Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Pinnacle Foods Finance LLC | d8k.htm |

Exhibit 99.1

| Table of Contents | ||||

| I. |

Executive Summary | 2 | ||

| II. |

Investment Highlights | 11 | ||

| III. |

Company Overview | 16 | ||

| IV. |

Industry Overview | 29 | ||

| V. |

Historical Financials | 32 | ||

1

I. EXECUTIVE SUMMARY

Unless the context requires otherwise, in this confidential information memorandum, “Pinnacle,” refers to Pinnacle Foods Finance LLC (“PFF”) and its subsidiaries.

Pinnacle uses a combination of data provided by Information Resources, Inc. (“IRI”) and The Nielsen Company (“Nielsen”). Unless otherwise indicated, retail sales, market share, category and other industry data used throughout this confidential information memorandum for all categories and segments are: for Pinnacle brands, U.S. IRI data for the 52-week period ended September 27, 2009; for Pinnacle brands in Canada, Nielsen data for the 52-week period ended September 26, 2009; and for the Birds Eye brands, IRI data for the 52-week period ended September 6, 2009. These data include retail sales in supermarkets with at least $2 million in total annual sales but exclude sales in mass merchandiser, club, drug, convenience or dollar stores. Retail sales are dollar sales estimated by IRI and represent the value of units sold through supermarket cash registers for the relevant period.

A. Transaction Overview

On November 18th, 2009, Pinnacle Foods Group LLC, a wholly owned subsidiary of Pinnacle Foods Finance LLC (“Pinnacle” or the “Company”), a manufacturer and distributor of high-quality dry and frozen packaged food products, entered into an agreement to acquire Birds Eye Foods, Inc. (“Birds Eye”), a leading packaged foods company and the largest player in the U.S. frozen vegetables category (the “Acquisition”). Pinnacle believes that Birds Eye represents a strong strategic fit with its existing portfolio of brands. On a pro forma combined basis, Pinnacle and Birds Eye generated net sales of $2.6 billion and adjusted EBITDA of approximately $472 million for the twelve month period ended September 27, 2009.

The Acquisition will be financed through (the “Transactions”):

| • | $875 million Senior Secured Credit Facilities (the “Facilities”) |

| • | $25 million Incremental Revolving Credit Facility (the “Incremental Revolver”), expected to be undrawn at close |

| • | $850 million Incremental Term Loan C Facility (the “Incremental Term Loan C”) |

| • | $300 million senior unsecured debt (the “new senior unsecured debt”) |

| • | $312 million of equity contribution from the Sponsor (based on 9/26/09 Birds Eye debt balances) |

| • | Represents the approximate equity contribution to be made by investment funds affiliated with Blackstone based on Birds Eye’s 9/26/09 debt balance. Actual equity contribution will be based on Birds Eye’s balance sheet at the Closing. Net debt of Birds Eye was $37.6 million lower on 11/28/09 than on 9/26/09, which would have reduced the equity contribution to $274.6 million, had the transaction closed on that date |

Pro forma for the Acquisition, including expected synergies of $45 million, the Company will have senior secured leverage of 4.4x (vs. 4.8x on a standalone basis), senior leverage of 5.7x (vs. 6.0x), and total leverage of 6.2x (vs. 6.8x) based on pro forma adjusted EBITDA of approximately $472 million for the twelve months ended September 27, 2009. See “Historical Financials — Reconciliation of Pro Forma LTM Adjusted EBITDA” below for further details.

B. Company Overview

Pinnacle

Pinnacle is a leading manufacturer, marketer, and distributor of branded, high-quality dry and frozen packaged food products in North America. The Company’s major brands hold leading market positions in their respective retail categories and enjoy high consumer awareness. Most of Pinnacle’s brands have been part of American lives for at least 50 years, and about 80% of U.S. households purchase a Pinnacle product. The Company’s products are sold through a combination of a national sales

2

broker, regional sales brokers, and a direct sales force that reaches supermarkets, grocery wholesalers and distributors, mass merchandisers, super centers, convenience stores, dollar stores, drug stores, warehouse clubs, foodservice, and other alternative channels in the United States and Canada. Pinnacle also distributes a selection of its products in Mexico, the Caribbean, and Latin America. The combination of new product innovation, core product renovation, effective consumer marketing, and strategic acquisitions have helped Pinnacle create and grow its diverse brand portfolio.

Pinnacle’s products and operations are managed and reported in two operating segments: dry foods and frozen foods. The dry foods segment consists primarily of Duncan Hines baking mixes and frostings, Vlasic shelf-stable pickles, peppers, and relish, Mrs. Butterworth’s and Log Cabin table syrups, and Armour canned meats. The frozen foods segment consists primarily of Hungry-Man and Swanson frozen dinners and entrées, Mrs. Paul’s and Van de Kamp’s frozen seafood, Aunt Jemima frozen breakfasts, Lender’s bagels, and Celeste frozen pizza-for-one.

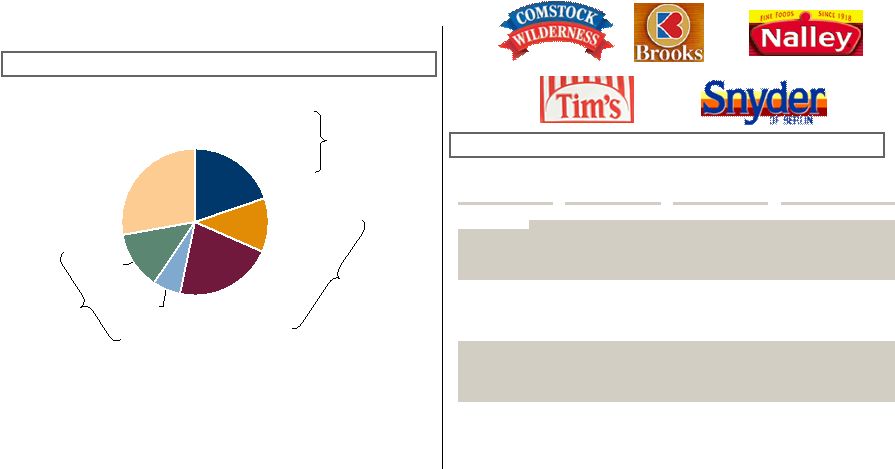

| PINNACLE NET SALES BY BRAND LTM 9/27/09 |

|

% of Total Net Sales:

Duncan Hines - 16%

Vlasic - 14%

Armour - 9%

Mrs. Butterworth’s - 4%

Log Cabin - 2%

Open Pit - 1%

Hungry-Man - 9%

Mrs. Paul’s and Van de Kamp’s - 5%

Aunt Jemima - 6%

Lender’s - 4%

Celeste - 3%

Swanson - 2%

Country Kitchen - 1%

Hawaiian Bowls - 1%

Foodservice - 9%

Private Label - 10%

Canada - 4% |

Birds Eye

Birds Eye Foods is a leading marketer, manufacturer, and distributor of branded packaged food products, including an expanding platform of healthy, high-quality frozen vegetables and frozen meals and a portfolio of primarily branded specialty dry foods which are well-aligned with Pinnacle’s existing dry foods segment. Frozen food products are marketed under the Birds Eye brand name, which holds the #1 market share in frozen vegetables and the #1 market share in the value sub-segment of complete bagged meals. Birds Eye markets traditional boxed and bagged frozen vegetables, as well as steamed vegetables using innovative steam-in-packaging technology, under the Birds Eye and Birds Eye Steamfresh brands. Birds Eye’s complete bagged meals, marketed primarily under the value-oriented Birds Eye Voila! brand, offer consumers value-added meal solutions that include a protein, starch, and vegetables in one convenient package. Birds Eye’s branded specialty dry food products hold leading market share positions in their core geographic markets, and include Comstock and Wilderness fruit pie fillings and toppings, Brooks and Nalley chili and chili ingredients, and snack foods by Tim’s Cascade and Snyder of Berlin.

The Birds Eye brand generated approximately $1 billion in retail sales during the fiscal year ended June 26, 2009. In addition, Birds Eye is one of the fastest growing major frozen food brands in the United States, having grown retail sales at a 14.9% compounded annual growth rate from 2005 to 2008. The brand also has a strong track record of successful product innovation. For example, with the launch of its Birds Eye Steamfresh vegetables in 2006, Birds Eye was the first company to capture nationwide market share with a product that offers consumers the ability to steam frozen vegetables conveniently in a specially designed microwaveable bag. These innovations have helped the company increase its #1 market share in frozen vegetables from 22.1% in 2005 to 26.5% today.

3

| BIRDS EYE NET SALES BY BRAND LTM 9/26/09 |

|

% of Total Net Sales:

Birds Eye vegetables - 28%

Birds Eye Steamfresh vegetables - 27%

Birds Eye Voila! - 11%

Birds Eye Steamfresh meals - 3%

Comstock and Wilderness - 6%

Snyder of Berlin - 7%

Tim’s Cascade - 4%

Nalley - 4%

Brooks - 2%

Other - 9% |

| BIRDS EYE: LEADING MARKET POSITIONS |

|

Frozen Vegetables Dollar Market Share:

Birds Eye - 27%

Green Giant - 18%

A/O Brands - 17%

Private Label - 39%

* Represents third largest sub-sector in U.S. frozen food market

* Key category for retailers

* Birds Eye growing market share due to increasing category penetration of steamed vegetables

* Private label penetration in category has been flat for several years

Value Complete Bagged Meals Dollar Market Share:

Voila! - 34%

Stouffer’s - 27%

Banquet - 8%

Private Label - 8%

A/O Brands - 23%

* Meals represent largest sub-sector in the U.S. frozen foods market

* Birds Eye is #1 in the value sub-segment of complete bagged meals

* New product innovation and convenience attributes will continue to drive growth |

4

C. Industry Overview

The U.S. packaged food manufacturing industry has historically been characterized by relatively stable sales growth, driven primarily by population growth and modest sales price increases. Given the non-discretionary nature of food consumption, the industry historically has demonstrated stability during periods of economic recession. In recent years, the industry has been characterized by a number of broad trends, including:

| • | Changing Consumer Lifestyles. Food manufacturers are highly attuned to changing consumer preferences and needs, and have responded to consumers’ increasingly busy lifestyles and greater focus on health and nutrition by introducing a variety of convenient, high-quality, and healthy food products and meal solutions. Industry participants seek to gain a competitive advantage by addressing consumer needs through new product introductions, core product renovations, and marketing. Pinnacle continues to expand and refine its brands and offerings so they remain relevant and continue to be preferred by consumers. |

| • | Channel Shifting. Consumers are increasingly purchasing food products at outlets other than traditional grocery retailers. Mass merchandisers, club stores, dollar stores, and other alternative channels are gaining share versus traditional grocery stores. Pinnacle is well positioned in both grocery and alternative channels, maintaining strong customer relationships across key retailers in each segment. |

| • | Return to Eating at Home. Historically, U.S. consumers had been increasing the proportion of their food consumption at restaurants and other foodservice venues. Recently, however, this trend has reversed, with more consumers eating at home, which has been driven by consumers’ increased desire to spend time with family in the home, the growing popularity of cooking as a leisure activity, and consumers’ renewed focus on managing their personal finances prudently given the economic environment. Pinnacle is taking advantage of these trends through increased targeted marketing and new product introductions. |

| • | Increase in Private Label. Private label and store brands represent approximately 20% of total packaged food purchases at grocery retail, up from 18.5% a year ago. The Company believes the recent rise in private label share has been driven by consumers’ increased focus on product costs, certain retailers’ support of store brands, and the improved quality of some private label offerings. However, Pinnacle believes that brands with well established equities, strong awareness, and consumer preference that continue to differentiate themselves and provide value to the consumer are well positioned to withstand private label competition. Pinnacle generally competes in categories with lower private label penetration and often occupies a value positioning in its categories, which further insulates Pinnacle’s brands from private label competition. |

5

D. Overview of Sponsor

Blackstone is one of the world’s leading investment and advisory firms. Blackstone’s alternative asset management businesses include the management of private equity funds, real estate funds, funds of hedge funds, credit-oriented funds, collateralized loan obligation vehicles and closed-end mutual funds. Through its different investment businesses, as of September 30, 2009, Blackstone had total assets under management of approximately $97.6 billion. This is comprised of $44.7 billion in corporate private equity and real estate private equity funds and $52.8 billion in credit and marketable alternatives. Through September 30, 2009, Blackstone’s various private equity funds have invested or committed total equity of approximately $31 billion to 139 transactions, representing an aggregate transaction value of over $284 billion. Blackstone also provides various financial advisory services, including mergers and acquisitions advisory, restructuring and reorganization advisory and fund placement services. In June 2007, Blackstone conducted an initial public offering of common units representing limited partner interests in The Blackstone Group L.P., which are listed on the New York Stock Exchange under the symbol “BX.”

6

E. Sources & Uses and Pro Forma Capitalization

| SOURCES & USES – AS OF 9/27/09 | ||||||

| ($ in millions) | ||||||||

| Sources of Funds |

Amount | Uses of Funds |

Amount | |||||

| New Incremental Term Loan C Facility |

$ | 850.0 | Purchase Equity |

$ | 670.0 | |||

| Senior unsecured debt |

300.0 | Refinance Birds Eye Net Debt |

704.1 | |||||

| New Sponsor Equity |

312.2 | Fees & Expenses |

88.1 | |||||

| Total Sources |

$ | 1,462.2 | Total Uses |

$ | 1,462.2 | |||

| • | $312.2mm equity contribution represents the approximate equity contribution to be made by investment funds affiliated with Blackstone based on Birds Eye’s 9/26/09 debt balance. Actual equity contribution will be based on Birds Eye’s balance sheet at the Closing. Net debt of Birds Eye was $37.6 million lower on November 28, 2009 than on September 26, 2009, which would have reduced the equity contribution to $274.6 million, had the Closing occurred on that date. |

| PRO FORMA CAPITALIZATION | ||||||

| ($ in millions) | Pinnacle 9/27/09A |

Birds Eye 9/26/09A |

Combined | Adj. | PF Pinnacle 9/27/09A | |||||||||||

| Cash |

$ | 2.6 | $ | 44.4 | $ | 47.0 | $ | (44.4 | ) | $ | 2.6 | |||||

| Existing Revolver |

7.7 | 36.2 | 43.9 | (36.2 | ) | 7.7 | ||||||||||

| Pinnacle Term Loan |

1,225.0 | — | 1,225.0 | — | 1,225.0 | |||||||||||

| New Incremental Term Loan C Facility |

— | — | — | 850.0 | 850.0 | |||||||||||

| Birds Eye Term Loan |

— | 379.9 | 379.9 | (379.9 | ) | — | ||||||||||

| Capital Leases |

1.8 | 1.8 | 3.6 | — | 3.6 | |||||||||||

| Total Senior Secured Debt |

$ | 1,234.4 | $ | 417.9 | $ | 1,652.3 | $ | 433.9 | $ | 2,086.2 | ||||||

| Pinnacle Senior Notes |

325.0 | — | 325.0 | — | 325.0 | |||||||||||

| New senior unsecured debt |

— | — | — | 300.0 | 300.0 | |||||||||||

| Total Senior Debt |

$ | 1,559.4 | $ | 417.9 | $ | 1,977.3 | $ | 733.9 | $ | 2,711.2 | ||||||

| Pinnacle Senior Subordinated Notes |

199.0 | — | 199.0 | — | 199.0 | |||||||||||

| Birds Eye HoldCo PIK Term Loan |

— | 327.7 | 327.7 | (327.7 | ) | — | ||||||||||

| Other Debt |

0.3 | 4.7 | 5.0 | (4.7 | ) | 0.3 | ||||||||||

| Total Debt |

$ | 1,758.7 | $ | 750.3 | $ | 2,509.0 | $ | 401.5 | $ | 2,910.5 | ||||||

| LTM Operating Metrics |

Pinnacle 9/27/09A |

Birds Eye 9/26/09A |

Pre- Synergies |

Post- Synergies | ||||||||||||

| Adj. EBITDA |

$ | 259.0 | $ | 168.0 | $ | 427.0 | $ | 472.0 | ||||||||

| Maintenance Capex |

35.0 | 26.0 | 61.0 | 61.0 | ||||||||||||

| Credit Statistics |

||||||||||||||||

| Senior Secured Debt / EBITDA |

4.8x | 4.9x | 4.4x | |||||||||||||

| Senior Debt / EBITDA |

6.0x | 6.4x | 5.7x | |||||||||||||

| Total Debt / EBITDA |

6.8x | 6.8x | 6.2x | |||||||||||||

| Net Debt / EBITDA |

6.8x | 6.8x | 6.2x | |||||||||||||

| Total Debt / (EBITDA - CapEx) |

7.9x | 8.0x | 7.1x | |||||||||||||

7

Pro Forma LTM EBITDA Reconciliation

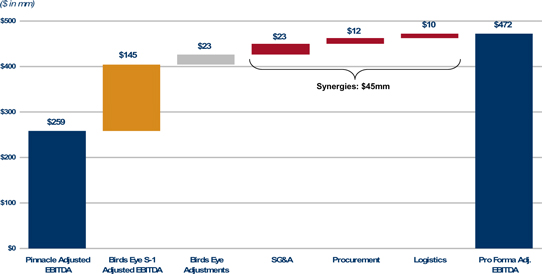

| PRO FORMA LTM ADJUSTED EBITDA BRIDGE | ||||||

|

| ||||||

Pro Forma LTM 9/27/09 Adjusted EBITDA:

| • | Pinnacle 9/27/09 Adjusted EBITDA of $259mm as per 10-Q |

| • | Birds Eye 9/26/09 Adjusted EBITDA of $145mm as per Amendment No. 1 to Form S-1 filed 11/10/09 |

| • | Birds Eye adjustments of $23mm are primarily related to loss-making businesses which Pinnacle is expecting to exit |

| • | Pinnacle expects the Birds Eye Acquisition to create significant opportunities to reduce its operating costs. The Company expects to achieve $45.0 million or more in annual cost savings by eliminating duplicative overhead functions and redundant operating expenses, leveraging its supplier relationships and combined purchasing power to obtain procurement savings on raw materials and packaging, and optimizing and rationalizing its overlapping frozen warehousing and distribution networks. Within the first six months after the Closing, Pinnacle expects to take the actions necessary to achieve the entirety of these synergies, with approximately half of the annual cost savings expected to be realized during 2010, and the full amount of the annual cost savings expected to be realized during 2011. See “Historical Financials—Reconciliation of Pro Forma LTM Adjusted EBITDA.” |

8

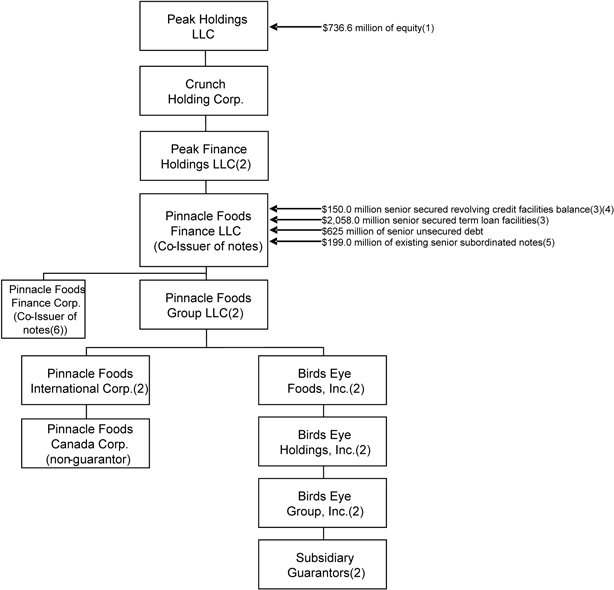

Corporate Structure

| PRO FORMA CORPORATE STRUCTURE | ||||||

|

1. Consists of $424.4 million of common equity from investors, the majority of which was contributed by investment funds affiliated with Blackstone in connection with the Blackstone Transaction, and $312.2 million of cash equity that would have been contributed by investment funds affiliated with Blackstone in connection with the Birds Eye Acquisition had the Closing occurred on September 27, 2009. Actual equity contribution will be based on Birds Eye’s balance sheet at the Closing. Net debt of Birds Eye was $37.6 million lower on November 28, 2009 than on September 26, 2009, which would have reduced the equity contribution to $274.6 million, had the Closing occurred on that date. 2. The obligations under Pinnacle’s existing and new senior secured credit facilities will be guaranteed by Peak Finance Holdings LLC and all of Pinnacle Foods Finance LLC’s existing and future direct and indirect wholly-owned domestic subsidiaries, including Birds Eye and its domestic subsidiaries, subject to certain exceptions. The senior debt will be guaranteed by all of Pinnacle Foods Finance LLC’s domestic subsidiaries, other than the co-issuer, Pinnacle Foods Finance Corp., that guarantee the obligations under Pinnacle’s new senior secured credit facilities, subject to certain exceptions. 3. Represents $875.0 million of new senior secured credit facilities Pinnacle will enter into upon the closing of the Transactions, net of an assumed 2%, or $17.0 million, original issue discount, which will be amortized and included in interest expense over the life of the term loans, and $1,350.0 million of existing senior secured credit facilities (together with the new senior secured credit facilities, the “senior secured credit facilities”) the Company entered into upon the closing of the Blackstone Transaction. The new senior secured credit facilities will consist of a (a) $25.0 million incremental revolving credit facility with a maturity of April 2013, which the Company expects will not be drawn at the Closing, and (b) $850.0 million incremental term loan facility with a maturity of April 2014, which is expected to be fully drawn at the Closing and is assumed to be issued with the 2%, or $17.0 million, original issue discount described above. The existing senior secured credit facilities consist of (a) $125.0 million revolving credit facilities with a six-year maturity and (b) $1,225.0 million term loan facility with a seven-year maturity. As of September 27, 2009, there were $7.7 million of borrowings outstanding under the existing revolving credit facility. 4. Prior to November 20, 2009, a $15.0 million commitment under Pinnacle’s existing revolving credit facility was held by Lehman |

9

| Brothers Commercial Paper Inc. (“LCPI”), a subsidiary of Lehman Brothers Holding Inc. On September 19, 2008, the Company attempted to borrow under the revolving credit facility and LCPI failed to fund its pro-rata commitment. As of November 20, 2009, Barclays Capital has assumed LCPI’s commitment under the revolving credit facility and the funds under this portion of the revolving credit facility are available. 5. Represents $300.0 million of senior unsecured debt that Pinnacle expects to issue in connection with the Transactions and $325.0 million of existing senior notes and $250.0 million of senior subordinated notes the Company issued upon closing of the Blackstone Transaction, less $51.0 million aggregate principal amount of the senior subordinated notes the Company repurchased in December 2007. 6. Pinnacle Foods Finance LLC and Pinnacle Foods Finance Corp. are co-issuers of the existing senior notes and the senior subordinated notes and will be co-issuers of the senior debt to be issued by the co-issuers. Pinnacle Foods Finance Corp. was formed solely to act as a co-issuer of the existing senior notes and to be issued senior debt and the senior subordinated notes, has only nominal assets and does not conduct any operations. |

10

II. INVESTMENT HIGHLIGHTS

A. Strong Strategic Fit

The combination of Pinnacle and Birds Eye results in a leading dry and frozen branded food company with enhanced stability as a result of significant product, customer, and channel diversity. Both Pinnacle and Birds Eye offer a broad mix of well-recognized packaged food products that consumers purchase largely independent of economic cycles, providing the Company with strong and stable cash flows.

Pinnacle’s and Birds Eye’s major brands hold leading market positions in their respective retail categories and enjoy high consumer awareness. Pinnacle holds the #1 or #2 position in 7 of the 10 major category segments in which it competes. Birds Eye holds the #1 market position in the $2.3 billion frozen vegetable category and #1 market position in the value sub-segment of the rapidly-growing complete bagged meals category. In addition, several brands within Birds Eye’s Specialty Foods Group, particularly its pie filling and chili products, are highly complementary with Pinnacle’s existing baking (Duncan Hines) and canned meat (Armour) businesses, respectively. Overall, the acquisition creates a diverse portfolio of iconic brands and top-ranked products in the categories in which the Company competes.

| BALANCED, COMPLEMENTARY PORTFOLIO PROVIDES DIVERSITY AND STABILITY | ||||||

| Pinnacle LTM 9/27/09 Net Sales (% of Total):

Baking, Toppings and Fillings (Duncan Hines) - 16%

Snacks and Enhancers (Vlasic, Mrs. Butterworth’s, Log Cabin, Country Kitchen, Open Pit) - 22%

Canned Meat and Beans (Armour) - 9%

Frozen Meals and Entrees (Hungry-Man, Aunt Jemima, Swanson) - 16%

Frozen Snacks (Van de Kamp’s, Mrs. Paul’s, Lender’s, Celeste, Hawaiian Bowls) - 13%

Other - 24%

Birds Eye LTM 9/26/09 Net Sales (% of Total):

Baking, Toppings and Fillings (Comstock and Wilderness) - 6%

Snacks and Enhancers (Snyder of Berlin, Tim’s Cascade, Bernstein’s) - 11%

Canned Meat and Beans (Brooks, Nalley) - 6%

Frozen Meals and Entrees (Birds Eye Steamfresh Meals, Birds Eye Voila!) - 14%

Frozen Vegetables and Sides (Birds Eye, Birds Eye Steamfresh) - 54%

Other - 9%

Pro forma Combined 9/27/09 Net Sales (% of Total):

Baking, Toppings and Fillings - 13%

Snacks and Enhancers - 18%

Canned Meat and Beans - 8%

Frozen Meals and Entrees - 15%

Frozen Vegetables and Sides - 20%

Frozen Snacks - 8%

Other - 18% |

11

| BROAD MIX OF LEADING AND WELL RECOGNIZED BRANDS | ||||||

| Category Segments |

Category Size ($ mm) |

Major brands |

Market Position (1) |

Market Share |

|||||||

| Frozen vegetables |

$ | 2,321 | Birds Eye Steamfresh |

#1 | 26.5 | % | |||||

| Shelf-stable pickles, peppers and relish |

963 | Vlasic | #1 | 18.8 | % | ||||||

| Baking mixes and frostings |

1,437 | Duncan Hines | #2 | 17.7 | % | ||||||

| Frozen waffles, pancakes and French toast |

717 | Aunt Jemima | #2 | 9.8 | % | ||||||

| Frozen pizza-for-one |

677 | Celeste | #2 | 10.6 | % | ||||||

| Frozen prepared seafood |

606 | Van de Kamp’s Mrs. Paul’s |

#2 | 17.6 | % | ||||||

| Frozen complete bagged meals |

586 | Birds Eye Voila! Steamfresh Meals |

#2 | (2) | 21.8 | % | |||||

| Frozen breakfast entrées / savory handhelds |

533 | Aunt Jemima | #2 | 10.9 | % | ||||||

| Table syrups |

486 | Log Cabin Mrs. Butterworth’s |

#2 | 18.2 | % | ||||||

| Canned meat |

1,188 | Armour | #3 | (3) | 7.5 | % | |||||

| Bagels |

654 | Lender’s | #3 | 9.1 | % | ||||||

| Single-serve frozen dinners and entrées |

2,016 | Hungry-Man Swanson |

#4 | 9.5 | % | ||||||

Note: IRI data for the 52-week period ended 9/27/09 for Pinnacle and 9/6/09 for Birds Eye.

| 1. | Combined market position among branded players. |

| 2. | Birds Eye Voila! holds #1 market position in the value sub-segment of frozen complete bagged meals. |

| 3. | Armour holds #1 market position in the Vienna sausage, potted meat, and sliced dried beef segments of the canned meat category. |

12

B. Creation of a Scale Player with Leading EBITDA Margins

A Pinnacle and Birds Eye combination is expected to result in a diversified scale player with leading EBITDA margins among its industry peer group. The addition of Birds Eye brings critical competitive scale and capabilities to Pinnacle’s current frozen platform. The attractive margins of the combined company reflect the quality of its diversified brand portfolio and its efficient operating structure.

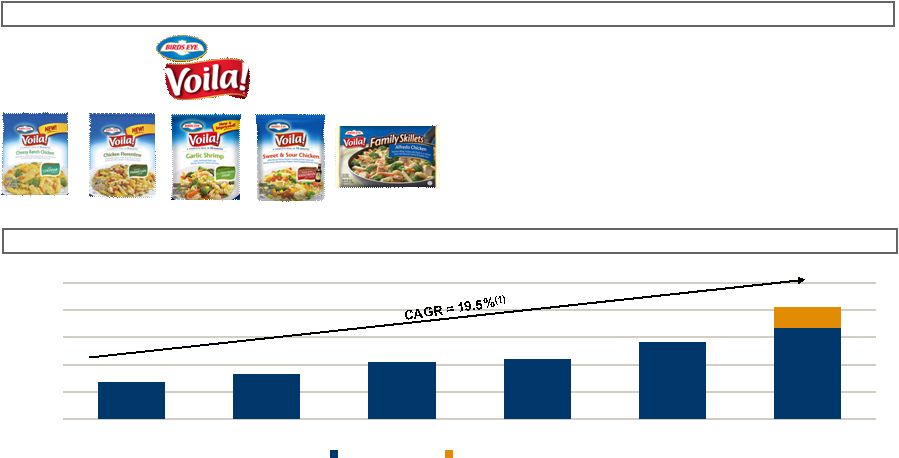

C. Proven Brand Equities

Birds Eye is the most recognized frozen vegetables brand in the United States as evidenced by its #1 branded market position and 26.5% share of the U.S. frozen vegetables category. In the value sub-segment of complete bagged meals, Birds Eye holds the #1 market position with its Birds Eye Voila! brand, which has grown at a FY2005-2009 net sales CAGR of ~20%. Birds Eye enhances Pinnacle’s existing portfolio of iconic brands, most of which have been part of American lives for over 50 years. The Company’s leading brand equities provide a competitive advantage in key areas such as shelf space allocation and promotions, and enhance its ability to grow through brand extensions and new product development.

D. Successful History of Innovation, Renovation, and Product Upgrades

Pinnacle is focused on tailoring its products to meet changing consumer preferences by improving their health and nutrition profile, increasing convenience, expanding into new occasions, and upgrading and renovating to differentiate and contemporize its products. The conversion of Van de Kamp’s to whole white fish fillets, the elimination of high-fructose corn syrup in Log Cabin, and the move to whole grain formulas for Duncan Hines muffins are examples of recent successful product upgrades and renovations. Both Pinnacle and Birds Eye have a history of developing and introducing innovative products into the marketplace. Successful product innovations have contributed to Birds Eye becoming one of the fastest growing major frozen food brands in the United States, having grown retail sales at a 14.9% compounded annual growth rate from 2005 to 2008. Pinnacle expects to continue product launches by leveraging its Multi-Functional Innovation Team and Birds Eye’s research and development team to generate new ideas, build new product platforms, and expand into adjacent categories. Pinnacle plans to drive further sales growth and pursue market share gains through continued investment in product innovations and core product renovation initiatives.

E. Well-Aligned with Consumer Preferences

Birds Eye’s products are well-aligned with consumer trends, including increased focus on health and nutrition, quality, and convenience. Product developments, such as the Steamfresh technology, which enables consumers to steam vegetables in the microwave within their existing packaging, have supported the company’s credentials in these key areas. The steam technology preserves freshness and offers a healthy way to prepare food. In combination with the value-oriented nature of the existing Pinnacle portfolio, the combined company has a set of brands that is favorably aligned with consumer shifts toward value, health and wellness, and convenience.

F. Strong Customer Relationships

The addition of the Birds Eye portfolio further enhances Pinnacle’s strong relationships with its customer base, especially given the size and importance of frozen vegetables to retailers. Birds Eye currently serves as category captain for many of its customers, which allows the company to provide counsel on shelving and merchandising strategies to drive both category and retailer growth. The increased diversity of Pinnacle’s multiple-channel distribution system enhances the stability of its financial results by allowing Pinnacle to capitalize on differential growth trends within various distribution channels. In addition, this diversity reduces the company’s dependence on any one of these channels. The company continues to expand its distribution in alternative channels, including dollar stores, club stores and mass merchandisers, and to grow its footprint in Canada and Mexico.

G. Strong Recurring Cash Flow

Pinnacle has historically generated consistently high cash flows and expects the acquisition of Birds Eye to further enhance its cash flow profile. The Company’s resilient portfolio continues to perform well despite changes in the

13

economic environment, driven by an attractive value proposition, product innovation, and continued consumer investment. High, stable EBITDA margins compare favorably to the core comparable group, and the Company has continued to enhance profitability through proactive rationalization of SKUs and harmonization of packaging and ingredients. Starting in 2006, Birds Eye exited its lower-margin, non-branded frozen vegetable business as part of a successful reemphasis on its higher-growth and higher-margin branded frozen products, reducing total SKUs from over 4,500 to under 500. In 2009, Pinnacle enacted pricing increases across much of its private label and foodservice businesses to bring these products to a more appropriate level of profitability. Through actively managing product mix toward the branded business, the combined company plans to reduce operational complexity, increase productivity in the supply chain, and drive margin enhancement. In addition, Pinnacle has a strong organizational focus on obtaining productivity-related cost savings through the active management of procurement, manufacturing, logistics and selling, general and administrative costs.

Additionally, the combined company requires minimal maintenance capital expenditures (between 2%-3% of net sales per year) and also has attractive tax attributes, including $1.1 billion in federal net operating losses, which the company believes will result in minimal cash taxes over the next several years.

H. Specifically Identified, Achievable Synergies

Pinnacle expects the Birds Eye Acquisition to create significant opportunities to reduce its operating costs. The Company expects to achieve $45.0 million or more in annual cost savings by eliminating duplicative overhead functions and redundant operating expenses, leveraging its supplier relationships and combined purchasing power to obtain procurement savings on raw materials and packaging, and optimizing and rationalizing its overlapping frozen warehousing and distribution networks. Within the first six months after the Closing, Pinnacle expects to take the actions necessary to achieve the entirety of these synergies, with approximately half of the annual cost savings expected to be realized during 2010, and the full amount of the annual cost savings expected to be realized during 2011. The planned initiatives include:

| • | Selling, General and Administrative: Birds Eye’s corporate and administrative support functions will be consolidated with Pinnacle’s existing systems, processes and operating platform. Pinnacle estimates that the elimination of duplicative resources in corporate office, executive staff, and selling and administrative functions will result in annual cost savings of approximately $23.0 million. |

| • | Procurement: Management expects to achieve approximately $12.0 million in annual cost savings through consolidated procurement of raw materials, including sourcing products from the most cost efficient suppliers and leveraging the Company’s combined purchasing volumes. The anticipated cost savings represent approximately 1% of Pinnacle’s estimated annual raw material and packaging spend after the consummation of the Acquisition, with the majority of the cost reductions coming from procurement of vegetables, proteins, and packaging materials. |

| • | Logistics: The Company expects to achieve approximately $10.0 million in annual cost savings from consolidating customer shipments, improving its freight rates, and optimizing its frozen warehousing configuration. By combining Pinnacle and Birds Eye customer shipments, the Company expects to reduce the total number of required shipments through more efficient utilization of existing routes and increasing average truck weights. Pinnacle expects further savings from leveraging its combined scale to drive lower freight rates and from rationalizing and integrating its frozen distribution centers. |

14

I. Proven Management Team and Board of Directors

The Pinnacle senior management team is highly regarded in the food and beverage industry, with significant prior experience in key leadership roles at leading consumer products organizations. The top six senior executives have an average of over 25 years of professional experience at large food and beverage companies. The team has a track record of delivering strong operating performance through brand-building initiatives and achieving cost savings through increased productivity. Additionally, the management team has been successful at acquiring and integrating companies.

Pinnacle is led by its CEO, Bob Gamgort, who spent over 10 years at Mars Incorporated (“Mars”), where he served as President of Mars North America from 2002 to 2009, managing the company’s over $8 billion net sales portfolio of confectionery, main meal, pet food and retail businesses. During his tenure, he was responsible for integrating four acquisitions with combined net sales of over $2.3 billion. Craig Steeneck, Pinnancle’s CFO since July 2007, joined the Company in 2005 as Executive Vice President, Supply Chain Finance & IT, prior to which he served as Executive Vice President, Chief Financial Officer and Chief Administrative Officer of Cendant Timeshare Group. In his various roles, Mr. Steeneck has integrated seven acquisitions with combined net sales of over $3 billion. Other key executives have extensive industry expertise and most of the management team has significant experience integrating acquisitions.

Additionally, Pinnacle’s Board of Directors provides significant additional industry experience and guidance. Chairman Roger Deromedi, who has nearly 30 years of experience in the food industry globally, has held the positions of Chairman and CEO of Kraft Foods Inc. and President and CEO of Kraft Foods International. Joseph Jimenez, currently CEO of Novartis Pharma AG, has more than 20 years of food industry experience including former positions as President and CEO of Heinz Europe and Heinz North America. Raymond Silcock, currently Executive Vice President and Chief Financial Officer of KB Home, adds over 25 years of industry experience including financial management positions at UST Inc., Swift and Company, Cott Corporation, and Campbell Soup Company.

15

III. COMPANY OVERVIEW

Pinnacle is a leading manufacturer, marketer and distributor of branded, high-quality dry and frozen packaged food products in North America. The Company’s major brands hold leading market positions in their respective retail categories and enjoy high consumer awareness. Most of Pinnacle’s brands have been part of American lives for at least 50 years, and about 80% of U.S. households purchase a Pinnacle product. The Company’s products are sold through a combination of a national sales broker, regional sales brokers, and a direct sales force that reaches supermarkets, grocery wholesalers and distributors, mass merchandisers, super centers, convenience stores, dollar stores, drug stores, warehouse clubs, foodservice, and other alternative channels in the United States and Canada. Pinnacle also distributes a selection of its products in Mexico, the Caribbean, and Latin America. The combination of new product innovation, core product renovation, effective consumer marketing, and strategic acquisitions have helped Pinnacle create and grow a diverse brand portfolio.

Pinnacle’s products and operations are managed and reported in two operating segments: dry foods and frozen foods. The dry foods segment consists primarily of Duncan Hines baking mixes and frostings, Vlasic shelf-stable pickles, peppers, and relish, Mrs. Butterworth’s and Log Cabin table syrups and Armour canned meats. The frozen foods segment consists primarily of Hungry-Man and Swanson frozen dinners and entrées, Mrs. Paul’s and Van de Kamp’s frozen seafood, Aunt Jemima frozen breakfasts, Lender’s bagels, and Celeste frozen pizza-for-one.

Through the Birds Eye Acquisition, Pinnacle will significantly enhance its frozen foods segment and create a balanced and diversified portfolio of iconic dry and frozen brands. Birds Eye’s product offering includes an expanding platform of healthy, high-quality frozen vegetables and frozen meals and a portfolio of primarily branded specialty dry foods which are well-aligned with the Company’s existing dry foods segment. Frozen food products are marketed under the Birds Eye brand name, which holds the #1 market share in frozen vegetables and the #1 market share in the value sub-segment of complete bagged meals. Birds Eye markets traditional boxed and bagged frozen vegetables, as well as steamed vegetables using innovative steam-in-packaging technology, under the Birds Eye and Birds Eye Steamfresh brands. Birds Eye’s complete bagged meals, marketed primarily under the value-oriented Birds Eye Voila! brand, offer consumers value-added meal solutions that include a protein, starch and vegetables in one convenient package. Birds Eye’s branded specialty dry food products hold leading market share positions in their core geographic markets, and include Comstock and Wilderness fruit pie fillings and toppings, Brooks and Nalley chili and chili ingredients, and snack foods by Tim’s Cascade and Snyder of Berlin.

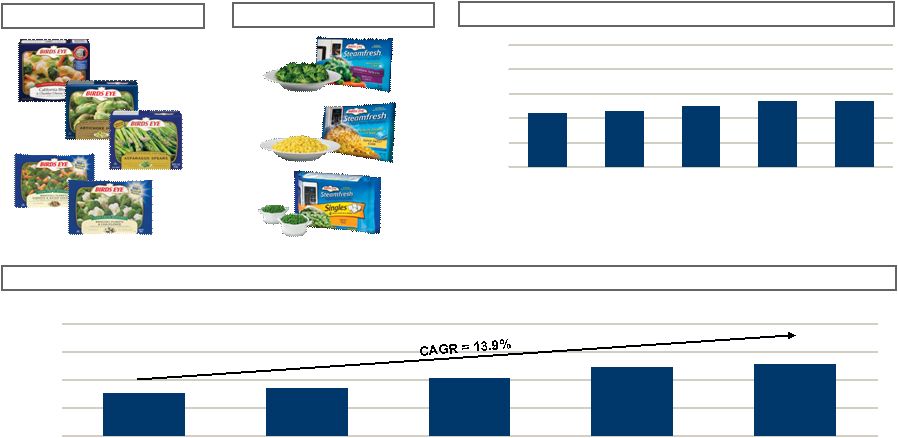

The Birds Eye brand generated approximately $1 billion in retail sales during the fiscal year ended June 26, 2009. In addition, Birds Eye is one of the fastest growing major frozen food brands in the United States, having grown retail sales at a 14.9% compounded annual growth rate from 2005 to 2008. The brand also has a strong track record of successful product innovation. For example, with the launch of its Birds Eye Steamfresh vegetables in 2006, Birds Eye was the first company to capture nationwide market share with a product that offers consumers the ability to steam frozen vegetables conveniently in a specially designed microwaveable bag. These innovations have helped the company increase its #1 market share in frozen vegetables from 22.1% in 2005 to 26.5% today.

For the twelve months ended September 27, 2009, on a pro forma basis for the acquisition of Birds Eye, Pinnacle generated net sales of approximately $2.6 billion and Adjusted EBITDA of approximately $472 million.

Pinnacle believes the acquisition of Birds Eye creates numerous compelling strategic and financial benefits including:

| • | Augments Pinnacle Portfolio with High Quality Brands. The Birds Eye Acquisition further diversifies Pinnacle’s product mix by adding the large, on-trend Birds Eye frozen foods brand as well as several other highly complementary shelf-stable brands. As a result, Pinnacle will enjoy the benefits of enhanced scale, particularly in the frozen foods segment. Birds Eye’s leading brand equity has strong health and wellness, quality, and convenience credentials and should provide greater scale, allowing the Company to better manage shelf space allocation, promotional events, brand extensions, and expansion into new usages and occasions. |

| • | Enhances Pinnacle’s Credit Profile. The Birds Eye Acquisition creates a combined business with increased scale and diversification, industry-leading margins, and a strong free cash flow profile with modest ongoing capital expenditures and attractive tax attributes which will result in limited cash taxes. Pinnacle believes Birds Eye’s presence in recession resistant categories will provide additional stability to its already resilient and diverse brand portfolio. The transaction also improves Pinnacle’s leverage ratios and interest coverage after the inclusion of expected cost synergies from the transaction. |

16

| • | Provides Significant Cost Synergy Opportunity. Pinnacle expects to achieve $45 million or more in annual cost synergies from a combination with Birds Eye. The Company plans to achieve these synergies by eliminating redundant selling, general and administrative costs, leveraging supplier relationships and combined purchasing power to obtain procurement savings on purchases of raw materials and packaging, and optimizing and rationalizing overlapping frozen warehousing and distribution networks. To achieve these synergies, the Company expects to incur one-time costs and capital expenditures of approximately $26 million and $3 million, respectively. Within the first six months after the Closing, Pinnacle expects to take the actions necessary to achieve the entirety of these synergies, with approximately half of the annual cost savings expected to be realized during 2010, and the full amount of the annual cost savings expected to be realized during 2011. |

17

Products

Pinnacle

Dry Foods

| • | Baking mixes and frostings – Pinnacle’s baking mixes and frostings include Duncan Hines cake mixes, ready-to-serve frostings, brownie mixes, muffin mixes, and cookie mixes. Duncan Hines was introduced as a national brand in 1956 when Duncan Hines, a renowed restaurant critic and gourmet, launched the brand as part of his efforts to bring restaurant-quality food to American homes. Duncan Hines has 95% total brand awareness and is a premium quality brand positioned to the baking enthusiast. Duncan Hines has been gaining share in a growing category, driven by successful new product launches (such as Decadent Carrot Cake Mix in 2008 and Duncan Hines Whole Grain Muffins in 2009), increased and more effective consumer marketing via both traditional and non-traditional media, and distribution gains in retail and alternative channels. Duncan Hines is the #2 brand with a 17.7% market share of the $1.4 billion baking mixes and frostings category. The Company also distributes Duncan Hines in Canada, where it is the #2 brand with a 30.6% market share of the C$81 million baking mixes and frostings category. All Duncan Hines products are produced by contract manufacturers. |

| • | Pickles, peppers, and relish – Pinnacle offers a complete line of shelf-stable pickle, pepper, and relish products that the Company markets and distributes nationally, primarily under the Vlasic brand, and regionally under the Milwaukee’s and Wiejske Wyroby brands. The Vlasic brand, represented by its trademark Vlasic stork, was introduced over 65 years ago and has the highest consumer awareness and quality ratings in the pickle category. Vlasic is the #1 brand in the $963 million shelf-stable pickles, peppers, and relish category, with an 18.8% share of the overall category and a 29.8% share of the $514 million shelf-stable pickle segment. Vlasic is also distributed in Canada, where it is the #2 brand in the category, and in the foodservice channel. |

| • | Table syrups – Pinnacle’s table syrups primarily include products marketed under the Log Cabin and Mrs. Butterworth’s brands. Log Cabin was introduced in 1888 and, with its cabin-shaped bottle and distinct maple flavor, appeals to a broad consumer base. In 2009, Pinnacle converted the Log Cabin regular and lite recipes to a natural sugar formula, becoming the only national table syrup brand to offer a product without high-fructose corn syrup. Mrs. Butterworth’s was introduced in 1962 and, with its distinctive grandmother-shaped bottle and thick, rich and buttery flavor, appeals to families with children. Earlier in 2009, the brand sponsored a contest to guess Mrs. Butterworth’s first name, and received extensive media coverage, reflecting the brand’s iconic status and highly engaged consumer franchise. Both table syrup brands are available in original, lite and sugar-free varieties. The Log Cabin and Mrs. Butterworth’s brands collectively are the #2 participant in the $486 million table syrup category, with an 18.2% market share. The Company also distributes these products through the foodservice channel. |

| • | Canned meat – Pinnacle’s canned meat products are marketed primarily under the Armour brand. Armour was introduced in 1868 by Philip Danforth Armour for California gold miners. Armour is the #3 brand in the $1.2 billion canned meat category, with a 7.5% market share, and is the #1 brand in the Vienna sausage, potted meat, and sliced dried beef segments. Armour Vienna sausage has particularly high penetration in the southeastern United States, where it is an important and high-volume product for retailers. Armour has a broad product line which also includes stews, chilis, and hashes. The Company also manufactures private label products and produces canned meat under certain co-pack arrangements. |

| • | Barbecue sauce – Pinnacle markets a complete line of barbecue sauce products under the Open Pit brand, which was introduced in 1955. Open Pit is a regional brand that competes primarily in the Midwest markets, where it has a leading market share. |

Frozen Foods

| • | Single-serve frozen dinners and entrées – Pinnacle’s single-serve frozen dinners and entrées consist primarily of products sold in the United States and Canada under the Hungry-Man and Swanson brands. Hungry-Man is a highly differentiated brand with strong brand awareness and is uniquely positioned to male consumers. This distinctive position has been increasingly valuable to retail customers as the percentage of food shopping done by men has grown. Swanson, The Original TV Dinner, was launched in 1953 and enjoys a strong brand heritage and high awareness. The Hungry-Man and Swanson brands collectively represent the fourth largest participant in the $2.0 billion single-serve full-calorie dinners and entrées segment and hold the #3 position in Canada in the C$449 million single-serve full-calorie dinners and entrées segment. |

18

| • | Frozen prepared seafood – Pinnacle’s frozen prepared seafood products, marketed under the Mrs. Paul’s and Van de Kamp’s brands, include breaded and battered fish sticks and fish fillets, lightly breaded fish, breaded shrimp and some specialty seafood items. The Van de Kamp’s brand started in Los Angeles and dates back to 1915, and the Mrs. Paul’s brand started in Philadelphia and dates back to the mid-1940s. The Company utilizes a dual-brand strategy to capitalize on the well-developed regional positions of the Van de Kamp’s and Mrs. Paul’s brands. In 2009, the brands dramatically upgraded product quality based on consumer preference, resulting in year-to-date growth in retail sales of 29.2% and market share gain of 3.2 percentage points. Mrs. Paul’s and Van de Kamp’s brands collectively are the #2 participant in the $606 million frozen prepared seafood category, with a 17.6% market share. |

| • | Frozen breakfast – Pinnacle’s frozen breakfast products are marketed under the Aunt Jemima brand and include waffles, pancakes, French toast, breakfast entrées, and savory breakfast handhelds. The Aunt Jemima brand was established over a century ago and enjoys high brand awareness and quality rankings. Aunt Jemima is positioned to families as a warm, wholesome breakfast for busy mornings. The Aunt Jemima brand is currently the #4 brand in the $1.5 billion frozen breakfast category with an 8.7% market share. Aunt Jemima is the #2 brand in both the $717 million grain segment, which includes frozen waffles, pancakes and French toast, and the $533 million protein segment, which includes frozen breakfast entrées and savory breakfast handhelds. |

| • | Bagels – Pinnacle’s bagel products primarily consist of Lender’s packaged bagels, which are distributed among all scannable (pre-packaged) sections of the grocery store (i.e., the frozen, refrigerated, and fresh bread aisles). Founded in 1927, Lender’s ranks #3 among branded, pre-packaged bagels, with a 9.1% market share of the $654 million pre-packaged bagel category. The brand has the leading market share in both refrigerated and frozen bagel sub-categories. The Company also distributes these products through the foodservice channel. |

| • | Frozen pizza-for-one – Pinnacle markets frozen pizza under the Celeste brand, which dates back to the 1940s. Celeste is the #2 brand in the $677 million frozen pizza-for-one category, with a 10.6% market share. Its sales are concentrated in the Northeast, Chicago, Florida, and California markets. Celeste is positioned as a high quality meal at an affordable price. |

19

Birds Eye

Frozen Foods

| • | Frozen vegetables – Birds Eye is the largest brand in the $2.3 billion frozen vegetables category. Its steamed and non-steamed product offerings hold the #1 position with a 26.5% market share. With the launch of Birds Eye Steamfresh in January 2006, Birds Eye was the first company to capture a nationwide market share with a microwaveable product that enables consumers to conveniently steam vegetables in its packaging. The steamed segment has since grown to $586 million in retail sales, and has been a major contributor to the growth in the total frozen vegetables category, which has increased 4.6% over the prior year period and grown at a 4.8% compounded annual growth rate from 2005 to 2008. The steamed segment represents approximately 25% of the overall category, and Birds Eye holds a 54.1% market share of the steamed segment. The non-steamed segment comprises 75% of the overall category, and Birds Eye holds a 17.1% market share of the non-steamed segment. |

| • | Frozen multi-serve dinners and entrées – Birds Eye competes in the frozen complete bagged meals segment of the multi-serve dinners and entrées category with its Birds Eye Voila! brand in the value sub-segment and its Birds Eye Steamfresh brand in the premium sub-segment. Birds Eye’s complete bagged meals product portfolio holds a combined 21.8% market share of the $586 million complete bagged meals category, making it the #2 competitor in the category. Birds Eye Voila! and Birds Eye Steamfresh complete bagged meals offer consumers value-added meal solutions that include a protein, starch and vegetables in one convenient package. With its Birds Eye Voila! brand, Birds Eye holds the #1 position in the value sub-segment of complete bagged meals. |

Dry Foods

| • | Specialty foods – Birds Eye offers a variety of shelf-stable specialty food products, including Comstock and Wilderness fruit pie fillings and toppings, Brooks and Nalley chili and chili ingredients, and snack items by Tim’s Cascade and Snyder of Berlin. These dry foods brands have strong local awareness and hold leading market share positions in their core geographic markets. |

20

Company History

| PINNACLE HISTORY | ||||

| Date |

Event |

Selected Brands Acquired | ||

| 2001 |

Pinnacle Foods Holding Corporation (the predecessor) formed by Hicks, Muse, Tate & Furst Incorporated and CDM Investor Group LLC to acquire the North American business of Vlasic Foods International Inc. | Hungry-Man and Swanson Vlasic Open Pit | ||

| 2003 |

Pinnacle Foods Holding Corporation acquired by J.P. Morgan Partners, LLC, J.W. Childs Associates, L.P. and CDM Investor Group LLC | |||

| 2004 |

Merger of Pinnacle Foods Holding Corporation with Aurora completed and surviving company renamed Pinnacle Foods Group Inc. (now known as PFG LLC) | Duncan Hines Van de Kamp’s and Mrs. Paul’s Log Cabin and Mrs. Butterworth’s Lender’s Celeste | ||

| 2006 |

Acquired Armour Business | Armour | ||

| 2007 |

Crunch Holding Corp. acquired by The Blackstone Group | |||

| 2009 |

Announced acquisition of Birds Eye Foods | Birds Eye Birds Eye Steamfresh Birds Eye Voila! Comstock Wilderness Brooks Nalley Tim’s Cascade Snyder of Berlin | ||

Pinnacle Foods Group Inc. was incorporated under Delaware law on June 19, 1998. Pinnacle Foods Finance LLC and Pinnacle Foods Finance Corp. were formed under Delaware law on March 5, 2007 and February 28, 2007, respectively. The Company’s principal executive offices are located at 1 Old Bloomfield Avenue, Mountain Lakes, New Jersey 07046. Pinnacle’s telephone number is (973) 541-6620.

21

Armour Acquisition

On March 1, 2006, PFGI acquired certain assets and assumed certain liabilities of the food products business (the “Armour Business”) of The Dial Corporation for $189.2 million in cash. The Armour Business is a leading manufacturer, distributor, and marketer of products in the $1.2 billion canned meat category. The Armour Business offers products in twelve of the fifteen segments within the canned meat category and maintains the leading market position in the Vienna sausage, potted meat and sliced beef categories. The business also includes meat spreads, chili, luncheon meat, corned and roast beef hash and beef stew. The majority of the products are produced at the manufacturing facility located in Ft. Madison, Iowa, which was acquired in the transaction. Products are sold under the Armour brand name as well as through certain private label and co-pack arrangements.

Blackstone Transaction

On February 10, 2007, Crunch Holding Corp. (“CHC”), a Delaware corporation and the parent company of Pinnacle Foods Group Inc. (“PFGI”), entered into an Agreement and Plan of Merger with Peak Holdings LLC (“Peak Holdings”), a Delaware limited liability company controlled by affiliates of The Blackstone Group L.P. (“Blackstone”), Peak Acquisition Corp. (“Peak Acquisition”), a wholly-owned subsidiary of Peak Holdings, and Peak Finance LLC (“Peak Finance”), an indirect wholly-owned subsidiary of Peak Acquisition, providing for the acquisition of CHC. Under the terms of the Agreement and Plan of Merger, the purchase price for CHC was $2,162.5 million in cash less the amount of indebtedness (including capital lease obligations) of CHC and its subsidiaries outstanding immediately prior to the closing and certain transaction costs, subject to purchase price adjustments based on the balance of working capital and indebtedness as of the closing. Pursuant to the Agreement and Plan of Merger, immediately prior to the closing, CHC contributed all of the outstanding shares of capital stock of its wholly-owned subsidiary PFGI to a newly-formed Delaware limited liability company, PFF. At the closing, Peak Acquisition merged with and into CHC, with CHC as the surviving corporation, and Peak Finance merged with and into PFF, with PFF as the surviving entity. As a result of this transaction, CHC became a wholly-owned subsidiary of Peak Holdings. This transaction (the “Blackstone Transaction”) closed on April 2, 2007.

Reorganization of Subsidiaries

In order to simplify administrative matters and financial reporting and to place both frozen foods and dry foods under one entity, Pinnacle consummated a reorganization of its subsidiaries in September 2007 (the “Reorganization”) whereby the Company formed Pinnacle Foods International Corp., a Delaware corporation (“PF International”) on September 26, 2007, as a subsidiary to Pinnacle Foods Corporation (“PFC”). In connection with the Reorganization, PFC contributed all of the issued and outstanding shares of Pinnacle Foods Canada Corp. (“PF Canada”) to PF International, making PF International the parent of PF Canada. As a further step to the Reorganization, on September 30, 2007, two of the Company’s domestic operating subsidiaries, Pinnacle Foods Management Corporation (“PF Management”) and PFC, merged with and into PFGI. As a final step to the Reorganization, PFGI was converted from a Delaware corporation into a Delaware limited liability company under Delaware law on October 1, 2007 under the name Pinnacle Foods Group LLC.

Birds Eye Acquisition

On November 18, 2009, PFG LLC entered into the Stock Purchase Agreement with Birds Eye Holdings and Birds Eye pursuant to which PFG LLC will acquire all of the issued and outstanding common stock of Birds Eye from Birds Eye Holdings. PFG LLC is controlled by certain affiliates of Blackstone. In connection with the Birds Eye Acquisition, PFG LLC will purchase all of the outstanding shares of Birds Eye’s common stock, par value $0.01 per share, for a purchase price of $670.0 million in cash.

22

Company Strategy

Pinnacle intends to profitably grow its business through the following strategic initiatives:

Maximize the Value of its Brands

Pinnacle’s strategy is to drive demand for its brands through developing consumer insights, investing in targeted product innovation and core product renovation, and executing effective consumer advertising. The Company believes that its business model, which appropriately balances consumer marketing, trade support and brand innovation, will strengthen its brands and enhance sales for Pinnacle and its customers. Pinnacle makes extensive use of marketing mix modeling tools to optimize marketing investments and utilizes consumer insights to contemporize brands through relevant products, packaging and communication. The Company’s innovation program is focused on expanding into new occasions and attracting new users into its franchises. Pinnacle intends to continue to improve the health and nutrition profile of its offerings to satisfy changing consumer preferences.

The Company’s Multi-Functional Innovation Team focuses on creating new ideas to generate incremental sales and earnings through new platforms and expansion into adjacent categories. Pinnacle utilizes rigorous and consistently applied models and protocols to launch successful new products, and then support these new products with strategic consumer marketing and trade promotions. The Company intends to leverage Birds Eye’s position as a leading innovator in frozen foods to further enhance its innovation capability across the business.

The Company strives to be a preferred supplier to its key customers. Pinnacle and Birds Eye have longstanding relationships with leading retailers, and intend to continue to partner with them to maximize mutual profitability. The Company’s strategy prioritizes resources to customers and channels that are growing share of consumer purchases. Consumer and category insights allow the Company to enhance customer category management and optimize SKU range to ensure distribution of high-velocity items. Pinnacle expects to continue to leverage the strengths of its mutual national food broker for improved retail merchandising and in-store promotional performance.

Enhance Margins through Optimization of Product Mix and Ongoing Cost Reduction Initiatives

The Company intends to continue to enhance profitability through proactive line and SKU management and harmonization of packaging and ingredients. In 2006, Birds Eye exited its lower margin, non-branded frozen vegetables business as part of a successful reemphasis on its higher growth and higher margin branded frozen products, reducing total SKUs from greater than 4,500 to less than 500. In 2008, Pinnacle began a similar initiative to exit significant portions of its private label business, retaining only certain strategic accounts and products. As a combined entity, the Company plans to continue to focus attention and resources on driving the growth of core brands. Through actively managing product mix toward the branded business, Pinnacle believes it can reduce operational complexity, increase productivity in the supply chain, and drive margin enhancement.

Pinnacle has a strong organizational focus on obtaining annual productivity-related cost savings through the active management of procurement, manufacturing, logistics and selling, general and administrative costs. The Company has various ongoing initiatives designed to better manage purchasing, manufacturing, and warehousing and transportation costs, while improving customer service levels and reducing net working capital requirements. Among other initiatives, Pinnacle has implemented LEAN manufacturing programs and installed process monitoring systems across its plants.

Beginning in 2009, Pinnacle began a targeted program to invest nearly $60 million of incremental capital in key projects to strengthen the infrastructure in manufacturing facilities, enhance equipment reliability, drive annual cost savings through operating efficiencies, and expand production capacities. The Company plans to have invested over $20 million of this capital by the end of 2009, and expect the balance of the capital investment to be made primarily during 2010 and 2011. As a result of this capital spending program, Pinnacle expects significant cost savings to be realized in its financial results beginning in 2010.

Realize Identified Cost Synergy Opportunities from Combination with Birds Eye

Pinnacle expects the Birds Eye Acquisition to create significant opportunities to reduce operating costs. The Company expects to achieve $45.0 million or more in annual cost savings by eliminating duplicative overhead functions and redundant operating expenses, leveraging supplier relationships and combined purchasing power to obtain procurement savings on raw materials and packaging, and optimizing and rationalizing overlapping frozen warehousing and distribution networks. Within the first six months after the Closing, management expects to take the actions necessary to achieve the entirety of these synergies, with approximately half of the annual cost savings expected to be realized during 2010, and the full amount of the annual cost savings expected to be realized during 2011. Pinnacle’s planned initiatives include:

Selling, General and Administrative. Birds Eye’s corporate and administrative support functions will be consolidated with Pinnacle’s existing systems, processes and operating platform. Management estimates that the elimination of duplicative resources in corporate office, executive staff, and selling and administrative functions will result in annual cost savings of approximately $23.0 million.

23

Procurement. Pinnacle expects to achieve approximately $12.0 million in annual cost savings through consolidated procurement of raw materials, including sourcing products from the most cost efficient suppliers and leveraging combined purchasing volumes. The anticipated cost savings represent approximately 1% of estimated annual raw material and packaging spend after the consummation of the Birds Eye Acquisition, with the majority of the cost reductions coming from procurement of vegetables, proteins, and packaging materials.

Logistics. The Company expects to achieve approximately $10.0 million in annual cost savings from consolidating customer shipments, improving freight rates, and optimizing frozen warehousing configuration. By combining Pinnacle and Birds Eye customer shipments, Pinnacle expects to reduce the total number of required shipments through more efficient utilization of existing routes and increasing average truck weights. The Company expects further savings from leveraging the combined scale to drive lower freight rates and from rationalizing and integrating frozen distribution centers.

Evaluate Targeted Strategic Acquisition Opportunities

In addition to pursuing organic revenue and earnings growth in the Company’s existing businesses, Pinnacle will continue to evaluate targeted, value-enhancing acquisitions that complement its current portfolio. These acquisitions will be evaluated using the following criteria:

| • | iconic brands with leading market positions and attractive and sustainable margins; |

| • | in adjacent or identifiable growth categories; |

| • | allowing Pinnacle to leverage existing capabilities in marketing, sales, manufacturing and/or logistics; and |

| • | transactions which enhance the Company’s financial flexibility by reducing its leverage ratios. |

Pinnacle’s management team has demonstrated its ability to identify and successfully integrate value-enhancing acquisitions, and the Company believes its capabilities are further enhanced with the support of The Blackstone Group and Pinnacle’s Board of Directors.

Marketing, Sales, and Distribution

Pinnacle’s marketing programs consist of consumer advertising, consumer promotions, trade promotions, direct marketing, and public relations. The Company’s advertising consists of television, newspaper, magazine, and web advertising aimed at increasing consumer preference and usage of Pinnacle’s brands. Consumer promotions include free trial offers, targeted coupons, and on-package offers to generate trial usage and increase purchase frequency. Trade promotions focus on obtaining retail feature and display support, achieving optimum retail product prices, and securing retail shelf space. The Company continues to shift its marketing efforts toward building long-term brand equity through increased consumer marketing.

Pinnacle and Birds Eye sell a majority of their products in the United States through one national broker with whom they have a long-term working relationship. In Canada, the Company uses one national broker to distribute the majority of its products. Pinnacle employs other brokers for the foodservice, military, club and convenience channels. Through this sales broker network, products reach all traditional classes of trade, including supermarkets, grocery wholesalers and distributors, mass merchandisers, super centers, convenience stores, drug stores, warehouse clubs, foodservice, and other alternative channels.

Due to the different demands of distribution for frozen and shelf-stable products, the Company maintains separate distribution systems. At Pinnacle, the frozen product warehouse and distribution network consists of 12 locations. Frozen products are distributed by means of three owned and operated warehouses at the Fayetteville, Arkansas, Mattoon, Illinois, and Jackson, Tennessee plants. In addition, the Company utilizes seven distribution centers in the United States and two distribution centers in Canada, all of which are owned and operated by third-party logistics providers. The dry product warehouse and distribution network consists of 11 locations. Dry foods products are distributed through a system of ten distribution sites in the United States, which include four warehouses that are owned and operated by Pinnacle at its plants in

24

Imlay City, Michigan, Millsboro, Delaware, St. Elmo, Illinois and Ft. Madison, Iowa, as well as six other locations which are owned and operated by third-party logistics providers. The Company also distributes dry products from one leased distribution center in Canada. In each third-party operated location, the provider receives, handles and stores products. Pinnacle’s distribution system uses a combination of common carrier trucking and inter-modal rail transport. The Company believes that its sales and distribution network is scalable and has the capacity to support substantial increases in volume.

Birds Eye distributes its frozen products through a network of three primary distribution centers throughout the United States, all of which are owned and operated by third-party logistics providers. In addition, Birds Eye owns and operates warehouses at its Darien, Wisconsin, Waseca, Minnesota, and Fulton, New York plants. Birds Eye Specialty Food Group products are distributed through a company-owned warehouse in Tacoma, Washington as well as two distribution centers in Coloma, Michigan and Brockport, New York, which are owned and operated by third-party logistics providers. In addition, Birds Eye owns and operates a warehouse at the Fennville, Michigan plant. Snack products within the Specialty Food Group are primarily distributed through a direct store delivery (“DSD”) network in the Midwest, Mid-Atlantic, and Pacific Northwest, a portion of which is owned and operated by Birds Eye and a portion of which utilizes third-party providers.

Research and Development

Pinnacle’s Product Development and Technical Services team based in Cherry Hill, New Jersey currently consists of 28 full-time employees focused on product-quality improvements, product creation, package development, regulatory compliance, quality assurance, and consumer affairs. Pinnacle’s internal research and development expenditures totaled $3.5 million, $4.4 million and $4.0 million for fiscal years 2008, 2007 and 2006, respectively.

Birds Eye operates a technical center located in Green Bay, Wisconsin that is responsible for new product development and brand extensions. Approximately 30 full-time employees are currently employed at this facility. Birds Eye’s internal research and development expenditures were $4.0 million, $3.7 million and $3.0 million in fiscal years 2009, 2008, and 2007, respectively.

Ingredients and Packaging

Pinnacle believes that the ingredients and packaging used to produce its products are readily available through multiple sources. Ingredients typically account for approximately 46% of its cost of products sold, and primarily include sugar, cucumbers, flour (wheat), poultry, seafood, vegetable oils, shortening, meat, corn syrup, and other agricultural products. Packaging costs, primarily for aluminum, glass jars, plastic trays, corrugated fiberboard, and plastic packaging materials, typically account for approximately 20% of its annual cost of products sold.

Birds Eye’s ingredients, which account for approximately 64% of annual cost of products sold, primarily consist of raw materials including vegetables, fruits, and proteins. Certain vegetables and fruits are purchased under dedicated acreage supply contracts from a number of growers prior to each growing season, while a smaller portion is sourced directly from third parties. Birds Eye also sources materials used in the packaging and manufacturing of its products, including polyfilm, plastic trays, cans, corrugated, and other materials, which account for approximately 10% of its annual cost of products sold.

25

Manufacturing and Facilities

Pinnacle and Birds Eye own a number of manufacturing facilities in the U.S. Pinnacle owns four dry product facilities as well as three frozen product facilities. Birds Eye operates seven manufacturing facilities made up of three facilities supporting the Frozen Foods Group and four facilities supporting the Specialty Foods Group.

Pinnacle has entered into co-packing (third-party manufacturing) agreements with several manufacturers for certain finished products. These co-packed finished products include the Duncan Hines product line, Aunt Jemima breakfast sandwich product line, and certain seafood products. All of Duncan Hines cake mix, brownie mix, specialty mix and frosting production equipment, including co-milling, blending and packaging equipment, is located at the contract manufacturers’ facilities. The most significant Duncan Hines co-packing agreement will expire in June 2015. The Company believes that its manufacturing facilities, together with its co-packing agreements, provide the Company with sufficient capacity to accommodate its planned internal growth.

Customers

Pinnacle has several large customers that account for a significant portion of net sales. Wal-Mart and its affiliates are the Company’s largest customer and represented approximately 23%, 24%, and 22% of its consolidated net sales in fiscal 2008, 2007, and 2006, respectively. Cumulatively, including Wal-Mart, Pinnacle’s top ten customers accounted for approximately 57% of its net sales in each of fiscal 2008, 2007, and 2006.

Birds Eye’s largest customer is also Wal-Mart, which represented approximately 25%, 23%, and 21% of its consolidated net sales in fiscal 2009, 2008, and 2007, respectively. Cumulatively, including Wal-Mart, Birds Eye’s top ten customers accounted for approximately of 64%, 59%, and 57% of its net sales in fiscal 2009, 2008, and 2007, respectively.

Competition

Pinnacle and Birds Eye face competition in each of their product lines. Although Pinnacle operates in a highly competitive industry, the Company believes that the strength of its brands has resulted in a strong competitive position. Pinnacle competes with producers of similar products on the basis of, among other things, product quality, brand recognition and loyalty, price, customer service, effective consumer marketing and promotional activities and the ability to identify and satisfy emerging consumer preferences.

The Company’s most significant competitors for its products are shown below by category:

| COMPETITOR OVERVIEW |

| Pinnacle:

Frozen Dinners - Nestle, ConAgra, Heinz Pickles and Peppers - B&G, Mt. Olive, Kraft, Private Label Baking Products - Smucker’s, General Mills Syrup - PepsiCo, Kellogg’s, Private Label Frozen Seafood - Gorton’s, SeaPak Frozen Breakfast - Kellogg’s, General Mills, Sara Lee Bagels - Weston, Sara Lee, Private Label Canned Meat - ConAgra, Hormel Pizza - General Mills, Private Label

Birds Eye:

Frozen Vegetables - Green Giant, Private Label Bagged Meals - Unilever, Contessa, Nestle, ConAgra Specialty Foods - Knouse, Hormel, PepsiCo, Private Label |

26

Trademarks and Patents

Pinnacle owns a number of registered trademarks in the United States, Canada and other countries, including Appian Way®, Casa Regina®, Celeste®, Chocolate Lovers®, Country Kitchen®, Duncan Hines®, Fun Frosters®, Grabwich®, Great Starts®, Grill Classics®, Hawaiian Bowls®, Hearty Bowls®, Hearty Hero®, Hungry-Man®, Hungry-Man Sports Grill®, Hungry-Man Steakhouse®, It’s Good to be Full®, Just Add the Warmth®, Lender’s®, Log Cabin®, Lunch Bucket®, Magic Mini’s®, Milwaukee’s®, Moist Deluxe®, Mrs. Butterworth’s®, Mrs. Paul’s®, Open Pit®, Oval’s®, Signature Desserts®, Simply Classic®, Snack’mms®, So Moist, So Delicious and So Much More®, So Rich, So Moist, So Very Duncan Hines®, Stackers®, Taste the Juicy Crunch®, That’s the Tastiest Crunch I Ever Heard®, The Original TV Dinner®, Treet®, Van de Kamp’s®, and Vlasic®. Pinnacle protects its trademarks by obtaining registrations where appropriate and opposing any infringement in key markets. The Company also owns a design trademark in the United States, Canada, and other countries on the Vlasic stork.

Pinnacle manufactures and markets certain frozen food products under the Swanson brand pursuant to two royalty-free, exclusive and perpetual trademark licenses granted by Campbell Soup Company. The licenses gives Pinnacle the right to use certain Swanson trademarks both inside and outside of the United States in connection with the manufacture, distribution, marketing, advertising, and promotion of frozen foods and beverages of any type except for frozen soup or broth. The licenses require the Company to obtain the prior written approval of Campbell Soup Company for the visual appearance and labeling of all packaging, advertising materials, and promotions bearing the Swanson trademark. The licenses contain standard provisions, including those dealing with quality control and termination by Campbell Soup Company as well as assignment and consent. If the Company were to breach any material term of the licenses and not timely cure such breach, Campbell Soup Company could terminate the licenses.

Pinnacle manufactures and markets certain frozen breakfast products under the Aunt Jemima brand pursuant to a royalty-free, exclusive (as to frozen breakfast products only) and perpetual license granted by The Quaker Oats Company. The license gives Pinnacle the right to use certain Aunt Jemima trademarks both inside and outside the United States in connection with the manufacture and sale of waffles, pancakes, French toast, pancake batter, biscuits, muffins, strudel, croissants, and all other frozen breakfast products, excluding frozen cereal. The license requires the Company to obtain the approval of The Quaker Oats Company for any labels, packaging, advertising, and promotional materials bearing the Aunt Jemima trademark. The license contains standard provisions, including those dealing with quality control and termination by The Quaker Oats Company as well as assignment and consent. If Pinnacle were to breach any material term of the license and not timely cure such breach, The Quaker Oats Company could terminate the license.