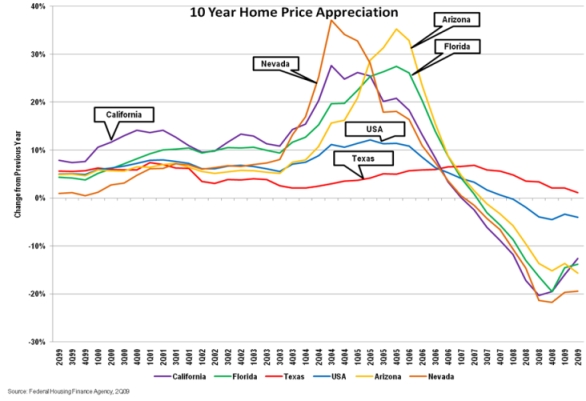

While

housing woes beleaguer the national economy, Texas housing markets have held up

as some of the best in the country. We believe the Texas markets,

though weakened from their highs in 2007, have remained fairly healthy due to

strong demographics, economies and housing affordability ratios. The

graph below illustrates the declines in home price appreciation nationally, as

well as in California, Florida, Arizona, and Nevada, which have experienced

steep declines in home prices. Recently, though, price declines have

begun to moderate in those states, and certain markets within California,

Arizona, and Florida have even experienced small, month-over-month price

increases, based on the S&P Case-Shiller Home Price

Indices. Further, the graph illustrates how Texas has maintained home

price stability and not experienced such pronounced

declines.

According

to numbers publicly released by Residential Strategies, Inc. or Metrostudy,

leading providers of primary and secondary market information, the median new

home prices for September 2009 in the metropolitan areas of Austin, Houston,

Dallas, and San Antonio are $206,888, $189,348, $204,031 and $179,837,

respectively. These amounts are at par with or slightly below the

September 2009 national median sales price of new homes sold of $204,800,

according to estimates released jointly by the U.S. Census Bureau and the

Department of Housing and Urban Development.

Using the

Department of Housing and Urban Development’s estimated 2009 median family

income for the respective metropolitan areas of Austin, Houston, Dallas, and San

Antonio, the median income earner in those areas has 1.42 times, 1.35 times,

1.33 times, and 1.28 times the income required to qualify for a mortgage to

purchase the median priced new home in the respective metropolitan

area. These numbers illustrate the high affordability of Texas

homes. Our measurement of housing affordability, as referenced above,

is determined as the ratio of median family income to the income required to

qualify for a 90 percent, 30-year fixed-rate mortgage to purchase the

median-priced new home, assuming an annual mortgage insurance premium of 50

basis points for private mortgage insurance and a cost that includes estimated

property taxes and insurance for the home. Using the U.S. Census Bureau’s

2009 income data to project an estimated median income for the United States of

$64,000 and the September 2009 national median sales prices of new homes sold of

$204,800, we conclude that the national median income earner has 1.25 times the

income required to qualify for a mortgage loan to purchase the median-priced new

home in the United States. This estimation reflects the increase in home

affordability in housing markets outside of Texas over the past 24 months, as

new home prices in housing markets outside of Texas generally have fallen.

Indeed, the national median new home price of $204,800 has fallen by 9.06% from

the September 2008 median new home sales price of $225,200, according to the

Department of Housing and Urban Development. As a result of these

falling home prices, we believe that affordability has been restored to the

national housing market.

16

Though

recent job growth has ceased due to the current economic climate, the Texas

Workforce Commission reports that Texas has added nearly three quarters of a

million new jobs over the past five years, and we believe that the long term

fundamentals remain sound. However, due to the national and global

recession, the Texas economy slowed in the fourth quarter of 2008 and has

continued through the first three quarters of 2009. Over the twelve

month period ending September 2009, the United States Department of Labor

reported that Texas lost approximately 303,700 jobs and the unemployment rate is

8.2%, up from 5.1% in September 2008. However, the same source states

that, nationally, the United States lost approximately 5,785,000 jobs, and the

unemployment rate rose to 9.8% from 6.2% in September 2008.

The Texas

Workforce Commission reports that as of September 2009, the unemployment rate

for Austin-Round Rock, Texas was 7.2%, up from 4.6% in September 2008;

Dallas-Fort Worth-Arlington, Texas was 8.3%, up from 5.2%; Houston-Sugar

Land-Baytown, Texas was 8.5%, up from 5.1%; and San Antonio, Texas was 7.1%, up

from 4.9%. In the most recent quarter, Austin experienced a net loss

of 5,500 jobs year-over-year for the twelve month period ending September

2009. During those same 12 months, Houston, Dallas-Fort Worth, and

San Antonio experienced net losses of 76,700, 64,500, and 9,200 jobs,

respectively. However, these cities have added an estimated net total

of 617,000 jobs over the past five years. Austin added 103,700; Dallas-Fort

Worth added 209,800; Houston added 221,800; and San Antonio added

81,700.

Due to

the national and global recession, we believe it is likely that the Texas

economy will continue to slow and that Texas will suffer a net loss of jobs in

2009. The National Bureau of Economic Research has concluded that the

U.S. economy entered into a recession in December 2007, ending an economic

expansion that began in November 2001. We believe that the transition

from month-over-month and year-over-year job gains in Texas, to year-over-year

and month-over-month job losses indicates that the Texas economy has slowed

significantly beginning in the fourth

quarter of 2008 when we believe Texas followed the nation into

recession. However, we also believe that the Texas economy will

continue to outperform the national economy. According to a study

published by the Texas Workforce Commission, Texas tends to enter into

recessions after the national economy has entered a recession and usually leads

among states in the economic recovery. In the current downturn,

Texas’ recession trailed the national recession by nearly a year, and the

state’s economy now looks poised for recovery. The Federal Reserve

Bank of Dallas index of Texas leading indicators has steadily improved since

reaching a low in March 2009, and independent reports and forecasts are now

predicting that Texas cities will be among the first to recover based on

employment figures, gross metropolitan product, and home prices.

The

United States Census Bureau reported in its 2008 Estimate of Population Change

July 1, 2007 to July 1, 2008 that Texas led the country in population growth

during that period. The estimate concluded that Texas grew by 483,542

people, or 2% – a number that was 1.28 times greater than the next closest state

in terms of raw population growth, California, and more than 2.67 times the

second closest state in terms of raw population growth, North

Carolina. The United States Census Bureau also reported that among

the 15 counties that added the largest number of residents between July 1, 2007

and July 1, 2008, six were in Texas (Harris (Houston), Tarrant (Fort Worth),

Bexar (San Antonio), Collin (North Dallas), Dallas (Dallas) and Travis

(Austin).

On March 19, 2009, the United States Census Bureau reported that Texas’ five

major cities – Austin, Houston, San Antonio, Dallas and Fort Worth – were among

the top 15 in the nation for population growth from 2007 to 2008. Dallas-Fort

Worth-Arlington led the nation in numerical population growth with an estimated

population increase of 146,532, with Dallas-Plano-Irving having an estimated

increase of 97,036 and Fort Worth-Arlington having an estimated increase of

49,496. Houston-Sugarland-Baytown was second in the nation with a

population increase of 130,185 from July 1, 2007 to July 1,

2008. Austin-Round Rock had an estimated population growth of 60,012

and San Antonio had an estimated population growth of 46,524 over the same

period. The percentage increase in population for these major Texas

cities ranged from 2.34% to 3.77%.

17

The Third

Quarter 2009 U.S. Market Risk Index, a study prepared by PMI Mortgage Insurance

Co., the U.S. subsidiary of The PMI Group, Inc., which ranks the nation’s 50

largest metropolitan areas through the second quarter of 2009 according to the

likelihood that home prices will be lower in two years, reported that Texas

cities are among the nation’s best for home price stability. This

index analyzes housing price trends, the impact of foreclosure rates, and the

consequence of excess housing supply on home prices. The quarterly

report projects that there is less than a 20.0% chance that the Dallas/Fort

Worth-area and Houston-area home prices will fall during the next two years; a

9.4% chance that San Antonio-area home prices will fall during the next two

years; and a 39.6% chance that Austin-area home prices will fall during the next

two years. Except for the Austin area, all Texas metropolitan areas

included in the report are in the Top 10 least-likely areas to experience a

decline in home prices in two years. The Austin area is ranked the

sixteenth least-likely area to experience a

decline. Dallas-Plano-Irving, Texas is the nation’s fifth

least-likely metropolitan area, Fort Worth-Arlington, Texas is seventh

least-likely, Houston-Sugar Land-Baytown, Texas is ninth

least-likely, and San Antonio, Texas is second

least-likely.

In their

second quarter all-transactions price index, the Federal Housing Finance Agency

(“FHFA”) reports that Texas had an existing home price appreciation of 1.12%

between the second quarter of 2009 and the second quarter of

2008. That report provides that existing home price appreciation

between the second quarter of 2009 and the second quarter of 2008 for (a) Austin

was 0.09%; (b) Houston was 2.42%; (c) Dallas was 1.13%; (d) Fort Worth was

1.63%; (e) San Antonio was 0.67%; and (f) Lubbock was 2.27%. The FHFA

tracks average house price changes in repeat sales or refinancings of the same

single-family properties utilizing conventional, conforming mortgage

transactions.

The August 2009 Federal Reserve Bank of

Dallas’ Regional Economic Update reported that housing inventories and sales

continue to be more positive in Texas than the national average. The

Texas Comptroller of Public Accounts has noted that Texas foreclosures and

defaults have remained generally stable for the past three years and well below

the nation as a whole. However, homebuilding and residential

construction employment are likely to remain weak for some

time. Despite these unsteady signs, Texas will likely continue to

outperform the national average. Texas’ housing sector is in better

shape, the cost of living and doing business is lower, and energy still plays a

positive role in the economy.

In sharp

contrast to the conditions of many homebuilding markets in the country where

unsold housing inventory remains a challenge, new home sales are greater than

new home starts in Texas markets, indicating that home builders in Texas are

focused on preserving a balance between new home demand and new home

supply. Home builders and developers in Texas have remained

disciplined on new home construction and project

development. New home starts are outpaced by new home sales in

all of our Texas markets where such data is available. Inventories of

finished new homes and total new housing (finished vacant, under construction,

and model homes) remain at healthy and balanced levels in all four major Texas

markets: Austin, Dallas-Fort Worth, Houston, and San

Antonio. Each major Texas market has experienced a rise in the number

of months of finished lot inventories as homebuilders have reduced the number of

new home starts, with each major Texas market reaching elevated

levels. Houston has an estimated inventory of finished lots of

approximately 44.6 months, Austin has an estimated inventory of finished lots of

approximately 49.4 months, San Antonio has an estimated inventory of finished

lots of approximately 61.9 months, and Dallas-Fort Worth has an estimated

inventory of finished lots of approximately 81.0 months. A 24-28

month supply is considered equilibrium for finished lot supplies.

The

elevation in month’s supply of finished lot inventory in Texas markets owes

itself principally to the decrease in the pace of annual starts rather than an

increase in the raw number of developed lots. Indeed, the number of

finished lots dropped by more than 1,200 lots in Austin and San Antonio, by more

than 2,000 lots in Houston, and by more than 3,500 lots in Dallas-Fort Worth in

the third quarter of 2009. Annual starts in each of the Austin, San

Antonio, Houston, and Dallas-Fort Worth markets are outpacing lot

deliveries. With the discipline evident in these markets, we expect

to see a continued decline in raw numbers of finished lot inventories in coming

quarters as new projects have been significantly reduced. As demand

returns and the pace of starts increase, we expect to see a corresponding drop

in the month supply.

Texas

markets continue to be some of the strongest homebuilding markets in the

country, though home building in Texas has weakened through the past few

quarters. While the decline in housing starts has caused vacant lot

inventory to become elevated from its previously balanced position, it has also

maintained a balance in the housing inventory. Annual new home sales

in Austin outpace starts 8,107 versus 6,888, with annual new home sales

declining year-over-year by approximately 31.60%. Finished housing

inventory and total new housing inventory (finished vacant, under construction

and model homes) are at healthy levels of 2.7 months and 7.3 months,

respectively. The generally accepted equilibrium levels for finished

housing inventory and total new housing inventory are a 2-to-2.5 month supply

and a 6.0 month supply, respectively. Like Austin, San Antonio is

also a healthy homebuilding market. Annual new home sales in San

Antonio outpace starts 8,486 versus 7,408, with annual new home sales declining

year-over-year by approximately 19.56%. Finished housing inventory

and total new housing inventory remain at generally healthy levels with a 2.3

month supply and 6.4 month supply, respectively. Houston, too, is a

relatively healthy homebuilding market. Annual new home sales there

outpace starts 23,116 versus 18,458, with annual new home sales declining

year-over-year by approximately 33.08%. Finished housing inventory

and total new housing inventory are slightly above equilibrium levels at a 3.24

month supply and a 7.2 month supply, respectively. Dallas-Fort Worth

is a generally healthy homebuilding market, as well. Annual new home

sales in Dallas-Fort Worth outpace starts 18,055 versus 13,107, with annual new

home sales declining year-over-year by approximately 33.35%. Finished

housing inventory and total new housing inventory stand at a 3.1 month supply

and a 6.9 month supply, respectively. Each supply is slightly above

the considered equilibrium level. All numbers are as publicly

released by Residential Strategies, Inc. or Metrostudy, leading providers of

primary and secondary market information.

18

The Real

Estate Center at Texas A&M University has reported that the sales of

existing homes remain relatively healthy in our Texas markets, as

well. Though the year-over-year sales pace has fallen between 11% and

16% in each of the four largest Texas markets, inventory levels have generally

remained stable. The number of months of home inventory for sale in

Austin, Houston, Dallas, Fort Worth, and Lubbock is 6.4 months, 6.5 months, 6.3

months, 6.7 months, and 5.5 months, respectively. San Antonio’s

inventory is more elevated with an 8.1 month supply of homes for

sale. A 6-month supply of inventory is considered a balanced market

with more than 6 months of inventory generally being considered a buyer’s market

and less than 6 months of inventory generally being considered a seller’s

market. Through September 2009, the number of existing homes sold

year-to-date in (a) Austin is 15,651, down 15% year-over-year; (b) San Antonio

is 13,889, down 11% year-over-year; (c) Houston is 44,561, down 14%

year-over-year, (d) Dallas is 34,285, down 16% year-over-year, (e) Fort Worth is

6,288, down 20% year-over-year, and (f) Lubbock is 2,508, down 7%