Attached files

Exhibit 99.1

FORWARD-LOOKING STATEMENTS

This offering circular includes “forward-looking statements.” Forward-looking statements include statements concerning our plans, asset valuations, objectives, goals, strategies, future events, future sales or performance—including our estimated financial results for the three months and full year ending December 31, 2009, capital expenditures, financing needs, intentions or expected cost savings relating to acquisitions and our cost savings initiatives, business trends and other information that is not historical information and, in particular, appear under the headings “Offering Circular Summary,” “Unaudited Pro Forma Condensed Consolidated Financial Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Words such as “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts” and variations of such words or similar expressions that predict or indicate future events or trends, or that do not relate to historical matters, identify forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf apply only as of the date of this offering circular and are expressly qualified in their entirety by the cautionary statements included in this offering circular. Our expectations, beliefs and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will result or be achieved. Uncertainties and other factors that could cause actual results to differ materially from our expectations include, but are not limited to:

| Ÿ | the need to allocate significant amounts of cash flow to make payments on our indebtedness, which in turn could reduce our financial flexibility and ability to fund other activities; |

| Ÿ | the effect of leverage on our financial position and earnings; |

| Ÿ | changes in interest rates; |

| Ÿ | risks associated with the global economic downturn and its impact on capital markets and liquidity; |

| Ÿ | the impact of the global economic downturn, which has adversely affected advertising revenue across our businesses and other general economic and political conditions in the United States and in other countries in which we currently do business, including those resulting from recessions, political events and acts or threats of terrorism or military conflicts; |

| Ÿ | events or conditions that cause us to reassess the reasonableness of the estimates and assumptions we use to calculate the fair value of our assets or that cause changes in the estimated fair value of our assets; |

| Ÿ | our cost savings initiatives not being successful in the timeframe we anticipate, or at all; |

| Ÿ | the impact of the geopolitical environment; |

| Ÿ | industry conditions, including competition; |

| Ÿ | fluctuations in operating costs; |

| Ÿ | technological changes and innovations; |

| Ÿ | changes in labor conditions; |

| Ÿ | fluctuations in exchange rates and currency values; |

| Ÿ | capital expenditure requirements; |

| Ÿ | legislative or regulatory requirements; |

| Ÿ | taxes; |

| Ÿ | our ability to integrate the operations of acquired companies; |

| Ÿ | the impact of the above and similar factors on Clear Channel Communications, Inc., our primary source of capital; and |

| Ÿ | the other factors described in this offering circular under the heading “Risk Factors.” |

The foregoing factors are not exhaustive and new factors may emerge or changes to the foregoing factors may occur that could impact our business. Except to the extent required by law, we undertake no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise. You should review carefully the section captioned “Risk Factors” in this offering circular for a more complete discussion of the risks of an investment in the notes.

OFFERING CIRCULAR SUMMARY

Clear Channel Worldwide Holdings, Inc., the issuer of the notes, is an indirect, wholly-owned subsidiary of Clear Channel Outdoor Holdings, Inc. The notes will be guaranteed by Clear Channel Outdoor Holdings, Inc. and certain of its existing and future domestic subsidiaries, including Clear Channel Outdoor, Inc.

Unless otherwise stated or the context otherwise requires, all references in this offering circular to (i) “Clear Channel Outdoor Holdings,” “we,” “our,” “us” and the “Company” refer to Clear Channel Outdoor Holdings, Inc. and its consolidated subsidiaries, including Clear Channel Worldwide Holdings, Inc. and Clear Channel Outdoor, Inc.; (ii) “Clear Channel Worldwide Holdings” refer to Clear Channel Worldwide Holdings, Inc., an indirect, wholly-owned subsidiary of Clear Channel Outdoor Holdings and the issuer of the notes, and its consolidated subsidiaries; (iii) “CCOI” refer to Clear Channel Outdoor, Inc., a direct, wholly-owned subsidiary of Clear Channel Outdoor Holdings and a guarantor of the notes; (iv) “Clear Channel Communications” refer to Clear Channel Communications, Inc., the indirect holder of approximately 89% of the common stock of Clear Channel Outdoor Holdings; and (v) “CC Media Holdings” refer to CC Media Holdings, Inc., the indirect parent company of Clear Channel Communications. Clear Channel Communications merged with a subsidiary of CC Media Holdings, a company formed by private equity funds sponsored by Bain Capital Partners, LLC (“Bain Capital”) and Thomas H. Lee Partners, L.P. (“THL”), in July 2008.

The issuer of the notes is Clear Channel Worldwide Holdings, which is an indirect, wholly-owned subsidiary of Clear Channel Outdoor Holdings. Clear Channel Worldwide Holdings is a holding company that owns 100% of our International segment through the indirect ownership of numerous international subsidiaries. Clear Channel Worldwide Holdings also owns certain other immaterial subsidiaries that are included in our Americas segment. Clear Channel Worldwide Holdings has no direct operations or operating assets.

The financial statements included in this offering circular are those of Clear Channel Outdoor Holdings.

We refer to the offer and sale of the notes offered hereby and the application of proceeds thereof, including (i) repayment of a portion of, extension of the maturity of and modification of the interest rate payable on, the CCU Intercompany Note (as defined herein), (ii) repayment of a portion of, extension of the maturity of and modification of the interest rate payable on the cash management note issued by Clear Channel Communications payable to us, (iii) extension of the maturity of the cash management note issued by us payable to Clear Channel Communications, and (iv) the payment of fees and expenses, as the “offering.”

The following summary contains basic information about Clear Channel Outdoor Holdings and the offering of the notes by Clear Channel Worldwide Holdings. It likely does not contain all the information that is important to your investment decision. Before you make an investment decision, we encourage you to read this entire offering circular, including the risk factors, our financial statements and the related notes and the unaudited pro forma financial statements appearing elsewhere herein.

Overview

We are one of the largest outdoor media companies in the world, with one of the leading market positions, based on revenue, in each of our operating segments: Americas Outdoor Advertising and International Outdoor Advertising.

| • | Americas Outdoor Advertising. We are one of the largest outdoor media companies in the Americas, which includes the United States, Canada and Latin America. As of December 31, |

2

| 2008, we owned or operated approximately 237,000 displays in our Americas Outdoor Advertising segment. Our Americas outdoor assets consist of billboards, street furniture displays, transit displays and other out-of-home advertising displays which we believe are in premier real estate locations in each of our markets throughout the Americas. As of December 31, 2008, we had operations in 49 of the 50 largest markets in the United States, including all of the 20 largest markets. For the twelve months ended September 30, 2009, Americas Outdoor Advertising generated revenue of $1,240 million. |

| • | International Outdoor Advertising. We are one of the leading outdoor media companies internationally with operations in Asia, Australia and Europe. As of December 31, 2008, we owned or operated approximately 670,000 displays in approximately 36 countries, including key positions in attractive international markets. Our international outdoor assets consist of billboards, street furniture displays, transit displays and other out-of-home advertising displays. For the twelve months ended September 30, 2009, International Outdoor Advertising generated revenue of $1,480 million. |

Within each of these segments, we generate revenue through the sale of advertising copy placed on our display inventory, which consists of billboards, street furniture and transit displays, airport displays, mall displays, and wallscapes and other spectaculars, which we own or operate under lease management agreements. Our advertising business is focused on urban markets with dense populations. Billboards, street furniture and transit displays, and other displays comprised approximately 49%, 24%, 12% and 15% of our revenue in the year ended December 31, 2008, respectively. For the twelve months ended September 30, 2009, we generated consolidated revenue of approximately $2,720 million.

Our Strengths

Global Scale and Local Market Leadership. We are one of the largest outdoor media companies in the world. As of December 31, 2008, we operated approximately 907,000 outdoor advertising displays worldwide in urban and densely-populated real estate locations, providing advertisers with both a global and a local reach. Our global scale enables productive and cost-effective investment across our portfolio, which supports our competitive position.

| • | Our business is focused on urban markets with dense populations. Our real estate locations in these markets provide reach to a broad audience and therefore a compelling opportunity for our advertisers to reach a mass audience at a relatively low cost. We believe that the buying decision for our customers is based on the strength of the network of locations for outdoor advertising we can offer. The strength of our network is reflected in the value of our permits and site-leases. In the United States, we have operations in 49 of the top 50 markets, and our International division currently has a presence in 34 countries, including one of the leading positions in China, France, Italy, Spain and the United Kingdom. |

| • | Our scale has enabled cost-effective investment in new display technologies, such as digital billboards, which we believe will support future growth. This technology will enable us to transition from selling space on a display to a single advertiser to selling time on that display to multiple advertisers, creating new revenue opportunities from both new and existing clients. |

Strong Collection of Assets. Through acquisitions and organic growth, we have aggregated a sizable portfolio of assets. The domestic outdoor industry is regulated by the Federal government as well as state and municipal governments. Statutes and regulations govern the construction, repair, maintenance, lighting, spacing, location, replacement and content of outdoor advertising structures. Due to such regulation, it has become increasingly difficult to construct new outdoor advertising structures. Further, for many of our existing billboards, a permit for replacement cannot be sought by

3

our competitors or landlords. Internationally, regulations vary by country and region but generally provide for limitations on the number, placement, size, nature and density of outdoor displays. As a result, our existing billboards in top demographic areas have significant value.

Attractive Outdoor Industry Fundamentals. We believe outdoor advertising offers a compelling value proposition to advertisers, broad reach, valuable out-of-home positions and low cost per thousand persons reached relative to other media. Accordingly, we also believe the outdoor industry is also well-positioned to benefit from the fragmentation of audiences of other media as it is able to reach mass audiences on a local market basis.

| • | Compelling Value Proposition. Outdoor media provides advertisers with highly cost-effective media advertising as measured by cost per thousand persons reached compared to other traditional media. |

| • | Broad Audience Reach. According to the Arbitron 2009 In-Car Study, the average American spends about 20 hours in a car per week, a 31% increase since 2003. The captive in-car audience is subject to increasing out-of-home advertiser exposures as time and distance of commutes increase. |

| • | Valuable Out-of-Home Position. Outdoor media reaches potential consumers outside the home, where they are closer to purchase decisions. Many of our billboards are located along major roadways that are highly trafficked and have the potential to direct consumers to nearby businesses. |

| • | Fragmentation of Other Media. We believe that the proliferation of content and distribution models provides a means for the continued fragmentation of audiences of most traditional media, rendering outdoor advertising more attractive for its mass reach capabilities. |

Attractive Long-Term Business Model. While spending on outdoor advertising is, like most media, correlated with the overall economy, we believe the industry holds attractive long term prospects and is well positioned to benefit from a macroeconomic recovery and has historically generated strong cash flows.

| Ÿ | Cyclical Recovery. Prior to 2008, the advertising industry experienced two significant downturns since 1970, and after each, the outdoor advertising industry experienced higher growth than the overall advertising market over the three-year period following the end of the decline. |

| • | Strong Cash Flow Generation. We have double-digit operating margins, driven by our significant scale and a leading position in outdoor advertising. In addition, outdoor media is a low capital intensity business. The combination of high margins and low capital requirements allows for the conversion of a significant portion of our revenue into cash flow. |

| • | Geographic and Customer Diversity. For the year ended December 31, 2008, approximately 43% and 57% of our revenue was generated from our Americas and our International segments, respectively, and as of December 31, 2008, we had operations in 55 countries. No single market in the United States and no ad category represented greater than 8% and 10%, respectively, of our revenue during the year ended December 31, 2008. |

Experienced Management Team. We have an experienced management team from our senior executives to our local market managers. Our executive officers and certain outdoor senior managers possess an average of over 20 years of industry experience. The executive management team is led by Chief Executive Officer Mark P. Mays, who has been with Clear Channel Communications for more than 19 years (and with the Company since its acquisition). Many of our senior managers have managed the business through several business cycles.

4

Our Strategy

We are currently in a very challenging global economic environment, as witnessed by the declines in GDP in most locations in which we operate. With the weakening in consumer spending, many forms of media advertising have been, and continue to be, negatively impacted as companies reduce investment across the board, notably in marketing and advertising. In the face of these difficult conditions, we plan to focus on our competitive strengths to position the Company through the following strategies:

Significant Cost Reductions and Capital Discipline. To address the softness in advertising demand resulting from the economic environment, we have taken steps to reduce our fixed costs and discretionary expenses and maximize cash flow. In the fourth quarter of 2008, we commenced a restructuring plan to reduce our cost base through renegotiations of lease agreements, workforce reductions, the elimination of overlapping functions and other cost savings initiatives and expect to realize $176 million in cost savings through 2009. In order to achieve these cost savings, we expect to incur a total of $66 million in one-time cash charges through the end of 2009, $59 million had been incurred as of September 30, 2009. In addition, we plan to refocus our capital expenditures selectively on opportunities that we expect to yield higher returns, leveraging our flexibility to make capital outlays based on the environment.

Promote Overall Outdoor Media Spending. Outdoor advertising only represented 3% of total dollars spent on advertising in the United States in 2008. We believe we can continue to drive growth in outdoor advertising’s share of total media spending given our national scale and local reach. In both our Americas and International segments, we own and operate displays on real estate in highly trafficked areas of large markets. We believe these locations are highly attractive to advertisers, enabling them to effectively communicate with a mass audience on a local level. As audiences become increasingly fragmented and outdoor audience delivery measurement systems improve, we believe advertisers will continue to shift their budgets towards the outdoor advertising medium.

Roll Out Digital Billboards. Digital outdoor advertising provides significant advantages over traditional outdoor media. Our electronic displays may be linked through centralized computer systems to instantaneously and simultaneously change advertising copy on a large number of displays. The ability to change copy by time-of-day and quickly change messaging based on advertisers’ needs creates additional flexibility for our customers. The advantages of digital allow us to penetrate new accounts and categories of advertisers as well as serve a broader set of needs for existing advertisers. We expect this to continue as we increase our quantity of digital inventory. We intend to have deployed a total of approximately 450 digital displays in 34 markets by the end of 2009, of which approximately 90 are in the top 20 U.S. markets.

Capitalize on International Opportunities. We are also focused on growing our business internationally through new product offerings, optimization of our current display portfolio and selective investments targeting promising growth markets. We have continued to innovate and introduce new products, such as our SmartBike programs, in international markets based on local demands.

5

Recent Developments

As of December 10, 2009, we estimate revenue for the three months ending December 31, 2009 to be between $740 million and $760 million, and revenue for the full year ending December 31, 2009 to be between $2,675 million and $2,695 million. Set forth below is the percentage change in actual revenue for our Americas and International operating segments for the month of October 2009 compared to October 2008 and our estimates of the percentage change in revenue for the months of November and December 2009 compared to actual revenues in the corresponding months in 2008. We prepare estimated monthly revenues based on estimated monthly average foreign exchange rates, whereas annual average foreign exchange rates are used in determining our actual annual revenue. The percentage changes in estimated monthly revenue for November and December 2009 as compared to the same period in 2008 are based on monthly average foreign exchange rates and thus, may be materially different than the percentage changes in actual revenue determined using annual foreign exchange rates for the quarter and year ended December 31, 2009.

| October (Actual) |

November (Estimated) |

December (Estimated) | ||||

| Americas Outdoor |

-4% | 0% | 0% | |||

| International Outdoor |

-8% | -4% | -8% |

As of December 10, 2009, we estimate operating expenses to be between $565 million and $575 million and between $2,097 million and $2,107 million, respectively, for the three months and the full year ending December 31, 2009. Operating expenses include direct operating expenses, selling, general and administrative expenses and corporate expenses, but exclude restructuring and other non-recurring charges related to our restructuring program discussed herein and non-cash compensation charges related to employee compensation costs associated with stock option grants and restricted stock awards.

Also, as of December 10, 2009, we estimate long-term debt at December 31, 2009 to be between $2,560 million and $2,610 million.

Our estimated financial information is based on assumptions and estimates that are inherently uncertain. Such assumptions and estimates may not be realized and are subject to significant business, economic and competitive risks and uncertainties, all of which are difficult to predict and many of which are beyond our control. Such risks and uncertainties include, but are not limited to, changes in the level of competition for advertising dollars, changes in operating performance, quarter-end closing adjustments, adjustments related to the annual audit of our financial statements, and fluctuations in exchange rates and currency values. These and other risks and uncertainties may cause our estimated financial information to materially adversely differ from our actual results. Accordingly, no assurance can be made that we will achieve the results set forth in our estimated financial information, and investors should not place undue reliance on our estimated financial information.

Corporate Information

Our principal executive offices are located at 200 East Basse Road, San Antonio, TX 78209 (telephone: (210) 832-3700).

Clear Channel Worldwide Holdings was incorporated in Nevada in 2004. The principal executive offices of Clear Channel Worldwide Holdings are located at 200 East Basse Road, San Antonio, TX 78209 (telephone: (210) 832-3700).

6

Risk Factors

Investing in the notes involves substantial risks. These risks include, but are not limited to:

| • | our substantial indebtedness and the need to allocate significant amounts of cash flow to make payments thereon, which in turn could reduce our financial flexibility and ability to fund other activities; |

| • | our ability to achieve our cost savings goals in the timeframe we anticipate, or at all; |

| • | the potential impact of certain arrangements we have with our indirect parent, Clear Channel Communications; |

| • | our reliance on Clear Channel Communications for our liquidity and its ability to maintain adequate liquidity; |

| • | the impact of the global economic downturn; and |

| • | industry conditions, including competition. |

If any of the foregoing risks or risks described under the heading “Risk Factors” were to occur, we may not be able to make payments on the notes. See “Risk Factors” for a description of certain of the risks you should consider before investing in the notes.

Original Issue Discount

Except where otherwise indicated or where the context otherwise requires, in this offering circular, we have assumed that the notes will be issued at 100% of their principal amount. If the notes are issued at a discount to the principal amount, the proceeds to us will be reduced by the amount of any such discount. In addition, if the notes are issued with more than a de minimis amount of original issue discount (“OID”), for U.S. Federal income tax purposes, U.S. Holders will generally be required to include such OID as ordinary income over the life of the notes in advance of the receipt of cash attributable to that income regardless of their regular method of accounting. Special rules apply to non-U.S. Holders. For more information, see “Certain U.S. Federal Income Tax Considerations.”

7

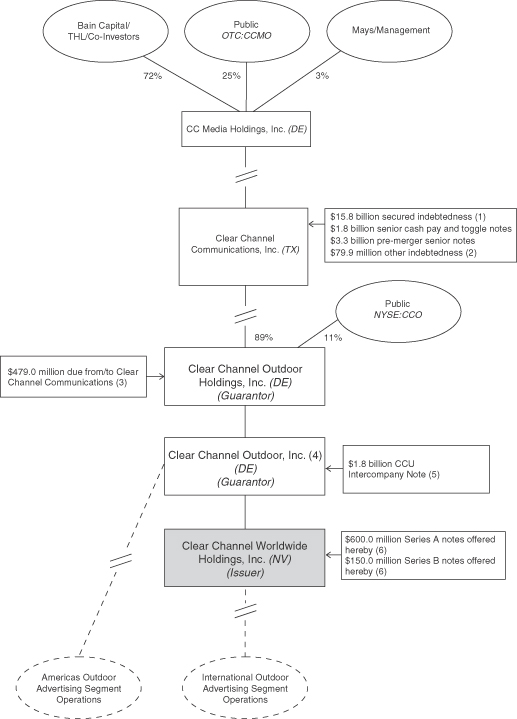

Corporate Structure

(as of September 30, 2009, pro forma for the offering)

8

| (1) | Secured indebtedness includes senior secured credit facilities of $15.8 billion (giving effect to the offering) and secured indebtedness of $5.4 million held at various subsidiaries. In connection with the offering, Clear Channel Worldwide Holdings intends to loan an amount equal to the aggregate principal amount of the notes to CCOI. CCOI intends to use these funds to repay approximately $730 million in aggregate principal amount owed to Clear Channel Communications under the CCU Intercompany Note (as defined in footnote 5 below). Clear Channel Communications intends to repay $150 million of indebtedness under its senior secured credit facilities (equal to the aggregate principal amount of the Series B notes). |

| (2) | The $79.9 million of other indebtedness includes (a) $49.4 million held at various subsidiaries within the International Outdoor Advertising Segment, (b) $30.4 million held at a subsidiary within the Americas Outdoor Advertising Segment and (c) $0.1 million held at a Radio Broadcasting subsidiary. |

| (3) | As part of the day-to-day cash management services provided by Clear Channel Communications, we maintain accounts that represent net amounts due to or from Clear Channel Communications, which is recorded as “Due from/to Clear Channel Communications” on the consolidated balance sheet. As part of the offering, Clear Channel Communications will repay $50.0 million in principal amount of the Due from Clear Channel Communications. The “Due from/to Clear Channel Communications” accounts are scheduled to mature on August 10, 2010 but will be extended to December , 2017. |

| (4) | Includes substantially all of the operations of the Americas Outdoor Advertising Segment. The remaining operations of the Americas Outdoor Advertising Segment, including those in Mexico, Canada and Peru, are operated through various subsidiaries of CCOI. |

| (5) | In August 2005, we distributed a note issued by CCOI in the original principal amount of $2.5 billion to Clear Channel Communications as a dividend (the “CCU Intercompany Note” or “Debt with Clear Channel Communications”). The CCU Intercompany Note is scheduled to mature on August 2, 2010 but will be extended to December , 2017 and may be prepaid in whole or in part at any time. CCOI will repay $730 million of the CCU Intercompany Note with a portion of the proceeds of the loans from Clear Channel Worldwide Holdings. See footnote 6 below and “Use of Proceeds.” |

| (6) | Clear Channel Worldwide Holdings will loan an amount equal to the aggregate principal amount of the notes to CCOI pursuant to two intercompany notes that will be due and payable in the same amounts and at the same times as the aggregate payments under the notes. |

9

The Offering

The summary below describes the principal terms of the notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Series A Notes” and the “Description of the Series B Notes” sections of this offering circular contain a more detailed description of the terms and conditions of the notes.

| Issuer |

Clear Channel Worldwide Holdings, Inc. |

Notes Offered:

| Series A Notes |

$600,000,000 aggregate principal amount of % Series A Senior Notes due 2017. |

| Series B Notes |

$150,000,000 aggregate principal amount of % Series B Senior Notes due 2017. |

The Series A notes and the Series B notes are each a separate class of notes and will be issued under separate indentures. Accordingly, they will be treated as separate obligations for all purposes, including with respect to any amendment, consent or waiver.

Maturity:

| Series A Notes |

The Series A notes will mature on December , 2017. |

| Series B Notes |

The Series B notes will mature on December , 2017. |

Interest Rate:

| Series A Notes |

The Series A notes will bear interest at a rate per annum equal to %. |

| Series B Notes |

The Series B notes will bear interest at a rate per annum equal to %. |

| Interest Payment Dates |

Interest on the notes will be payable by Clear Channel Worldwide Holdings to the Trustee as described below and payable by the Trustee to noteholders semi-annually in arrears on and of each year, commencing on , 2010. Interest shall be payable by or on behalf of Clear Channel Worldwide Holdings on a daily basis into an account established by the Trustee for the benefit of holders of notes. See “Description of the Series A Notes—Principal, Maturity and Interest” and “Description of the Series B Notes—Principal, Maturity and Interest.” |

| Ranking |

The notes: |

| • | will be the senior unsecured obligations of Clear Channel Worldwide Holdings; |

| • | will be pari passu in right of payment with all existing and future unsubordinated indebtedness of Clear Channel Worldwide Holdings, including under any credit facilities of Clear Channel Worldwide Holdings; |

10

| • | will be effectively subordinated to all existing and future secured indebtedness of Clear Channel Worldwide Holdings to the extent of the value of such assets securing such indebtedness; |

| • | will be senior in right of payment to all subordinated indebtedness of Clear Channel Worldwide Holdings; and |

| • | will be structurally subordinated to all existing and future obligations of any existing or future subsidiaries of Clear Channel Outdoor Holdings that do not guarantee the notes. |

| Guarantees |

The notes will be initially guaranteed, jointly and severally, irrevocably and unconditionally, on an unsecured senior basis, by Clear Channel Outdoor Holdings, CCOI and certain of the existing and future domestic subsidiaries of Clear Channel Outdoor Holdings. See “Description of the Series A Notes—Guarantees” and “Description of the Series B Notes—Guarantees.” The guarantee of each guarantor: |

| • | will be a senior unsecured obligation of such guarantor; |

| • | will rank pari passu in right of payment with all existing and future unsubordinated indebtedness of such guarantor, including under any credit facilities of such guarantor and, in the case of (i) CCOI, CCOI’s obligations under the CCU Intercompany Note and (ii) the Company, the Company’s obligations under the CCOH Mirror Note (as defined in “Description of the Series A Notes” and “Description of the Series B Notes”); and |

| • | will be effectively subordinated to all existing and future secured indebtedness of such guarantor to the extent of the value of such assets securing such Indebtedness. |

Optional Redemption:

| Series A Notes |

The issuer may redeem some or all of the Series A notes at any time and from time to time on or after , 2012, at the redemption prices described in this offering circular. Prior to , 2012, the issuer may redeem some or all of the Series A notes at a redemption price equal to 100% of the principal amount of the Series A notes plus accrued and unpaid interest, if any, to the applicable redemption date plus the applicable “make-whole” premium described in this offering circular. See “Description of the Series A Notes—Optional Redemption.” In addition, at any time prior to , 2012, Clear Channel Worldwide Holdings may redeem up to 35% of the aggregate principal amount of the Series A notes with the proceeds of certain equity offerings at a redemption price of %, plus accrued and unpaid interest, if any, to the applicable redemption date. See “Description of the Series A Notes—Optional Redemption.” |

11

| Series B Notes |

Clear Channel Worldwide Holdings may redeem some or all of the Series B notes at any time and from time to time on or after , 2012, at the redemption prices described in this offering circular. Prior to , 2012, Clear Channel Worldwide Holdings may redeem some or all of the Series B notes at a redemption price equal to 100% of the principal amount of the Series B notes plus accrued and unpaid interest, if any, to the applicable redemption date plus the applicable “make-whole” premium described in this offering circular. See “Description of the Series B Notes—Optional Redemption.” In addition, at any time prior to , 2012, Clear Channel Worldwide Holdings may redeem up to 35% of the aggregate principal amount of the Series B notes with the proceeds of certain equity offerings at a redemption price of %, plus accrued and unpaid interest, if any, to the applicable redemption date. See “Description of the Series B Notes—Optional Redemption.” |

| Change of Control |

If a change of control occurs, we will be required to make an offer to purchase the notes at a price equal to 101% of the principal amount of such notes, plus accrued and unpaid interest, if any, to the date of purchase. The term “Change of Control” is defined under “Description of the Series A Notes—Certain Definitions” and “Description of the Series B Notes—Certain Definitions.” This term includes important limitations and exceptions. For more information, see “Description of the Series A Notes—Repurchase at the Option of Holders—Change of Control” and “Description of the Series B Notes—Repurchase at the Option of Holders—Change of Control.” |

| Certain Covenants |

The indentures governing the Series A notes and the Series B notes will have different covenants and definitions of the same term may be different in each indenture. |

| Series A Notes |

The indenture governing the Series A notes will contain covenants that will limit our ability and the ability of our restricted subsidiaries to, among other things: |

| • | incur or guarantee additional debt to persons other than Clear Channel Communications and its subsidiaries (other than the Company) or issue certain preferred stock; |

| • | create liens on our or our restricted subsidiaries’ assets to secure debt; |

| • | create restrictions on the payment of dividends or other amounts to us from our restricted subsidiaries that are not guarantors of the notes; |

12

| • | enter into certain transactions with affiliates; |

| • | merge or consolidate with another person, or sell or otherwise dispose of all or substantially all of our assets; |

| • | sell certain assets, including capital stock of our subsidiaries, to persons other than Clear Channel Communications and its subsidiaries (other than the Company); |

The indenture governing the Series A notes will not include limitations on dividends, distributions, investments or asset sales. In addition, the covenants in the indenture governing the Series A notes are subject to important exceptions and qualifications, which are described under “Description of the Series A Notes—Certain Covenants in the 2017 A Indenture” and “—Certain Definitions.”

| Series B Notes |

The indenture governing the Series B notes will contain covenants that will limit our ability and the ability of our restricted subsidiaries to, among other things: |

| • | incur or guarantee additional debt or issue certain preferred stock; |

| • | redeem, repurchase or retire our subordinated debt; |

| • | make certain investments; |

| • | create liens on our or our restricted subsidiaries’ assets to secure debt; |

| • | create restrictions on the payment of dividends or other amounts to us from our restricted subsidiaries that are not guarantors of the notes; |

| • | enter into certain transactions with affiliates; |

| • | merge or consolidate with another person, or sell or otherwise dispose of all or substantially all of our assets; |

| • | sell certain assets, including capital stock of our subsidiaries; |

| • | designate our subsidiaries as unrestricted subsidiaries; and |

| • | pay dividends, redeem or repurchase capital stock or make other restricted payments. |

The covenants in the indenture governing the Series B notes are subject to important exceptions and qualifications, which are described under “Description of the Series B Notes—Certain Covenants in the 2017 B Indenture” and “—Certain Definitions.”

| Repurchase Ratio |

None of Clear Channel Outdoor Holdings or any of its subsidiaries shall make any purchase of, or otherwise effectively cancel or retire any Series B notes if, after giving |

13

| effect thereto and, if applicable, any concurrent purchase of or other action with respect to any Series A notes, the ratio of (a) the outstanding aggregate principal amount of the Series B notes to (b) the outstanding aggregate principal amount of the Series A notes shall be less than 0.250, subject to certain exceptions. See “Description of the Series A Notes—Mandatory Redemption; Offers to Purchase; Open Market Purchases” and “Description of the Series B Notes—Mandatory Redemption; Offers to Purchase; Open Market Purchases.” |

| Liquidity Amount |

Each of (a) Clear Channel Worldwide Holdings and the guarantors and (b) the restricted subsidiaries that are not guarantors will be required to maintain $50.0 million designated as a liquidity amount. The requirement may be satisfied with cash, other liquid assets and availability under certain credit facilities. The requirement for a liquidity amount is reduced during certain bankruptcy events at Clear Channel Communications. See “Description of the Series A Notes—Certain Covenants in the 2017 A Indenture—Liquidity Amount” and “Description of the Series B Notes—Certain Covenants in the 2017 B Indenture—Liquidity Amount.” |

| Exchange Offer; Registration Rights |

Clear Channel Worldwide Holdings has agreed to use commercially reasonable efforts to file an exchange offer registration statement to exchange the notes for a new issue of substantially identical debt securities registered under the Securities Act. Clear Channel Worldwide Holdings has also agreed to file a shelf registration statement to cover resales of the notes under certain circumstances. If Clear Channel Worldwide Holdings fails to satisfy these obligations, it has agreed to pay additional interest to the holders of the notes under certain circumstances. See “Exchange Offer; Registration Rights.” |

| Use of Proceeds |

Clear Channel Worldwide Holdings intends to loan amounts equal to the aggregate principal amount of the notes to CCOI pursuant to two intercompany notes that will be due and payable in the same amounts and at the same times as the aggregate payments under the notes offered hereby. CCOI intends to use amounts borrowed under the intercompany notes with Clear Channel Worldwide Holdings to (i) pay discounts, fees and expenses of approximately $20 million and (ii) fund the repayment of approximately $730 million aggregate principal amount of the CCU Intercompany Note. Clear Channel Communications intends to use amounts received from CCOI in repayment of the CCU Intercompany Note to repay $150 million of indebtedness under its senior secured credit facilities, with the balance available for general corporate purposes. |

14

| Transfer Restrictions |

Clear Channel Worldwide Holdings has not registered the notes under the Securities Act. The notes are subject to restrictions on transfer and may only be offered or sold in transactions exempt from or not subject to the registration requirements of the Securities Act. See “Notice to Investors.” |

| No Public Market |

The notes will be new securities for which there is currently no market. Although the Initial Purchasers have informed us that they intend to make a market in the notes, they are not obligated to do so and may discontinue market-making at any time without notice. Accordingly, we cannot assure you that a liquid market for the notes will develop or be maintained. |

| Certain U.S. Federal Income Tax Considerations |

If the notes are issued with more than a de minimis amount of OID, for U.S. Federal income tax purposes, U.S. Holders will generally be required to include such OID as ordinary income over the life of the notes in advance of the receipt of cash attributable to that income regardless of their regular method of accounting. See “Certain U.S. Federal Income Tax Considerations.” |

15

Summary Historical and Unaudited Pro Forma

Consolidated Financial and Other Data

The following table sets forth the summary historical and unaudited pro forma consolidated financial and other data of Clear Channel Outdoor Holdings as of the dates and for the periods indicated. The summary historical consolidated financial data for the years ended December 31, 2008, 2007 and 2006, and as of December 31, 2008 and 2007, are derived from our audited consolidated financial statements included elsewhere in this offering circular. The summary historical consolidated financial data for, and as of, the nine months ended September 30, 2009 and 2008 is derived from our unaudited consolidated financial statements included elsewhere in this offering circular. The summary historical consolidated financial data as of December 31, 2006 are derived from our audited consolidated financial statements and related notes not included herein. The financial data as of and for the years ended December 31, 2008, 2007 and 2006, and as of and for the nine months ended September 30, 2008, have been revised to reflect the adoption of ASC 810-10-45, which requires minority interests to be recharacterized as noncontrolling interests and reclassified as a component of equity within the consolidated balance sheets. In the opinion of management, the interim data reflects all adjustments (consisting only of normal and recurring adjustments) necessary for a fair presentation of the results for the interim periods. Historical results are not necessarily indicative of the results to be expected for future periods and operating results for the nine months ended September 30, 2009 are not necessarily indicative of the results that may be expected for the year ending December 31, 2009.

The unaudited pro forma financial data for, and as of, the last twelve months ended September 30, 2009 gives effect to the offering and the merger of Clear Channel Communications with a subsidiary of CC Media Holdings in the manner described in “Unaudited Pro Forma Condensed Consolidated Financial Statements.” We have derived the pro forma financial data for the last twelve months ended September 30, 2009 by adding the pro forma financial data for the year ended December 31, 2008 and the pro forma financial data for the nine months ended September 30, 2009 and subtracting the pro forma financial data for the nine months ended September 30, 2008. The pro forma adjustments are based upon available data and certain assumptions we believe are reasonable. The summary unaudited pro forma condensed consolidated financial data is for informational purposes only and does not purport to represent what our results of operations or financial position would actually be if the offering occurred at any date, nor does such data purport to project the results of operations for any future period.

The notes may be issued with more than a de minimis amount of OID, but the pro forma financial data included herein does not give effect to any OID that may result from the offering. In addition, if the notes are issued with OID, the proceeds to us will be reduced by the amount of any such discount. See footnote 5 below.

The summary historical and unaudited pro forma consolidated financial and other data should be read in conjunction with “Risk Factors,” “Selected Historical Consolidated Financial and Other Data,” “Unaudited Pro Forma Condensed Consolidated Financial Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto appearing elsewhere in this offering circular. The amounts in the tables may not add due to rounding.

16

| Historical | ||||||||||||||||||||||||

| (Dollars in millions) | Year Ended December 31, | Nine Months Ended September 30, |

Pro Forma Twelve Months Ended September 30, 2009(1) |

|||||||||||||||||||||

| 2008 | 2007 | 2006 | 2009 | 2008 | ||||||||||||||||||||

| Combined(2) | Pre-Merger | Pre-Merger | Post-Merger | Combined(2) | ||||||||||||||||||||

| Results of Operations Data: |

||||||||||||||||||||||||

| Revenue |

$ | 3,289 | $ | 3,282 | $ | 2,898 | $ | 1,935 | $ | 2,504 | $ | 2,720 | ||||||||||||

| Operating expenses: |

||||||||||||||||||||||||

| Direct operating expenses(3) |

1,882 | 1,735 | 1,515 | 1,171 | 1,424 | 1,629 | ||||||||||||||||||

| Selling, general and administrative expenses(3) |

606 | 538 | 487 | 348 | 438 | 516 | ||||||||||||||||||

| Depreciation and amortization |

472 | 399 | 408 | 328 | 329 | 471 | ||||||||||||||||||

| Corporate expenses(3) |

71 | 66 | 66 | 45 | 50 | 66 | ||||||||||||||||||

| Impairment charge(4) |

3,218 | — | — | 812 | — | 4,030 | ||||||||||||||||||

| Other operating income— net |

16 | 12 | 23 | 10 | 12 | 14 | ||||||||||||||||||

| Operating income (loss) |

(2,944 | ) | 556 | 445 | (759 | ) | 275 | (3,978 | ) | |||||||||||||||

| Interest expense, net (including interest on debt with Clear Channel Communications)(5) |

161 | 158 | 163 | 115 | 118 | 183 | ||||||||||||||||||

| Loss on marketable securities |

60 | — | — | 11 | — | 71 | ||||||||||||||||||

| Equity in earnings (loss) of nonconsolidated affiliates |

69 | 4 | 8 | (26 | ) | 70 | (27 | ) | ||||||||||||||||

| Other income (expense)—net |

25 | 10 | 1 | (5 | ) | 12 | 8 | |||||||||||||||||

| Income (loss) before income taxes |

(3,071 | ) | 412 | 291 | (916 | ) | 239 | (4,251 | ) | |||||||||||||||

| Income tax (expense) benefit |

220 | (147 | ) | (122 | ) | 102 | (57 | ) | 380 | |||||||||||||||

| Consolidated net income (loss) |

(2,851 | ) | 265 | 169 | (814 | ) | 182 | (3,871 | ) | |||||||||||||||

| Amount attributable to noncontrolling interest |

— | 19 | 16 | (3 | ) | 4 | (7 | ) | ||||||||||||||||

| Net income (loss) attributable to the Company |

$ | (2,851 | ) | $ | 246 | $ | 153 | $ | (811 | ) | $ | 178 | $ | (3,864 | ) | |||||||||

| Cash Flow Data: |

||||||||||||||||||||||||

| Cash interest expense(6) |

$ | 168 | $ | 166 | $ | 166 | $ | 115 | $ | 122 | $ | 221 | ||||||||||||

| Capital expenditures(7) |

358 | 276 | 234 | 114 | 238 | 234 | ||||||||||||||||||

| Net cash provided by operating activities |

603 | 694 | 539 | 270 | 447 | |||||||||||||||||||

| Net cash (used in) investing activities |

(426 | ) | (356 | ) | (489 | ) | (93 | ) | (308 | ) | ||||||||||||||

| Net cash (used in) financing activities |

(233 | ) | (306 | ) | (53 | ) | (111 | ) | (195 | ) | ||||||||||||||

| Other Financial Data (total debt and ratios at end of period): |

||||||||||||||||||||||||

| Total debt |

$ | 2,631 | ||||||||||||||||||||||

| EBITDA(8) |

$ | 840 | $ | 969 | $ | 862 | $ | 350 | $ | 686 | 504 | |||||||||||||

| OIBDAN(8) |

742 | 953 | 836 | 379 | 601 | 520 | ||||||||||||||||||

| Adjusted EBITDA(8) |

677 | |||||||||||||||||||||||

| Ratio of total debt to Adjusted EBITDA |

3.9x | |||||||||||||||||||||||

| Ratio of earnings to fixed charges(9) |

— | 1.76 | x | 1.57 | x | — | 1.38x | — | ||||||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||||||

| Current assets |

$ | 1,555 | $ | 1,607 | $ | 1,190 | $ | 1,697 | $ | 1,594 | ||||||||||||||

| Property, plant and equipment—net |

2,587 | 2,244 | 2,192 | 2,498 | 2,587 | |||||||||||||||||||

| Total assets |

8,051 | 5,936 | 5,422 | 7,239 | 11,859 | |||||||||||||||||||

| Current liabilities |

792 | 921 | 842 | 702 | 727 | |||||||||||||||||||

| Long-term debt, including current maturities |

2,602 | 2,682 | 2,684 | 2,611 | 2,576 | $ | 2,631 | |||||||||||||||||

| Shareholders’ equity |

3,544 | 2,199 | 1,768 | 2,820 | 6,809 | |||||||||||||||||||

17

| (1) | Information for the twelve months ended September 30, 2009 is presented on a pro forma basis to give effect to the offering as well as the application of push down accounting recorded in accordance with ASC 805-50-S99-1, which resulted from Clear Channel Communications’ merger with a subsidiary of CC Media Holdings, a company formed by private equity funds sponsored by Bain Capital and THL. Pro forma adjustments are made to depreciation and amortization, interest expense and income tax benefit (expense). |

| (2) | The accompanying consolidated financial statements are presented for two periods: post-merger and pre-merger. Preliminary purchase accounting adjustments pursuant to the aforementioned standard were pushed down to the opening balance sheet July 31, 2008 and resulted in a new basis of accounting beginning on July 31, 2008. The 2008 post-merger and pre-merger financial data is presented as follows: |

| (In millions) | Post-Merger | Pre-Merger | Combined | |||||||||

| Period from July 31 through December 31, 2008 |

Period from January 1 through July 30, 2008 |

Year Ended December 31, 2008 |

||||||||||

| Revenue |

$ | 1,327 | $ | 1,962 | $ | 3,289 | ||||||

| Operating expenses: |

||||||||||||

| Direct operating expenses |

763 | 1,119 | 1,882 | |||||||||

| Selling, general and administrative expenses |

261 | 345 | 606 | |||||||||

| Depreciation and amortization |

224 | 248 | 472 | |||||||||

| Corporate expenses |

32 | 39 | 71 | |||||||||

| Impairment charge |

3,218 | — | 3,218 | |||||||||

| Other operating income—net |

5 | 11 | 16 | |||||||||

| Operating income (loss) |

(3,166 | ) | 222 | (2,944 | ) | |||||||

| Interest expense (including interest on debt with Clear Channel Communications) |

73 | 88 | 161 | |||||||||

| Loss on marketable securities |

60 | — | 60 | |||||||||

| Equity in earnings (loss) of nonconsolidated affiliates |

(2 | ) | 71 | 69 | ||||||||

| Other income (expense)—net |

12 | 13 | 25 | |||||||||

| Income (loss) before income taxes |

(3,289 | ) | 218 | (3,071 | ) | |||||||

| Income tax (expense) benefit: |

||||||||||||

| Current |

3 | (30 | ) | (27 | ) | |||||||

| Deferred |

269 | (22 | ) | 247 | ||||||||

| Income tax (expense) benefit |

272 | (52 | ) | 220 | ||||||||

| Consolidated net income (loss) |

(3,017 | ) | 166 | (2,851 | ) | |||||||

| Amount attributable to noncontrolling interest |

2 | (2 | ) | — | ||||||||

| Net income (loss) attributable to the Company |

$ | (3,019 | ) | $ | 168 | $ | (2,851 | ) | ||||

| Cash Flow Data: |

||||||||||||

| Cash interest expense |

$ | 76 | $ | 92 | $ | 168 | ||||||

| Capital expenditures |

159 | 199 | 358 | |||||||||

| Net cash provided by operating activities |

272 | 331 | 603 | |||||||||

| Net cash (used in) investing activities |

(193 | ) | (233 | ) | (426 | ) | ||||||

| Net cash (used in) financing activities |

(69 | ) | (164 | ) | (233 | ) | ||||||

| Other Financial Data: |

||||||||||||

| Consolidated net income (loss) |

$ | (3,017 | ) | $ | 166 | $ | (2,851 | ) | ||||

| Interest expense |

73 | 88 | 161 | |||||||||

| Income tax (benefit) expense |

(272 | ) | 52 | (220 | ) | |||||||

| Depreciation and amortization |

224 | 248 | 472 | |||||||||

| Impairment charge |

3,218 | — | 3,218 | |||||||||

| Loss on marketable securities |

60 | — | 60 | |||||||||

| EBITDA |

$ | 286 | $ | 554 | $ | 840 | ||||||

| Non-cash compensation |

5 | 7 | 12 | |||||||||

| Other operating (income) expense—net |

(5 | ) | (11 | ) | (16 | ) | ||||||

| Equity in (earnings) loss of nonconsolidated affiliates |

2 | (71 | ) | (69 | ) | |||||||

| Other (income) expense—net |

(12 | ) | (13 | ) | (25 | ) | ||||||

| OIBDAN |

$ | 276 | $ | 466 | $ | 742 | ||||||

18

| (In millions) |

Post-Merger | Pre-Merger | Combined | |||||||||

| Period from July 31 through September 30, 2008 |

Period from January 1 through July 30, 2008 |

Nine Months Ended September 30, 2008 |

||||||||||

| Revenue |

$ | 542 | $ | 1,962 | $ | 2,504 | ||||||

| Operating expenses: |

||||||||||||

| Direct operating expenses (excludes depreciation and amortization) |

305 | 1,119 | 1,424 | |||||||||

| Selling, general and administrative expenses (excludes depreciation and amortization) |

93 | 345 | 438 | |||||||||

| Depreciation and amortization |

81 | 248 | 329 | |||||||||

| Corporate expenses |

11 | 39 | 50 | |||||||||

| Other operating income—net |

1 | 11 | 12 | |||||||||

| Operating income |

53 | 222 | 275 | |||||||||

| Interest expense (including interest on debt with Clear Channel Communications) |

30 | 88 | 118 | |||||||||

| Equity in earnings (loss) of nonconsolidated affiliates |

(1 | ) | 71 | 70 | ||||||||

| Other income (expense)—net |

(1 | ) | 13 | 12 | ||||||||

| Income before income taxes |

21 | 218 | 239 | |||||||||

| Income tax expense: |

||||||||||||

| Current |

5 | 30 | 35 | |||||||||

| Deferred |

— | 22 | 22 | |||||||||

| Income tax expense |

5 | 52 | 57 | |||||||||

| Consolidated net income |

$ | 16 | $ | 166 | $ | 182 | ||||||

| Amount attributable to noncontrolling interest |

6 | (2 | ) | 4 | ||||||||

| Net income attributable to the Company |

$ | 10 | $ | 168 | $ | 178 | ||||||

| Cash Flow Data: |

||||||||||||

| Cash interest expense |

30 | 92 | 122 | |||||||||

| Capital expenditures |

39 | 199 | 238 | |||||||||

| Net cash provided by operating activities |

116 | 331 | 447 | |||||||||

| Net cash (used in) investing activities |

(75 | ) | (233 | ) | (308 | ) | ||||||

| Net cash (used in) financing activities |

(31 | ) | (164 | ) | (195 | ) | ||||||

| Other Financial Data: |

||||||||||||

| Consolidated net income |

16 | 166 | 182 | |||||||||

| Interest expense |

30 | 88 | 118 | |||||||||

| Income tax expense |

5 | 52 | 57 | |||||||||

| Depreciation and amortization |

81 | 248 | 329 | |||||||||

| EBITDA |

$ | 132 | $ | 554 | $ | 686 | ||||||

| Non-cash compensation |

2 | 7 | 9 | |||||||||

| Other operating (income)—net |

(1 | ) | (11 | ) | (12 | ) | ||||||

| Equity in (earnings) loss of nonconsolidated affiliates |

1 | (71 | ) | (70 | ) | |||||||

| Other (income) expense—net |

1 | (13 | ) | (12 | ) | |||||||

| OIBDAN |

$ | 135 | $ | 466 | $ | 601 | ||||||

| (3) | Includes non-cash compensation expense. |

| (4) | As a result of the global economic downturn that has adversely affected advertising revenue across the Company’s businesses, the Company performed an interim impairment test as of December 31, 2008 and again as of June 30, 2009 on its indefinite-lived permits and goodwill. The interim impairment tests resulted in the Company recognizing non-cash impairment charges of $3.2 billion in 2008 and $812.4 million in 2009. |

| (5) | The notes may be issued with more than a de minimis amount of OID, but the pro forma interest expense does not give effect to any OID that may result from the offering. For each 1% change in the original issue price of the notes offered hereby, the pro forma interest expense would change by $0.9 million for the twelve months ended September 30, 2009. |

| (6) | Pro forma cash interest expense, a non-GAAP financial measure, includes cash paid for interest expense and excludes amortization of deferred financing costs and original issue discount. The most directly comparable GAAP financial measure is interest expense. Interest expense was $161 million, $158 million and $163 million, respectively, for the years ended December 31, 2008, 2007 and 2006, and was $115 million and $118 million, respectively, for the nine months ended September 30, 2009 and 2008. |

| (7) | Capital expenditures include additions to our property, plant and equipment and do not include any proceeds from disposal of assets, nor any expenditures for acquisitions of operating (revenue-producing) assets. |

19

| (8) | The following table discloses the Company’s EBITDA (defined as consolidated net income (loss) before interest expense, income tax (benefit) expense, depreciation and amortization, impairment charge and loss on marketable securities), OIBDAN (defined as EBITDA excluding non-cash compensation expense and the following line items presented in the Statement of Operations: other operating income—net; equity in earnings (loss) of nonconsolidated affiliates and other income (expense)—net) and Adjusted EBITDA (OIBDAN adjusted for items described below), each of which are non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP. EBITDA, OIBDAN and Adjusted EBITDA do not represent and should not be considered as alternatives to net income or cash flow from operations, as determined under GAAP. We believe that EBITDA, OIBDAN and Adjusted EBITDA provide investors with helpful information with respect to our operations. We present EBITDA, OIBDAN and Adjusted EBITDA to provide additional information with respect to our ability to meet our future debt service, capital expenditures and working capital requirements. Some adjustments to EBITDA may not be in accordance with current SEC practice or with regulations adopted by the SEC that apply to registration statements filed under the Securities Act and periodic reports presented under the Exchange Act. Accordingly, EBITDA, OIBDAN and Adjusted EBITDA may be presented differently in filings made with the SEC than as presented in this offering circular. |

EBITDA, OIBDAN and Adjusted EBITDA have limitations as analytical tools, and you should not consider them either in isolation or as substitutes for analyzing our results as reported under GAAP. Some of these limitations are:

| • | EBITDA, OIBDAN and Adjusted EBITDA do not reflect (i) changes in, or cash requirements for, our working capital needs; (ii) our interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; (iii) our tax expense or the cash requirements to pay our taxes; and (iv) our historical cash expenditures or future requirements for capital expenditures or contractual commitments; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA, OIBDAN and Adjusted EBITDA do not reflect any cash requirements for such replacements; |

| • | other companies in our industry may calculate EBITDA, OIBDAN and Adjusted EBITDA differently, limiting their usefulness as comparative measures; and |

| • | the adjustment attributable to cost savings permits an estimate as to amount of cost savings which will be realized as a result of actions which either have been taken or are then expected to be taken. |

Although our management believes these estimates and assumptions are reasonable, investors should not place undue reliance upon the calculation of Adjusted EBITDA, given how it is calculated and the possibility that the underlying estimates and assumptions may ultimately not reflect actual results.

20

The following table summarizes the calculation of the Company’s historical and pro forma EBITDA, OIBDAN and pro forma Adjusted EBITDA and provides a reconciliation to the Company’s consolidated net income (loss) for the periods indicated:

| Historical | Pro Forma | |||||||||||||||||||||||

| (Dollars in millions) | Year Ended December 31, | Nine Months Ended September 30, |

Twelve Months Ended September 30, 2009 |

|||||||||||||||||||||

| 2008 Combined |

2007 Pre-Merger |

2006 Pre-Merger |

2009 Post-Merger |

2008 Combined |

||||||||||||||||||||

| Consolidated net income (loss) |

$ | (2,851 | ) | $ | 265 | $ | 169 | $ | (814 | ) | $ | 182 | $ | (3,871 | ) | |||||||||

| Interest expense(a) |

161 | 158 | 163 | 115 | 118 | 183 | ||||||||||||||||||

| Income tax (benefit) expense |

(220 | ) | 147 | 122 | (102 | ) | 57 | (380 | ) | |||||||||||||||

| Depreciation and amortization |

472 | 399 | 408 | 328 | 329 | 471 | ||||||||||||||||||

| Impairment charge |

3,218 | — | — | 812 | — | 4,030 | ||||||||||||||||||

| Loss on marketable securities |

60 | — | — | 11 | — | 71 | ||||||||||||||||||

| EBITDA |

$ | 840 | $ | 969 | $ | 862 | $ | 350 | $ | 686 | $ | 504 | ||||||||||||

| Non-cash compensation |

12 | 10 | 6 | 8 | 9 | 11 | ||||||||||||||||||

| Other operating (income) expense—net |

(16 | ) | (12 | ) | (23 | ) | (10 | ) | (12 | ) | (14 | ) | ||||||||||||

| Equity in (earnings) loss of nonconsolidated affiliates |

(69 | ) | (4 | ) | (8 | ) | 26 | (70 | ) | 27 | ||||||||||||||

| Other (income) expense—net |

(25 | ) | (10 | ) | (1 | ) | 5 | (12 | ) | (8 | ) | |||||||||||||

| OIBDAN |

$ | 742 | $ | 953 | $ | 836 | $ | 379 | $ | 601 | $ | 520 | ||||||||||||

| Projected cost savings: |

||||||||||||||||||||||||

| Real estate cost savings(b) |

$ | 38 | ||||||||||||||||||||||

| Workforce reductions(c) |

16 | |||||||||||||||||||||||

| Other cost savings initiatives(d) |

5 | |||||||||||||||||||||||

| Restructuring charges(e) |

59 | |||||||||||||||||||||||

| Non-cash rent expense(f) |

26 | |||||||||||||||||||||||

| Cash received from nonconsolidated affiliates(g) |

4 | |||||||||||||||||||||||

| Disposition of line of business(h) |

2 | |||||||||||||||||||||||

| Other miscellaneous(i) |

7 | |||||||||||||||||||||||

| Adjusted EBITDA |

$ | 677 | ||||||||||||||||||||||

| (a) | See footnote 5 above. |

| (b) | Represents an adjustment to give effect to the full year impact of implemented cost savings attributable to actions we have taken to date to reduce our real estate costs. Our estimates are based on the cost savings we have achieved assuming those cost savings continue on an annual basis. Our actions relate to lease renegotiations, dismantling of certain assets and specialty displays contract renegotiations. Although we anticipate achieving ongoing cost savings attributable to these actions, the nature of our leases is such that they expire and must be renewed. Any cost savings we have achieved may not be sustained when we renew those leases in the future. |

| (c) | Represents an adjustment to give effect to the full year impact of implemented cost savings attributable to the historical salaries, benefits and taxes of employees terminated as part of our cost reduction initiatives. Our estimates are based on the cost savings we have achieved assuming those cost savings continue on an annual basis. |

| (d) | Represents an adjustment to give effect to the full year impact of implemented cost savings primarily attributable to our (1) reduction in use of, and price related to, subcontracted labor, (2) reduction in external services for legal and other administrative functions, (3) renegotiation of certain supplier contracts and (4) other direct operating costs. Although we anticipate achieving ongoing cost savings attributable to these actions, the nature of these cost savings is such that they may not be sustained when we renew our labor, supplier and other contracts in the future. |

| (e) | In connection with the restructuring program commenced in the fourth quarter of 2008, the Company has incurred $59 million in one-time cash charges for the twelve months ended September 30, 2009. |

| (f) | Represents the difference between cash rent expense and GAAP rent expense totalling $26 million for the twelve months ended September 30, 2009. |

| (g) | Represents cash dividends received from nonconsolidated affiliates of $4 million for the twelve months ended September 30, 2009 as the equity in earnings from these investments has been deducted in the calculation of OIBDAN. |

| (h) | Represents adjustment to EBITDA for the disposition of business units totaling $2 million for the twelve months ended September 30, 2009. |

| (i) | Represents the portion of the management fees payable by Clear Channel Communications and attributable to us of $7 million for the twelve months ended September 30, 2009. |

| (9) | Ratio of earnings to fixed charges represents the ratio of earnings (defined as pre-tax income (loss) from continuing operations before equity in earnings (loss) of nonconsolidated affiliates) to fixed charges (defined as interest expense plus the interest portion of rental expense). Our earnings, which included impairment charges of $3.2 billion and $812.4 million for the year ended December 31, 2008, and nine months ended September 30, 2009, respectively, were not sufficient to cover our fixed charges by $3.1 billion and $890.4 million for the year ended December 31, 2008 and the nine months ended September 30, 2009, respectively. Our pro forma earnings (after giving effect to the offering and which include impairment charges of $3.2 billion and $812.4 million) for the twelve months ended September 30, 2009 were not sufficient to cover fixed charges by $4.2 billion. |

21

Segment Information

| Pro Forma: | ||||||||||||||||

| Twelve Months Ended September 30, 2009 |

||||||||||||||||

| Americas Segment |

International Segment |

Corporate | Consolidated | |||||||||||||

| OIBDAN |

$ | 418 | $ | 167 | $ | (65 | ) | $ | 520 | |||||||

| Non-cash compensation |

(8 | ) | (2 | ) | (1 | ) | (11 | ) | ||||||||

| Depreciation and amortization |

(211 | ) | (260 | ) | — | (471 | ) | |||||||||

| Impairment charge |

— | — | (4,030 | ) | (4,030 | ) | ||||||||||

| Other operating income |

— | — | 14 | 14 | ||||||||||||

| Operating income (loss) |

$ | 199 | $ | (95 | ) | $ | (4,082 | ) | $ | (3,978 | ) | |||||

| Historical: | ||||||||||||||||

| Year Ended December 31, 2008 |

||||||||||||||||

| Americas Segment |

International Segment |

Corporate | Consolidated | |||||||||||||

| OIBDAN |

$ | 538 | $ | 273 | $ | (69 | ) | $ | 742 | |||||||

| Non-cash compensation |

(9 | ) | (2 | ) | (1 | ) | (12 | ) | ||||||||

| Depreciation and amortization |

(207 | ) | (265 | ) | — | (472 | ) | |||||||||

| Impairment charge |

— | — | (3,218 | ) | (3,218 | ) | ||||||||||

| Other operating income |

— | — | 16 | 16 | ||||||||||||

| Operating income (loss) |

$ | 322 | $ | 6 | $ | (3,272 | ) | $ | (2,944 | ) | ||||||

| Nine Months Ended September 30, 2009 |

||||||||||||||||

| Americas Segment |

International Segment |

Corporate | Consolidated | |||||||||||||

| OIBDAN |

$ | 316 | $ | 109 | $ | (46 | ) | $ | 379 | |||||||

| Non-cash compensation |

(6 | ) | (2 | ) | — | (8 | ) | |||||||||

| Depreciation and amortization |

(159 | ) | (169 | ) | — | (328 | ) | |||||||||

| Impairment charge |

— | — | (812 | ) | (812 | ) | ||||||||||

| Other operating income |

— | — | 10 | 10 | ||||||||||||

| Operating income (loss) |

$ | 151 | $ | (62 | ) | $ | (848 | ) | $ | (759 | ) | |||||

| Nine Months Ended September 30, 2008 |

||||||||||||||||

| Americas Segment |

International Segment |

Corporate | Consolidated | |||||||||||||

| OIBDAN |

$ | 436 | $ | 215 | $ | (50 | ) | $ | 601 | |||||||

| Non-cash compensation |

(7 | ) | (2 | ) | — | (9 | ) | |||||||||

| Depreciation and amortization |

(155 | ) | (174 | ) | — | (329 | ) | |||||||||

| Other operating income |

— | — | 12 | 12 | ||||||||||||

| Operating income (loss) |

$ | 274 | $ | 39 | $ | (38 | ) | $ | 275 | |||||||

22

RISK FACTORS

An investment in the notes involves a high degree of risk. You should carefully consider the risks described below, together with the other information contained in this offering circular, before making your decision to invest in the notes. Any of the following risks, as well as other risks and uncertainties, could harm the value of the notes directly, or our business and financial results and thus indirectly cause the value of the notes to decline. The risks described below are not the only ones that could impact the Company or the value of the notes. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition or results of operations. As a result of any of these risks, known or unknown, you may lose all or part of your investment in the notes.

Risks Related to the Notes and the Offering

We have substantial indebtedness that could restrict our operations and impair our financial condition and your investment in the notes.

At September 30, 2009, our total indebtedness for borrowed money was $2.6 billion, approximately $2.5 billion of which was indebtedness owed to Clear Channel Communications. As of September 30, 2009, approximately $2.6 billion of such total indebtedness (excluding interest) was classified as current, and $31.3 million is due in 2013 and thereafter. We may also incur additional substantial indebtedness in the future.

After the offering, we will continue to have a significant amount of indebtedness. As of September 30, 2009, on a pro forma basis after giving effect to the offering, the outstanding total indebtedness of Clear Channel Outdoor Holdings would have been approximately $2.6 billion, of which $750 million would represent indebtedness of Clear Channel Worldwide Holdings related to the notes offered hereby. As of September 30, 2009, on a pro forma basis after giving effect to the offering, approximately $79.9 million of such total debt (excluding interest) would have been classified as current, and $2.6 billion would be due in 2013 and thereafter.

Our substantial level of indebtedness and other financial obligations increase the possibility that we may be unable to generate cash sufficient to pay, when due, the principal of, interest on or other amounts due, in respect of our indebtedness, including the notes in the event we are required to make such payments on the notes pursuant to our guarantee.

Our substantial indebtedness could have other adverse consequences, including:

| • | increasing our vulnerability to adverse economic, competitive, regulatory and industry conditions, including those currently present; |

| • | limiting our ability to compete and our flexibility in planning for, or reacting to, current changes in our business and the industry; |

| • | requiring us to dedicate a substantial portion of our cash flow from operations to the payment of our indebtedness, thereby reducing the funds available to us for working capital, capital expenditures and any future business opportunities; |

| • | exposing us to the risk of increased interest rates as certain of our indebtedness is at variable rates of interest; |

| • | restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; |

| • | limiting our planning flexibility for, or ability to react to, changes in our business and the industries in which we operate; |

| • | placing us at a competitive disadvantage with competitors who may have less indebtedness and other obligations or greater access to financing; and |

23

| • | limiting our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes on satisfactory terms, or at all. |

If our cash flow and capital resources are insufficient to service our debt obligations, we may be forced to sell assets, seek additional equity or debt capital or restructure our indebtedness. However, given the current economic climate, these measures might be unsuccessful or inadequate in permitting us to meet scheduled debt service obligations. In light of the current credit crisis or any future crisis we may be unable to restructure or refinance our obligations and obtain additional equity financing or sell assets on satisfactory terms or at all. As a result, inability to meet our debt obligations could cause us to default on those obligations. A default under any debt instrument could, in turn, result in defaults under other debt instruments.

To service our debt obligations and to fund capital expenditures, we will require a significant amount of cash to meet our needs, which depend on many factors beyond our control.

Our earnings, which included impairment charges of $3.2 billion for the year ended December 31, 2008 and $812.4 million for the nine months ended September 30, 2009 were not sufficient to cover our fixed charges by $3.1 billion and $890.4 million for the year ended December 31, 2008 and the nine months ended September 30, 2009, respectively. Our pro forma earnings (after giving effect to the offering and which include impairment charges of $3.2 billion and $812.4 million) for the twelve months ended September 30, 2009 were not sufficient to cover fixed charges by $4.2 billion. Our cash debt service for 2009, based on the amount of indebtedness outstanding at September 30, 2009 (after giving pro forma effect to the offering), is expected to be approximately $220.9 million based on current interest rates, of which $63.8 million represents debt service on fixed-rate obligations.

Our ability to service our debt obligations and to fund capital expenditures for display construction or renovation will require a significant amount of cash, which depends on general economic, financial, competitive, legislative, regulatory and other factors beyond our control, which may prevent us from securing any cash to meet these needs. Our ability to make payments on and to refinance our indebtedness will also depend on our ability to generate cash in the future.

We cannot ensure that our business will generate sufficient cash flow or that future borrowings will be available to us in an amount sufficient to enable us to pay our indebtedness, including our indebtedness to Clear Channel Communications, or to fund our other liquidity needs. If our future cash flow from operations and other capital resources are insufficient to pay our obligations as they mature or to fund our liquidity needs, we may be forced to reduce or delay our business activities and capital expenditures, sell assets, or attempt to obtain additional equity capital or restructure or refinance all or a portion of indebtedness, including the indebtedness with Clear Channel Communications, on or before maturity. We cannot ensure that we will be able to refinance any of our indebtedness, including the indebtedness with Clear Channel Communications, on a timely basis, on satisfactory terms or at all. In addition, the terms of our existing indebtedness, including the indebtedness with Clear Channel Communications, and other future indebtedness may limit our ability to pursue any of these alternatives.

Our agreements with Clear Channel Communications impose restrictions on our ability to finance operations and capital needs, make acquisitions or engage in other business activities.

The Master Agreement (as defined herein) with Clear Channel Communications includes restrictive covenants that, among other things, restrict our ability to:

| • | issue any shares of capital stock or securities convertible into capital stock; |

| • | incur additional indebtedness; |

24

| • | make certain acquisitions and investments; |

| • | repurchase our stock; |

| • | dispose of certain assets; and |

| • | merge or consolidate. |

The existence of these restrictions limits our ability to finance operations and capital needs, make acquisitions or engage in other business activities, including our ability to grow and increase our revenue or respond to competitive changes. The following is a discussion of our sources of capital:

| • | We do not have any material committed external sources of capital independent from Clear Channel Communications. |

| • | Under our Master Agreement with Clear Channel Communications and the CCU Intercompany Note, we are limited in our borrowing from third parties to no more than $400.0 million. In connection with the offering, the Company and Clear Channel Communications will amend the Master Agreement and amend and restate the CCU Intercompany Note to exclude from such $400.0 million limitation the issuance of the notes and future issuances of debt securities with maturities no earlier than the notes that are used to repay the CCU Intercompany Note. As a result of current borrowings and commitments we were limited to approximately $139.4 million in additional external borrowings as of September 30, 2009. |